| Investment Company Act file number |

811‑09135 |

| Item 1. | Reports to Stockholders. |

|

|

| Nuveen Arizona Quality Municipal Income Fund |

NAZ | |||

| Nuveen California AMT‑Free Quality Municipal Income Fund |

NKX | |||

| Nuveen California Municipal Value Fund |

NCA | |||

| Nuveen California Quality Municipal Income Fund |

NAC | |||

| Nuveen New Jersey Quality Municipal Income Fund |

NXJ | |||

| Nuveen New York AMT‑Free Quality Municipal Income Fund |

NRK | |||

| Nuveen New York Municipal Value Fund |

NNY | |||

| Nuveen New York Quality Municipal Income Fund |

NAN | |||

| Nuveen Pennsylvania Quality Municipal Income Fund |

NQP | |||

| 3 | ||||

| 4 | ||||

| 13 | ||||

| 15 | ||||

| 16 | ||||

| 35 | ||||

| 37 | ||||

| 128 | ||||

| 130 | ||||

| 132 | ||||

| 141 | ||||

| 144 | ||||

| 157 | ||||

| 176 | ||||

| 222 | ||||

| 223 | ||||

| 225 | ||||

| 226 | ||||

| 230 | ||||

| 238 | ||||

| • | Municipal bond yields rose across longer maturities and fell across shorter maturities, steepening the municipal yield curve over the reporting period. Yields saw elevated volatility during the period, in response to uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal and trade policy under the Trump administration, and the impacts to the economy, inflation and federal debt sustainability. |

| • | While credit fundamentals remained strong, unprecedented supply pressure weighed on the municipal market during the reporting period. Demand for municipal debt increased during the reporting period but was less robust when compared to the elevated level of supply. |

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. During the reporting period, the Fund continued to emphasize a long-term view of investing in longer-duration and lower-rated bonds, which offered incrementally higher yields to support the Fund’s income earnings capability. |

| • | The portfolio management team took advantage of periods of market weakness to buy bonds at attractive valuations and continued to seek enhanced income opportunities by selling bonds with lower book yields and replacing them with bonds with higher book yields. |

| • | Overweights to the dedicated tax and single-family housing sectors. |

| • | Exposure to shorter-duration higher education bonds. |

| • | The Fund’s use of leverage through the issuance of preferred shares. |

| • | Overweight to bonds with durations of eight years and longer. |

| • | Overweight to lower-rated credits, particularly non‑rated bonds. |

| • | Municipal bond yields rose across longer maturities and fell across shorter maturities, steepening the municipal yield curve over the reporting period. Yields saw elevated volatility during the period, in response to uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal and trade policy under the Trump administration, and the impacts to the economy, inflation and federal debt sustainability. |

| • | While credit fundamentals remained strong, unprecedented supply pressure weighed on the municipal market during the reporting period. Demand for municipal debt increased during the reporting period but was less robust when compared to the elevated level of supply. |

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. During the reporting period, the Fund continued to emphasize a long-term view of investing in longer-duration and lower-rated bonds, which offered incrementally higher yields to support the Fund’s income earnings capability. |

| • | The portfolio management team took advantage of periods of market stress to buy bonds at attractive valuations and continued to carefully manage the Fund’s income sustainability via tactical trading. |

| • | Underweight to tobacco bonds. |

| • | Underweight to dedicated tax bonds. |

| • | The Fund’s use of leverage through inverse floating rate securities and the issuance of preferred shares. |

| • | Overall duration positioning, especially an overweight to bonds with durations greater than 12.0 years. |

| • | Overweights to below-investment-grade and non‑rated bonds. |

| • | Overweight to the health care sector. |

| 5 |

| • | Municipal bond yields rose across longer maturities and fell across shorter maturities, steepening the municipal yield curve over the reporting period. Yields saw elevated volatility during the period, in response to uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal and trade policy under the Trump administration, and the impacts to the economy, inflation and federal debt sustainability. |

| • | While credit fundamentals remained strong, unprecedented supply pressure weighed on the municipal market during the reporting period. Demand for municipal debt increased during the reporting period but was less robust when compared to the elevated level of supply. |

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. During the reporting period, the Fund continued to emphasize a long-term view of investing in longer-duration and lower-rated bonds, which offered incrementally higher yields to support the Fund’s income earnings capability. |

| • | The portfolio management team took advantage of periods of market stress to buy bonds at attractive valuations and continued to carefully manage the Fund’s income sustainability via tactical trading. |

| • | Overall credit ratings positioning. |

| • | Underweight to tobacco bonds. |

| • | Overall duration positioning, especially an overweight to bonds with durations greater than 12.0 years. |

| • | Overweights to BB‑rated bonds. |

| • | Overweight to the health care sector. |

| 6 |

| • | Municipal bond yields rose across longer maturities and fell across shorter maturities, steepening the municipal yield curve over the reporting period. Yields saw elevated volatility during the period, in response to uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal and trade policy under the Trump administration, and the impacts to the economy, inflation and federal debt sustainability. |

| • | While credit fundamentals remained strong, unprecedented supply pressure weighed on the municipal market during the reporting period. Demand for municipal debt increased during the reporting period but was less robust when compared to the elevated level of supply. |

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. During the reporting period, the Fund continued to emphasize a long-term view of investing in longer-duration and lower-rated bonds, which offered incrementally higher yields to support the Fund’s income earnings capability. |

| • | The portfolio management team took advantage of periods of market stress to buy bonds at attractive valuations and continued to carefully manage the Fund’s income sustainability via tactical trading. |

| • | Overall credit ratings positioning. |

| • | Overall sector positioning. |

| • | The Fund’s use of leverage through inverse floating rate securities and the issuance of preferred shares. |

| • | Overall duration positioning, especially an overweight to bonds with durations greater than 12.0 years. |

| • | Overweight to below-investment-grade bonds. |

| • | Overweight to the health care sector. |

| • | Municipal bond yields rose across longer maturities and fell across shorter maturities, steepening the municipal yield curve over the reporting period. Yields saw elevated volatility during the period, in response to uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal and trade policy under the Trump administration, and the impacts to the economy, inflation and federal debt sustainability. |

| • | While credit fundamentals remained strong, unprecedented supply pressure weighed on the municipal market during the reporting period. Demand for municipal debt increased during the reporting period but was less robust when compared to the elevated level of supply. |

| 7 |

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. During the reporting period, the Fund continued to emphasize a long-term view of investing in longer-duration and lower-rated bonds, which offered incrementally higher yields to support the Fund’s income earnings capability. |

| • | The portfolio management team took advantage of periods of market stress to buy bonds at attractive valuations and continued to carefully manage the Fund’s income sustainability via tactical trading. |

| • | Credit quality positioning, particularly an overweight to non‑rated bonds. |

| • | Sector allocations, driven by an overweight to local tax‑supported debt and underweights to the New Jersey tax‑ supported debt and higher education sectors. |

| • | Duration and yield curve positioning, driven by an overweight to long-term maturities, especially to 12 years and longer duration structures and an underweight to zero- to four-year duration structures. |

| • | Security selection. |

| • | The Fund’s use of leverage through inverse floating rate securities and the issuance of preferred shares detracted from relative performance during the reporting period. |

| • | Municipal bond yields rose across longer maturities and fell across shorter maturities, steepening the municipal yield curve over the reporting period. Yields saw elevated volatility during the period, in response to uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal and trade policy under the Trump administration, and the impacts to the economy, inflation and federal debt sustainability. |

| • | While credit fundamentals remained strong, unprecedented supply pressure weighed on the municipal market during the reporting period. Demand for municipal debt increased during the reporting period but was less robust when compared to the elevated level of supply. |

| 8 |

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. During the reporting period, the Fund continued to emphasize a long-term view of investing in longer-duration and lower-rated bonds, which offered incrementally higher yields to support the Fund’s income earnings capability. |

| • | The portfolio management team took advantage of periods of market stress to buy bonds at attractive valuations and continued to carefully manage the Fund’s income sustainability via tactical trading. |

| • | Underweight to dedicated tax bonds. |

| • | Underweight to tobacco bonds. |

| • | The Fund’s use of leverage through inverse floating rate securities and the issuance of preferred shares. |

| • | Overall duration positioning, especially an overweight to bonds with durations greater than 12.0 years. |

| • | Overall credit ratings positioning, especially an overweight to non‑rated bonds. |

| • | Overweights to the health care and multi-family housing sectors. |

| • | Municipal bond yields rose across longer maturities and fell across shorter maturities, steepening the municipal yield curve over the reporting period. Yields saw elevated volatility during the period, in response to uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal and trade policy under the Trump administration, and the impacts to the economy, inflation and federal debt sustainability. |

| • | While credit fundamentals remained strong, unprecedented supply pressure weighed on the municipal market during the reporting period. Demand for municipal debt increased during the reporting period but was less robust when compared to the elevated level of supply. |

| 9 |

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. During the reporting period, the Fund continued to emphasize a long-term view of investing in longer-duration and lower-rated bonds, which offered incrementally higher yields to support the Fund’s income earnings capability. |

| • | The portfolio management team took advantage of periods of market stress to buy bonds at attractive valuations and continued to carefully manage the Fund’s income sustainability via tactical trading. |

| • | Underweight to dedicated tax bonds. |

| • | Underweight to tobacco bonds. |

| • | Overall duration positioning, especially an overweight to bonds with durations greater than 12.0 years. |

| • | Overall credit ratings positioning, especially an overweight to non‑rated bonds. |

| • | Overall sector positioning. |

| • | Municipal bond yields rose across longer maturities and fell across shorter maturities, steepening the municipal yield curve over the reporting period. Yields saw elevated volatility during the period, in response to uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal and trade policy under the Trump administration, and the impacts to the economy, inflation and federal debt sustainability. |

| • | While credit fundamentals remained strong, unprecedented supply pressure weighed on the municipal market during the reporting period. Demand for municipal debt increased during the reporting period but was less robust when compared to the elevated level of supply. |

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. During the reporting period, the Fund continued to emphasize a long-term view of investing in longer-duration and lower-rated bonds, which offered incrementally higher yields to support the Fund’s income earnings capability. |

| 10 |

| • | The portfolio management team took advantage of periods of market stress to buy bonds at attractive valuations and continued to carefully manage the Fund’s income sustainability via tactical trading. |

| • | Underweight to dedicated tax bonds. |

| • | Underweight to tobacco bonds. |

| • | The Fund’s use of leverage through inverse floating rate securities and the issuance of preferred shares. |

| • | Overall duration positioning, especially an overweight to bonds with durations greater than 12.0 years. |

| • | Overall credit ratings positioning, especially an overweight to non‑rated bonds. |

| • | Overweights to the health care and higher ed sectors. |

| • | Municipal bond yields rose across longer maturities and fell across shorter maturities, steepening the municipal yield curve over the reporting period. Yields saw elevated volatility during the period, in response to uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal and trade policy under the Trump administration, and the impacts to the economy, inflation and federal debt sustainability. |

| • | While credit fundamentals remained strong, unprecedented supply pressure weighed on the municipal market during the reporting period. Demand for municipal debt increased during the reporting period but was less robust when compared to the elevated level of supply |

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. During the reporting period, the Fund continued to emphasize a long-term view of investing in longer-duration and lower-rated bonds, which offered incrementally higher yields to support the Fund’s income earnings capability. |

| • | The portfolio management team took advantage of periods of market stress to buy bonds at attractive valuations and continued to carefully manage the Fund’s income sustainability via tactical trading. |

| 11 |

| • | Credit quality positioning, driven by an overweight to non‑rated bonds. |

| • | An overweight to the single-family housing bond sector. |

| • | Duration and yield curve positioning, including an overweight to 10‑years and longer duration structures and an underweight in zero‑ to six‑year duration structures. |

| • | The Fund’s use of leverage through inverse floating rate securities and the issuance of preferred shares. |

| • | The Fund’s use of total return swaps for hedging purposes. |

| 12 |

| Per Common Share Amounts | ||||||||||||||||||||||||

| Monthly Distributions (Ex‑Dividend Date) | NAZ | NKX | NCA | NAC | NXJ | |||||||||||||||||||

| September |

$0.0725 | $0.0760 | $0.0290 | $0.0735 | $0.0785 | |||||||||||||||||||

| October |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| November |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| December |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| January |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| February |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| March |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| April |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| May |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| June |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| July |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| August |

0.0725 | 0.0760 | 0.0290 | 0.0735 | 0.0785 | |||||||||||||||||||

| Total Distributions from Net Investment Income |

$0.8700 | $0.9120 | $0.3480 | $0.8820 | $0.9420 | |||||||||||||||||||

| Per Common Share Amounts | ||||||||||||||||||||||||

| Monthly Distributions (Ex‑Dividend Date) | NRK | NNY | NAN | NQP | ||||||||||||||||||||

| September |

$0.0690 | $0.0295 | $0.0720 | $0.0780 | ||||||||||||||||||||

| October |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| November |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| December |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| January |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| February |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| March |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| April |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| May |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| June |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| July |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| August |

0.0690 | 0.0295 | 0.0720 | 0.0780 | ||||||||||||||||||||

| Total Distributions from Net Investment Income |

$0.8280 | $0.3540 | $0.8640 | $0.9360 | ||||||||||||||||||||

| Yields | NAZ | NKX | NCA | NAC | NXJ | NRK | ||||||||||||||||||

| Market Yield1 |

7.34% | 7.72% | 4.08% | 7.85% | 8.25% | 8.71% | ||||||||||||||||||

| Taxable-Equivalent Yield1 |

12.94% | 16.81% | 8.90% | 17.11% | 17.04% | 18.03% | ||||||||||||||||||

| Yields | NNY | NAN | NQP | |||||||||||||||||||||

| Market Yield1 |

4.38% | 7.88% | 8.54% | |||||||||||||||||||||

| Taxable-Equivalent Yield1 |

9.06% | 16.31% | 15.22% | |||||||||||||||||||||

| 1 | Market Yield is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after‑tax basis. It is based on a combined federal and state income tax rate of 43.3%, 54.1%, 54.1%, 54.1%, 51.6%, 51.7%,51.7%, 51.7% and 43.9% for NAZ, NKX, NCA, NAC, NXJ, NRK, NNY, NAN and NQP, respectively. Your actual combined federal and state income tax rate may differ from the assumed rate. The Taxable-Equivalent Yield also takes into account the percentage of the Fund’s income generated and paid by the Fund (based on payments made during the previous calendar year) that was either exempt from federal income tax but not from state income tax (e.g., income from an out‑of‑state municipal bond), or was exempt from neither federal nor state income tax. Separately, if the comparison were instead to investments that generate qualified dividend income, which is taxable at a rate lower than an individual’s ordinary graduated tax rate, the fund’s Taxable-Equivalent Yield would be lower. |

| NAZ | NKX | NAC | NAN | |||||||||||||

| Maximum aggregate offering |

1,200,000 | 4,800,000 | 14,500,000 | 3,100,000 | ||||||||||||

| NAZ | NKX | NAC | NAN | |||||||||||||

| Common shares sold through shelf offering |

490,326 | 2,040,416 | 1,006,029 | 166,880 | ||||||||||||

| Weighted average premium to NAV per common share sold |

4.97% | 1.51% | 1.41% | 0.87% | ||||||||||||

| NAZ | NKX | NCA | NAC | NXJ | ||||||||||||||||

| Common shares cumulatively repurchased and retired |

133,000 | 230,000 | - | 383,000 | 1,960,343 | |||||||||||||||

| Common shares authorized for repurchase |

1,155,000 | 4,775,000 | 3,310,000 | 14,470,000 | 4,120,000 | |||||||||||||||

| NRK | NNY | NAN | NQP | |||||||||||||||||

| Common shares cumulatively repurchased and retired |

390,000 | - | 292,714 | 900,440 | ||||||||||||||||

| Common shares authorized for repurchase |

8,720,000 | 1,885,000 | 3,080,000 | 3,720,000 | ||||||||||||||||

| 14 |

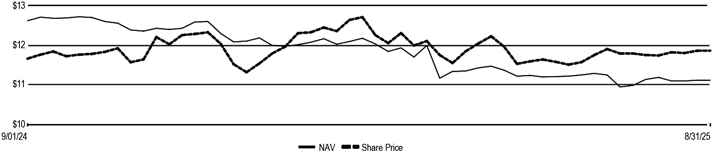

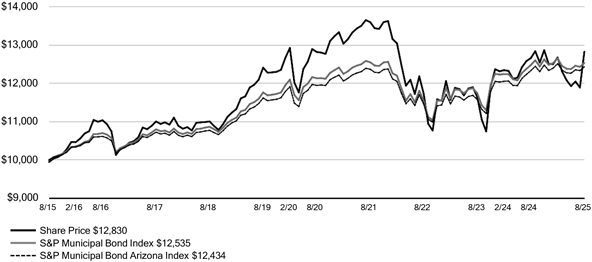

| NAZ | Nuveen Arizona Quality Municipal Income Fund Fund Performance, Leverage and Holdings Summaries August 31, 2025 |

| Total Returns as of August 31, 2025 |

||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

| NAZ at Common Share NAV |

11/19/92 | (5.10)% | (1.48)% | 1.71% | ||||||||||||

| NAZ at Common Share Price |

11/19/92 | 9.53% | 0.78% | 2.52% | ||||||||||||

| S&P Municipal Bond Index |

– | 0.44% | 0.65% | 2.28% | ||||||||||||

| S&P Municipal Bond Arizona Index |

– | 0.81% | 0.80% | 2.20% | ||||||||||||

| Common Share NAV |

Common Share Price |

Premium/(Discount) to NAV |

Average Premium/(Discount) to NAV |

|||||||||

| $11.12 |

$11.86 | 6.65% | 0.70% | |||||||||

| Leverage | ||||

| Effective Leverage |

39.62% | |||

| Regulatory Leverage |

39.62% | |||

| Fund Allocation | ||||

| (% of net assets) | ||||

| Municipal Bonds |

162.0% | |||

| Other Assets & Liabilities, Net |

3.6% | |||

| AMTP Shares, Net |

(65.6)% | |||

| Net Assets |

100% | |||

| Portfolio Credit Quality | ||||

| (% of total investments) | ||||

| AAA |

9.1% | |||

| AA |

55.7% | |||

| A |

14.8% | |||

| BBB |

3.6% | |||

| BB or Lower |

5.0% | |||

| N/R (not rated) |

11.8% | |||

| Total |

100% | |||

| Portfolio Composition1 | ||||

| (% of total investments) | ||||

| Tax Obligation/Limited |

23.7% | |||

| Utilities |

20.4% | |||

| Education and Civic Organizations |

19.0% | |||

| Tax Obligation/General |

13.4% | |||

| Health Care |

12.3% | |||

| Transportation |

4.2% | |||

| Housing/Single Family |

2.4% | |||

| Long-Term Care |

2.2% | |||

| Other |

2.4% | |||

| Total |

100% | |||

| States and Territories2 | ||||

| (% of total municipal bonds) | ||||

| Arizona |

94.4% | |||

| Puerto Rico |

3.9% | |||

| Guam |

1.4% | |||

| Virgin Islands |

0.3% | |||

| Total |

100% | |||

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | The Fund may invest up to 20% of its net assets in municipal bonds that are exempt from regular federal income tax, but not from Arizona personal income tax if, in the judgement of the Fund’s sub‑adviser, such purchases are expected to enhance the Fund’s after‑tax total return potential. |

| 18 |

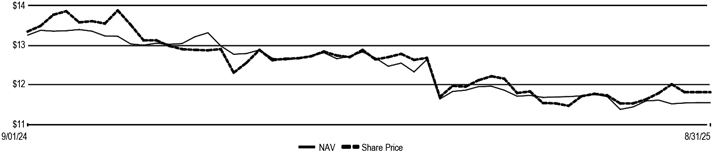

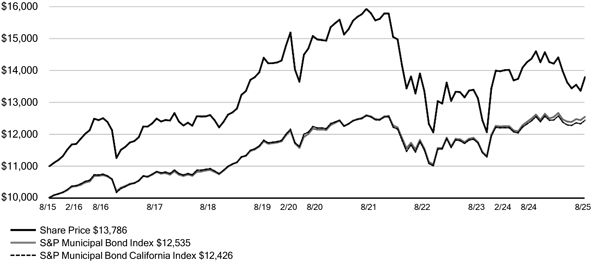

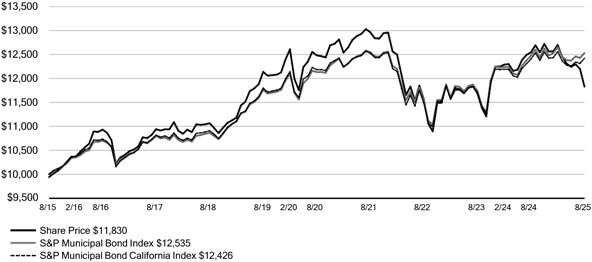

| NKX | Nuveen California AMT‑Free Quality Municipal Income Fund Fund Performance, Leverage and Holdings Summaries August 31, 2025 |

| Total Returns as of August 31, 2025 |

||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

| NKX at Common Share NAV |

11/21/02 | (6.12)% | (2.35)% | 1.76% | ||||||||||||

| NKX at Common Share Price |

11/21/02 | (4.64)% | (0.07)% | 3.26% | ||||||||||||

| S&P Municipal Bond Index |

– | 0.44% | 0.65% | 2.28% | ||||||||||||

| S&P Municipal Bond California Index |

– | 0.15% | 0.39% | 2.20% | ||||||||||||

| Common Share NAV |

Common Share Price |

Premium/(Discount) to NAV |

Average Premium/(Discount) to NAV |

|||||||||

| $11.56 |

$11.82 | 2.25% | 0.71% | |||||||||

| Leverage | ||||

| Effective Leverage |

42.84% | |||

| Regulatory Leverage |

40.87% | |||

| Fund Allocation | ||||

| (% of net assets) | ||||

| Municipal Bonds |

172.4% | |||

| Short-Term Municipal Bonds |

2.8% | |||

| Other Assets & Liabilities, Net |

(0.5)% | |||

| Floating Rate Obligations |

(5.8)% | |||

| MFP Shares, Net |

(24.4)% | |||

| VRDP Shares, Net |

(44.5)% | |||

| Net Assets |

100% | |||

| Portfolio Credit Quality | ||||

| (% of total investments) | ||||

| AAA |

6.7% | |||

| AA |

42.1% | |||

| A |

17.7% | |||

| BBB |

9.0% | |||

| BB or Lower |

4.4% | |||

| N/R (not rated) |

20.1% | |||

| Total |

100% | |||

| Portfolio Composition1 | ||||

| (% of total investments) | ||||

| Tax Obligation/General |

23.0% | |||

| Health Care |

18.6% | |||

| Utilities |

15.9% | |||

| Tax Obligation/Limited |

12.3% | |||

| Housing/Multifamily |

10.3% | |||

| Transportation |

9.5% | |||

| Education and Civic Organizations |

6.8% | |||

| U.S. Guaranteed |

2.5% | |||

| Other |

1.1% | |||

| Total |

100% | |||

| States and Territories2 | ||||

| (% of total municipal bonds) | ||||

| California |

92.7% | |||

| Puerto Rico |

5.6% | |||

| Guam |

1.2% | |||

| Virgin Islands |

0.4% | |||

| New York |

0.1% | |||

| Total |

100% | |||

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | The Fund may invest up to 20% of its net assets in municipal bonds that are exempt from regular federal income tax, but not from California personal income tax if, in the judgement of the Fund’s sub‑adviser, such purchases are expected to enhance the Fund’s after‑tax total return potential. |

| 20 |

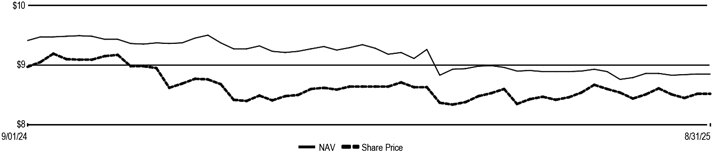

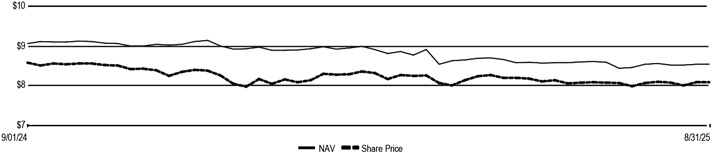

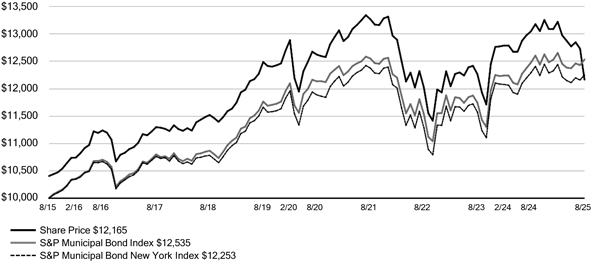

| NCA | Nuveen California Municipal Value Fund Fund Performance, Leverage and Holdings Summaries August 31, 2025 |

| Total Returns as of August 31, 2025 |

||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

| NCA at Common Share NAV |

10/07/87 | (2.31)% | (0.51)% | 2.00% | ||||||||||||

| NCA at Common Share Price |

10/07/87 | (1.12)% | (0.72)% | 1.69% | ||||||||||||

| S&P Municipal Bond Index |

– | 0.44% | 0.65% | 2.28% | ||||||||||||

| S&P Municipal Bond California Index |

– | 0.15% | 0.39% | 2.20% | ||||||||||||

| Common Share NAV |

Common Share Price |

Premium/(Discount) to NAV |

Average Premium/(Discount) to NAV |

|||||||||

| $8.85 |

$8.52 | (3.73)% | (5.54)% | |||||||||

| Leverage | ||||

| Effective Leverage |

0.00% | |||

| Regulatory Leverage |

0.00% | |||

| Fund Allocation | ||||

| (% of net assets) | ||||

| Municipal Bonds |

94.8% | |||

| Variable Rate Demand Preferred Shares |

0.8% | |||

| Short-Term Municipal Bonds |

3.4% | |||

| Other Assets & Liabilities, Net |

1.0% | |||

| Net Assets |

100% | |||

| Portfolio Credit Quality | ||||

| (% of total investments) | ||||

| AAA |

8.1% | |||

| AA |

57.8% | |||

| A |

13.3% | |||

| BBB |

4.8% | |||

| BB or Lower |

2.7% | |||

| N/R (not rated) |

13.3% | |||

| Total |

100% | |||

| Portfolio Composition1 | ||||

| (% of total investments) | ||||

| Tax Obligation/General |

27.4% | |||

| Transportation |

18.7% | |||

| Utilities |

17.7% | |||

| Health Care |

11.4% | |||

| Housing/Multifamily |

9.3% | |||

| Tax Obligation/Limited |

9.2% | |||

| Education and Civic Organizations |

3.3% | |||

| Other |

3.0% | |||

| Total |

100% | |||

| States and Territories2 | ||||

| (% of total municipal bonds) | ||||

| California |

97.0% | |||

| Puerto Rico |

3.0% | |||

| Total |

100% | |||

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | The Fund may invest up to 20% of its net assets in municipal bonds that are exempt from regular federal income tax, but not from California personal income tax if, in the judgement of the Fund’s sub‑adviser, such purchases are expected to enhance the Fund’s after‑tax total return potential. |

| 22 |

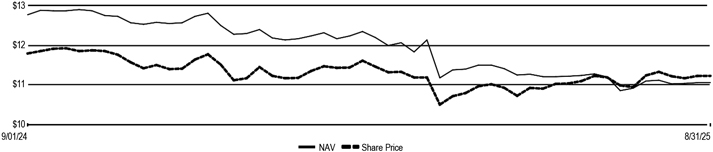

| NAC | Nuveen California Quality Municipal Income Fund Fund Performance, Leverage and Holdings Summaries August 31, 2025 |

| Total Returns as of August 31, 2025 |

||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

| NAC at Common Share NAV |

5/26/99 | (6.68)% | (2.56)% | 1.42% | ||||||||||||

| NAC at Common Share Price |

5/26/99 | 2.96% | 0.03% | 2.73% | ||||||||||||

| S&P Municipal Bond Index |

– | 0.44% | 0.65% | 2.28% | ||||||||||||

| S&P Municipal Bond California Index |

– | 0.15% | 0.39% | 2.20% | ||||||||||||

| Common Share NAV |

Common Share Price |

Premium/(Discount) to NAV |

Average Premium/(Discount) to NAV |

|||||||||

| $11.06 |

$11.23 | 1.54% | (5.26)% | |||||||||

| Leverage | ||||

| Effective Leverage |

42.87% | |||

| Regulatory Leverage |

41.96% | |||

| Fund Allocation | ||||

| (% of net assets) | ||||

| Municipal Bonds |

172.7% | |||

| Short-Term Municipal Bonds |

1.5% | |||

| Other Assets & Liabilities, Net |

0.7% | |||

| Floating Rate Obligations |

(2.8)% | |||

| MFP Shares, Net |

(15.9)% | |||

| VRDP Shares, Net |

(56.2)% | |||

| Net Assets |

100% | |||

| Portfolio Credit Quality | ||||

| (% of total investments) | ||||

| AAA |

4.4% | |||

| AA |

47.7% | |||

| A |

18.8% | |||

| BBB |

7.1% | |||

| BB or Lower |

4.6% | |||

| N/R (not rated) |

17.4% | |||

| Total |

100% | |||

| Portfolio Composition1 | ||||

| (% of total investments) | ||||

| Tax Obligation/General |

18.0% | |||

| Utilities |

17.8% | |||

| Health Care |

17.4% | |||

| Transportation |

16.7% | |||

| Housing/Multifamily |

10.9% | |||

| Tax Obligation/Limited |

9.4% | |||

| Education and Civic Organizations |

6.7% | |||

| Other |

3.1% | |||

| Total |

100% | |||

| States and Territories2 | ||||

| (% of total municipal bonds) | ||||

| California |

95.1% | |||

| Puerto Rico |

4.1% | |||

| Guam |

0.7% | |||

| Virgin Islands |

0.1% | |||

| Total |

100% | |||

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | The Fund may invest up to 20% of its net assets in municipal bonds that are exempt from regular federal income tax, but not from California personal income tax if, in the judgement of the Fund’s sub‑adviser, such purchases are expected to enhance the Fund’s after‑tax total return potential. |

| 24 |

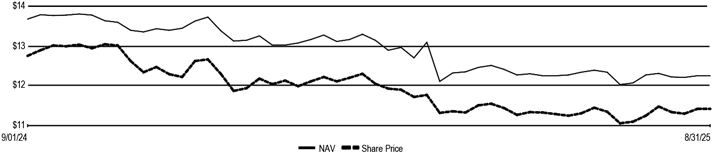

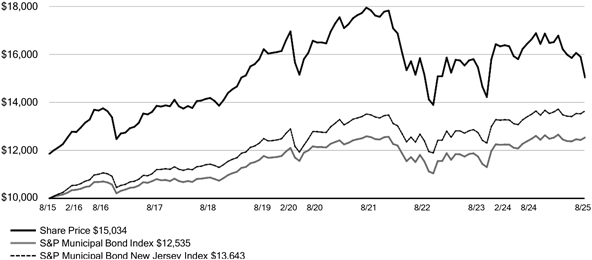

| NXJ | Nuveen New Jersey Quality Municipal Income Fund Fund Performance, Leverage and Holdings Summaries August 31, 2025 |

| Total Returns as of August 31, 2025 |

||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

| NXJ at Common Share NAV |

3/27/01 | (3.62)% | (0.99)% | 2.50% | ||||||||||||

| NXJ at Common Share Price |

3/27/01 | (3.08)% | 1.54% | 4.16% | ||||||||||||

| S&P Municipal Bond Index |

– | 0.44% | 0.65% | 2.28% | ||||||||||||

| S&P Municipal Bond New Jersey Index |

– | 1.04% | 1.32% | 3.16% | ||||||||||||

| Common Share NAV |

Common Share Price |

Premium/(Discount) to NAV |

Average Premium/(Discount) to NAV |

|||||||||

| $12.25 |

$11.42 | (6.78)% | (7.51)% | |||||||||

| Leverage | ||||

| Effective Leverage |

42.78% | |||

| Regulatory Leverage |

38.32% | |||

| Fund Allocation | ||||

| (% of net assets) | ||||

| Municipal Bonds |

173.0% | |||

| Short-Term Municipal Bonds |

0.4% | |||

| Other Assets & Liabilities, Net |

1.1% | |||

| Floating Rate Obligations |

(12.6)% | |||

| VRDP Shares, Net |

(61.9)% | |||

| Net Assets |

100% | |||

| Portfolio Credit Quality | ||||

| (% of total investments) | ||||

| AAA |

8.2% | |||

| AA |

53.2% | |||

| A |

21.8% | |||

| BBB |

8.9% | |||

| BB or Lower |

3.2% | |||

| N/R (not rated) |

4.7% | |||

| Total |

100% | |||

| Portfolio Composition1 | ||||

| (% of total investments) | ||||

| Tax Obligation/Limited |

29.1% | |||

| Transportation |

18.7% | |||

| Tax Obligation/General |

11.8% | |||

| Education and Civic Organizations |

11.8% | |||

| Health Care |

8.3% | |||

| Housing/Single Family |

7.5% | |||

| Housing/Multifamily |

4.4% | |||

| Utilities |

3.5% | |||

| Consumer Staples |

3.1% | |||

| Other |

1.8% | |||

| Total |

100% | |||

| States and Territories2 | ||||

| (% of total municipal bonds) | ||||

| New Jersey |

91.1% | |||

| New York |

4.1% | |||

| Pennsylvania |

2.8% | |||

| Puerto Rico |

1.5% | |||

| Delaware |

0.4% | |||

| Guam |

0.1% | |||

| Total |

100% | |||

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | The Fund may invest up to 20% of its net assets in municipal bonds that are exempt from regular federal income tax, but not from New Jersey personal income tax if, in the judgement of the Fund’s sub‑adviser, such purchases are expected to enhance the Fund’s after‑tax total return potential. |

| 26 |

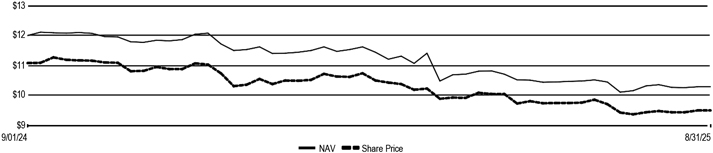

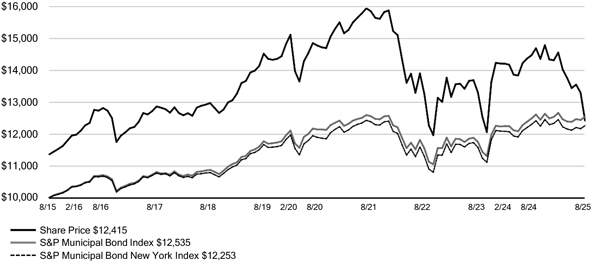

| NRK | Nuveen New York AMT‑Free Quality Municipal Income Fund Fund Performance, Leverage and Holdings Summaries August 31, 2025 |

| Total Returns as of August 31, 2025 |

||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

| NRK at Common Share NAV |

11/21/02 | (7.66)% | (2.37)% | 1.20% | ||||||||||||

| NRK at Common Share Price |

11/21/02 | (7.08)% | (1.06)% | 2.19% | ||||||||||||

| S&P Municipal Bond Index |

– | 0.44% | 0.65% | 2.28% | ||||||||||||

| S&P Municipal Bond New York Index |

– | (0.33)% | 0.61% | 2.05% | ||||||||||||

| Common Share NAV |

Common Share Price |

Premium/(Discount) to NAV |

Average Premium/(Discount) to NAV |

|||||||||

| $10.30 |

$9.51 | (7.67)% | (7.72)% | |||||||||

| Leverage | ||||

| Effective Leverage |

42.97% | |||

| Regulatory Leverage |

42.48% | |||

| Fund Allocation | ||||

| (% of net assets) | ||||

| Municipal Bonds |

170.4% | |||

| Short-Term Municipal Bonds |

3.1% | |||

| Other Assets & Liabilities, Net |

1.7% | |||

| Floating Rate Obligations |

(1.5)% | |||

| MFP Shares, Net |

(8.9)% | |||

| VRDP Shares, Net |

(64.8)% | |||

| Net Assets |

100% | |||

| Portfolio Credit Quality | ||||

| (% of total investments) | ||||

| AAA |

8.6% | |||

| AA |

49.7% | |||

| A |

13.7% | |||

| BBB |

8.0% | |||

| BB or Lower |

8.1% | |||

| N/R (not rated) |

11.9% | |||

| Total |

100% | |||

| Portfolio Composition1 | ||||

| (% of total investments) | ||||

| Tax Obligation/Limited |

28.6% | |||

| Health Care |

17.1% | |||

| Education and Civic Organizations |

14.1% | |||

| Utilities |

13.9% | |||

| Transportation |

11.5% | |||

| Tax Obligation/General |

4.8% | |||

| Consumer Staples |

4.6% | |||

| Industrials |

2.1% | |||

| Other |

3.3% | |||

| Total |

100% | |||

| States and Territories2 | ||||

| (% of total municipal bonds) | ||||

| New York |

93.7% | |||

| Puerto Rico |

5.6% | |||

| Guam |

0.7% | |||

| Total |

100% | |||

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | The Fund may invest up to 20% of its net assets in municipal bonds that are exempt from regular federal income tax, but not from New York personal income tax if, in the judgement of the Fund’s sub‑adviser, such purchases are expected to enhance the Fund’s after‑tax total return potential. |

| 28 |

| NNY | Nuveen New York Municipal Value Fund Fund Performance, Leverage and Holdings Summaries August 31, 2025 |

| Total Returns as of August 31, 2025 |

||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

| NNY at Common Share NAV |

10/07/87 | (1.89)% | 0.15% | 1.99% | ||||||||||||

| NNY at Common Share Price |

10/07/87 | (1.58)% | (1.28)% | 1.98% | ||||||||||||

| S&P Municipal Bond Index |

– | 0.44% | 0.65% | 2.28% | ||||||||||||

| S&P Municipal Bond New York Index |

– | (0.33)% | 0.61% | 2.05% | ||||||||||||

| Common Share NAV |

Common Share Price |

Premium/(Discount) to NAV |

Average Premium/(Discount) to NAV |

|||||||||

| $8.54 |

$8.09 | (5.27)% | (6.65)% | |||||||||

| Leverage | ||||

| Effective Leverage |

0.00% | |||

| Regulatory Leverage |

0.00% | |||

| Fund Allocation | ||||

| (% of net assets) | ||||

| Municipal Bonds |

97.8% | |||

| Short-Term Municipal Bonds |

2.2% | |||

| Other Assets & Liabilities, Net |

0.0% | |||

| Net Assets |

100% | |||

| Portfolio Credit Quality | ||||

| (% of total investments) | ||||

| AAA |

8.5% | |||

| AA |

41.1% | |||

| A |

12.8% | |||

| BBB |

18.7% | |||

| BB or Lower |

10.1% | |||

| N/R (not rated) |

8.8% | |||

| Total |

100% | |||

| Portfolio Composition1 | ||||

| (% of total investments) | ||||

| Transportation |

22.2% | |||

| Tax Obligation/Limited |

16.8% | |||

| Utilities |

15.2% | |||

| Health Care |

14.7% | |||

| Education and Civic Organizations |

13.2% | |||

| Tax Obligation/General |

9.6% | |||

| Industrials |

4.1% | |||

| Consumer Staples |

2.9% | |||

| Other |

1.3% | |||

| Total |

100% | |||

| States and Territories2 | ||||

| (% of total municipal bonds) | ||||

| New York |

95.0% | |||

| Puerto Rico |

3.4% | |||

| Guam |

1.6% | |||

| Total |

100% | |||

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | The Fund may invest up to 20% of its net assets in municipal bonds that are exempt from regular federal income tax, but not from New York personal income tax if, in the judgement of the Fund’s sub‑adviser, such purchases are expected to enhance the Fund’s after‑tax total return potential. |

| 30 |

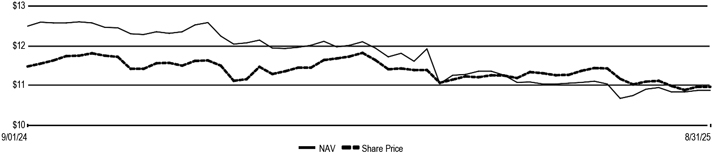

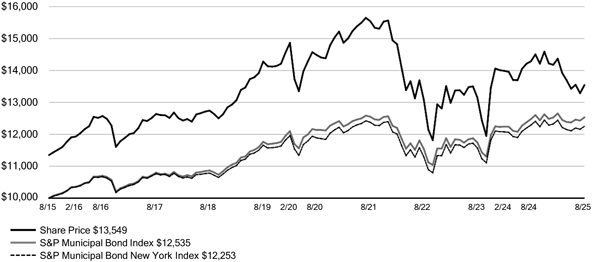

| NAN | Nuveen New York Quality Municipal Income Fund Fund Performance, Leverage and Holdings Summaries August 31, 2025 |

| Total Returns as of August 31, 2025 |

||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

| NAN at Common Share NAV |

5/26/99 | (6.24)% | (1.92)% | 1.27% | ||||||||||||

| NAN at Common Share Price |

5/26/99 | 3.08% | 0.91% | 3.08% | ||||||||||||

| S&P Municipal Bond Index |

– | 0.44% | 0.65% | 2.28% | ||||||||||||

| S&P Municipal Bond New York Index |

– | (0.33)% | 0.61% | 2.05% | ||||||||||||

| Common Share NAV |

Common Share Price |

Premium/(Discount) to NAV |

Average Premium/(Discount) to NAV |

|||||||||

| $10.88 |

$10.97 | 0.83% | (2.69)% | |||||||||

| Leverage | ||||

| Effective Leverage |

42.03% | |||

| Regulatory Leverage |

39.01% | |||

| Fund Allocation | ||||

| (% of net assets) | ||||

| Municipal Bonds |

170.8% | |||

| Other Assets & Liabilities, Net |

1.5% | |||

| Floating Rate Obligations |

(8.5)% | |||

| AMTP Shares, Net |

(37.6)% | |||

| VRDP Shares, Net |

(26.2)% | |||

| Net Assets |

100% | |||

| Portfolio Credit Quality | ||||

| (% of total investments) | ||||

| AAA |

12.2% | |||

| AA |

37.9% | |||

| A |

11.5% | |||

| BBB |

17.7% | |||

| BB or Lower |

10.1% | |||

| N/R (not rated) |

10.6% | |||

| Total |

100% | |||

| States and Territories2 | ||||

| (% of total municipal bonds) | ||||

| New York |

93.9% | |||

| Puerto Rico |

5.0% | |||

| Guam |

1.1% | |||

| Total |

100% | |||

| Portfolio Composition1 | ||||

| (% of total investments) | ||||

| Tax Obligation/Limited |

30.2% | |||

| Transportation |

28.0% | |||

| Health Care |

15.4% | |||

| Education and Civic Organizations |

6.8% | |||

| Utilities |

6.0% | |||

| Consumer Staples |

3.7% | |||

| Industrials |

3.4% | |||

| Tax Obligation/General |

3.2% | |||

| Financials |

2.3% | |||

| Other |

1.0% | |||

| Total |

100% | |||

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | The Fund may invest up to 20% of its net assets in municipal bonds that are exempt from regular federal income tax, but not from New York personal income tax if, in the judgement of the Fund’s sub‑adviser, such purchases are expected to enhance the Fund’s after‑tax total return potential. |

| 32 |

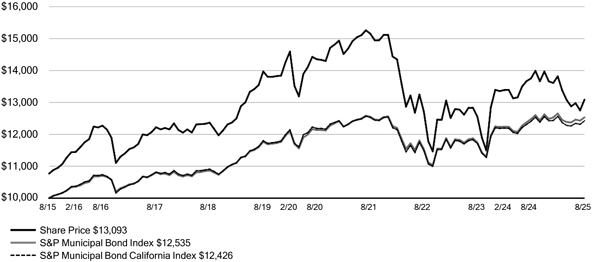

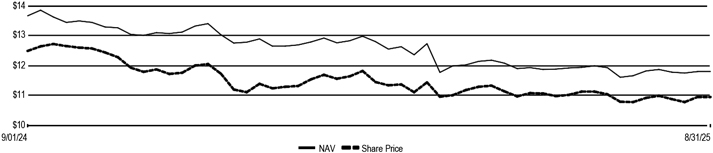

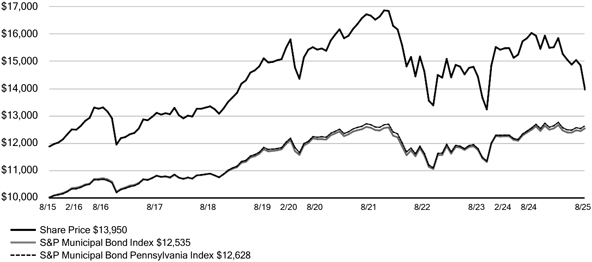

| NQP | Nuveen Pennsylvania Quality Municipal Income Fund Fund Performance, Leverage and Holdings Summaries August 31, 2025 |

| Total Returns as of August 31, 2025 |

||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

| NQP at Common Share NAV |

2/21/91 | (6.93)% | (1.04)% | 1.82% | ||||||||||||

| NQP at Common Share Price |

2/21/91 | (4.89)% | 0.66% | 3.38% | ||||||||||||

| S&P Municipal Bond Index |

– | 0.44% | 0.65% | 2.28% | ||||||||||||

| S&P Municipal Bond Pennsylvania Index |

– | 0.65% | 0.68% | 2.36% | ||||||||||||

| Common Share NAV |

Common Share Price |

Premium/(Discount) to NAV |

Average Premium/(Discount) to NAV |

|||||||||

| $11.81 |

$10.96 | (7.20)% | (8.60)% | |||||||||

| Leverage | ||||

| Effective Leverage |

42.46% | |||

| Regulatory Leverage |

33.10% | |||

| Fund Allocation | ||||

| (% of net assets) | ||||

| Municipal Bonds |

168.4% | |||

| Variable Rate Senior Loan Interests |

0.0% | |||

| Other Assets & Liabilities, Net |

5.2% | |||

| Floating Rate Obligations |

(24.3)% | |||

| VRDP Shares, Net |

(49.3)% | |||

| Net Assets |

100% | |||

| Portfolio Credit Quality | ||||

| (% of total investments) | ||||

| AAA |

0.5% | |||

| AA |

60.8% | |||

| A |

18.2% | |||

| BBB |

9.0% | |||

| BB or Lower |

2.2% | |||

| N/R (not rated) |

9.3% | |||

| Total |

100% | |||

| States and Territories2 | ||||

| (% of total municipal bonds) | ||||

| Pennsylvania |

98.4% | |||

| Puerto Rico |

0.9% | |||

| New Jersey |

0.7% | |||

| Total |

100% | |||

| Portfolio Composition1 | ||||

| (% of total investments) | ||||

| Health Care |

15.9% | |||

| Tax Obligation/General |

15.3% | |||

| Housing/Single Family |

14.8% | |||

| Utilities |

12.9% | |||

| Education and Civic Organizations |

12.4% | |||

| Transportation |

11.1% | |||

| Tax Obligation/Limited |

7.3% | |||

| Long-Term Care |

5.6% | |||

| U.S. Guaranteed |

2.5% | |||

| Other |

2.2% | |||

| Variable Rate Senior Loan Interests |

0.0% | |||

| Total |

100% | |||

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | The Fund may invest up to 20% of its net assets in municipal bonds that are exempt from regular federal income tax, but not from Pennsylvania personal income tax if, in the judgement of the Fund’s sub‑adviser, such purchases are expected to enhance the Fund’s after‑tax total return potential. |

| 34 |

| (1) | Statement of operations, statement of changes in net assets, statement of cash flows and financial highlights for the year ended August 31, 2025 |

| (2) | Statement of operations, statement of changes in net assets and financial highlights for the year ended August 31, 2025 |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

| |

|

|||||||||||||||||

| LONG-TERM INVESTMENTS - 162.0% (100.0% of Total Investments) | ||||||||||||||||||

| MUNICIPAL BONDS - 162.0% (100.0% of Total Investments) | ||||||||||||||||||

| EDUCATION AND CIVIC ORGANIZATIONS - 30.8% (19.0% of Total Investments) | ||||||||||||||||||

| $ | 2,175,000 | Arizona Board of Regents, Arizona State University System Revenue Bonds, Green Series 2016B | 5.000% | 07/01/47 | $ | 2,157,858 | ||||||||||||

| 2,000,000 | Arizona Board of Regents, Arizona State University System Revenue Bonds, Green Series 2024A | 5.000 | 07/01/50 | 2,029,924 | ||||||||||||||

| 2,030,000 | Arizona Board of Regents, Arizona State University System Revenue Bonds, Series 2020B | 4.000 | 07/01/47 | 1,777,126 | ||||||||||||||

| 425,000 | (a) | Arizona Board of Regents, Arizona State University System Revenue Bonds, Series 2025A | 5.000 | 07/01/45 | 438,270 | |||||||||||||

| 1,000,000 | Arizona Board of Regents, University of Arizona, System Revenue Bonds, Refunding Series 2021A | 5.000 | 06/01/42 | 1,029,258 | ||||||||||||||

| 2,000,000 | Arizona Board of Regents, University of Arizona, System Revenue Bonds, Refunding Series 2025A | 5.000 | 06/01/50 | 2,024,018 | ||||||||||||||

| 515,000 | (b) | Arizona Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Basis Schools, Inc. Projects, Series 2017A | 5.125 | 07/01/37 | 516,169 | |||||||||||||

| 525,000 | Arizona Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Basis Schools, Inc. Projects, Series 2017C | 5.000 | 07/01/47 | 510,825 | ||||||||||||||

| 250,000 | (b) | Arizona Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Basis Schools, Inc. Projects, Series 2017D | 5.000 | 07/01/47 | 229,709 | |||||||||||||

| 1,700,000 | Arizona Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Basis Schools, Inc. Projects, Series 2017F | 5.000 | 07/01/37 | 1,719,261 | ||||||||||||||

| 1,000,000 | Arizona Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Basis Schools, Inc. Projects, Series 2017F | 5.000 | 07/01/52 | 950,674 | ||||||||||||||

| 380,000 | (b) | Arizona Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Basis Schools, Inc. Projects, Series 2017G | 5.000 | 07/01/47 | 349,157 | |||||||||||||

| 240,000 | (b) | Arizona Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Montessori Academy Projects, Refunding Series 2017A | 6.250 | 11/01/50 | 203,226 | |||||||||||||

| 420,000 | (b) | Arizona Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Somerset Academy of Las Vegas - Aliante and Skye Canyon Campus Projects, Series 2021A | 4.000 | 12/15/41 | 348,621 | |||||||||||||

| 375,000 | (b) | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Arizona Agribusiness and Equine Center, Inc. Project, Series 2017B | 5.000 | 03/01/48 | 327,289 | |||||||||||||

| 100,000 | (b) | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Academies of Math & Science Projects, Series 2017B | 4.250 | 07/01/27 | 100,330 | |||||||||||||

| 615,000 | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Academies of Math & Science Projects, Series 2018A | 5.000 | 07/01/38 | 617,519 | ||||||||||||||

| 1,000,000 | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Academies of Math & Science Projects, Series 2018A | 5.000 | 07/01/48 | 931,043 | ||||||||||||||

| 125,000 | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, GreatHearts Arizona Projects, Series 2021A | 5.000 | 07/01/28 | 131,423 | ||||||||||||||

| 125,000 | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, GreatHearts Arizona Projects, Series 2021A | 5.000 | 07/01/29 | 133,169 | ||||||||||||||

| 130,000 | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, GreatHearts Arizona Projects, Series 2021A | 5.000 | 07/01/30 | 139,672 | ||||||||||||||

| 125,000 | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, GreatHearts Arizona Projects, Series 2021A | 5.000 | 07/01/31 | 134,660 | ||||||||||||||

| 455,000 | (b) | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Pinecrest Academy of Nevada’s Horizon, Inspirada and St. Rose Campus Projects, Series 2018A | 5.750 | 07/15/38 | 457,433 | |||||||||||||

| 100,000 | (b) | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Social Bonds Pensar Academy Project, Series 2020 | 4.000 | 07/01/30 | 97,199 | |||||||||||||

| 1,645,000 | Arizona Industrial Development Authority, Arizona, Lease Revenue Bonds, University of Indianapolis - Health Pavilion Project, Series 2019A | 4.000 | 10/01/39 | 1,430,916 | ||||||||||||||

| 1,080,000 | Arizona Industrial Development Authority, Arizona, Lease Revenue Bonds, University of Indianapolis - Health Pavilion Project, Series 2019A | 4.000 | 10/01/49 | 806,659 | ||||||||||||||

| See Notes to Financial Statements |

37 |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

| |

|

|||||||||||||||||

| EDUCATION AND CIVIC ORGANIZATIONS (continued) | ||||||||||||||||||

| $ | 1,500,000 | (b),(c) | Arizona Industrial Development Authority, Education Facility Revenue Bonds, Caurus Academy Project, Series 2018A | 6.375% | 06/01/39 | $ | 1,050,000 | |||||||||||

| 360,000 | Industrial Development Authority, Pima County, Arizona, Education Revenue Bonds, Center for Academic Success Project, Refunding Series 2019 | 4.000 | 07/01/31 | 359,773 | ||||||||||||||

| 340,000 | Industrial Development Authority, Pima County, Arizona, Education Revenue Bonds, Center for Academic Success Project, Refunding Series 2019 | 4.000 | 07/01/33 | 332,842 | ||||||||||||||

| 780,000 | (b) | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Arizona Autism Charter Schools Project, Series 2020A | 5.000 | 07/01/50 | 686,338 | |||||||||||||

| 195,000 | (b) | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Arizona Autism Charter Schools Project, Social Series 2021A | 4.000 | 07/01/51 | 143,640 | |||||||||||||

| 355,000 | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Great Hearts Academies Projects, Series 2017A | 5.000 | 07/01/37 | 358,711 | ||||||||||||||

| 490,000 | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Great Hearts Academies Projects, Series 2017C | 5.000 | 07/01/48 | 470,311 | ||||||||||||||

| 1,715,000 | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Highland Prep Project, Series 2019 | 5.000 | 01/01/50 | 1,633,056 | ||||||||||||||

| 700,000 | (b) | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Legacy Traditional Schools Projects, Series 2021A | 4.000 | 07/01/41 | 596,956 | |||||||||||||

| 335,000 | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Legacy Traditional Schools Projects, Series 2024 | 4.250 | 07/01/44 | 283,407 | ||||||||||||||

| 870,000 | (b) | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Paradise Schools Projects, Series 2016 | 5.000 | 07/01/47 | 760,883 | |||||||||||||

| 520,000 | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Reid Traditional School Projects, Series 2016 | 5.000 | 07/01/36 | 515,297 | ||||||||||||||

| 300,000 | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Reid Traditional School Projects, Series 2016 | 5.000 | 07/01/47 | 268,157 | ||||||||||||||

| 2,000,000 | Maricopa County Industrial Development Authority, Arizona, Educational Facilities Revenue Bonds, Creighton University Projects, Series 2020 | 4.000 | 07/01/50 | 1,628,856 | ||||||||||||||

| 775,000 | McAllister Academic Village LLC, Arizona, Revenue Bonds, Arizona State University Hassayampa Academic Village Project, Refunding Series 2016 | 5.000 | 07/01/37 | 781,252 | ||||||||||||||

| 1,000,000 | McAllister Academic Village LLC, Arizona, Revenue Bonds, Arizona State University Hassayampa Academic Village Project, Refunding Series 2016 | 5.000 | 07/01/38 | 1,005,925 | ||||||||||||||

| 1,000,000 | Northern Arizona University, System Revenue Bonds, Refunding Series 2020B - BAM Insured | 5.000 | 06/01/39 | 1,030,942 | ||||||||||||||

| 70,000 | (b) | Phoenix Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Basis Schools, Inc. Projects, Series 2016A | 5.000 | 07/01/46 | 64,572 | |||||||||||||

| 800,000 | Phoenix Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Great Hearts Academies Project, Series 2016A | 5.000 | 07/01/41 | 792,704 | ||||||||||||||

| 315,000 | (b) | Phoenix Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Legacy Traditional Schools Projects, Series 2015 | 5.000 | 07/01/35 | 315,065 | |||||||||||||

| 300,000 | (b) | Phoenix Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Legacy Traditional Schools Projects, Series 2015 | 5.000 | 07/01/45 | 277,250 | |||||||||||||

| 650,000 | (b) | Phoenix Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Legacy Traditional Schools Projects, Series 2016A | 5.000 | 07/01/41 | 622,923 | |||||||||||||

| 1,110,000 | (b) | Phoenix Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Northwest Christian School Project, Series 2020A | 5.000 | 09/01/45 | 925,148 | |||||||||||||

| 38 |

See Notes to Financial Statements |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

| |

|

|||||||||||||||||

| EDUCATION AND CIVIC ORGANIZATIONS (continued) | ||||||||||||||||||

| $ | 400,000 | Phoenix Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Villa Montessori, Inc. Projects, Series 2015 | 5.000% | 07/01/35 | $ | 400,100 | ||||||||||||

| 900,000 | Phoenix Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Vista College Preparatory Project, Series 2018A | 4.125 | 07/01/38 | 836,604 | ||||||||||||||

| 1,995,000 | Phoenix Industrial Development Authority, Arizona, Lease Revenue Bonds, Eastern Kentucky University Project, Series 2016 | 5.000 | 10/01/36 | 2,011,678 | ||||||||||||||

| 500,000 | Pima County Community College District, Arizona, Revenue Bonds, Series 2019 | 5.000 | 07/01/36 | 515,562 | ||||||||||||||

| 120,000 | (b) | Pima County Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Champion Schools Project, Series 2017 | 6.000 | 06/15/37 | 120,445 | |||||||||||||

| 680,000 | (b) | Pima County Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Champion Schools Project, Series 2017 | 6.125 | 06/15/47 | 668,343 | |||||||||||||

| 200,000 | (c) | Pima County Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Edkey Charter Schools Project, Series 2016 | 5.250 | 07/01/36 | 140,000 | |||||||||||||

| 115,000 | (b) | Pima County Industrial Development Authority, Arizona, Education Facility Revenue Bonds, San Tan Montessori School Project, Series 2017 | 6.750 | 02/01/50 | 110,614 | |||||||||||||

| 500,000 | (b) | Pima County Industrial Development Authority, Arizona, Education Revenue Bonds, Noah Webster Schools - Mesa Project, Series 2015A | 5.000 | 12/15/34 | 485,080 | |||||||||||||

| 730,000 | Pinal County Community College District, Arizona, Revenue Bonds, Central Arizona College, Series 2017 - BAM Insured | 5.000 | 07/01/35 | 740,538 | ||||||||||||||

| 1,000,000 | (b) | Sierra Vista Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Desert Heights Charter School Project, Refunding Series 2024 | 6.125 | 06/01/57 | 897,073 | |||||||||||||

| |

|

|||||||||||||||||

| TOTAL EDUCATION AND CIVIC ORGANIZATIONS | 41,421,453 | |||||||||||||||||

| |

||||||||||||||||||

| HEALTH CARE - 19.9% (12.3% of Total Investments) | ||||||||||||||||||

| 890,000 | Arizona Industrial Development Authority, Arizona, Lease Revenue Bonds, Children’s National Prince County Regional Medical Center, Series 2020A | 4.000 | 09/01/38 | 863,757 | ||||||||||||||

| 4,975,000 | Arizona Industrial Development Authority, Hospital Revenue Bonds, Phoenix Children’s Hospital, Series 2020A | 4.000 | 02/01/50 | 4,089,054 | ||||||||||||||

| 1,000,000 | Maricopa County Industrial Development Authority, Arizona, Hospital Revenue Bonds, Honor Health, Series 2024D | 5.000 | 12/01/44 | 1,000,708 | ||||||||||||||

| 1,250,000 | Maricopa County Industrial Development Authority, Arizona, Hospital Revenue Bonds, HonorHealth, Series 2019A | 5.000 | 09/01/42 | 1,253,426 | ||||||||||||||

| 3,275,000 | Maricopa County Industrial Development Authority, Arizona, Hospital Revenue Bonds, HonorHealth, Series 2021A | 4.000 | 09/01/51 | 2,620,355 | ||||||||||||||

| 1,250,000 | Maricopa County Industrial Development Authority, Arizona, Revenue Bonds, Banner Health, Series 2016A | 5.000 | 01/01/32 | 1,280,902 | ||||||||||||||

| 1,000,000 | Maricopa County Industrial Development Authority, Arizona, Revenue Bonds, Banner Health, Series 2016A | 5.000 | 01/01/35 | 1,019,377 | ||||||||||||||

| 2,000,000 | Maricopa County Industrial Development Authority, Arizona, Revenue Bonds, Banner Health, Series 2017A | 5.000 | 01/01/41 | 2,026,290 | ||||||||||||||

| 2,000,000 | Maricopa County Industrial Development Authority, Arizona, Revenue Bonds, Banner Health, Series 2019A | 4.000 | 01/01/44 | 1,770,592 | ||||||||||||||

| 3,000,000 | Phoenix Industrial Development Authority, Arizona, Lease Revenue Bonds, Mayo/Brooks Rehabilitation Facility Project, Series 2024A | 5.000 | 10/31/44 | 3,036,785 | ||||||||||||||

| 2,250,000 | Pima County Industrial Development Authority, Arizona, Revenue Bonds, Tucson Medical Center, Series 2021A | 3.000 | 04/01/51 | 1,453,572 | ||||||||||||||

| 1,025,000 | Yavapai County Industrial Development Authority, Arizona, Hospital Revenue Bonds, Yavapai Regional Medical Center, Refunding Series 2016 | 5.000 | 08/01/36 | 1,033,057 | ||||||||||||||

| 815,000 | Yavapai County Industrial Development Authority, Arizona, Hospital Revenue Bonds, Yavapai Regional Medical Center, Series 2019 | 5.000 | 08/01/39 | 832,250 | ||||||||||||||

| 650,000 | Yavapai County Industrial Development Authority, Arizona, Hospital Revenue Bonds, Yavapai Regional Medical Center, Series 2019 | 4.000 | 08/01/43 | 570,651 | ||||||||||||||

| See Notes to Financial Statements |

39 |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

| |

|

|||||||||||||||||

| HEALTH CARE (continued) | ||||||||||||||||||

| $ | 2,125,000 | Yuma Industrial Development Authority, Arizona, Hospital Revenue Bonds, Yuma Regional Medical Center, Series 2024A | 5.250% | 08/01/49 | $ | 2,155,397 | ||||||||||||

| 500,000 | Yuma Industrial Development Authority, Arizona, Hospital Revenue Bonds, Yuma Regional Medical Center, Series 2024A | 4.000 | 08/01/54 | 418,699 | ||||||||||||||

| 1,325,000 | Yuma Industrial Development Authority, Arizona, Hospital Revenue Bonds, Yuma Regional Medical Center, Series 2024A | 5.250 | 08/01/54 | 1,333,504 | ||||||||||||||

| |

|

|||||||||||||||||

| TOTAL HEALTH CARE | 26,758,376 | |||||||||||||||||

| |

||||||||||||||||||

| HOUSING/MULTIFAMILY - 1.8% (1.1% of Total Investments) | ||||||||||||||||||

| 1,830,000 | Arizona Industrial Development Authority, Student Housing Revenue Bonds, Provident Group - NCCU Properties LLC - North Carolina Central University, Series 2019A - BAM Insured | 5.000 | 06/01/49 | 1,808,815 | ||||||||||||||

| 250,000 | (b),(d) | Sierra Vista Industrial Development Authority, Arizona, Economic Development Revenue Bonds, Convertible Capital Appreciation Revenue Bonds, Series 2021A | 0.000 | 10/01/56 | 193,093 | |||||||||||||

| 500,000 | Sierra Vista Industrial Development Authority, Arizona, Economic Development Revenue Bonds, Convertible Capital Appreciation Revenue Bonds, Series 2022A | 7.000 | 10/01/56 | 481,844 | ||||||||||||||

| |

|

|||||||||||||||||

| TOTAL HOUSING/MULTIFAMILY | 2,483,752 | |||||||||||||||||

| |

||||||||||||||||||

| HOUSING/SINGLE FAMILY - 3.9% (2.4% of Total Investments) | ||||||||||||||||||

| 940,000 | Maricopa County and Phoenix City Industrial Development Authority, Arizona, Single Family Mortgage Revenue Bonds, Series 2023A | 5.450 | 09/01/48 | 939,320 | ||||||||||||||

| 815,000 | Maricopa County and Phoenix City Industrial Development Authority, Arizona, Single Family Mortgage Revenue Bonds, Series 2024A | 4.650 | 09/01/54 | 768,068 | ||||||||||||||

| 1,855,000 | Maricopa County and Phoenix City Industrial Development Authority, Arizona, Single Family Mortgage Revenue Bonds, Series 2024C | 4.850 | 09/01/54 | 1,793,503 | ||||||||||||||

| 735,000 | Tucson and Pima County Industrial Development Authority, Arizona, Joint Single Family Mortgage Revenue Bonds, Series 2023A | 4.850 | 07/01/48 | 719,971 | ||||||||||||||

| 1,090,000 | Tucson and Pima County Industrial Development Authority, Arizona, Joint Single Family Mortgage Revenue Bonds, Series 2024A | 4.800 | 07/01/54 | 1,045,695 | ||||||||||||||

| |

|

|||||||||||||||||

| TOTAL HOUSING/SINGLE FAMILY | 5,266,557 | |||||||||||||||||

| |

||||||||||||||||||

| INFORMATION TECHNOLOGY - 0.3% (0.2% of Total Investments) | ||||||||||||||||||

| 410,000 | Chandler Industrial Development Authority, Arizona, Industrial Development Revenue Bonds, Intel Corporation Project, Series 2007, (AMT), (Mandatory Put 6/15/28) | 4.100 | 12/01/37 | 413,713 | ||||||||||||||

| |

|

|||||||||||||||||

| TOTAL INFORMATION TECHNOLOGY | 413,713 | |||||||||||||||||

| |

||||||||||||||||||

| LONG-TERM CARE - 3.5% (2.2% of Total Investments) | ||||||||||||||||||

| 585,000 | Arizona Industrial Development Authority, Multifamily Housing Revenue Bonds, Bridgewater Avondale Project, Series 2017 | 5.375 | 01/01/38 | 458,463 | ||||||||||||||

| 1,000,000 | Glendale Industrial Development Authority, Arizona, Senior Living Revenue Bonds, Royal Oaks Royal Oaks - Inspirata Pointe Project, Series 2020A | 5.000 | 05/15/41 | 921,170 | ||||||||||||||

| 1,760,000 | Phoenix Industrial Development Authority, Arizona, Multi-Family Housing Revenue Bonds, 3rd and Indian Road Assisted Living Project, Series 2016 | 5.400 | 10/01/36 | 1,373,476 | ||||||||||||||

| 1,435,000 | Tempe Industrial Development Authority, Arizona, Revenue Bonds, Friendship Village of Tempe Project, Refunding Series 2021A | 4.000 | 12/01/38 | 1,297,068 | ||||||||||||||

| 1,080,000 | (b) | Tempe Industrial Development Authority, Arizona, Revenue Bonds, Mirabella at ASU Project, Series 2017A | 6.125 | 10/01/47 | 702,422 | |||||||||||||

| |

|

|||||||||||||||||

| TOTAL LONG-TERM CARE | 4,752,599 | |||||||||||||||||

| |

||||||||||||||||||

| TAX OBLIGATION/GENERAL - 21.8% (13.4% of Total Investments) | ||||||||||||||||||

| 575,000 | Buckeye Union High School District 201, Maricopa County, Arizona, General Obligation Bonds, School Improvement Project, Refunding Series 2017 - BAM Insured | 5.000 | 07/01/35 | 593,195 | ||||||||||||||

| 1,215,000 | Buckeye, Arizona, General Obligation Bonds, Series 2025 | 5.250 | 07/01/50 | 1,259,969 | ||||||||||||||

| 665,000 | Glendale, Arizona, General Obligation Bonds, Series 2024 | 5.000 | 07/01/44 | 695,402 | ||||||||||||||

| 2,105,000 | Golder Ranch Fire District, Pima and Pinal Counties, Arizona, General Obligation Bonds, Series 2021 | 4.000 | 07/01/45 | 1,888,447 | ||||||||||||||

| 40 |

See Notes to Financial Statements |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

| |

|

|||||||||||||||||

| TAX OBLIGATION/GENERAL (continued) | ||||||||||||||||||

| $ | 1,045,000 | Maricopa County School District 14 Creighton Elementary, Arizona, General Obligation Bonds, School Improvement Series 2021C | 4.000% | 07/01/34 | $ | 1,079,591 | ||||||||||||

| 2,315,000 | Maricopa County School District 214 Tolleson Union High, Arizona, General Obligation Bonds, School Improvement Project 1990, Series 1990A | 5.000 | 07/01/38 | 2,383,907 | ||||||||||||||

| 630,000 | Maricopa County School District 214 Tolleson Union High, Arizona, General Obligation Bonds, School Improvement Project 2017, Series 2018A | 5.000 | 07/01/37 | 646,524 | ||||||||||||||

| 800,000 | Maricopa County School District 3 Tempe Elementary, Arizona, General Obligation Bonds, School Improvement, Project of 2022, Series 2025B | 5.000 | 07/01/43 | 835,459 | ||||||||||||||

| 300,000 | Maricopa County School District 3 Tempe Elementary, Arizona, General Obligation Bonds, School Improvement, Project of 2022, Series 2025B | 5.000 | 07/01/44 | 311,275 | ||||||||||||||

| 600,000 | Maricopa County School District 6, Arizona, General Obligation Bonds, Washington Elementary School Improvement Project of 2022, Series 2025B - BAM Insured | 5.000 | 07/01/44 | 618,995 | ||||||||||||||

| 1,250,000 | Maricopa County School District 66 Roosevelt Elementary, Arizona, General Obligation Bonds, School Improvement Project of 2020, Series 2024C - AGM Insured | 5.000 | 07/01/43 | 1,283,003 | ||||||||||||||

| 1,500,000 | Maricopa County Special Health Care District, Arizona, General Obligation Bonds, Series 2018C | 5.000 | 07/01/36 | 1,545,874 | ||||||||||||||

| 2,000,000 | Maricopa County Unified School District 69 Paradise Valley, Arizona, General Obligation Bonds, School Improvement Project of 2019, Series 2022D | 4.000 | 07/01/41 | 1,889,923 | ||||||||||||||

| 1,275,000 | Maricopa County Union High School District 210 Phoenix, Arizona, General Obligation Bonds, School Improvement & Project of 2011 Series 2017E | 5.000 | 07/01/33 | 1,321,568 | ||||||||||||||

| 1,295,000 | Maricopa County Union High School District 216 Agua Fria, Arizona, General Obligation Bonds, School Improvement, Project of 2023, Series 2024A | 5.000 | 07/01/43 | 1,340,388 | ||||||||||||||

| 200,000 | Maricopa County Union High School District 216 Agua Fria, Arizona, General Obligation Bonds, School Improvement, Projects of 2023 and 2024, Series 2025 | 5.000 | 07/01/44 | 207,510 | ||||||||||||||

| 1,000,000 | Mohave County Union High School District 2 Colorado River, Arizona, General Obligation Bonds, School Improvement Series 2017 | 5.000 | 07/01/34 | 1,034,894 | ||||||||||||||

| 1,000,000 | Mohave County Union High School District 2 Colorado River, Arizona, General Obligation Bonds, School Improvement Series 2017 | 5.000 | 07/01/36 | 1,029,485 | ||||||||||||||

| 690,000 | Northwest Fire District of Pima County, Arizona, General Obligation Bonds, Series 2017 | 5.000 | 07/01/36 | 707,994 | ||||||||||||||

| 1,000,000 | Phoenix, Arizona, General Obligation Bonds, Various Purpose Series 2024A | 5.000 | 07/01/45 | 1,039,110 | ||||||||||||||

| 200,000 | Pima County Unified School District 1, Tucson, Arizona, General Obligation Bonds, Project of 2023 School Improvement Series 2024A - AGM Insured | 5.000 | 07/01/43 | 207,948 | ||||||||||||||

| 750,000 | Pima County Unified School District 6 Marana, Arizona, General Obligation Bonds, School Improvement, Project of 2022, Series 2025C | 5.000 | 07/01/43 | 772,414 | ||||||||||||||

| 620,000 | Pinal County School District 4 Casa Grande Elementary, Arizona, General Obligation Bonds, School improvement Project 2016, Series 2017A - BAM Insured | 5.000 | 07/01/34 | 640,962 | ||||||||||||||

| 1,000,000 | Pinal County School District 4 Casa Grande Elementary, Arizona, General Obligation Bonds, School improvement Project 2016, Series 2017A - BAM Insured | 5.000 | 07/01/35 | 1,031,644 | ||||||||||||||

| 550,000 | Pinal County Unified School District 20 Maricopa, Arizona, General Obligation Bonds, School Improvement Project of 2024, Series 2025A - BAM Insured | 5.000 | 07/01/44 | 563,209 | ||||||||||||||

| 2,000,000 | Puerto Rico, General Obligation Bonds, Restructured Series 2022A‑1 | 4.000 | 07/01/46 | 1,652,983 | ||||||||||||||

| 500,000 | Tempe Union High School District 213, Maricopa County, Arizona, General Obligation Bonds, School Improvement Project of 2022, Series 2025B | 5.000 | 07/01/43 | 521,214 | ||||||||||||||

| See Notes to Financial Statements |

41 |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

| |

|

|||||||||||||||||

| TAX OBLIGATION/GENERAL (continued) | ||||||||||||||||||

| $ | 1,025,000 | Tempe, Arizona, General Obligation Bonds, Refunding Series 2024 | 5.000% | 07/01/44 | $ | 1,066,525 | ||||||||||||

| 950,000 | Tempe, Arizona, General Obligation Bonds, Series 2021 | 5.000 | 07/01/39 | 1,002,739 | ||||||||||||||

| 105,000 | Western Maricopa Education Center District 402, Maricopa County, Arizona, General Obligation Bonds, School Improvement Project 2012, Series2014B | 4.500 | 07/01/33 | 105,095 | ||||||||||||||

| |

|

|||||||||||||||||

| TOTAL TAX OBLIGATION/GENERAL | 29,277,246 | |||||||||||||||||

| |

||||||||||||||||||

| TAX OBLIGATION/LIMITED - 38.4% (23.7% of Total Investments) | ||||||||||||||||||

| 100,000 | (b) | Arizona Industrial Development Authority, Arizona, Economic Development Revenue Bonds, Linder Village Project in Meridian, Ada County, Idaho, Series 2020 | 5.000 | 06/01/31 | 100,692 | |||||||||||||

| 1,250,000 | Arizona State Transportation Board, Highway Revenue Bonds, Refunding Series 2016 | 5.000 | 07/01/35 | 1,266,604 | ||||||||||||||

| 275,000 | Buckeye, Arizona, Excise Tax Revenue Obligations, Refunding Series 2016 | 4.000 | 07/01/36 | 274,612 | ||||||||||||||

| 1,000,000 | Buckeye, Arizona, Excise Tax Revenue Obligations, Refunding Series 2025 | 4.500 | 07/01/43 | 976,329 | ||||||||||||||

| 1,215,000 | Cadence Community Facilities District, Mesa, Arizona, Special Assessment Revenue Bonds, Assessment District 3, Series 2020 | 4.000 | 07/01/45 | 970,188 | ||||||||||||||

| 122,853 | (b),(c) | Cahava Springs Revitalization District, Cave Creek, Arizona, Special Assessment Bonds, Series 2017A | 7.000 | 07/01/41 | 85,997 | |||||||||||||

| 1,210,000 | (b) | Eastmark Community Facilities District 1, Mesa, Arizona, General Obligation Bonds, Series 2015 | 5.000 | 07/15/39 | 1,147,297 | |||||||||||||

| 1,810,000 | Eastmark Community Facilities District 1, Mesa, Arizona, General Obligation Bonds, Series 2017 - AGM Insured | 5.000 | 07/15/42 | 1,828,432 | ||||||||||||||

| 2,445,000 | Eastmark Community Facilities District 1, Mesa, Arizona, General Obligation Bonds, Series 2018 - BAM Insured | 4.375 | 07/15/43 | 2,314,394 | ||||||||||||||

| 650,000 | Eastmark Community Facilities District 1, Mesa, Arizona, General Obligation Bonds, Series 2021 - BAM Insured | 4.000 | 07/15/41 | 597,553 | ||||||||||||||

| 484,000 | Eastmark Community Facilities District 1, Mesa, Arizona, Special Assessment Revenue Bonds, Assessment District 1, Series 2013 | 5.250 | 07/01/38 | 464,860 | ||||||||||||||

| 696,000 | Eastmark Community Facilities District 1, Mesa, Arizona, Special Assessment Revenue Bonds, Assessment District 1, Series 2019 | 5.200 | 07/01/43 | 617,203 | ||||||||||||||

| 2,279,000 | Eastmark Community Facilities District 1, Mesa, Arizona, Special Assessment Revenue Bonds, Assessment District 12, Series 2021 | 3.750 | 07/01/45 | 1,650,745 | ||||||||||||||

| 1,035,000 | Eastmark Community Facilities District 2, Mesa, Arizona, General Obligation Bonds, Series 2020 | 3.500 | 07/15/44 | 706,175 | ||||||||||||||

| 105,000 | Estrella Mountain Ranch Community Facilities District, Goodyear, Arizona, General Obligation Bonds, Refunding Series 2017 —AGM Insured | 5.000 | 07/15/32 | 108,878 | ||||||||||||||

| 1,145,000 | Estrella Mountain Ranch Community Facilities District, Goodyear, Arizona, Special Assessment Revenue Bonds, Lucero Assessment District 2, Series 2023 | 5.750 | 07/01/46 | 1,094,520 | ||||||||||||||

| 370,000 | Festival Ranch Community Facilities District, Buckeye, Arizona, General Obligation Bonds, Series 2016 - BAM Insured | 4.000 | 07/15/36 | 364,450 | ||||||||||||||

| 1,000,000 | Festival Ranch Community Facilities District, Buckeye, Arizona, General Obligation Bonds, Series 2017 - BAM Insured | 5.000 | 07/15/37 | 1,011,530 | ||||||||||||||

| 590,000 | Festival Ranch Community Facilities District, Buckeye, Arizona, General Obligation Bonds, Series 2018 - BAM Insured | 5.000 | 07/15/38 | 595,595 | ||||||||||||||

| 1,000,000 | Festival Ranch Community Facilities District, Buckeye, Arizona, General Obligation Bonds, Series 2020 - BAM Insured | 4.000 | 07/15/40 | 926,012 | ||||||||||||||

| 1,000,000 | Festival Ranch Community Facilities District, Buckeye, Arizona, General Obligation Bonds, Series 2022 - AGM Insured | 5.000 | 07/15/42 | 997,156 | ||||||||||||||

| 308,000 | Festival Ranch Community Facilities District, Buckeye, Arizona, Special Assessment Revenue Bonds, Assessment District 11, Series 2017 | 5.200 | 07/01/37 | 287,947 | ||||||||||||||

| 1,469,000 | Floreo at Teravalis Community Facilities District, Arizona, Special Assessment Revenue Bonds, District 1 Series 2025 | 5.750 | 07/01/40 | 1,474,512 | ||||||||||||||

| 545,000 | Goodyear Community Facilities Utilities District 1, Arizona, General Obligation Bonds, Refunding Series 2016 | 4.000 | 07/15/32 | 548,829 | ||||||||||||||

| 1,500,000 | Government of Guam, Business Privilege Tax Bonds, Refunding Series 2015D | 5.000 | 11/15/39 | 1,507,411 | ||||||||||||||

| 1,250,000 | Guam Government, Limited Obligation Section 30 Revenue Bonds, Series 2016A | 5.000 | 12/01/46 | 1,227,987 | ||||||||||||||

| 42 |

See Notes to Financial Statements |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

| |

|

|||||||||||||||||

| TAX OBLIGATION/LIMITED (continued) | ||||||||||||||||||