Please wait

CEMEX

Building the future™

Cemex

Hector Medina Executive Vice President, Planning & Finance October 27,

2006

Disclaimer

This presentation has been prepared by CEMEX, S.A.B. de C. V. (“CEMEX” or the

"Company"), solely for informational purposes in connection with the proposed

transaction described herein. This presentation does not constitute an offer

to

or an invitation for any person or to the general public to subscribe for or

otherwise acquire securities issued by CEMEX in any jurisdiction or an

inducement to enter into investment activity. This presentation also does not

constitute a solicitation of any vote or approval in connection with the

proposed transaction. The information contained in this presentation has not

been independently verified. No representation or warranty express or implied

is

made or given as to and no reliance should be placed on, the fairness, accuracy,

completeness or correctness of the information, statements, estimates,

projections or the opinions contained herein and no person is authorized to

make

any such representation or warranty. None of the Company nor any of its

respective affiliates shall have any liability whatsoever (in negligence or

otherwise) for any loss or damages however arising from any use of this

presentation or its contents by any person or otherwise arising in connection

with the presentation. This presentation is only for persons having qualified

professional experience in financial matters relating to investments and must

not be acted or relied on by persons who are not experienced in financial

matters. This presentation includes ‘forward-looking statements’. These

statements contain the words “anticipate”, “believe”, “intend”, “estimate”,

“expect” and words of similar meaning. All statements other than statements of

historical facts included in this presentation, including, without limitation,

those regarding the Company’s financial position, business strategy, plans and

objectives of management for future operations (including development plans

and

objectives relating to the Company’s products and services) are forward-looking

statements. Such forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause the actual results,

performance or achievements of the Company to be materially different from

future results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are based on

numerous assumptions regarding the Company’s operations and present and future

business strategies and the environment in which the Company will operate in

the

future. These forward-looking statements speak only as of the date of this

presentation. Accordingly, there can be no assurance that such statements,

estimates or projections will be realized. None of the projections or

assumptions in this presentation should be taken as forecasts or promises nor

should they be taken as implying any indication, assurance or guarantee that

the

assumptions on which such projections have been prepared are correct or

exhaustive or, in the case of assumptions, fully stated in this presentation.

The Company expressly disclaims any obligation or undertaking to disseminate

any

updates or revisions to any forward-looking information contained herein to

reflect any change in the Company’s results or expectations with regard thereto

or any change in events, conditions or circumstances on which any such statement

is based, except as required by law. The projections and forecasts included

in

the forward-looking statements herein were not prepared in accordance with

published guidelines of the American Institute of Certified Public Accountants,

the U.S. Securities and Exchange Commission or any similar body or guidelines

regarding projections and forecasts, nor have such projections or forecasts

been

audited, examined or otherwise reviewed by the independent auditors of the

Company. You should not place undue reliance on these forward-looking

statements. CEMEX’s bidder’s statement will be lodged with the Australian

Securities and Investments Commission, the Australian Stock Exchange, the

Mexican Stock Exchange, and the Mexican Stock Market Authorities shortly. When

the bidder’s statement is sent to Rinker Group Limited (“Rinker”) shareholders

it will be filed with the United States Securities and Exchange Commission

(the

“Commission”). Investors and security holders are urged to read the bidder’s

statement from regarding the proposed offer referred to in the foregoing

information, when it becomes available, as it will contain important

information. Once filed in the United States with the Commission the bidder’s

statement will be available on the Commission’s web site. Investors and security

holders may obtain a free copy of the bidder’s statement (when it is available)

and other documents filed by the Company with the Commission on the Commission’s

web site at www.sec.gov. The bidder’s statement and these other documents may

also be obtained for free from the Company, when they become available, by

directing a request to the representatives of the Company listed below. No

information made available to you in connection with this presentation may

be

passed on, copied, reproduced or otherwise disseminated to any other person.

The

release, publication or distribution of this presentation in certain

jurisdictions may be restricted by law and therefore persons in any such

jurisdictions into which this presentation is released, published or distributed

should inform themselves about and observe such restrictions. Past performance

cannot be relied upon as a guide to future performance. None of the statements

in this presentation are intended to mean that CEMEX's earnings per share for

any period will necessarily exceed those of any prior period as a result of

the

proposed acquisition of Rinker. All communications, inquiries and requests

for

information regarding the proposed transaction or this presentation should

be

directed to the representatives of the Company listed below: Ricardo Sales,

Analyst Relations, ricardojavier.sales@CEMEX.com, +1 212 317 6008 Eduardo

Rendón, Investor Relations, eduardo.rendon@CEMEX.com, +52 81 8888 4256 This

presentation is the property of CEMEX. This information may not be copied,

quoted or transmitted without the prior written consent of CEMEX. Copyright

CEMEX and its subsidiaries.

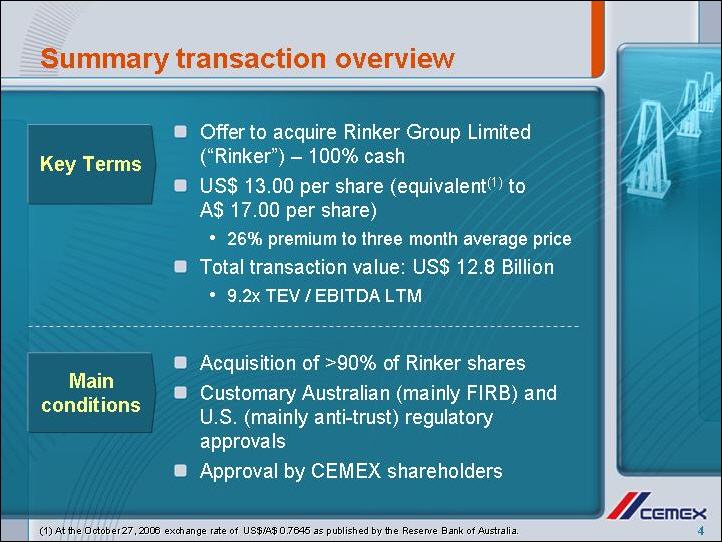

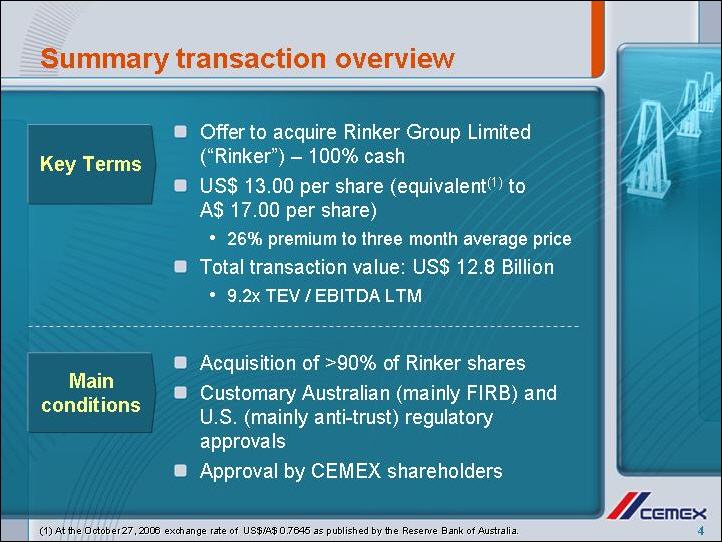

Summary

transaction overview Key Terms Offer to acquire Rinker Group Limited (“Rinker”)

- 100% cash US$ 13.00 per share (equivalent(1) to A$ 17.00 per share)

26% premium to three month average price Total transaction value: US$ 12.8

Billion 9.2x TEV / EBITDA LTM Main conditions Acquisition of >90% of Rinker

shares Customary Australian (mainly FIRB) and U.S. (mainly anti-trust)

regulatory approvals Approval by CEMEX shareholders (1) At the October 27,

2006

exchange rate of US$/A$ 0.7645 as published by the Reserve Bank of

Australia.

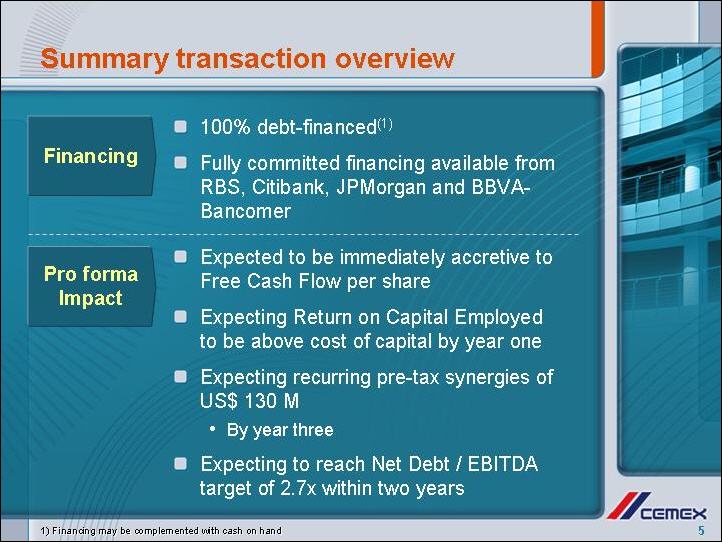

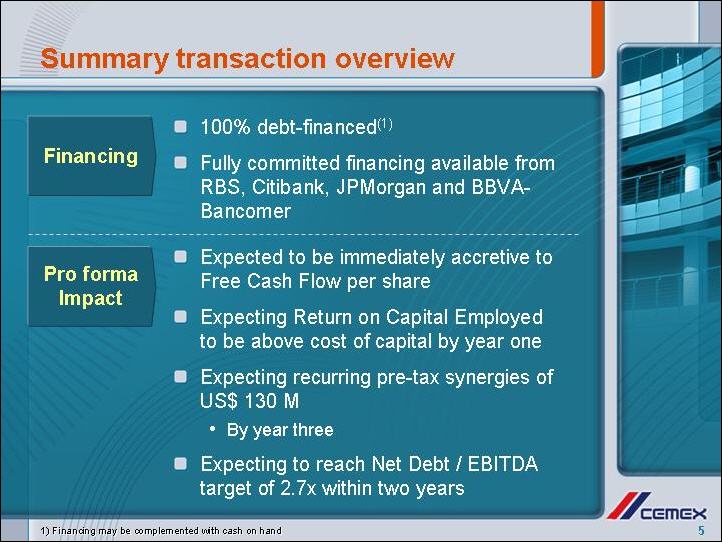

Summary

transaction overview Financing 100% debt-financed(1) Fully committed

financing available from RBS, Citibank, JPMorgan and BBVA-Bancomer Pro forma

Impact Expected to be immediately accretive to Free Cash Flow per share

Expecting Return on Capital Employed to be above cost of capital by year

one

Expecting recurring pre-tax synergies of US$ 130 M By year three Expecting

to

reach Net Debt / EBITDA target of 2.7x within two years 1) Financing may

be

complemented with cash on hand

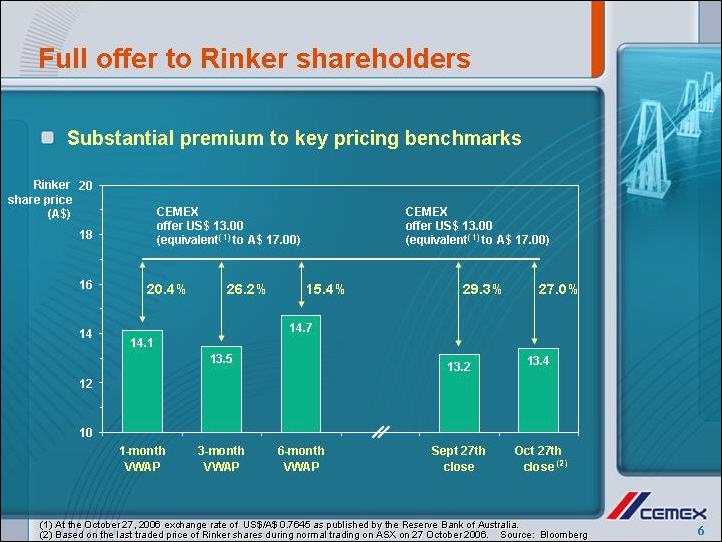

Full

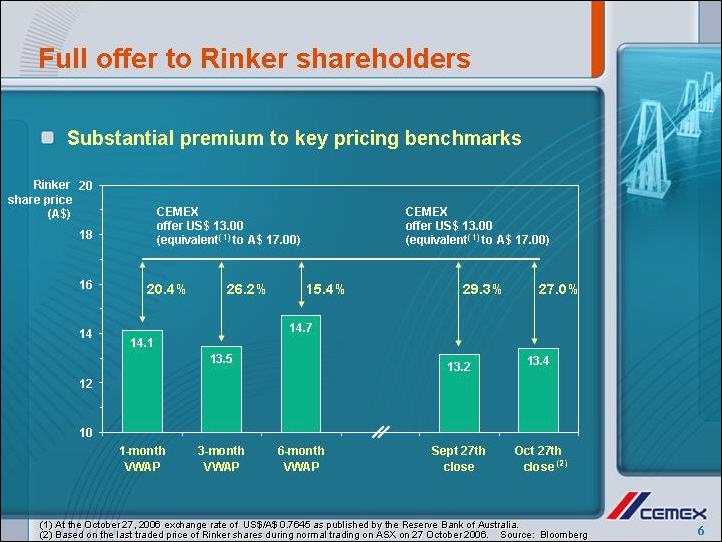

offer to Rinker shareholders Substantial premium to key pricing benchmarks

Rinker share price (A$) CEMEX offer US$ 13.00 (equivalent(1) to A$

17.00) 20.4% 14.1 1-month VWAP 26.2% 13.5 3-month VWAP 15.4% 14.7 6-month

VWAP

CEMEX offer US$ 13.00 (equivalent(1) to A$ 17.00) 29.3% 13.2 Sept

27th close 27.0% 13.4 Oct 27th close(2) (1) At the October 27, 2006

exchange rate of US$/A$ 0.7645 as published by the Reserve Bank of Australia.

(2) Based on the last traded price of Rinker shares during normal trading

on ASX

on 27 October 2006. Source: Bloomberg

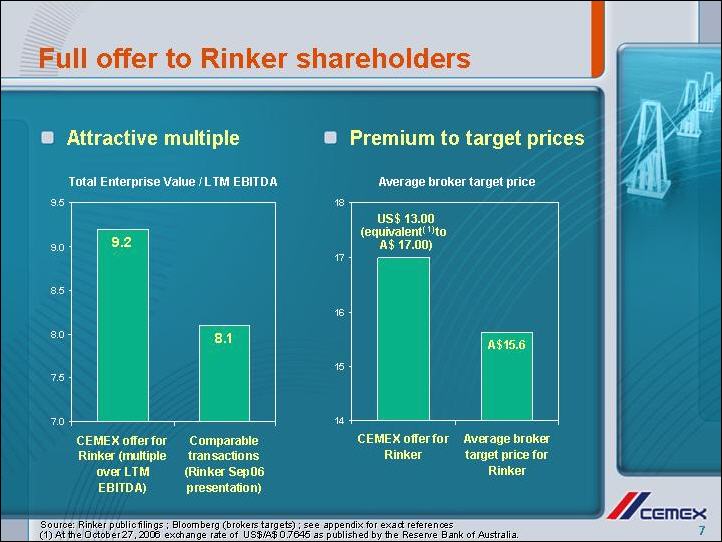

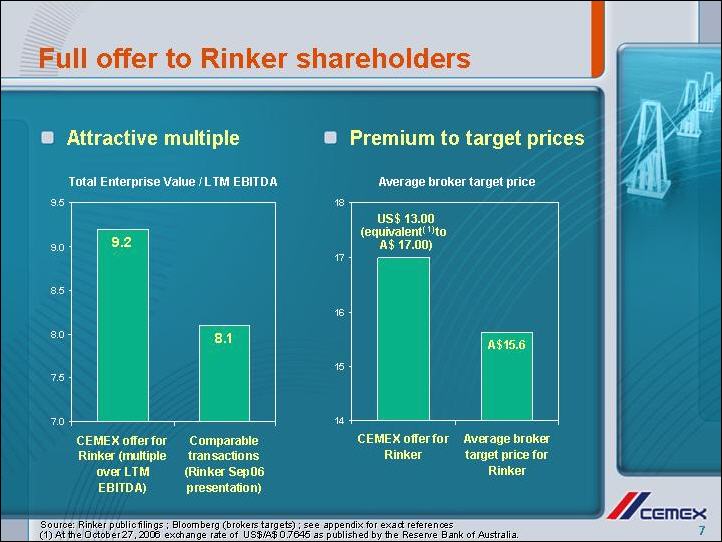

Full

offer to Rinker shareholders Attractive multiple Total Enterprise Value /

LTM

EBITDA 9.2 CEMEX offer for Rinker (multiple over LTM EBITDA) 8.1 Comparable

transactions (Rinker Sep06 presentation) Premium to target prices Average

broker

target price US$ 13.00 (equivalent(1) to A$ 17.00) CEMEX offer for Rinker

A$15.6

Average broker target price for Rinker Source: Rinker public filings ; Bloomberg

(brokers targets) ; see appendix for exact references (1) At the October

27,

2006 exchange rate of US$/A$ 0.7645 as published by the Reserve Bank of

Australia.

CEMEX

Lorenzo Zambrano Chairman & CEO October 27, 2006

A

solid strategic rationale for CEMEX Enhances CEMEX’s position across the value

chain Cement, Aggregates, Ready-Mix and Concrete Products Improves CEMEX’s

positioning in the U.S. Complementary products and geographies Provides CEMEX

with a major presence in Australia Captures synergies and leverages best

practices Reduces cash-flow volatility and lowers cost of

capital

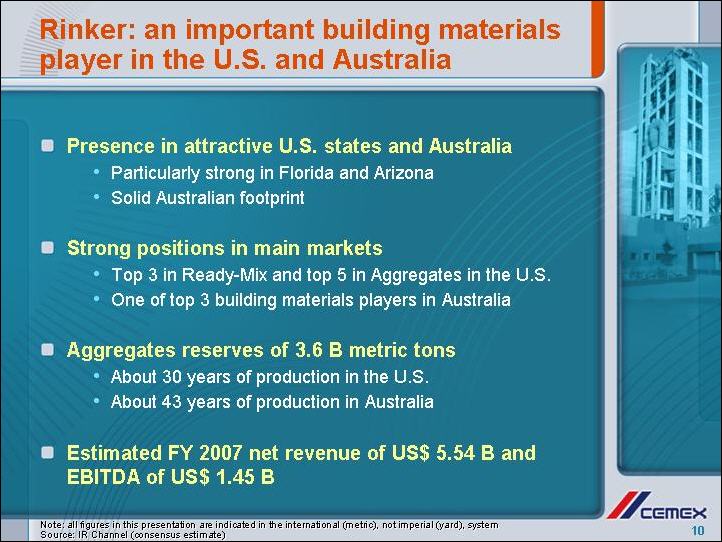

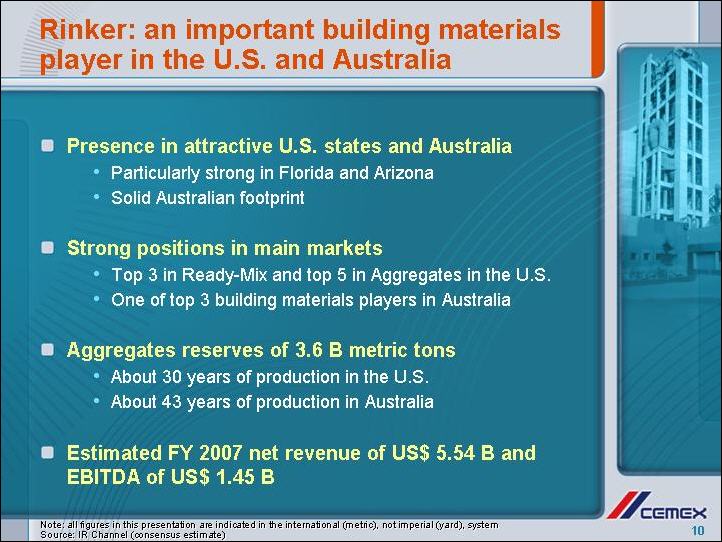

Rinker:

an important building materials player in the U.S. and Australia Presence

in

attractive U.S. states and Australia Particularly strong in Florida and Arizona

Solid Australian footprint Strong positions in main markets Top 3 in Ready-Mix

and top 5 in Aggregates in the U.S. One of top 3 building materials players

in

Australia Aggregates reserves of 3.6 B metric tons About 30 years of production

in the U.S. About 43 years of production in Australia Estimated FY 2007 net

revenue of US$ 5.54 B and EBITDA of US$ 1.45 B Note: all figures in this

presentation are indicated in the international (metric), not imperial (yard),

system Source: IR Channel (consensus estimate)

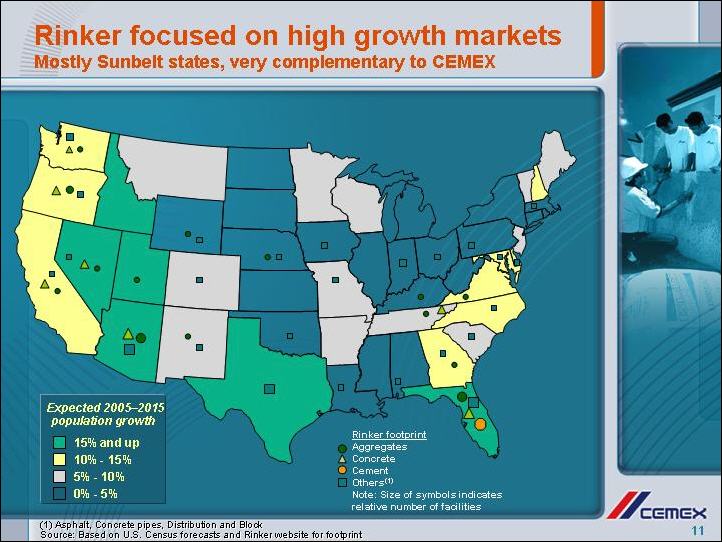

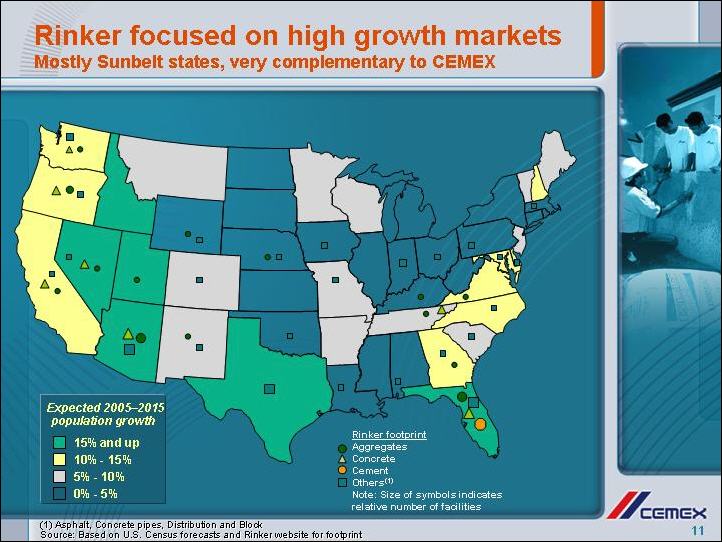

Rinker

focused on high growth markets Mostly Sunbelt states, very complementary

to

CEMEX Expected 2005-2015 population growth 15% and up 10% - 15% 5% - 10%

0% - 5%

Rinker footprint Aggregates Concrete Cement Others(1) Note: Size of

symbols indicates relative number of facilities (1) Asphalt, Concrete pipes,

Distribution and Block Source: Based on U.S. Census forecasts and Rinker

website

for footprint

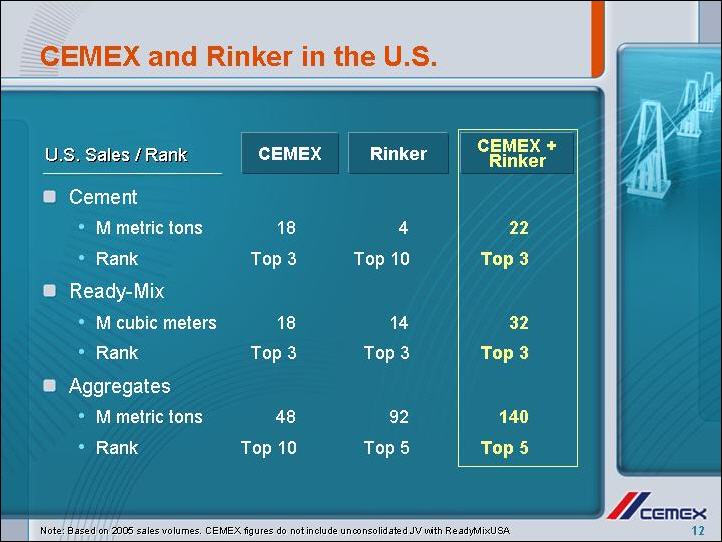

CEMEX

and Rinker in the U.S U.S. Sales / Rank CEMEX Rinker CEMEX + Rinker Cement

M

metric tons 18 4 22 Rank Top 3 Top 10 Top 3 Ready-Mix M cubic meters 18 14

32 Rank Top 3 Top 3 Top 3 Aggregates M metric tons 48 92 140 Rank Top 10

Top 5

Top 5 Note: Based on 2005 sales volumes. CEMEX figures do not include

unconsolidated JV with ReadyMixUSA

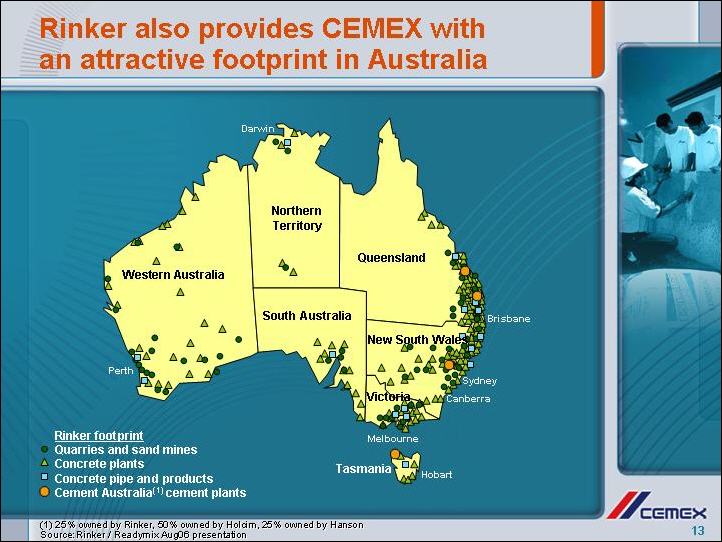

Rinker

also provides CEMEX with an attractive footprint in Australia Darwin Northern

Territory Western Australia Queensland South Australia Brisbane New South

Wales

Perth Sydney Victoria Canberra Melbourne Tasmania Hobart Rinker footprint

Quarries and sand mines Concrete plants Concrete pipe and products Cement

Australia(1) cement plants (1) 25% owned by Rinker, 50% owned by

Holcim, 25% owned by Hanson Source: Rinker / Readymix Aug06

presentation

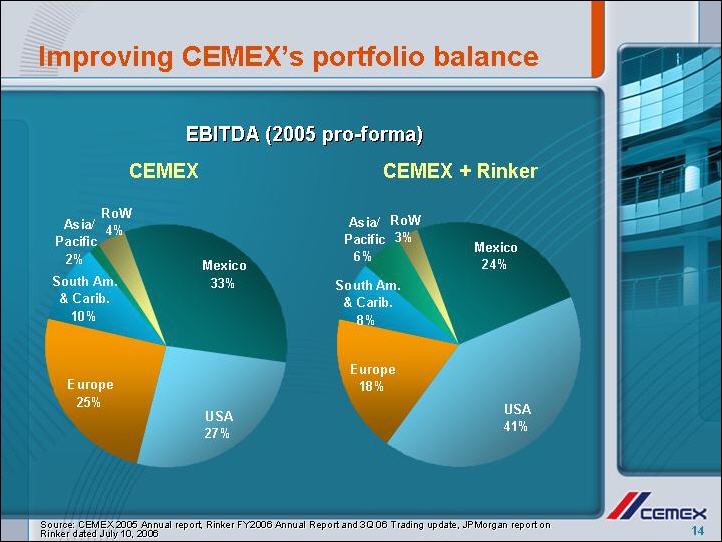

Improving

CEMEX’s portfolio balance EBITDA (2005 pro-forma) CEMEX Mexico 33% USA 27%

Europe 25% South Am. & Carib. 10% Asia/Pacific 2% RoW 4% CEMEX + Rinker

Mexico 24% USA 41% Europe 18% South Am. & Carib 8% Asia/Pacific 6% RoW 3%

Source: CEMEX 2005 Annual report, Rinker FY2006 Annual Report and 3Q 06 Trading

update, JPMorgan report on Rinker dated July 10, 2006

Improving

CEMEX’s portfolio balance EBITDA (2005 pro-forma) CEMEX Cement 72% Concrete 15%

Aggregates 9% Others 4% CEMEX + Rinker Cement 56% Concrete 19% Aggregates

14%

Others 10% Source: CEMEX 2005 Annual report, Rinker FY2006 Annual Report

and 3Q

06 Trading update, JPMorgan report on Rinker dated July 10,

2006

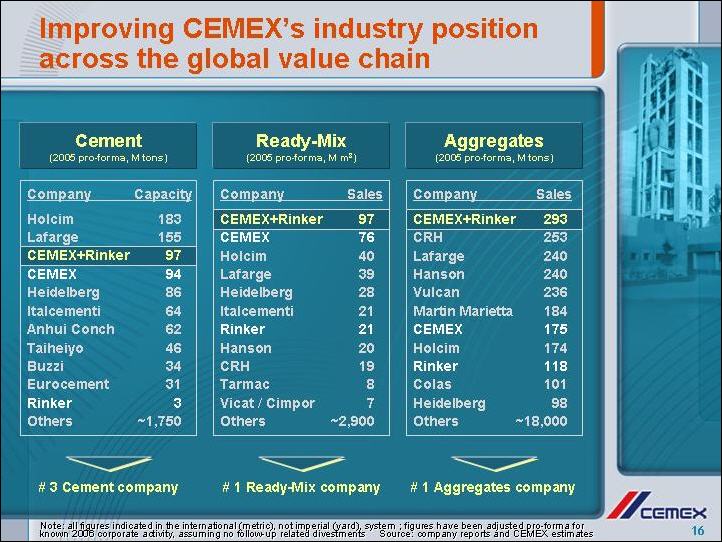

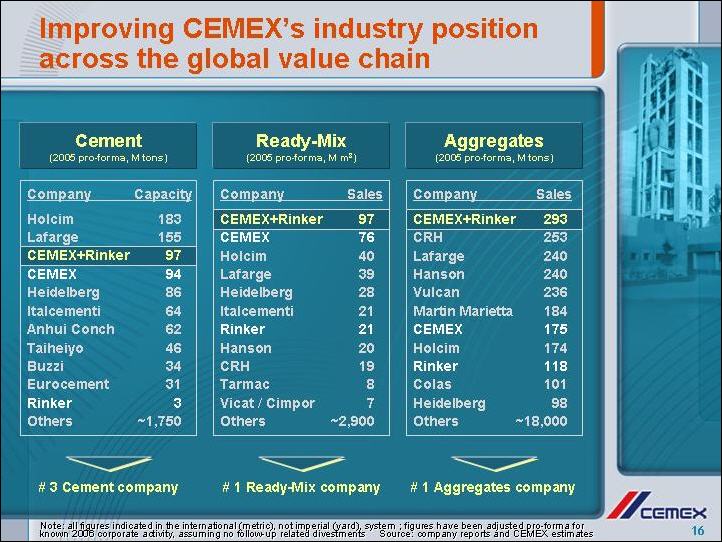

Improving

CEMEX’s industry position across the global value chain Cement (2005 pro-forma,

M tons) Company Capacity Holcim 183 Lafarge 155 CEMEX+Rinker 97 CEMEX 94

Heidelberg 86 Italcementi 64 Anhui Conch 62 Taiheiyo 46 Buzzi 34 Eurocement

31

Rinker 3 Others ~1,750 # 3 Cement company Ready-Mix (2005 pro-forma, M

m3) Company Sales CEMEX+Rinker 97 CEMEX 76 Holcim 40 Lafarge 39

Heidelberg 28 Italcementi 21 Rinker 21 Hanson 20 CRH 19 Tarmac 8 Vicat /

Cimpor

7 Others ~2,900 # 1 Ready-Mix company Aggregates (2005 pro-forma, M tons)

Company Sales CEMEX+Rinker 293 CRH 253 Lafarge 240 Hanson 240 Vulcan 236

Martin Marietta 184 CEMEX 175 Holcim 174 Rinker 118 Colas 101 Heidelberg

98

Others ~18,000 # 1 Aggregates company Note: all figures indicated in the

international (metric), not imperial (yard), system ; figures have been adjusted

pro-forma for known 2006 corporate activity, assuming no follow-up related

divestments Source: company reports and CEMEX estimates

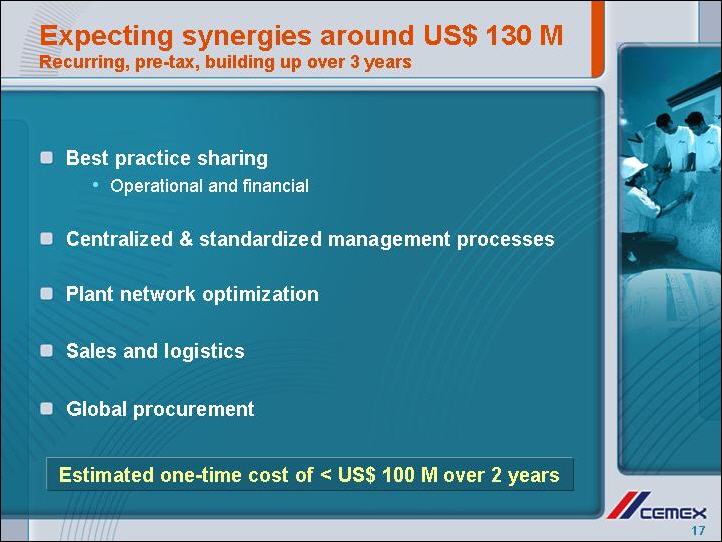

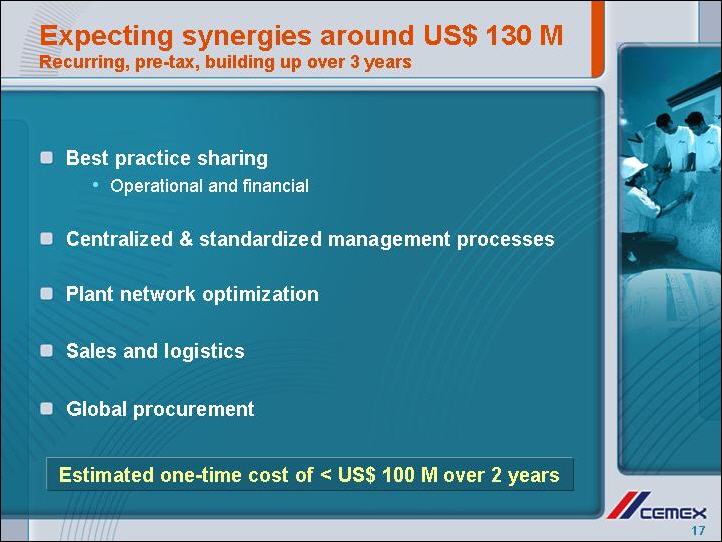

Expecting

synergies around US$ 130 M Recurring, pre-tax, building up over 3 years Best

practice sharing Operational and financial Centralized & standardized

management processes Plant network optimization Sales and logistics Global

procurement Estimated one-time cost of < US$ 100 M over 2

years

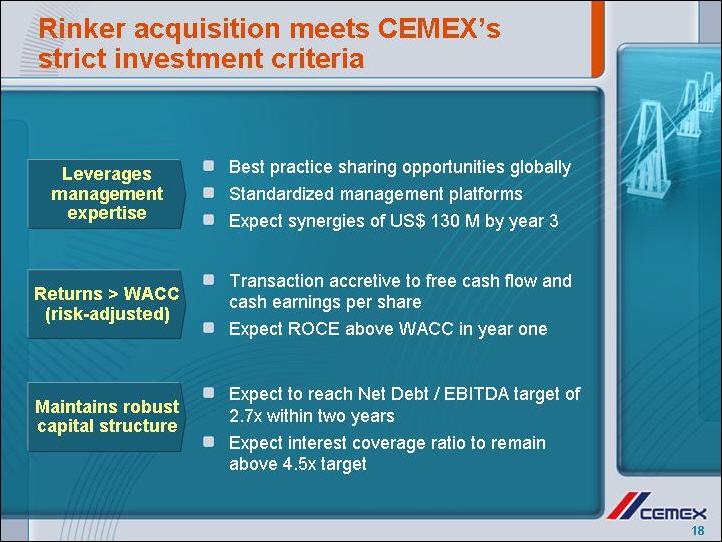

Rinker

acquisition meets CEMEX’s strict investment criteria Leverages management

expertise Best practice sharing opportunities globally Standardized management

platforms Expect synergies of US$ 130 M by year 3 Returns > WACC

(risk-adjusted) Transaction accretive to free cash flow and cash earnings

per

share Expect ROCE above WACC in year one Maintains robust capital structure

Expect to reach Net Debt / EBITDA target of 2.7x within two years Expect

interest coverage ratio to remain above 4.5x target

A

good transaction for both CEMEX and Rinker shareholders Full and fair offer

CEMEX’s successful track record in integrating acquisitions Favorable long term

prospects for US construction Demonstrated ability to recover financial

flexibility after acquisitions

CEMEX

Building the future™

CEMEX

Appendix October 27, 2006

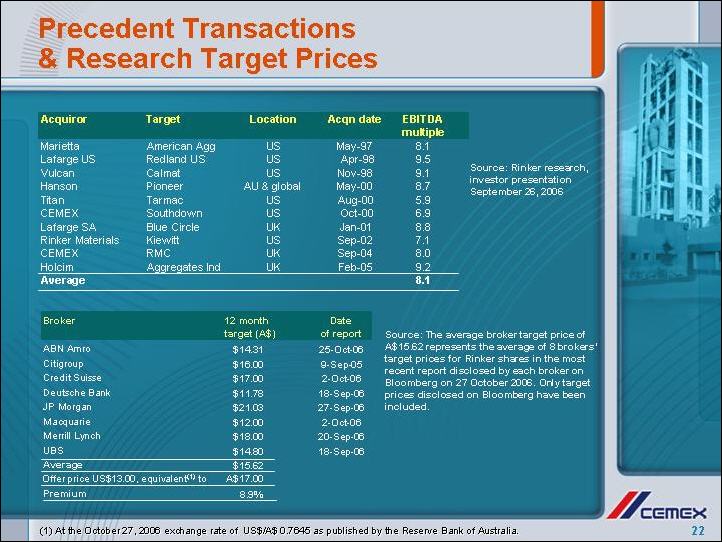

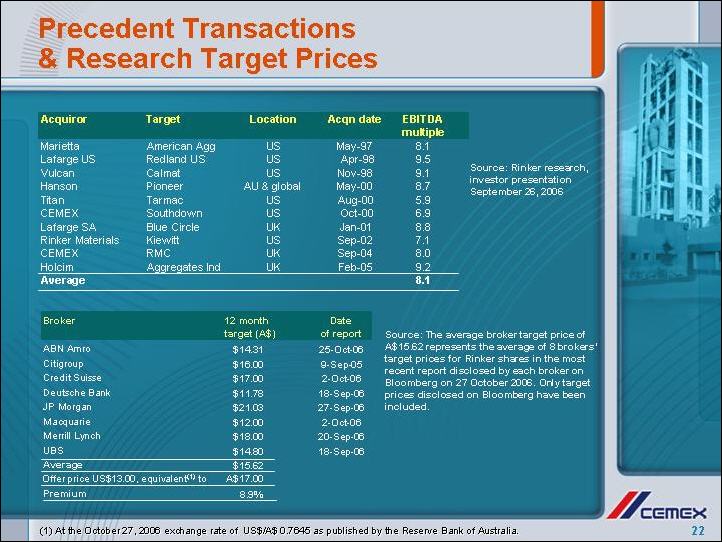

Precedent

Transactions & Research Target Prices Acquiror Target Location Acqn date

EBITDA multiple Marietta American Agg US May-97 8.1 Lafarge US Redland US

US

Apr-98 9.5 Vulcan Calmat US Nov-98 9.1 Hanson Pioneer AU & global May-00 8.7

Titan Tarmac US Aug-00 5.9 CEMEX Southdown US Oct-00 6.9 Lafarge SA Blue

Circle

UK Jan-01 8.8 Rinker Materials Kiewitt US Sep-02 7.1 CEMEX RMC UK Sep-04

8.0

Holcim Aggregates Ind UK Feb-05 9.2 Average 8.1 Source: Rinker research,

investor presentation September 26, 2006 Broker 12 month target (A$) Date

of

report ABN Amro $14.31 25-Oct-06 Citigroup $16.00 9-Sep-05 Credit Suisse

$17.00

2-Oct-06 Deutsche Bank $11.78 18-Sep-06 JP Morgan $21.03 27-Sep-06 Macquarie

$12.00 2-Oct-06 Merrill Lynch $18.00 20-Sep-06 UBS $14.80 18-Sep-06 Average

$15.62 Offer price US$13.00, equivalent(1) to A$17.00 Premium 8.9%

Source: The average broker target price of A$15.62 represents the average

of 8

brokers’ target prices for Rinker shares in the most recent report disclosed by

each broker on Bloomberg on 27 October 2006. Only target prices disclosed

on

Bloomberg have been included. (1) At the October 27, 2006 exchange rate of

US$/A$ 0.7645 as published by the Reserve Bank of Australia.

CEMEX

Building the future™