INDEX

| 1. | POLICY STATEMENT |

1 | ||||

| 2. |

POLICY INTERPRETATION, ENFORCEMENT AND ADMINISTRATION |

2 | ||||

| 3. |

GENERAL PROVISIONS |

2 | ||||

| 3.1. DEFINITIONS |

2 | |||||

| 3.2. TRANSACTIONS WITH CEMEX SECURITIES |

7 | |||||

| ARTICLE 1. COMPLIANCE |

7 | |||||

| ARTICLE 2. GENERAL TRADING RESTRICTIONS |

7 | |||||

| ARTICLE 3. TRADING WHEN IN POSSESSION OF MATERIAL NON-PUBLIC INFORMATION IS PROHIBITED |

7 | |||||

| ARTICLE 4. STOCK COMPENSATION PLANS |

8 | |||||

| ARTICLE 5. INTERNAL DISCLOSURE OBLIGATIONS |

8 | |||||

| ARTICLE 6. CERTAIN RESTRICTIONS AND REPORTING REQUIREMENTS |

9 | |||||

| ARTICLE 7. INTERNAL CONTROL MECHANISMS |

10 | |||||

| ARTICLE 8. DISCLOSURE OF INFORMATION: HANDLING OF MATERIAL NON-PUBLIC INFORMATION |

12 | |||||

| ARTICLE 9. QUIET PERIODS |

12 | |||||

| 3.3. AMENDMENTS AND WAIVERS |

13 | |||||

| 3.4. NON-COMPLIANCE PROCESS AND REPORTING |

13 | |||||

| 3.5. NO RETALIATION |

13 | |||||

| 3.6. TRAININGS AND AUDITS |

14 | |||||

| EXHIBIT A |

16 | |||||

| EXHIBIT B |

17 | |||||

| EXHIBIT C |

19 | |||||

1. POLICY STATEMENT

Applicable securities laws and regulations prohibit the purchase or sale of securities by persons who are aware of material non-public information about a company, as well as the disclosure of material non-public information about a company to others who then trade in the company’s securities. These transactions are commonly known as “insider trading”.

Insider trading violations are heavily pursued and punished by securities regulators, including but not limited to the:

| • | Comisión Nacional Bancaria y de Valores in Mexico (“CNBV”); |

| • | United States Securities and Exchange Commission (“SEC”); and |

| • | U.S. Attorney Offices in the United States of America. |

While the regulatory authorities concentrate their efforts on individuals who trade, or who provide inside information to others who trade, applicable securities laws and regulations also impose potential liability on companies and other “controlling persons” if they fail to take reasonable steps to prevent insider trading by company employees.

The Cemex Board of Directors has adopted this Policy with the intention to:

|

Prevent insider trading and to provide guidance to all the members of the Cemex Board of Directors (“Cemex BODM”), Cemex’s Senior Management and Employees of the Cemex Group to avoid the consequences associated with violations of insider trading laws; |

|

Prevent improper conduct, including the appearance of improper conduct, on the part of anyone employed by or associated with the Cemex Group, not just so-called “Insiders”; |

|

Follow and comply with the principles of transparency in the execution of operations, equal opportunities in the markets, protecting the confidence in the stock market, good observation of Stock Exchange practices, absence of conflicts of interest, and prevention of wrong behaviors; and |

|

Promote compliance with control and/or reporting mechanisms contemplated for the Cemex BODM, Cemex’s Senior Management and Employees of the Cemex Group when transacting with any securities issued by a Cemex Group company, including procuring such compliance by a third party, when in possession of Material Non-Public Information (as defined below). |

Please note that this Policy is not intended to be a complete description of applicable securities laws and regulations. Compliance with this Policy does not ensure that compliance with applicable securities laws and regulations will follow. You must err on the side of caution, as securities laws and regulations are strict and may contain certain provisions or presumptions that may cause inadvertent non-compliance and/or put a Cemex BODM, a member of the Board of Directors of any Cemex Group company, a Cemex Senior Management member or an Employee in a position where compliance with such laws and regulations would be required to be evidenced.

Compliance with this Policy is mandatory for all Employees, regardless of where they reside or conduct business.

1

2. POLICY INTERPRETATION, ENFORCEMENT AND ADMINISTRATION

This Policy, as amended and restated, was approved by the Cemex Board of Directors.

The parties involved in the application, administration, and enforcement of this Policy are the following:

| 1. | The Senior Vice President of Legal (or equivalent position) of Cemex; and |

| 2. | The Cemex Corporate Legal Compliance Department. |

When in doubt as to the content or application of this Policy, or where there is conflict between applicable legal requirements under this Policy, Employees have an obligation to contact the Cemex Corporate Legal Compliance Department for guidance. The Cemex Corporate Legal Compliance Department will have the ultimate responsibility for the interpretation of this Policy after consulting with Cemex’s Senior Vice President of Legal and, if necessary, with internal and/or external legal counsel, provided any services from external legal counsel are previously duly authorized by the Cemex Senior Vice President of Legal or Cemex’s CFO.

When in doubt as to any requirement or formality to be complied by any person subject to this Policy as it relates to Cemex Securities Transactions, in particular regarding Trading with Cemex Securities, such person shall hire their own legal advisors or consultants at such person’s own expense and ensure that such person complies with all applicable laws and regulations. The Cemex Senior Vice President of Legal may provide or may authorize for any members of the Cemex Corporate Legal Compliance Department to provide guidance to any such person, without any liability to any Cemex Group company.

This Policy should be observed in strict compliance with any applicable General Framework.

3. GENERAL PROVISIONS

3.1. DEFINITIONS

| • | “Affiliate” means, with respect to any corporation, limited liability company, trust, joint venture, association, company, partnership, or other entity, another corporation, limited liability company, trust, joint venture, association, company, partnership, or other entity that directly, or indirectly through one or more intermediaries, controls or is controlled by or is under common control with the corporation, limited liability company, trust, joint venture, association, company, partnership, or other entity specified. |

| • | “Business Unit” means any area with personnel, resources or assets. The term “Business Unit” also includes countries, regions, departments, divisions, functional areas (including global initiatives within the Cemex Group), companies or specific facilities (ready-mix plants, quarries, etc.) and their Presidents, Executive Vice-presidents, Vice-presidents, Directors or Business Unit Leaders. |

| • | “Business Unit Leader” means the head of any Business Unit. |

| • | “Cemex” means Cemex, S.A.B. de C.V. |

| • | “Cemex CFO” means Cemex’s Executive Vice-President of Finance and Administration and Chief Financial Officer or any other person with an equivalent title who may, in the future exercise similar functions in relation to the matters contained herein. |

2

| • | “Cemex Corporate Legal Compliance Department” means the Cemex’s Corporate Legal Compliance Department of Cemex’s Global Legal Department or any other department which may in the future exercise similar functions in relation to the matters covered herein. |

| • | “Cemex Group” means Cemex and its consolidated Affiliates. |

| • | “Cemex Internal Audit Department” means the Cemex’s Corporate Internal Audit or Process Assessment Department or any other department which may in the future exercise similar functions in relation to the matters covered herein. |

| • | “Cemex Local Legal Department” means any Cemex Local Legal Department that supervises a specific country, region or Business Unit or any other local department which may in the future exercise similar functions in relation to the matters covered herein. |

| • | “Cemex Regional Compliance Department” means any Cemex Regional Compliance Department that supervises a specific region or any other regional department which may in the future exercise similar functions in relation to the matters covered herein. |

| • | “Cemex Securities” means, as applicable, the shares, notes, debentures, bonds, warrants, certificates, promissory notes, bills of exchange, and other securities registered or not in any registry, capable of circulating in an exchange, which are issued in series or in mass and represent Cemex´s capital stock, a proportional part of a good or the participation in a collective credit or any individual credit right, in the terms of applicable national or foreign laws. |

Without limiting the foregoing, Cemex Securities include, but are not limited to:

| 1. | Any security issued by a Cemex Group company that is registered or not in any registry, stock market, or Stock Exchange; |

| 2. | Deposit certificates commonly known as “American Depositary Receipts” (“ADRs”) and/or Ordinary Participation Certificates (“CPOs”) that have Cemex Securities as underlying security, or other instruments similar to the securities registered in any registry, securities market, or Stock Exchange; and |

| 3. | Derivative financial instruments, provided that they have as their underlying asset securities registered in any registry, stock market, or Stock Exchange. |

| • | “Cemex Securities Transactions” means those transactions involving Cemex Securities carried out directly or indirectly by Cemex BODM, members of the Board of Directors of any Cemex Group company, Cemex Senior Management and/or Employees, who, due to their functions in the Cemex Group, may have access to Material Non-Public Information of the Cemex Group. |

| • | “Cemex Senior Management” means the senior management of the Cemex Group as identified in Cemex’s annual reports filed with the SEC and the CNBV, and/or any other persons determined by the Cemex Corporate Legal Compliance Department. |

| • | “Confidential Information” means information that Cemex expressly classifies as such in its databases, submissions, documents, contracts, or agreements employed or submitted in the course of its business and/or that regulates the relationship with its customers or other parties or when it is classified as such in terms of the applicable legal provisions, in any event related to Securities registration processes in any registry, market or Stock Exchange, public offers, acquisitions or sale of Cemex’s own shares, as well as that which Cemex would have qualified as confidential. |

3

| • | “Employees” means the individuals who occupy a position in or are directly or indirectly employed by any company of the Cemex Group. |

| • | “General Framework” means (i) the terms and conditions set forth in this Policy, (ii) applicable local laws and regulations to which each Employee is subject to, (iii) charter documents (i.e., by-laws, articles of incorporation, etc.) of the Cemex Group; and (iv) any applicable Cemex Group internal policies. |

| • | “Insider”, refers to: |

| (a) | Cemex BODM, members of the Board of Directors of any Cemex Group company, Cemex Senior Management and Cemex Group Employees that has access to Material Non-Public Information; |

| (b) | Consultants to the Cemex Group or other persons associated with the Cemex Group, including distributors, sales agents or other partners that may, in the course of their work with the Cemex Group, receive access to Material Non-Public Information (as defined below); and |

| (c) | Household and immediate family members of those listed in (a) and (b) above. |

A copy of this Policy is to be delivered or made available to all persons covered by items (a) and (b) above. Additionally, Insiders must alert persons covered by (c) above about the obligations of this Policy.

| • | “Material Non-Public Information” means information, including Confidential Information: (i) in relation to which there is a substantial likelihood that a reasonable investor would consider the information to be important in making an investment decision or that the disclosure of such information would be viewed by a reasonable investor as having significantly altered the overall information available to the public on the corresponding subject matter or that such disclosure is reasonably certain to have a substantial effect on the market price of a security, which has not been disseminated in a manner making it available to all investors generally or that when disseminated sufficient time did not pass-by for the securities markets to digest the information, and/or (ii) that applicable laws identifies as such. |

Please consider the following:

Information may be material even if it relates to future, speculative or contingent events and even if it is significant only when considered in combination with publicly available information.

Such information can be positive or negative, and includes but is not limited to:

| • | Earnings announcements or estimates, or changes to previously released announcements or estimates; |

| • | Other unpublished financial results; |

| • | Write-downs and additions to reserves for bad debts; |

| • | Expansion or curtailment of operations; |

| • | New products, inventions or discoveries; |

4

| • | Major litigation or government actions; |

| • | Mergers, acquisitions, tender offers, joint ventures or changes in assets; |

| • | Changes in analyst recommendations or debt ratings; |

| • | Events regarding a company’s securities (e.g., defaults on senior securities, calls of securities for redemption, repurchase plans, stock splits, changes in dividends, changes to the rights of security holders or public or private sales of additional securities); |

| • | Changes in control of a company or extraordinary management developments; |

| • | Extraordinary borrowing; |

| • | Liquidity problems; and |

| • | Changes in auditors or auditor notification that a company may no longer rely on an audit report. |

It is important to note that information is NOT necessarily public merely because it has been discussed in the press, which will sometimes report rumors. Information is non-public unless one can point to its official release by the Cemex Group in at least one of the following ways:

| • | Public filings with securities regulatory authorities; |

| • | Issuance of press releases; |

| • | Meetings with members of the press and the public that are simultaneously filed with securities authorities; or |

| • | Information contained in proxy statements and prospectuses. |

| • | “Material Public Information” means information that has been officially released by the Cemex Group through a public filing with securities regulatory authorities; issuance of a press release; meetings with members of the press and the public that are simultaneously filed with securities authorities; or information contained in proxy statements and prospectuses. |

Please consider the following:

The information is considered Material Public Information when in relation to such information:

| • | There is a substantial likelihood that a reasonable investor would consider the information to be important in making an investment decision or that the disclosure of such information would be viewed by a reasonable investor as having significantly altered the overall information available to the public on the corresponding subject matter or that such disclosure is reasonably certain to have a substantial effect on the market price of a security; and/or, |

| • | When the applicable laws identify the information as such. |

Such information can be positive or negative, and includes but is not limited:

| • | To earnings announcements or estimates, or changes to previously released announcements or estimates; |

| • | Other unpublished financial results; |

| • | Write-downs and additions to reserves for bad debts; |

| • | Expansion or curtailment of operations; |

| • | New products, inventions or discoveries; |

| • | Major litigation or government actions; |

| • | Mergers, acquisitions, tender offers, joint ventures or changes in assets; changes in analyst recommendations or debt ratings; |

5

| • | Events regarding a company’s securities (e.g., defaults on senior securities, calls of securities for redemption, repurchase plans, stock splits, changes in dividends, changes to the rights of security holders or public or private sales of additional securities); |

| • | Changes in control of a company or extraordinary management developments; |

| • | Extraordinary borrowing; |

| • | Liquidity problems; and |

| • | Changes in auditors or auditor notification that a company may no longer rely on an audit report. |

In most cases the judicial or administrative courts are the ultimate decision-makers about whether something is or is not material under this test, and they usually judge these cases with the benefit of hindsight.

| • | “Policy” means this Insider Trading and Transactions with Cemex Securities Policy as may from time to time be changed, amended, restated and/or supplemented. |

| • | “Quiet Period” or “Black-Out Period” means the period in which Trading of Cemex Securities carried out directly or indirectly by Cemex BODM, members of the Board of Directors of any Cemex Group company, Cemex Senior Management and Employees is NOT permitted. |

Generally, this period begins on the earlier of any of these two situations:

| 1. | The date set forth on a notification sent by the Cemex Corporate Legal Compliance Department or by the Cemex Senior Vice President of Legal informing of the beginning of a Quiet Period or Black-Out Period, and ends on the date set forth on the corresponding notification sent by the Cemex Corporate Legal Compliance Department or by Cemex Senior Vice President of Legal informing the end of a Quiet Period or Black-Out Period; or |

| 2. | 1 (one) calendar day after the closing of each calendar quarter (March, June, September and December), and ends at the end the second business day that follows the day the quarterly financial information of Cemex or the relevant Material Non-Public Information becomes Material Public Information (i.e., if Cemex publishes its quarterly results on a Thursday before the market opens, the Quiet Period would cover Friday and end Monday at 11:59 PM (U.S. Eastern Time), so that any Cemex BODM, member of the Board of Directors of any Cemex Group company, Cemex Senior Management and/or Employees can start trading on 12:00 AM on Tuesday). |

| • | “Stock Compensation Plan” means any stock-based compensation plan implemented by Cemex to eligible participants. |

| • | “Stock Exchange” means Bolsa Mexicana de Valores, S.A.B. de C.V. and/or the New York Stock Exchange, and/or any stock exchange or market, in Mexico, the U.S. or outside of Mexico and the U.S., in which any Cemex Securities are listed at any given time, including but not limited to debt Cemex Securities listed in the Irish Stock Exchange plc on which senior secured notes and other securities of any company of the Cemex Group are listed on. |

| • | “Trading” includes the purchase and sale of Cemex Securities or securities of any third-party. This Policy includes trades made pursuant to any investment direction under employee benefit plans as well as trades in the open market. This Policy also applies to the exercise of options with an immediate sale of some or all the shares through a broker (“a cashless exercise”). |

| • | “UDI” means mexican investment units (unidad de inversión) which are inflation indexed currency units. |

6

3.2. TRANSACTIONS WITH CEMEX SECURITIES

ARTICLE 1. COMPLIANCE

Every Cemex BODM, members of the Board of Directors of any Cemex Group company, member of Cemex’s Senior Management and Employees, are fully responsible for ensuring that they do not violate any securities laws, regulations or any applicable Cemex Group policy concerning securities trading in general.

Every Cemex BODM, members of the Board of Directors of any Cemex Group company, member of Cemex’s Senior Management and Employees, are, individually, equally responsible for compliance with this Policy by their immediate family members and any other persons with whom they reside, to whom they provide material financial support to or have a close relation with.

ARTICLE 2. GENERAL TRADING RESTRICTIONS

Unless this Policy provides for an exception, any Cemex BODM, member of the Board of Directors of any Cemex Group company, Cemex Senior Management member, and Employee must NOT:

|

1. |

Carry out any Cemex Securities Transaction when in possession of Material Non-Public Information; | ||

|

2. |

Carry out any Cemex Securities Transaction during a Quiet Period or Black-Out Period; or | ||

|

3. |

After carrying out a Cemex Securities Transaction (acquisition or sale), execute an opposite Cemex Securities Transaction (sale or acquisition, as applicable) within a period of 3 (three) months from the corresponding Cemex Securities Transaction. | ||

Additionally, unless this Policy provides for an exception, any Cemex BODM, members of the Board of Directors of any Cemex Group company, Cemex Senior Management member and Employee, when in possession of Material Non-Public Information, may only sell or buy Cemex Securities under any Stock Compensation Plan, or may only sell or buy from Cemex, directly or indirectly, Cemex Securities that any Cemex Group company offers to acquire or place, by means of a public offer.

ARTICLE 3. TRADING WHEN IN POSSESSION OF MATERIAL NON-PUBLIC INFORMATION IS PROHIBITED

|

Until any Material Non-Public Information becomes Material Public Information, any Cemex BODM, members of the Board of Directors of any Cemex Group company, Cemex Senior Management member and Employee with knowledge of such Material Non-Public Information may NOT Trade in Cemex Securities. |

In addition, if any Cemex BODM, members of the Board of Directors of any Cemex Group company, Cemex Senior Management member and Employee obtains Material Non-Public Information concerning another company, including news of a possible transaction between that company and any company of the Cemex Group, such Cemex BODM, members of the Board of Directors of any Cemex Group company, Cemex Senior Management member and Employee, respectively, may NOT Trade in that other company’s securities.

7

Even after the Material Non-Public Information has been disclosed, the corresponding Cemex BODM, member of the Board of Directors of any Cemex Group company, Cemex Senior Management member and/or Employee that was in possession of such Material Non-Public Information, respectively, must wait until sufficient time (one calendar day) before Trading in Cemex Securities or such other company’s securities, in order to allow the market to digest the information.

ARTICLE 4. STOCK COMPENSATION PLANS

Under the Mexican Securities Market Law (Ley del Mercado de Valores), any person that has rights to acquire Cemex Securities under the terms and conditions of any Stock Compensation Plan, may instruct the sale of said Cemex Securities, granted and released from any restriction through the aforementioned Stock Compensation Plan, without violating the provisions of this Policy, as long as they meet the following conditions:

| 1. | That the instruction to transfer the corresponding Cemex Securities released from any restriction, is formalized or notified to the corresponding plan administrator within 10 (ten) business days following the date of release of any restriction of the Cemex Securities granted under the Stock Compensation Plan, with the understanding that said term will be suspended when Cemex declares a Quiet Period or a Black-Out Period, and once such Quiet Period or Black-Out Period has concluded, the computation of the working days of the aforementioned period will continue; and |

| 2. | That the corresponding Cemex BODM, member of the Board of Directors of any Cemex Group company, Cemex Senior Management member and Employee have not acquired Cemex Securities, directly or indirectly, during a period of 3 (three) months prior to the date in which the instruction to the plan’s administrator to dispose of the Cemex Securities referred to in the previous paragraph plan is formalized or notified. |

ARTICLE 5. INTERNAL DISCLOSURE OBLIGATIONS

Any Cemex BODM, any member of the Board of Directors of any Cemex Group company, any Cemex Senior Management member or any Employee must provide reports each time any such person carries out a Cemex Security Transaction when they have access to Confidential Information or Material Non-Public Information, including when either any such transaction is executed (a) in violation of, or (b) in reliance of any exemption provided by applicable laws or this Policy.

This report must be sent to the Cemex Senior Vice President of Legal, (or person holding the equivalent position), within 10 (ten) business days following the conclusion of the operation in question and be completed; the report must include the details of the Cemex Security Transaction (type of Cemex Securities involved in the transaction, date executed, monetary amounts involved and known parties involved in the Cemex Securities Transaction).

8

ARTICLE 6. CERTAIN RESTRICTIONS AND REPORTING REQUIREMENTS

| Under the Mexican Securities Market Law |

Cemex BODM and any Cemex Senior Management member will have, in addition to any other obligation contained in this Policy and/or required by applicable laws and regulations, the following obligations:

1. Obligation to inform the CNBV about any Cemex Securities Transaction (only when such Cemex Security represents Cemex’s outstanding capital stock or when required by applicable laws and regulations) carried out during a calendar quarter within 5 (five) business days after the end of each quarter, provided that the total amount operated within said period is equal to or greater than 1,000,000 UDIs, considering the value of the UDI at the end of the relevant quarter;

2. Obligation to inform the CNBV of the sales or acquisitions of Cemex Securities (only when such Cemex Security represents Cemex’s outstanding capital stock or when required by applicable laws and regulations) made within a period of 5 (five) business days, for an amount equal to or greater than 1,000,000 UDIs, considering the value of the UDI on the day of the last Cemex Security Transaction, on the business day following the date on which such amount is reached; and

3. Obligation to inform the Cemex Corporate Legal Compliance Department no later than the 15th (fifteenth) day of May of each year, the number, series, and class of the Cemex Securities in which they are owners or beneficiaries, directly or indirectly, as well as the amount and percentage they represent with respect to Cemex´s capital stock (only when such Cemex Security represents a percentage of Cemex’s outstanding capital stock), through the form attached hereto as Exhibit A or any other form that may be required under applicable laws, regulations or rules. | |

| Under U.S. Securities laws and regulations | Sales of Cemex Securities representing Cemex’s outstanding capital stock made in the U.S. open market by a Cemex BODM or Cemex Senior Management member or any other Employee identified as an “Affiliate” by the Cemex Corporate Legal Compliance Department must be made in compliance with SEC Rule 144 (as may be amended) or any other applicable laws, regulations and/or rules, as may be required.

As of the date of this Policy, SEC Rule 144 requires that:

1. Such sales be made through ordinary broker transactions (and brokers may not receive more than a normal commission), | |

9

| 2. Cemex be current in its filing requirements,

3. The corresponding seller does not sell more than the “volume limitations” permitted by the rule in any three-month period, and

4. If the corresponding seller is selling more than 500 ADRs (5,000 CPOs) or an aggregate of more than U.S.$50,000 in any three-month period, such seller file a Form 144 notice in the form attached as Exhibit B hereto (or any other form which may be required or replaces Form 144 under applicable laws, regulations or rules) electronically on the SEC’s EDGAR database.

For purposes of this paragraph, as of the date of this Policy, the “volume limitations” discussed above prohibit the corresponding seller from selling more than the greater of the following in any three-month period: (x) 1% of the outstanding class of Cemex Securities being sold, and (y) the average reported weekly trading volume during the four weeks preceding the filing of a notice of sale on Form 144.

The Cemex BODM or Senior Management member or any other Employee identified as an “Affiliate” by the Cemex Corporate Legal Compliance Department must submit Form 144 (or any other form which replaces Form 144 in the future) through the corresponding means, as required by the applicable General Framework and contact the Cemex Corporate Legal Compliance Department for guidance. |

Cemex BODM, the members of the Board of Directors of any Cemex Group company, Cemex Senior Management and Employees must seek advice when transacting with Cemex Securities, including but not limited to notes, bonds, among others, listed in any exchange or market in order to comply with any reporting requirements.

ARTICLE 7. INTERNAL CONTROL MECHANISMS

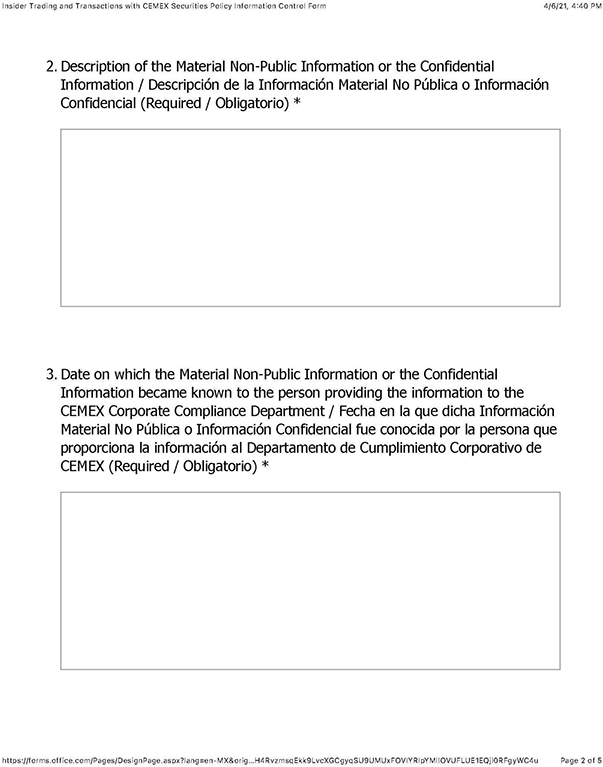

A control mechanism has been implemented where certain information must be provided by any Cemex BODM, Cemex Senior Manager and Employees to the Cemex Corporate Legal Compliance Department in order to maintain a record of the people who have access to Confidential Information and Material Non-Public Information (the “Information Control”).

The Information Control has the objective of identifying and limiting access to Material Non-Public Information. Therefore, the Information Control requests and records:

| 1. Description of the Material Non-Public Information or the Confidential Information; |

5. Description of the documents accessed or consulted that contain the Material Non-Public Information or the Confidential Information; |

10

| 2. Date on which the Material Non-Public Information or the Confidential Information became known to the person providing the information to the Cemex Corporate Legal Compliance Department; |

6. Job title of the person providing the information to the Cemex Corporate Legal Compliance Department; and | |

| 3. Country in which the person providing the information to the Cemex Corporate Legal Compliance Department resides; |

7. Names of other persons who had knowledge of the corresponding Material Non-Public Information or Confidential Information being reported. | |

|

4. Attachments (if applicable) of documents that contain the Material Non-Public Information or the Confidential Information; | ||

A sample format is attached to this Policy as Exhibit C.

Except as provided for at the end of this paragraph, it is the responsibility of each Cemex BODM, member of the Board of Directors of any Cemex Group company, Cemex Senior Manager member and/or Employee gaining access to Material Non-Public Information or Confidential Information to provide the information described above in the Information Control to the Cemex Corporate Legal Compliance Department promptly upon gaining access to the corresponding Material Non-Public Information or Confidential Information. It is the responsibility of the Cemex Corporate Legal Compliance Department to make available the means to register such information in the Information Control document.

Regarding any information received by Cemex BODM in connection with any Cemex Board of Directors meetings and Cemex Board Committee meetings, including any information sent previously to these meetings as part of the materials distributed and to be discussed in these meetings, the Cemex Senior Vice President of Legal (or any person with the equivalent title) shall be responsible for arranging for registering the corresponding information in the Information Control document.

The Information Control will be available to the CNBV and will be retained, as applicable, for a period of 5 (five) years as of the date that such Material Non-Public Information becomes Material Public Information, 5 (five) years after the report was submitted to the Cemex Corporate Legal Compliance Department if such Material Non-Public Information never became Material Public Information, or the date in which the Confidential Information was generated or obtained by Cemex or the corresponding Cemex BODM, Cemex Senior Management member or Employee.

The Information Control will be under the responsibility of the Cemex Corporate Legal Compliance Department.

The procedures for the effective control of access to Material Non-Public Information and the Confidential Information must ensure the following:

|

Allow access to Material Non-Public Information or Confidential Information only to those Cemex BODM, members of the Board of Directors of any Cemex Group company, Cemex Senior Management, and Employees, who, due to the nature of their position or employment, find its knowledge essential; |

11

|

A separation and control are kept with regards to the access of archives that contains Material Non-Public Information or Confidential Information pertaining to Cemex’s processes, substantive or business areas; and |

|

Updating Cemex Code of Ethics and Business Conduct, this Policy, and other related policies, including the Cemex BODM manual (or equivalent document) when applicable. |

ARTICLE 8. DISCLOSURE OF INFORMATION: HANDLING OF MATERIAL NON-PUBLIC INFORMATION

|

Any Insider has the obligation to handle any Material Non-Public Information in a secure and discrete manner. | |

|

Any Insider who is in possession of Material Non-Public Information is PROHIBITED from sharing or communicating that information to anyone unless authorized in writing by their supervisor. | |

|

Unless otherwise permitted as per this Policy, every Insider who is in possession of Material Non-Public Information must ABSTAIN from Trading with Cemex Securities. | |

Each person covered by the scope of this Policy should remember that the ultimate responsibility for adhering to this Policy and avoiding improper Trading rests with them. In this regard, it is important that each person covered by this Policy use their best judgment and seek guidance from the Cemex Corporate Legal Compliance Department whenever in doubt. No Cemex Group company is responsible for any person’s non-compliance with this Policy.

There may be situations in which disclosure of Material Non-Public Information is required. As examples, this may be the case when such disclosure is done pursuant to a requirement of law or an order from a competent authority, or in order to obtain advice from a specialized professional for the evaluation of a business opportunity, among other cases. In any such case, in addition to obtaining any authorizations described in this Policy to share any Material Non-Public Information, an Insider shall, before disclosing any Material Non-Public Information, make reasonable efforts to obtain reasonable assurance that the recipient of the Material Non-Public Information intends to act in such a manner that is not inconsistent with this Policy, its own securities transactions policies, and/or applicable laws and regulations. Such reasonable assurance may be in the form of, but is not limited to, the assumption of a non-disclosure and non-use obligation in the relevant agreement, engagement letter, etc.

Selective disclosure of Material Non-public Information must be AVOIDED. Cemex has established procedures for releasing material information in a manner that is designed to achieve broad public dissemination of the information immediately upon its release. Any Cemex BODM, member of the Board of Directors of any Cemex Group company, Cemex Senior Management member and Employee who inadvertently disclose any Material Non-public Information must immediately advise the Cemex Corporate Legal Compliance Department so that Cemex can assess its obligations under applicable securities laws.

ARTICLE 9. QUIET PERIODS

Because of the sensitivity to quarterly earnings results, Cemex instituted Quiet Periods during which Cemex BODM, any member of the Board of Directors of any Cemex Group company, Cemex Senior Management member and/or Employees may not trade Cemex Securities beginning on the first calendar day after the closing of each calendar quarter (March, June, September and December), and ending at the end the second business day that follows the day the quarterly financial information of Cemex or the relevant Material Non-Public Information becomes Material Public Information.

12

For instance, if Cemex publishes its quarterly results on a Thursday before the market opens, the Quiet Period would cover Friday and end Monday at 11:59 PM (U.S. Eastern Time), so that any Cemex BODM, member of the Board of Directors of any Cemex Group company, any member of Cemex Senior Management and/or Employees can start trading on 12:00 AM on Tuesday.

If an additional Quiet Period is declared, this will be communicated directly to you through the Cemex Corporate Legal Compliance Department or by the Cemex Senior Vice President of Legal (or person holding the equivalent position).

3.3. AMENDMENTS AND WAIVERS

Cemex’s Board of Directors delegates the authority to amend and update this Policy to the Cemex Senior Vice President of Legal (or any person with the equivalent title), only when such amendment or update is required to clarify any interpretations of this Policy, implement changes to the content of any Annex, reflect changes in the process and methodology to comply with this Policy, and to incorporate any updates required by changes in applicable laws or regulations, provided that any such amendment or update is not contrary to the current terms of this Policy.

This Policy must be analyzed and reviewed at least every two years, or before in accordance with any applicable General Framework, to determine if any updates or amendments are necessary, with the ultimate decision being of the Cemex Corporate Legal Compliance Department.

All changes or amendments to this Policy must be informed to the Cemex Internal Control Department.

All waivers and exceptions to this Policy, the processes contained herein, and any rules and/or guidelines set forth in this document, must be expressly approved in writing by the Cemex Corporate Legal Compliance Department.

3.4. NON-COMPLIANCE PROCESS AND REPORTING

Strict compliance of this Policy is expected and required from all Employees and Cemex representatives. Any violation of this Policy may result in disciplinary action including but not limited to, employment suspension or termination, as well as any other sanctions set forth and applicable pursuant to applicable laws.

The Cemex Group encourages reporting, in good faith, of any violation regarding this Policy or any applicable laws. The official channels for reporting any actual or suspected breaches to this Policy are the following:

| • | ETHOSline, via online, phone, or e-mail; |

| • | Cemex Internal Audit Department; |

| • | The corresponding Cemex Regional Legal Department or Cemex Local Legal Department; or |

| • | Cemex Corporate Legal Compliance Department. |

3.5. NO RETALIATION

The Cemex Group strictly prohibits retaliation against any individual who reports in good faith any possible non-compliance with this Policy. Such retaliation would be grounds for discipline, including potential termination of employment. No Employee shall be terminated, demoted, suspended, harassed, or discriminated against solely because they reported in good faith an actual or suspected violation of this Policy or General Framework.

13

3.6. TRAININGS AND AUDITS

If and when required by the Cemex Corporate Legal Compliance Department, or the corresponding Cemex Regional Legal Department or Cemex Local Legal Department, Employees could be required to attend necessary trainings. Employees that receive training on this Policy can be asked to provide written confirmation that they have received the corresponding training. The Employees that require any training shall be identified by the Cemex Corporate Legal Compliance Department, or the corresponding Cemex Regional Legal Department or Cemex Local Legal Department, at their discretion.

Additionally, the Cemex Corporate Legal Compliance Department, through the corresponding Cemex Regional Legal Department or Cemex Local Legal Department and the Cemex Internal Audit Department and any other internal areas of the Cemex Group deemed necessary by the Cemex Corporate Legal Compliance Department, or any external third-party required for any audit also determined by the Cemex Corporate Legal Compliance Department, has the authority to carry out audits, including audits of Cemex Group devices, systems and platforms, to evaluate Employees´ compliance with this Policy.

14

EXHIBITS CONTAINED IN FOLLOWING PAGES

15

EXHIBIT A

MEXICAN SECURITIES EXCHANGE COMMISSION FORM

REPORTE DE OPERACIONES CELEBRADAS CON VALORES OBJETO DE REVELACIÓN

| NOMBRE DE LA EMISORA/ NAME OF THE ISSUER |

| Cemex, S.A.B. DE C.V. |

| DATOS PERSONALES PERSONA FÍSICA/ NAME OF THE PERSON | ||||

| APELLIDO PATERNO/ PATERNAL SURNAME | APELLIDO MATERNO/ MATERNAL SURNAME

|

NOMBRE(S)/ NAME(S) | ||

| VÍNCULO CON LA EMISORA/ RELATION TO THE ISSUER (artículo 111 de la Ley del Mercado de Valores) | ||||

| a) Persona que tenga 10% o más/ Holder of 10% of all outstanding shares or more | c) Miembro del Consejo de Administración/ Member of the Board of Directors | |||

| b) Grupo de personas que tenga el 10% o más/ Group of persons that hold 10% of all outstanding shares or more | d) Directivo relevante/ Relevant Officer | |||

| OPERACIONES CELEBRADAS/ TRANSACTIONS | ||||||||

| VALOR/ SECURITY (CPOs o ADRs)/ (CPOs or ADRs) | TIPO/ TYPE (Enajenación o adquisición)/ (Purchase or Sale) |

FECHA DE CONCERTACIÓN/ TRANSACTION DATE | VOLUMEN/ QUANTITY | PRECIO/ PRICE | ||||

| FECHA DE ENTREGA DE INFORMACIÓN A CNBV/ DATE OF FILING |

|

Domicilio para recibir notificaciones de la persona de que se trate o del representante autorizado. / Address of the aforementioned person or its representative to receive notifications.

Teléfono/ Telephone number: |

El suscrito, bajo protesta de decir verdad, manifiesta que la información y datos contenidos en el presente documento son ver daderos. / The undersigned, under oath to tell the truth, hereby declares that the information and data contained herein is true.

NOMBRE COMPLETO Y FIRMA/ NAME AND SIGNATURE: ____________________________

THIS FORM IS INCLUDED AS AN EXHIBIT TO THIS POLICY FOR ILLUSTRATIVE PURPOSES ONLY AND MAY BE UPDATED FROM TIME TO TIME WITHOUT NOTICE. BEFORE SUBMITTING A REPORT USING THIS FORM, PLEASE CONTACT THE CEMEX CORPORATE LEGAL COMPLIANCE DEPARTMENT TO ENSURE THAT YOU HAVE THE MOST UP-TO-DATE VERSION.

16

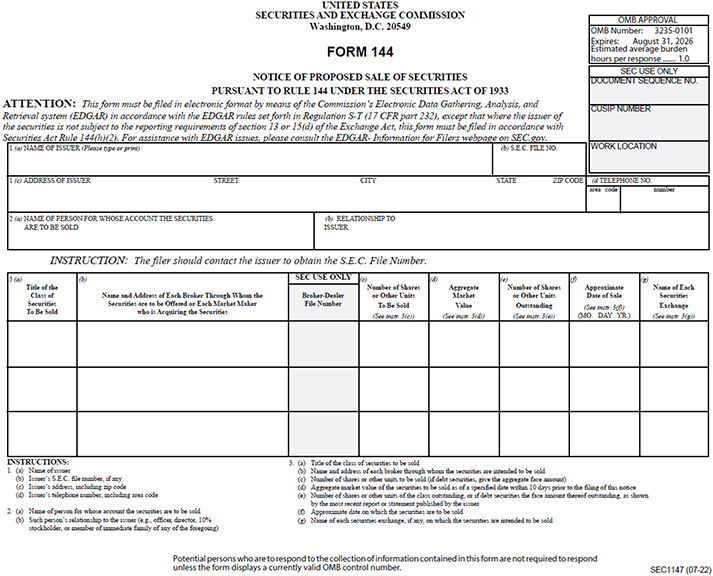

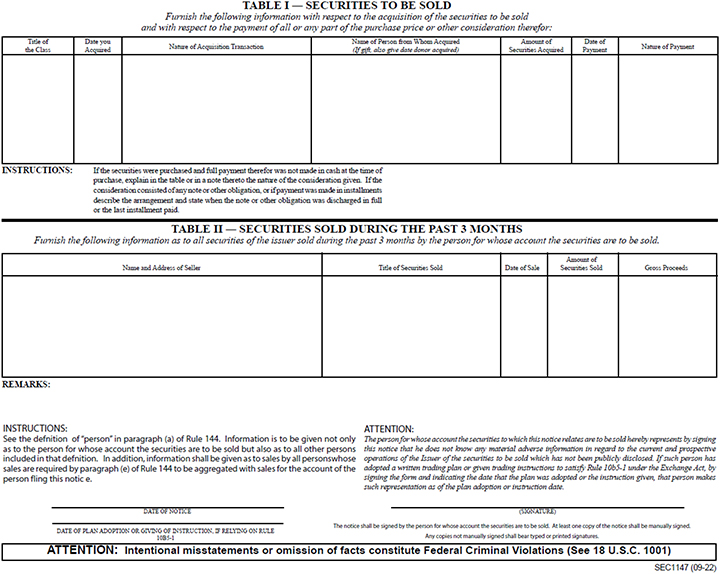

EXHIBIT B

UNITED STATES SECURITIES EXCHANGE COMMISSION FORM 144

17

THIS FORM IS INCLUDED AS AN EXHIBIT TO THIS POLICY FOR ILLUSTRATIVE PURPOSES ONLY AND MAY BE UPDATED FROM TIME TO TIME WITHOUT NOTICE. BEFORE SUBMITTING A REPORT USING THIS FORM, PLEASE CONTACT THE CEMEX CORPORATE LEGAL COMPLIANCE DEPARTMENT TO ENSURE THAT YOU HAVE THE MOST UP-TO-DATE VERSION.

18

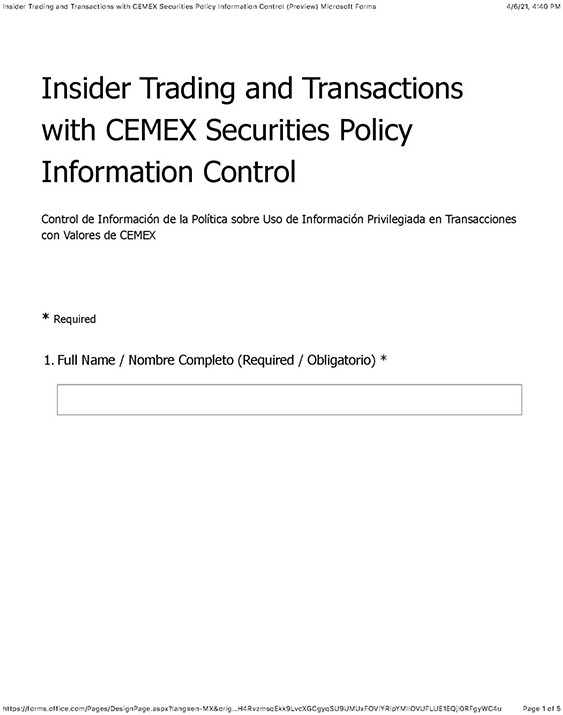

EXHIBIT C

DISCLOSURE FORMAT

To complete the Disclosure Format, please access the following link:

https://forms.office.com/Pages/ResponsePage.aspx?id=AZDhbsTQEWvi_8A8W0H4RvzmsqEkk9LvcXGCgyqSU9UMUxFOVlYRlpYMll

OVUFLUE1EQjI0RFgyWC4u

19

20

21

22

THIS FORM IS INCLUDED AS AN EXHIBIT TO THIS POLICY FOR ILLUSTRATIVE PURPOSES ONLY AND MAY BE UPDATED FROM TIME TO TIME WITHOUT NOTICE. ANY INFORMATION SUBMITTED AS PART OF THE INFORMATION CONTROL MUST BE SUBMITTED USING THE FORM AT THE LINK SPECIFIED IN ARTICLE 7 OF THIS POLICY.

23