© 2025 Texas Capital Bank Member FDIC October 22, 2025 Q3-2025 Earnings

2 Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of and pursuant to the Private Securities Litigation Reform Act of 1995 regarding, among other things, TCBI’s financial condition, results of operations, business plans and future performance. These statements are not historical in nature and may often be identified by the use of words such as “believes,” “projects,” “expects,” “may,” “estimates,” “should,” “plans,” “targets,” “intends” “could,” “would,” “anticipates,” “potential,” “confident,” “optimistic” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy, objectives, estimates, trends, guidance, expectations and future plans. Because forward-looking statements relate to future results and occurrences, they are subject to inherent and various uncertainties, risks, and changes in circumstances that are difficult to predict, may change over time, are based on management’s expectations and assumptions at the time the statements are made and are not guarantees of future results. Numerous risks and other factors, many of which are beyond management’s control, could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. While there can be no assurance that any list of risks is complete, important risks and other factors that could cause actual results to differ materially from those contemplated by forward- looking statements include, but are not limited to: economic or business conditions in Texas, the United States or globally that impact TCBI or its customers; negative credit quality developments arising from the foregoing or other factors, including recent trade policies and their impact on our customers; increased or expanded competition from banks and other financial service providers in TCBI’s markets; TCBI’s ability to effectively manage its liquidity and maintain adequate regulatory capital to support its businesses; TCBI’s ability to pursue and execute upon growth plans, whether as a function of capital, liquidity or other limitations; TCBI’s ability to successfully execute its business strategy, including its strategic plan and developing and executing new lines of business and new products and services and potential strategic acquisitions; the extensive regulations to which TCBI is subject and its ability to comply with applicable governmental regulations, including legislative and regulatory changes; TCBI’s ability to effectively manage information technology systems, including third party vendors, cyber or data privacy incidents or other failures, disruptions or security breaches; TCBI’s ability to use technology to provide products and services to its customers; risks related to the development and use of artificial intelligence; changes in interest rates, including the impact of interest rates on TCBI’s securities portfolio and funding costs, as well as related balance sheet implications stemming from the fair value of our assets and liabilities; the effectiveness of TCBI’s risk management processes strategies and monitoring; fluctuations in commercial and residential real estate values, especially as they relate to the value of collateral supporting TCBI’s loans; the failure to identify, attract and retain key personnel and other employees; adverse developments in the banking industry and the potential impact of such developments on customer confidence, liquidity and regulatory responses to these developments, including in the context of regulatory examinations and related findings and actions; negative press and social media attention with respect to the banking industry or TCBI, in particular; claims, litigation or regulatory investigations and actions that TCBI may become subject to; severe weather, natural disasters, climate change, acts of war, terrorism, global or other geopolitical conflicts, or other external events, as well as related legislative and regulatory initiatives; and the risks and factors more fully described in TCBI’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents and filings with the SEC. The information contained in this communication speaks only as of its date. Except to the extent required by applicable law or regulation, we disclaim any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments.

3 Foundational Tenants of Value Creation in Place Financial Priorities Described 9/1/2021 Building Tangible Book Value // Reinvesting organically generated capital to improve client relevance and create a more valuable franchise Investment // Re-aligning the expense base to directly support the business and investing aggressively to take advantage of market opportunities that we are uniquely positioned to serve Revenue Growth // Growing top- line revenue as a result of expanded banking capabilities for best-in-class clients in our Texas and national markets Flagship Results Proactive, disciplined engagement with the best clients in our markets to provide the talent, products, and offerings they need through their entire life-cycles Structurally higher, more sustainable earnings driving greater performance and lower annual variability Consistent communication, enhanced accountability, and a bias for action ensure execution and delivery Commitment to financial resilience allowing us to serve clients, access markets, and support communities through all cycles Higher quality earnings and a lower cost of capital drive a significant expansion in incremental shareholder returns

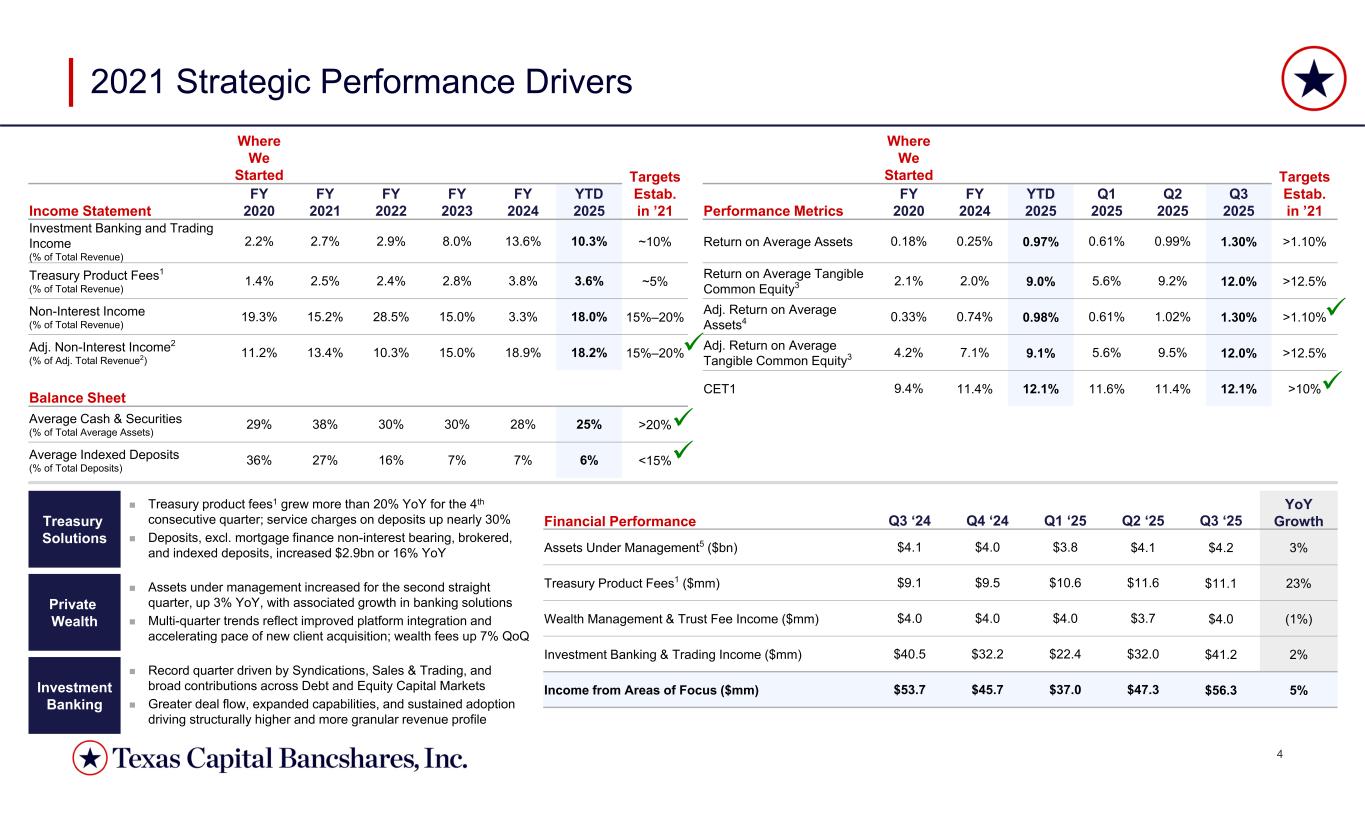

4 Targets Estab. in ’21 Where We StartedTargets Estab. in ’21 Where We Started Q3 2025 Q2 2025 Q1 2025 YTD 2025 FY 2024 FY 2020Performance Metrics YTD 2025 FY 2024 FY 2023 FY 2022 FY 2021 FY 2020Income Statement >1.10%1.30%0.99%0.61%0.97%0.25%0.18%Return on Average Assets~10%10.3%13.6%8.0%2.9%2.7%2.2% Investment Banking and Trading Income (% of Total Revenue) >12.5%12.0%9.2%5.6% 9.0% 2.0% 2.1%Return on Average Tangible Common Equity3~5%3.6%3.8%2.8%2.4%2.5%1.4%Treasury Product Fees1 (% of Total Revenue) >1.10%1.30%1.02%0.61%0.98%0.74%0.33%Adj. Return on Average Assets415%–20% 18.0%3.3%15.0%28.5%15.2%19.3%Non-Interest Income (% of Total Revenue) >12.5%12.0%9.5%5.6%9.1%7.1%4.2%Adj. Return on Average Tangible Common Equity315%–20%18.2%18.9%15.0%10.3%13.4%11.2%Adj. Non-Interest Income2 (% of Adj. Total Revenue2) >10%12.1%11.4%11.6%12.1%11.4%9.4%CET1Balance Sheet >20%25%28%30%30%38%29%Average Cash & Securities (% of Total Average Assets) <15%6%7%7%16%27%36%Average Indexed Deposits (% of Total Deposits) 2021 Strategic Performance Drivers Treasury Solutions Private Wealth Investment Banking YoY GrowthQ3 ‘25Q2 ‘25Q1 ‘25Q4 ‘24Q3 ‘24Financial Performance 3%$4.2 $4.1 $3.8 $4.0$4.1Assets Under Management5 ($bn) 23%$11.1 $11.6 $10.6 $9.5 $9.1 Treasury Product Fees1 ($mm) (1%)$4.0 $3.7 $4.0 $4.0 $4.0 Wealth Management & Trust Fee Income ($mm) 2%$41.2 $32.0 $22.4 $32.2 $40.5 Investment Banking & Trading Income ($mm) 5%$56.3 $47.3 $37.0 $45.7 $53.7 Income from Areas of Focus ($mm) Treasury product fees1 grew more than 20% YoY for the 4th consecutive quarter; service charges on deposits up nearly 30% Deposits, excl. mortgage finance non-interest bearing, brokered, and indexed deposits, increased $2.9bn or 16% YoY Record quarter driven by Syndications, Sales & Trading, and broad contributions across Debt and Equity Capital Markets Greater deal flow, expanded capabilities, and sustained adoption driving structurally higher and more granular revenue profile Assets under management increased for the second straight quarter, up 3% YoY, with associated growth in banking solutions Multi-quarter trends reflect improved platform integration and accelerating pace of new client acquisition; wealth fees up 7% QoQ

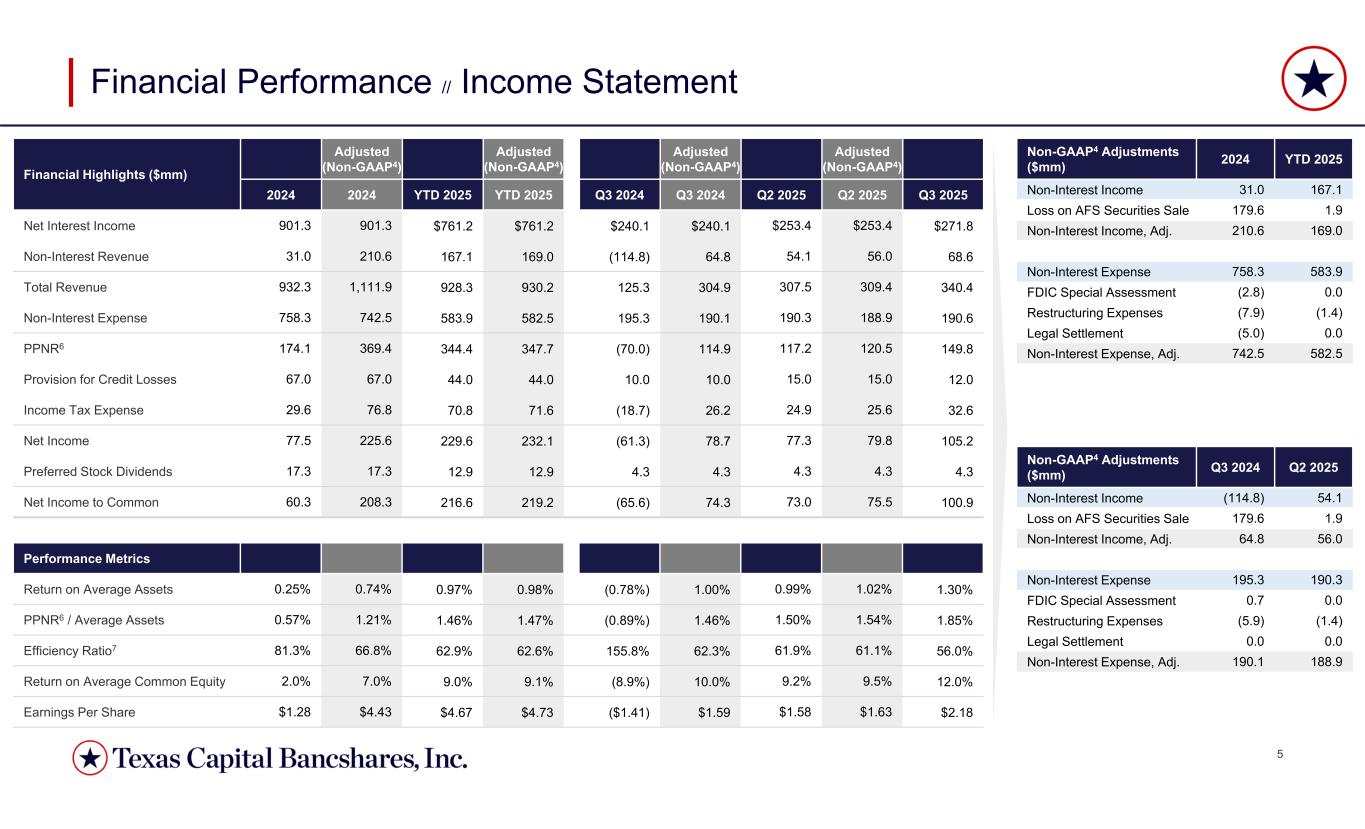

5 Q2 2025Q3 2024Non-GAAP4 Adjustments ($mm) 54.1(114.8)Non-Interest Income 1.9179.6Loss on AFS Securities Sale 56.064.8Non-Interest Income, Adj. 190.3195.3Non-Interest Expense 0.00.7FDIC Special Assessment (1.4)(5.9)Restructuring Expenses 0.00.0Legal Settlement 188.9190.1Non-Interest Expense, Adj. Financial Performance // Income Statement Adjusted (Non-GAAP4) Adjusted (Non-GAAP4) Adjusted (Non-GAAP4) Adjusted (Non-GAAP4)Financial Highlights ($mm) Q3 2025Q2 2025Q2 2025Q3 2024Q3 2024YTD 2025YTD 202520242024 $271.8 $253.4 $253.4 $240.1 $240.1 $761.2 $761.2 901.3 901.3 Net Interest Income 68.6 56.0 54.1 64.8 (114.8)169.0 167.1 210.6 31.0 Non-Interest Revenue 340.4 309.4 307.5 304.9 125.3 930.2 928.3 1,111.9 932.3 Total Revenue 190.6 188.9 190.3 190.1 195.3 582.5 583.9 742.5 758.3 Non-Interest Expense 149.8 120.5 117.2 114.9 (70.0)347.7 344.4 369.4 174.1 PPNR6 12.0 15.0 15.0 10.0 10.0 44.0 44.0 67.0 67.0 Provision for Credit Losses 32.6 25.6 24.9 26.2 (18.7)71.6 70.8 76.8 29.6 Income Tax Expense 105.2 79.8 77.3 78.7 (61.3)232.1 229.6 225.6 77.5 Net Income 4.3 4.3 4.3 4.3 4.3 12.9 12.9 17.3 17.3 Preferred Stock Dividends 100.9 75.5 73.0 74.3 (65.6)219.2 216.6 208.3 60.3 Net Income to Common Performance Metrics 1.30% 1.02% 0.99% 1.00% (0.78%)0.98% 0.97% 0.74% 0.25% Return on Average Assets 1.85% 1.54% 1.50% 1.46% (0.89%)1.47% 1.46% 1.21% 0.57% PPNR6 / Average Assets 56.0% 61.1% 61.9% 62.3% 155.8% 62.6% 62.9% 66.8% 81.3% Efficiency Ratio7 12.0% 9.5% 9.2% 10.0% (8.9%)9.1% 9.0% 7.0% 2.0% Return on Average Common Equity $2.18 $1.63 $1.58 $1.59 ($1.41)$4.73 $4.67 $4.43 $1.28 Earnings Per Share YTD 20252024Non-GAAP4 Adjustments ($mm) 167.131.0Non-Interest Income 1.9179.6Loss on AFS Securities Sale 169.0210.6Non-Interest Income, Adj. 583.9758.3Non-Interest Expense 0.0(2.8)FDIC Special Assessment (1.4)(7.9)Restructuring Expenses 0.0(5.0)Legal Settlement 582.5742.5Non-Interest Expense, Adj.

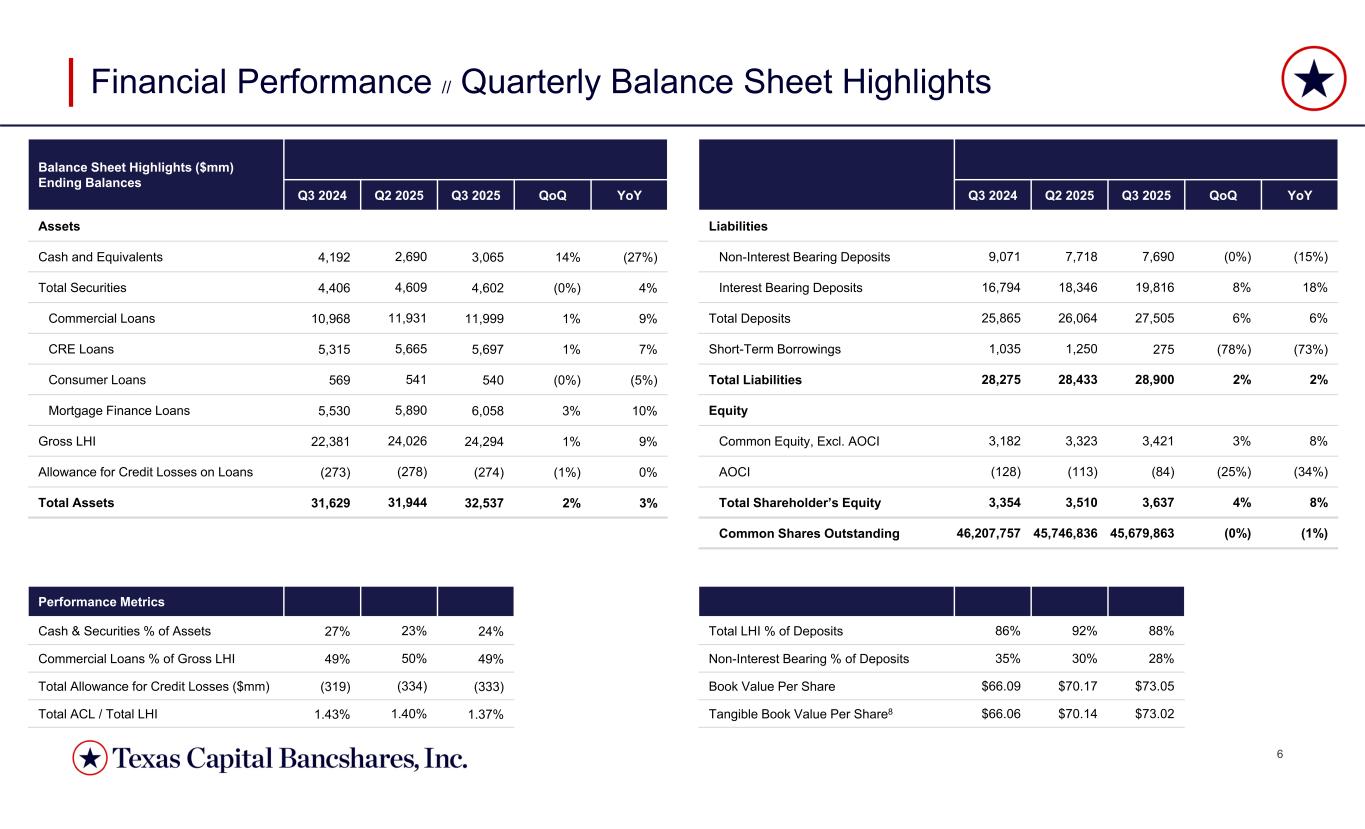

6 Balance Sheet Highlights ($mm) Ending Balances YoYQoQQ3 2025Q2 2025Q3 2024 Assets (27%)14% 3,065 2,690 4,192 Cash and Equivalents 4% (0%)4,602 4,609 4,406 Total Securities 9% 1% 11,999 11,931 10,968 Commercial Loans 7% 1% 5,697 5,665 5,315 CRE Loans (5%)(0%)540 541 569 Consumer Loans 10% 3% 6,058 5,890 5,530 Mortgage Finance Loans 9% 1% 24,294 24,026 22,381 Gross LHI 0% (1%)(274)(278)(273)Allowance for Credit Losses on Loans 3% 2% 32,537 31,944 31,629 Total Assets Financial Performance // Quarterly Balance Sheet Highlights Performance Metrics 24% 23% 27% Cash & Securities % of Assets 49% 50% 49% Commercial Loans % of Gross LHI (333)(334)(319)Total Allowance for Credit Losses ($mm) 1.37% 1.40% 1.43% Total ACL / Total LHI YoYQoQQ3 2025Q2 2025Q3 2024 Liabilities (15%)(0%)7,690 7,718 9,071 Non-Interest Bearing Deposits 18% 8% 19,816 18,346 16,794 Interest Bearing Deposits 6% 6% 27,505 26,064 25,865 Total Deposits (73%)(78%)275 1,250 1,035 Short-Term Borrowings 2% 2% 28,900 28,433 28,275 Total Liabilities Equity 8% 3% 3,421 3,323 3,182 Common Equity, Excl. AOCI (34%)(25%)(84)(113)(128)AOCI 8% 4% 3,637 3,510 3,354 Total Shareholder’s Equity (1%)(0%)45,679,863 45,746,836 46,207,757 Common Shares Outstanding 88% 92% 86% Total LHI % of Deposits 28% 30% 35% Non-Interest Bearing % of Deposits $73.05 $70.17 $66.09 Book Value Per Share $73.02 $70.14 $66.06 Tangible Book Value Per Share8

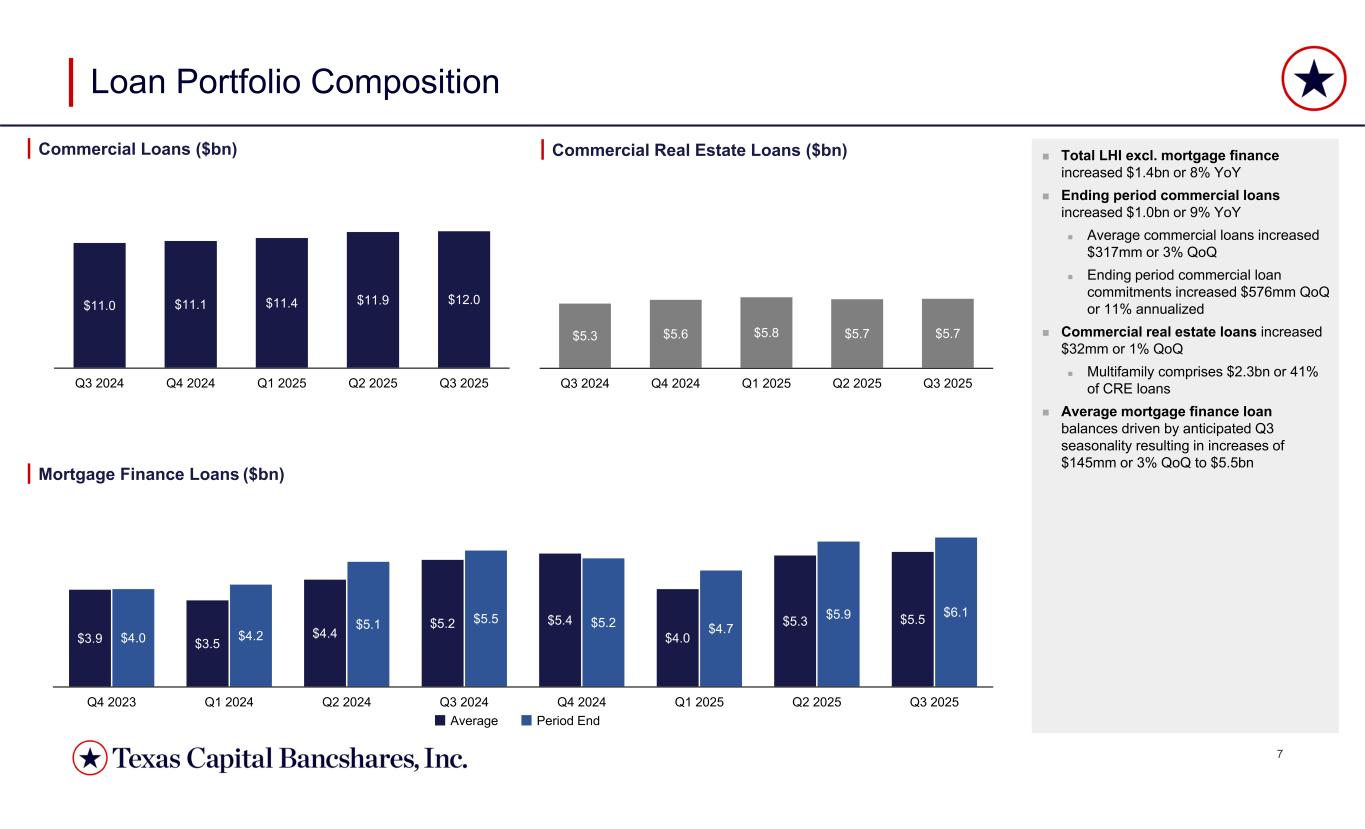

7 $3.9 $3.5 $4.4 $5.2 $5.4 $4.0 $5.3 $5.5 $4.0 $4.2 $5.1 $5.5 $5.2 $4.7 $5.9 $6.1 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $5.3 $5.6 $5.8 $5.7 $5.7 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $11.0 $11.1 $11.4 $11.9 $12.0 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Total LHI excl. mortgage finance increased $1.4bn or 8% YoY Ending period commercial loans increased $1.0bn or 9% YoY Average commercial loans increased $317mm or 3% QoQ Ending period commercial loan commitments increased $576mm QoQ or 11% annualized Commercial real estate loans increased $32mm or 1% QoQ Multifamily comprises $2.3bn or 41% of CRE loans Average mortgage finance loan balances driven by anticipated Q3 seasonality resulting in increases of $145mm or 3% QoQ to $5.5bn Loan Portfolio Composition Mortgage Finance Loans ($bn) Commercial Loans ($bn) Commercial Real Estate Loans ($bn) Average Period End

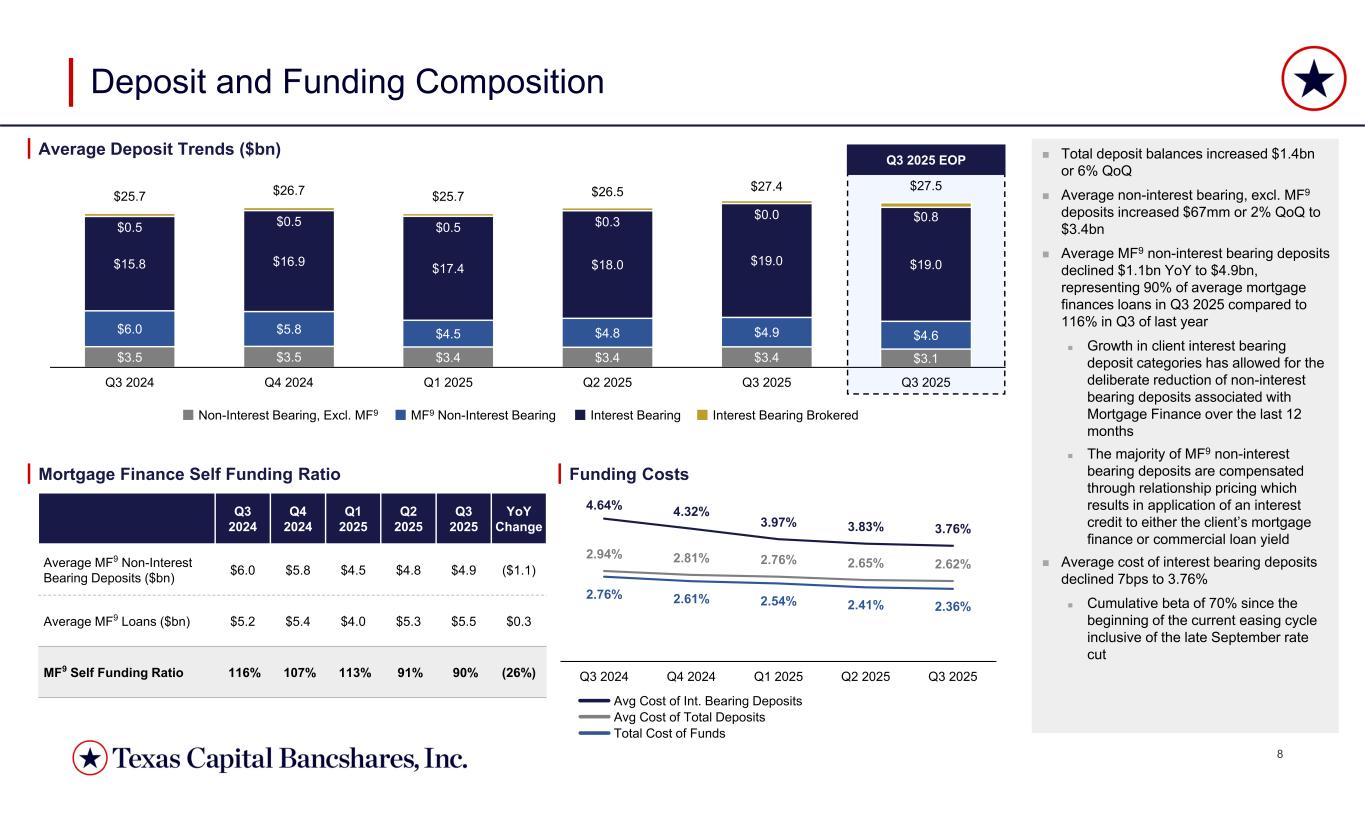

8 $3.5 $3.5 $3.4 $3.4 $3.4 $3.1 $6.0 $5.8 $4.5 $4.8 $4.9 $4.6 $15.8 $16.9 $17.4 $18.0 $19.0 $19.0 $0.5 $0.5 $0.5 $0.3 $0.0 $0.8 $25.7 $26.7 $25.7 $26.5 $27.4 $27.5 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q3 2025 2.94% 2.81% 2.76% 2.65% 2.62% 2.76% 2.61% 2.54% 2.41% 2.36% 4.64% 4.32% 3.97% 3.83% 3.76% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q3 2025 EOP Deposit and Funding Composition Total deposit balances increased $1.4bn or 6% QoQ Average non-interest bearing, excl. MF9 deposits increased $67mm or 2% QoQ to $3.4bn Average MF9 non-interest bearing deposits declined $1.1bn YoY to $4.9bn, representing 90% of average mortgage finances loans in Q3 2025 compared to 116% in Q3 of last year Growth in client interest bearing deposit categories has allowed for the deliberate reduction of non-interest bearing deposits associated with Mortgage Finance over the last 12 months The majority of MF9 non-interest bearing deposits are compensated through relationship pricing which results in application of an interest credit to either the client’s mortgage finance or commercial loan yield Average cost of interest bearing deposits declined 7bps to 3.76% Cumulative beta of 70% since the beginning of the current easing cycle inclusive of the late September rate cut Average Deposit Trends ($bn) Mortgage Finance Self Funding Ratio Funding Costs Avg Cost of Total Deposits Total Cost of Funds Avg Cost of Int. Bearing Deposits Non-Interest Bearing, Excl. MF9 MF9 Non-Interest Bearing Interest Bearing Interest Bearing Brokered YoY Change Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 ($1.1)$4.9 $4.8 $4.5 $5.8 $6.0 Average MF9 Non-Interest Bearing Deposits ($bn) $0.3 $5.5 $5.3 $4.0 $5.4 $5.2 Average MF9 Loans ($bn) (26%)90% 91% 113% 107% 116% MF9 Self Funding Ratio

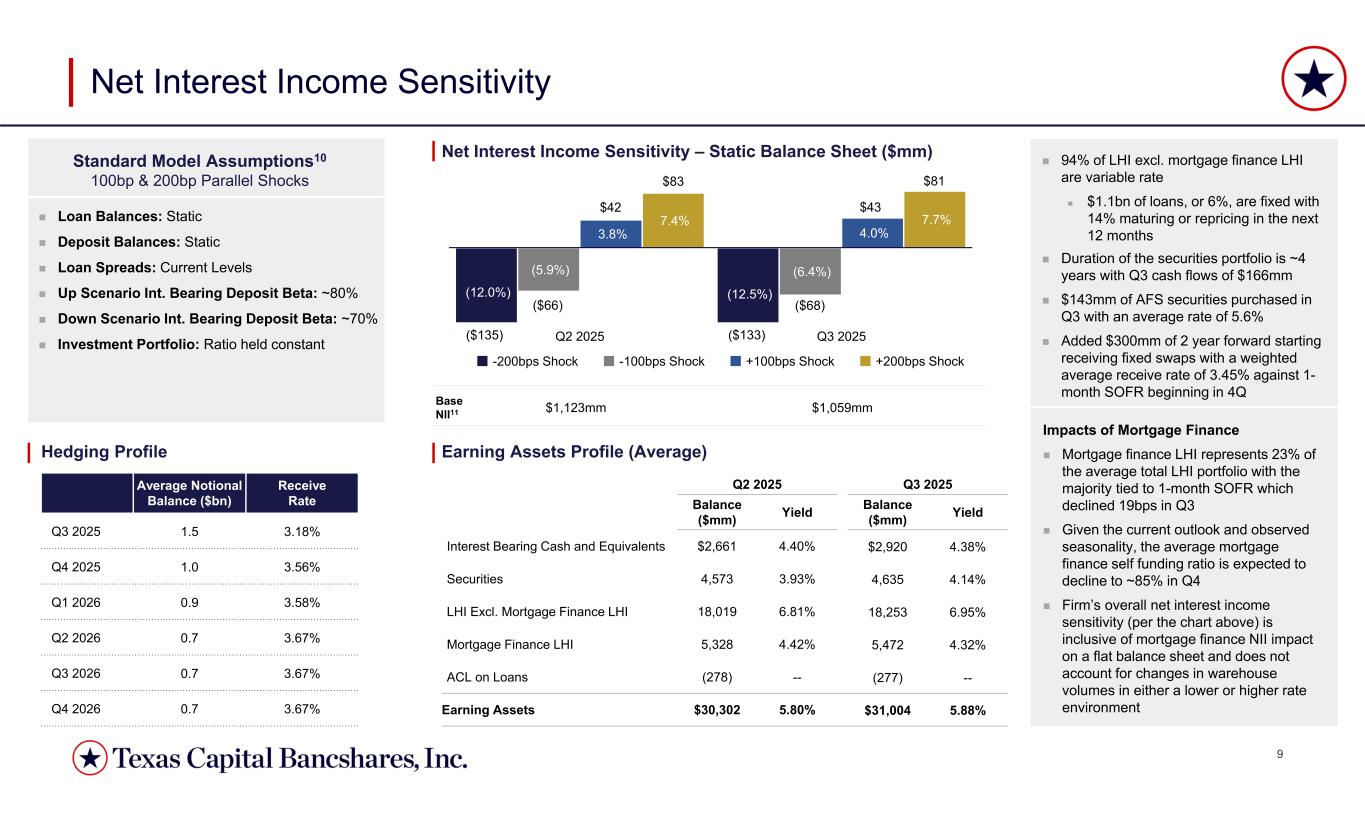

9 (12.0%) (12.5%) (5.9%) (6.4%) 3.8% 4.0% 7.4% 7.7% (10.0%) (8.0%) (6.0%) (4.0%) (2.0%) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Q2 2025 Q3 2025 -200bps Shock -100bps Shock +100bps Shock +200bps Shock Net Interest Income Sensitivity Standard Model Assumptions10 100bp & 200bp Parallel Shocks Loan Balances: Static Deposit Balances: Static Loan Spreads: Current Levels Up Scenario Int. Bearing Deposit Beta: ~80% Down Scenario Int. Bearing Deposit Beta: ~70% Investment Portfolio: Ratio held constant Hedging Profile Net Interest Income Sensitivity – Static Balance Sheet ($mm) $1,059mm$1,123mmBase NII11 Earning Assets Profile (Average) Q3 2025Q2 2025 YieldBalance ($mm)YieldBalance ($mm) 4.38% $2,920 4.40% $2,661 Interest Bearing Cash and Equivalents 4.14% 4,635 3.93% 4,573 Securities 6.95% 18,253 6.81% 18,019 LHI Excl. Mortgage Finance LHI 4.32% 5,472 4.42% 5,328 Mortgage Finance LHI --(277)--(278)ACL on Loans 5.88% $31,004 5.80% $30,302 Earning Assets 94% of LHI excl. mortgage finance LHI are variable rate $1.1bn of loans, or 6%, are fixed with 14% maturing or repricing in the next 12 months Duration of the securities portfolio is ~4 years with Q3 cash flows of $166mm $143mm of AFS securities purchased in Q3 with an average rate of 5.6% Added $300mm of 2 year forward starting receiving fixed swaps with a weighted average receive rate of 3.45% against 1- month SOFR beginning in 4Q Impacts of Mortgage Finance Mortgage finance LHI represents 23% of the average total LHI portfolio with the majority tied to 1-month SOFR which declined 19bps in Q3 Given the current outlook and observed seasonality, the average mortgage finance self funding ratio is expected to decline to ~85% in Q4 Firm’s overall net interest income sensitivity (per the chart above) is inclusive of mortgage finance NII impact on a flat balance sheet and does not account for changes in warehouse volumes in either a lower or higher rate environment $83 $42 ($66) ($135) $81 $43 ($68) ($133) Receive Rate Average Notional Balance ($bn) 3.18%1.5Q3 2025 3.56%1.0Q4 2025 3.58%0.9Q1 2026 3.67%0.7Q2 2026 3.67%0.7Q3 2026 3.67%0.7Q4 2026

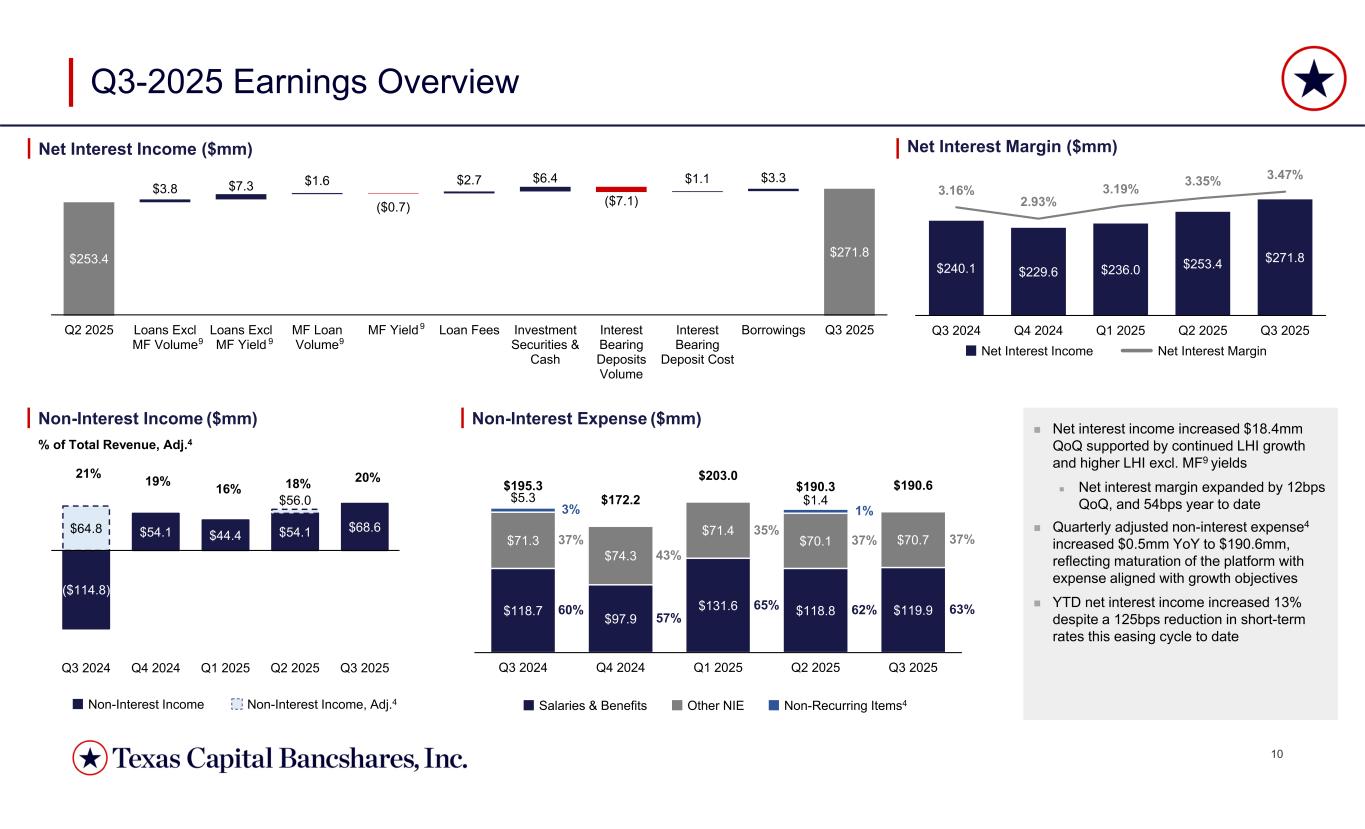

10 $118.7 $97.9 $131.6 $118.8 $119.9 $71.3 $74.3 $71.4 $70.1 $70.7 $5.3 $1.4 $195.3 $172.2 $203.0 $190.3 $190.6 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 ($114.8) $54.1 $44.4 $54.1 $68.6 $64.8 $56.0 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $240.1 $229.6 $236.0 $253.4 $271.8 3.16% 2.93% 3.19% 3.35% 3.47% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $253.4 $3.8 $7.3 $1.6 ($0.7) $2.7 $6.4 ($7.1) $1.1 $3.3 $271.8 Q2 2025 Loans Excl MF Volume Loans Excl MF Yield MF Loan Volume MF Yield Loan Fees Investment Securities & Cash Interest Bearing Deposits Volume Interest Bearing Deposit Cost Borrowings Q3 2025 60% 57% 65% 62% Q3-2025 Earnings Overview Net Interest Margin ($mm)Net Interest Income ($mm) Non-Interest Income ($mm) Non-Interest Expense ($mm) 63% Net interest income increased $18.4mm QoQ supported by continued LHI growth and higher LHI excl. MF9 yields Net interest margin expanded by 12bps QoQ, and 54bps year to date Quarterly adjusted non-interest expense4 increased $0.5mm YoY to $190.6mm, reflecting maturation of the platform with expense aligned with growth objectives YTD net interest income increased 13% despite a 125bps reduction in short-term rates this easing cycle to date 9 9 9 9 37% % of Total Revenue, Adj.4 21% 19% 16% 18% 20% 3% 43% 1% 35% Net Interest Income Net Interest Margin Salaries & Benefits Other NIE Non-Recurring Items4Non-Interest Income Non-Interest Income, Adj.4 37% 37%

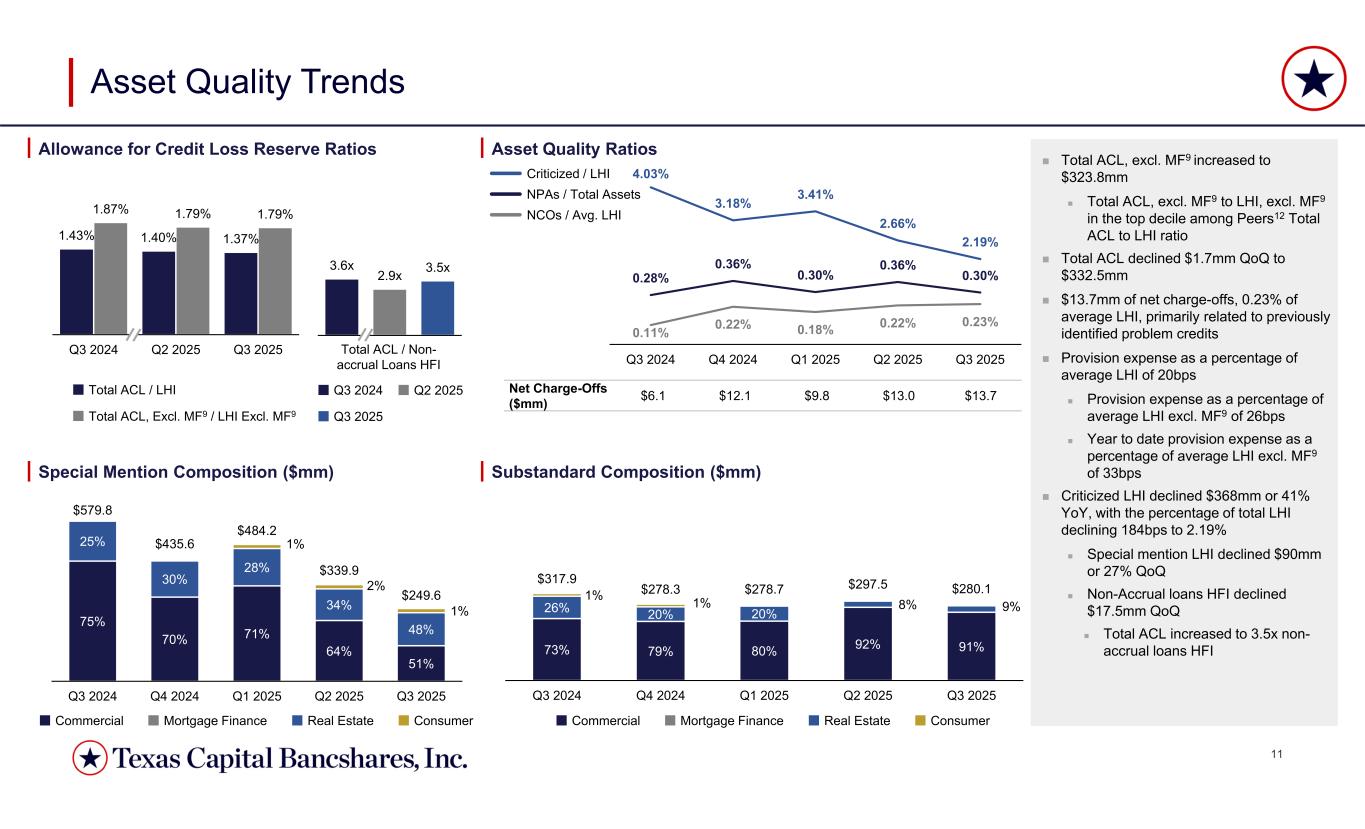

11 75% 70% 71% 64% 51% 25% 30% 28% 34% 48% 1% 2% 1% $579.8 $435.6 $484.2 $339.9 $249.6 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 73% 79% 80% 92% 91% 26% 20% 20% 8% 9% 1% 1% $317.9 $278.3 $278.7 $297.5 $280.1 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 3.6x 2.9x 3.5x 0.28% 0.36% 0.30% 0.36% 0.30% 0.11% 0.22% 0.18% 0.22% 0.23% 4.03% 3.18% 3.41% 2.66% 2.19% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 1.43% 1.40% 1.37% 1.87% 1.79% 1.79% Q3 2024 Q2 2025 Q3 2025 Asset Quality Trends Allowance for Credit Loss Reserve Ratios Asset Quality Ratios Special Mention Composition ($mm) Substandard Composition ($mm) $13.7$13.0$9.8$12.1 $6.1 Net Charge-Offs ($mm) Total ACL / Non- accrual Loans HFI Total ACL, excl. MF9 increased to $323.8mm Total ACL, excl. MF9 to LHI, excl. MF9 in the top decile among Peers12 Total ACL to LHI ratio Total ACL declined $1.7mm QoQ to $332.5mm $13.7mm of net charge-offs, 0.23% of average LHI, primarily related to previously identified problem credits Provision expense as a percentage of average LHI of 20bps Provision expense as a percentage of average LHI excl. MF9 of 26bps Year to date provision expense as a percentage of average LHI excl. MF9 of 33bps Criticized LHI declined $368mm or 41% YoY, with the percentage of total LHI declining 184bps to 2.19% Special mention LHI declined $90mm or 27% QoQ Non-Accrual loans HFI declined $17.5mm QoQ Total ACL increased to 3.5x non- accrual loans HFI Commercial Mortgage Finance Real Estate ConsumerCommercial Mortgage Finance Real Estate Consumer Total ACL / LHI Total ACL, Excl. MF9 / LHI Excl. MF9 Q3 2024 Q2 2025 Q3 2025 Criticized / LHI NPAs / Total Assets NCOs / Avg. LHI

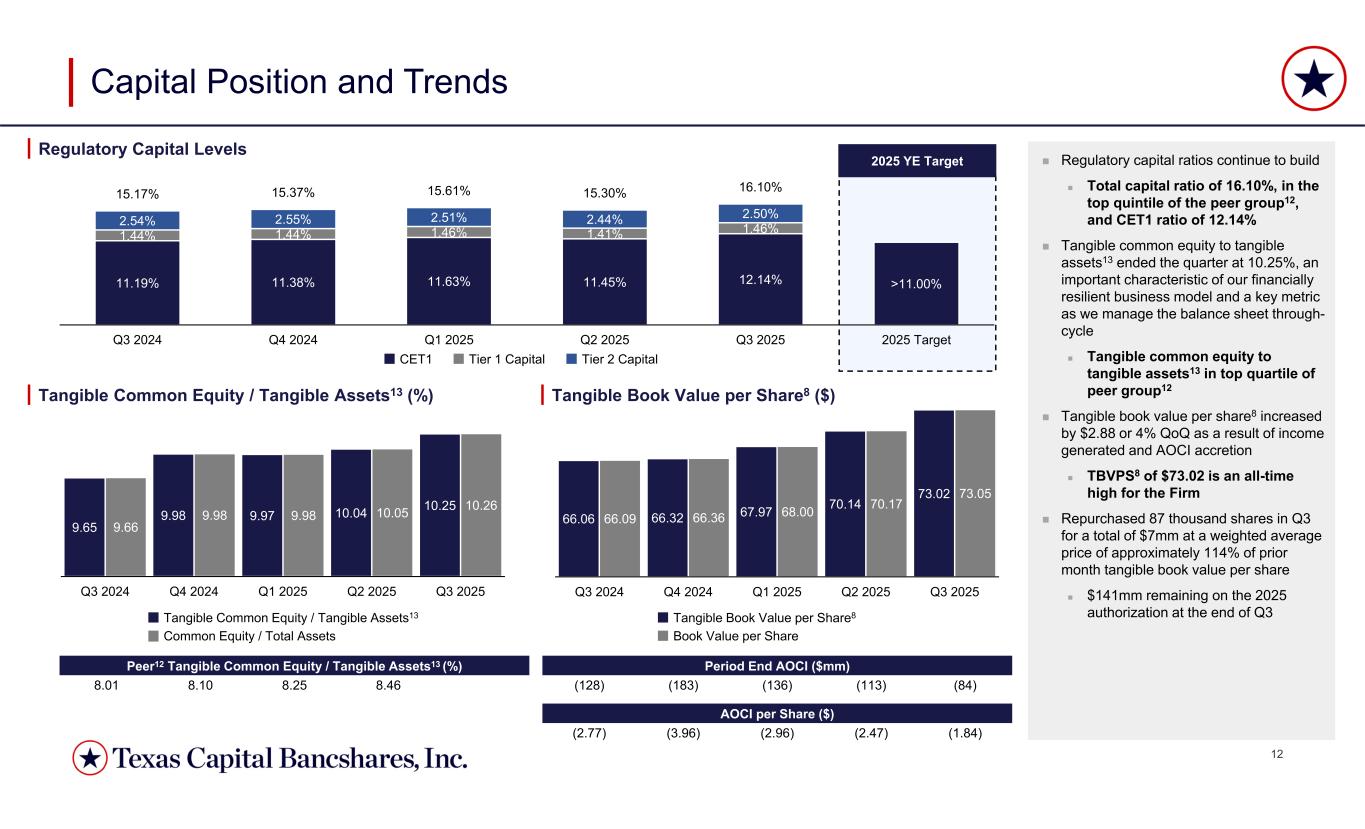

12 66.06 66.32 67.97 70.14 73.02 66.09 66.36 68.00 70.17 73.05 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 9.65 9.98 9.97 10.04 10.25 9.66 9.98 9.98 10.05 10.26 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 11.19% 11.38% 11.63% 11.45% 12.14% >11.00% 1.44% 1.44% 1.46% 1.41% 1.46% 2.54% 2.55% 2.51% 2.44% 2.50% 15.17% 15.37% 15.61% 15.30% 16.10% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 2025 Target Tangible Common Equity / Tangible Assets13 Common Equity / Total Assets 2025 YE Target Capital Position and Trends Regulatory capital ratios continue to build Total capital ratio of 16.10%, in the top quintile of the peer group12, and CET1 ratio of 12.14% Tangible common equity to tangible assets13 ended the quarter at 10.25%, an important characteristic of our financially resilient business model and a key metric as we manage the balance sheet through- cycle Tangible common equity to tangible assets13 in top quartile of peer group12 Tangible book value per share8 increased by $2.88 or 4% QoQ as a result of income generated and AOCI accretion TBVPS8 of $73.02 is an all-time high for the Firm Repurchased 87 thousand shares in Q3 for a total of $7mm at a weighted average price of approximately 114% of prior month tangible book value per share $141mm remaining on the 2025 authorization at the end of Q3 Regulatory Capital Levels Tangible Common Equity / Tangible Assets13 (%) Period End AOCI ($mm) (84)(113)(136)(183)(128) AOCI per Share ($) (1.84)(2.47)(2.96)(3.96)(2.77) Peer12 Tangible Common Equity / Tangible Assets13 (%) 8.468.258.108.01 CET1 Tier 1 Capital Tier 2 Capital Tangible Book Value per Share8 Book Value per Share Tangible Book Value per Share8 ($)

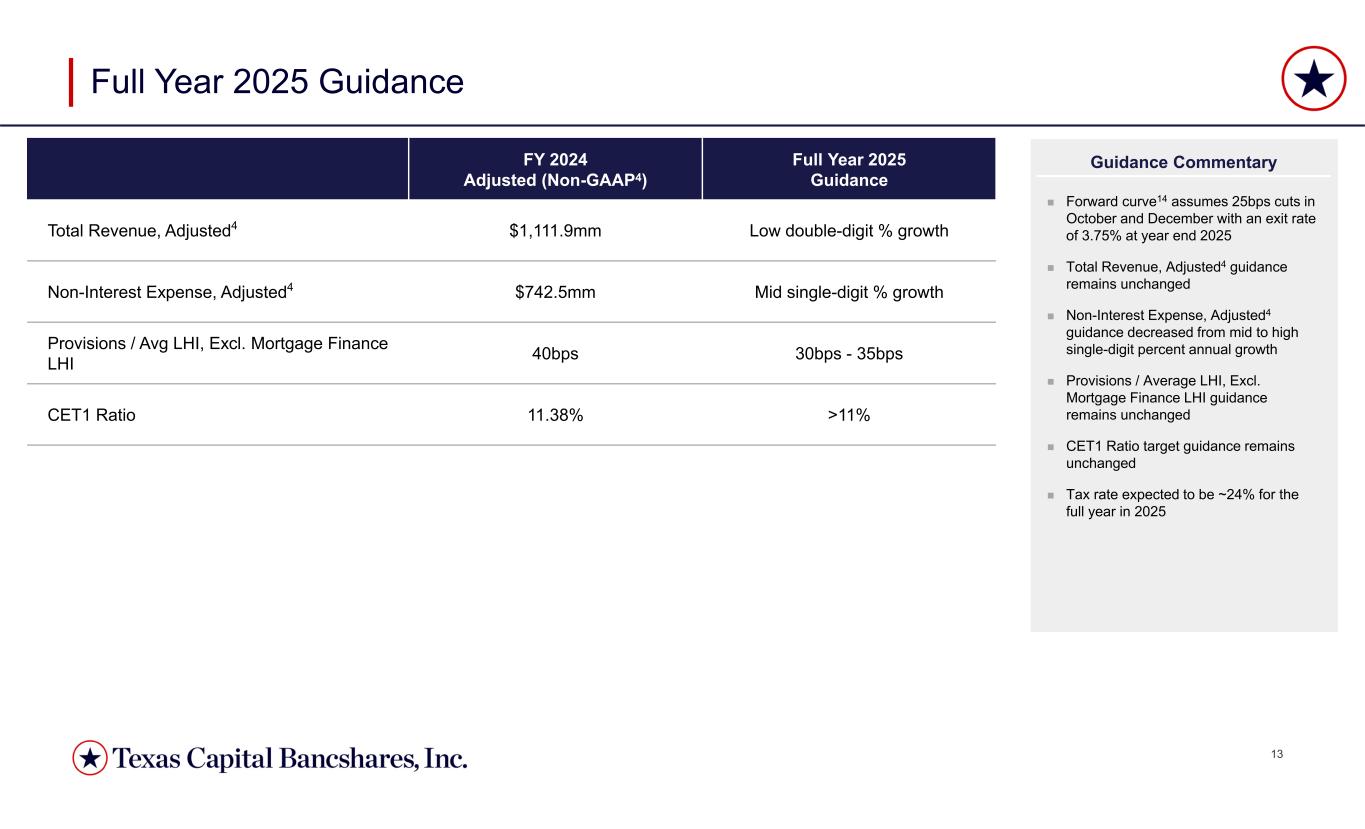

13 Full Year 2025 Guidance FY 2024 Adjusted (Non-GAAP4) Low double-digit % growth$1,111.9mmTotal Revenue, Adjusted4 Mid single-digit % growth$742.5mmNon-Interest Expense, Adjusted4 30bps - 35bps40bpsProvisions / Avg LHI, Excl. Mortgage Finance LHI >11%11.38%CET1 Ratio Full Year 2025 Guidance Forward curve14 assumes 25bps cuts in October and December with an exit rate of 3.75% at year end 2025 Total Revenue, Adjusted4 guidance remains unchanged Non-Interest Expense, Adjusted4 guidance decreased from mid to high single-digit percent annual growth Provisions / Average LHI, Excl. Mortgage Finance LHI guidance remains unchanged CET1 Ratio target guidance remains unchanged Tax rate expected to be ~24% for the full year in 2025 Guidance Commentary

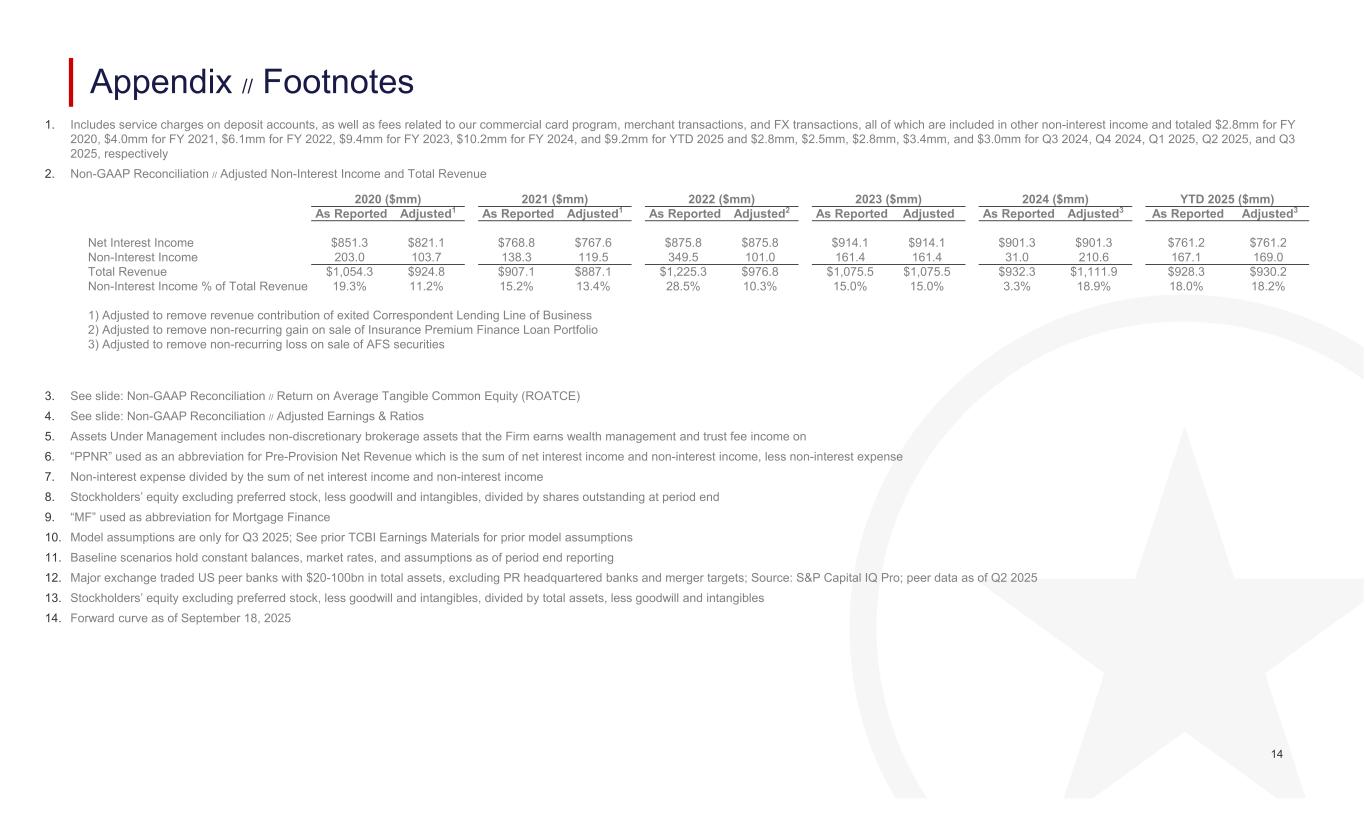

14 1. Includes service charges on deposit accounts, as well as fees related to our commercial card program, merchant transactions, and FX transactions, all of which are included in other non-interest income and totaled $2.8mm for FY 2020, $4.0mm for FY 2021, $6.1mm for FY 2022, $9.4mm for FY 2023, $10.2mm for FY 2024, and $9.2mm for YTD 2025 and $2.8mm, $2.5mm, $2.8mm, $3.4mm, and $3.0mm for Q3 2024, Q4 2024, Q1 2025, Q2 2025, and Q3 2025, respectively 2. Non-GAAP Reconciliation // Adjusted Non-Interest Income and Total Revenue 3. See slide: Non-GAAP Reconciliation // Return on Average Tangible Common Equity (ROATCE) 4. See slide: Non-GAAP Reconciliation // Adjusted Earnings & Ratios 5. Assets Under Management includes non-discretionary brokerage assets that the Firm earns wealth management and trust fee income on 6. “PPNR” used as an abbreviation for Pre-Provision Net Revenue which is the sum of net interest income and non-interest income, less non-interest expense 7. Non-interest expense divided by the sum of net interest income and non-interest income 8. Stockholders’ equity excluding preferred stock, less goodwill and intangibles, divided by shares outstanding at period end 9. “MF” used as abbreviation for Mortgage Finance 10. Model assumptions are only for Q3 2025; See prior TCBI Earnings Materials for prior model assumptions 11. Baseline scenarios hold constant balances, market rates, and assumptions as of period end reporting 12. Major exchange traded US peer banks with $20-100bn in total assets, excluding PR headquartered banks and merger targets; Source: S&P Capital IQ Pro; peer data as of Q2 2025 13. Stockholders’ equity excluding preferred stock, less goodwill and intangibles, divided by total assets, less goodwill and intangibles 14. Forward curve as of September 18, 2025 YTD 2025 ($mm)2024 ($mm)2023 ($mm)2022 ($mm)2021 ($mm)2020 ($mm) Adjusted3As Reported Adjusted3As Reported Adjusted As Reported Adjusted2As Reported Adjusted1As Reported Adjusted1As Reported $761.2 $761.2 $901.3 $901.3 $914.1 $914.1 $875.8 $875.8 $767.6 $768.8 $821.1 $851.3 Net Interest Income 169.0167.1210.6 31.0 161.4 161.4 101.0 349.5 119.5 138.3 103.7 203.0 Non-Interest Income $930.2 $928.3$1,111.9 $932.3 $1,075.5 $1,075.5 $976.8 $1,225.3 $887.1 $907.1 $924.8 $1,054.3 Total Revenue 18.2%18.0%18.9%3.3%15.0%15.0%10.3%28.5%13.4%15.2%11.2%19.3%Non-Interest Income % of Total Revenue 1) Adjusted to remove revenue contribution of exited Correspondent Lending Line of Business 2) Adjusted to remove non-recurring gain on sale of Insurance Premium Finance Loan Portfolio 3) Adjusted to remove non-recurring loss on sale of AFS securities Appendix // Footnotes

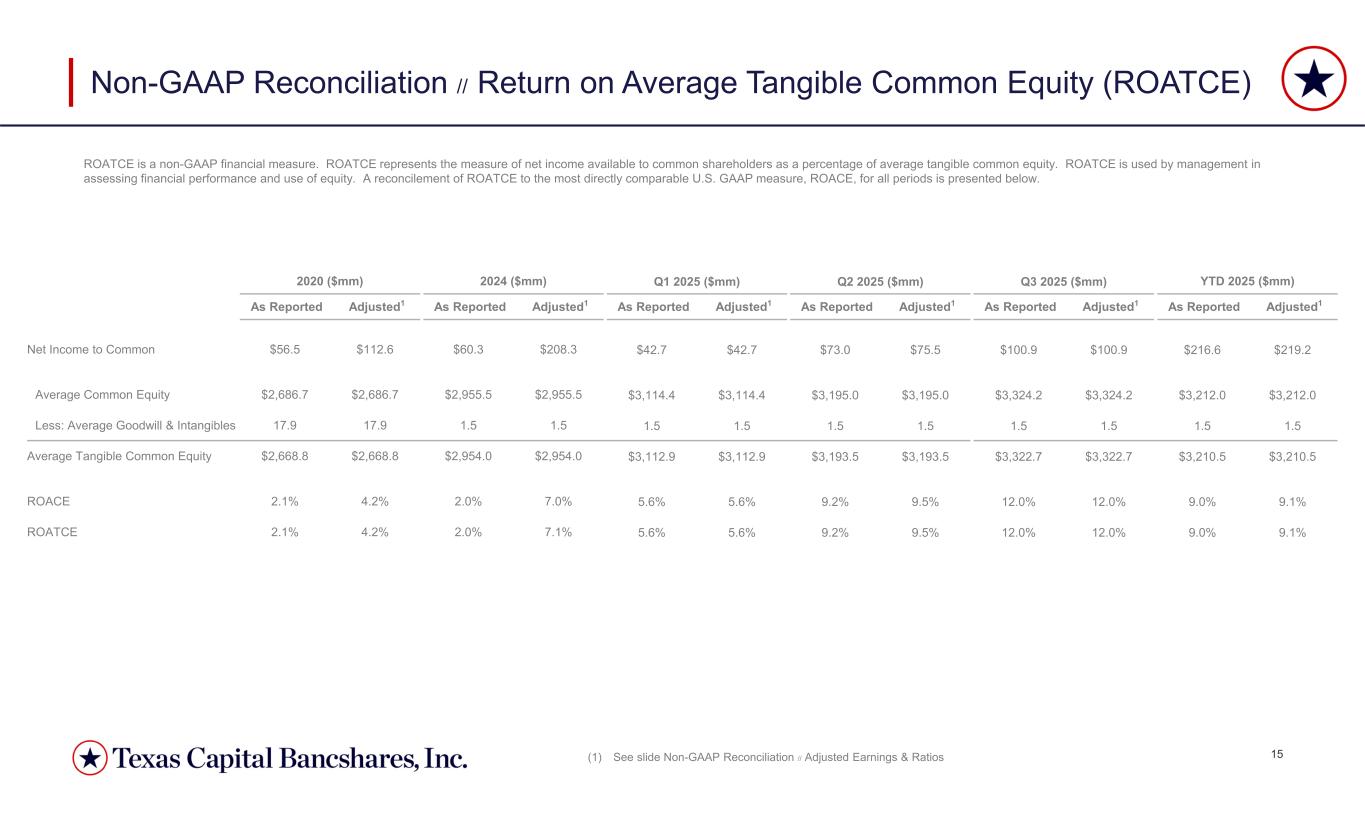

15 YTD 2025 ($mm)Q3 2025 ($mm)Q2 2025 ($mm)Q1 2025 ($mm)2024 ($mm)2020 ($mm) Adjusted1As Reported Adjusted1As Reported Adjusted1As Reported Adjusted1As Reported Adjusted1As Reported Adjusted1As Reported $219.2 $216.6 $100.9 $100.9 $75.5 $73.0 $42.7 $42.7 $208.3 $60.3 $112.6$56.5Net Income to Common $3,212.0 $3,212.0 $3,324.2 $3,324.2 $3,195.0 $3,195.0 $3,114.4 $3,114.4 $2,955.5 $2,955.5 $2,686.7$2,686.7Average Common Equity 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 17.917.9Less: Average Goodwill & Intangibles $3,210.5 $3,210.5 $3,322.7 $3,322.7 $3,193.5 $3,193.5 $3,112.9 $3,112.9 $2,954.0 $2,954.0 $2,668.8$2,668.8Average Tangible Common Equity 9.1%9.0%12.0%12.0%9.5%9.2%5.6%5.6%7.0%2.0%4.2%2.1%ROACE 9.1%9.0%12.0%12.0%9.5%9.2%5.6%5.6%7.1%2.0%4.2%2.1%ROATCE Non-GAAP Reconciliation // Return on Average Tangible Common Equity (ROATCE) ROATCE is a non-GAAP financial measure. ROATCE represents the measure of net income available to common shareholders as a percentage of average tangible common equity. ROATCE is used by management in assessing financial performance and use of equity. A reconcilement of ROATCE to the most directly comparable U.S. GAAP measure, ROACE, for all periods is presented below. (1) See slide Non-GAAP Reconciliation // Adjusted Earnings & Ratios

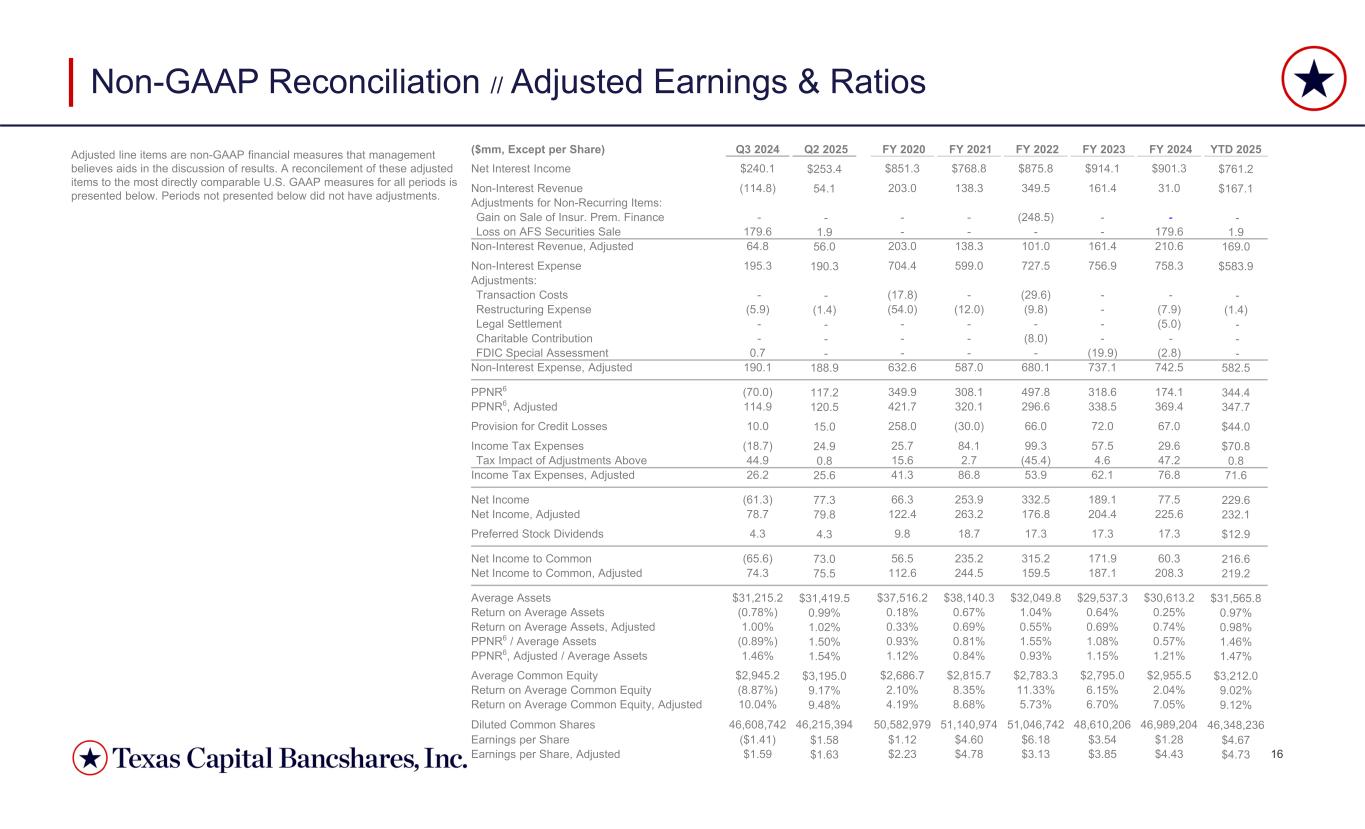

16 Non-GAAP Reconciliation // Adjusted Earnings & Ratios Adjusted line items are non-GAAP financial measures that management believes aids in the discussion of results. A reconcilement of these adjusted items to the most directly comparable U.S. GAAP measures for all periods is presented below. Periods not presented below did not have adjustments. YTD 2025FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Q2 2025 Q3 2024 ($mm, Except per Share) $761.2 $901.3 $914.1 $875.8 $768.8 $851.3 $253.4 $240.1 Net Interest Income $167.131.0 161.4 349.5 138.3 203.0 54.1 (114.8)Non-Interest Revenue Adjustments for Non-Recurring Items: ---(248.5)----Gain on Sale of Insur. Prem. Finance 1.9 179.6 ----1.9 179.6Loss on AFS Securities Sale 169.0210.6 161.4 101.0 138.3 203.056.0 64.8 Non-Interest Revenue, Adjusted $583.9758.3 756.9 727.5 599.0 704.4 190.3 195.3 Non-Interest Expense Adjustments: ---(29.6)-(17.8)--Transaction Costs (1.4)(7.9)-(9.8)(12.0)(54.0)(1.4)(5.9)Restructuring Expense -(5.0)------Legal Settlement ---(8.0)----Charitable Contribution -(2.8)(19.9)----0.7 FDIC Special Assessment 582.5742.5 737.1 680.1 587.0 632.6 188.9 190.1 Non-Interest Expense, Adjusted 344.4174.1 318.6 497.8 308.1 349.9 117.2 (70.0)PPNR6 347.7 369.4 338.5 296.6 320.1 421.7 120.5 114.9 PPNR6, Adjusted $44.067.0 72.0 66.0 (30.0)258.0 15.0 10.0 Provision for Credit Losses $70.829.6 57.5 99.3 84.1 25.7 24.9 (18.7)Income Tax Expenses 0.8 47.2 4.6 (45.4)2.7 15.6 0.8 44.9 Tax Impact of Adjustments Above 71.6 76.8 62.1 53.9 86.8 41.3 25.6 26.2 Income Tax Expenses, Adjusted 229.677.5 189.1 332.5 253.9 66.3 77.3 (61.3)Net Income 232.1 225.6 204.4 176.8 263.2 122.4 79.8 78.7 Net Income, Adjusted $12.917.3 17.3 17.3 18.7 9.8 4.3 4.3 Preferred Stock Dividends 216.660.3 171.9 315.2 235.2 56.5 73.0 (65.6)Net Income to Common 219.2 208.3 187.1 159.5 244.5 112.6 75.5 74.3 Net Income to Common, Adjusted $31,565.8$30,613.2 $29,537.3 $32,049.8 $38,140.3 $37,516.2 $31,419.5 $31,215.2 Average Assets 0.97% 0.25% 0.64%1.04%0.67%0.18%0.99% (0.78%)Return on Average Assets 0.98% 0.74% 0.69%0.55%0.69%0.33%1.02% 1.00% Return on Average Assets, Adjusted 1.46% 0.57% 1.08%1.55%0.81%0.93%1.50% (0.89%)PPNR6 / Average Assets 1.47% 1.21% 1.15%0.93%0.84%1.12%1.54% 1.46% PPNR6, Adjusted / Average Assets $3,212.0 $2,955.5 $2,795.0 $2,783.3 $2,815.7 $2,686.7 $3,195.0 $2,945.2 Average Common Equity 9.02% 2.04% 6.15%11.33%8.35%2.10%9.17% (8.87%)Return on Average Common Equity 9.12% 7.05% 6.70%5.73%8.68%4.19%9.48% 10.04% Return on Average Common Equity, Adjusted 46,348,23646,989,204 48,610,206 51,046,742 51,140,974 50,582,979 46,215,394 46,608,742 Diluted Common Shares $4.67 $1.28 $3.54 $6.18 $4.60 $1.12 $1.58 ($1.41)Earnings per Share $4.73$4.43 $3.85 $3.13 $4.78 $2.23 $1.63 $1.59 Earnings per Share, Adjusted