Inadequate Governance and Oversight Demand Change at Hooker Furnishing Corporation June 3, 2025

Background Global Value Investment Corporation (“GVIC”) is an investment management firm that deploys patient capital to build generational wealth. The firm was founded in 2007 in Milwaukee, Wisconsin as a fundamental value manager with a long-term investment horizon. GVIC provides investment research and portfolio management services to individual and institutional clients, primarily registered investment advisors and broker-dealers, through separately managed accounts and private fund investments. Through our rigorous analytical process, we narrow in on a small set of high-conviction investment ideas. By focusing on a limited number of investable securities, we are able to study each in great depth. We believe this creates a distinct information advantage that results in superior performance. When we invest, we have a responsibility to our clients to hold a company’s management and directors accountable for developing and executing a thoughtful strategy while prudently allocating capital. To that end, we regularly engage with management and directors to inquire about these topics, share our observations, and when needed, advocate for change. Our active engagement leverages a broad spectrum of mechanisms designed to positively impact investor outcomes.

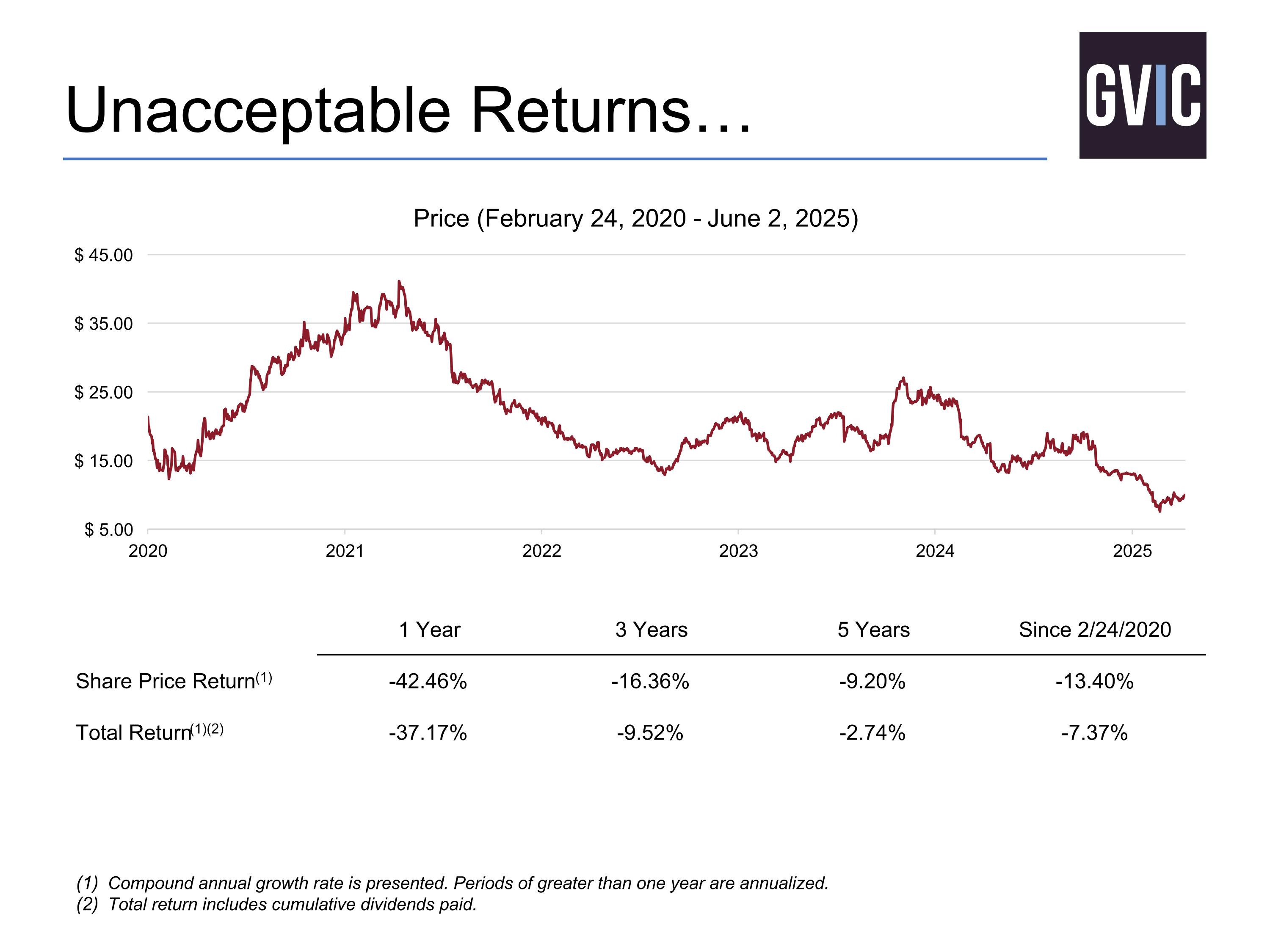

Background GVIC first invested in Hooker Furnishings Corporation (“HOFT” or the “Company”) on February 24, 2020, at an average price of $21.35 per share. Since then, GVIC has enjoyed a thoughtful and constructive ongoing dialogue with HOFT’s senior management. GVIC’s associates have visited the Company’s headquarters in Martinsville, Virginia, and its showroom in High Point, North Carolina. We believe the combination of an attractive business model, sound fundamental financial characteristics, and an enviable position as an industry leader make HOFT an attractive long-term investment. However, public markets have not ascribed an appropriate value to the enterprise, in our opinion. We believe this is partially attributable to decisions by past and present directors and senior managers that have resulted in demonstrable value destruction. As disclosed on Schedule 13D, filed with the Securities and Exchange Commission on March 17, 2025, GVIC beneficially owns 544,179.5 shares of HOFT, representing approximately 5.08% of the common stock outstanding. As of December 31, 2024, GVIC had realized a total annualized return of -3.16% on its investment in HOFT, and as of April 18, 2025, GVIC has realized a total annualized return of -9.25% on its investment in HOFT.

Unacceptable Returns… Compound annual growth rate is presented. Periods of greater than one year are annualized. Total return includes cumulative dividends paid. 1 Year 3 Years 5 Years Since 2/24/2020 Share Price Return(1) -42.46% -16.36% -9.20% -13.40% Total Return(1)(2) -37.17% -9.52% -2.74% -7.37%

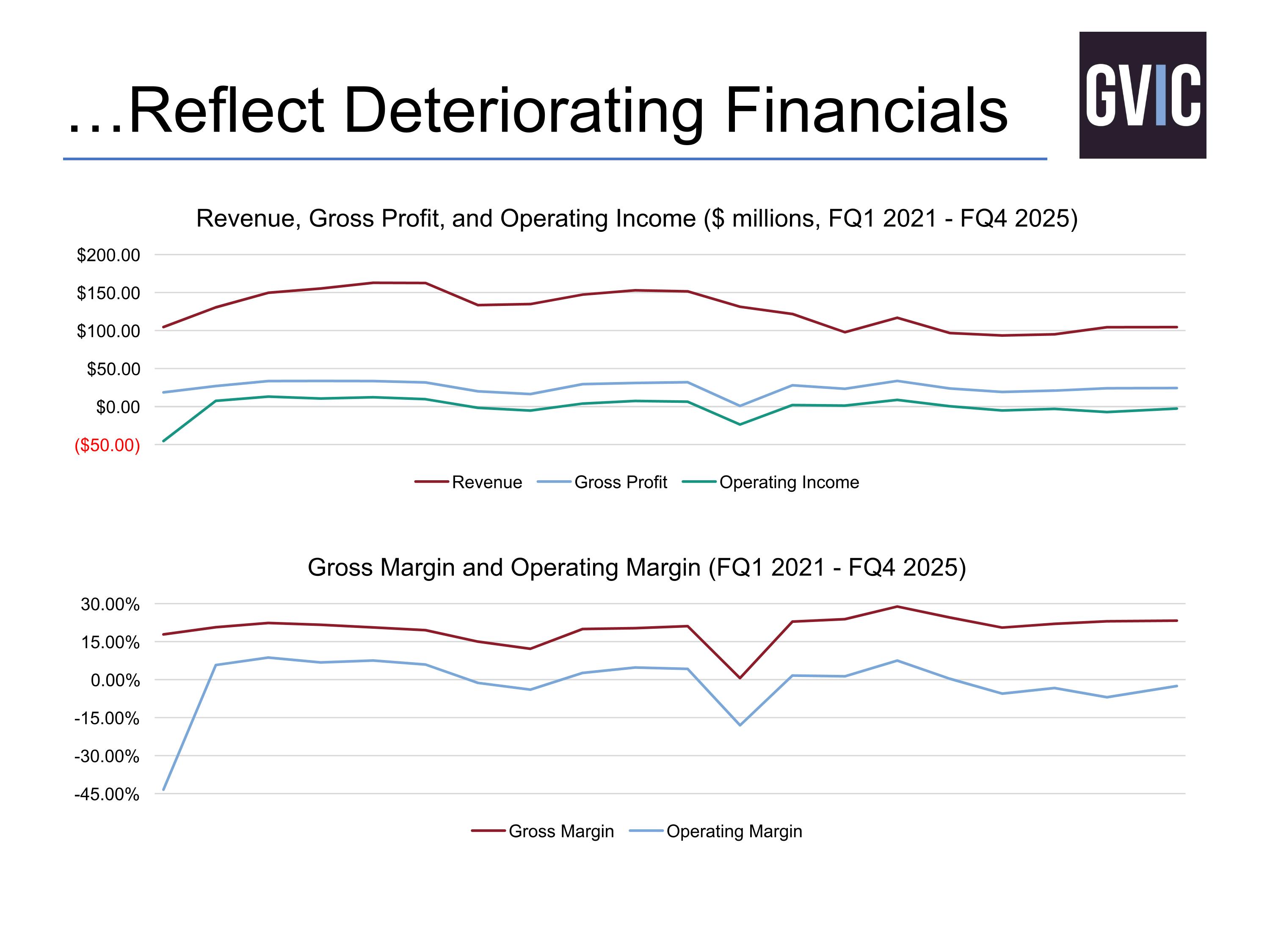

…Reflect Deteriorating Financials

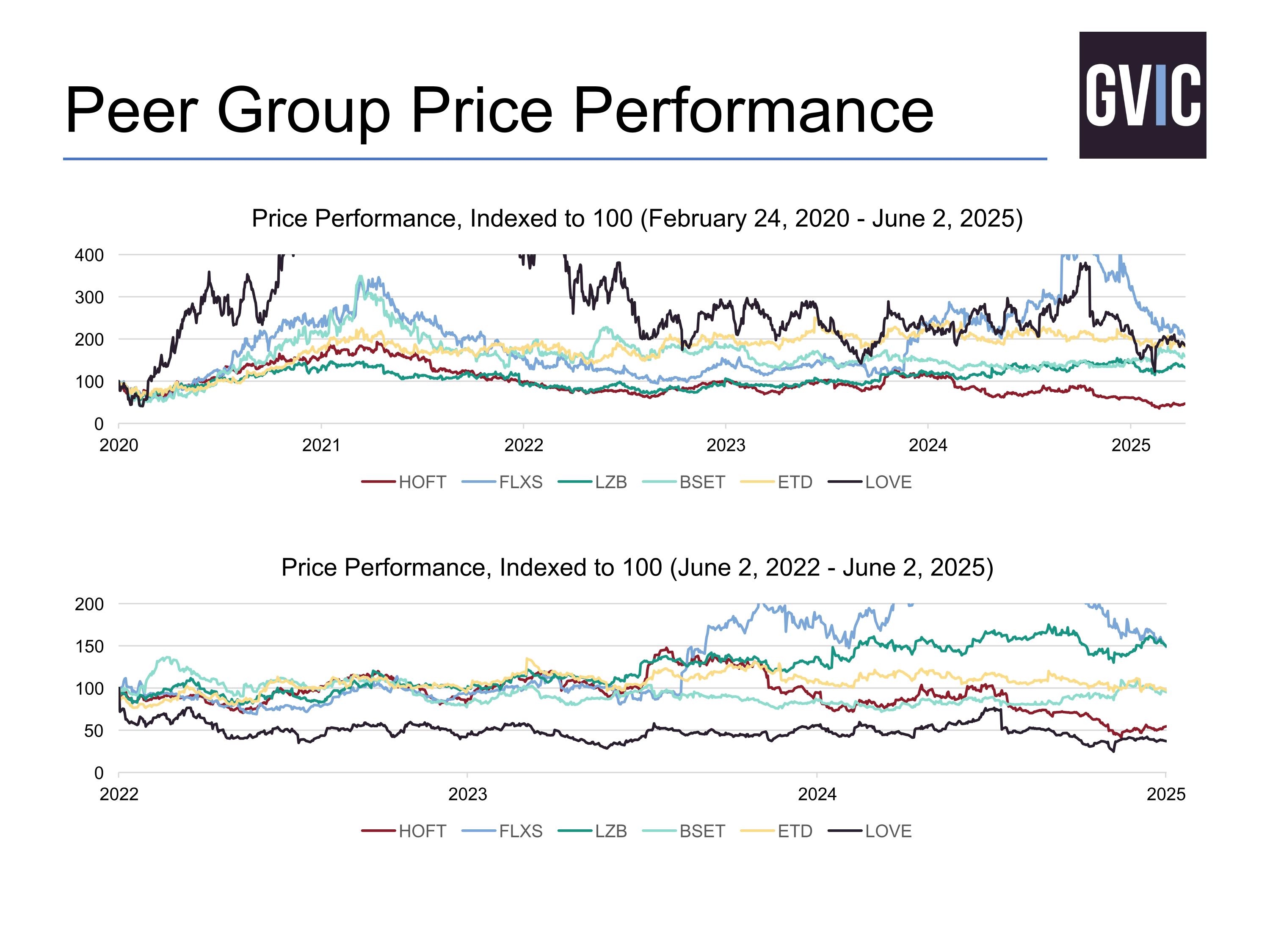

Peer Group Price Performance

Operational Missteps Calamitous exit from clubs channel: Driven by higher freight costs, exit costs from the RTA furniture category, and significant chargebacks from the Clubs distribution channel, HMI reported a $21.3 million operating loss for the year. Higher freight costs adversely impacted gross margin by approximately 530 bps in fiscal 2022 and were the primary driver of increased product costs. Current and expected future freight costs, which will have an adverse effect on potential profit margins caused us to rethink our entry into the RTA furniture category. Consequently, HMI exited the RTA furniture category and incurred one-time order cancellation costs of $2.6 million in fiscal 2022. In addition, due to continued poor profitability and excess chargebacks of $2.9 million, HMI made the decision to exit the Clubs channel and incurred one-time order cancellation costs of $900,000.(1) Inventory write-downs: The Company recorded a $24.4 million non-cash charge related to its exit of the Accentrics Home (ACH) line of lower-priced, low-margin accent items, for the write down of ACH inventories and other excess inventories in the Home Meridian segment.(2) Source: “Hooker Furnishings Reports Sales & Earnings for 2022 Fiscal Year,” published April 13, 2022. https://investors.hookerfurnishings.com/news-releases/news-release-details/hooker-furnishings-reports-sales-earnings-2022-fiscal-year Source: “Hooker Furnishings Reports Fiscal 2023 Results,” published April 14, 2023. https://investors.hookerfurnishings.com/news-releases/news-release-details/hooker-furnishings-reports-fiscal-2023-results

Operational Missteps “Shoot first, aim later” warehousing strategy: “We’re now positioning our working capital and resources on solid businesses like Pulaski, Samuel Lawrence, ACH and PRI with a goal to be in stock in our new 800,000-square-foot Georgia warehouse to service growing channels such as brick and mortar retailers, the interior design trade and ecommerce, while still growing our major partners,” Hoff said.(1) The Company is finalizing estimates of the potential financial impacts of the Savannah warehouse exit. Currently, it expects to record net charges of between $3.0 million to $4.0 million in fiscal 2026, related to the Savannah exit.(2) Source: “Hooker Furnishings Reports Sales & Earnings for 2022 Fiscal Year,” published April 13, 2022. https://investors.hookerfurnishings.com/news-releases/news-release-details/hooker-furnishings-reports-sales-earnings-2022-fiscal-year Source: “Hooker Furnishings Reports Improved Sales in Fourth Quarter, Additional Planned Cost Savings,” published April 17, 2025. https://investors.hookerfurnishings.com/news-releases/news-release-details/hooker-furnishings-reports-improved-sales-fourth-quarter

Operational Missteps Spiraling ERP system costs ($16.8 million to date): We are implementing a common Enterprise Resource Planning (ERP) system across all divisions. The ERP system went live at Sunset West in December 2022 and in the legacy Hooker divisions and for consolidated reporting in early September 2023. Due to our cost reduction initiatives, we have temporarily paused the ERP project in the Home Meridian segment beginning in the third quarter of fiscal 2025.(1) Implementation costs of $3.0 million and interest expense of $239,000 were capitalized in fiscal 2025. Implementation costs of $5.1 million and interest expense of $273,000 were capitalized in fiscal 2024. Implementation costs of $5.4 million and interest expense of $84,000 were capitalized in fiscal 2023. Amortization expenses of $1.2 million, $410,000 and $12,000 were recorded in fiscal 2025, 2024 and 2023, respectively.(1) Source: Form 10-K, filed with the U.S. Securities and Exchange Commission on April 18, 2025. SEC Accession No. 0001185185-25-000321.

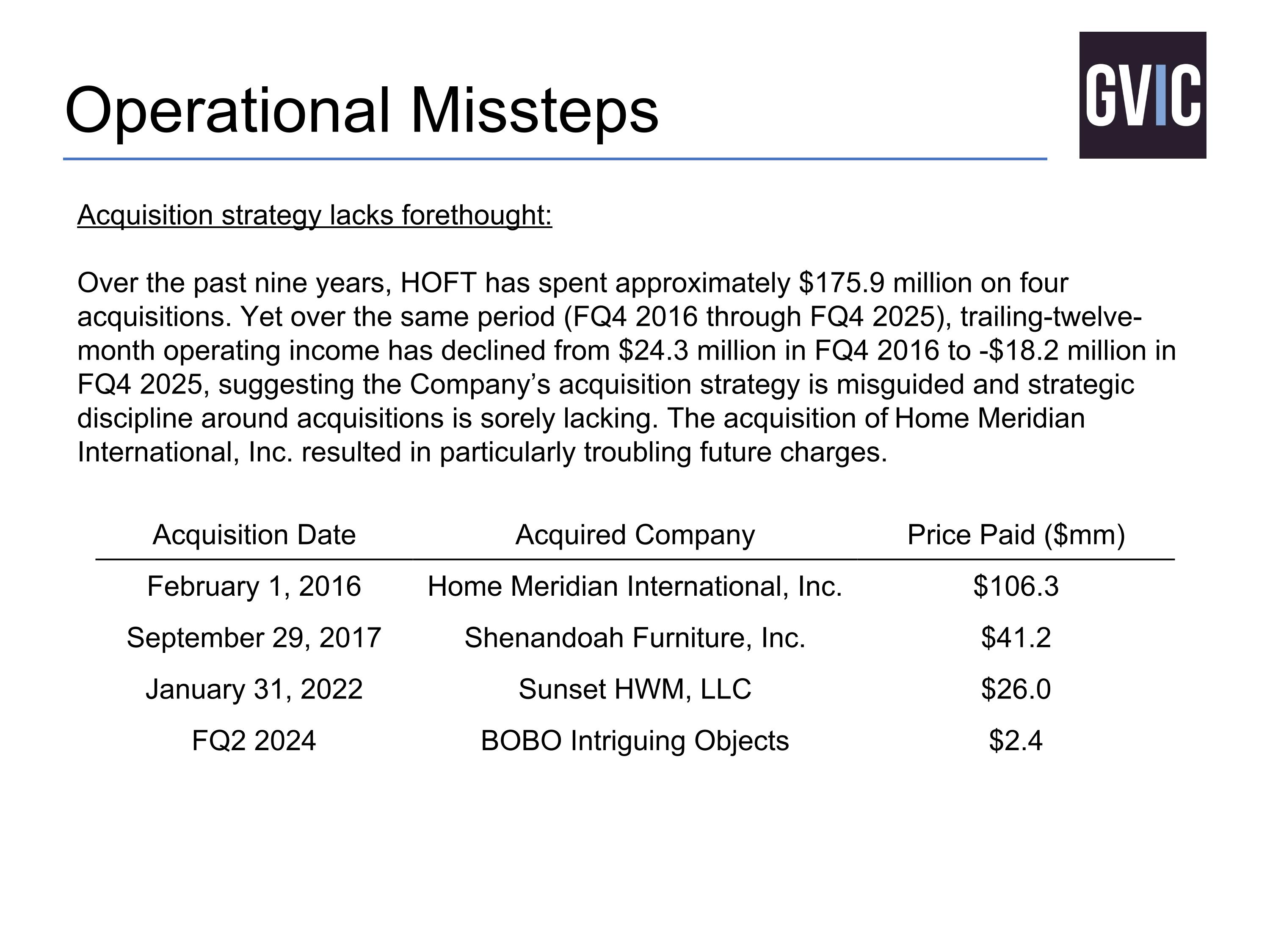

Operational Missteps Acquisition strategy lacks forethought: Over the past nine years, HOFT has spent approximately $175.9 million on four acquisitions. Yet over the same period (FQ4 2016 through FQ4 2025), trailing-twelve-month operating income has declined from $24.3 million in FQ4 2016 to -$18.2 million in FQ4 2025, suggesting the Company’s acquisition strategy is misguided and strategic discipline around acquisitions is sorely lacking. The acquisition of Home Meridian International, Inc. resulted in particularly troubling future charges. Acquisition Date Acquired Company Price Paid ($mm) February 1, 2016 Home Meridian International, Inc. $106.3 September 29, 2017 Shenandoah Furniture, Inc. $41.2 January 31, 2022 Sunset HWM, LLC $26.0 FQ2 2024 BOBO Intriguing Objects $2.4

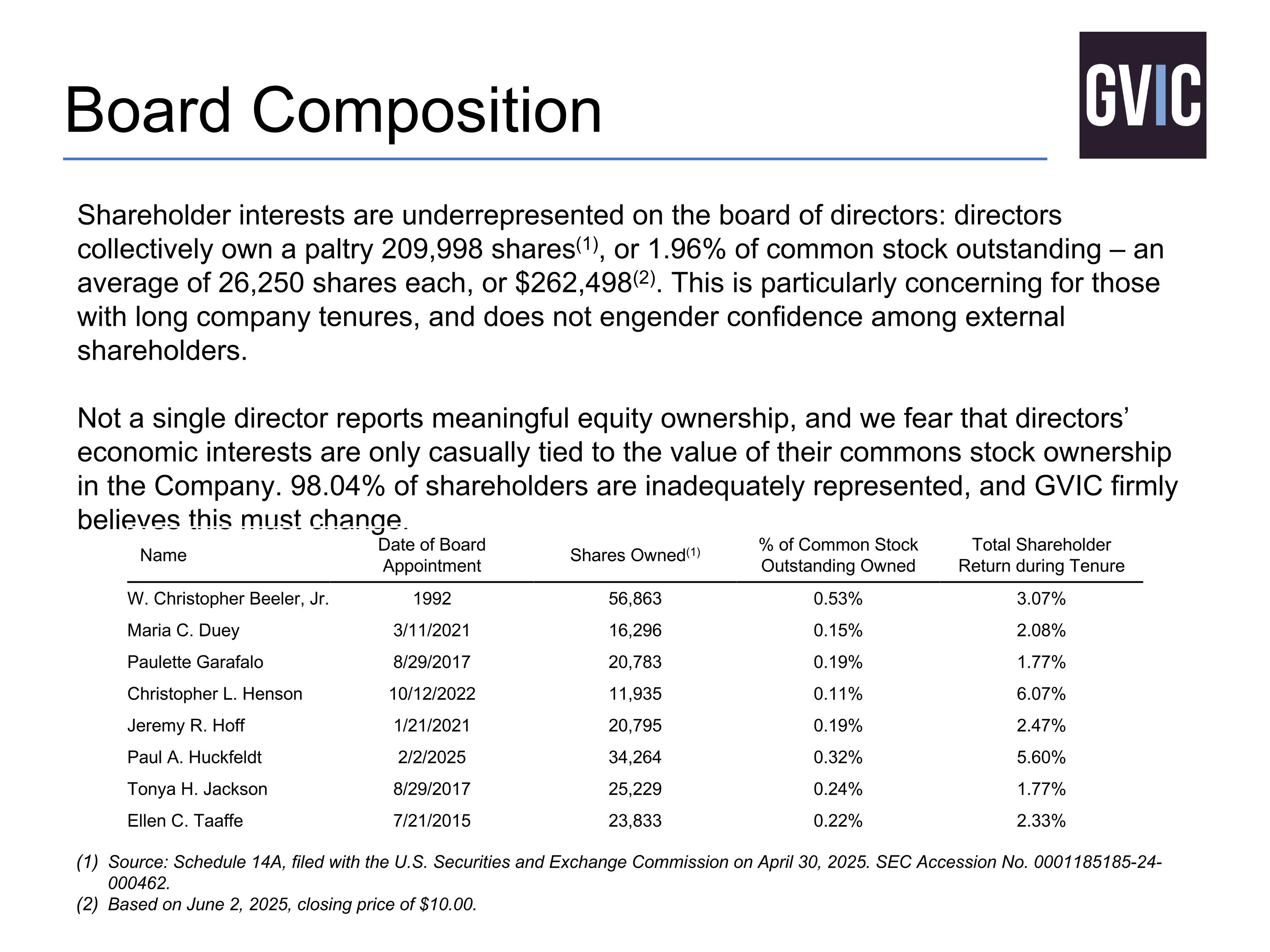

Board Composition Shareholder interests are underrepresented on the board of directors: directors collectively own a paltry 209,998 shares(1), or 1.96% of common stock outstanding – an average of 26,250 shares each, or $262,498(2). This is particularly concerning for those with long company tenures, and does not engender confidence among external shareholders. Not a single director reports meaningful equity ownership, and we fear that directors’ economic interests are only casually tied to the value of their commons stock ownership in the Company. 98.04% of shareholders are inadequately represented, and GVIC firmly believes this must change. Source: Schedule 14A, filed with the U.S. Securities and Exchange Commission on April 30, 2025. SEC Accession No. 0001185185-24-000462. Based on June 2, 2025, closing price of $10.00. Name Date of Board Appointment Shares Owned(1) % of Common Stock Outstanding Owned Total Shareholder Return during Tenure W. Christopher Beeler, Jr. 1992 56,863 0.53% 3.07% Maria C. Duey 3/11/2021 16,296 0.15% 2.08% Paulette Garafalo 8/29/2017 20,783 0.19% 1.77% Christopher L. Henson 10/12/2022 11,935 0.11% 6.07% Jeremy R. Hoff 1/21/2021 20,795 0.19% 2.47% Paul A. Huckfeldt 2/2/2025 34,264 0.32% 5.60% Tonya H. Jackson 8/29/2017 25,229 0.24% 1.77% Ellen C. Taaffe 7/21/2015 23,833 0.22% 2.33%

Conclusion GVIC is a patient investor willing to engage with company management and directors to drive long-term value. However, we have determined that HOFT’s corporate governance function is inadequate, as evidenced by poor strategic decision making, executional issues, and anemic share price performance. We have engaged with HOFT’s management for more than five years as a supportive investor. Over that period, the Company’s financial performance as been indefensible for those responsible – the board of directors. GVIC intends to obtain governance rights and work constructively with existing directors and manager to enhance strategic direction, capital discipline, and drive long-term value creation.

Disclosures This document is published by Global Value Investment Corporation (“GVIC” or the “Firm”). All statements or opinions contained herein are solely the responsibility of GVIC. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision. This publication is intended for informational purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice.