UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☐ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☒ |

Soliciting Material under §240.14a-12

|

| Arena Pharmaceuticals, Inc. |

|

(Name of Registrant as Specified In Its Charter)

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

|

This Schedule 14A filing consists of communications from Arena Pharmaceuticals, Inc., a Delaware corporation (the “Company” or “Arena”), to the Company’s employees relating to

the Agreement and Plan of Merger, dated December 12, 2021, by and among the Company, Pfizer Inc., a Delaware corporation (“Pfizer”) and Antioch Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Pfizer (the “Merger

Agreement”).

The following slides were used at an all employee presentation held on December 14, 2021:

HR Related Integration Matters X 1

Disclosure Cautionary Statement Regarding Forward-Looking StatementsThis communication and any

documents referred to in this communication contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Pfizer and Arena, including, but not limited to,

statements regarding the expected benefits of the proposed transaction and the anticipated timing of the proposed transaction, strategies, objectives and the products and markets of each company. These forward-looking statements generally

are identified by the words “believe,” “predict,” “target,” “contemplate,” “potential,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “could,” “will

be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result,

are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction

may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Arena and the receipt of

certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (iv) the effect of the announcement or pendency of the proposed

transaction on Arena’s business relationships, operating results, and business generally, (v) risks that the proposed transaction disrupts current plans and operations of Arena or Pfizer and potential difficulties in Arena employee

retention as a result of the proposed transaction, (vi) risks related to diverting management’s attention from Arena’s ongoing business operations, and (vii) the outcome of any legal proceedings that may be instituted against Pfizer or

against Arena related to the Merger Agreement or the proposed transaction. The risks and uncertainties may be amplified by the COVID-19 pandemic (and related variants), which has caused significant economic uncertainty. The extent to which

the COVID-19 pandemic (and related variants) impacts Arena’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not

limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The foregoing list of factors

is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Pfizer and Arena described in the “Risk Factors” section of their respective Annual Reports on Form

10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Arena assumes no

obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Arena gives no assurance that it will achieve its

expectations.Additional Information and Where to Find ItIn connection with the proposed transaction, Arena will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction.

The definitive proxy statement will be mailed to Arena’s stockholders in connection with the proposed transaction. This communication is not a substitute for the proxy statement or any other document that may be filed by Arena with the

SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR

INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at Arena’s stockholder meeting to

approve the proposed transaction or other responses in relation to the proposed transaction should be made only on the basis of the information contained in Arena’s proxy statement. Investors and security holders may obtain free copies of

these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, on Arena’s website at https://invest.arenapharm.com or by contacting Arena Investor Relations at (858)

453-7200.No Offer or SolicitationThis communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise

acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.Participants in the SolicitationArena and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in

connection with the proposed transaction. Information about Arena’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the

SEC’s web site at www.sec.gov and by going to Arena’s website at https://invest.arenapharm.com. 12/14/2021 2

Agenda My employment Understanding implications to your role My cash compensation Current pay

and 2021 bonus - and 2022 merit, promotion, and bonus My benefits Overview of Arena benefits plans and implications as a result of this merger My equity and LTI (Long-term incentives) Implications to RSUs and options covering both

vested and unvested Severance plan Overview of how Arena’s severance plans work Continuing operations How we will continue business operations during the integration planning period

4 12/14/2021 DISCLAIMER The material in this Presentation is intended to provide a summary of

potential employment implications based on the Acquisition. In the event there is a conflict between the information in this Presentation and any official Arena Plan Document or Merger Agreement, the official Plan Document and/or the Merger

Agreement will control.

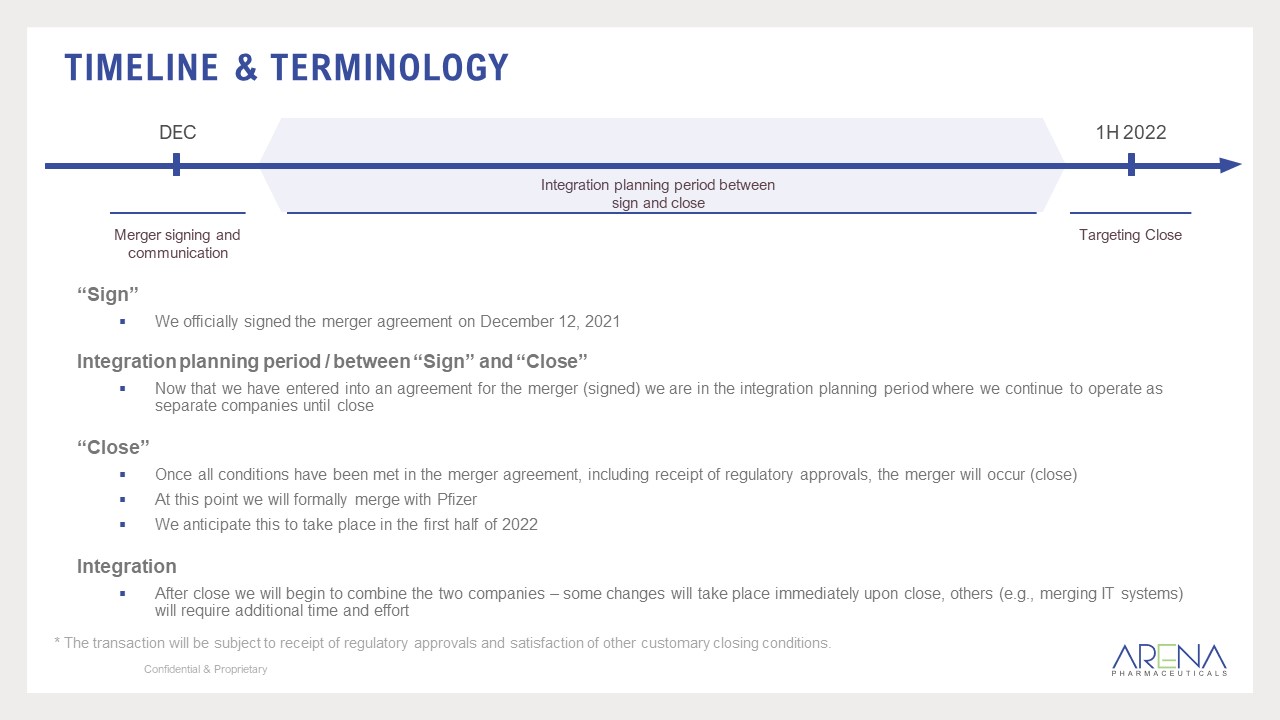

Timeline & terminology “Sign”We officially signed the merger agreement on December 12,

2021Integration planning period / between “Sign” and “Close”Now that we have entered into an agreement for the merger (signed) we are in the integration planning period where we continue to operate as separate companies until close

“Close”Once all conditions have been met in the merger agreement, including receipt of regulatory approvals, the merger will occur (close)At this point we will formally merge with PfizerWe anticipate this to take place in the first half of

2022IntegrationAfter close we will begin to combine the two companies – some changes will take place immediately upon close, others (e.g., merging IT systems) will require additional time and effort DEC 1H 2022 Targeting

Close Integration planning period between sign and close Merger signing and communication * The transaction will be subject to receipt of regulatory approvals and satisfaction of other customary closing conditions.

My Employment My employment My cash compensation My benefits My equity and LTI Severance

plan Continuing operations Will there be any changes to my job?Prior to closing, there will be no changes to titles, job levels, or roles as a result of the acquisition. Post close, we anticipate that Pfizer will align go-forward

roles to their existing organizational structure. Should I still complete performance reviews and ratings in Workday?Employees and managers should complete 2021 performance reviews and ratings as previously communicated.Can we continue to

work remotely?There will be no changes to our Work Together, Live Wherever approach between now and close. Pfizer will advise us of any changes to this policy post close.Will there be any changes to our current org structure? Will I have a

new manager?We do not plan to make any changes to reporting or org structures as a result of this transaction. The integration team, including members from both Arena and Pfizer, will work together to define the post-close organizational

structure. Can I apply to roles at Pfizer? If you were to move into a role before close, you would effectively be terminating your employment with Arena and forfeiting any unvested equity.We will be completing robust integration planning,

including structure and role alignment. Please ensure your manager is aware of your career/job interests so we can take this into consideration during the planning process.

My cash compensation My employment My cash compensation My benefits My equity and

LTI Severance plan Continuing operations Base Salary Review and PromotionsWe will continue with our annual salary review process as planned in January 2022, including identifying individuals for promotion [subject to certain

limited restrictions on promotion in the Merger Agreement].2021 BonusThe Board of Directors have approved 100% achievement of our OKRs for our 2021 bonus.We will pay the bonus early – December 31, 2021 for U.S. employees; January 25, 2022

for employees in Switzerland.Your bonus will be calculated based on your annual base salary in effect on December 31, 2021 times your bonus target percentage times the company achievement of 100%. There will be no pro-rating of the bonus

for those who joined mid-2021.2022 CompensationFor a period of 12 months following the close of the acquisition, Pfizer has agreed to provide an annual base salary or wage rate and annual cash bonus opportunity that are no less favorable

than the annual base salary or wage rate and annual cash bonus opportunity at the time of close for continuing employees.

My benefits My employment My cash compensation My benefits My equity and LTI Severance

plan Continuing operations Will my benefits change?We will continue to roll out our enhanced 2022 benefit programs that are effective as of January 1, 2022. These will continue through close. As we go through the integration process

and learn more about how each benefit plan will be addressed post close, we will share that information with you at the appropriate time.For a period of 12 months following the close of the merger, Pfizer has agreed to provide each

continuing employee benefits that are no less favorable in the aggregate than either the current Arena benefits or the benefits provided to similarly situated Pfizer employees.Will Arena’s flexible time off / vacation policy change?There

will be no change to Arena’s flexible time off / vacation policy between now and close.As we go through the integration process and learn more about how flexible time off / vacation policies will be addressed post close, we will share that

information with you at the appropriate time.Will my existing tenure / credited service transfer over?Pfizer will count your service with Arena for the purpose of their vacation policy and certain health and welfare plans where benefit

eligibility or vesting provisions are based on service (excluding any benefits that would result in a duplication of benefits)

My equity and Long-term incentive (ltI) My employment My cash compensation My benefits My

equity and LTI Severance plan Continuing operations What happens to my existing LTI when the acquisition closes?All unvested, time-based vesting restricted stock units (RSUs) granted prior to December 12, 2021 and stock options

will vest at the close of the transaction.Performance restricted stock units (PRSUs) will vest at Target at the close of the transaction.At the close of the transaction, RSUs (other than the January 3, 2022 grants and those granted after

December 12, 2021), PRSUs at Target, and stock options (less the exercise price) will be converted to cash at the consideration price of $100 and paid through the payroll process. Will there be any further LTI grants made by Arena prior to

the close?We will make an annual grant on January 3, 2022 consistent with our past eligibility practices (regular employees hired before November 1, 2021 and who are on active pay status on the grant date).We will continue to make grants to

new hires joining after the signing date according to our normal grant schedule.All LTI grants made from the date of signing will be in time-based RSUs only.At the close of the transaction, all Arena RSUs granted after signing will be

substituted with equivalent value of Pfizer RSUs (as outlined in the Merger Agreement) and will retain the same vesting terms. However, if you are involuntarily separated following the close of the transaction (not for Cause) or if you

voluntarily terminate in connection with certain forced relocations (Relocation Requirement), the vesting of these RSUs will accelerate.

My equity and LTI My employment My cash compensation My benefits My equity and

LTI Severance plan Continuing operations What happens if I am currently enrolled in the Arena ESPP?If the transaction closes prior to May 20, 2022 (the scheduled ESPP purchase date), we will set a new purchase date that occurs

prior to close and use any accumulated contributions towards a final purchase of Arena Shares. The 15% discount will apply to the lower of the offering price on November 22, 2021 or the fair market value on the date of the purchase. If the

transaction closes after May 20, 2022 (the scheduled ESPP purchase date), the purchase will occur as planned. The 15% discount will apply to the lower of the offering price on November 22, 2021 or the fair market value on May 20, 2022.This

will be the last purchase under the ESPP. The plan will terminate following this purchase.Any shares that have been acquired through the ESPP that have not been sold will be converted to cash at the consideration price.

Severance plans My employment My cash compensation My benefits My equity and

LTI Severance plan Continuing operations What constitutes a “Change in Control?”When this transaction closes, it will constitute a “Change in Control” as defined by our Severance Plan as there will be a transfer of more than 50%

ownership of Arena’s securities.If I’m laid off, will I receive severance?Employees who are involuntarily terminated, not for Cause, following the acquisition will be eligible for "Change in Control" severance benefits under the terms of

Arena’s Employee Severance Benefit Plans. This acquisition meets the "Change in Control" definition under the Plan.The provisions of Arena's severance plan will apply for all involuntary separations, not for Cause, for a period of 24 months

following the close date according to the “Change in Control” protection of Arena's Severance Plan.How does Arena’s severance plan work?In the case of involuntary separation, other than for Cause, resulting from a Change in Control, our

severance plans provide for a lump sum cash benefit based on a number of months’ salary and bonus target according to your job level, and whether your separation occurred within two years following a Change in Control. In the U.S., if

you’re in the medical / dental / vision plan, an equivalent number of months is covered as part of your severance.The plans for U.S. employees and non-U.S. employees are substantially similar. Employees can review Arena’s Employee Severance

Plans in Box > Arena Central > 1. Policies, Processes, Forms > Policies > Human Resources Policies. We have also linked to them from the FAQ document.

Continuing business operations My employment My cash compensation My benefits My equity and

LTI Severance plan Continuing operations Will we still set 2022 goals? We will follow our planned 2022 goal-setting process that will kick off in early Q1. Functions will set goals that support our continued commitment to our

patients and the critical priorities we’ve defined, including advancing our research and development efforts and building out our early-stage pipeline. In some cases, functions may define goals that directly support the transition process.

Will we continue to hire?Yes. Throughout the integration planning period, we will continue to hire critical roles that help us further advance our priorities. In certain cases, relating to hires that exceed certain salary thresholds, we

will need to get Pfizer’s advance consent to the hire. If you have questions about whether a particular hire is permitted, you should contact your Human Resources business partner.What will happen with pending offers of employment?We plan

to onboard all individuals to whom we have already made offers of employment.I have a contractor as part of my team. What happens to their contract?No changes as a result of this transaction are anticipated between now and close.Will there

be changes to our existing policies (expense, etc.)?Prior to close, there will be no changes to our existing policies. We may adjust our policies in accordance with need, consistent with past practices.We will have more information on

changes to policies post close as we go through the integration planning process.

Why should I stay THROUGH THE ACQUISITION? Employees who remain with Arena through the acquisition

process will vest in their existing outstanding equity awards that were granted prior to signing and will receive cash equal to the merger consideration (less the applicable exercise price in the case of options) on the close.Arena shares

granted to new hires after the effective date will be converted into equivalent value of Pfizer RSUs (as outlined in the Merger Agreement) and will retain the same vesting terms.Arena will continue with annual equity grants to eligible

employees that will be made on January 3, 2022. Those grants will be substituted with equivalent value of Pfizer RSUs (as outlined in the Merger Agreement) and will retain the same vesting terms.Any Arena grants made between signing and

close will accelerate and vest upon involuntary separation, not for Cause, for the duration of the vesting period.In case of involuntary separation, not for Cause within 24 months of the closing, severance benefits will be paid to those

whose positions are eliminated as a result of this transaction.

Next steps, Communications & Questions All questions regarding the merger can be sent to the

email below. We will engage the appropriate individuals to provide you with an answer: ***@***.com Next stepsAll-Staff Meeting – Thursday, December 16Winter Break – Friday, December 24 – Sunday, January 2Integration Team named

CommunicationsWe will establish a regular cadence of ongoing communications to keep you informed throughout the integration planning processQuestionsWe encourage you to reach out to your manager or your HR business partner with any

questions.We are creating a SharePoint site where we will post the FAQs and provide updated information as it becomes available. We will share this link as soon as the page is ready.