Transocean Inc. Reports Third Quarter 2008 Results |

Transocean Inc. Reports Third Quarter 2008 Results |

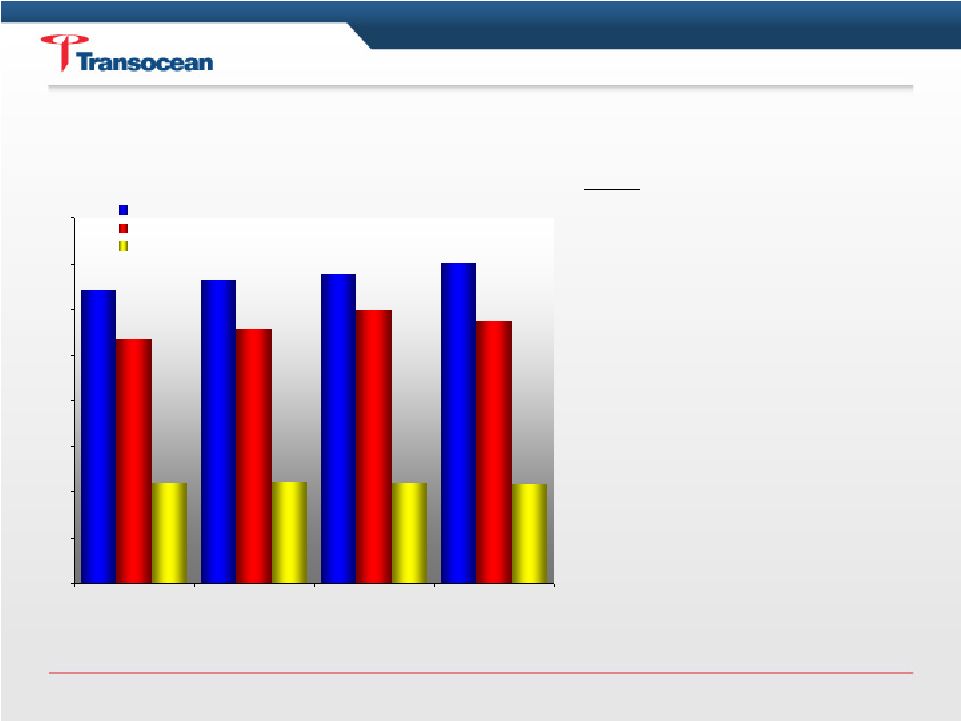

371 382 388 400 318 329 349 337 160 161 160 159 $50k $100k $150k $200k $250k $300k $350k $400k $450k Qtr 4 08 Qtr 1 09 Qtr 2 09 Qtr 3 09 High Specification Floaters Other Floaters Jackups Chart #1: Average Contracted Dayrate by Rig Type Qtr 4 2008 through Qtr 3 2009 (Unaudited) The Jackups category consists of our jackup fleet. Jackups The Other Floaters category is generally comprised of those non-High-Specification Floaters with a water depth capacity of less than 4,500 feet. Other Floaters The Other Deepwater Floaters include the remaining semi-submersible rigs and drillships that have a water depth capacity of at least 4,500 feet. Other High-Specification Floaters were built in the in the mid to late 1980s, are capable of drilling in harsh environments and have greater displacement than previously constructed rigs resulting in larger variable load capacity, more useable deck space and better motion characteristics. Ultra-Deepwater Floaters have high-pressure mud pumps and a water depth capability of 7,500 feet or greater. The High-Specification Floaters category is a consolidation of the Ultra-Deepwater Floaters, Other High-Specification Floaters and Other Deepwater Floaters as described below. High- Specification Floaters The weighted average contract dayrate for each rig type based on current backlog from the company's most recent Fleet Status Update Report as of November 3, 2008. Includes firm contracts only. Average Dayrate Definitions |

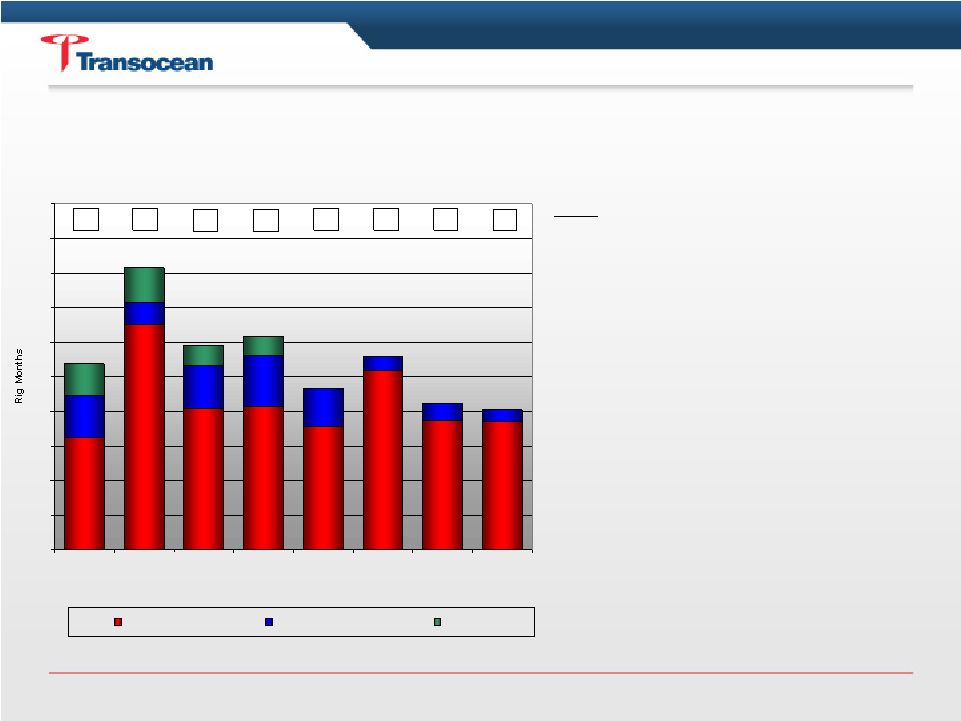

Chart #2: Out-of-Service Rig Months Qtr 1 2008 through Qtr 4 2009 (Unaudited) Rig time described as "shipyard" refers to periods during which a rig is out of service as a result of other planned shipyards, surveys, repairs, regulatory inspections or other planned service or work on the rig excluding reactivations and upgrades. Shipyard Rig time described as "upgrade" includes the Sedco 702 and Sedco 706 which are undergoing or forecast to undergo a shipyard project to enhance the operational capabilities of the rig. Upgrade Includes mobilization and demobilization to and from operating contracts and other activities such as shipyards excluding those mobilization and demobilization periods covered in Reactivation and Upgrades. Mobilization Time when a rig is not available to earn an operating dayrate due to shipyards, contract preparation, mobilization, reactivation or upgrades. Out-of-Service Time expressed in months that each rig has been, or is forecast to be Out of Service as reflected in the company's Fleet Status Update Report as of November 3, 2008. Also includes out of service time of less than 14 days that is not disclosed in the Fleet Status report. Rig Months Definitions 16 33 20 21 18 26 19 19 6 3 6 7 5 2 3 2 5 5 3 3 0 5 10 15 20 25 30 35 40 45 50 Qtr 1 - 08A Qtr 2 - 08A Qtr 3 - 08A Qtr 4 - 08F Qtr 1 - 09F Qtr 2 - 09F Qtr 3 - 09F Qtr 4 - 09F Period ( A = actual data, F = forecast data) Shipyard Mobilization Upgrade 28 42 30 31 23 28 22 21 |

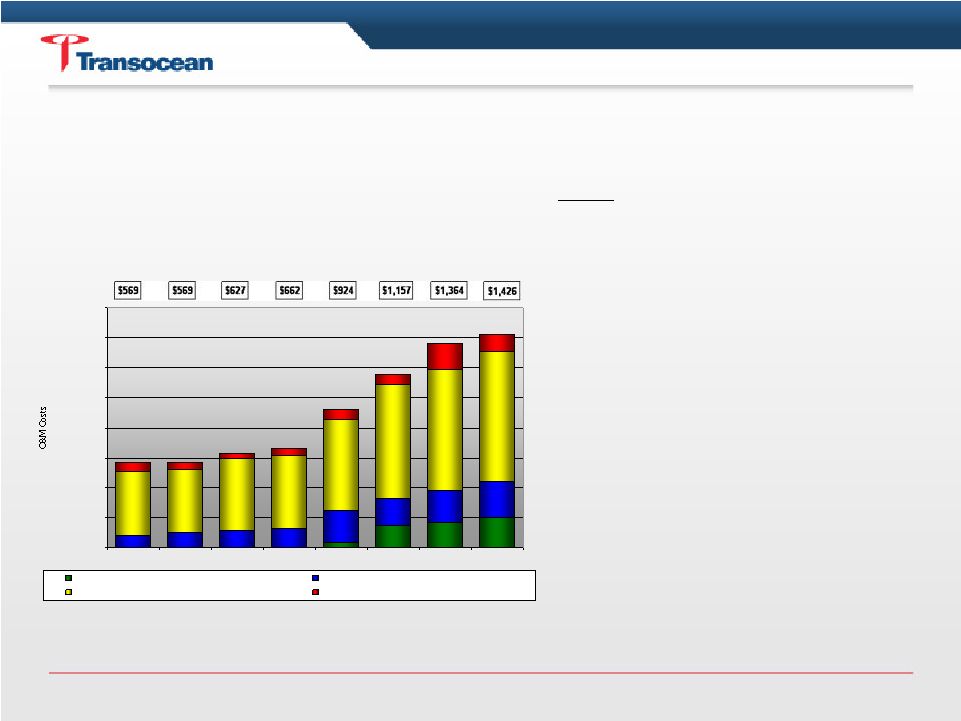

Chart

#3: Operating & Maintenance (O&M) Costs Trends (Unaudited) Our operating and maintenance costs represent all direct and indirect costs associated with the operation and maintenance of our drilling rigs. Operating and maintenance costs also includes all costs related to local and regional offices as well as all costs related to operations support, engineering support, marketing and other similar costs. The principal elements of these costs are direct and indirect labor and benefits, repair and maintenance, contract preparation expenses, insurance, boat and helicopter rentals, professional and technical fees, freight costs, communications, customs duties, tool rentals and services, fuel and water, general taxes and licenses. Labor, repair and maintenance costs, insurance premiums, personal injury losses and drilling rig casualty losses represent the most significant components of our operating and maintenance costs O&M Costs * Includes the total amount of days a rig is deemed to be out of service. This relates to times when a rig is out of service due to shipyards, mobilization and short-term idle periods. Out of Service Days Denotes the total O&M costs while a rig is out of service based upon Out of Service Days, as defined below. Out of Service costs are the difference between total operating and maintenance costs and the In-Service Costs. Out of Service Denotes the total amount of days a rig is deemed to be in- service under contract operations. This excludes all out of service time relating to shipyards, mobilization and short-term out of contract periods but includes the operational downtime of in service rigs. The average number of days may also fluctuate from quarter to quarter as a result of rigs being reactivated, sold or stacked in the quarters. Rig Operating Days Denotes the total O&M costs of a rig while in service based upon the Rig Operating Days (excluding shorebase or common support costs), as defined below. Operating Rigs Includes Integrated Services, Drilling Management Services, Oil and Gas Properties, and all shorebase or common support costs (on-shore offices, yards, pool equipment). Support & Non- Drilling Costs Definitions $36 $148 $167 $205 $82 $105 $117 $130 $216 $182 $211 $240 $425 $419 $474 $488 $599 $762 $809 $867 $62 $45 $36 $44 $73 $65 $177 $114 $- $200 MM $400 MM $600 MM $800 MM $1,000 MM $1,200 MM $1,400 MM $1,600 MM Qtr4'06 Qtr1'07 Qtr2'07 Qtr3'07 Qtr4'07 Qtr1'08 Qtr2'08 Qtr3'08 Period Drilling Management Services and Oil & Gas $ Support and Integrated Services $ Operating Rig $ Out of Service $ |

Chart

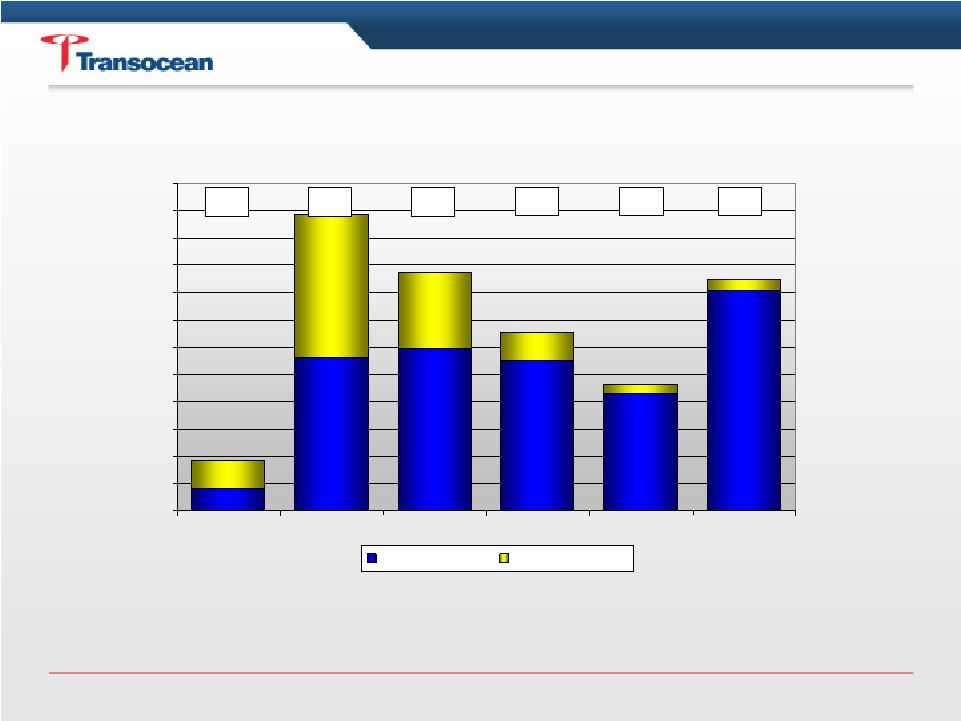

#4: Contract Backlog by Years (Unaudited) Total Contract Backlog (1) = $41.1 Billion Remaining (1) Calculated by multiplying the contracted operating dayrate by the firm contract

period from November 3, 2008 forward. Reflects firm commitments represented by signed contracts. Contract backlog excludes revenues from

mobilization, demobilization, contract preparation, integrated services and customer reimbursables. Our backlog calculation assumes that we receive the full

contractual dayrate, which could be higher than the actual Dayrate that we receive because of a number of factors (rig downtime, suspension of operations, etc.) including some beyond our control. 0.8 5.6 5.9 5.5 4.3 8.1 1.1 5.3 2.8 1.0 0.4 0.4 $0.0B $1.0B $2.0B $3.0B $4.0B $5.0B $6.0B $7.0B $8.0B $9.0B $10.0B $11.0B $12.0B 2008 2009 2010 2011 2012 2013-2020 High-Spec Fleet Remaining Fleet $1.9 $8.5 $4.7 $6.5 $8.7 $10.9 |