Please wait

Dear Stockholders,

| | | | | | | | | | | | | | |

| | Reflecting on fiscal year 2025, this year was really about building for a future we know is coming: faster, more connected, and more demanding than ever before.

While others stick to fixed courses, we’ve redesigned how we operate so we can turn on a dime, bringing the right expertise to clients exactly when and where they need it.

We live in a time when organizations can’t afford to stand still. The challenge isn’t finding talent. It’s finding the right talent, right now, for the moments that matter most. This is the new reality, and it plays directly to RGP’s strengths. |

|

|

The Shift We’re Leading

The professional services industry is undergoing the same kind of shift technology went through when cloud-based replaced on-premise software. Companies no longer want big, inflexible contracts that assume the future will look like the past. They want speed. Precision. Specialists who can plug in instantly, deliver, and move on, leaving the organization stronger.

We’re leading that shift with a model that blends:

▪On-Demand Talent for immediate needs

▪Consulting Teams for transformational work

▪Outsourced Services powered by AI and human expertise for startups, spinouts, and carveouts that need to invest in growth, not back-office complexity

▪Global Reach to serve multinational clients anywhere

Together, these create a one-stop, flexible experience for solving the most complex business problems.

Where We’re Focused

Through strategic acquisitions and organizational realignment, we’ve honed in on two areas where the need and opportunity are robust. These will serve as the core growth engines for RGP’s future:

(1)The Office of the CFO: Our recent research shows nearly 70% of CFOs expect their organization’s financial health to remain stable, and 60% anticipate a stronger outlook over the next year. But optimism doesn’t erase risk. Concerns over tariffs, supply chain fragility, and geopolitical volatility remain high. In this environment, CFOs need partners who combine

financial expertise with flexibility. We’ll help finance leaders modernize ERP and cloud finance systems, enhance financial planning and analysis, streamline the accounting close process, ensure SEC compliance, integrate acquisitions, and manage risk, all while keeping their organizations resilient in uncertain markets.

(2)Digital, Data and Cloud: Through our acquisitions of CloudGo and Reference Point, we’ve expanded our capabilities in cloud platform implementation, data strategy, analytics, AI adoption, and enterprise digital transformation. We’ll continue to help clients modernize systems, drive employee engagement in system investments, reveal the value hidden in their data, and scale technology to meet evolving market demands.

The Year in Perspective

We faced a tough market in 2025, and we made deliberate choices to adapt. We evolved and streamlined our consulting practices, improved average bill rate, reduced costs without cutting capability, modernized our technology stack, and maintained a strong balance sheet. We will continue to improve and align our cost structure to serve our business today and to position ourselves for scale when demand accelerates again.

We also earned recognition from Forbes and U.S. News & World Report as top employers and consulting firms, and, most importantly, from our clients, as we’ve served 88% of the Fortune 100 as of May 2025. That’s trust built over years, and it’s what gives us the confidence in our future.

Fiscal 2025 Key Highlights & Financial Performance Amid Market Adversity

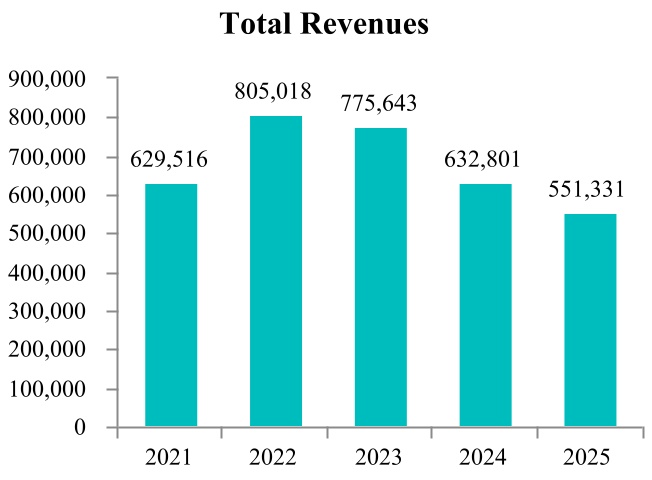

▪Revenue: $551.3 million, down ~13% year-over-year (–13.9% constant currency), reflecting continued macroeconomic pressure.

▪Gross Margin: 37.6%, reflecting lower utilization in a slower demand environment and deleveraging of cost of services.

▪Net Loss: $191.8 million primarily attributable to non-cash goodwill impairments of $194.4 million, reflecting a decline in our market capitalization amid uncertain market recovery.

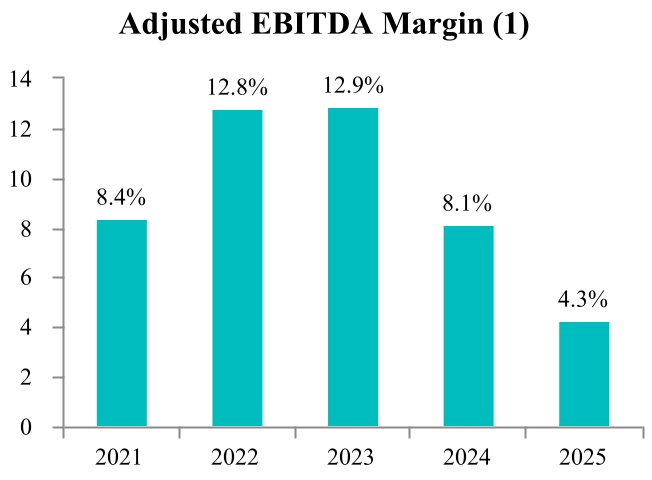

▪Adjusted EBITDA: $23.5 million (4.3% margin), reflecting a softer topline, mitigated by significant progress in cost structure redesign given market disruptions.

▪Cash Flow from Operations: Generated $18.9 million in cash flow from operations.

▪Client Retention: Retained 78% of our top 100 clients.

▪Key Accomplishments: Despite these challenges, we completed the sale of our Irvine office (gain recognized), modernized our technology stack, including new ERP systems, and secured a new $50 million credit facility in July 2025 – actions that strengthen financial flexibility.

Looking Ahead

While fiscal 2025 presented headwinds, our investments have laid a stronger foundation for agile, scalable, and profitable growth. We remain committed to:

▪Deepening client partnerships through our diversified services platform.

▪Expanding our high-growth solutions in the Office of the CFO and Digital, Data, and Cloud.

▪Leveraging value-based pricing and expanding cross-sell opportunities.

▪Continuing disciplined cost management while investing in innovation.

With a unified brand, improving cost structure, and solutions portfolio aligned to high-demand areas, RGP is well-positioned to deliver sustainable shareholder value.

In Closing

Fiscal 2025 tested our resilience and adaptability. Yet, we remain confident. Our realigned structure, strategic acquisitions, focused solutions relevant for today’s business needs, strong client base, expanded footprint and technology upgrade provide clear advantages. We believe RGP is well-positioned to navigate the current uncertainty and emerge stronger – delivering value to shareholders, clients and our people alike.

Thank you for your continued support.

Best,

| | | | | | | | | | | |

| | | |

| | | |

| | | |

| Kate W. Duchene Chief Executive Officer | | |

| | |

| | | |

RESOURCES CONNECTION, INC.

TABLE OF CONTENTS

rgp. 2025 Annual Report — 1

FORWARD LOOKING STATEMENTS

This Annual Report, including information incorporated herein by reference, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to expectations concerning matters that are not historical facts. Such forward-looking statements may be identified by words such as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “forecast,” “future,” “intends,” “may,” “plans,” “potential,” “predicts,” “remain,” “should,” “strategy,” or “will” or the negative of these terms or other comparable terminology. In this Annual Report, such statements include statements regarding our expectations regarding our expected recovery and growth and operational plans. Such statements and all phases of the Company’s operations are subject to known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievements and those of our industry to differ materially from those expressed or implied by these forward-looking statements. Risks and uncertainties include, but are not limited to, the following: risks related to an economic downturn or deterioration of general macroeconomic conditions, potential adverse effects to our and our clients’ liquidity and financial performances from bank failures or other events affecting financial institutions, the highly competitive nature of the market for professional services, risks related to the loss of a significant number of our consultants, or an inability to attract and retain new consultants, the possible impact on our business from the loss of the services of one or more key members of our senior management or key sales professionals, risks related to potential significant increases in wages or payroll-related costs, our ability to secure new projects from clients, our ability to achieve or maintain a suitable pay/bill ratio, our ability to compete effectively in the competitive bidding process, risks related to unfavorable provisions in our contracts which may permit our clients to, among other things, terminate the contracts partially or completely at any time prior to completion, our ability to realize the level of benefit that we expect from our restructuring initiatives, risks that our recent digital expansion and technology transformation efforts may not be successful, our ability to build an efficient support structure as our business continues to grow and transform, our ability to grow our business, manage our growth or sustain our current business, our ability to serve clients internationally, additional operational challenges from our international activities, possible disruption of our business from our past and future acquisitions, the possibility that our recent rebranding efforts may not be successful, our potential inability to adequately protect our intellectual property rights, risks that our computer hardware and software and telecommunications systems are damaged, breached or interrupted, risks related to the failure to comply with data privacy laws and regulations and the adverse effect it may have on our reputation, results of operations or financial condition, our ability to comply with governmental, regulatory and legal requirements and company policies, the possible legal liability for damages resulting from the performance of projects by our consultants or for our clients’ mistreatment of our personnel, risks arising from changes in applicable tax laws or adverse results in tax audits or interpretations, the possible adverse effect on our business model from the reclassification of our independent contractors by foreign tax and regulatory authorities, the possible difficulty for a third party to acquire us and resulting depression of our stock price, the operating and financial restrictions from our credit facility, risks related to the variable rate of interest in our credit facility, the possible impact of activist shareholders, the possibility that we are unable to or elect not to pay our quarterly dividend payment, and other factors and uncertainties as are identified in our most recent Annual Report on Form 10-K for the year ended May 31, 2025, which was filed on July 28, 2025, and our other public filings made with the Securities and Exchange Commission (File No. 0-32113). Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business or operating results. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company does not intend, and undertakes no obligation, to update the forward-looking statements in this Annual Report to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, unless required by law to do so.

2 — rgp. 2025 Annual Report

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | |

| | Years Ended |

| (In thousands, except per share data) | | May 31, 2025 | | May 25, 2024 |

| Financial Results: | | | | |

| Revenue ................................................................................................................ | | $ | 551,331 | | $ | 632,801 |

| Gross margin ........................................................................................................ | | 207,424 | | | 246,068 | |

| Restructuring charges............................................................................................ | | 5,061 | | | 4,087 | |

| Operating income ................................................................................................. | | (196,757) | | | 28,776 | |

| Net income ............................................................................................................ | | (191,780) | | | 21,034 | |

| Net Income per common share - Diluted ............................................................. | | $ | (5.80) | | $ | 0.62 |

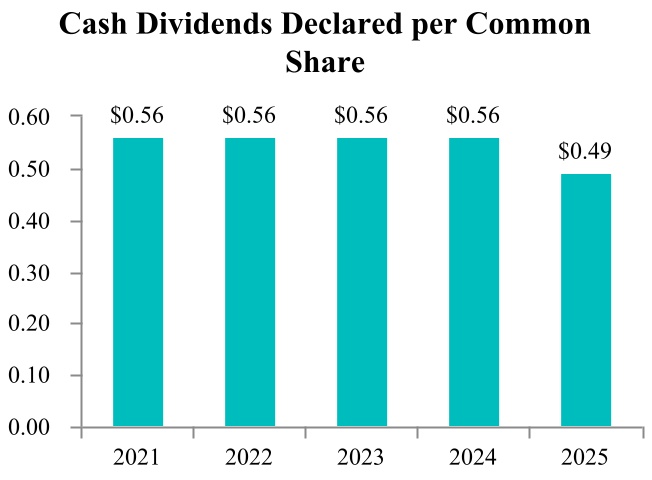

| Cash dividends declared per common share......................................................... | | $ | 0.49 | | $ | 0.56 |

| | | | |

| | | May 31, 2025 | | May 25, 2024 |

| Balance Sheet Data: | | | | |

| Cash, cash equivalents …..................................................................................... | | $ | 86,147 | | | $ | 108,892 | |

| Trade accounts receivable, net.............................................................................. | | 99,210 | | | 108,515 | |

| Total assets............................................................................................................ | | 304,688 | | | 510,914 | |

| Total Stockholders’ equity.................................................................................... | | 207,081 | | | 418,763 | |

| | | | |

| | | | |

| | | May 31, 2025 | | May 25, 2024 |

| Cash Flow Data: | | | | |

| Cash flows from operating activities..................................................................... | | $ | 18,899 | | | $ | 21,919 | |

| Cash flows from investing activities..................................................................... | | (13,571) | | | (8,554) | |

| Cash flows from financing activities..................................................................... | | (27,731) | | | (20,709) | |

rgp. 2025 Annual Report — 3

(1)Adjusted EBITDA is a key performance indicator we use to assess our financial and operating performance. We define Adjusted EBITDA as net income (loss) before amortization expense, depreciation expense, interest and income taxes, excluding stock-based compensation expense, amortized Enterprise Resource Planning (“ERP”) system costs, technology transformation costs, goodwill impairment, acquisition costs, gain on sale of assets, restructuring costs, and contingent consideration adjustments. Adjusted EBITDA is a non-GAAP financial measure. A non-GAAP financial measure is defined as a numerical measure of a company’s financial performance that (i) excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the comparable measure calculated and presented in accordance with generally accepted accounting principles (“GAAP”) in the Consolidated Statements of Operations; or (ii) includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the comparable GAAP measure so calculated and presented. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by revenue. For further discussion of Adjusted EBITDA and Adjusted EBITDA margin, see page 23.

4 — rgp. 2025 Annual Report

SERVICES AND STRATEGY OF RESOURCES GLOBAL PROFESSIONALS

Resources Global Professionals (“RGP”) is a professional services firm based in Dallas, Texas (with offices worldwide) focused on delivering flexible and high impact solutions to businesses through strategic and execution consulting, on-demand resourcing, and fully outsourcing services. As a next-generation human capital partner for our clients, we are a trusted partner to the C suite, specializing in navigating complex business challenges typically precipitated by business transformation, strategic transactions, or regulatory compliance. Our engagements are designed to leverage a combination of bench and agile talent that are highly experienced to deliver practical solutions and more impactful results that power our clients’, employees’ and partners’ success.

We attract top-caliber professionals with in-demand skill sets who seek a workplace environment characterized by choice and control, collaboration and human connection. The trends in today’s marketplace favor flexibility and agility as businesses confront transformation pressures and skilled labor shortages even in the face of protracted economic uncertainty. Our client engagement and talent delivery model offer speed and agility, strongly positioning us to help our clients transform their businesses and workplaces.

We serve more than 1,600 clients around the world with approximately 3,100 professionals collectively engaged from 41 physical practice offices and multiple virtual offices. Headquartered in Dallas, Texas, we are proud to have served 88% of the Fortune 100 as of May 2025.

Business Segments

During the first quarter of fiscal 2025, the Company reorganized the Company’s business by forming multiple discrete operational business units. To align the new operating model and financial reporting, the Company made management organizational changes and implemented new reporting modules and processes to provide discrete information to manage the business. During the first quarter of fiscal 2025, the Company completed its assessment of the Company's operating segments and identified the following newly defined operating segments:

•On-Demand Talent – this segment provides businesses with a go-to source for bringing in experts to fill resource gaps when they need them.

•Consulting – this segment drives transformation across people, processes and technology across domain areas including accounting and finance, technology and digital, risk and compliance and supply chain transformation.

•Europe & Asia Pacific – is a geographically defined segment that offers both on-demand and consulting services to clients throughout Europe and Asia Pacific.

•Outsourced Services – operating under the Countsy by RGPTM brand, this segment offers finance, accounting and human resources (“HR”) services provided to startups, spinouts and scale-up enterprises, utilizing a technology platform and fractional team.

•Sitrick – a crisis communications and public relations firm that provides corporate, financial, transactional and crisis communication and management services.

Each of these segments reports through a separate segment manager to the Company’s Chief Executive Officer and Chief Operating Officer, who are collectively designated as the Company's Chief Operating Decision Maker (“CODM”) for segment reporting purposes. The Company's reportable segments are comprised of On-Demand Talent, Consulting, Europe & Asia Pacific, and Outsourced Services. Sitrick does not individually meet the quantitative thresholds to qualify as a reportable segment. Therefore, Sitrick is disclosed under the “All Other” segment. Each of these segments represents a reporting unit for the purposes of assessing goodwill for impairment.

rgp. 2025 Annual Report — 5

Industry Background and Trends

Changing Market for Project- or Initiative-Based Professional Services

Our services respond to what we believe is a permanent marketplace shift: namely, organizations are increasingly choosing to address their workforce needs in more flexible ways. Permanent professional personnel positions are being reduced as organizations engage agile talent for project initiatives and transformation work.

Organizations use a mix of alternative resources to execute initiatives and projects. Some companies rely solely on their own employees who may lack the requisite time, experience or skills for specific projects. Other companies may outsource entire projects to consulting firms, which provides them access to the expertise of the firm but often entails significant cost, insufficient management control of the project and a lack of ultimate ownership at project completion. As a more cost-efficient alternative, companies sometimes use temporary employees from traditional and internet-based staffing firms, although these employees may be less experienced or less qualified than employees from professional services firms. Finally, companies can supplement their internal resources with employees from agile consulting or other traditional professional services firms, like RGP. The use of project consultants as a viable alternative to traditional accounting, consulting, and law firms allows companies to:

•Strategically access specialized skills and expertise for projects of set durations;

•Engage the very best expert talent across regions and geographies;

•Be nimble and mobilize quickly;

•Blend independent and fresh points of view;

•Effectively supplement internal resources;

•Increase labor flexibility; and

•Reduce overall hiring, training and termination costs.

Supply of Project Consultants

Based on our review of labor market dynamics and discussions with our consultants, we believe that there is sustained demand among professionals seeking to work on an agile basis due to a desire for:

•More flexible hours and work arrangements, coupled with an evolving professional culture that offers competitive wages and benefits;

•The ability to learn and contribute to different environments and collaborate with diverse team members;

•Challenging engagements that advance their careers, develop their skills and add to their portfolio of experience;

•A work environment that provides a diversity of, and more control over, client engagements; and

•Alternative employment opportunities throughout the world.

The traditional employment options available to professionals may fulfill some, but not all, of an individual’s career objectives. A professional working for a Big Four firm or a consulting firm may receive challenging assignments and training; however, he or she may encounter a career path with less choice and less flexible hours, extensive travel demands and limited control over work engagements. On the other hand, a professional who works as an independent contractor assumes the ongoing burden of sourcing assignments and significant administrative obligations, including potential tax and legal issues.

RGP’s Solution

We believe RGP is ideally positioned to capitalize on the confluence of the industry shifts described above. We believe, based on discussions with our clients, that RGP provides the agility companies desire in today’s highly competitive and quickly evolving business environment. Our solution offers the following elements:

•A relationship-oriented and collaborative approach to client service;

•Flexible engagement models to meet clients where they need us, whether it's embedded expertise, strategic and execution oriented consulting or fully outsourced solutions;

•A dedicated talent acquisition and management team adept at developing, managing and deploying a project-based workforce;

6 — rgp. 2025 Annual Report

•Deep functional and/or technical experts who can assess clients’ project needs and customize solutions to meet those needs;

•Highly qualified and pedigreed consultants with the requisite expertise, experience and points of view;

•Competitive rates on an hourly basis as well as on a project basis; and

•Significant client control of their projects with effective knowledge transfer and change management.

RGP’s Strategic Priorities

Our Business Strategy

We are dedicated to serving our clients with flexible engagement models and highly qualified and experienced talent in support of projects and initiatives in a broad array of functional areas, including:

| | | | | |

| |

Transactions •Integration and divestitures •Bankruptcy/restructuring •Going public readiness and support •Financial process optimization •System implementation | Regulations •Accounting regulations •Internal audit and compliance •Data privacy and security •Healthcare compliance •Regulatory compliance |

Transformations •Finance transformation •Digital transformation •Supply chain management •Cloud migration •Data design and analytics | |

Our objective is to build and maintain RGP’s reputation as the premier provider of project execution services for companies facing transformation, change and compliance challenges. We have developed the following business strategies to achieve our objectives:

•Hire and retain highly qualified, experienced consultants. We believe our highly qualified, experienced consultants provide us with a distinct competitive advantage. Therefore, one of our top priorities is to continue to attract and retain high-caliber consultants who are committed to serving clients and solving their problems. We believe we have been successful in attracting and retaining qualified professionals by providing interesting work assignments within a blue-chip client base, competitive compensation and benefits, and continuing professional development and learning opportunities, as well as membership in an exclusive community of like-minded professionals, while offering flexible work schedules and more control over choosing client engagements.

•Maintain our distinctive culture. Our corporate culture is a core pillar of our business strategy, and we believe it has been a significant component of our success. See “Human Capital Management” below for further discussions about our culture.

•Deepen our consulting capabilities and establish consultative relationships with clients. We emphasize a relationship-oriented approach to business rather than a transaction-oriented or assignment-oriented approach. We believe the professional services experience of our management and consultants enables us to understand the needs of our clients and deliver an integrated, relationship-based approach to meeting those needs. Client relationships and needs are addressed from a client-centric, not geographic, perspective. Our team regularly meets with our existing and prospective clients to understand their business issues and identify tailored solutions to meet the clients’ objectives, whether it’s resourcing with highly skilled experts or strategic consulting with RGP's specific points of view. We believe that by establishing relationships with our clients to solve their professional service needs, we are more likely to identify new opportunities to serve them. The strength and depth of our client relationships is demonstrated by the 78% retention rate of our top 100 clients over the last five fiscal years.

rgp. 2025 Annual Report — 7

•Build the RGP brand. We have historically built our brand through the consistent and reliable delivery of high-quality, value-added services to our clients as well as a significant referral network of approximately 2,400 consultants and approximately 700 management and administrative employees as of May 31, 2025. In recent years, we have invested in global, regional and local marketing and brand building and activation efforts that reinforce our brand. In fiscal 2025, we launched a brand refresh to clarify what we do, who we serve, when to engage us, and the impact we deliver, reflected across our updated digital properties to enhance understanding of our full capabilities and client value. We expect to continue to engage in these efforts in the upcoming fiscal year. We rely on trademark registrations and common law trademark rights to protect the distinctiveness of our brand.

Our Growth Strategy

Since inception, our growth has been primarily organic with certain strategic acquisitions along the way that augmented our geographic presence or solution offerings. We believe we have significant opportunity for continued organic growth in our core business as well as through strategic and highly targeted acquisitions. Key elements of our growth strategy include:

•Increase penetration of existing client base. A principal component of our strategy is to secure additional work from the clients that we serve. Based on discussions with our clients, we believe that the amount of revenue that we currently generate from many of our clients represents a relatively small percentage of the total amount that they spend on professional services. We believe our clients may increase that spend as businesses adopt a more agile workforce strategy. We believe that by continuing to deliver high-quality services and by deepening our relationships with our clients, we can capture a significantly larger share of our clients’ professional services budgets. We maintain our Strategic Client Account program to serve a number of our largest clients with dedicated global account teams. We have and will continue to expand the Strategic Client Account program by taking a more client-centric and borderless approach to serving these clients. In addition to serving our largest clients with a differentiated focus, we also segment our clients by industry verticals. We believe this focus enhances our opportunity to develop in-depth knowledge of these clients’ needs and the ability to increase the scope and size of projects with those clients. The Strategic Client Account and Industry Vertical programs have been key drivers for our revenue and business development.

•Grow our client base. We continue to focus on attracting new clients. We strive to develop new client relationships primarily by leveraging the significant contact networks of our management and consultants, through referrals from existing clients and through a dedicated business development team targeting specific clients. We believe we can continue to attract new clients by building our brand identity and reputation, supplemented by our global, regional and local marketing efforts. We anticipate our growth efforts will continue to focus on identifying strategic target accounts especially in the large and middle-market client segments and within certain focus industries, such as healthcare, technology and financial services.

•Optimize service offerings with a focus on digital capabilities. We continue to evolve and optimize our portfolio of professional service offerings, and when appropriate, consider entry into new professional service offerings. Since our founding, we have diversified our professional service offerings from a primary focus on accounting and finance to other areas in which our clients have significant needs such as digital transformation, finance transformation, accounting regulations, internal audit and compliance, healthcare compliance, integration and divestitures, and supply chain management. We continuously identify project opportunities we can market at a broader level with our talent, tools and methodologies and commercialize into solution offerings. When evaluating new or existing solution offerings to invest in, we consider (among other things) profitability, cross-marketing opportunities, buyer personas, competition, growth potential and cultural fit. We offer valuable digital consulting services, particularly related to experience and automation. With our acquisition of Reference Point in July 2024, we expanded our tailored technology and data modernization offerings to our many financial services industry clients. Customer experience and employee and workspace experience continue to be growing themes in the marketplace and within our client portfolio. The need for automation and self-service has also been an increasing trend. We will continue to focus on expanding our technology and digital consulting capabilities and their geographic reach to drive growth in the business by capturing the market demand and opportunities.

•Further our strategic brand marketing. RGP has always focused our business on project execution, which is a distinct space on the continuum between strategy consulting and interim deployment. Our business model of utilizing experienced talent to flatten the traditional consulting delivery pyramid is highly sought after in today’s market. Most clients are capable of formulating business strategy organically or with the help of a strategy firm; where they need help is in the ownership of executing the strategy. Our co-delivery ethos is focused around partnering with clients on project execution.

8 — rgp. 2025 Annual Report

Our brand marketing will continue to emphasize and accentuate our unique qualifications in this arena. We believe clear articulation and successful marketing of our distinctive market position is key to attracting and retaining both clients and talent, enabling us to drive continued growth.

•Engage in strategic acquisitions. Our acquisition strategy is to engage in targeted M&A efforts that are designed to complement our core service offerings and enhance our consulting capabilities that are in line with market demands and trends. Our acquisition of CloudGo, now integrated into our Consulting practice, expanded our ServiceNow capabilities as well as our ServiceNow footprint in the Asia Pacific region. In addition, as noted above, our acquisition of Reference Point in July 2024 has allowed us to expand our offerings to clients within the financial services industry. We will continue to seek acquisition opportunities to augment and expand the breadth and depth of our digital and other core capabilities.

Our Service Offerings

•Project Consulting Services. We partner with our people and clients to deliver value and impact, bringing our depth of experience and “sleeves up” approach to project execution. While many companies find their internal employees lack the time, experience, or skills for project execution, we seek out talent who can bring fresh ideas to drive any project to a successful conclusion.

•On-demand Talent Services. Tapping into our agile talent pool, we mobilize the right resources to build delivery teams for our consulting offerings and directly support client talent needs in today’s rapidly changing business environment. Our workforce strategy provides flexible, collaborative resources to meet our clients’ needs.

•Outsourced Services. We offer outsourced finance, accounting and HR services to startups, spinouts and scale-up enterprises, utilizing a technology platform and fractional team.

•Crisis Communication Services. Through Sitrick, we provide corporate, financial, transactional and crisis communication and management services. .

Human Capital Management

Our internal employees and consultants represent our greatest asset and operate together to provide the highest quality of service to our clients. As of May 31, 2025, we had 3,055 employees, including 687 management and administrative employees and 2,368 consultants. Our employees are not covered by any collective bargaining agreements.

Our Culture and Values

Our culture is the cornerstone of all our human capital programs. Our senior management team, the majority of whom are Big Four, management consulting and/or Fortune 500 alumni, has created a culture that combines the commitment to quality and the client service focus of a Big Four firm with the entrepreneurial energy of an innovative, high-growth company. Our culture is built upon our shared, core values of Loyalty, Integrity, Focus, Enthusiasm, Accountability and Talent, and we believe this is a key reason for our success.

We strive to earn the trust of our clients, employees, and the communities we serve by operating a legal, ethical and trustworthy manner. Our corporate policies and structure allow our employees, executives and board to lead with integrity and transparency. Along with our core values, we act in accordance with our Code of Business Conduct and Ethics (“Code of Conduct”), which sets forth the standards our employees and board members must adhere to at all times in the execution of their duties. Our Code of Conduct covers topics such as honest and candid conduct, conflicts of interest, protecting confidential information, anti-corruption, compliance with laws, rules and regulations, fair dealing, equal opportunities and non-harassment, maintaining a safe workplace, and the reporting of violations. The Code of Conduct reflects our commitment to operating in a fair, honest, responsible and ethical manner and also provides direction for reporting complaints in the event of alleged violations of our policies (including through an anonymous hotline).

rgp. 2025 Annual Report — 9

Inclusion and Belonging

At RGP, we aim to create a workplace where people feel valued and supported. We believe our success comes from building teams with unique skills, perspectives and backgrounds. We offer three employee resource groups (“ERGs”) open to all employees — Women in Leadership, Multicultural, and Interfaith ERGs—which are voluntary, employee-led groups that are dedicated to fostering an inclusive work environment.

In fiscal 2025, we continued our charitable giving matching fund with company matching contributions upwards of $100,000. Since fiscal 2021, we have supported approximately 250 unique charitable organizations with over $500,000 in contributions. We also encourage our employees' community involvement through our Spirit of Volunteerism Initiative, which supports causes important to employees. We are committed to fostering growth, community and connections both inside and outside of RGP.

Employee Wellbeing and Resilience

Employee safety and wellbeing is of paramount importance to us. Our Global Business Continuity Team continued to improve our disaster preparedness plans and implement strategies to manage the health and security of our employees, business continuity, client confidence, and excellent customer service.

To promote employee wellbeing and collaboration, we continued to offer a hybrid work policy, where employees are invited to work collaboratively with colleagues in the office and are permitted to work remotely as desired. Our goal is to help every human in our workforce maintain a positive, productive and connected work experience. We provide productivity and collaboration tools and resources for employees working remotely. During fiscal 2025, we also enhanced and promoted programs to support our employees’ physical and mental wellbeing, including the launch of a wellness app, YuLife, to all U.S. employees. This gamified app is designed to promote healthy habits by rewarding employees for walking, cycling, meditating and brain training. We continue to support physical, mental and financial wellness through communications and webinars. Our You Matter recognition program is ongoing and allows employees to share gratitude and kudos for colleagues. We also offer an Employee Assistance Program for U.S. employees and a Global Workforce Support Program for our international employees. Both programs provide resources to support personal and family health and wellbeing.

Building Strong Leaders and Talent Management

Strong “human leadership” is critical to fostering employee engagement and positioning employees to perform at their best. We offer “Leadership U” to foster leadership development, peer mentorship opportunities and to support the building and maintenance of high-performing teams. In fiscal 2025, we saw a continued and strengthened desire from employees seeking authentic, empathetic and adaptive behaviors from their leaders. For these reasons, we invest in the ongoing professional development of our employees and leaders. We designed and delivered curated programs such as “Leadership U” to onboard and acclimate employees to the business and promote personal, professional and leadership growth.

Successful talent development starts with hiring the right people. We seek to recruit and hire candidates that demonstrate skills and competencies that align with our core values and that have an aptitude to further develop and expand those capabilities. After onboarding, our Life + Learning team remains committed to providing employees with training and development opportunities to allow our employees to progress in their careers. We offer newly hired employees the opportunity to participate in our “RGP U” program to accelerate and support their integration into our organization. This program gives our new hires a connected cohort to drive a sense of belonging early in their career at RGP and offers their leaders a more efficient use of individual coaching time with new employees. We also offer “RGP U Consultant” to ensure strong connectivity and supported success in a consultant’s first year with RGP. Additionally, we offer a Sales Effectiveness curriculum focused on deepening sales and client service acumen and effectiveness.

In addition, we continued to invest in the professional development and growth of our employees as we focused on employee experience, effectiveness, upskilling and reskilling in a changing work environment. This support was focused and delivered to all employees with emphasis in the areas of leadership development, on-boarding, functional/technical learning and digital fluency. We continued to actively engage with our internal leaders by integrating wellness and leadership development topics into our quarterly senior leadership meetings. We also conducted intentional leader listening forums and mentorship programs to help guide our leaders during fiscal 2025.

10 — rgp. 2025 Annual Report

Compensation and Benefits

We provide a competitive compensation and benefits program to attract and reward our employees. In addition to salaries or hourly rates, our eligible employees, including our consultants, are offered participation in a comprehensive benefits program (based on location) including: paid time off and holidays, group medical and dental programs, a basic term life insurance program, health savings accounts, flexible spending accounts, a 401(k) retirement plan, contributions to statutory retirement programs, the 2019 Employee Stock Purchase Plan, as amended (“ESPP”), which enables employees to purchase shares of our stock at a discount, and an employee assistance program. In addition, eligible management and administrative employees may participate in annual cash incentive programs or receive stock-based awards. We also allow eligible consultants in the U.S. to maintain continuation of benefits for 90 days following the completion of a consulting project.

We utilize a Pay for Success Total Rewards Philosophy that promotes consistent and transparent practices for rewarding and incentivizing our employees and the alignment of pay results with the Company’s success. The Total Rewards Philosophy is comprised of three main components: (i) base pay, designed to reflect an individual’s value, knowledge and skills that contribute to the organization through an individual’s day-to-day job performance; (ii) short-term incentives, awarded to employees based on results delivered during the applicable fiscal year and determined by quantitative metrics, qualitative contributions, individual goals, and demonstration of company values; and (iii) long-term incentives, granted to recognize and retain employees who have strategic influence on the long-term success of the Company. As a listening organization, we continue to communicate with our people to understand what components of Total Rewards are priority for them and leverage that feedback, along with quantitative benchmarking data and affordability considerations, to continually evolve our Total Rewards offerings in a way that positions us to attract and retain top talent.

During fiscal 2025, we also continued our “You Matter” digital global employee recognition and appreciation program. You Matter includes service awards to acknowledge key milestones, including employment anniversaries and hours of service. This program provides all employees with the ability to both give and receive recognition, contributing to our culture of gratitude and excellence.

Clients

We provide our services and solutions to a diverse client base in a broad range of industries. In fiscal 2025, we served more than 1,600 clients in 32 countries. Our revenues are not concentrated with any particular client. No single client accounted for more than 10% of revenue for the 2025, 2024 or 2023 fiscal years. In fiscal 2025, our 10 largest clients accounted for approximately 22% of our revenue.

Operations

We generally provide our professional services to clients at a local level, with the oversight of our revenue team (including market or account leaders) and engagement leaders when delivering solutions on consulting projects. The revenue team in each market, in collaboration with subject matter experts in the consulting business, are responsible for new client acquisition, expanding client relationships, ensuring client satisfaction throughout engagements, coordinating services for clients on a national and international level and maintaining client relationships post-engagement. Market or account revenue leadership and their teams identify, develop and close new and existing client opportunities, often working in a coordinated effort with other markets on multi-national/multi-location proposals. While the majority of our client relationships are driven at a local market level, our Strategic Client Accounts, which are comprised of approximately 20 accounts, are led by account leaders responsible for relationships across markets and who are specifically tasked with growing our global relationships in these key accounts.

Market or account level leadership works closely with our talent management team to identify, hire and cultivate a relationship with seasoned professionals that fit our clients' needs. Our consultant recruiting efforts are regionally and nationally based, depending upon the skill sets required and our clients' preference for local talent. Recognizing the complexity of multinational client relationships, we've also utilized a hybrid approach that leverages the strengths of both local relationships and global delivery. We utilize a Borderless Talent model and seek to provide borderless solutions, anytime, anywhere, bringing the best talent to meet our clients’ business needs, based on expected outcome, not zip code. In addition, in order to meet our clients where they need us and expand our reach for in-demand talent and skill sets, we operate global delivery centers in India and the Philippines. We often blend our delivery teams with talent across the globe to maximize the impact we deliver to our clients.

rgp. 2025 Annual Report — 11

Our consulting business is organized by practice areas. Each practice has team members with deep subject matter expertise who focus on a combination of sales pursuit (in collaboration with the revenue team), project delivery/oversight and solution development.

We believe our ability to deliver professional services successfully to clients is dependent on our leaders in the field working together as a collegial and collaborative team. To build a sense of team spirit and increase camaraderie among our leaders, we have a program for field personnel that awards annual incentives based on specific agreed-upon goals focused on the performance of the individual and performance of the Company. We also share across the Company and with new team members the best and most effective practices of our highest achieving offices, consulting practices and accounts. New leadership also spends time in other markets or otherwise partners with experienced personnel to understand how best to serve current clients, expand our presence with prospects and identify and recruit highly qualified consultants, among many other important skills. This allows the veteran leadership to share their success stories, foster our culture with new team members and review specific client and consultant development programs. We believe these team-based practices enable us to better serve clients who prefer a centrally organized service approach.

We provide administrative, marketing, finance, HR, information technology (“IT”), legal and real estate support throughout our U.S. offices. We also have a business support operations center in our Utrecht, Netherlands office to provide centralized finance, HR, IT, payroll and legal support to our European offices. These centralized functions minimize the administrative burdens on our front office market leaders and enable operational efficiency and scalability throughout the enterprise.

Business Development

Our business development initiatives are comprised of:

•local and global initiatives focused on existing clients and target companies;

•national and international targeting efforts focused on multinational companies;

•brand marketing activities; and

•national and local advertising and direct mail programs.

Our business development efforts are driven by the networking and sales efforts of our management, with our worldwide Salesforce software platform providing a common database of opportunities and clients and enhancing our local and global business development efforts. While local senior management focus on market-related activities, they are also part of the regional, national and international sales efforts, especially when the client is part of a multinational entity. In certain markets, sales efforts are also enhanced by management professionals focused solely on business development efforts on a market and national basis based on firm-wide and industry-focused initiatives. These business development professionals, in partnership with the vice-presidents and client service teams, are responsible for initiating and fostering relationships with the senior management and decision makers of our targeted client companies.

We believe our national marketing efforts have effectively generated incremental revenues from existing clients and developed new client relationships. Our brand marketing initiatives help bolster RGP’s reputation in the markets we serve. Our brand is reinforced by our professionally designed website, print, and online advertising, direct marketing, seminars, thought leadership whitepapers, initiative-oriented brochures, social media and public relations efforts. We believe our branding initiatives, coupled with our high-quality client service, help to differentiate us from our competitors and to establish RGP as a credible and reputable global professional services firm.

Competition

We operate in an extremely competitive, highly fragmented market and compete for clients and consultants with a variety of organizations that offer similar services. The competition for talent and clients is likely to increase in the future due to workforce gaps caused by the tightening labor market, a changing market for project- or initiative-based services and the relatively few barriers to entry. Our principal competitors include:

•business operations and financial consulting firms;

•local, regional, national and international accounting and other traditional professional services firms;

•independent contractors;

•traditional and internet-based staffing firms; and

•the in-house or former in-house resources of our clients.

12 — rgp. 2025 Annual Report

We compete for clients based on the quality of professionals we bring to our clients, the knowledge base they possess, our ability to mobilize the right talent quickly, the effectiveness of our solutions, the scope and price of services, and the geographic reach of services. We believe our attractive value proposition, consisting of our diversified and relevant solution offerings, highly qualified consultants, relationship-oriented approach, delivery model (agile, bench and offshore) and professional culture, enables us to compete effectively in the marketplace.

Regulatory Environment

Our operations are subject to regulations by federal, state, local and professional governing bodies and laws and regulations in various foreign countries, including, but not limited to: (a) licensing and registration requirements and (b) regulation of the employer/employee relationship, such as worker classification regulations, wage and hour regulations, tax withholding and reporting, immigration/H-1B visa regulations, social security and other retirement, anti-discrimination, and employee benefits and workers’ compensation regulations. Our operations could be impacted by legislative changes by these bodies, particularly with respect to provisions relating to payroll and benefits, tax and accounting, employment, worker classification and data privacy which could materially affect our capital expenditures, earnings and/or competitive position. Due to the complex regulatory environment that we operate in, we remain focused on compliance with governmental and professional organizations’ regulations. For more discussion of the potential impact that the regulatory environment could have on our financial results, refer to Item 1A “Risk Factors” of our Annual Report on Form 10-K filed with the SEC on July 28, 2025.

rgp. 2025 Annual Report — 13

Market Information and Holders

Our common stock is listed on The Nasdaq Stock Market LLC and trades on the Nasdaq Global Select Market under the symbol “RGP.” As of July 18, 2025, the approximate number of holders of record of our common stock was 39 (a holder of record is the name of an individual or entity that an issuer carries in its records as the registered holder (not necessarily the beneficial owner) of the issuer’s securities).

Dividend Policy

Our Board of Directors has established a quarterly dividend, subject to quarterly Board of Directors’ approval. Pursuant to declaration and approval by our Board of Directors, we declared a dividend of $0.14 per share of common stock during each quarter in fiscal 2024 and 2023, and the first three quarters of fiscal 2025. On April 29, 2025, our Board of Directors approved a regular quarterly dividend of $0.07 per share of our common stock, which was subsequently paid on July 21, 2025 to stockholders of record at the close of business on June 23, 2025. Continuation of the quarterly dividend will be at the discretion of our Board of Directors and will depend upon our financial condition, results of operations, capital requirements, general business condition, contractual restrictions contained in our current or future credit agreements and other agreements, and other factors deemed relevant by our Board of Directors.

Issuances of Unregistered Securities

None.

Issuer Purchases of Equity Securities

Our Board of Directors has previously approved two stock repurchase programs authorizing the repurchase, at the discretion of our senior executives, of our common stock for a designated aggregate dollar limit. In July 2015, the first program was authorized for an aggregate dollar limit not to exceed $150 million, and in October 2024, the second program was authorized for an additional dollar limit not to exceed $50 million (collectively, the “Stock Repurchase Programs”). Subject to the aggregate dollar limits, the currently authorized Stock Repurchase Programs do not have an expiration date. Repurchases under the programs may take place in the open market or in privately negotiated transactions and may be made pursuant to a Rule 10b5-1 plan. As of May 31, 2025, approximately $79.2 million remained available for future repurchases of the Company’s common stock under the Stock Repurchase Programs.

There were no repurchases of our common stock during the fourth quarter of fiscal 2025

Performance Graph

Set forth below is a line graph comparing the annual percentage change in the cumulative total return to the holders of our common stock against the cumulative total return of each of the Russell 3000 Index, a customized peer group consisting of eight companies listed below the following table and a combined classification of companies under Standard Industry Codes as 8742-Management Consulting Services, in each case for the five years ended May 31, 2025. The graph assumes $100 was invested at market close on May 29, 2020 in our common stock and in each index (based on prices from the close of trading on May 29, 2020), and that all dividends are reinvested. Stockholder returns over the indicated period may not be indicative of future stockholder returns.

The information contained in the performance graph shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933,

14 — rgp. 2025 Annual Report

as amended or the Securities Exchange Act of 1934, as amended except to the extent that we specifically incorporate it by reference into such filing.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

*$100 invested on 5/29/2020 in stock or index, including reinvestment of dividends.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| May 29, 2020 | | May 29, 2021 | | May 28, 2022 | | May 27, 2023 | | May 25, 2024 | | May 31, 2025 |

| Resources Connection, Inc. | $ | 100.00 | | $ | 138.57 | | $ | 178.65 | | $ | 157.85 | | $ | 117.94 | | $ | 57.82 |

| Russell 3000 | $ | 100.00 | | $ | 143.91 | | $ | 139.64 | | $ | 142.27 | | $ | 181.42 | | $ | 204.11 |

| SIC Code 8742 - Management Consulting | $ | 100.00 | | $ | 143.84 | | $ | 145.93 | | $ | 143.79 | | $ | 200.55 | | $ | 191.50 |

| Peer Group | $ | 100.00 | | $ | 149.01 | | $ | 161.97 | | $ | 172.04 | | $ | 224.03 | | $ | 204.25 |

Our customized peer group includes the following ten professional services companies that we believe reflect the competitive landscape in which we operate and acquire talent: Barrett Business Services, Inc.; CBIZ, Inc.; CRA International, Inc.; FTI Consulting, Inc.; Heidrick & Struggles International, Inc.; Huron Consulting Group Inc.; ICF International, Inc.; Kforce, Inc.; Korn Ferry; and MISTRAS Group, Inc.

rgp. 2025 Annual Report — 15

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and related notes. This discussion and analysis contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors including, but not limited to, those discussed in Part I, Item 1A “Risk Factors” of our Annual Report on Form 10 K filed with the SEC on July 18, 2025. See “Forward Looking Statements” above for further explanation.

Overview

Resources Global Professionals (“RGP”) is a professional services firm based in Dallas, Texas (with offices worldwide) focused on delivering consulting execution services that power clients’ operational needs and change initiatives utilizing a combination of bench and on-demand, expert and diverse talent. As a next-generation human capital partner for our clients, we specialize in leadership and co-delivery of enterprise initiatives typically precipitated by business transformation, strategic transactions or regulatory change. Our engagements are designed to leverage human connection and collaboration to deliver practical solutions and more impactful results that power our clients’, employees’ and partners’ success.

We attract top-caliber professionals with in-demand skill sets who seek a workplace environment characterized by choice and control, collaboration and human connection. The trends in today’s marketplace favor flexibility and agility as businesses confront transformation pressures and skilled labor shortages even in the face of protracted economic uncertainty. Our client engagement and talent delivery model offers speed and agility, strongly positioning us to help clients transform their businesses and workforce. Our model is especially relevant at a time where cost reduction initiatives drive an enhanced reliance on a flexible workforce to execute transformational projects.

We are laser-focused on driving long-term growth in our business by seizing favorable macro shifts in workforce strategies and preferences, building an efficient and scalable operating model, and maintaining a distinctive culture and approach to professional services. Our enterprise initiatives in recent years include refining the operating model for sales, talent and delivery to be more client-centric, cultivating a more robust performance culture by aligning incentives to business performance, enhancing our consulting capabilities in digital transformation to align with market demand, improving operating leverage through pricing, operating efficiency and cost reduction, and driving growth through strategic acquisitions. We believe our focus and execution on these initiatives will serve as the foundation for growth ahead. See “Business” for further discussions about our business and operations.

Fiscal 2025 Strategic Focus Areas

In fiscal 2025, our strategic focus areas were:

•Evolve and execute under our new business segments;

•Launch and activate new brand identity; and

•Enhance digital and artificial intelligence (“AI”) capabilities

Evolve and execute under our new business segments – Our first area of focus for fiscal 2025 has been to evolve our business by focusing on three core engagement models: On-Demand Talent, Consulting, and Outsourced Services. This shift has enabled us to better serve our clients along their transformation journey by providing targeted skill sets, high value consulting services, and outsourced delivery under a single umbrella. Our approach combines flexibility, best of breed technology, and human-centered design with functional and subject matter expertise. This fiscal year, we have made tremendous progress in clarifying and operationalizing these models to unlock the cross selling of our diversified capabilities throughout our blue-chip, loyal and longstanding client base. Our growing consulting capability provides us with deeper visibility into our clients’ transformation agendas to drive greater opportunity for our on-demand execution capabilities, while our agile talent base within our on-demand business provides greater financial flexibility and better skill set alignment for our consulting business. In our outsourced services business, we have expanded Countsy’s total addressable market beyond the start-up ecosystem to serve the finance, accounting and human resources needs surrounding spin-outs and carve-outs. Europe and Asia has continued to operate in the geographic regions as one business segment, serving our clients with consulting capabilities and on-demand experts. Evolving our business through this reorganization ensures that we are well positioned to execute and succeed as the macro environment recovers.

16 — rgp. 2025 Annual Report

Launch and activate new brand – In connection with the evolution of our business segments, we also evolved and aligned our brand identity to clarify to our stakeholders what we do, who we serve, when to call us, and the impact we deliver. We believe the added brand clarity will strengthen our market position and is a critical part of our long-term value creation.

Enhance digital and AI capabilities – Our third focus area for fiscal 2025 has been continuing to expand and enhance our technology, digital and data capabilities across all business units. The increased adoption of digital tools, remote work styles, generative AI, and globalization is driving new areas of need within our client base. We are actively adding skilled on-demand and consulting professionals in areas such as technology migration, data modernization and data privacy, and user experience to proactively meet these evolving client needs. Our Digital/Technology and Data practices bring together the unique combination of technology transformation and the deep functional expertise within our consulting practice. We believe this combined offering will uniquely position us to offer our clients integrated end-to-end consulting solutions in the digital arena.

We have historically accelerated growth through strategic acquisitions that drive additional scale or expand and complement our existing core capabilities. In addition to enhancing our digital and AI capabilities organically, we acquired Reference Point LLC (“Reference Point”) in July 2024, a management consulting firm with deep technology and data capabilities. We believe the added capabilities from Reference Point has accelerated growth in the existing consulting business and contributed favorably to the execution of our cross selling strategy.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations included in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are based upon our Consolidated Financial Statements, which have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities. Actual results may differ from these estimates under different assumptions or conditions.

The following represents a summary of our accounting policies that involve critical accounting estimates, defined as those estimates made in accordance with GAAP that involve a significant level of estimation uncertainty and have had or are reasonably likely to have a material impact on our financial condition or results of operations.

Revenue recognition — Revenue is recognized when control of the promised service is transferred to our clients, in an amount that reflects the consideration expected in exchange for the services. Revenue is recorded net of sales or other transaction taxes collected from clients and remitted to taxing authorities. Revenues for the vast majority of our contracts are recognized over time, based on hours worked by our professionals. The performance of the agreed-upon service over time is the single performance obligation for revenues.

On a limited basis, the Company may have fixed-price contracts, for which revenue is recognized over time using the input method based on time incurred as a proportion of estimated total time. Time incurred represents work performed, which corresponds with, and therefore best depicts, the transfer of control to the client. Management uses significant judgments when estimating the total hours expected to complete the contract performance obligation. It is possible that updated estimates for consulting engagements may vary from initial estimates with such updates being recognized in the period of determination. Depending on the timing of billings and services rendered, the Company accrues or defers revenue as appropriate.

Certain clients may receive discounts (for example, volume discounts or rebates) to the amounts billed. These discounts or rebates are considered variable consideration. Management evaluates the facts and circumstances of each contract and client relationship to estimate the variable consideration, assessing the most likely amount to recognize and considering management’s expectation of the volume of services to be provided over the applicable period. Rebates are the largest component of variable consideration and are estimated using the most-likely-amount method prescribed by Accounting Standards Codification Topic 606, Revenue from Contracts with Customers, contracts terms and estimates of

rgp. 2025 Annual Report — 17

revenue. Revenues are recognized net of variable consideration to the extent that it is probable that a significant reversal of revenues will not occur in subsequent periods. Changes in estimates would result in cumulative catch-up adjustments and could materially impact our financial results. Rebates recognized as contra-revenue for the years ended May 31, 2025, May 25, 2024 and May 27, 2023 were $2.2 million, $2.5 million and $3.2 million, respectively.

Allowance for credit losses — We maintain an allowance for credit losses for estimated losses resulting from our clients failing to make required payments for services rendered. We estimate this allowance based upon our knowledge of the financial condition of our clients (which may not include knowledge of all significant events), review of historical receivable and reserve trends and other pertinent information. While such losses have historically been within our expectations and the provisions established, we cannot guarantee that we will continue to experience the same credit loss rates we have in the past. As of May 31, 2025 and May 25, 2024, we had an allowance for credit losses of $2.6 million and $2.8 million, respectively. A significant change in the liquidity or financial position of our clients could cause unfavorable trends in receivable collections and additional allowances may be required. These additional allowances could materially affect our future financial results.

Income taxes — In order to prepare our Consolidated Financial Statements, we are required to make estimates of income taxes, if applicable, in each jurisdiction in which we operate. The process incorporates an assessment of any income subject to taxation in each jurisdiction together with temporary differences resulting from different treatment of transactions for tax and financial statement purposes. These differences result in deferred tax assets and liabilities that are included in our Consolidated Balance Sheets. The recovery of deferred tax assets from future taxable income must be assessed and, to the extent recovery is not likely, we will establish a valuation allowance. An increase in the valuation allowance results in recording additional tax expense and any such adjustment may materially affect our future financial results. If the ultimate tax liability differs from the amount of tax expense we have reflected in the Consolidated Statements of Operations, an adjustment of tax expense may need to be recorded and this adjustment may materially affect our future financial results and financial condition.

We evaluate the realizability of our deferred tax assets based on all available evidence and establish a valuation allowance to reduce deferred tax assets when it is more likely than not that they will not be realized. When all available evidence indicates that the deferred tax assets are more likely than not to be realized, a valuation allowance is not required to be recorded or an existing valuation allowance is reversed. Management assesses all available positive and negative evidence, including (1) three-year cumulative pre-tax income or loss adjusted for permanent tax differences, (2) history of operating losses and of net operating loss carryforwards expiring unused, (3) evidence of future reversal of existing taxable temporary differences, (4) availability of sufficient taxable income in prior years, (5) tax planning strategies, and (6) projection of future taxable income, to determine the need to establish or release a valuation allowance on the deferred tax assets. An increase or decrease in valuation allowance will result in a corresponding increase or decrease in tax expense, and any such adjustment may materially affect our future financial results.

We also evaluate our uncertain tax positions and only recognize the tax benefit from an uncertain tax position if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such positions are measured based on the largest benefit that has a greater than 50 percentage likelihood of being realized upon settlement. We record a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be taken in a tax return. Any change in judgment related to the expected ultimate resolution of uncertain tax positions is recognized in earnings in the period in which such change occurs.

As of May 31, 2025 and May 25, 2024, a valuation allowance of $29.4 million and $8.6 million was established on deferred tax assets totaling $44.4 million and $34.2 million, respectively. Our income tax for the years ended May 31, 2025, May 25, 2024 and May 27, 2023 was a benefit of $4.3 million, an expense of $8.8 million, and an expense of $18.3 million, respectively. As of May 31, 2025 and May 25, 2024, our total liability for unrecognized tax benefits was $1.1 million and $1.0 million, respectively.

Stock-based compensation — Under our 2020 Performance Incentive Plan, officers, employees, and outside directors have received or may receive grants of restricted stock awards, restricted stock units, performance stock units, options to purchase common stock or other stock or stock-based awards. Under our 2019 Employee Stock Purchase Plan, as amended (“ESPP”), eligible officers and employees may purchase our common stock at a discount in accordance with the terms of the plan. Performance stock unit awards granted under the 2020 Performance Incentive Plan vest upon the

18 — rgp. 2025 Annual Report

achievement of certain company-wide performance targets at the end of the defined three-year performance period. Vesting periods for restricted stock awards, restricted stock units and stock option awards range from three to four years.

We estimate the fair value of stock-based payment awards on the date of grant as described below. We determine the estimated value of restricted stock awards, restricted stock unit and performance stock unit awards using the closing price of our common stock on the date of grant. We have elected to use the Black-Scholes option-pricing model for our stock options and stock purchased under our ESPP which takes into account assumptions regarding a number of complex and subjective variables. These variables include the expected stock price volatility over the term of the awards and actual and projected employee stock option exercise behaviors. Additional variables to be considered are the expected term, expected dividends and the risk-free interest rate over the expected term of our employee stock options.

We use our historical volatility over the expected life of the stock option award and ESPP award to estimate the expected volatility of the price of our common stock. The risk-free interest rate assumption is based upon observed interest rates appropriate for the term of our employee stock options. The impact of expected dividends is also incorporated in determining the estimated value per share of employee stock option grants and purchases under our ESPP. Such dividends are subject to quarterly Board of Directors’ approval. Our expected life of stock option grants is 5.6 years for non-officers and 8.1 years for officers, and the expected life of grants under our ESPP is 6 months.

In addition, because stock-based compensation expense recognized in the Consolidated Statements of Operations is based on awards ultimately expected to vest, it is reduced for estimated forfeitures. Forfeitures are estimated at the time of grant and revised in subsequent periods if actual forfeitures differ from those estimates, and in the case of performance stock units, based on the actual performance. The number of performance stock units earned at the end of the performance period may equal, exceed or be less than the targeted number of shares depending on whether the performance criteria are met, surpassed or not met. During each reporting period, the Company uses the latest forecasted results to estimate the number of shares to be issued at the end of the performance period. Any resulting changes to stock compensation expense are adjusted in the period in which the change in estimates occur. Forfeitures are estimated based on historical experience.

We review the underlying assumptions related to stock-based compensation at least annually or more frequently if we believe triggering events exist. If facts and circumstances change and we employ different assumptions in future periods, the compensation expense recorded may differ materially from the amount recorded in the current period. Stock-based compensation expense for the years ended May 31, 2025, May 25, 2024 and May 27, 2023 was $6.8 million, $5.7 million and $9.5 million, respectively.

Valuation of long-lived assets — For long-lived tangible and intangible assets other than goodwill, including property and equipment, right-of-use (“ROU”) assets, and definite-lived intangible assets, we assess the potential impairment periodically or whenever events or changes in circumstances indicate the carrying value may not be recoverable from the estimated undiscounted expected future cash flows expected to result from their use and eventual disposition. In cases where the estimated undiscounted expected future cash flows are less than the net book value, an impairment loss is recognized equal to the amount by which the net book value exceeds the estimated fair value of assets. We performed our assessment of potential qualitative impairment indicators of long-lived assets, including property and equipment, ROU assets outside of exited under the real estate exit initiatives taken, and definite-lived intangible assets. We determined that for such long-lived assets, no impairment indicators were present as of May 31, 2025, and no impairment charge was recorded during fiscal 2025 for long-lived assets.

Estimating future cash flows requires significant judgment, and our projections may vary from the cash flows eventually realized. Future events and unanticipated changes to assumptions could result in an impairment in the future. Although any impairment is a non-cash expense, it could materially affect our future financial results and financial condition.

Goodwill — Goodwill represents the excess of the purchase price over the fair value of the net tangible and identifiable intangible assets acquired in each business combination. We evaluate goodwill for impairment annually, and whenever events indicate that it is more likely than not that the fair value of a reporting unit could be less than its carrying amount. In assessing the recoverability of goodwill, we make a series of assumptions including forecasted revenue and costs, estimates of future cash flows, discount rates and other factors, which require significant judgment. A potential impairment in the future, although a non-cash expense, could materially affect our financial results and financial condition.