Third Quarter 2025 Investor Presentation Encore Capital Group, Inc. November 5, 2025

Encore Capital Group, Inc. 2 Legal Disclaimers The statements in this presentation that are not historical facts, including, most importantly, those statements preceded by, or that include, the words “will,” “may,” “believe,” “projects,” “expects,” “anticipates” or the negation thereof, or similar expressions, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). These statements may include, but are not limited to, statements regarding our future operating results (including portfolio purchase volumes, collections, cash generation and yields), performance, business plans or prospects, as well as statements regarding supply, portfolio pricing, returns, run rates, tax rates, interest expense, ability to access capital markets, the consumer credit cycle, interest rates and other macroeconomic factors. For all “forward-looking statements,” the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. Such forward-looking statements involve risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks, uncertainties and other factors are discussed in the reports filed by the Company with the Securities and Exchange Commission, including its most recent report on Form 10-K, as it may be amended from time to time. The Company disclaims any intent or obligation to update these forward-looking statements. Totals in this presentation may reflect slight differences due to rounding.

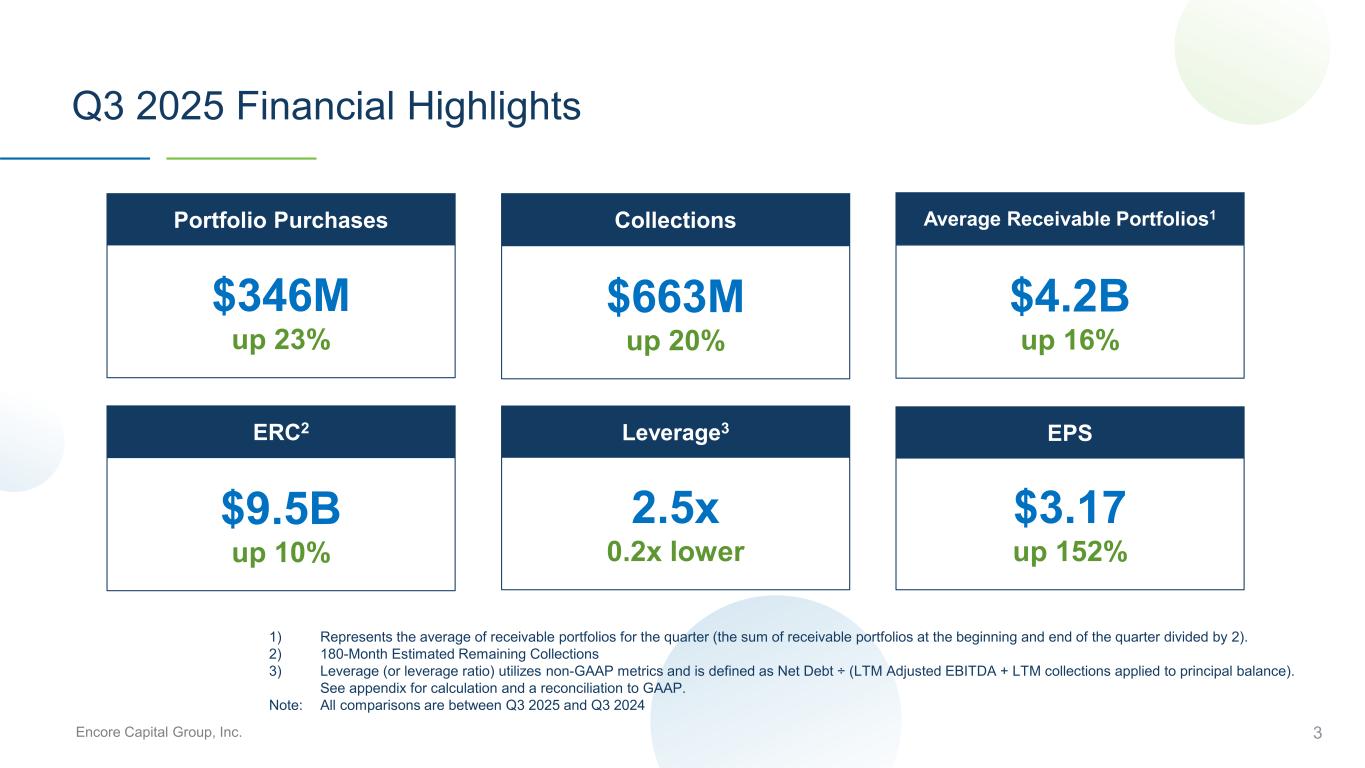

Encore Capital Group, Inc. 3 Q3 2025 Financial Highlights 1) Represents the average of receivable portfolios for the quarter (the sum of receivable portfolios at the beginning and end of the quarter divided by 2). 2) 180-Month Estimated Remaining Collections 3) Leverage (or leverage ratio) utilizes non-GAAP metrics and is defined as Net Debt ÷ (LTM Adjusted EBITDA + LTM collections applied to principal balance). See appendix for calculation and a reconciliation to GAAP. Note: All comparisons are between Q3 2025 and Q3 2024 Portfolio Purchases $346M up 23% Collections $663M up 20% ERC2 $9.5B up 10% Leverage3 2.5x 0.2x lower EPS $3.17 up 152% Average Receivable Portfolios1 $4.2B up 16%

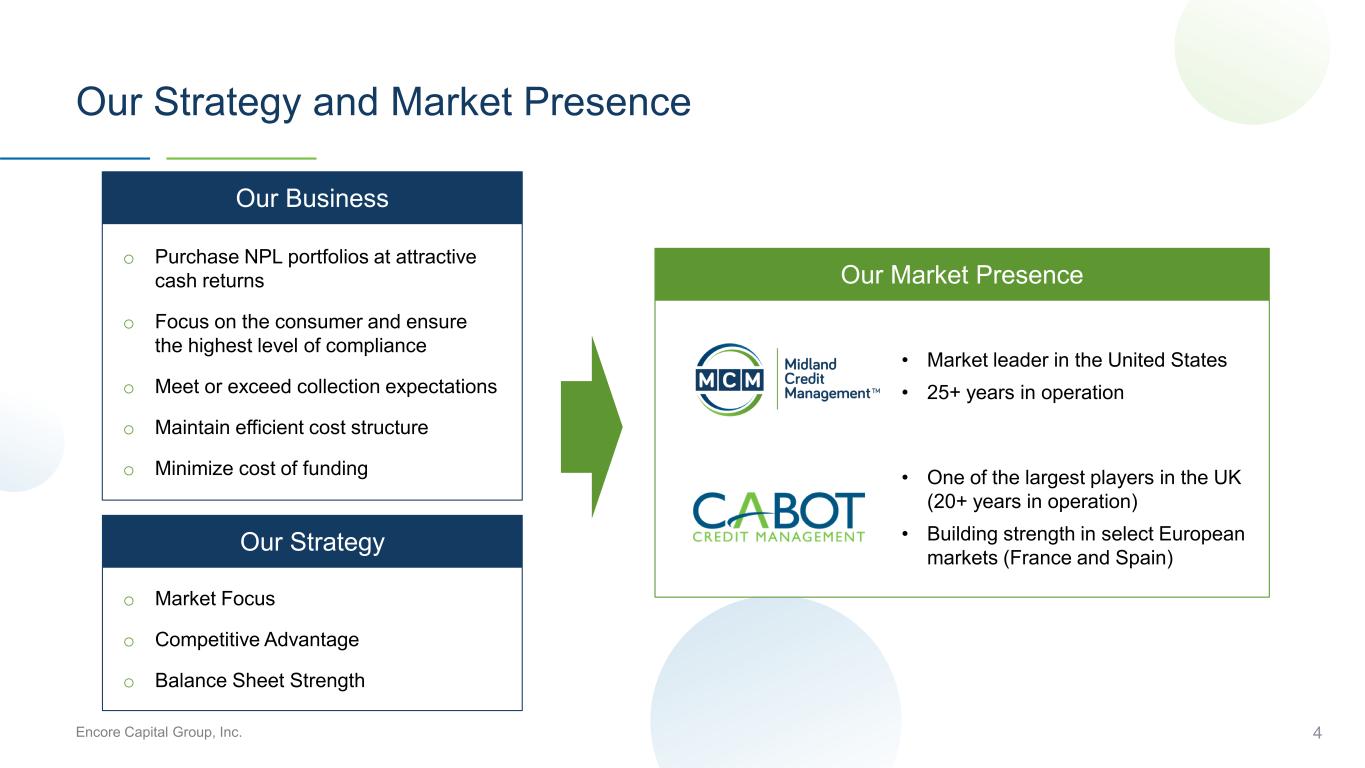

Encore Capital Group, Inc. 4 Our Strategy and Market Presence o Market Focus o Competitive Advantage o Balance Sheet Strength Our Strategy • Market leader in the United States • 25+ years in operation • One of the largest players in the UK (20+ years in operation) • Building strength in select European markets (France and Spain) Our Market Presence Our Business o Purchase NPL portfolios at attractive cash returns o Focus on the consumer and ensure the highest level of compliance o Meet or exceed collection expectations o Maintain efficient cost structure o Minimize cost of funding

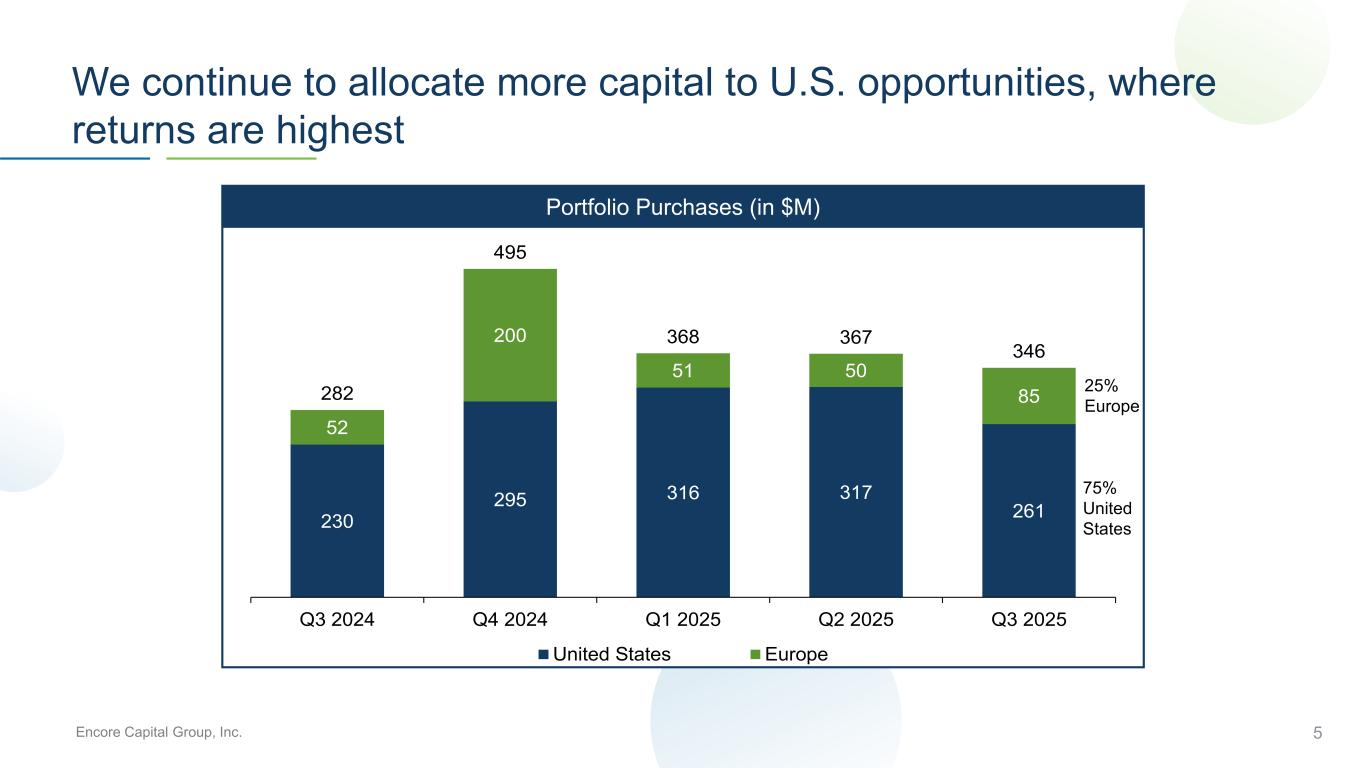

Encore Capital Group, Inc. 230 295 316 317 261 52 200 51 50 85282 495 368 367 346 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 United States Europe Portfolio Purchases (in $M) 5 We continue to allocate more capital to U.S. opportunities, where returns are highest 25% Europe 75% United States

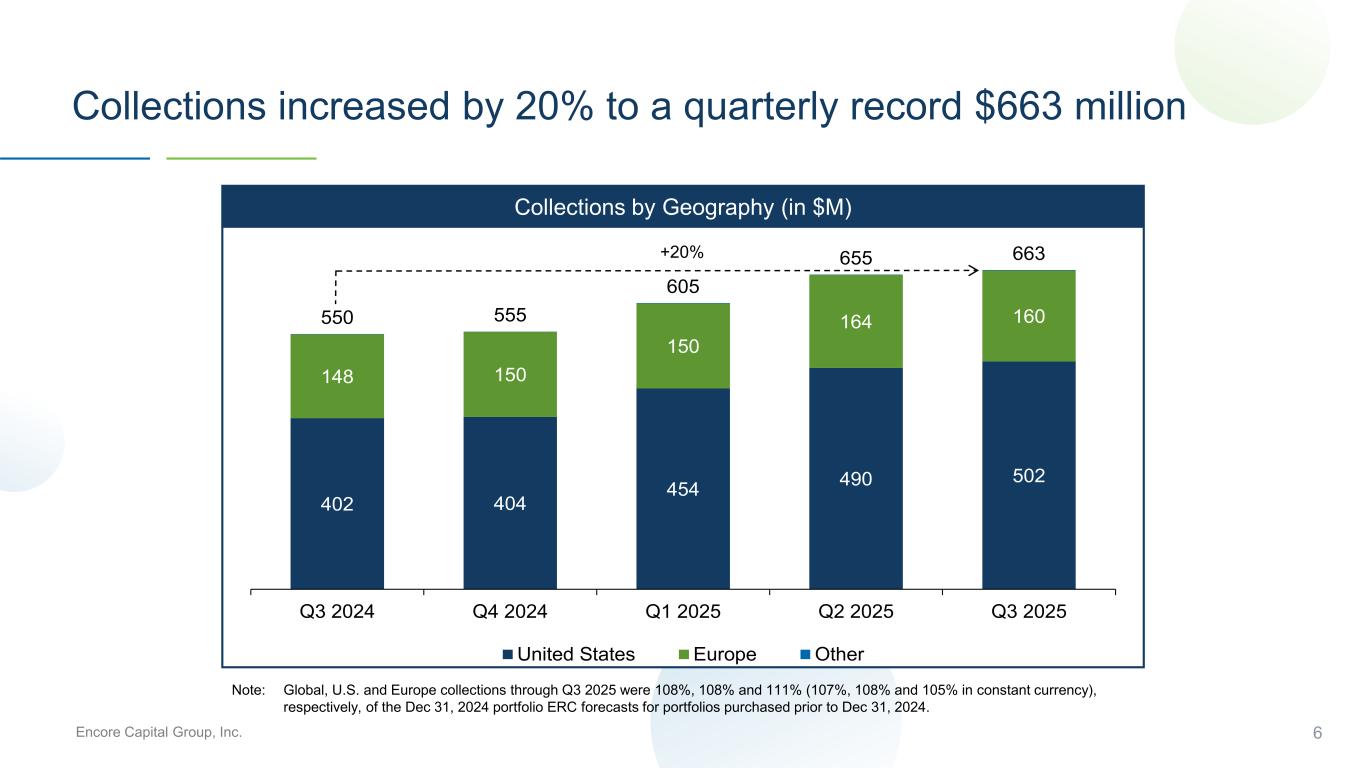

Encore Capital Group, Inc. 402 404 454 490 502 148 150 150 164 160550 555 605 655 663 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 United States Europe Other Collections by Geography (in $M) 6 Collections increased by 20% to a quarterly record $663 million Note: Global, U.S. and Europe collections through Q3 2025 were 108%, 108% and 111% (107%, 108% and 105% in constant currency), respectively, of the Dec 31, 2024 portfolio ERC forecasts for portfolios purchased prior to Dec 31, 2024. +20%

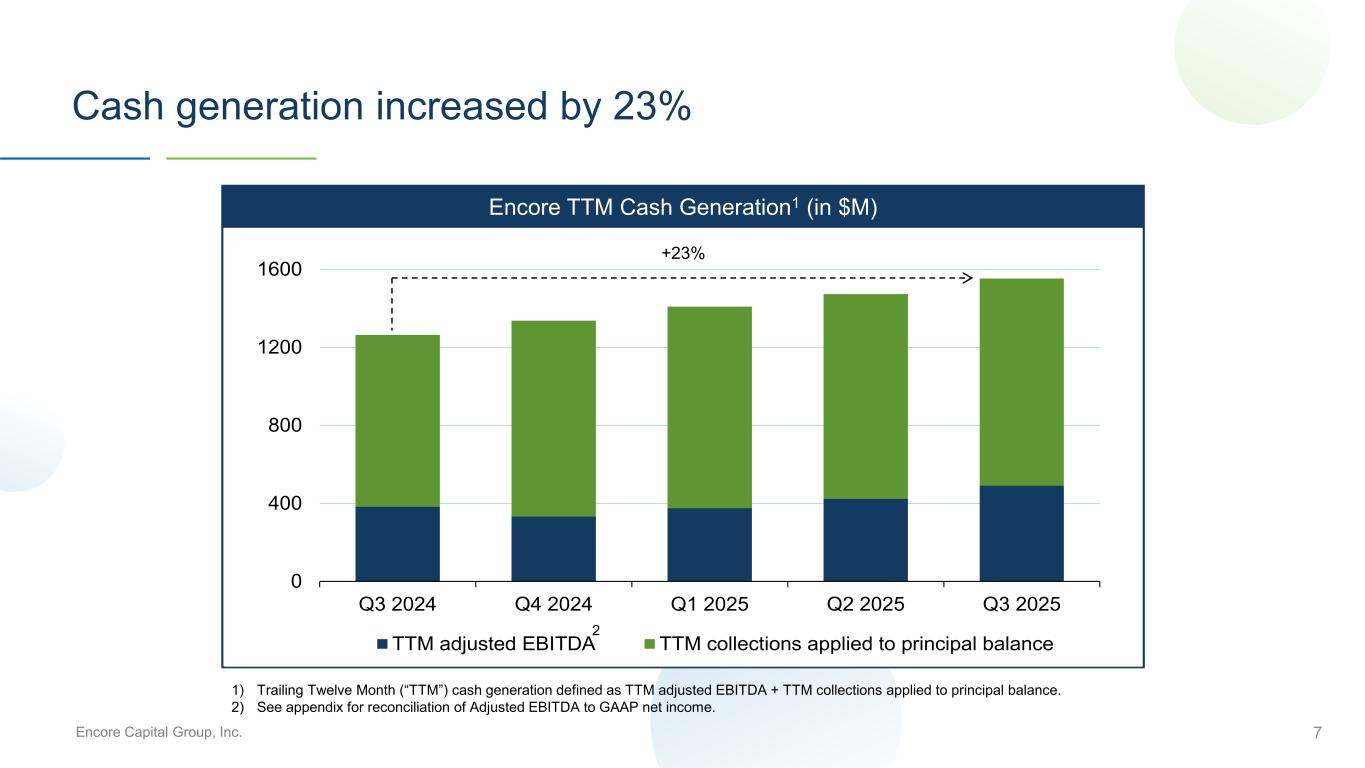

Encore Capital Group, Inc. 0 400 800 1200 1600 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 TTM adjusted EBITDA TTM collections applied to principal balance Encore TTM Cash Generation1 (in $M) 7 Cash generation increased by 23% 1) Trailing Twelve Month (“TTM”) cash generation defined as TTM adjusted EBITDA + TTM collections applied to principal balance. 2) See appendix for reconciliation of Adjusted EBITDA to GAAP net income. 2 +23%

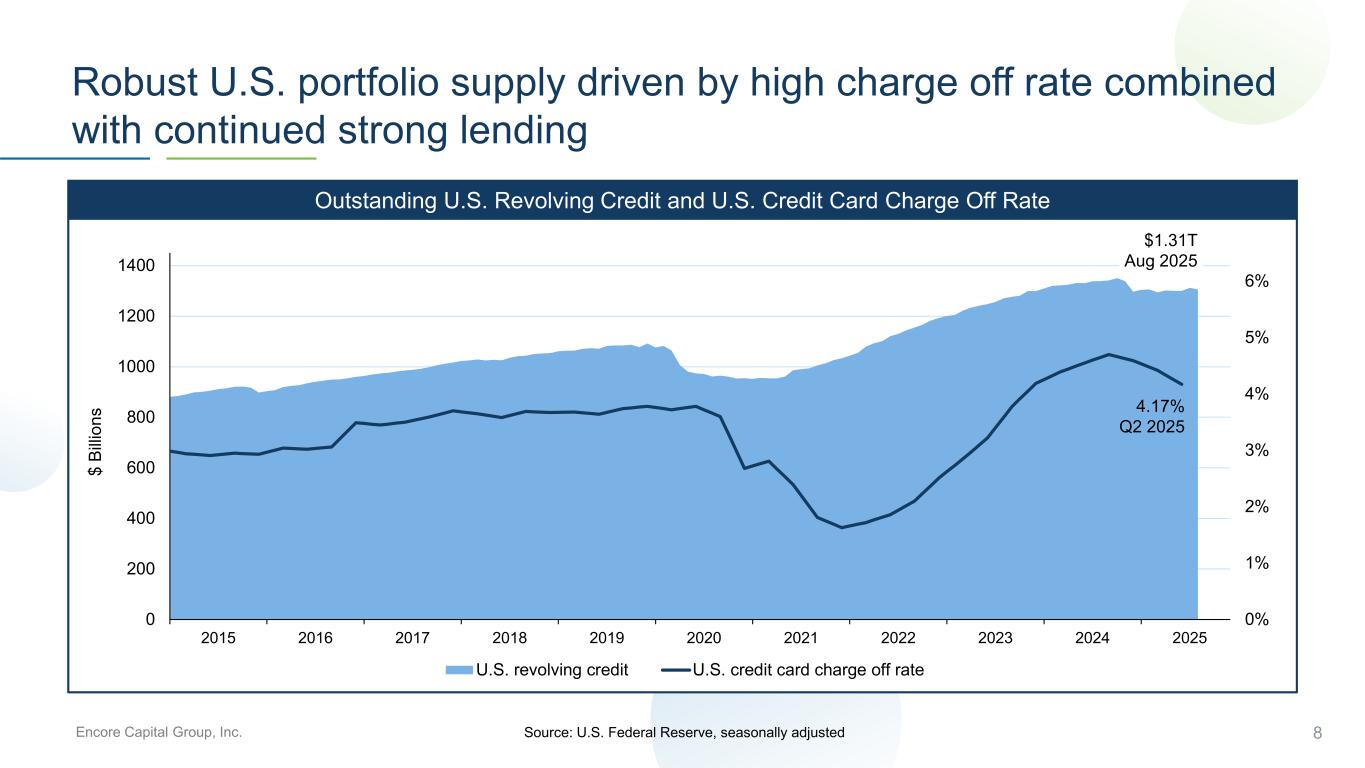

Encore Capital Group, Inc. 8 Robust U.S. portfolio supply driven by high charge off rate combined with continued strong lending Outstanding U.S. Revolving Credit and U.S. Credit Card Charge Off Rate Source: U.S. Federal Reserve, seasonally adjusted 0% 1% 2% 3% 4% 5% 6% 0 200 400 600 800 1000 1200 1400 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 U.S. revolving credit U.S. credit card charge off rate $ Bi llio ns $1.31T Aug 2025 4.17% Q2 2025

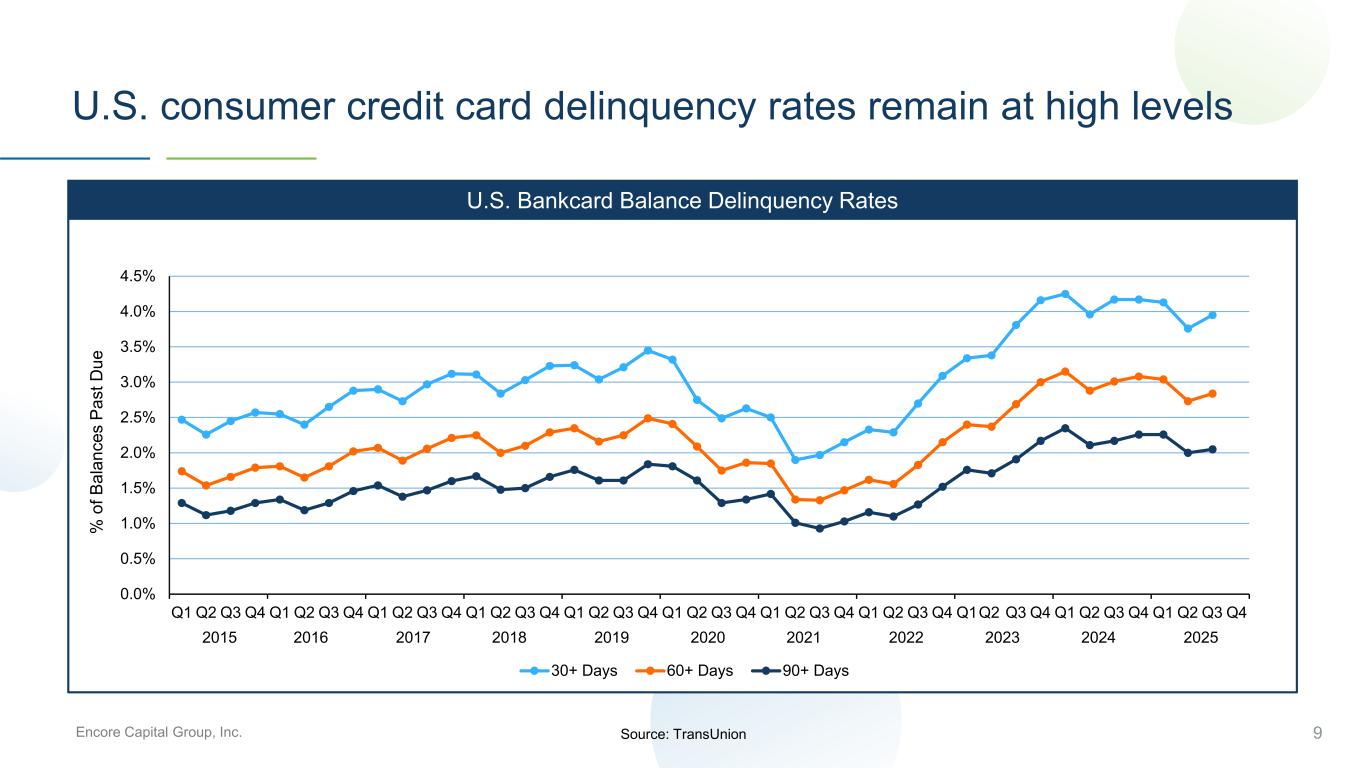

Encore Capital Group, Inc. 9 U.S. consumer credit card delinquency rates remain at high levels Source: TransUnion 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 30+ Days 60+ Days 90+ Days U.S. Bankcard Balance Delinquency Rates 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 % o f B al an ce s Pa st D ue

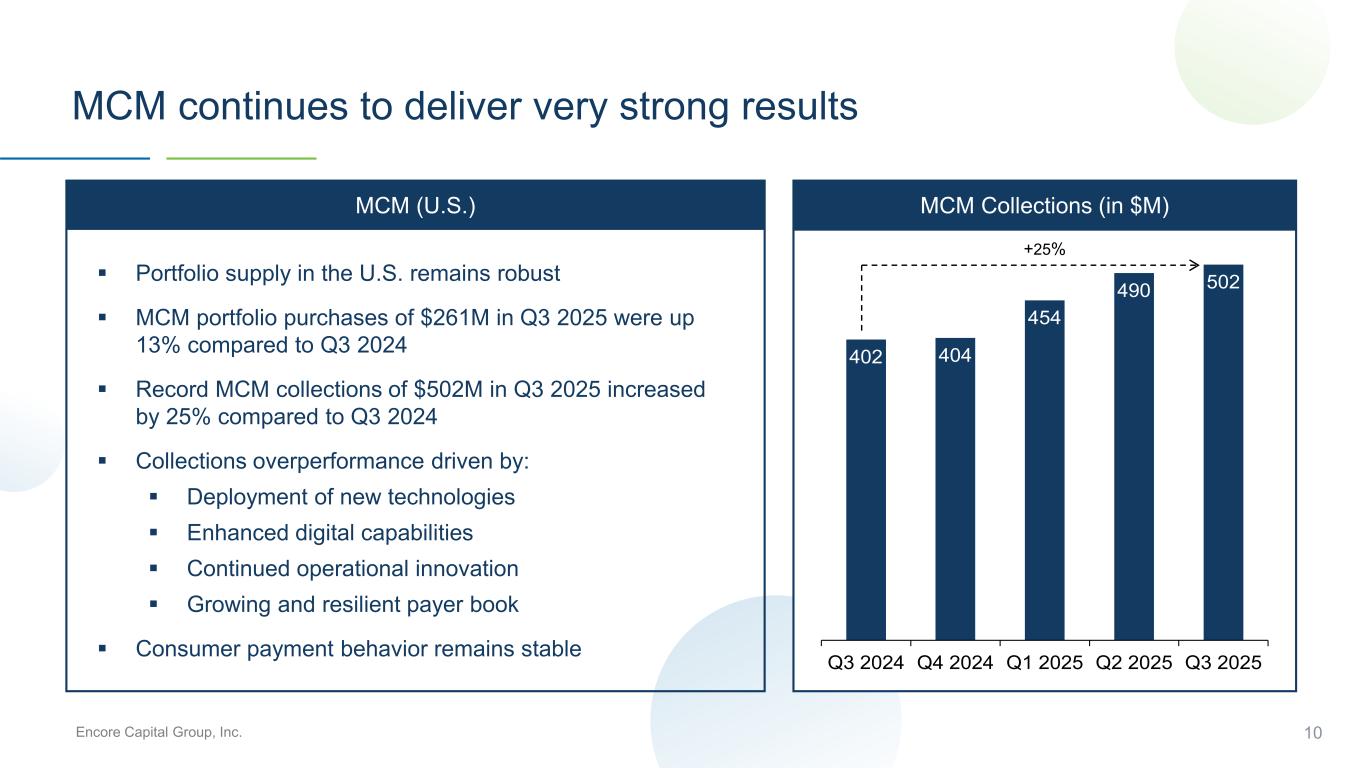

Encore Capital Group, Inc. 402 404 454 490 502 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 MCM (U.S.) Portfolio supply in the U.S. remains robust MCM portfolio purchases of $261M in Q3 2025 were up 13% compared to Q3 2024 Record MCM collections of $502M in Q3 2025 increased by 25% compared to Q3 2024 Collections overperformance driven by: Deployment of new technologies Enhanced digital capabilities Continued operational innovation Growing and resilient payer book Consumer payment behavior remains stable 10 MCM continues to deliver very strong results MCM Collections (in $M) +25%

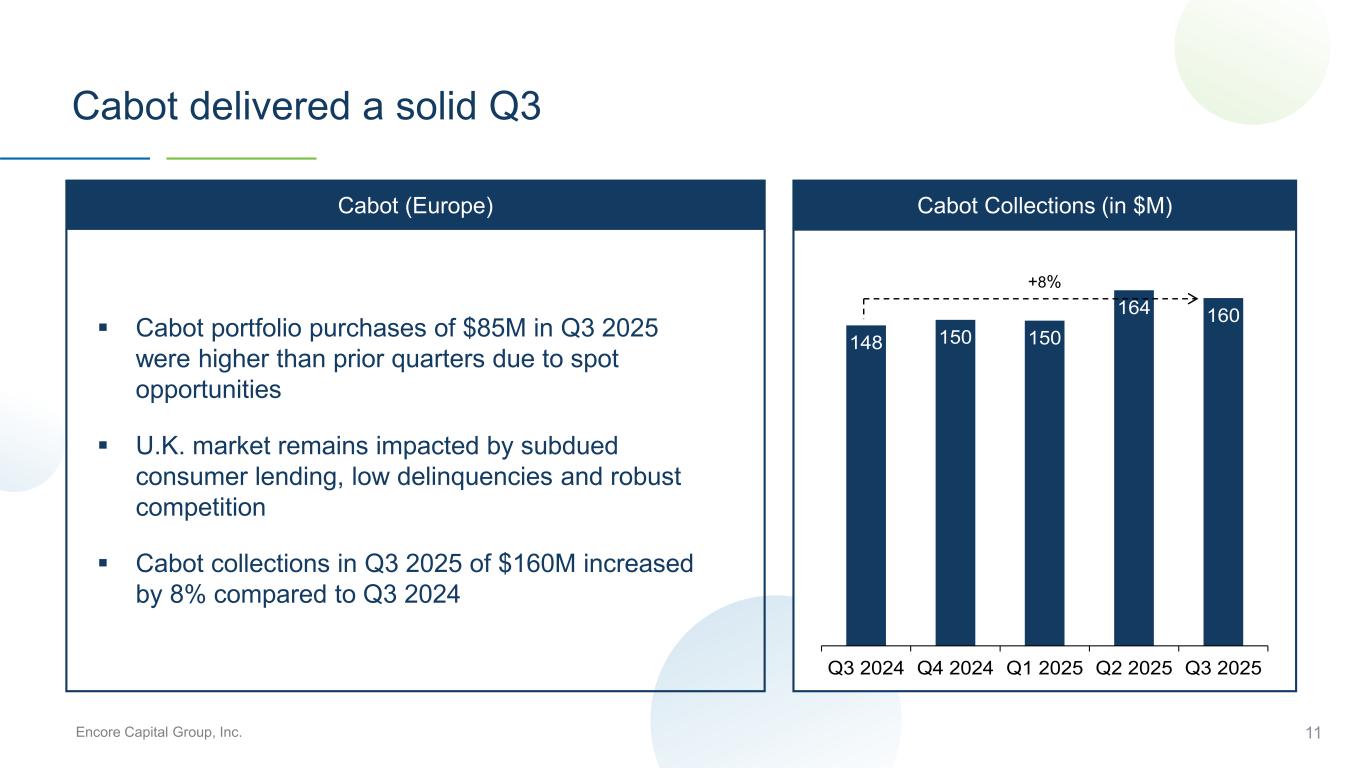

Encore Capital Group, Inc. 148 150 150 164 160 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 11 Cabot delivered a solid Q3 Cabot portfolio purchases of $85M in Q3 2025 were higher than prior quarters due to spot opportunities U.K. market remains impacted by subdued consumer lending, low delinquencies and robust competition Cabot collections in Q3 2025 of $160M increased by 8% compared to Q3 2024 Cabot (Europe) Cabot Collections (in $M) +8%

Encore Capital Group, Inc. 12 Detailed Financial Discussion

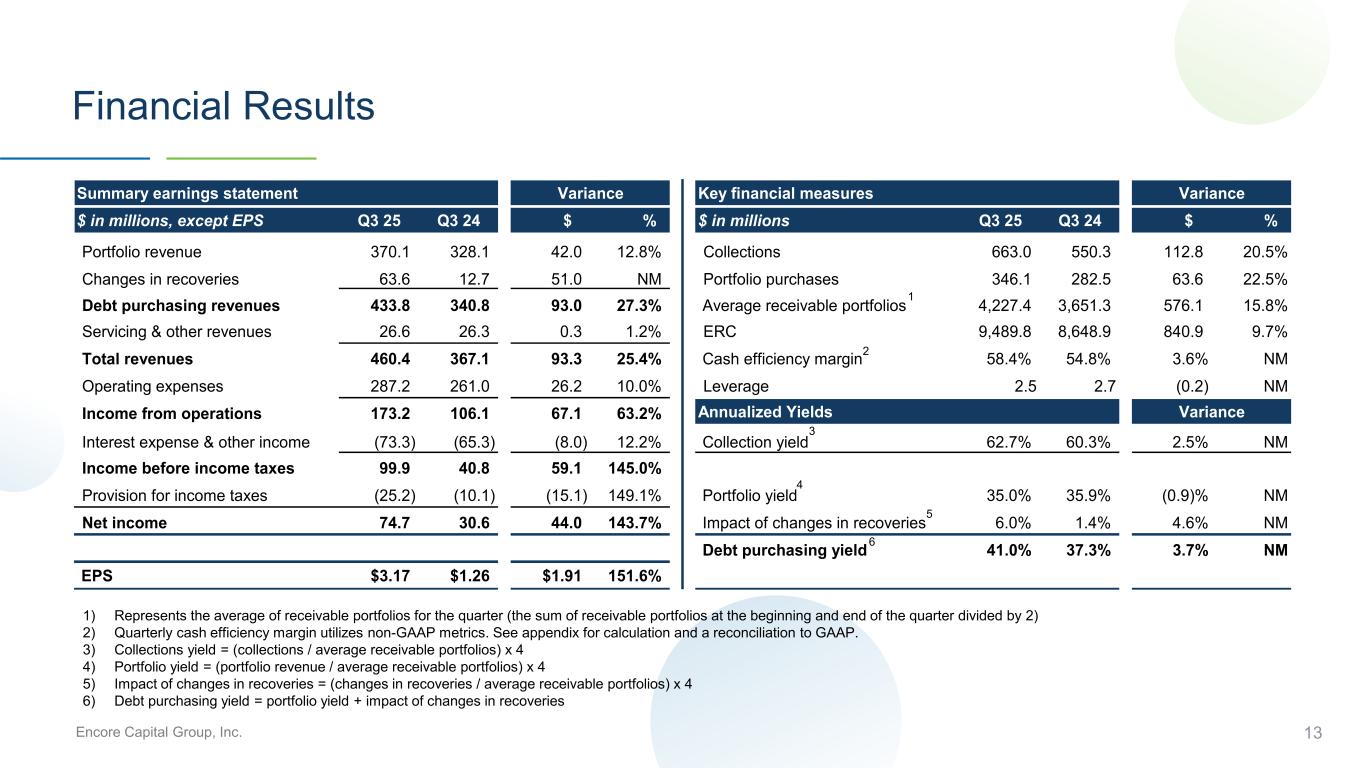

Encore Capital Group, Inc. Summary earnings statement Variance Key financial measures Variance $ in millions, except EPS Q3 25 Q3 24 $ % $ in millions Q3 25 Q3 24 $ % Portfolio revenue 370.1 328.1 42.0 12.8% Collections 663.0 550.3 112.8 20.5% Changes in recoveries 63.6 12.7 51.0 NM Portfolio purchases 346.1 282.5 63.6 22.5% Debt purchasing revenues 433.8 340.8 93.0 27.3% Average receivable portfolios 4,227.4 3,651.3 576.1 15.8% Servicing & other revenues 26.6 26.3 0.3 1.2% ERC 9,489.8 8,648.9 840.9 9.7% Total revenues 460.4 367.1 93.3 25.4% Cash efficiency margin 58.4% 54.8% 3.6% NM Operating expenses 287.2 261.0 26.2 10.0% Leverage 2.5 2.7 (0.2) NM Income from operations 173.2 106.1 67.1 63.2% Annualized Yields 0.00 0.00 Variance Interest expense & other income (73.3) (65.3) (8.0) 12.2% Collection yield 62.7% 60.3% 2.5% NM Income before income taxes 99.9 40.8 59.1 145.0% - - Provision for income taxes (25.2) (10.1) (15.1) 149.1% Portfolio yield 35.0% 35.9% (0.9)% NM Net income 74.7 30.6 44.0 143.7% Impact of changes in recoveries 6.0% 1.4% 4.6% NM Debt purchasing yield 41.0% 37.3% 3.7% NM EPS $3.17 $1.26 $1.91 151.6% 3.17$ 1.26$ 1 13 Financial Results 1) Represents the average of receivable portfolios for the quarter (the sum of receivable portfolios at the beginning and end of the quarter divided by 2) 2) Quarterly cash efficiency margin utilizes non-GAAP metrics. See appendix for calculation and a reconciliation to GAAP. 3) Collections yield = (collections / average receivable portfolios) x 4 4) Portfolio yield = (portfolio revenue / average receivable portfolios) x 4 5) Impact of changes in recoveries = (changes in recoveries / average receivable portfolios) x 4 6) Debt purchasing yield = portfolio yield + impact of changes in recoveries 2 3 4 5 6

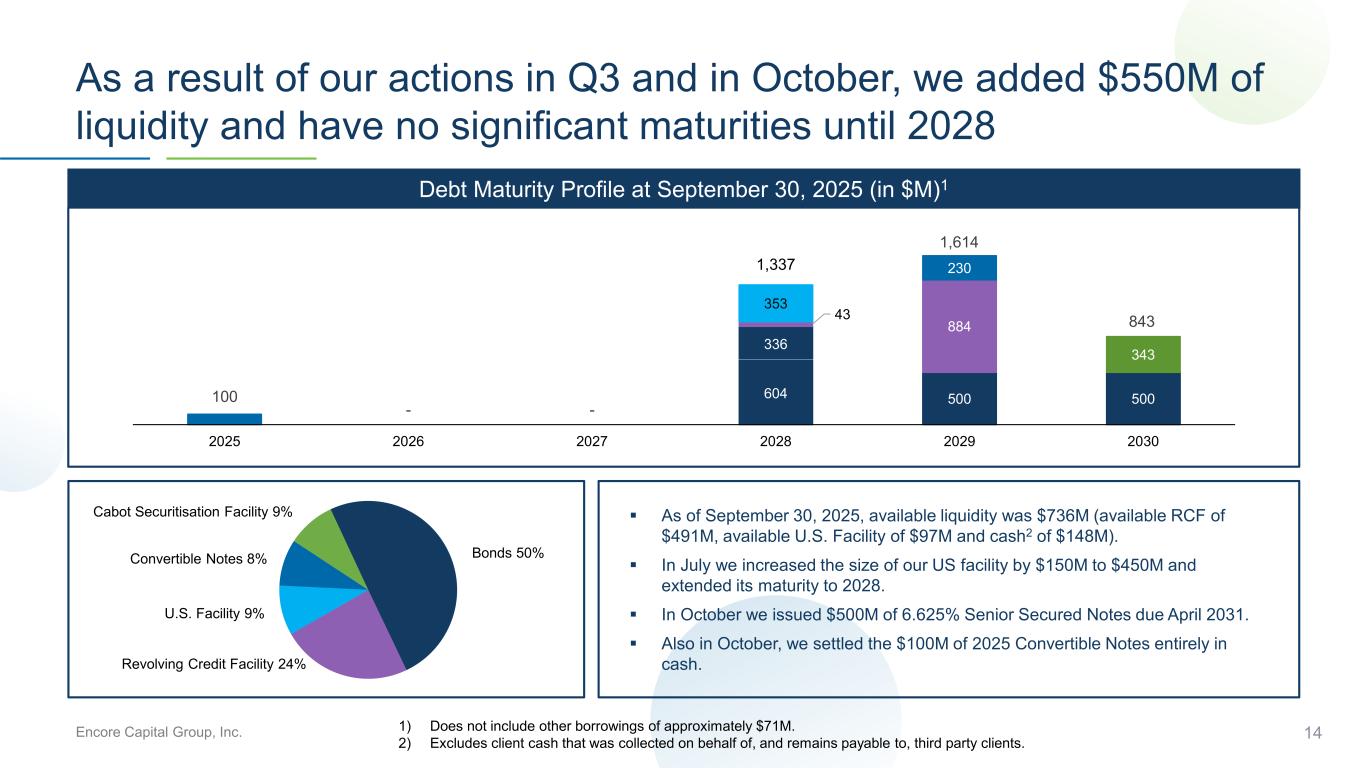

Encore Capital Group, Inc. 14 As a result of our actions in Q3 and in October, we added $550M of liquidity and have no significant maturities until 2028 Debt Maturity Profile at September 30, 2025 (in $M)1 604 500 500 336 43 884 353 343 230 100 - - 1,337 1,614 843 0 200000000 400000000 600000000 800000000 1E+09 1.2E+09 1.4E+09 1.6E+09 1.8E+09 2E+09 2025 2026 2027 2028 2029 2030 As of September 30, 2025, available liquidity was $736M (available RCF of $491M, available U.S. Facility of $97M and cash2 of $148M). In July we increased the size of our US facility by $150M to $450M and extended its maturity to 2028. In October we issued $500M of 6.625% Senior Secured Notes due April 2031. Also in October, we settled the $100M of 2025 Convertible Notes entirely in cash. Bonds 50% Revolving Credit Facility 24% U.S. Facility 9% Convertible Notes 8% Cabot Securitisation Facility 9% 1) Does not include other borrowings of approximately $71M. 2) Excludes client cash that was collected on behalf of, and remains payable to, third party clients.

Encore Capital Group, Inc. 15 Our capital allocation priorities Preserve financial flexibility Target leverage1 between 2.0x and 3.0x Maintain a strong BB debt rating Portfolio purchases at attractive returns Share Repurchases Strategic M&A Deliver strong ROIC through the credit cycle Balance Sheet Objectives Capital Allocation Priorities 1) Leverage defined as Net Debt ÷ (LTM Adjusted EBITDA + LTM collections applied to principal balance), which we also refer to as our Leverage Ratio.

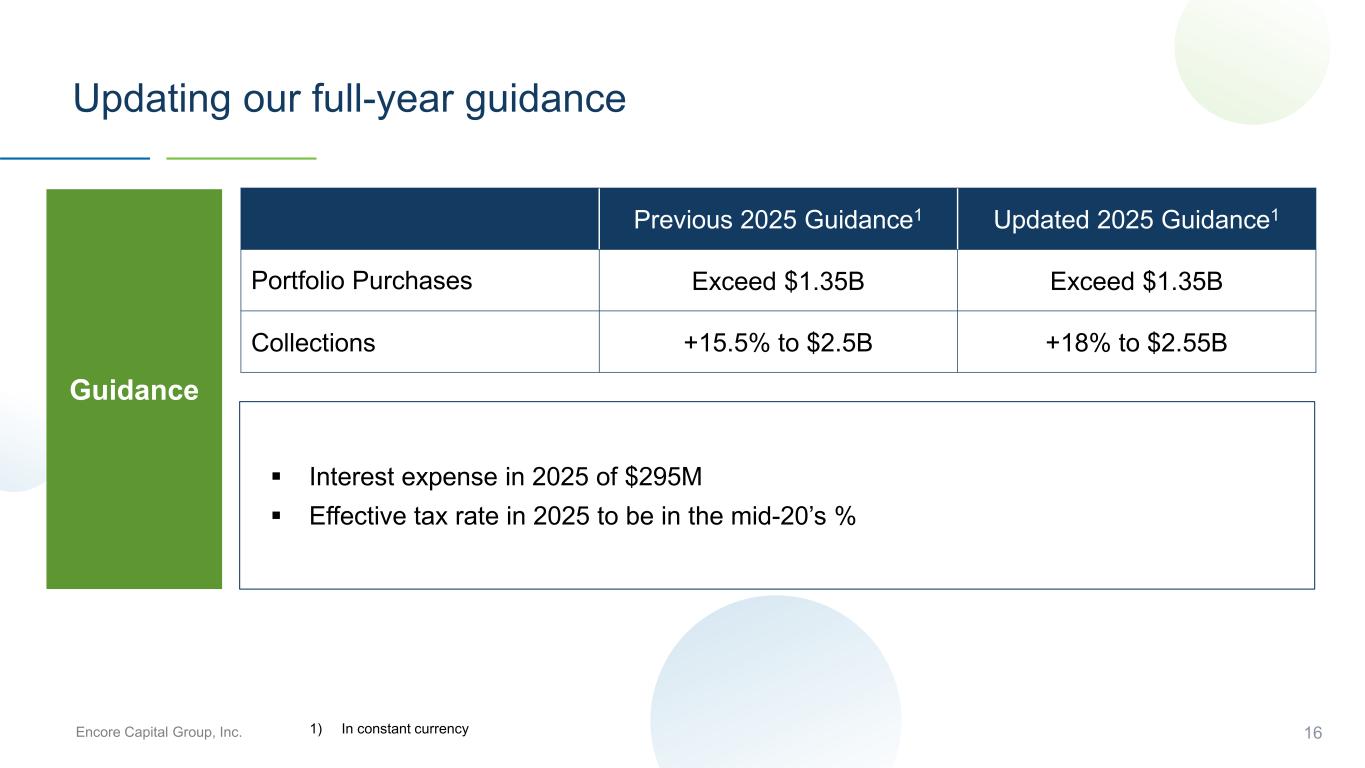

Encore Capital Group, Inc. 16 Updating our full-year guidance Guidance Interest expense in 2025 of $295M Effective tax rate in 2025 to be in the mid-20’s % Previous 2025 Guidance1 Updated 2025 Guidance1 Portfolio Purchases Exceed $1.35B Exceed $1.35B Collections +15.5% to $2.5B +18% to $2.55B 1) In constant currency

Encore Capital Group, Inc. 17 Appendix

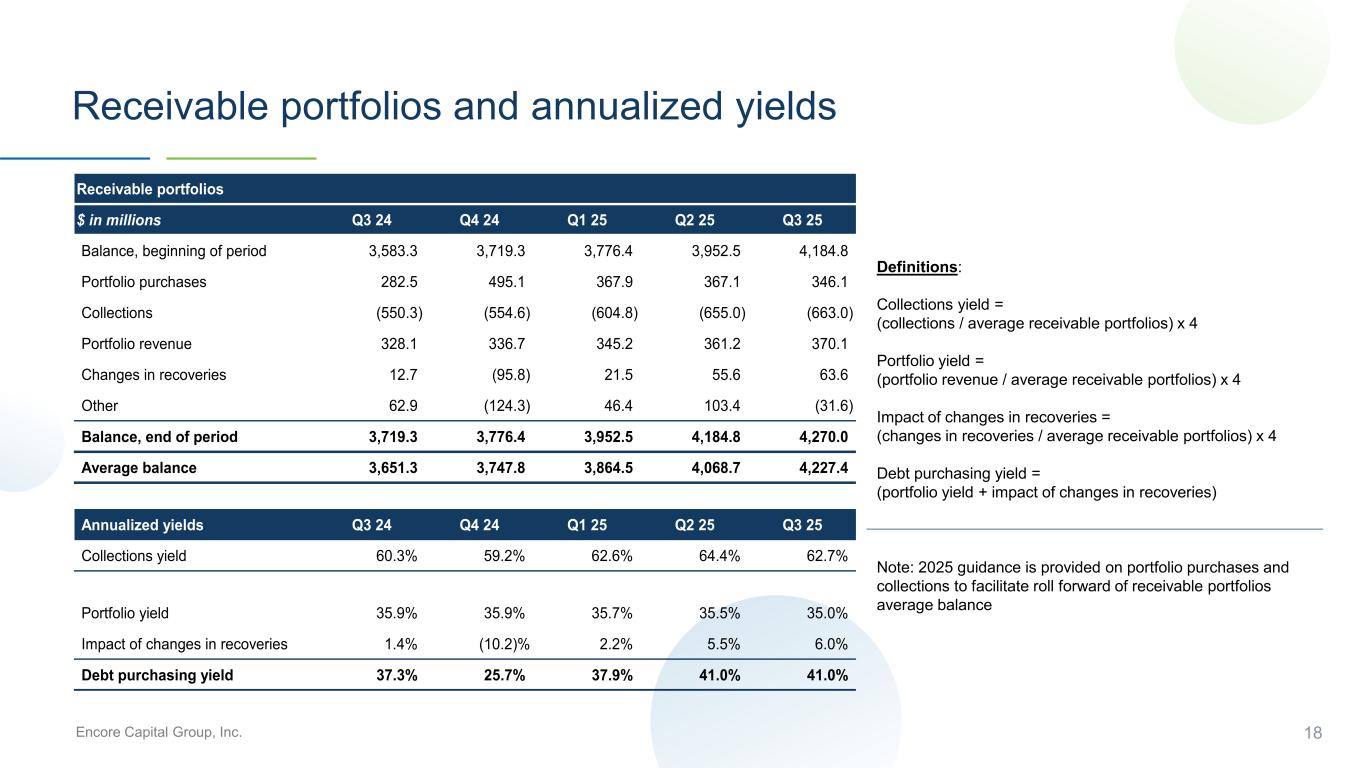

Encore Capital Group, Inc. 18 Receivable portfolios and annualized yields Definitions: Collections yield = (collections / average receivable portfolios) x 4 Portfolio yield = (portfolio revenue / average receivable portfolios) x 4 Impact of changes in recoveries = (changes in recoveries / average receivable portfolios) x 4 Debt purchasing yield = (portfolio yield + impact of changes in recoveries) Note: 2025 guidance is provided on portfolio purchases and collections to facilitate roll forward of receivable portfolios average balance Receivable portfolios $ in millions Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Balance, beginning of period 3,583.3 3,719.3 3,776.4 3,952.5 4,184.8 Portfolio purchases 282.5 495.1 367.9 367.1 346.1 Collections (550.3) (554.6) (604.8) (655.0) (663.0) Portfolio revenue 328.1 336.7 345.2 361.2 370.1 Changes in recoveries 12.7 (95.8) 21.5 55.6 63.6 Other 62.9 (124.3) 46.4 103.4 (31.6) Balance, end of period 3,719.3 3,776.4 3,952.5 4,184.8 4,270.0 Average balance 3,651.3 3,747.8 3,864.5 4,068.7 4,227.4 Annualized yields Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Collections yield 60.3% 59.2% 62.6% 64.4% 62.7% Portfolio yield 35.9% 35.9% 35.7% 35.5% 35.0% Impact of changes in recoveries 1.4% (10.2)% 2.2% 5.5% 6.0% Debt purchasing yield 37.3% 25.7% 37.9% 41.0% 41.0%

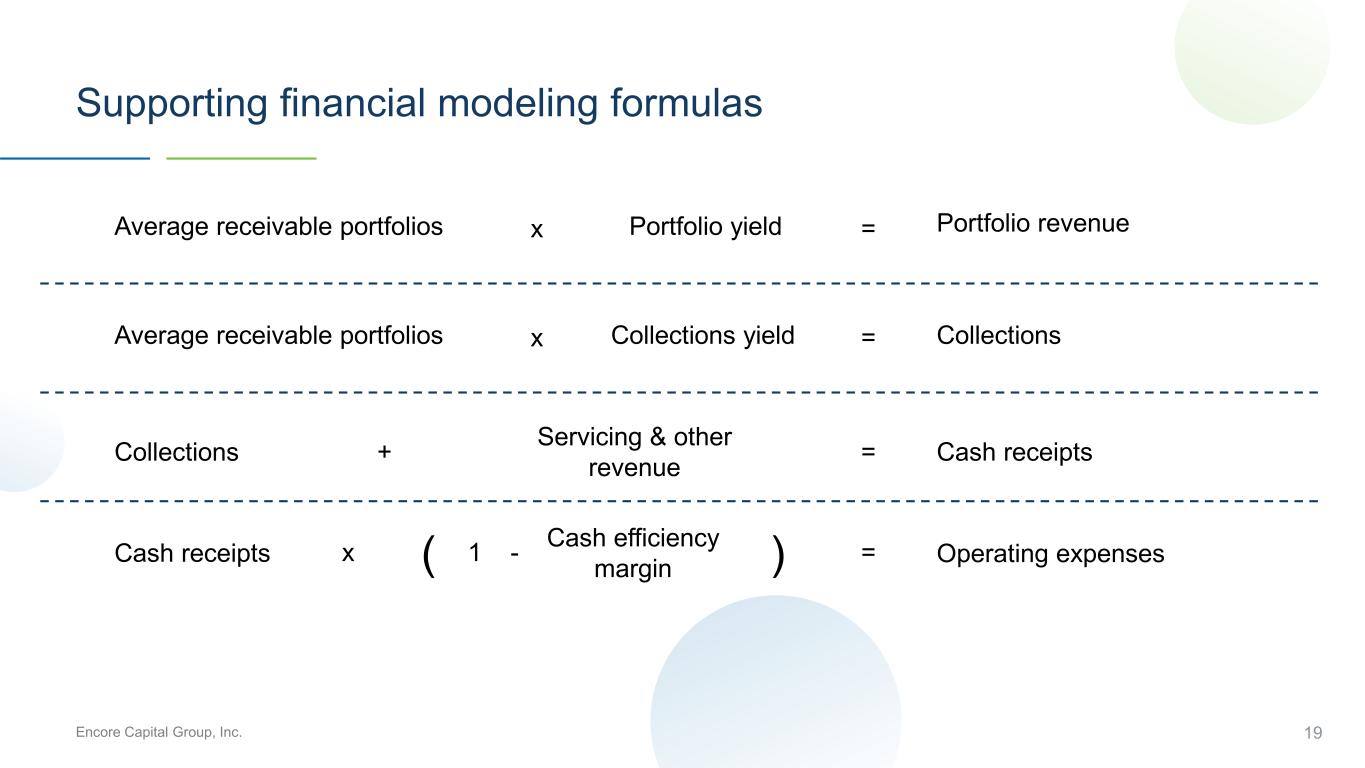

Encore Capital Group, Inc. 19 Supporting financial modeling formulas Average receivable portfolios Portfolio yield Portfolio revenue Collections yield Collections Collections Servicing & other revenue Average receivable portfolios Cash receipts x = x = Cash receipts+ = x ( Cash efficiency margin1 - ) = Operating expenses

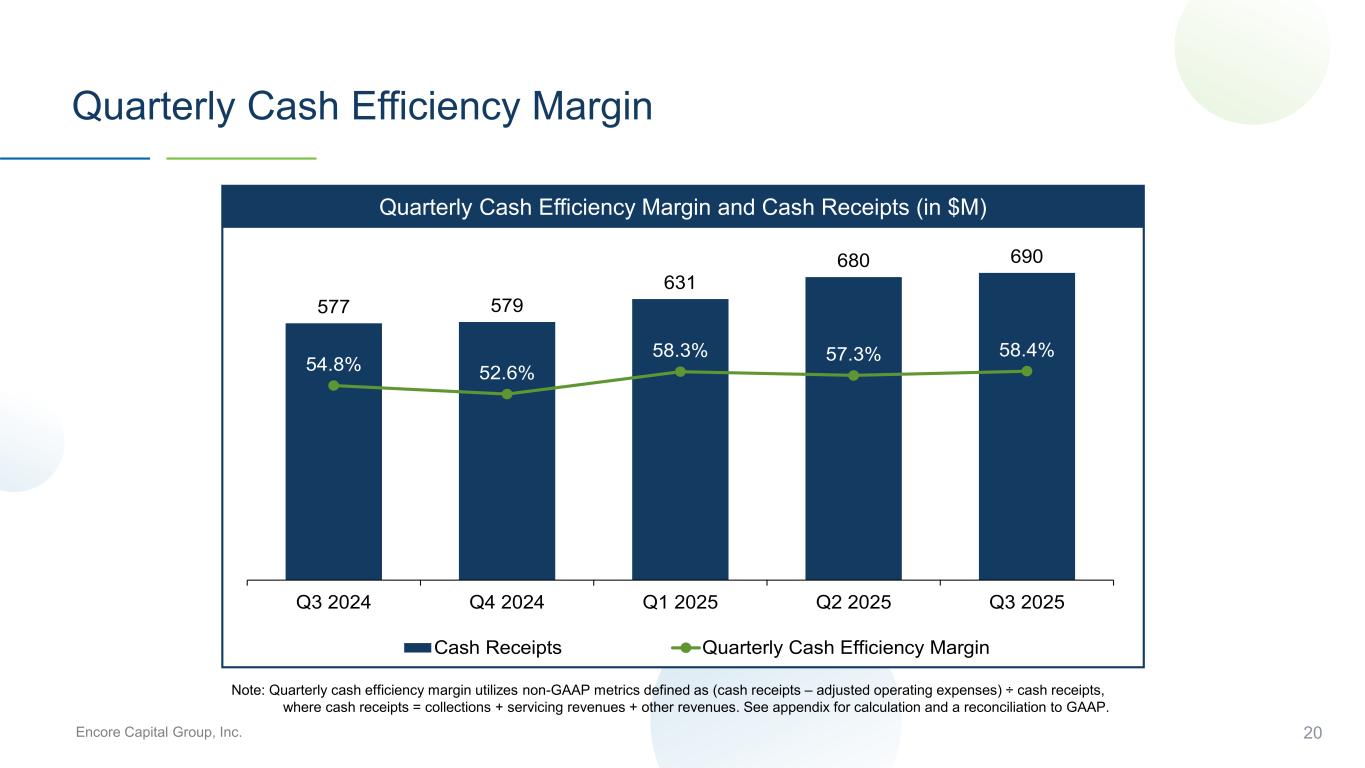

Encore Capital Group, Inc. 577 579 631 680 690 54.8% 52.6% 58.3% 57.3% 58.4% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% -50 50 150 250 350 450 550 650 750 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Cash Receipts Quarterly Cash Efficiency Margin 20 Quarterly Cash Efficiency Margin Quarterly Cash Efficiency Margin and Cash Receipts (in $M) Note: Quarterly cash efficiency margin utilizes non-GAAP metrics defined as (cash receipts – adjusted operating expenses) ÷ cash receipts, where cash receipts = collections + servicing revenues + other revenues. See appendix for calculation and a reconciliation to GAAP.

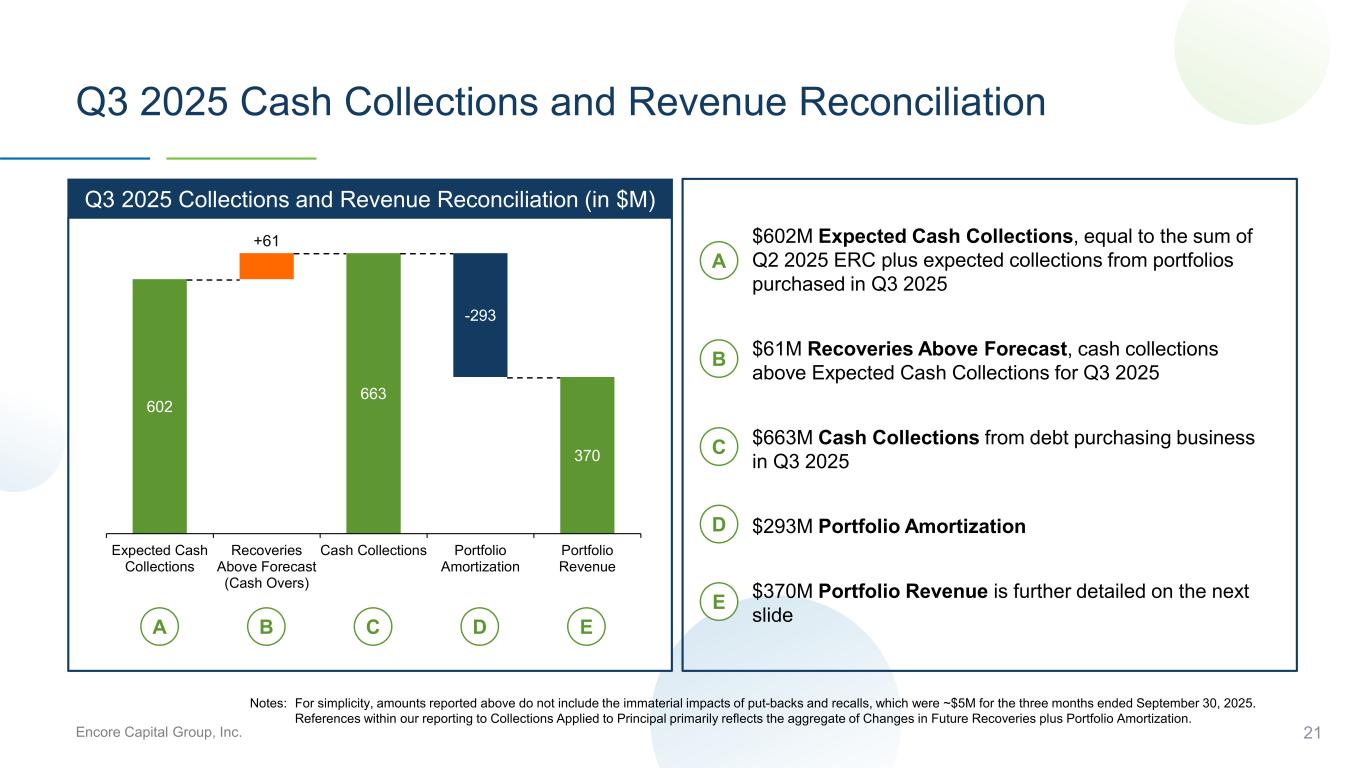

Encore Capital Group, Inc. 21 Q3 2025 Cash Collections and Revenue Reconciliation 602 663 370 +61 -293 0 100 200 300 400 500 600 700 Expected Cash Collections Recoveries Above Forecast (Cash Overs) Cash Collections Portfolio Amortization Portfolio Revenue Q3 2025 Collections and Revenue Reconciliation (in $M) $602M Expected Cash Collections, equal to the sum of Q2 2025 ERC plus expected collections from portfolios purchased in Q3 2025 $61M Recoveries Above Forecast, cash collections above Expected Cash Collections for Q3 2025 $663M Cash Collections from debt purchasing business in Q3 2025 $293M Portfolio Amortization $370M Portfolio Revenue is further detailed on the next slide A A C CB D E B D E Notes: For simplicity, amounts reported above do not include the immaterial impacts of put-backs and recalls, which were ~$5M for the three months ended September 30, 2025. References within our reporting to Collections Applied to Principal primarily reflects the aggregate of Changes in Future Recoveries plus Portfolio Amortization.

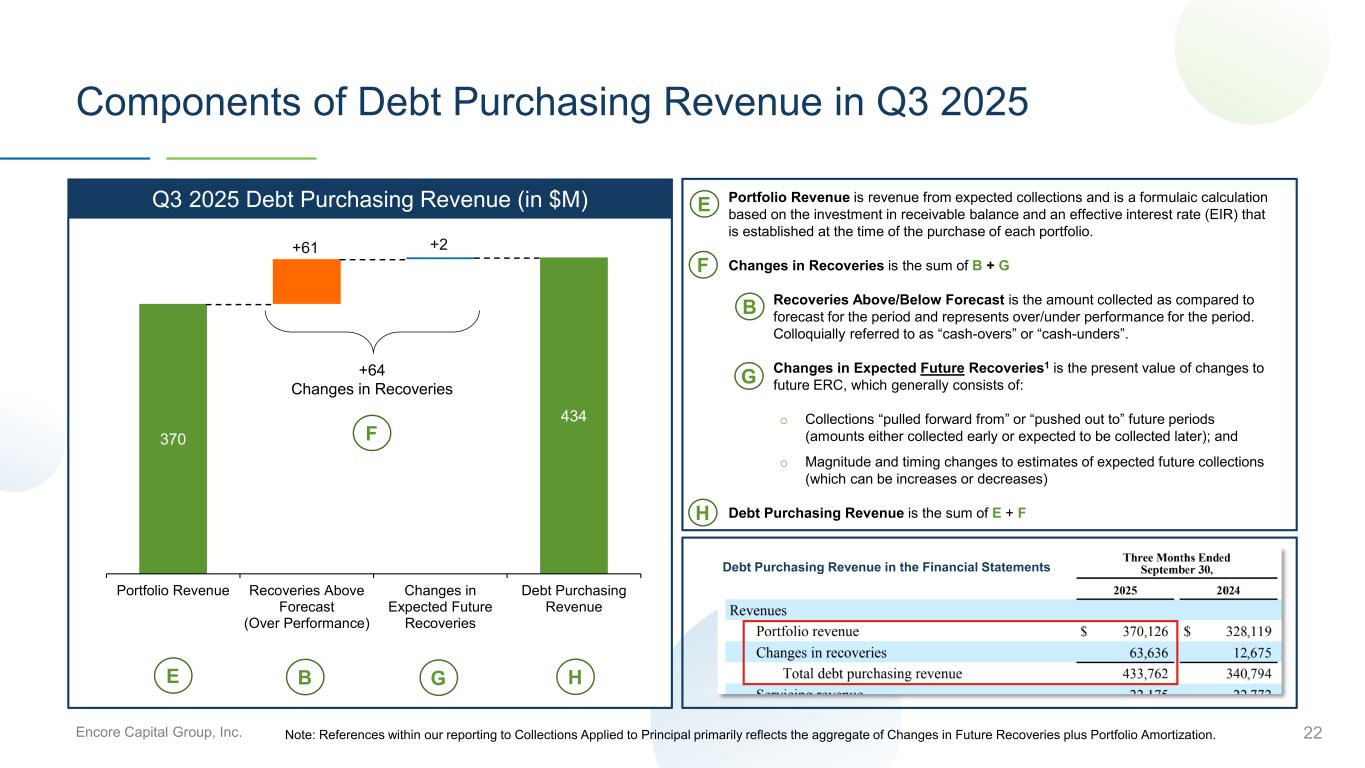

Encore Capital Group, Inc. 22 Components of Debt Purchasing Revenue in Q3 2025 370 434 +61 +2 0 50 100 150 200 250 300 350 400 450 Portfolio Revenue Recoveries Above Forecast (Over Performance) Changes in Expected Future Recoveries Debt Purchasing Revenue Q3 2025 Debt Purchasing Revenue (in $M) 1. Portfolio Revenue is revenue from expected collections and is a formulaic calculation based on the investment in receivable balance and an effective interest rate (EIR) that is established at the time of the purchase of each portfolio. 2. Changes in Recoveries is the sum of B + G 3. Recoveries Above/Below Forecast is the amount collected as compared to forecast for the period and represents over/under performance for the period. Colloquially referred to as “cash-overs” or “cash-unders”. 4. Changes in Expected Future Recoveries1 is the present value of changes to future ERC, which generally consists of: o Collections “pulled forward from” or “pushed out to” future periods (amounts either collected early or expected to be collected later); and o Magnitude and timing changes to estimates of expected future collections (which can be increases or decreases) 5. Debt Purchasing Revenue is the sum of E + F +64 Changes in Recoveries E B G H E B G H Note: References within our reporting to Collections Applied to Principal primarily reflects the aggregate of Changes in Future Recoveries plus Portfolio Amortization. F F Debt Purchasing Revenue in the Financial Statements

Encore Capital Group, Inc. 23 Non-GAAP Financial Measures This presentation includes certain financial measures that exclude the impact of certain items and therefore have not been calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The Company has included information concerning Adjusted EBITDA because management utilizes this information in the evaluation of its operations and believes that this measure, when added to collections applied to principal balance, is a useful indicator of the Company’s ability to generate cash collections in excess of operating expenses through the liquidation of its receivable portfolios. The Company has included Pre-Tax ROIC as management uses this measure to monitor and evaluate operating performance relative to our invested capital and because the Company believes it is a useful measure for investors to evaluate effective use of capital. The Company has included Net Debt and Leverage as management uses these measures to monitor and evaluate its ability to incur and service debt. The Company has included Adjusted Operating Expenses in order to calculate Cash Efficiency Margin, which can be used as a measure of expense efficiency. The Company has included impacts from foreign currency exchange rates to facilitate a comparison of operating metrics that are unburdened by variations in foreign currency exchange rates over time. Adjusted EBITDA, Adjusted Income from Operations (used in Pre-Tax ROIC), Net Debt, Leverage, Adjusted Operating Expenses (used in Cash Efficiency Margin) and impacts from foreign currency exchange rates have not been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, net income, income from operations, or operating expenses as indicators of the Company’s operating performance or liquidity. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this presentation a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. Constant Currency figures are calculated by employing Q3 2024 foreign currency exchange rates to recalculate Q3 2025 results. Constant Currency values for operating metrics are calculated based on the average exchange rates during the respective periods.

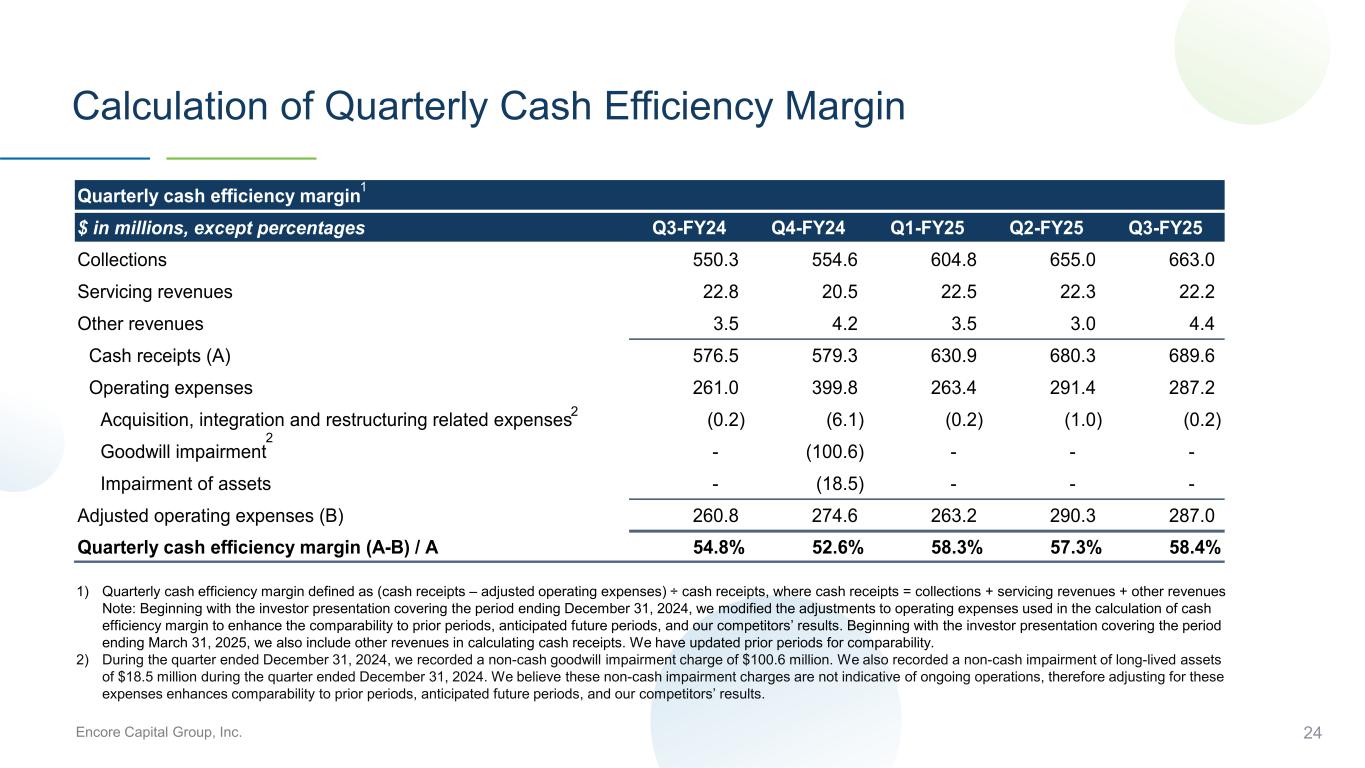

Encore Capital Group, Inc. Quarterly cash efficiency margin $ in millions, except percentages Q3-FY24 Q4-FY24 Q1-FY25 Q2-FY25 Q3-FY25 Collections 550.3 554.6 604.8 655.0 663.0 Servicing revenues 22.8 20.5 22.5 22.3 22.2 Other revenues 3.5 4.2 3.5 3.0 4.4 Cash receipts (A) 576.5 579.3 630.9 680.3 689.6 Operating expenses 261.0 399.8 263.4 291.4 287.2 Acquisition, integration and restructuring related expenses (0.2) (6.1) (0.2) (1.0) (0.2) Goodwill impairment - (100.6) - - - Impairment of assets - (18.5) - - - Adjusted operating expenses (B) 260.8 274.6 263.2 290.3 287.0 Quarterly cash efficiency margin (A-B) / A 54.8% 52.6% 58.3% 57.3% 58.4% 24 Calculation of Quarterly Cash Efficiency Margin 1) Quarterly cash efficiency margin defined as (cash receipts – adjusted operating expenses) ÷ cash receipts, where cash receipts = collections + servicing revenues + other revenues Note: Beginning with the investor presentation covering the period ending December 31, 2024, we modified the adjustments to operating expenses used in the calculation of cash efficiency margin to enhance the comparability to prior periods, anticipated future periods, and our competitors’ results. Beginning with the investor presentation covering the period ending March 31, 2025, we also include other revenues in calculating cash receipts. We have updated prior periods for comparability. 2) During the quarter ended December 31, 2024, we recorded a non-cash goodwill impairment charge of $100.6 million. We also recorded a non-cash impairment of long-lived assets of $18.5 million during the quarter ended December 31, 2024. We believe these non-cash impairment charges are not indicative of ongoing operations, therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 1 2 2

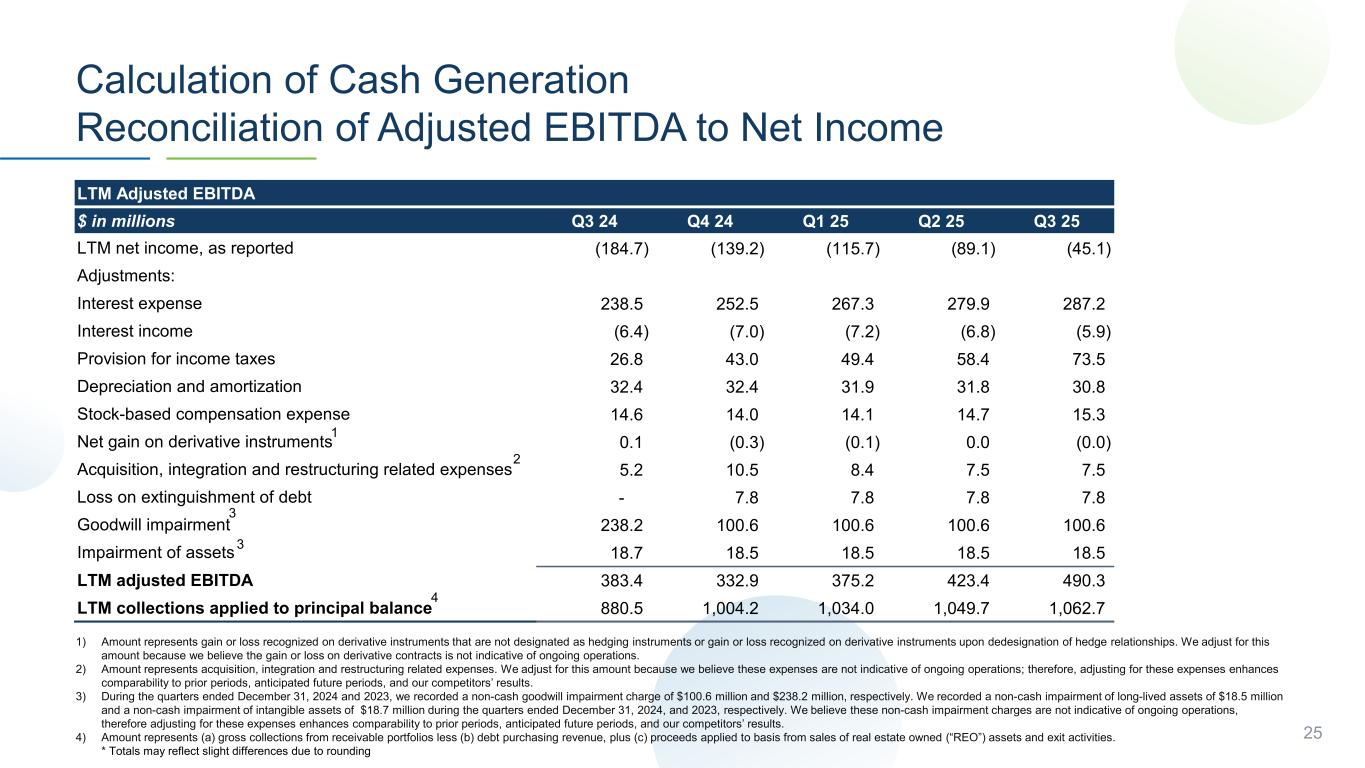

Encore Capital Group, Inc. LTM Adjusted EBITDA $ in millions Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 (184.7) (139.2) (115.7) (89.1) (45.1) 238.5 252.5 267.3 279.9 287.2 (6.4) (7.0) (7.2) (6.8) (5.9) 26.8 43.0 49.4 58.4 73.5 32.4 32.4 31.9 31.8 30.8 14.6 14.0 14.1 14.7 15.3 0.1 (0.3) (0.1) 0.0 (0.0) 5.2 10.5 8.4 7.5 7.5 - 7.8 7.8 7.8 7.8 238.2 100.6 100.6 100.6 100.6 18.7 18.5 18.5 18.5 18.5 383.4 332.9 375.2 423.4 490.3 880.5 1,004.2 1,034.0 1,049.7 1,062.7 LTM adjusted EBITDA LTM collections applied to principal balance Depreciation and amortization Stock-based compensation expense Net gain on derivative instruments Acquisition, integration and restructuring related expenses Loss on extinguishment of debt Goodwill impairment Impairment of assets LTM net income, as reported Adjustments: Interest expense Interest income Provision for income taxes Calculation of Cash Generation Reconciliation of Adjusted EBITDA to Net Income 25 1) Amount represents gain or loss recognized on derivative instruments that are not designated as hedging instruments or gain or loss recognized on derivative instruments upon dedesignation of hedge relationships. We adjust for this amount because we believe the gain or loss on derivative contracts is not indicative of ongoing operations. 2) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore, adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) During the quarters ended December 31, 2024 and 2023, we recorded a non-cash goodwill impairment charge of $100.6 million and $238.2 million, respectively. We recorded a non-cash impairment of long-lived assets of $18.5 million and a non-cash impairment of intangible assets of $18.7 million during the quarters ended December 31, 2024, and 2023, respectively. We believe these non-cash impairment charges are not indicative of ongoing operations, therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 4) Amount represents (a) gross collections from receivable portfolios less (b) debt purchasing revenue, plus (c) proceeds applied to basis from sales of real estate owned (“REO”) assets and exit activities. * Totals may reflect slight differences due to rounding 1 2 3 4 3

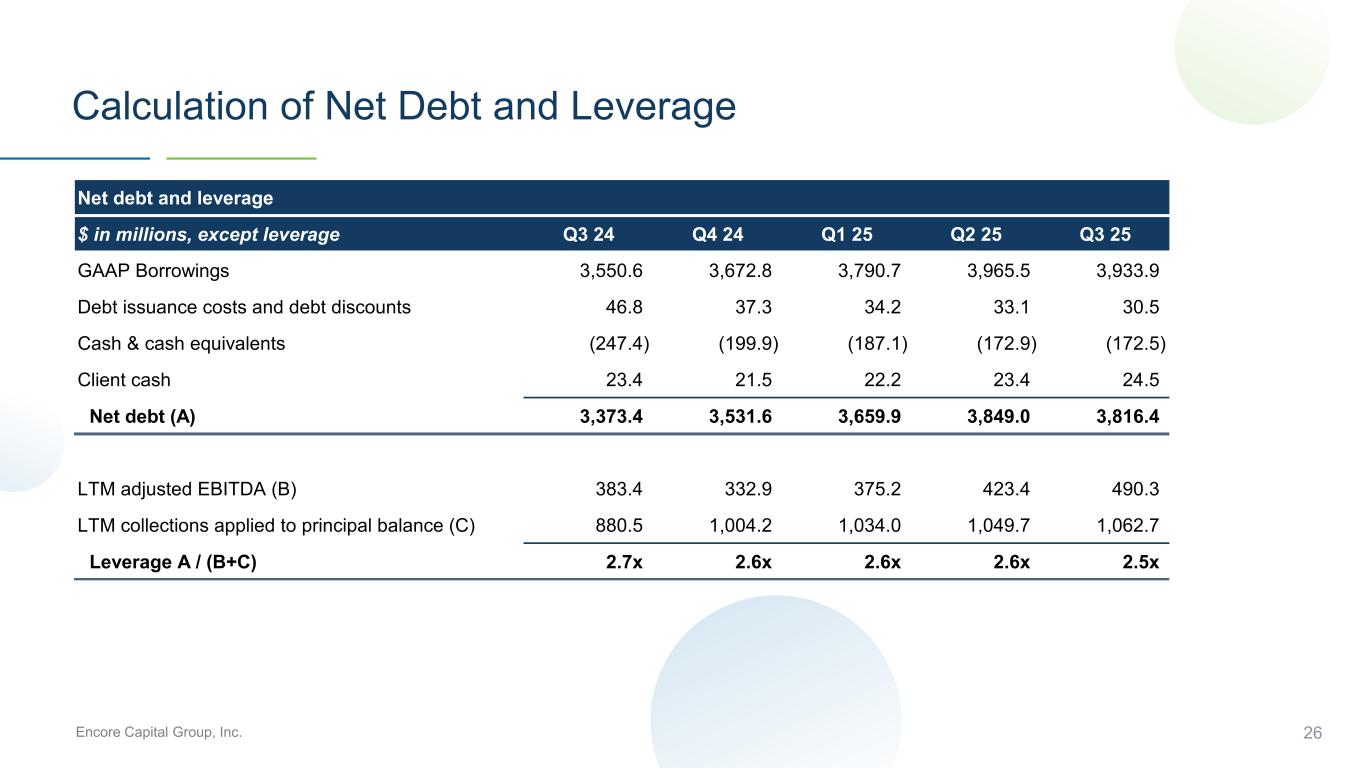

Encore Capital Group, Inc. 26 Calculation of Net Debt and Leverage Net debt and leverage $ in millions, except leverage Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 GAAP Borrowings 3,550.6 3,672.8 3,790.7 3,965.5 3,933.9 Debt issuance costs and debt discounts 46.8 37.3 34.2 33.1 30.5 Cash & cash equivalents (247.4) (199.9) (187.1) (172.9) (172.5) Client cash 23.4 21.5 22.2 23.4 24.5 Net debt (A) 3,373.4 3,531.6 3,659.9 3,849.0 3,816.4 LTM adjusted EBITDA (B) 383.4 332.9 375.2 423.4 490.3 LTM collections applied to principal balance (C) 880.5 1,004.2 1,034.0 1,049.7 1,062.7 Leverage A / (B+C) 2.7x 2.6x 2.6x 2.6x 2.5x

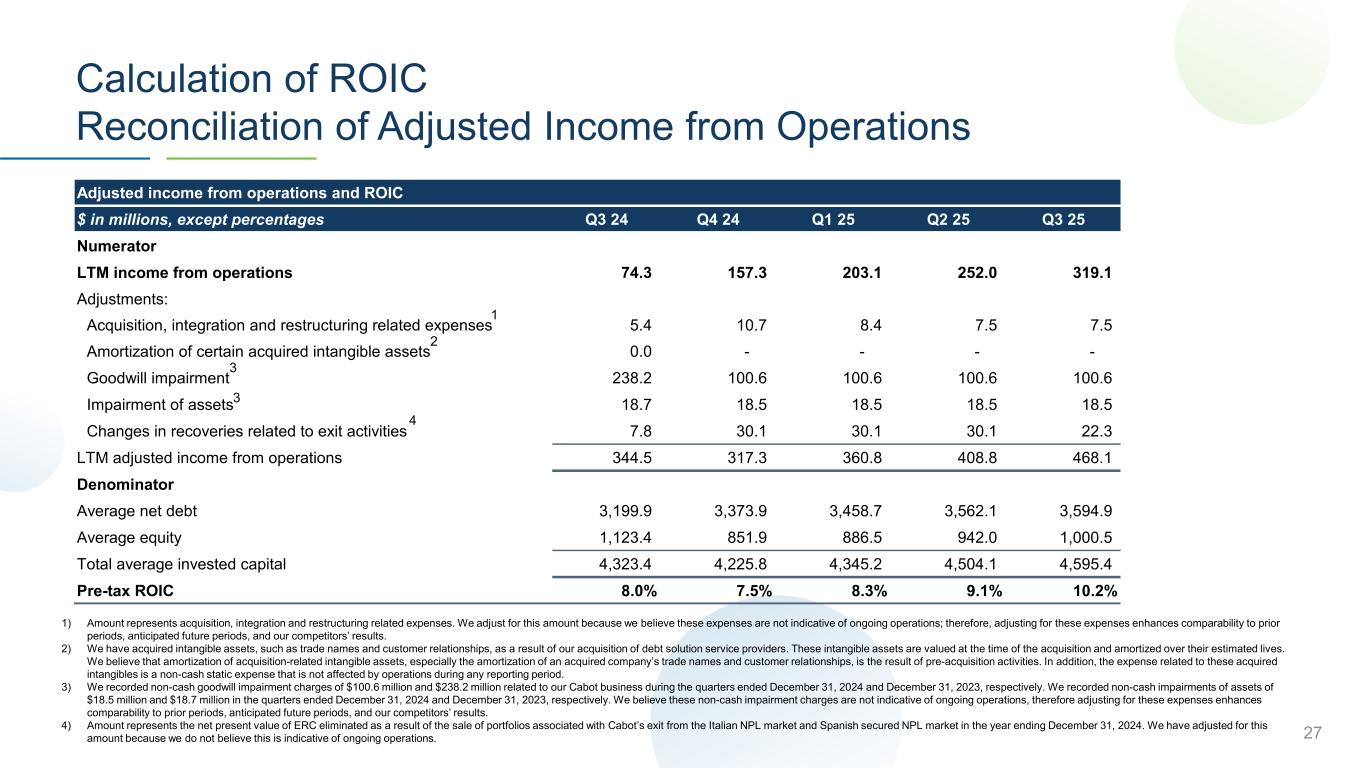

Encore Capital Group, Inc. Adjusted income from operations and ROIC $ in millions, except percentages Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Numerator LTM income from operations 74.3 157.3 203.1 252.0 319.1 Adjustments: Acquisition, integration and restructuring related expenses 5.4 10.7 8.4 7.5 7.5 Amortization of certain acquired intangible assets 0.0 - - - - Goodwill impairment 238.2 100.6 100.6 100.6 100.6 Impairment of assets 18.7 18.5 18.5 18.5 18.5 Changes in recoveries related to exit activities 7.8 30.1 30.1 30.1 22.3 LTM adjusted income from operations 344.5 317.3 360.8 408.8 468.1 Denominator Average net debt 3,199.9 3,373.9 3,458.7 3,562.1 3,594.9 Average equity 1,123.4 851.9 886.5 942.0 1,000.5 Total average invested capital 4,323.4 4,225.8 4,345.2 4,504.1 4,595.4 Pre-tax ROIC 8.0% 7.5% 8.3% 9.1% 10.2% 27 Calculation of ROIC Reconciliation of Adjusted Income from Operations 1) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore, adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 2) We have acquired intangible assets, such as trade names and customer relationships, as a result of our acquisition of debt solution service providers. These intangible assets are valued at the time of the acquisition and amortized over their estimated lives. We believe that amortization of acquisition-related intangible assets, especially the amortization of an acquired company’s trade names and customer relationships, is the result of pre-acquisition activities. In addition, the expense related to these acquired intangibles is a non-cash static expense that is not affected by operations during any reporting period. 3) We recorded non-cash goodwill impairment charges of $100.6 million and $238.2 million related to our Cabot business during the quarters ended December 31, 2024 and December 31, 2023, respectively. We recorded non-cash impairments of assets of $18.5 million and $18.7 million in the quarters ended December 31, 2024 and December 31, 2023, respectively. We believe these non-cash impairment charges are not indicative of ongoing operations, therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 4) Amount represents the net present value of ERC eliminated as a result of the sale of portfolios associated with Cabot’s exit from the Italian NPL market and Spanish secured NPL market in the year ending December 31, 2024. We have adjusted for this amount because we do not believe this is indicative of ongoing operations. 1 2 3 3 4