SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 16, 2025

Charter Communications, Inc.

CCO Holdings, LLC

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

|

001-33664

|

84-1496755

|

|

|

001-37789

|

86-1067239

|

|

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

400 Washington Blvd.

Stamford, Connecticut 06902

(Address of principal executive offices, including zip code)

(203) 905-7801

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock, $.001 Par Value

|

CHTR

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 7.01. |

REGULATION FD DISCLOSURE.

|

On May 16, 2025, Charter Communications, Inc., a Delaware corporation (together with its subsidiaries, “Charter”), and Cox Enterprises, Inc., a

Delaware corporation (“Cox Parent”), announced that they entered into a definitive agreement to combine Cox Parent’s Cox Communications business with Charter. Pursuant to the definitive agreement, Charter will acquire Cox Parent’s residential

cable business, commercial fiber business and managed IT and cloud services business. A copy of the press release and investor presentation are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by

reference.

The information provided under Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, is being furnished and is not

deemed to be “filed” with the Securities and Exchange Commission (the “SEC”) for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section and is

not incorporated by reference into any filing of Charter or CCO Holdings, LLC under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, whether made before or after the date hereof, except as shall be expressly

set forth by specific reference to this Current Report on Form 8-K in such a filing.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS.

|

(d) Exhibits

|

Exhibit

|

Description

|

|

|

Joint Press Release, dated May 16, 2025.

|

||

|

Joint Investor Presentation, dated May 16, 2025.

|

||

|

104

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

|

Cautionary Note Regarding Forward Looking Statements

This communication includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act,

regarding, among other things, the proposed transaction between Charter and Cox Parent. Although we believe that our plans, intentions and expectations as reflected in or suggested by these forward-looking statements are reasonable, we cannot

assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions including, without limitation: (i) the effect of the announcement of

the proposed transaction on the ability of Charter and Cox Parent to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; (ii) the timing of the proposed transaction; (iii) the

ability to satisfy closing conditions to the completion of the proposed transaction (including stockholder and regulatory approvals); (iv) the possibility that the transaction may be more expensive to complete than anticipated, including as a

result of unexpected factors or events; (v) the ultimate outcome and results of integrating operations and application of Charter’s operating strategies to the acquired assets and the ultimate ability to realize synergies at the levels

currently expected as well as potential dis-synergies; (vi) the impact of the proposed transaction on our stock price and future operating results, including due to transaction and integration costs, increased interest expense, business

disruption, and diversion of management time and attention; (vii) the reduction in our current stockholders’ percentage ownership and voting interest as a result of the proposed transaction; (viii) the increase in our indebtedness as a result

of the proposed transaction, which will increase interest expenses and may decrease our operating flexibility; (ix) litigation relating to the proposed transaction; (x) other risks related to the completion of the proposed transaction and

actions related thereto; and (xi) the factors described under “Risk Factors” from time to time in Charter’s filings with the SEC. Many of the forward-looking statements contained in this communication may be identified by the use of

forward-looking words such as “believe,” “expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,” “estimated,” “aim,” “on track,” “target,” “opportunity,” “tentative,” “positioning,” “designed,” “create,” “predict,” “project,”

“initiatives,” “seek,” “would,” “could,” “continue,” “ongoing,” “upside,” “increases,” “grow,” “focused on” and “potential,” among others.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. Charter assumes no

obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities

laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Additional Information

Charter intends to file a proxy statement with the SEC in connection with the proposed transaction. Investors and security holders of Charter and Cox

Parent are urged to read the proxy statement and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. The definitive proxy

statement (if and when available) will be mailed to stockholders of Charter. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Charter through

the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Charter at 400 Washington Blvd., Stamford, CT 06902, Attention: Investor Relations, (203) 905-7801.

Participants in Solicitation

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC.

Nonetheless, Charter and its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding the interests of such potential

participants will be included in one or more proxy statements or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website

http://www.sec.gov.

Charter anticipates that the following individuals will be participants (the “Charter Participants”) in the solicitation of proxies from holders of

Charter common stock in connection with the proposed transaction: Eric L. Zinterhofer, Non-Executive Chairman of the Charter Board, W. Lance Conn, Kim C. Goodman, John D. Markley, Jr., David C. Merritt, Steven A. Miron, Balan Nair, Michael A.

Newhouse, Martin E. Patterson, Mauricio Ramos, Carolyn J. Slaski and J. David Wargo, all of whom are members of the Charter Board, Christopher L. Winfrey, President, Chief Executive Officer and Director, Jessica M. Fischer, Chief Financial

Officer, and Kevin D. Howard, Executive Vice President, Chief Accounting Officer and Controller. Information about the Charter Participants, including a description of their direct or indirect interests, by security holdings or otherwise, and

Charter’s transactions with related persons is set forth in the sections entitled “Proposal No. 1: Election of Directors”, “Compensation Committee Interlocks and Insider Participation”, “Compensation Discussion and Analysis”, “Certain

Beneficial Owners of Charter Class A Common Stock”, “Certain Relationships and Related Transactions”, “Proposal No. 2: Approve the Charter Communications, Inc. 2025 Employee Stock Purchase Plan”, “Pay Versus Performance” and “CEO Pay Ratio”

contained in Charter’s definitive proxy statement for its 2025 annual meeting of shareholders, which was filed with the SEC on March 13, 2025 (which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001091667/000114036125008627/ny20042259x1_def14a.htm) and other documents subsequently filed by Charter with the SEC. To the extent holdings of Charter stock by the directors and executive

officers of Charter have changed from the amounts of Charter stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or

approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, each of Charter Communications, Inc. and CCO Holdings, LLC has

duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

CHARTER COMMUNICATIONS, INC.

|

||

|

Registrant

|

||

|

By:

|

/s/ Jessica M. Fischer | |

|

Jessica M. Fischer

|

||

|

Date: May 16, 2025

|

Chief Financial Officer

|

|

|

CCO HOLDINGS, LLC

|

||

|

Registrant

|

||

|

By:

|

/s/ Jessica M. Fischer | |

|

Jessica M. Fischer

|

||

|

Date: May 16, 2025

|

Chief Financial Officer

|

|

|

|

CHARTER COMMUNICATIONS AND COX COMMUNICATIONS ANNOUNCE DEFINITIVE AGREEMENT TO COMBINE COMPANIES

The Transaction Will Create an Industry Leader in Communications, Seamless Entertainment and High-Quality Customer Service that Will Benefit Employees, Customers,

Local Communities and Shareholders

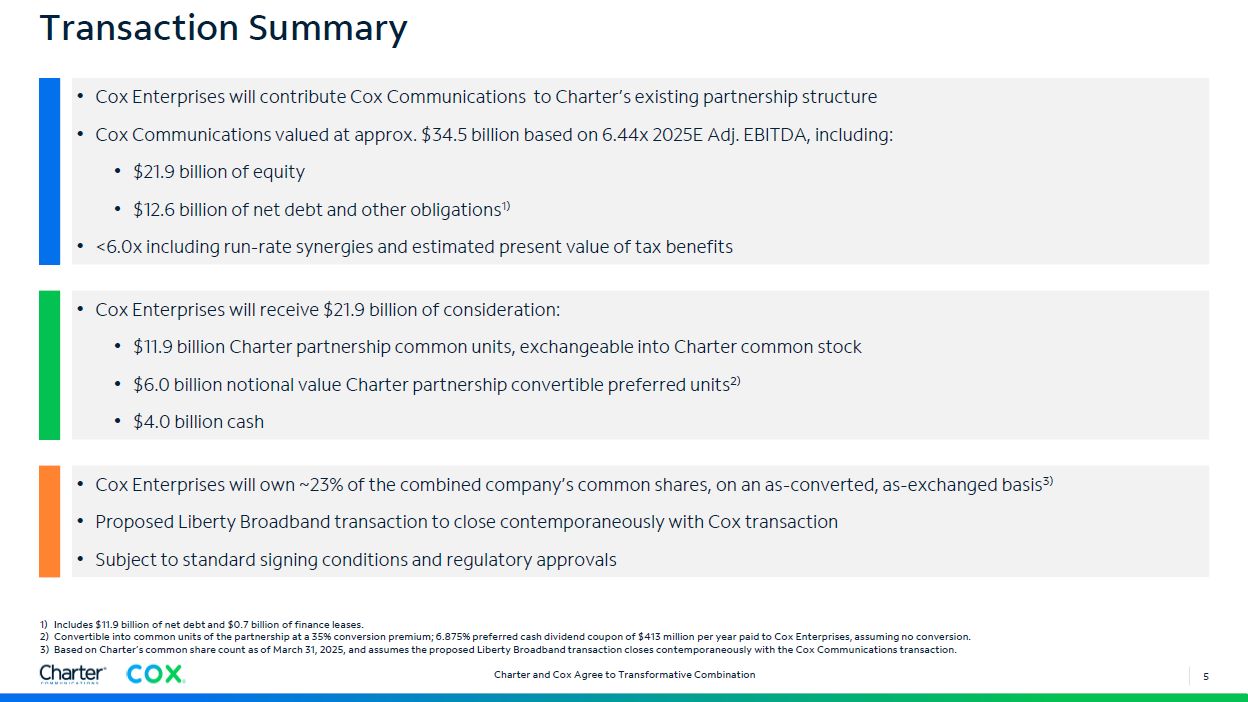

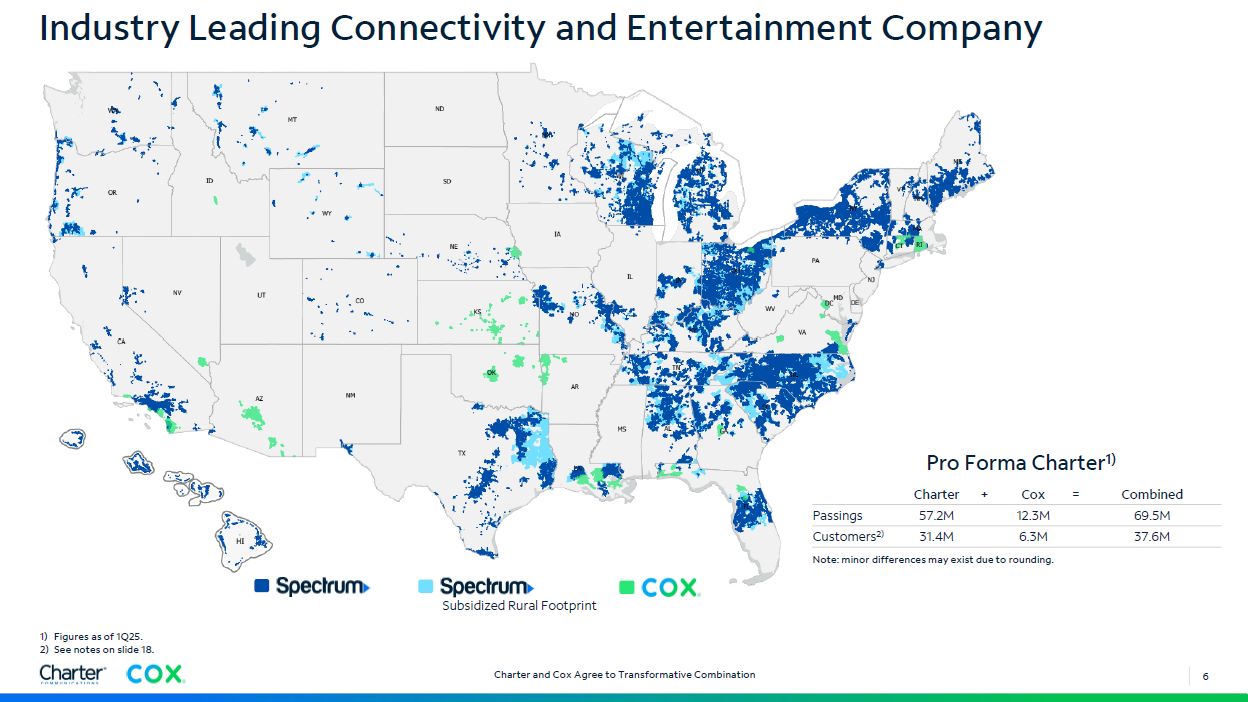

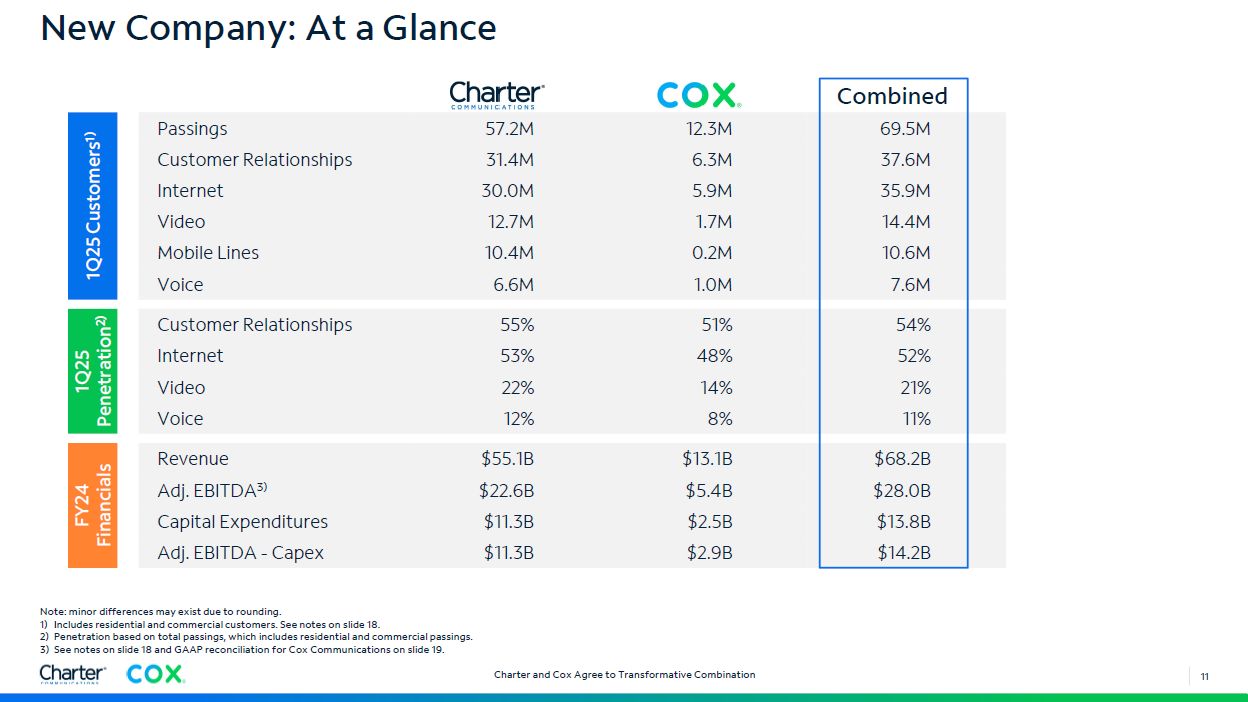

Stamford, CT and Atlanta, GA – May 16, 2025 – Charter Communications, Inc. (NASDAQ: CHTR) (along with its subsidiaries, “Charter”) and Cox

Communications (“Cox”) today announced that they have entered into a definitive agreement to combine their businesses in a transformative transaction that will create an industry leader in mobile and broadband communications services,

seamless video entertainment, and high-quality customer service delivering powerful benefits for American employees, customers, communities, and shareholders. The proposed transaction

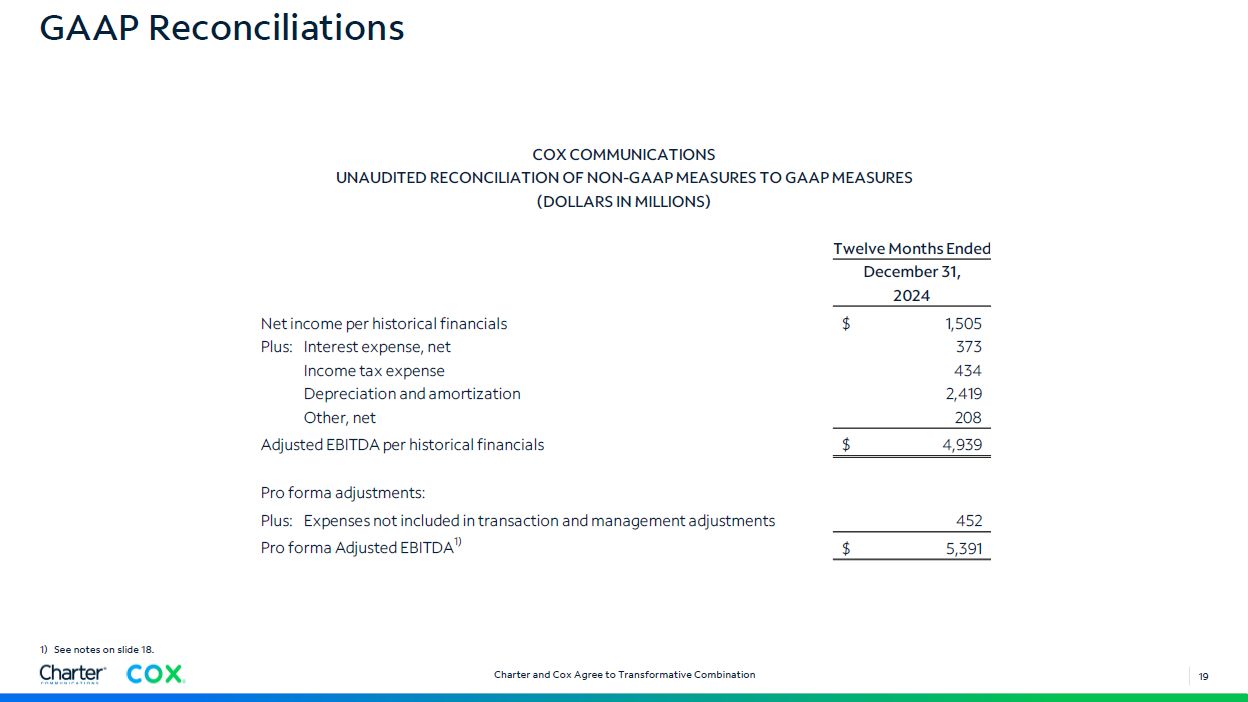

values Cox Communications at an enterprise value of approximately $34.5 billion1 based on, and at parity with, Charter’s recent enterprise value to 2025

estimated Adjusted EBITDA trading multiple.

“We’re honored that the Cox family has entrusted us with its impressive legacy and are excited by the opportunity to benefit from the

terrific operating history and community leadership of Cox,” said Chris Winfrey, President and CEO of Charter. “Cox and Charter have been innovators in connectivity and entertainment

services – with decades of work and hundreds of billions of dollars invested to build, upgrade, and expand our complementary regional networks to provide high-quality internet, video,

voice and mobile services. This combination will augment our ability to innovate and provide high-quality, competitively priced products, delivered with outstanding customer service, to millions of homes and businesses. We will continue to deliver high-value products that save American families money, and we’ll onshore jobs from overseas to create new, good-paying

careers for U.S. employees that come with great benefits, career training and advancement, and retirement and ownership opportunities.”

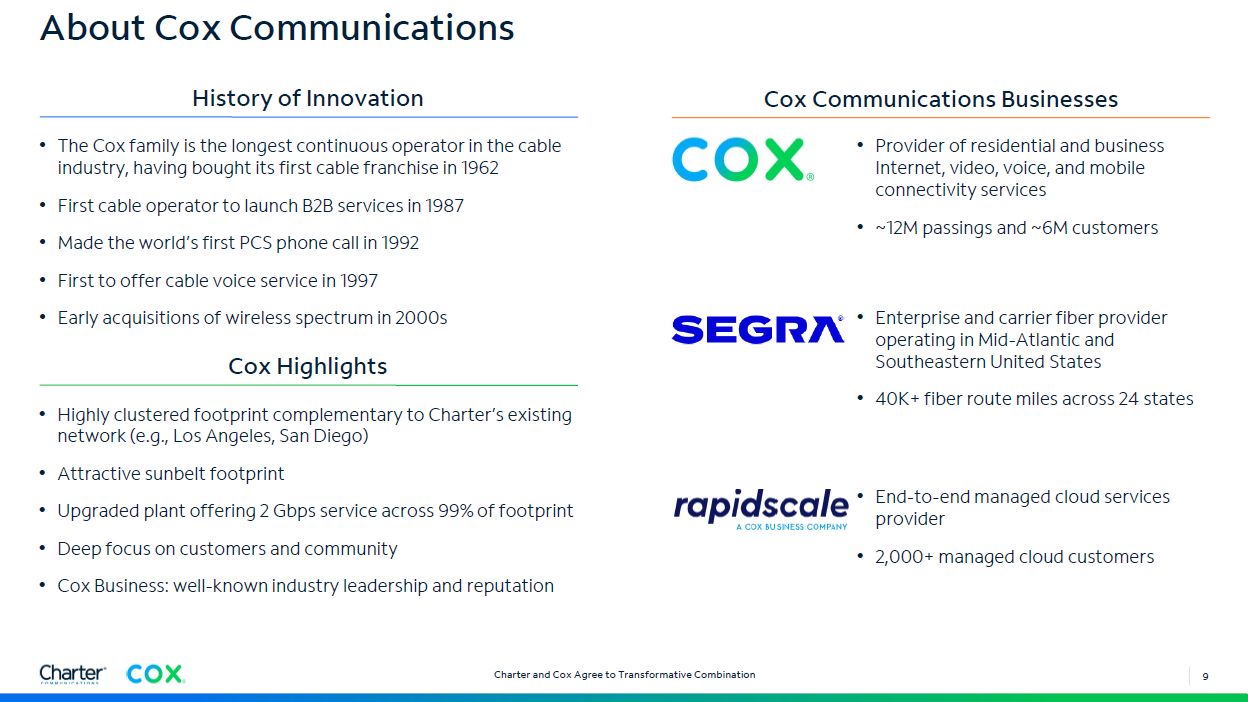

The Cox family is the longest continuous operator in the industry, having acquired its

first cable television franchise in 1962. “Our family has always believed that investing for the long-term and staying committed to the best interests of our customers, employees and communities is the best recipe for success,” said Alex

Taylor, Chairman and CEO of Cox Enterprises. “In Charter, we’ve found the right partner at the right time and in the right position to take this commitment to a higher level than ever before, delivering an incredible outcome for our

customers, employees, suppliers and the local communities we serve.”

1. Comprised of $21.9 billion of equity and $12.6 billion of net debt and other obligations.

1

“Charter’s board and I are excited about this transaction and very supportive of Alex stepping into the board Chairman role,” said Eric

Zinterhofer, Chairman of Charter’s Board of Directors. “The combination of Cox Communications with Charter is an excellent outcome for our collective shareholders, customers, employees and the industry.”

Structure and Timing

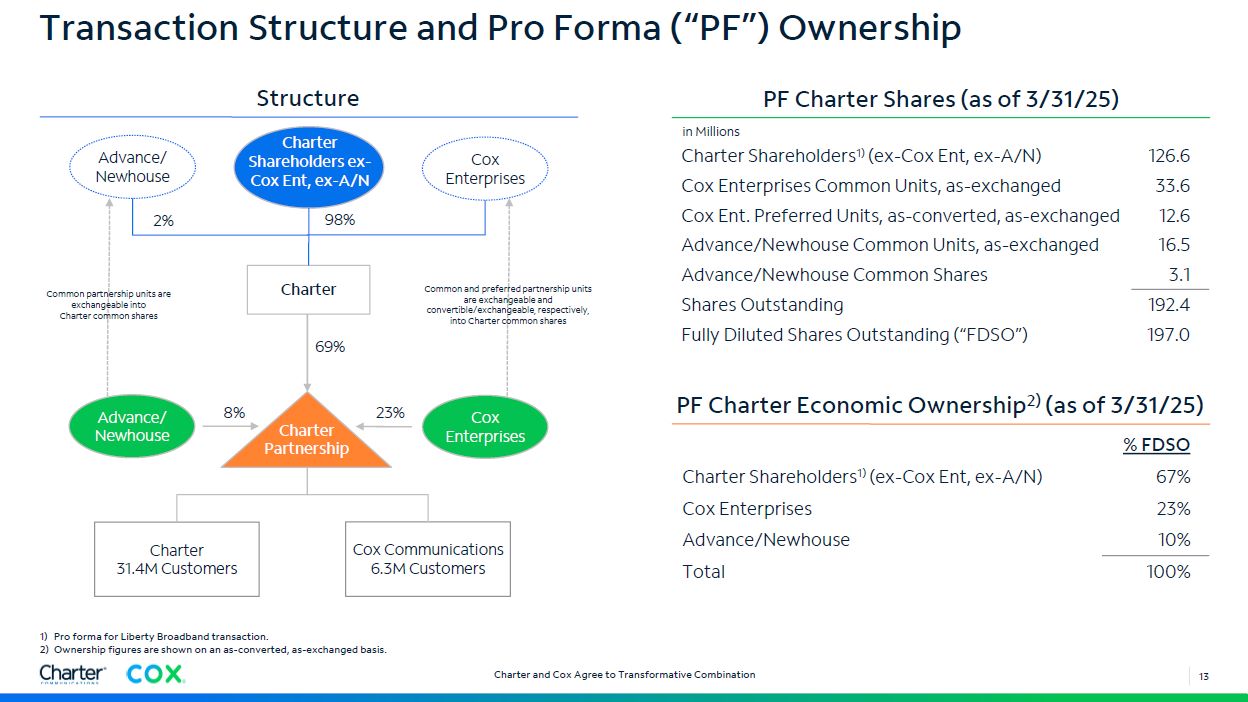

In the transaction, Charter will acquire Cox Communications’ commercial fiber and managed IT and cloud businesses, and Cox Enterprises

will contribute Cox Communications’ residential cable business to Charter Holdings, an existing subsidiary partnership of Charter. Cox’s assets have been valued using Cox’s 2025

estimated Adjusted EBITDA, multiplied by Charter’s total enterprise value to 2025 estimated Adjusted EBITDA trading multiple of 6.44x, based on:

| • |

Wall Street consensus for Charter’s 2025 Adjusted EBITDA, and

|

| • |

Charter’s (NASDAQ: CHTR) 60-day Volume Weighted Average Price of $353.64, as of 4/25/25.

|

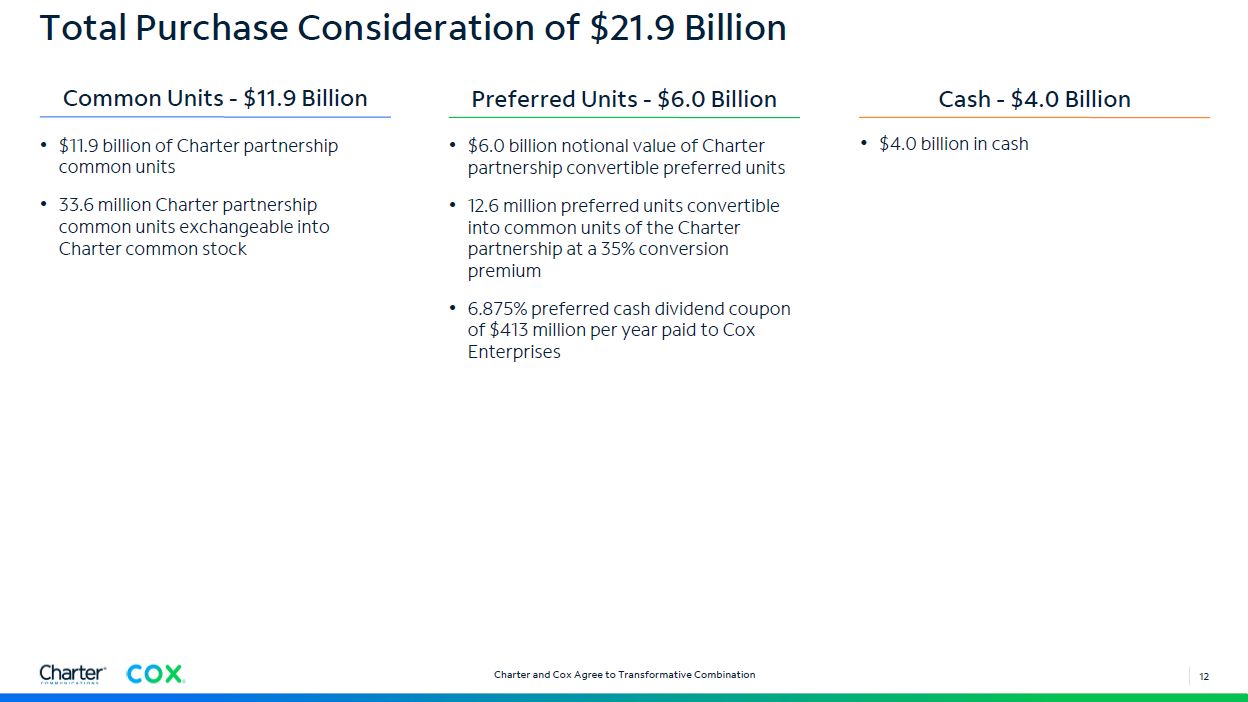

As consideration in the transaction, Cox Enterprises will receive:

| • |

$4 billion in cash,

|

| • |

$6 billion notional amount of convertible preferred units in Charter’s existing partnership, which pay a 6.875% coupon, and which are convertible into Charter partnership units, which are

then exchangeable for Charter common shares, and

|

| • |

Approximately 33.6 million common units in Charter’s existing partnership, with an implied value of $11.9 billion1,

and which are exchangeable for Charter common shares.

|

Based on Charter’s share count as of March 31, 2025, at the closing, Cox Enterprises will own approximately 23% of the combined entity’s

fully diluted shares outstanding, on an as-converted, as-exchanged basis, and pro forma for the closing of the Liberty Broadband merger. The transaction is subject to customary closing

conditions, including the receipt of regulatory and Charter shareholder approvals. The combined entity will assume Cox’s approximately $12 billion in outstanding debt.

Within a year after the closing, the combined company will change its name to Cox Communications. Spectrum will become the consumer-facing

brand within the communities Cox serves. The combined company will remain headquartered in Stamford, CT, and will maintain a significant presence on Cox’s Atlanta, GA campus following the closing.

1. Assumes 33.6 million common units are exchanged for 33.6 million Charter common shares, multiplied by Charter’s (NASDAQ: CHTR) 60-day Volume Weighted

Average Price of $353.64, as of 4/25/25.

2

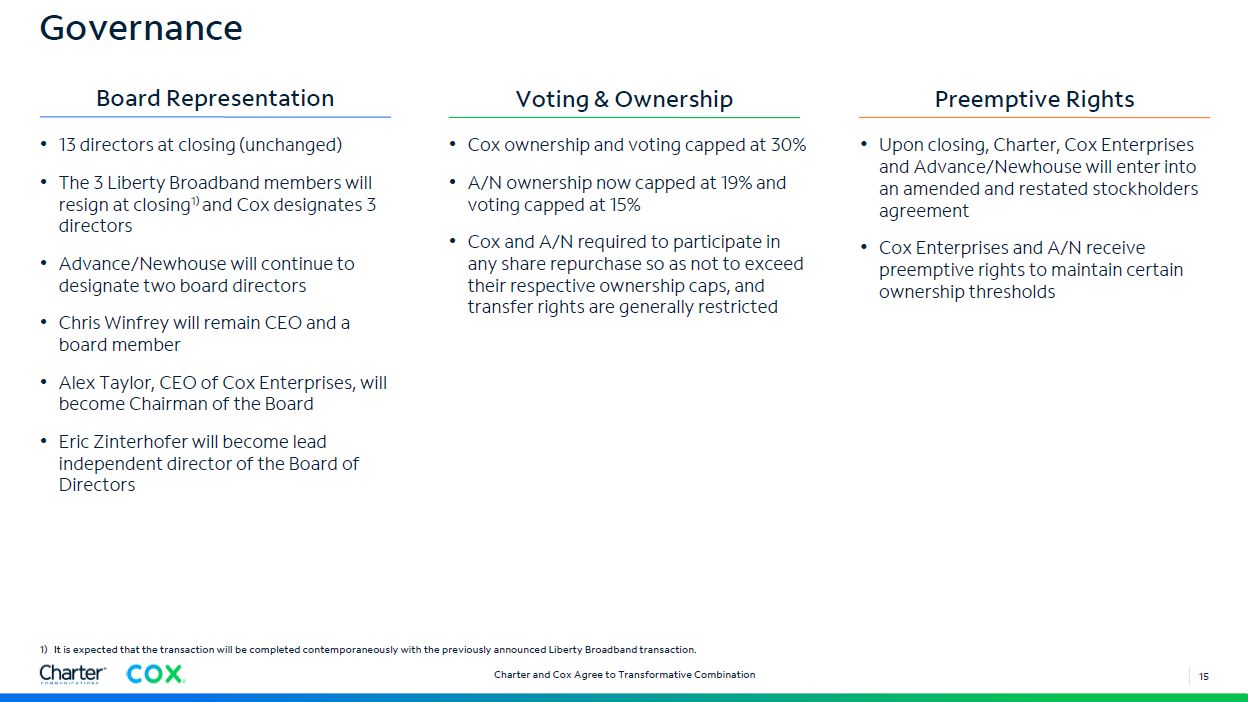

Governance

Following the closing, Mr. Winfrey will continue in his current role as President & CEO,

and board member. Mr. Taylor will join the board as Chairman, and Mr. Zinterhofer will become the lead independent director on Charter’s board. Cox will have the right to nominate an additional two board members to Charter’s 13-member

board. Advance/Newhouse, another storied cable innovator, which contributed its operations to Charter’s partnership in 2016, will retain its two board nominees.

It is expected that Charter’s combination with Cox will be completed contemporaneously with the previously announced Liberty Broadband

merger. As a result, Liberty Broadband will cease to be a direct shareholder in Charter and will no longer designate directors for election to the Charter Board. Accordingly, the three

current Liberty Broadband nominees on Charter’s board will resign at closing. Liberty Broadband shareholders will receive direct interests in Charter as a result of the Liberty Broadband merger.

Upon closing, Charter, Cox Enterprises and Advance/Newhouse will enter into an amended and restated stockholders agreement, which will

provide for preemptive rights over certain issuances, voting caps and required participation in Charter common share repurchases at specified acquisition caps, and transfer restrictions among other shareholder governance matters.

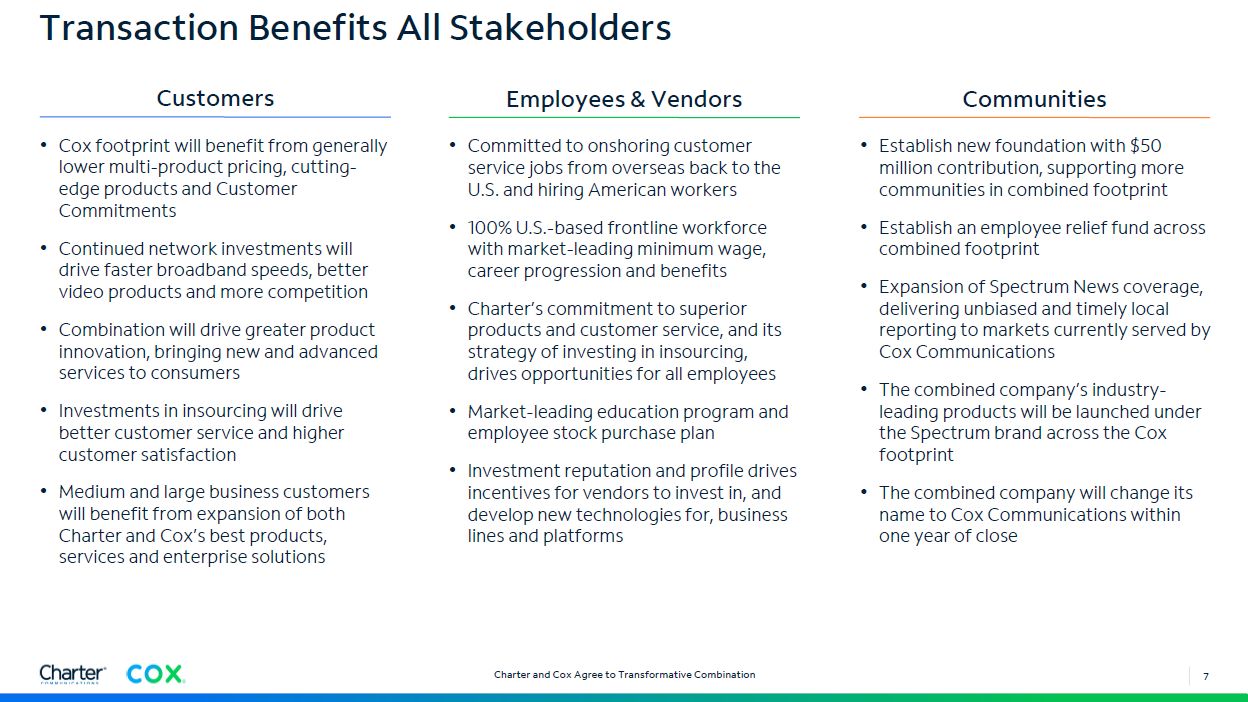

Community Leadership

The Cox family of businesses was founded 127 years ago on the promise of “building a better future for the next generation.” Both Cox and

Charter want to see that intent reinforced in this new partnership. The Cox family’s commitment to supporting its communities through the philanthropic work of the James M. Cox Foundation will be continued by Charter’s $50 million grant

to establish a separate foundation that will encourage community leadership and support where the combined company does business. Additionally, Charter will make an initial $5 million investment to establish an employee relief fund that

mirrors the Cox Employee Relief Fund, which Cox and the Cox family created in 2005 to help employees through times of hardships such as natural disasters or other unexpected life challenges.

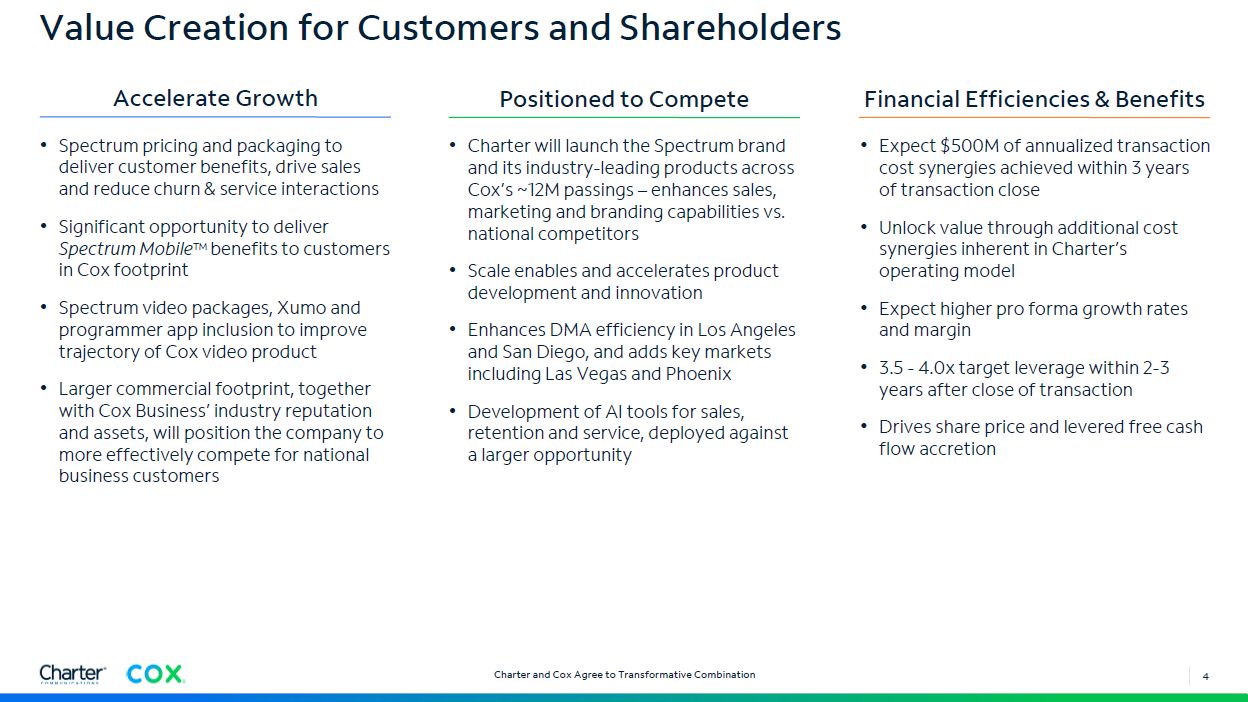

Strategic and Customer Objectives

Following the closing, the combined company’s industry-leading products will launch across Cox’s approximately 12 million passings and 6

million existing customers, under the Spectrum brand – including Spectrum’s Advanced WiFi, Spectrum Mobile with Mobile Speed Boost, the Spectrum TV App, Seamless Entertainment and Xumo – and which, when coupled with Spectrum’s transparent

and customer-focused pricing and packaging structure, will provide Cox customers with enhanced flexibility and convenience, as well as the choice to pay less for new Spectrum bundled

services or to keep their current plans.

3

The new combination will create a best-in-class customer service model. That model will integrate Cox’s rich service history with

Charter’s 100% U.S.-based, employee-focused service and sales model and industry-leading customer commitments. Charter customers

will benefit from Cox Business’ well-known industry leadership in business telecommunications, including Segra and RapidScale.

Charter and Cox employees will benefit from investments in employee-focused technology and AI tools and an expansion of Charter’s

self-progression career advancement model for promotions and standardized pay increases.

Specific benefits from the combination include:

| • |

The combined company will bring together the best products and practices of each company to benefit all of the combined company’s customers and employees.

|

| • |

The combined company will be better positioned to aggressively compete in an expanding and dynamic marketplace that includes:

|

| - |

Larger, national broadband companies with wireline and wireless capabilities,

|

| - |

Regional wireline and mobile competitors,

|

| - |

Global video distribution providers and platforms, and satellite broadband companies.

|

| • |

The combined company also will be better positioned for continued and expanded investment and innovation:

|

| - |

In mobile, given the increased footprint;

|

| - |

In video, where Big Tech currently leverages global scale in content and distribution;

|

| - |

In advertising, where the transaction will expand opportunities for advertisers large and small, national, regional, and local, bringing new competition in an area now dominated by Big

Tech;

|

| - |

In the business sector, where the combined company will have additional coverage, yet still remain a regional player competing against larger, national competitors;

|

| - |

And through greater product innovation in areas including AI tools and small cell deployment of licensed, shared licensed and unlicensed spectrum, bringing new and advanced services and

capabilities to consumers and businesses.

|

| • |

Cox customers will gain access to Charter’s simple and transparent pricing and packaging structure,

includingno annual contracts for any residential services, which means customers are free to change service providers at any time, with no risk of early termination fees.

|

| • |

Cox customers also will benefit from Charter’s industry-first Customer Service Commitments, which include:

|

| - |

Charter’s 100% U.S.-based customer service team available 24/7.

|

| - |

Charter has committed to fixing service disruptions quickly, including same-day technician dispatch when requested before 5:00 pm; if not, the next day.

|

| - |

Charter provides customers credits for outages that last longer than two hours.

|

4

| • |

This proposed transaction puts America first by returning jobs from overseas and creating new, good-paying customer service and

sales careers.

|

| - |

The combined company will adopt Charter’s sales and service workforce model, which will fully return Cox’s customer service function to the U.S.

|

| - |

All employees will earn a starting wage of at least $20 per hour and will gain access to Charter’s

industry-leading benefits, which include:

|

| ◾ |

Comprehensive medical, dental, and vision coverage for all full-time and part-time employees; Charter has absorbed the full premium cost increase for the last 12 years.

|

| ◾ |

Market-leading retirement benefits, including a 401(k) plan with a company match up to 6% of their eligible pay, with an additional 3% contribution available for most employees.

|

| ◾ |

Free or discounted Spectrum Mobile, TV and Internet service.

|

| ◾ |

Multiple opportunities for upward advancement and to build careers, including through tuition-free undergraduate degree and certificate programs via flexible online learning;

self-progression programs with standardized pay raises, and formal development programs, such as the Broadband Field Technician Apprenticeship program.

|

| ◾ |

Employee Stock Purchase Plan, which provides frontline employees the ability to purchase stock and receive a matching grant of Charter Restricted Stock Units (RSUs) up to 1 for 1 based on

years of service, offering employees another meaningful incentive to grow their careers with Charter.

|

| • |

The combined company will expand Charter’s award-winning local Spectrum News stations in the Cox footprint, bringing hyper-local, unbiased news coverage to more communities. The combined

company will not own any national programming.

|

| • |

The combined company will retain its industry leadership in protecting the security of U.S. communications networks from foreign threats.

|

Financial Outlook

By deploying Charter’s operating strategy across Cox’s footprint, the combined company will:

| • |

Offer Cox customers the choice to pay less for new Spectrum bundled services or to keep their current plans,

|

| • |

Invest in more U.S.-based employees,

|

| • |

Continually improve service quality,

|

| • |

And support the development of third-party platforms for new consumer products through continuing network evolution.

|

5

Despite those investments, the combined business is expected to produce higher cash flow per passing and investment returns over time by

creating and preserving more relationships on a fixed network, selling more products to each customer, and reducing operating and capital costs per passing by lowering service transactions, churn and fixed cost leverage.

Charter also currently expects approximately $500 million of annualized cost synergies achieved within three years of close – stemming

from typical procurement and overhead savings.

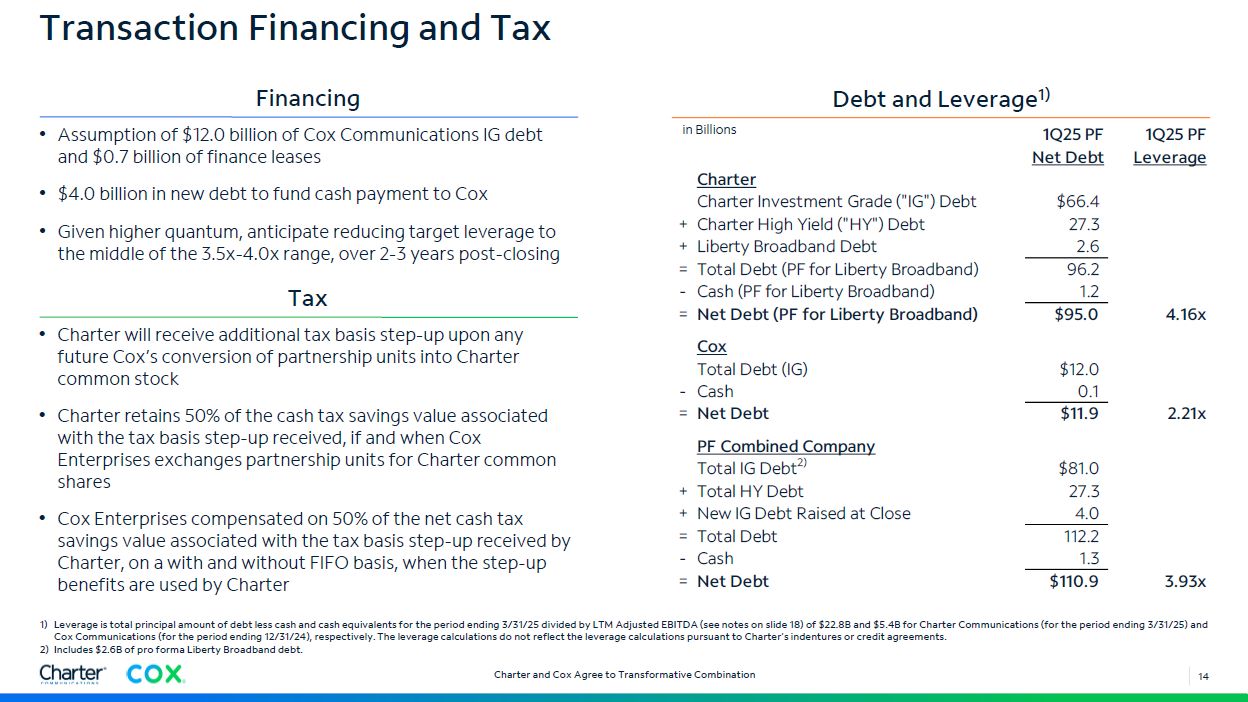

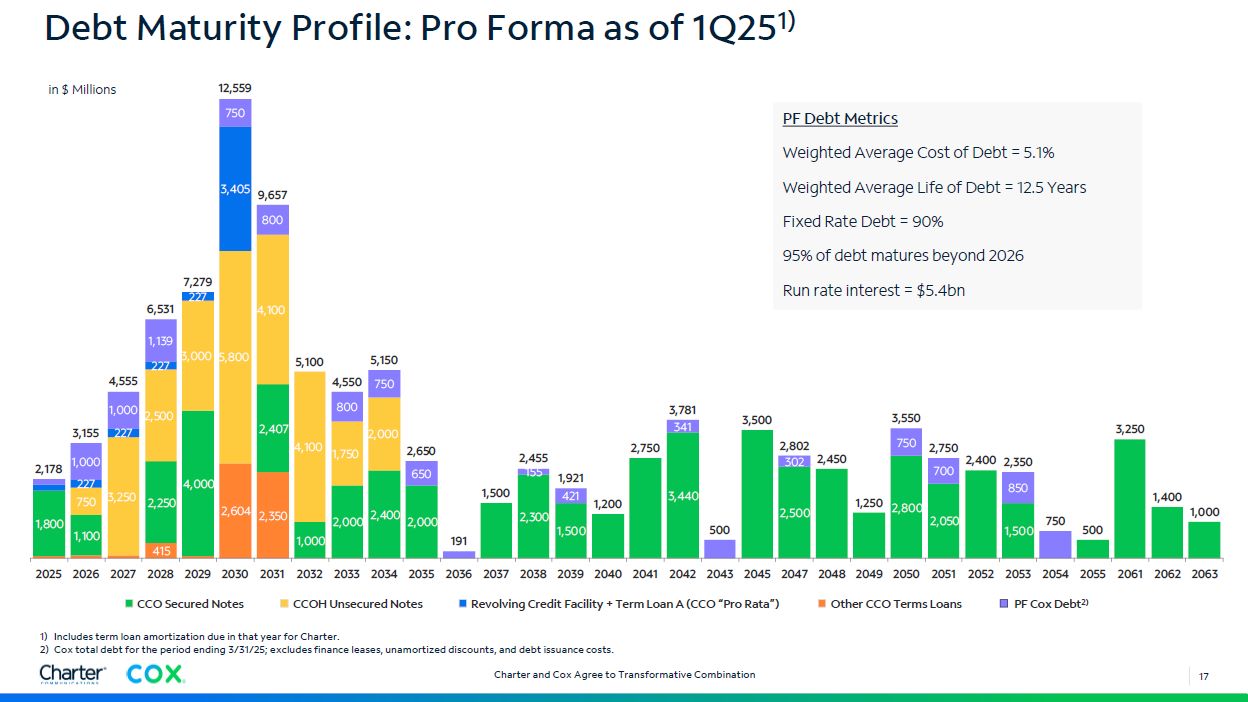

As part of the transaction, Charter expects to assume approximately $12 billion of

Cox Communications debt at closing and will have approximately 3.9x net leverage, including the impact of the Liberty Broadband and Cox transactions, based on the net debt of each company as of March 31, 2025. Charter expects to adjust at closing its long-term target leverage range to 3.50 – 4.00x to reflect the enhanced size of its balance sheet.

Citi and LionTree are serving as financial advisors and Wachtell, Lipton, Rosen & Katz is serving as legal counsel to Charter. Allen

& Company is serving as financial advisor to Cox Enterprises. BDT & MSD Partners, Evercore and Wells Fargo are serving as financial advisors to Cox Communications. Latham & Watkins LLP is serving as the legal advisor to Cox

Enterprises.

Webcast

Charter will host a webcast on Friday, May 16, 2025 at 8:30 a.m. Eastern Time (ET) related to the contents of this release. The webcast can be accessed live

via the Company’s investor relations website at ir.charter.com. Participants should go to the webcast link no later than 10 minutes prior to the start time to register. The webcast will

be archived at ir.charter.com two hours after completion of the webcast.

|

Contacts:

|

|

|

Media:

|

Analysts:

|

|

Cameron Blanchard

|

Stefan Anninger

|

|

Charter Communications

|

Charter Communications

|

|

cameron.blanchard@charter.com

|

stefan.anninger@charter.com

|

Craig Hodges

Cox Enterprises

craig.hodges@coxinc.com

6

About Charter

Charter Communications, Inc. (NASDAQ:CHTR) is a leading broadband connectivity company and cable operator with services available to more than 57 million

homes and businesses in 41 states through its Spectrum brand. Over an advanced communications network, supported by a 100% U.S.-based workforce, the Company offers a full range of state-of-the-art residential and business services

including Spectrum Internet®, TV, Mobile and Voice.

More information about Charter can be found at corporate.charter.com.

About Cox Communications

Cox Communications is committed to creating meaningful moments of human connection through technology. As the largest private broadband company in America,

Cox Communications owns network infrastructure that reaches more than 30 states. Cox Communications’ fiber-powered wireline and wireless connections are available to more than 12 million homes and businesses and support advanced cloud and

managed IT services nationwide. Through Cox Business, Hospitality Network, RapidScale and Segra, Cox Communications provides a broad commercial services portfolio including advanced cloud, managed IT and fiber-based network solutions that

create connected environments, unique hospitality experiences and support operational applications for nearly 370,000 businesses. We’re the largest division of Cox Enterprises, a family-owned business founded in 1898 by Governor James M.

Cox that is dedicated to empowering others to build a better future for the next generation.

Cautionary Note Regarding Forward Looking Statements

This communication includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding, among other things, the proposed transaction between Charter and Cox. Although we believe that our plans, intentions and expectations as

reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks,

uncertainties and assumptions including, without limitation: (i) the effect of the announcement of the proposed transaction on the ability of Charter and Cox to operate their respective businesses and retain and hire key personnel and to

maintain favorable business relationships; (ii) the timing of the proposed transaction; (iii) the ability to satisfy closing conditions to the completion of the proposed transaction (including stockholder and regulatory approvals); (iv)

the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (v) the ultimate outcome and results of integrating operations and application of Charter’s

operating strategies to the acquired assets and the ultimate ability to realize synergies at the levels currently expected as well as potential dis-synergies; (vi) the impact of the proposed transaction on our stock price and future

operating results, including due to transaction and integration costs, increased interest expense, business disruption, and diversion of management time and attention; (vii) the reduction in our current stockholders’ percentage ownership

and voting interest as a result of the proposed transaction; (viii) the increase in our indebtedness as a result of the proposed transaction, which will increase interest expenses and may decrease our operating flexibility; (ix)

litigation relating to the proposed transaction; (x) other risks related to the completion of the proposed transaction and actions related thereto; and (xi) the factors described under “Risk Factors” from time to time in Charter’s filings

with the SEC. Many of the forward-looking statements contained in this communication may be identified by the use of forward-looking words such as “believe,” “expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,”

“estimated,” “aim,” “on track,” “target,” “opportunity,” “tentative,” “positioning,” “designed,” “create,” “predict,” “project,” “initiatives,” “seek,” “would,” “could,” “continue,” “ongoing,” “upside,” “increases,” “grow,” “focused on”

and “potential,” among others.

7

All forward-looking statements speak only as of the date they are made and are based on information available at that time. Charter assumes no obligation to

update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As

forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Additional Information

Charter intends to file a proxy statement with the SEC in connection with the proposed transaction. Investors and security holders of Charter and Cox are

urged to read the proxy statement and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. The definitive proxy

statement (if and when available) will be mailed to stockholders of Charter. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Charter

through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Charter at 400 Washington Blvd., Stamford, CT 06902, Attention: Investor Relations, (203) 905-7801.

Participants in Solicitation

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless,

Charter and its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding the interests of such potential participants

will be included in one or more proxy statements or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website http://www.sec.gov.

8

Charter anticipates that the following individuals will be participants (the “Charter Participants”) in the solicitation of proxies from holders of Charter

common stock in connection with the proposed transaction: Eric L. Zinterhofer, Non-Executive Chairman of the Charter Board, W. Lance Conn, Kim C. Goodman, John D. Markley, Jr., David C. Merritt, Steven A. Miron, Balan Nair, Michael A.

Newhouse, Martin E. Patterson, Mauricio Ramos, Carolyn J. Slaski and J. David Wargo, all of whom are members of the Charter Board, Christopher L. Winfrey, President, Chief Executive

Officer and Director, Jessica M. Fischer, Chief Financial Officer, and Kevin D. Howard, Executive Vice President, Chief Accounting Officer and Controller. Information about the Charter Participants, including a description of their

direct or indirect interests, by security holdings or otherwise, and Charter’s transactions with related persons is set forth in the sections entitled “Proposal No. 1: Election of Directors”, “Compensation Committee Interlocks and Insider

Participation”, “Compensation Discussion and Analysis”, “Certain Beneficial Owners of Charter Class A Common Stock”, “Certain Relationships and Related Transactions”, “Proposal No. 2: Approve the Charter Communications, Inc. 2025 Employee

Stock Purchase Plan”, “Pay Versus Performance” and “CEO Pay Ratio” contained in Charter’s definitive proxy statement for its 2025 annual meeting of shareholders, which was filed with the SEC on March 13, 2025 (which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001091667/000114036125008627/ny20042259x1_def14a.htm) and other documents subsequently filed by Charter with the SEC. To the extent holdings of Charter stock by the directors and executive

officers of Charter have changed from the amounts of Charter stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

# # #

9