UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

Axesstel, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a 6(i)(4) and 0 11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0 11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

AXESSTEL, INC.

6815 Flanders Drive, Suite 210

San Diego, California 92121

858-625-2100

www.axesstel.com

Dear Fellow Stockholder:

We are pleased to invite you to attend our 2009 Annual Meeting of Stockholders to be held on June 11, 2009 at our offices located at 6815 Flanders Drive, Suite 210, San Diego, California 92121, beginning at 10:00 a.m., local time.

Enclosed are the notice of annual meeting of stockholders and the proxy statement describing the business that will be acted upon at the annual meeting. Please vote on the business to come before the meeting, as it is important that your shares are represented. Instructions on the proxy card explain how you may vote on the Internet or by returning your proxy card by mail. If you decide to attend the meeting, you may, of course, revoke your proxy and cast your vote in person.

Whether or not you plan to attend the meeting, please vote on the Internet or complete, sign, date and return the enclosed proxy card in the envelope provided.

We have also enclosed a copy of our annual report on Form 10-K for our fiscal year ended December 31, 2008. We encourage you to read our annual report, which includes information on our products, operations and markets, as well as our audited financial statements for the fiscal year ended December 31, 2008.

We look forward to seeing you at the meeting.

Sincerely,

H. Clark Hickock

Chief Executive Officer

May 1, 2009

San Diego, California

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting

to be Held on June 11, 2009: The Proxy Statement and Annual Report to Stockholders

are available at http://investors.axesstel.com.

AXESSTEL, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

JUNE 11, 2009

TO THE STOCKHOLDERS OF AXESSTEL, INC.:

NOTICE IS HEREBY GIVEN that the 2009 Annual Meeting of Stockholders of Axesstel, Inc., a Nevada corporation, will be held on June 11, 2009 at 10:00 a.m. local time, at our offices located at 6815 Flanders Drive, Suite 210, San Diego, California 92121. At the annual meeting you will be asked to:

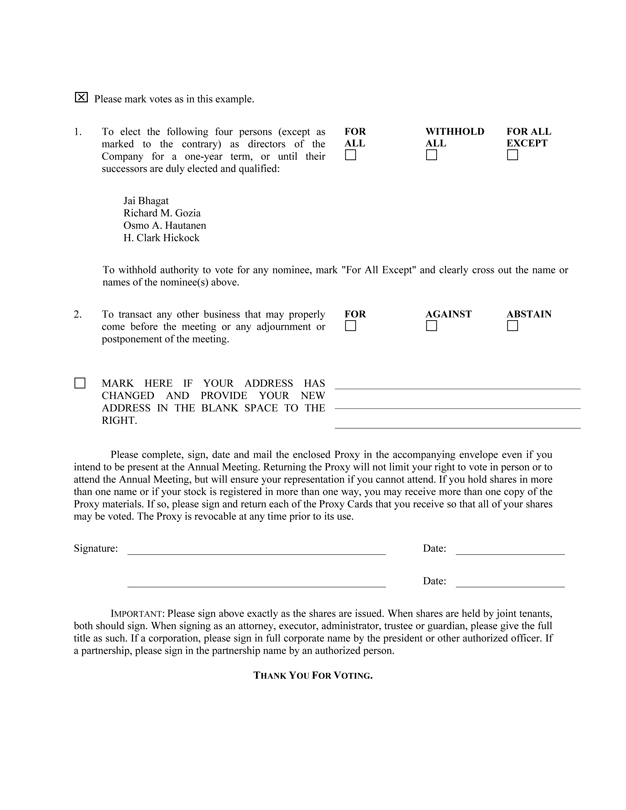

1. Elect four directors to hold office until our next annual meeting of stockholders and until their respective successors have been elected and qualified.

2. Transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the accompanying proxy statement.

Our board of directors has fixed the close of business on April 27, 2009 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting and at any adjournment or postponement thereof.

By Order of the Board of Directors

Patrick Gray

Chief Financial Officer and Secretary

San Diego, California

May 1, 2009

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. YOU MAY VOTE BY USING THE INTERNET AS INSTRUCTED ON THE PROXY CARD, OR BY COMPLETING, SIGNING AND DATING THE PROXY CARD AND RETURNING IT IN THE ENCLOSED ENVELOPE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

AXESSTEL, INC.

PROXY STATEMENT

2009 ANNUAL MEETING OF STOCKHOLDERS

JUNE 11, 2009

ABOUT THE ANNUAL MEETING

| Q: | What is the purpose of the annual meeting? |

| A: | At the annual meeting, our stockholders will vote to elect four directors to serve until our next annual meeting and until their successors are elected. Our stockholders will also vote on any other business to properly come before the meeting. |

| Q: | Who is entitled to vote at the annual meeting? |

| A: | Only stockholders of record at the close of business on April 27, 2009, the record date for the annual meeting, are entitled to receive notice of and to participate in the annual meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the annual meeting, or any postponements or adjournments of the annual meeting. |

| Q: | What are the voting rights of the holders of common stock? |

| A: | Each outstanding share of our common stock will be entitled to one vote on each matter considered at the annual meeting. |

| Q: | How is a quorum determined? |

| A: | Holders of a majority of the outstanding shares of our common stock entitled to vote must be present, in person or by proxy, at the annual meeting to achieve the required quorum for the transaction of business. As of the record date, 23,228,982 shares of common stock, representing the same number of votes, were outstanding. Therefore, the presence of the holders of common stock representing at least 11,614,491 votes will be required to establish a quorum. |

All votes will be tabulated by the inspector of elections appointed for the annual meeting. The inspector will separately count affirmative and negative votes, abstentions and broker non-votes. Proxies that are received but marked as abstentions (or refusals to vote) and broker non-votes (votes from shares held of record in “street name” as to which the beneficial owners have not provided voting instructions) will be included in the calculation of the number of votes considered to be present at the annual meeting. If a quorum is not achieved, holders of the votes present, in person or by proxy, may adjourn the annual meeting to another date.

| Q: | How do I vote? |

| A: | If you complete and sign the accompanying proxy card and return it to us, it will be voted as you direct. If you are a registered stockholder and attend the annual meeting, you may deliver your completed proxy card in person. “Street name” stockholders who wish to vote at the annual meeting will need to obtain a proxy form from the institution that holds their shares. You may also vote on the Internet as explained on the enclosed proxy card. |

| Q: | Can I revoke my proxy later? |

| A: | Yes. You have the right to revoke your proxy at any time before the annual meeting by: |

| (1) | filing a written notice of revocation with our Corporate Secretary at our principal office (6815 Flanders Drive, Suite 210, San Diego, CA 92121); |

1

| (2) | filing a properly executed proxy bearing a later date with our Corporate Secretary at our principal office (see address immediately above); or |

| (3) | attending the annual meeting and voting in person (attendance at the annual meeting will not, by itself, revoke your proxy); however, if your shares are held of record by a broker, bank or other nominee and you wish to vote at the annual meeting, you must obtain from the record holder a proxy issued in your name. |

| Q: | How does the board of directors recommend I vote on the proposal? |

| A: | Our board of directors recommends a vote FOR each of the four nominees for director set forth in this proxy statement. |

| Q: | What is required to approve the proposal? |

| A: | Directors are elected by a plurality of the votes cast by holders of shares entitled to vote. This means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be elected. |

| Q: | What happens if I abstain from voting or my broker submits a non-vote? |

| A: | We will count proxies marked “abstain” as shares present for the purpose of determining the presence of a quorum, but for purposes of determining the outcome of a proposal, the shares represented by these proxies will not be treated as affirmative votes. In other words, abstentions are not counted with respect to the proposal regarding the election of directors and are treated as votes cast against with respect to the other proposals. While broker non-votes are similarly counted as shares present for the purpose of determining the presence of a quorum, the shares represented by these proxies are not counted for any purpose in determining whether a proposal has been approved. |

Q: How will my shares be voted if I return a blank proxy card?

| A: | If you sign and send in your proxy card and do not indicate how you want to vote, we will count your proxy as a vote FOR each of the director nominees named in this proxy statement. |

| Q: | How will voting on any other business be conducted? |

| A: | Although we do not know of any business to be conducted at the annual meeting other than the proposal discussed in this proxy statement, if any other business comes before the annual meeting, your signed proxy card gives authority to the proxy holders, Clark Hickock and Patrick Gray, to vote on those matters at their discretion. |

| Q: | Who will bear the costs of this solicitation? |

| A: | We will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to our stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially owned by others to forward to the beneficial owners. We may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials to the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile or personal solicitation by our directors, officers or other regular employees. |

| Q: | How can I find out the results of the voting at the annual meeting? |

| A: | Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our quarterly report on Form 10-Q for the second quarter of fiscal year 2009. |

2

| Q: | When are stockholder proposals due for next year’s annual meeting? |

| A: | The deadline for submitting a stockholder proposal for inclusion in our proxy statement and form of proxy for our next annual meeting of stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission, or SEC, is December 31, 2009. You should also review our bylaws, which contain additional requirements about advance notice of stockholder proposals, and the section, “Director Nominees,” in this proxy statement. |

ADDITIONAL INFORMATION

Our annual report on Form 10-K for our fiscal year ended December 31, 2008 accompanies this proxy statement but does not constitute a part of the proxy soliciting material. A copy of such annual report, including financial statements but without exhibits, is available without charge to any person whose vote is solicited by this proxy upon written request to our corporate secretary at our principal office (6815 Flanders Drive, Suite 210, San Diego, CA 92121). Copies may also be obtained through the SEC’s web site at www.sec.gov.

3

PROPOSAL 1

ELECTION OF DIRECTORS

Directors are elected at each annual meeting of stockholders and, if elected, hold office until the next annual meeting of stockholders and until their successors have been elected and qualified, subject to any such director’s earlier resignation or removal.

Our board of directors currently consists of five directors. The four nominees for director are all incumbent directors. In accordance with authority conferred to the board under our Bylaws, the board of directors has determined to reduce the size of the board to four members effective as of the date of the 2009 Annual Meeting of Stockholders. The board of directors and the nominating committee are currently reviewing candidates who meet the company’s governance guidelines for directors and have industry expertise in markets that are most relevant for the company’s planned growth. The board may vote to increase the size of the board and appoint an additional member if it identifies such a qualified candidate.

VOTE REQUIRED

Directors are elected by a plurality of the votes present in person and represented by proxy and entitled to vote at a meeting at which a quorum is present. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees for director named above. Abstentions and broker non-votes will be counted as present for purposes of determining the presence of a quorum. If a quorum is present, the nominees director receiving the highest number of votes will be elected as directors. Abstentions and broker non-votes will have no effect on the vote. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as our board of directors may propose. Each person nominated for election has agreed to serve if elected, and our board of directors has no reason to believe that any nominee will be unable to serve.

DIRECTOR NOMINEES

Based on the recommendation of the nominating and governance committee of our board of directors, our board of directors has nominated the four individuals set forth below for election. If elected, the nominees will serve as directors until the annual stockholders meeting in 2010 and until their successors are elected and qualified, subject to earlier resignation or removal. Each of Messrs. Bhagat, Hautanen, and Hickock served on our board of directors during the past fiscal year. Mr. Gozia was appointed to our board of directors on February 11, 2009.

| Name |

Age | Position(s) with Axesstel, Inc. |

Director Since | |||

| Jai Bhagat |

62 | Vice Chairman and Director | 2003 | |||

| Richard M. Gozia |

64 | Director | 2009 | |||

| Osmo A. Hautanen |

54 | Chairman and Director | 2005 | |||

| H. Clark Hickock |

53 | Director and Chief Executive Officer | 2008 |

Jai Bhagat is chair of our compensation committee and has been a director since August 2003. In 2000, he founded AIR2LAN, a broadband service provider that was merged with US Wireless OnLine in 2005. Previously, he was a co-founder of SkyTel Communications, Inc., where he served as Vice Chairman and Chief Executive Officer prior to SkyTel’s merger with MCI. Mr. Bhagat also served as Chairman of the License Exempt sector of the Wireless Communications Association International (WCA) trade association, which represents the broadband wireless industry. He has served as Chairman and a board member of both the Personal Communications Industry Association (PCIA) and American Mobile Satellite Corporation. In addition, Mr. Bhagat has served as a board member or chairman of several wireless communications based companies, and was inducted into the RCR Wireless Hall of Fame in 2002 for his significant contributions to the wireless

4

industry. Past industry awards include the PCIA Chairman’s Award, the Radio Club Sarnoff Citation, PCIA’s Technology and Innovation of the Year, and RCR’s Personality of the Year. Mr. Bhagat received an M.S. in Electrical Engineering from Howard University, a B.S. in electrical engineering from Birla Institute of Technology & Science, Pilani, India, and completed the Executive Management program at Stanford University.

Richard M. Gozia is chair of the audit committee and has served as director since February 2009. He served as CEO of ForeFront Holdings, Inc., a publicly traded company in the golf accessories business, from 2007 to 2008. From 2000 to 2004, Mr. Gozia served as chief executive officer of Fenix LLC, the holding company for Union Pacific Corporation’s extensive portfolio of technology assets. From 1996 until 1999, Mr. Gozia held various executive positions with CellStar Corporation (Nasdaq: CLST), a publicly traded distributor of cell phones and wireless devices, including president, chief operating officer and chief financial officer. From 1994 to 1996, he served as the chief financial officer of SpectraVision Inc. (AMEX: SVN), a provider of in-room interactive video entertainment services to the lodging industry. Prior to that time, he served as the chief financial officer of Harte-Hanks, Inc. (NYSE: HHS). Mr. Gozia began his career as an accountant with Arthur Young & Co. Mr. Gozia holds a bachelor of science degree in accounting and finance from the University of Missouri at Columbia.

Osmo A. Hautanen is chairman of the board. He has been a director since November 2005. Mr. Hautanen has served as chief executive officer of Magnolia Broadband, Inc., a fabless semiconductor-design company for the cellular communications industry, since 2004. From 2002 to 2004, he was president of Cosmos Consulting, a private consulting firm providing organizational and business services to international companies. From 2000 to 2001, Hautanen was the CEO of Fenix LLC, the holding company for Union Pacific Corporation’s extensive portfolio of technology assets. From 1998 to 1999, he served as CEO of Formus Communications, an international wireless communications company. From 1996 to 1998, Hautanen was President of Americas for Philips Consumer Communications group. Before that time, Hautanen had an 18-year career with Nokia, where he served in multiple roles including vice president of sales and marketing for North America, vice president and general manager of Latin America, as well as vice president and general manager of Personal Communications Services, which led Nokia’s dominance in the North American handset market. Hautanen holds a bachelor of science in international business from Technical College of Varkaus (Finland), and a MBA in international business from Georgia State University. He is fluent in Finnish, German and English.

H. Clark Hickock was appointed CEO and became a director on March 13, 2008. He joined Axesstel as Chief Operating Officer in April 2005 and was responsible for all areas of operations including global contract manufacturing, supply chain, procurement, quality control and product cost reduction and new product introductions. In addition he has managed Global Sales. Prior to joining Axesstel, Mr. Hickock was executive vice president (EVP) of global operations for Cherokee International Corporation, responsible for operations and supply chain management in the U.S., Mexico, China and Europe. Prior to that he served as EVP of global operations for REMEC, Inc., where he managed an international team of over 4,000 in the manufacturing services business unit, new product introduction, and supply chain. While at REMEC, he also led a major corporate restructuring by consolidating 22 separately acquired manufacturing operations into a unified global supply chain of three low cost offshore manufacturing facilities. Prior to REMEC, Mr. Hickock was director of materials of E-systems Inc., an aerospace and defense division of Raytheon Company, where he managed the material and subcontract department. Hickock holds a B.A. in Finance and Economics from the University of Texas.

There are no family relationships among any of our executive officers and directors.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE FOREGOING NOMINEES TO OUR BOARD OF DIRECTORS.

* * * * *

5

BOARD AND COMMITTEE MATTERS AND CORPORATE GOVERNANCE MATTERS

BOARD STRUCTURE AND MEETINGS

During our fiscal year ended December 31, 2008, our board of directors held five meetings and took action by written consent on one occasion. During this period, all of the incumbent directors attended or participated in more than 75% of the aggregate of the total number of meetings of our board of directors and the total number of meetings held by all committees of our board of directors on which each such director served, during the period for which each such director served.

Our board of directors has three standing committees: an audit committee, a compensation committee, and a nominating and governance committee. Each of these committees has a written charter approved by our board of directors. The charters, which have previously been filed with the SEC, can be viewed by visiting our website at www.axesstel.com and clicking on “Investors/Public Relations” and then on “Corporate Governance.” The members of the committees are identified in the following table.

| Director |

Audit Committee |

Compensation Committee |

Nominating & Governance Committee | |||

| Jai Bhagat |

· | CHAIR | · | |||

| Richard M. Gozia |

CHAIR | · | ||||

| Osmo A. Hautanen |

· | · | CHAIR | |||

| H. Clark Hickock |

||||||

| Dr. Seung Taik Yang |

· | |||||

INFORMATION REGARDING COMMITTEES OF OUR BOARD OF DIRECTORS

Audit Committee

The audit committee of our board of directors, among other things:

| • | oversees the accounting and financial reporting processes of our company and the audits of the financial statements of our company; |

| • | serves as an independent and objective party to monitor our company’s policies for internal control systems; |

| • | retains the independent auditors, reviews and appraises their independence, qualifications and performance, and approves the terms of engagement for audit service and non-audit services; and |

| • | provides an open avenue of communication among the independent auditors, financial and senior management, and the Board. |

The audit committee held nine meetings during the last fiscal year.

See “Report of the Audit Committee” contained elsewhere in this proxy statement. Our board of directors has determined that Mr. Gozia, the chair of the audit committee, qualifies as an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K. Each member of the audit committee is an independent director and meets each of the other requirements for audit committee members under applicable listing standards of the listing standards of the NYSE Amex (formerly known as the American Stock Exchange).

Compensation Committee

The compensation committee of our board of directors, among other things:

| • | reviews and approves performance goals and objectives for executive officers and recommends to our board of directors the compensation level of our executive officers; |

6

| • | reviews and makes recommendations to our board of directors with respect to our equity incentive plans; |

| • | administers and makes grants under our 2004 Equity Incentive Plan; and |

| • | establishes and reviews general policies relating to compensation and benefits of our employees. |

This committee held six meetings during the last fiscal year, and took action by written consent on one occasion.

See the “Compensation Committee Report” contained elsewhere in this proxy statement. The members of the compensation committee are all independent directors under applicable listing standards of the NYSE Amex.

Compensation Committee Interlocks and Insider Participation

The compensation committee is comprised entirely of independent directors. No member of the compensation committee is a former officer of Axesstel.

Nominating and Governance Committee

The nominating and governance committee of our board of directors, among other things:

| • | identifies, evaluates and recommends nominees to our board of directors and committees of our board of directors; |

| • | conducts searches for appropriate directors; |

| • | evaluates the performance of our board of directors and of individual directors; |

| • | reviews developments in corporate governance practices; |

| • | evaluates the adequacy of our corporate governance practices and reporting; and |

| • | makes recommendations to our board of directors concerning corporate governance matters. |

This committee held five meetings during the last fiscal year.

The members of the nominating and governance committee are all independent directors under applicable NYSE Amex rules.

BOARD MEMBER INDEPENDENCE

Our board of directors has affirmatively determined that, other than H. Clark Hickock, all of the members of our board of directors are “independent” under the criteria established by NYSE Amex for independent board members. In addition, our board of directors has determined that the members of the audit committee meet the additional independence criteria required for audit committee membership. Mr. Hickock is not considered independent because he is currently our chief executive officer.

CORPORATE GOVERNANCE

Our policies and practices reflect corporate governance initiatives that are designed to be compliant with the listing standards of the NYSE Amex and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, including:

| • | a majority of the members of our board of directors are independent of our company and our management; |

7

| • | all members of the audit committee, the compensation committee, and the nominating and governance committee are independent; |

| • | the independent members of our board of directors meet regularly without the presence of management; |

| • | we have a clear code of ethics that applies to our principal executive officers, our directors and all of our employees; |

| • | the charters of the committees of our board of directors clearly establish respective roles and responsibilities of each committee; and |

| • | we have a hotline available to all employees, and the audit committee has procedures in place for the anonymous submission of employee complaints on accounting, internal accounting controls, or auditing matters. |

BOARD EFFECTIVENESS

It is important that our board of directors and its committees are performing effectively and in the best interests of our company and our stockholders. Toward that end, our board of directors performs an annual self-assessment, led by the chair of the nominating and governance committee, to evaluate its effectiveness in fulfilling its obligations.

DIRECTOR ATTENDANCE AT ANNUAL MEETINGS

Our directors are strongly encouraged to attend our annual meeting of stockholders. Three of our five directors attended our 2008 annual meeting of stockholders.

EXECUTIVE SESSIONS

Our independent directors meet in executive session without management present at least twice a year. During the year ended December 31, 2008, our independent directors met in executive session on four occasions.

CODE OF ETHICS

Our board of directors adopted a “Code of Ethics for Directors, Officers and Employees” that applies to our directors and all employees, including our executive officers. Our code of ethics can be viewed by visiting our website at www.axesstel.com and clicking on “Investors/Public Relations” and then on “Corporate Governance.” In the event we make any amendments to, or grant any waivers of, a provision of our code of ethics that applies to our principal executive officer, principal financial officer, or principal accounting officer that requires disclosure under applicable SEC rules, we intend to disclose such amendment or waiver and the reasons therefor on a Form 8-K or on our next periodic report in accordance with SEC rules.

CONSIDERATION OF DIRECTOR NOMINEES

Director Qualifications

The nominating and governance committee believes that new candidates for director should be evaluated according to certain guidelines, including having the knowledge, capabilities, experience and contacts that complement those currently existing within our company; ability and qualifications to provide our management with an expanded opportunity to explore ideas, concepts and creative approaches to existing and future issues, and to guide management through the challenges and complexities of building a quality company; ability to meet contemporary public company board standards with respect to general governance; stewardship, depth of review, independence, financial certification, personal integrity and responsibility to stockholders; genuine desire and

8

availability to participate actively in the development of our future; and an orientation toward maximizing stockholder value in realistic time frames. The nominating and governance committee also considers such factors as ability to contribute strategically through relevant industry background and experience, on either the vendor or the end user side; strong current industry contacts; ability and willingness to introduce and open doors to executives of potential customers and partners; independence from our company and current members of our board of directors; and a recognizable name that would add credibility and value to our company and our stockholders. The committee may modify these guidelines from time to time.

Evaluating Nominees for Director

The nominating and governance committee reviews candidates for director nominees in the context of the current composition of our board of directors, our operating requirements and the long-term interests of our stockholders. In conducting this assessment, the committee currently considers, among other factors, diversity, experience, skills, and such other factors as it deems appropriate given the current needs of our board of directors and our company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the nominating and governance committee reviews such directors’ overall service to our company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the committee also determines whether the nominee must be independent, which determination is based upon applicable listing standards of the NYSE Amex (formerly known as the American Stock Exchange), applicable SEC rules and regulations and the advice of counsel, if necessary. The committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of our board of directors. The committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to our board of directors by majority vote. To date, neither the nominating and governance committee nor any predecessor to the committee has paid a fee to any third party to assist in the process of identifying or evaluating director candidates. To date, neither the nominating and governance committee nor any predecessor to the committee has rejected a director nominee from a stockholder or stockholders holding more than 5% of our voting stock.

Stockholder Nominations

The nominating and governance committee applies the same guidelines (described above) to stockholder nominees as applied to nominees from other sources. Any stockholder who wishes to recommend a prospective nominee to serve on our board of directors for the nominating and governance committee’s consideration may do so by giving the candidate’s name and qualifications in writing to the chairman of our board of directors at the following address: Axesstel, Inc., Attn: Corporate Secretary, 6815 Flanders Drive, Suite 210, San Diego, California 92121.

COMMUNICATIONS WITH DIRECTORS

Our board of directors has adopted a formal process by which stockholders may communicate with our board of directors. Our board of directors recommends that stockholders initiate any communications with our board of directors in writing and send them in care of our corporate secretary by mail to our offices, 6815 Flanders Drive, Suite 210, San Diego, California 92121. This centralized process will assist our board of directors in reviewing and responding to stockholder communications in an appropriate manner. The name of any specific intended recipient should be noted in the communication. Our board of directors has instructed our corporate secretary to forward such correspondence only to the intended recipients; however, our board of directors has also instructed our corporate secretary, prior to forwarding any correspondence, to review such correspondence and, in his or her discretion, not to forward certain items if they are deemed of a personal, illegal, commercial, offensive or frivolous nature or otherwise inappropriate for our board’s consideration.

9

EXECUTIVE OFFICERS

Set forth below are the names and certain information about our current executive officers.

| Name |

Age | Position(s) | ||

| H. Clark Hickock |

53 | Chief Executive Officer and Director | ||

| Patrick Gray |

48 | Chief Financial Officer and Secretary | ||

| Stephen Sek |

42 | Chief Technology Officer |

H. Clark Hickock was appointed as our chief executive officer on March 13, 2008. Previously, since April 2005, Mr. Hickock was our chief operating officer. Please see his biography under “PROPOSAL 1—ELECTION OF DIRECTORS—Director Nominees,” above.

Patrick Gray joined us in March 2004 as vice president, controller. In 2005, he was promoted to senior vice president, corporate controller and in February 2007, he was named chief financial officer. From 1996 to 2004, Mr. Gray served in various finance and accounting positions at REMEC, Inc., a San Diego based designer and manufacturer of telecom equipment for the worldwide mobile communications market, including vice president, corporate controller and vice president, controller of global operations. At REMEC, Mr. Gray was responsible for the financial management of all domestic and international entities including China, Costa Rica, Mexico and the Philippines. He also participated in over twenty merger and acquisition transactions and multiple financings. Gray holds an M.B.A. from Pepperdine University and a B.S. in business administration with a concentration in accounting from California State University, Northridge.

Stephen Sek joined us in November 2006 as chief technology officer. Mr. Sek most recently served as the director of technology and standards at Novatel Wireless, a San Diego-based provider of wireless broadband access solutions for the worldwide mobile communications market. He was responsible for leading the office of the CTO, the patent committee, the company’s technology realization, and product introduction in all technologies to customers. At Novatel Wireless from August 2000 through October 2006, Mr. Sek also served as director, systems, test and accreditation engineering, general manager of Asia Pacific, and director of customer technical solutions and technologies. Responsibilities included heading the company-wide systems engineering, regulatory and industrial product accreditation, carriers’ product certification and releases for all technologies in all products and form factors. Mr. Sek holds a B.S. from Boston University and a M.S. in electrical engineering from the University of Southern California.

10

EXECUTIVE COMPENSATION AND OTHER INFORMATION

COMPENSATION DISCUSSION AND ANALYSIS

General Philosophy. We compensate our executive officers through a mix of base salary, bonus and equity compensation. Our compensation policies are designed to be competitive with comparable employers and to align management’s incentives with both near term and long-term interests of our stockholders.

Prior to 2007, we used informal methods for benchmarking our executive compensation, based on the experience of our directors or, in some cases, third party studies of industry practices. Our executive employment agreements were negotiated on a case by case basis, with attention being given to the amount of compensation necessary to make a competitive offer to the executive officer and to provide relative equity in compensation among our executive officers.

In February 2007, the compensation committee of our board of directors retained an independent consultant, Towers Perrin, to advise us with respect to benchmarking our current compensation package against comparable competitors, the allocation of compensation among base, bonus and equity compensation and the establishment of appropriate standards for performance based compensation. We worked with Towers Perrin during 2007 on the implementation of compensation policies based on the information derived from that benchmarking. In connection with that work, we established a peer group of similarly situated companies. Since that time we have measured our compensation against that peer group, initially targeting compensation to our executive officers to be at the median range of the group.

Board Process. The compensation committee has been delegated the authority by our board of directors to approve all compensation and awards to executive officers. The compensation committee generally meets at least quarterly to review issues related to performance and compensation for new and existing officers. The compensation committee reviews the performance and compensation of our executive officers following discussions with those individuals. The compensation committee has the authority to retain independent consulting services to assist it in benchmarking our compensation levels against the marketplace and in developing our base and performance compensation targets in accordance with our general compensation philosophy and goals. With respect to equity compensation awarded to the executive officers and others, the compensation committee acts as the administrator under our 2004 Equity Incentive Plan and has the authority under that plan to grant restricted stock or stock options. Generally, equity grants are based upon the recommendation of our chief executive officer, with the compensation committee retaining ultimate authority to accept, reject or modify such recommendation.

Base Salaries. We want to provide our executive management with a level of assured cash compensation in the form of base salary that facilitates an appropriate lifestyle given their professional status and accomplishments.

In 2006, we had established base salaries for our executive officers as follows: chief executive officer $350,000, chief operating officer $250,000, chief financial officer $190,000, vice president sales $250,000, and chief technology officer $200,000. These ranges were not objectively determined, but instead reflected levels that were individually negotiated or that we concluded were appropriate based upon our general experience.

For 2007, with the assistance of our compensation consultant, we reviewed the compensation of our executive officers against our peer group and determined to make certain adjustments in line with our median benchmarking, including the following increases in base salary: chief executive officer compensation to $375,000, chief operating officer $260,000, and chief financial officer $218,000. In November 2007, our chief executive officer resigned. Our founder, Mike Kwon, was re-appointed as our chief executive officer on an interim basis at base salary at $200,000 per annum. The amount of base compensation was specially negotiated and predicated upon the fact that Mr. Kwon was taking the position on an interim basis.

11

During 2008, Mike Kwon stepped down as our interim chief executive officer and Clark Hickock was promoted from chief operating officer to chief executive officer. In connection with that appointment Mr. Hickock’s base salary was set at $330,000, an increase over his base salary as chief operating officer, but less than the amounts paid to similarly situated executives in the peer group. Also during 2008, we made minor increases in base salaries for other executive officers, including chief financial officer $225,000, and chief technology officer $206,000.

For 2009, the our compensation committee again reviewed the compensation of our executive officers against our peer group and a 2008 Radford Survey. The compensation committee then approved the following changes in base salaries for executive officers for 2009: chief executive officer compensation to $350,000, chief financial officer $250,000, and chief technology officer $212,000. The base compensation for our chief executive officer and chief financial officer at these levels remains approximately 5 to 10% below the median range for both the peer group and 2008 Radford study; however, the committee determined that our current financial position did not support increases to the median level.

Incentive Compensation. Our practice is to award cash bonuses based upon the achievement of specified performance objectives. We maintain an Executive Bonus Plan which provides our certain executive officers and non-executive officers the ability to earn cash bonuses based on the achievement of performance targets. The size of the bonus payment and the performance targets for the Executive Bonus Plan are set annually by the compensation committee, based on management recommendations and a review of our peer group. For the past two years, the amount of the target cash bonus for each executive has been set to 70% of base salary for the chief executive officer, and up to 45% of base salary for other executive and non-executive officers.

For 2007, the performance targets were based on achieving revenue and operating income targets. The performance targets were established on a “dual trigger” basis where both the minimum revenue and minimum operating income target must be met for any bonus to be payable. One-half of the incentive compensation was payable in connection with the revenue target and the other half was payable on attaining the operating income target. The revenue target for 2007 was $135 million, with a portion of the revenue bonus payable on achievement of 80% of that target, or $108 million in revenues. The operating income target was to have positive operating income (after giving effect to any bonus payment). Neither the revenue target nor the operating income target was reached for 2007, and no bonuses were paid under the Executive Bonus Plan in 2007.

For 2008, the performance targets were based on achieving revenue and operating income targets. Again, the performance targets were established on a “dual trigger” basis where both the minimum revenue and minimum operating income target must be met for any bonus to be payable. One-half of the incentive compensation was payable in connection with the revenue target and the other half was payable on attaining the operating income target. The revenue target for 2008 was $100 million, with a portion of the revenue bonus payable on achievement of 80% of that target, or $80 million in revenues. The operating income target was to have positive operating income (after giving effect to any bonus payment). Both targets were met for 2008 and an aggregate of $506,000 was paid out in bonuses under the Executive Bonus Plan in 2008.

In setting the performance targets for 2009, our compensation committee has added additional performance objectives tied to diversifying our customer base. The performance targets and their respective weighting include (i) achieving revenue target weighted at 40% of incentive compensation, (ii) achieving operating income target weighted at 40% of incentive compensation, and (iii) achieving new customer targets weighted at 20% of incentive compensation.

Equity Compensation. The primary form of equity compensation we have awarded has been stock options. For the past three years, option grants have been administered and awarded by the compensation committee under our 2004 Equity Incentive Plan. Options are usually granted and priced on the date that the compensation committee meets; however if we have not yet released operating results for the prior quarter, granting and pricing is established as of the third business day following our earnings release. This timing is intended to ensure that

12

current information is available and reflected in the market price for our common stock. We expect to continue to use equity compensation, including stock option grants, as part of our overall compensation plan.

Our historical practice has been to grant executive officers stock options in connection with their initial hiring. The amount of these options was determined on the basis of one on one negotiations with the executive officers. In 2006, we granted additional options to some of our executive officers. In making that award we considered the pricing of their vested options, and the economic incentive represented by those options. We did not authorize any new equity grants to executive officers in 2007.

In March 2008, in connection with its annual compensation review, the compensation committee elected to allocate 700,000 options among all employees of the company, including 375,000 options to executive management. The total number of options granted was equal to approximately 3% of the outstanding shares of the company. The committee’s philosophy is to maintain total compensation for executive officers, including equity compensation, in line with the median range for our peer group. Because of the fair market value at the time of the grants, the dollar value of the options to executive officers in 2008 was less than the committee would have allocated as a part of a total compensation package. However, the committee determined that it did not want to grant more than 700,000 options in connection with the annual grant, anticipating that it may provide similar grants over the next few years, depending upon market circumstances.

In connection with the compensation committee’s review of executive compensation for 2009, the Committee granted an additional 750,000 options among all employees of the company in March 2009, including 375,000 options to executive management. The total number of options granted was again equal to approximately 3% of the outstanding shares of the Company.

Severance Benefits. We are generally an at will employer, but have negotiated severance benefits with certain of our executive officers on a case by case basis in connection with their employment agreements. Specific severance benefits granted to our named executive officers are discussed, in connection with their employment agreements below.

Retirement Plans. We have never maintained a defined benefit pension plan. We do maintain a 401(k) plan. We have the right to make contributions to the 401(k) plan, but we have not done so to date, and we have no immediate intention of making contributions.

Perquisites and Other Benefits. The primary perquisite provided to our executive officers is an automobile allowance. Our founder and honorary chairman, Mr. Mike Kwon, was provided with an interest in life insurance policies insuring Mr. Kwon that have been purchased and maintained by the company. The amounts of these benefits are included in the Summary Compensation Table. In addition, our executive officers participate in our other benefit plans, including medical, dental and long term disability insurance, on the same terms as other employees.

13

COMPENSATION COMMITTEE REPORT*

The compensation committee of the board of directors is comprised of independent non-employee directors and operates pursuant to a written charter. A copy of the charter can be viewed by visiting Axesstel’s website at www.axesstel.com and clicking on “Investors/Public Relations” and then on “Corporate Governance.” The compensation committee is responsible for setting and overseeing the administration of the policies governing annual compensation of Axesstel’s executive officers. The compensation committee reviews the performance and compensation levels for executive officers, including the chief executive officer, and sets salary levels.

The compensation committee has reviewed and discussed with Axesstel’s management the “Compensation Discussion and Analysis” included in this proxy statement. Based upon that review and analysis, the compensation committee recommended to the board of directors that the “Compensation Discussion and Analysis” be included in this proxy statement.

Submitted by the compensation committee,

COMPENSATION COMMITTEE

Jai Bhagat, (Chair)

Richard M. Gozia

Osmo Hautanen

| * | The material in this report is not "soliciting material," is not deemed filed with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act or the Exchange Act whether made before or after the date of this proxy statement and irrespective of any general incorporation language therein. |

14

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION

The following table sets forth all compensation awarded to, earned by, or paid to our named executive officers during the fiscal years ended December 31, 2008, 2007 and 2006. Individuals we refer to as our “named executive officers” include our chief executive officer (and any individual serving in that capacity during the last fiscal year), our chief financial officer and the three other most highly compensated executive officers whose salary and bonus for services rendered in all capacities exceeded $100,000 during the fiscal year ended December 31, 2008.

Summary Compensation Table

| Name and Principal Position |

Year | Salary ($) | Bonus ($) |

Stock Awards (4) ($) |

Option Awards (5) ($) |

Non-Equity Incentive Plan Compensation (6) ($) |

All Other Compensation (7) ($) |

Total ($) | ||||||||

| H. Clark Hickock (1) |

2008 | 317,192 | — | — | 50,000 | 275,317 | 24,820 | 667,329 | ||||||||

| Chief Executive Officer |

2007 | 255,833 | — | 15,500 | 30,100 | — | 12,000 | 313,433 | ||||||||

| 2006 | 250,000 | — | 11,500 | 2,201 | 45,461 | 12,000 | 321,162 | |||||||||

| Patrick Gray |

2008 | 224,813 | — | — | 25,000 | 120,428 | 12,000 | 382,241 | ||||||||

| Chief Financial Officer |

2007 | 206,329 | — | — | 30,100 | — | 12,000 | 248,429 | ||||||||

| 2006 | 190,000 | — | — | 2,201 | 34,551 | 12,000 | 238,752 | |||||||||

| Stephen Sek (2) |

2008 | 206,250 | — | — | 18,750 | 110,484 | 12,000 | 347,484 | ||||||||

| Chief Technology Officer |

2007 | 200,000 | — | — | 82,500 | — | 12,000 | 294,500 | ||||||||

| 2006 | 39,487 | — | — | 12,120 | — | 3,000 | 54,607 | |||||||||

| Mike H.P. Kwon (3) |

2008 | 111,057 | — | — | — | — | 306,000 | 417,057 | ||||||||

| Former Chief Executive Officer |

2007 | 334,358 | — | — | — | — | 13,410 | 347,768 | ||||||||

| 2006 | 312,760 | — | — | — | — | 574,050 | 886,810 | |||||||||

| (1) | Mr. Hickock was appointed as our chief executive officer on March 13, 2008. Previously, he was our chief operating officer, a position he held since April 2005. |

| (2) | Mr. Sek commenced employment in October 2006. |

| (3) | Mr. Kwon served as our chief executive officer from November 20, 2007 to March 13, 2008. Mr. Kwon previously held the same office during our 2006 fiscal year until May 16, 2006. |

| (4) | Stock award valued at the fair value of the stock at the closing market price on the day of grant per SFAS 123R. There can be no assurance that the SFAS 123R amounts will ever be realized. |

| (5) | Stock options awards valued based on the estimated fair value on the date of grant using the Black-Scholes option valuation model per SFAS 123R. There can be no assurance that the FAS 123R amounts will ever be realized. |

| (6) | Non-equity incentive plan compensation payment per the Executive Bonus Plan. |

| (7) | Amounts in this column include the following: (i) for Mr. Hickock, with respect to 2008, an automobile allowance of $16,750 and life insurance premium payments of $8,070; and, with respect to 2007 and 2006, automobile allowance of $12,000; (ii) for Mr. Gray, automobile allowance of $12,000; (iii) for Mr. Sek, automobile allowance of $12,000 and $3,000; and (iv) for Mr. Kwon, with respect to 2008, consulting fees earned from April to December after serving as our chief executive officer of $306,000; and, with respect to 2007, an automobile allowance of $13,410; and, with respect to 2006, a payment in the amount of $540,000 under the terms of his separation and general release agreement, an automobile allowance of $17,880, and life insurance premium payments of $16,170. |

15

GRANTS OF PLAN BASED AWARDS

The following table sets forth certain information with respect to grants of plan based awards to our named executives during the fiscal year ended December 31, 2008.

Grants of Plan-Based Awards Table

| Name |

Grant Date(2) |

Estimated Future Payouts Under Non-Equity Incentive Plan Awards (1) |

All Other Stock Awards: Number of Shares of Stocks or Units (#) |

All Other Option Awards: Number of Securities Underlying Options (#)(2) |

Exercise or Base Price of Option Awards ($/Sh) |

Grant Date Fair Value of Stock and Option Awards | ||||||||||||

| Threshold ($) |

Target ($) |

Maximum ($) |

||||||||||||||||

| H. Clark Hickock |

3/18/2008 | 184,800 | 231,000 | 346,500 | — | 200,000 | $ | 0.34 | $ | 50,000 | ||||||||

| Patrick Gray |

3/18/2008 | 80,000 | 100,000 | 150,000 | — | 100,000 | 0.34 | 25,000 | ||||||||||

| Stephen Sek |

3/18/2008 | 72,000 | 90,000 | 135,000 | — | 75,000 | 0.34 | 18,750 | ||||||||||

| Mike H.P. Kwon |

— | — | — | — | — | — | — | — | ||||||||||

| (1) | Consists of bonus awards granted under the Company’s 2008 Executive Bonus Plan. |

| (2) | Consists of stock option awards granted under the Company’s 2004 Equity Incentive Plan. |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END.

The following table sets forth certain information with respect to outstanding equity awards held by each of our named executive officers at fiscal year end December 31, 2008.

Outstanding Equity Awards At Fiscal Year-End Table

| Option Awards | Stock Awards | |||||||||||||||||||||

| Name |

Number of Securities Underlying Unexercised Options (#) |

Number of Securities Underlying Unexercised Options (#) |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units of Stock That Have Not Vested ($) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |||||||||||||

| Exercisable | Unexercisable | |||||||||||||||||||||

| H. Clark Hickock |

270,000 | — | — | $ | 3.35 | 4/28/2015 | — | $ | — | $ | — | $ | — | |||||||||

| 46,667 | 23,333 | — | $ | 1.99 | 11/13/2016 | — | $ | — | $ | — | $ | — | ||||||||||

| — | 200,000 | — | $ | 0.34 | 3/18/2018 | — | $ | — | $ | — | $ | — | ||||||||||

| Patrick Gray |

50,000 | — | — | $ | 2.25 | 3/15/2014 | — | $ | — | $ | — | $ | — | |||||||||

| 50,000 | — | — | $ | 3.25 | 12/31/2014 | — | $ | — | $ | — | $ | — | ||||||||||

| 46,667 | 23,333 | — | $ | 1.99 | 11/13/2016 | — | $ | — | $ | — | $ | — | ||||||||||

| — | 100,000 | — | $ | 0.34 | 3/18/2018 | — | $ | — | $ | — | $ | — | ||||||||||

| Stephen Sek |

150,000 | 75,000 | — | $ | 1.70 | 10/20/2016 | — | $ | — | $ | — | $ | — | |||||||||

| — | 75,000 | — | $ | 0.34 | 3/18/2018 | — | $ | — | $ | — | $ | — | ||||||||||

| Mike H.P. Kwon |

65,974 | — | — | $ | 0.07 | 5/1/2012 | — | $ | — | $ | — | $ | — | |||||||||

| 104,500 | — | — | $ | 0.60 | 9/16/2012 | — | $ | — | $ | — | $ | — | ||||||||||

16

DIRECTOR COMPENSATION

Cash. Each of our non-employee directors is compensated $7,500 per calendar quarter for their service on our board of directors. Any non-employee director serving as chairman of our board of directors is paid an additional $3,750 per calendar quarter. Non-employee directors are also compensated for service on board committees at that rate of $1,250 per calendar quarter ($1,875 per calendar quarter in the case of the audit committee). In addition, any director serving as chair of a board committee is paid an additional $1,250 per calendar quarter ($1,875 per calendar quarter in the case of the audit committee chair). It is also our policy to reimburse our directors for their reasonable out-of-pocket expenditures.

Equity. Prior to 2007, we had a policy of granting directors 45,000 shares of restricted stock when they joined our board of directors, with one-third of such shares vesting immediately and then annually on the director’s first and second anniversary of service. This compensation policy was consistent with our board structure at the time, which provided for a classified board with members serving for three year terms. In 2007, we eliminated the classified board and determined to review equity compensation for directors on an annual basis. In 2008, we determined to award outside directors with stock options that would have a value equal to approximately $20,000. In June 2008 following our 2008 Annual Meeting of Stockholders we awarded each outside director options to purchase 25,000 shares of our common stock at an exercise price of $0.81 per share. The options vest over the director’s one year term, on the basis of one–twelfth of the options monthly, and become fully vested on the earlier of (i) one year from the date of grant or (ii) the date of the 2009 Annual Meeting of Stockholders.

2008 DIRECTOR COMPENSATION TABLE

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) |

Option Awards ($) (2) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) | |||||||

| Bryan Min (1) |

67,500 | — | 15,250 | — | — | — | 82,750 | |||||||

| Jai Bhagat |

52,500 | — | 15,250 | — | — | — | 67,750 | |||||||

| Osmo A. Hautanen |

52,500 | — | 15,250 | — | — | — | 67,750 | |||||||

| Seung Taik Yang |

35,000 | — | 15,250 | — | — | — | 50,250 |

| (1) | Mr. Min served as chairman of our board of directors until his resignation on December 31, 2008. |

| (2) | Stock option awards valued at the fair value of the stock award at the closing market price on the day of grant per SFAS 123R. There can be no assurance that the SFAS 123R amounts will ever be realized. |

17

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTS

EMPLOYMENT CONTRACTS

H. Clark Hickock

We entered into a letter agreement dated April 27, 2005 with Mr. H. Clark Hickock pursuant to which Mr. Hickock joined us as an employee in April 2005, and assumed full duties as our chief operating officer in May 2005. The agreement provided for a base salary of $250,000 and the grant of options to purchase 270,000 shares of our common stock and a restricted stock award of 30,000 shares of our common stock of which 10,000 shares were granted on each of May 23, 2005, May 23, 2006 and May 23, 2007.

On March 13, 2008, we appointed Mr. Hickock as our chief executive officer and entered into an employment agreement with him which superseded and replaced the letter agreement dated April 27, 2005. Under the terms of his new employment agreement, Mr. Hickock is entitled to receive (i) an annual base salary of $330,000 and (ii) a performance bonus opportunity targeted at $231,000 annually. The amount of the base salary and performance bonus opportunity is subject to increase in the discretion of the compensation committee of our board of directors. Mr. Hickock is eligible to participate in our employee benefit programs. Mr. Hickock also receives a car allowance of $1,500 per month and we agreed to pay all premiums on an existing $1 million life insurance policy owned by Mr. Hickock. In addition, if we terminate his employment without cause, we agreed to make a lump-sum payment equal to 12 months of Mr. Hickock’s annual base salary at the level in place at the time of termination (less appropriate employment tax withholdings) and accelerate the vesting of all stock options issued to Mr. Hickock that are outstanding as of March 13, 2008. No severance benefit will be paid if Mr. Hickock resigns or if his employment is terminated for cause.

Patrick Gray

We entered into a letter agreement, dated as of February 11, 2004, with Mr. Patrick Gray under which he was initially employed as vice president, controller. The letter agreement originally provided for a base salary of $130,000 and the grant of an option to purchase 50,000 shares of our common stock. In December 2004, the compensation committee of our board of directors voted to increase Mr. Gray’s annual base salary to $165,000 as of December 31, 2004, and the committee granted to Mr. Gray an additional option to purchase 50,000 shares of our common stock. In December 2005, Mr. Gray assumed the position of senior vice president finance and corporate controller, and the compensation committee approved an increase of Mr. Gray’s annual base salary to $190,000 and payment of a monthly vehicle allowance of $1,000. In February 2007, Mr. Gray was appointed as our chief financial officer and his base salary was increased to $218,000.

Stephen Sek

On October 20, 2006, we entered into an employment agreement with Mr. Stephen Sek pursuant to which he was appointed our chief technology officer and entitled to receive (i) an annual base salary of $200,000; (ii) a car allowance of $1,000 per month; and (iii) a performance bonus opportunity targeted at $60,000 annually. Mr. Sek was also granted, effective October 20, 2006, an option to purchase 225,000 shares of our common stock at an exercise price equal to $1.70, which vests as to one-third of the shares on the first anniversary of the grant and one-twelfth of the shares each quarter thereafter until the option is fully vested.

18

EQUITY COMPENSATION PLAN INFORMATION

The following table describes our equity compensation plans as of December 31, 2008:

| Plan Category |

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) |

Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (b) |

Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (excluding securities referenced in column (a)) (c) | |||||

| Equity compensation plans approved by our stockholders (1) |

2,075,500 | $ | 1.66 | 2,634,953 | ||||

| Equity compensation plans not approved by our stockholders |

925,332 | (2) | $ | 2.23 | — | |||

| (1) | Equity compensation plans approved by our stockholders consists of our 2004 Equity Incentive Plan. |

| (2) | Includes (i) options to purchase 666,057 shares of common stock granted pursuant to our stock option plans established by our board of directors in September 2002, March 2003 and September 2003 with a weighted average exercise price of $2.10 per share; (ii) 193,301 shares of common stock subject to warrants issued to various consultants for services and various equity financings with a weighted average exercise price of $3.41 per share; and (iii) 65,974 shares of common stock subject to a warrant issued to our former director and chief executive officer, Mike H.P. Kwon, with an exercise price of $0.07 per share in 2002. |

19

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information concerning the beneficial ownership of the shares of our common stock as of March 31, 2009 by:

| • | each person we know to be the beneficial owner of 5% or more of the outstanding shares of our common stock; |

| • | each of our named executive officers; |

| • | each of our directors; and |

| • | all of our current executive officers and directors as a group. |

Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power over securities. Except in cases where community property laws apply or as indicated in the footnotes to this table, we believe that each stockholder identified in the table possesses sole voting and investment power over all shares of common stock shown as beneficially owned by the stockholder.

The percentage of beneficial ownership is based on 23,228,982 shares outstanding on March 31, 2009. Shares of common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of March 31, 2009 are considered outstanding and beneficially owned by the person holding the options for the purpose of computing the percentage ownership of that person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

| Name and Address:(1) |

Number of Shares Beneficially Owned |

Percent of Class |

|||

| Directors and Executive Officers: |

|||||

| H. Clark Hickock (2) |

520,000 | 2.2 | % | ||

| Patrick Gray (3) |

291,666 | 1.3 | % | ||

| Stephen Sek (4) |

223,300 | * | |||

| Jai Bhagat (5) |

102,917 | * | |||

| Seung Taik Yang (6) |

92,917 | * | |||

| Osmo A. Hautanen (7) |

73,917 | * | |||

| Richard M. Gozia (8) |

32,000 | * | |||

| All current executive officers and directors as a group (7 persons) |

1,336,717 | 5.5 | % | ||

| 5% or Greater Stockholders: |

|||||

| Mike H.P. Kwon(9) |

2,272,885 | 9.7 | % | ||

| Potomac Capital Management LLC (10) |

1,570,626 | 6.7 | % | ||

| 825 Third Avenue, 33rd Floor |

|||||

| New York, NY 10022 |

|||||

| Entities affiliated with ComVentures (11) |

3,817,105 | 16.4 | % | ||

| 305 Lytton Avenue |

|||||

| Palo Alto, CA 94301 |

| * | Less than one percent |

| (1) | Except as otherwise indicated, the address for each beneficial owner is 6815 Flanders Drive, Suite 210, San Diego, California 92121. |

| (2) | Includes 395,000 shares of common stock issuable upon exercise of options. Mr. Hickock is our chief executive officer. |

| (3) | Includes 191,666 shares of common stock issuable upon exercise of options. Mr. Gray is our chief financial officer. |

| (4) | Includes 212,500 shares of common stock issuable upon exercise of options. Mr. Sek is our chief technology officer. |

20

| (5) | Includes 37,917 shares of common stock issuable upon exercise of options. Mr. Bhagat is a director. |

| (6) | Includes 37,917 shares of common stock issuable upon exercise of options. Dr. Yang is a director. |

| (7) | Includes 22,917 shares of common stock issuable upon exercise of options. Mr. Hautanen is a director. |

| (8) | Includes 22,000 shares of common stock issuable upon exercise of options. Mr. Gozia is a director. |

| (9) | Includes 170,474 shares of common stock issuable upon exercise of options and warrants. |

| (10) | Based solely upon Schedule 13G filing made with the SEC by Potomac Capital Management on March 2, 2009. |

| (11) | Includes 3,580,468 shares held by ComVentures V, L.P.; 221,987 shares held by ComVentures V-B CEO Fund, L.P.; and 14,650 shares held by ComVentures V Entrepreneurs’ Fund, L.P. ComVen V, LLC is the general partner of each of the foregoing entities. |

21

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

REVIEW, APPROVAL OR RATIFICATION OF TRANSACTIONS WITH RELATED PERSONS

Our board of directors has approved a written policy for the review, approval or ratification of all related party transactions with a value above $120,000, including loans between us and our officers, directors and principal stockholders and their affiliates. Under the charter of the nominating and governance committee of our board of directors, that committee is responsible for considering conflicts of interest of board members and senior management, and, to the extent a conflict constitutes a related party transaction, the committee refers the matter to the audit committee for review and recommendation of what action is to be taken, if any, by our board of directors. All related party transactions are to be on terms no less favorable to us than those that we could obtain from unaffiliated third parties. We believe that all of the transactions described below were reviewed and approved under the foregoing policies and procedures.

TRANSACTIONS WITH RELATED PERSONS

Except as discussed below or for compensation reflected in the Summary Compensation table above, we had no related party transactions within the meaning of applicable SEC rules for the year ended December 31, 2008.

On May 16, 2006, Mr. Kwon loaned us $346,950 pursuant to the terms of a promissory note. At the time of the loan, Mr. Kwon was a director and 10% stockholder of the company. The principal balance under the note bore interest at a rate of prime plus one percent. All amounts outstanding under the note were due and payable on the earlier of the date Mr. Kwon’s employment with us was terminated or May 15, 2008. On November 20, 2007, Mr. Kwon’s employment was terminated, but Mr. Kwon agreed to extend receipt of $270,000 then due from us until the first quarter of 2008. The promissory note was paid in full in March 2008.

AGREEMENTS WITH OFFICERS AND DIRECTORS

We have entered into an indemnification agreement with each of our directors and officers. The indemnification agreements and our certificate of incorporation and bylaws require us to indemnify our directors and officers to the fullest extent permitted by Nevada law.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors, and persons who own more than ten percent of a registered class of our securities, to file with the SEC reports of ownership of our securities and changes in reported ownership. Officers, directors and greater than ten percent stockholders are required by SEC rules to furnish us with copies of all Section 16(a) reports they file.

Based solely on a review of the reports furnished to us, or written representations from reporting persons that all reportable transaction were reported, we believe that during the fiscal year ended December 31, 2008, our officers, directors and greater than ten percent stockholders timely filed all reports they were required to file under Section 16(a).

22

PRINCIPAL ACCOUNTANT AUDIT FEES AND SERVICES FEES

We have selected Gumbiner Savett, Inc. as our independent registered public accounting firm for 2009. The audit committee of our board of directors intends to meet with the auditor in June 2009 to discuss the terms of the audit engagement for fiscal 2009. Gumbiner Savett has been our principal accountant since September 2003 and was our principal accountant for the fiscal year ended December 31, 2008. Representatives from Gumbiner Savett have been invited to attend the annual meeting. If they attend, they will be provided the opportunity to make a statement if they desire to do so, and are expected to be available to answer appropriate questions.

For purposes of the tables below:

| Audit Fees |

include fees and expenses for professional services rendered for the audits of our annual financial statements for the applicable year and for the review of the financial statements included in our quarterly reports on Form 10-Q for the applicable year. | |

| Audit-Related Fees |

consist of fees billed for assurance and related services that are related to the performance of the audit or review of our financial statements and are not reported as audit fees. | |

| Tax Fees |

consist of preparation of our federal and state tax returns, review of quarterly estimated payments, and consultation concerning tax compliance issues. | |

| All Other Fees |

include any fees for services not covered above. Fees noted for both annual periods primarily represent fees associated with informal assessment of our internal controls and assisting us in the preparation or correspondence to the SEC and NYSE Amex. | |

The following table sets forth the aggregate fees billed for services from January 1, 2008 to December 31, 2008 by Gumbiner Savett:

| Audit Fees |

$ | 250,000 | |

| Audit Related Fees |

$ | — | |

| Tax Fees |

$ | — | |

| All Other Fees |

$ | 8,835 | |

| Total |

$ | 258,835 | |

The following table sets forth the aggregate fees billed for services from January 1, 2007 to December 31, 2007 by Gumbiner Savett:

| Audit Fees |

$ | 244,105 | |

| Audit Related Fees |

$ | — | |

| Tax Fees |

$ | — | |

| All Other Fees |

$ | 5,275 | |

| Total |

$ | 249,380 | |

23

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

The policy of the audit committee of our board of directors is to pre-approve all audit and permissible non-audit services provided by our independent auditors. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services. The independent auditor and management are required to periodically report to the audit committee regarding the extent of services provided by the independent auditor in accordance with this pre-approval. The chair of the audit committee is also authorized, pursuant to delegated authority, to pre-approve additional services of up to $25,000 per engagement on a case-by-case basis, and such approvals are communicated to the full audit committee at its next meeting.

24

AUDIT COMMITTEE REPORT*

The audit committee of the board of directors is comprised entirely of independent directors who meet the independence requirements of the NYSE Amex (formerly known as the American Stock Exchange) and the SEC. The audit committee oversees the financial reporting process of the Company on behalf of the board of directors. Management is responsible for the preparation, presentation and integrity of the financial statements, including establishing accounting and financial reporting principles and designing systems of internal control over financial reporting. The Company’s independent auditors are responsible for expressing an opinion as to the conformity of our consolidated financial statements with U.S. generally accepted accounting principles.

In performing its responsibilities, the audit committee has reviewed and discussed with the Company’s management and the independent auditors the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2008. The audit committee has also discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards 61, “Communications with Audit Committees.”

Pursuant to Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” the audit committee received the written disclosures and letter from the independent auditors, and discussed with the auditors their independence.

Based on the reviews and discussions referred to above, the audit committee recommended to the board of directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2008.

Submitted by the audit committee of the board of directors,

AUDIT COMMITTEE

Richard M. Gozia (Chair)

Jai Bhagat

Osmo Hautanen