PAGE 1 Q1 Fiscal Year 2026 Supplemental Slides Supplemental Information Related to Company’s Divestiture of its Feminine Care Business

PAGE 2 Forward-looking statements This presentation contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You should not place undue reliance on these statements. Forward-looking statements generally can be identified by the use of words or phrases such as "believe," "expect," "expectation," "anticipate," "may," "could," "intend," "belief," "estimate," "plan," "target," "predict," "likely," "will," "should," "forecast," "outlook," or other similar words or phrases. These statements are not based on historical facts, but instead reflect the Company's expectations, estimates or projections concerning future results or events, including, without limitation, the future earnings and performance of Edgewell or any of its businesses. Many factors outside our control could affect the realization of these estimates. These statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause the Company's actual results to differ materially from those indicated by those statements. The Company cannot assure you that any of its expectations, estimates or projections will be achieved. The forward-looking statements included in this document are only made as of the date of this document and the Company disclaims any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances, except as required by law. You should not place undue reliance on these statements. Factors that could cause fluctuations in our actual results include, but are not limited to, the following: our ability to compete in products and prices, as well as costs, in an intensely competitive industry; the loss of any of our principal customers or changes in the policies of our principal customers; our inability to design and execute a successful omnichannel strategy; our ability to attract, retain and develop key personnel; fluctuations in the price and supply of raw materials and costs of labor, warehousing and transportation; the impact of seasonal volatility on our sales, financial performance, working capital requirements and cash flow; the ability to successfully manage evolving global financial risks, including tariffs, foreign currency fluctuations, currency exchange or pricing controls and localized volatility; impacts from any loss of our principal customers or changes in the policies or strategies of our customers; our level of indebtedness and the various covenants related thereto, and to generate sufficient income and cash flow to allow the Company to effect the expected share repurchases and dividend payment; our failure to maintain our brands’ reputation and successfully respond to changing consumer habits; and perceptions of certain ingredients, negative perceptions of packaging, lack of recyclability or other environmental attributes; our access to capital markets and borrowing capacity; impairment of our goodwill and other intangible assets; the ability to successfully manage the financial, legal, reputational and operational risks associated with third-party relationships, such as our suppliers, contract manufacturers, distributors, contractors and external business partners; risks associated with our international operations; our ability to effectively integrate acquired companies and successfully manage divestiture activities; our ability to successfully implement our cost savings initiatives, including rationalization or restructuring efforts; the ability to rely on and maintain key Company and third-party information and operational technology systems, networks and services and maintain the security and functionality of such systems, networks and services and the data contained therein; the ability to successfully achieve, maintain or adjust our environmental or sustainability goals and priorities; the ability to successfully manage current and expanding regulatory and legal requirements and matters (including, without limitation, those laws and regulations involving product liability, product and packaging composition, manufacturing processes, intellectual property, labor and employment, antitrust, privacy, cybersecurity and data protection, artificial intelligence, tax, the environment, due diligence, risk oversight, accounting and financial reporting) and to resolve new and pending matters within current estimates; the ability to adequately protect our intellectual property rights; product quality and safety issues, including recalls and product liability; losses or increased funding and expenses related to our pension plans; and the other important factors described in our Annual Report on Form 10-K for the fiscal year ended September 30, 2025 (“2025 Annual Report”) under Part I. Item 1A. “Risk Factors,” and in our other filings with the Securities and Exchange Commission (“SEC”). In addition, other risks and uncertainties not presently known to the Company or that it presently considers immaterial could significantly affect the accuracy of any such forward-looking statements. Risks and uncertainties include those detailed from time to time in the Company's publicly filed documents, including in Item 1A. Risk Factors of Part I of the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on November 18, 2025. The recast financial results for periods in fiscal 2025 as presented herein, other than with respect to the first quarter of fiscal 2025, are preliminary and subject to change based on the completion of closing and review procedures and the execution of the Company’s internal control over financial reporting.

PAGE 3 Non-GAAP financial measures While the Company reports financial results in accordance with generally accepted accounting principles ("GAAP") in the U.S., this discussion also includes non-GAAP measures. These non-GAAP measures are referred to as "adjusted" or "organic" and exclude items which are considered by the Company as unusual or non-recurring and which may have a disproportionate positive or negative impact on the Company’s financial results in any particular period. Reconciliations of non-GAAP measures, including reconciliations of measures related to the Company's fiscal 2026 financial outlook, are included within the Notes to Condensed Consolidated Financial Statements included with this release. This non-GAAP information is provided as a supplement to, not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The Company uses this non-GAAP information internally to make operating decisions and believes it is helpful to investors because it allows more meaningful period-to-period comparisons of ongoing operating results. The information can also be used to perform analysis and to better identify operating trends that may otherwise be masked or distorted by the types of items that are excluded. This non-GAAP information is a component in determining management's incentive compensation. Finally, the Company believes this information provides a higher degree of transparency. These non-GAAP financial measures, however, have limitations as analytical tools, and should not be considered in isolation from, a substitute for, or superior to, the related financial information that the Company reports in accordance with GAAP. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. Investors are encouraged to review the definitions and reconciliations of these non-GAAP financial measures to their most comparable GAAP financial measures included in the footnotes and appendix of this presentation, and not to rely on any single financial measure to evaluate the Company’s businesses. The definitions, calculations and reconciliations of these non-GAAP measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP can be found in the Notes to Condensed Consolidated Financial Statements in the Company’s earnings release for the first quarter of the 2026 fiscal year which can be found on the Company’s Investor Relations website at http://ir.edgewell.com and Item 2 of the Company’s Quarterly Report on Form 10-Q filed with the SEC on February 9, 2026.

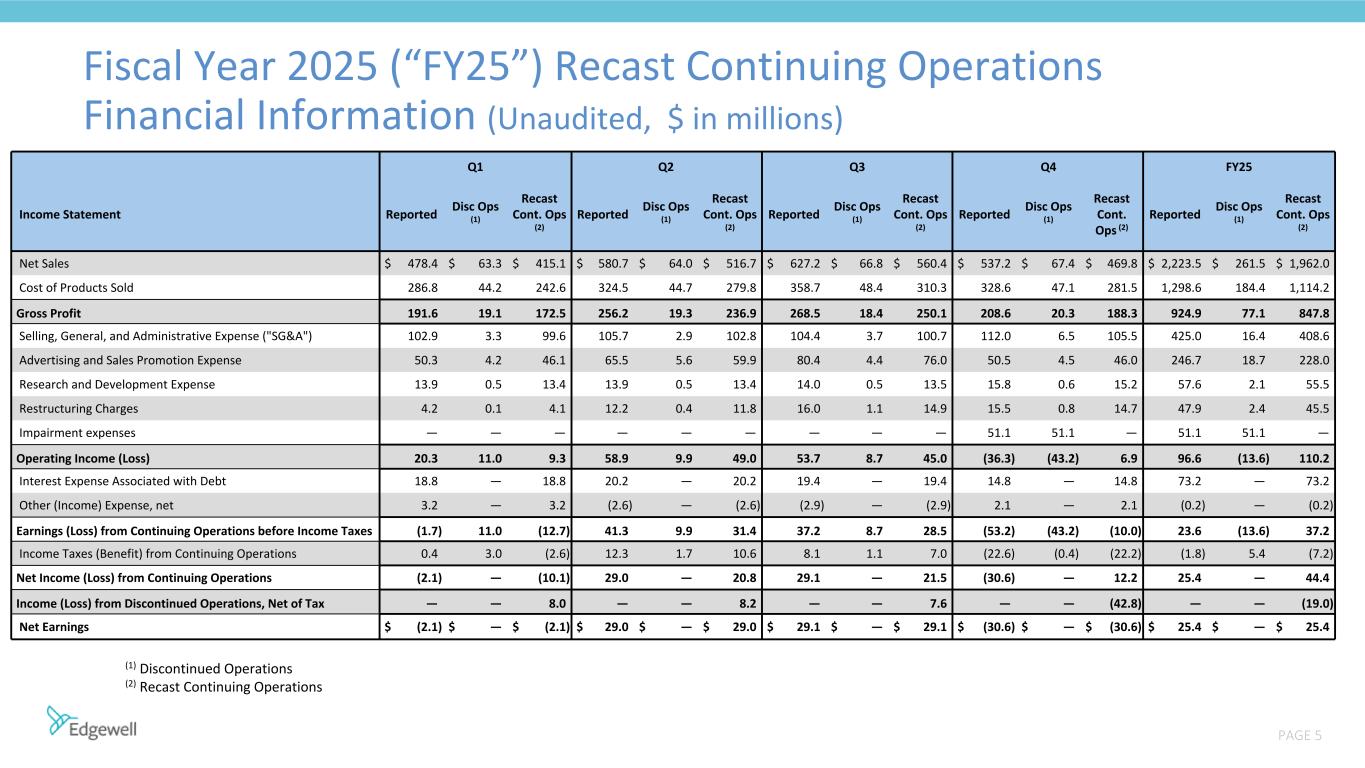

PAGE 4 Fiscal Year 2025 Recast Continuing Operations Financial Information (Unaudited)

PAGE 5 Fiscal Year 2025 (“FY25”) Recast Continuing Operations Financial Information (Unaudited, $ in millions) Q1 Q2 Q3 Q4 FY25 Income Statement Reported Disc Ops (1) Recast Cont. Ops (2) Reported Disc Ops (1) Recast Cont. Ops (2) Reported Disc Ops (1) Recast Cont. Ops (2) Reported Disc Ops (1) Recast Cont. Ops (2) Reported Disc Ops (1) Recast Cont. Ops (2) Net Sales $ 478.4 $ 63.3 $ 415.1 $ 580.7 $ 64.0 $ 516.7 $ 627.2 $ 66.8 $ 560.4 $ 537.2 $ 67.4 $ 469.8 $ 2,223.5 $ 261.5 $ 1,962.0 Cost of Products Sold 286.8 44.2 242.6 324.5 44.7 279.8 358.7 48.4 310.3 328.6 47.1 281.5 1,298.6 184.4 1,114.2 Gross Profit 191.6 19.1 172.5 256.2 19.3 236.9 268.5 18.4 250.1 208.6 20.3 188.3 924.9 77.1 847.8 Selling, General, and Administrative Expense ("SG&A") 102.9 3.3 99.6 105.7 2.9 102.8 104.4 3.7 100.7 112.0 6.5 105.5 425.0 16.4 408.6 Advertising and Sales Promotion Expense 50.3 4.2 46.1 65.5 5.6 59.9 80.4 4.4 76.0 50.5 4.5 46.0 246.7 18.7 228.0 Research and Development Expense 13.9 0.5 13.4 13.9 0.5 13.4 14.0 0.5 13.5 15.8 0.6 15.2 57.6 2.1 55.5 Restructuring Charges 4.2 0.1 4.1 12.2 0.4 11.8 16.0 1.1 14.9 15.5 0.8 14.7 47.9 2.4 45.5 Impairment expenses — — — — — — — — — 51.1 51.1 — 51.1 51.1 — Operating Income (Loss) 20.3 11.0 9.3 58.9 9.9 49.0 53.7 8.7 45.0 (36.3) (43.2) 6.9 96.6 (13.6) 110.2 Interest Expense Associated with Debt 18.8 — 18.8 20.2 — 20.2 19.4 — 19.4 14.8 — 14.8 73.2 — 73.2 Other (Income) Expense, net 3.2 — 3.2 (2.6) — (2.6) (2.9) — (2.9) 2.1 — 2.1 (0.2) — (0.2) Earnings (Loss) from Continuing Operations before Income Taxes (1.7) 11.0 (12.7) 41.3 9.9 31.4 37.2 8.7 28.5 (53.2) (43.2) (10.0) 23.6 (13.6) 37.2 Income Taxes (Benefit) from Continuing Operations 0.4 3.0 (2.6) 12.3 1.7 10.6 8.1 1.1 7.0 (22.6) (0.4) (22.2) (1.8) 5.4 (7.2) Net Income (Loss) from Continuing Operations (2.1) — (10.1) 29.0 — 20.8 29.1 — 21.5 (30.6) — 12.2 25.4 — 44.4 Income (Loss) from Discontinued Operations, Net of Tax — — 8.0 — — 8.2 — — 7.6 — — (42.8) — — (19.0) Net Earnings $ (2.1) $ — $ (2.1) $ 29.0 $ — $ 29.0 $ 29.1 $ — $ 29.1 $ (30.6) $ — $ (30.6) $ 25.4 $ — $ 25.4 (1) Discontinued Operations (2) Recast Continuing Operations

PAGE 6 Bumper slides Fiscal Year 2025 Recast Continuing Operations – Reconciliation Tables (Unaudited)

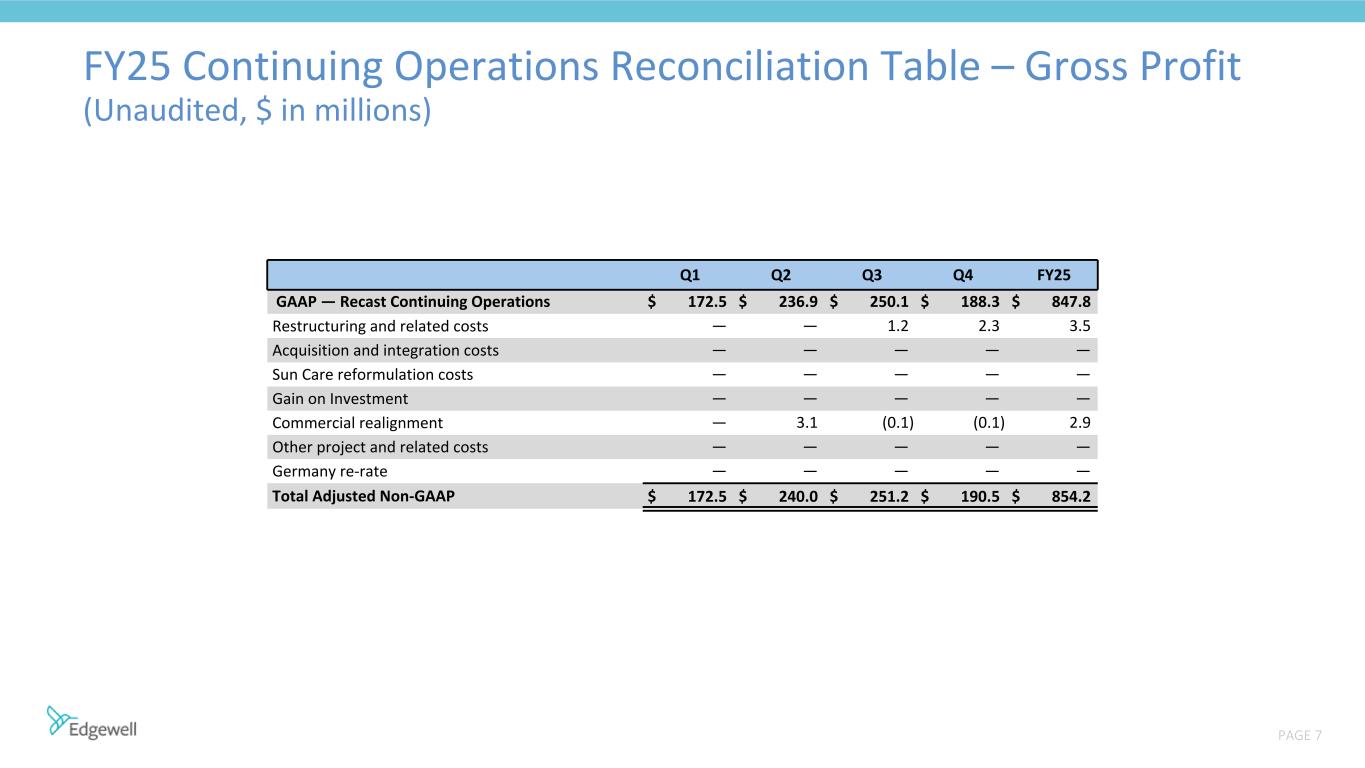

PAGE 7 FY25 Continuing Operations Reconciliation Table – Gross Profit (Unaudited, $ in millions) Q1 Q2 Q3 Q4 FY25 GAAP — Recast Continuing Operations $ 172.5 $ 236.9 $ 250.1 $ 188.3 $ 847.8 Restructuring and related costs — — 1.2 2.3 3.5 Acquisition and integration costs — — — — — Sun Care reformulation costs — — — — — Gain on Investment — — — — — Commercial realignment — 3.1 (0.1) (0.1) 2.9 Other project and related costs — — — — — Germany re-rate — — — — — Total Adjusted Non-GAAP $ 172.5 $ 240.0 $ 251.2 $ 190.5 $ 854.2

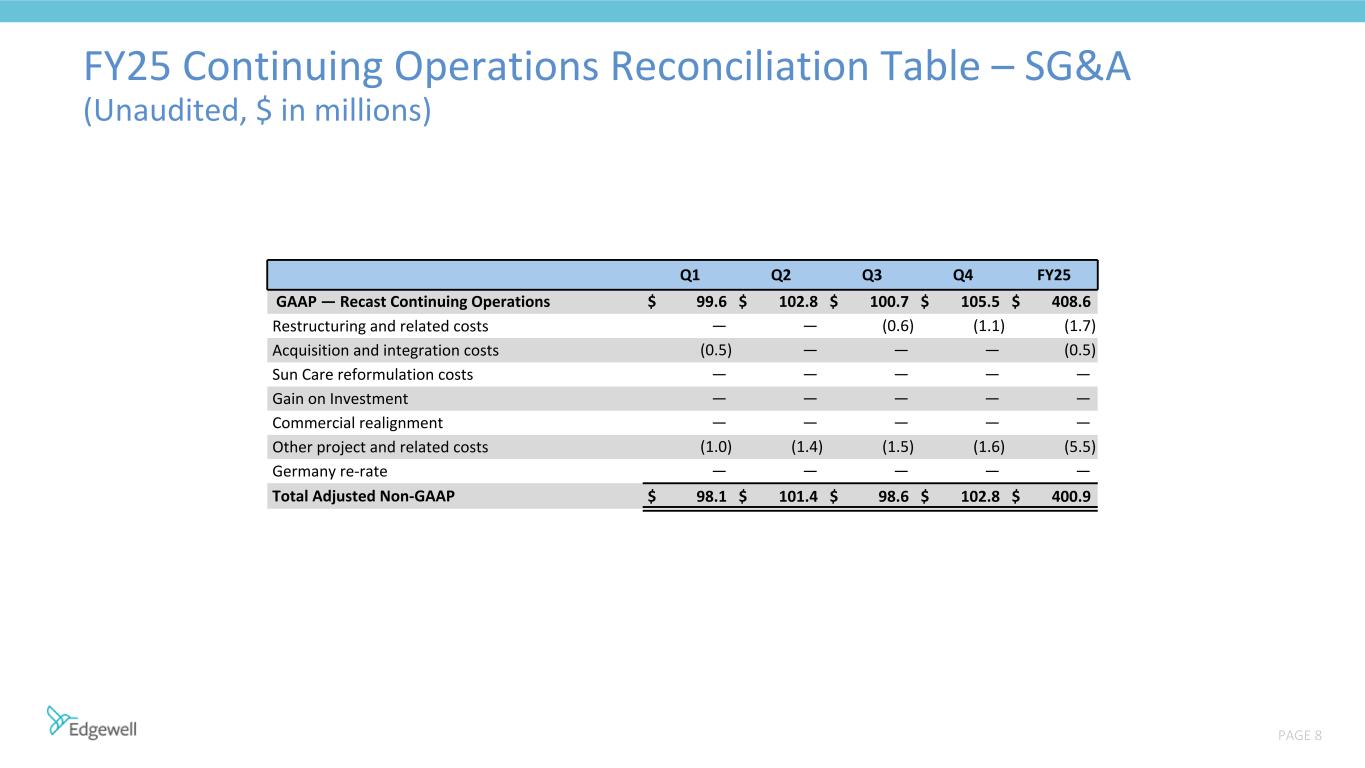

PAGE 8 FY25 Continuing Operations Reconciliation Table – SG&A (Unaudited, $ in millions) Q1 Q2 Q3 Q4 FY25 GAAP — Recast Continuing Operations $ 99.6 $ 102.8 $ 100.7 $ 105.5 $ 408.6 Restructuring and related costs — — (0.6) (1.1) (1.7) Acquisition and integration costs (0.5) — — — (0.5) Sun Care reformulation costs — — — — — Gain on Investment — — — — — Commercial realignment — — — — — Other project and related costs (1.0) (1.4) (1.5) (1.6) (5.5) Germany re-rate — — — — — Total Adjusted Non-GAAP $ 98.1 $ 101.4 $ 98.6 $ 102.8 $ 400.9

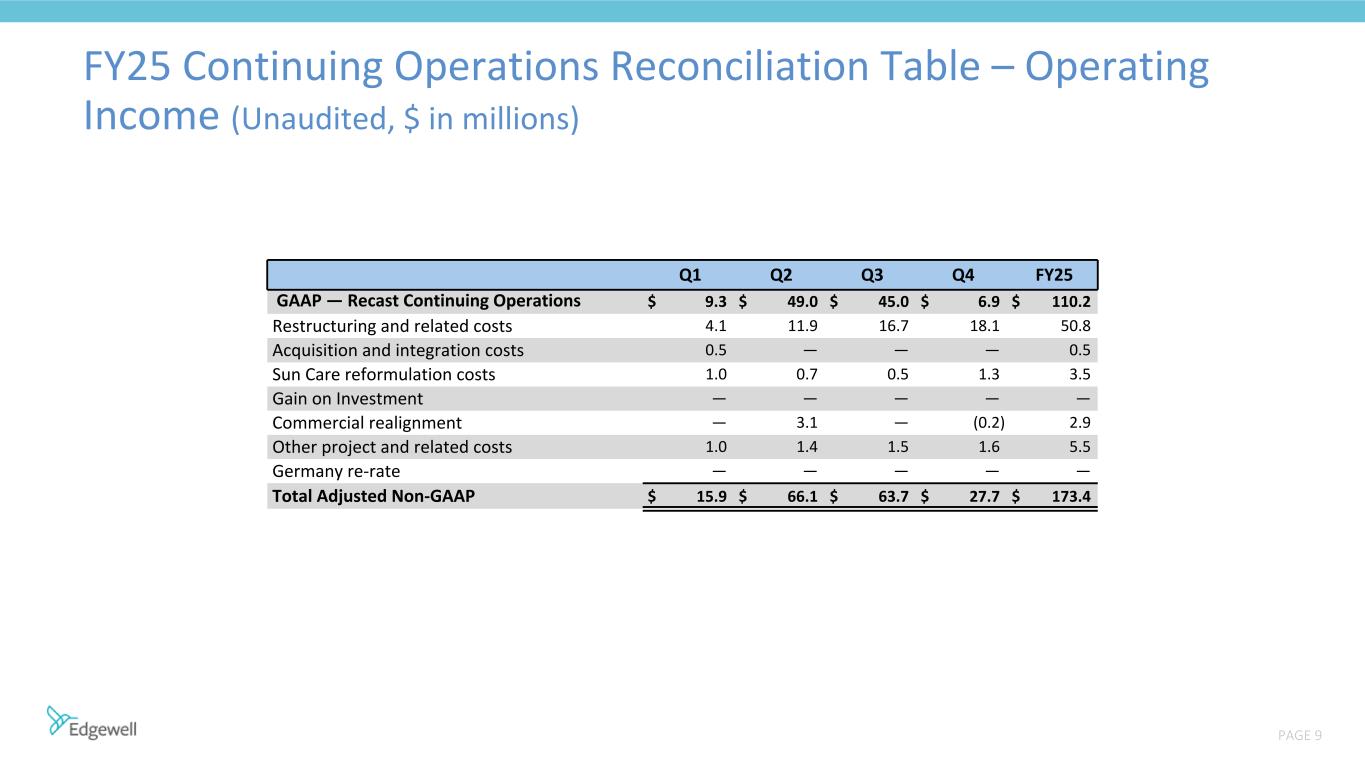

PAGE 9 FY25 Continuing Operations Reconciliation Table – Operating Income (Unaudited, $ in millions) Q1 Q2 Q3 Q4 FY25 GAAP — Recast Continuing Operations $ 9.3 $ 49.0 $ 45.0 $ 6.9 $ 110.2 Restructuring and related costs 4.1 11.9 16.7 18.1 50.8 Acquisition and integration costs 0.5 — — — 0.5 Sun Care reformulation costs 1.0 0.7 0.5 1.3 3.5 Gain on Investment — — — — — Commercial realignment — 3.1 — (0.2) 2.9 Other project and related costs 1.0 1.4 1.5 1.6 5.5 Germany re-rate — — — — — Total Adjusted Non-GAAP $ 15.9 $ 66.1 $ 63.7 $ 27.7 $ 173.4

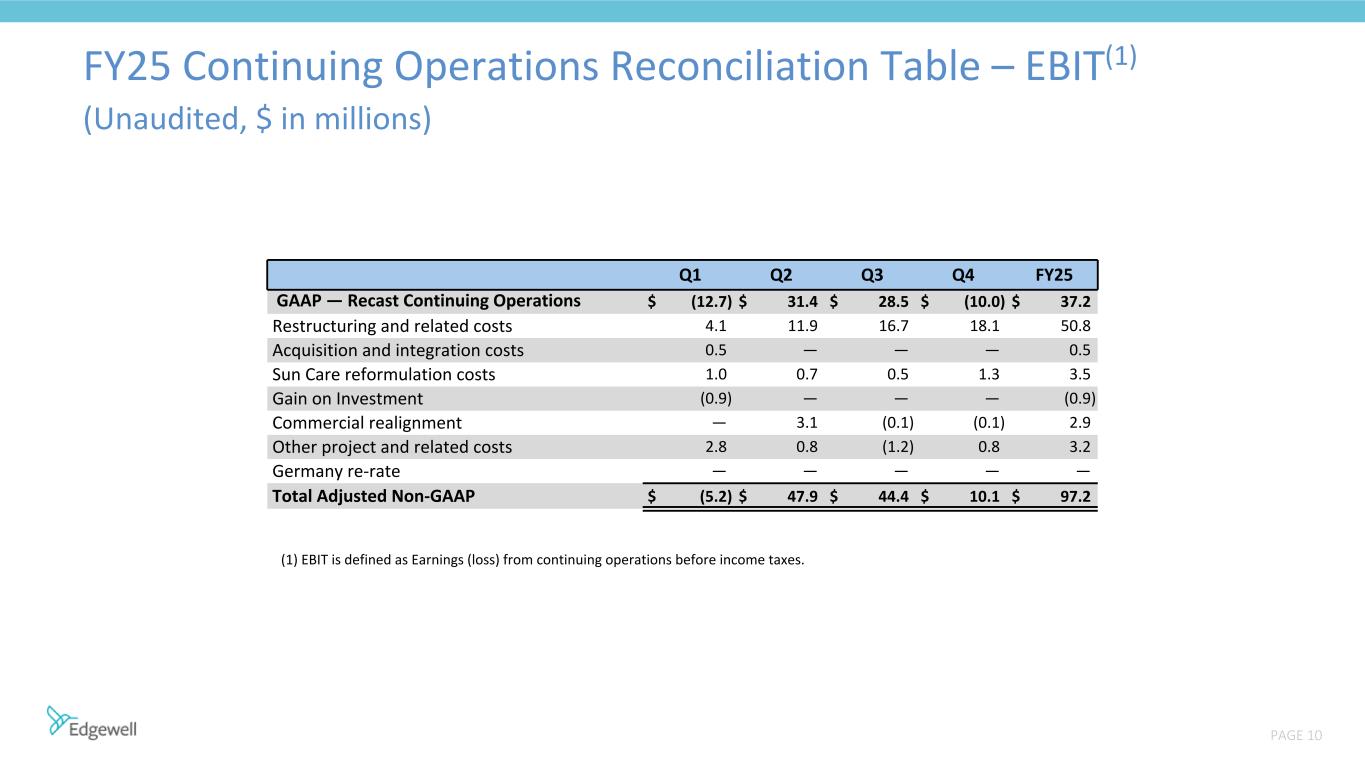

PAGE 10 FY25 Continuing Operations Reconciliation Table – EBIT(1) (Unaudited, $ in millions) (1) EBIT is defined as Earnings (loss) from continuing operations before income taxes. Q1 Q2 Q3 Q4 FY25 GAAP — Recast Continuing Operations $ (12.7) $ 31.4 $ 28.5 $ (10.0) $ 37.2 Restructuring and related costs 4.1 11.9 16.7 18.1 50.8 Acquisition and integration costs 0.5 — — — 0.5 Sun Care reformulation costs 1.0 0.7 0.5 1.3 3.5 Gain on Investment (0.9) — — — (0.9) Commercial realignment — 3.1 (0.1) (0.1) 2.9 Other project and related costs 2.8 0.8 (1.2) 0.8 3.2 Germany re-rate — — — — — Total Adjusted Non-GAAP $ (5.2) $ 47.9 $ 44.4 $ 10.1 $ 97.2

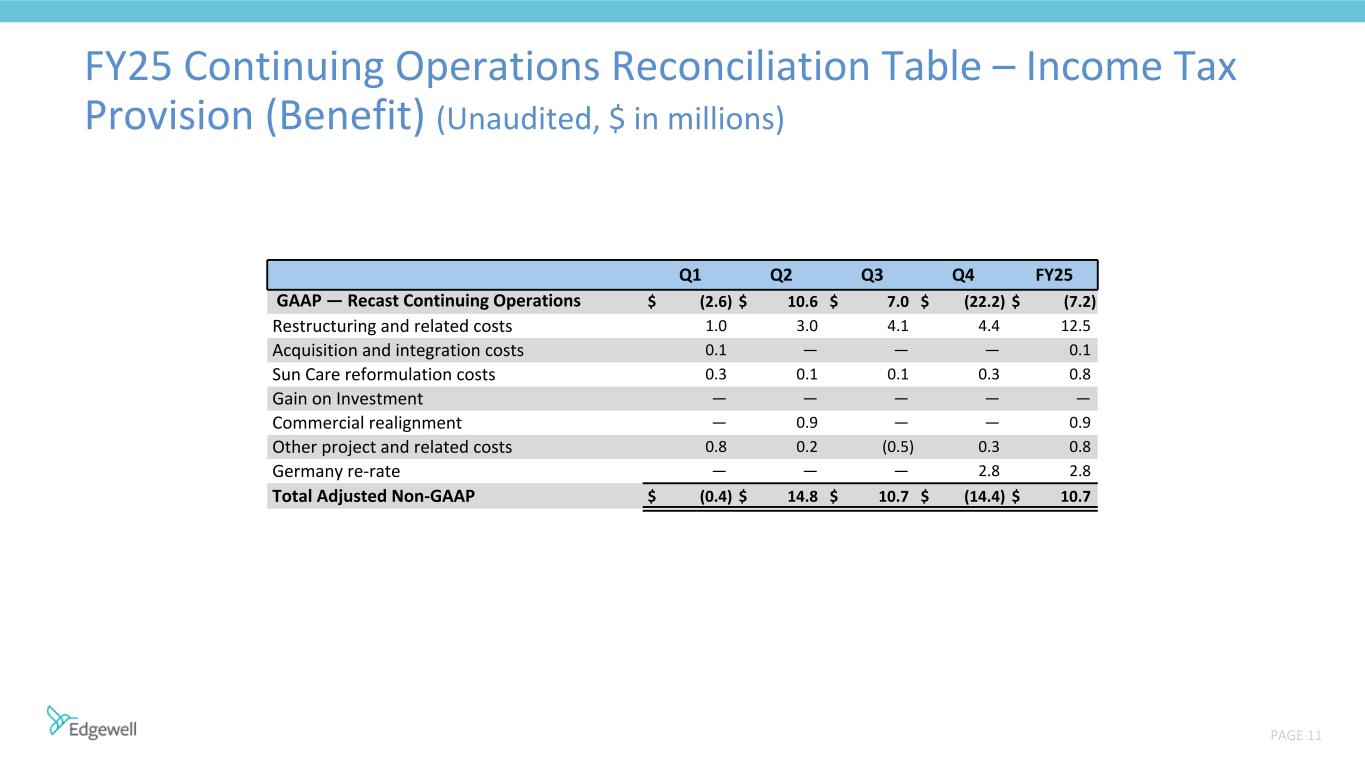

PAGE 11 FY25 Continuing Operations Reconciliation Table – Income Tax Provision (Benefit) (Unaudited, $ in millions) Q1 Q2 Q3 Q4 FY25 GAAP — Recast Continuing Operations $ (2.6) $ 10.6 $ 7.0 $ (22.2) $ (7.2) Restructuring and related costs 1.0 3.0 4.1 4.4 12.5 Acquisition and integration costs 0.1 — — — 0.1 Sun Care reformulation costs 0.3 0.1 0.1 0.3 0.8 Gain on Investment — — — — — Commercial realignment — 0.9 — — 0.9 Other project and related costs 0.8 0.2 (0.5) 0.3 0.8 Germany re-rate — — — 2.8 2.8 Total Adjusted Non-GAAP $ (0.4) $ 14.8 $ 10.7 $ (14.4) $ 10.7

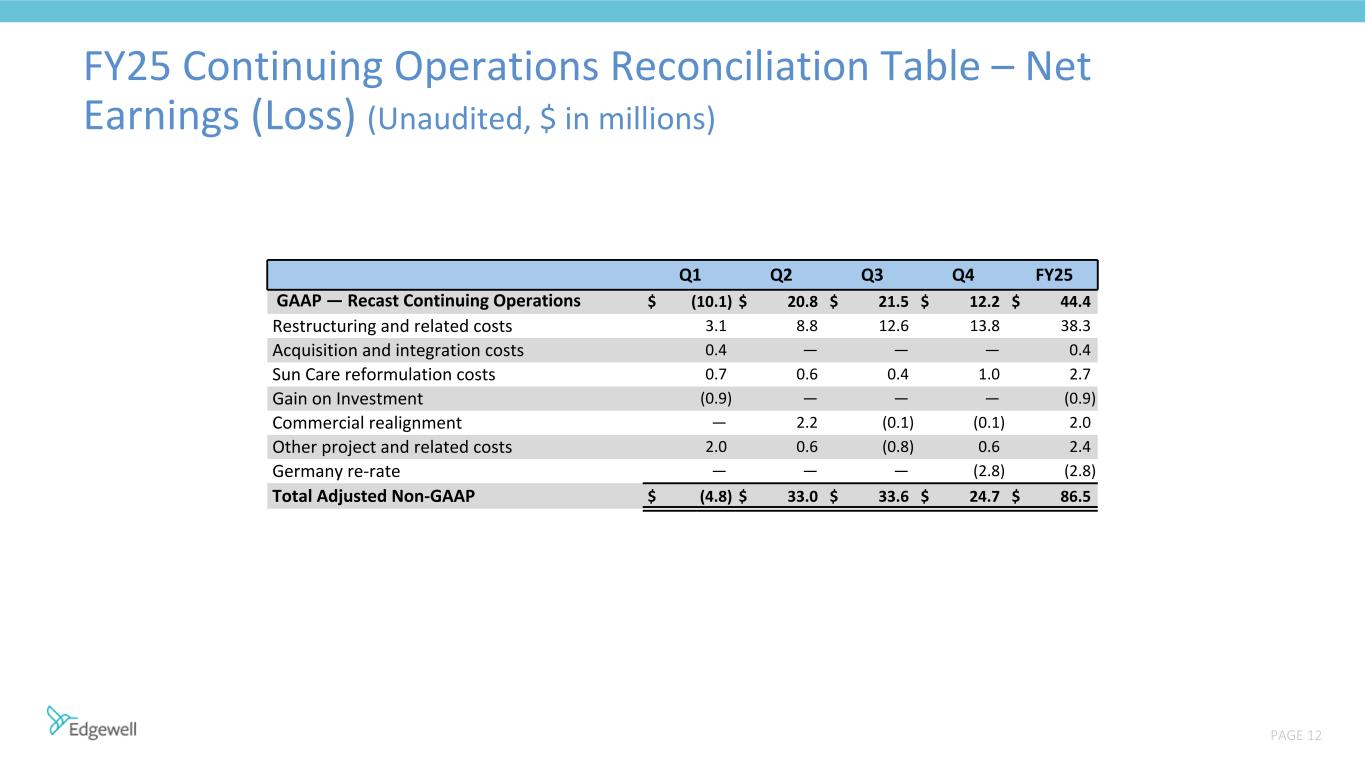

PAGE 12 FY25 Continuing Operations Reconciliation Table – Net Earnings (Loss) (Unaudited, $ in millions) Q1 Q2 Q3 Q4 FY25 GAAP — Recast Continuing Operations $ (10.1) $ 20.8 $ 21.5 $ 12.2 $ 44.4 Restructuring and related costs 3.1 8.8 12.6 13.8 38.3 Acquisition and integration costs 0.4 — — — 0.4 Sun Care reformulation costs 0.7 0.6 0.4 1.0 2.7 Gain on Investment (0.9) — — — (0.9) Commercial realignment — 2.2 (0.1) (0.1) 2.0 Other project and related costs 2.0 0.6 (0.8) 0.6 2.4 Germany re-rate — — — (2.8) (2.8) Total Adjusted Non-GAAP $ (4.8) $ 33.0 $ 33.6 $ 24.7 $ 86.5

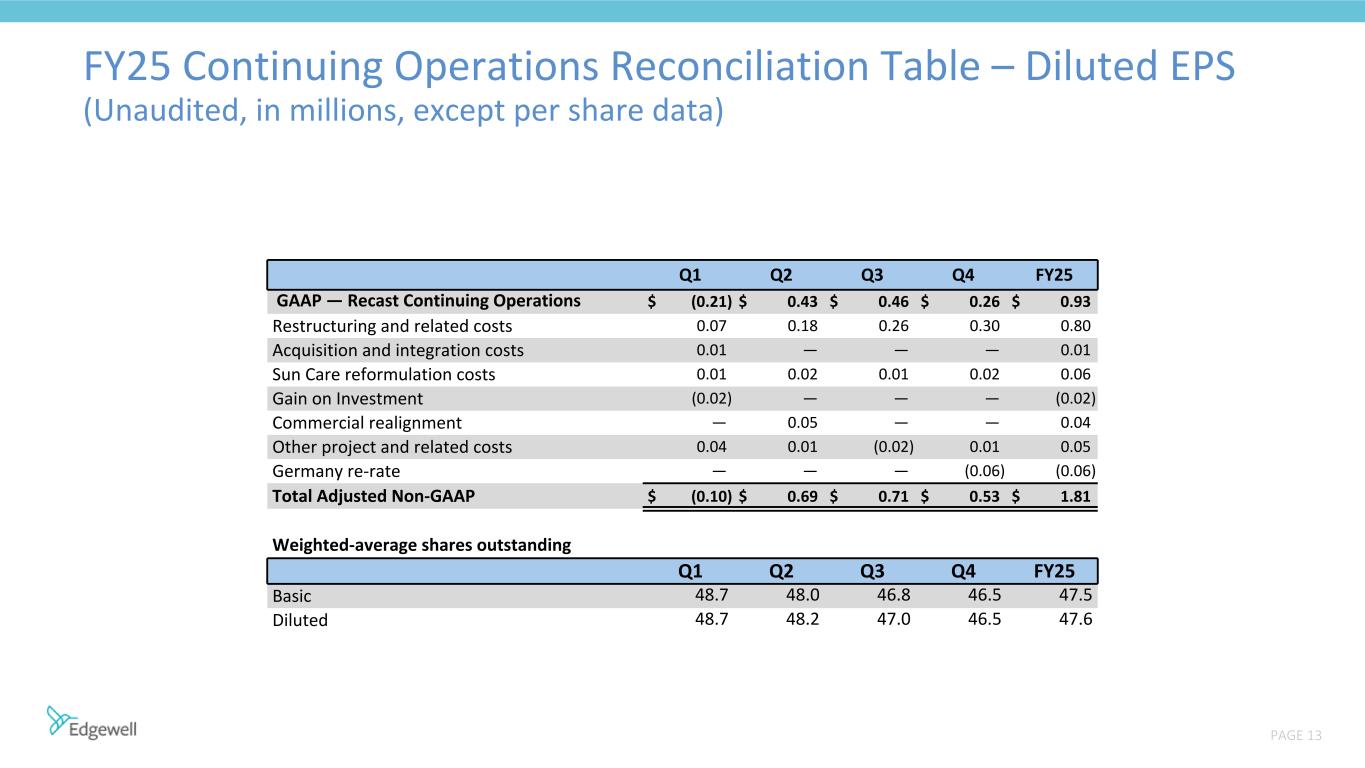

PAGE 13 FY25 Continuing Operations Reconciliation Table – Diluted EPS (Unaudited, in millions, except per share data) Weighted-average shares outstanding Q1 Q2 Q3 Q4 FY25 Basic 48.7 48.0 46.8 46.5 47.5 Diluted 48.7 48.2 47.0 46.5 47.6 Q1 Q2 Q3 Q4 FY25 GAAP — Recast Continuing Operations $ (0.21) $ 0.43 $ 0.46 $ 0.26 $ 0.93 Restructuring and related costs 0.07 0.18 0.26 0.30 0.80 Acquisition and integration costs 0.01 — — — 0.01 Sun Care reformulation costs 0.01 0.02 0.01 0.02 0.06 Gain on Investment (0.02) — — — (0.02) Commercial realignment — 0.05 — — 0.04 Other project and related costs 0.04 0.01 (0.02) 0.01 0.05 Germany re-rate — — — (0.06) (0.06) Total Adjusted Non-GAAP $ (0.10) $ 0.69 $ 0.71 $ 0.53 $ 1.81

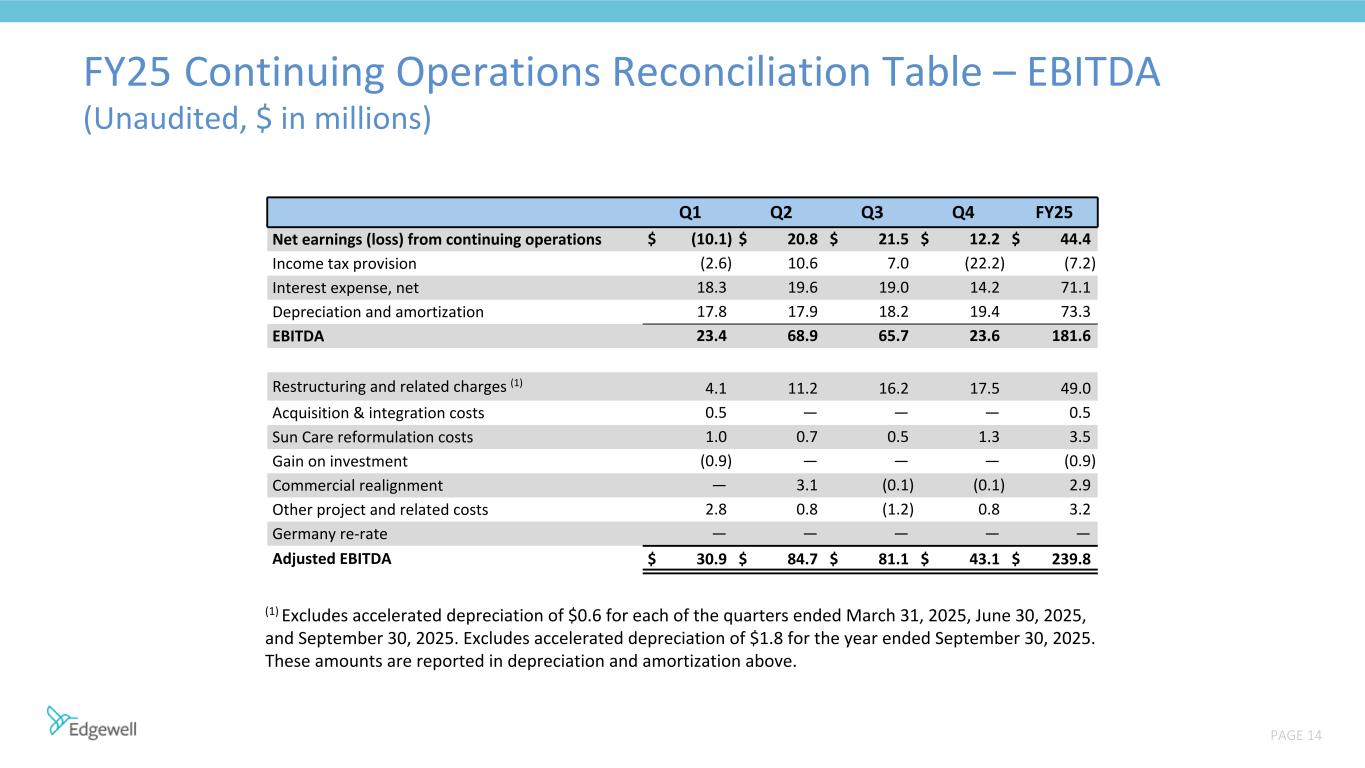

PAGE 14 (1) Excludes accelerated depreciation of $0.6 for each of the quarters ended March 31, 2025, June 30, 2025, and September 30, 2025. Excludes accelerated depreciation of $1.8 for the year ended September 30, 2025. These amounts are reported in depreciation and amortization above. FY25 Continuing Operations Reconciliation Table – EBITDA (Unaudited, $ in millions) Q1 Q2 Q3 Q4 FY25 Net earnings (loss) from continuing operations $ (10.1) $ 20.8 $ 21.5 $ 12.2 $ 44.4 Income tax provision (2.6) 10.6 7.0 (22.2) (7.2) Interest expense, net 18.3 19.6 19.0 14.2 71.1 Depreciation and amortization 17.8 17.9 18.2 19.4 73.3 EBITDA 23.4 68.9 65.7 23.6 181.6 Restructuring and related charges (1) 4.1 11.2 16.2 17.5 49.0 Acquisition & integration costs 0.5 — — — 0.5 Sun Care reformulation costs 1.0 0.7 0.5 1.3 3.5 Gain on investment (0.9) — — — (0.9) Commercial realignment — 3.1 (0.1) (0.1) 2.9 Other project and related costs 2.8 0.8 (1.2) 0.8 3.2 Germany re-rate — — — — — Adjusted EBITDA $ 30.9 $ 84.7 $ 81.1 $ 43.1 $ 239.8