Please wait

MANAGEMENT'S

DISCUSSION

AND ANALYSIS

| | | | | | | | | | | |

| | | |

| A. HOW WE REPORT OUR RESULTS | | J. CAPITAL AND LIQUIDITY MANAGEMENT |

| | | 1. Capital |

| B. OVERVIEW | | 2. Capital Adequacy |

| 1. Strategy | | 3. Shareholder Dividends |

| 2. Financial Objectives | | 4. Principal Sources and Uses of Funds |

| 3. Acquisitions and Other | | 5. Liquidity |

| | | |

| C. FINANCIAL SUMMARY | | K. RISK MANAGEMENT |

| | | 1. Risk Management Framework |

| D. PROFITABILITY | | 2. Risk Governance |

| | | 3. Risk Universe |

| E. GROWTH | | 4. Risk Appetite |

| 1. Sales, Gross Flows and Value of New Business | | 5. Risk Management Policies |

| 2. Assets Under Management | | 6. Risk Management Process |

| | | 7. Three Lines of Defence |

| F. CONTRACTUAL SERVICE MARGIN | | 8. Culture and Managing Risk |

| | | 9. Risk Categories |

| G. FINANCIAL STRENGTH | | |

| | | L. ADDITIONAL FINANCIAL DISCLOSURE |

| H. PERFORMANCE BY BUSINESS GROUP | | 1. Selected Annual Information |

| 1. Asset Management | | 2. Items related to Statement of Operations |

| 2. Canada | | 3. Items related to Statement of Financial Position |

| 3. U.S. | | 4. Fourth Quarter 2025 Profitability |

| 4. Asia | | 5. Fourth Quarter 2025 Growth |

| 5. Corporate | | 6. Previous Quarters |

| | | |

| I. INVESTMENTS | | M. NON-IFRS FINANCIAL MEASURES |

| 1. Investment Profile | | |

| 2. Debt Securities | | N. ACCOUNTING AND CONTROL MATTERS |

| 3. Equities | | 1. Critical Accounting Policies and Estimates |

| 4. Mortgages and Loans | | 2. Changes in Accounting Policies |

| 5. Derivatives | | 3. Disclosure Controls and Procedures |

| 6. Investment Properties | | |

| 7. Loss Allowance and Provision for Credit Loss | | O. LEGAL AND REGULATORY PROCEEDINGS |

| | | |

| | | P. FORWARD-LOOKING STATEMENTS |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 1 |

| | |

Management's Discussion and Analysis |

February 11, 2026

| | | | | |

| A. How We Report Our Results | |

Sun Life is a leading international financial services organization providing asset management, wealth, insurance and health solutions to individual and institutional Clients. Sun Life has operations in a number of markets worldwide including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda. As of December 31, 2025, Sun Life had total assets under management ("AUM") of $1.60 trillion. For more information, please visit www.sunlife.com.

Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.

Sun Life Financial Inc. ("SLF Inc.") is a publicly traded company domiciled in Canada and is the holding company of Sun Life Assurance Company of Canada ("Sun Life Assurance"). In this management's discussion and analysis ("MD&A"), SLF Inc., its subsidiaries and, where applicable, its joint ventures and associates are collectively referred to as "the Company", "Sun Life", "we", "our", and "us". Unless otherwise indicated, all information in this MD&A is presented as at and for the year ended December 31, 2025 and the information contained in this document is in Canadian dollars. Amounts in this document may be impacted by rounding.

Where information at and for the year ended December 31, 2025 is not available, information available for the latest period before December 31, 2025 is used. Except where otherwise noted, financial information is presented in accordance with International Financial Reporting Standards ("IFRS") and the accounting requirements of the Office of the Superintendent of Financial Institutions ("OSFI"). Reported net income (loss) refers to Common shareholders' net income (loss) determined in accordance with IFRS.

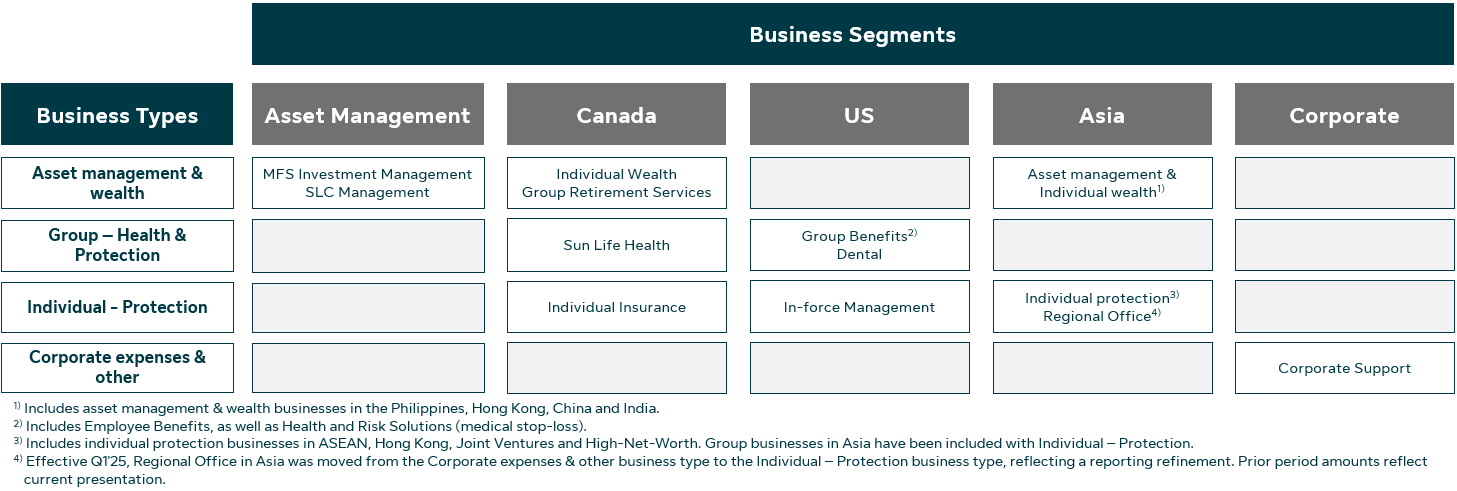

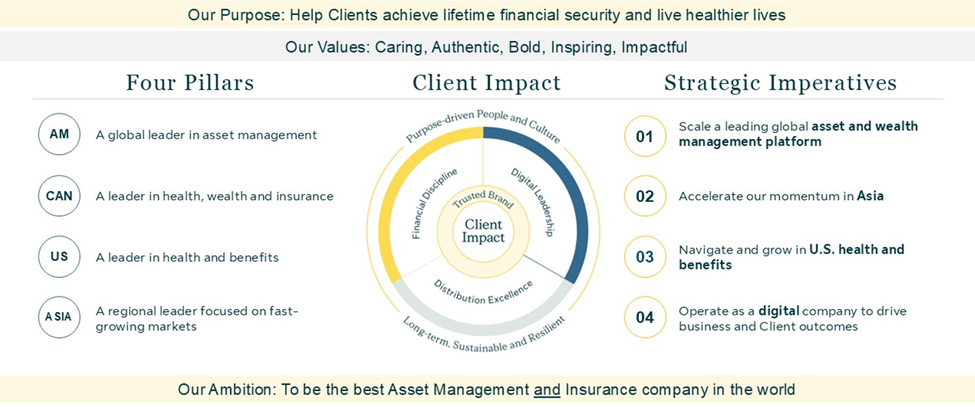

We manage our operations and report our financial results in five business segments: Asset Management, Canada, United States ("U.S."), Asia, and Corporate. Information concerning these segments is included in our annual and interim consolidated financial statements and accompanying notes ("Annual Consolidated Financial Statements" and "Interim Consolidated Financial Statements", respectively, and "Consolidated Financial Statements" collectively), and this MD&A document.

Underlying net income by Business Types

Sun Life has a diversified mix of businesses and our earnings by business type supports the analysis of our results:

•Asset management & wealth(1): Sun Life’s asset management & wealth businesses generate fee income and/or spread on investment products.

•Group - Health & Protection: Group businesses provide health and protection benefits to employer and government plan members. The products generally have shorter-term coverage periods, and more frequent repricing. The revenues are driven by premiums for coverage provided as well as fee-based earnings (i.e., Administrative Services Only plans, and dental fees).

•Individual - Protection: Generally, individual protection businesses have a longer-term profitability profile and are more sensitive to experience trends. The premiums include a margin for providing protection and are invested to earn a return over the expected amounts required to fulfill insurance liabilities.

The following provides an overview of the business types in Sun Life's business segments/business groups:

(1)Effective Q1'25, the Wealth & asset management business type was renamed to Asset management & wealth.

| | | | | | | | | | | | | | | | | | | | |

2 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

1. Use of Non-IFRS Financial Measures

We report certain financial information using non-IFRS financial measures, as we believe that these measures provide information that is useful to investors in understanding our performance and facilitate a comparison of our quarterly and full year results from period to period. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed in isolation from or as alternatives to measures of financial performance determined in accordance with IFRS. Additional information concerning non-IFRS financial measures and, if applicable, reconciliations to the closest IFRS measures are available in section M - Non-IFRS Financial Measures in this document and the Supplementary Financial Information package on www.sunlife.com under Investors - Financial results and reports.

2. Forward-looking Statements

Certain statements in this document are forward-looking statements within the meaning of certain securities laws, including the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Additional information concerning forward-looking statements and important risk factors that could cause our assumptions, estimates, expectations and projections to be inaccurate and our actual results or events to differ materially from those expressed in or implied by such forward-looking statements can be found in section P - Forward-looking Statements in this document.

3. Additional Information

Additional information about SLF Inc. can be found in the Consolidated Financial Statements, the annual and interim MD&A, and SLF Inc.'s Annual Information Form ("AIF") for the year ended December 31, 2025. These documents are filed with securities regulators in Canada and are available at www.sedarplus.ca. SLF Inc.'s Annual Consolidated Financial Statements, annual MD&A and AIF are filed with the United States Securities and Exchange Commission ("SEC") in SLF Inc.'s annual report on Form 40-F and SLF Inc.'s interim MD&A and Interim Consolidated Financial Statements are furnished to the SEC on Form 6-Ks and are available at www.sec.gov.

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 3 |

Sun Life is a leading international financial services organization providing a diverse range of asset management, wealth, insurance, and health solutions to individual and institutional Clients. We have four business pillars: Asset Management, Canada, U.S. and Asia.

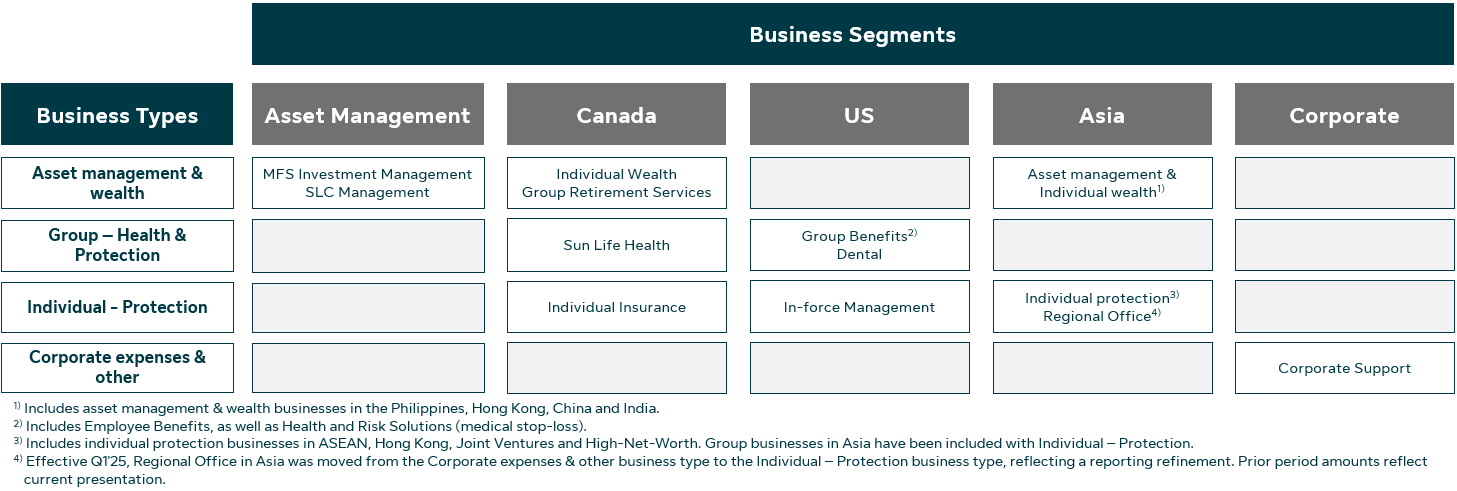

1. Strategy

Our strategy places the Client at the centre of everything we do. Our enterprise strategy, as described below, reflects our priorities and our diversified business mix. We believe by effectively executing on our strategy, we can fulfill our Purpose, create a positive impact for our Clients, and achieve our goal to be a leader in each of our four pillars.

Purpose and Ambition

Our Purpose is to help our Clients achieve lifetime financial security and live healthier lives. Our Purpose shapes our strategy, structure, and people and culture.

We seek to provide outstanding value and impact for our Clients in three ways:

Driving positive financial actions by:

•Helping Clients build wealth and provide lifetime financial security.

•Providing quality products and solutions that meet the needs of our Clients.

•Delivering timely and expert advice through consistently superior Client experiences.

Delivering solid long-term Client investment returns by:

•Leveraging our collective expertise to make better investment decisions.

•Sourcing broad investment capabilities to serve global Client needs.

•Delivering on investment objectives of Clients.

Driving positive health actions by:

•Being a trusted provider of a broad range of health and wellness coverages.

•Helping Clients access, navigate, and afford the care they need.

•Improving health outcomes, including physical and mental well-being, by providing health solutions and empowering Clients to manage their health.

While our Purpose guides us, our values; caring, authentic, bold, inspiring, and impactful, align how we deliver every day to create impact.

Our Ambition is "to be the best asset management and insurance company in the world". We define this as delivering strong return on equity ("ROE") for shareholders, while creating exceptional Client Impact and digital experience, deriving value from integrating insurance and asset management businesses, and being Purpose-driven for Clients, while also focusing on strong execution to meet our medium-term financial objectives(1):

•Underlying Earnings Per Share ("EPS") growth: 10%.

•Underlying ROE: 20%.

•Underlying Dividend Payout Ratio: 40%-50%.

(1)For more information about our medium-term financial objectives, see section B - Overview - 2 - Financial Objectives in this document. Underlying EPS, underlying ROE and underlying dividend payout ratio are Non-IFRS financial measures. See section M - Non-IFRS Financial Measures in this document.

| | | | | | | | | | | | | | | | | | | | |

4 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

Our Four Pillars

Our four pillars define the businesses and markets in which we operate. In each of these pillars, we focus on creating value and positively impacting our Clients through businesses that meet Client needs and have strong growth prospects, favourable ROE and strong capital generation in attractive global markets. We are well-positioned across each of our pillars.

Asset Management: A global leader in asset management

We deliver value and drive positive Client impact through our offering of quality investment products:

•MFS Investment Management ("MFS") is a long-standing premier active investment manager offering a comprehensive set of asset management products and services to retail and institutional investors around the world.

•SLC Management is a global investment manager delivering alternative fixed income, private credit, infrastructure, and real estate solutions to institutional investors and High-Net-Worth ("HNW") and retail Clients.

Canada: A leader in health, wealth, and insurance

We deliver value and impact to approximately 1 in 3 Canadians via our group and individual businesses by:

•Providing a wide range of asset management, wealth, health and protection solutions to retail Clients.

•Helping Canadians live healthy lives, both as a major provider of group benefits and through a growing focus on innovative products and services that lead to better health outcomes.

•Remaining a market leader in group retirement services in the workplace, including defined contribution pensions, and defined benefit pension de-risking.

U.S.: A leader in health and benefits

We have deep expertise in the health and benefits market, and help our Clients access the care and coverage they need while improving health outcomes. We are:

•The largest independent medical stop-loss provider in the U.S., offering protection against large medical claims for employers who self-insure their employee health plans, as well as programs for complex conditions and health care navigation services to help members improve outcomes.

•One of the largest dental benefits provider in the U.S. based on membership(1) with some of the largest nationwide networks of dentists. The U.S. Dental business serves approximately 32 million members(2) through government programs and commercial group dental and vision solutions for employers of all sizes.

•A top ten group life and disability provider in the U.S., offering a broad portfolio of group insurance products and services, as well as turnkey risk management solutions for health plans and other insurance carriers.

Asia: A regional leader focused on fast-growing markets

We are well-positioned in Asia to achieve our growth aspirations, through our portfolio of distinct businesses in the Philippines, Indonesia, Vietnam, Hong Kong, China, India, Malaysia, and High Net Worth including Singapore, Bermuda, and Dubai. These markets account for approximately 72% of Asia’s Gross domestic product ("GDP") with high potential for future growth(3). We are:

•A provider of individual life and health insurance that delivers Client value across all of our markets.

•A provider, in select markets, of asset management and group retirement products and services.

•Among the global leaders in providing life insurance solutions to HNW Clients.

Our Client Impact Strategy

Our Client Impact strategy has seven areas of focus that we are pursuing across our four pillars. These areas of focus define how we compete in our markets, extend our competitive advantages, fulfill our Purpose and support our Ambition to be the best asset management and insurance company in the world. We are committed to advancing our leadership position through a relentless focus on execution excellence, digital leadership, and cultivating strong talent and a culture that enables high performance.

Client Impact: Our Clients are at the centre of everything we do. Whether it is helping to navigate health concerns, save and plan for retirement or provide financial security for their families, our focus is on the positive impact we have on our Clients' lives. We believe this allows us to develop and offer the right solutions and experiences, build lasting and trusted Client relationships, and create value for Clients that also deliver better business outcomes for Sun Life. We are committed to helping Clients by driving positive health and financial actions, and delivering solid long-term investment returns.

Trusted Brand: Preserving our long standing reputation of being a trusted brand is paramount in an increasingly complex and digitized world. For more than 160 years, we have built and enjoyed strong, trusted relationships with our Clients in all Sun Life markets and through our distribution partnerships. Our brand reflects the differentiated Sun Life experiences we create, the products and service experiences we deliver, and the culture we live by, to achieve our Purpose. Our forward-looking brand strategy remains focused on delivering Client Impact and we will work to build our future competitive advantage and brand appeal with both new and existing Clients.

Execution Excellence: We have a refreshed focus to deepen financial discipline and execution excellence through clear prioritization and alignment across the business, transparent metrics and milestones, effectively resourced programs with clear ownership, and adaptability in response to changing conditions. Our approach aims to fully realize the value of our investments, unlock new opportunities, and strengthen organizational adaptability.

(1)Based on membership as of December 31, 2025, for plans provided or administered by a Sun Life company. Ranking compiled by Sun Life and based on data disclosed by competitors.

(2)Includes members who also have a Sun Life Group coverage.

(3)World Bank, 2024.

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 5 |

Distribution Excellence: We have established an omni-channel approach to distribution that makes it easier for Clients to do business with us across all markets. To excel at distribution, we prioritize exceptional service, connecting with our Clients when and how they want to engage, and providing personalized and holistic solutions. We are focused on meeting our Clients' needs by being an exceptional distribution partner that empowers our advisors and partners to provide seamless Client experiences.

Digital Leadership: We are focused on enabling our businesses to create meaningful, digitally-enabled connections with Clients to generate the greatest Client and Business impact:

•Delivering exceptional and personalized digital experiences for Clients, employees, advisors and partners.

•Leveraging digital capabilities and ways of working to drive speed and cost-effectiveness in everything we do.

•Unlocking the potential of new technologies such as generative artificial intelligence ("GenAI") while continuing to invest in a modern technology stack that powers the best Client experiences and overall business productivity.

•Maintaining brand trust by keeping Sun Life resilient and secure.

Financial Discipline: Our strategy is underpinned by a continued commitment to strong financial performance and risk management, coupled with a focus on capital management. Sustained focus across these areas supports our medium-term financial objectives through:

•Delivering strong, stable earnings growth and disciplined expense management.

•Managing our capital to protect our policyholders and to maintain financial flexibility, to generate shareholder value.

•Disciplined organic investments and a programmatic M&A(1) approach.

Long-Term, Sustainable and Resilient: We embed long-term, sustainable and resilient thinking into our strategy, culture, and operations, to drive meaningful social and economic outcomes for our Clients, employees, advisors, investors and communities. We aspire to be a responsibly-managed business that is Client-focused, Purpose-driven, competitive, forward-thinking, sustainable and resilient for the long-term.

Purpose-Driven People and Culture: Delivering on our strategy is supported by our ability to attract, retain, and develop the best talent, and to empower our people to drive results. We are focused on preserving and strengthening our Client focus, integrity, collaboration and inclusivity. Specifically, our focus is to:

•Be the employer of choice for top talent.

•Develop talent that combines strong leadership skills with technological savvy, to support our transformation to a leading digital organization.

•Empower all employees and advisors to take action, make decisions, and be accountable.

•Continue to build a high-performing, inclusive environment that demonstrates diversity of thought and attracts top talent.

•Offer employees flexibility in how and where we work.

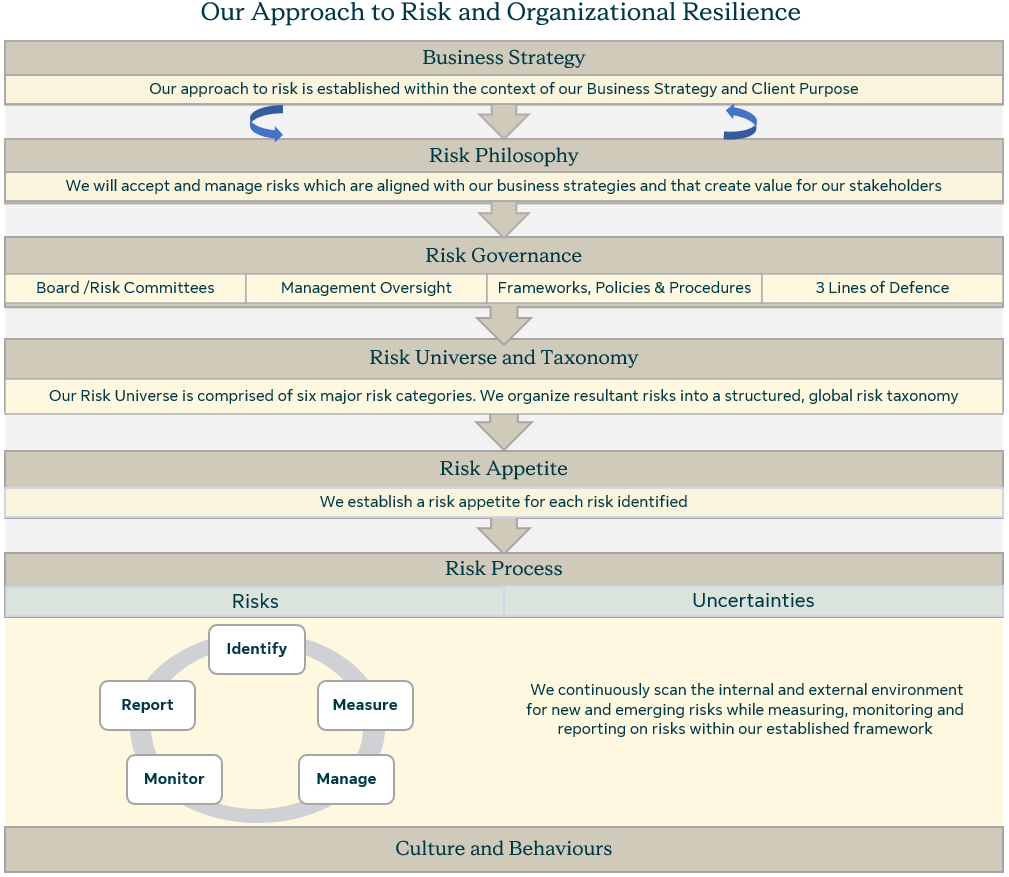

Key Strategic Priorities

Together with the strong foundation of our four pillars and key medium-term strategic areas of focus, our strategy emphasizes four key strategic priorities:

1.Scale a leading global asset and wealth management platform: We aim to establish ourselves as a global leader in asset management by growing SLC Management, upholding our leadership in MFS, and unlocking further growth opportunities between our asset management, insurance and wealth businesses.

2.Accelerate our momentum in Asia: Our objective is to become a regional leader in fast-growing markets by strengthening distribution channels, accelerating our speed-to-value through digital advancements, broadening our wealth management services, and emphasizing execution excellence.

3.Navigate and grow in U.S. health and benefits: We strive to be a trusted health partner, enhancing access to care, improving affordability, and empowering members. We're committed to supporting the care needs of our most complex members, leveraging digital capabilities to make health and benefits easier, and strengthening our position in dental care while navigating market dynamics.

4.Operate as a digital company to drive business and Client outcomes: We are dedicated to being a digital leader by integrating digital capabilities throughout the organization, embedding a digital mindset, modernizing our technology infrastructure, leveraging Client insights, and leading the charge in GenAI to drive measurable business and Client outcomes while managing risk, supported by solid and secure foundations.

We believe we are well-positioned to execute on each of these strategic priorities and that by doing so we will accelerate growth, improve competitive positioning, and create positive Client Impact.

Looking ahead, we are confident that our strategy will allow us to deliver on our Purpose, drive positive Client outcomes, create meaningful value for our shareholders, and support our Ambition to be the best asset management and insurance company in the world.

(1)Mergers & Acquisitions ("M&A").

| | | | | | | | | | | | | | | | | | | | |

6 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

2. Financial Objectives

Following the adoption of IFRS 17 and IFRS 9, progress against our medium-term financial objectives are measured on a four-year basis. Our medium-term financial objectives are outlined as follows:

| | | | | | | | | | | | |

| IFRS 17 and IFRS 9 | |

Measure(1) | Medium-term financial objectives(2) | 4-Year(3)(4) | 2025 Results | |

Underlying EPS growth Growth in EPS reflects the Company's focus on generating sustainable earnings for shareholders. | 10% | 9% | 12% | |

Underlying ROE ROE is a significant driver of shareholder value and is a major focus for management across all businesses. | 20% | 17.6% | 18.2% | |

Underlying dividend payout ratio Payout of capital versus shareholder value, based on underlying net income. | 40%-50% | 48% | 47% | |

(1)Underlying EPS, underlying ROE and underlying dividend payout ratio are non-IFRS financial measures. See section M - Non-IFRS Financial Measures in this document. Underlying dividend payout ratio represents the ratio of common shareholders' dividends to diluted underlying EPS. See

section J - Capital and Liquidity Management - 3 - Shareholder Dividends in this document for further information regarding dividends.

(2)Our medium-term financial objectives are forward-looking non-IFRS financial measures and do not constitute guidance. Additional information is provided in this MD&A in section P - Forward-looking Statements - Medium-Term Financial Objectives.

(3)2022 results have been restated for the adoption of IFRS 17 and the related IFRS 9 classification overlay (“the new standards”). The restated results may not be fully representative of our future earnings profile, as we were not managing our asset and liability portfolios under the new standards. The majority of the actions taken to re-balance asset portfolios and transition asset-liability management execution to an IFRS 17 basis occurred in Q1'23. Accordingly, analysis based on 2022 comparative results may not necessarily be indicative of future trends, and should be interpreted with this context.

(4)Underlying EPS growth is calculated using a three-year compound annual growth rate. Underlying ROE and dividend payout ratio are calculated using a four-year average of 2022-2025. These calculations reflect data available under the new standards. As we continue to report under the new standards in future periods, an additional year will be added until we reach a five-year period, consistent with disclosures in 2022 and prior.

In the year and over the medium-term, we have solid performance against our medium-term financial objectives.

3. Acquisitions and Other

The following developments occurred since January 1, 2025. Additional information concerning acquisitions and dispositions is provided in Note 3 in our 2025 Annual Consolidated Financial Statements.

On July 15, 2025, we invested $55 million cash in Bowtie Life Insurance Company Limited ("Bowtie"), which increased our ownership interest, excluding dilution, by approximately 11% and resulted in a total ownership interest of 55.8%. Our previously held interest in Bowtie was remeasured to its fair value, which resulted in a gain of $176 million recognized in reported net income in Q3'25. The investment reinforces Sun Life's long-term partnership with Bowtie, and our shared goal to make health insurance simple, accessible and affordable. Bowtie is Hong Kong's first virtual insurer and the market leader in the direct sales channel(1).

On December 17, 2025, we signed an implementation agreement to increase our existing ownership interest in our Malaysia joint ventures to a majority stake for approximately $240 million. The transaction requires regulatory approval and is expected to close in late 2026.

(1)According to Insurance Authority's Provisional Statistics for Long Term Business 2024, in the fourth quarter of 2024, Bowtie Life ranked first in number of new individual non-single premium policies sold through Direct channel in Hong Kong.

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 7 |

| | | | | | | | | | | | | | | | |

| ($ millions, unless otherwise noted) | | | | |

| | | | | | | |

| Profitability | | | | | | 2025 | 2024 |

| Net income (loss) | | | | | | | |

| Underlying net income (loss)(1) | | | | | | 4,201 | 3,856 |

| Reported net income (loss) - Common shareholders | | | | | | 3,472 | 3,049 |

| Diluted earnings per share ("EPS") ($) | | | | | | | |

| Underlying EPS (diluted)(1) | | | | | | 7.45 | 6.66 |

| Reported EPS (diluted) | | | | | | 6.15 | 5.26 |

| Return on equity ("ROE") (%) | | | | | | | |

| Underlying ROE(1) | | | | | | 18.2% | 17.2% |

| Reported ROE(1) | | | | | | 15.1% | 13.6% |

| | | | | | | | |

| Growth | | | | | | 2025 | 2024 |

| Sales | | | | | | | |

| Asset management gross flows & wealth sales(1) | | | | | | 236,911 | 196,074 |

| Group - Health & Protection sales(1) | | | | | | 3,416 | 2,737 |

| Individual - Protection sales(1) | | | | | | 3,751 | 2,983 |

| Total assets under management ($ billions)(1)(2) | | | | | | 1,604.9 | 1,542.6 |

| New business Contractual Service Margin ("CSM")(1) | | | | | | 1,727 | 1,473 |

| | | | | | | | |

| Financial Strength | | | | | | 2025 | 2024 |

| LICAT ratios(3) | | | | | | | |

| Sun Life Financial Inc. | | | | | | 157% | 152% |

| Sun Life Assurance(4) | | | | | | 140% | 146% |

| Financial leverage ratio(1)(5) | | | | | | 23.5% | 20.1% |

| Book value per common share ($) | | | | | | 40.25 | 40.63 |

| Weighted average common shares outstanding for basic EPS (millions) | | | | | | 563 | 579 |

| Closing common shares outstanding (millions) | | | | | | 554 | 574 |

(1)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

(2)Prior period amounts have been updated.

(3)Life Insurance Capital Adequacy Test ("LICAT") ratio. Our LICAT ratios are calculated in accordance with the OSFI-mandated guideline, Life Insurance Capital Adequacy Test.

(4)Sun Life Assurance is SLF Inc.’s principal operating life insurance subsidiary.

(5)The calculation for the financial leverage ratio includes the CSM balance (net of taxes) in the denominator. The CSM (net of taxes) was $11.3 billion as at December 31, 2025 (December 31, 2024 - $10.3 billion).

| | | | | | | | | | | | | | | | | | | | |

8 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

The following table reconciles our Common shareholders' net income ("reported net income") and underlying net income. All factors discussed in this document that impact underlying net income are also applicable to reported net income. Certain adjustments and notable items also impact the CSM, such as mortality experience and assumption changes; see section F - Contractual Service Margin in this document for more information.

| | | | | | | | | | | |

| | |

| ($ millions, after-tax) | | | | 2025 | 2024 |

Underlying net income (loss) by business type(1): | | | | | |

Asset management & wealth | | | | 1,976 | 1,823 |

| Group - Health & Protection | | | | 1,248 | 1,196 |

Individual - Protection(2) | | | | 1,347 | 1,201 |

Corporate expenses & other(2) | | | | (370) | (364) |

Underlying net income(1) | | | | 4,201 | 3,856 |

Add: Market-related impacts | | | | (381) | (373) |

Assumption changes and management actions ("ACMA") | | | | (45) | 56 |

Other adjustments | | | | (303) | (490) |

| Reported net income - Common shareholders | | | | 3,472 | 3,049 |

Underlying ROE(1) | | | | 18.2% | 17.2% |

Reported ROE(1) | | | | 15.1% | 13.6% |

Notable items attributable to reported and underlying net income(1): | | | | | |

| Mortality | | | | 119 | 43 |

| Morbidity | | | | (14) | 30 |

| Lapse and other policyholder behaviour ("policyholder behaviour") | | | | (12) | (25) |

| Expenses | | | | (114) | (70) |

Net credit(3) | | | | 12 | (15) |

Other(4) | | | | 126 | 91 |

(1)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document. For more information about business types in Sun Life's business groups, see section A - How We Report Our Results in this document.

(2)Effective Q1'25, Regional Office in Asia was moved from the Corporate expenses & other business type to the Individual - Protection business type, reflecting a reporting refinement. Prior period amounts reflect current presentation.

(3)Credit includes rating changes on assets measured at Fair value through profit or loss ("FVTPL"), and the Expected credit loss ("ECL") impact for assets measured at Fair value through other comprehensive income ("FVOCI"). Effective Q1'25, the release of credit risk adjustments, which are reported in Expected Investment Earnings in the Driver of Earnings analysis, are included in this balance. Prior period amounts reflect current presentation.

(4)Other notable items are recorded in Net Insurance Service Result and Net Investment Result in the Drivers of Earnings analysis. For more details, see section M - Non-IFRS Financial Measures in this document.

2025 vs. 2024

Underlying net income(1) of $4,201 million increased $345 million or 9%, driven by:

•Asset management & wealth(1) up $153 million: Higher fee-related earnings and strong performance of net seed investment income in SLC Management, higher fee income in Canada, MFS, and Asia, and improved credit experience in Canada wealth, partially offset by a decease in net investment income in MFS.

•Group - Health & Protection(1) up $52 million: Business growth and favourable mortality experience in Canada, and higher U.S. Dental results, partially offset by lower U.S. Group Benefits results.

•Individual - Protection(1)(2) up $146 million: Business growth and higher contributions from joint ventures in Asia, and higher investment earnings in Asia and Canada, partially offset by unfavourable credit experience in Asia.

•Corporate expenses & other(1)(2) $(6) million increase in net loss primarily reflecting higher financing costs supporting the acquisition of our remaining interests in SLC Management affiliates.

(1)Refer to section M - Non-IFRS Financial Measures in this document for a reconciliation between reported net income and underlying net income.

(2)Effective Q1'25, Regional Office in Asia was moved from the Corporate expenses & other business type to the Individual - Protection business type, reflecting a reporting refinement. Prior period amounts reflect current presentation.

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 9 |

Reported net income of $3,472 million increased $423 million or 14%, driven by:

•The increase in underlying net income;

•Changes in tax-exempt investment income primarily in Corporate(1) reflecting higher losses in the prior year;

•A gain from increased ownership interest in Bowtie(2); and

•The prior year impacts from an impairment charge of $186 million on an intangible asset related to bancassurance in Vietnam, restructuring charge of $108 million in Corporate(3), and a provision in U.S. Dental; partially offset by

•Unfavourable ACMA(4) impacts;

•An impairment charge of $61 million on a customer relationship intangible asset from the early termination of a U.S. group dental contract; and

•The prior year decrease in SLC Management's acquisition-related liabilities(5) and gains on partial sale of ABSLAMC(6) and the early termination of a distribution agreement in Asset Management.

•Market-related impacts were in line with the prior year as favourable interest rate impacts and improved real estate experience(7) were offset by unfavourable other market-related impacts driven primarily across Asia and Canada, and unfavourable equity market impacts.

Underlying ROE was 18.2% and reported ROE was 15.1% (2024 - 17.2% and 13.6%, respectively).

1.Market-related impacts

Market-related impacts represent the difference between actual versus expected market movements(8). Market-related impacts resulted in a decrease of $381 million to reported net income, reflecting unfavourable real estate experience and unfavourable other market-related impacts primarily from Asia and Canada, partially offset by favourable interest rate impacts.

2.Assumption changes and management actions

The net impact of assumption changes and management actions was a decrease of $45 million to reported net income and includes methods and assumptions changes on insurance contracts as well as related impacts. These included unfavourable impacts from model refinements across all business groups, expense updates mainly in Asia, and policyholder behaviour updates in Canada, partially offset by favourable financial updates in Canada and Asia, and mortality updates in Canada. For additional details refer to "Assumption Changes and Management Actions by Type" in section F - Contractual Service Margin in this document.

3.Other adjustments

Other adjustments decreased reported net income by $303 million, driven by:

•DentaQuest acquisition, integration and restructuring costs and amortization of acquired intangible assets;

•Changes in SLC Management's acquisition-related liabilities(9);

•An impairment charge of $61 million on a customer relationship intangible asset from the early termination of a U.S. group dental contract; and

•Lower than expected tax-exempt investment income primarily in Corporate(1); partially offset by

•A gain from increased ownership interest in Bowtie.

4. Experience-related items

Notable experience items in the current year included:

•Favourable mortality experience primarily in Canada, Asia and the U.S.;

•Unfavourable morbidity experience in the U.S. largely offset by favourable morbidity experience in Canada;

•Unfavourable expense experience largely in the U.S., Canada and Asia; and

•Other experience was favourable primarily from the U.S., Canada, and Asia.

(1)Q4'25 results reflect lower than expected tax-exempt investment income of $49 million (Q4'24 - lower than expected tax-exempt investment income of $234 million).

(2)On July 15, 2025, we acquired an additional interest in Bowtie Life Insurance Company Limited ("Bowtie"), which increased our ownership interest, excluding dilution, by approximately 11% and resulted in a total ownership interest of 55.8%. Total consideration was cash of $55 million. Our previously held interest in Bowtie was remeasured to its fair value, which resulted in a gain of $176 million recognized in reported net income in Q3'25 ("gain from increased ownership interest in Bowtie"). For additional information, refer to Note 3 of our 2025 Annual Consolidated Financial Statements.

(3)A restructuring charge of $108 million (pre-tax $138 million) recorded in Q2'24 reflecting actions taken to improve financial discipline and productivity, consistent with our Client Impact Strategy, supporting our Medium-Term Financial Objective for underlying EPS growth ("prior year restructuring charge in Corporate"). We expect these actions to result in annual savings of approximately $200 million (pre-tax) by 2026.

(4)Assumption Changes and Management Actions ("ACMA").

(5)An increase of $4 million in estimated future payments for options to purchase the remaining ownership interests of SLC Management affiliates in 2025 (2024 - a decrease of $344 million). For additional information, refer to Note 5 and Note 11 of our 2025 Annual Consolidated Financial Statements.

(6)To meet regulatory obligations, on March 21, 2024, we sold 6.3% of our ownership interest in Aditya Birla Sun Life AMC Limited (“partial sale of ABSLAMC”), generating a gain of $84 million. As a result of this transaction, our ownership interest in ABSLAMC was reduced from 36.5% to 30.2% for gross proceeds of $136 million. Subsequently, on May 31, 2024, we sold an additional 0.2% of our ownership interest.

(7)Real estate experience reflects the difference between the actual value of real estate investments compared to management's longer-term expected returns supporting insurance contract liabilities ("real estate experience").

(8)Except for risk free rates which are based on current rates, expected market movements are based on our medium-term outlook which is reviewed annually.

(9)Amounts primarily relate to acquisition costs for our SLC Management affiliates, BentallGreenOak, Crescent Capital Group LP and Advisors Asset Management, Inc, which include the unwinding of the discount for Other financial liabilities.

| | | | | | | | | | | | | | | | | | | | |

10 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

5.Income taxes

The statutory tax rate is impacted by various items, such as lower taxes on income subject to tax in foreign jurisdictions, tax-exempt or low-taxed investment income, and other sustainable tax benefits.

Global Minimum Tax ("GMT") rules applied to Sun Life effective January 1, 2024:

•Canadian GMT legislation requires the ultimate parent entity of a group to pay top-up tax, on a jurisdiction-by-jurisdiction basis, on profits of its subsidiaries that are taxed below 15%. Some jurisdictions have enacted a Qualifying Domestic Minimum Top-Up Tax ("QDMTT") which requires the GMT top-up tax to be paid locally rather than to the ultimate parent entity's jurisdiction.

•In response to the GMT rules, Bermuda enacted a Corporate Income Tax ("CIT") regime, including a corporate income tax rate of 15%, which applies to Sun Life effective January 1, 2025. The Bermuda CIT is not a QDMTT for the purposes of GMT. Top-up tax may still be payable by the ultimate parent entity under the Income Inclusion Rule ("IIR"), depending on the effective tax rate in Bermuda.

•Other Sun Life subsidiaries that are currently subject to a statutory tax rate or to a tax regime that could result in taxing profits at a rate below 15% include those in Hong Kong and Ireland, which have both enacted a QDMTT.

•For additional information, refer to Note 19 in our 2025 Annual Consolidated Financial Statements.

The 2025 Canadian Federal Budget, which was announced on November 4, 2025, proposed changes clarifying that investment income supporting Canadian insurance risks is taxable in Canada, even when derived from assets held by a foreign affiliate of a Canadian insurance company. This proposed legislation would apply to Sun Life effective January 1, 2026 and is not expected to have a material impact on our consolidated financial statements when it becomes enacted.

On July 4, 2025, the United States Congress enacted the 2025 Budget Reconciliation Act, which introduced several tax provisions, including amendments to the Internal Revenue Code section governing the deductibility of executive compensation. Certain provisions apply to Sun Life, however they are not expected to have a material impact on our consolidated financial statements.

The effective income tax rate(1) for the current year on underlying net income and reported net income was 19.5% and 21.2%, respectively.

6. Impacts of foreign exchange translation

We operate in many markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda, and generate revenues and incur expenses in local currencies in these jurisdictions, which are translated to Canadian dollars.

Items impacting a reporting period, such as Revenue, Expenses, and Reported net income (loss) in our Consolidated Statements of Operations, as well as underlying net income (loss), and sales, are translated into Canadian dollars using average exchange rates for the appropriate daily, monthly, or quarterly period. For Assets and Liabilities in our Consolidated Statements of Financial Position, as well as the AUM and certain components of the Drivers of Earnings disclosure, period-end rates are used for currency translation purposes.

The following table provides the foreign exchange rates for the U.S. dollar, which generates the most significant impact of foreign exchange translation, over the past four quarters and two years.

| | | | | | | | | | | | | | | | | | | | |

| Exchange rate | Quarterly results | Full year |

| Q4'25 | Q3'25 | Q2'25 | Q1'25 | 2025 | 2024 |

U.S. Dollar - Average | 1.394 | 1.377 | 1.384 | 1.435 | 1.398 | 1.370 |

U.S. Dollar - Period end | 1.372 | 1.392 | 1.361 | 1.439 | 1.372 | 1.438 |

The relative impacts of foreign exchange translation in any given period are driven by the movement of foreign exchange rates as well as the proportion of earnings generated in our foreign operations. In general, net income benefits from a weakening Canadian dollar and is adversely affected by a strengthening Canadian dollar as net income from the Company's international operations is translated back to Canadian dollars. Conversely, in a period of losses, the weakening of the Canadian dollar has the effect of increasing losses in foreign jurisdictions. We generally express the impacts of foreign exchange translation on net income on a year-over-year basis.

For the full year 2025, foreign exchange translation led to an increase of $50 million in underlying net income and an increase of $56 million in reported net income.

(1)Our effective income tax rate on reported net income is calculated using Total income (loss) before income taxes, as detailed in Note 19 in our

2025 Annual Consolidated Financial Statements. Our effective income tax rate on underlying net income is calculated using pre-tax underlying net income, as detailed in section M - Non-IFRS Financial Measures in this document, and the associated income tax expense.

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 11 |

1. Sales and Gross Flows

| | | | | | | | | | | |

| | |

| ($ millions) | | | | 2025 | 2024 |

Asset management gross flows & wealth sales by business segment(1) | | | | | |

Asset Management gross flows | | | | 204,286 | 169,867 |

Canada asset management gross flows & wealth sales | | | | 22,531 | 18,144 |

Asia asset management gross flows & wealth sales | | | | 10,094 | 8,063 |

Total asset management gross flows & wealth sales(1) | | | | 236,911 | 196,074 |

Group - Health & Protection sales by business segment(1) | | | | | |

| Canada | | | | 769 | 666 | |

U.S. | | | | 2,546 | 1,984 | |

Asia(2) | | | | 101 | 87 |

Total group sales(1) | | | | 3,416 | 2,737 |

Individual - Protection sales by business segment(1) | | | | | |

| Canada | | | | 538 | 551 |

| Asia | | | | 3,213 | 2,432 |

Total individual sales(1) | | | | 3,751 | 2,983 |

CSM - Impact of new insurance business ("New business CSM")(1) | | | | 1,727 | 1,473 |

(1)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

(2)In underlying net income by business type, Group businesses in Asia have been included with Individual - Protection. For more information about business types in Sun Life's business groups, see section A - How We Report Our Results in this document.

Total asset management gross flows & wealth sales increased $40.8 billion or 21% year-over-year ($37.0 billion(1) or 19%(1), excluding foreign exchange translation).

•Asset Management gross flows increased $30.6 billion(1) or 18%(1) from prior year, driven by higher gross flows in MFS and SLC Management.

•Canada asset management gross flows & wealth sales increased $4.4 billion or 24%, driven by Group Retirement Services ("GRS") and higher mutual fund sales in Individual Wealth. GRS sales reflect higher defined contribution sales from large case sales, and increased rollover volumes, partially offset by lower defined benefit solution sales reflecting a slower market for pension risk transfer transactions.

•Asia asset management gross flows & wealth sales increased $2.1 billion(1) or 26%(1), driven by higher fixed income fund sales in India.

Total group health & protection sales increased $679 million or 25% from prior year ($668 million(1) or 24%(1), excluding foreign exchange translation).

•Canada group sales increased $103 million or 15%, driven by higher large case sales.

•U.S. group sales increased $551 million(1) or 27%(1), driven by medical stop-loss and large case employee benefits sales in Group Benefits and higher Medicare and Medicaid sales in Dental.

Total individual protection sales increased $768 million or 26% from prior year ($726 million(1) or 24%(1), excluding foreign exchange translation).

•Canada individual sales decreased $13 million or 2%, reflecting a combination of lower participating life sales and strong non-participating life sales.

•Asia individual sales increased $739 million(1) or 30%(1), driven by:

◦Higher sales in Hong Kong from growth across all channels; and

◦Higher sales in India and Indonesia reflecting growth primarily in the bancassurance channel; partially offset by

◦Lower sales in High Net Worth from the broker channel.

New business CSM represents growth derived from sales activity in the period. The impact of new insurance business resulted in a $1,727 million increase in CSM, compared to $1,473 million in the prior year, driven by higher sales and profit margins partially offset by unfavourable business mix in Asia, primarily in Hong Kong.

(1)This change excludes the impacts of foreign exchange translation. For more information about these non-IFRS financial measures, see section

M - Non-IFRS Financial Measures in this document.

| | | | | | | | | | | | | | | | | | | | |

12 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

2. Assets Under Management

AUM consists of general funds, the investments for segregated fund holders ("segregated funds") and third-party assets managed by the Company. Third-party AUM is comprised of institutional and managed funds, as well as other AUM related to our joint ventures.

| | | | | | | | | | | | | |

| | | |

| ($ millions) | | | | | | 2025 | 2024 |

Assets under management(1)(2) | | | | | | | |

| General fund assets | | | | | | 231,889 | 221,935 |

| Segregated funds | | | | | | 166,566 | 148,786 |

Third-party assets under management(1) | | | | | | | |

Retail | | | | | | 666,852 | 648,515 |

Institutional, managed funds and other | | | | | | 591,829 | 568,437 |

Total third-party AUM(1) | | | | | | 1,258,681 | 1,216,952 |

Consolidation adjustments(2) | | | | | | (52,272) | (45,057) |

Total assets under management(1)(2) | | | | | | 1,604,864 | 1,542,616 |

(1)Represents a non-IFRS financial measure. See section M - Non-IFRS Financial Measures in this document.

(2)Prior period amounts have been updated.

AUM increased $62.2 billion or 4% from December 31, 2024, primarily driven by:

(i)favourable market movements on the value of segregated, retail, institutional and managed funds of $141.0 billion;

(ii)an increase in AUM of general fund assets of $10.0 billion, primarily driven by net fair value growth from changes in interest rates and credit spreads, and business growth and capital activities, partially offset by unfavourable impacts from foreign exchange translation; and

(iii)an increase of $5.0 billion primarily from business growth; partially offset by

(iv)a decrease of $49.2 billion from foreign exchange translation (excluding the impacts of general fund assets);

(v)net outflows from segregated funds and third-party AUM of $36.9 billion; and

(vi)Client distributions of $7.6 billion.

Segregated fund and third-party AUM net outflows of $36.9 billion for the year were comprised of:

| | | | | | | | | | | | | |

| | | |

| ($ billions) | | | | | | 2025 | 2024 |

Net flows for Segregated fund and Third-party AUM: | | | | | | | |

MFS | | | | | | (58.1) | (79.4) |

| SLC Management | | | | | | 18.2 | 16.6 |

| Canada, Asia and other | | | | | | 3.0 | 2.1 |

Total net flows for Segregated fund and Third-party AUM | | | | | | (36.9) | (60.7) |

Third-Party AUM increased by $41.7 billion or 3% from December 31, 2024, primarily driven by:

(i)favourable market movements of $132.2 billion; and

(ii)an increase of $5.0 billion primarily from business growth; partially offset by

(iii)foreign exchange translation of $50.8 billion;

(iv)net outflows of $37.0 billion; and

(v)Client distributions of $7.6 billion.

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 13 |

| | | | | |

| F. Contractual Service Margin | |

Contractual Service Margin represents a source of stored value for future insurance profits and qualifies as available capital for LICAT purposes. CSM is a component of insurance contract liabilities. The following table shows the change in CSM including its recognition into net income in the period, as well as the growth from new insurance sales activity.

| | | | | | | | |

| For the full year ended | For the full year ended |

| ($ millions) | December 31, 2025 | December 31, 2024 |

| Beginning of Period | 13,366 | 11,786 |

Impact of new insurance business(1) | 1,727 | 1,473 |

Expected movements from asset returns & locked-in rates(1) | 774 | 703 |

Insurance experience gains/losses(1) | (88) | (77) |

| CSM recognized for services provided | (1,263) | (1,135) |

Organic CSM Movement(1)(2) | 1,150 | 964 |

Impact of markets & other(1) | 275 | 124 |

Impact of change in assumptions(1) | 49 | 30 |

| Currency impact | (348) | 462 |

| | |

| Total CSM Movement | 1,126 | 1,580 |

Contractual Service Margin, End of Period(3) | 14,492 | 13,366 |

(1)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

(2)Organic CSM movement is a component of both total CSM movement and organic capital generation.

(3)Total company CSM presented above is comprised of CSM on Insurance contracts issued of $14,166 million (December 31, 2024 - $13,028 million), net of CSM Reinsurance contracts held of $(326) million (December 31, 2024 - $(338) million).

Total CSM ended Q4'25 at $14.5 billion, an increase of $1.1 billion or 8% from December 31, 2024.

•Organic CSM movement was driven by the impact of new insurance business, reflecting strong sales and profit margins in Asia, primarily in Hong Kong, and individual protection sales in Canada.

•Unfavourable insurance experience in Canada and the U.S.

•Favourable impact of markets and other driven by interest and equity experience.

•Impact of change in assumptions include the favourable impact of mortality updates in Canada and model refinements across all business groups, partially offset by unfavourable policyholder behaviour and expense updates.

•Unfavourable currency impacts primarily in Asia.

| | | | | | | | | | | | | | | | | | | | |

14 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

Assumption Changes and Management Actions by Type

The impact on CSM of ACMA is attributable to insurance contracts and related impacts under the general measurement approach ("GMA") and variable fee approach ("VFA"). For insurance contracts measured under the GMA, the impacts flow through the CSM at locked-in discount rates. For insurance contracts measured under the VFA, the impact flows through the CSM at current discount rates.

The following table sets out the impacts of ACMA on our reported net income and CSM in 2025.

| | | | | | | | | | | |

At and For the Year Ended December 31, 2025 | |

| ($ millions) | Reported net income impacts (After-tax)(1)(2) | Deferred in CSM (Pre-tax)(2)(3) | Comments |

| Mortality/morbidity | 14 | 266 | Updates to reflect mortality and morbidity experience in all jurisdictions. The largest item was a favourable mortality update mainly to GRS and Individual Wealth in Canada. |

| Policyholder behaviour | (13) | (145) | Updates to reflect lapse and policyholder behaviour in all jurisdictions. The largest item was an adverse lapse and policyholder behaviour impact in Individual Insurance in Canada. |

| Expense | (29) | (95) | Updates to expenses in all jurisdictions. |

| Financial | 31 | 7 | Updates to various financial-related assumptions. |

| Modelling enhancement and other | (48) | 16 | Various enhancements and methodology changes. The largest items were the unfavourable impact of a new reinsurance treaty in Individual Insurance in Canada, partially offset by favourable refinements in Hong Kong and High Net Worth in Asia. |

Total impact of change in assumptions | (45) | 49 | |

(1)In this document, the reported net income impact of ACMA is shown in aggregate for Net insurance service result and Net investment result, and excludes amounts attributable to participating policyholders.

(2)CSM is shown on a pre-tax basis as it reflects the changes in our insurance contract liabilities, while reported net income is shown on a post-tax basis to reflect the impact on capital.

(3)Total impact of change in assumptions represents a non-IFRS financial measure for amounts deferred in CSM. For more details, see section

M - Non-IFRS Financial Measures in this document.

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 15 |

| | | | | | | | | | | | | |

| | | | | | |

| ($ millions, unless otherwise stated) | | | | | 2025 | | 2024 |

LICAT ratio(1) | | | | | | | |

Sun Life Financial Inc. | | | | | 157% | | 152% |

Sun Life Assurance | | | | | 140% | | 146% |

Capital | | | | | | | |

Subordinated debt | | | | | 8,171 | | 6,179 |

Innovative capital instruments(2) | | | | | 200 | | 200 |

| Equity in the participating account | | | | | 696 | | 496 |

| Non-controlling interests | | | | | 264 | | 76 |

| Preferred shares and other equity instruments | | | | | 2,239 | | 2,239 |

Common shareholders' equity(3) | | | | | 22,293 | | 23,318 |

Contractual Service Margin(4) | | | | | 14,492 | | 13,366 |

Total capital | | | | | 48,355 | | 45,874 |

Financial leverage ratio(4)(5) | | | | | 23.5% | | 20.1% |

| Dividend | | | | | | | |

Underlying dividend payout ratio(5) | | | | | 47% | | 49% |

| Dividends per common share ($) | | | | | 3.520 | | 3.240 |

Book value per common share ($) | | | | | 40.25 | | 40.63 |

(1)Our LICAT ratios are calculated in accordance with the OSFI-mandated guideline, Life Insurance Capital Adequacy Test.

(2)Innovative capital instruments consist of Sun Life ExchangEable Capital Securities ("SLEECS"), For more details, see section J - Capital and Liquidity Management in this document.

(3)Common shareholders’ equity is equal to Total shareholders’ equity less Preferred shares and other equity instruments.

(4)The calculation for the financial leverage ratio includes the CSM balance (net of taxes) in the denominator. The CSM (net of taxes) was $11.3 billion as at December 31, 2025 ( December 31, 2024 - $10.3 billion).

(5)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

1. Life Insurance Capital Adequacy Test

The Office of the Superintendent of Financial Institutions has developed the regulatory capital framework referred to as the Life Insurance Capital Adequacy Test for Canada. LICAT measures the capital adequacy of an insurer using a risk-based approach and includes elements that contribute to financial strength through periods when an insurer is under stress as well as elements that contribute to policyholder and creditor protection wind-up.

SLF Inc. is a non-operating insurance company and is subject to the LICAT guideline. Sun Life Assurance, SLF Inc.'s principal operating life insurance subsidiary, is also subject to the LICAT guideline.

SLF Inc.'s LICAT ratio of 157% as at December 31, 2025 increased five percentage points compared to December 31, 2024, driven by organic capital generation and subordinated debt issuance, partially offset by shareholder dividend payments, share buybacks, M&A activity, and scenario switches.

Sun Life Assurance's LICAT ratio of 140% as at December 31, 2025 decreased six percentage points compared to December 31, 2024, driven by organic capital generation more than offset by dividend payments to SLF Inc., M&A activity, and scenario switches.

The Sun Life Assurance LICAT ratios in both periods are well above OSFI's supervisory ratio of 100% and regulatory minimum ratio of 90%.

| | | | | | | | | | | | | | | | | | | | |

16 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

2. Capital

Our total capital consists of subordinated debt and other capital instruments, CSM, equity in the participating account and total shareholders' equity which includes common shareholders' equity, preferred shares and other equity instruments, and non-controlling interests ("NCI"). As at December 31, 2025, our total capital was $48.4 billion, an increase of $2.5 billion compared to December 31, 2024. The increase to total capital included reported net income of $3,472 million, an increase of $1,126 million in CSM, the issuance of $1,000 million principal amount of Series 2025-1 Subordinated Unsecured 4.14% Fixed/Floating Debentures and the issuance of $1,000 million principal amount of Series 2025-2 Subordinated Unsecured 4.56% Fixed/Floating Debentures, which are detailed below, net unrealized gains on FVOCI assets of $255 million, and non-controlling interests of $221 million reflecting our increased ownership interest in Bowtie(1). This was partially offset by the payment of $1,975 million of dividends on common shares of SLF Inc. ("common shares"), a decrease of $1,707 million from the repurchase and cancellation of common shares, which is detailed below, and unfavourable impacts from foreign exchange translation of $899 million included in other comprehensive income (loss) ("OCI").

In 2025, organic capital generation(2) was $2,256 million, which measures the change in capital, net of dividends, above LICAT requirements excluding the impacts of markets and other non-recurring items. Organic capital generation was driven by growth in underlying net income and new business CSM, partially offset by shareholder dividend payments.

Our capital and liquidity positions remain strong with a LICAT ratio of 157% at SLF Inc., a financial leverage ratio of 23.5%(2) and $2.4 billion in cash and other liquid assets(2) as at December 31, 2025 in SLF Inc.(3) (December 31, 2024 - $1.4 billion).

Capital Transactions

On June 30, 2025, 2,664,916 of the 4,982,669 Class A Non-cumulative Floating Rate Preferred Shares Series 9QR (the "Series 9QR Shares") were converted into Class A Non-Cumulative Rate Reset Preferred Shares Series 8R (the "Series 8R Shares") on a one-for-one basis and 1,400 of its 6,217,331 Series 8R Shares were converted into Series 9QR Shares on a one-for-one basis. As a result, as of June 30, 2025, SLF Inc. has 8,880,847 Series 8R Shares and 2,319,153 Series 9QR Shares issued and outstanding.

On September 11, 2025, SLF Inc. issued $1 billion principal amount of Series 2025-1 Subordinated Unsecured 4.14% Fixed/Floating Debentures due 2037 (the "September 2025 Debenture Offering"). On December 3, 2025, SLF Inc. issued $1 billion principal amount of Series 2025-2 Subordinated Unsecured 4.56% Fixed/Floating Debentures due 2040 (the "December 2025 Debenture Offering"). The net proceeds from the September 2025 Debenture Offering and the December 2025 Debenture Offering will be used for general corporate purposes, which may include supporting the acquisition of SLF Inc.'s remaining interests in the SLC Management affiliates BentallGreenOak and Crescent Capital Group LP, investments in subsidiaries, repayment of indebtedness and other strategic investments.

Normal Course Issuer Bids

On August 29, 2024, SLF Inc. commenced a normal course issuer bid, which was in effect until June 6, 2025 (the "2024 NCIB").

On June 4, 2025, SLF Inc. announced that OSFI and the Toronto Stock Exchange (“TSX”) had approved its previously announced early renewal of its normal course issuer bid. As of June 4, 2025, SLF Inc. had purchased on the TSX, other Canadian stock exchanges and/or alternative Canadian trading platforms 14,429,085 of the 15,000,000 common shares that it was authorized to repurchase under the 2024 NCIB. Under SLF Inc.'s renewed normal course issuer bid (the "2025 NCIB"), it is permitted to purchase up to 10,570,915 common shares, being equal to the remaining 570,915 common shares that it had not repurchased under the 2024 NCIB plus an additional 10,000,000 common shares. The 2025 NCIB commenced on June 9, 2025 and will continue until May 21, 2026 or such earlier date as SLF Inc. may determine. Any common shares purchased by SLF Inc. pursuant to the 2025 NCIB will be cancelled or used in connection with certain equity settled incentive arrangements.

Shares purchased and subsequently cancelled under both bids were as follows:

| | | | | | | | | | | | | | | | | | | | |

| Quarterly results | Year-to-date | Aggregate(1) |

| Q4'25 | 2025 |

| Common shares purchased (millions) | Amount ($ millions)(2) | Common shares purchased (millions) | Amount ($ millions)(2) | Common shares purchased (millions) | Amount ($ millions)(2) |

2024 NCIB (ended June 6, 2025) | — | | — | | 10.6 | | 863 | | 14.4 | | 1,172 | |

2025 NCIB | 4.7 | | 392 | | 10.1 | | 844 | | 10.1 | | 844 | |

Total | 4.7 | | 392 | | 20.7 | | 1,707 | | | |

(1)Represents the balance of common shares purchased and subsequently cancelled under the life of the normal course issuer bid to-date.

(2)Excludes the impact of excise tax on net repurchases of equity.

(1)On July 15, 2025, we acquired an additional interest in Bowtie Life Insurance Company Limited ("Bowtie"), which increased our ownership interest, excluding dilution, by approximately 11% and resulted in a total ownership interest of 55.8%. Total consideration was cash of $55 million. For additional information, refer to Note 3 of our 2025 Annual Consolidated Financial Statements.

(2)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

(3)SLF Inc. (the ultimate parent company) and its wholly-owned holding companies.

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 17 |

Financial Strength Ratings

Independent rating agencies assign credit ratings to securities issued by companies and assign financial strength ratings to financial institutions such as Sun Life Assurance.

The financial strength ratings assigned by rating agencies are intended to provide an independent view of the creditworthiness and financial strength of a financial institution. Each rating agency has developed its own methodology for the assessment and subsequent rating of life insurance companies.

Rating agencies do not assign a financial strength rating for SLF Inc., however, credit ratings are assigned to the securities issued by SLF Inc. and its subsidiaries and are described in SLF Inc.'s AIF under the heading Security Ratings.

The following table summarizes the financial strength ratings for Sun Life Assurance as at January 31, 2026 and January 31, 2025.

| | | | | | | | | | | | | | |

| A.M. Best | DBRS | Moody's | Standard & Poor's |

| January 31, 2026 | A+ | AA | Aa3 | AA |

| January 31, 2025 | A+ | AA | Aa3 | AA |

Most recent rating agency actions on the financial strength rating of Sun Life Assurance:

•November 19, 2025 - Moody's affirmed the financial strength rating with a stable outlook.

•October 21, 2025 - DBRS affirmed the financial strength rating with a stable outlook.

•April 3, 2025 - A.M. Best affirmed the financial strength rating with a stable outlook.

•March 6, 2025 - Standard and Poor's ("S&P") affirmed the financial strength rating with a stable outlook.

| | | | | | | | | | | | | | | | | | | | |

18 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

| | | | | |

| H. Performance by Business Segment | |

Sun Life's business is well-diversified across geographies and business types, supported by our four pillar strategy and diversified offerings of wealth and insurance products.

| | | | | | | | | | | |

| | |

| ($ millions) | | | | 2025 | 2024 |

Underlying net income (loss)(1) | | | | | |

| Asset Management | | | | 1,371 | 1,293 |

| Canada | | | | 1,594 | 1,453 |

| U.S. | | | | 770 | 773 |

| Asia | | | | 836 | 701 |

| Corporate | | | | (370) | (364) |

Total underlying net income (loss)(1) | | | | 4,201 | 3,856 |

| Reported net income (loss) - Common shareholders | | | | | |

| Asset Management | | | | 1,214 | 1,528 |

| Canada | | | | 1,402 | 1,217 |

| U.S. | | | | 520 | 556 |

| Asia | | | | 768 | 429 |

| Corporate | | | | (432) | (681) |

| Total reported net income (loss) - Common shareholders | | | | 3,472 | 3,049 |

(1)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

All factors discussed in this document that impact our underlying net income are also applicable to reported net income.

| | | | | | | | | | | | | | | | | | | | |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | Sun Life Financial Inc. | December 31, 2025 | 19 |

1. Asset Management

| | |

Our Asset Management business group is comprised of MFS and SLC Management. MFS is a premier global asset manager offering a comprehensive selection of financial products and services that deliver superior value, actively managing assets for retail and institutional investors around the world. SLC Management is a global asset manager with capabilities across fixed income and alternative asset classes including public and private fixed income, real estate equity and debt, and infrastructure equity, and manages assets on behalf of institutional investors, and HNW and retail Clients around the world. |

2025 Highlights

| | |

•We ended 2025 with $1,154.0 billion in assets under management(1) consisting of $894.0 billion (US$651.4 billion) in MFS and $260.0 billion in SLC Management. •Total Asset Management net outflows(1) of $39.9 billion reflected net outflows of $58.1 billion (US$41.5 billion) from MFS partially offset by SLC Management net inflows of $18.2 billion. •Effective January 1, 2026, we extended and formalized our asset management pillar in Sun Life Asset Management. In addition to MFS and SLC Management, Sun Life Asset Management includes Sun Life's stake in Aditya Birla Sun Life Asset Management, previously part of the Asia business segment, as well as Sun Life's pension risk transfer business, previously part of the Canada business segment. This new structure will help accelerate growth between our asset management, insurance, and wealth businesses and drive strategic partnerships to the benefit of our Clients. Effective January 1, 2026, Sun Life's asset management financial results will reflect this new structure.

|

| | |

MFS •MFS continued to experience solid fixed income fund performance, generating net inflows(1) of US$5.5 billion for this asset class in the year. •MFS remains the 9th largest fund group(2) for the U.S. retail mutual fund industry based on AUM, despite continued challenging market conditions. •Active exchange traded funds ("ETFs") experience solid momentum in 2025, with US$1.2 billion in net inflows(1) since the launch in late 2024, ending the year with over US$1.4 billion in AUM(1). MFS expanded its ETF platform with an additional three funds launched in the year, including two funds managed using MFS' proprietary Blended Research® approach, continuing to expand the diverse range of investment products offered to Clients. |

| | |

SLC Management •SLC Management was named one of Pensions & Investments(3) 2025 Best Places to Work in Money Management. This represents SLC Management's sixth consecutive year of recognition. •BentallGreenOak ("BGO") launched BGO DataCenters, its European Hyperscale investment and development platform, focused on delivering customized sustainable, hyperscale, and AI-optimized digital infrastructure across Europe, meeting growing demand in one of real estate’s fastest-growing sectors. •Crescent Capital Group ("Crescent") launched GP Financing, which offers sponsors flexible financing solutions to address strategic growth needs, and Bank Capital Solutions, which focuses on credit risk-sharing transactions. These strategies broaden Crescent's private credit offerings. •Crescent was recognized by Private Debt Investor in 2025 as the Lower Mid-Market Lender of the Year in Europe for the publication’s 2024 Annual Awards. This award reflects Crescent’s consistent performance, deep market expertise and commitment to providing flexible financial solutions to lower mid-market companies and their sponsors across Europe. •SLC Management appointed Richard Familetti to President and Chief Investment Officer, SLC Fixed Income. •Advisors Asset Management, Inc. ("AAM") appointed Lindsay DeGrazia as Managing Director, Head of Alternative Investments Distribution, to oversee sales and distribution for private markets investments in U.S. wealth channels. •Sonny Kalsi, President and CEO of SLC Management, ranked among one of the top ten Most Influential figures globally in private equity real estate in the 2025 PERE(4) rankings. BGO also ranked fourth among the world’s top private real estate managers in the 2025(5) rankings. The achievement reflects BGO’s strong fundraising over the last five years despite macroeconomic headwinds. •Crescent closed its third European specialty lending fund in April, raising approximately €3 billion. This fundraise represents a significant increase from its predecessor fund and continues Crescent’s strategy of investing primarily in a diversified portfolio of private secured debt securities issued by European companies. •InfraRed Capital Partners ("InfraRed") announced the formation of a strategic Separately Managed Account ("SMA") with a large European pension services provider. The SMA has been established to provide the company with diversified exposure to social infrastructure investments across Europe. •InfraRed entered into a definitive agreement to acquire a large Canadian telecommunications firms' data centre business to expand its footprint in Canada’s digital infrastructure market, capitalizing on rising demand for secure and reliable data centre services. |

(1)Represents a non-IFRS financial measure. For more details, see section M - Non-IFRS Financial Measures in this document.

(2)ISS Market Intelligence Simfund.

(3)Pensions & Investments, a global news source of money management.

(4)Private Equity Real Estate ("PERE"). 2025 PERE 100 Most Influential; those who had the biggest impact on the world's private real estate capital markets.

(5)2025 PERE 100 ranking of the world’s largest private real estate companies.

| | | | | | | | | | | | | | | | | | | | |

20 | December 31, 2025 | Sun Life Financial Inc. | | MANAGEMENT'S DISCUSSION & ANALYSIS | |

Strategy and Outlook

Our strategy is to provide investment products through MFS and SLC Management that will deliver long-term value to our Clients in active asset management as well as fixed income and alternative asset classes. MFS competes primarily in the global institutional, U.S. retail and select non-U.S. retail markets. SLC Management competes primarily in the global institutional market, offering a broad and deep fixed income and real assets platform through affiliate managers. SLC Management leverages Sun Life’s long-standing expertise in private asset class investments, augmented by the specialized alternative capabilities of SLC Management's affiliate managers, to offer customized investment solutions to investors. In addition, with our majority interest in AAM and partnership with Scotia Global Wealth Management, SLC Management is also delivering solutions to the retail HNW market in North America.

| | |

MFS: Continue to deliver superior investment performance while allocating capital responsibly for our Clients MFS' active management strategy focuses on delivering value to our Clients over the long-term. Our relative performance provides us with a strong competitive position: •MFS is well-positioned to attract flows from all Client sectors that are seeking risk-managed returns over the long-term based on our disciplined, long-term approach. We are engaging Clients to align with MFS to focus on longer investment horizons, to leverage our proven ability to deliver risk-adjusted performance through a market cycle. •To help our Clients maximize the financial return of their portfolio within appropriate risk parameters, we employ an investment approach that focuses on issuers with durable, long-term competitive advantages. This means we consider all factors that we believe will materially impact the economic value of the issuer in our fundamental investment process. •Our strategic focus for long-term success is based on our collaborative and excellence-driven organization. •MFS strives to maintain margins in the top quartile of active managers while maintaining our commitment to provide long-term value to Clients. •Our people are our greatest investment, and we believe in the power of teamwork, which makes sustaining and enhancing inclusivity a top priority. |

| | |

SLC Management: Help investors meet their investment objectives by offering a broad suite of alternative asset classes and fixed income strategies We are well-positioned to take advantage of key trends in our target markets: •Consolidation of investment manager relationships by institutional investors. •Improvement in interest rate environment for risk assets, driven by central banks rate cuts. •Likely bottoming of real estate valuations, spurring increased activity. •Continued growth and broadening of private credit, supported by the long-term shift from public to private markets, and rising demand from insurance companies. •AI and data centre demand driving continued long-term growth in real assets. •Wealth as the next big growth area for alternatives, with AUM projected to triple over the next decade(1).

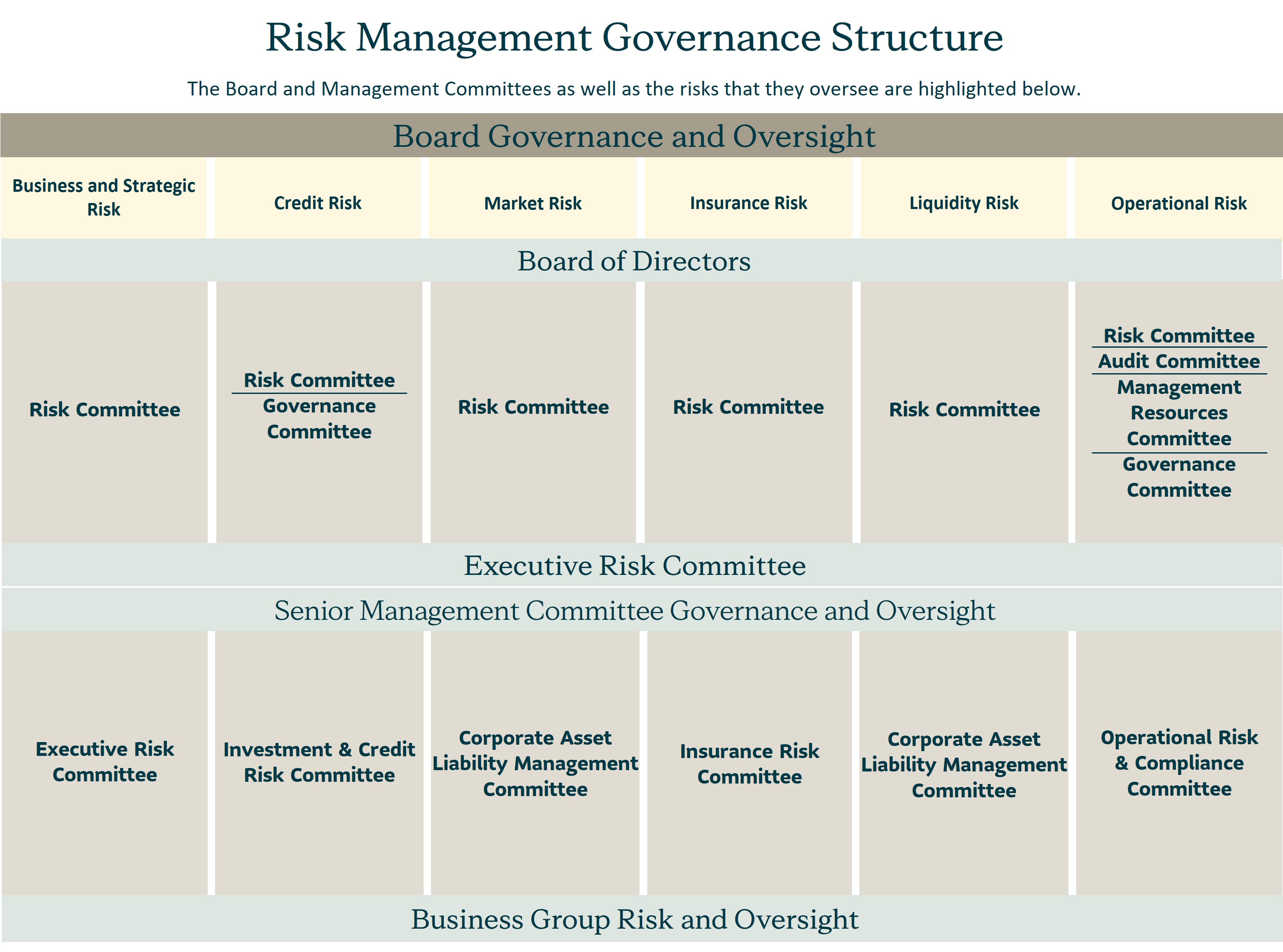

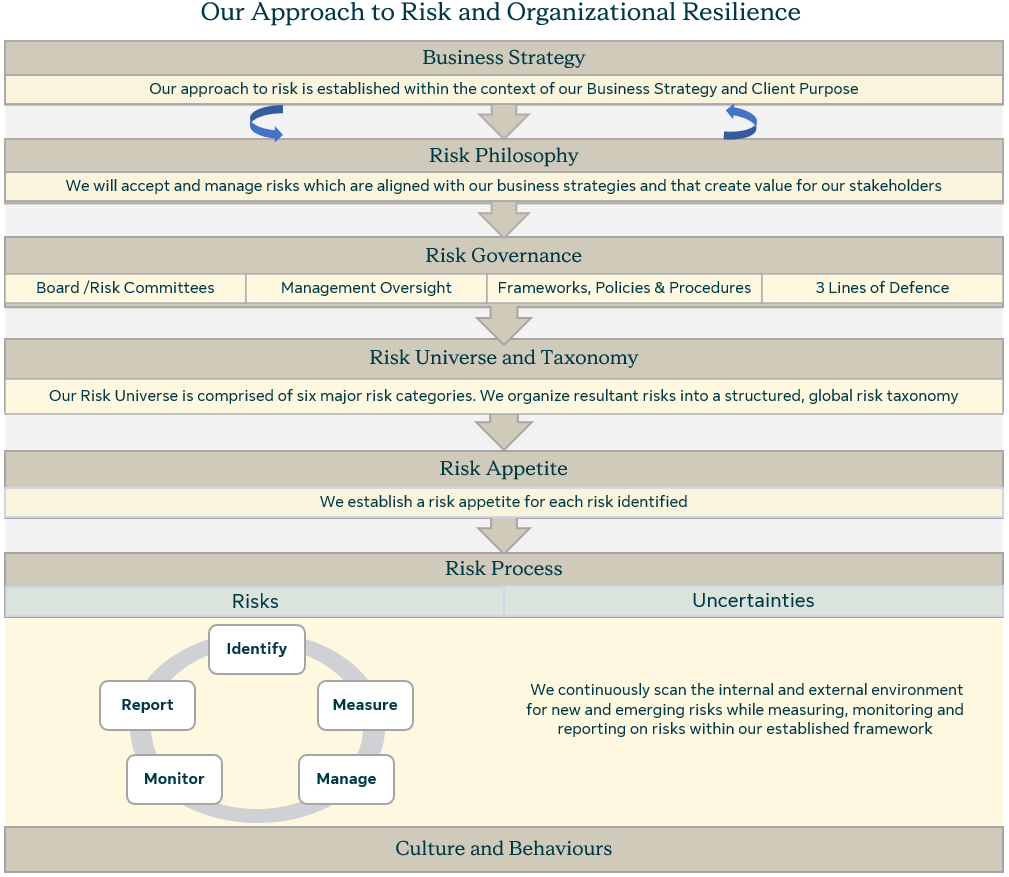

Our strategy is to continue to deliver superior investment performance, expand and deepen our distribution relationships, and build out our product lineup, while retaining our top talent. We offer our Clients a compelling suite of investment capabilities to meet their needs, including: •Leading public and private fixed income capabilities, spanning both investment grade and alternative credit; •Global real estate expertise across both equity and debt investments; and •Global infrastructure capabilities. |