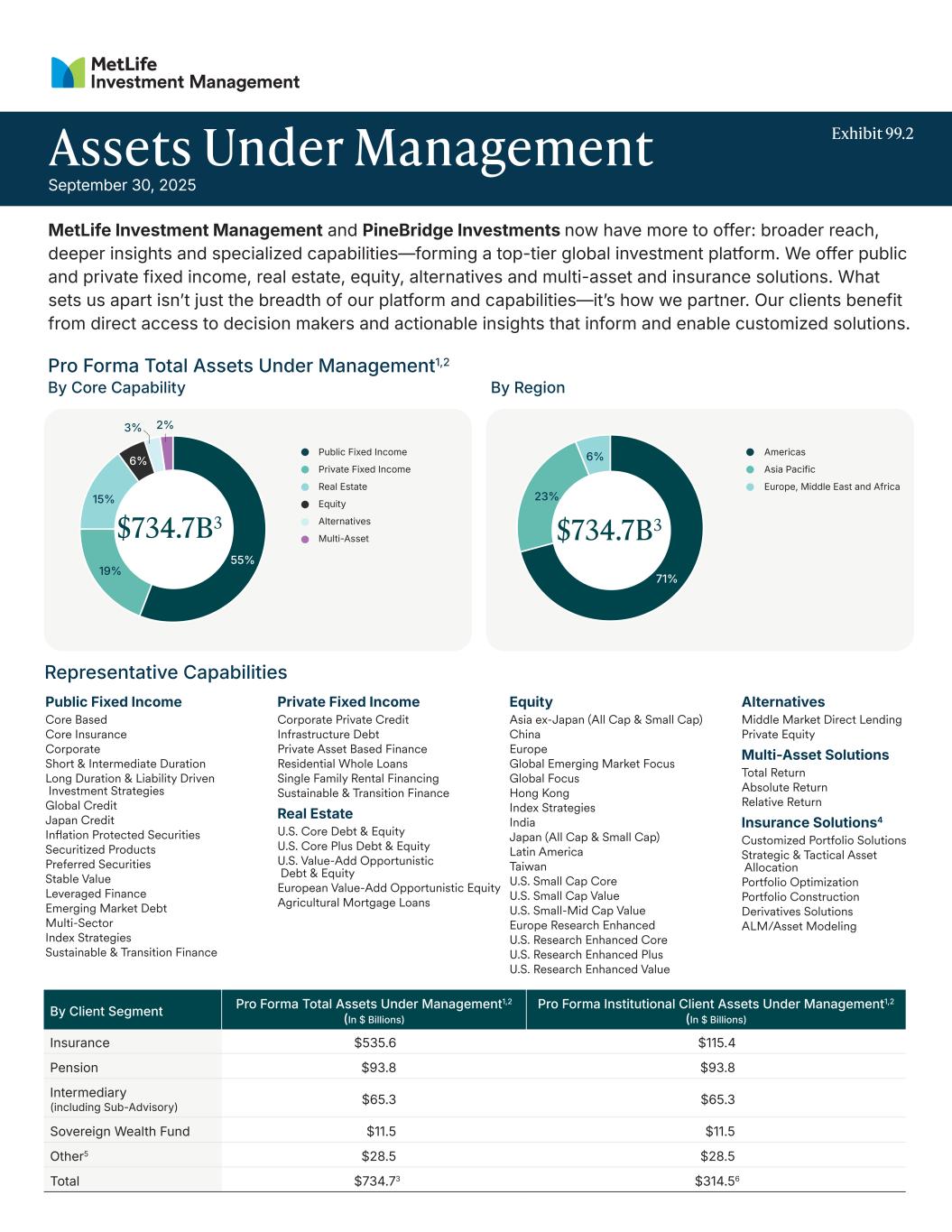

Public Fixed Income Core Based Core Insurance Corporate Short & Intermediate Duration Long Duration & Liability Driven Investment Strategies Global Credit Japan Credit Inflation Protected Securities Securitized Products Preferred Securities Stable Value Leveraged Finance Emerging Market Debt Multi-Sector Index Strategies Sustainable & Transition Finance Private Fixed Income Corporate Private Credit Infrastructure Debt Private Asset Based Finance Residential Whole Loans Single Family Rental Financing Sustainable & Transition Finance Real Estate U.S. Core Debt & Equity U.S. Core Plus Debt & Equity U.S. Value-Add Opportunistic Debt & Equity European Value-Add Opportunistic Equity Agricultural Mortgage Loans Equity Asia ex-Japan (All Cap & Small Cap) China Europe Global Emerging Market Focus Global Focus Hong Kong Index Strategies India Japan (All Cap & Small Cap) Latin America Taiwan U.S. Small Cap Core U.S. Small Cap Value U.S. Small-Mid Cap Value Europe Research Enhanced U.S. Research Enhanced Core U.S. Research Enhanced Plus U.S. Research Enhanced Value Alternatives Middle Market Direct Lending Private Equity Multi-Asset Solutions Total Return Absolute Return Relative Return Insurance Solutions4 Customized Portfolio Solutions Strategic & Tactical Asset Allocation Portfolio Optimization Portfolio Construction Derivatives Solutions ALM/Asset Modeling Assets Under Management September 30, 2025 .2 MetLife Investment Management and PineBridge Investments now have more to offer: broader reach, deeper insights and specialized capabilities—forming a top-tier global investment platform. We offer public and private fixed income, real estate, equity, alternatives and multi-asset and insurance solutions. What sets us apart isn’t just the breadth of our platform and capabilities—it’s how we partner. Our clients benefit from direct access to decision makers and actionable insights that inform and enable customized solutions. Public Fixed Income Private Fixed Income Real Estate Equity Alternatives Multi-Asset Americas Asia Pacific Europe, Middle East and Africa Representative Capabilities Pro Forma Total Assets Under Management1,2 $734.7B3 55% 71% 3% 2% 6% 15% 19% $734.7B3 6% 23% By RegionBy Core Capability By Client Segment Pro Forma Total Assets Under Management1,2 (In $ Billions) Pro Forma Institutional Client Assets Under Management1,2 (In $ Billions) Insurance $535.6 $115.4 Pension $93.8 $93.8 Intermediary (including Sub-Advisory) $65.3 $65.3 Sovereign Wealth Fund $11.5 $11.5 Other5 $28.5 $28.5 Total $734.73 $314.56

investments.metlife.com © 2025 MetLife Investment Management Footnotes 1 Represents the pro forma combined assets under management of MetLife Investment Management, LLC and certain of its affiliates (“MetLife Investment Management”) and PineBridge Investments, LLC and those of its affiliates acquired by MetLife Investment Management (“PineBridge”) on December 30, 2025 (“Acquisition”) as if the Acquisition had occurred as of September 30, 2025. The pro forma figures are presented for illustrative purposes only and do not reflect actual combined results for any completed period. 2 At September 30, 2025. At estimated fair value. See Explanatory Note. 3 Comprised of $632.6 billion and $102.1 billion of assets under management managed or advised by MetLife Investment Management and PineBridge, respectively, as of September 30, 2025. For further information, see MetLife Investment Management’s Total Assets Under Management fact sheet for the quarter ended September 30, 2025 available on MetLife’s Investor Relations web page at https://investor.metlife.com. 4 Represents advisory services that are not reflected in Total Assets Under Management. 5 Includes health service organizations, endowments, foundations, non-profits, family office, high net worth, fund of funds, funds, retail, supranationals and central authorities. 6 Comprised of $212.4 billion and $102.1 billion of assets under management managed or advised by MetLife Investment Management and PineBridge, respectively, as of September 30, 2025. Of the $314.5 billion of pro forma Institutional Client AUM, $17.3 billion, $11.3 billion and $285.9 billion are Separate Account AUM, Reinsurance AUM and Third-Party AUM, respectively. For further information, see MetLife Investment Management’s Total Assets Under Management fact sheet for the quarter ended September 30, 2025 available on MetLife’s Investor Relations web page at https://investor.metlife.com. Explanatory Note The following information is relevant to an understanding of our assets under management (“AUM”) managed or advised by MetLife Investment Management, LLC and certain of its affiliates (“MetLife Investment Management”), and PineBridge Investments, LLC and those of its affiliates acquired by MetLife Investment Management (“PineBridge”) on December 30, 2025. “MIM,” including MetLife Investment Management and PineBridge, is MetLife, Inc.’s institutional asset management business. Our definitions may differ from those used by other companies. Total Assets Under Management (“Total AUM”) is comprised of MIM General Account AUM plus Institutional Client AUM (each, as defined below). MIM General Account AUM (“MIM GA AUM”) is used by MetLife to describe the portion of GA AUM (as defined below) that MIM manages or advises. General Account AUM (“GA AUM”) is used by MetLife to describe assets in its general account (“GA”) investment portfolio. GA AUM is stated at estimated fair value and is comprised of GA total investments, the portion of the GA investment portfolio classified within assets held-for- sale, cash and cash equivalents, and accrued investment income on such assets, and excludes policy loans, contractholder-directed equity securities, fair value option securities, mortgage loans originated for third parties, assets subject to ceded reinsurance arrangements with third parties and joint ventures, and certain other invested assets. Mortgage loans, net of mortgage loans originated for third parties (“net mortgage loans”) (including commercial (“net commercial mortgage loans”), agricultural (“net agricultural mortgage loans”) and residential mortgage loans) and real estate equity (including real estate and real estate joint ventures) included in GA AUM (at net asset value, net of deduction for encumbering debt) have been adjusted from carrying value to estimated fair value. Classification of GA AUM by sector is based on the nature and characteristics of the underlying investments which can vary from how they are classified under GAAP. Accordingly, the underlying investments within certain real estate and real estate joint ventures that are primarily net commercial mortgage loans (at net asset value, net of deduction for encumbering debt) have been reclassified to exclude them from real estate equity and include them as net commercial mortgage loans. Institutional Client AUM is comprised of SA AUM plus Reinsurance AUM plus TP AUM (each, as defined below). MIM manages or advises Institutional Client AUM in accordance with client guidelines contained in each investment advisory agreement. Separate Account AUM (“SA AUM”) is comprised of certain (i) separate account investment portfolios and (ii) unit-linked separate account investments that are directed by contractholders of MetLife insurance companies, which are managed or advised by MIM and included in MetLife, Inc.’s consolidated financial statements at estimated fair value, as well as accrued investment income on such assets. Reinsurance AUM is comprised of GA assets subject to ceded reinsurance arrangements with third parties and joint ventures, which are managed or advised by MIM and are generally included in MetLife, Inc.’s consolidated financial statements at estimated fair value, as well as accrued investment income on such assets. Third-Party AUM (“TP AUM”) is comprised of non-proprietary assets managed or advised by MIM on behalf of unaffiliated/third-party clients, which are stated at estimated fair value, as well as accrued investment income on such assets. Such non-proprietary assets are owned by unaffiliated/third-party clients and, accordingly, are generally not included in MetLife, Inc.’s consolidated financial statements. Additional information about MetLife’s general account investment portfolio is available in MetLife, Inc.’s quarterly financial materials for the quarter ended September 30, 2025, which may be accessed through MetLife’s Investor Relations web page at https://investor.metlife.com. Neither MetLife, Inc.’s quarterly financial materials, nor any other information included in or linked to the MetLife website, is a part of or incorporated by reference into this fact sheet. 12-27 5087540-[MIM, LLC (US)]