MONTEVIDEO, Uruguay; October 29, 2025 -- MercadoLibre, Inc. (Nasdaq: MELI) (http://www.mercadolibre.com), Latin America’s leading e-commerce and fintech company, today reported financial results for the third quarter ended September 30, 2025. Net revenues & financial income of $7,409 million, up 39% YoY and 49% FX-neutral Income from operations of $724 million, with a 9.8% margin Net income of $421 million, with a 5.7% margin Total Payment Volume of $71.2 billion, up 41% YoY and 54% FX-neutral Gross Merchandise Volume of $16.5 billion, up 28% YoY and 35% FX-neutral To our Shareholders We are pleased to report another strong quarter, demonstrating that our investments are delivering results across our ecosystem. From widening access to credit and payments to strengthening our marketplace value proposition and reducing the frictions of shopping online, our investments underpin the rapid growth of our key operating metrics. Our net revenue and financial income grew 39% YoY in Q3’25 – the 27th consecutive quarter of growth above 30% YoY. During this seven-year period, market share and NPS data show that we have significantly strengthened our competitive position across our businesses, while margins and cash flow have improved markedly. This shows the power of scale and our ability to balance growth, investment and profitability over multiple years. We see ourselves as exceptionally well-positioned to accelerate financial inclusion and ecommerce penetration across Latin America, and are committed to investing to achieve this. Commerce We continue to make strong progress in leading the shift of offline retail to ecommerce in our region. Ecommerce penetration has the potential to double in the coming years, which implies the ecommerce market more than doubling. Our ambition is always to grow ahead of the market. Offering more free shipping is a key pillar of our strategy to capture this long-term growth opportunity. The recent reduction in the free shipping threshold in Brazil from R$79 to R$19 is already driving strong results, consistent with previous threshold reductions. Unique buyers in Brazil grew 29% YoY in Q3'25 – the fastest pace since Q1'21 and the largest quarterly addition of unique buyers ever, surpassing even the pandemic peak. Sold items growth in Brazil accelerated to 42% YoY and FX-neutral GMV also accelerated, rising 34% YoY. Market share gains accelerated and our NPS reached its highest level ever. We are also seeing solid momentum on the supply side of our marketplace in Brazil. The number of merchants making sales in the R$19–79 range grew at a double-digit YoY pace in Q3’25, while new listings in that range grew 3x YoY. These trends make our marketplace more dynamic by broadening buyer choice and expanding opportunities for sellers. This explains why the number of visits accelerated substantially, conversion reached an all-time high and retention hit record levels for new and existing customers. Put simply, the lower free shipping threshold is attracting more buyers and enabling sellers to turn that traffic into higher sales. This, in turn, creates a powerful flywheel of supply and demand. The strength of our logistics network enabled us to absorb a 28% QoQ increase in shipments in Brazil without any negative impact on service levels or speed. We are seeing good progress in the slow layer of our logistics network, which underpins free shipping below R$79. The speed of those deliveries improved markedly through the quarter, making slow/free delivery options more attractive. This has further reduced shipping revenue but, more importantly, has lifted conversion to record highs. Unit shipping costs in Brazil fell 8% QoQ in local currency as our slow volumes increase scale and leverage unused capacity across our network. This is an important milestone in a gradual journey to reduce unit shipping costs across the business. Mexico delivered another outstanding quarter in Q3’25 as sold items growth accelerated to 42% YoY and FX-neutral GMV was up 34%. This growth reflects the broad strength of our value proposition, with on-time deliveries and free shipping penetration MercadoLibre, Inc. Letter to Shareholders MercadoLibre Letter to Shareholders 1 Q3’25 Results

reaching record highs, while 1P and CBT sustained their strong momentum. Fulfillment penetration also reached a new high, and the resulting scale – together with ongoing productivity and efficiency initiatives – enabled us to achieve our lowest-ever unit shipping cost in fulfillment in Mexico, down more than 12% YoY in local currency In Argentina, we have added nearly 1mn new buyers per quarter so far this year – more than in any previous quarter in our history. This reflects the strength of our value proposition compared to physical retail, which still represents approximately 85% of the total retail market. The share of same- and next-day deliveries increased nearly 7ppts YoY as fulfillment penetration reached a new record, even before our new Buenos Aires fulfillment center came online. We added drop-shipping from China to our CBT platform and although the business remains small, we see potential to complement our US assortment with lower ASP categories, such as fashion, toys and baby. Growth in Argentina remained resilient in Q3'25 despite a challenging macro backdrop, with sold items up 34% YoY and FX-neutral GMV up 44%. Our marketing investments focus on expanding our social platforms and presence, positioning Mercado Libre as the destination for the best prices, deals and assortment, and strengthening our brand. Latin Americans spend over three hours per day on social media – well above the global average of two hours and twenty minutes. This is why we have intensified investment in social commerce, with affiliate participants up 4x YoY in Q3'25. At the same time, our content creators produced tens of thousands of videos driving traffic to our site for specific campaigns. Together, these programs put us at the center of younger users’ attention and strengthen our position in categories such as apparel and beauty. Our branding campaigns also contributed to record brand preference scores across Brazil, Mexico, Argentina and Chile. Mercado Ads is becoming a comprehensive digital media platform that goes beyond retail media by leveraging our first-party data as a competitive advantage. Brands have responded positively to the expansion of our off-ecosystem inventory announced in Q2'25, which enables campaigns to achieve high frequency and low CPMs. This complements on-ecosystem campaigns, where users have higher intent (leading to higher CPMs). We are also adding new premium advertising inventory through partnerships with Roku and HBO. Display & Video revenue is growing close to triple-digits, helping drive an acceleration of FX-neutral Ads revenue growth to 63% YoY in Q3'25 (56% in USD). Loyalty We continue to strengthen MELI+ as its user base expands. In October, we announced that MELI+ subscribers in Brazil will be eligible for fast shipping on marketplace purchases from R$19 (versus slow shipping for non-MELI+ buyers in the R$19-79 range). This reintroduces a differentiated shipping benefit for MELI+ users in Brazil following the expansion of free shipping below R$79 to all users in June. We launched the MELI+ Mega “super bundle” that includes Disney+, Netflix, HBO Max, Apple TV+, and our ecosystem benefits, all managed in a single subscription. This shows the strength of MELI+ as a distribution channel for our partners, and its compelling benefits for users. We also signed partnerships with McDonald’s, Petrobras, and 99 in Brazil to offer MELI+ users co-funded cashback in Meli Dólar when paying with their Mercado Pago credit card. We think we are uniquely positioned to offer the most compelling benefits package in LatAm, which will drive engagement with the Mercado Libre and Mercado Pago platforms. Fintech Services Our goal in Fintech Services is to become the largest digital bank in Latin America by having the best value proposition. We made further progress on both fronts in Q3'25 with MAUs up 29% YoY to 72mn and NPS reaching record highs – again – in Brazil. Our internal data shows we now have the highest NPS among fintechs in Brazil, and we have maintained NPS leadership among fintechs in Mexico. The next step toward our goal is to continue driving principality. Principal relationships bring clear benefits: higher retention, lower delinquency and broader cross-sell. NPS among principal users in Brazil is double-digit percentage points higher than our overall NPS, which itself ranks among the market's highest. This gives us confidence that we have the right product and experience to generate engagement and build principality. In Q3'25, the share of principal users rose 11ppts YoY in Brazil and 2ppts in Mexico. MercadoLibre Letter to Shareholders 2 Q3’25 Results

The Mercado Pago credit card is one of the key drivers of rising principality and strong NPS, and its compelling value proposition is translating into higher usage. In Brazil, Mercado Pago’s share of wallet among low risk users has been rising consistently. More than 50% of credit card TPV in Brazil is transacted off-platform, showing how the card is used broadly beyond our ecosystem, not just as a ‘MELI store card’. On-platform trends are also positive, with our credit card now consistently the #1 choice for installment transactions in Brazil, surpassing all third-party cards. Offering extra installments has supported this, reflecting the power of our ecosystem synergies. We aim to replicate this dynamic in Argentina, where we launched our credit card in August. Engagement with Mercado Pago is high due to widespread and frequent use of our QR payments network and our longstanding commitment to remunerating funds held in our account. This solid foundation for the credit card is another demonstration of the strength of the ecosystem. The card will enable users to further consolidate their finances with Mercado Pago and will strengthen our efforts to increase financial inclusion in Argentina, where six out of ten adults do not have a credit card. The total number of users in our credit portfolio surpassed 27mn in Q3’25. User growth was a key contributor to the portfolio’s expansion, which rose 83% YoY to $11.0bn in Q3’25. The increasing accuracy of our underwriting models alongside improvement in our asset quality metrics underpins our confidence to grow at a rapid pace. NIMAL compressed sequentially by 2ppts to 21.0% in Q3'25, partly due to higher funding costs in Argentina; excluding Argentina, the compression would have been less than 1ppt. The 15-90 day NPL remained stable at 6.8%. Put simply, we are growing rapidly without compromising the quality of our portfolio. We are able to do this because of our huge marketplace audience and the increasing accuracy of our models. In Q3’25, we issued a record number of credit cards in Brazil as first payment defaults reached another record low. This metric also improved YoY in Mexico. Our credit card cohorts continue to show consistent progress towards breakeven, profitability and payback. Approximately half of the Brazil credit card portfolio is now profitable. Acquiring Our Acquiring business leverages the payments infrastructure we have built over more than two decades, originally for our marketplace and then for merchants outside our ecosystem. Our market share is rising across all our markets, and has done so consistently for several years. This is the result of the quality of our product and our wider value proposition, which includes credits, banking services and, increasingly, software solutions. This helps us to increase retention and promote financial inclusion. For example, our recent Brazil Impact Report showed that two out of three entrepreneurs in our ecosystem made their first financial investment via Mercado Pago and 60% received their first ever credit from us. This strong foundation enabled us to grow FX-neutral Acquiring TPV at 28% YoY in Q3'25 in Brazil, even with intense competition, as growth rates picked up sequentially in In-store and Online Payments, and remained solid in QR. In Mexico, our Acquiring business is also a key pillar of our efforts to digitalize cash. It enables merchants to accept payments with the debit and credit cards issued by Mercado Pago (as well as other cards), increasing the usefulness of those cards. We surpassed 1mn active POS devices in Mexico in Q3'25 and continue to grow rapidly – a testament to strong demand, as well as the quality of our product. Merchants using these devices can also access credit lines, providing another lever to promote financial inclusion in Mexico. This structural growth opportunity helped us maintain strong momentum in Q3'25, with Mexico's FX-neutral Acquiring TPV up 53% YoY, supported by much higher growth in the In-store segment. Near-term trends in Argentina are mixed. FX-neutral Acquiring TPV is growing at a solid pace – 70% YoY in Q3'25 – despite macro headwinds, but growth has slowed. This is driven by our In-store and QR segments, which have been impacted by near-term weakness in consumption. Online Payments remains resilient as we attract new customers and ramp up new features, such as our recurring payments product. We continue to believe there many long-term growth opportunities in Argentina. MercadoLibre Letter to Shareholders 3 Q3’25 Results

Consolidated Financial Results Net revenue and financial income grew 39% in Q3’25 to $7.4bn. Growth accelerated sequentially, despite a major increase in free shipping and lower seller shipping charges, which reduced shipping revenue. FX-neutral growth decelerated modestly to 49% YoY due to lower inflation in Argentina; growth in Brazil (35% YoY) and Mexico (42% YoY) remained strong, as we continued executing on the structural growth opportunities we are pursuing in both countries. Income from operations grew 30% YoY to $724mn in Q3’25. We made strategic investments that increased cost of revenue, sales & marketing and provisions for doubtful accounts as a percentage of revenue. These include lowering our free shipping threshold in Brazil, ramping-up 1P, investing in social commerce and expanding our credits business. In parallel, their contribution to revenue and a combination of scale, efficiency and tight cost management allowed us to significantly dilute product development and G&A expenses. The net effect was a modest YoY decline in our income from operations margin – a reasonable trade-off for investments that expand our addressable markets, seed future growth, strengthen our competitive position and drive long-term scale. Direct Contribution (DC) margin in Brazil declined YoY for the reasons discussed above. However, strong top line growth in Brazil also contributed significantly to the dilution of product development and G&A expenses, much of which is recorded between DC and income from operations. Short-term macro headwinds in Argentina resulted in lower growth on the marketplace and increased funding costs in our acquiring and credit businesses. This led to a 4-5ppt compression of DC margin YoY and QoQ. Net income of $421mn rose 6% YoY, growing at a slower pace than income from operations due to larger FX losses and a higher tax rate YoY. The depreciation of the Argentine Peso against the US Dollar has a negative translation impact on our P&L, and generates FX losses. This means that revaluations of monetary assets and liabilities nominated in local currency are recorded in our P&L, which is not the case for other countries, due to Argentina being considered hyperinflationary under US GAAP. Furthermore, this increases our tax rate under US GAAP because these FX losses are not deductible under local accounting rules. We continue to generate strong cash flow, even with an intense pace of investment and the growth of our credit portfolio. Adjusted free cash flow reached $206mn in Q3’25 after capex of $357mn and investment of $1,730mn in the growth of the credit portfolio (partially offset by $485mn of third-party funding). Looking ahead We believe we are still in the early stages of realizing our full potential, with ecommerce penetration of just mid-teens in Latin America, and single-digit market shares – in some cases, low-single digits – in many of our fintech businesses and advertising. This conviction drives our approach to investments aimed at continuing to improve our value proposition for individuals and merchants in commerce and fintech. While these investments put short term pressure on our margins, other investments, such as the credit card in Brazil, begin to mature and their margin pressure eases. The balance between new and maturing investments will vary over time, but the common theme across all of them is their long-term nature, and our conviction that they will drive sustainable engagement, growth and scale. We are confident in our ability to execute on these growth opportunities and we remain committed to doing so in a disciplined manner. This ensures that the best is yet to come. MercadoLibre Letter to Shareholders 4 Q3’25 Results

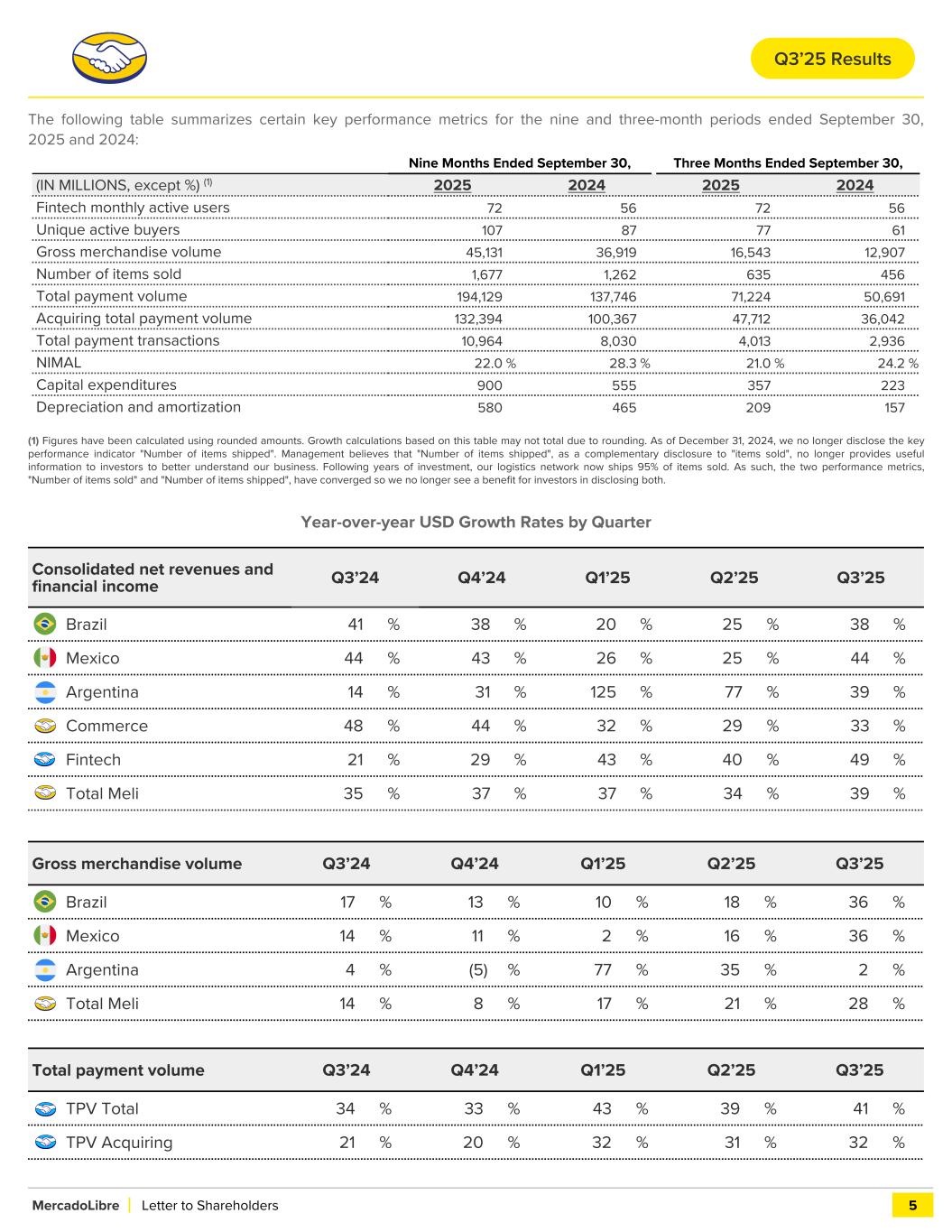

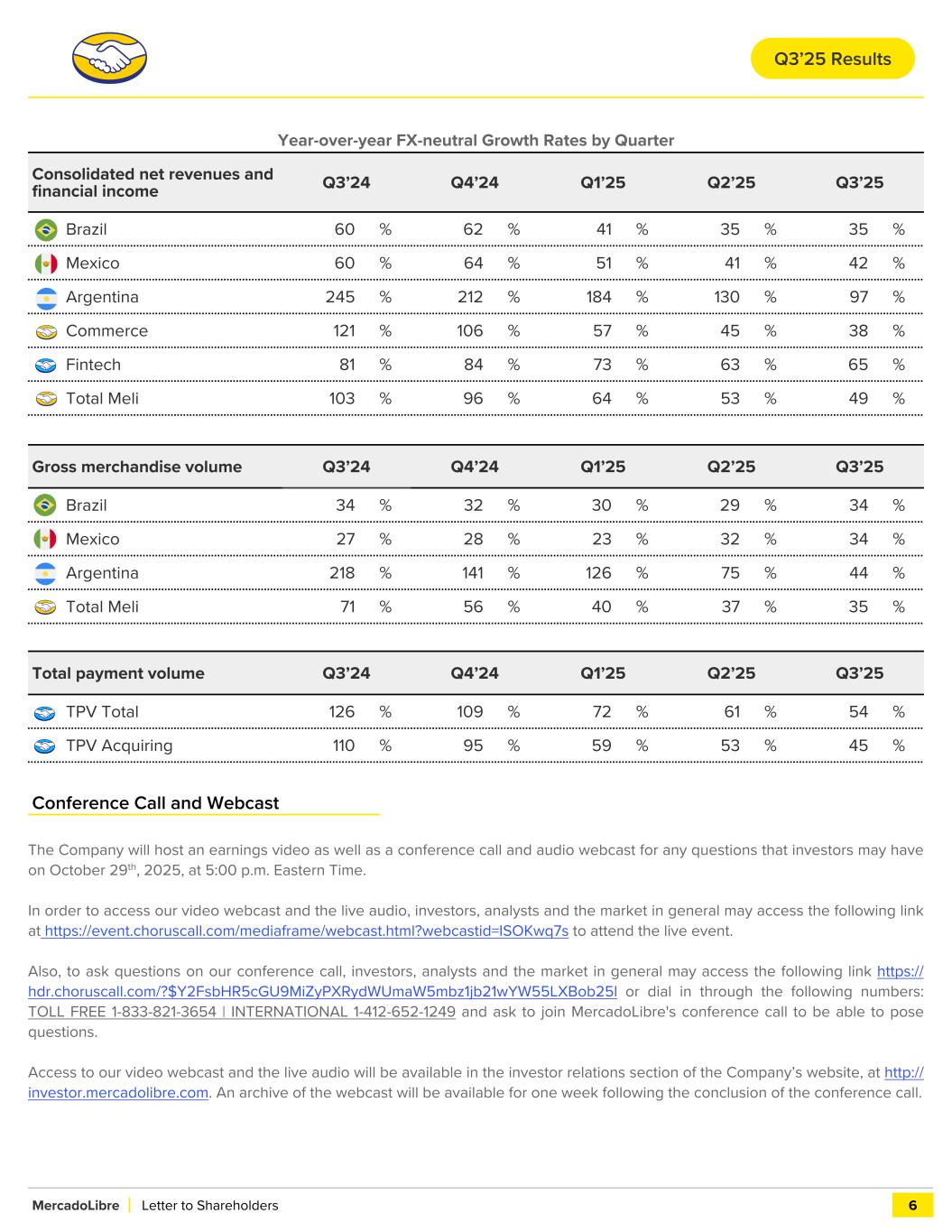

The following table summarizes certain key performance metrics for the nine and three-month periods ended September 30, 2025 and 2024: (1) Figures have been calculated using rounded amounts. Growth calculations based on this table may not total due to rounding. As of December 31, 2024, we no longer disclose the key performance indicator "Number of items shipped". Management believes that "Number of items shipped", as a complementary disclosure to "items sold", no longer provides useful information to investors to better understand our business. Following years of investment, our logistics network now ships 95% of items sold. As such, the two performance metrics, "Number of items sold" and "Number of items shipped", have converged so we no longer see a benefit for investors in disclosing both. Year-over-year USD Growth Rates by Quarter Consolidated net revenues and financial income Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 Brazil 41 % 38 % 20 % 25 % 38 % Mexico 44 % 43 % 26 % 25 % 44 % Argentina 14 % 31 % 125 % 77 % 39 % Commerce 48 % 44 % 32 % 29 % 33 % Fintech 21 % 29 % 43 % 40 % 49 % Total Meli 35 % 37 % 37 % 34 % 39 % Gross merchandise volume Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 Brazil 17 % 13 % 10 % 18 % 36 % Mexico 14 % 11 % 2 % 16 % 36 % Argentina 4 % (5) % 77 % 35 % 2 % Total Meli 14 % 8 % 17 % 21 % 28 % Total payment volume Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 TPV Total 34 % 33 % 43 % 39 % 41 % TPV Acquiring 21 % 20 % 32 % 31 % 32 % MercadoLibre Letter to Shareholders 5 Nine Months Ended September 30, Three Months Ended September 30, (IN MILLIONS, except %) (1) 2025 2024 2025 2024 Fintech monthly active users 72 56 72 56 Unique active buyers 107 87 77 61 Gross merchandise volume 45,131 36,919 16,543 12,907 Number of items sold 1,677 1,262 635 456 Total payment volume 194,129 137,746 71,224 50,691 Acquiring total payment volume 132,394 100,367 47,712 36,042 Total payment transactions 10,964 8,030 4,013 2,936 NIMAL 22.0 % 28.3 % 21.0 % 24.2 % Capital expenditures 900 555 357 223 Depreciation and amortization 580 465 209 157 Q3’25 Results

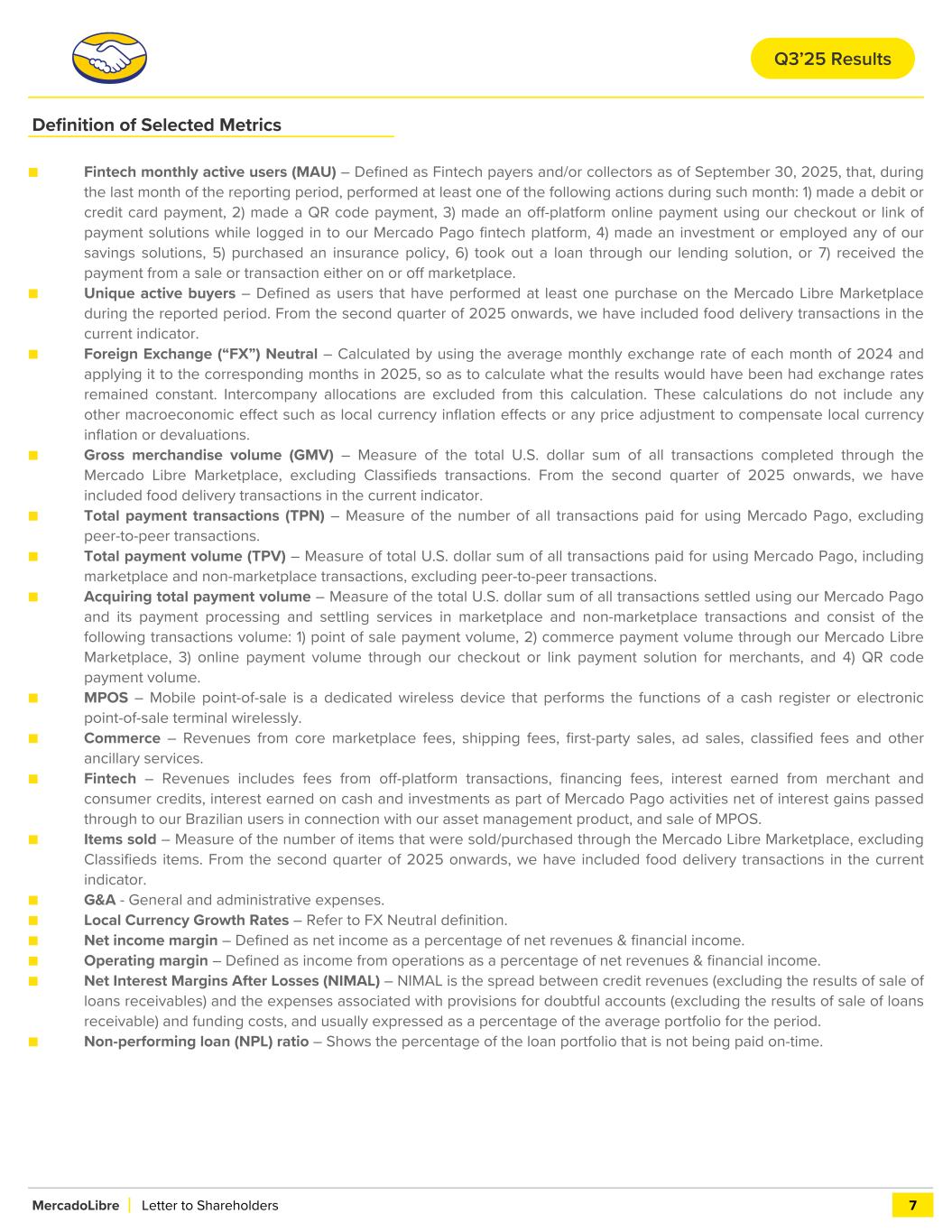

Year-over-year FX-neutral Growth Rates by Quarter Consolidated net revenues and financial income Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 Brazil 60 % 62 % 41 % 35 % 35 % Mexico 60 % 64 % 51 % 41 % 42 % Argentina 245 % 212 % 184 % 130 % 97 % Commerce 121 % 106 % 57 % 45 % 38 % Fintech 81 % 84 % 73 % 63 % 65 % Total Meli 103 % 96 % 64 % 53 % 49 % Gross merchandise volume Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 Brazil 34 % 32 % 30 % 29 % 34 % Mexico 27 % 28 % 23 % 32 % 34 % Argentina 218 % 141 % 126 % 75 % 44 % Total Meli 71 % 56 % 40 % 37 % 35 % Total payment volume Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 TPV Total 126 % 109 % 72 % 61 % 54 % TPV Acquiring 110 % 95 % 59 % 53 % 45 % Conference Call and Webcast The Company will host an earnings video as well as a conference call and audio webcast for any questions that investors may have on October 29th, 2025, at 5:00 p.m. Eastern Time. In order to access our video webcast and the live audio, investors, analysts and the market in general may access the following link at https://event.choruscall.com/mediaframe/webcast.html?webcastid=ISOKwq7s to attend the live event. Also, to ask questions on our conference call, investors, analysts and the market in general may access the following link https:// hdr.choruscall.com/?$Y2FsbHR5cGU9MiZyPXRydWUmaW5mbz1jb21wYW55LXBob25l or dial in through the following numbers: TOLL FREE 1-833-821-3654 | INTERNATIONAL 1-412-652-1249 and ask to join MercadoLibre's conference call to be able to pose questions. Access to our video webcast and the live audio will be available in the investor relations section of the Company’s website, at http:// investor.mercadolibre.com. An archive of the webcast will be available for one week following the conclusion of the conference call. MercadoLibre Letter to Shareholders 6 Q3’25 Results

Definition of Selected Metrics ■ Fintech monthly active users (MAU) – Defined as Fintech payers and/or collectors as of September 30, 2025, that, during the last month of the reporting period, performed at least one of the following actions during such month: 1) made a debit or credit card payment, 2) made a QR code payment, 3) made an off-platform online payment using our checkout or link of payment solutions while logged in to our Mercado Pago fintech platform, 4) made an investment or employed any of our savings solutions, 5) purchased an insurance policy, 6) took out a loan through our lending solution, or 7) received the payment from a sale or transaction either on or off marketplace. ■ Unique active buyers – Defined as users that have performed at least one purchase on the Mercado Libre Marketplace during the reported period. From the second quarter of 2025 onwards, we have included food delivery transactions in the current indicator. ■ Foreign Exchange (“FX”) Neutral – Calculated by using the average monthly exchange rate of each month of 2024 and applying it to the corresponding months in 2025, so as to calculate what the results would have been had exchange rates remained constant. Intercompany allocations are excluded from this calculation. These calculations do not include any other macroeconomic effect such as local currency inflation effects or any price adjustment to compensate local currency inflation or devaluations. ■ Gross merchandise volume (GMV) – Measure of the total U.S. dollar sum of all transactions completed through the Mercado Libre Marketplace, excluding Classifieds transactions. From the second quarter of 2025 onwards, we have included food delivery transactions in the current indicator. ■ Total payment transactions (TPN) – Measure of the number of all transactions paid for using Mercado Pago, excluding peer-to-peer transactions. ■ Total payment volume (TPV) – Measure of total U.S. dollar sum of all transactions paid for using Mercado Pago, including marketplace and non-marketplace transactions, excluding peer-to-peer transactions. ■ Acquiring total payment volume – Measure of the total U.S. dollar sum of all transactions settled using our Mercado Pago and its payment processing and settling services in marketplace and non-marketplace transactions and consist of the following transactions volume: 1) point of sale payment volume, 2) commerce payment volume through our Mercado Libre Marketplace, 3) online payment volume through our checkout or link payment solution for merchants, and 4) QR code payment volume. ■ MPOS – Mobile point-of-sale is a dedicated wireless device that performs the functions of a cash register or electronic point-of-sale terminal wirelessly. ■ Commerce – Revenues from core marketplace fees, shipping fees, first-party sales, ad sales, classified fees and other ancillary services. ■ Fintech – Revenues includes fees from off-platform transactions, financing fees, interest earned from merchant and consumer credits, interest earned on cash and investments as part of Mercado Pago activities net of interest gains passed through to our Brazilian users in connection with our asset management product, and sale of MPOS. ■ Items sold – Measure of the number of items that were sold/purchased through the Mercado Libre Marketplace, excluding Classifieds items. From the second quarter of 2025 onwards, we have included food delivery transactions in the current indicator. ■ G&A - General and administrative expenses. ■ Local Currency Growth Rates – Refer to FX Neutral definition. ■ Net income margin – Defined as net income as a percentage of net revenues & financial income. ■ Operating margin – Defined as income from operations as a percentage of net revenues & financial income. ■ Net Interest Margins After Losses (NIMAL) – NIMAL is the spread between credit revenues (excluding the results of sale of loans receivables) and the expenses associated with provisions for doubtful accounts (excluding the results of sale of loans receivable) and funding costs, and usually expressed as a percentage of the average portfolio for the period. ■ Non-performing loan (NPL) ratio – Shows the percentage of the loan portfolio that is not being paid on-time. MercadoLibre Letter to Shareholders 7 Q3’25 Results

About Mercado Libre Founded in 1999, MercadoLibre is the largest ecommerce and fintech ecosystem in Latin America. The company's efforts are centered on enabling e-commerce and digital financial services for our users through a complete suite of technology solutions, with a mission of democratizing access to commerce and financial services. The Company is listed on NASDAQ (Nasdaq: MELI) following its initial public offering in 2007. For more information about the Company visit: http://investor.mercadolibre.com. The MercadoLibre, Inc. logo is available at https://resource.globenewswire.com/Resource/Download/6ab227b7-693f-4b17- b80c-552ae45c76bf?size=0 Forward-Looking Statements This press release and the investor conference call contain forward-looking statements, including, but not limited to, statements regarding MercadoLibre, Inc.’s possible or assumed future results of operations; expectations, objectives and progress against strategic priorities; initiatives and strategies related to our products and services; our inability to successfully deliver new products and services; business and market outlook, opportunities, strategies and trends; financing plans; competitive position; the macroeconomic environment; customer preferences and demand and market expansion; our planned product and services releases and capabilities; industry growth rates and internet and credit card penetration in Latin America; and inflation. Words such as, but not limited to, “believe,” “will,” “so we can,” “when,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are used to identify forward-looking statements, although not all forward-looking statements contain these words. Our forward-looking statements, and the risks and uncertainties related to them, convey MercadoLibre, Inc.’s current assumptions, expectations or forecasts of future events. Forward-looking statements regarding MercadoLibre, Inc. involve known and unknown risks, uncertainties and other factors that may cause MercadoLibre, Inc.’s actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Additional information on the potential risks, uncertainties and factors that could affect MercadoLibre, Inc.’s results is included in filings we make with the Securities and Exchange Commission ("SEC") from time to time, including in the sections entitled “Risk Factors” and “Forward-Looking Statements” of MercadoLibre, Inc.’s annual report on Form 10-K for the year ended December 31, 2024 and in any of MercadoLibre, Inc.’s other applicable filings with the SEC. The financial information contained in this press release should be read in conjunction with the consolidated financial statements and notes thereto included in MercadoLibre, Inc.’s most recent reports on Forms 10-K and 10-Q, each as may be amended from time to time. MercadoLibre, Inc.’s financial results for its third quarter of 2025 are not necessarily indicative of MercadoLibre Inc.’s operating results for any future periods. The information provided herein is as of September 30, 2025. Unless required by law, MercadoLibre, Inc. undertakes no obligation to, and does not intend to, publicly update or revise any forward-looking statements to reflect circumstances or events after the date hereof. MercadoLibre Letter to Shareholders 8 Q3’25 Results

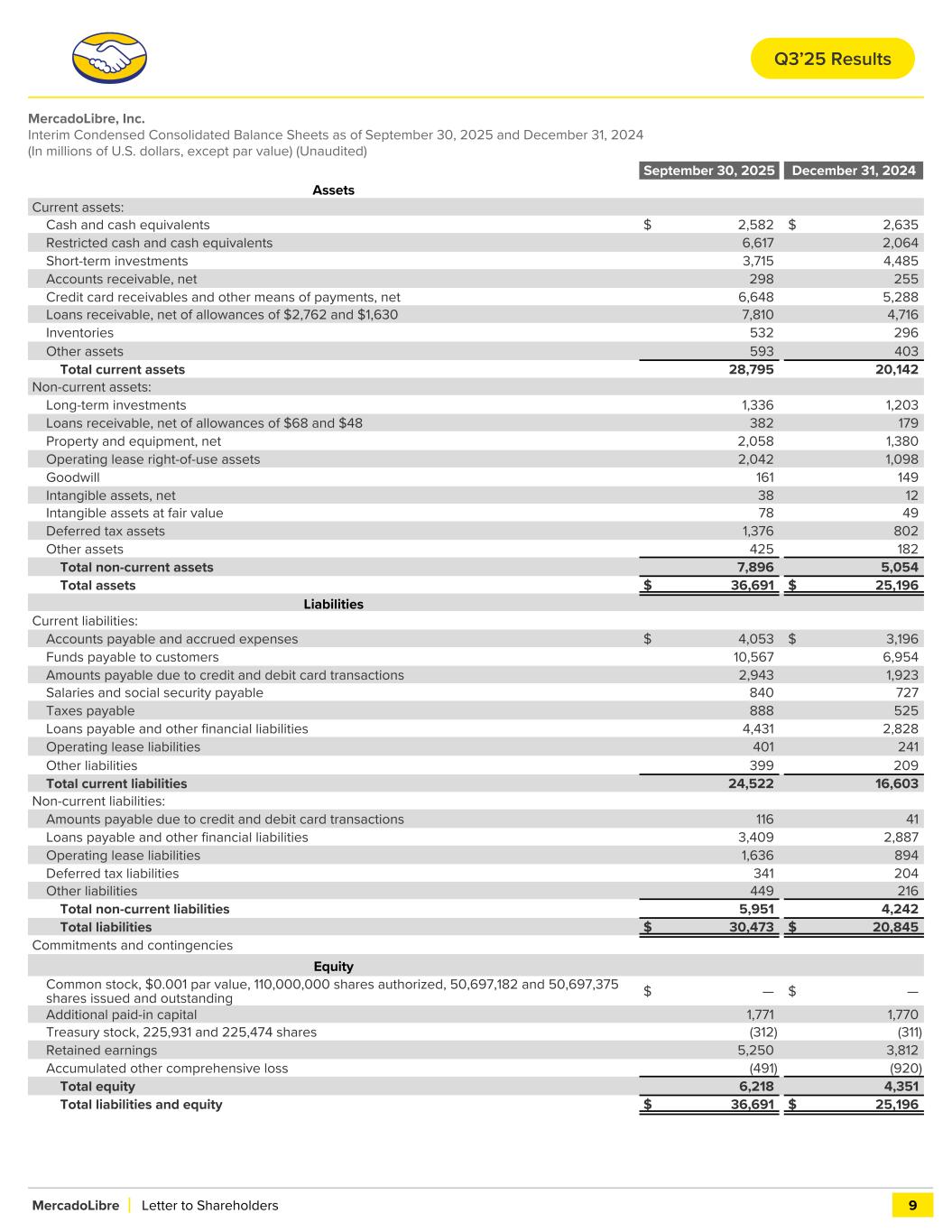

MercadoLibre, Inc. Interim Condensed Consolidated Balance Sheets as of September 30, 2025 and December 31, 2024 (In millions of U.S. dollars, except par value) (Unaudited) September 30, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $ 2,582 $ 2,635 Restricted cash and cash equivalents 6,617 2,064 Short-term investments 3,715 4,485 Accounts receivable, net 298 255 Credit card receivables and other means of payments, net 6,648 5,288 Loans receivable, net of allowances of $2,762 and $1,630 7,810 4,716 Inventories 532 296 Other assets 593 403 Total current assets 28,795 20,142 Non-current assets: Long-term investments 1,336 1,203 Loans receivable, net of allowances of $68 and $48 382 179 Property and equipment, net 2,058 1,380 Operating lease right-of-use assets 2,042 1,098 Goodwill 161 149 Intangible assets, net 38 12 Intangible assets at fair value 78 49 Deferred tax assets 1,376 802 Other assets 425 182 Total non-current assets 7,896 5,054 Total assets $ 36,691 $ 25,196 Liabilities Current liabilities: Accounts payable and accrued expenses $ 4,053 $ 3,196 Funds payable to customers 10,567 6,954 Amounts payable due to credit and debit card transactions 2,943 1,923 Salaries and social security payable 840 727 Taxes payable 888 525 Loans payable and other financial liabilities 4,431 2,828 Operating lease liabilities 401 241 Other liabilities 399 209 Total current liabilities 24,522 16,603 Non-current liabilities: Amounts payable due to credit and debit card transactions 116 41 Loans payable and other financial liabilities 3,409 2,887 Operating lease liabilities 1,636 894 Deferred tax liabilities 341 204 Other liabilities 449 216 Total non-current liabilities 5,951 4,242 Total liabilities $ 30,473 $ 20,845 Commitments and contingencies Equity Common stock, $0.001 par value, 110,000,000 shares authorized, 50,697,182 and 50,697,375 shares issued and outstanding $ — $ — Additional paid-in capital 1,771 1,770 Treasury stock, 225,931 and 225,474 shares (312) (311) Retained earnings 5,250 3,812 Accumulated other comprehensive loss (491) (920) Total equity 6,218 4,351 Total liabilities and equity $ 36,691 $ 25,196 MercadoLibre Letter to Shareholders 9 Q3’25 Results

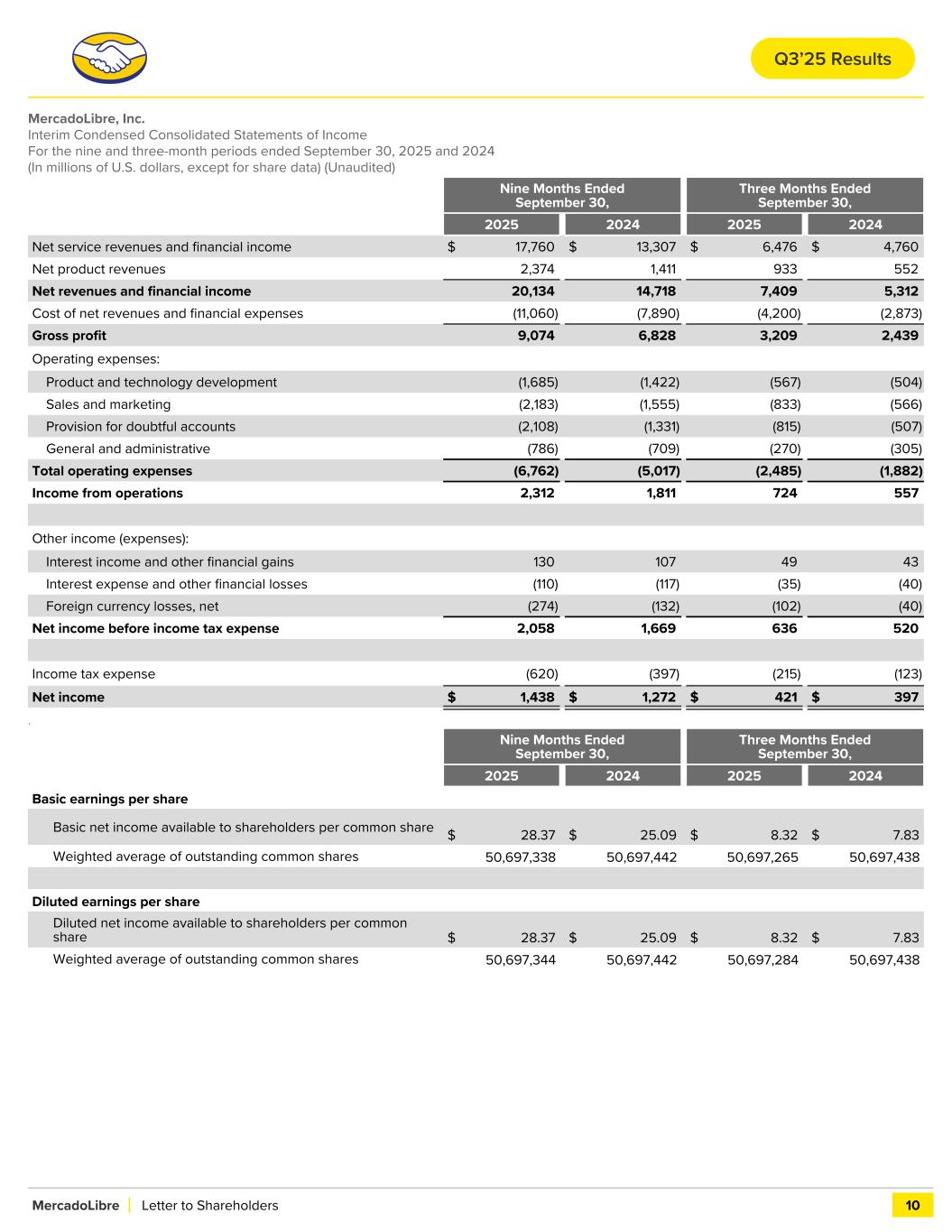

MercadoLibre, Inc. Interim Condensed Consolidated Statements of Income For the nine and three-month periods ended September 30, 2025 and 2024 (In millions of U.S. dollars, except for share data) (Unaudited) Nine Months Ended September 30, Three Months Ended September 30, 2025 2024 2025 2024 Net service revenues and financial income $ 17,760 $ 13,307 $ 6,476 $ 4,760 Net product revenues 2,374 1,411 933 552 Net revenues and financial income 20,134 14,718 7,409 5,312 Cost of net revenues and financial expenses (11,060) (7,890) (4,200) (2,873) Gross profit 9,074 6,828 3,209 2,439 Operating expenses: Product and technology development (1,685) (1,422) (567) (504) Sales and marketing (2,183) (1,555) (833) (566) Provision for doubtful accounts (2,108) (1,331) (815) (507) General and administrative (786) (709) (270) (305) Total operating expenses (6,762) (5,017) (2,485) (1,882) Income from operations 2,312 1,811 724 557 Other income (expenses): Interest income and other financial gains 130 107 49 43 Interest expense and other financial losses (110) (117) (35) (40) Foreign currency losses, net (274) (132) (102) (40) Net income before income tax expense 2,058 1,669 636 520 Income tax expense (620) (397) (215) (123) Net income $ 1,438 $ 1,272 $ 421 $ 397 . Nine Months Ended September 30, Three Months Ended September 30, 2025 2024 2025 2024 Basic earnings per share Basic net income available to shareholders per common share $ 28.37 $ 25.09 $ 8.32 $ 7.83 Weighted average of outstanding common shares 50,697,338 50,697,442 50,697,265 50,697,438 Diluted earnings per share Diluted net income available to shareholders per common share $ 28.37 — $ 25.09 $ — $ 8.32 — $ 7.83 Weighted average of outstanding common shares 50,697,344 50,697,442 50,697,284 50,697,438 MercadoLibre Letter to Shareholders 10 Q3’25 Results

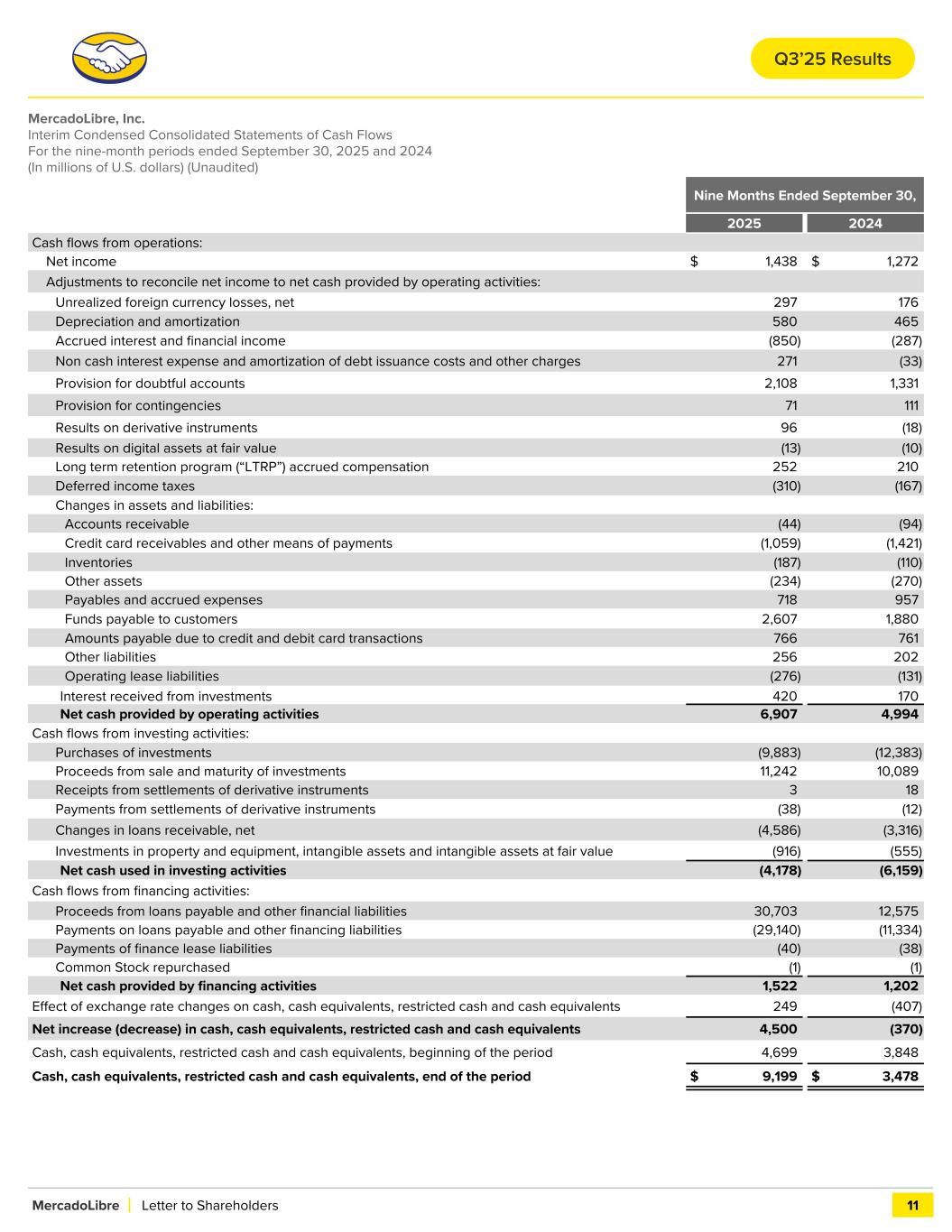

MercadoLibre, Inc. Interim Condensed Consolidated Statements of Cash Flows For the nine-month periods ended September 30, 2025 and 2024 (In millions of U.S. dollars) (Unaudited) Nine Months Ended September 30, 2025 2024 Cash flows from operations: Net income $ 1,438 $ 1,272 Adjustments to reconcile net income to net cash provided by operating activities: Unrealized foreign currency losses, net 297 176 Depreciation and amortization 580 465 Accrued interest and financial income (850) (287) Non cash interest expense and amortization of debt issuance costs and other charges 271 (33) Provision for doubtful accounts 2,108 1,331 Provision for contingencies 71 111 Results on derivative instruments 96 (18) Results on digital assets at fair value (13) (10) Long term retention program (“LTRP”) accrued compensation 252 210 Deferred income taxes (310) (167) Changes in assets and liabilities: Accounts receivable (44) (94) Credit card receivables and other means of payments (1,059) (1,421) Inventories (187) (110) Other assets (234) (270) Payables and accrued expenses 718 957 Funds payable to customers 2,607 1,880 Amounts payable due to credit and debit card transactions 766 761 Other liabilities 256 202 Operating lease liabilities (276) (131) Interest received from investments 420 170 Net cash provided by operating activities 6,907 4,994 Cash flows from investing activities: Purchases of investments (9,883) (12,383) Proceeds from sale and maturity of investments 11,242 10,089 Receipts from settlements of derivative instruments 3 18 Payments from settlements of derivative instruments (38) (12) Changes in loans receivable, net (4,586) (3,316) Investments in property and equipment, intangible assets and intangible assets at fair value (916) (555) Net cash used in investing activities (4,178) (6,159) Cash flows from financing activities: Proceeds from loans payable and other financial liabilities 30,703 12,575 Payments on loans payable and other financing liabilities (29,140) (11,334) Payments of finance lease liabilities (40) (38) Common Stock repurchased (1) (1) Net cash provided by financing activities 1,522 1,202 Effect of exchange rate changes on cash, cash equivalents, restricted cash and cash equivalents 249 (407) Net increase (decrease) in cash, cash equivalents, restricted cash and cash equivalents 4,500 (370) Cash, cash equivalents, restricted cash and cash equivalents, beginning of the period 4,699 3,848 Cash, cash equivalents, restricted cash and cash equivalents, end of the period $ 9,199 $ 3,478 MercadoLibre Letter to Shareholders 11 Q3’25 Results

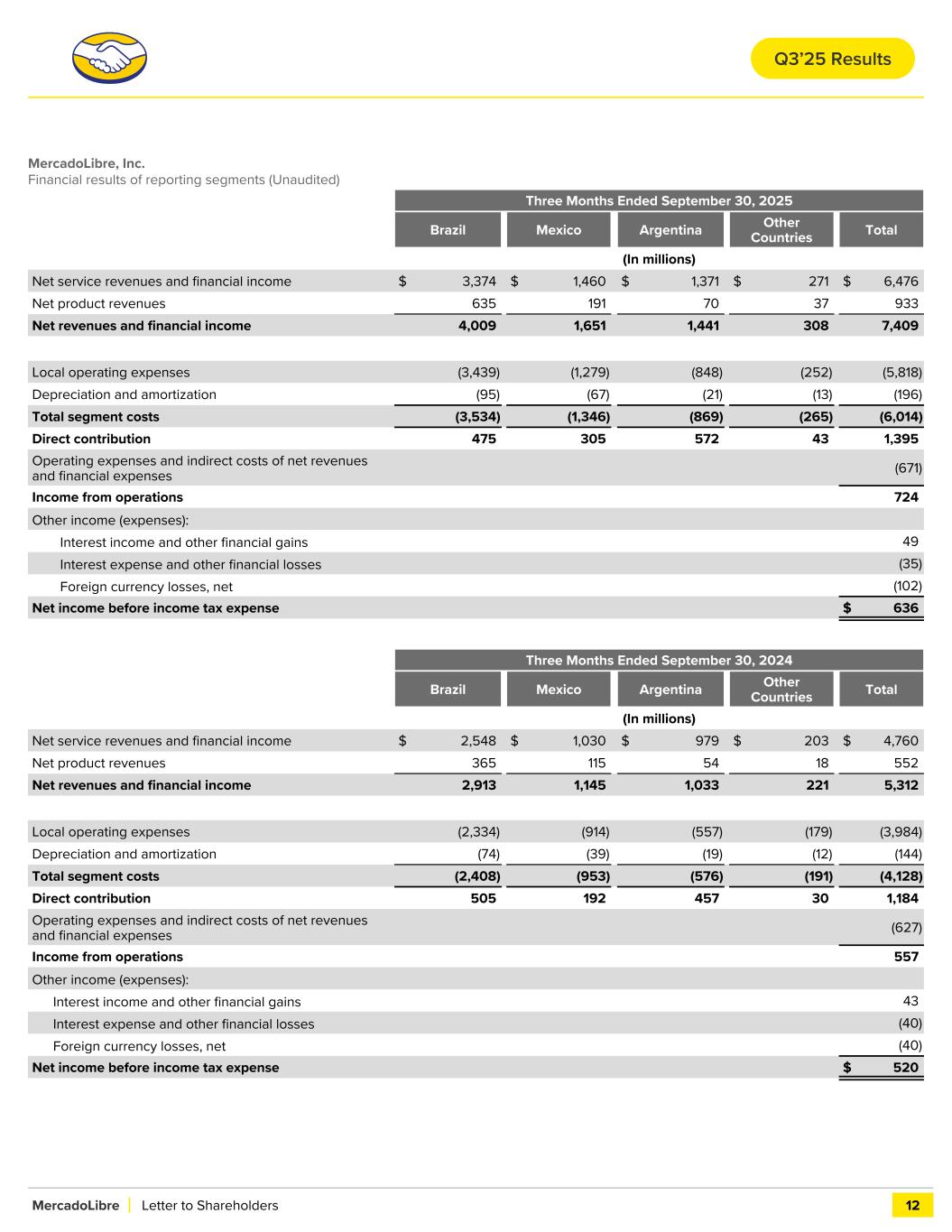

MercadoLibre, Inc. Financial results of reporting segments (Unaudited) Three Months Ended September 30, 2025 Brazil Mexico Argentina Other Countries Total (In millions) Net service revenues and financial income $ 3,374 $ 1,460 $ 1,371 $ 271 $ 6,476 Net product revenues 635 191 70 37 933 Net revenues and financial income 4,009 1,651 1,441 308 7,409 Local operating expenses (3,439) (1,279) (848) (252) (5,818) Depreciation and amortization (95) (67) (21) (13) (196) Total segment costs (3,534) (1,346) (869) (265) (6,014) Direct contribution 475 305 572 43 1,395 Operating expenses and indirect costs of net revenues and financial expenses (671) Income from operations 724 Other income (expenses): Interest income and other financial gains 49 Interest expense and other financial losses (35) Foreign currency losses, net (102) Net income before income tax expense $ 636 Three Months Ended September 30, 2024 Brazil Mexico Argentina Other Countries Total (In millions) Net service revenues and financial income $ 2,548 $ 1,030 $ 979 $ 203 $ 4,760 Net product revenues 365 115 54 18 552 Net revenues and financial income 2,913 1,145 1,033 221 5,312 Local operating expenses (2,334) (914) (557) (179) (3,984) Depreciation and amortization (74) (39) (19) (12) (144) Total segment costs (2,408) (953) (576) (191) (4,128) Direct contribution 505 192 457 30 1,184 Operating expenses and indirect costs of net revenues and financial expenses (627) Income from operations 557 Other income (expenses): Interest income and other financial gains 43 Interest expense and other financial losses (40) Foreign currency losses, net (40) Net income before income tax expense $ 520 MercadoLibre Letter to Shareholders 12 Q3’25 Results

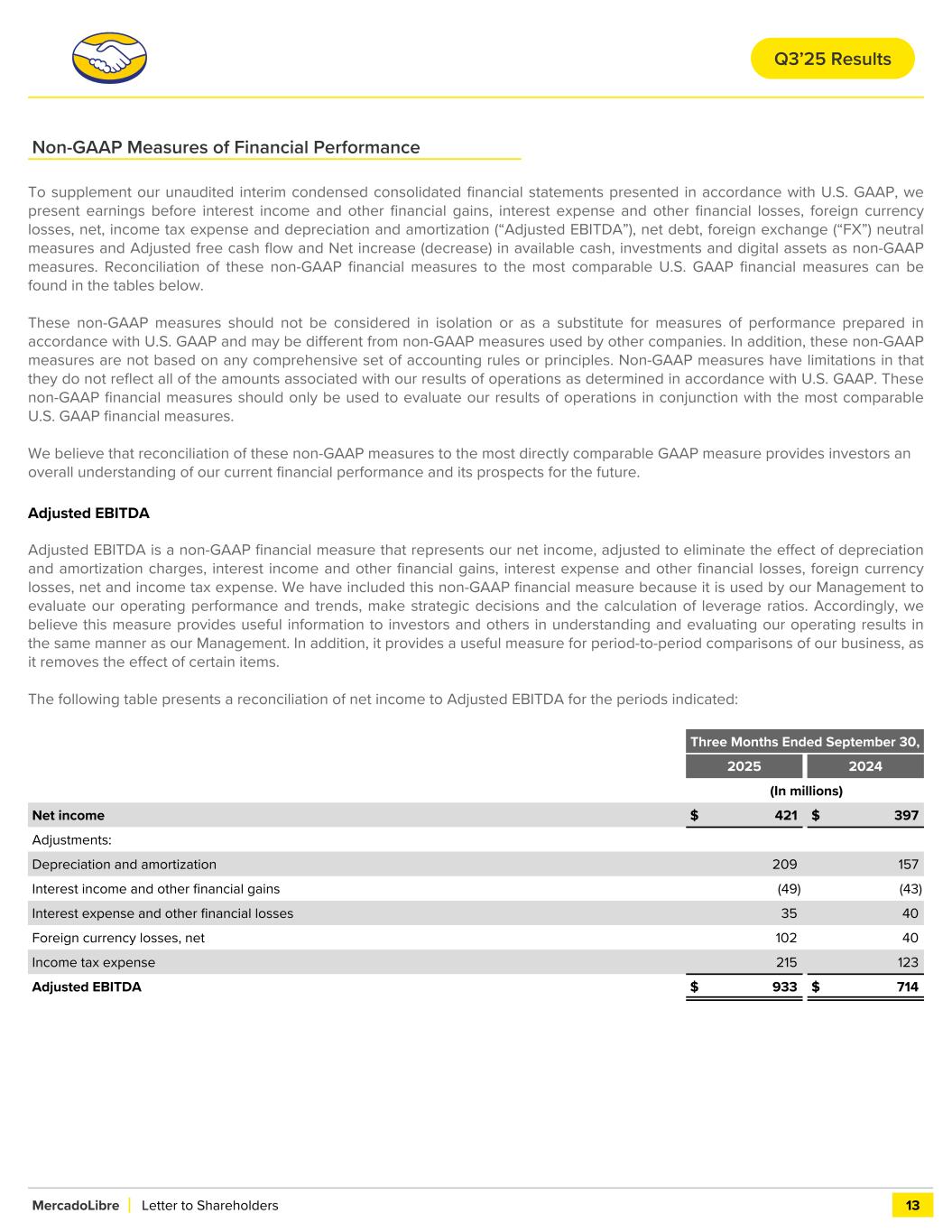

Non-GAAP Measures of Financial Performance To supplement our unaudited interim condensed consolidated financial statements presented in accordance with U.S. GAAP, we present earnings before interest income and other financial gains, interest expense and other financial losses, foreign currency losses, net, income tax expense and depreciation and amortization (“Adjusted EBITDA”), net debt, foreign exchange (“FX”) neutral measures and Adjusted free cash flow and Net increase (decrease) in available cash, investments and digital assets as non-GAAP measures. Reconciliation of these non-GAAP financial measures to the most comparable U.S. GAAP financial measures can be found in the tables below. These non-GAAP measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with U.S. GAAP and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with U.S. GAAP. These non-GAAP financial measures should only be used to evaluate our results of operations in conjunction with the most comparable U.S. GAAP financial measures. We believe that reconciliation of these non-GAAP measures to the most directly comparable GAAP measure provides investors an overall understanding of our current financial performance and its prospects for the future. Adjusted EBITDA Adjusted EBITDA is a non-GAAP financial measure that represents our net income, adjusted to eliminate the effect of depreciation and amortization charges, interest income and other financial gains, interest expense and other financial losses, foreign currency losses, net and income tax expense. We have included this non-GAAP financial measure because it is used by our Management to evaluate our operating performance and trends, make strategic decisions and the calculation of leverage ratios. Accordingly, we believe this measure provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our Management. In addition, it provides a useful measure for period-to-period comparisons of our business, as it removes the effect of certain items. The following table presents a reconciliation of net income to Adjusted EBITDA for the periods indicated: Three Months Ended September 30, 2025 2024 (In millions) Net income $ 421 $ 397 Adjustments: Depreciation and amortization 209 157 Interest income and other financial gains (49) (43) Interest expense and other financial losses 35 40 Foreign currency losses, net 102 40 Income tax expense 215 123 Adjusted EBITDA $ 933 $ 714 MercadoLibre Letter to Shareholders 13 Q3’25 Results

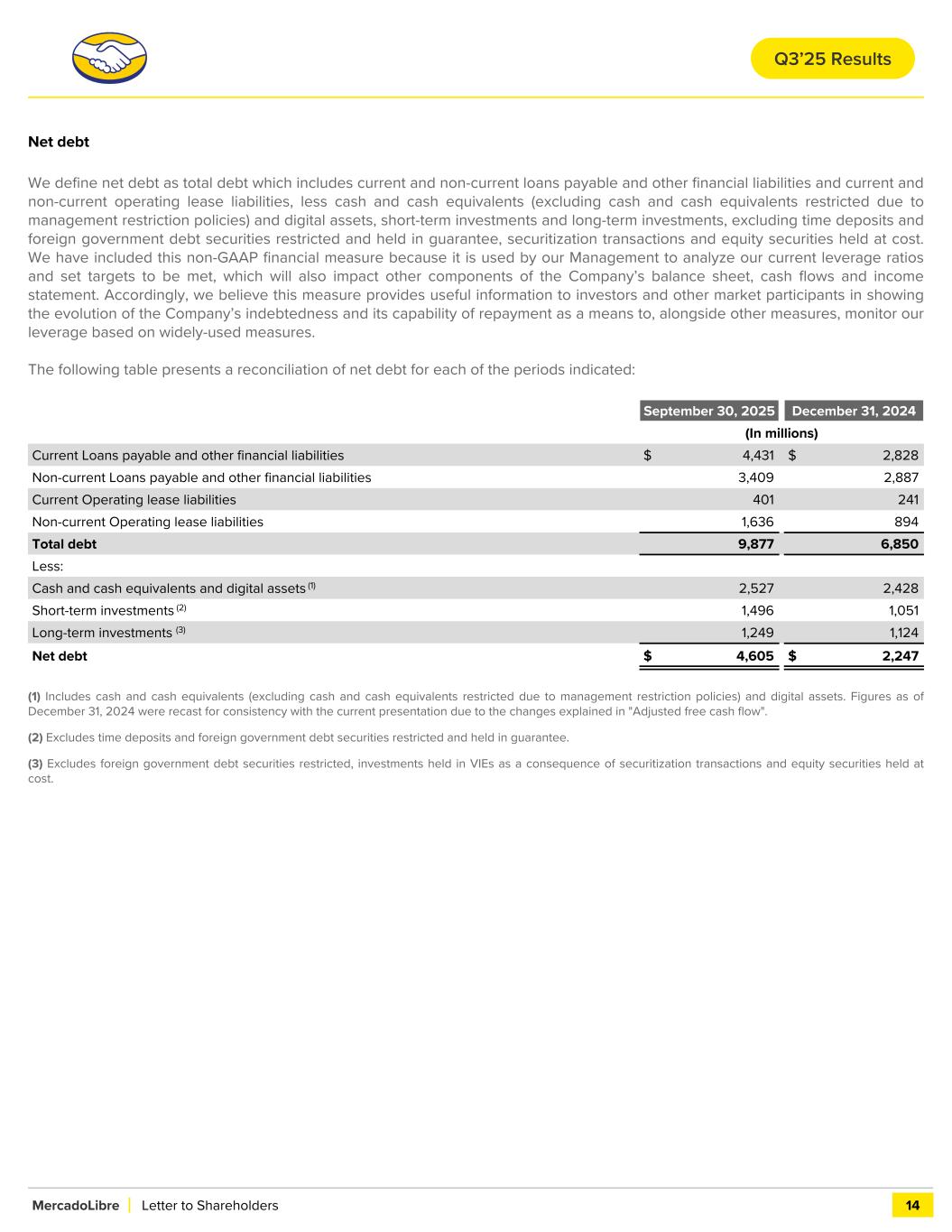

Net debt We define net debt as total debt which includes current and non-current loans payable and other financial liabilities and current and non-current operating lease liabilities, less cash and cash equivalents (excluding cash and cash equivalents restricted due to management restriction policies) and digital assets, short-term investments and long-term investments, excluding time deposits and foreign government debt securities restricted and held in guarantee, securitization transactions and equity securities held at cost. We have included this non-GAAP financial measure because it is used by our Management to analyze our current leverage ratios and set targets to be met, which will also impact other components of the Company’s balance sheet, cash flows and income statement. Accordingly, we believe this measure provides useful information to investors and other market participants in showing the evolution of the Company’s indebtedness and its capability of repayment as a means to, alongside other measures, monitor our leverage based on widely-used measures. The following table presents a reconciliation of net debt for each of the periods indicated: September 30, 2025 December 31, 2024 (In millions) Current Loans payable and other financial liabilities $ 4,431 $ 2,828 Non-current Loans payable and other financial liabilities 3,409 2,887 Current Operating lease liabilities 401 241 Non-current Operating lease liabilities 1,636 894 Total debt 9,877 6,850 Less: Cash and cash equivalents and digital assets (1) 2,527 2,428 Short-term investments (2) 1,496 1,051 Long-term investments (3) 1,249 1,124 Net debt $ 4,605 $ 2,247 (1) Includes cash and cash equivalents (excluding cash and cash equivalents restricted due to management restriction policies) and digital assets. Figures as of December 31, 2024 were recast for consistency with the current presentation due to the changes explained in "Adjusted free cash flow". (2) Excludes time deposits and foreign government debt securities restricted and held in guarantee. (3) Excludes foreign government debt securities restricted, investments held in VIEs as a consequence of securitization transactions and equity securities held at cost. MercadoLibre Letter to Shareholders 14 Q3’25 Results

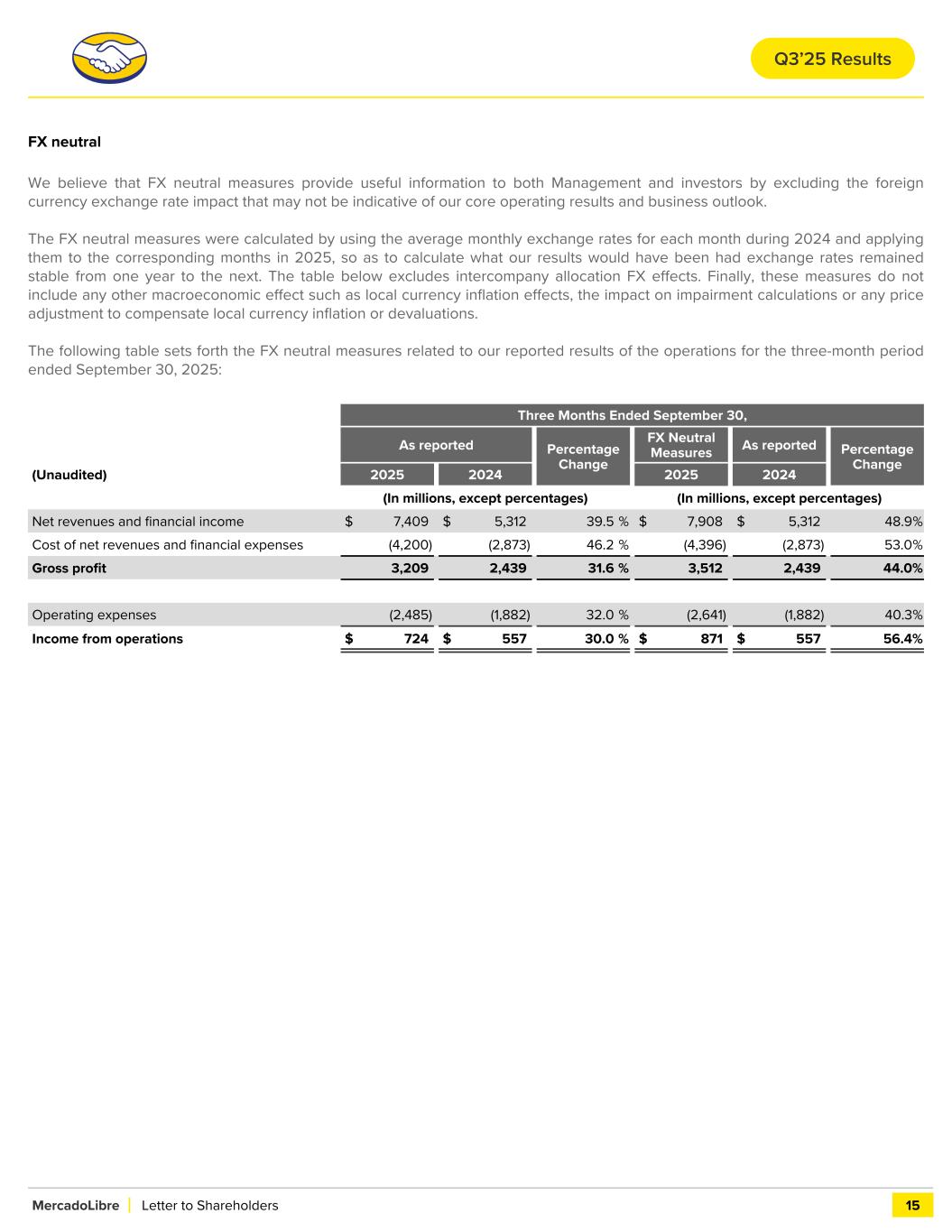

FX neutral We believe that FX neutral measures provide useful information to both Management and investors by excluding the foreign currency exchange rate impact that may not be indicative of our core operating results and business outlook. The FX neutral measures were calculated by using the average monthly exchange rates for each month during 2024 and applying them to the corresponding months in 2025, so as to calculate what our results would have been had exchange rates remained stable from one year to the next. The table below excludes intercompany allocation FX effects. Finally, these measures do not include any other macroeconomic effect such as local currency inflation effects, the impact on impairment calculations or any price adjustment to compensate local currency inflation or devaluations. The following table sets forth the FX neutral measures related to our reported results of the operations for the three-month period ended September 30, 2025: Three Months Ended September 30, As reported Percentage Change FX Neutral Measures As reported Percentage Change (Unaudited) 2025 2024 2025 2024 (In millions, except percentages) (In millions, except percentages) Net revenues and financial income $ 7,409 $ 5,312 39.5 % $ 7,908 $ 5,312 48.9 % Cost of net revenues and financial expenses (4,200) (2,873) 46.2 % (4,396) (2,873) 53.0 % Gross profit 3,209 2,439 31.6 % 3,512 2,439 44.0 % Operating expenses (2,485) (1,882) 32.0 % (2,641) (1,882) 40.3 % Income from operations $ 724 $ 557 30.0 % $ 871 $ 557 56.4 % MercadoLibre Letter to Shareholders 15 Q3’25 Results

Adjusted free cash flow and Net increase (decrease) in available cash, investments and digital assets Adjusted free cash flow Adjusted free cash flow represents cash from operating activities less the increase (decrease) in cash and cash equivalents and investments related to customer funds due to regulatory requirements and other restrictions and equity securities held at cost, investments in property and equipment and intangible assets, changes in loans receivable, net and net proceeds from/payments on loans payable and other financial liabilities related to our Fintech solutions, since we consider those liabilities as the working capital of the Fintech activities. From the second quarter of 2025 onwards, we have also included increase (decrease) in cash and cash equivalents and investments restricted due to management restriction policies and digital assets as an adjustment in the calculation of our adjusted free cash flow. We consider adjusted free cash flow to be a measure of liquidity generation that provides useful information to management and investors since it shows how much cash the Company generates with its core activities that can be used for discretionary purposes and to repay its corporate and/or commerce debt. A limitation of the utility of adjusted free cash flow as a measure of liquidity generation is that it is a partial representation of the total increase or decrease in our available cash, investments and digital assets balance for the period. Therefore, we believe it is important to view the adjusted free cash flow measure only as a complement to our entire consolidated statements of cash flows. Net increase (decrease) in available cash, investments and digital assets Net increase (decrease) in available cash, investments and digital assets (from the second quarter of 2025 onwards, our available funds include digital asset holdings) represents adjusted free cash flow less net proceeds from/payments on loans payable and other financial liabilities, related to our Commerce and corporate activities, payments of finance lease obligations, other investing and/or financing activities not considered above and the effect of exchange rates changes on available cash and investments. We consider Net increase (decrease) in available cash, investments and digital assets to be a measure of liquidity availability that provides useful information to management and investors after netting out all other debt and corporate payments and activities from the adjusted free cash flow. MercadoLibre Letter to Shareholders 16 Q3’25 Results

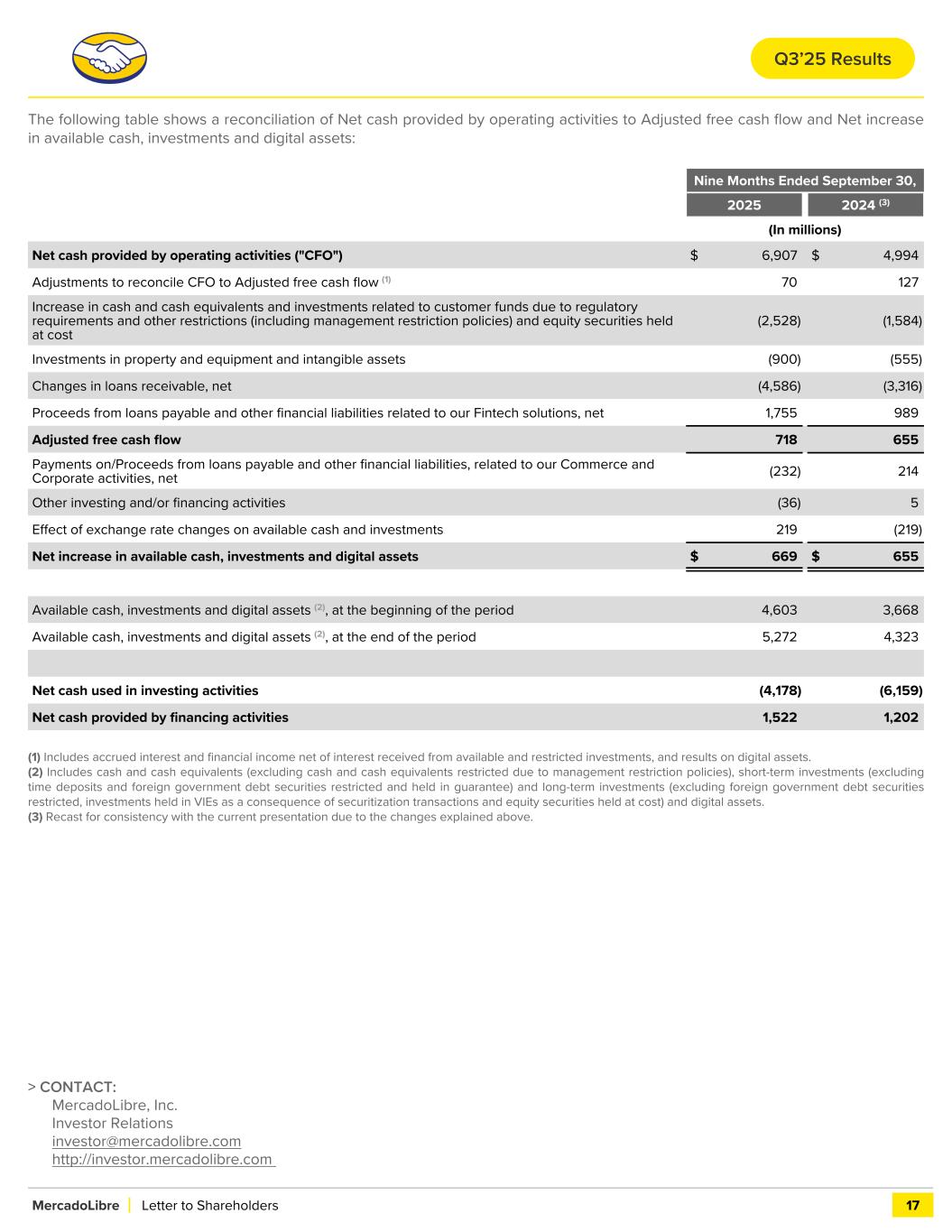

The following table shows a reconciliation of Net cash provided by operating activities to Adjusted free cash flow and Net increase in available cash, investments and digital assets: Nine Months Ended September 30, 2025 2024 (3) (In millions) Net cash provided by operating activities ("CFO") $ 6,907 $ 4,994 Adjustments to reconcile CFO to Adjusted free cash flow (1) 70 127 Increase in cash and cash equivalents and investments related to customer funds due to regulatory requirements and other restrictions (including management restriction policies) and equity securities held at cost (2,528) (1,584) Investments in property and equipment and intangible assets (900) (555) Changes in loans receivable, net (4,586) (3,316) Proceeds from loans payable and other financial liabilities related to our Fintech solutions, net 1,755 989 Adjusted free cash flow 718 655 Payments on/Proceeds from loans payable and other financial liabilities, related to our Commerce and Corporate activities, net (232) 214 Other investing and/or financing activities (36) 5 Effect of exchange rate changes on available cash and investments 219 (219) Net increase in available cash, investments and digital assets $ 669 $ 655 Available cash, investments and digital assets (2), at the beginning of the period 4,603 3,668 Available cash, investments and digital assets (2), at the end of the period 5,272 4,323 Net cash used in investing activities (4,178) (6,159) Net cash provided by financing activities 1,522 1,202 (1) Includes accrued interest and financial income net of interest received from available and restricted investments, and results on digital assets. (2) Includes cash and cash equivalents (excluding cash and cash equivalents restricted due to management restriction policies), short-term investments (excluding time deposits and foreign government debt securities restricted and held in guarantee) and long-term investments (excluding foreign government debt securities restricted, investments held in VIEs as a consequence of securitization transactions and equity securities held at cost) and digital assets. (3) Recast for consistency with the current presentation due to the changes explained above. > CONTACT: MercadoLibre, Inc. Investor Relations investor@mercadolibre.com http://investor.mercadolibre.com MercadoLibre Letter to Shareholders 17 Q3’25 Results