UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☐ Definitive Proxy Statement ☒ Definitive Additional Materials ☐ Soliciting Material under §240.14a-12 Edwards Lifesciences Corporation (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee paid previously with preliminary materials. ☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0- 11.

Edwards Lifesciences Spring 2025 Stockholder Presentation

Cautionary Statement and Use of Non-GAAP Financial Measures 2 This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements contained in this Proxy Statement to be covered by the safe harbor provisions of such Acts. Some statements other than statements of historical fact in this Proxy Statement or referred to or incorporated by reference into this Proxy Statement are “forward-looking statements” for purposes of these sections. These statements can sometimes be identified by the use of the forward-looking words, such as “may,” “believe,” “will,” “expect,” “project,” “estimate,” “should,” “anticipate,” “plan,” “goal,” “continue,” “seek,” “pro forma,” “forecast,” “intend,” “guidance,” “optimistic,” “aspire,” “confident,” other forms of these words, or similar words or expressions or the negatives thereof. Statements of past performance, efforts or results about which inferences or assumptions may be made can also be forward-looking statements and are not indicative of future performance or results; these statements can be identified by the use of words such as “preliminary,” “initial,” "potential," "possible," “diligence,” “industry-leading,” “compliant,” “indications,” or “early feedback” or other forms of these words or similar words or expressions or the negatives thereof. These forward-looking statements are subject to substantial risks and uncertainties that could cause our results or future business, financial condition, results of operations, or performance to differ materially from our historical results or experiences or those expressed or implied in any forward-looking statements contained in this Proxy Statement. These risks and uncertainties include, but are not limited to, the risks listed in Edwards’ Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the U.S. Securities and Exchange Commission, to which your attention is directed. These forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of the statement, except as required by law. If we do update or correct one or more of these statements, investors and others should not conclude that we will make additional updates or corrections. Unless otherwise indicated, all figures are GAAP financial measures A reconciliation of non-GAAP historical financial measures to the most comparable GAAP measure is available at www.edwards.com The Company is not able to provide a reconciliation of future projections that exclude special items to expected reported results due to the unknown effect, timing and potential significance of special charges or gains, and management’s inability to forecast charges associated with future transactions and initiatives

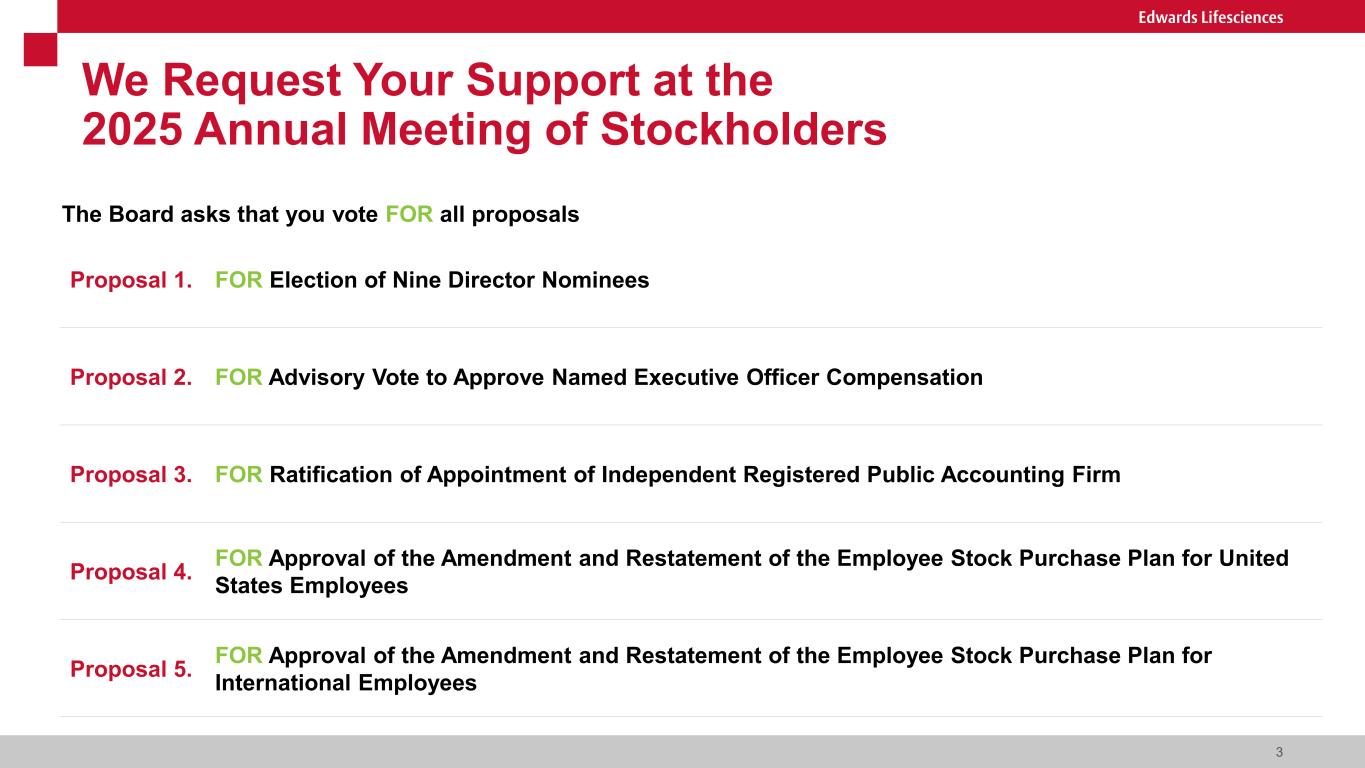

We Request Your Support at the 2025 Annual Meeting of Stockholders 3 Proposal 1. FOR Election of Nine Director Nominees Proposal 2. FOR Advisory Vote to Approve Named Executive Officer Compensation Proposal 3. FOR Ratification of Appointment of Independent Registered Public Accounting Firm Proposal 4. FOR Approval of the Amendment and Restatement of the Employee Stock Purchase Plan for United States Employees Proposal 5. FOR Approval of the Amendment and Restatement of the Employee Stock Purchase Plan for International Employees The Board asks that you vote FOR all proposals

At Edwards Lifesciences, we are dedicated to providing innovative solutions for people fighting cardiovascular disease. Through our actions, we will become trusted partners with customers, colleagues, and patients – creating a community unified in its mission to improve the quality of life around the world. Our results will benefit customers, patients, employees and shareholders. We will celebrate our successes, thrive on discovery, and continually expand our boundaries. We will act boldly, decisively, and with determination on behalf of people fighting cardiovascular disease. Our Credo

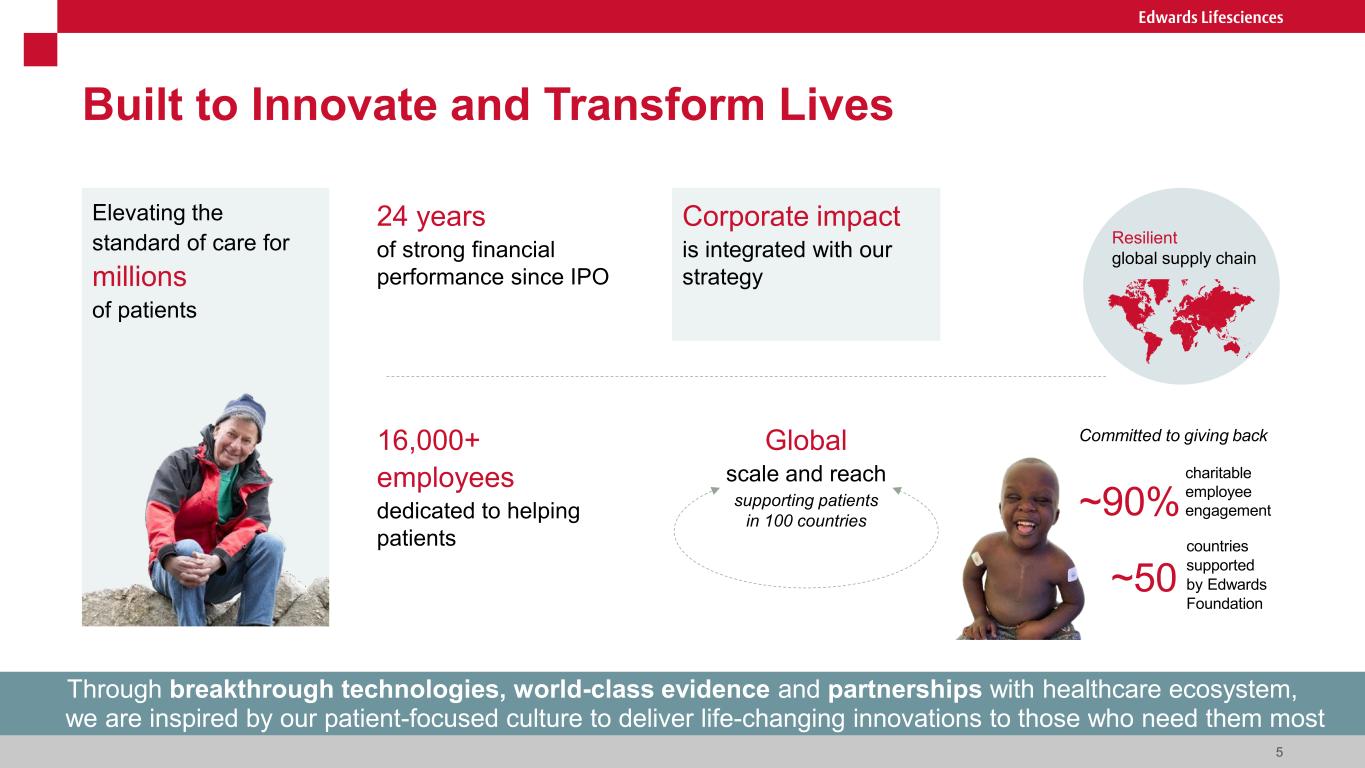

5 Built to Innovate and Transform Lives Elevating the standard of care for millions of patients Corporate impact is integrated with our strategy 24 years of strong financial performance since IPO 16,000+ employees dedicated to helping patients Global scale and reach supporting patients in 100 countries Resilient global supply chain Committed to giving back ~50 countries supported by Edwards Foundation ~90% charitable employee engagement Through breakthrough technologies, world-class evidence and partnerships with healthcare ecosystem, we are inspired by our patient-focused culture to deliver life-changing innovations to those who need them most

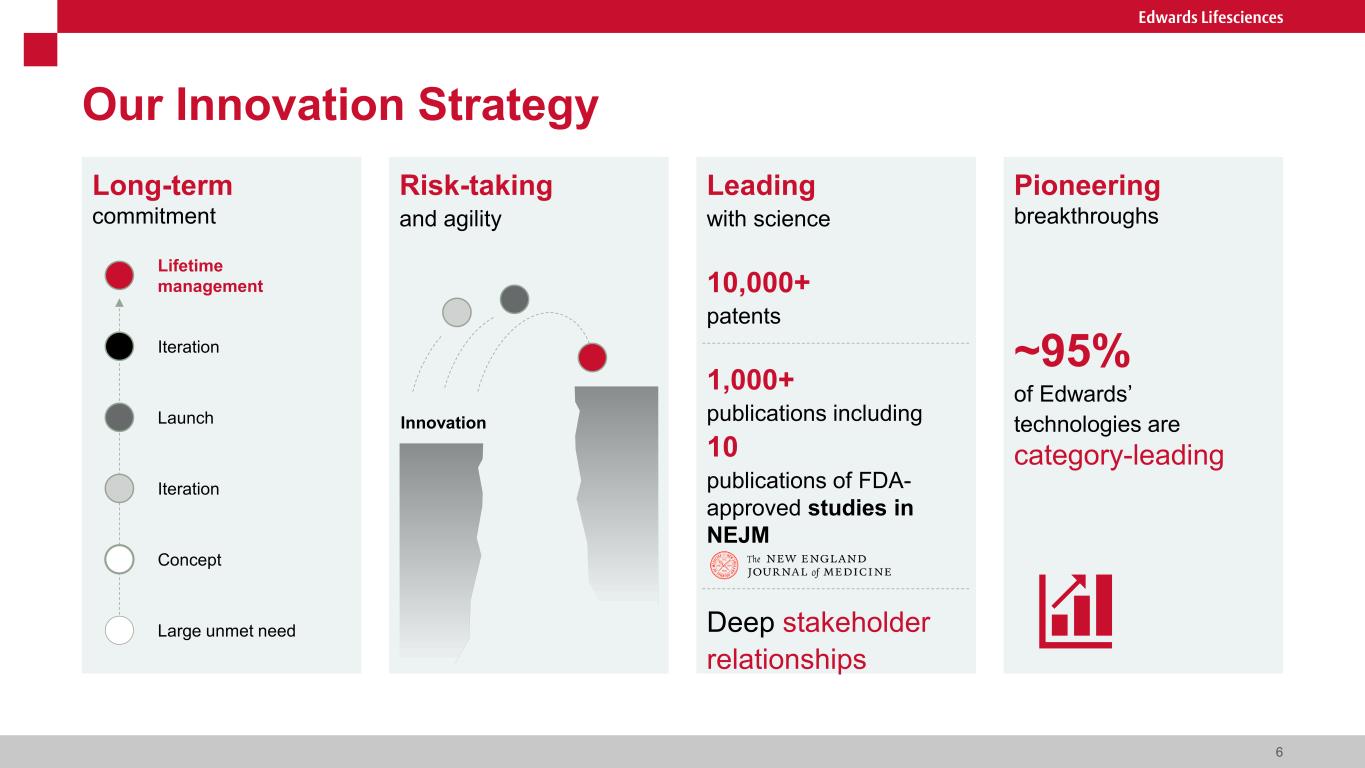

6 Our Innovation Strategy Long-term commitment Risk-taking and agility Leading with science 10,000+ patents 1,000+ publications including 10 publications of FDA- approved studies in NEJM Deep stakeholder relationships Pioneering breakthroughs ~95% of Edwards’ technologies are category-leading Lifetime management Iteration Launch Iteration Concept Large unmet need Innovation

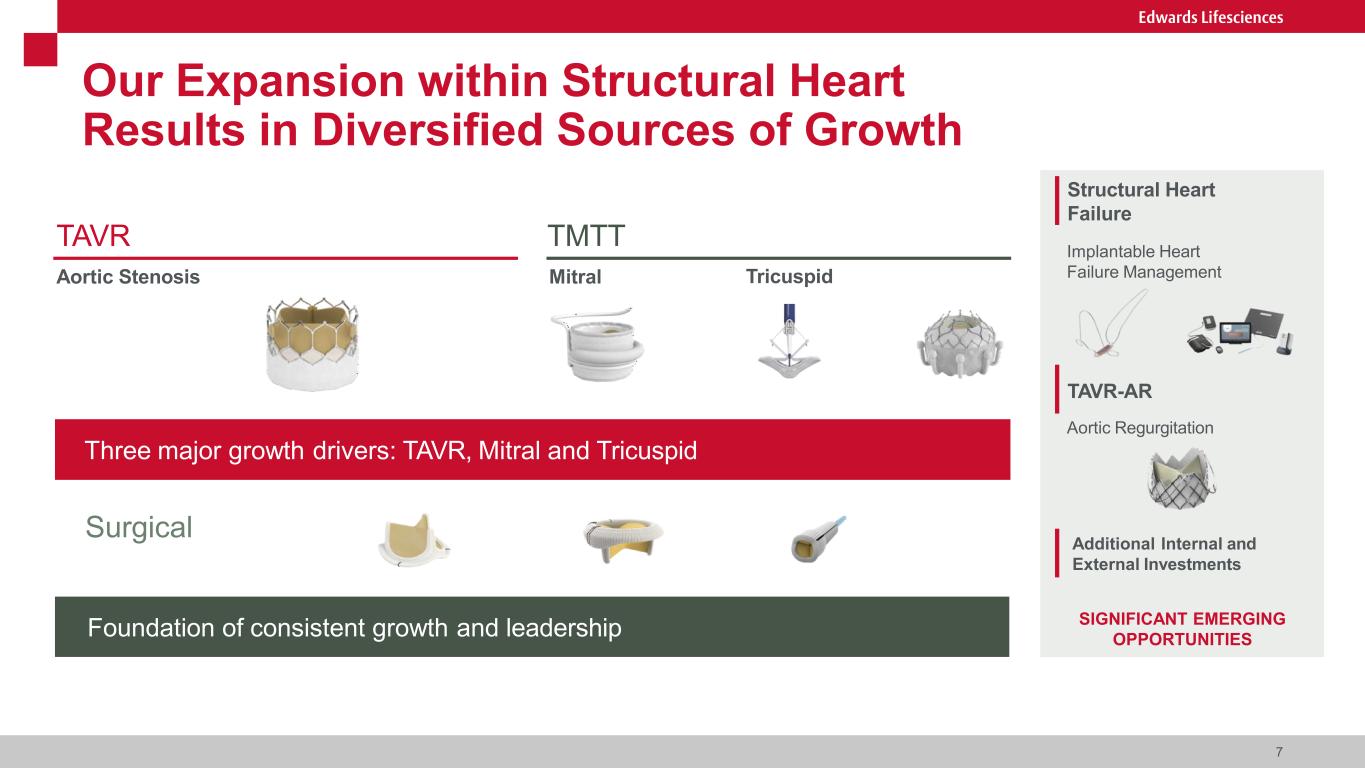

Tricuspid TMTT Mitral TAVR Aortic Stenosis Foundation of consistent growth and leadership Our Expansion within Structural Heart Results in Diversified Sources of Growth SIGNIFICANT EMERGING OPPORTUNITIES TAVR-AR Aortic Regurgitation Structural Heart Failure Implantable Heart Failure Management Additional Internal and External Investments Three major growth drivers: TAVR, Mitral and Tricuspid Surgical 7

Well-Qualified Board with Broad Expertise 8 Provides valuable insights and direction to our Board gained through extensive executive management experience at medical technology companies Brings global manufacturing and operational experience in highly regulated industries and experience leading large, global corporations with intensive data privacy components More than 40 years of medical technology industry experience in a variety of leadership roles at a large and complex global company as well as deep operational expertise Kieran T. Gallahue Joined in 2015 Former Chairman and CEO, CareFusion Corporation Nicholas J. Valeriani Independent Chairman Joined in 2014 Former CEO, Gary and Mary West Health Institute; Former EVP, Johnson & Johnson Steven R. Loranger Joined in 2016 Former Chairman, President and CEO, ITT Corporation David T. Feinberg Joined in 2024 Chairman, Oracle Health Bernard J. Zovighian CEO, Edwards Lifesciences Joined Edwards in 2015 Joined Board in 2023 Paul A. LaViolette Compensation & Governance Committee Chair Joined in 2020 CEO, Pulse Biosciences Inc.; Managing Partner and COO, SV Health Investors Brings to the Board almost 30 years of experience in health system and health information technology services management Extensive global executive experience from over 40 years in the medical technology industry and unique perspective on strategy working with large, global organizations and start-ups Brings a global mindset and teams-based leadership approach informed by 30 years in the medical technology industry, leading global businesses across two world-class companies More than 25 years of pharmaceutical industry experience with leadership roles in multiple markets, successfully launching products and delivering sustainable growth Career in the banking industry and in-depth knowledge of capital markets enhances our Board’s ability to effectively oversee financial reporting and risk management Experience as a CEO and leading operations at large health services organizations adds critical perspective and provides unique insights during strategic discussions Leslie S. Heisz Audit Committee Chair Joined in 2016 Former Managing Director, Lazard Frères & Co. Ramona Sequeira Joined in 2020 President, Global Portfolio Division, Takeda Pharmaceuticals Company Leslie C. Davis Joined in 2024 CEO and President, UPMC Director added in 2024 Edwards maintains a robust Board refreshment process; in 2024, the Board welcomed two new Directors, Leslie Davis and David Feinberg, each bringing extensive leadership experience in relevant industries

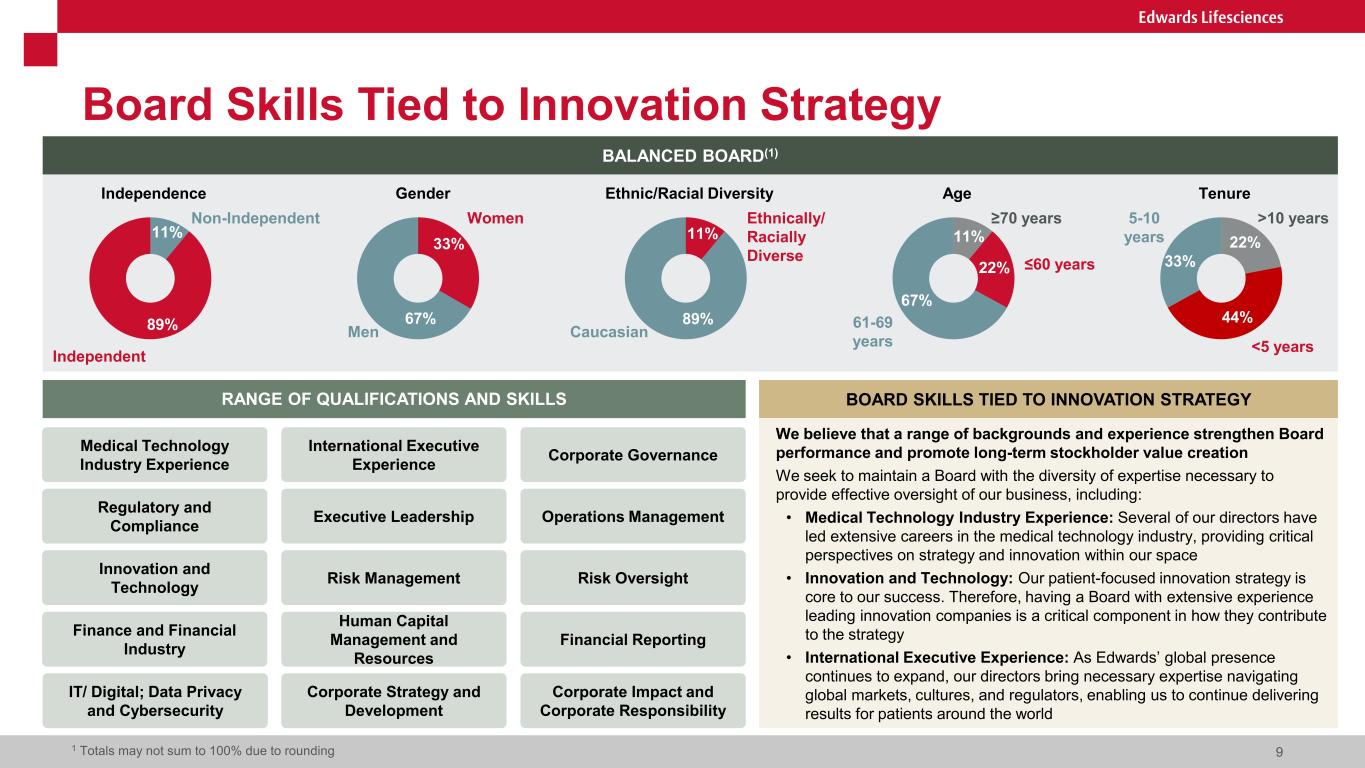

Board Skills Tied to Innovation Strategy 9 Medical Technology Industry Experience International Executive Experience Corporate Governance Risk Management Risk Oversight Executive Leadership Innovation and Technology Corporate Impact and Corporate Responsibility Operations Management Corporate Strategy and Development IT/ Digital; Data Privacy and Cybersecurity Regulatory and Compliance RANGE OF QUALIFICATIONS AND SKILLS Human Capital Management and Resources Financial ReportingFinance and Financial Industry 1 Totals may not sum to 100% due to rounding BOARD SKILLS TIED TO INNOVATION STRATEGY We believe that a range of backgrounds and experience strengthen Board performance and promote long-term stockholder value creation We seek to maintain a Board with the diversity of expertise necessary to provide effective oversight of our business, including: • Medical Technology Industry Experience: Several of our directors have led extensive careers in the medical technology industry, providing critical perspectives on strategy and innovation within our space • Innovation and Technology: Our patient-focused innovation strategy is core to our success. Therefore, having a Board with extensive experience leading innovation companies is a critical component in how they contribute to the strategy • International Executive Experience: As Edwards’ global presence continues to expand, our directors bring necessary expertise navigating global markets, cultures, and regulators, enabling us to continue delivering results for patients around the world BALANCED BOARD(1) 11% 89% 33% 67% 22% 33% 11% 89% 11% 67% Men Women Gender Ethnically/ Racially Diverse Caucasian Ethnic/Racial Diversity ≤60 years 61-69 years ≥70 years Age <5 years 5-10 years Tenure Independent Independence 44% Non-Independent >10 years 22%

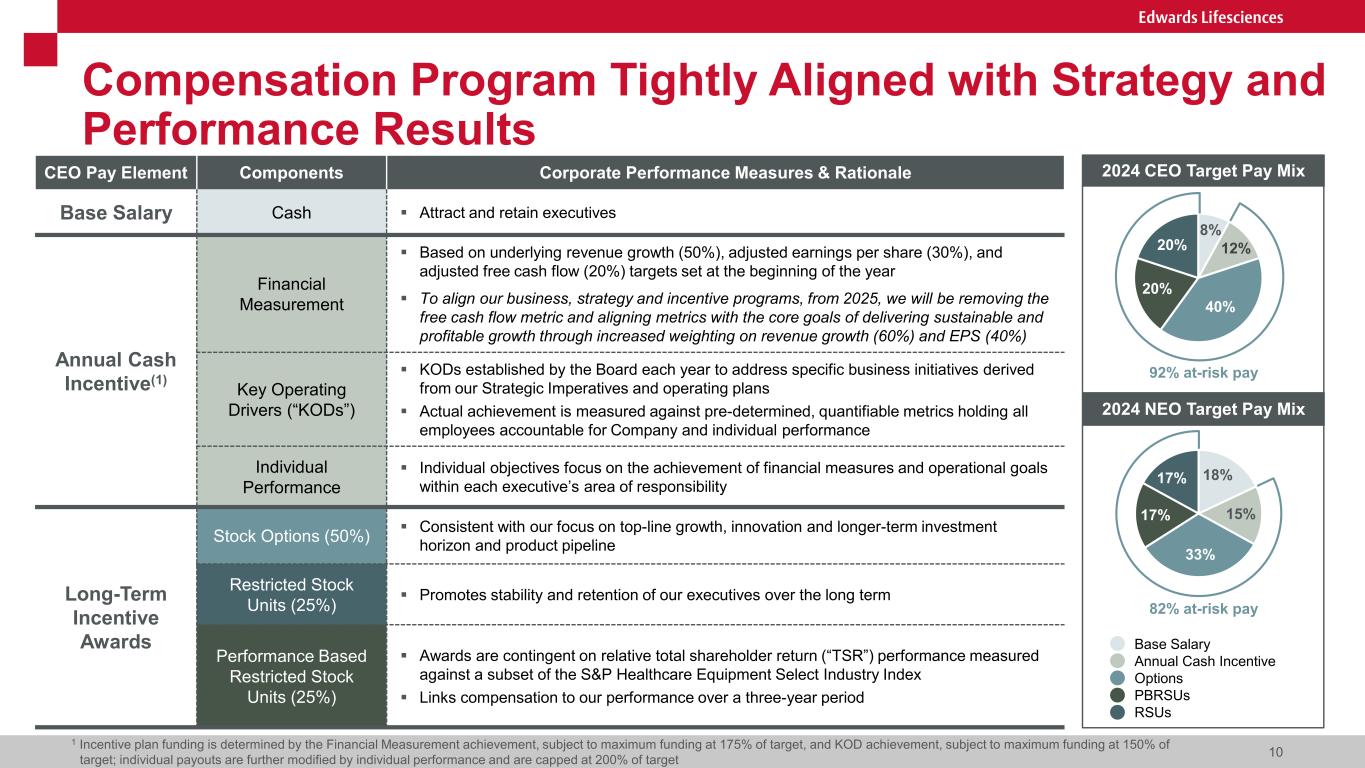

18% 15% 33% 17% 17% CEO Pay Element Components Corporate Performance Measures & Rationale Base Salary Cash Attract and retain executives Annual Cash Incentive(1) Financial Measurement Based on underlying revenue growth (50%), adjusted earnings per share (30%), and adjusted free cash flow (20%) targets set at the beginning of the year To align our business, strategy and incentive programs, from 2025, we will be removing the free cash flow metric and aligning metrics with the core goals of delivering sustainable and profitable growth through increased weighting on revenue growth (60%) and EPS (40%) Key Operating Drivers (“KODs”) KODs established by the Board each year to address specific business initiatives derived from our Strategic Imperatives and operating plans Actual achievement is measured against pre-determined, quantifiable metrics holding all employees accountable for Company and individual performance Individual Performance Individual objectives focus on the achievement of financial measures and operational goals within each executive’s area of responsibility Long-Term Incentive Awards Stock Options (50%) Consistent with our focus on top-line growth, innovation and longer-term investment horizon and product pipeline Restricted Stock Units (25%) Promotes stability and retention of our executives over the long term Performance Based Restricted Stock Units (25%) Awards are contingent on relative total shareholder return (“TSR”) performance measured against a subset of the S&P Healthcare Equipment Select Industry Index Links compensation to our performance over a three-year period Compensation Program Tightly Aligned with Strategy and Performance Results 10 1 Incentive plan funding is determined by the Financial Measurement achievement, subject to maximum funding at 175% of target, and KOD achievement, subject to maximum funding at 150% of target; individual payouts are further modified by individual performance and are capped at 200% of target 8% 12% 40% 20% 20% 2024 CEO Target Pay Mix 92% at-risk pay 82% at-risk pay 2024 NEO Target Pay Mix Base Salary Annual Cash Incentive Options PBRSUs RSUs

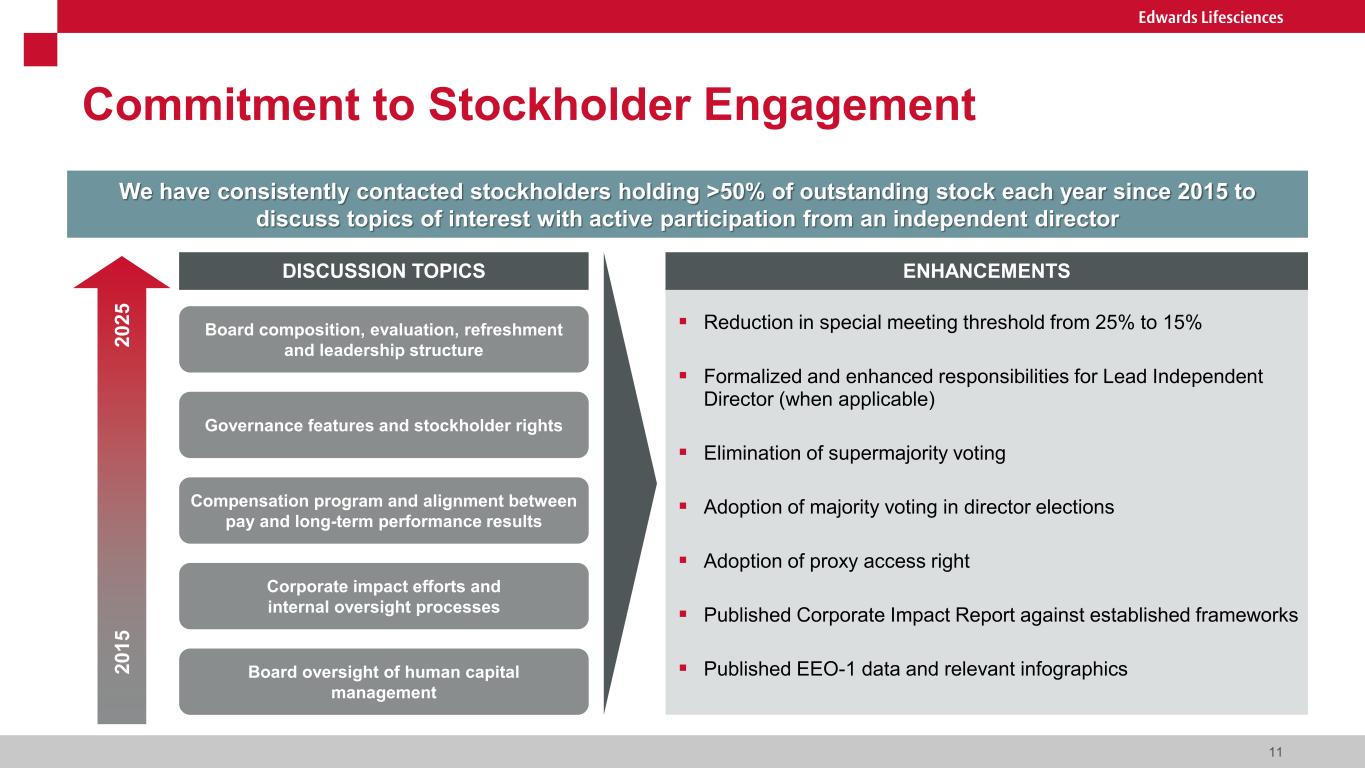

11 Commitment to Stockholder Engagement We have consistently contacted stockholders holding >50% of outstanding stock each year since 2015 to discuss topics of interest with active participation from an independent director 20 25 20 15 DISCUSSION TOPICS Governance features and stockholder rights Board oversight of human capital management Corporate impact efforts and internal oversight processes Compensation program and alignment between pay and long-term performance results Board composition, evaluation, refreshment and leadership structure Reduction in special meeting threshold from 25% to 15% Formalized and enhanced responsibilities for Lead Independent Director (when applicable) Elimination of supermajority voting Adoption of majority voting in director elections Adoption of proxy access right Published Corporate Impact Report against established frameworks Published EEO-1 data and relevant infographics ENHANCEMENTS