ENTEGRIS PROPRIETARY AND CONFIDENTIAL – INTERNAL Third Quarter 2025 October 30, 2025 Entegris Earnings Summary .2

2 Safe Harbor ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY This presentation contains “forward-looking statements.” The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “should,” “may,” “will,” “would” or the negative thereof and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on current management expectations and assumptions only as of the date of this presentation. They are not guarantees of future performance and they involve substantial risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. These risks and uncertainties include, but are not limited to, fluctuations in the demand for semiconductors and the overall volume of semiconductor manufacturing; the impact of global economic uncertainty, including financial market volatility, which may result in lower consumer spending, inflationary pressures, a higher interest rate environment, an economic recession, and instability; raw material shortages, supply and labor constraints, and price increases; fluctuations in the Company’s revenues and operating results and their impact on the Company’s stock price; supply chain interruptions and the Company’s dependence on sole, single and limited source suppliers; risks related to the Company’s international operations, including challenges in hiring and integrating workers in different countries, maintaining appropriate business practices across the varied jurisdictions in which we operate, and engaging and managing global, regional and local third-party service providers; the impact of regional and global instabilities, hostilities and geopolitical uncertainty, including, but not limited to, the ongoing conflicts between Ukraine and Russia, between Israel and Hamas and other conflicts in the Middle East, as well as the global responses thereto; export controls, economic sanctions, and similar restrictions; tariffs, additional taxes, and other protectionist measures resulting from international trade disputes, strained international relations, and changes in foreign and national security policy; the concentration and consolidation of the Company’s customer base; the Company’s ability to meet rapid demand shifts; the Company’s ability to continue technological innovation and to introduce new products to meet customers’ rapidly changing requirements; manufacturing and other operational disruptions or delays; IT system failures, network disruptions, and cybersecurity risks; the risks associated with the use and manufacture of hazardous materials; goodwill impairment; challenges in attracting and retaining qualified personnel; the Company’s ability to protect and enforce intellectual property rights; the Company’s environmental, social, and governance commitments; legal and regulatory risks, including changes in laws and regulations related to the environment, health and safety, accounting standards, and corporate governance, across the jurisdictions in which the Company operates; changes in taxation or adverse tax rulings; the ability to obtain government incentives and the possibility that competitors will benefit from government incentives for which the Company does not qualify; the amount and consequences of the Company’s indebtedness, its ability to repay its debt and to obtain future financing, and the Company’s obligations under its current outstanding credit facilities; volatility in the Company’s stock price; the payment of cash dividends and the adoption of future share repurchase programs; the Company’s ability to effectively implement any organizational changes; substantial competition; the Company’s ability to identify, complete and integrate acquisitions, joint ventures, divestitures or other similar transactions; the impacts of climate change; and other matters. These risks and uncertainties also include, but are not limited to, the risk factors and additional information described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the Securities and Exchange Commission (the “SEC”) on February 12, 2025, including under the heading “Risk Factors” in Item 1A, and in the Company’s other periodic filings with the SEC. Except as required under the federal securities laws and the rules and regulations of the SEC, the Company undertakes no obligation to update any forward-looking statements or information contained herein, which speak as of their respective dates. This presentation contains references to "Adjusted Net Sales ", “Adjusted EBITDA,” “Adjusted EBITDA – as a % of Net Sales,” “Adjusted Operating Income,” “Adjusted Operating Margin,” “Adjusted Gross Profit,” “Adjusted Gross Margin – as a % of Net Sales,” “Adjusted Segment Profit,” “Adjusted Segment Profit Margin,” “Non-GAAP Operating Expenses,” “Non-GAAP Tax Rate,” “Non-GAAP Net Income,” “Diluted Non-GAAP Earnings per Common Share,” “Free Cash Flow,” and other measures that are not presented in accordance GAAP. The non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures but should instead be read in conjunction with the GAAP financial measures. Further information with respect to and reconciliations of such measures to the most directly comparable GAAP measure can be found attached to this presentation.

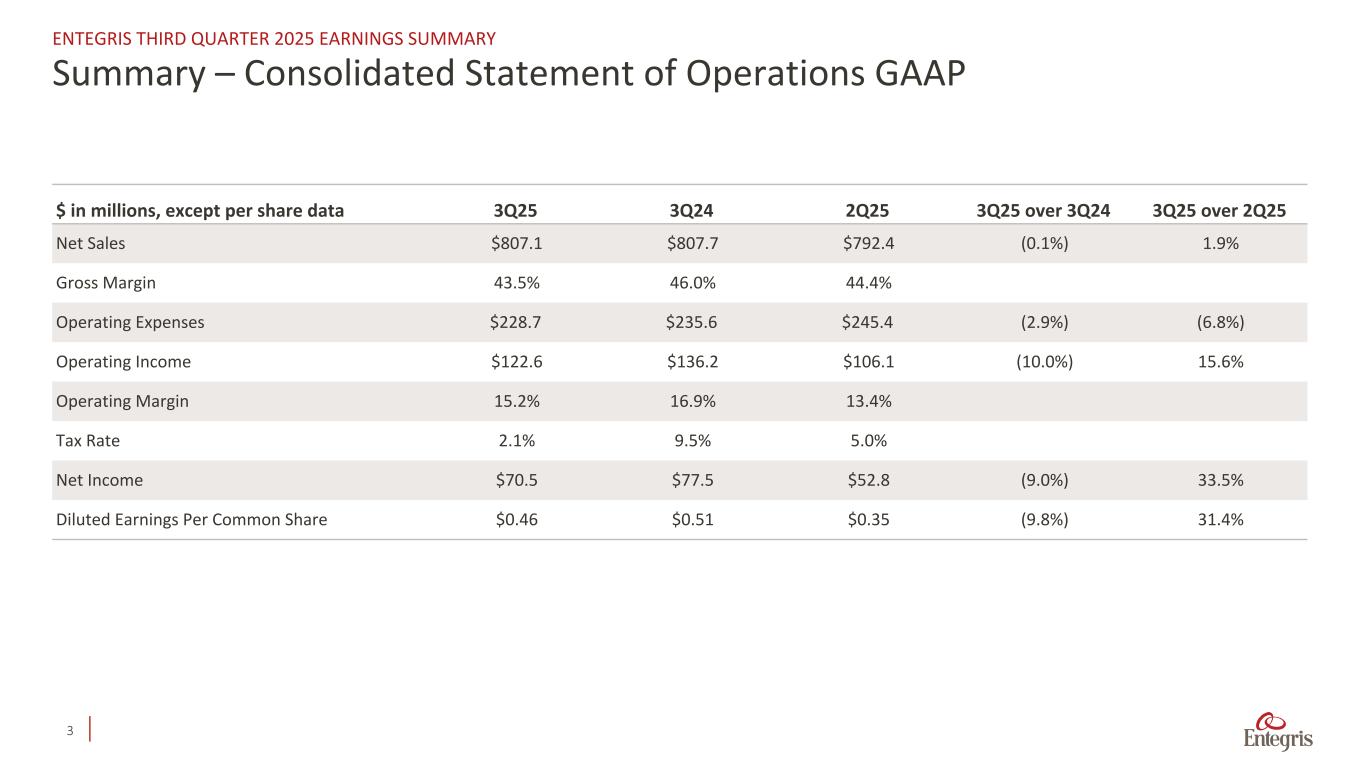

3 Summary – Consolidated Statement of Operations GAAP ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY $ in millions, except per share data 3Q25 3Q24 2Q25 3Q25 over 3Q24 3Q25 over 2Q25 Net Sales $807.1 $807.7 $792.4 (0.1%) 1.9% Gross Margin 43.5% 46.0% 44.4% Operating Expenses $228.7 $235.6 $245.4 (2.9%) (6.8%) Operating Income $122.6 $136.2 $106.1 (10.0%) 15.6% Operating Margin 15.2% 16.9% 13.4% Tax Rate 2.1% 9.5% 5.0% Net Income $70.5 $77.5 $52.8 (9.0%) 33.5% Diluted Earnings Per Common Share $0.46 $0.51 $0.35 (9.8%) 31.4%

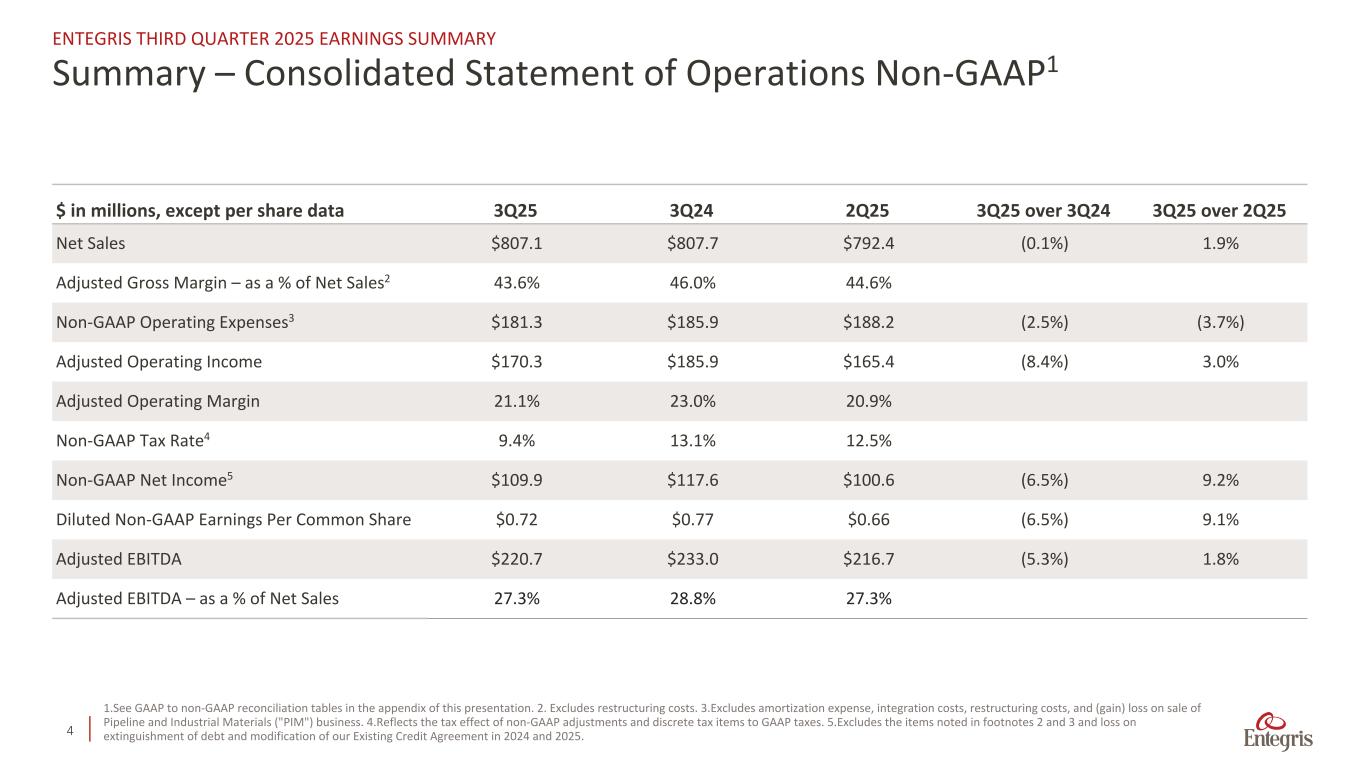

4 Summary – Consolidated Statement of Operations Non-GAAP1 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY $ in millions, except per share data 3Q25 3Q24 2Q25 3Q25 over 3Q24 3Q25 over 2Q25 Net Sales $807.1 $807.7 $792.4 (0.1%) 1.9% Adjusted Gross Margin – as a % of Net Sales2 43.6% 46.0% 44.6% Non-GAAP Operating Expenses3 $181.3 $185.9 $188.2 (2.5%) (3.7%) Adjusted Operating Income $170.3 $185.9 $165.4 (8.4%) 3.0% Adjusted Operating Margin 21.1% 23.0% 20.9% Non-GAAP Tax Rate4 9.4% 13.1% 12.5% Non-GAAP Net Income5 $109.9 $117.6 $100.6 (6.5%) 9.2% Diluted Non-GAAP Earnings Per Common Share $0.72 $0.77 $0.66 (6.5%) 9.1% Adjusted EBITDA $220.7 $233.0 $216.7 (5.3%) 1.8% Adjusted EBITDA – as a % of Net Sales 27.3% 28.8% 27.3% 1.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. 2. Excludes restructuring costs. 3.Excludes amortization expense, integration costs, restructuring costs, and (gain) loss on sale of Pipeline and Industrial Materials ("PIM") business. 4.Reflects the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 5.Excludes the items noted in footnotes 2 and 3 and loss on extinguishment of debt and modification of our Existing Credit Agreement in 2024 and 2025.

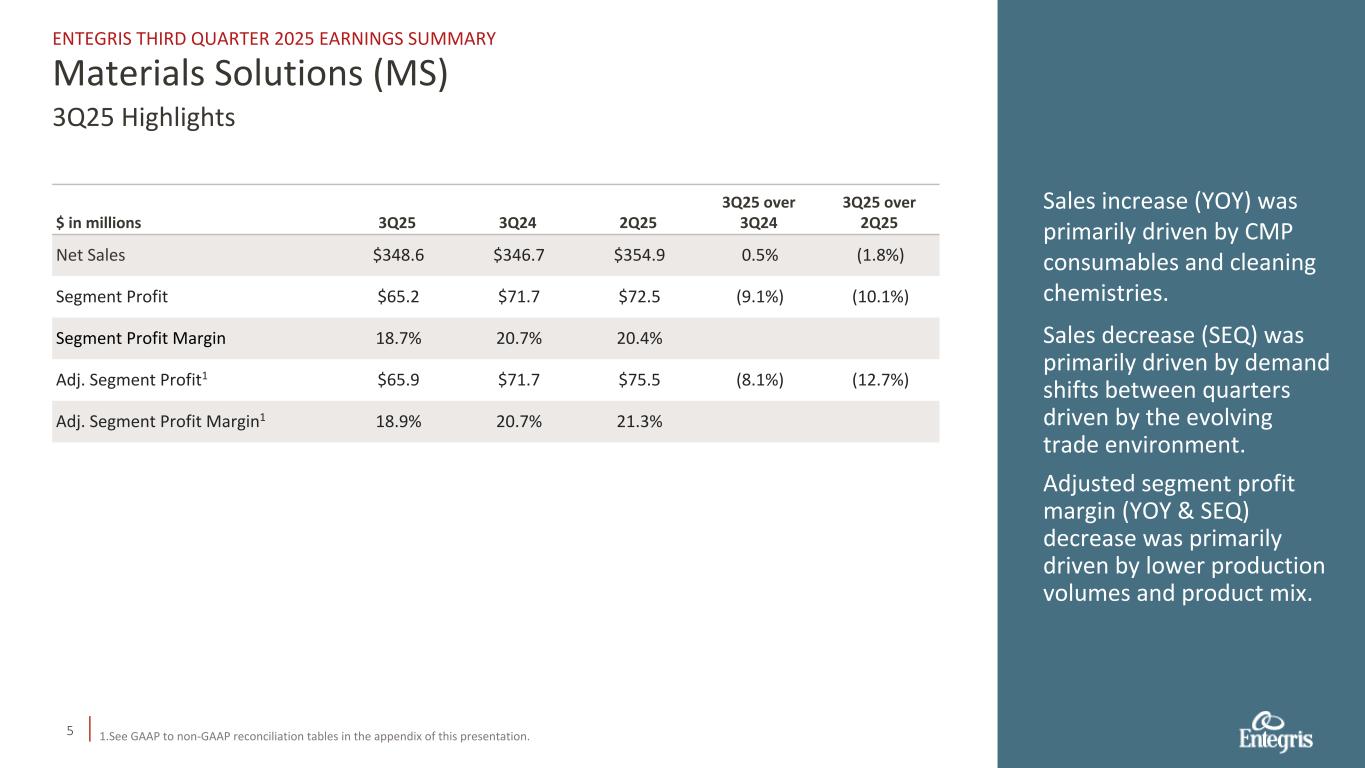

5 Sales increase (YOY) was primarily driven by CMP consumables and cleaning chemistries. Sales decrease (SEQ) was primarily driven by demand shifts between quarters driven by the evolving trade environment. Adjusted segment profit margin (YOY & SEQ) decrease was primarily driven by lower production volumes and product mix. $ in millions 3Q25 3Q24 2Q25 3Q25 over 3Q24 3Q25 over 2Q25 Net Sales $348.6 $346.7 $354.9 0.5% (1.8%) Segment Profit $65.2 $71.7 $72.5 (9.1%) (10.1%) Segment Profit Margin 18.7% 20.7% 20.4% Adj. Segment Profit1 $65.9 $71.7 $75.5 (8.1%) (12.7%) Adj. Segment Profit Margin1 18.9% 20.7% 21.3% Materials Solutions (MS) ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 3Q25 Highlights 1.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation.

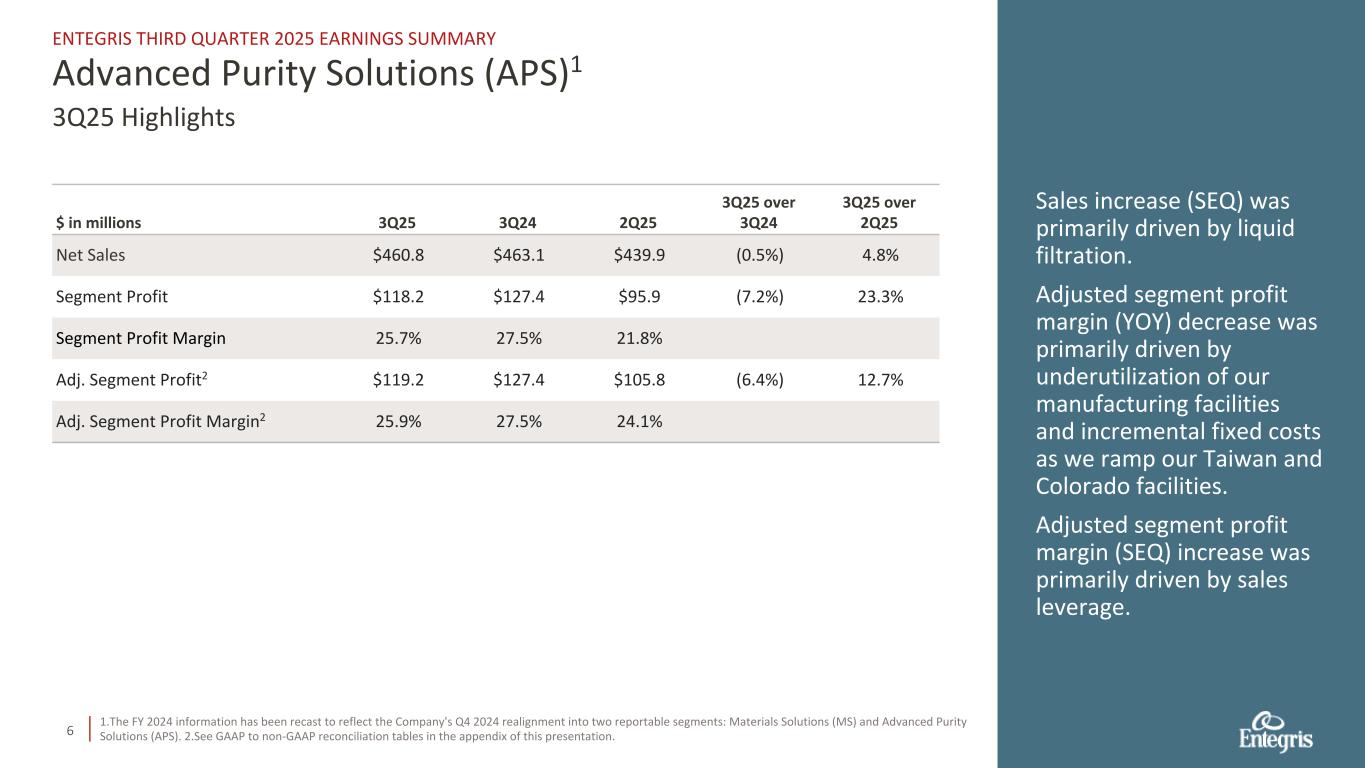

6 Sales increase (SEQ) was primarily driven by liquid filtration. Adjusted segment profit margin (YOY) decrease was primarily driven by underutilization of our manufacturing facilities and incremental fixed costs as we ramp our Taiwan and Colorado facilities. Adjusted segment profit margin (SEQ) increase was primarily driven by sales leverage. $ in millions 3Q25 3Q24 2Q25 3Q25 over 3Q24 3Q25 over 2Q25 Net Sales $460.8 $463.1 $439.9 (0.5%) 4.8% Segment Profit $118.2 $127.4 $95.9 (7.2%) 23.3% Segment Profit Margin 25.7% 27.5% 21.8% Adj. Segment Profit2 $119.2 $127.4 $105.8 (6.4%) 12.7% Adj. Segment Profit Margin2 25.9% 27.5% 24.1% Advanced Purity Solutions (APS)1 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 3Q25 Highlights 1.The FY 2024 information has been recast to reflect the Company's Q4 2024 realignment into two reportable segments: Materials Solutions (MS) and Advanced Purity Solutions (APS). 2.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation.

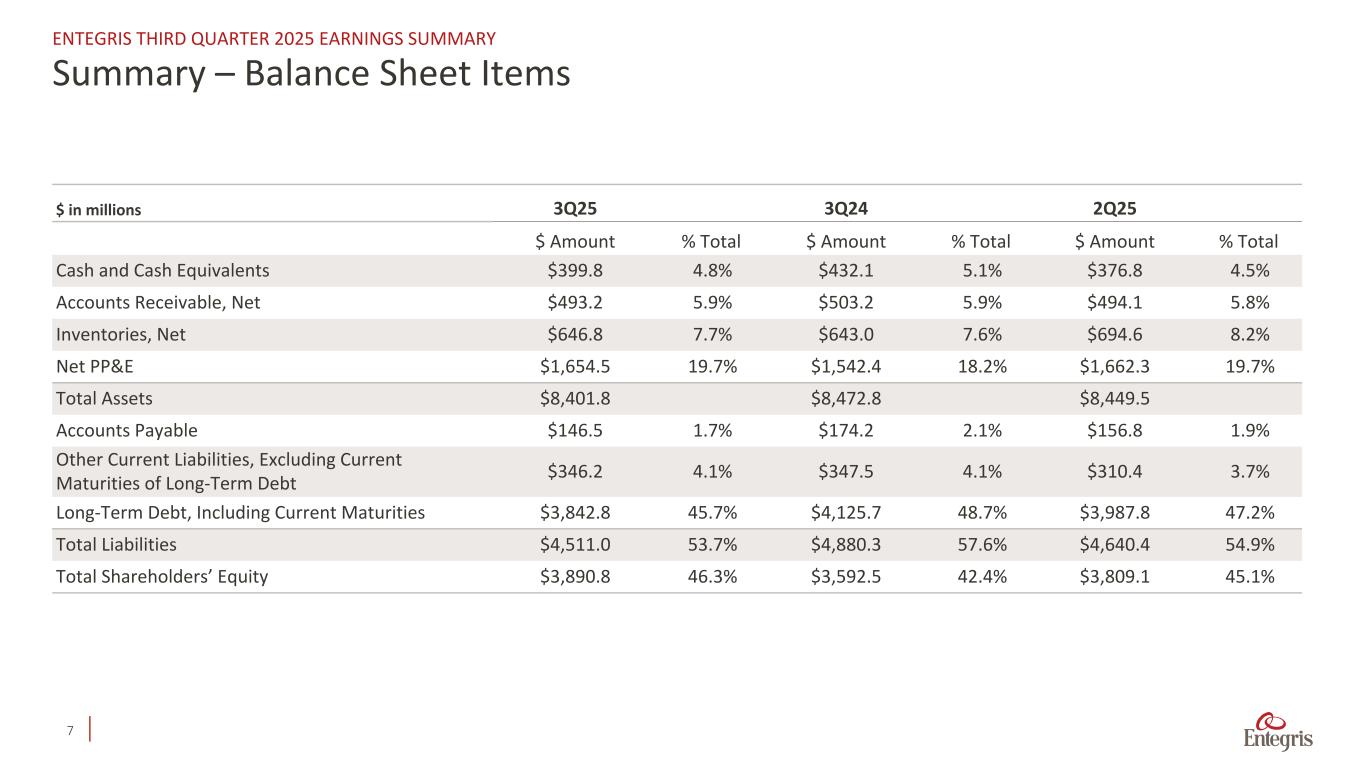

7 Summary – Balance Sheet Items ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY $ in millions 3Q25 3Q24 2Q25 $ Amount % Total $ Amount % Total $ Amount % Total Cash and Cash Equivalents $399.8 4.8% $432.1 5.1% $376.8 4.5% Accounts Receivable, Net $493.2 5.9% $503.2 5.9% $494.1 5.8% Inventories, Net $646.8 7.7% $643.0 7.6% $694.6 8.2% Net PP&E $1,654.5 19.7% $1,542.4 18.2% $1,662.3 19.7% Total Assets $8,401.8 $8,472.8 $8,449.5 Accounts Payable $146.5 1.7% $174.2 2.1% $156.8 1.9% Other Current Liabilities, Excluding Current Maturities of Long-Term Debt $346.2 4.1% $347.5 4.1% $310.4 3.7% Long-Term Debt, Including Current Maturities $3,842.8 45.7% $4,125.7 48.7% $3,987.8 47.2% Total Liabilities $4,511.0 53.7% $4,880.3 57.6% $4,640.4 54.9% Total Shareholders’ Equity $3,890.8 46.3% $3,592.5 42.4% $3,809.1 45.1%

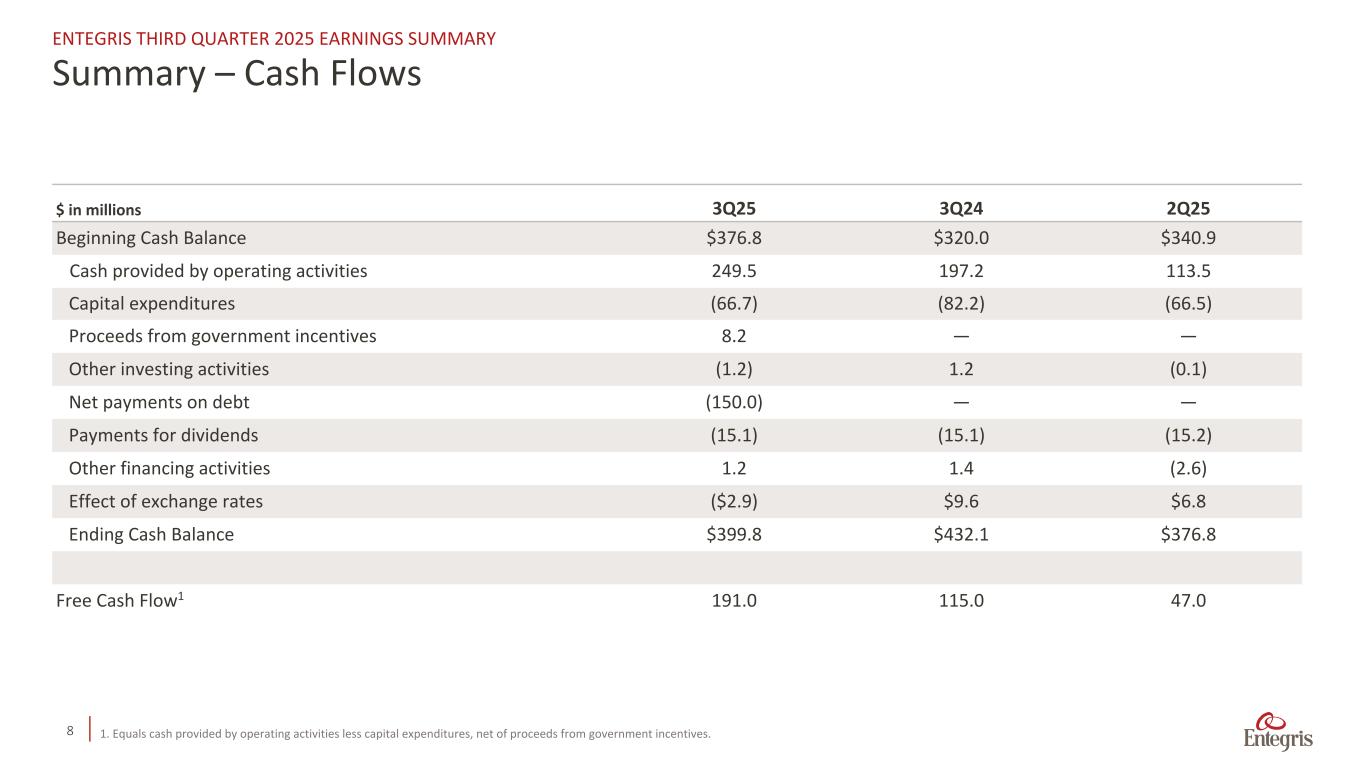

8 Summary – Cash Flows ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY $ in millions 3Q25 3Q24 2Q25 Beginning Cash Balance $376.8 $320.0 $340.9 Cash provided by operating activities 249.5 197.2 113.5 Capital expenditures (66.7) (82.2) (66.5) Proceeds from government incentives 8.2 — — Other investing activities (1.2) 1.2 (0.1) Net payments on debt (150.0) — — Payments for dividends (15.1) (15.1) (15.2) Other financing activities 1.2 1.4 (2.6) Effect of exchange rates ($2.9) $9.6 $6.8 Ending Cash Balance $399.8 $432.1 $376.8 Free Cash Flow1 191.0 115.0 47.0 1. Equals cash provided by operating activities less capital expenditures, net of proceeds from government incentives.

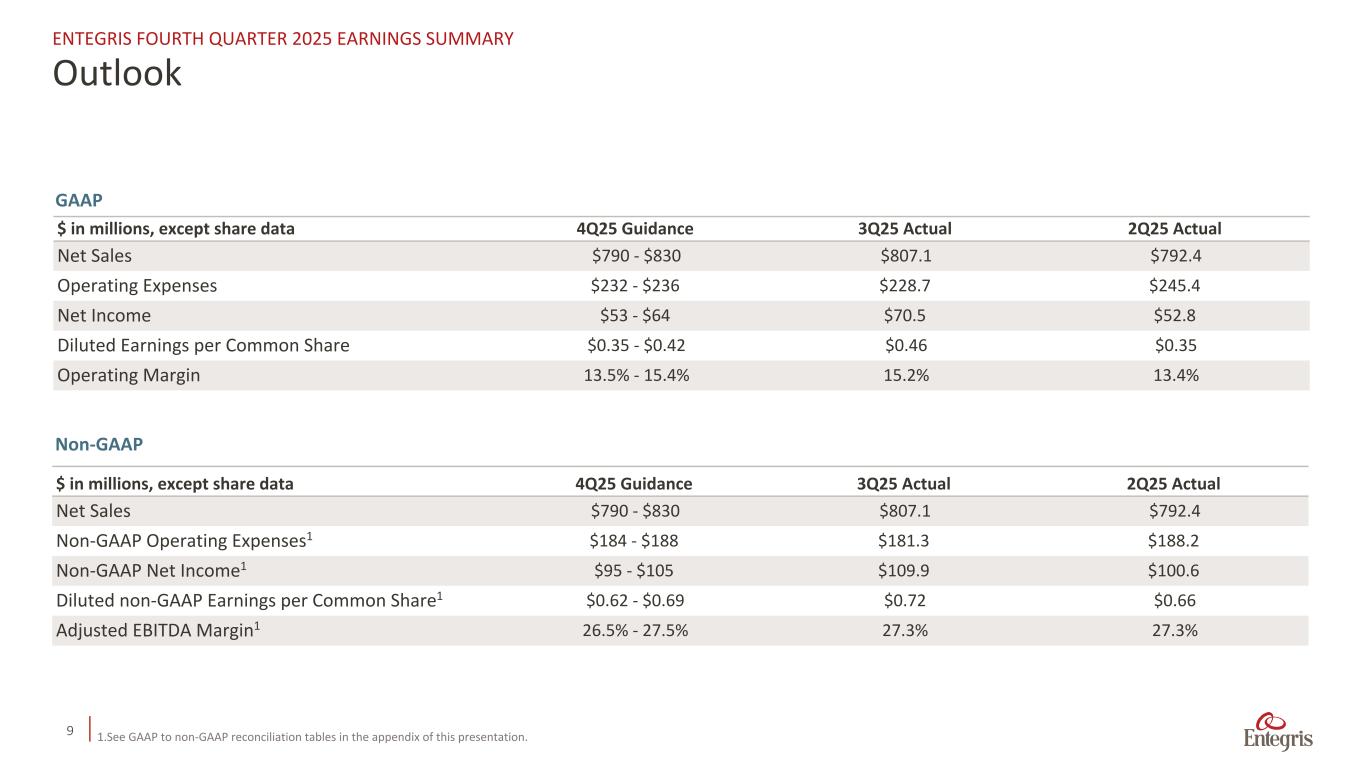

9 ENTEGRIS FOURTH QUARTER 2025 EARNINGS SUMMARY 1.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. GAAP $ in millions, except share data 4Q25 Guidance 3Q25 Actual 2Q25 Actual Net Sales $790 - $830 $807.1 $792.4 Non-GAAP Operating Expenses1 $184 - $188 $181.3 $188.2 Non-GAAP Net Income1 $95 - $105 $109.9 $100.6 Diluted non-GAAP Earnings per Common Share1 $0.62 - $0.69 $0.72 $0.66 Adjusted EBITDA Margin1 26.5% - 27.5% 27.3% 27.3% Non-GAAP $ in millions, except share data 4Q25 Guidance 3Q25 Actual 2Q25 Actual Net Sales $790 - $830 $807.1 $792.4 Operating Expenses $232 - $236 $228.7 $245.4 Net Income $53 - $64 $70.5 $52.8 Diluted Earnings per Common Share $0.35 - $0.42 $0.46 $0.35 Operating Margin 13.5% - 15.4% 15.2% 13.4% Outlook

10 Appendix

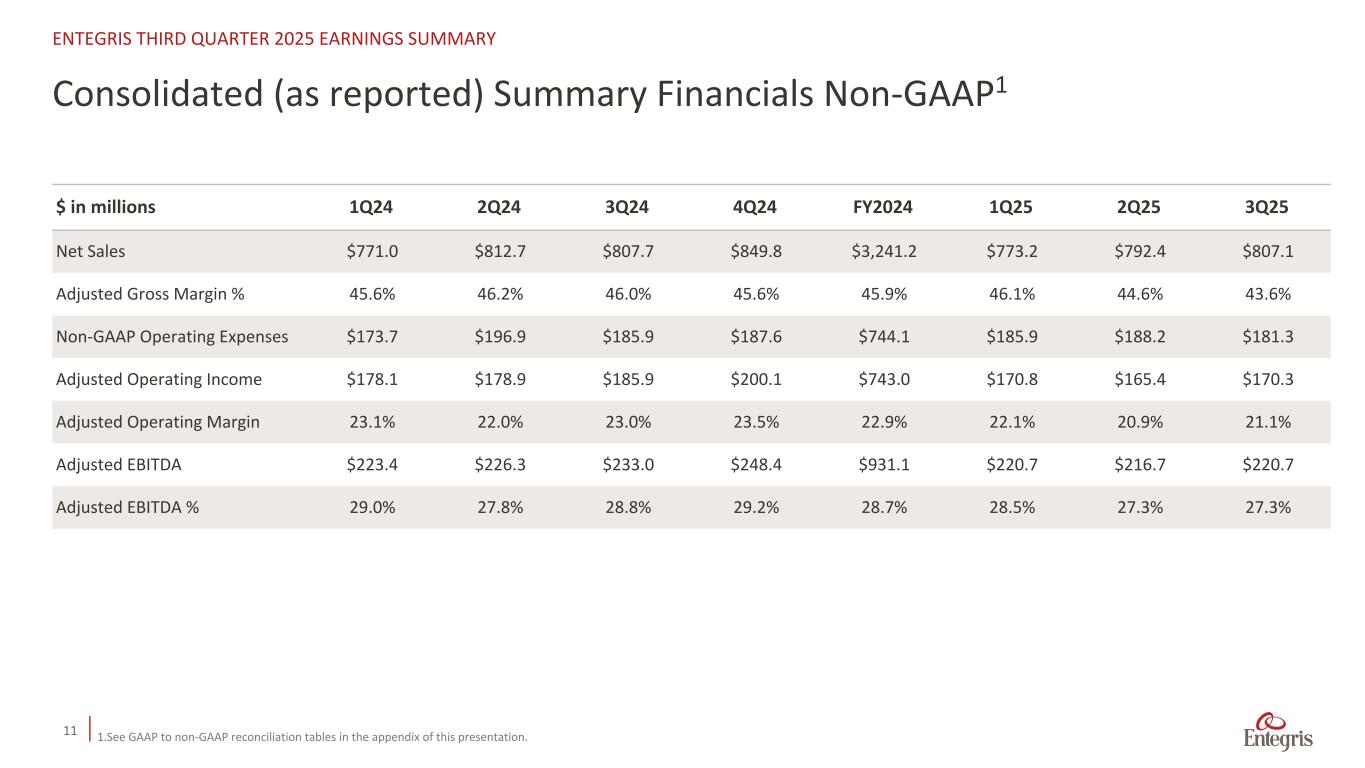

11 Consolidated (as reported) Summary Financials Non-GAAP1 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Net Sales $771.0 $812.7 $807.7 $849.8 $3,241.2 $773.2 $792.4 $807.1 Adjusted Gross Margin % 45.6% 46.2% 46.0% 45.6% 45.9% 46.1% 44.6% 43.6% Non-GAAP Operating Expenses $173.7 $196.9 $185.9 $187.6 $744.1 $185.9 $188.2 $181.3 Adjusted Operating Income $178.1 $178.9 $185.9 $200.1 $743.0 $170.8 $165.4 $170.3 Adjusted Operating Margin 23.1% 22.0% 23.0% 23.5% 22.9% 22.1% 20.9% 21.1% Adjusted EBITDA $223.4 $226.3 $233.0 $248.4 $931.1 $220.7 $216.7 $220.7 Adjusted EBITDA % 29.0% 27.8% 28.8% 29.2% 28.7% 28.5% 27.3% 27.3% 1.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation.

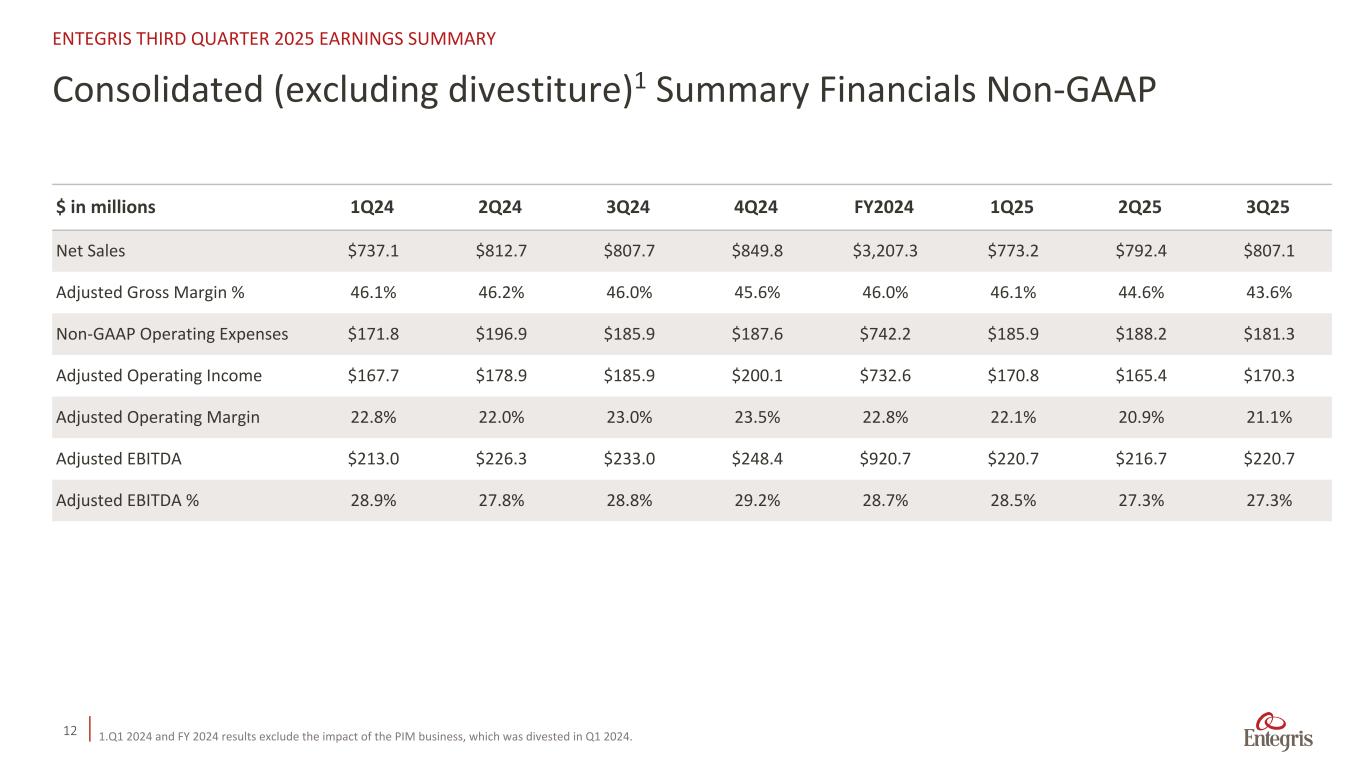

12 Consolidated (excluding divestiture)1 Summary Financials Non-GAAP ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Net Sales $737.1 $812.7 $807.7 $849.8 $3,207.3 $773.2 $792.4 $807.1 Adjusted Gross Margin % 46.1% 46.2% 46.0% 45.6% 46.0% 46.1% 44.6% 43.6% Non-GAAP Operating Expenses $171.8 $196.9 $185.9 $187.6 $742.2 $185.9 $188.2 $181.3 Adjusted Operating Income $167.7 $178.9 $185.9 $200.1 $732.6 $170.8 $165.4 $170.3 Adjusted Operating Margin 22.8% 22.0% 23.0% 23.5% 22.8% 22.1% 20.9% 21.1% Adjusted EBITDA $213.0 $226.3 $233.0 $248.4 $920.7 $220.7 $216.7 $220.7 Adjusted EBITDA % 28.9% 27.8% 28.8% 29.2% 28.7% 28.5% 27.3% 27.3% 1.Q1 2024 and FY 2024 results exclude the impact of the PIM business, which was divested in Q1 2024.

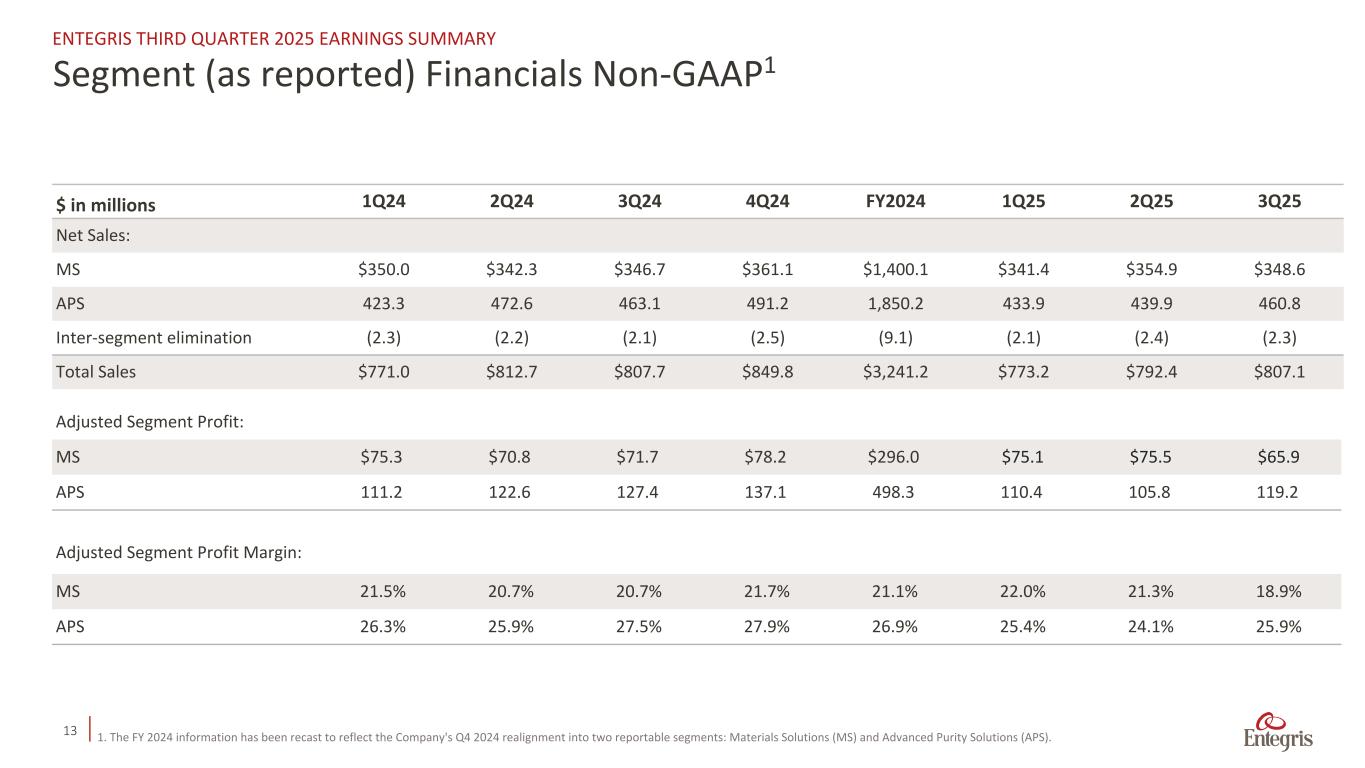

13 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 1. The FY 2024 information has been recast to reflect the Company's Q4 2024 realignment into two reportable segments: Materials Solutions (MS) and Advanced Purity Solutions (APS). Segment (as reported) Financials Non-GAAP1 Adjusted Segment Profit: MS $75.3 $70.8 $71.7 $78.2 $296.0 $75.1 $75.5 $65.9 APS 111.2 122.6 127.4 137.1 498.3 110.4 105.8 119.2 Adjusted Segment Profit Margin: MS 21.5% 20.7% 20.7% 21.7% 21.1% 22.0% 21.3% 18.9% APS 26.3% 25.9% 27.5% 27.9% 26.9% 25.4% 24.1% 25.9% $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Net Sales: MS $350.0 $342.3 $346.7 $361.1 $1,400.1 $341.4 $354.9 $348.6 APS 423.3 472.6 463.1 491.2 1,850.2 433.9 439.9 460.8 Inter-segment elimination (2.3) (2.2) (2.1) (2.5) (9.1) (2.1) (2.4) (2.3) Total Sales $771.0 $812.7 $807.7 $849.8 $3,241.2 $773.2 $792.4 $807.1

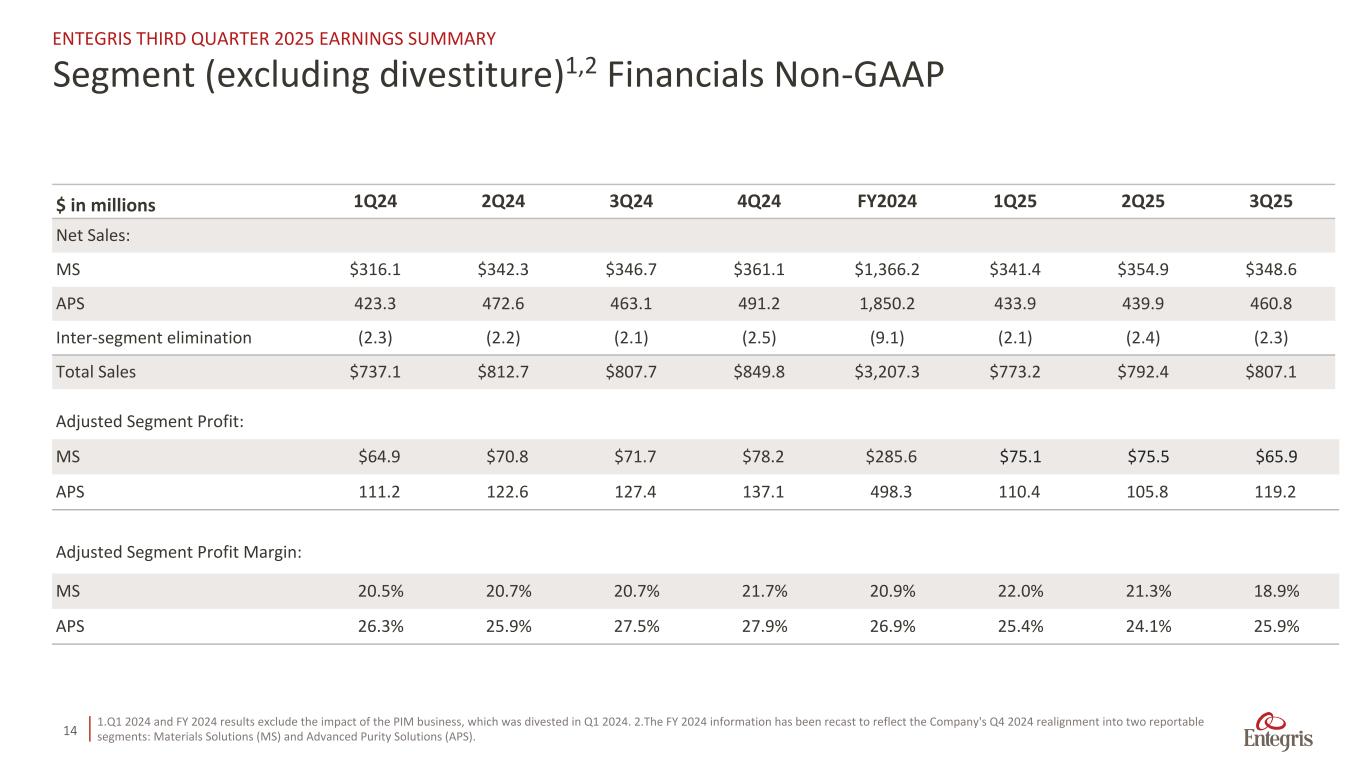

14 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 1.Q1 2024 and FY 2024 results exclude the impact of the PIM business, which was divested in Q1 2024. 2.The FY 2024 information has been recast to reflect the Company's Q4 2024 realignment into two reportable segments: Materials Solutions (MS) and Advanced Purity Solutions (APS). Segment (excluding divestiture)1,2 Financials Non-GAAP Adjusted Segment Profit: MS $64.9 $70.8 $71.7 $78.2 $285.6 $75.1 $75.5 $65.9 APS 111.2 122.6 127.4 137.1 498.3 110.4 105.8 119.2 Adjusted Segment Profit Margin: MS 20.5% 20.7% 20.7% 21.7% 20.9% 22.0% 21.3% 18.9% APS 26.3% 25.9% 27.5% 27.9% 26.9% 25.4% 24.1% 25.9% $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Net Sales: MS $316.1 $342.3 $346.7 $361.1 $1,366.2 $341.4 $354.9 $348.6 APS 423.3 472.6 463.1 491.2 1,850.2 433.9 439.9 460.8 Inter-segment elimination (2.3) (2.2) (2.1) (2.5) (9.1) (2.1) (2.4) (2.3) Total Sales $737.1 $812.7 $807.7 $849.8 $3,207.3 $773.2 $792.4 $807.1

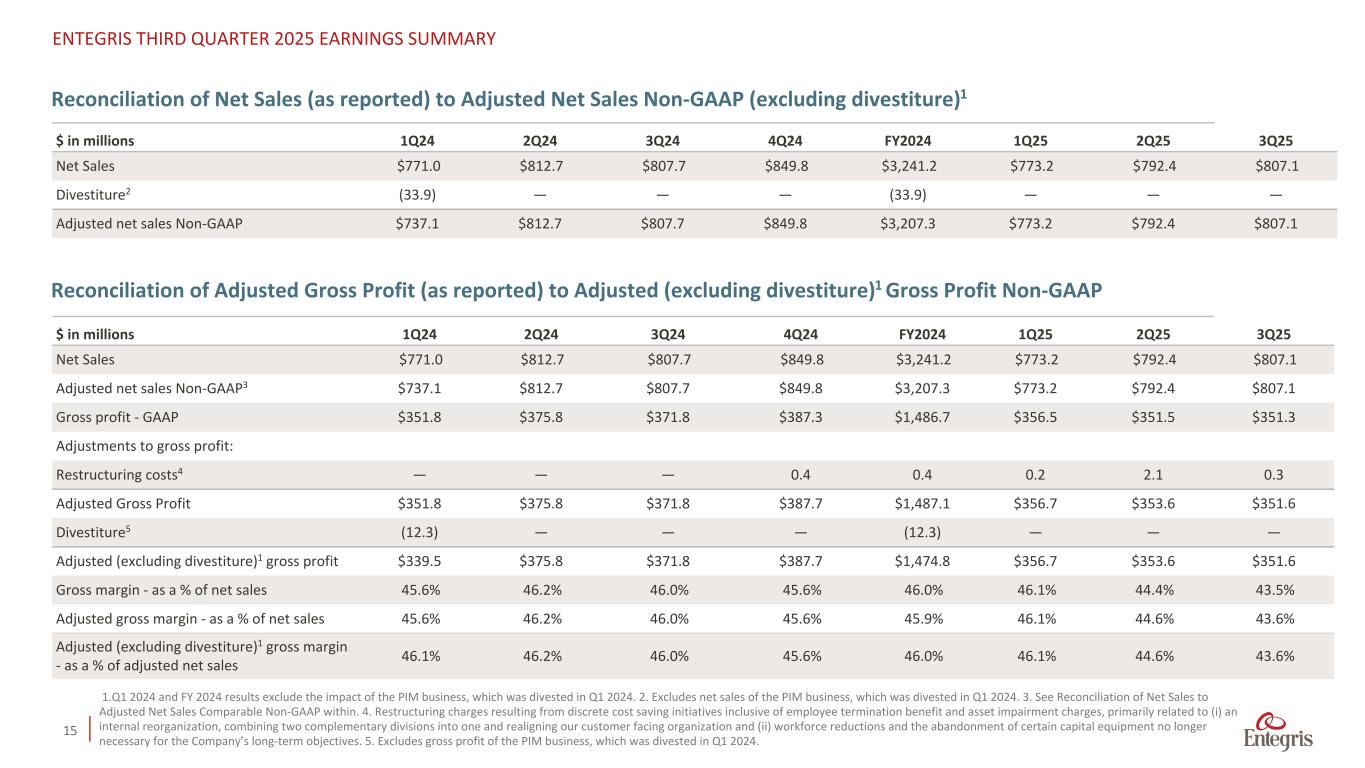

15 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 1.Q1 2024 and FY 2024 results exclude the impact of the PIM business, which was divested in Q1 2024. 2. Excludes net sales of the PIM business, which was divested in Q1 2024. 3. See Reconciliation of Net Sales to Adjusted Net Sales Comparable Non-GAAP within. 4. Restructuring charges resulting from discrete cost saving initiatives inclusive of employee termination benefit and asset impairment charges, primarily related to (i) an internal reorganization, combining two complementary divisions into one and realigning our customer facing organization and (ii) workforce reductions and the abandonment of certain capital equipment no longer necessary for the Company’s long-term objectives. 5. Excludes gross profit of the PIM business, which was divested in Q1 2024. $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Net Sales $771.0 $812.7 $807.7 $849.8 $3,241.2 $773.2 $792.4 $807.1 Adjusted net sales Non-GAAP3 $737.1 $812.7 $807.7 $849.8 $3,207.3 $773.2 $792.4 $807.1 Gross profit - GAAP $351.8 $375.8 $371.8 $387.3 $1,486.7 $356.5 $351.5 $351.3 Adjustments to gross profit: Restructuring costs4 — — — 0.4 0.4 0.2 2.1 0.3 Adjusted Gross Profit $351.8 $375.8 $371.8 $387.7 $1,487.1 $356.7 $353.6 $351.6 Divestiture5 (12.3) — — — (12.3) — — — Adjusted (excluding divestiture)1 gross profit $339.5 $375.8 $371.8 $387.7 $1,474.8 $356.7 $353.6 $351.6 Gross margin - as a % of net sales 45.6% 46.2% 46.0% 45.6% 46.0% 46.1% 44.4% 43.5% Adjusted gross margin - as a % of net sales 45.6% 46.2% 46.0% 45.6% 45.9% 46.1% 44.6% 43.6% Adjusted (excluding divestiture)1 gross margin - as a % of adjusted net sales 46.1% 46.2% 46.0% 45.6% 46.0% 46.1% 44.6% 43.6% Reconciliation of Adjusted Gross Profit (as reported) to Adjusted (excluding divestiture)1 Gross Profit Non-GAAP $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Net Sales $771.0 $812.7 $807.7 $849.8 $3,241.2 $773.2 $792.4 $807.1 Divestiture2 (33.9) — — — (33.9) — — — Adjusted net sales Non-GAAP $737.1 $812.7 $807.7 $849.8 $3,207.3 $773.2 $792.4 $807.1 Reconciliation of Net Sales (as reported) to Adjusted Net Sales Non-GAAP (excluding divestiture)1

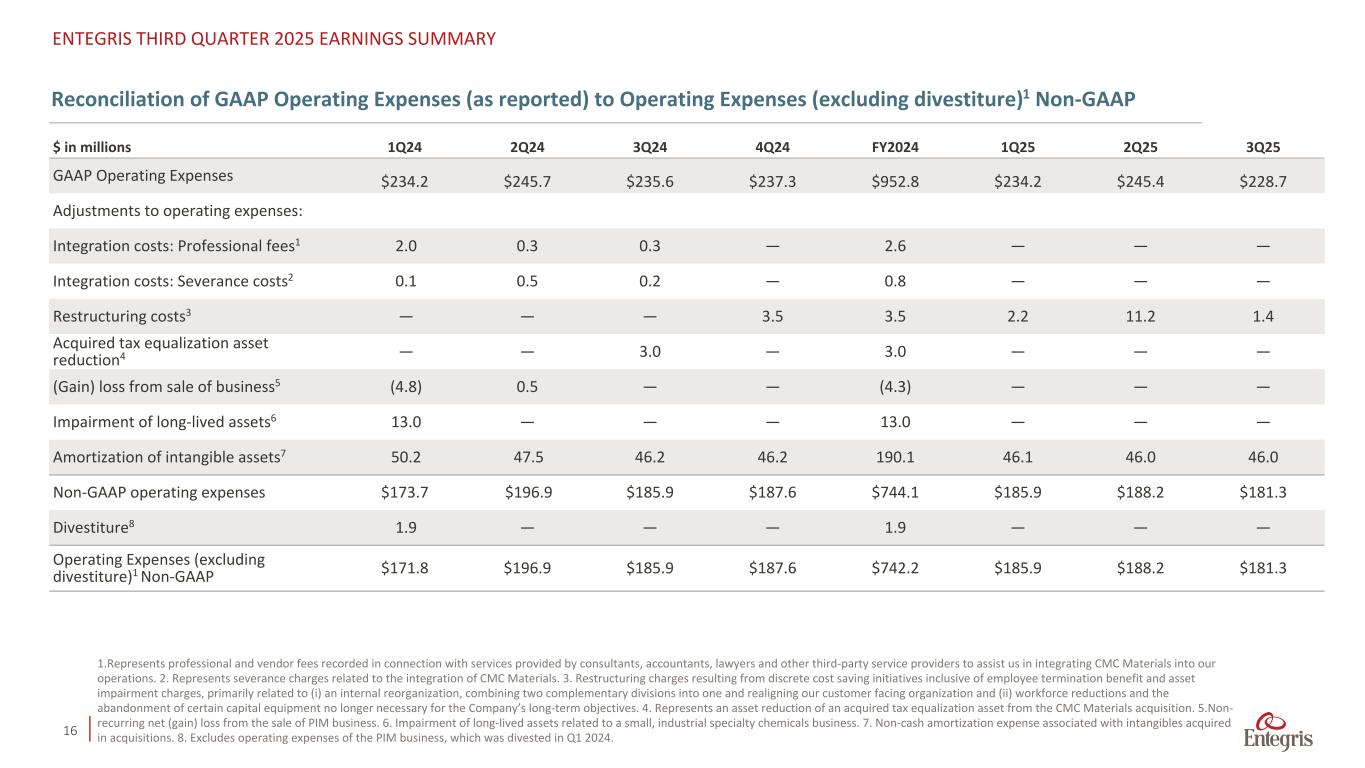

16 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 1.Represents professional and vendor fees recorded in connection with services provided by consultants, accountants, lawyers and other third-party service providers to assist us in integrating CMC Materials into our operations. 2. Represents severance charges related to the integration of CMC Materials. 3. Restructuring charges resulting from discrete cost saving initiatives inclusive of employee termination benefit and asset impairment charges, primarily related to (i) an internal reorganization, combining two complementary divisions into one and realigning our customer facing organization and (ii) workforce reductions and the abandonment of certain capital equipment no longer necessary for the Company’s long-term objectives. 4. Represents an asset reduction of an acquired tax equalization asset from the CMC Materials acquisition. 5.Non- recurring net (gain) loss from the sale of PIM business. 6. Impairment of long-lived assets related to a small, industrial specialty chemicals business. 7. Non-cash amortization expense associated with intangibles acquired in acquisitions. 8. Excludes operating expenses of the PIM business, which was divested in Q1 2024. Reconciliation of GAAP Operating Expenses (as reported) to Operating Expenses (excluding divestiture)1 Non-GAAP $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 GAAP Operating Expenses $234.2 $245.7 $235.6 $237.3 $952.8 $234.2 $245.4 $228.7 Adjustments to operating expenses: Integration costs: Professional fees1 2.0 0.3 0.3 — 2.6 — — — Integration costs: Severance costs2 0.1 0.5 0.2 — 0.8 — — — Restructuring costs3 — — — 3.5 3.5 2.2 11.2 1.4 Acquired tax equalization asset reduction4 — — 3.0 — 3.0 — — — (Gain) loss from sale of business5 (4.8) 0.5 — — (4.3) — — — Impairment of long-lived assets6 13.0 — — — 13.0 — — — Amortization of intangible assets7 50.2 47.5 46.2 46.2 190.1 46.1 46.0 46.0 Non-GAAP operating expenses $173.7 $196.9 $185.9 $187.6 $744.1 $185.9 $188.2 $181.3 Divestiture8 1.9 — — — 1.9 — — — Operating Expenses (excluding divestiture)1 Non-GAAP $171.8 $196.9 $185.9 $187.6 $742.2 $185.9 $188.2 $181.3

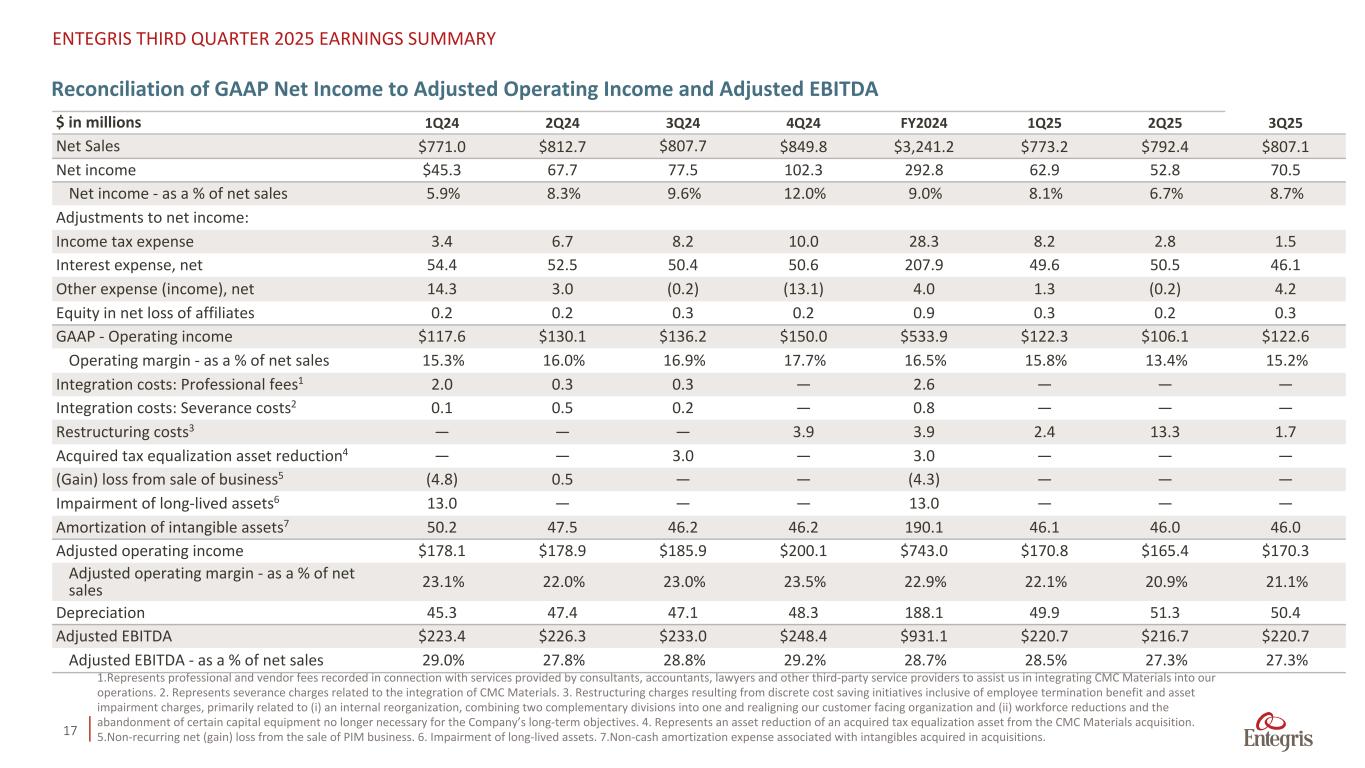

17 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 1.Represents professional and vendor fees recorded in connection with services provided by consultants, accountants, lawyers and other third-party service providers to assist us in integrating CMC Materials into our operations. 2. Represents severance charges related to the integration of CMC Materials. 3. Restructuring charges resulting from discrete cost saving initiatives inclusive of employee termination benefit and asset impairment charges, primarily related to (i) an internal reorganization, combining two complementary divisions into one and realigning our customer facing organization and (ii) workforce reductions and the abandonment of certain capital equipment no longer necessary for the Company’s long-term objectives. 4. Represents an asset reduction of an acquired tax equalization asset from the CMC Materials acquisition. 5.Non-recurring net (gain) loss from the sale of PIM business. 6. Impairment of long-lived assets. 7.Non-cash amortization expense associated with intangibles acquired in acquisitions. Reconciliation of GAAP Net Income to Adjusted Operating Income and Adjusted EBITDA $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Net Sales $771.0 $812.7 $807.7 $849.8 $3,241.2 $773.2 $792.4 $807.1 Net income $45.3 67.7 77.5 102.3 292.8 62.9 52.8 70.5 Net income - as a % of net sales 5.9% 8.3% 9.6% 12.0% 9.0% 8.1% 6.7% 8.7% Adjustments to net income: Income tax expense 3.4 6.7 8.2 10.0 28.3 8.2 2.8 1.5 Interest expense, net 54.4 52.5 50.4 50.6 207.9 49.6 50.5 46.1 Other expense (income), net 14.3 3.0 (0.2) (13.1) 4.0 1.3 (0.2) 4.2 Equity in net loss of affiliates 0.2 0.2 0.3 0.2 0.9 0.3 0.2 0.3 GAAP - Operating income $117.6 $130.1 $136.2 $150.0 $533.9 $122.3 $106.1 $122.6 Operating margin - as a % of net sales 15.3% 16.0% 16.9% 17.7% 16.5% 15.8% 13.4% 15.2% Integration costs: Professional fees1 2.0 0.3 0.3 — 2.6 — — — Integration costs: Severance costs2 0.1 0.5 0.2 — 0.8 — — — Restructuring costs3 — — — 3.9 3.9 2.4 13.3 1.7 Acquired tax equalization asset reduction4 — — 3.0 — 3.0 — — — (Gain) loss from sale of business5 (4.8) 0.5 — — (4.3) — — — Impairment of long-lived assets6 13.0 — — — 13.0 — — — Amortization of intangible assets7 50.2 47.5 46.2 46.2 190.1 46.1 46.0 46.0 Adjusted operating income $178.1 $178.9 $185.9 $200.1 $743.0 $170.8 $165.4 $170.3 Adjusted operating margin - as a % of net sales 23.1% 22.0% 23.0% 23.5% 22.9% 22.1% 20.9% 21.1% Depreciation 45.3 47.4 47.1 48.3 188.1 49.9 51.3 50.4 Adjusted EBITDA $223.4 $226.3 $233.0 $248.4 $931.1 $220.7 $216.7 $220.7 Adjusted EBITDA - as a % of net sales 29.0% 27.8% 28.8% 29.2% 28.7% 28.5% 27.3% 27.3%

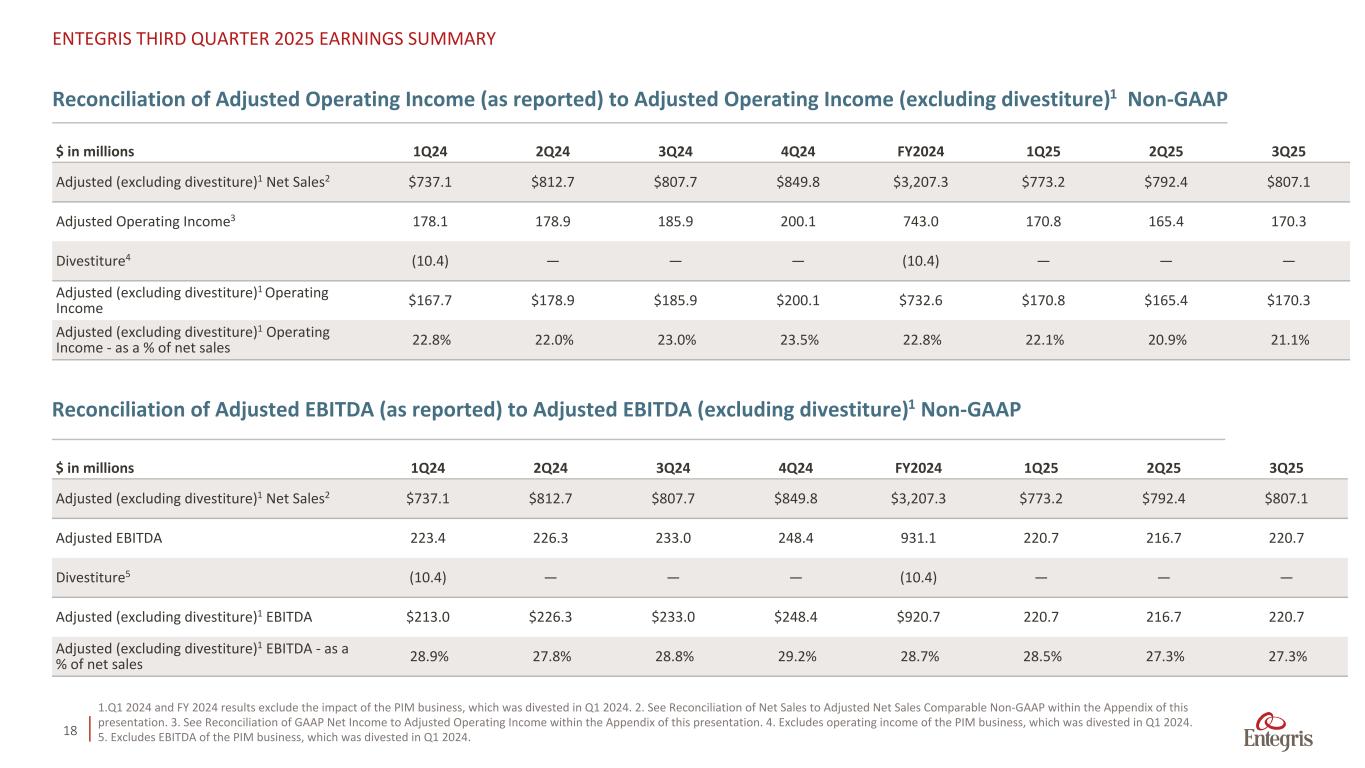

18 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 1.Q1 2024 and FY 2024 results exclude the impact of the PIM business, which was divested in Q1 2024. 2. See Reconciliation of Net Sales to Adjusted Net Sales Comparable Non-GAAP within the Appendix of this presentation. 3. See Reconciliation of GAAP Net Income to Adjusted Operating Income within the Appendix of this presentation. 4. Excludes operating income of the PIM business, which was divested in Q1 2024. 5. Excludes EBITDA of the PIM business, which was divested in Q1 2024. Reconciliation of Adjusted Operating Income (as reported) to Adjusted Operating Income (excluding divestiture)1 Non-GAAP $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Adjusted (excluding divestiture)1 Net Sales2 $737.1 $812.7 $807.7 $849.8 $3,207.3 $773.2 $792.4 $807.1 Adjusted EBITDA 223.4 226.3 233.0 248.4 931.1 220.7 216.7 220.7 Divestiture5 (10.4) — — — (10.4) — — — Adjusted (excluding divestiture)1 EBITDA $213.0 $226.3 $233.0 $248.4 $920.7 220.7 216.7 220.7 Adjusted (excluding divestiture)1 EBITDA - as a % of net sales 28.9% 27.8% 28.8% 29.2% 28.7% 28.5% 27.3% 27.3% Reconciliation of Adjusted EBITDA (as reported) to Adjusted EBITDA (excluding divestiture)1 Non-GAAP $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Adjusted (excluding divestiture)1 Net Sales2 $737.1 $812.7 $807.7 $849.8 $3,207.3 $773.2 $792.4 $807.1 Adjusted Operating Income3 178.1 178.9 185.9 200.1 743.0 170.8 165.4 170.3 Divestiture4 (10.4) — — — (10.4) — — — Adjusted (excluding divestiture)1 Operating Income $167.7 $178.9 $185.9 $200.1 $732.6 $170.8 $165.4 $170.3 Adjusted (excluding divestiture)1 Operating Income - as a % of net sales 22.8% 22.0% 23.0% 23.5% 22.8% 22.1% 20.9% 21.1%

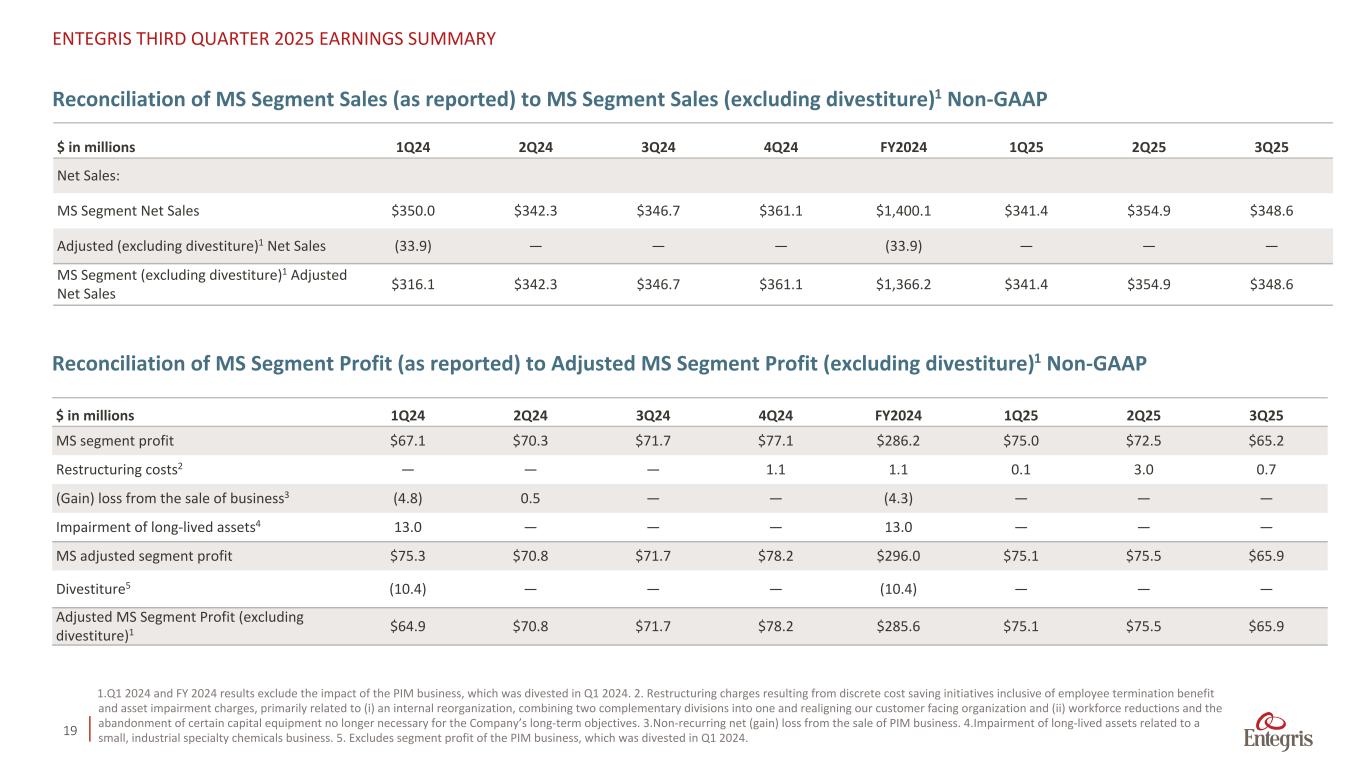

19 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 1.Q1 2024 and FY 2024 results exclude the impact of the PIM business, which was divested in Q1 2024. 2. Restructuring charges resulting from discrete cost saving initiatives inclusive of employee termination benefit and asset impairment charges, primarily related to (i) an internal reorganization, combining two complementary divisions into one and realigning our customer facing organization and (ii) workforce reductions and the abandonment of certain capital equipment no longer necessary for the Company’s long-term objectives. 3.Non-recurring net (gain) loss from the sale of PIM business. 4.Impairment of long-lived assets related to a small, industrial specialty chemicals business. 5. Excludes segment profit of the PIM business, which was divested in Q1 2024. Reconciliation of MS Segment Sales (as reported) to MS Segment Sales (excluding divestiture)1 Non-GAAP $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 MS segment profit $67.1 $70.3 $71.7 $77.1 $286.2 $75.0 $72.5 $65.2 Restructuring costs2 — — — 1.1 1.1 0.1 3.0 0.7 (Gain) loss from the sale of business3 (4.8) 0.5 — — (4.3) — — — Impairment of long-lived assets4 13.0 — — — 13.0 — — — MS adjusted segment profit $75.3 $70.8 $71.7 $78.2 $296.0 $75.1 $75.5 $65.9 Divestiture5 (10.4) — — — (10.4) — — — Adjusted MS Segment Profit (excluding divestiture)1 $64.9 $70.8 $71.7 $78.2 $285.6 $75.1 $75.5 $65.9 Reconciliation of MS Segment Profit (as reported) to Adjusted MS Segment Profit (excluding divestiture)1 Non-GAAP $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 Net Sales: MS Segment Net Sales $350.0 $342.3 $346.7 $361.1 $1,400.1 $341.4 $354.9 $348.6 Adjusted (excluding divestiture)1 Net Sales (33.9) — — — (33.9) — — — MS Segment (excluding divestiture)1 Adjusted Net Sales $316.1 $342.3 $346.7 $361.1 $1,366.2 $341.4 $354.9 $348.6

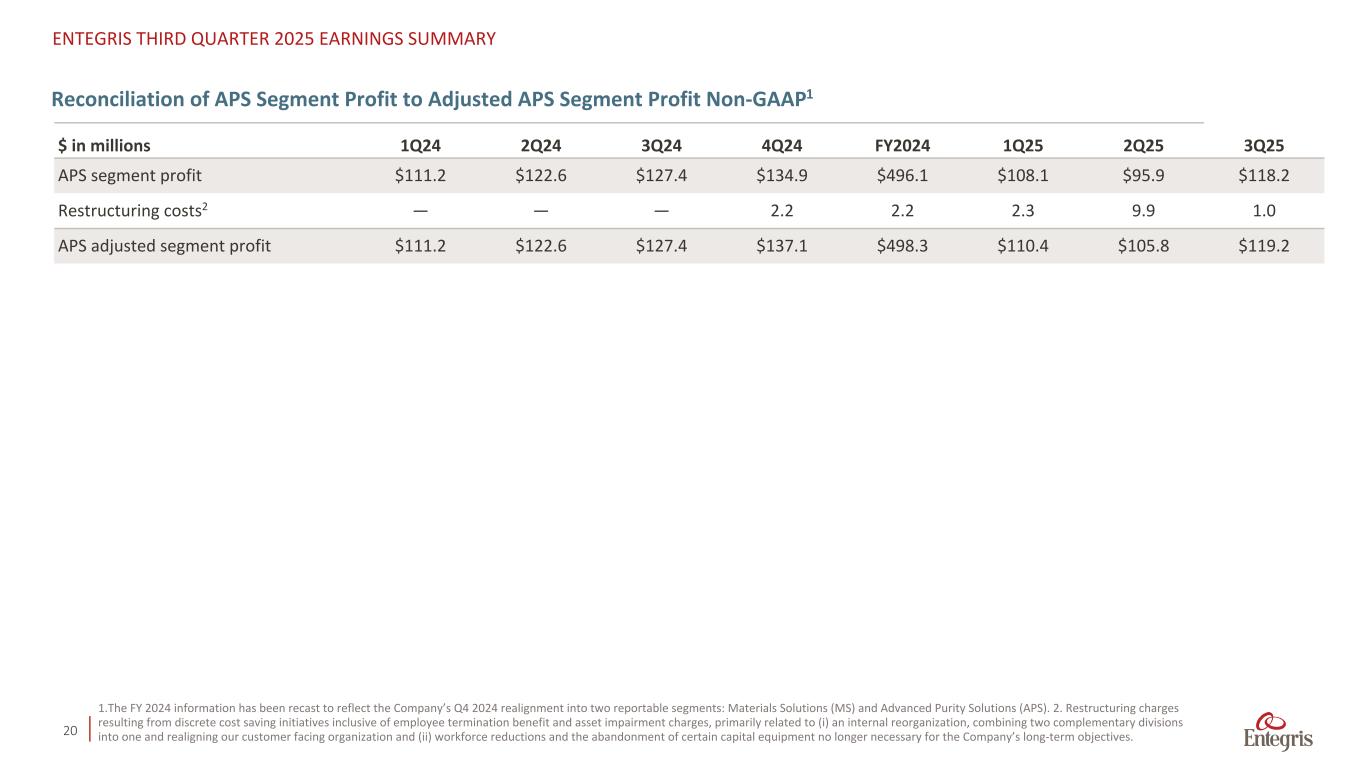

20 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 1.The FY 2024 information has been recast to reflect the Company’s Q4 2024 realignment into two reportable segments: Materials Solutions (MS) and Advanced Purity Solutions (APS). 2. Restructuring charges resulting from discrete cost saving initiatives inclusive of employee termination benefit and asset impairment charges, primarily related to (i) an internal reorganization, combining two complementary divisions into one and realigning our customer facing organization and (ii) workforce reductions and the abandonment of certain capital equipment no longer necessary for the Company’s long-term objectives. Reconciliation of APS Segment Profit to Adjusted APS Segment Profit Non-GAAP1 $ in millions 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 APS segment profit $111.2 $122.6 $127.4 $134.9 $496.1 $108.1 $95.9 $118.2 Restructuring costs2 — — — 2.2 2.2 2.3 9.9 1.0 APS adjusted segment profit $111.2 $122.6 $127.4 $137.1 $498.3 $110.4 $105.8 $119.2

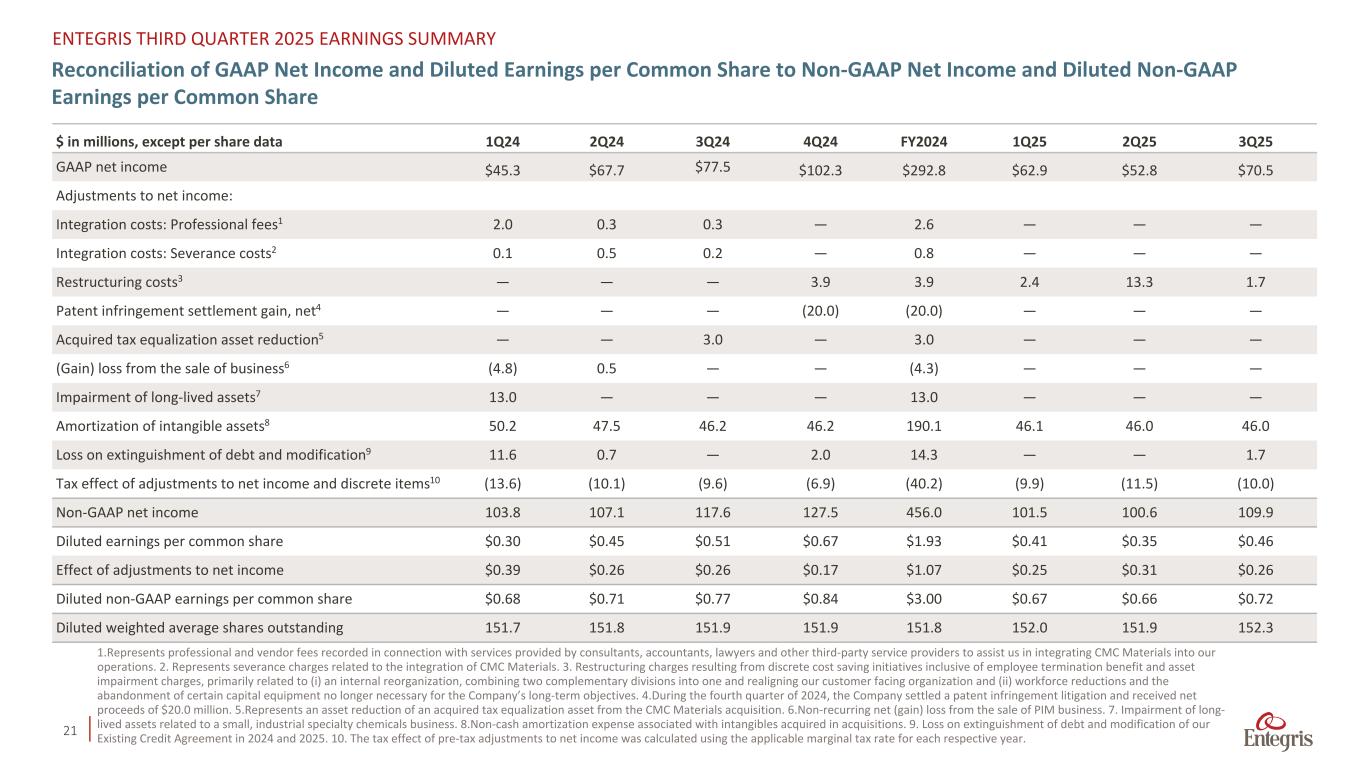

21 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY 1.Represents professional and vendor fees recorded in connection with services provided by consultants, accountants, lawyers and other third-party service providers to assist us in integrating CMC Materials into our operations. 2. Represents severance charges related to the integration of CMC Materials. 3. Restructuring charges resulting from discrete cost saving initiatives inclusive of employee termination benefit and asset impairment charges, primarily related to (i) an internal reorganization, combining two complementary divisions into one and realigning our customer facing organization and (ii) workforce reductions and the abandonment of certain capital equipment no longer necessary for the Company’s long-term objectives. 4.During the fourth quarter of 2024, the Company settled a patent infringement litigation and received net proceeds of $20.0 million. 5.Represents an asset reduction of an acquired tax equalization asset from the CMC Materials acquisition. 6.Non-recurring net (gain) loss from the sale of PIM business. 7. Impairment of long- lived assets related to a small, industrial specialty chemicals business. 8.Non-cash amortization expense associated with intangibles acquired in acquisitions. 9. Loss on extinguishment of debt and modification of our Existing Credit Agreement in 2024 and 2025. 10. The tax effect of pre-tax adjustments to net income was calculated using the applicable marginal tax rate for each respective year. Reconciliation of GAAP Net Income and Diluted Earnings per Common Share to Non-GAAP Net Income and Diluted Non-GAAP Earnings per Common Share $ in millions, except per share data 1Q24 2Q24 3Q24 4Q24 FY2024 1Q25 2Q25 3Q25 GAAP net income $45.3 $67.7 $77.5 $102.3 $292.8 $62.9 $52.8 $70.5 Adjustments to net income: Integration costs: Professional fees1 2.0 0.3 0.3 — 2.6 — — — Integration costs: Severance costs2 0.1 0.5 0.2 — 0.8 — — — Restructuring costs3 — — — 3.9 3.9 2.4 13.3 1.7 Patent infringement settlement gain, net4 — — — (20.0) (20.0) — — — Acquired tax equalization asset reduction5 — — 3.0 — 3.0 — — — (Gain) loss from the sale of business6 (4.8) 0.5 — — (4.3) — — — Impairment of long-lived assets7 13.0 — — — 13.0 — — — Amortization of intangible assets8 50.2 47.5 46.2 46.2 190.1 46.1 46.0 46.0 Loss on extinguishment of debt and modification9 11.6 0.7 — 2.0 14.3 — — 1.7 Tax effect of adjustments to net income and discrete items10 (13.6) (10.1) (9.6) (6.9) (40.2) (9.9) (11.5) (10.0) Non-GAAP net income 103.8 107.1 117.6 127.5 456.0 101.5 100.6 109.9 Diluted earnings per common share $0.30 $0.45 $0.51 $0.67 $1.93 $0.41 $0.35 $0.46 Effect of adjustments to net income $0.39 $0.26 $0.26 $0.17 $1.07 $0.25 $0.31 $0.26 Diluted non-GAAP earnings per common share $0.68 $0.71 $0.77 $0.84 $3.00 $0.67 $0.66 $0.72 Diluted weighted average shares outstanding 151.7 151.8 151.9 151.9 151.8 152.0 151.9 152.3

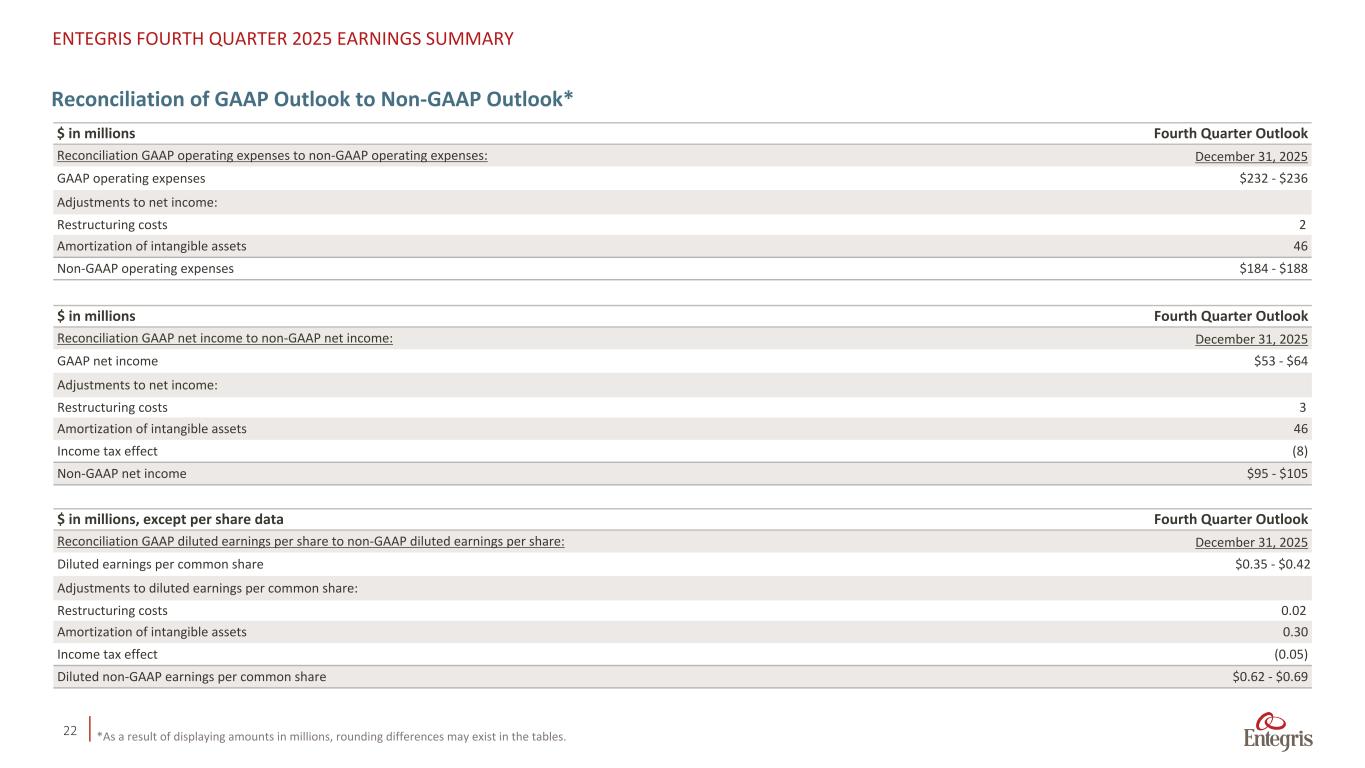

22 ENTEGRIS FOURTH QUARTER 2025 EARNINGS SUMMARY *As a result of displaying amounts in millions, rounding differences may exist in the tables. Reconciliation of GAAP Outlook to Non-GAAP Outlook* $ in millions Fourth Quarter Outlook Reconciliation GAAP operating expenses to non-GAAP operating expenses: December 31, 2025 GAAP operating expenses $232 - $236 Adjustments to net income: Restructuring costs 2 Amortization of intangible assets 46 Non-GAAP operating expenses $184 - $188 $ in millions Fourth Quarter Outlook Reconciliation GAAP net income to non-GAAP net income: December 31, 2025 GAAP net income $53 - $64 Adjustments to net income: Restructuring costs 3 Amortization of intangible assets 46 Income tax effect (8) Non-GAAP net income $95 - $105 $ in millions, except per share data Fourth Quarter Outlook Reconciliation GAAP diluted earnings per share to non-GAAP diluted earnings per share: December 31, 2025 Diluted earnings per common share $0.35 - $0.42 Adjustments to diluted earnings per common share: Restructuring costs 0.02 Amortization of intangible assets 0.30 Income tax effect (0.05) Diluted non-GAAP earnings per common share $0.62 - $0.69

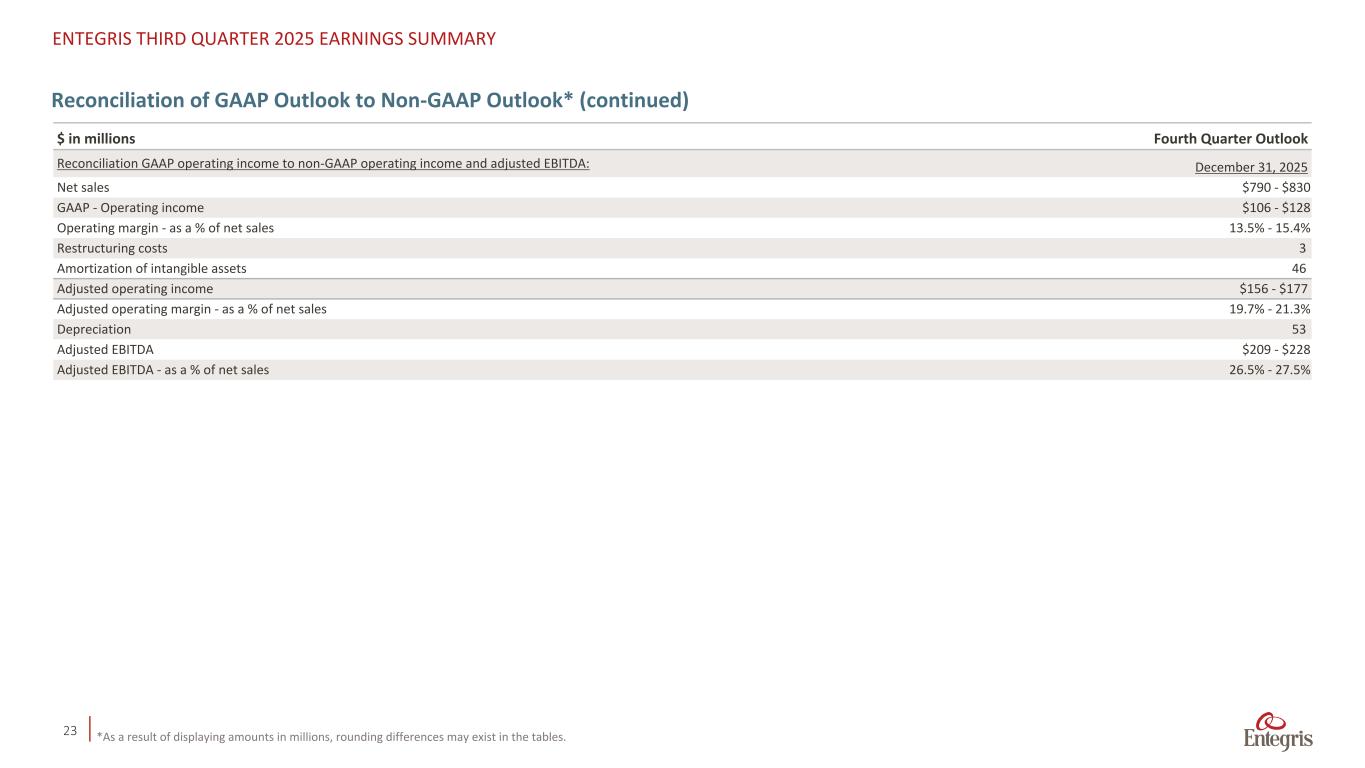

23 ENTEGRIS THIRD QUARTER 2025 EARNINGS SUMMARY *As a result of displaying amounts in millions, rounding differences may exist in the tables. Reconciliation of GAAP Outlook to Non-GAAP Outlook* (continued) $ in millions Fourth Quarter Outlook Reconciliation GAAP operating income to non-GAAP operating income and adjusted EBITDA: December 31, 2025 Net sales $790 - $830 GAAP - Operating income $106 - $128 Operating margin - as a % of net sales 13.5% - 15.4% Restructuring costs 3 Amortization of intangible assets 46 Adjusted operating income $156 - $177 Adjusted operating margin - as a % of net sales 19.7% - 21.3% Depreciation 53 Adjusted EBITDA $209 - $228 Adjusted EBITDA - as a % of net sales 26.5% - 27.5%