.2

October 30, 2025 Third-Quarter 2025 Earnings Presentation

Forward Looking Statements TPIP: Treprostinil Palmitil Inhalation Powder | MAC /

MAC LD: Mycobacterium avium complex lung disease | FDA: Food & Drug Administration The forward-looking statements in this presentation are based upon the Company’s current expectations and beliefs, and involve known and unknown risks,

uncertainties and other factors, which may cause the Company’s actual results, performance and achievements and the timing of certain events to differ materially from the results, performance, achievements or timings discussed, projected,

anticipated or indicated in any forward-looking statements. Such risks, uncertainties and other factors include, among others, the following: failure to continue to successfully commercialize ARIKAYCE in the U.S., Europe or Japan or failure to

successfully commercialize BRINSUPRI in the U.S., or to maintain U.S., European or Japanese approval for ARIKAYCE or U.S. approval for BRINSUPRI; our inability to obtain full approval of ARIKAYCE from the FDA, including the risk that we will

not successfully or in a timely manner complete the confirmatory post-marketing clinical trial required for full approval of ARIKAYCE, or our failure to obtain regulatory approval to expand ARIKAYCE’s indication to a broader patient population;

failure to obtain, or delays in obtaining, regulatory approvals for our product candidates in the U.S., Europe or Japan, for ARIKAYCE outside the U.S., Europe or Japan, including separate regulatory approval for Lamira® in each market and for

each usage, or for brensocatib in Europe or Japan; failure to successfully commercialize our product candidates, if approved by applicable regulatory authorities, or to maintain applicable regulatory approvals for such product candidates, if

approved; uncertainties or changes in the degree of market acceptance of our marketed products or, if approved, our product candidates, by physicians, patients, third-party payors and others in the healthcare community; our inability to obtain

and maintain adequate reimbursement from government or third-party payors for our marketed products or, if approved, our product candidates, or acceptable prices for our marketed products or, if approved, our product candidates; inaccuracies in

our estimates of the size of the potential markets for our marketed products and our product candidates or in data we have used to identify physicians, expected rates of patient uptake, duration of expected treatment, or expected patient

adherence or discontinuation rates; failure of third parties on which we are dependent to manufacture sufficient quantities of our marketed products and our product candidates for commercial or clinical needs, as applicable, to conduct our

clinical trials, or to comply with our agreements or laws and regulations that impact our business; the risks and uncertainties associated with, and the perceived benefits of, our senior secured loan with certain funds managed by Pharmakon

Advisors LP and our royalty financing with OrbiMed Royalty & Credit Opportunities IV, LP, including our ability to maintain compliance with the covenants in the agreements for the senior secured loan and royalty financing and the impact of

the restrictions on our operations under these agreements; our inability to create or maintain an effective direct sales and marketing infrastructure or to partner with third parties that offer such an infrastructure for distribution of our

marketed products or any of our product candidates that are approved in the future; failure to successfully conduct future clinical trials for our marketed products or our product candidates and our potential inability to enroll or retain

sufficient patients to conduct and complete the trials or generate data necessary for regulatory approval of our product candidates or to permit the use of ARIKAYCE in the broader population of patients with MAC lung disease, among other

things; development of unexpected safety or efficacy concerns related to our marketed products or our product candidates; risks that our clinical studies will be delayed, that serious side effects will be identified during drug development, or

that any protocol amendments submitted will be rejected; failure to successfully predict the time and cost of development, regulatory approval and commercialization for novel gene therapy products; risk that interim, topline or preliminary data

from our clinical trials that we announce or publish from time to time may change as more patient data become available or may be interpreted differently if additional data are disclosed, or that blinded data will not be predictive of unblinded

data; risk that our competitors may obtain orphan drug exclusivity for a product that is essentially the same as a product we are developing for a particular indication; our inability to attract and retain key personnel or to effectively manage

our growth; our inability to successfully integrate our acquisitions and appropriately manage the amount of management’s time and attention devoted to integration activities; risks that our acquired technologies, products and product candidates

will not be commercially successful; inability to adapt to our highly competitive and changing environment; inability to access, upgrade or expand our technology systems or difficulties in updating our existing technology or developing or

implementing new technology; risk that we are unable to maintain our significant customers; risk that government healthcare reform materially increases our costs and damages our financial condition; business or economic disruptions due to

catastrophes or other events, including natural disasters or public health crises; risk that our current and potential future use of AI and machine learning may not be successful; deterioration in general economic conditions in the U.S.,

Europe, Japan and globally, including the effect of prolonged periods of inflation, affecting us, our suppliers, third-party service providers and potential partners; the risk that we could become involved in costly intellectual property

disputes, be unable to adequately protect our intellectual property rights or prevent disclosure of our trade secrets and other proprietary information, and incur costs associated with litigation or other proceedings related to such matters;

restrictions or other obligations imposed on us by agreements related to our marketed products or our product candidates, including our license agreements with PARI and AstraZeneca AB, and failure to comply with our obligations under such

agreements; the cost and potential reputational damage resulting from litigation to which we are or may become a party, including product liability claims; risk that our operations are subject to a material disruption in the event of a

cybersecurity attack or issue; our limited experience operating internationally; changes in laws and regulations applicable to our business, including any pricing reform and laws that impact our ability to utilize certain third parties in the

research, development or manufacture of our product candidates, and failure to comply with such laws and regulations; our history of operating losses, and the possibility that we never achieve or maintain profitability; goodwill impairment

charges affecting our results of operations and financial condition; inability to repay our existing indebtedness and uncertainties with respect to our ability to access future capital; and delays in the execution of plans to build out an

additional third-party manufacturing facility approved by the appropriate regulatory authorities and unexpected expenses associated with those plans. Additional Disclaimers: Please be aware that TPIP, INS1201, INS1202, and INS1033 are

investigational products that have not been approved for sale or found safe or effective by the FDA or any regulatory authority. In addition, ARIKAYCE has not been approved for the treatment of all patients with MAC lung disease and brensocatib

has not been approved for the treatment of patients with non-cystic fibrosis bronchiectasis outside the U.S. This presentation is not promotion or advertisement of ARIKAYCE, BRINSUPRI, TPIP, INS1201, INS1202, or INS1033. Insmed, ARIKAYCE and

BRINSUPRI are trademarks of Insmed Incorporated. All other trademarks are property of their respective owner(s).

Opening Remarks Clinical Updates Early-Stage Updates Commercial

Updates Financial Results 4-6 7-14 15-17 19-24 25-28 Will Lewis Chair & CEO Sara Bonstein Chief Financial Officer Roger Adsett Chief Operating Officer

Opening Remarks Will Lewis | Chair & CEO

Third-Quarter Highlights U.S.: United States Received U.S. approval and launched

BRINSUPRI™ Positive reception to BRINSUPRI supports potential for large commercial opportunity Expect first full quarter of BRINSUPRI sales to illustrate clearer picture of underlying dynamics Ambition for BRINSUPRI sales to perform in-line

with historically strong respiratory launches

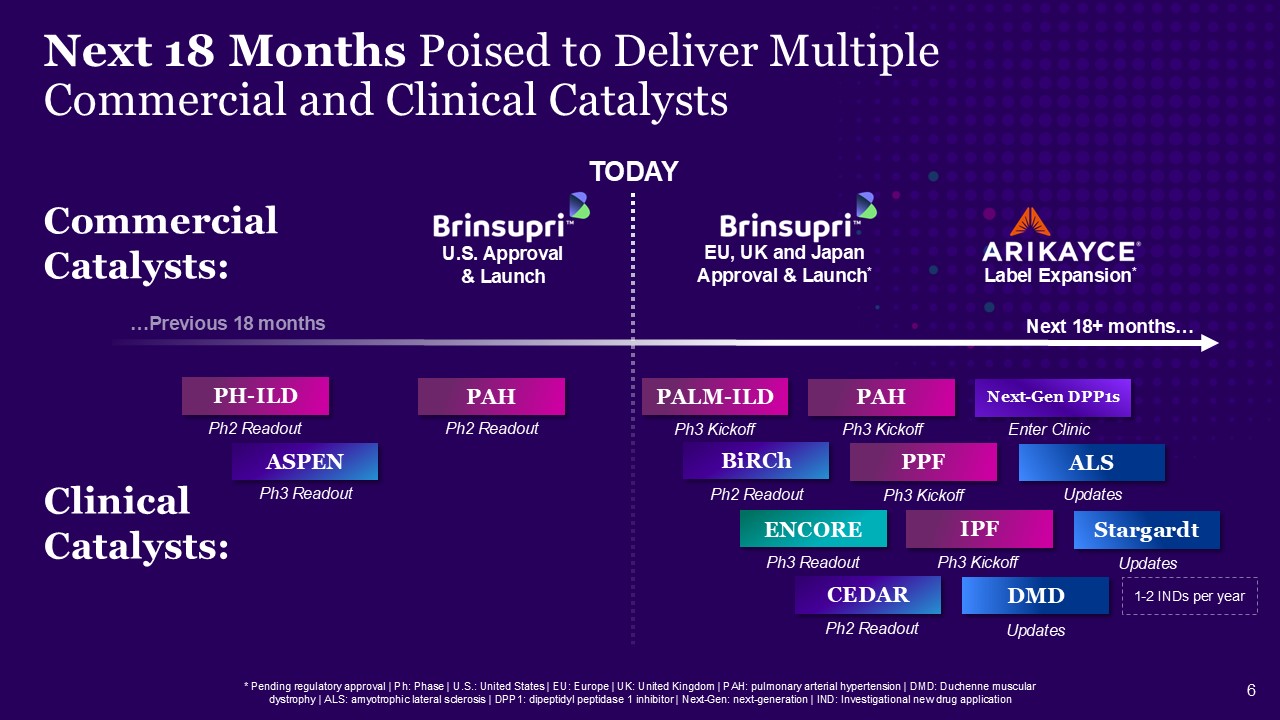

Next 18 Months Poised to Deliver Multiple Commercial and Clinical Catalysts *

Pending regulatory approval | Ph: Phase | U.S.: United States | EU: Europe | UK: United Kingdom | PAH: pulmonary arterial hypertension | DMD: Duchenne muscular dystrophy | ALS: amyotrophic lateral sclerosis | DPP1: dipeptidyl peptidase 1

inhibitor | Next-Gen: next-generation | IND: Investigational new drug application TODAY …Previous 18 months Next 18+ months… ASPEN PAH PAH PALM-ILD ENCORE BiRCh CEDAR DMD ALS Next-Gen DPP1s PPF IPF Ph3 Readout Ph2 Readout Ph3

Kickoff Ph3 Kickoff Ph3 Kickoff Ph3 Kickoff Ph3 Readout Ph2 Readout Ph2 Readout Enter Clinic Updates Updates Clinical Catalysts: Commercial Catalysts: Stargardt Updates Label Expansion* U.S. Approval & Launch EU, UK and

Japan Approval & Launch* 1-2 INDs per year PH-ILD Ph2 Readout

Brensocatib Updates Will Lewis | Chair & CEO

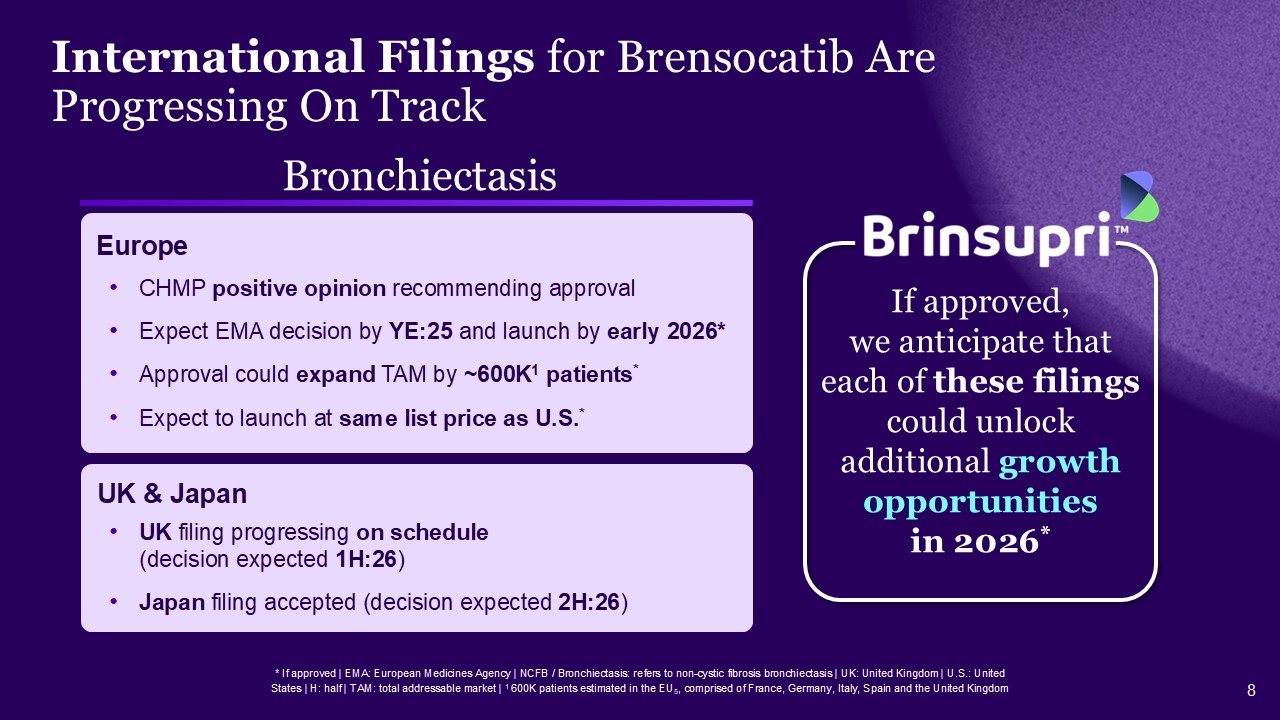

* If approved | EMA: European Medicines Agency | NCFB / Bronchiectasis: refers to

non-cystic fibrosis bronchiectasis | UK: United Kingdom | U.S.: United States | H: half | TAM: total addressable market | 1 600K patients estimated in the EU5, comprised of France, Germany, Italy, Spain and the United Kingdom International

Filings for Brensocatib Are Progressing On Track If approved, we anticipate that each of these filings could unlock additional growth opportunities in 2026* Bronchiectasis CHMP positive opinion recommending approval Expect EMA

decision by YE:25 and launch by early 2026* Approval could expand TAM by ~600K1 patients* Expect to launch at same list price as U.S.* Europe UK & Japan UK filing progressing on schedule (decision expected 1H:26) Japan filing accepted

(decision expected 2H:26)

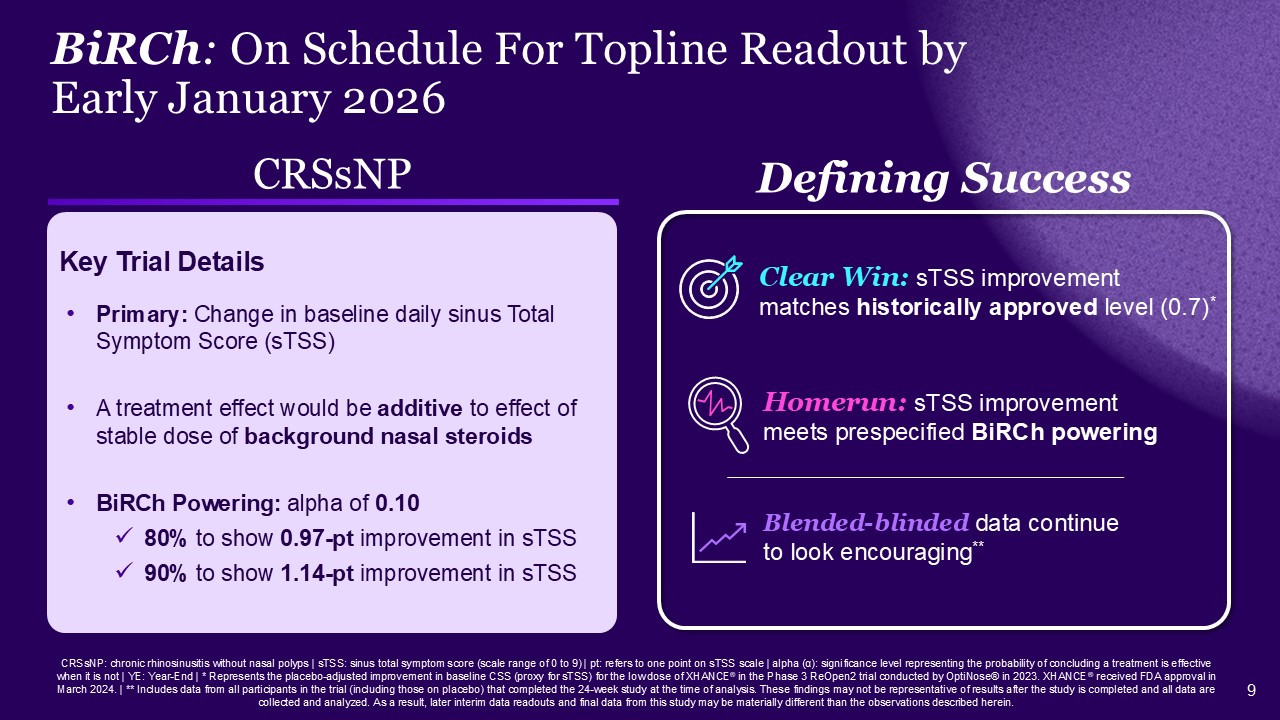

CRSsNP: chronic rhinosinusitis without nasal polyps | sTSS: sinus total symptom

score (scale range of 0 to 9) | pt: refers to one point on sTSS scale | alpha (α): significance level representing the probability of concluding a treatment is effective when it is not | YE: Year-End | * Represents the placebo-adjusted

improvement in baseline CSS (proxy for sTSS) for the low dose of XHANCE® in the Phase 3 ReOpen2 trial conducted by OptiNose® in 2023. XHANCE® received FDA approval in March 2024. | ** Includes data from all participants in the trial (including

those on placebo) that completed the 24-week study at the time of analysis. These findings may not be representative of results after the study is completed and all data are collected and analyzed. As a result, later interim data readouts and

final data from this study may be materially different than the observations described herein. BiRCh: On Schedule For Topline Readout by Early January 2026 CRSsNP Primary: Change in baseline daily sinus Total Symptom Score (sTSS) A

treatment effect would be additive to effect of stable dose of background nasal steroids BiRCh Powering: alpha of 0.10 80% to show 0.97-pt improvement in sTSS 90% to show 1.14-pt improvement in sTSS Key Trial Details Defining

Success Blended-blinded data continue to look encouraging** Homerun: sTSS improvement meets prespecified BiRCh powering Clear Win: sTSS improvement matches historically approved level (0.7)*

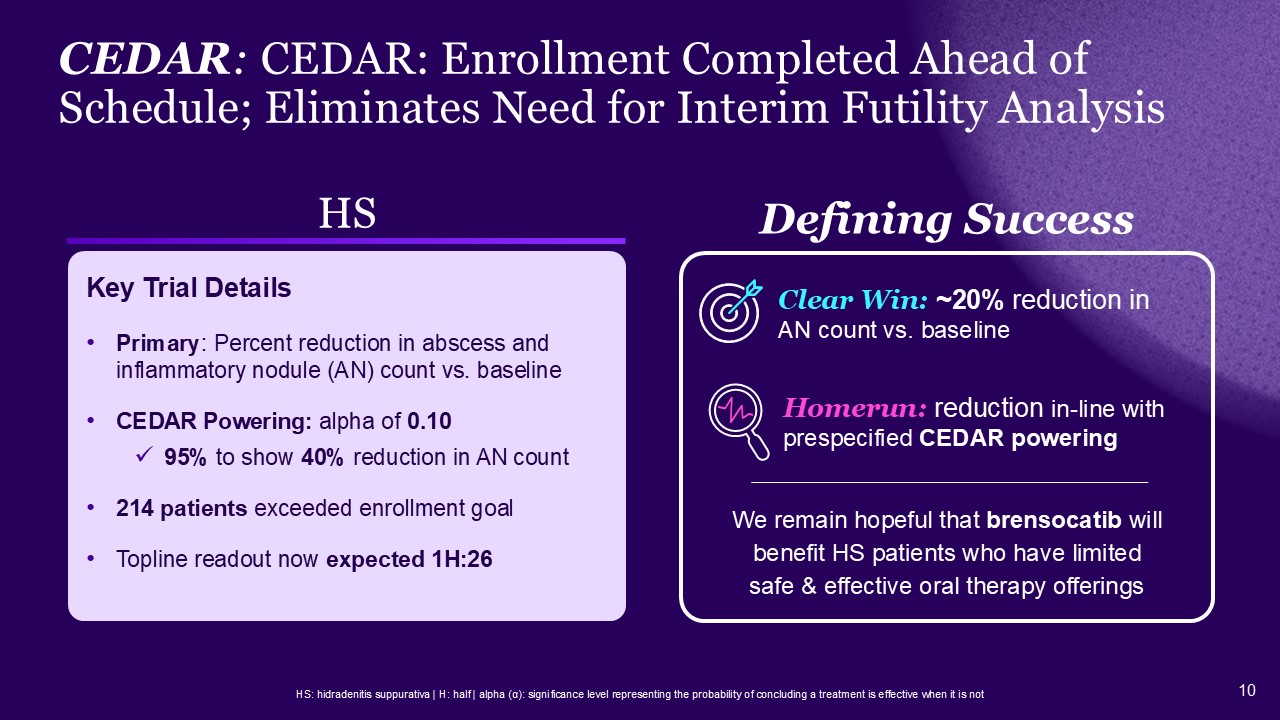

HS: hidradenitis suppurativa | H: half | alpha (α): significance level

representing the probability of concluding a treatment is effective when it is not HS Primary: Percent reduction in abscess and inflammatory nodule (AN) count vs. baseline CEDAR Powering: alpha of 0.10 95% to show 40% reduction in AN

count 214 patients exceeded enrollment goal Topline readout now expected 1H:26 CEDAR: CEDAR: Enrollment Completed Ahead of Schedule; Eliminates Need for Interim Futility Analysis Defining Success Homerun: reduction in-line with

prespecified CEDAR powering Clear Win: ~20% reduction in AN count vs. baseline Key Trial Details We remain hopeful that brensocatib will benefit HS patients who have limited safe & effective oral therapy offerings

TPIP Updates TPIP: Treprostinil Palmitil Inhalation Powder Will Lewis | Chair

& CEO

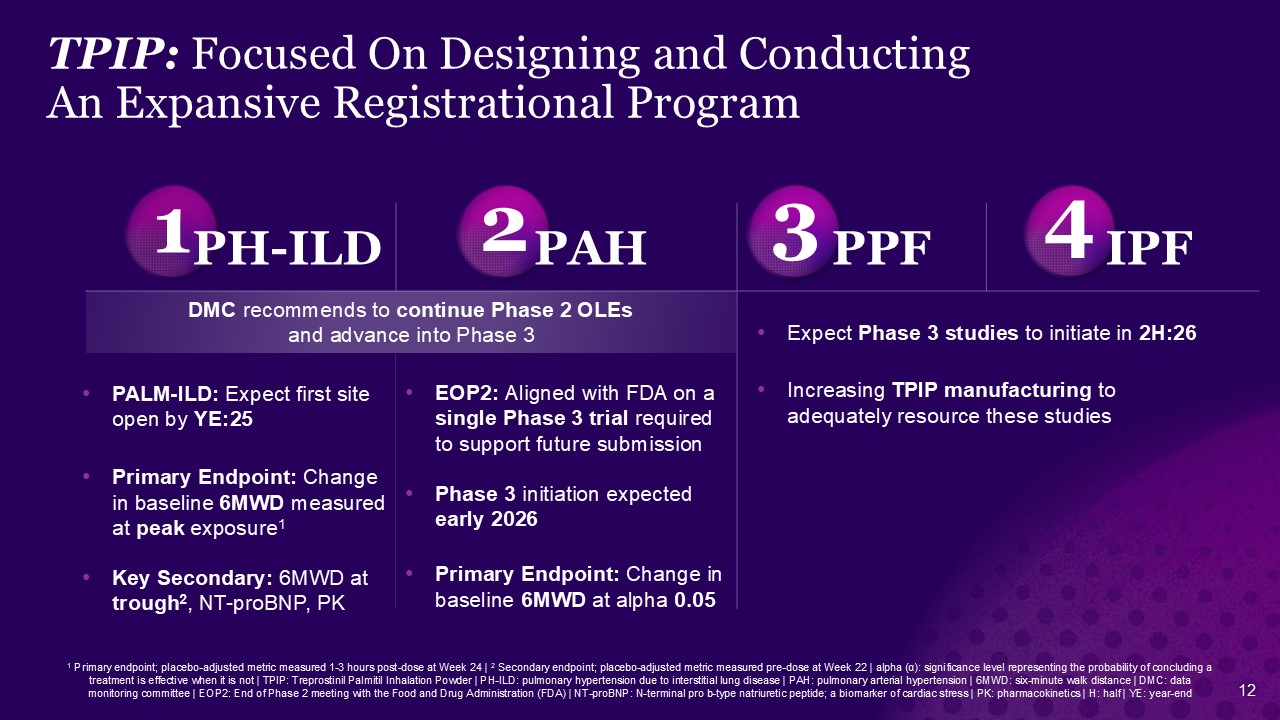

TPIP: Focused On Designing and Conducting An Expansive Registrational

Program 1 2 3 4 PH-ILD PAH PPF IPF PALM-ILD: Expect first site open by YE:25 Primary Endpoint: Change in baseline 6MWD measured at peak exposure1 Key Secondary: 6MWD at trough2, NT-proBNP, PK EOP2: Aligned with FDA on a single

Phase 3 trial required to support future submission Phase 3 initiation expected early 2026 Primary Endpoint: Change in baseline 6MWD at alpha 0.05 1 Primary endpoint; placebo-adjusted metric measured 1-3 hours post-dose at Week 24 | 2

Secondary endpoint; placebo-adjusted metric measured pre-dose at Week 22 | alpha (α): significance level representing the probability of concluding a treatment is effective when it is not | TPIP: Treprostinil Palmitil Inhalation Powder |

PH-ILD: pulmonary hypertension due to interstitial lung disease | PAH: pulmonary arterial hypertension | 6MWD: six-minute walk distance | DMC: data monitoring committee | EOP2: End of Phase 2 meeting with the Food and Drug Administration (FDA)

| NT-proBNP: N-terminal pro b-type natriuretic peptide; a biomarker of cardiac stress | PK: pharmacokinetics | H: half | YE: year-end Expect Phase 3 studies to initiate in 2H:26 Increasing TPIP manufacturing to adequately resource these

studies DMC recommends to continue Phase 2 OLEs and advance into Phase 3

ARIKAYCE® Clinical Updates Will Lewis | Chair & CEO

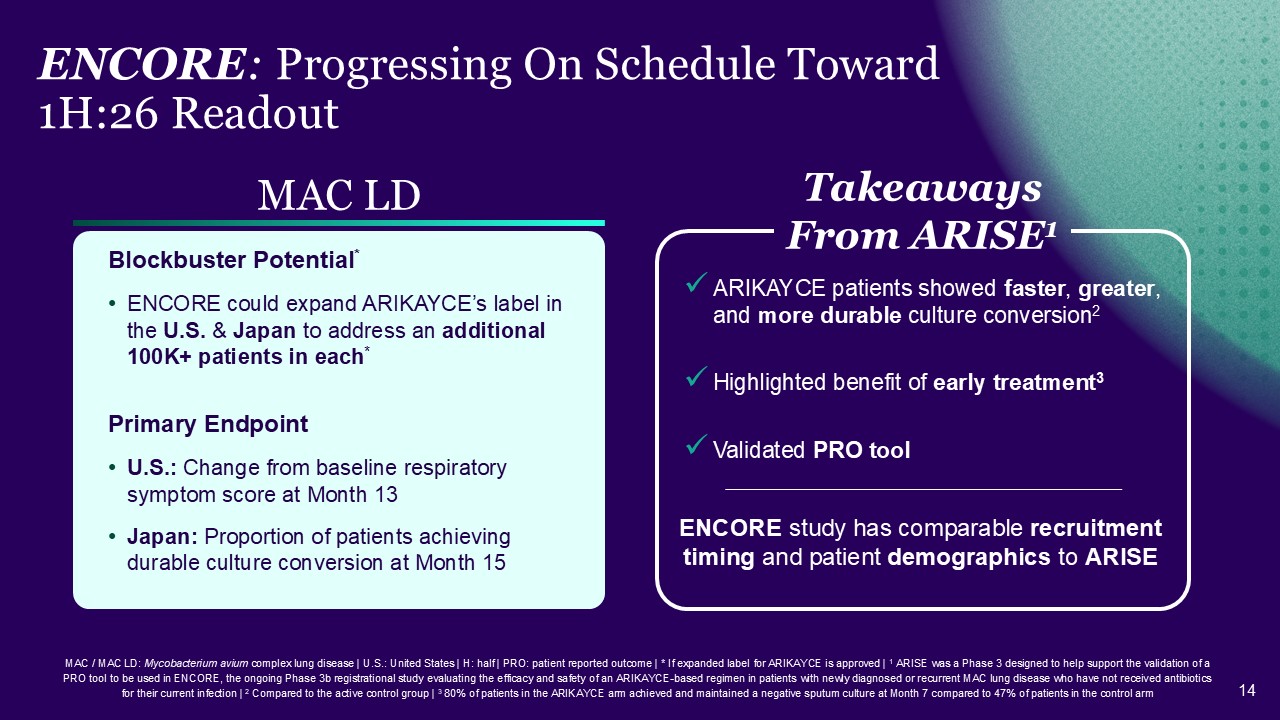

MAC / MAC LD: Mycobacterium avium complex lung disease | U.S.: United States | H:

half | PRO: patient reported outcome | * If expanded label for ARIKAYCE is approved | 1 ARISE was a Phase 3 designed to help support the validation of a PRO tool to be used in ENCORE, the ongoing Phase 3b registrational study evaluating the

efficacy and safety of an ARIKAYCE-based regimen in patients with newly diagnosed or recurrent MAC lung disease who have not received antibiotics for their current infection | 2 Compared to the active control group | 3 80% of patients in the

ARIKAYCE arm achieved and maintained a negative sputum culture at Month 7 compared to 47% of patients in the control arm ENCORE: Progressing On Schedule Toward 1H:26 Readout MAC LD Blockbuster Potential* ENCORE could expand ARIKAYCE’s

label in the U.S. & Japan to address an additional 100K+ patients in each* Primary Endpoint U.S.: Change from baseline respiratory symptom score at Month 13 Japan: Proportion of patients achieving durable culture conversion at Month

15 ENCORE study has comparable recruitment timing and patient demographics to ARISE ARIKAYCE patients showed faster, greater, and more durable culture conversion2 Highlighted benefit of early treatment3 Validated PRO tool Takeaways From

ARISE1

Early-Stage Updates Will Lewis | Chair & CEO

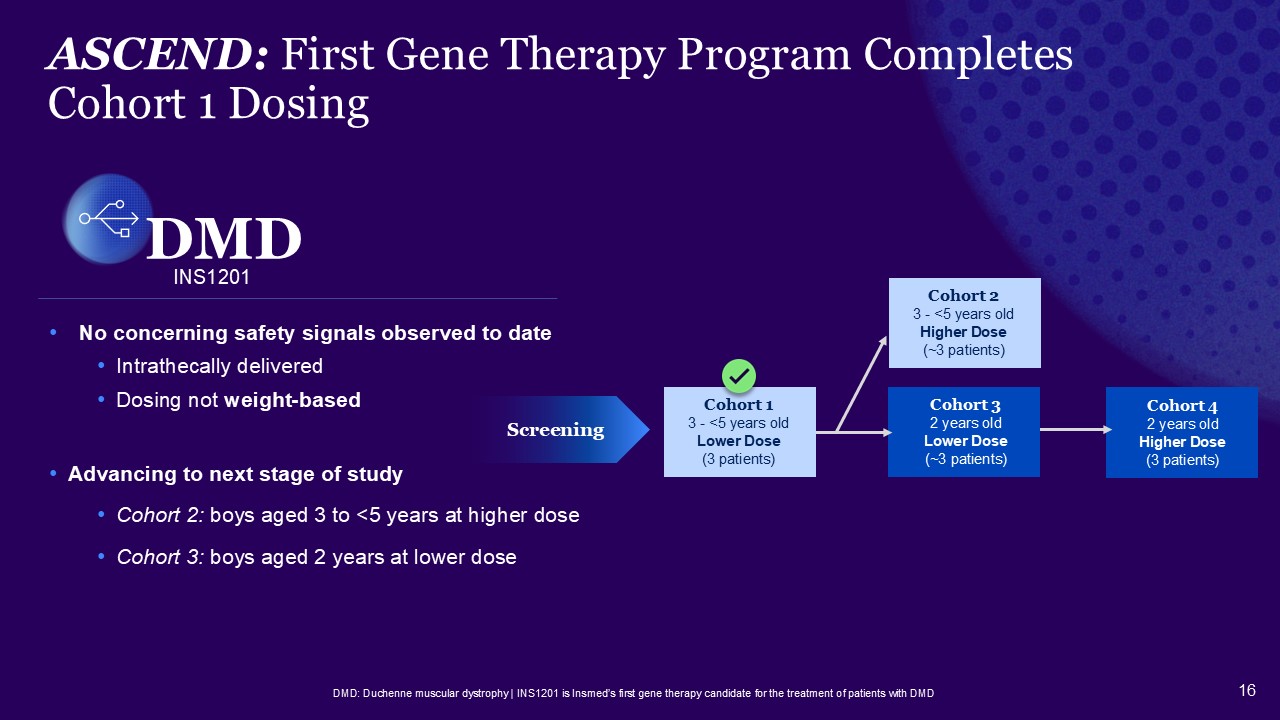

ASCEND: First Gene Therapy Program Completes Cohort 1 Dosing DMD: Duchenne

muscular dystrophy | INS1201 is Insmed’s first gene therapy candidate for the treatment of patients with DMD No concerning safety signals observed to date Intrathecally delivered Dosing not weight-based Advancing to next stage of

study Cohort 2: boys aged 3 to <5 years at higher dose Cohort 3: boys aged 2 years at lower dose INS1201 DMD Cohort 4 2 years old Higher Dose (3 patients) Cohort 2 3 - <5 years old Higher Dose (~3 patients) Cohort 3 2 years

old Lower Dose (~3 patients) Screening Cohort 1 3 - <5 years old Lower Dose (3 patients)

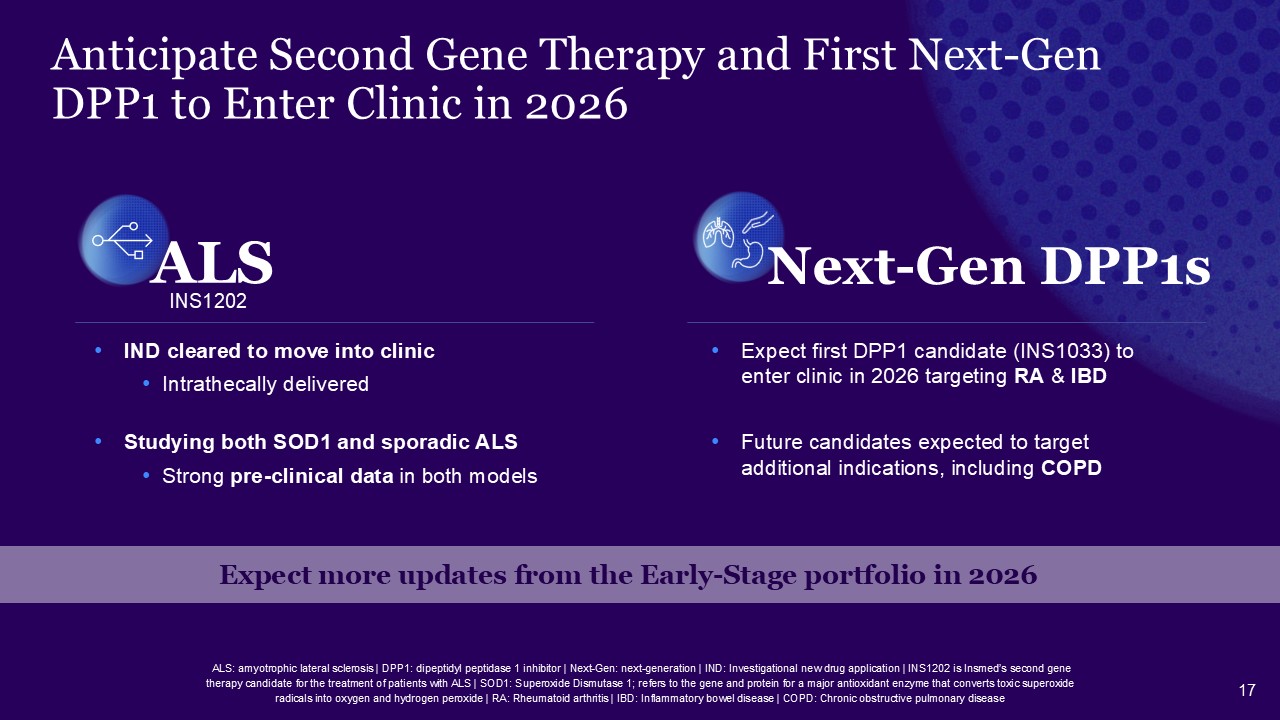

IND cleared to move into clinic Intrathecally delivered Studying both SOD1 and

sporadic ALS Strong pre-clinical data in both models Anticipate Second Gene Therapy and First Next-Gen DPP1 to Enter Clinic in 2026 ALS INS1202 Next-Gen DPP1s Expect first DPP1 candidate (INS1033) to enter clinic in 2026 targeting RA

& IBD Future candidates expected to target additional indications, including COPD Expect more updates from the Early-Stage portfolio in 2026 ALS: amyotrophic lateral sclerosis | DPP1: dipeptidyl peptidase 1 inhibitor | Next-Gen:

next-generation | IND: Investigational new drug application | INS1202 is Insmed’s second gene therapy candidate for the treatment of patients with ALS | SOD1: Superoxide Dismutase 1; refers to the gene and protein for a major antioxidant enzyme

that converts toxic superoxide radicals into oxygen and hydrogen peroxide | RA: Rheumatoid arthritis | IBD: Inflammatory bowel disease | COPD: Chronic obstructive pulmonary disease

Let’s Recap Recent achievements have unlocked additional opportunities to deliver

on behalf of patients Well-positioned to deliver innovative, first- or best-in-class therapies to patients with serious diseases Recipient of Science’s Top Employer recognition for fifth consecutive year

Commercial Updates: BRINSUPRI™ & ARIKAYCE® Roger Adsett| Chief Operating

Officer

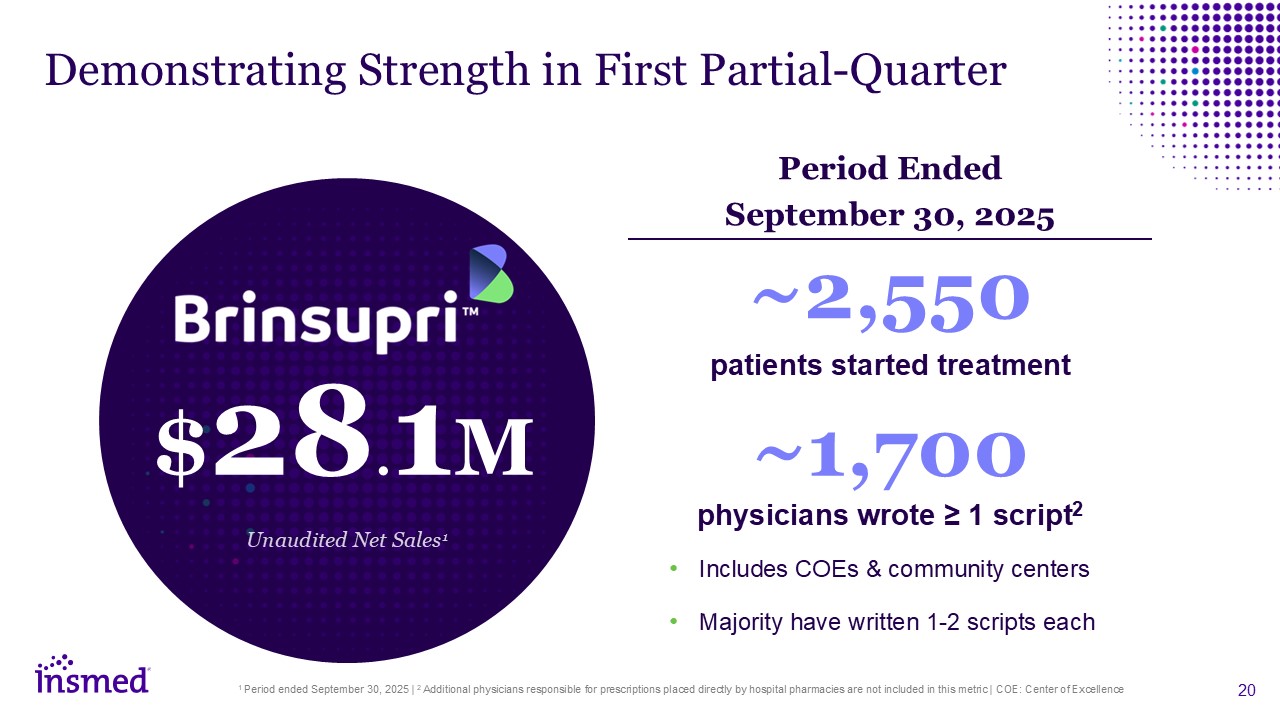

Demonstrating Strength in First Partial-Quarter 1 Period ended September 30, 2025

| 2 Additional physicians responsible for prescriptions placed directly by hospital pharmacies are not included in this metric | COE: Center of Excellence ~2,550 patients started treatment Includes COEs & community centers Majority

have written 1-2 scripts each ~1,700 physicians wrote ≥ 1 script2 $28.1M Unaudited Net Sales1 Period Ended September 30, 2025

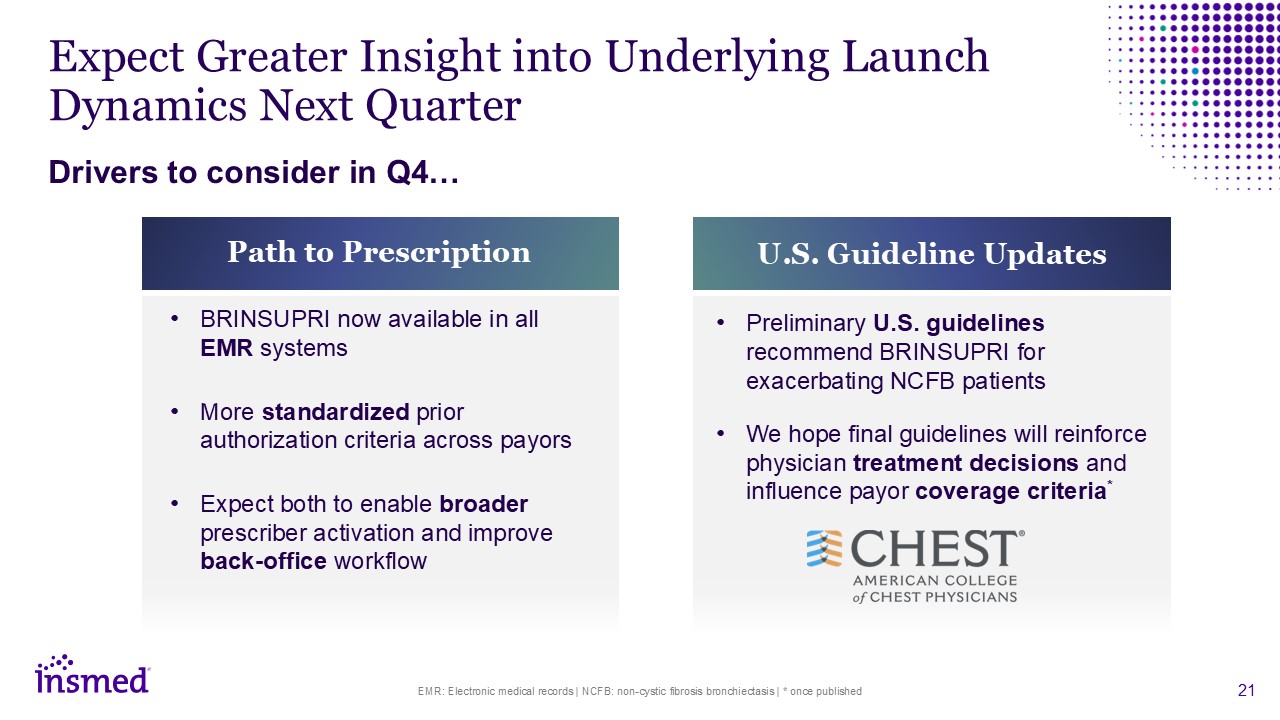

Expect Greater Insight into Underlying Launch Dynamics Next Quarter EMR:

Electronic medical records | NCFB: non-cystic fibrosis bronchiectasis | * once published BRINSUPRI now available in all EMR systems More standardized prior authorization criteria across payors Expect both to enable broader prescriber

activation and improve back-office workflow Path to Prescription U.S. Guideline Updates Preliminary U.S. guidelines recommend BRINSUPRI for exacerbating NCFB patients We hope final guidelines will reinforce physician treatment decisions and

influence payor coverage criteria* Drivers to consider in Q4…

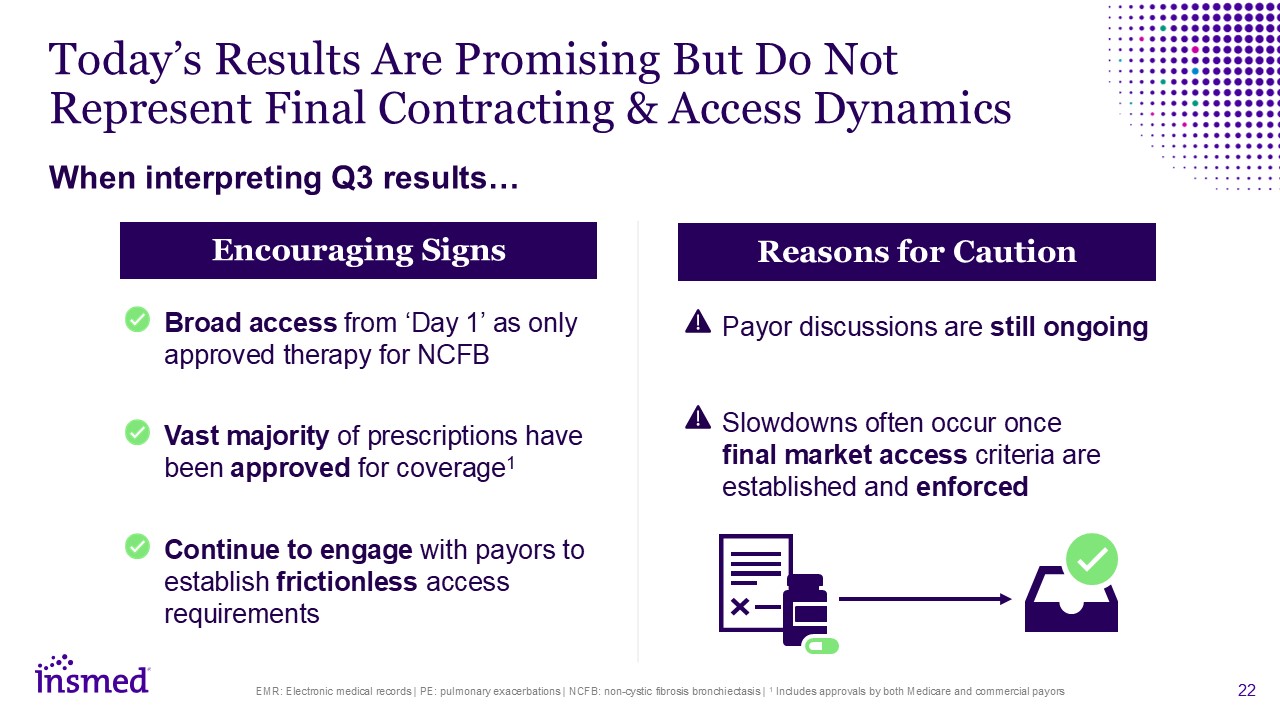

Today’s Results Are Promising But Do Not Represent Final Contracting & Access

Dynamics EMR: Electronic medical records | PE: pulmonary exacerbations | NCFB: non-cystic fibrosis bronchiectasis | 1 Includes approvals by both Medicare and commercial payors When interpreting Q3 results… Broad access from ‘Day 1’ as only

approved therapy for NCFB Vast majority of prescriptions have been approved for coverage1 Continue to engage with payors to establish frictionless access requirements Payor discussions are still ongoing Slowdowns often occur once final

market access criteria are established and enforced Encouraging Signs Reasons for Caution

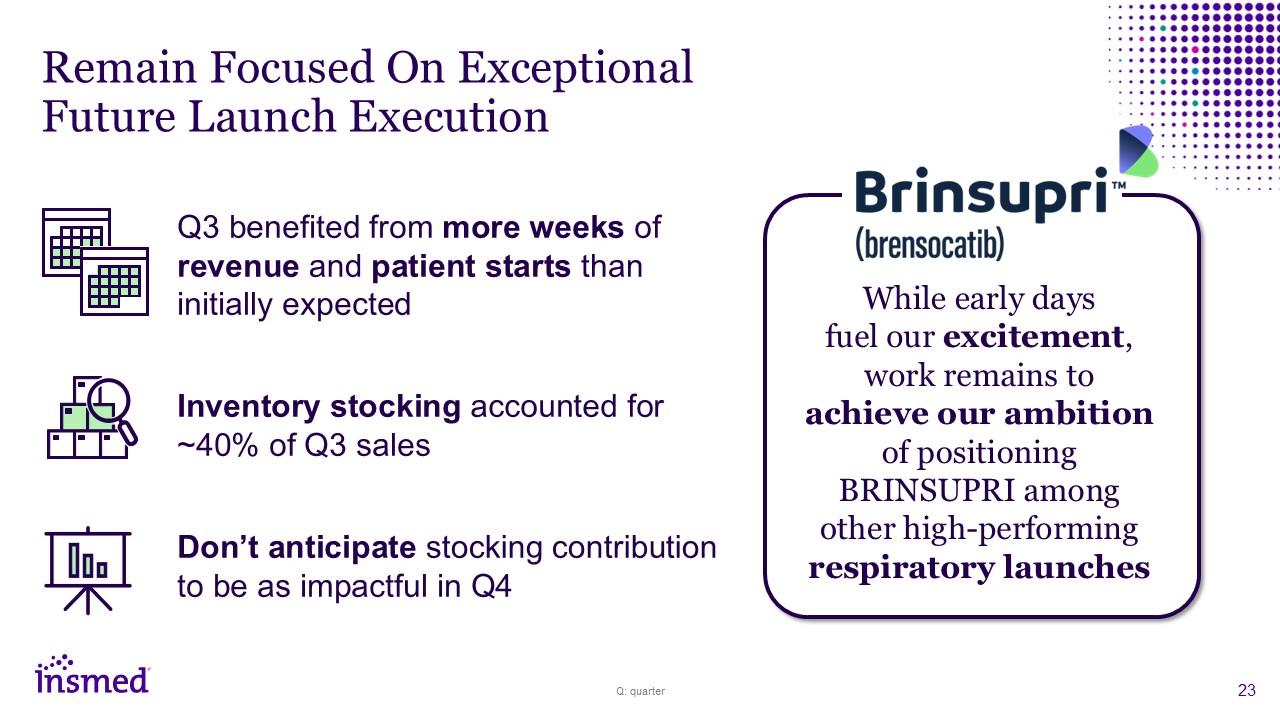

Remain Focused On Exceptional Future Launch Execution Q: quarter While early

days fuel our excitement, work remains to achieve our ambition of positioning BRINSUPRI among other high-performing respiratory launches Q3 benefited from more weeks of revenue and patient starts than initially expected Inventory stocking

accounted for ~40% of Q3 sales Don’t anticipate stocking contribution to be as impactful in Q4

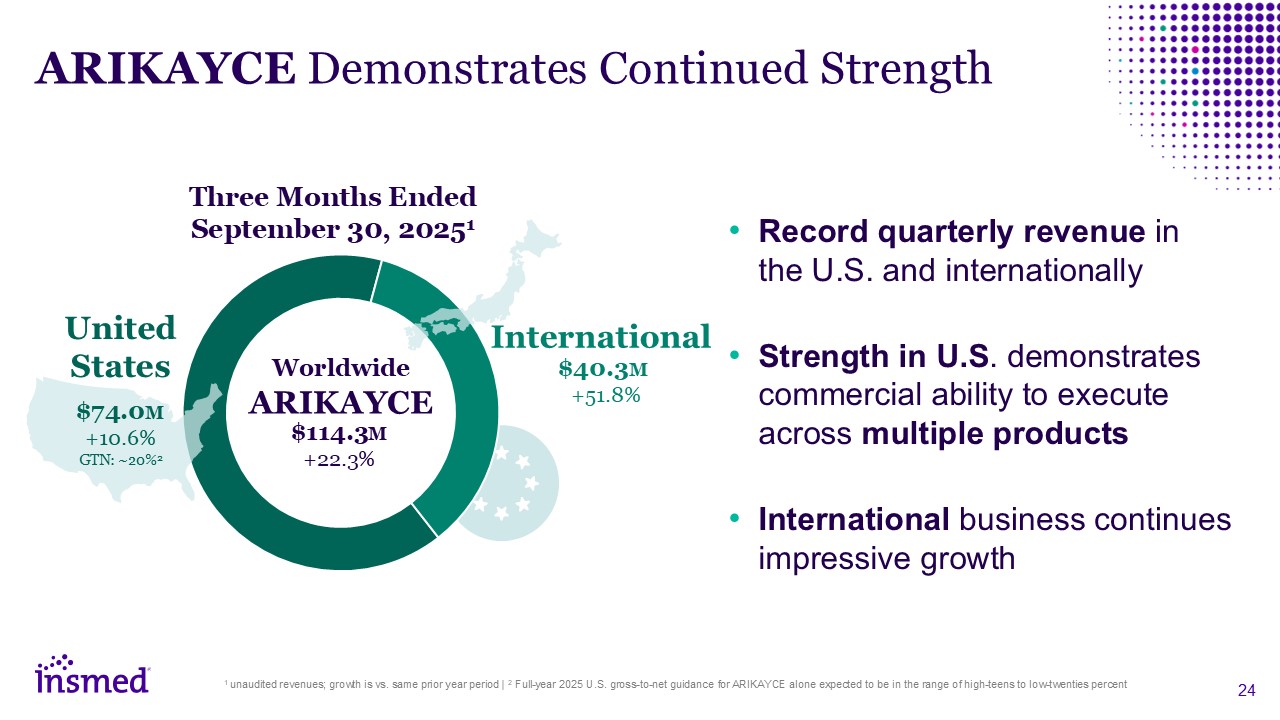

ARIKAYCE Demonstrates Continued Strength Record quarterly revenue in the U.S. and

internationally Strength in U.S. demonstrates commercial ability to execute across multiple products International business continues impressive growth 1 unaudited revenues; growth is vs. same prior year period | 2 Full-year 2025 U.S.

gross-to-net guidance for ARIKAYCE alone expected to be in the range of high-teens to low-twenties percent United States $74.0M +10.6% GTN: ~20%2 International $40.3M +51.8% Worldwide ARIKAYCE $114.3M +22.3% Three Months Ended

September 30, 20251

Financial Results Sara Bonstein | Chief Financial Officer

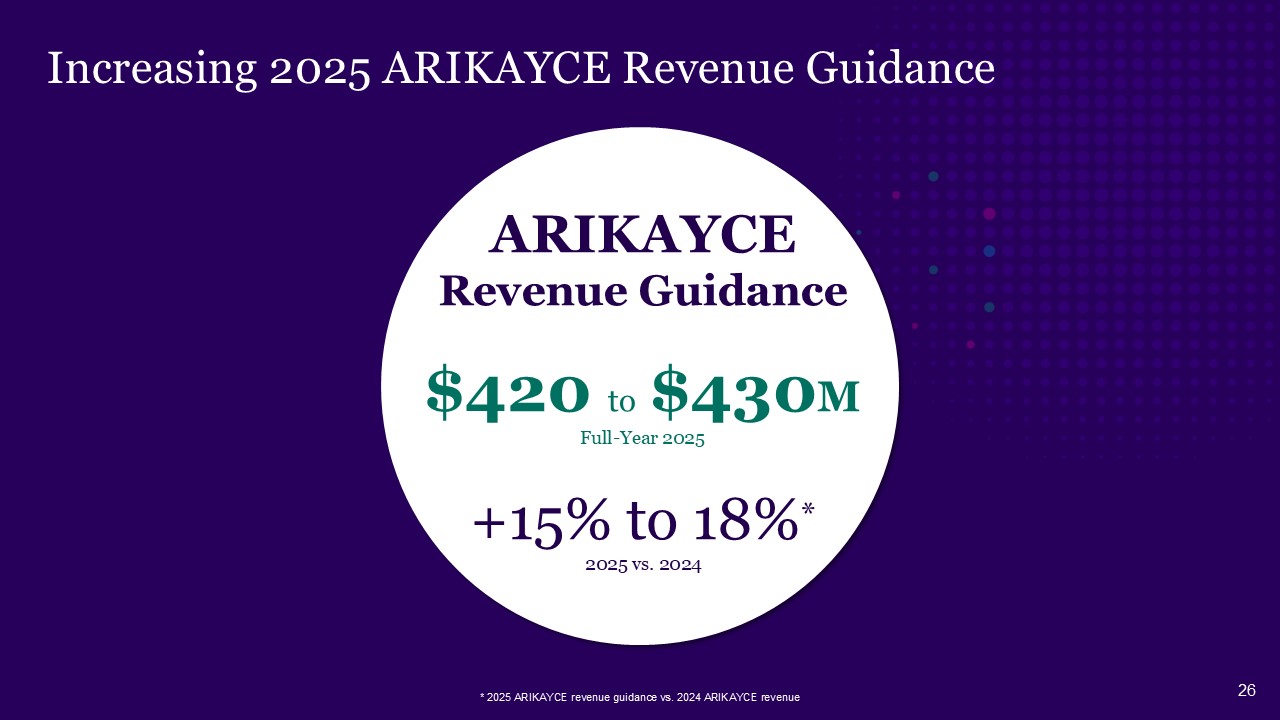

Increasing 2025 ARIKAYCE Revenue Guidance * 2025 ARIKAYCE revenue guidance vs.

2024 ARIKAYCE revenue $420 to $430M Full-Year 2025 +15% to 18%* 2025 vs. 2024 ARIKAYCE Revenue Guidance

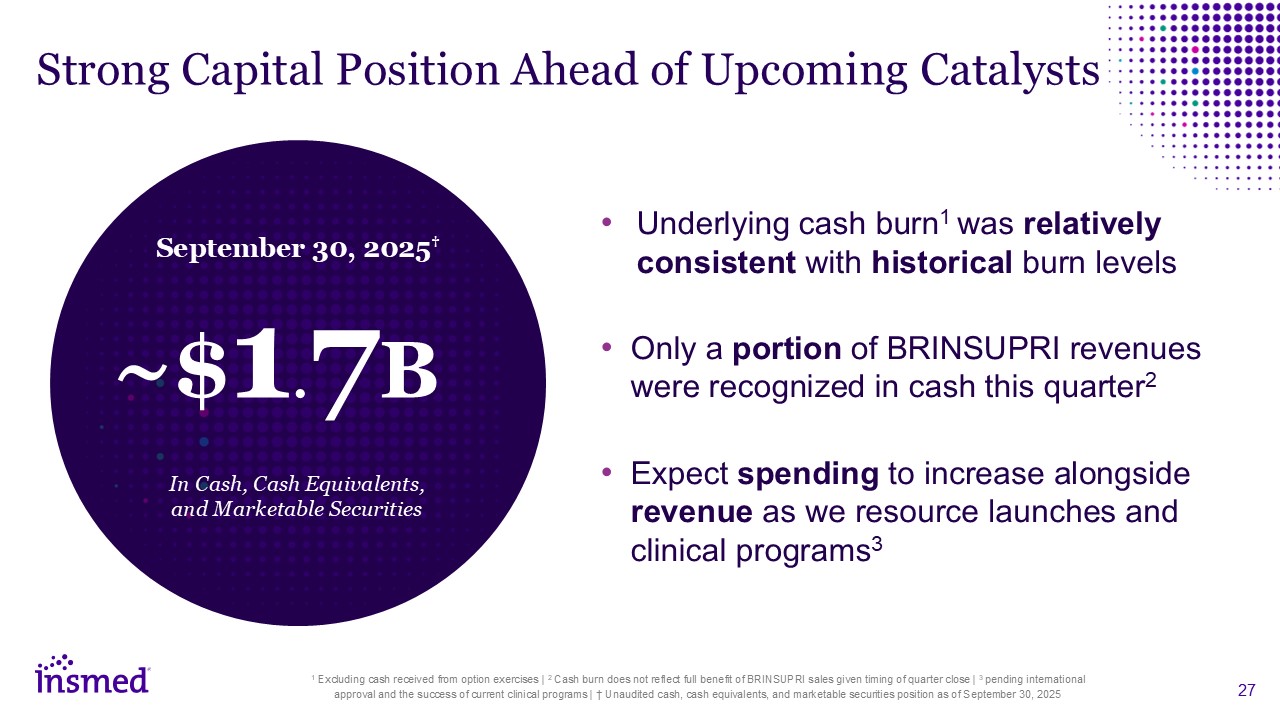

Strong Capital Position Ahead of Upcoming Catalysts Underlying cash burn1 was

relatively consistent with historical burn levels Only a portion of BRINSUPRI revenues were recognized in cash this quarter2 Expect spending to increase alongside revenue as we resource launches and clinical programs3 1 Excluding cash

received from option exercises | 2 Cash burn does not reflect full benefit of BRINSUPRI sales given timing of quarter close | 3 pending international approval and the success of current clinical programs | † Unaudited cash, cash equivalents,

and marketable securities position as of September 30, 2025 ~$1.7B September 30, 2025† In Cash, Cash Equivalents, and Marketable Securities

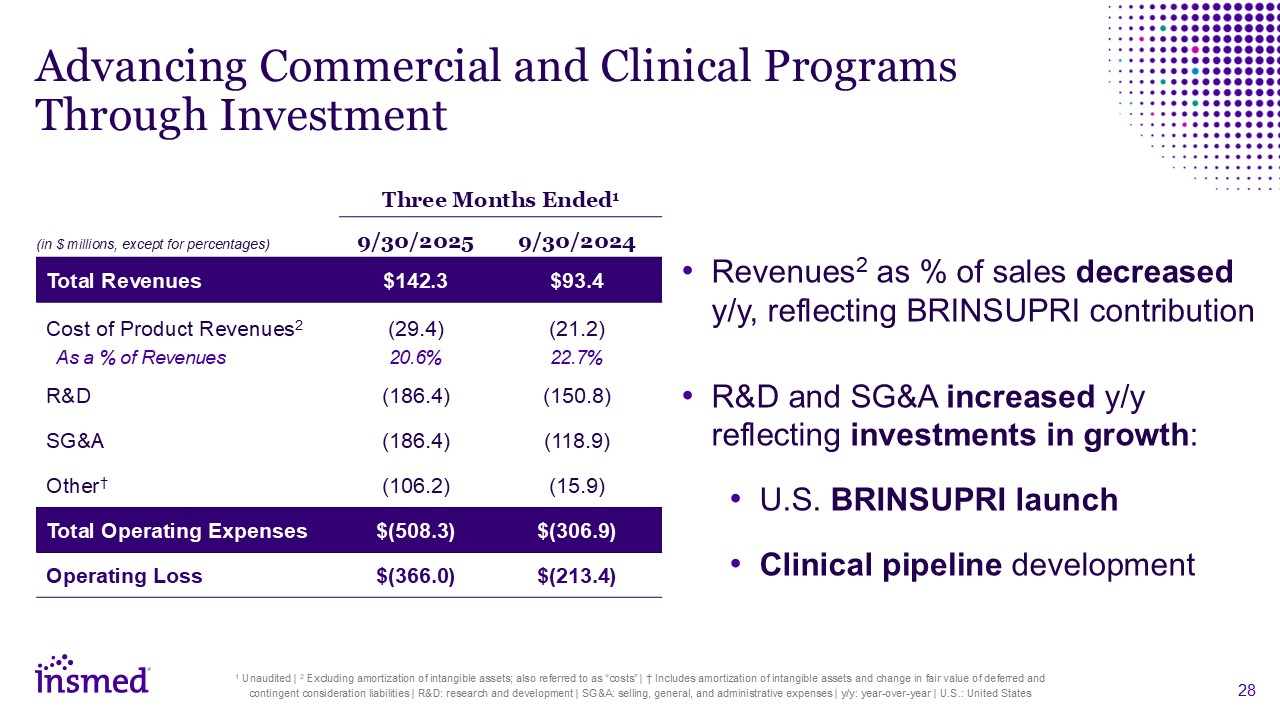

Advancing Commercial and Clinical Programs Through Investment Three Months

Ended1 9/30/2025 9/30/2024 Total Revenues $142.3 $93.4 Cost of Product Revenues2 As a % of Revenues (29.4) 20.6% (21.2) 22.7% R&D (186.4) (150.8) SG&A (186.4) (118.9) Other† (106.2) (15.9) Total Operating

Expenses $(508.3) $(306.9) Operating Loss $(366.0) $(213.4) Revenues2 as % of sales decreased y/y, reflecting BRINSUPRI contribution R&D and SG&A increased y/y reflecting investments in growth: U.S. BRINSUPRI launch Clinical

pipeline development 1 Unaudited | 2 Excluding amortization of intangible assets; also referred to as “costs” | † Includes amortization of intangible assets and change in fair value of deferred and contingent consideration liabilities |

R&D: research and development | SG&A: selling, general, and administrative expenses | y/y: year-over-year | U.S.: United States (in $ millions, except for percentages)

Closing Remarks Past 18 Months: Clinical and commercial achievements created new

opportunities to serve patients Next 18+ Months: Plan to invest behind multiple commercial & clinical catalysts with the potential to change patient lives We believe we are in a strong financial position to execute on these

opportunities

Q&A Session Will Lewis Chair & CEO Sara Bonstein Chief Financial

Officer Dr. Martina Flammer Chief Medical Officer Roger Adsett Chief Operating Officer