j

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))m |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Under Rule 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April 3, 2025

DEAR FELLOW STOCKHOLDERS,

We are pleased to announce the Community Health Systems, Inc. 2025 Annual Meeting of Stockholders, to be held on Tuesday, May 13, 2025, at 8:00 a.m. (Central Daylight Time) at the Hilton Franklin Cool Springs, 601 Corporate Centre Drive, Franklin, TN 37067. The attached Notice of Annual Meeting of Stockholders and Proxy Statement describe the business to be considered and voted on during that meeting. We encourage you to read the Proxy Statement carefully for more information.

It is important that your shares be represented at the Annual Meeting. Whether or not you plan on attending the meeting, please promptly vote your shares. Additional information on how to vote your shares can be found in the Proxy Statement.

We do not believe that communication with our stockholders begins and ends with the Annual Meeting. We appreciate the dialogue we have with our stockholders throughout the year and look forward to continuing this dialogue in the future. The Proxy Statement provides additional information regarding how to contact the Company.

Thank you for your investment in Community Health Systems, Inc. and your continued support.

Sincerely,

|

|

|

|

|

|

Wayne T. Smith |

|

Tim L. Hingtgen |

Chairman of the Board of Directors |

|

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMUNITY HEALTH SYSTEMS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Tuesday, May 13, 2025

8:00 a.m. (Central Daylight Time)

Hilton Franklin Cool Springs, 601 Corporate Centre Drive, Franklin, TN 37067

The Annual Meeting of Stockholders of Community Health Systems, Inc. (the “Annual Meeting”) will be held on Tuesday, May 13, 2025 at 8:00 a.m. (Central Daylight Time) at the Hilton Franklin Cool Springs, 601 Corporate Centre Drive, Franklin, TN 37067.

The Annual Meeting will be held for the purpose of considering and acting upon the following matters:

The close of business on March 17, 2025, has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the meeting and any adjournment or postponement thereof.

YOU ARE REQUESTED, WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE MEETING, TO VOTE VIA THE INTERNET OR BY TELEPHONE, OR COMPLETE, DATE, SIGN AND RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED ENVELOPE (IF APPLICABLE). IF YOU ATTEND THE MEETING AND WISH TO VOTE YOUR SHARES PERSONALLY, YOU MAY DO SO AT ANY TIME BEFORE THE PROXY IS EXERCISED. IF YOU HOLD YOUR SHARES THROUGH A BANK, BROKER OR OTHER NOMINEE, YOU MAY VOTE YOUR SHARES BY THE METHODS SPECIFIED ON THE VOTING INSTRUCTION FORM THAT THEY PROVIDE. WE ENCOURAGE YOU TO VOTE YOUR SHARES AS SOON AS POSSIBLE.

|

|

By Order of the Board of Directors, Christopher G. Cobb Vice President-Legal and Corporate Secretary |

Franklin, Tennessee April 3, 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL MEETING OF STOCKHOLDERS OF

COMMUNITY HEALTH SYSTEMS, INC.

PROXY STATEMENT

TABLE OF CONTENTS

|

Page |

S-1 |

|

1 |

|

8 |

|

25 |

|

Security Ownership of Certain Beneficial Owners and Management |

34 |

37 |

|

38 |

|

39 |

|

41 |

|

42 |

|

44 |

|

44 |

|

70 |

|

71 |

|

73 |

|

75 |

|

77 |

|

79 |

|

80 |

|

81 |

|

82 |

|

86 |

|

87 |

|

91 |

|

107 |

|

Proposal 5 — Ratification of the Appointment of Independent Registered Public Accounting Firm |

110 |

112 |

|

A-1 |

|

Annex B — Amended and Restated Community Health Systems, Inc. 2009 Stock Option and Award Plan |

B-1 |

C-1 |

FORWARD-LOOKING STATEMENTS

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995 that involve risk and uncertainties. All statements in this Proxy Statement other than statements of historical fact, including statements regarding projections, expected operating results, and other events that depend upon or refer to future events or conditions or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “thinks,” and similar expressions, are forward-looking statements. Although the Company believes that these forward-looking statements are based on reasonable assumptions, these assumptions are inherently subject to significant economic and competitive uncertainties and contingencies, which are difficult or impossible to predict accurately and may be beyond the control of the Company. Accordingly, the Company cannot give any assurance that its expectations will in fact occur and cautions that actual results may differ materially from those in the forward-looking statements. A number of factors could affect the future results of the Company or the healthcare industry generally and could cause the Company’s expected results to differ materially from those expressed in this Proxy Statement. These factors including, without limitation, the risks and uncertainties disclosed in our public filings with the Securities and Exchange Commission (the “SEC”), including in our Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 19, 2025. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY

This summary highlights information about Community Health Systems, Inc. (the “Company”, “we”, “our”, or “us”) and certain information contained elsewhere in this Proxy Statement. Our stockholders will be asked to consider and vote on the matters listed below at our 2025 Annual Meeting of Stockholders. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement before voting. In addition, for more complete information about the Company’s business and details about the Company’s 2024 performance highlights and the financial measures mentioned in this Proxy Statement, please review the Company’s Annual Report on Form 10-K filed with the SEC on February 19, 2025.

2024 FINANCIAL PERFORMANCE HIGHLIGHTS

Overall, the operating environment for the Company improved during 2024, yet remained challenging. During 2024, our patient volumes continued to increase, we made further progress in stabilizing our workforce in the face of challenging labor market conditions, and certain ongoing inflationary pressures continued to moderate. At the same time, other industry-wide challenges continued to impact the Company’s operations, such as the shift of Medicare-age patients in the Company’s communities from traditional fee-for-service to Medicare Advantage plans, which results in lower reimbursement for care, the increasing frequency of third-party payors downgrading status, denying claims, and delaying payment for services rendered, higher medical specialist fees, and adverse trends in the resolution of professional liability claims. Despite these challenges, the Company continued to make progress on many of its key strategic priorities.

During 2024, net operating revenues of $12.6 billion represented a 1.2% increase compared to the prior year. Patient volumes increased as demand continued to improve in our markets and we saw benefits from previous investments to achieve growth, increase capacity, and expand the scale of offerings in our healthcare systems. In addition, over the course of the year, the Company made progress in relation to managing labor expense, with effective recruitment efforts helping to further reduce utilization of contract labor. Additionally, ongoing execution of the Company’s margin improvement program positively impacted non-labor expenses during 2024.

In 2024, the Company continued to pursue opportunities to lower overall debt and leverage and further improve our capital structure. In June 2024, the Company refinanced a portion of its senior secured debt through a private offering of an additional $1.225 billion aggregate principal value of its outstanding 10⅞% Senior Secured Notes due 2032 and the associated redemption of $1.116 billion aggregate principal value of 8% Senior Secured Notes due 2026, extending the maturity of the refinanced debt. The Company also extinguished approximately $130 million principal value of 6⅞% Senior Notes due 2028 at a discount in a privately-negotiated transaction. Also in June 2024, the Company’s asset-based loan (ABL) credit agreement was amended and restated to, among other things, extend the maturity to June 5, 2029. Additionally, during 2024, the Company extinguished approximately $143 million principal value of its outstanding 5⅝% Senior Secured Notes due 2027 at a discount through open market repurchases utilizing cash on hand.

The Company has implemented a number of strategic initiatives designed to improve our market position, expand services to our patients, and capture a greater share of healthcare spending in our markets. These initiatives included strengthening regional networks and local market operations; expanding patient access

S-1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

points, health services and infrastructure; recruiting and/or employing additional primary care physicians and specialists; and developing a more consumer-centric experience and facilitating connections between episodes of care. During 2024, we saw progress in each of these areas. For example, in our efforts to strengthen our regional networks and expand infrastructure, we added new access points, including through the acquisition of ten urgent care clinics in Tucson, Arizona, the opening of two new freestanding emergency rooms, and the opening of two major campus expansion projects featuring new inpatient bed towers, emergency department and surgical services capacity in our Knoxville, Tennessee and Foley, Alabama markets.

Our consolidated results during 2024 and 2023 are reflected in the chart below.

Performance Results |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Metrics |

|

2024 |

|

2023 |

|

% Increase/ |

|

|

|

|

|

|

|

Net Operating Revenues |

|

$12,634 |

|

$12,490 |

|

1.2% |

Net (loss) attributable to Community Health Systems, |

|

$(516) |

|

$(133) |

|

(288.0)% |

Net (loss) attributable to Community Health Systems, |

|

(4.1)% |

|

(1.1)% |

|

|

Adjusted EBITDA (1) |

|

$1,540 |

|

$1,453 |

|

6.0% |

Adjusted EBITDA as a % of net operating revenues (1) |

|

12.2% |

|

11.6% |

|

|

Cash Flows from Operations |

|

$480 |

|

$210 |

|

128.6% |

(Loss) per Diluted Share, as reported |

|

$(3.90) |

|

$(1.02) |

|

(282.4)% |

(Loss) per Diluted Share, excluding Adjustments (1) |

|

$(1.03) |

|

$(1.39) |

|

25.9% |

Stock Price as of December 31 |

|

$2.99 |

|

$3.13 |

|

(4.5)% |

|

|

|

|

|

|

|

(1) Adjusted EBITDA and (Loss) per Diluted Share, excluding Adjustments, are non-GAAP financial measures. For a definition of these non-GAAP financial measures and why we believe these non-GAAP financial measures present useful information to investors, as well as a reconciliation of these non-GAAP financial measures to the most comparable GAAP measures, see Annex A. |

||||||

S-2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Operating Revenues (in millions) |

|

|

Earnings (Loss) per Diluted Share As Reported and Adjusted (1) |

|

|

Adjusted EBITDA (1) (in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Price (as of December 31) |

|

|

Cash Flows from Operations (in millions) |

|

|

Capital Expenditures (in millions) |

|

|

|

|

|

|

|

(1) Earnings (loss) per diluted share, as adjusted, is a non-GAAP financial measure which reflects our reported earnings (loss) attributable to Community Health Systems, Inc. stockholders per diluted share for the periods presented adjusted for certain items as reflected on Annex A. Adjusted EBITDA is EBITDA (which is a non-GAAP financial measure that consists of net (loss) income attributable to Community Health Systems, Inc. stockholders before interest, income taxes and depreciation and amortization) adjusted for certain items as reflected on Annex A. For definitions and reconciliations of Adjusted EBITDA and (Loss) Earnings per diluted share, as adjusted, to the most comparable GAAP measures, and why we believe these non-GAAP financial measures present useful information to investors, see Annex A.

S-3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD OF DIRECTORS NOMINEES

Upon the recommendation of our Governance and Nominating Committee, our Board of Directors has nominated fourteen (14) people for election at this Annual Meeting to hold office until the next annual meeting and the election of their successors. A more detailed biography of each director can be found on pages 25 to 33 of the Proxy Statement.

|

Name/Experience/Occupation |

|

Director Since |

Committee |

|

|

|

|

|

|

Susan W. Brooks

Ms. Brooks is a former Congresswoman and former U.S. Attorney. Her deep knowledge of and experience in both the legislative and judicial branches of the Federal government provide our Board with valuable insight into the governmental processes and priorities that impact the heavily-regulated industry in which we operate. In addition, through her diverse experience, including advising public and privately-held companies, non-profits, educational institutions, and hospitals, she has an understanding of the healthcare industry as well as to other sectors with which our Company frequently interacts. |

|

2022 |

Governance & Nominating |

|

|

|

|

|

|

Lt. Gen. Ronald L. Burgess, Jr. U.S. Army (Retired)

Gen. Burgess brings extensive cybersecurity knowledge and executive leadership experience to the Board. He served as the head of the U.S. Defense Intelligence Agency and as acting Principal Deputy Director of National Intelligence. In these roles he provided advice and expertise regarding national security, including cybersecurity threats, to the President of the United States, the Secretary of Defense, the Director of National Intelligence, the Chairman of the Joint Chiefs of Staff and Congressional leaders. Following his retirement from active military service, Gen. Burgess served in various roles at Auburn University, where he interfaced and coordinated with federal and state government representatives among others on cybersecurity and national security issues. |

|

2023 |

Audit & Compliance |

|

John A. Clerico

Mr. Clerico is our independent Lead Director. He brings executive leadership experience to the Board. He has held the positions of chairman of the board, chief executive officer, co-chief operating officer, chief financial officer and treasurer at various points of his career. His years of service on our Board lend important continuity to financial, audit, and compliance oversight functions. He is currently chairman and a registered financial advisor of ChartMark Investments. |

|

2003 |

Compensation |

|

|

|

|

|

|

Michael Dinkins

Mr. Dinkins brings extensive experience, having served on the board and as chief financial officer of a publicly-traded company. He provides understanding of complex financial and operational issues and strategy and risk assessment processes. In addition, Mr. Dinkins brings the perspective of the insurance industry and the medical device industry to the Board. He is currently president and chief executive officer of Dinkins Financial. |

|

2017 |

Audit & Compliance* |

|

|

|

|

|

|

James S. Ely III

Mr. Ely’s years of experience in the financing industry and in the healthcare sector in particular, provides a needed area of expertise. He is able to assist our Board and management in evaluating financing opportunities, as he has specific experience in financing the types of indebtedness reflected on our balance sheet. Mr. Ely founded PriCap Advisors, LLC, an investment management firm, and currently serves as its chief executive officer. |

|

2009 |

Compensation* Audit & Compliance |

|

|

|

|

|

|

John A. Fry

Mr. Fry’s experience as the president of an academic institution, service on the executive committee of the University of Pennsylvania Health System, and service on the boards of non-profit institutions, bring important perspectives to our Board. His familiarity with the issues faced by non-profit organizations assists in understanding the competitive environment. His experience in financial management, financial reporting, audit and compliance, and risk management are valuable skill sets. He is currently the President of Temple University in Philadelphia, Pennsylvania. |

|

2004 |

Governance & Nominating* Compensation |

|

|

|

|

|

|

Joseph A. Hastings, D.M.D.

Dr. Hastings brings the perspective of a healthcare practitioner as well as previous experience as a board member of a publicly-traded company. His experience in managing a healthcare practice is similar to that of many of the Company’s affiliated physician practices, and he can provide valuable advice to the Board and management regarding trends in both medicine and the organization and operation of healthcare practices. Dr. Hastings recently retired as a private practice orthodontist in Mobile, Alabama. He has more than 40 years of healthcare experience.. |

|

2021 |

Governance & Nominating |

S-4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name/Experience/Occupation |

|

Director Since |

Committee |

|

Tim L. Hingtgen

Mr. Hingtgen is our Chief Executive Officer. He is responsible for strategic and operational priorities and provides oversight and direction to senior corporate and regional operations leaders who directly support our health systems. He is a highly accomplished hospital operator with a track record of successfully optimizing hospital operations and developing regional healthcare networks. Prior to joining CHS in 2008, Mr. Hingtgen served as a chief executive officer and chief operating officer of hospitals affiliated with other for-profit hospital systems. |

|

2017 |

|

|

Elizabeth T. Hirsch

Ms. Hirsch’s experience as an accounting and finance executive in a publicly-traded corporation provides the Board with valuable insight, including financial statement preparation, internal controls, SEC reporting, and debt financings. She also brings investor relations expertise and an understanding of the perspective of institutional investors. She is currently retired, but most recently served as vice president and controller of Praxair. |

|

2018 |

Audit & Compliance Compensation |

|

William Norris Jennings, M.D.

Dr. Jennings brings the perspective of a physician to the Board. His experience managing large physician practices, with a focus on risk and quality oversight, offers a physician’s viewpoint to the Board in these areas. He also brings practitioner insight to quality measures and reporting, electronic health records, and federal regulation of practitioner-hospital relationships. Dr. Jennings is currently retired. |

|

2008 |

Governance & Nominating |

|

K. Ranga Krishnan, MBBS

Dr. Krishnan’s service as an executive and administrator at a large medical center and as the dean of two medical schools provides the Board with valuable insight about recent trends in medicine as well as experience in the management of physician practices and in maintaining compliance with the complex regulatory requirements of the hospital and healthcare industries. Dr. Krishnan is a professor of psychiatry at Rush Medical College. From 2019 to 2022, he served as chief executive officer of Rush University System for Health, where he also served as executive vice chairman and senior advisor from 2022 to 2024. |

|

2017 |

Governance & Nominating |

|

Fawn D. Lopez

Ms. Lopez brings a deep understanding of the healthcare industry, combined with expertise in media, marketing and strategic relationships with key industry leaders from her many years as the publisher of Modern Healthcare and vice president of Crain Communications. Throughout her career, she has demonstrated a commitment to advancing health equity, diversity and promoting the success of women and underrepresented groups in healthcare, including through her service in advisory roles for educational institutions, privately-held companies, and non-profit organizations. |

|

2024 |

Governance & Nominating |

|

Wayne T. Smith

Mr. Smith is the Chairman of the Board of Directors. At the time of his retirement as an executive of the Company, he was one of the most tenured executives in the healthcare industry and had led the Company to become one of the largest publicly-traded providers of healthcare services in the nation. He is the past-chair of the board of the Federation of American Hospitals, past-chair and former board member of both the Nashville Area Chamber of Commerce and Nashville Health Care Council and serves on the board of trustees of Auburn University. |

|

1997 |

Chairman of the Board of Directors |

|

H. James Williams, Ph.D.

Dr. Williams’ educational background and extensive teaching experience provides accounting expertise to the Board. Additionally, his diverse experience, including serving as president of academic institutions and service on the boards of a number of non-profit institutions and a bank, bring a unique perspective to the Board. Dr. Williams currently serves as president of Mount St. Joseph University in Cincinnati, Ohio. Prior to that, he served as president of Fisk University in Nashville, Tennessee. |

|

2015 |

Audit & Compliance |

|

|

|

* Committee Chair |

|

S-5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

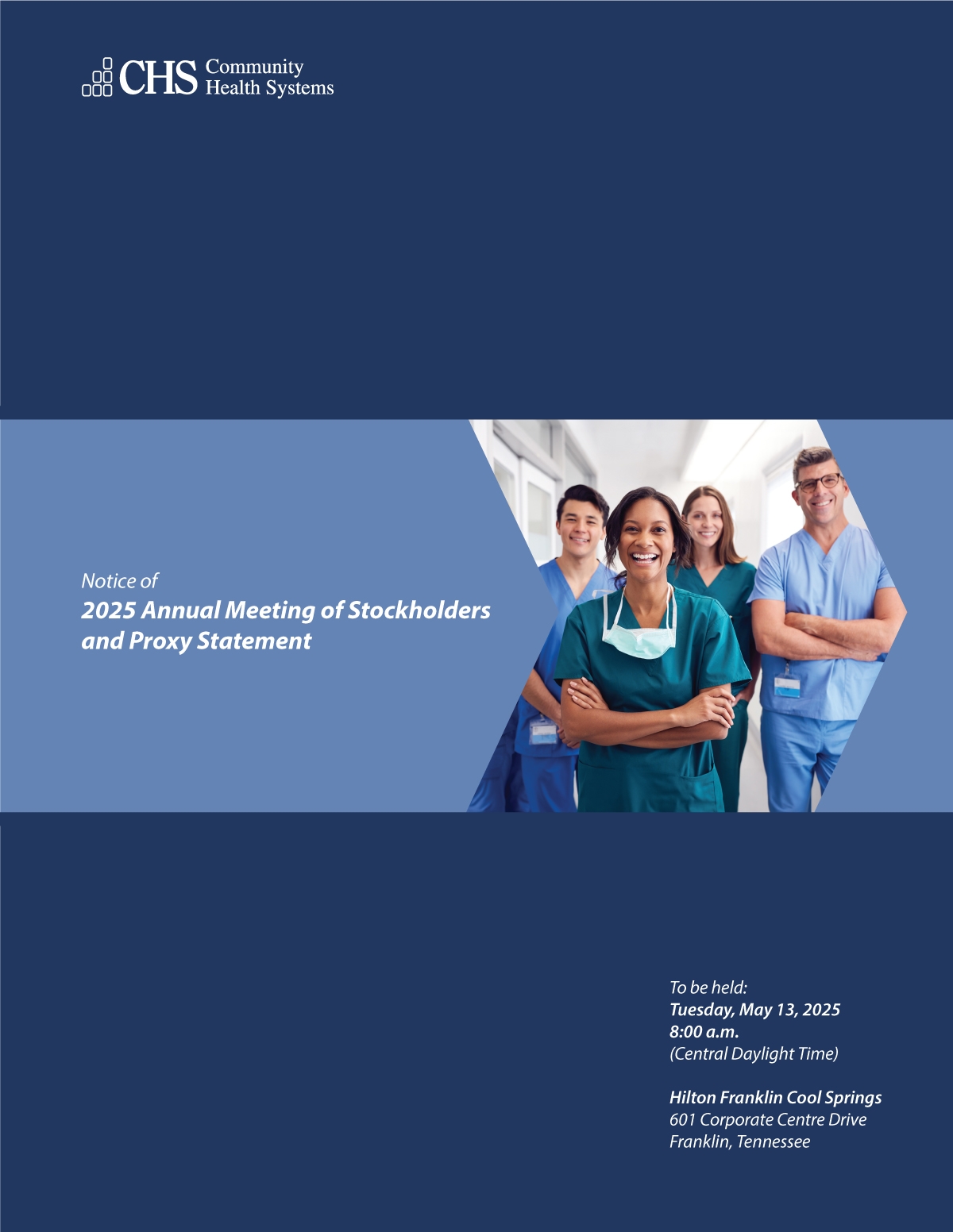

BOARD OF DIRECTORS NOMINEES’ CORE SKILLS AND EXPERIENCE

The following table highlights certain core skills and experiences of our director nominees in addition to those described in the biographies outlined above and beginning on page 25 of this proxy statement.

S-6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORPORATE GOVERNANCE HIGHLIGHTS

• Annual election of all directors • Directors elected by majority vote • Resignation policy for directors who do not receive more votes “for” than “against” their election • Proxy access • Independent directors comprise super-majority of the Board • All Board Committees consist solely of independent directors • Board includes six current members who are diverse based on gender or race/ethnicity • Non-management directors meet regularly in executive sessions and independent directors meet in executive session at least annually. |

• Robust Independent Lead Director role • Separate Board Chair and Chief Executive Officer • Comprehensive Code of Conduct and Corporate Governance Guidelines, which are reviewed annually • Written charters for all Board Committees, which are reviewed annually • Limits on the number of other public company boards on which our directors may serve • Risk oversight by full Board and Board Committees • Equity ownership guidelines for directors and executive officers aligned with industry standards • Policy prohibiting pledging and hedging of our stock • Strong compliance program |

• Approximately 99% Board and Board Committee meeting attendance in 2024 • Annual Board and Board Committee self-evaluations • Board participation in executive succession planning sessions • Compensation “clawback” policy broader than NYSE requirements • Strong pay-for-performance philosophy • Longstanding commitment to corporate responsibility and sustainability • Robust stockholder engagement • One class of voting shares outstanding • No supermajority stockholder voting requirements in our certificate of incorporation or bylaws |

STOCKHOLDER ENGAGEMENT

We value our stockholders’ perspective on our business and each year we interact with stockholders through a variety of stockholder engagement activities. In 2024, our key stockholder engagement activities included in-person or virtual attendance at seven investor conferences, three large group investor and prospective investor meetings at our corporate offices, and our 2024 Annual Meeting of Stockholders, among other activities. Our Investor Relations department is the contact point for stockholder interaction with the Company. Stockholders may also access investor information about the Company through our website (www.chs.net/investor-relations/). Please note that the information on our website (whether referenced here or elsewhere in this Proxy Statement) is not incorporated by reference into this Proxy Statement. For questions concerning Investor Relations, you may call (615) 465-7000 or email us from the Contact Us section on our website (www.chs.net/contact-us/).

S-7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALIGNING PAY AND PERFORMANCE

2024 Executive Compensation

At our 2024 Annual Meeting of Stockholders, approximately 97% of the votes cast by our stockholders, excluding broker non-votes, were voted in favor of the Company’s advisory Say-on-Pay proposal with respect to the compensation of our named executive officers as described in our 2024 Proxy Statement. As our Compensation Committee has continued to review our compensation practices, it is mindful of the level of support received from our stockholders with respect to this Say-on-Pay proposal.

As a leading operator of general acute care hospitals and outpatient facilities within the healthcare industry, one of the nation’s largest and most dynamic industries, the Company must ensure that it attracts and retains the leadership and managerial talent needed to sustain its position in this rapidly changing industry. To remain competitive in the Company’s financial, capital and business markets, the Company views improving earnings and profitability as well as achieving growth as paramount objectives of the Company’s strategy. We believe these strategic objectives are fundamental points of alignment between stockholder value and the compensation of executive management.

Despite ongoing challenges in the operating environment in 2024, the Company had a higher level of achievement in 2024 compared to 2023 with respect to the performance metrics in our short-term cash incentive program, and continued to make progress on many of its key strategic goals, which we believe will result in a stronger organization as we progress into 2025 and beyond. This progress included increasing volumes across key services, continuing to expand access points, successfully managing non-labor expenses despite certain ongoing inflationary pressures, producing strong provider recruitment results, continuing to opportunistically insource previously outsourced medical specialists, achieving further reductions in contract labor expenses, expanding and implementing additional programs to support and monitor patient safety and quality of care, and continuing to advance the Company’s workforce diversity and competency objectives. To further improve operating efficiency, the Company continued the execution of its margin improvement program, which contributed to additional cost savings during the year. During 2024, the Company also substantially completed implementation of its new enterprise resource planning (ERP) system and expansion of shared business operations to redesign and consolidate key business functions. Consistent with the Company’s pay-for-performance philosophy, taking these factors into account, our Chief Executive Officer received 108% of his target cash incentive award for 2024 (as compared to 72% of his target cash incentive award during 2023).

Our long-term incentive (“LTI”) mix further aligns our executive compensation program with stockholder interests by virtue of the fact that 75% of the target LTI awards (based on the number of shares subject to such awards) granted to each of our named executive officers during 2024 was in the form of performance-based restricted stock or non-qualified stock options, which will result in value to the named executive officers only to the extent the Company achieves its long-term performance goals and/or our stock price increases in the future.

With respect to the performance-based restricted stock awards granted to our named executive officers in March 2022, which vested on the third anniversary of the grant date based on the Company’s three-year cumulative financial results during the 2022-2024 performance period, the Company achieved less than 80% of the target for the Cumulative Consolidated Adjusted EBITDA Growth three-year performance objective (i.e., below threshold) and 84.5% of the target for the Cumulative Same-Store Net Revenue Growth three-year performance objective underlying these awards, which targets were set in February 2022. In addition, the Company’s three-year TSR Percentile Rank (which was an additional performance objective for the Chief Executive Officer and Chief Financial Officer) was below the 25th percentile of the Company’s TSR peer group. As a result, the performance-based restricted stock awards granted to our

S-8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Executive Officer and Chief Financial Officer in March 2022 were earned at 16.8% of the target number of shares originally granted, and the performance based restricted stock awards to the other named executive officers were earned at 21% of the target number of shares originally granted.

We conduct year-round proactive stockholder interaction and are committed to a continuing dialogue between stockholders and the Company to fully understand and consider stockholder perspectives on executive compensation and other topics that are important to our stockholders. In addition to our SEC filings, press releases, Community Impact Report, Sustainability Report, and company website, we also communicate with stakeholders through earnings calls, investor conferences and other meetings. In addition, during 2024, we met or consulted with stockholders that held over 50% of our shares outstanding at that time to discuss topics that are important to our stockholders, including soliciting feedback on corporate governance matters and our executive compensation program. Our Compensation Committee considers the feedback and suggestions we receive in light of both market best practices and what we believe to be necessary to execute a best-in-class compensation program that successfully addresses our senior executive talent attraction and retention needs.

Going forward, we will continue to evaluate our executive compensation program in light of stockholder feedback, governance best practices, regulatory requirements, economic and industry factors, current trends in public company pay practices, and competitive considerations. We intend to continue to make changes, as applicable, that both ensure the alignment between the interests of our stockholders and our executives and reflect industry-leading executive compensation programs.

S-9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 COMPENSATION PROGRAM

The Company’s executive compensation philosophy is to develop and utilize a combination of compensation elements that reward current period performance, continued service, and attainment of future goals, and is designed to encourage the retention of executive talent. The key elements of executive compensation are linked either directly or indirectly to enhancing stockholder value. Attainment of annual cash incentive compensation and performance-based restricted stock requires achievement of challenging goals and incentive compensation for above-target performance is capped. The Company continues to develop its compensation policies, programs, and disclosures to provide transparency and accountability to all of its stakeholders.

ELEMENT |

PURPOSE |

KEY CHARACTERISTICS |

|

|

|

BASE SALARY |

Reflects responsibility, leadership, tenure, qualifications and contribution to the Company and the competitive marketplace for our industry. |

Fixed compensation that is reviewed annually and adjusted if and when appropriate. |

|

|

|

EMPLOYEE PERFORMANCE INCENTIVE PLAN |

Motivates executives to achieve our short-term business objectives that drive long-term benefit. |

“At Risk” annual cash awards based on performance compared to multiple pre-established short-term financial goals and non-financial strategic and operational performance improvement goals. |

|

|

|

LONG-TERM INCENTIVE AWARDS |

Motivates executives to achieve our business objectives by tying incentives to the performance of our Common Stock over the long term; links the interest of our executives and stockholders; serves as a retention tool |

For 2024, consistent with recent years, a total of 75% of the target annual LTI award granted to each of our Named Executive Officers was in the form of (i) performance-based restricted stock, which will result in value to the Named Executive Officer only to the extent the Company achieves its long-term performance goals, and (ii) non-qualified stock options, which will result in value to the Named Executive Officer only if the Company’s stock price increases in the future. The other 25% of the target annual LTI awards (based on the number of shares subject to such awards) granted to each Named Executive Officer was allocated to time-based restricted stock which vests in one-third increments on each of the first three anniversaries of the grant date. The ultimate value realized for long-term incentive awards varies based on our performance against pre-determined incentive metrics and with the price of our Common Stock. |

|

|

|

RETIREMENT AND DEFERRED COMPENSATION |

Encourages retention and rewards continued service through our executives’ most productive years. |

Supplemental benefit after retirement that is based on years of service and annual retirement benefit. |

|

|

|

OTHER BENEFITS |

Provides benefits that promote employee health and work-life balance, which assist in attracting and retaining our executives. |

Other benefits consist of health and welfare plans and minimal perquisites. |

S-10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

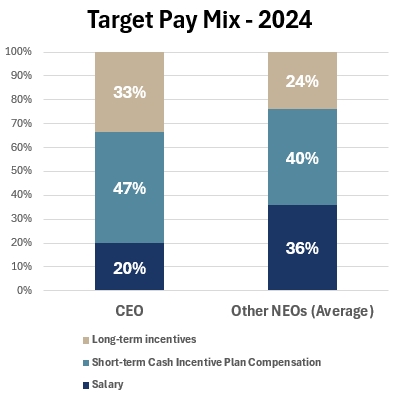

Our Compensation Target Pay Mix

We believe that at risk compensation focuses our management on achieving our key financial, strategic and business goals. For fiscal 2024, approximately 80% of the Chief Executive Officer’s target direct compensation value and approximately 64% of our other named executive officers’ average target direct compensation value was at risk in the form of short-term cash incentive awards and long-term incentives. Actual amounts realized for these programs are dependent upon our annual or longer-term performance and, in the case of such stock awards, subject to fluctuations in our stock price. The following graph depicts the “target pay mix” for our named executive officers in 2024, reflecting the base salary, target short-term cash incentive opportunity and grant date fair value of our annual equity grants made in 2024.

S-11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

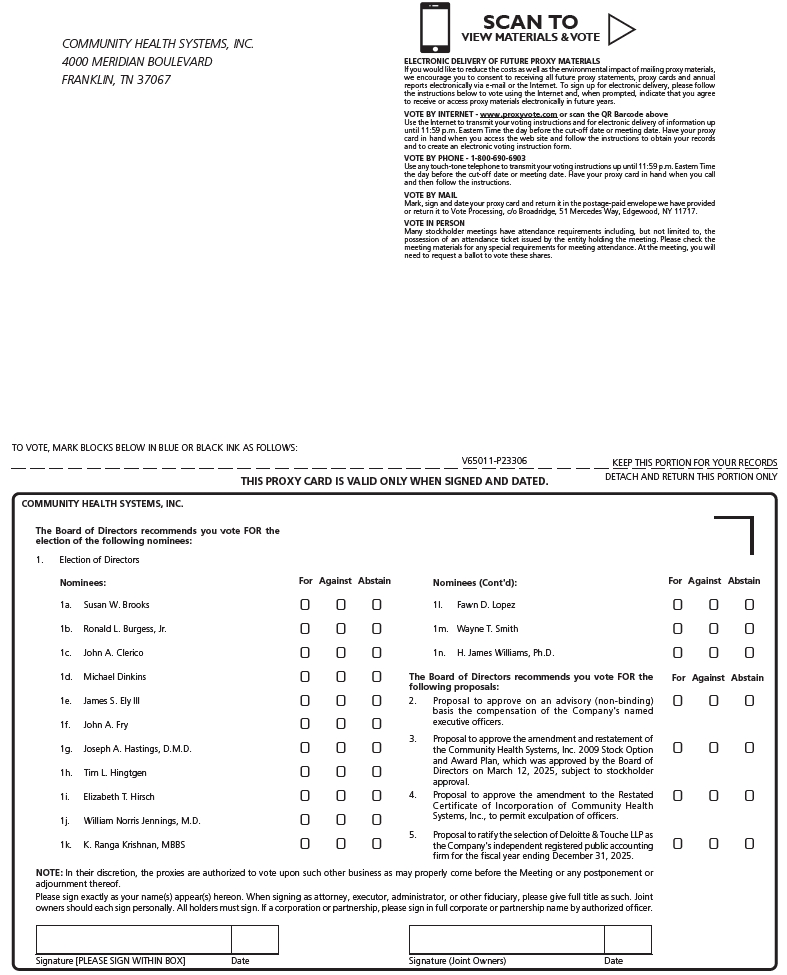

ROADMAP OF VOTING ITEMS

VOTING ITEM |

|

BOARD RECOMMENDATION |

PAGE REFERENCE |

PROPOSAL 1. ELECTION OF DIRECTORS We are asking stockholders to vote on each director nominee to our Board. The Board and the Governance and Nominating Committee believe that the director nominees have the qualifications, experience and skills necessary to represent our stockholders’ interests through service on the Board. |

|

FOR each nominee |

41 |

PROPOSAL 2. ADVISORY VOTE ON EXECUTIVE COMPENSATION The Company has designed its executive compensation program with a mix of compensation elements with the purpose of generating a compensation package that is competitive with an appropriate peer group, provides for the attainment of performance and growth objectives through annual target incentive cash compensation and long-term incentive awards of equity-based compensation, aligns the interests of executive management with stockholders, and retains and attracts valuable executive talent. We are submitting to our stockholders a nonbinding advisory vote to enable them to express their views with respect to the compensation of our named executive officers as described in this Proxy Statement. The Board values stockholders’ opinions and the Compensation Committee will take into account the outcome of the advisory vote when considering future executive compensation decisions. |

|

FOR |

42 |

PROPOSAL 3. APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE COMMUNITY HEALTH SYSTEMS, INC. 2009 STOCK OPTION AND AWARD PLAN, WHICH WAS APPROVED BY THE BOARD OF DIRECTORS ON MARCH 12, 2025, SUBJECT TO STOCKHOLDER APPROVAL. The Board of Directors proposes that the stockholders approve the amendment and restatement of the Community Health Systems, Inc. 2009 Stock Option and Award Plan, as previously amended and restated, which was approved by the Board on March 12, 2025, subject to stockholder approval at this Annual Meeting. The amendment and restatement of this plan would increase the number of shares available for future grants by 7,000,000 shares. |

|

FOR |

91 |

PROPOSAL 4. APPROVAL OF THE AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION OF COMMUNITY HEALTH SYSTEMS, INC. The Board of Directors proposes that the stockholders approve the amendment to the Restated Certificate of Incorporation of Community Health Systems, Inc. The amendment would permit the exculpation of specified officers of the Company, subject to certain exceptions specified in the Delaware General Corporation Law. |

|

FOR |

107 |

PROPOSAL 5. RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Audit and Compliance Committee has appointed Deloitte & Touche LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025. The Audit and Compliance Committee believes that the continued retention of Deloitte & Touche LLP to serve as the independent registered public accounting firm is in the best interests of the Company and its stockholders. Stockholders are being asked to ratify the Audit and Compliance Committee’s selection of Deloitte & Touche LLP. |

|

FOR |

110 |

S-12

ANNUAL MEETING OF STOCKHOLDERS

OF

COMMUNITY HEALTH SYSTEMS, INC.

4000 Meridian Boulevard

Franklin, Tennessee 37067

PROXY STATEMENT

April 3, 2025

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERS’ MEETING TO BE HELD ON MAY 13, 2025: THIS PROXY STATEMENT, THE FORM OF PROXY CARD AND THE 2025 ANNUAL Report TO STOCKHOLDERS ARE AVAILABLE AT WWW.CHS.NET. ADDITIONALLY, AND IN ACCORDANCE WITH SECURITIES AND EXCHANGE COMMISSION (“SEC”) RULES, YOU MAY ACCESS OUR PROXY MATERIALS AT WWW.PROXYVOTE.COM.

INTRODUCTION

Solicitation

This Proxy Statement and the form of proxy card of Community Health Systems, Inc. (the “Company”) are being mailed or made available to stockholders beginning on or about April 3, 2025. The Board of Directors of the Company (the “Board” or the “Board of Directors”) is soliciting your proxy to vote your shares at the Company’s 2025 Annual Meeting of Stockholders (the “Meeting”). The Board is soliciting your proxy to give all stockholders the opportunity to vote on matters that will be presented at the Meeting. This Proxy Statement provides you with information on these matters to assist you in voting your shares.

For simplicity of presentation throughout this Proxy Statement, we refer to employees of our indirect subsidiaries as “employees of the Company,” “our employees” or similar language. Notwithstanding this presentation style, the Company itself does not have any employees. Similarly, the hospitals, operations and businesses described in this Proxy Statement are owned and operated and management services provided by distinct and indirect subsidiaries of the Company.

When and where will the Meeting be held?

The Meeting will be held on Tuesday, May 13, 2025 at 8:00 a.m. (Central Daylight Time) at the Hilton Franklin Cool Springs, 601 Corporate Centre Drive, Franklin, Tennessee 37067. We encourage you to vote your shares prior to the Meeting.

Why did I receive a one-page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to SEC rules and in order to help reduce the environmental impact as well as the cost to the Company associated with the printing and mailing of proxy materials, the Company has elected to provide access to our proxy materials via the internet. Accordingly, we are sending to many of our stockholders a Notice of Internet Availability of Proxy Materials (a “Notice”) instead of sending a paper copy of the proxy materials. All stockholders receiving a Notice will have the ability to access the proxy materials on a website referenced in the Notice or to request a printed set of proxy materials. Instructions on how to access the proxy materials via the internet or to request printed copies may be found in the Notice and in this Proxy Statement.

1

What is a proxy?

A proxy is your legal designation of another person (the “proxy”) to vote on your behalf. By completing and returning the enclosed proxy card (if applicable) or by indicating your vote via one of the other voting methods described below under “How do I vote my shares?”, you are giving the Chief Executive Officer and the President and Chief Legal and Administrative Officer and Assistant Secretary of the Company the authority to vote your shares in the manner you indicate.

Why did I receive more than one proxy card or Notice?

You may receive multiple proxy cards and/or Notices if you hold your shares in different ways (e.g., joint tenancy, trusts, and custodial accounts) or in multiple accounts. You should follow the instructions set forth below under “How do I vote my shares?” for each proxy card and/or Notice you receive. If your shares are held by one or more brokers, banks, trustees or other nominees (i.e., in “street name” as explained further below), you will receive separate voting instructions regarding how you may vote such shares from each broker, bank, trustee or other nominee holding shares on your behalf for each account in which you own shares. You should follow the voting instructions received from each broker, bank, trustee or other nominee to separately indicate your vote for the shares held in each such account.

How can I elect to receive proxy materials electronically in future years?

We encourage stockholders to take advantage of the availability of the proxy materials on the internet in order to reduce the environmental impact of our annual meetings as well as the cost to the Company associated with the printing and mailing of proxy materials. If you received a paper copy of these proxy materials and wish to instead access the proxy materials electronically in the future, the proxy card (or voting instructions) provided with the proxy materials contains instructions on how you may elect to stop receiving a paper copy of proxy materials and access the proxy materials electronically in the future. If you received more than one paper copy of the proxy materials, please follow these instructions on each proxy card (or voting instructions) you received.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single Notice or proxy materials addressed to those stockholders. This process, commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers may be householding our Notice or proxy materials by delivering a single Notice or proxy materials and annual report to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker, or us, that they, or we, will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If at any time you no longer wish to participate in householding and would prefer to receive a separate Notice or proxy statement and annual report, or if you are receiving multiple copies of the Notice or proxy statement and annual report and wish to receive only one, please notify your broker if your shares are held in a brokerage account or us if you are a stockholder of record. You can notify us by sending a written request to our Corporate Secretary at Community Health Systems, Inc., 4000 Meridian Boulevard, Franklin, TN 37067, or by calling our Corporate Secretary at (615) 465-7000. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the annual report and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered.

2

Voting Information

Who is qualified to vote?

You are qualified to receive notice of and to vote on the matters described in this Proxy Statement if you owned shares of common stock of the Company (“Common Stock”) at the close of business on our record date of Monday, March 17, 2025.

How many shares of Common Stock may vote at the Meeting?

As of March 17, 2025, there were 140,302,924 shares of Common Stock outstanding and entitled to vote. Each share of Common Stock is entitled to one vote on each matter presented.

What is the difference between a “stockholder of record” and a “street name” holder?

These terms describe how your shares are held. If your shares are registered directly in your name with Equiniti Trust Company, LLC, the Company’s transfer agent, you are a “stockholder of record.” If your shares are held in the name of a broker, bank, trust or other nominee as a custodian, you are a “street name” holder.

How do I vote my shares?

If you are a “stockholder of record” who received printed copies of the proxy materials, you can vote your proxy by indicating your vote on, signing and mailing in the enclosed proxy card or you can vote by using one of the alternatives below prior to the Meeting:

To vote by telephone: 1-800-690-6903

To vote by internet: www.proxyvote.com

Please refer to the specific instructions set forth on the enclosed proxy card. In addition, please have the 16-digit control number, located on the proxy card, available when voting your shares. If you choose to vote your shares by telephone or through the internet, as noted above, it is not necessary for you to mail back your proxy card.

If you received one or more Notices instead of printed copies of the proxy materials, you should follow the voting instructions set forth in each Notice.

If you hold your shares in “street name,” your broker, bank, trustee or other nominee will provide you with materials and instructions for voting your shares, which allow you to vote your shares prior to the Meeting by using the internet or a toll-free telephone number. If you hold shares through more than one broker, bank, trustee or other nominee or in multiple accounts, you should receive separate materials and voting instructions from each. You will need to separately follow the instructions received from each broker, bank, trustee or other nominee through which you hold shares for each such account in order to ensure that all of your shares are voted.

In addition to the voting methods set forth above, “stockholders of record” and holders of shares in “street name” may vote at the Meeting as set forth below under “Can I vote my shares at the Meeting?”

Can I vote my shares at the Meeting?

If you are a “stockholder of record,” you may vote your shares in person at the Meeting. If you hold your shares in “street name,” you must obtain a proxy from your broker, bank, trustee or other nominee, giving you the right to vote the shares at the Meeting. In order to be admitted to the Meeting, you must present a valid government-issued photo identification and proof of ownership of the Company’s stock as of the record date. This can be a brokerage statement or letter from a bank indicating ownership as of the record date, a proxy card or a legal proxy provided by your broker, bank, trustee or other nominee. If you

3

hold your shares in “street name,” please consult with your broker, bank, trustee or other nominee, as necessary, in advance of the Meeting date to ensure that you have what you need to be admitted to the Meeting.

What are the Board’s recommendations on how I should vote my shares?

The Board recommends that you vote your shares as follows:

Proposal 1 |

FOR the election of each of the following fourteen (14) nominees for director: Susan W. Brooks; Ronald L. Burgess, Jr.; John A. Clerico; Michael Dinkins; James S. Ely III; John A. Fry; Joseph A. Hastings, D.M.D.; Tim L. Hingtgen; Elizabeth T. Hirsch; William Norris Jennings, M.D.; K. Ranga Krishnan, MBBS; Fawn D. Lopez; Wayne T. Smith; and H. James Williams, Ph.D. to one-year terms expiring at the 2026 Annual Meeting of Stockholders. |

|

|

Proposal 2 |

FOR the approval, on an advisory basis, of the compensation of our named executive officers, as disclosed in this Proxy Statement. |

|

|

Proposal 3 — |

FOR the approval of the amendment and restatement of the 2009 Stock Option and Award Plan (the "2009 Plan"), which was approved by the Board on March 12, 2025, subject to stockholder approval. |

|

|

Proposal 4 — |

FOR the approval of the amendment to the Company’s Restated Certificate of Incorporation to permit the exculpation of officers of the Company. |

|

|

Proposal 5 |

FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm (independent auditors) for the fiscal year ending December 31, 2025. |

4

How would my shares be voted if I do not specify how they should be voted?

If you are a stockholder of record and you sign and return your proxy card without indicating how you want your shares to be voted, your shares will be voted in accordance with the Board’s recommendations for the proposals listed above and in the discretion of the named proxies regarding any other matters properly presented for a vote at the Meeting.

If you are a beneficial owner of shares held in “street name” and do not provide each broker, bank, trustee or other nominee that holds your shares with specific voting instructions as set forth above under “How do I vote my shares?”, under the rules of the New York Stock Exchange (“NYSE”), the broker, bank, trustee or other nominee that holds your shares may generally vote on “routine” matters without instructions from you. We expect the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025 (Proposal 5) to be the only proposal that is considered a “routine” matter. Accordingly, if your shares are held through a broker, bank, trust or other nominee, that person will have discretion to vote your shares on only that matter if you fail to provide instructions.

Conversely, under NYSE rules, your broker, bank, trustee or other nominee is not entitled to vote your shares on any “non-routine” matters if it does not receive instructions from you on how to vote. The election of directors (Proposal 1), the approval, on an advisory basis, of named executive officer compensation (Proposal 2), the proposal to approve the amendment and restatement of the 2009 Plan (Proposal 3), and the proposal to amend the Company’s Restated Certificate of Incorporation to permit the exculpation of officers of the Company (Proposal 4) will be considered “non-routine” matters. Thus, if you do not give your broker, bank, trustee or other nominee specific instructions on how to vote your shares with respect to those proposals, your broker, bank, trustee or other nominee will not have the authority to vote on those matters with respect to your shares. This is generally referred to as a “broker non-vote.” A broker non-vote may also occur if your broker, bank, trustee or other nominee fails to vote your shares for any reason. Therefore, if you hold your shares through a broker, bank, trustee or other nominee, please instruct that person regarding how to vote your shares on at least Proposals 1, 2 3, and 4.

How many votes must be present to hold the Meeting?

The presence, in person or represented by proxy, of the holders of a majority of the shares of Common Stock issued and outstanding on the record date for the Meeting will constitute a quorum for the transaction of business at the Meeting.

How are abstentions and broker non-votes treated?

Abstentions are deemed to be “present” at the Meeting and are counted for quorum purposes. In addition, for Proposal 1 (election of directors), if you abstain with respect to any nominee, the abstention will not have any effect on the outcome of the vote with respect to such nominee. With respect to Proposals 2, 3, 4 and 5, if you abstain with respect to any such proposal, such abstention will have the same effect as a vote against the matter. For all non-routine matters (i.e., all proposals other than Proposal 5 (ratification of independent registered public accounting firm) other than Proposal 4 (amendment of the Company’s Restated Certificate of Incorporation to permit exculpation of officers), broker non-votes, while counted for general quorum purposes, will have no effect on the voting results for such non-routine matter in respect of which there may be broker non-votes. For Proposal 4 (amendment of the Company’s Restated Certificate of Incorporation to permit exculpation of officers), a broker non-vote will have the same effect as a vote against the matter.

Can I change my vote?

If you are a stockholder of record, you may revoke your proxy by doing one of the following:

5

* By sending a written notice of revocation to the Corporate Secretary of the Company that must be received prior to the Meeting, stating that you revoke your proxy;

* By signing a later-dated proxy card and submitting it so that it is received prior to the Meeting in accordance with the instructions included in the proxy card;

* By submitting another vote by telephone or via the internet prior to the Meeting; or

* By attending the Meeting and voting your shares in person at the Meeting before your proxy is exercised at the Meeting.

If you hold your shares in “street name,” your broker, bank, trustee or other nominee will provide you with instructions on how to revoke your proxy.

What vote is required to approve each proposal?

Proposal |

|

Vote Required |

Broker Discretionary Voting Allowed |

Proposal 1 |

Election of fourteen (14) directors |

Votes cast for the election of that nominee must exceed votes cast against the election of that nominee |

No |

|

|

|

|

Proposal 2 |

Advisory vote on executive compensation |

Majority of the shares entitled to vote and present in person or represented by proxy |

No |

|

|

|

|

Proposal 3 |

Approval of the amendment and restatement of the 2009 Plan, which was approved by the Board on March 12, 2025, subject to stockholder approval at this Meeting |

Majority of the shares entitled to vote and present in person or represented by proxy |

No |

|

|

|

|

Proposal 4 |

Approval of the amendment to the Restated Certificate of Incorporation to permit the exculpation of officers |

Majority of the shares of Common Stock issued and outstanding on the record date |

No |

|

|

|

|

Proposal 5 |

Ratification of independent registered public accounting firm for 2025 |

Majority of the shares entitled to vote and present in person or represented by proxy |

Yes |

With respect to Proposal 1, you may vote FOR, AGAINST or ABSTAIN with respect to each nominee. If you ABSTAIN from voting on Proposal 1 with respect to any nominee, the abstention will not have any effect on the outcome of the vote with respect to such nominee.

With respect to Proposals 2, 3, 4 and 5, you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on any of Proposals 2, 3, 4 or 5, the abstention will have the same effect as a vote AGAINST the proposal.

Who will count the votes?

Representatives from Broadridge Financial Solutions, Inc. will count the votes and serve as our Inspectors of Election. The Inspectors of Election will be present at the Meeting.

6

Who pays the cost of proxy solicitation?

The Company pays the costs of soliciting proxies. The Company has engaged Georgeson Inc. to aid in the solicitation of proxies for a fee of approximately $19,000, plus reimbursement of reasonable expenses. Upon request, the Company will reimburse brokers, banks, trustees or their other nominees for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of shares of the Company’s Common Stock. In addition, certain of our directors and officers, as well as employees may aid in the solicitation of proxies. These individuals will not receive additional compensation for this task.

Is this Proxy Statement the only way that proxies are being solicited?

No. As stated above, in addition to mailing or providing notice of the availability of these proxy materials, our proxy solicitor, Georgeson Inc., and certain of our directors and officers, as well as employees, may solicit proxies by telephone, e-mail or personal contact. These directors, officers and employees will not be specifically compensated for doing so.

If you have any further questions about voting your shares or attending the Meeting, please call our Corporate Secretary at (615) 465-7000.

7

GENERAL INFORMATION

How may I contact the Chairman of the Board of Directors, the Lead Director or other non-management members of the Board of Directors?

The Chairman of the Board of Directors, or Board Chair, is Wayne T. Smith, and the independent Lead Director is John C. Clerico. They and any of the other non-management directors (including the chair of any of the standing committees of our Board) may be contacted by any stockholder or other interested party in the following manner:

c/o Community Health Systems

4000 Meridian Boulevard

Franklin, TN 37067

Attention: Corporate Secretary

(615) 465-7000

Investor_Communications@chs.net

Stockholders or other interested parties may also communicate with our directors or our corporate compliance officer by accessing the Confidential Disclosure Program established under our Code of Conduct:

Corporate Compliance and Privacy Officer

Community Health Systems

4000 Meridian Boulevard

Franklin, TN 37067

(800) 495-9510

https://www.mycompliancereport.com/ (use code “CYH”)

Generally, all materials that are appropriate director communications will be forwarded to the intended recipient; however, management may simultaneously conduct an investigation of any operational, compliance, or legal matter in accordance with its established policies and procedures. Management reserves the right not to forward any material that is harassing, unduly offensive or otherwise not credible, or that solicits business on behalf of the sender.

How is the Board of Directors organized and how is the independence of the Board of Directors determined?

The role of our Board is governed by the Company’s Amended and Restated By-laws (the “By-laws”), and is further described in our Governance Guidelines (the “Governance Guidelines”). Currently, our Board has fourteen (14) members.

A majority of our directors must be “independent” under NYSE rules. In addition, our Governance Guidelines include independence standards established by our Board to assist it in determining independence in accordance with such rules. To determine whether our incumbent directors and any new director nominees are independent, the Board evaluates any relationships of our directors and director nominees with the Company and the members of the Company’s management, against the independence standards set forth in our Governance Guidelines and the applicable rules of the NYSE and SEC. In making its independence determinations, the Board broadly considers all relevant facts and circumstances, including the responses of our directors and director nominees to a questionnaire completed by each of them on an annual basis, which solicits information about their relationships and other facts and circumstances that may be relevant to such independence determination. The Board also considers any relationships between the Company and other organizations on which our directors or

8

director nominees serve as directors or with respect to which such directors or director nominees are otherwise affiliated. With the exception of Mr. Smith, our former Chief Executive Officer who served as an executive of the Company until January 1, 2023, the Board determined that each of our incumbent non-management directors satisfied all of the independence standards set forth in our Governance Guidelines and the applicable rules of the NYSE and the SEC (including the specific standards applicable to members of our Audit and Compliance Committee and Compensation Committee) and did not otherwise have a material relationship with the Company (either directly or as an officer, employee, shareholder or partner of an organization that has a relationship with the Company). After such evaluations, our Board has affirmatively determined that each of the following non-management directors are independent under our Governance Guidelines and the applicable rules of the NYSE and the SEC:

Susan W. Brooks

Ronald L. Burgess, Jr.

John A. Clerico

Michael Dinkins

James S. Ely III

John A. Fry

Joseph A. Hastings, D.M.D.

Elizabeth T. Hirsch

William Norris Jennings, M.D.

K. Ranga Krishnan, MBBS

Fawn D. Lopez

H. James Williams, Ph.D.

In addition to Mr. Smith, Mr. Hingtgen, who is our Chief Executive Officer and employed by a subsidiary of the Company, is not independent.

Do the non-management members and independent members of the Board of Directors meet in separate sessions?

The non-management members of our Board meet frequently in executive sessions, typically at the end of each regularly scheduled Board meeting, and otherwise as needed. During 2024, the non-management members of our Board met in executive session ten (10) times, either in conjunction with a Board meeting or a committee meeting at which the other non-management directors were present. The Board Chair generally presides over those sessions. In the absence of the Board Chair or when leadership by the Board Chair is not deemed advisable, the Lead Director may preside at such meetings. If an executive session is held in conjunction with a committee meeting at which the other non-management directors are present, the chair of the applicable committee may preside at such meeting. In addition, at least annually, the independent directors meet in executive session presided over by the Lead Director. All directors are encouraged to offer feedback throughout the year, during these sessions or at any other time, regarding topics to be included as agenda items for upcoming Board or committee meetings.

What is the leadership structure of the Board of Directors?

The Board is currently led by Mr. Smith as Chairman of the Board. The Board has carefully considered its leadership structure and believes at this time that the Company and its stockholders are best served by having the positions of Board Chair and Chief Executive Officer filled by different individuals. This allows the Chief Executive Officer to focus on the Company’s day-to-day operations, while allowing the Board Chair to lead the Board in providing advice and oversight to management. The Board believes that Mr. Smith’s broad and lengthy leadership experience in the healthcare industry, including 24 years of prior service as the Chief Executive Officer of the Company, uniquely qualify him for

9

the role of Board Chair. In addition, the Board believes that certain other practices and policies (including the role of our independent Lead Director) assure that the independent members of the Board (who comprise a super-majority of the Board) provide appropriate oversight, consultation, and involvement. The Governance and Nominating Committee is responsible for reviewing the Board’s leadership structure, including to assess whether to separate or combine the roles of Board Chair and Chief Executive Officer, based on the Company’s particular facts and circumstances at the time. Under the terms of a final order of settlement in the derivative actions In re Community Health Systems, Inc. Shareholder Derivative Litigation entered into by the Company in January 2024, the Company is obligated to maintain separate roles of Board Chair and Chief Executive Officer for a period of five (5) years from the date of such settlement.

The Board is responsible for broad corporate policy and overseeing the overall performance of the Company. Members of the Board are kept informed of the Company’s business by various documents sent to them before each meeting and presentations made to them during these meetings by the Company’s Chief Executive Officer and other corporate executives. All directors are advised of actions taken by the various committees of the Board and are invited to, and frequently do, attend meetings of Board committees on which they do not serve. Directors have access to the Company’s books, records and reports, and members of management are available at all times to answer their questions.

The Governance and Nominating Committee, which consists entirely of independent directors, regularly considers the Board leadership structure, as well as other governance practices, and also conducts an annual evaluation of the effectiveness of the Board and its standing committees. The Governance and Nominating Committee has determined that the present leadership structure is effective and appropriate.

As discussed above under “Do the non-management members and independent members of the Board of Directors meet in separate sessions?”, the non-management members of the Board meet in executive sessions that are generally presided over by the Board Chair. The Board Chair serves as the principal liaison between the non-management directors and members of management. In addition, as noted above, at least annually, the independent directors meet in an executive session presided over by the Lead Director. The Lead Director and the committee chairs also have the authority to call meetings of the independent directors and prepare agendas for such meetings. The Lead Director may serve as a liaison between the independent directors and management, as needed. The Lead Director may also advise on the quality, sufficiency and currency of the materials sent to the Board in connection with its meetings and offer input on regular meeting agendas. As requested, the Lead Director is available for consultation and direct communication with major stakeholders.

Board independence is further achieved through the completely independent composition of the three standing committees of the Board: Audit and Compliance, Compensation, and Governance and Nominating, each of which is supported by an appropriate charter and holds executive sessions without management present. Each of the Board’s independent directors serves on one or more of these committees and, as noted above, is invited to, and frequently does, attend meetings and executive sessions of Board committees on which he or she does not serve. Thus, there is ample opportunity to meet and confer without any member of management present.

The Board has concluded that the structure and practices of the independent members of the Board assure effective independent oversight as well as effective independent leadership, while maintaining practical efficiency.

10

What are the Company’s environmental, social and governance initiatives and where can I find additional information regarding these initiatives?

In addition to our good corporate governance practices highlighted above in the Corporate Governance Highlights section, we have implemented, various environmental, social and governance (“ESG”) initiatives, including in the following areas:

Environment/Sustainability. We are committed to providing high-quality care in the communities we serve while identifying and implementing processes that improve energy efficiency, reduce consumption and waste, minimize environmental impact and improve community well-being. We continue to be focused on the reduction of our carbon footprint, water and energy usage and material waste, and our initiatives in this area can often be cost-effective as well as important for environmental sustainability. Our key environmental initiatives include the following:

11

Patient Safety and High Quality of Care. We maintain an emphasis on safety and patient outcomes and we are continuously focused on ways to improve patient, physician and employee satisfaction. To improve outcomes, healthcare personnel at our facilities use evidence-based medicine and clinical care paths in the treatment of our patients. We also leverage technology to identify and mitigate risk in real time, as care is being provided, by using artificial intelligence and tele-care capabilities. Examples include use of machine learning capabilities in maternal/fetal monitoring as well as early identification of patients at risk for readmission. We believe that a focus on continuous improvement yields the best results for patients, reduces risk and liability, and creates value for the people and communities we serve. Moreover, over the past decade, we have instituted numerous programs to improve safety in care environments. As a result of our patient safety efforts, our Serious Safety Event Rate has declined 90% compared to our 2013 baseline standard.

We also have expanded our network of outpatient services to create greater access and more convenience for our patients. We have also deployed innovative programs to deliver better outcomes including remote monitoring for patients with certain chronic conditions.

For additional information regarding our focus on patient safety and quality of care, see the discussion under “Our Business Strategy — Continuously improve patient safety and quality of care” in Part I, Item 1 (Business) of our Annual Report on Form 10-K for our fiscal year ended December 31, 2024, filed with the SEC on February 19, 2025 (the "2024 Form 10-K").

Workforce Diversity and Competency. We are committed to workforce diversity and competency, including recruiting and retaining a diverse population of employees with respect to their experiences, education, socioeconomic status, race, color, ethnicity, religion, national origin, disability, culture, sexual orientation and gender identity or expression that are reflective of the communities we serve. Our workforce diversity and competency objectives include a focus on workforce diversity and health equity. For example, as we strive to deepen our culture of inclusion, we endeavor to strengthen our individual and collective cultural competence through formal training and development programs. Our health equity work is rooted in a desire to provide care that does not vary in quality because of personal characteristics such as gender, ethnicity, geographic location or socioeconomic status. By fostering a culture of inclusion, we believe that we are able to retain the best and brightest talent by making all employees feel valued by members of their respective team. As of December 31, 2024, approximately 80% of our employees were women and approximately 31% were people of color.

Supporting Our People. Our employees are vital contributors to the success of our organization, and we devote significant resources to recruit, retain and develop our workforce. We provide a wide range of development programs and resources, several of which were initiated and/or expanded in 2024, are designed to enable career pathways and advancement. These programs and resources include the following:

12