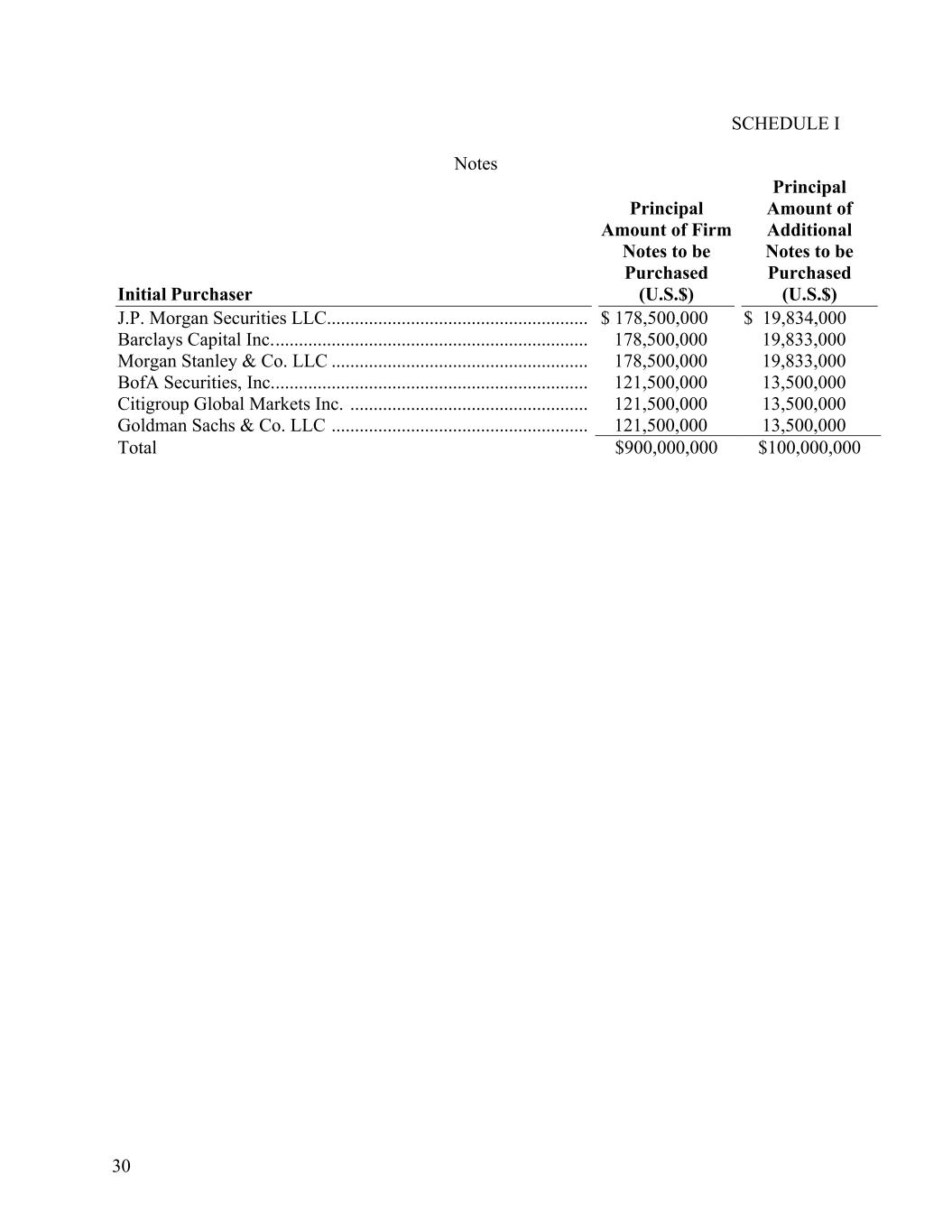

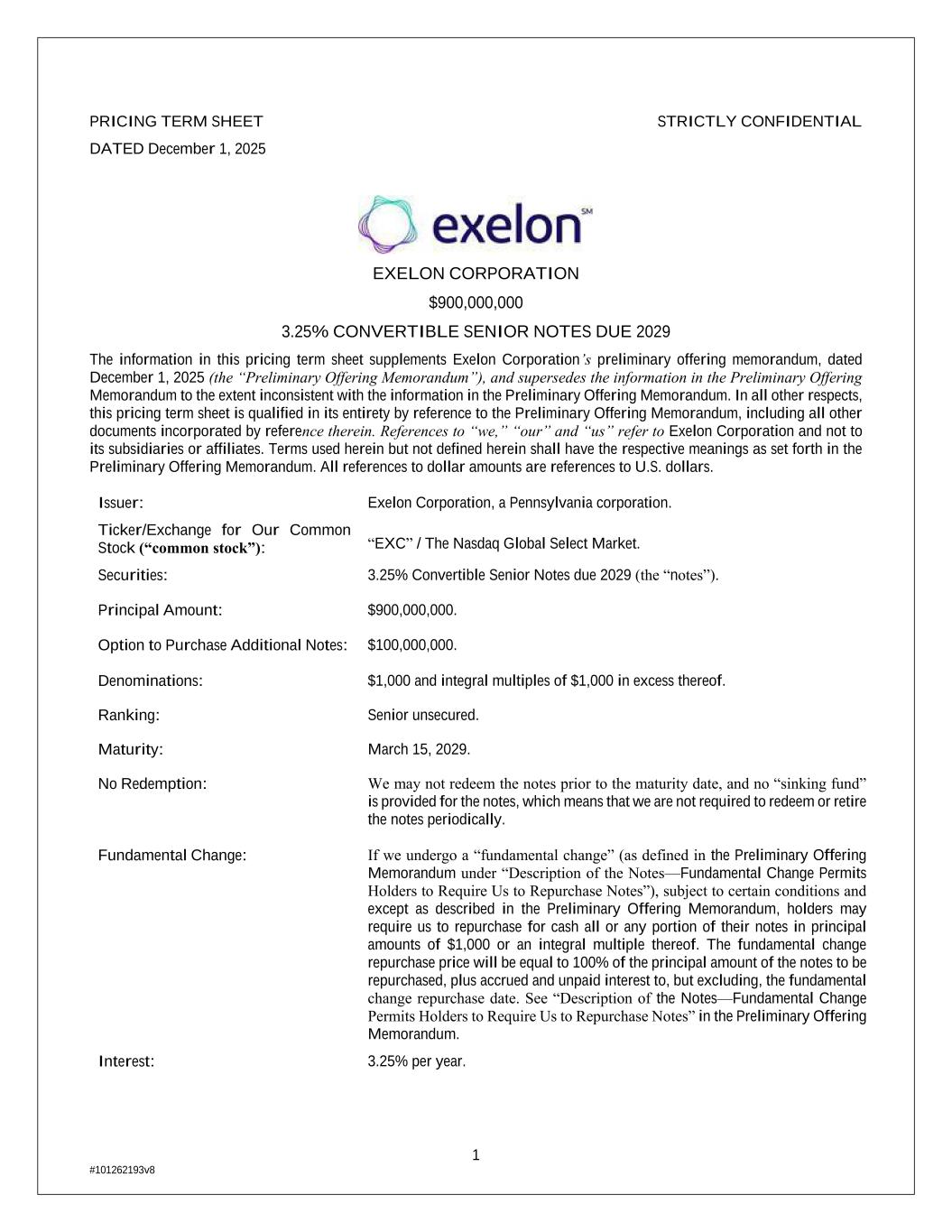

Execution Version 1 EXELON CORPORATION $900,000,000 3.25% Convertible Senior Notes due 2029 PURCHASE AGREEMENT December 1, 2025 J.P. Morgan Securities LLC 270 Park Avenue, New York, New York 10017 Barclays Capital Inc. 745 Seventh Avenue New York, New York 10019 Morgan Stanley & Co. LLC 1585 Broadway New York, New York 10036 as Representatives of the several Initial Purchasers listed in Schedule I hereto Ladies and Gentlemen: Exelon Corporation, a corporation organized under the laws of the Commonwealth of Pennsylvania (the “Company”), proposes to issue and sell $900,000,000 aggregate principal amount of its 3.25% Convertible Senior Notes due 2029 (the “Firm Notes”) to the several parties in Schedule I hereto (each, an “Initial Purchaser” and collectively, the “Initial Purchasers”) for which J.P. Morgan Securities LLC, Barclays Capital Inc., and Morgan Stanley & Co. LLC are acting as representatives (collectively, the “Representatives”). The Notes will (i) have terms and provisions which are summarized in the Disclosure Package as of the Applicable Time and the Offering Memorandum dated the date hereof (each as defined in Section 2(a) hereof), and (ii) are to be issued pursuant to an Indenture by and between the Company and The Bank of New York Mellon Trust Company, N.A., as trustee (the “Trustee”), to be dated as of December 4, 2025 (the “Indenture”). The Company also proposes to issue and sell to the Initial Purchasers, not more than an additional $100,000,000 of its 3.25% Convertible Senior Notes due 2029 (the “Additional Notes”) if and to the extent that the Initial Purchasers shall have determined to exercise the right to purchase such 3.25% Convertible Senior Notes due 2029 granted to the Initial Purchasers in Section 3(b) hereof. The Firm Notes and the Additional Notes are hereinafter collectively referred to as the “Notes.” The Notes will be convertible into cash up to the aggregate principal amount of such Notes and cash, shares (the “Underlying Common Stock”) of the Company’s common stock, no par value (the “Common Stock”), or a combination of cash and shares of Common Stock, at the Company’s election, in respect of the remainder, if any, of the Company’s conversion obligation in excess of the aggregate principal amount of such Notes being converted. This

2 agreement (this “Agreement”) is to confirm the agreement concerning the purchase of the Notes from the Company by the Initial Purchasers. 1. Purchase of the Notes by the Initial Purchasers. Subject to the terms and conditions and upon the basis of the representations and warranties herein set forth, the Company agrees to issue and sell to the Initial Purchasers, and each of the Initial Purchasers agrees, severally and not jointly, to purchase from the Company, at a price equal to 98.75% of the principal amount thereof, plus accrued interest, if any, from December 4, 2025, the principal amount of the Notes set forth opposite such Initial Purchaser’s name in Schedule I hereto. It is understood and acknowledged that upon original issuance thereof, and until such time as the same is no longer required under the applicable requirements of the Securities Act of 1933, as amended (the “Securities Act”), the Notes (and all securities issued in exchange therefor or in substitution thereof) will bear a restricted legend substantially as set forth in the Disclosure Package and the Offering Memorandum. You have advised the Company that you will make offers (the “Exempt Resales”) of the Notes purchased by you hereunder on the terms set forth in the Disclosure Package and the Offering Memorandum, as amended or supplemented, solely to persons whom you reasonably believe to be “qualified institutional buyers” (“QIBs”) as defined in Rule 144A under the Securities Act. 2. Representations, Warranties and Agreements of the Company. As of the date of this Agreement, the Applicable Time and the Closing Date, the Company represents and warrants to, and agrees with, each Initial Purchaser that: (a) The Company (i) has prepared the preliminary offering memorandum dated December 1, 2025, (the “Preliminary Offering Memorandum”) and will prepare the offering memorandum dated the date hereof (the “Offering Memorandum”), each relating to the Notes and provided to the Representatives for use by the Initial Purchasers in connection with the offering of the Notes; and (ii) will prepare the term sheets pursuant to Section 7(a) hereof and substantially in the form attached in Schedule II hereto (collectively, the “Final Term Sheet”), and may prepare any Issuer Written Information (as defined below) for use by the Company in connection with the offering of the Notes at or before 5:00 P.M. (New York City time) on the date of this Agreement (the “Applicable Time”) (the Preliminary Offering Memorandum and such Final Term Sheet, together, the “Disclosure Package”). Any reference to the Preliminary Offering Memorandum, the Disclosure Package or the Offering Memorandum will be deemed to refer to and include the Company’s most recent Annual Report on Form 10-K and all subsequent documents filed with the Securities and Exchange Commission (the “Commission”) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1943, as amended (the “Exchange Act”), on or prior to the date of the Preliminary Offering Memorandum, the Disclosure Package or the Offering Memorandum, as the case may be. Any reference to the Preliminary Offering Memorandum, Disclosure Package or the Offering Memorandum, as the case may be, as amended or supplemented, as of any specified date, will be deemed to include any documents filed with the Commission pursuant to Section 13(a) or 15(d)

3 of the Exchange Act after the date of the Preliminary Offering Memorandum, Disclosure Package or the Offering Memorandum, as the case may be, and prior to such specified date. (b) When the Notes are issued and delivered pursuant to this Agreement, the Notes will not be of the same class (within the meaning of Rule 144A) as securities of the Company that are listed on a national securities exchange registered under Section 6 of the Exchange Act or that are quoted in a United States automated inter-dealer quotation system. (c) Assuming the accuracy of your representations and warranties in Section 3(b), the purchase and resale of the Notes pursuant hereto (including pursuant to the Exempt Resales) are exempt from the registration requirements of the Securities Act. (d) None of the Company or any person acting on its behalf (other than the Initial Purchasers, as to whom no representation or warranty is made) has solicited offers for, or offered or sold, the Notes by means of any form of general solicitation or general advertising within the meaning of Rule 502(c) of Regulation D or in any manner involving a public offering within the meaning of Section 4(2) of the Securities Act. (e) Each of the Preliminary Offering Memorandum, as of its date, the Disclosure Package, as of the Applicable Time, and the Offering Memorandum, as of its date and the Closing Date, contains or will contain, as the case may be, all the information specified in, and meeting the requirements of, Rule 144A(d)(4) under the Securities Act. (f) The Preliminary Offering Memorandum, the Disclosure Package and the Offering Memorandum have been prepared by the Company for use by the Initial Purchasers in connection with the Exempt Resales. No order or decree preventing or suspending the use of the Preliminary Offering Memorandum, the Disclosure Package or the Offering Memorandum, or any order asserting that the transactions contemplated by this Agreement are subject to the registration requirements of the Securities Act has been issued, and no proceeding for any such purpose has commenced or is pending or, to the knowledge of the Company is contemplated. (g) No proceeding has been instituted or threatened by the Commission with respect to any document incorporated by reference in the Disclosure Package and the Offering Memorandum. (h) The Company has not made and will not make any written communication that constitutes an offer to sell or solicitation of an offer to buy the Notes (each such communication by the Company, an Issuer Written Information) without the prior consent of the Representatives; and any such Issuer Written Information, the use of which has been previously consented to by the Initial Purchasers, (i) is identified on Schedule IV, (ii) will not, as of its issue date and through the time the Notes are delivered pursuant to Section 3 hereof, include any information that conflicts with the information contained in the Disclosure Package and the Offering Memorandum and (iii) when considered together with the information contained in the Disclosure Package, did not, as of the Applicable Time, does not, as of the date hereof, and will not, as of the Closing Date, contain any untrue statement of a material fact or omit to state any material fact required to be

4 stated therein or necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading. (i) None of the Company or any other person acting on behalf of the Company has sold or issued any securities that would be integrated with the offering of the Notes contemplated by this Agreement pursuant to the Securities Act, the rules and regulations thereunder or the interpretations thereof by the Commission. (j) The Disclosure Package did not, as of the Applicable Time, contain any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading; provided, however, that no representation or warranty is made as to information contained in or omitted from the Disclosure Package in reliance upon and in conformity with written information furnished to the Company through the Representatives by or on behalf of any Initial Purchaser specifically for inclusion therein (which information is specified in Section 7(b) hereof). (k) The Offering Memorandum, and any amendment or supplement thereto, will not, as of its date and on the Closing Date, contain any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading; provided, however, that no representation or warranty is made as to information contained in or omitted from the Offering Memorandum in reliance upon and in conformity with written information furnished to the Company through the Representatives by or on behalf of any Initial Purchaser specifically for inclusion therein (which information is specified in Section 7(b) hereof). (l) The documents incorporated by reference in the Disclosure Package or the Offering Memorandum did not, and any further documents incorporated by reference therein will not, when filed with the Commission, contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. (m) There is no contract or document required to be described in the Disclosure Package or the Offering Memorandum or to be filed as an exhibit to a document incorporated by reference into the Disclosure Package or the Offering Memorandum which is not described or filed as required. (n) The Notes, if and when issued, will satisfy the eligibility requirements of Rule 144A(d)(3) under the Securities Act. (o) Assuming the accuracy of the representations and warranties of the Initial Purchasers in Section 3 of this Agreement, no registration under the Securities Act of the Notes, and no qualification of the Indenture under the Trust Indenture Act, will be required for the sale and delivery of the Notes in the manner contemplated herein, in the Disclosure Package and the Offering Memorandum.

5 (p) The Company has been duly organized and is validly subsisting as a corporation in good standing under the laws of the Commonwealth of Pennsylvania with full power and authority under its charter and bylaws to execute, deliver and perform its obligations under each Transaction Agreement, and to own or lease, as the case may be, and to operate its properties and conduct its business as described in the Disclosure Package and the Offering Memorandum, and is duly qualified to do business as a foreign entity and is in good standing under the laws of each jurisdiction which requires such qualification, except where the failure to be so qualified would not reasonably be expected, individually or in the aggregate, to have a material adverse effect on the condition (financial or otherwise), results of operations, stockholders’ equity, properties or prospects of the Company and its subsidiaries, taken as a whole (a “Material Adverse Effect”). (q) The Company has an authorized capitalization as set forth in the Disclosure Package and the Offering Memorandum and all of the issued shares of capital stock of the Company have been duly and validly authorized and issued and are fully paid and non-assessable and conform to the description thereof contained in the Disclosure Package and Offering Memorandum; and all of the issued shares of capital stock of each Significant Subsidiary of the Company have been duly and validly authorized and issued, are fully paid and nonassessable and (except for directors’ qualifying shares and except as otherwise set forth in the Disclosure Package and the Offering Memorandum) are owned directly or indirectly by the Company, free and clear of all liens, encumbrances, equities or claims. (r) This Agreement has been duly authorized, executed and delivered by the Company and constitutes the valid and binding agreement of the Company, enforceable against the Company in accordance with its terms, except as the enforceability thereof may be limited by bankruptcy, insolvency, reorganization or similar laws relating to or affecting creditors’ rights generally, by general equitable principles (regardless of whether such enforceability is considered in a proceeding in equity or at law) and, as to rights of indemnification and contribution, by considerations of public policy. (s) The Indenture has been duly authorized, executed and delivered by the Company and is a valid and binding agreement of the Company enforceable against the Company in accordance with its terms, except as the enforceability thereof may be limited by bankruptcy, insolvency, reorganization or similar laws relating to or affecting creditors’ rights generally and by general equitable principles (regardless of whether such enforceability is considered in a proceeding in equity or at law). On the date hereof and on the Closing Date, the Indenture did and will comply in all material respects with the applicable requirements of the Trust Indenture Act and the rules thereunder. The Indenture conforms to the description thereof in the Disclosure Package and the Offering Memorandum. (t) The Notes have been duly authorized by the Company and, when executed by the Company and authenticated by the Trustee in accordance with the Indenture and delivered to the Initial Purchasers against payment therefor in accordance with the terms of this Agreement, will be validly issued and delivered, and will constitute valid and binding obligations of the Company entitled to the benefits of the Indenture and enforceable against the Company in accordance with their terms, except as enforcement thereof may be limited by bankruptcy, insolvency, reorganization or other similar laws relating to or affecting the enforcement of creditors’ rights

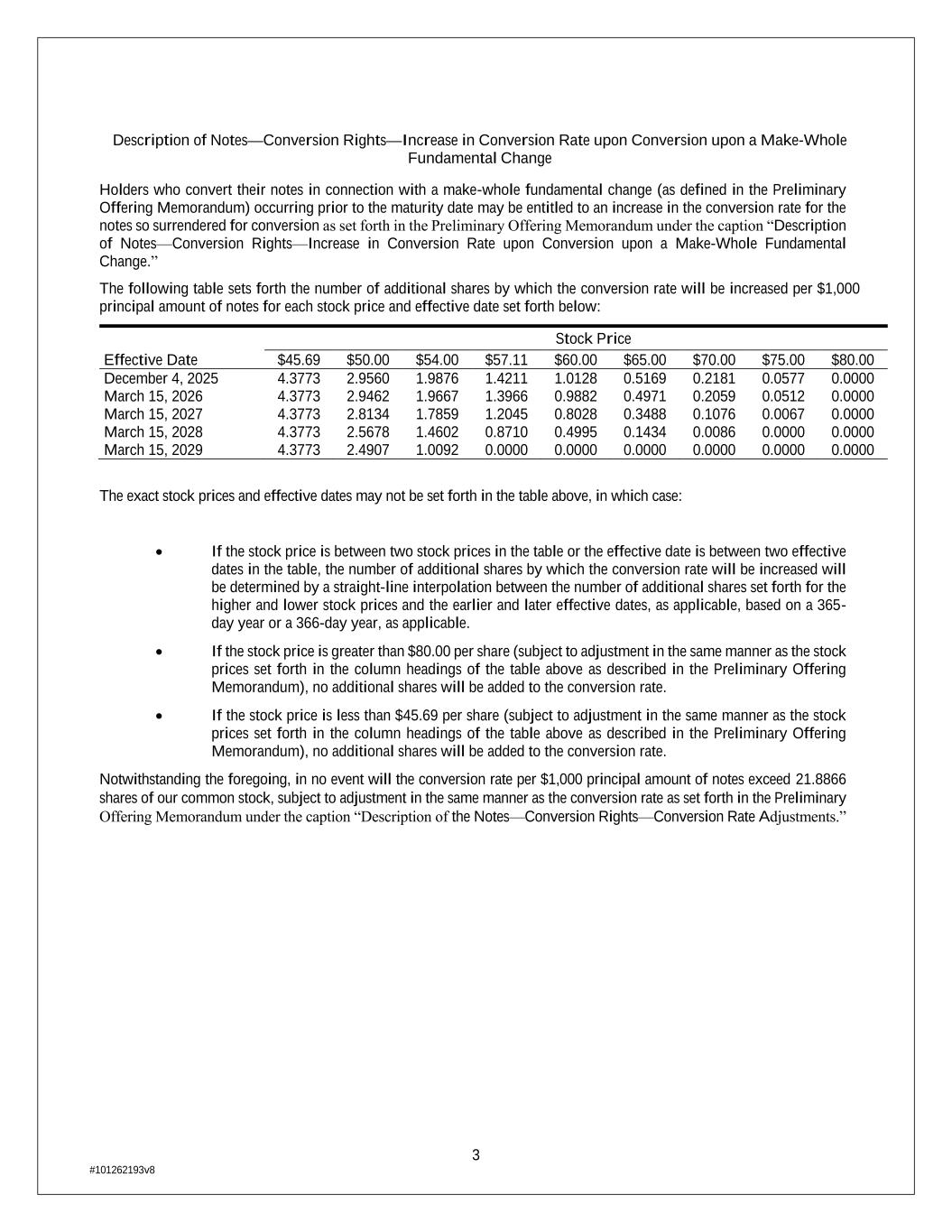

6 generally and by general equitable principles (regardless of whether such enforceability is considered in a proceeding in equity or at law), and the Notes conform, or will conform, to the description thereof in the Disclosure Package and the Offering Memorandum. (u) Upon issuance and delivery of the Notes in accordance with this Agreement and the Indenture, the Notes will be convertible at the option of the holders thereof into cash up to the aggregate principal amount of such Notes and cash, shares of Underlying Common Stock or a combination of cash and shares of Underlying Common Stock, at the Company’s election, in respect of the remainder, if any, of the Company’s conversion obligation in excess of the aggregate principal amount of such Notes being converted, in accordance with the terms of the Notes and the Indenture. A number of shares of Underlying Common Stock equal to the product of (x) the number of Notes (assuming the Initial Purchasers exercise their option to purchase Additional Notes in full) and (y) the Conversion Rate (as such term is defined in the Indenture) for the Notes (assuming the maximum increase to the Conversion Rate (as such term is defined in the Indenture) upon conversion of the Notes in connection with a Make-Whole Fundamental Change (as such term is defined in the Indenture)) (the “Maximum Number of Underlying Common Stock”) have been duly authorized and reserved by the Company and, when issued upon conversion of the Notes in accordance with the terms of the Notes, will be validly issued, fully paid and non- assessable, and any issuance of any Underlying Common Stock will not be subject to any preemptive or similar rights, and the Underlying Common Stock will conform, when so issued, to the description thereof in the Disclosure Package and the Offering Memorandum. (v) None of the execution or delivery of this Agreement by the Company, the consummation of the transactions contemplated hereby, the execution and delivery of the Indenture and the Notes (together with this Agreement, collectively, the “Transaction Agreements”) by the Company, or compliance by the Company with all of the provisions of the Transaction Agreements (including issuance of up to the Maximum Number of Underlying Common Stock) will result in a breach or violation of, or constitute a default under, or result in the creation or imposition of any claim, lien, encumbrance or security interest upon any property or asset of the Company or any of its Significant Subsidiaries under, (i) the charter or bylaws of the Company or the organizational documents of any of its Significant Subsidiaries; (ii) the terms of any indenture, contract, lease, mortgage, deed of trust, note agreement, loan agreement or other agreement, obligation, condition, covenant or instrument to which the Company or any of its Significant Subsidiaries is a party or bound or to which its or their property is subject; or (iii) any statute, law, rule, regulation, judgment, order or decree applicable to the Company or any of its Significant Subsidiaries of any court, regulatory body, administrative agency, governmental body, arbitrator or other authority having jurisdiction over the Company or any of its Significant Subsidiaries or any of its or their properties except (x) in the case of clauses (ii) and (iii) above, for any such conflict, breach, violation or default that would not, individually or in the aggregate, (A) reasonably be expected to have a material adverse effect on the performance of the Transaction Agreements, or the consummation of any of the transactions contemplated herein; or (B) reasonably be expected to have a Material Adverse Effect and (y) in the case of clause (iii) above, for any such violation that may arise (A) under applicable state securities laws or rules and regulations of the Financial Industry Regulatory Authority (“FINRA”) or any foreign laws or statutes in connection with the purchase and distribution of the Notes by the Initial Purchasers or

7 (B) as a result of the legal or regulatory status of any person (other than the Company) or because of any other facts specifically pertaining to such person. (w) No consent, approval, order, filing or authorization of any governmental agency or body or court is required in connection with the consummation of the transactions contemplated by the Transaction Agreements (including issuance of up to the Maximum Number of Underlying Common Stock) except such as may be required under the blue sky laws of any jurisdiction in connection with the purchase and distribution of the Notes by the Initial Purchasers and the listing of the Underlying Common Stock on the Nasdaq Global Select Market (the “Exchange”) in the manner contemplated by this Agreement, the Disclosure Package and the Offering Memorandum. (x) The Company and its subsidiaries own or lease all such properties as are necessary for the conduct of the Company’s operations as presently conducted. (y) The statements in the Disclosure Package and the Offering Memorandum under the headings “Description of the Notes” and “Description of the Notes—No Registration Rights; Additional Interest” fairly summarize the matters therein described. (z) There are no contracts, agreements or understandings among the Company and any person granting such person the right to require the Company to file a registration statement under the Securities Act with respect to any securities of the Company owned or to be owned by such person or to require the Company to include such securities in any securities being registered pursuant to any other registration statement filed by the Company under the Securities Act. (aa) The financial statements and the related notes thereto included or incorporated by reference in each of the Disclosure Package and the Offering Memorandum present fairly in all material respects the financial position of the entities purported to be shown thereby as of the dates indicated and the results of their operations and the changes in their cash flows for the periods specified; such financial statements have been prepared in conformity with U.S. generally accepted accounting principles applied on a consistent basis throughout the periods covered thereby; and the other financial information included or incorporated by reference in each of the Disclosure Package and the Offering Memorandum has been derived from the accounting records of the entities purported to be shown thereby and presents fairly in all material respects the information shown thereby. (bb) PricewaterhouseCoopers LLP is an independent registered public accounting firm with respect to the Company as required by the Securities Act and the rules and regulations of the Commission and the Public Company Accounting Oversight Board thereunder. (cc) The Company maintains systems of internal accounting controls sufficient to provide reasonable assurance that transactions are executed in accordance with management’s general or specific authorizations, transactions are recorded as necessary to permit preparation of financial statements in conformity with generally accepted accounting principles and to maintain asset accountability, access to assets is permitted only in accordance with management’s general or specific authorizations, and the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences.

8 (dd) The Company maintains disclosure controls and procedures (as such term is defined in Rule 13a-15(e) under the Exchange Act) that comply with the requirements of the Exchange Act, such disclosure controls and procedures have been designed to ensure that material information relating to the Company is made known to the Company’s principal executive officer and principal financial officer by others within those entities, and such disclosure controls and procedures are effective. (ee) The Company has not taken, directly or indirectly, any action designed to or that would constitute or that might reasonably be expected to cause or result, under the Exchange Act or otherwise, in the stabilization or manipulation of the price of any security of the Company to facilitate the sale or resale of the Notes. (ff) Neither the Company, any of its subsidiaries, or any director, officer, or employee thereof, nor, to the knowledge of the Company, any agent affiliate, or other person associated with or acting on behalf of the Company or any of its subsidiaries, has (i) used any corporate funds for any unlawful contribution, gift, entertainment or other unlawful expense relating to political activity; (ii) made any direct or indirect unlawful payment to any foreign or domestic government official or employee from corporate funds; (iii) violated or is in violation of any provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended, the UK Bribery Act 2010, or other similar anti-bribery or anti-corruption law (collectively, “Anti-Corruption Laws”); or (iv) made, offered, agreed, requested or taken an act in furtherance of any unlawful bribe or other unlawful benefit, including, without limitation, any rebate, payoff, influence payment, kickback or other unlawful or improper payment or benefit. The Company and its subsidiaries have conducted, and will continue to conduct, their businesses in compliance with Anti-Corruption Laws and have instituted, maintained and enforced, and will continue to institute, maintain and enforce, policies and procedures designed to promote compliance with all applicable Anti-Corruption Laws. (gg) The operations of the Company and its subsidiaries are and have been conducted at all times in compliance with applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended (including, without limitation, by Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act)), the money laundering statutes of all jurisdictions where the Company or any of its subsidiaries conducts business, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency (collectively, the “Anti- Money Laundering Laws”) and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company or its subsidiaries with respect to the Anti-Money Laundering Laws is pending or, to the knowledge of the Company, threatened. The Company and its subsidiaries have instituted and maintained and will continue to maintain policies and procedures reasonably designed to promote and achieve compliance with the Anti-Money Laundering Laws. (hh) Neither the Company, any of its subsidiaries, or any director, officer, or employee thereof, nor to the knowledge of the Company, any agent affiliate, or other person associated with or acting on behalf of the Company or any of its subsidiaries is currently subject to any sanctions

9 administered or enforced by the United States Government (including the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”) and the U.S. Department of State), the United Nations Security Council, the European Union, His Majesty’s Treasury, or any other relevant sanctions authority (collectively, “Sanctions”); nor is the Company or any of its subsidiaries located, organized or resident in a country or territory that is the subject or the target of Sanctions, including, without limitation, Russia, Cuba, Iran, North Korea, Syria, Crimea, the so-called Donetsk People’s Republic, the so-called Luhansk People’s Republic, the non-Ukrainian government controlled areas of the Zaporizhzhia and Kherson regions of Ukraine, or any other Covered Region of Ukraine identified pursuant to Executive Order 14065 (each, a “Sanctioned Country”). The Company and its subsidiaries have instituted and maintained and will continue to maintain policies and procedures reasonably designed to promote and achieve compliance with Sanctions. Since April 24, 2019, to the knowledge of the Company, neither the Company nor any of its subsidiaries has engaged in or is now engaged in any dealings or transactions with any Person, or in any country or territory, that at the time of this dealing or transaction is or was, or whose government is or was, the subject of Sanctions, to the extent such dealings or transactions would be prohibited by applicable Sanctions. The Company will not directly or indirectly use the proceeds of the offering, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other person or entity, (i) to fund or finance the activities of or business with any person, or in any country or territory, that is the subject or the target of Sanctions; (ii) to fund or facilitate any money laundering or terrorist financing activities; or (iii) in any other manner that would cause or result in a violation of any Anti-Corruption Laws, Anti-Money Laundering Laws, or Sanctions by any Person (including any Party to this Agreement). (ii) Except as disclosed in the Disclosure Package and the Offering Memorandum, (i)(x) there has been no material security breach or incident involving unauthorized access or disclosure of any of the Company’s or its subsidiaries’ information technology and computer systems, networks, hardware, software, data (including the data of their respective customers, employees, suppliers, vendors and any third party data maintained by or on behalf of them), equipment or technology (collectively, “IT Systems and Data”) that could reasonably be expected to give rise to a data breach notification obligation to affected individuals under applicable data breach notification law or that could reasonably be expected to require disclosure or a notification thereof to the Commission or other applicable regulatory authority (a “Security Breach”) and (y) the Company and its subsidiaries have not been notified of, and have no knowledge of any event or condition that would reasonably be expected to result in, any Security Breach to their IT Systems and Data; (ii) the Company and its subsidiaries are presently in compliance with all applicable laws or statutes and all judgments, orders, rules and regulations of any court or arbitrator or governmental or regulatory authority, internal policies and contractual obligations relating to the privacy and security of IT Systems and Data and to the protection of such IT Systems and Data from unauthorized use, access, misappropriation or modification, except as would not, in the case of this clause (ii), individually or in the aggregate, have a Material Adverse Effect; and (iii) the Company and its subsidiaries have implemented backup and disaster recovery technology reasonably consistent with industry standards and practices.

10 (jj) No action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company or any of its subsidiaries or its or their property is pending or, to the best knowledge of the Company, threatened that could reasonably be expected, individually or in the aggregate, to have a Material Adverse Effect or materially effect the ability of the Company to perform its obligations under the Transaction Agreements, except as set forth in the Disclosure Package and the Offering Memorandum (exclusive of any amendment or supplement thereto made after the date of this Agreement). (kk) Neither the Company nor any subsidiary is (i) in violation of its operating agreement or its charter, bylaws or other organizational instrument or document; (ii) in default in the performance or observance of any material obligation, agreement, covenant or condition contained in any indenture, contract, lease, mortgage, deed of trust, note agreement, loan agreement or other agreement, obligation, condition, covenant or instrument to which it is a party or bound or to which its property is subject; or (iii) in violation of any material law, rule, regulation, judgment, order or decree applicable to the Company or any of its subsidiaries or any court, regulatory body, administrative agency, governmental body, arbitrator or other authority having jurisdiction over the Company or such subsidiary or any of its properties, as applicable. (ll) The Company and its subsidiaries possess all material licenses, certificates, permits and other authorizations issued by the appropriate federal, state or foreign regulatory authorities necessary to conduct their respective businesses; and neither the Company nor any such subsidiary has received any notice of proceedings relating to the revocation or modification of any such license, certificate, permit or other authorization which, singly or in the aggregate, if the subject of an unfavorable decision, ruling or finding, would have a Material Adverse Effect, whether or not arising from transactions in the ordinary course of business, except as set forth in the Disclosure Package and the Offering Memorandum (exclusive of any amendment or supplement thereto made after the date of this Agreement). (mm) Since the date of the most recent financial statements included or incorporated by reference in the Disclosure Package and the Offering Memorandum, there has not occurred any Material Adverse Effect, or any development involving a prospective Material Adverse Effect, from that set forth in the Disclosure Package. (nn) The Company is not, and after giving effect to the offering and sale of the Notes and the application of the proceeds thereof as described in the Disclosure Package and the Offering Memorandum, will not be required to register as an “investment company” as such term is defined in the Investment Company Act. (oo) The Company is not, and has not been at any time previously, a “shell company” as described in Rule 144(i) under the Securities Act. For purposes of this Section 2, as well as for Section 5 hereof, references to “the Disclosure Package and the Offering Memorandum” are to the Disclosure Package and the Offering Memorandum as separate or stand-alone documentation (and not the Disclosure Package and the Offering Memorandum taken together), so that representations, warranties, agreements, conditions and legal opinions will be made, given or measured independently in respect of each of the Disclosure Package and the Offering Memorandum. Any certificate signed by any officer of the

11 Company and delivered to the Representatives or counsel for the Initial Purchasers in connection with the offering of the Notes shall be deemed a representation and warranty by the Company, as to matters covered thereby, to each Initial Purchaser. 3. Purchase of the Notes by the Initial Purchasers, Agreements to Sell, Purchase and Resell. (a) The Company hereby agrees, on the basis of the representations, warranties, covenants and agreements of the Initial Purchasers contained herein and subject to all the terms and conditions set forth herein, to issue and sell to the Initial Purchasers and, upon the basis of the representations, warranties and agreements of the Company herein contained and subject to all the terms and conditions set forth herein, the Initial Purchasers agree, severally and not jointly, to purchase from the Company, at a purchase price of 98.75% of the principal amount thereof, plus accrued interest from the Closing Date to the date of payment, if any, the principal amount of Firm Notes set forth opposite the name of such Initial Purchaser in Schedule I hereto. The Company shall not be obligated to deliver any of the securities to be delivered hereunder except upon payment for all of the securities to be purchased as provided herein. (b) In addition, the Company hereby agrees, on the basis of the representations and warranties, covenants and agreements of the Initial Purchasers contained herein and subject to all the terms and conditions set forth herein, to issue and sell to the Initial Purchasers the Additional Notes, and the Initial Purchasers shall have the right to purchase, severally and not jointly, up to $100,000,000 aggregate principal amount of Additional Notes, solely for the purpose of covering sales of Securities in excess of the number of Firm Notes, at a purchase price referred to in the preceding paragraph, plus accrued interest from the Closing Date to the date of payment, if any. The Representatives may exercise this right on behalf of the Initial Purchasers in whole or from time to time in part by giving written notice, provided that any Option Closing Date (as defined below) must occur during the thirteen calendar day period from, and including, the Closing Date. Any exercise notice shall specify the principal amount of Additional Notes to be purchased by the Initial Purchasers and the date on which such Additional Notes are to be purchased. Unless otherwise agreed to by the Company, each purchase date must be at least one business day after the written notice is given and may not be earlier than the closing date for the Firm Notes nor later than ten business days after the date of such notice. On each day, if any, that Additional Notes are to be purchased (an “Option Closing Date”), each Initial Purchaser agrees, severally and not jointly, to purchase the principal amount of Additional Notes (subject to such adjustments to eliminate fractional Notes as you may determine) that bears the same proportion to the total principal amount of Additional Notes to be purchased on such Option Closing Date as the principal amount of Firm Notes set forth in Schedule I opposite the name of such Initial Purchaser bears to the total principal amount of Firm Notes. (c) Each of the Initial Purchasers, severally and not jointly hereby represents and warrants to the Company that it will offer the Notes for sale upon the terms and conditions set forth in this Agreement and in the Disclosure Package. Each of the Initial Purchasers, severally and not jointly, hereby represents and warrants to, and agrees with, the Company, on the basis of the representations, warranties and agreements of the Company, that such Initial Purchaser: (i) is a QIB with such knowledge and experience in financial and business matters as are necessary in order to evaluate the merits and risks of an investment in the Notes; (ii) is purchasing the Notes

12 pursuant to a private sale exempt from registration under the Securities Act; and (iii) in connection with the Exempt Resales, will solicit offers to buy the Notes only from, and will offer to sell the Notes only to, QIBs in accordance with this Agreement and on the terms contemplated by the Disclosure Package in connection with the offering of the Notes. (d) The Initial Purchasers have not nor, prior to the later to occur of (A) the Closing Date and (B) completion of the distribution of the Notes, will not, use, authorize use of, refer to or distribute any material in connection with the offering and sale of the Notes other than (i) the Preliminary Offering Memorandum, the Disclosure Package, the Offering Memorandum, (ii) any written communication that contains either (x) no “issuer information” (as defined in Rule 433(h)(2) under the Securities Act) or (y) “issuer information” that was included (including through incorporation by reference) in the Preliminary Offering Memorandum or any Free Writing Offering Document listed on Schedule IV hereto, (iii) the Issuer Written Information listed on Schedule IV hereto, (iv) any written communication prepared by such Initial Purchaser and approved by the Company in writing, or (v) any written communication relating to or that contains the terms of the Notes and/or other information that was included (including through incorporation by reference) in the Preliminary Offering Memorandum, the Disclosure Package or the Offering Memorandum. (e) Each of the Initial Purchasers hereby acknowledges that upon original issuance thereof, and until such time as the same is no longer required under the applicable requirements of the Securities Act, the Notes (and all securities issued in exchange therefore or in substitution thereof) shall bear legends substantially in the forms as set forth in the “Transfer Restrictions” section of the Disclosure Package and Offering Memorandum (along with such other legends as the Company and its counsel deem necessary). Each of the Initial Purchasers understands that the Company and, for purposes of the opinions to be delivered to the Initial Purchasers pursuant to Sections 6(c) and 6(d) hereof, counsel to the Company and counsel to the Initial Purchasers, will rely upon the accuracy and truth of the foregoing representations, warranties and agreements, and the Initial Purchasers hereby consent to such reliance. 4. Payment and Delivery. Delivery of the Notes will be made at the offices of Ballard Spahr LLP, 1735 Market Street, 51st Floor, Philadelphia, Pennsylvania 19103, or at such place or places as mutually may be agreed upon by the Company and the Initial Purchasers, at 10:00 A.M., New York City time, on December 4, 2025 or on such later date not more than three Business Days after such date as may be determined by the Representatives and the Company (the “Closing Date”). Payment for any Additional Notes shall be made to the Company against delivery of such Additional Notes for the respective accounts of the several Initial Purchasers at 10:00 A.M., New York City time, on the Option Closing Date. Delivery of the Notes will be made to the Representatives by or on behalf of the Company against payment of the purchase price therefor by wire transfer of immediately available funds. Delivery of the Notes will be made through the facilities of The Depository Trust Company unless

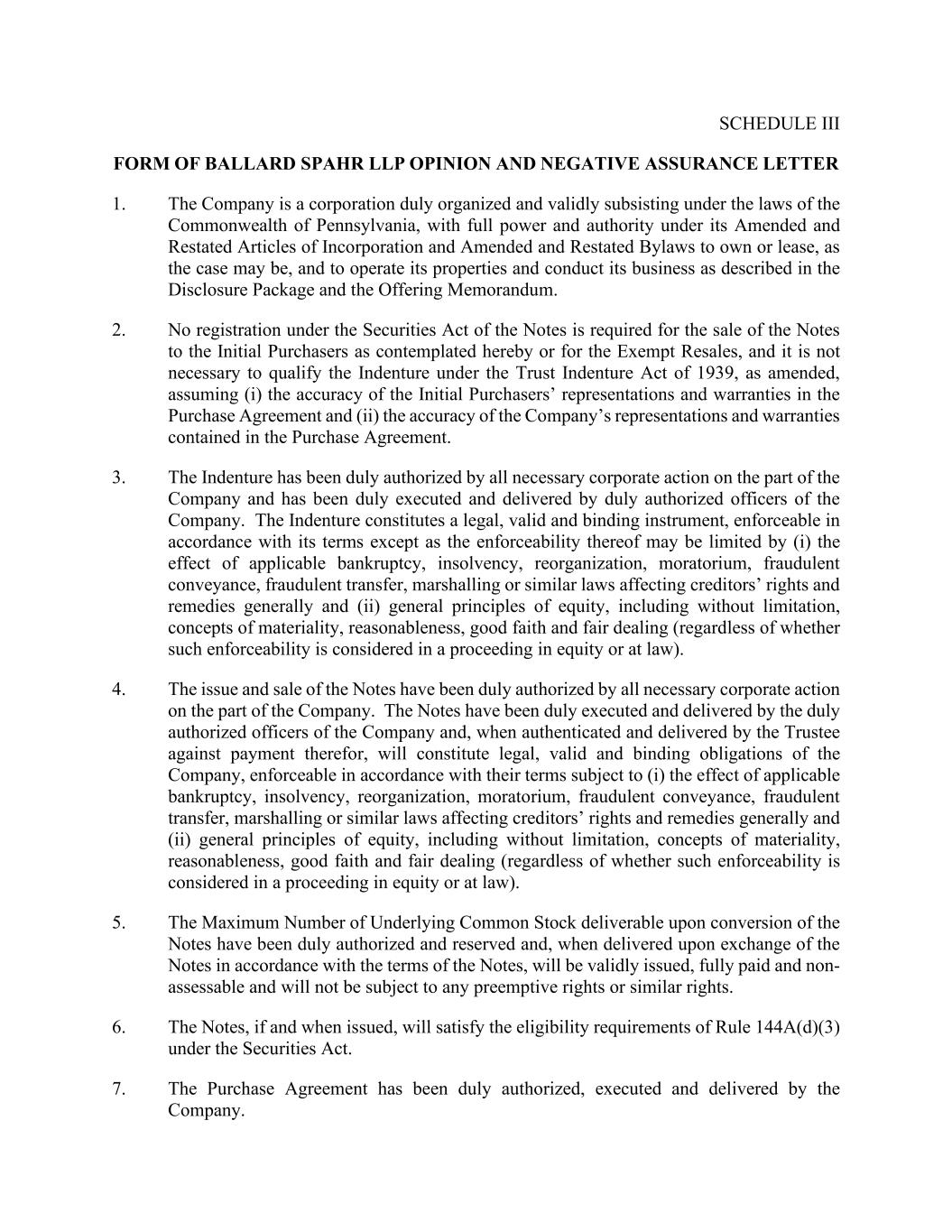

13 the Representatives will otherwise instruct. Delivery of the Notes at the time and place specified in this Agreement is a further condition to the obligations of each Initial Purchaser. 5. Reserved. 6. Conditions to the Initial Purchasers’ Obligations. The obligation of each Initial Purchaser to purchase the Notes on the Closing Date shall be subject to the accuracy of the representations and warranties on the part of the Company contained herein as of the Applicable Time and the Closing Date, to the accuracy of the statements of the Company made in any certificates pursuant to the provisions hereof, and to the performance by the Company of its covenants and other obligations hereunder and to the following additional conditions: (a) No stop order or decree preventing or suspending the qualification of the Notes for offering or sale in any jurisdiction will have been issued. (b) No Initial Purchaser will have been advised by the Company, or will have discovered and disclosed to the Company, that the Disclosure Package, the Offering Memorandum, any Issuer Written Information or any amendment or supplement thereto contains an untrue statement of fact which, in the opinion of the Representatives or of counsel to the Initial Purchasers, is material, or omits to state any fact which, in the opinion of the Representatives or of counsel to the Initial Purchasers, is material and is required to be stated therein or is necessary to make the statements therein not misleading. (c) Ballard Spahr LLP, special counsel for the Company, shall have furnished to the Representatives its opinion, including a negative assurance statement, dated the Closing Date, in substantially the form set forth in Schedule III. (d) The Representatives shall have received from Winston & Strawn LLP, counsel for the Initial Purchasers, such opinion or opinions, including a negative assurance statement, dated the Closing Date and addressed to the Representatives, with respect to the issuance and sale of the Notes, the Indenture, the Offering Memorandum and Disclosure Package and other related matters as the Representatives may reasonably require, and the Company shall have furnished to such counsel such documents as they request for the purpose of enabling them to pass upon such matters. In rendering such opinion, Winston & Strawn LLP may rely, as to matters governed by the laws of the Commonwealth of Pennsylvania, upon the opinion of counsel for the Company referred to in Section 6(c). (e) The Representatives shall have received from Davis Polk & Wardwell LLP, special product counsel for the Initial Purchasers, dated the Closing Date and addressed to the Representatives, such opinion or opinions with respect to such matters as may be reasonably required by the Initial Purchasers and the Company shall have furnished to such counsel such documents as they request for the purpose of enabling them to pass upon such matters. In rendering such opinion, Davis Polk & Wardwell LLP may rely, as to matters governed by the laws of the Commonwealth of Pennsylvania, upon the opinion of counsel for the Company referred to in Section 6(c);

14 (f) The Company shall have furnished to the Representatives a certificate of the Company, signed by two officers, who shall be any of the chief executive officer, the principal financial officer, the principal accounting officer, the chief strategy officer, the treasurer or an assistant treasurer of the Company, dated the Closing Date, to the effect that the signers of such certificate have carefully examined the Disclosure Package, the Offering Memorandum and that: (i) the representations and warranties of the Company in this Agreement are true and correct on and as of the Closing Date, with the same effect as if made on the Closing Date and the Company has complied in all material respects with all the agreements and satisfied all the conditions on its part to be performed or satisfied at or prior to the Closing Date; (ii) the signers of such certificate have carefully examined the Disclosure Package and the Offering Memorandum, and any amendments or supplements thereto (including any documents incorporated or deemed to be incorporated by reference into the Disclosure Package and the Offering Memorandum), and, in their opinion, the Disclosure Package, as of the Applicable Time, and the Offering Memorandum, as of its date, did not and, on the Closing Date, will not include any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading; (iii) since the date of the Preliminary Offering Memorandum, there has occurred no event required to be set forth in an amendment or supplement to the Disclosure Package or the Offering Memorandum which has not been so set forth and there has been no document required to be filed under the Securities Act and the Rules and Regulations or the Exchange Act and the rules and regulations thereunder that upon such filing would be deemed to be incorporated by reference into the Disclosure Package or the Offering Memorandum that has not been so filed; and (iv) since the date of the most recent financial statements included or incorporated by reference in the Disclosure Package and the Offering Memorandum (exclusive of any amendment or supplement thereto), there has been no Material Adverse Effect, except as set forth in or contemplated in the Disclosure Package and the Offering Memorandum (exclusive of any amendment or supplement thereto). (g) Subsequent to the execution and delivery of this Agreement and prior to the Closing Date: (i) there shall not have occurred any downgrading, nor shall the Company have received any notice from any “nationally recognized statistical rating organization,” as such term is defined in Section 3(a)(62) under the Exchange Act of any intended or potential downgrading or of any review for a possible change that does not indicate the direction of the possible change, in the rating accorded the Company or any of the securities of the Company or any of its subsidiaries or in the rating outlook for the Company; and (ii) there shall not have occurred any change, or any development involving a prospective change, in the condition, financial or otherwise, or in the earnings, business or operations of the Company and its subsidiaries, taken as a whole, from that set forth in the Disclosure Package that, in the judgment of the Representatives, is material and adverse

15 and that makes it, in the judgment of the Representatives, impracticable or inadvisable to proceed with the offer, sale and delivery of the Notes on the terms and in the manner contemplated in the this agreement and the Disclosure Package. (h) The Initial Purchasers shall have received, on each of the date hereof and the Closing Date, a letter dated the date hereof or the Closing Date, as the case may be, in form and substance satisfactory to the Initial Purchasers, from PricewaterhouseCoopers LLP, independent public accountants of the Company, containing statements and information of the type ordinarily included in accountants’ “comfort letters” to Initial Purchasers with respect to the financial statements and certain financial information contained in the Disclosure Package and the Offering Memorandum; provided that the letter delivered on the Closing Date shall use a “cut-off date” not earlier than three business days prior to the Closing Date. (i) On the Closing Date, the Initial Purchasers shall have received a fully executed copy of each Transaction Agreement. (j) The Company shall have executed and delivered each Transaction Agreement, in form and substance reasonably satisfactory to the Initial Purchasers, and the Initial Purchasers shall have received executed copies thereof. (k) Prior to the Closing Date, the Company shall have furnished to the Representatives such further information, certificates and documents as the Representatives may reasonably request. If any of the conditions specified in this Section 6 shall not have been fulfilled in all material respects when and as provided in this Agreement, or if any of the opinions and certificates mentioned above or elsewhere in this Agreement shall not be in all material respects reasonably satisfactory in form and substance to the Representatives and counsel for the Initial Purchasers, this Agreement and all obligations of the Initial Purchasers hereunder may be canceled at, or at any time prior to, the Closing Date by the Representatives. Notice of such cancellation shall be given to the Company in writing or by telephone or facsimile confirmed in writing. (l) A number of shares of Common Stock equal to the Maximum Number of Underlying Common Stock shall have been approved for listing on the Exchange, subject only to official notice of issuance, if required. The obligations of the Initial Purchasers to purchase Additional Notes hereunder are subject to the delivery to the Representatives on the applicable Option Closing Date of such documents as the Representatives may reasonably request with respect to the good standing of the Company, the due authorization and issuance of the Additional Notes to be sold on such Option Closing Date and other matters related to the issuance of such Additional Notes. 7. Covenants of the Company. The Company covenants with each Initial Purchaser that: (a) The Company (i) will prepare each of the Preliminary Offering Memorandum and the Offering Memorandum in a form approved by the Representatives; (ii) will not file any document under the Exchange Act before the completion of the distribution of the Notes by the Initial Purchasers if such document would be deemed to be incorporated by reference into the Disclosure Package or the Offering Memorandum, which filing is not consented to by the

16 Representatives after reasonable notice thereof (such consent not to be unreasonably withheld or delayed); (iii) will prepare the Final Term Sheet, substantially in the form of Schedule II hereto and approved by the Representatives; (iv) will advise the Representatives promptly after it receives notice thereof, of the issuance by the Commission or any state or other regulatory body of any order or decree preventing or suspending the use of the Preliminary Offering Memorandum, the Disclosure Package or the Offering Memorandum; and (v) will use its best efforts to prevent the issuance of any such order and, if such order is issued, to obtain as soon as possible the lifting or withdrawal thereof. (b) The Company will prepare, promptly upon the request of the Representatives, any amendments or supplements to the Disclosure Package or the Offering Memorandum which, in the opinion of the Representatives, may be necessary or advisable in connection with the offering of the Notes. (c) The Company will furnish to each of the Representatives and to counsel for the Initial Purchasers such number of conformed copies of the Preliminary Offering Memorandum, the Disclosure Package, the Offering Memorandum and any Issuer Written Information and all amendments or supplements to any of such documents (including any document filed under the Exchange Act and deemed to be incorporated by reference in the Disclosure Package or the Offering Memorandum), in each case as soon as available and in such quantities as the Representatives may from time to time reasonably request. (d) If at any time prior to completion of the distribution of the Notes any event occurs as a result of which the Disclosure Package or the Offering Memorandum as then amended or supplemented would include or incorporate by reference an untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the circumstances then existing, not misleading, or if during such period it is necessary to amend or supplement the Disclosure Package or the Offering Memorandum, the Company will promptly notify the Representatives and will, subject to Section 7(a) hereof, amend or supplement the Disclosure Package or the Offering Memorandum, as the case may be, (at the expense of the Company) so as to correct such statement or omission or to effect such compliance, and will furnish without charge to each Initial Purchaser as many written and electronic copies of any such amendment or supplement as the Representatives may from time to time reasonably request. (e) As soon as practicable, the Company will make generally available to the Initial Purchasers and its security holders all the information specified in, and meeting the requirements of, Rule 144A(d)(4) under the Securities Act; provided, however, that, so long as the Company files periodic reports pursuant to Section 13 or 15(d) of the Exchange Act for the foregoing periods, the Company will be deemed to comply with this Section 7(e). (f) The Company will, whether or not this Agreement becomes effective or is terminated or the sale of the Notes to the Initial Purchasers is consummated, pay all fees, expenses, costs and charges in connection with: (i) the preparation, printing, filing, delivery and shipping of the Preliminary Offering Memorandum, the Disclosure Package, the Offering Memorandum and any amendments or supplements thereto; (ii) the printing, producing, copying and delivering the Transaction Agreements, the closing documents (including any compilations thereof) and any other agreements, memoranda, correspondence and other documents printed and delivered in

17 connection with the offering, purchase, sale and delivery of the Notes and with the Exempt Resales; (iii) the services of the Company’s independent registered public accounting firm; (iv) the services of the Company’s counsel; (v) the qualification of the Notes under the securities laws of the several jurisdictions as provided in Section 7(j) hereof and the preparation, printing and distribution of a Blue Sky Memorandum (including the related fees and expenses of counsel to the Initial Purchasers); (vi) any rating of the Notes by rating agencies; (vii) the services of the Trustee and any agent of the Trustee (including the fees and disbursements of counsel for the Trustee); (viii) any “roadshow” or other investor presentations relating to the offering of the Notes (including, without limitation, for meetings and travel); (ix) all expenses and application fees related to the listing of the Maximum Number of Underlying Common Stock on the Exchange and (x) otherwise incident to the performance of its obligations hereunder for which provision is not otherwise made in this Section 7(f). It is understood, however, that, except as provided in this Section 7(f) or Sections 8 and 9 hereof, the Initial Purchasers will pay all of their own costs and expenses, including the fees and expenses of counsel to the Initial Purchasers and any advertising expenses incurred in connection with the offering of the Notes. If the sale of the Notes provided for herein is not consummated by reason of acts of the Company or changes in circumstances of the Company pursuant to Section 8 of this Agreement which prevent this Agreement from becoming effective, or by reason of any failure, refusal or inability on the part of the Company to perform any agreement on its part to be performed or because any other condition of the Initial Purchasers’ obligations hereunder is not fulfilled or if the Initial Purchasers decline to purchase the Notes for any reason permitted under this Agreement, the Company will reimburse the Initial Purchasers for all reasonable out-of-pocket disbursements (including fees and expenses of counsel to the Initial Purchasers) incurred by the Initial Purchasers in connection with any investigation or preparation made by them in respect of the marketing of the Notes or in contemplation of the performance by them of their obligations hereunder. (g) Until completion of the distribution of the Notes, the Company will timely file all reports, documents and amendments to previously filed documents required to be filed by it pursuant to Section 12, 13(a), 13(c), 14 or 15(d) of the Exchange Act. (h) The Company will apply the net proceeds from the sale of the Notes as set forth in the Disclosure Package and the Offering Memorandum. (i) For a period commencing on the date hereof and ending on the 30th day after the date of the Offering Memorandum, the Company agrees not to, directly or indirectly, (i) offer for sale, sell, or otherwise dispose of (or enter into any transaction or device that is designed to, or would be expected to, result in the disposition by any person at any time in the future of) any shares of Common Stock or securities convertible into or exchangeable for shares of Common Stock (other than the shares of Common Stock issued pursuant to (i) employee benefit plans, qualified stock option plans, other employee compensation plans or non-employee director compensation programs (collectively, “Compensation Plans”) existing on the date hereof and disclosed in the Disclosure Package or pursuant to currently outstanding options, warrants or rights not issued under one of those plans or (ii) any existing forward sales contract), or sell or grant options, rights or warrants with respect to any shares of Common Stock or securities convertible into or

18 exchangeable for shares of Common Stock (other than the grant of options and other equity awards pursuant to Compensation Plans existing on the date hereof and disclosed in the Disclosure Package), (ii) enter into any swap or other derivatives transaction that transfers to another, in whole or in part, any of the economic benefits or risks of ownership of such shares of Common Stock, whether any such transaction described in clause (i) or (ii) above is to be settled by delivery of Common Stock or other securities, in cash or otherwise, (iii) file or cause to be filed a registration statement, including any amendments, with respect to the registration of Common Stock or securities convertible, exercisable or exchangeable into Common Stock (other than any registration statement on Form S-8), or (iv) publicly disclose the intention to do any of the foregoing, in each case without the prior written consent of the Representatives, and to cause each officer, director and stockholder of the Company set forth on Schedule V hereto to furnish to the Representatives, prior to the date of this Agreement, a letter or letters, substantially in the form of Exhibit A hereto (the “Lock-Up Agreements”). Notwithstanding the foregoing, the Company may sell shares of Common Stock pursuant to the Company’s existing at-the-market equity offering program under that certain Equity Distribution Agreement, dated May 2, 2025, by and between the Company and the Agents, Forward Purchasers, and Forward Sellers party thereto (as each such term is defined therein) (including entry into forward contracts not outstanding on the date hereof thereunder), provided that no such sales are effected or forward contracts entered into prior to the earlier of the 14th day after the date of the Offering Memorandum or the date on which the Initial Purchasers exercise their option to purchase the Additional Notes pursuant to Section 3 hereof. For the avoidance of doubt, the preceding sentence shall not prevent the delivery of shares of Common Stock pursuant to the settlement, or early termination, of any forward contract outstanding on the date hereof. For the further avoidance of doubt, nothing contained in this Section 7(i) shall prohibit or in any way restrict, or be deemed to prohibit or in any way restrict, the issuance of the Notes pursuant to this Agreement, the issuance of any Additional Notes or any shares of Underlying Common Stock that may be delivered upon conversion thereof, in each case, in accordance with the terms of the Indenture. (j) The Company will cooperate with the Initial Purchasers and with counsel to the Initial Purchasers in connection with the qualification of the Notes for offering and sale by the Initial Purchasers and by dealers under the securities laws of such jurisdictions as the Initial Purchasers may designate and will file such consents to service of process or other documents necessary or appropriate in order to effect such qualification and to permit the continuance of sales and dealings in such jurisdictions for as long as may be necessary to complete the distribution of the Notes; provided, however, that in no event will either the Company be obligated to qualify to do business in any jurisdiction where it is not now so qualified or to take any action which would subject it to service of process in suits, other than for actions or proceedings arising out of the offering or sale of the Notes, in any jurisdiction where it is not now so subject. (k) The Company will not take, directly or indirectly, any action designed to cause or result in, or that might cause or result in, stabilization or manipulation of the price of the Notes to facilitate the sale or resale of the Notes.

19 (l) The Company will comply with all agreements set forth in the representation letters of the Company to DTC relating to the acceptance of the Notes for “book-entry” transfer through the facilities of DTC. (m) The Company will not, and will not permit any of its affiliates (as defined in Rule 144 under the Securities Act) to, resell any of the Notes that have been acquired by any of them, except for Notes purchased by the Company or any of its affiliates and resold in a transaction registered under the Securities Act. (n) The Company will not offer or sell any security that would be integrated with the sale of the Notes in a manner that would require the registration under the Securities Act of the sale to the Initial Purchasers or QIBs. (o) The Company will reserve and keep available at all times, free of pre-emptive rights, the Maximum Number of Underlying Common Stock for the purpose of enabling the Company to satisfy all obligations to issue any shares of Underlying Common Stock upon conversion of the Notes. The Company will use its best efforts to cause and maintain the listing of the Maximum Number of Underlying Common Stock on the Exchange. 8. Indemnity and Contribution. (a) The Company agrees to indemnify and hold harmless, each Initial Purchaser, each person, if any, who controls any Initial Purchaser within the meaning of either Section 15 of the Securities Act or Section 20 of the Exchange Act and each affiliate, director, officer, employee and agent of any Initial Purchaser from and against any and all losses, claims, damages and liabilities (including, without limitation, any legal or other expenses reasonably incurred in connection with defending or investigating any such action or claim) caused by any untrue statement or alleged untrue statement of a material fact contained in the Preliminary Offering Memorandum, the Disclosure Package, any Issuer Written Information that the Company has used or referred to in connection with the sale of the Notes or the Offering Memorandum or any amendment or supplement thereto (if the Company furnished any amendments or supplements thereto), or caused by any omission or alleged omission to state therein a material fact required to be stated therein or necessary to make the statements therein, with respect to the Preliminary Offering Memorandum, the Disclosure Package or any Issuer Written Information that the Company has used or referred to in connection with the sale of Notes or the Offering Memorandum or any amendment or supplement thereto (if the Company furnished any amendments or supplements thereto), not misleading in light of the circumstances under which they were made, except in each case insofar as such losses, claims, damages or liabilities are caused by any such untrue statement or omission or alleged untrue statement or omission based upon information relating to any Initial Purchaser furnished to the Company in writing by such Initial Purchaser through the Representatives expressly for use therein.

20 (b) Each Initial Purchaser agrees, severally and not jointly, to indemnify and hold harmless the Company and their respective directors, principal executive officer or officers, principal financial officer, controller or principal accounting officer, and each person if any, who controls the Company within the meaning of either Section 15 of the Securities Act or Section 20 of the Exchange Act to the same extent as the foregoing indemnity from the Company to such Initial Purchaser, but only with reference to information relating to such Initial Purchaser furnished to the Company in writing by such Initial Purchaser through the Representatives expressly for use in the Preliminary Offering Memorandum, the Disclosure Package or any Issuer Written Information that the Company have used or referred to in connection with the sale of Notes or the Offering Memorandum or any amendment or supplement thereto. The Company acknowledges that the statements in the first paragraph under the caption “Plan of Distribution – New Issue of Notes” in the Preliminary Offering Memorandum and the Offering Memorandum regarding market making activities of the Initial Purchasers and the first and second paragraphs under the caption “Plan of Distribution – Price Stabilization and Short Positions” in the Preliminary Offering Memorandum and the Offering Memorandum, constitute the only written information furnished to the Company by the Representatives on behalf of the Initial Purchasers, referred to in Sections 2(j), 2(k), 8(a) and 8(b) of this Agreement. (c) In case any proceeding (including any governmental investigation) shall be instituted involving any person in respect of which indemnity may be sought pursuant to Section 8(a) or 8(b), such person (the “indemnified party”) shall promptly notify the person against whom such indemnity may be sought (the “indemnifying party”) in writing and the indemnifying party, upon request of the indemnified party, shall retain counsel chosen by the indemnifying party and reasonably satisfactory to the indemnified party to represent the indemnified party and any others entitled to indemnification pursuant to this Section 8 the indemnifying party may designate in such proceeding and shall pay the reasonably incurred fees and expenses of such counsel related to such proceeding as incurred. In any such proceeding, any indemnified party shall have the right to retain its own counsel, but the reasonably incurred fees and expenses of such counsel shall be at the expense of such indemnified party unless (i) the indemnifying party and the indemnified party shall have mutually agreed to the retention of such counsel, (ii) the named parties to any such proceeding (including any impleaded parties) include both the indemnifying party and the indemnified party and representation of both parties by the same counsel would be inappropriate due to actual or potential differing interests between them or (iii) the indemnifying party shall not have employed counsel satisfactory to the indemnified party within a reasonable time after notice of commencement of any such proceeding. It is understood and agreed that the indemnifying party shall not, in connection with any proceeding or related proceedings in the same jurisdiction, be liable for the reasonably incurred fees and expenses of more than one separate firm (in addition to any local counsel) for all such indemnified parties and that all such reasonably incurred fees and expenses shall be reimbursed as they are incurred. Such firm shall be designated in writing by the Representatives in the case of parties indemnified pursuant to Section 8(a), and by the Company, in the case of parties indemnified pursuant to Section 8(b). The indemnifying party shall not be liable for any settlement of any proceeding effected without its written consent, such consent shall not be unreasonably withheld, but if settled with such consent or if there be a final judgment for the plaintiff, the indemnifying party agrees to indemnify the indemnified party from and against any loss or liability by reason of such settlement or judgment. No indemnifying party shall, without the prior written consent of the indemnified party, provided that such consent shall not be unreasonably withheld, effect any settlement of any pending or threatened proceeding in respect

21 of which any indemnified party is or could have been a party and indemnity could have been sought hereunder by such indemnified party, unless such settlement (x) includes an unconditional release of such indemnified party from all liability on claims that are the subject matter of such proceeding and does not include any statement as to, or an admission of, fault, culpability or failure to act by or on behalf of any indemnified party. Notwithstanding the foregoing sentence, if at any time an indemnified party shall have requested an indemnifying party to reimburse the indemnified party for fees and expenses of counsel as contemplated by the second and third sentences of this paragraph, the indemnifying party agrees that it shall be liable for any settlement of any proceeding effected without its written consent if (i) such settlement is entered into more than 30 days after receipt by such indemnifying party of the aforesaid request and (ii) such indemnifying party shall not have reimbursed the indemnified party in accordance with such request prior to the date of such settlement. (d) To the extent the indemnification provided for in Section 8(a) or Section 8(b) is unavailable to an indemnified party or insufficient in respect of any losses, claims, damages or liabilities referred to therein, then each indemnifying party under such paragraph, in lieu of indemnifying such indemnified party thereunder, shall contribute to the amount paid or payable by such indemnified party as a result of such losses, claims, damages or liabilities (i) in such proportion as is appropriate to reflect the relative benefits received by the indemnifying party or parties on the one hand and the indemnified party or parties on the other hand from the offering of the Notes or (ii) if the allocation provided by clause 8(d)(i) above is not permitted by applicable law, in such proportion as is appropriate to reflect not only the relative benefits referred to in clause 8(d)(i) above but also the relative fault of the indemnifying party or parties on the one hand and of the indemnified party or parties on the other hand in connection with the statements or omissions that resulted in such losses, claims, damages or liabilities, as well as any other relevant equitable considerations. The relative benefits received by the indemnifying party or parties on the one hand and the indemnified party or parties on the other hand in connection with the offering of the Notes shall be deemed to be in the same respective proportions as the net proceeds (before deducting expenses) received by the Company from the sale of Notes and the total discounts and commissions received by the Initial Purchasers in connection therewith, bear to the aggregate offering price of the Notes. The relative fault of the indemnifying party or parties on the one hand and the indemnified party or parties on the other hand shall be determined by reference to, among other things, whether the untrue or alleged untrue statement of a material fact or the omission or alleged omission to state a material fact relates to information supplied by the indemnifying party or parties on the one hand and the indemnified party or parties on the other hand and the parties’ relative intent, knowledge, access to information and opportunity to correct or prevent such statement or omission. The Initial Purchasers’ respective obligations to contribute pursuant to this Section 8 are several in proportion to the respective principal amounts of Notes they have purchased hereunder, and not joint. (e) The Company and the Initial Purchasers agree that it would not be just or equitable if contribution pursuant to this Section 8 were determined by pro rata allocation (even if the Initial Purchasers were treated as one entity for such purpose) or by any other method of allocation that does not take account of the equitable considerations referred to in Section 8(d). The amount paid or payable by an indemnified party as a result of the losses, claims, damages and liabilities referred to in Section 8(d) shall be deemed to include, subject to the limitations set forth above, any legal

22 or other expenses reasonably incurred by such indemnified party in connection with investigating or defending any such action or claim. Notwithstanding the provisions of this Section 8, no Initial Purchaser shall be required to contribute any amount in excess of the amount by which the total discounts and commissions received by such Initial Purchaser with respect to the offering of the Notes exceeds the amount of any damages that such Initial Purchaser has otherwise been required to pay by reason of such untrue or alleged untrue statement or omission or alleged omission. No person guilty of fraudulent misrepresentation (within the meaning of Section 11(f) of the Securities Act) shall be entitled to contribution from any person who was not guilty of such fraudulent misrepresentation. The remedies provided for in this Section 8 are not exclusive and shall not limit any rights or remedies which may otherwise be available to any indemnified party at law or in equity. (f) The indemnity and contribution provisions contained in this Section 8 and the representations, warranties and other statements of the Company contained in this Agreement shall remain operative and in full force and effect regardless of (i) any termination of this Agreement, (ii) any investigation made by or on behalf of any Initial Purchaser, any person controlling any Initial Purchaser or any affiliate, director, officer, employee or agent of any Initial Purchaser or by or on behalf of the Company and its respective officers or directors or any person controlling the Company and (iii) acceptance of and payment for any of the Notes. 9. Defaulting Initial Purchasers. (a) If, on the Closing Date or the Option Closing Date, as the case may be, any Initial Purchaser defaults in its obligations to purchase the Notes that it has agreed to purchase under this Agreement, the remaining non-defaulting Initial Purchasers may in their discretion arrange for the purchase of such Notes by the non-defaulting Initial Purchasers or other persons satisfactory to the Company on the terms contained in this Agreement. If, within 36 hours after any such default by any Initial Purchaser, the non-defaulting Initial Purchasers do not arrange for the purchase of such Notes, then the Company shall be entitled to a further period of 36 hours within which to procure other persons satisfactory to the non-defaulting Initial Purchasers to purchase such Notes on such terms. In the event that within the respective prescribed periods, the non-defaulting Initial Purchasers notify the Company that they have so arranged for the purchase of such Notes, or the Company notifies the non-defaulting Initial Purchasers that it has so arranged for the purchase of such Notes, either the non-defaulting Initial Purchasers or the Company may postpone the Closing Date or the Option Closing Date, as the case may be, for up to seven full business days in order to effect any changes that in the opinion of counsel for the Company or counsel for the Initial Purchasers may be necessary in the Disclosure Package, the Offering Memorandum or in any other document or arrangement, and the Company agrees to promptly prepare any amendment or supplement to the Disclosure Package or the Offering Memorandum that effects any such changes. As used in this Agreement, the term “Initial Purchaser,” unless the context requires otherwise, includes any party not listed in Schedule I hereto that, pursuant to this Section 9, purchases Notes that a defaulting Initial Purchaser agreed but failed to purchase. (b) If, after giving effect to any arrangements for the purchase of the Notes of a defaulting Initial Purchaser or Initial Purchasers by the non-defaulting Initial Purchasers and the Company as provided in paragraph (a) above, the aggregate principal amount of such Notes that remain unpurchased on the Closing Date or the Option Closing Date, as the case may be, does not