February 12, 2026 Earnings Conference Call Fourth Quarter 2025

2 Cautionary Statements Regarding Forward-Looking Information This presentation contains certain forward-looking statements within the meaning of federal securities laws that are subject to risks and uncertainties. Words such as “could,” “may,” “expects,” “anticipates,” “will,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “predicts,” "should," and variations on such words, and similar expressions that reflect our current views with respect to future events and operational, economic and financial performance, are intended to identify such forward-looking statements. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, the following important factors that may cause our actual results or outcomes to differ materially from those contained in our forward-looking statements, including, but not limited to: unfavorable legislative and/or regulatory actions; uncertainty as to outcomes and timing of regulatory approval proceedings and/or negotiated settlements thereof; environmental liabilities and remediation costs; state and federal legislation requiring use of low- emission, renewable, and/or alternate fuel sources and/or mandating implementation of energy conservation programs requiring implementation of new technologies; challenges to tax positions taken, tax law changes, and difficulty in quantifying potential tax effects of business decisions; negative outcomes in legal proceedings; physical security and cybersecurity risks; extreme weather events, natural disasters, operational accidents such as wildfires or natural gas explosions, war, acts and threats of terrorism, public health crises, epidemics, pandemics, or other significant events; disruptions or cost increases in the supply chain, including shortages in labor, materials or parts, or significant increases in relevant tariffs; lack of sufficient power generation resources to meet actual or forecasted demand or disruptions at generation facilities owned by third parties; emerging technologies that could affect or transform the energy industry; instability in capital and credit markets; a downgrade of any Registrant’s credit ratings or other failure to satisfy the credit standards in the Registrants’ agreements or regulatory financial requirements; significant economic downturns or increases in customer rates; impacts of climate change and weather on energy usage and maintenance and capital costs; and impairment of long-lived assets, goodwill, and other assets. New factors emerge from time to time, and it is impossible for us to predict all of such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. For more information, see those factors discussed with respect to the Registrants in PART I, ITEM 1A. RISK FACTORS, and in other reports filed by the Registrants from time to time with the SEC. Investors are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this Report. None of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation.

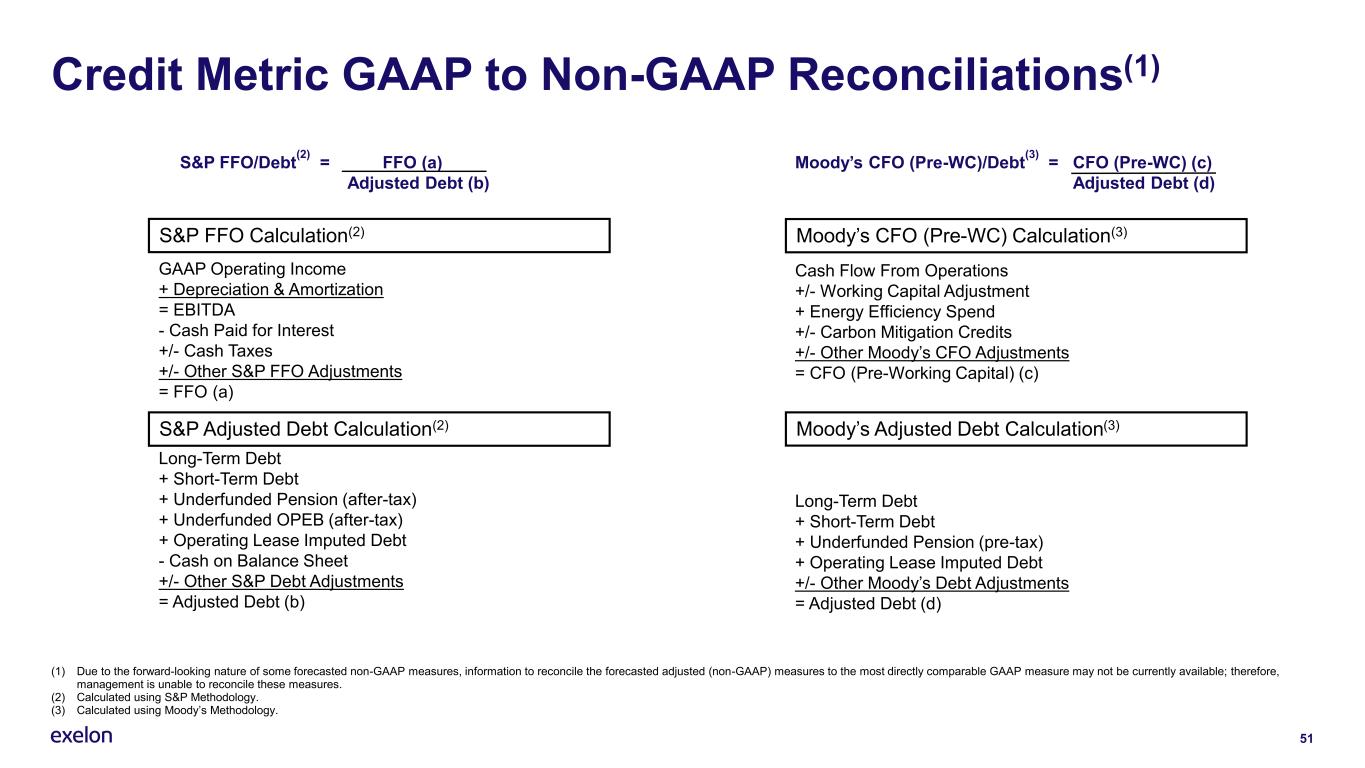

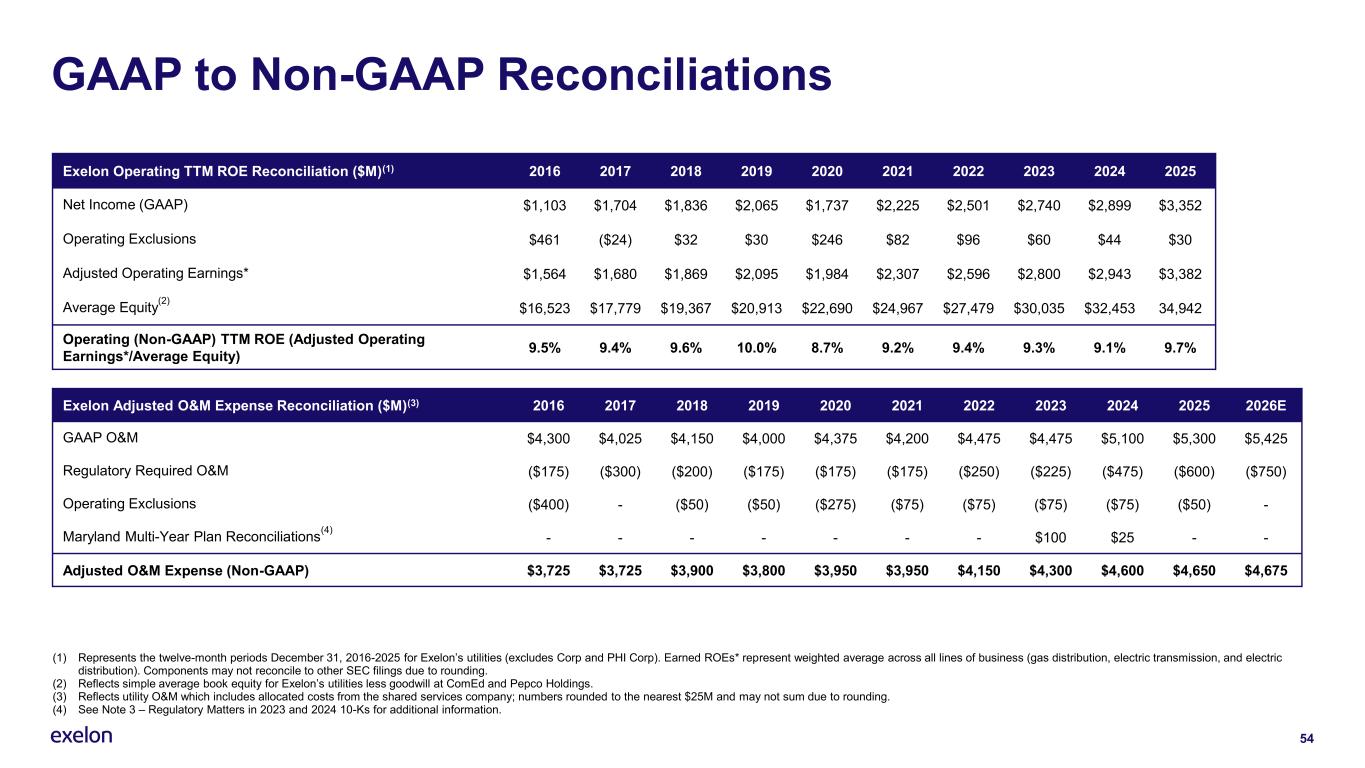

3 Non-GAAP Financial Measures Exelon reports its financial results in accordance with accounting principles generally accepted in the United States (GAAP). Exelon supplements the reporting of financial information determined in accordance with GAAP with certain non-GAAP financial measures, including: • Adjusted operating earnings (operating EPS) excludes certain costs, expenses, gains, and losses and other specified items that are considered by management to be not directly related to the ongoing operations of the business as described in Reconciliation of Non-GAAP Measures. • Adjusted operating and maintenance (O&M) expense excludes regulatory operating and maintenance costs for the utility businesses and certain excluded items. • Operating ROE is calculated using operating net income divided by average equity for the period. The operating income reflects all lines of business for the utility business (gas distribution, electric transmission, and electric distribution). • Adjusted cash from operations primarily includes cash flows from operating activities adjusted for common dividends and change in cash on hand. • S&P FFO/Debt and Moody’s CFO (Pre-WC)/Debt are calculated using the respective S&P and Moody’s methodologies described in Reconciliation of Non-GAAP Measures. Due to the forward-looking nature of some forecasted non-GAAP measures, information to reconcile the forecasted adjusted (non-GAAP) measures to the most directly comparable GAAP measure may not be currently available, therefore, management is unable to reconcile these measures. This information is intended to enhance an investor’s overall understanding of period over period financial results and provide an indication of Exelon’s baseline operating performance by excluding items that are considered by management to be not directly related to the ongoing operations of the business. In addition, this information is among the primary indicators management uses as a basis for evaluating performance, allocating resources, setting incentive compensation targets, and planning and forecasting of future periods. These non-GAAP financial measures are not a presentation defined under GAAP and may not be comparable to other companies’ presentations. Exelon has provided these non- GAAP financial measures as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. These non-GAAP measures should not be deemed more useful than, a substitute for, or an alternative to the most comparable GAAP measures provided in the materials presented. Non-GAAP financial measures are identified by the phrase “non-GAAP” or an asterisk (*). Reconciliations of these non-GAAP measures to the most comparable GAAP measures are provided in this presentation in Reconciliation of Non-GAAP Measures.

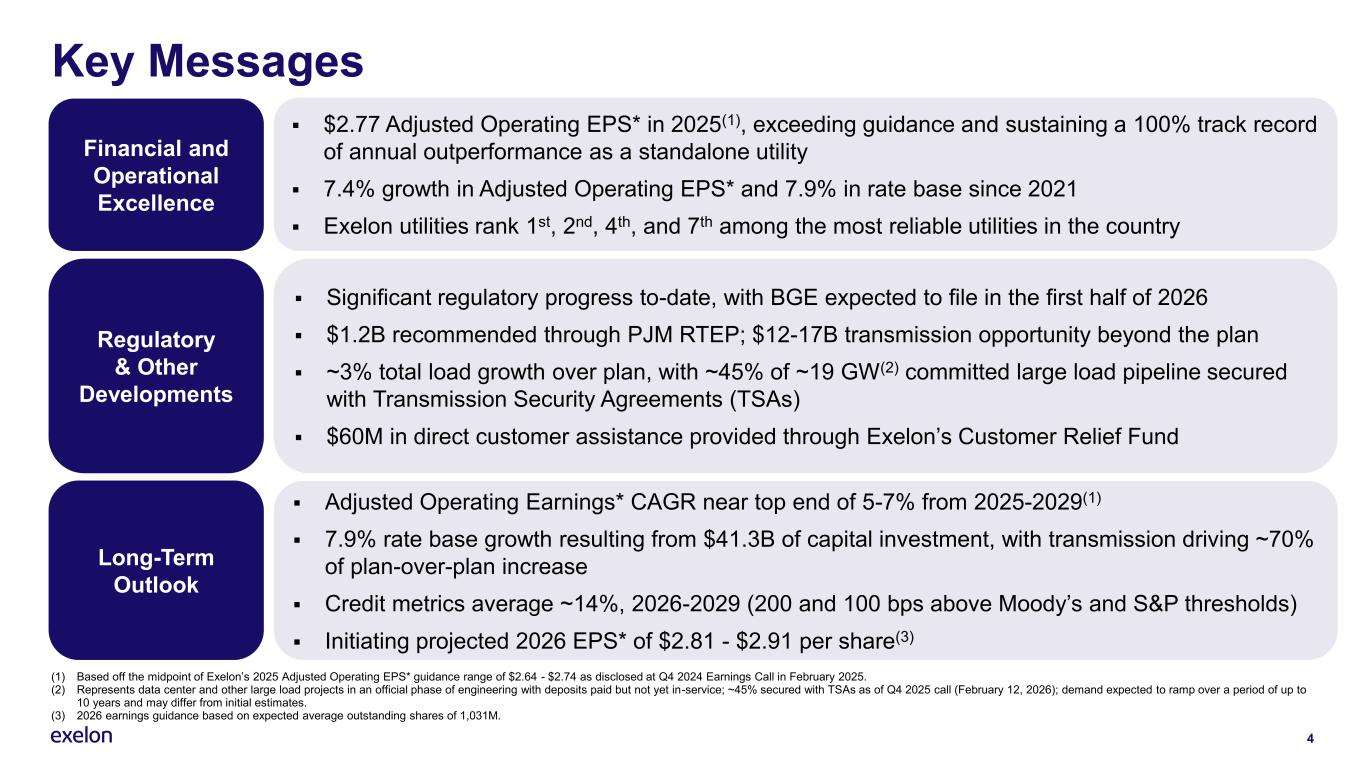

4 Key Messages Financial and Operational Excellence Regulatory & Other Developments Long-Term Outlook ▪ $2.77 Adjusted Operating EPS* in 2025(1), exceeding guidance and sustaining a 100% track record of annual outperformance as a standalone utility ▪ 7.4% growth in Adjusted Operating EPS* and 7.9% in rate base since 2021 ▪ Exelon utilities rank 1st, 2nd, 4th, and 7th among the most reliable utilities in the country ▪ Significant regulatory progress to-date, with BGE expected to file in the first half of 2026 ▪ $1.2B recommended through PJM RTEP; $12-17B transmission opportunity beyond the plan ▪ ~3% total load growth over plan, with ~45% of ~19 GW(2) committed large load pipeline secured with Transmission Security Agreements (TSAs) ▪ $60M in direct customer assistance provided through Exelon’s Customer Relief Fund ▪ Adjusted Operating Earnings* CAGR near top end of 5-7% from 2025-2029(1) ▪ 7.9% rate base growth resulting from $41.3B of capital investment, with transmission driving ~70% of plan-over-plan increase ▪ Credit metrics average ~14%, 2026-2029 (200 and 100 bps above Moody’s and S&P thresholds) ▪ Initiating projected 2026 EPS* of $2.81 - $2.91 per share(3) (1) Based off the midpoint of Exelon’s 2025 Adjusted Operating EPS* guidance range of $2.64 - $2.74 as disclosed at Q4 2024 Earnings Call in February 2025. (2) Represents data center and other large load projects in an official phase of engineering with deposits paid but not yet in-service; ~45% secured with TSAs as of Q4 2025 call (February 12, 2026); demand expected to ramp over a period of up to 10 years and may differ from initial estimates. (3) 2026 earnings guidance based on expected average outstanding shares of 1,031M.

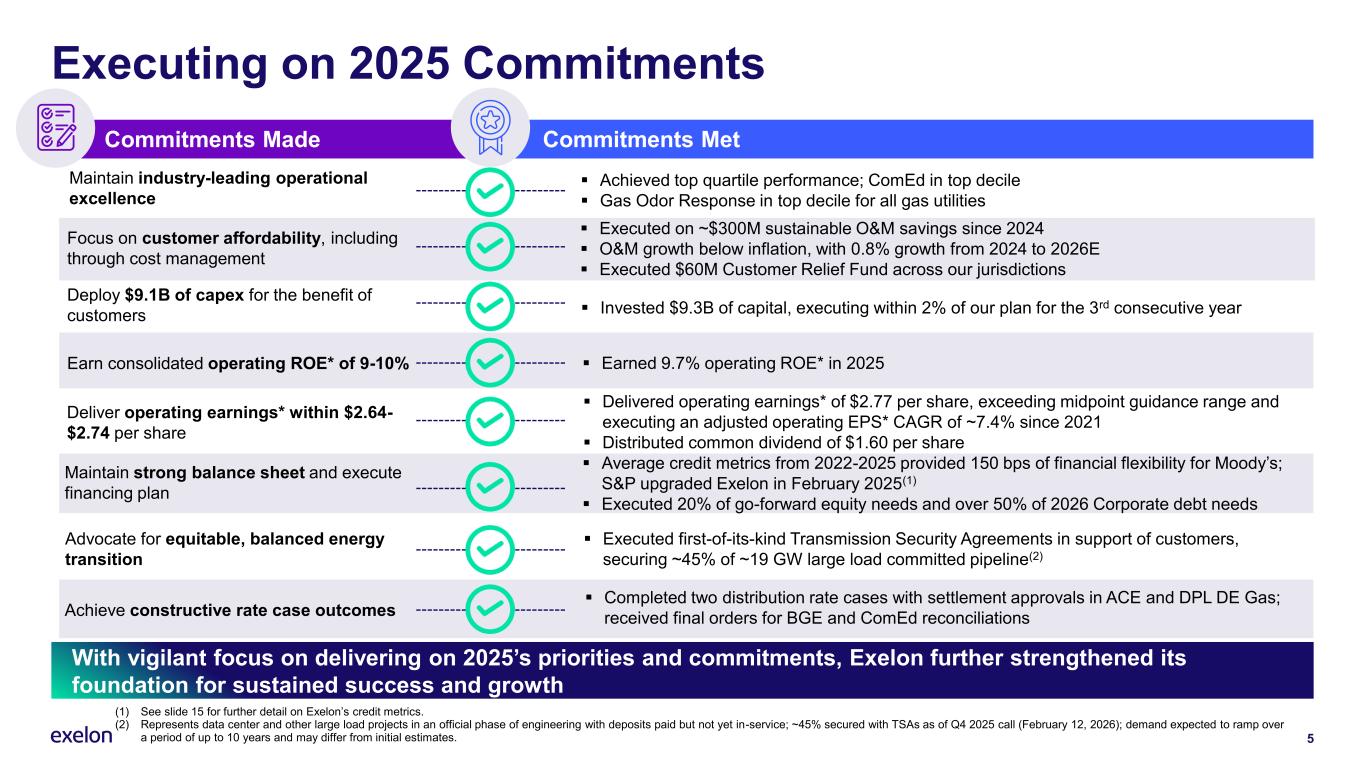

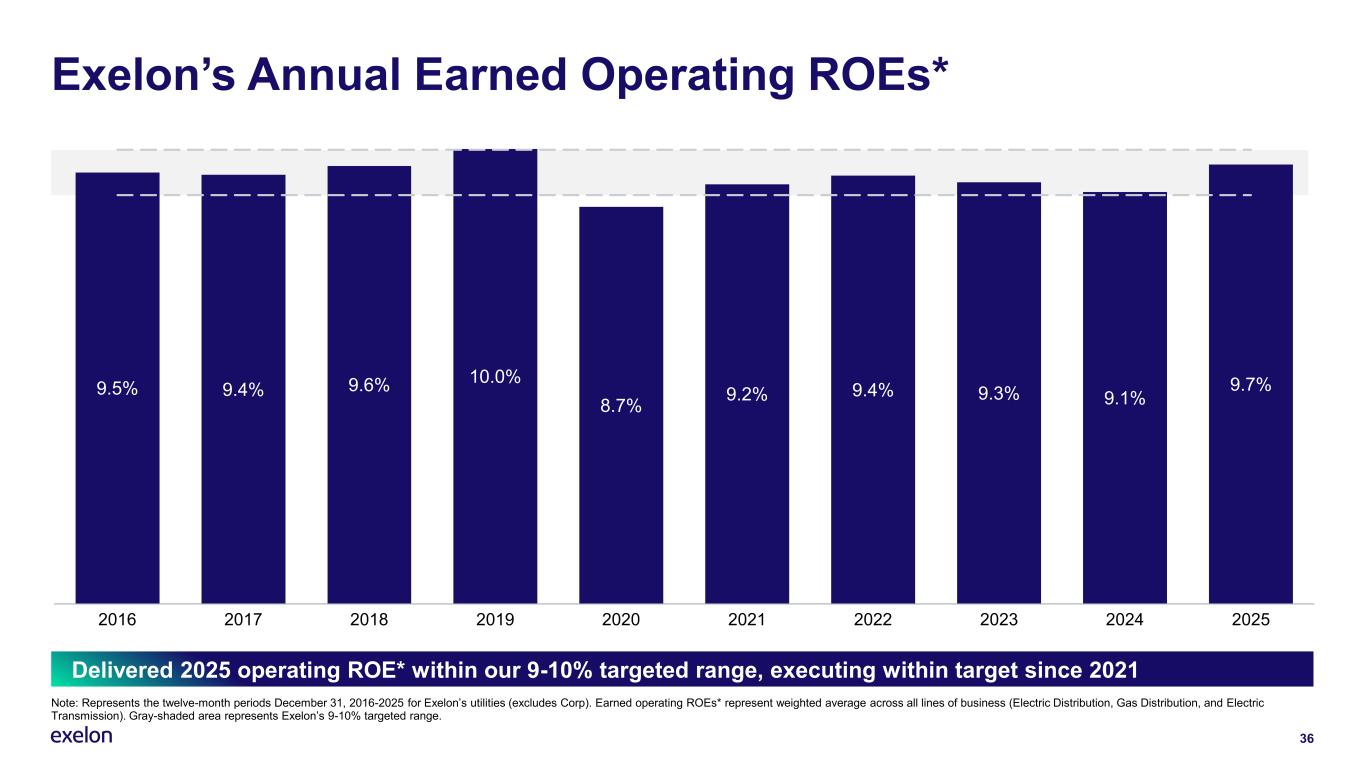

5 ▪ Earned 9.7% operating ROE* in 2025 ▪ Invested $9.3B of capital, executing within 2% of our plan for the 3rd consecutive year ▪ Achieved top quartile performance; ComEd in top decile ▪ Gas Odor Response in top decile for all gas utilities ▪ Delivered operating earnings* of $2.77 per share, exceeding midpoint guidance range and executing an adjusted operating EPS* CAGR of ~7.4% since 2021 ▪ Distributed common dividend of $1.60 per share ▪ Executed first-of-its-kind Transmission Security Agreements in support of customers, securing ~45% of ~19 GW large load committed pipeline(2) ▪ Executed on ~$300M sustainable O&M savings since 2024 ▪ O&M growth below inflation, with 0.8% growth from 2024 to 2026E ▪ Executed $60M Customer Relief Fund across our jurisdictions ▪ Average credit metrics from 2022-2025 provided 150 bps of financial flexibility for Moody’s; S&P upgraded Exelon in February 2025(1) ▪ Executed 20% of go-forward equity needs and over 50% of 2026 Corporate debt needs Earn consolidated operating ROE* of 9-10% Deploy $9.1B of capex for the benefit of customers Maintain industry-leading operational excellence Deliver operating earnings* within $2.64- $2.74 per share Maintain strong balance sheet and execute financing plan Advocate for equitable, balanced energy transition Achieve constructive rate case outcomes ▪ Completed two distribution rate cases with settlement approvals in ACE and DPL DE Gas; received final orders for BGE and ComEd reconciliations Executing on 2025 Commitments Commitments Made Commitments Met With vigilant focus on delivering on 2025’s priorities and commitments, Exelon further strengthened its foundation for sustained success and growth (1) See slide 15 for further detail on Exelon’s credit metrics. (2) Represents data center and other large load projects in an official phase of engineering with deposits paid but not yet in-service; ~45% secured with TSAs as of Q4 2025 call (February 12, 2026); demand expected to ramp over a period of up to 10 years and may differ from initial estimates. Focus on customer affordability, including through cost management

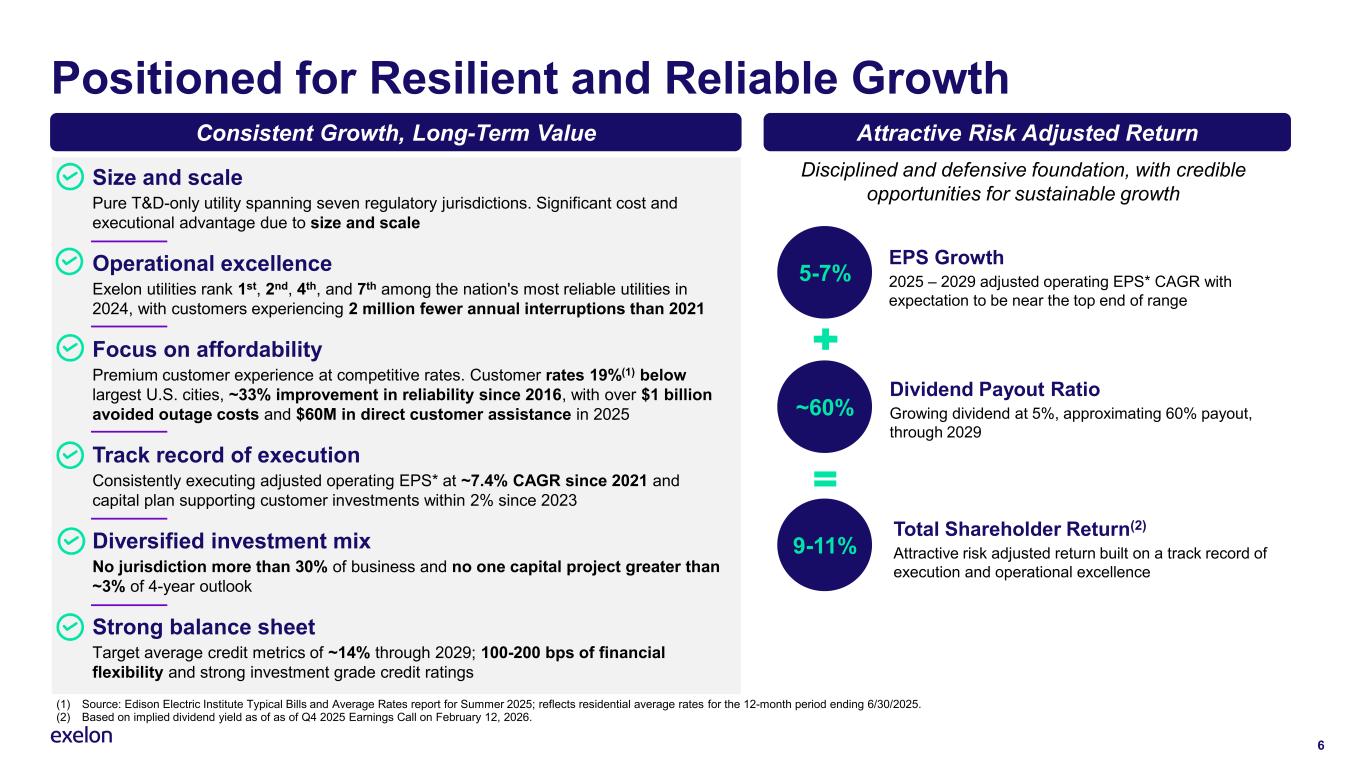

6 Positioned for Resilient and Reliable Growth (1) Source: Edison Electric Institute Typical Bills and Average Rates report for Summer 2025; reflects residential average rates for the 12-month period ending 6/30/2025. (2) Based on implied dividend yield as of as of Q4 2025 Earnings Call on February 12, 2026. Size and scale Pure T&D-only utility spanning seven regulatory jurisdictions. Significant cost and executional advantage due to size and scale Operational excellence Exelon utilities rank 1st, 2nd, 4th, and 7th among the nation's most reliable utilities in 2024, with customers experiencing 2 million fewer annual interruptions than 2021 Focus on affordability Premium customer experience at competitive rates. Customer rates 19%(1) below largest U.S. cities, ~33% improvement in reliability since 2016, with over $1 billion avoided outage costs and $60M in direct customer assistance in 2025 Track record of execution Consistently executing adjusted operating EPS* at ~7.4% CAGR since 2021 and capital plan supporting customer investments within 2% since 2023 Diversified investment mix No jurisdiction more than 30% of business and no one capital project greater than ~3% of 4-year outlook Strong balance sheet Target average credit metrics of ~14% through 2029; 100-200 bps of financial flexibility and strong investment grade credit ratings Consistent Growth, Long-Term Value Attractive Risk Adjusted Return EPS Growth 2025 – 2029 adjusted operating EPS* CAGR with expectation to be near the top end of range 5-7% ~60% 9-11% Dividend Payout Ratio Growing dividend at 5%, approximating 60% payout, through 2029 Total Shareholder Return(2) Attractive risk adjusted return built on a track record of execution and operational excellence Disciplined and defensive foundation, with credible opportunities for sustainable growth

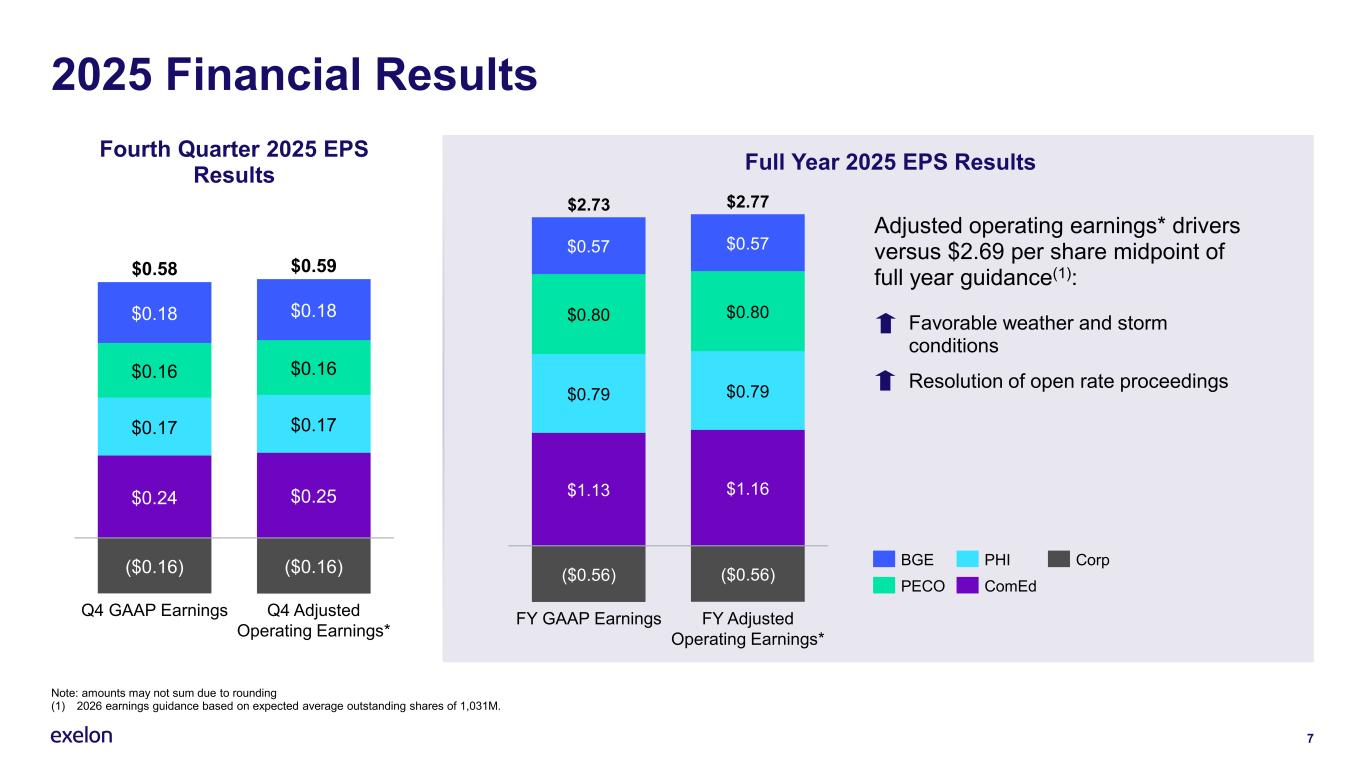

7 2025 Financial Results Fourth Quarter 2025 EPS Results $0.24 $0.25 $0.17 $0.17 $0.16 $0.16 $0.18 $0.18 ($0.16) ($0.16) Q4 GAAP Earnings Q4 Adjusted Operating Earnings* $0.58 $0.59 Note: amounts may not sum due to rounding (1) 2026 earnings guidance based on expected average outstanding shares of 1,031M. Adjusted operating earnings* drivers versus $2.69 per share midpoint of full year guidance(1): Favorable weather and storm conditions Resolution of open rate proceedings Full Year 2025 EPS Results $1.13 $1.16 $0.79 $0.79 $0.80 $0.80 $0.57 $0.57 ($0.56) ($0.56) FY GAAP Earnings FY Adjusted Operating Earnings* $2.73 $2.77 BGE PECO PHI ComEd Corp

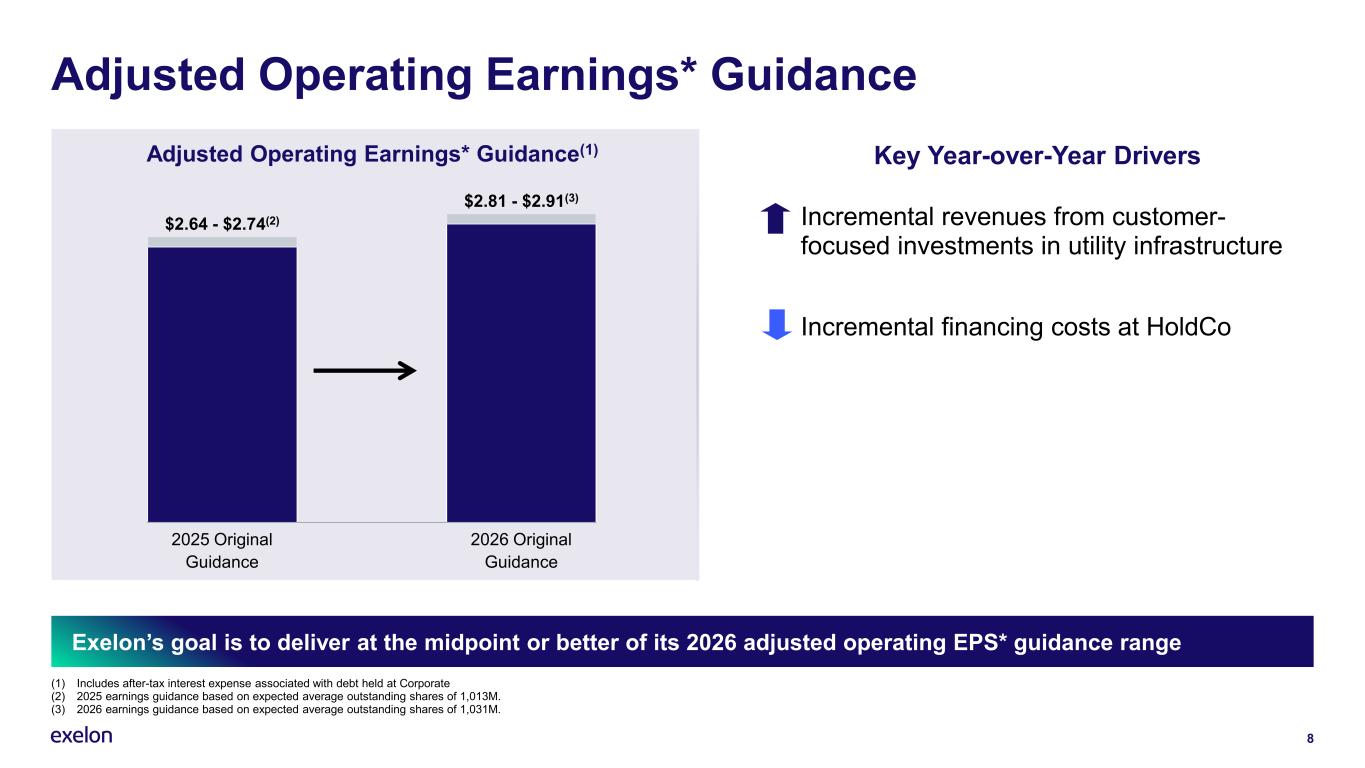

8 Adjusted Operating Earnings* Guidance Key Year-over-Year DriversAdjusted Operating Earnings* Guidance(1) Incremental revenues from customer- focused investments in utility infrastructure Incremental financing costs at HoldCo 2025 Original Guidance 2026 Original Guidance $2.64 - $2.74(2) $2.81 - $2.91(3) (1) Includes after-tax interest expense associated with debt held at Corporate (2) 2025 earnings guidance based on expected average outstanding shares of 1,013M. (3) 2026 earnings guidance based on expected average outstanding shares of 1,031M. Exelon’s goal is to deliver at the midpoint or better of its 2026 adjusted operating EPS* guidance range

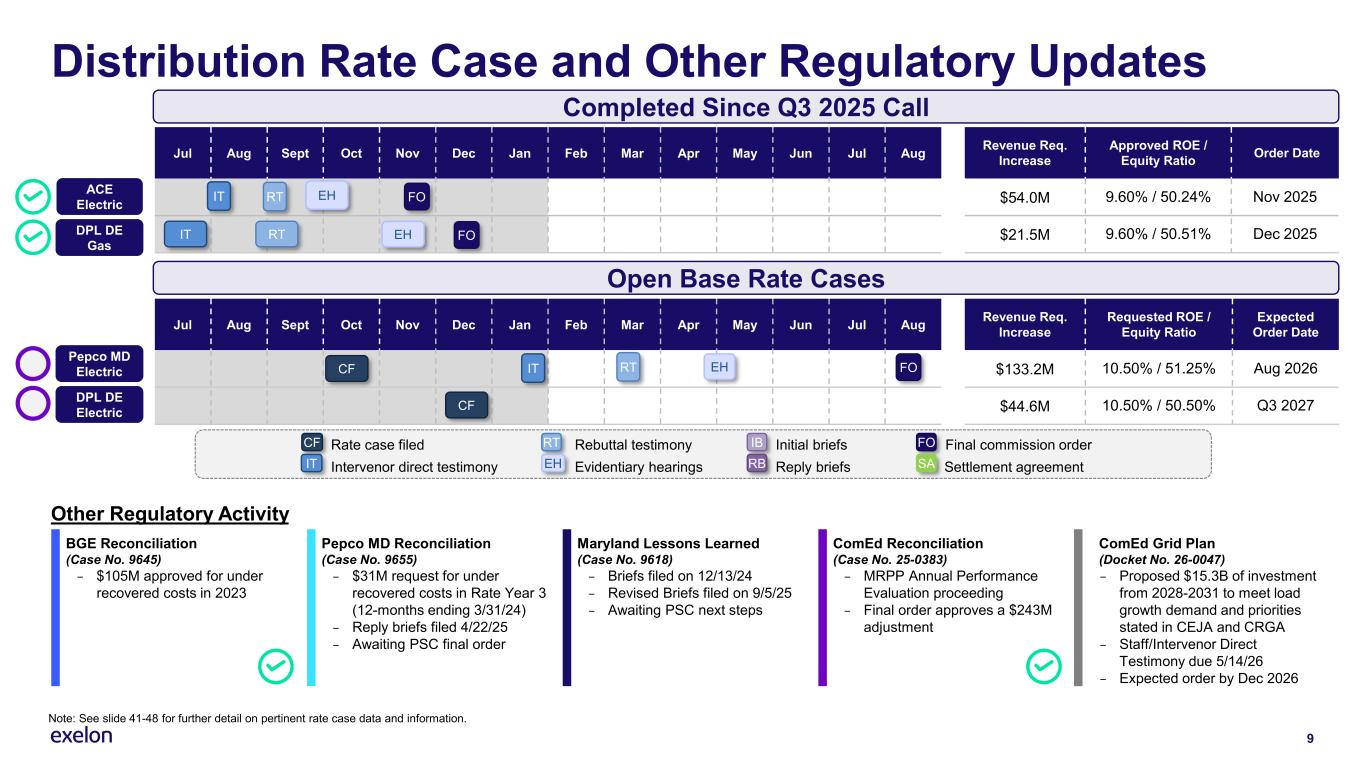

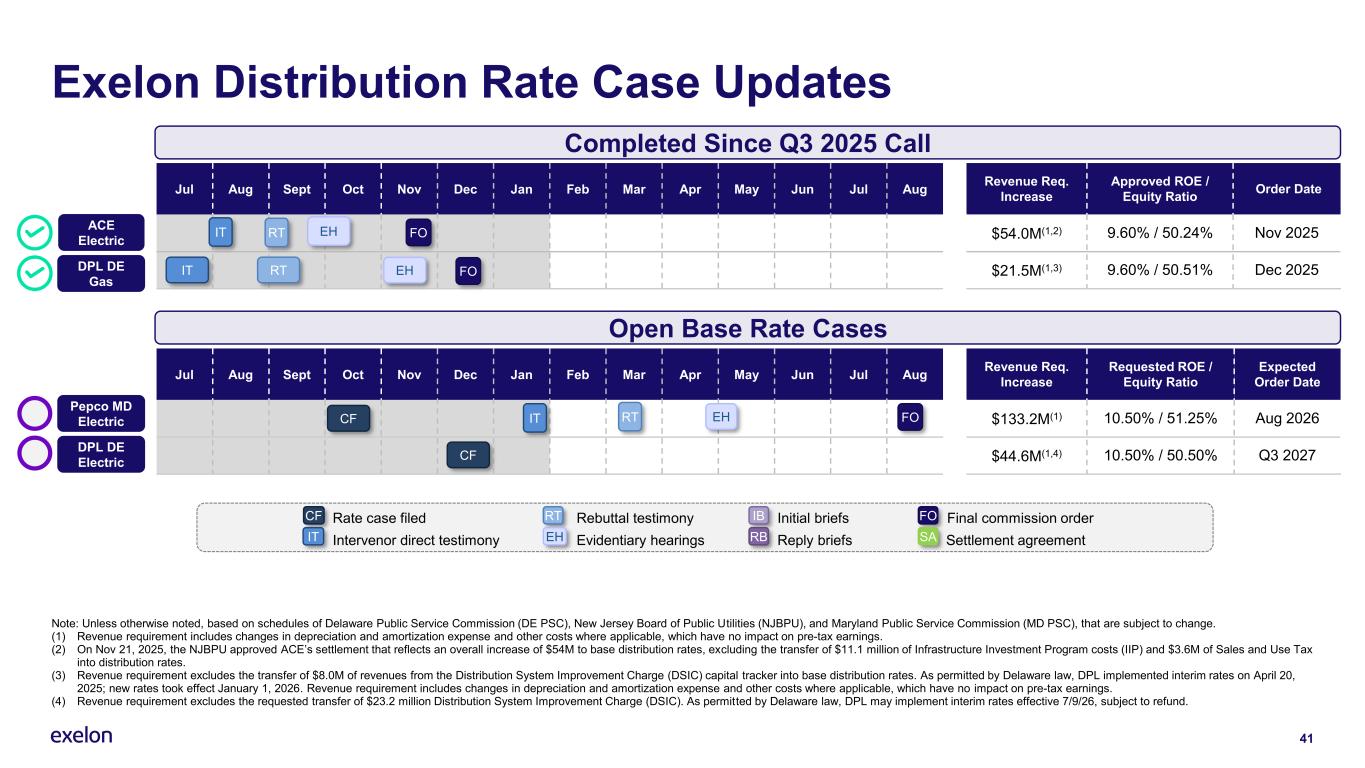

9 Distribution Rate Case and Other Regulatory Updates Jul Aug Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Revenue Req. Increase Approved ROE / Equity Ratio Order Date $54.0M 9.60% / 50.24% Nov 2025 $21.5M 9.60% / 50.51% Dec 2025 FOIT RT EH ACE Electric Rate case filed Rebuttal testimony Initial briefs Final commission order Intervenor direct testimony Evidentiary hearings Reply briefs Settlement agreement CF IT RT EH IB RB FO SA DPL DE Gas IT RT EH BGE Reconciliation (Case No. 9645) – $105M approved for under recovered costs in 2023 Pepco MD Reconciliation (Case No. 9655) – $31M request for under recovered costs in Rate Year 3 (12-months ending 3/31/24) – Reply briefs filed 4/22/25 – Awaiting PSC final order Maryland Lessons Learned (Case No. 9618) – Briefs filed on 12/13/24 – Revised Briefs filed on 9/5/25 – Awaiting PSC next steps ComEd Reconciliation (Case No. 25-0383) – MRPP Annual Performance Evaluation proceeding – Final order approves a $243M adjustment ComEd Grid Plan (Docket No. 26-0047) – Proposed $15.3B of investment from 2028-2031 to meet load growth demand and priorities stated in CEJA and CRGA – Staff/Intervenor Direct Testimony due 5/14/26 – Expected order by Dec 2026 Other Regulatory Activity Completed Since Q3 2025 Call Jul Aug Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Revenue Req. Increase Requested ROE / Equity Ratio Expected Order Date $133.2M 10.50% / 51.25% Aug 2026 $44.6M 10.50% / 50.50% Q3 2027 Pepco MD Electric DPL DE Electric CF Open Base Rate Cases IT RT EH FO CF FO Note: See slide 41-48 for further detail on pertinent rate case data and information.

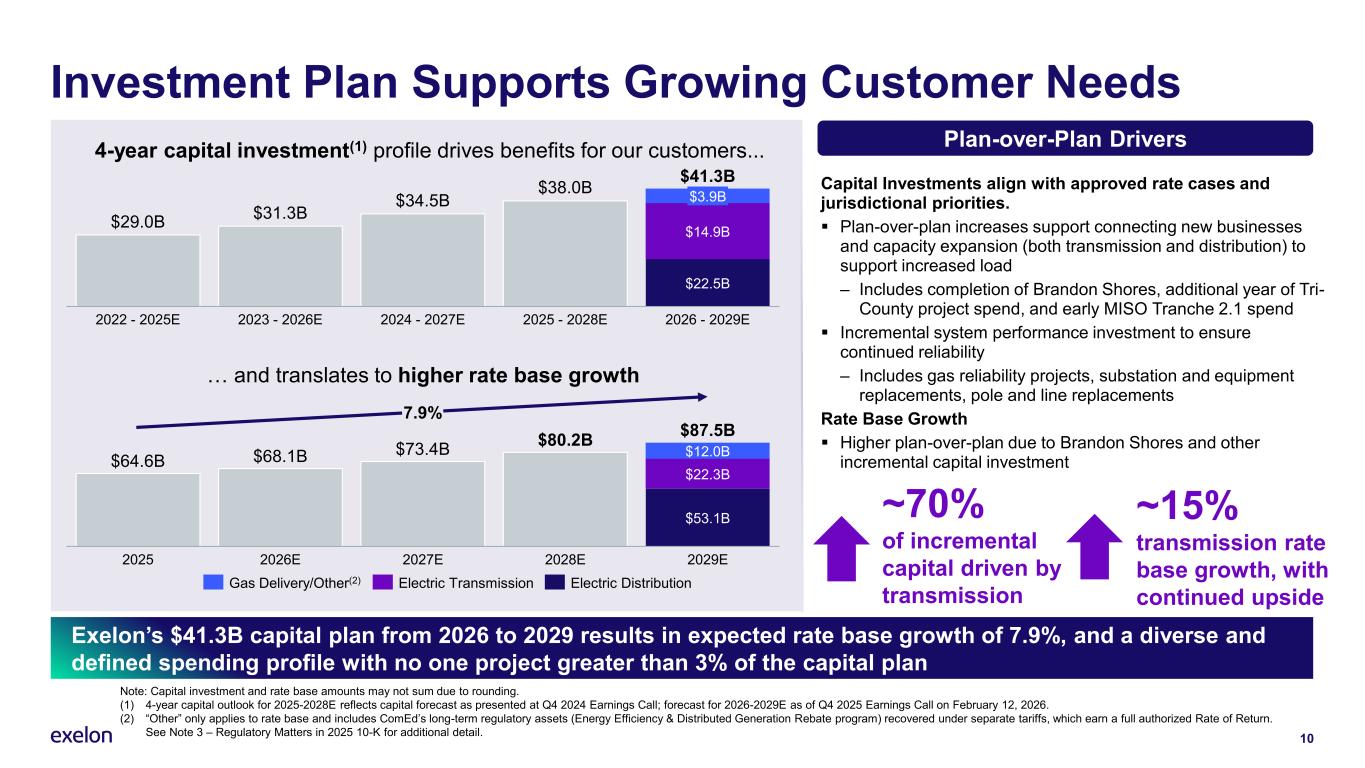

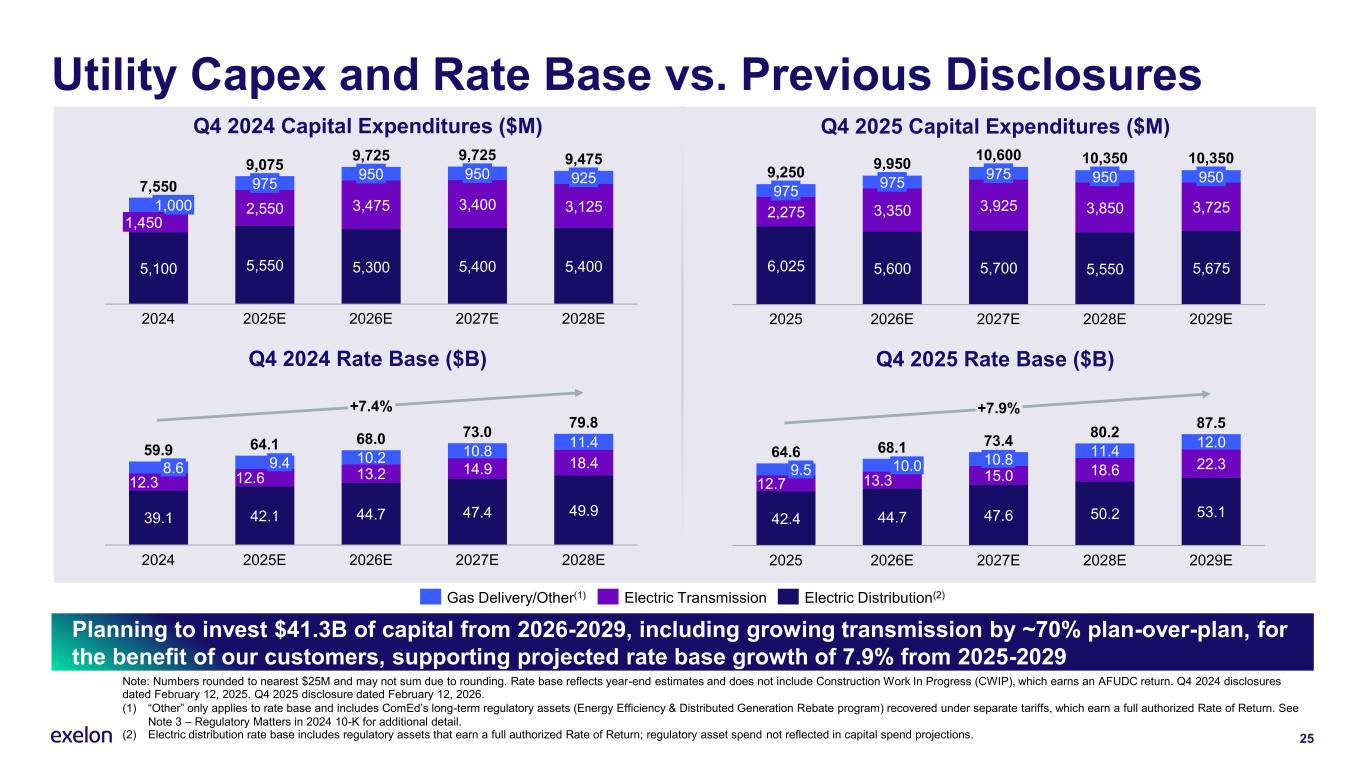

10 Investment Plan Supports Growing Customer Needs $29.0B $31.3B $34.5B $38.0B $22.5B $14.9B 2022 - 2025E 2023 - 2026E 2024 - 2027E 2025 - 2028E $3.9B 2026 - 2029E $41.3B … and translates to higher rate base growth 4-year capital investment(1) profile drives benefits for our customers... Note: Capital investment and rate base amounts may not sum due to rounding. (1) 4-year capital outlook for 2025-2028E reflects capital forecast as presented at Q4 2024 Earnings Call; forecast for 2026-2029E as of Q4 2025 Earnings Call on February 12, 2026. (2) “Other” only applies to rate base and includes ComEd’s long-term regulatory assets (Energy Efficiency & Distributed Generation Rebate program) recovered under separate tariffs, which earn a full authorized Rate of Return. See Note 3 – Regulatory Matters in 2025 10-K for additional detail. Exelon’s $41.3B capital plan from 2026 to 2029 results in expected rate base growth of 7.9%, and a diverse and defined spending profile with no one project greater than 3% of the capital plan $64.6B $68.1B $73.4B $80.2B $53.1B $22.3B $12.0B 2025 2026E 2027E 2028E 2029E $87.5B 7.9% Gas Delivery/Other(2) Electric Transmission Electric Distribution Capital Investments align with approved rate cases and jurisdictional priorities. ▪ Plan-over-plan increases support connecting new businesses and capacity expansion (both transmission and distribution) to support increased load – Includes completion of Brandon Shores, additional year of Tri- County project spend, and early MISO Tranche 2.1 spend ▪ Incremental system performance investment to ensure continued reliability – Includes gas reliability projects, substation and equipment replacements, pole and line replacements Rate Base Growth ▪ Higher plan-over-plan due to Brandon Shores and other incremental capital investment Plan-over-Plan Drivers ~15% transmission rate base growth, with continued upside ~70% of incremental capital driven by transmission

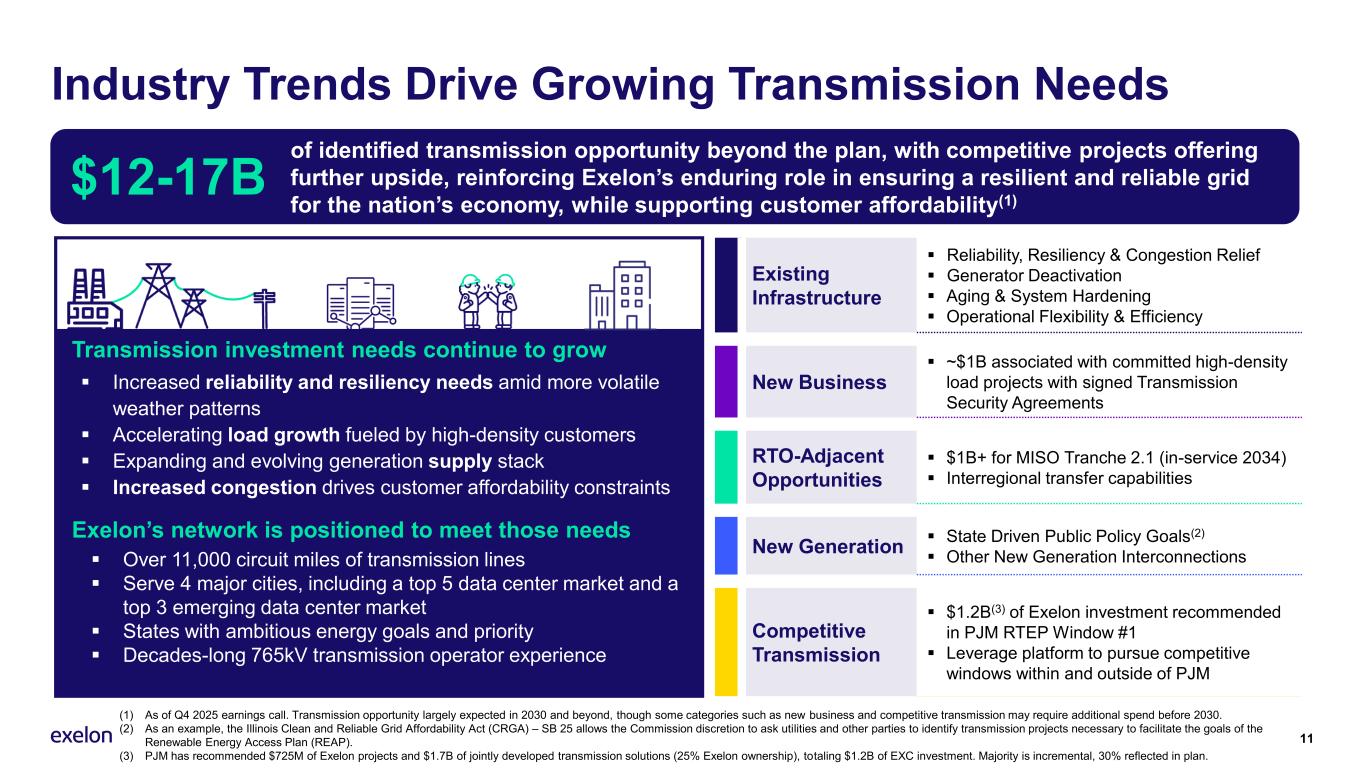

Industry Trends Drive Growing Transmission Needs 11 Existing Infrastructure ▪ Reliability, Resiliency & Congestion Relief ▪ Generator Deactivation ▪ Aging & System Hardening ▪ Operational Flexibility & Efficiency New Business ▪ ~$1B associated with committed high-density load projects with signed Transmission Security Agreements RTO-Adjacent Opportunities ▪ $1B+ for MISO Tranche 2.1 (in-service 2034) ▪ Interregional transfer capabilities New Generation ▪ State Driven Public Policy Goals(2) ▪ Other New Generation Interconnections Competitive Transmission ▪ $1.2B(3) of Exelon investment recommended in PJM RTEP Window #1 ▪ Leverage platform to pursue competitive windows within and outside of PJM Transmission investment needs continue to grow ▪ Increased reliability and resiliency needs amid more volatile weather patterns ▪ Accelerating load growth fueled by high-density customers ▪ Expanding and evolving generation supply stack ▪ Increased congestion drives customer affordability constraints of identified transmission opportunity beyond the plan, with competitive projects offering further upside, reinforcing Exelon’s enduring role in ensuring a resilient and reliable grid for the nation’s economy, while supporting customer affordability(1) $12-17B Exelon’s network is positioned to meet those needs ▪ Over 11,000 circuit miles of transmission lines ▪ Serve 4 major cities, including a top 5 data center market and a top 3 emerging data center market ▪ States with ambitious energy goals and priority ▪ Decades-long 765kV transmission operator experience (1) As of Q4 2025 earnings call. Transmission opportunity largely expected in 2030 and beyond, though some categories such as new business and competitive transmission may require additional spend before 2030. (2) As an example, the Illinois Clean and Reliable Grid Affordability Act (CRGA) – SB 25 allows the Commission discretion to ask utilities and other parties to identify transmission projects necessary to facilitate the goals of the Renewable Energy Access Plan (REAP). (3) PJM has recommended $725M of Exelon projects and $1.7B of jointly developed transmission solutions (25% Exelon ownership), totaling $1.2B of EXC investment. Majority is incremental, 30% reflected in plan.

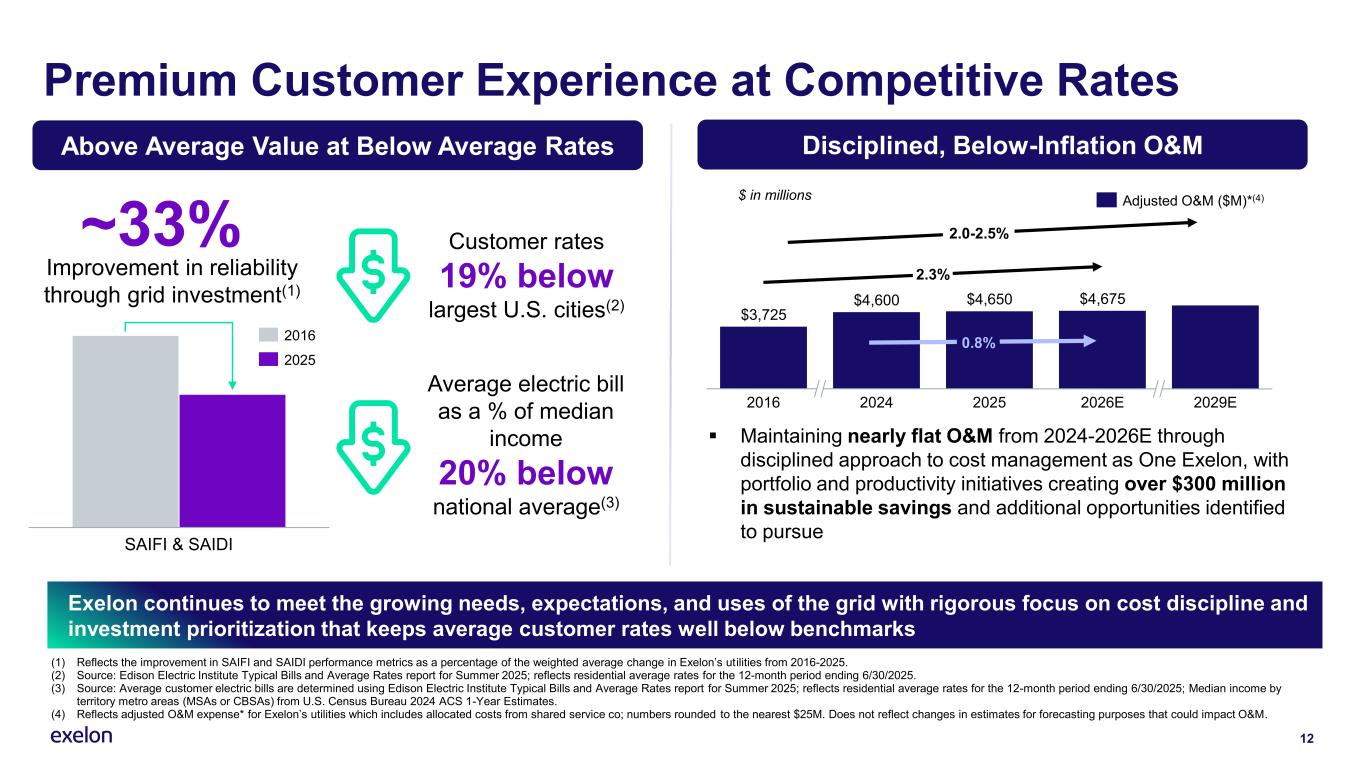

12 (1) Reflects the improvement in SAIFI and SAIDI performance metrics as a percentage of the weighted average change in Exelon’s utilities from 2016-2025. (2) Source: Edison Electric Institute Typical Bills and Average Rates report for Summer 2025; reflects residential average rates for the 12-month period ending 6/30/2025. (3) Source: Average customer electric bills are determined using Edison Electric Institute Typical Bills and Average Rates report for Summer 2025; reflects residential average rates for the 12-month period ending 6/30/2025; Median income by territory metro areas (MSAs or CBSAs) from U.S. Census Bureau 2024 ACS 1-Year Estimates. (4) Reflects adjusted O&M expense* for Exelon’s utilities which includes allocated costs from shared service co; numbers rounded to the nearest $25M. Does not reflect changes in estimates for forecasting purposes that could impact O&M. Exelon continues to meet the growing needs, expectations, and uses of the grid with rigorous focus on cost discipline and investment prioritization that keeps average customer rates well below benchmarks Above Average Value at Below Average Rates SAIFI & SAIDI Average electric bill as a % of median income 20% below national average(3) ~33% Improvement in reliability through grid investment(1) Customer rates 19% below largest U.S. cities(2) ▪ Maintaining nearly flat O&M from 2024-2026E through disciplined approach to cost management as One Exelon, with portfolio and productivity initiatives creating over $300 million in sustainable savings and additional opportunities identified to pursue $ in millions $3,725 $4,600 $4,650 $4,675 2016 2024 2025 2026E 2029E 2.3% Adjusted O&M ($M)*(4) 2.0-2.5% Disciplined, Below-Inflation O&M 0.8% 2016 2025 Premium Customer Experience at Competitive Rates

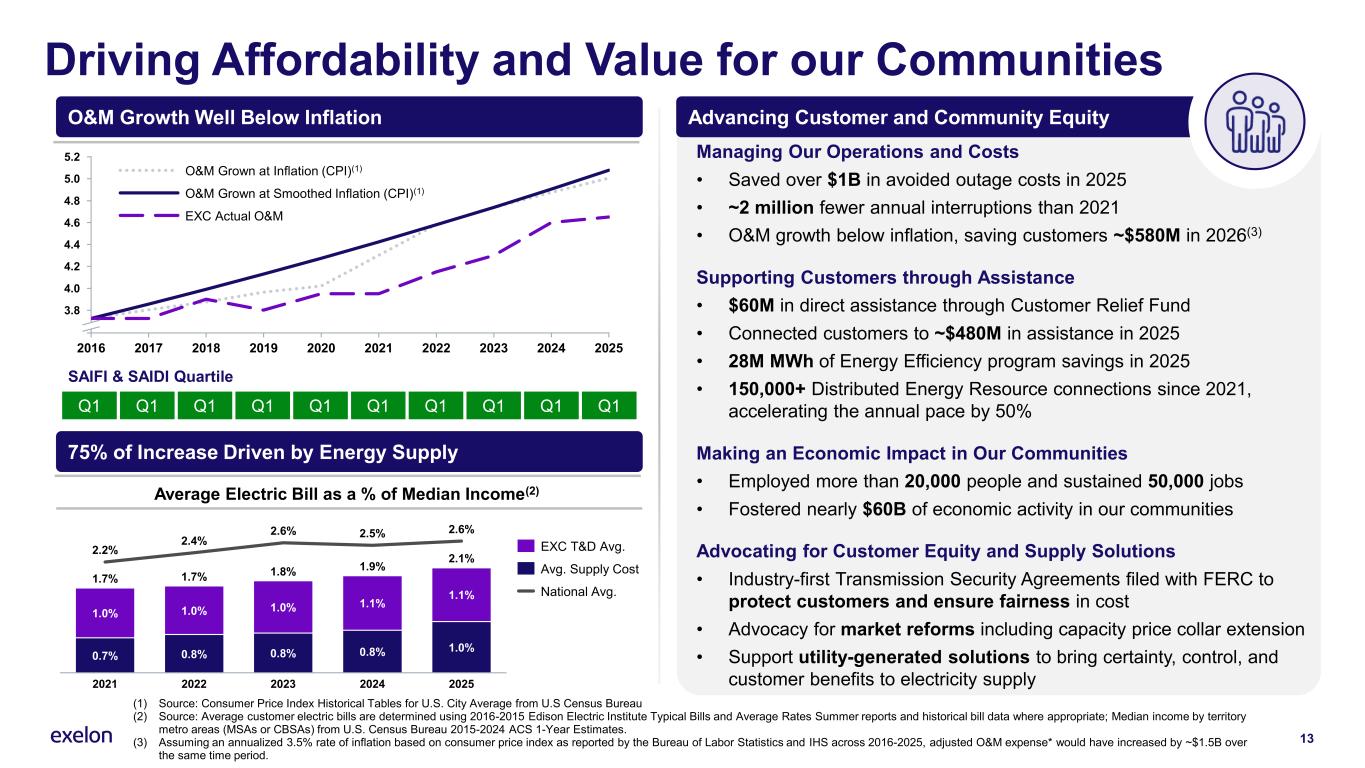

Managing Our Operations and Costs • Saved over $1B in avoided outage costs in 2025 • ~2 million fewer annual interruptions than 2021 • O&M growth below inflation, saving customers ~$580M in 2026(3) Supporting Customers through Assistance • $60M in direct assistance through Customer Relief Fund • Connected customers to ~$480M in assistance in 2025 • 28M MWh of Energy Efficiency program savings in 2025 • 150,000+ Distributed Energy Resource connections since 2021, accelerating the annual pace by 50% Making an Economic Impact in Our Communities • Employed more than 20,000 people and sustained 50,000 jobs • Fostered nearly $60B of economic activity in our communities Advocating for Customer Equity and Supply Solutions • Industry-first Transmission Security Agreements filed with FERC to protect customers and ensure fairness in cost • Advocacy for market reforms including capacity price collar extension • Support utility-generated solutions to bring certainty, control, and customer benefits to electricity supply 13 Driving Affordability and Value for our Communities (1) Source: Consumer Price Index Historical Tables for U.S. City Average from U.S Census Bureau (2) Source: Average customer electric bills are determined using 2016-2015 Edison Electric Institute Typical Bills and Average Rates Summer reports and historical bill data where appropriate; Median income by territory metro areas (MSAs or CBSAs) from U.S. Census Bureau 2015-2024 ACS 1-Year Estimates. (3) Assuming an annualized 3.5% rate of inflation based on consumer price index as reported by the Bureau of Labor Statistics and IHS across 2016-2025, adjusted O&M expense* would have increased by ~$1.5B over the same time period. O&M Growth Well Below Inflation Advancing Customer and Community Equity 75% of Increase Driven by Energy Supply 1.0% 0.7% 2.2% 2021 1.0% 0.8% 2.4% 2022 1.0% 0.8% 2.6% 2023 1.1% 0.8% 2.5% 2024 1.1% 1.0% 2.6% 2025 1.7% 1.7% 1.8% 1.9% 2.1% EXC T&D Avg. Avg. Supply Cost National Avg. 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 3.8 4.0 4.2 4.4 4.6 4.8 5.0 5.2 O&M Grown at Inflation (CPI)(1) O&M Grown at Smoothed Inflation (CPI)(1) EXC Actual O&M Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 SAIFI & SAIDI Quartile Average Electric Bill as a % of Median Income(2)

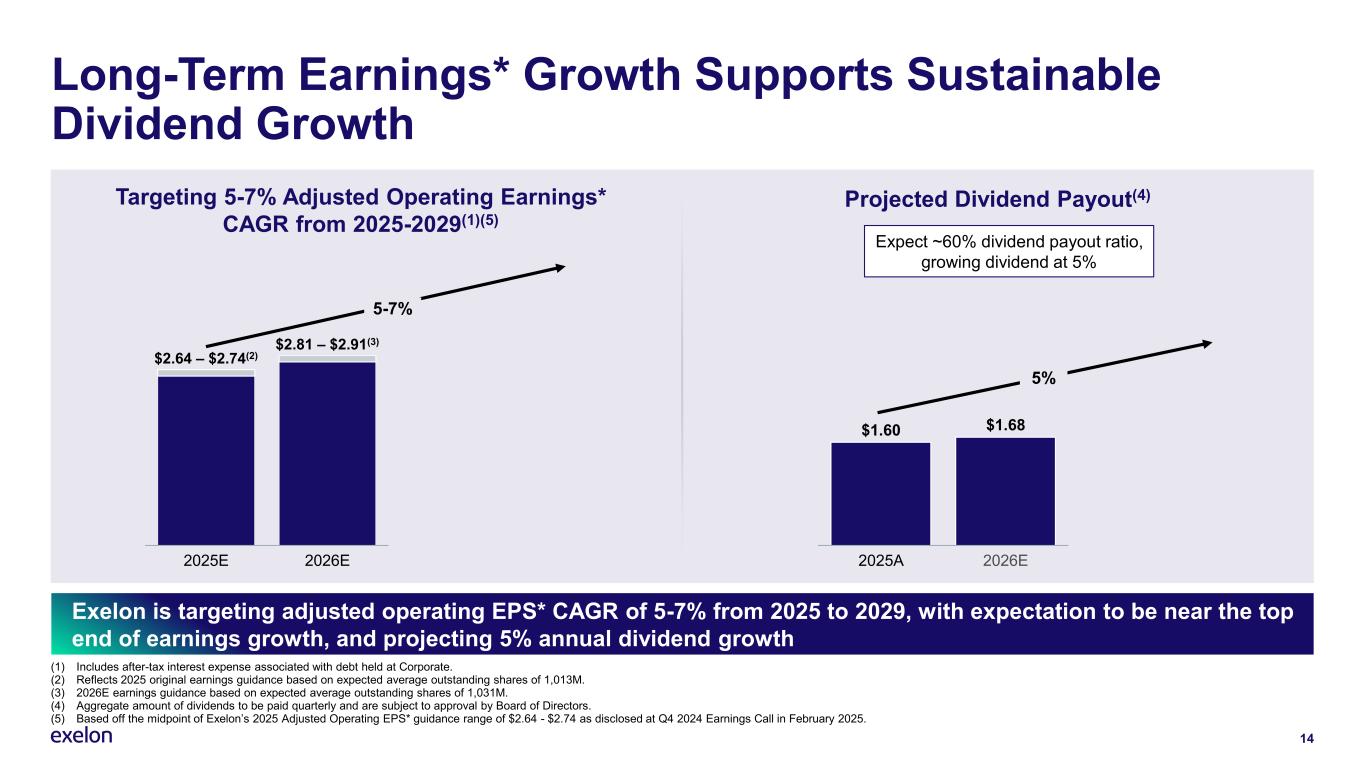

Long-Term Earnings* Growth Supports Sustainable Dividend Growth 14 Targeting 5-7% Adjusted Operating Earnings* CAGR from 2025-2029(1)(5) (1) Includes after-tax interest expense associated with debt held at Corporate. (2) Reflects 2025 original earnings guidance based on expected average outstanding shares of 1,013M. (3) 2026E earnings guidance based on expected average outstanding shares of 1,031M. (4) Aggregate amount of dividends to be paid quarterly and are subject to approval by Board of Directors. (5) Based off the midpoint of Exelon’s 2025 Adjusted Operating EPS* guidance range of $2.64 - $2.74 as disclosed at Q4 2024 Earnings Call in February 2025. Exelon is targeting adjusted operating EPS* CAGR of 5-7% from 2025 to 2029, with expectation to be near the top end of earnings growth, and projecting 5% annual dividend growth 2025E 2026E $2.64 – $2.74(2) $2.81 – $2.91(3) Expect ~60% dividend payout ratio, growing dividend at 5% Projected Dividend Payout(4) 5-7% $1.60 $1.68 2025A 2026E 5%

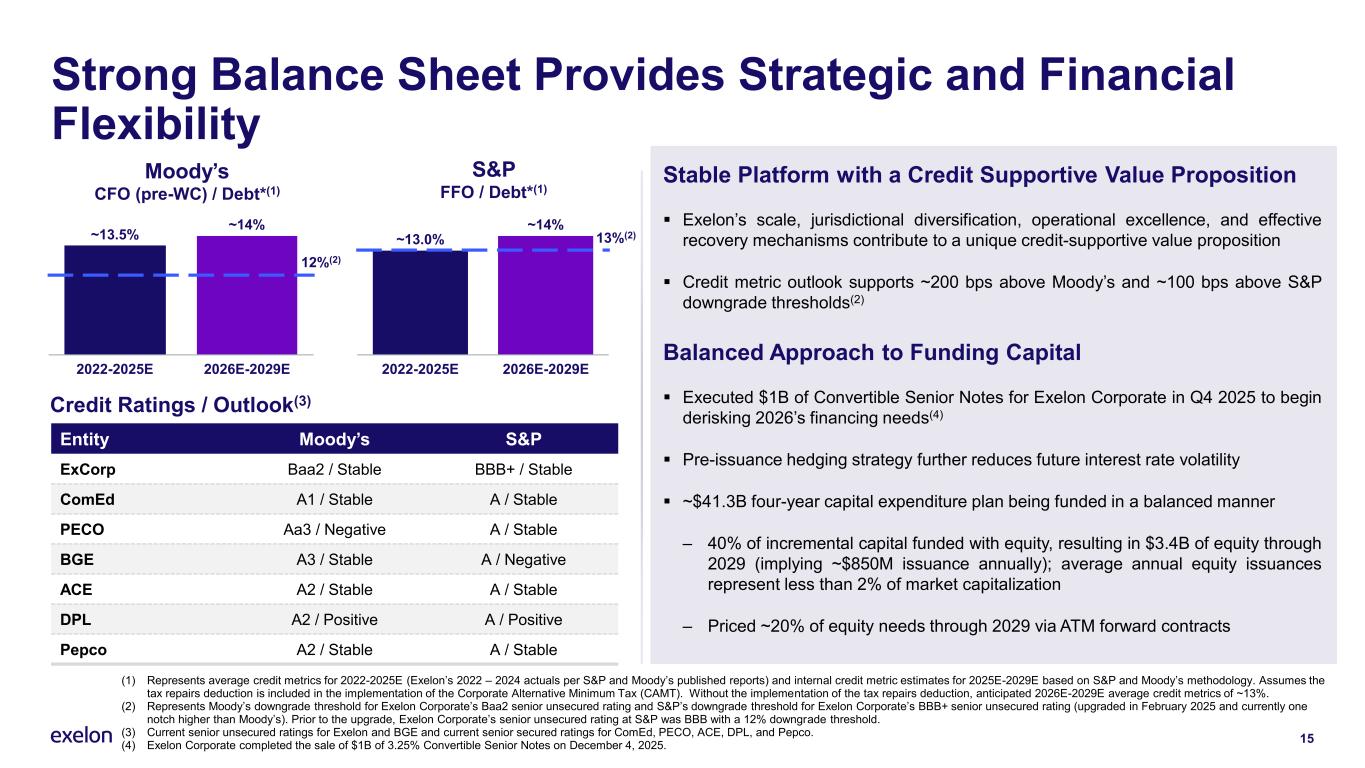

Strong Balance Sheet Provides Strategic and Financial Flexibility Entity Moody’s S&P ExCorp Baa2 / Stable BBB+ / Stable ComEd A1 / Stable A / Stable PECO Aa3 / Negative A / Stable BGE A3 / Stable A / Negative ACE A2 / Stable A / Stable DPL A2 / Positive A / Positive Pepco A2 / Stable A / Stable 15 (1) Represents average credit metrics for 2022-2025E (Exelon’s 2022 – 2024 actuals per S&P and Moody’s published reports) and internal credit metric estimates for 2025E-2029E based on S&P and Moody’s methodology. Assumes the tax repairs deduction is included in the implementation of the Corporate Alternative Minimum Tax (CAMT). Without the implementation of the tax repairs deduction, anticipated 2026E-2029E average credit metrics of ~13%. (2) Represents Moody’s downgrade threshold for Exelon Corporate’s Baa2 senior unsecured rating and S&P’s downgrade threshold for Exelon Corporate’s BBB+ senior unsecured rating (upgraded in February 2025 and currently one notch higher than Moody’s). Prior to the upgrade, Exelon Corporate’s senior unsecured rating at S&P was BBB with a 12% downgrade threshold. (3) Current senior unsecured ratings for Exelon and BGE and current senior secured ratings for ComEd, PECO, ACE, DPL, and Pepco. (4) Exelon Corporate completed the sale of $1B of 3.25% Convertible Senior Notes on December 4, 2025. 2022-2025E 2026E-2029E ~13.5% ~14% Credit Ratings / Outlook(3) 12%(2) 13%(2) Moody’s CFO (pre-WC) / Debt*(1) 2022-2025E 2026E-2029E ~13.0% ~14% S&P FFO / Debt*(1) Stable Platform with a Credit Supportive Value Proposition ▪ Exelon’s scale, jurisdictional diversification, operational excellence, and effective recovery mechanisms contribute to a unique credit-supportive value proposition ▪ Credit metric outlook supports ~200 bps above Moody’s and ~100 bps above S&P downgrade thresholds(2) Balanced Approach to Funding Capital ▪ Executed $1B of Convertible Senior Notes for Exelon Corporate in Q4 2025 to begin derisking 2026’s financing needs(4) ▪ Pre-issuance hedging strategy further reduces future interest rate volatility ▪ ~$41.3B four-year capital expenditure plan being funded in a balanced manner ‒ 40% of incremental capital funded with equity, resulting in $3.4B of equity through 2029 (implying ~$850M issuance annually); average annual equity issuances represent less than 2% of market capitalization ‒ Priced ~20% of equity needs through 2029 via ATM forward contracts

Capitalize on Growth Opportunities Focus on Customer Affordability and Value 16 2026 Business Priorities and Commitments ❖ Prioritize employee safety and engagement ❖ Deploy ~$10B of capex for the benefit of customers ❖ Maintain industry-leading operational excellence ❖ Focus on cost management and innovation ❖ Capture growth opportunities and new customer solutions ❖ Advocate for equitable and balanced energy future ❖ Earn consolidated operating ROE* of 9-10% ❖ Achieve constructive rate case outcomes for customers and shareholders ❖ Deliver Operating EPS* guidance of $2.81 - $2.91 per share ❖ Maintain strong balance sheet and execute on 2026 financing plan Execute Plan Consistent and Reliable Execution

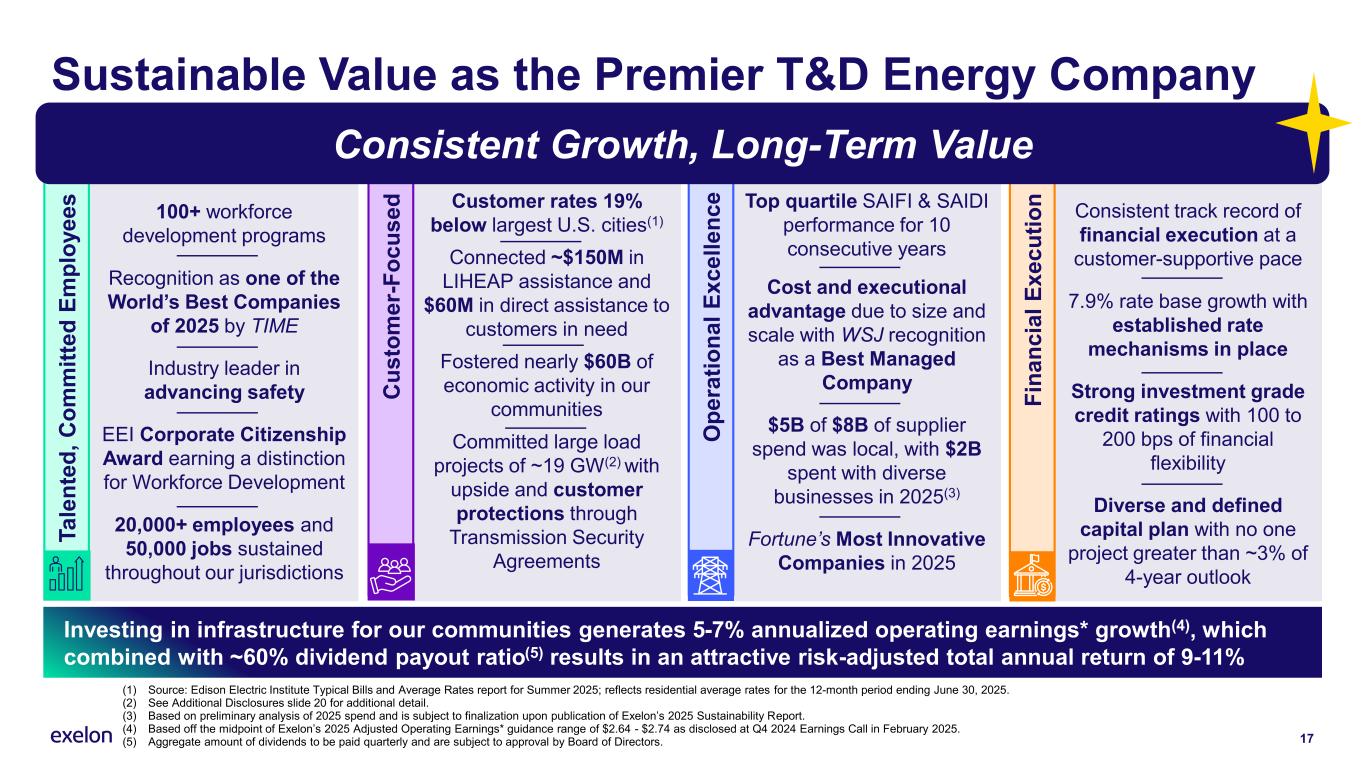

Customer rates 19% below largest U.S. cities(1) Connected ~$150M in LIHEAP assistance and $60M in direct assistance to customers in need Fostered nearly $60B of economic activity in our communities Committed large load projects of ~19 GW(2) with upside and customer protections through Transmission Security Agreements C u s to m e r- F o c u s e d Consistent track record of financial execution at a customer-supportive pace 7.9% rate base growth with established rate mechanisms in place Strong investment grade credit ratings with 100 to 200 bps of financial flexibility Diverse and defined capital plan with no one project greater than ~3% of 4-year outlook 17 Sustainable Value as the Premier T&D Energy Company (1) Source: Edison Electric Institute Typical Bills and Average Rates report for Summer 2025; reflects residential average rates for the 12-month period ending June 30, 2025. (2) See Additional Disclosures slide 20 for additional detail. (3) Based on preliminary analysis of 2025 spend and is subject to finalization upon publication of Exelon’s 2025 Sustainability Report. (4) Based off the midpoint of Exelon’s 2025 Adjusted Operating Earnings* guidance range of $2.64 - $2.74 as disclosed at Q4 2024 Earnings Call in February 2025. (5) Aggregate amount of dividends to be paid quarterly and are subject to approval by Board of Directors. Investing in infrastructure for our communities generates 5-7% annualized operating earnings* growth(4), which combined with ~60% dividend payout ratio(5) results in an attractive risk-adjusted total annual return of 9-11% Top quartile SAIFI & SAIDI performance for 10 consecutive years Cost and executional advantage due to size and scale with WSJ recognition as a Best Managed Company $5B of $8B of supplier spend was local, with $2B spent with diverse businesses in 2025(3) Fortune’s Most Innovative Companies in 2025 100+ workforce development programs Recognition as one of the World’s Best Companies of 2025 by TIME Industry leader in advancing safety EEI Corporate Citizenship Award earning a distinction for Workforce Development 20,000+ employees and 50,000 jobs sustained throughout our jurisdictions F in a n c ia l E x e c u ti o n O p e ra ti o n a l E x c e ll e n c e T a le n te d , C o m m it te d E m p lo y e e s Consistent Growth, Long-Term Value

18 Additional Disclosures

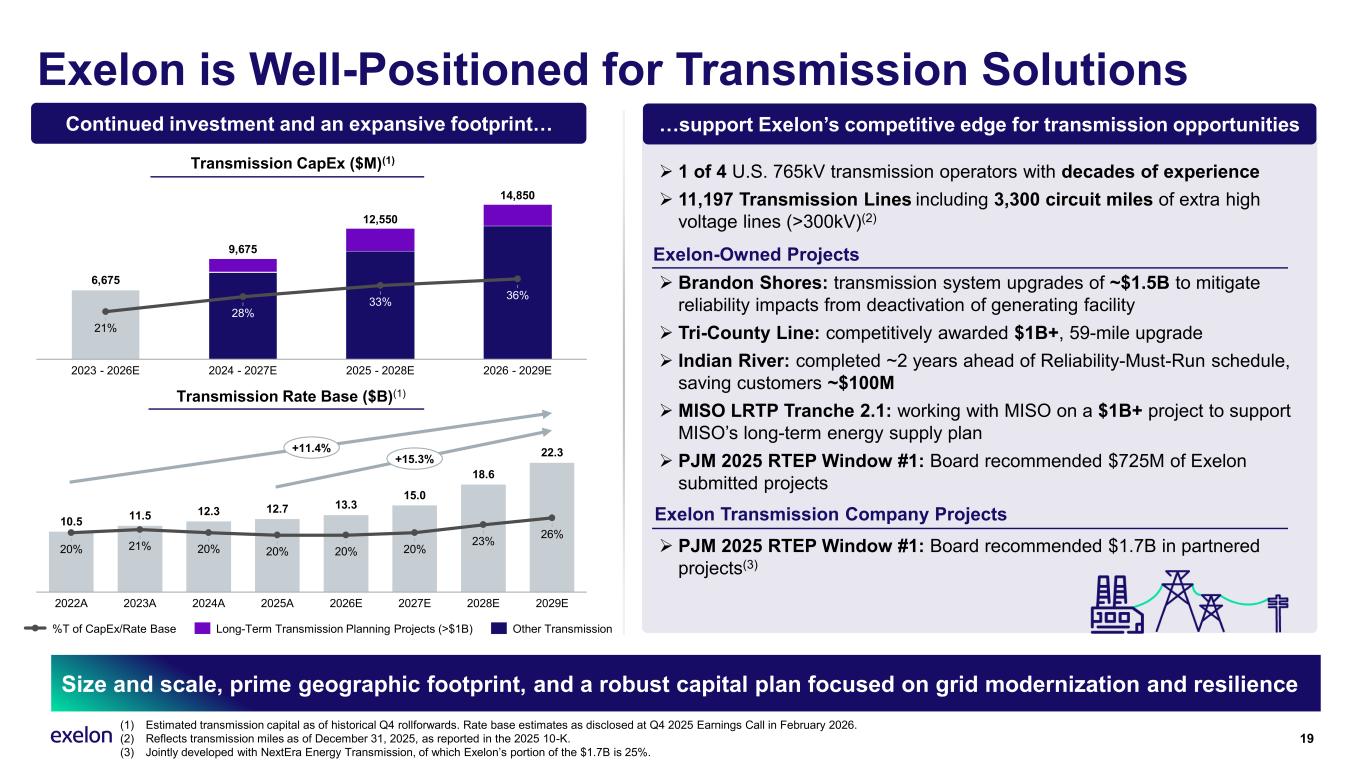

Exelon is Well-Positioned for Transmission Solutions 19 Size and scale, prime geographic footprint, and a robust capital plan focused on grid modernization and resilience (1) Estimated transmission capital as of historical Q4 rollforwards. Rate base estimates as disclosed at Q4 2025 Earnings Call in February 2026. (2) Reflects transmission miles as of December 31, 2025, as reported in the 2025 10-K. (3) Jointly developed with NextEra Energy Transmission, of which Exelon’s portion of the $1.7B is 25%. …support Exelon’s competitive edge for transmission opportunities ➢ 1 of 4 U.S. 765kV transmission operators with decades of experience ➢ 11,197 Transmission Lines including 3,300 circuit miles of extra high voltage lines (>300kV)(2) ➢ Brandon Shores: transmission system upgrades of ~$1.5B to mitigate reliability impacts from deactivation of generating facility ➢ Tri-County Line: competitively awarded $1B+, 59-mile upgrade ➢ Indian River: completed ~2 years ahead of Reliability-Must-Run schedule, saving customers ~$100M ➢ MISO LRTP Tranche 2.1: working with MISO on a $1B+ project to support MISO’s long-term energy supply plan ➢ PJM 2025 RTEP Window #1: Board recommended $725M of Exelon submitted projects ➢ PJM 2025 RTEP Window #1: Board recommended $1.7B in partnered projects(3) 10.5 11.5 12.3 12.7 13.3 15.0 18.6 22.3 20% 2022A 21% 2023A 20% 2024A 20% 2025A 20% 2026E 20% 2027E 23% 2028E 26% 2029E +11.4% +15.3% Transmission CapEx ($M)(1) Transmission Rate Base ($B)(1) 6,675 21% 2023 - 2026E 28% 2024 - 2027E 33% 2025 - 2028E 36% 2026 - 2029E 9,675 12,550 14,850 %T of CapEx/Rate Base Long-Term Transmission Planning Projects (>$1B) Other Transmission Continued investment and an expansive footprint… Exelon Transmission Company Projects Exelon-Owned Projects

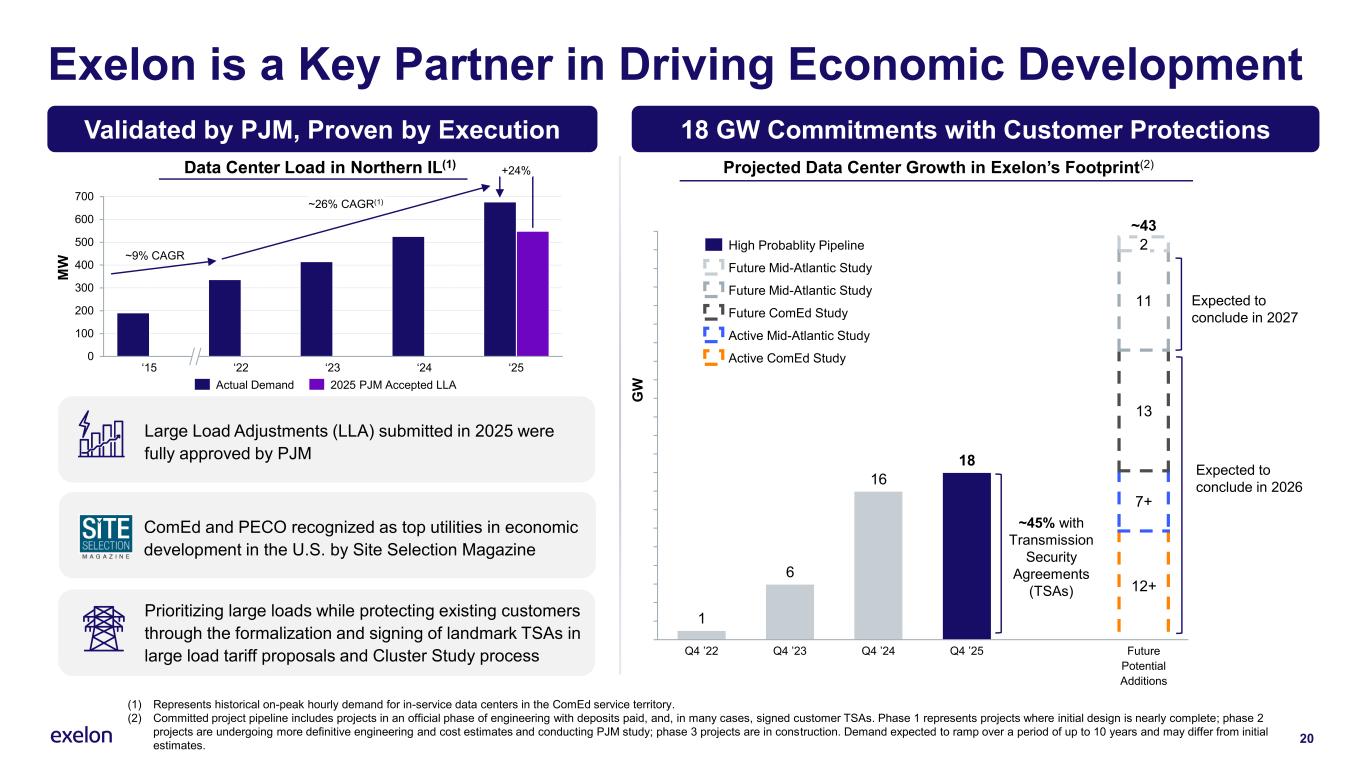

Data Center Load in Northern IL(1) Projected Data Center Growth in Exelon’s Footprint(2) 20 Exelon is a Key Partner in Driving Economic Development (1) Represents historical on-peak hourly demand for in-service data centers in the ComEd service territory. (2) Committed project pipeline includes projects in an official phase of engineering with deposits paid, and, in many cases, signed customer TSAs. Phase 1 represents projects where initial design is nearly complete; phase 2 projects are undergoing more definitive engineering and cost estimates and conducting PJM study; phase 3 projects are in construction. Demand expected to ramp over a period of up to 10 years and may differ from initial estimates. Validated by PJM, Proven by Execution 18 GW Commitments with Customer Protections 1 6 16 18 13 11 0 2 4 6 8 12 14 16 18 22 24 26 28 30 32 34 36 38 40 42 44 Q4 ’25 2 Q4 ’23 7+ Q4 ’22 Q4 ’24 12+ Future Potential Additions ~43 High Probablity Pipeline Future Mid-Atlantic Study Future Mid-Atlantic Study Future ComEd Study Active Mid-Atlantic Study Active ComEd Study Large Load Adjustments (LLA) submitted in 2025 were fully approved by PJM G W ComEd and PECO recognized as top utilities in economic development in the U.S. by Site Selection Magazine Prioritizing large loads while protecting existing customers through the formalization and signing of landmark TSAs in large load tariff proposals and Cluster Study process 0 100 200 300 400 500 600 700 ‘15 ‘22 ‘23 ‘24 ‘25 +24% ~26% CAGR(1) M W ~9% CAGR Actual Demand 2025 PJM Accepted LLA Expected to conclude in 2026 Expected to conclude in 2027 ~45% with Transmission Security Agreements (TSAs)

21 Rapid, large scale load growth creates significant economic development opportunity in our communities and accelerates interest in creative solutions to the energy transition The Power of Impact: Growth and Progress in Our Communities September 9, 2025 IL: Elk Grove Stream Data Center Campus June 9, 2025 PA: Northpoint Bucks County Data Center June 27, 2025 IL: Elk Grove Substation Expansion September 24, 2025 MD: BGE, Ford, & Sunrun Vehicle-to-Grid Pilot December 11, 2025 IL: ComEd 765kV Expansion July 15, 2025 IL: Itasca Substation Upgrades September 30, 2025 IL: PsiQuantum Utility- Scale Quantum Computer January 6, 2026 IL: ComEd Announces New TSAs of 6.5+ GW July 31, 2025 IL: Prologis Community Solar Launch January 16, 2026 IL: Tract plans for 1GW Data Center November 12, 2025 MD: BGE Battery Storage Proposal January 21, 2026 MD: Pepco White Flint Substation Supports Reliability

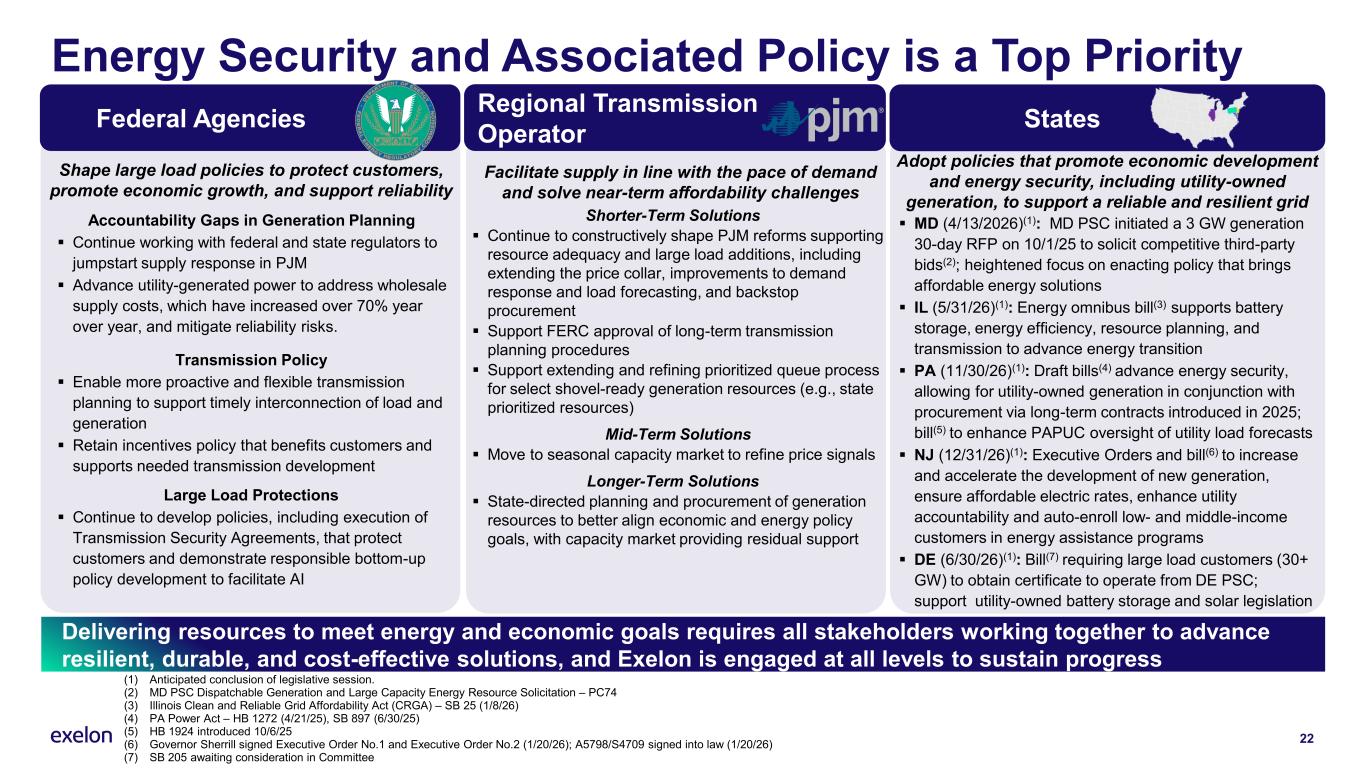

Energy Security and Associated Policy is a Top Priority Delivering resources to meet energy and economic goals requires all stakeholders working together to advance resilient, durable, and cost-effective solutions, and Exelon is engaged at all levels to sustain progress 22 StatesFederal Agencies Regional Transmission Operator (1) Anticipated conclusion of legislative session. (2) MD PSC Dispatchable Generation and Large Capacity Energy Resource Solicitation – PC74 (3) Illinois Clean and Reliable Grid Affordability Act (CRGA) – SB 25 (1/8/26) (4) PA Power Act – HB 1272 (4/21/25), SB 897 (6/30/25) (5) HB 1924 introduced 10/6/25 (6) Governor Sherrill signed Executive Order No.1 and Executive Order No.2 (1/20/26); A5798/S4709 signed into law (1/20/26) (7) SB 205 awaiting consideration in Committee ▪ MD (4/13/2026)(1): MD PSC initiated a 3 GW generation 30-day RFP on 10/1/25 to solicit competitive third-party bids(2); heightened focus on enacting policy that brings affordable energy solutions ▪ IL (5/31/26)(1): Energy omnibus bill(3) supports battery storage, energy efficiency, resource planning, and transmission to advance energy transition ▪ PA (11/30/26)(1): Draft bills(4) advance energy security, allowing for utility-owned generation in conjunction with procurement via long-term contracts introduced in 2025; bill(5) to enhance PAPUC oversight of utility load forecasts ▪ NJ (12/31/26)(1): Executive Orders and bill(6) to increase and accelerate the development of new generation, ensure affordable electric rates, enhance utility accountability and auto-enroll low- and middle-income customers in energy assistance programs ▪ DE (6/30/26)(1): Bill(7) requiring large load customers (30+ GW) to obtain certificate to operate from DE PSC; support utility-owned battery storage and solar legislation Adopt policies that promote economic development and energy security, including utility-owned generation, to support a reliable and resilient grid Shape large load policies to protect customers, promote economic growth, and support reliability Accountability Gaps in Generation Planning ▪ Continue working with federal and state regulators to jumpstart supply response in PJM ▪ Advance utility-generated power to address wholesale supply costs, which have increased over 70% year over year, and mitigate reliability risks. Transmission Policy ▪ Enable more proactive and flexible transmission planning to support timely interconnection of load and generation ▪ Retain incentives policy that benefits customers and supports needed transmission development Large Load Protections ▪ Continue to develop policies, including execution of Transmission Security Agreements, that protect customers and demonstrate responsible bottom-up policy development to facilitate AI Facilitate supply in line with the pace of demand and solve near-term affordability challenges Shorter-Term Solutions ▪ Continue to constructively shape PJM reforms supporting resource adequacy and large load additions, including extending the price collar, improvements to demand response and load forecasting, and backstop procurement ▪ Support FERC approval of long-term transmission planning procedures ▪ Support extending and refining prioritized queue process for select shovel-ready generation resources (e.g., state prioritized resources) Mid-Term Solutions ▪ Move to seasonal capacity market to refine price signals Longer-Term Solutions ▪ State-directed planning and procurement of generation resources to better align economic and energy policy goals, with capacity market providing residual support

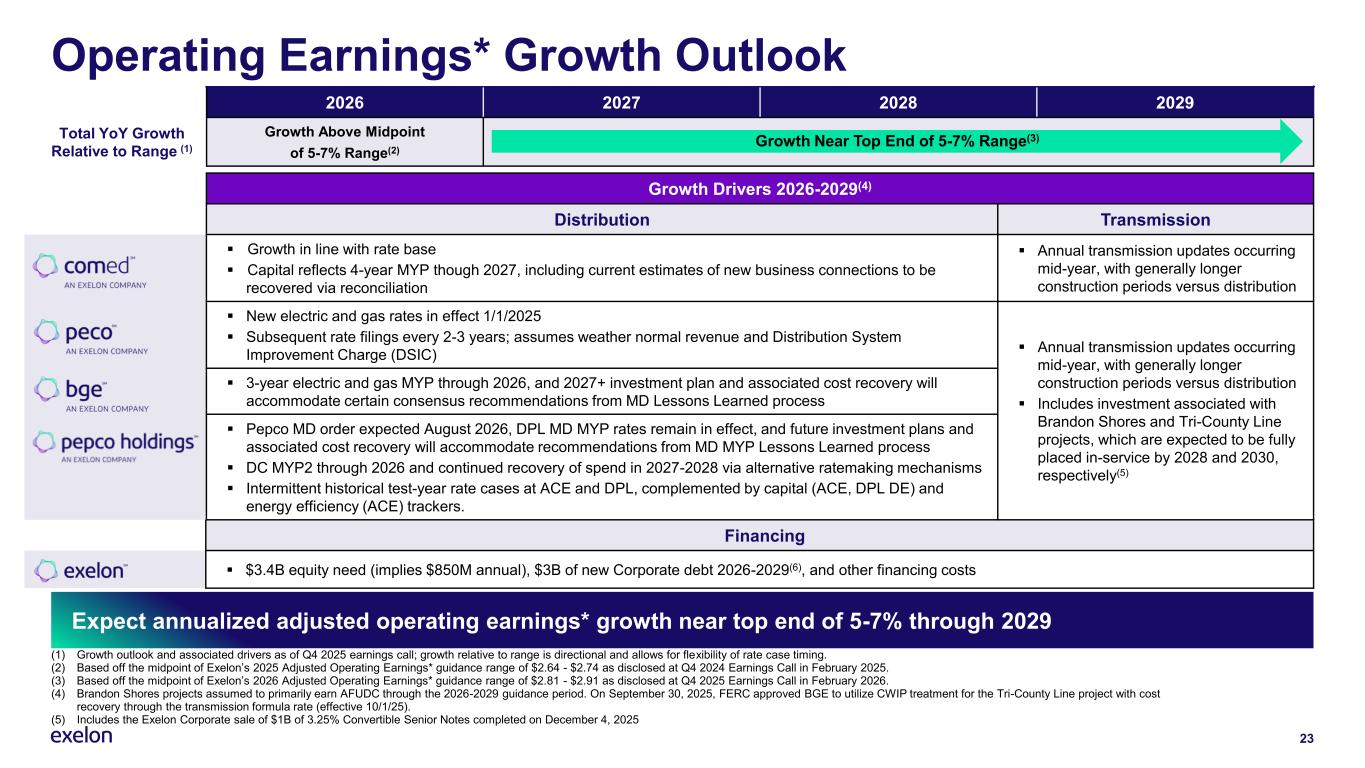

Financing ▪ $3.4B equity need (implies $850M annual), $3B of new Corporate debt 2026-2029(6), and other financing costs Operating Earnings* Growth Outlook 2026 2027 2028 2029 Total YoY Growth Relative to Range (1) Growth Above Midpoint of 5-7% Range(2) (1) Growth outlook and associated drivers as of Q4 2025 earnings call; growth relative to range is directional and allows for flexibility of rate case timing. (2) Based off the midpoint of Exelon’s 2025 Adjusted Operating Earnings* guidance range of $2.64 - $2.74 as disclosed at Q4 2024 Earnings Call in February 2025. (3) Based off the midpoint of Exelon’s 2026 Adjusted Operating Earnings* guidance range of $2.81 - $2.91 as disclosed at Q4 2025 Earnings Call in February 2026. (4) Brandon Shores projects assumed to primarily earn AFUDC through the 2026-2029 guidance period. On September 30, 2025, FERC approved BGE to utilize CWIP treatment for the Tri-County Line project with cost recovery through the transmission formula rate (effective 10/1/25). (5) Includes the Exelon Corporate sale of $1B of 3.25% Convertible Senior Notes completed on December 4, 2025 Expect annualized adjusted operating earnings* growth near top end of 5-7% through 2029 23 Growth Drivers 2026-2029(4) Distribution Transmission ▪ Growth in line with rate base ▪ Capital reflects 4-year MYP though 2027, including current estimates of new business connections to be recovered via reconciliation ▪ Annual transmission updates occurring mid-year, with generally longer construction periods versus distribution ▪ New electric and gas rates in effect 1/1/2025 ▪ Subsequent rate filings every 2-3 years; assumes weather normal revenue and Distribution System Improvement Charge (DSIC) ▪ Annual transmission updates occurring mid-year, with generally longer construction periods versus distribution ▪ Includes investment associated with Brandon Shores and Tri-County Line projects, which are expected to be fully placed in-service by 2028 and 2030, respectively(5) ▪ 3-year electric and gas MYP through 2026, and 2027+ investment plan and associated cost recovery will accommodate certain consensus recommendations from MD Lessons Learned process ▪ Pepco MD order expected August 2026, DPL MD MYP rates remain in effect, and future investment plans and associated cost recovery will accommodate recommendations from MD MYP Lessons Learned process ▪ DC MYP2 through 2026 and continued recovery of spend in 2027-2028 via alternative ratemaking mechanisms ▪ Intermittent historical test-year rate cases at ACE and DPL, complemented by capital (ACE, DPL DE) and energy efficiency (ACE) trackers. Growth Near Top End of 5-7% Range(3)

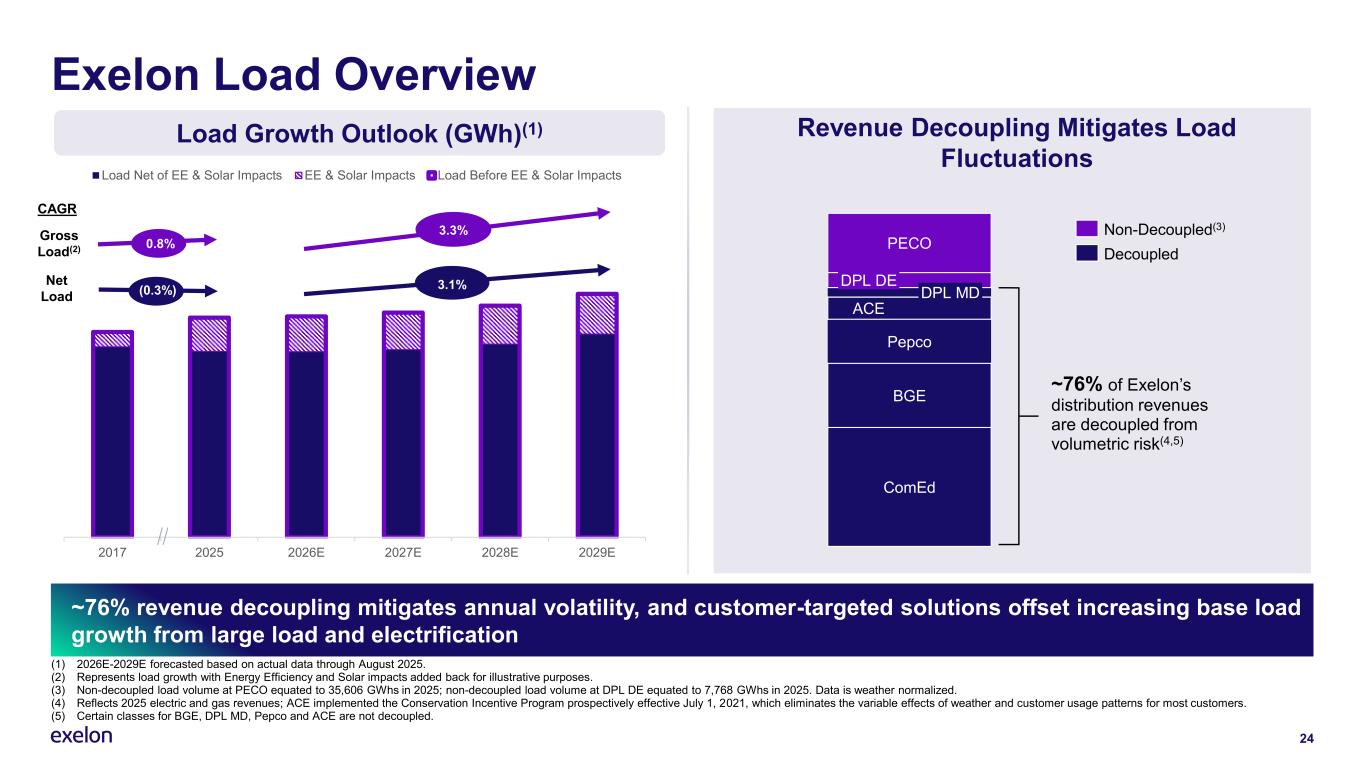

2017 2025 2026E 2027E 2028E 2029E Load Net of EE & Solar Impacts EE & Solar Impacts Load Before EE & Solar Impacts 24 Exelon Load Overview Revenue Decoupling Mitigates Load Fluctuations PECO DPL DE DPL MD ACE Pepco BGE ComEd Non-Decoupled(3) Decoupled ~76% of Exelon’s distribution revenues are decoupled from volumetric risk(4,5) (1) 2026E-2029E forecasted based on actual data through August 2025. (2) Represents load growth with Energy Efficiency and Solar impacts added back for illustrative purposes. (3) Non-decoupled load volume at PECO equated to 35,606 GWhs in 2025; non-decoupled load volume at DPL DE equated to 7,768 GWhs in 2025. Data is weather normalized. (4) Reflects 2025 electric and gas revenues; ACE implemented the Conservation Incentive Program prospectively effective July 1, 2021, which eliminates the variable effects of weather and customer usage patterns for most customers. (5) Certain classes for BGE, DPL MD, Pepco and ACE are not decoupled. ~76% revenue decoupling mitigates annual volatility, and customer-targeted solutions offset increasing base load growth from large load and electrification Load Growth Outlook (GWh)(1) 3.1% 3.3% 0.8% (0.3%) Gross Load(2) Net Load CAGR

25 Utility Capex and Rate Base vs. Previous Disclosures Q4 2025 Capital Expenditures ($M) Q4 2025 Rate Base ($B) 6,025 5,600 5,700 5,550 5,675 2,275 3,350 3,925 3,850 3,725 975 2025 975 2026E 975 2027E 950 2028E 950 2029E 9,250 10,600 10,350 10,3509,950 42.4 44.7 47.6 50.2 53.1 12.7 13.3 15.0 18.6 22.3 11.4 12.0 9.5 2025 10.0 2026E 10.8 2027E 2028E 2029E 64.6 68.1 73.4 80.2 87.5 +7.9% Gas Delivery/Other(1) Electric Transmission Electric Distribution(2) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates and does not include Construction Work In Progress (CWIP), which earns an AFUDC return. Q4 2024 disclosures dated February 12, 2025. Q4 2025 disclosure dated February 12, 2026. (1) “Other” only applies to rate base and includes ComEd’s long-term regulatory assets (Energy Efficiency & Distributed Generation Rebate program) recovered under separate tariffs, which earn a full authorized Rate of Return. See Note 3 – Regulatory Matters in 2024 10-K for additional detail. (2) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections. Planning to invest $41.3B of capital from 2026-2029, including growing transmission by ~70% plan-over-plan, for the benefit of our customers, supporting projected rate base growth of 7.9% from 2025-2029 Q4 2024 Capital Expenditures ($M) Q4 2024 Rate Base ($B) 5,100 5,550 5,300 5,400 5,400 2,550 3,475 3,400 3,1251,000 1,450 2024 975 2025E 950 2026E 950 2027E 925 2028E 7,550 9,075 9,725 9,725 9,475 39.1 42.1 44.7 47.4 49.9 12.3 12.6 13.2 14.9 18.410.2 10.8 11.4 8.6 2024 9.4 2025E 2026E 2027E 2028E 59.9 64.1 68.0 73.0 79.8 +7.4%

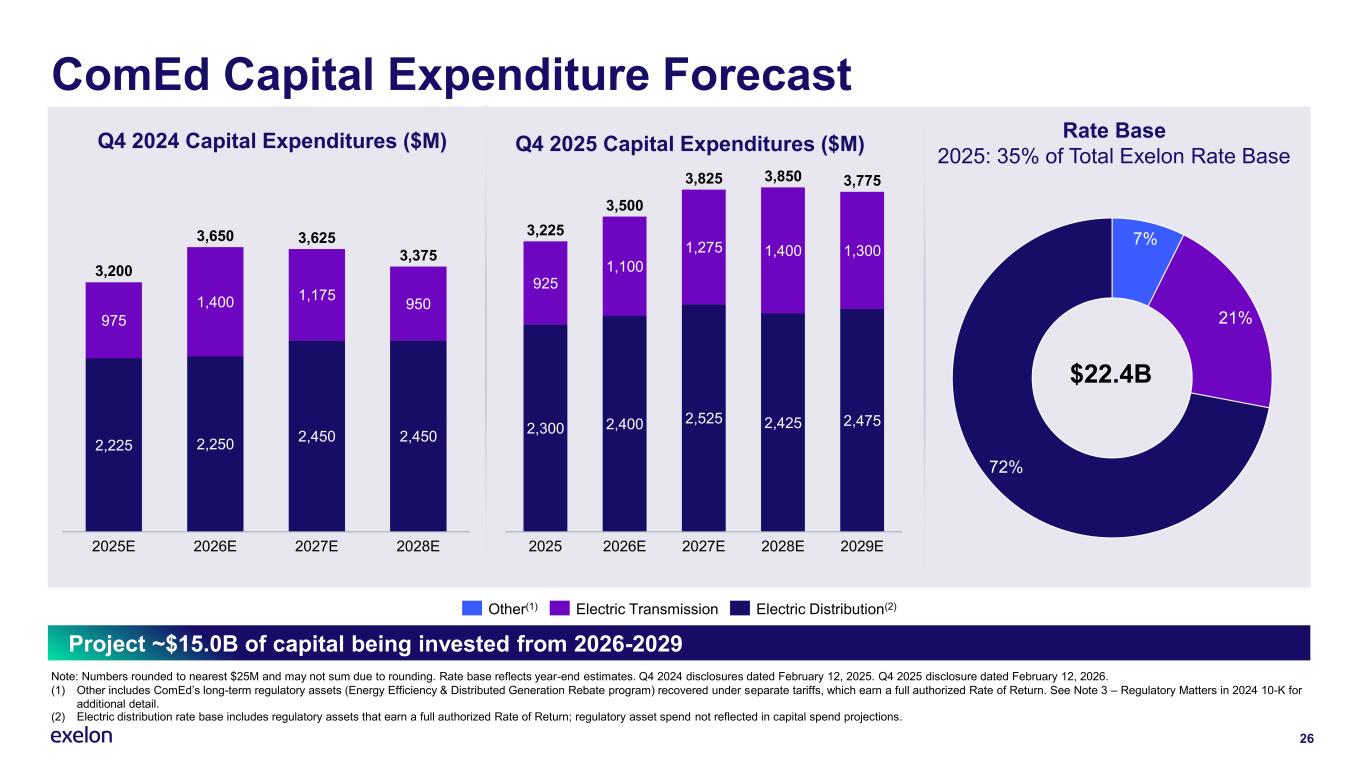

ComEd Capital Expenditure Forecast Q4 2025 Capital Expenditures ($M) Project ~$15.0B of capital being invested from 2026-2029 2,300 2,400 2,525 2,425 2,475 925 1,100 1,275 1,400 1,300 2025 2026E 2027E 2028E 2029E 3,225 3,500 3,825 3,7753,850 Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2024 disclosures dated February 12, 2025. Q4 2025 disclosure dated February 12, 2026. (1) Other includes ComEd’s long-term regulatory assets (Energy Efficiency & Distributed Generation Rebate program) recovered under separate tariffs, which earn a full authorized Rate of Return. See Note 3 – Regulatory Matters in 2024 10-K for additional detail. (2) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections. Rate Base 2025: 35% of Total Exelon Rate Base 7% 21% 72% Other(1) Electric Transmission Electric Distribution(2) $22.4B 26 Q4 2024 Capital Expenditures ($M) 2,225 2,250 2,450 2,450 975 1,400 1,175 950 2025E 2026E 2027E 2028E 3,200 3,650 3,625 3,375

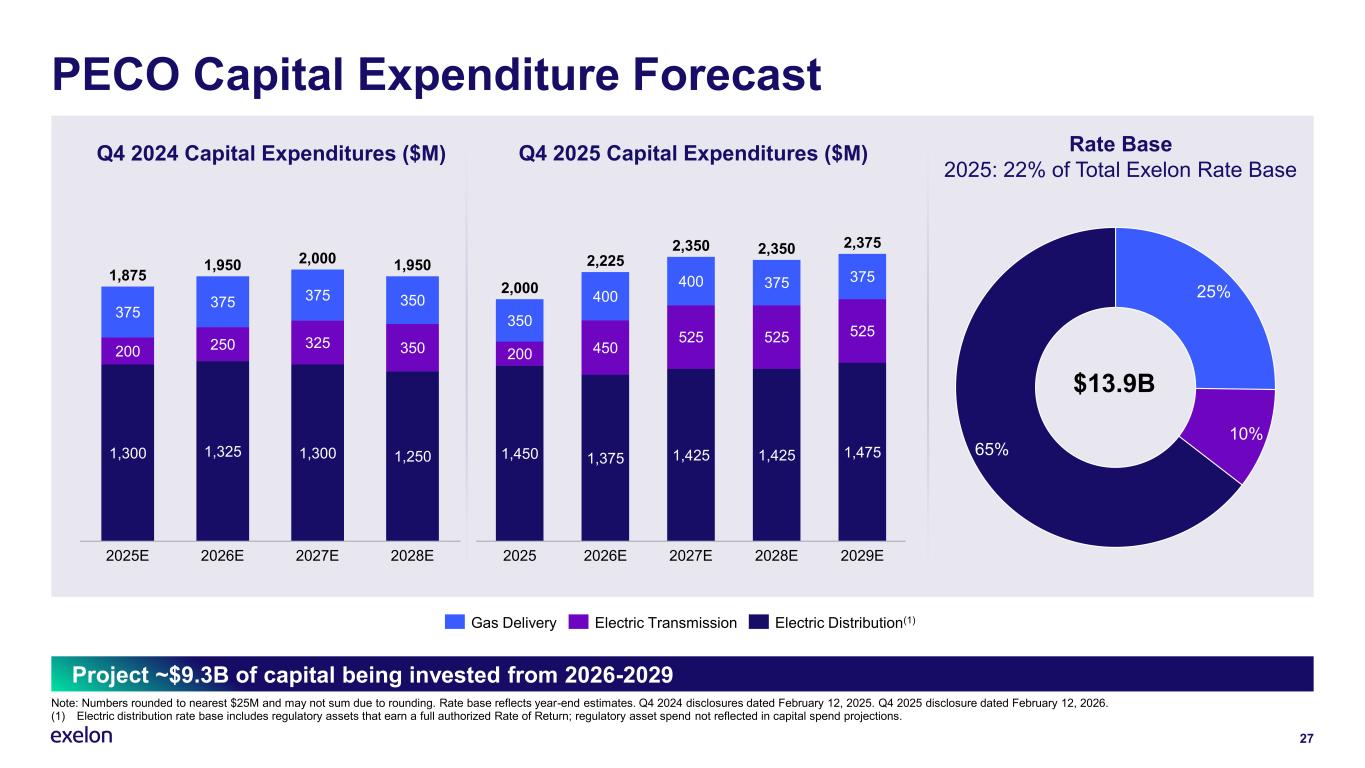

Project ~$9.3B of capital being invested from 2026-2029 27 PECO Capital Expenditure Forecast 1,450 1,375 1,425 1,425 1,475 200 450 525 525 525 350 400 400 375 375 2025 2026E 2027E 2028E 2029E 2,000 2,225 2,350 2,350 2,375 Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2024 disclosures dated February 12, 2025. Q4 2025 disclosure dated February 12, 2026. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections. Rate Base 2025: 22% of Total Exelon Rate Base 25% 10% 65% Gas Delivery Electric Transmission Electric Distribution(1) $13.9B Q4 2025 Capital Expenditures ($M) 1,300 1,325 1,300 1,250 200 250 325 350 375 375 375 350 2025E 2026E 2027E 2028E 1,875 1,950 2,000 1,950 Q4 2024 Capital Expenditures ($M)

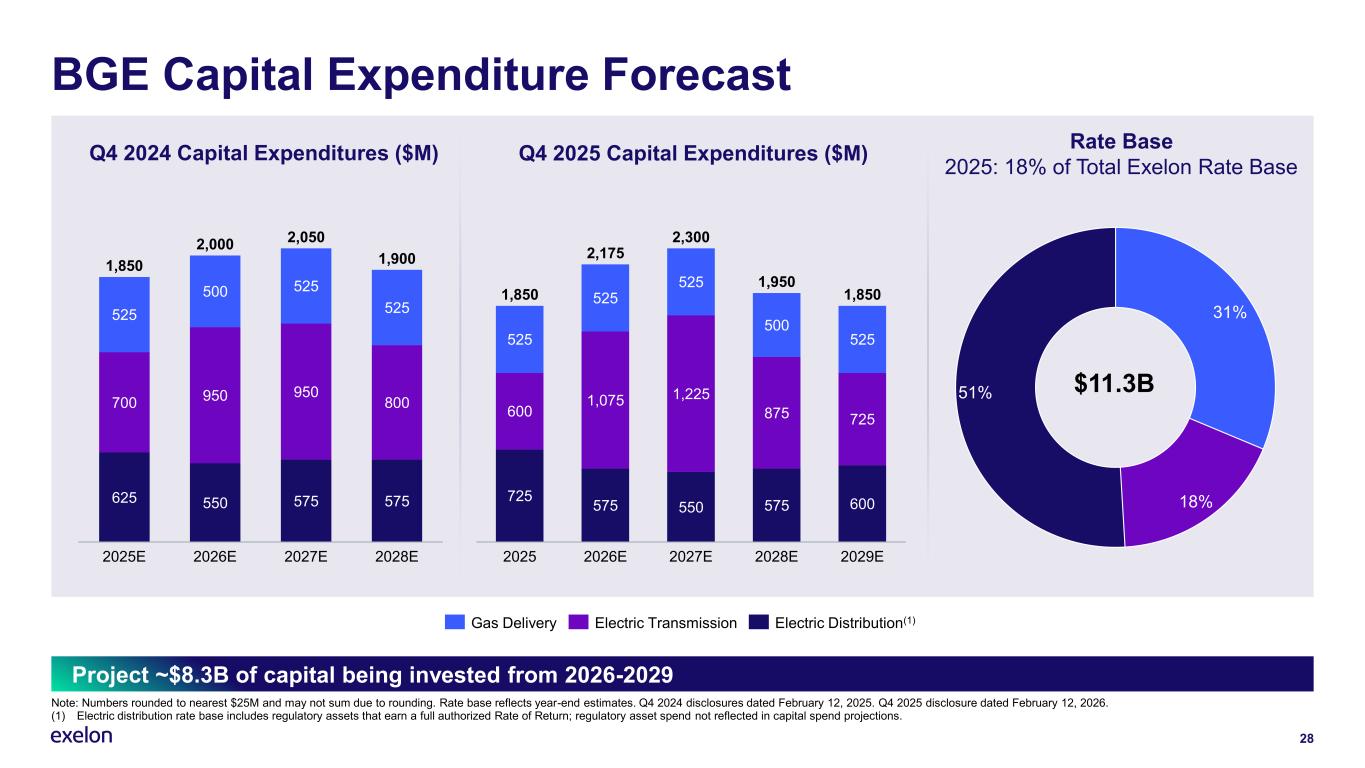

Project ~$8.3B of capital being invested from 2026-2029 28 BGE Capital Expenditure Forecast 725 575 550 575 600 600 1,075 1,225 875 725 525 525 525 500 525 2025 2026E 2027E 2028E 2029E 1,850 2,175 2,300 1,950 1,850 625 550 575 575 700 950 950 800 525 500 525 525 2025E 2026E 2027E 2028E 1,850 2,000 2,050 1,900 Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2024 disclosures dated February 12, 2025. Q4 2025 disclosure dated February 12, 2026. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections. Rate Base 2025: 18% of Total Exelon Rate Base 31% 18% 51% Gas Delivery Electric Transmission Electric Distribution(1) $11.3B Q4 2025 Capital Expenditures ($M)Q4 2024 Capital Expenditures ($M)

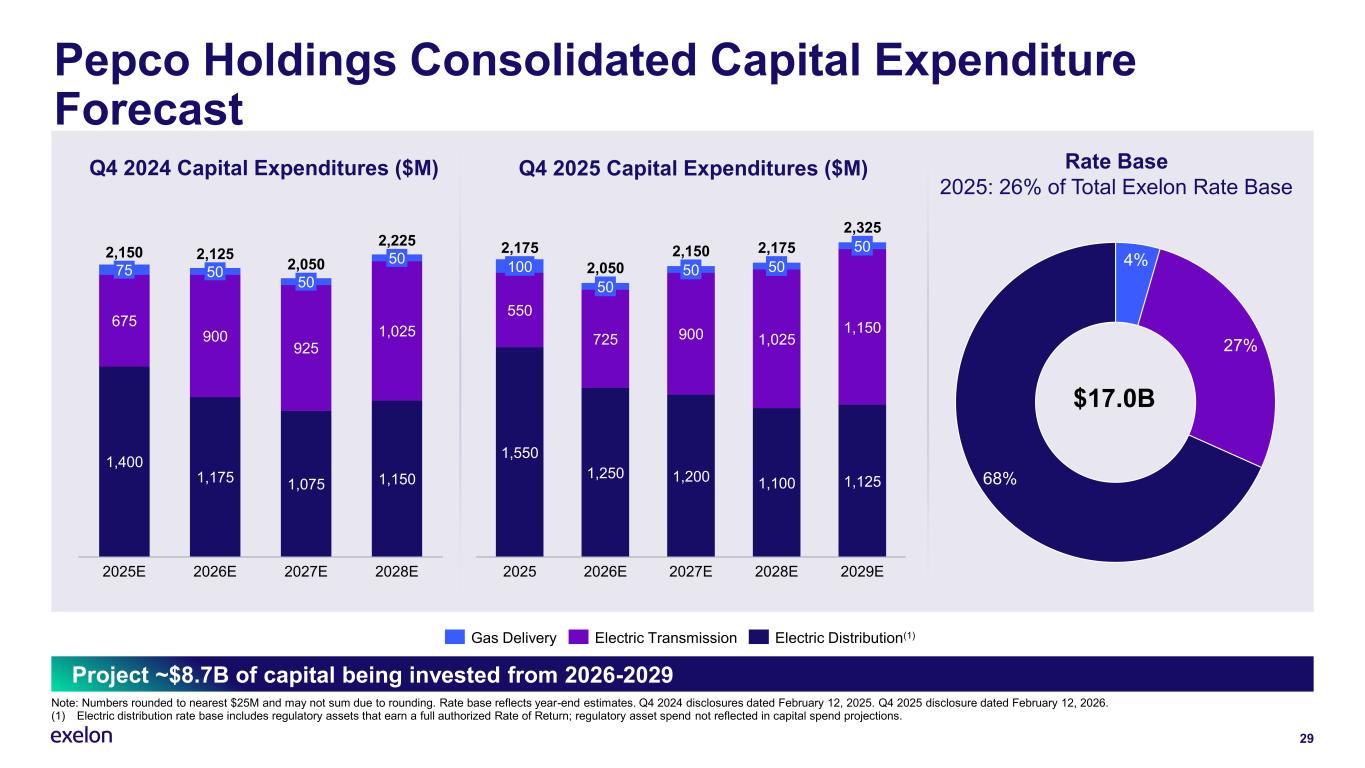

29 Pepco Holdings Consolidated Capital Expenditure Forecast 1,550 1,250 1,200 1,100 1,125 550 725 900 1,025 1,150 100 2025 50 2026E 50 2027E 50 2028E 50 2029E 2,175 2,050 2,150 2,175 2,325 1,400 1,175 1,075 1,150 675 900 925 1,025 75 2025E 50 2026E 50 2027E 50 2028E 2,150 2,125 2,050 2,225 Project ~$8.7B of capital being invested from 2026-2029 Rate Base 2025: 26% of Total Exelon Rate Base 4% 27% 68% Gas Delivery Electric Transmission Electric Distribution(1) $17.0B Q4 2025 Capital Expenditures ($M)Q4 2024 Capital Expenditures ($M) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2024 disclosures dated February 12, 2025. Q4 2025 disclosure dated February 12, 2026. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections.

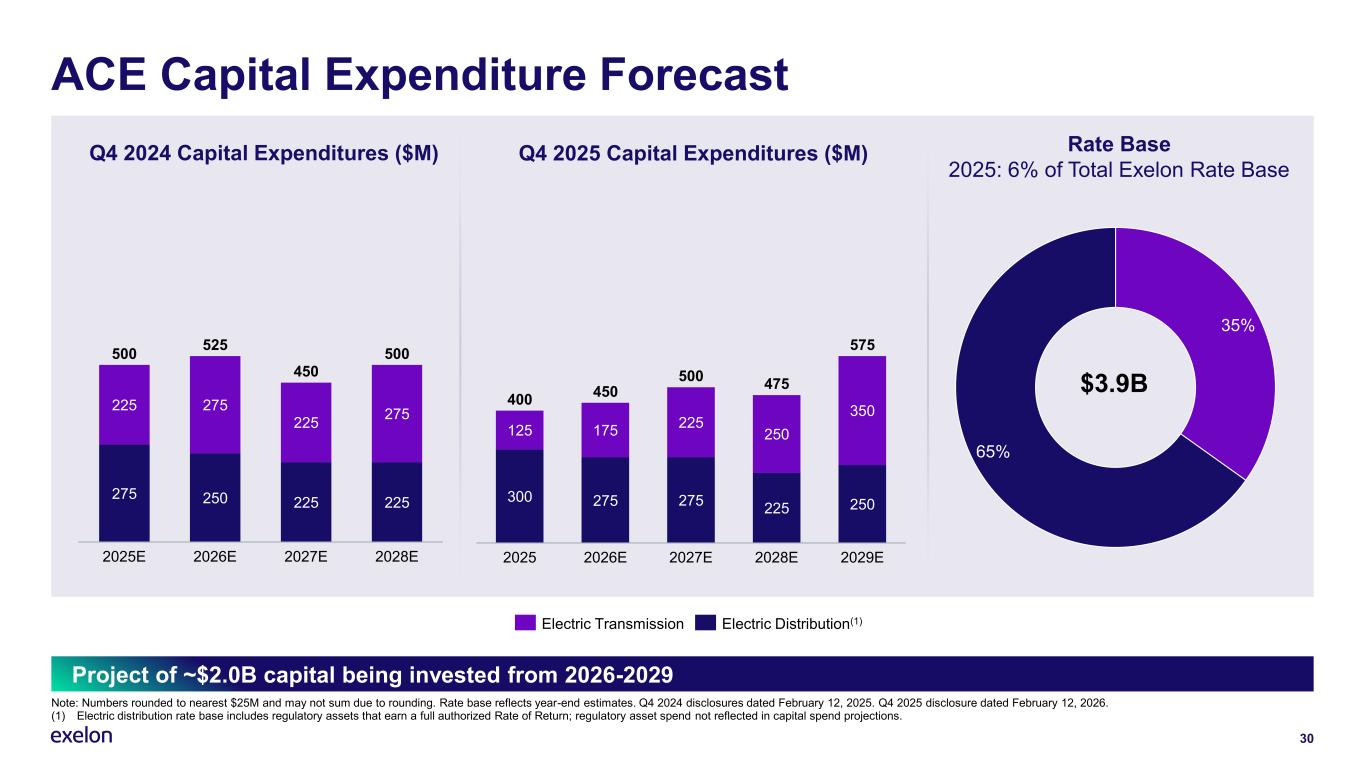

Project of ~$2.0B capital being invested from 2026-2029 30 ACE Capital Expenditure Forecast 300 275 225 250 125 175 225 250 350 2025 275 2026E 2027E 2028E 2029E 400 450 500 475 575 275 250 225 225 225 275 225 275 2025E 2026E 2027E 2028E 500 525 450 500 Electric Transmission Electric Distribution(1) Rate Base 2025: 6% of Total Exelon Rate Base 35% 65% $3.9B Q4 2025 Capital Expenditures ($M)Q4 2024 Capital Expenditures ($M) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2024 disclosures dated February 12, 2025. Q4 2025 disclosure dated February 12, 2026. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections.

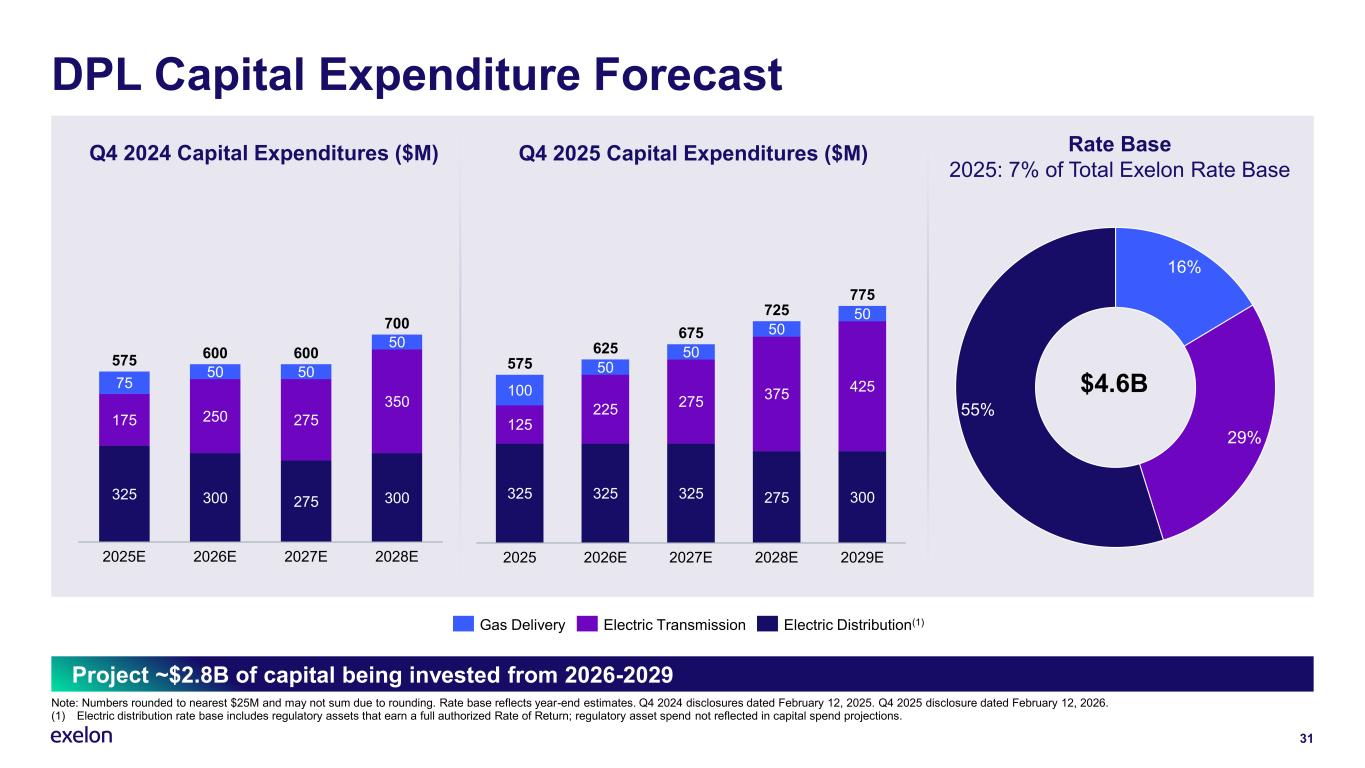

Project ~$2.8B of capital being invested from 2026-2029 31 DPL Capital Expenditure Forecast 325 325 325 300 125 225 275 375 425100 50 50 50 50 2025 2026E 2027E 275 2028E 2029E 575 625 675 725 775 325 300 275 300 175 250 275 350 75 50 50 50 2025E 2026E 2027E 2028E 575 600 600 700 Gas Delivery Electric Transmission Electric Distribution(1) Rate Base 2025: 7% of Total Exelon Rate Base 16% 29% 55% $4.6B Q4 2025 Capital Expenditures ($M)Q4 2024 Capital Expenditures ($M) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2024 disclosures dated February 12, 2025. Q4 2025 disclosure dated February 12, 2026. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections.

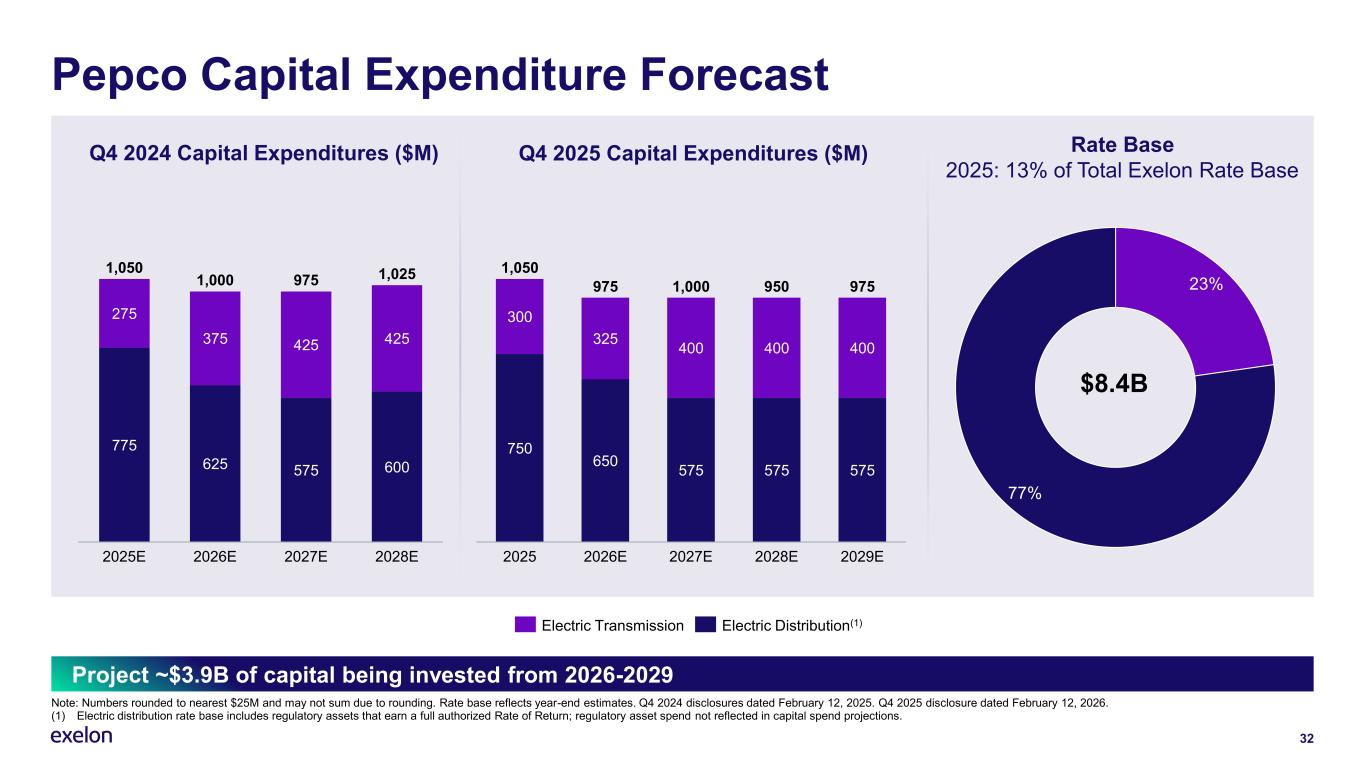

32 Pepco Capital Expenditure Forecast 750 650 575 575 575 300 325 400 400 400 2025 2026E 2027E 2028E 2029E 1,050 975 1,000 950 975 775 625 575 600 275 375 425 425 2025E 2026E 2027E 2028E 1,050 1,000 975 1,025 Electric Transmission Electric Distribution(1) Project ~$3.9B of capital being invested from 2026-2029 Rate Base 2025: 13% of Total Exelon Rate Base 23% 77% $8.4B Q4 2025 Capital Expenditures ($M)Q4 2024 Capital Expenditures ($M) Note: Numbers rounded to nearest $25M and may not sum due to rounding. Rate base reflects year-end estimates. Q4 2024 disclosures dated February 12, 2025. Q4 2025 disclosure dated February 12, 2026. (1) Electric distribution rate base includes regulatory assets that earn a full authorized Rate of Return; regulatory asset spend not reflected in capital spend projections.

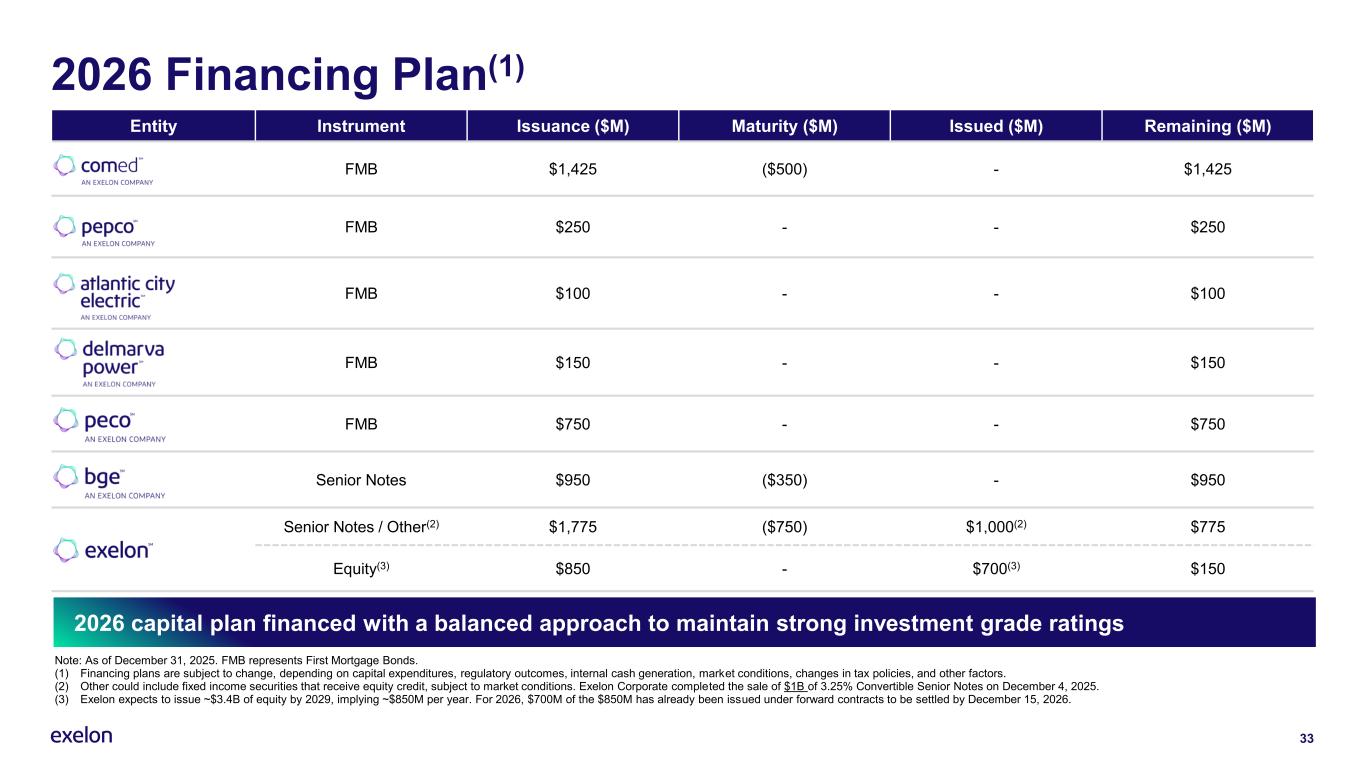

2026 Financing Plan(1) 2026 capital plan financed with a balanced approach to maintain strong investment grade ratings Entity Instrument Issuance ($M) Maturity ($M) Issued ($M) Remaining ($M) FMB $1,425 ($500) - $1,425 FMB $250 - - $250 FMB $100 - - $100 FMB $150 - - $150 FMB $750 - - $750 Senior Notes $950 ($350) - $950 Senior Notes / Other(2) $1,775 ($750) $1,000(2) $775 Equity(3) $850 - $700(3) $150 33 Note: As of December 31, 2025. FMB represents First Mortgage Bonds. (1) Financing plans are subject to change, depending on capital expenditures, regulatory outcomes, internal cash generation, market conditions, changes in tax policies, and other factors. (2) Other could include fixed income securities that receive equity credit, subject to market conditions. Exelon Corporate completed the sale of $1B of 3.25% Convertible Senior Notes on December 4, 2025. (3) Exelon expects to issue ~$3.4B of equity by 2029, implying ~$850M per year. For 2026, $700M of the $850M has already been issued under forward contracts to be settled by December 15, 2026.

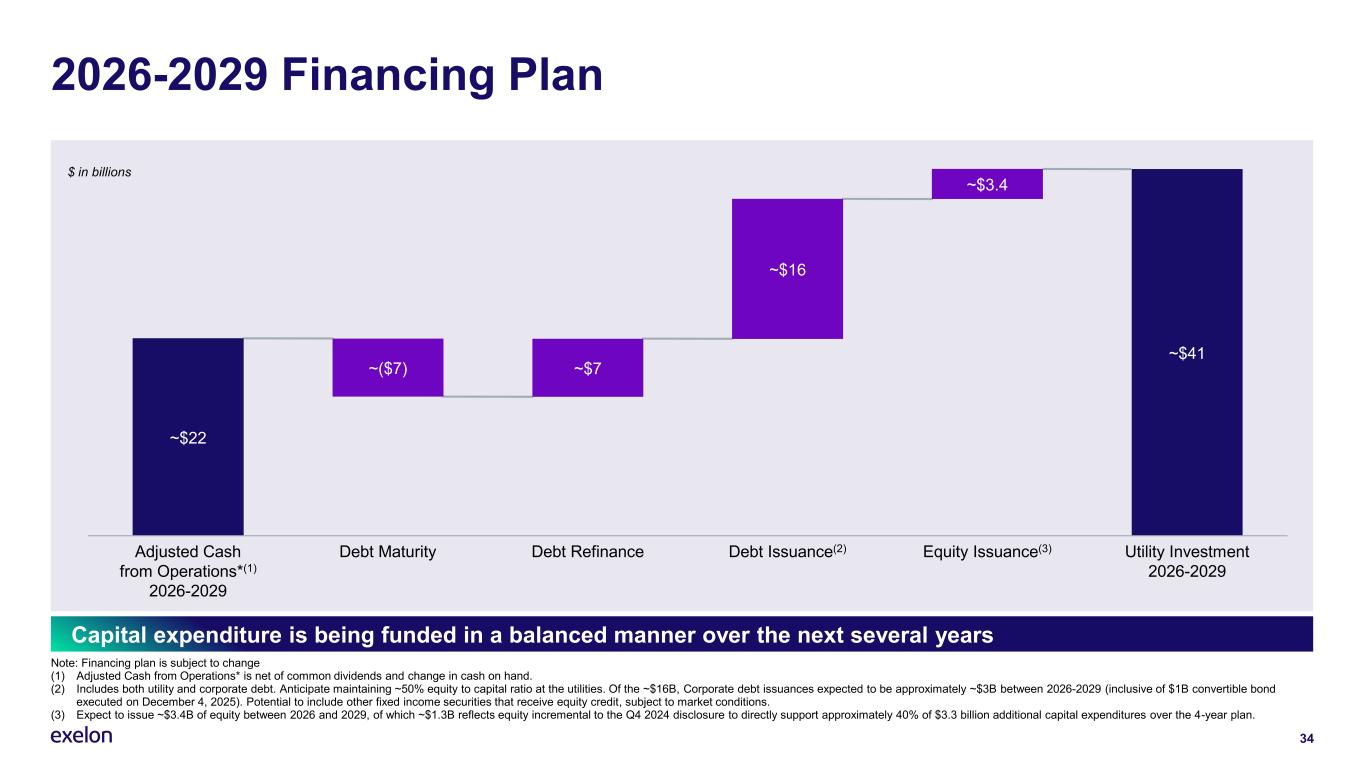

34 2026-2029 Financing Plan ~$22 ~$41 ~($7) ~$7 ~$16 Adjusted Cash from Operations*(1) 2026-2029 Debt Maturity Debt Refinance Debt Issuance(2) Equity Issuance(3) Utility Investment 2026-2029 ~$3.4 $ in billions Note: Financing plan is subject to change (1) Adjusted Cash from Operations* is net of common dividends and change in cash on hand. (2) Includes both utility and corporate debt. Anticipate maintaining ~50% equity to capital ratio at the utilities. Of the ~$16B, Corporate debt issuances expected to be approximately ~$3B between 2026-2029 (inclusive of $1B convertible bond executed on December 4, 2025). Potential to include other fixed income securities that receive equity credit, subject to market conditions. (3) Expect to issue ~$3.4B of equity between 2026 and 2029, of which ~$1.3B reflects equity incremental to the Q4 2024 disclosure to directly support approximately 40% of $3.3 billion additional capital expenditures over the 4-year plan. Capital expenditure is being funded in a balanced manner over the next several years

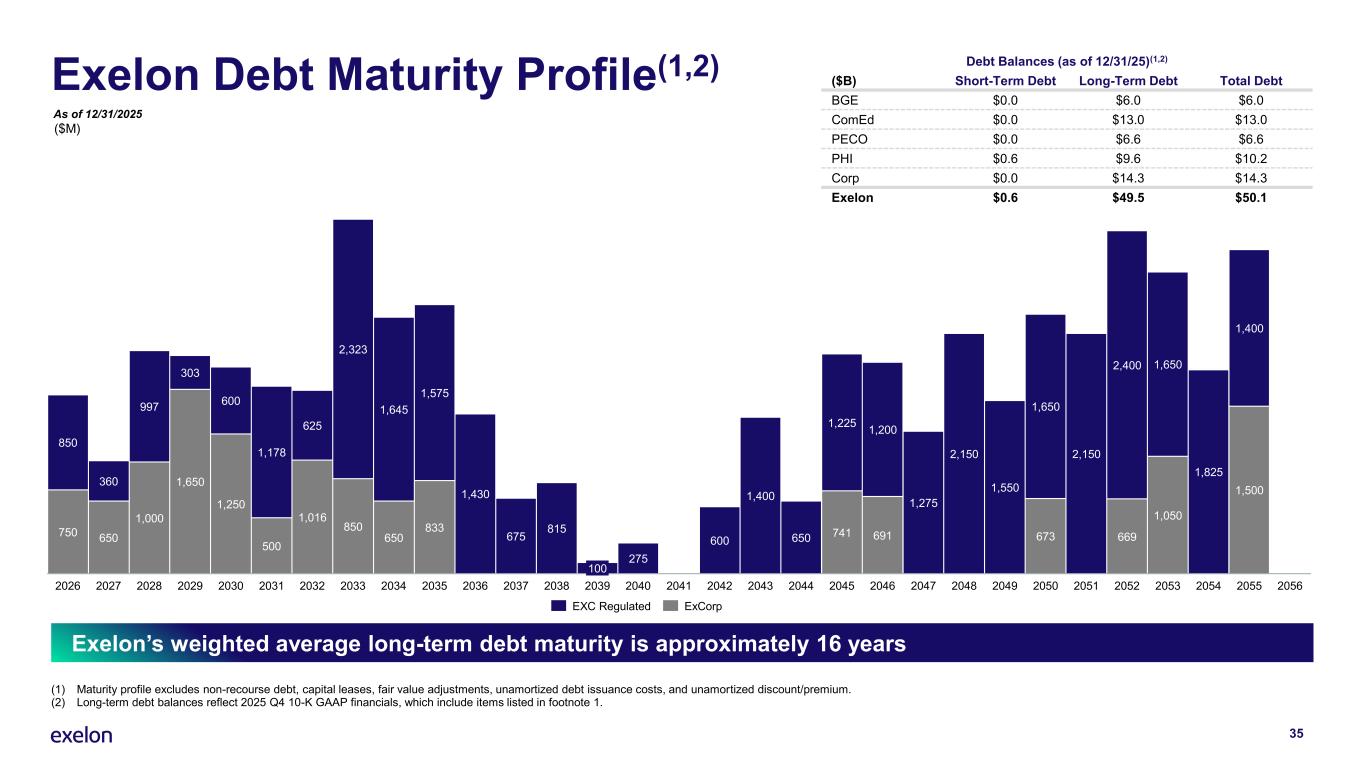

Exelon Debt Maturity Profile(1,2) Debt Balances (as of 12/31/25)(1,2) ($B) Short-Term Debt Long-Term Debt Total Debt BGE $0.0 $6.0 $6.0 ComEd $0.0 $13.0 $13.0 PECO $0.0 $6.6 $6.6 PHI $0.6 $9.6 $10.2 Corp $0.0 $14.3 $14.3 Exelon $0.6 $49.5 $50.1 750 650 1,000 1,650 1,250 500 1,016 850 650 833 1,430 675 815 275 600 1,400 650 741 691 1,275 2,150 1,550 673 2,150 669 1,050 1,825 1,500 850 360 997 303 600 1,178 625 2,323 1,645 1,575 1,225 1,200 1,650 2,400 1,650 1,400 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 100 2039 20402026 2042 2043 2044 2045 2046 2047 2048 2049 2050 2051 2052 2053 2054 2055 20562041 (1) Maturity profile excludes non-recourse debt, capital leases, fair value adjustments, unamortized debt issuance costs, and unamortized discount/premium. (2) Long-term debt balances reflect 2025 Q4 10-K GAAP financials, which include items listed in footnote 1. Exelon’s weighted average long-term debt maturity is approximately 16 years ($M) As of 12/31/2025 EXC Regulated ExCorp 35

36 Exelon’s Annual Earned Operating ROEs* 9.5% 9.4% 9.6% 10.0% 8.7% 9.2% 9.4% 9.3% 9.1% 9.7% 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Note: Represents the twelve-month periods December 31, 2016-2025 for Exelon’s utilities (excludes Corp). Earned operating ROEs* represent weighted average across all lines of business (Electric Distribution, Gas Distribution, and Electric Transmission). Gray-shaded area represents Exelon’s 9-10% targeted range. Delivered 2025 operating ROE* within our 9-10% targeted range, executing within target since 2021

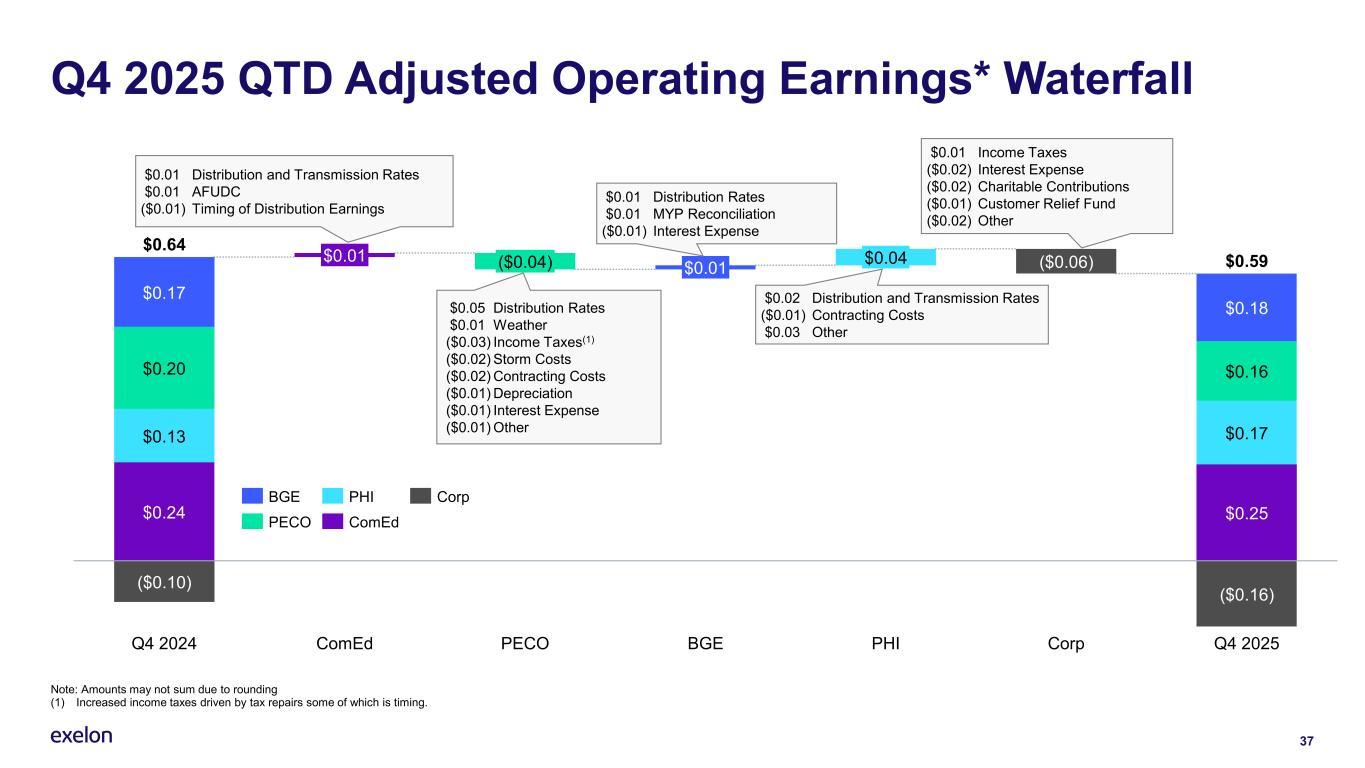

37 Q4 2025 QTD Adjusted Operating Earnings* Waterfall Note: Amounts may not sum due to rounding (1) Increased income taxes driven by tax repairs some of which is timing. $0.24 $0.13 $0.20 $0.17 ($0.10) ($0.16) Q4 2024 $0.01 ComEd ($0.04) PECO $0.01 BGE $0.04 PHI ($0.06) Corp $0.18 $0.16 $0.17 $0.25 Q4 2025 $0.64 $0.59 BGE PECO PHI ComEd Corp $0.01 Income Taxes ($0.02) Interest Expense ($0.02) Charitable Contributions ($0.01) Customer Relief Fund ($0.02) Other $0.01 Distribution and Transmission Rates $0.01 AFUDC ($0.01) Timing of Distribution Earnings $0.05 Distribution Rates $0.01 Weather ($0.03) Income Taxes(1) ($0.02) Storm Costs ($0.02) Contracting Costs ($0.01) Depreciation ($0.01) Interest Expense ($0.01) Other $0.01 Distribution Rates $0.01 MYP Reconciliation ($0.01) Interest Expense $0.02 Distribution and Transmission Rates ($0.01) Contracting Costs $0.03 Other

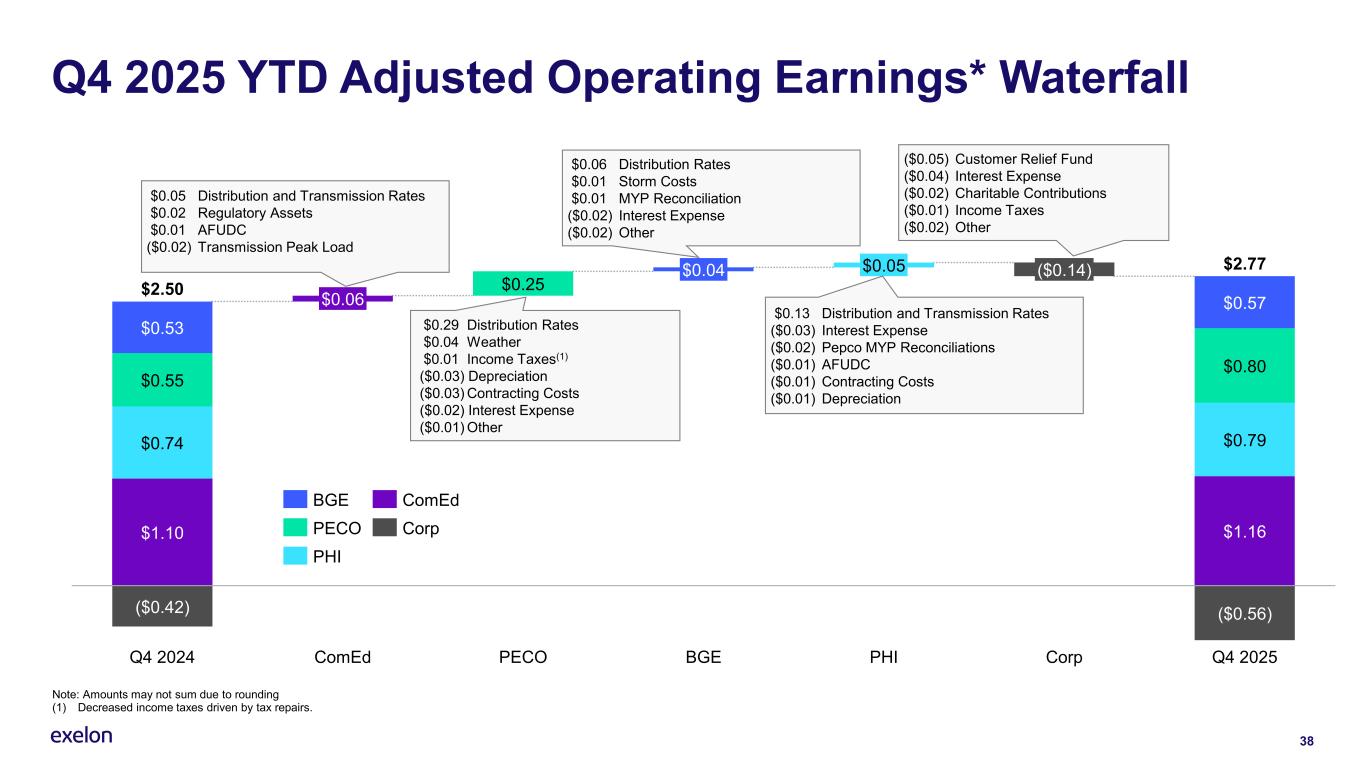

38 Q4 2025 YTD Adjusted Operating Earnings* Waterfall Note: Amounts may not sum due to rounding (1) Decreased income taxes driven by tax repairs. $0.25 ($0.42) ($0.56) $0.53 $0.55 $0.74 $1.10 Q4 2024 $0.06 ComEd PECO $0.04 BGE $0.05 PHI ($0.14) Corp $0.57 $0.80 $0.79 $1.16 Q4 2025 $2.50 $2.77 BGE PECO PHI ComEd Corp ($0.05) Customer Relief Fund ($0.04) Interest Expense ($0.02) Charitable Contributions ($0.01) Income Taxes ($0.02) Other $0.05 Distribution and Transmission Rates $0.02 Regulatory Assets $0.01 AFUDC ($0.02) Transmission Peak Load $0.29 Distribution Rates $0.04 Weather $0.01 Income Taxes(1) ($0.03) Depreciation ($0.03) Contracting Costs ($0.02) Interest Expense ($0.01) Other $0.06 Distribution Rates $0.01 Storm Costs $0.01 MYP Reconciliation ($0.02) Interest Expense ($0.02) Other $0.13 Distribution and Transmission Rates ($0.03) Interest Expense ($0.02) Pepco MYP Reconciliations ($0.01) AFUDC ($0.01) Contracting Costs ($0.01) Depreciation

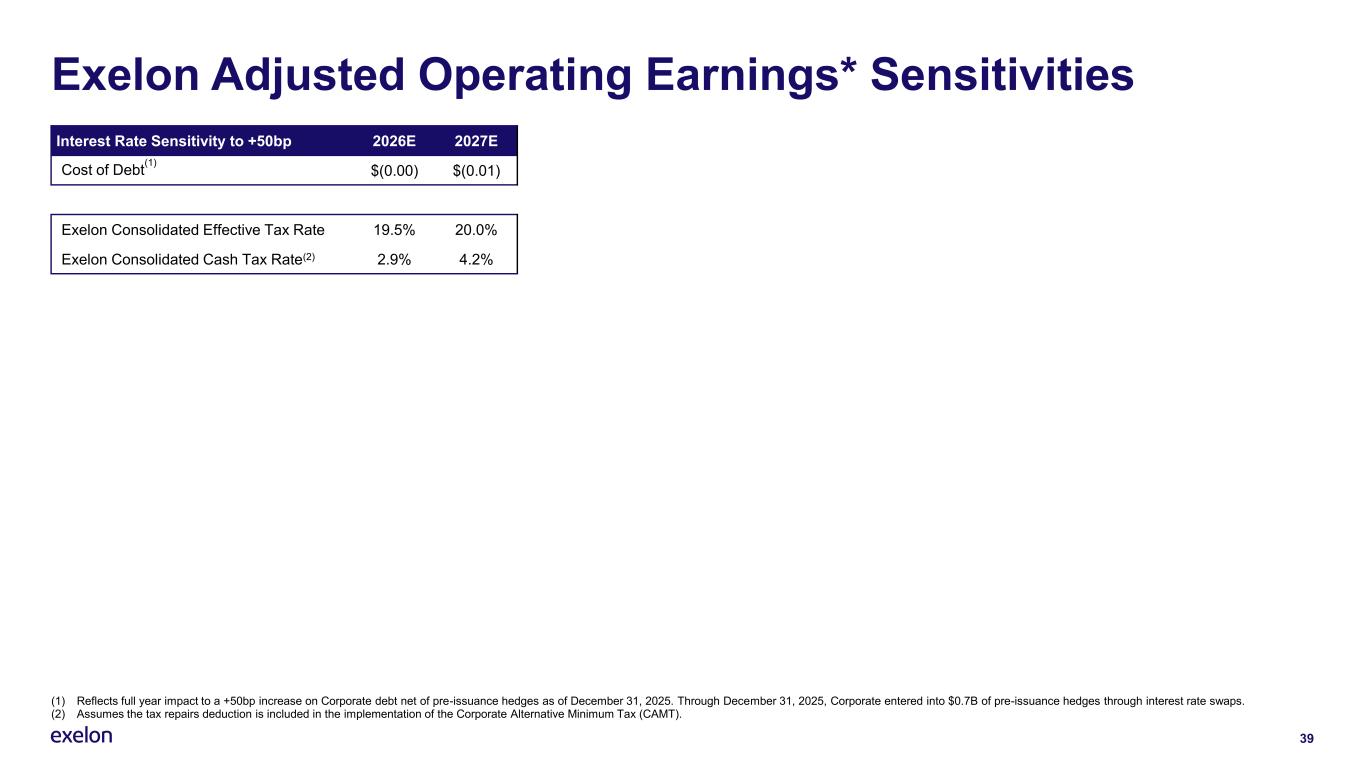

39 Exelon Adjusted Operating Earnings* Sensitivities Interest Rate Sensitivity to +50bp 2026E 2027E Cost of Debt (1) $(0.00) $(0.01) Exelon Consolidated Effective Tax Rate 19.5% 20.0% Exelon Consolidated Cash Tax Rate(2) 2.9% 4.2% (1) Reflects full year impact to a +50bp increase on Corporate debt net of pre-issuance hedges as of December 31, 2025. Through December 31, 2025, Corporate entered into $0.7B of pre-issuance hedges through interest rate swaps. (2) Assumes the tax repairs deduction is included in the implementation of the Corporate Alternative Minimum Tax (CAMT).

40 Rate Case Details

41 Exelon Distribution Rate Case Updates Note: Unless otherwise noted, based on schedules of Delaware Public Service Commission (DE PSC), New Jersey Board of Public Utilities (NJBPU), and Maryland Public Service Commission (MD PSC), that are subject to change. (1) Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings. (2) On Nov 21, 2025, the NJBPU approved ACE’s settlement that reflects an overall increase of $54M to base distribution rates, excluding the transfer of $11.1 million of Infrastructure Investment Program costs (IIP) and $3.6M of Sales and Use Tax into distribution rates. (3) Revenue requirement excludes the transfer of $8.0M of revenues from the Distribution System Improvement Charge (DSIC) capital tracker into base distribution rates. As permitted by Delaware law, DPL implemented interim rates on April 20, 2025; new rates took effect January 1, 2026. Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings. (4) Revenue requirement excludes the requested transfer of $23.2 million Distribution System Improvement Charge (DSIC). As permitted by Delaware law, DPL may implement interim rates effective 7/9/26, subject to refund. Jul Aug Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Revenue Req. Increase Approved ROE / Equity Ratio Order Date $54.0M(1,2) 9.60% / 50.24% Nov 2025 $21.5M(1,3) 9.60% / 50.51% Dec 2025 FOIT RT EH ACE Electric Rate case filed Rebuttal testimony Initial briefs Final commission order Intervenor direct testimony Evidentiary hearings Reply briefs Settlement agreement CF IT RT EH IB RB FO SA DPL DE Gas IT RT EH Completed Since Q3 2025 Call Jul Aug Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Revenue Req. Increase Requested ROE / Equity Ratio Expected Order Date $133.2M(1) 10.50% / 51.25% Aug 2026 $44.6M(1,4) 10.50% / 50.50% Q3 2027 Pepco MD Electric DPL DE Electric CF Open Base Rate Cases IT RT EH FO CF FO

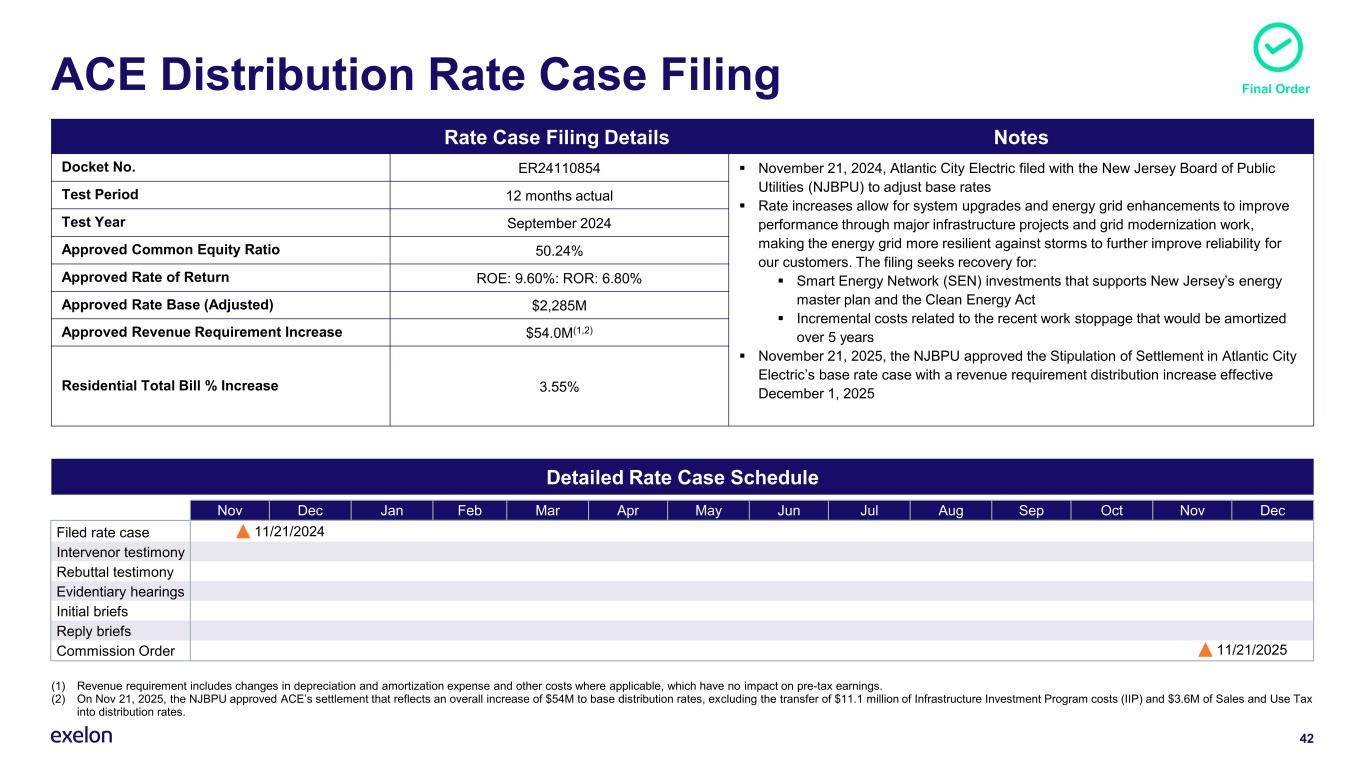

42 ACE Distribution Rate Case Filing Rate Case Filing Details Notes Docket No. ER24110854 ▪ November 21, 2024, Atlantic City Electric filed with the New Jersey Board of Public Utilities (NJBPU) to adjust base rates ▪ Rate increases allow for system upgrades and energy grid enhancements to improve performance through major infrastructure projects and grid modernization work, making the energy grid more resilient against storms to further improve reliability for our customers. The filing seeks recovery for: ▪ Smart Energy Network (SEN) investments that supports New Jersey’s energy master plan and the Clean Energy Act ▪ Incremental costs related to the recent work stoppage that would be amortized over 5 years ▪ November 21, 2025, the NJBPU approved the Stipulation of Settlement in Atlantic City Electric’s base rate case with a revenue requirement distribution increase effective December 1, 2025 Test Period 12 months actual Test Year September 2024 Approved Common Equity Ratio 50.24% Approved Rate of Return ROE: 9.60%: ROR: 6.80% Approved Rate Base (Adjusted) $2,285M Approved Revenue Requirement Increase $54.0M(1,2) Residential Total Bill % Increase 3.55% Detailed Rate Case Schedule Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 11/21/2024 Intervenor testimony Rebuttal testimony Filed rate case Evidentiary hearings Initial briefs Reply briefs Commission Order 11/21/2025 (1) Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings. (2) On Nov 21, 2025, the NJBPU approved ACE’s settlement that reflects an overall increase of $54M to base distribution rates, excluding the transfer of $11.1 million of Infrastructure Investment Program costs (IIP) and $3.6M of Sales and Use Tax into distribution rates. Final Order

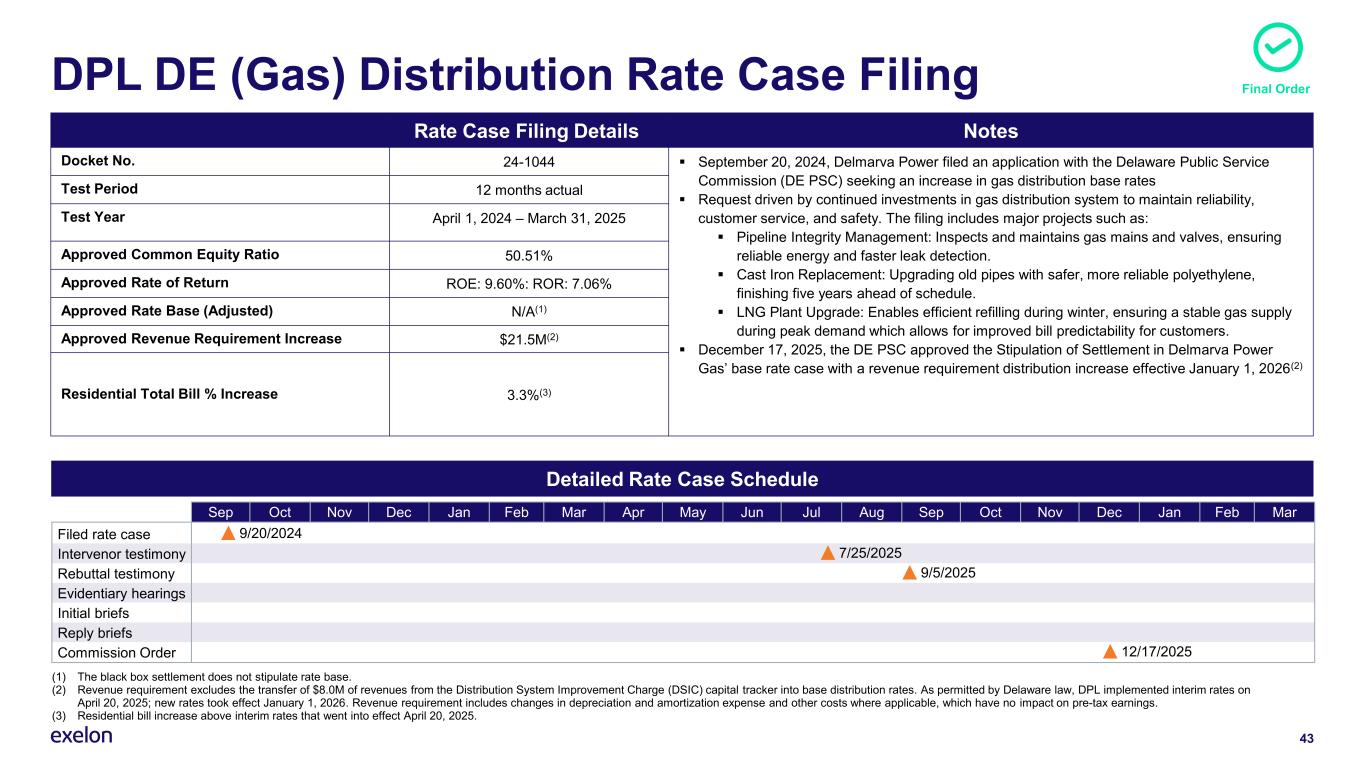

43 DPL DE (Gas) Distribution Rate Case Filing Rate Case Filing Details Notes Docket No. 24-1044 ▪ September 20, 2024, Delmarva Power filed an application with the Delaware Public Service Commission (DE PSC) seeking an increase in gas distribution base rates ▪ Request driven by continued investments in gas distribution system to maintain reliability, customer service, and safety. The filing includes major projects such as: ▪ Pipeline Integrity Management: Inspects and maintains gas mains and valves, ensuring reliable energy and faster leak detection. ▪ Cast Iron Replacement: Upgrading old pipes with safer, more reliable polyethylene, finishing five years ahead of schedule. ▪ LNG Plant Upgrade: Enables efficient refilling during winter, ensuring a stable gas supply during peak demand which allows for improved bill predictability for customers. ▪ December 17, 2025, the DE PSC approved the Stipulation of Settlement in Delmarva Power Gas’ base rate case with a revenue requirement distribution increase effective January 1, 2026(2) Test Period 12 months actual Test Year April 1, 2024 – March 31, 2025 Approved Common Equity Ratio 50.51% Approved Rate of Return ROE: 9.60%: ROR: 7.06% Approved Rate Base (Adjusted) N/A(1) Approved Revenue Requirement Increase $21.5M(2) Residential Total Bill % Increase 3.3%(3) Detailed Rate Case Schedule Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 9/20/2024 7/25/2025Intervenor testimony 9/5/2025Rebuttal testimony Filed rate case Evidentiary hearings Reply briefs Commission Order 12/17/2025 Initial briefs Final Order (1) The black box settlement does not stipulate rate base. (2) Revenue requirement excludes the transfer of $8.0M of revenues from the Distribution System Improvement Charge (DSIC) capital tracker into base distribution rates. As permitted by Delaware law, DPL implemented interim rates on April 20, 2025; new rates took effect January 1, 2026. Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings. (3) Residential bill increase above interim rates that went into effect April 20, 2025.

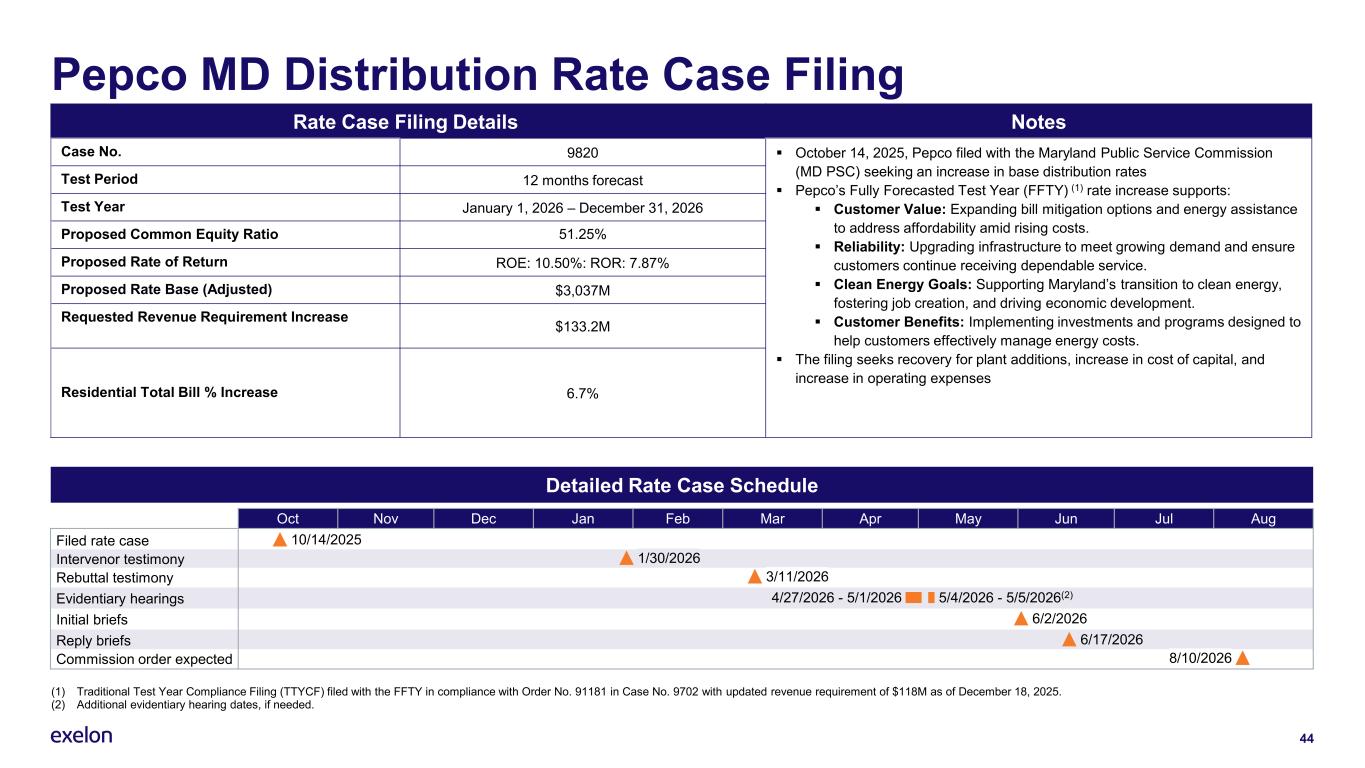

44 Pepco MD Distribution Rate Case Filing Rate Case Filing Details Notes Case No. 9820 ▪ October 14, 2025, Pepco filed with the Maryland Public Service Commission (MD PSC) seeking an increase in base distribution rates ▪ Pepco’s Fully Forecasted Test Year (FFTY) (1) rate increase supports: ▪ Customer Value: Expanding bill mitigation options and energy assistance to address affordability amid rising costs. ▪ Reliability: Upgrading infrastructure to meet growing demand and ensure customers continue receiving dependable service. ▪ Clean Energy Goals: Supporting Maryland’s transition to clean energy, fostering job creation, and driving economic development. ▪ Customer Benefits: Implementing investments and programs designed to help customers effectively manage energy costs. ▪ The filing seeks recovery for plant additions, increase in cost of capital, and increase in operating expenses Test Period 12 months forecast Test Year January 1, 2026 – December 31, 2026 Proposed Common Equity Ratio 51.25% Proposed Rate of Return ROE: 10.50%: ROR: 7.87% Proposed Rate Base (Adjusted) $3,037M Requested Revenue Requirement Increase $133.2M Residential Total Bill % Increase 6.7% Detailed Rate Case Schedule Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug 10/14/2025 4/27/2026 - 5/1/2026Evidentiary hearings 6/2/2026Initial briefs Rebuttal testimony 6/17/2026 8/10/2026Commission order expected 3/11/2026 Intervenor testimony 1/30/2026 Filed rate case 5/4/2026 - 5/5/2026(2) Reply briefs (1) Traditional Test Year Compliance Filing (TTYCF) filed with the FFTY in compliance with Order No. 91181 in Case No. 9702 with updated revenue requirement of $118M as of December 18, 2025. (2) Additional evidentiary hearing dates, if needed.

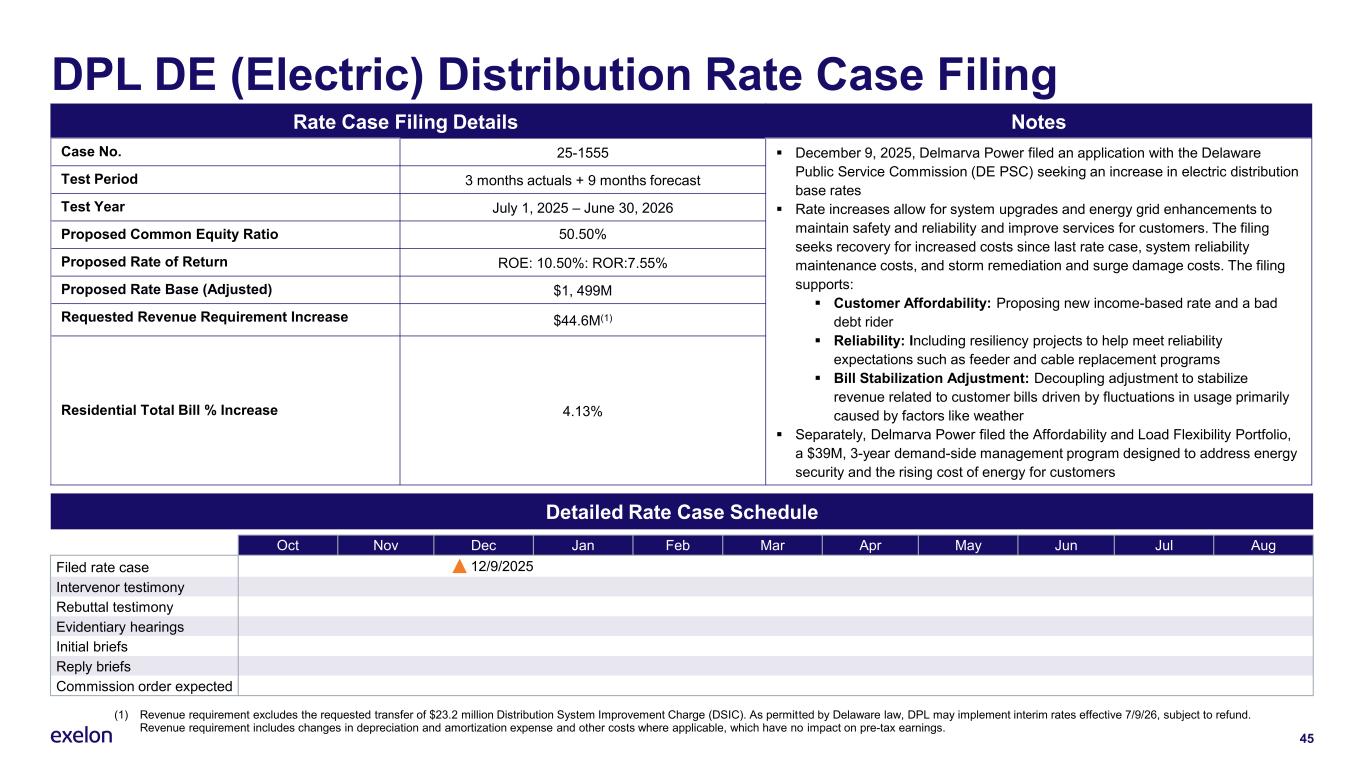

45 DPL DE (Electric) Distribution Rate Case Filing Rate Case Filing Details Notes Case No. 25-1555 ▪ December 9, 2025, Delmarva Power filed an application with the Delaware Public Service Commission (DE PSC) seeking an increase in electric distribution base rates ▪ Rate increases allow for system upgrades and energy grid enhancements to maintain safety and reliability and improve services for customers. The filing seeks recovery for increased costs since last rate case, system reliability maintenance costs, and storm remediation and surge damage costs. The filing supports: ▪ Customer Affordability: Proposing new income-based rate and a bad debt rider ▪ Reliability: Including resiliency projects to help meet reliability expectations such as feeder and cable replacement programs ▪ Bill Stabilization Adjustment: Decoupling adjustment to stabilize revenue related to customer bills driven by fluctuations in usage primarily caused by factors like weather ▪ Separately, Delmarva Power filed the Affordability and Load Flexibility Portfolio, a $39M, 3-year demand-side management program designed to address energy security and the rising cost of energy for customers Test Period 3 months actuals + 9 months forecast Test Year July 1, 2025 – June 30, 2026 Proposed Common Equity Ratio 50.50% Proposed Rate of Return ROE: 10.50%: ROR:7.55% Proposed Rate Base (Adjusted) $1, 499M Requested Revenue Requirement Increase $44.6M(1) Residential Total Bill % Increase 4.13% Detailed Rate Case Schedule Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Filed rate case Intervenor testimony Rebuttal testimony Evidentiary hearings Initial briefs Reply briefs Commission order expected 12/9/2025 (1) Revenue requirement excludes the requested transfer of $23.2 million Distribution System Improvement Charge (DSIC). As permitted by Delaware law, DPL may implement interim rates effective 7/9/26, subject to refund. Revenue requirement includes changes in depreciation and amortization expense and other costs where applicable, which have no impact on pre-tax earnings.

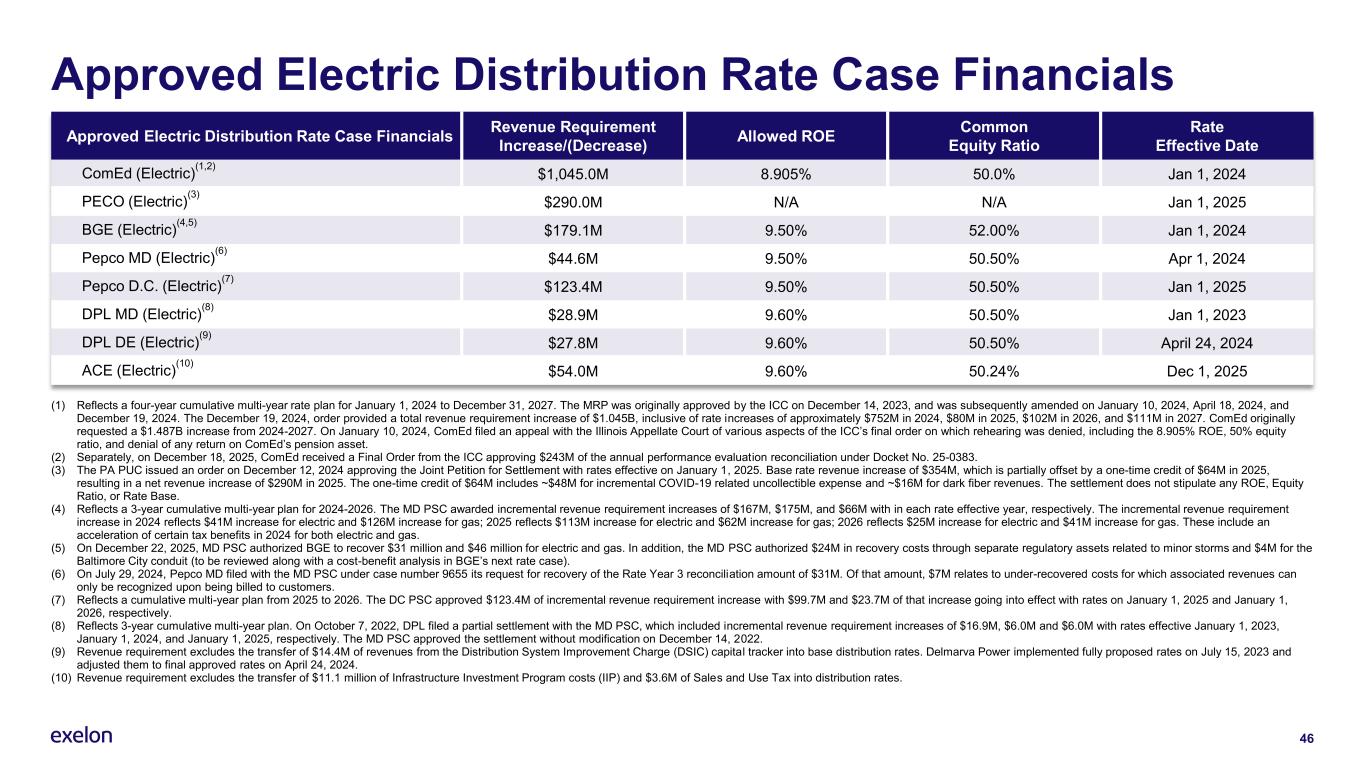

46 Approved Electric Distribution Rate Case Financials Approved Electric Distribution Rate Case Financials Revenue Requirement Increase/(Decrease) Allowed ROE Common Equity Ratio Rate Effective Date ComEd (Electric) (1,2) $1,045.0M 8.905% 50.0% Jan 1, 2024 PECO (Electric) (3) $290.0M N/A N/A Jan 1, 2025 BGE (Electric) (4,5) $179.1M 9.50% 52.00% Jan 1, 2024 Pepco MD (Electric) (6) $44.6M 9.50% 50.50% Apr 1, 2024 Pepco D.C. (Electric) (7) $123.4M 9.50% 50.50% Jan 1, 2025 DPL MD (Electric) (8) $28.9M 9.60% 50.50% Jan 1, 2023 DPL DE (Electric) (9) $27.8M 9.60% 50.50% April 24, 2024 ACE (Electric) (10) $54.0M 9.60% 50.24% Dec 1, 2025 (1) Reflects a four-year cumulative multi-year rate plan for January 1, 2024 to December 31, 2027. The MRP was originally approved by the ICC on December 14, 2023, and was subsequently amended on January 10, 2024, April 18, 2024, and December 19, 2024. The December 19, 2024, order provided a total revenue requirement increase of $1.045B, inclusive of rate increases of approximately $752M in 2024, $80M in 2025, $102M in 2026, and $111M in 2027. ComEd originally requested a $1.487B increase from 2024-2027. On January 10, 2024, ComEd filed an appeal with the Illinois Appellate Court of various aspects of the ICC’s final order on which rehearing was denied, including the 8.905% ROE, 50% equity ratio, and denial of any return on ComEd’s pension asset. (2) Separately, on December 18, 2025, ComEd received a Final Order from the ICC approving $243M of the annual performance evaluation reconciliation under Docket No. 25-0383. (3) The PA PUC issued an order on December 12, 2024 approving the Joint Petition for Settlement with rates effective on January 1, 2025. Base rate revenue increase of $354M, which is partially offset by a one-time credit of $64M in 2025, resulting in a net revenue increase of $290M in 2025. The one-time credit of $64M includes ~$48M for incremental COVID-19 related uncollectible expense and ~$16M for dark fiber revenues. The settlement does not stipulate any ROE, Equity Ratio, or Rate Base. (4) Reflects a 3-year cumulative multi-year plan for 2024-2026. The MD PSC awarded incremental revenue requirement increases of $167M, $175M, and $66M with in each rate effective year, respectively. The incremental revenue requirement increase in 2024 reflects $41M increase for electric and $126M increase for gas; 2025 reflects $113M increase for electric and $62M increase for gas; 2026 reflects $25M increase for electric and $41M increase for gas. These include an acceleration of certain tax benefits in 2024 for both electric and gas. (5) On December 22, 2025, MD PSC authorized BGE to recover $31 million and $46 million for electric and gas. In addition, the MD PSC authorized $24M in recovery costs through separate regulatory assets related to minor storms and $4M for the Baltimore City conduit (to be reviewed along with a cost-benefit analysis in BGE’s next rate case). (6) On July 29, 2024, Pepco MD filed with the MD PSC under case number 9655 its request for recovery of the Rate Year 3 reconciliation amount of $31M. Of that amount, $7M relates to under-recovered costs for which associated revenues can only be recognized upon being billed to customers. (7) Reflects a cumulative multi-year plan from 2025 to 2026. The DC PSC approved $123.4M of incremental revenue requirement increase with $99.7M and $23.7M of that increase going into effect with rates on January 1, 2025 and January 1, 2026, respectively. (8) Reflects 3-year cumulative multi-year plan. On October 7, 2022, DPL filed a partial settlement with the MD PSC, which included incremental revenue requirement increases of $16.9M, $6.0M and $6.0M with rates effective January 1, 2023, January 1, 2024, and January 1, 2025, respectively. The MD PSC approved the settlement without modification on December 14, 2022. (9) Revenue requirement excludes the transfer of $14.4M of revenues from the Distribution System Improvement Charge (DSIC) capital tracker into base distribution rates. Delmarva Power implemented fully proposed rates on July 15, 2023 and adjusted them to final approved rates on April 24, 2024. (10) Revenue requirement excludes the transfer of $11.1 million of Infrastructure Investment Program costs (IIP) and $3.6M of Sales and Use Tax into distribution rates.

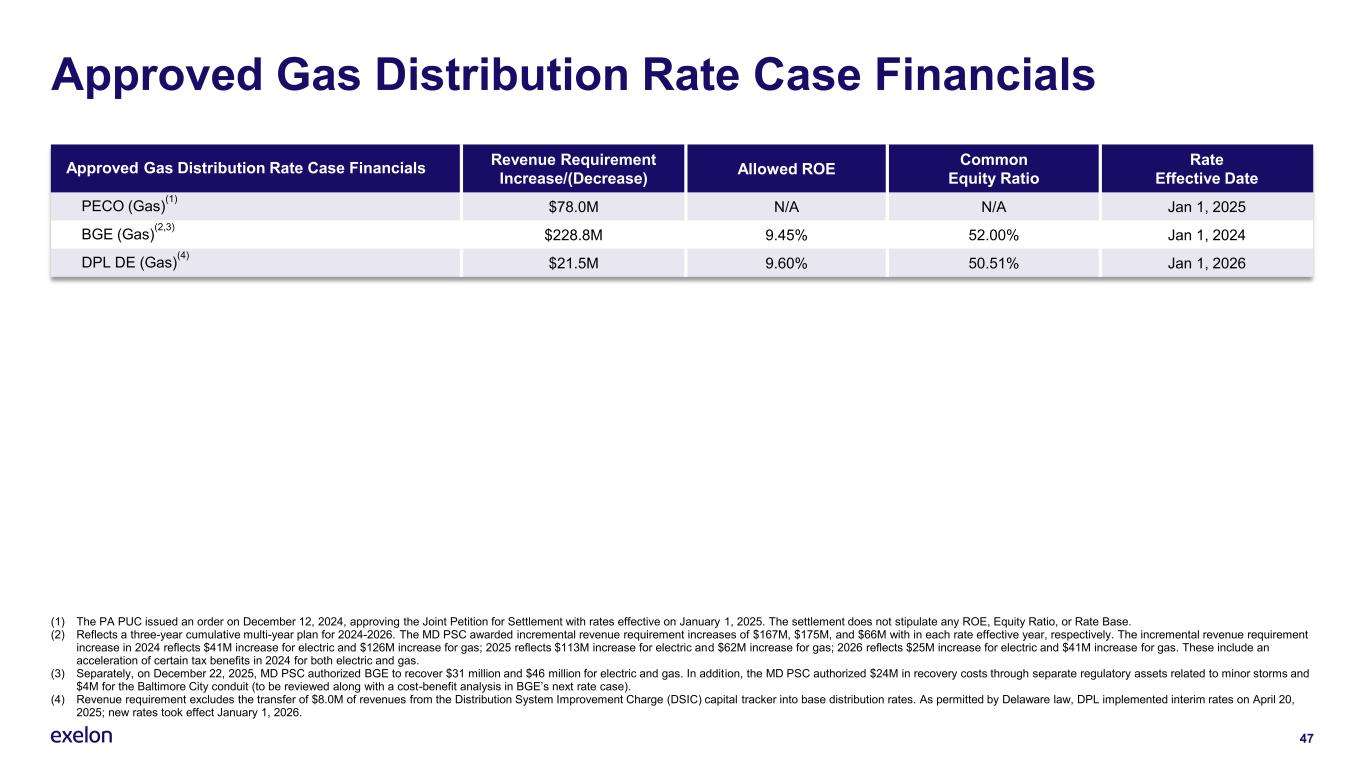

47 Approved Gas Distribution Rate Case Financials Approved Gas Distribution Rate Case Financials Revenue Requirement Increase/(Decrease) Allowed ROE Common Equity Ratio Rate Effective Date PECO (Gas) (1) $78.0M N/A N/A Jan 1, 2025 BGE (Gas) (2,3) $228.8M 9.45% 52.00% Jan 1, 2024 DPL DE (Gas) (4) $21.5M 9.60% 50.51% Jan 1, 2026 (1) The PA PUC issued an order on December 12, 2024, approving the Joint Petition for Settlement with rates effective on January 1, 2025. The settlement does not stipulate any ROE, Equity Ratio, or Rate Base. (2) Reflects a three-year cumulative multi-year plan for 2024-2026. The MD PSC awarded incremental revenue requirement increases of $167M, $175M, and $66M with in each rate effective year, respectively. The incremental revenue requirement increase in 2024 reflects $41M increase for electric and $126M increase for gas; 2025 reflects $113M increase for electric and $62M increase for gas; 2026 reflects $25M increase for electric and $41M increase for gas. These include an acceleration of certain tax benefits in 2024 for both electric and gas. (3) Separately, on December 22, 2025, MD PSC authorized BGE to recover $31 million and $46 million for electric and gas. In addition, the MD PSC authorized $24M in recovery costs through separate regulatory assets related to minor storms and $4M for the Baltimore City conduit (to be reviewed along with a cost-benefit analysis in BGE’s next rate case). (4) Revenue requirement excludes the transfer of $8.0M of revenues from the Distribution System Improvement Charge (DSIC) capital tracker into base distribution rates. As permitted by Delaware law, DPL implemented interim rates on April 20, 2025; new rates took effect January 1, 2026.

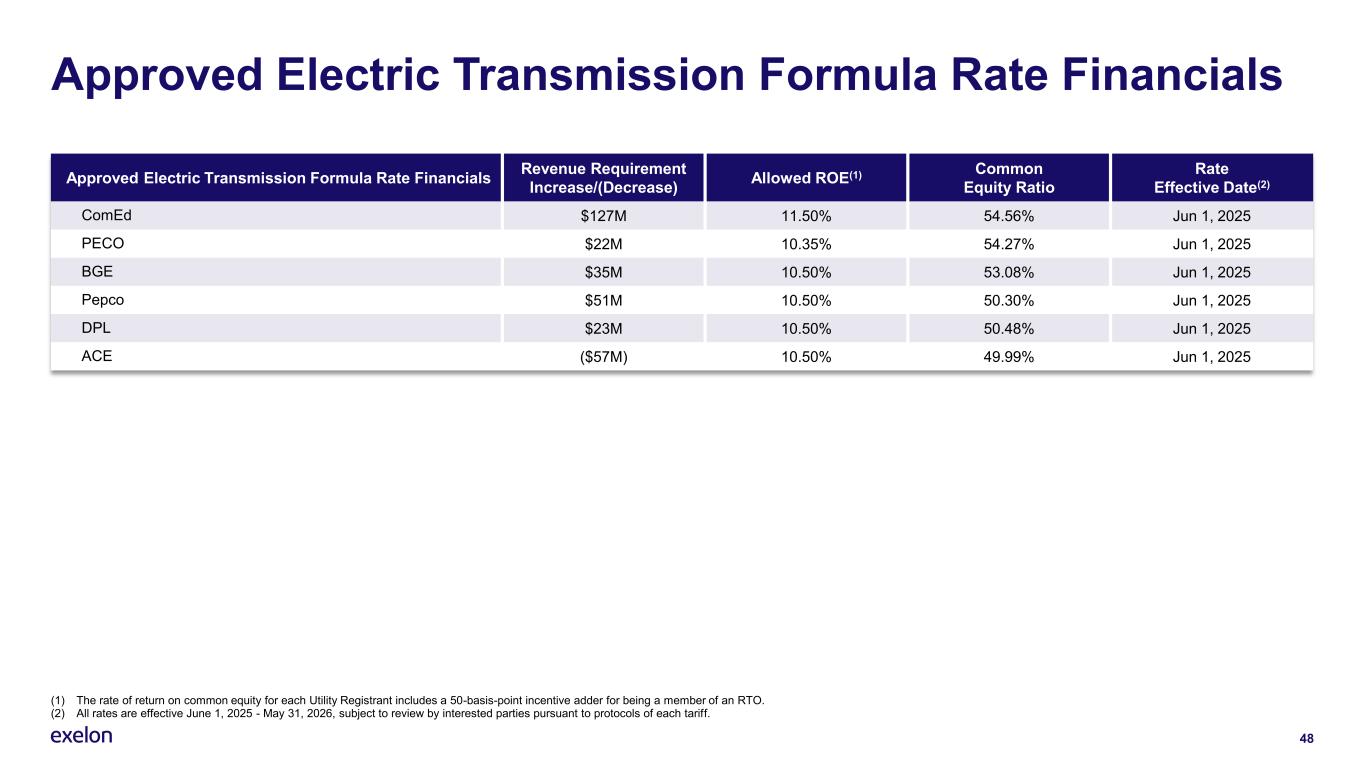

48 Approved Electric Transmission Formula Rate Financials Approved Electric Transmission Formula Rate Financials Revenue Requirement Increase/(Decrease) Allowed ROE(1) Common Equity Ratio Rate Effective Date(2) ComEd $127M 11.50% 54.56% Jun 1, 2025 PECO $22M 10.35% 54.27% Jun 1, 2025 BGE $35M 10.50% 53.08% Jun 1, 2025 Pepco $51M 10.50% 50.30% Jun 1, 2025 DPL $23M 10.50% 50.48% Jun 1, 2025 ACE ($57M) 10.50% 49.99% Jun 1, 2025 (1) The rate of return on common equity for each Utility Registrant includes a 50-basis-point incentive adder for being a member of an RTO. (2) All rates are effective June 1, 2025 - May 31, 2026, subject to review by interested parties pursuant to protocols of each tariff.

49 Reconciliation of Non-GAAP Measures

50 Projected Non-GAAP Operating Earnings Adjustments • There are no adjustments between 2026 projected GAAP earnings and adjusted (non-GAAP) operating earnings currently.

51 Credit Metric GAAP to Non-GAAP Reconciliations(1) GAAP Operating Income + Depreciation & Amortization = EBITDA - Cash Paid for Interest +/- Cash Taxes +/- Other S&P FFO Adjustments = FFO (a) Long-Term Debt + Short-Term Debt + Underfunded Pension (after-tax) + Underfunded OPEB (after-tax) + Operating Lease Imputed Debt - Cash on Balance Sheet +/- Other S&P Debt Adjustments = Adjusted Debt (b) S&P FFO Calculation(2) S&P Adjusted Debt Calculation(2) Moody’s CFO (Pre-WC)/Debt (3) = CFO (Pre-WC) (c) Adjusted Debt (d) Moody’s CFO (Pre-WC) Calculation(3) Cash Flow From Operations +/- Working Capital Adjustment + Energy Efficiency Spend +/- Carbon Mitigation Credits +/- Other Moody’s CFO Adjustments = CFO (Pre-Working Capital) (c) Long-Term Debt + Short-Term Debt + Underfunded Pension (pre-tax) + Operating Lease Imputed Debt +/- Other Moody’s Debt Adjustments = Adjusted Debt (d) S&P FFO/Debt (2) = FFO (a) Adjusted Debt (b) Moody’s Adjusted Debt Calculation(3) (1) Due to the forward-looking nature of some forecasted non-GAAP measures, information to reconcile the forecasted adjusted (non-GAAP) measures to the most directly comparable GAAP measure may not be currently available; therefore, management is unable to reconcile these measures. (2) Calculated using S&P Methodology. (3) Calculated using Moody’s Methodology.

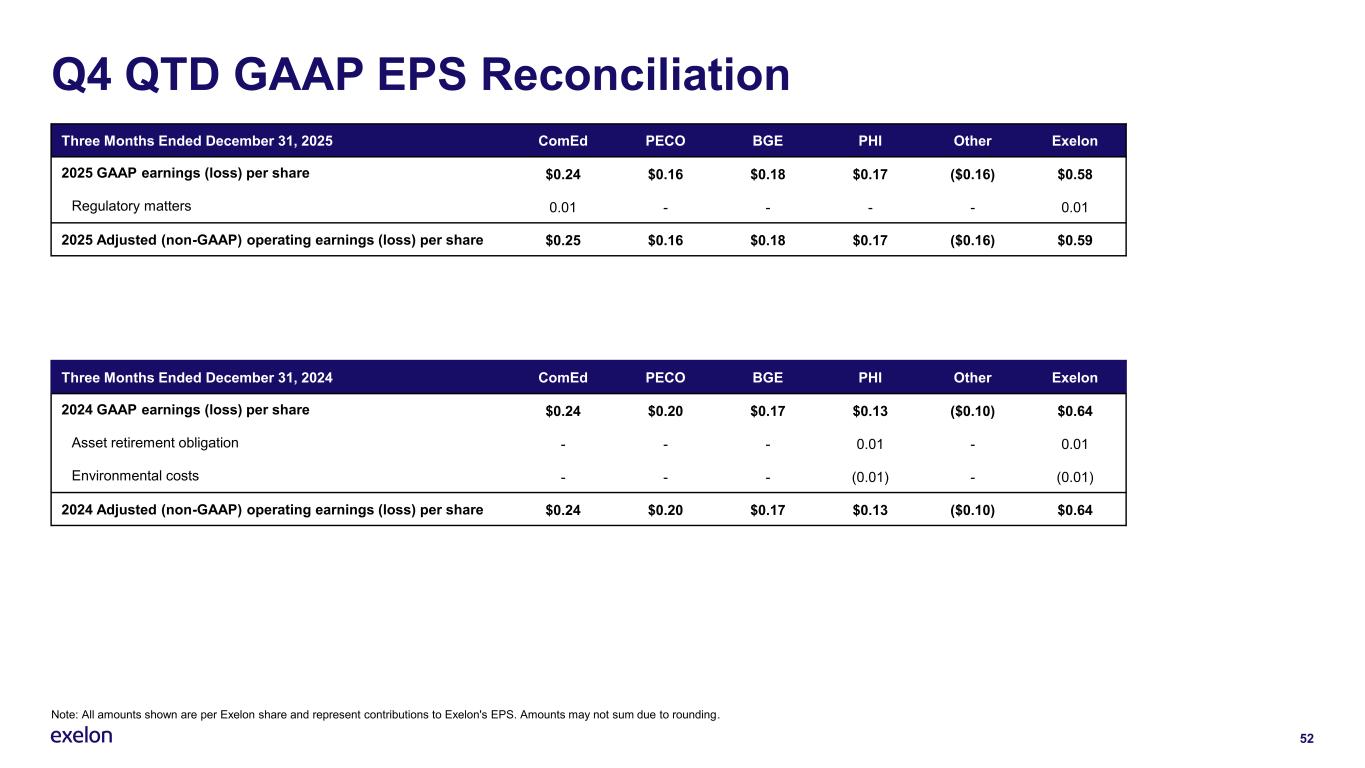

52 Q4 QTD GAAP EPS Reconciliation Three Months Ended December 31, 2025 ComEd PECO BGE PHI Other Exelon 2025 GAAP earnings (loss) per share $0.24 $0.16 $0.18 $0.17 ($0.16) $0.58 Regulatory matters 0.01 - - - - 0.01 2025 Adjusted (non-GAAP) operating earnings (loss) per share $0.25 $0.16 $0.18 $0.17 ($0.16) $0.59 Note: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not sum due to rounding. Three Months Ended December 31, 2024 ComEd PECO BGE PHI Other Exelon 2024 GAAP earnings (loss) per share $0.24 $0.20 $0.17 $0.13 ($0.10) $0.64 Asset retirement obligation - - - 0.01 - 0.01 Environmental costs - - - (0.01) - (0.01) 2024 Adjusted (non-GAAP) operating earnings (loss) per share $0.24 $0.20 $0.17 $0.13 ($0.10) $0.64

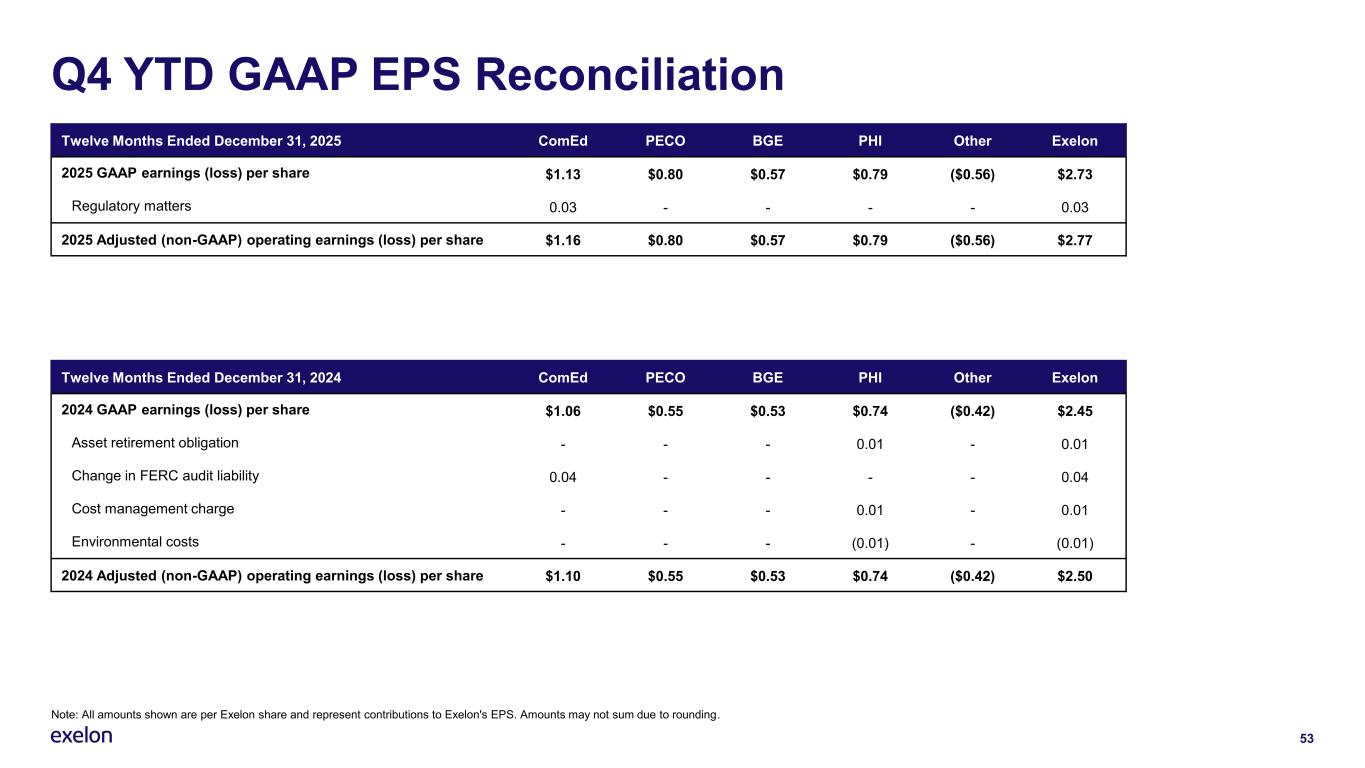

53 Q4 YTD GAAP EPS Reconciliation Twelve Months Ended December 31, 2025 ComEd PECO BGE PHI Other Exelon 2025 GAAP earnings (loss) per share $1.13 $0.80 $0.57 $0.79 ($0.56) $2.73 Regulatory matters 0.03 - - - - 0.03 2025 Adjusted (non-GAAP) operating earnings (loss) per share $1.16 $0.80 $0.57 $0.79 ($0.56) $2.77 Note: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not sum due to rounding. Twelve Months Ended December 31, 2024 ComEd PECO BGE PHI Other Exelon 2024 GAAP earnings (loss) per share $1.06 $0.55 $0.53 $0.74 ($0.42) $2.45 Asset retirement obligation - - - 0.01 - 0.01 Change in FERC audit liability 0.04 - - - - 0.04 Cost management charge - - - 0.01 - 0.01 Environmental costs - - - (0.01) - (0.01) 2024 Adjusted (non-GAAP) operating earnings (loss) per share $1.10 $0.55 $0.53 $0.74 ($0.42) $2.50

54 GAAP to Non-GAAP Reconciliations (1) Represents the twelve-month periods December 31, 2016-2025 for Exelon’s utilities (excludes Corp and PHI Corp). Earned ROEs* represent weighted average across all lines of business (gas distribution, electric transmission, and electric distribution). Components may not reconcile to other SEC filings due to rounding. (2) Reflects simple average book equity for Exelon’s utilities less goodwill at ComEd and Pepco Holdings. (3) Reflects utility O&M which includes allocated costs from the shared services company; numbers rounded to the nearest $25M and may not sum due to rounding. (4) See Note 3 – Regulatory Matters in 2023 and 2024 10-Ks for additional information. Exelon Operating TTM ROE Reconciliation ($M)(1) 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Net Income (GAAP) $1,103 $1,704 $1,836 $2,065 $1,737 $2,225 $2,501 $2,740 $2,899 $3,352 Operating Exclusions $461 ($24) $32 $30 $246 $82 $96 $60 $44 $30 Adjusted Operating Earnings* $1,564 $1,680 $1,869 $2,095 $1,984 $2,307 $2,596 $2,800 $2,943 $3,382 Average Equity (2) $16,523 $17,779 $19,367 $20,913 $22,690 $24,967 $27,479 $30,035 $32,453 34,942 Operating (Non-GAAP) TTM ROE (Adjusted Operating Earnings*/Average Equity) 9.5% 9.4% 9.6% 10.0% 8.7% 9.2% 9.4% 9.3% 9.1% 9.7% Exelon Adjusted O&M Expense Reconciliation ($M)(3) 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026E GAAP O&M $4,300 $4,025 $4,150 $4,000 $4,375 $4,200 $4,475 $4,475 $5,100 $5,300 $5,425 Regulatory Required O&M ($175) ($300) ($200) ($175) ($175) ($175) ($250) ($225) ($475) ($600) ($750) Operating Exclusions ($400) - ($50) ($50) ($275) ($75) ($75) ($75) ($75) ($50) - Maryland Multi-Year Plan Reconciliations (4) - - - - - - - $100 $25 - - Adjusted O&M Expense (Non-GAAP) $3,725 $3,725 $3,900 $3,800 $3,950 $3,950 $4,150 $4,300 $4,600 $4,650 $4,675

Thank you Please direct all questions to the Exelon Investor Relations team: InvestorRelations@ExelonCorp.com 779-231-0017