UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under Rule 14a-12

|

|

Illumina, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|||

| ☒ |

No fee required.

|

||

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

||

|

(1)

|

Title of each class of securities to which transaction applies:

|

||

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

| |

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

||

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form

or Schedule and the date of its filing.

|

||

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

On May 18, 2023, Illumina, Inc. (“Illumina”) issued the following press release in connection with Illumina’s 2023 Annual Meeting of Stockholders:

Illumina Board Chair Issues Letter to Shareholders and Urges Shareholders to Vote the WHITE Proxy Card FOR all Nine of Illumina's Nominees

|

●

|

Board Chair John Thompson issues letter to Illumina shareholders ahead of the company’s Annual Meeting on May 25, 2023, at 10:00 am Pacific Time (1:00 pm Eastern Time)

|

|

|

●

|

Illumina requests shareholders to vote the WHITE proxy card today FOR all nine of Illumina's director nominees

|

|

|

●

|

For more information, visit www.IlluminaForward.com

|

SAN DIEGO, May 18, 2023 /PRNewswire/ -- Illumina (NASDAQ: ILMN), a global leader in DNA sequencing and array-based technologies, today issued a shareholder letter from Board Chair John Thompson.

In his letter, Mr. Thompson reiterated the specific steps the company is taking to deliver results consistent with the high standards of performance and value creation expected by shareholders.

Mr. Thompson and the entire Board of Directors at Illumina request that shareholders protect their investment by voting the WHITE proxy card today FOR all nine of the company’s deeply experienced director nominees. The Annual Meeting will be held on May 25, 2023, at 10:00 am Pacific Time (1:00 pm Eastern Time). Shareholders of record as of close of business on April 3,

2023, are entitled to vote at the meeting, no matter how many or how few shares they own.

The full text of the letter follows:

VOTE USING THE WHITE PROXY CARD TODAY IN SUPPORT OF ILLUMINA’S NINE HIGHLY QUALIFIED DIRECTORS

May 18, 2023

Fellow Shareholders,

As Independent Chair of the Board of Illumina, I am writing today to share some reflections and my perspectives on the real “state of Illumina” as we quickly approach our contested Annual Meeting on May 25.

My fellow directors and I have met with each of our top shareholders to describe our plan for the company and, most importantly, take and act on shareholder feedback. While support for the company is widespread,

there is no doubt that a number of shareholders have had well-reasoned and pointed feedback for us as a Board, for Francis, and for the management team. We have heard these views and we understand the perspectives. While Illumina continues to

strive to improve what is possible in healthcare, our financial results and shareholder returns have not met shareholder expectations, nor our own expectations for ourselves.

I will describe how we plan to address these issues, and how the Board will continue to drive accountability for each:

|

●

|

On operating performance, we have challenged management to focus on topline growth acceleration and expanding margins. On April 25, 2023, the company announced a commitment to reduce annualized run rate

expenses by more than $100 million starting later this year, which will help accelerate operating margin improvements to 25% in 2024 and 27% in 2025.1 These commitments are the result of a redoubling of efforts on operational

excellence and we expect to achieve them without sacrificing our high-growth ambition.

|

1 The company only provides non‐GAAP measures for operating margin targets because of the difficulty

of projecting with reasonable certainty the financial impact of specific GAAP operating adjustments. Please see the “Statement regarding use of non‐GAAP financial measures” for more information.

|

●

|

On core execution, we’re ramping up the successful rollout of NovaSeqTM X, our breakthrough

high-throughput sequencer which improves speed and throughput by 200% and 250%, respectively. The Board and management team are laser-focused on ensuring that we carry out this launch to its full promise (its order book shows the

strongest pre-launch demand seen for any instrument) and that it paves the path for years of future growth.

|

|

|

●

|

On GRAIL, it is innovative breakthrough technology that was launched at Illumina and will forever change the way early-stage cancer is detected, saving many lives. We recognize investor concerns about

Illumina owning GRAIL and are re-evaluating our strategy to make an objective decision designed to maximize shareholder returns for this asset, including divesting if that is the best thing to do. That said, there is no faster path to resolution. This is a finite process ending in a decision by early 2024. Illumina would have to win both its U.S. and

EU appeals in order to keep GRAIL. Even if we do win both appeals, we are committed to a full review of the total GRAIL opportunity, including potential synergies still achievable, before

making a decision to keep GRAIL. The appeals processes do not impede preparatory divestiture work. A win in the EU appeal would remove any fines. A win in either the U.S. or EU appeal would nullify their respective divestiture order

requirements.

|

|

|

●

|

On conflicts of interest, there is an important question I would like to put to bed: “Did any Illumina directors have a financial interest in GRAIL at the time of the acquisition?” This question is not a

matter of interpretation or explanation. The answer is simply no. As we have said before, no director who oversaw any part of the GRAIL transaction has ever owned any equity interest in GRAIL – that includes Jay Flatley, Francis

deSouza, myself, and any member of the Board now or at the time of acquisition. In addition, no executive officers of Illumina held GRAIL shares at the signing or closing of the GRAIL acquisition (including indirect ownership interests

such as through trusts, LP or GP stakes in investment vehicles, or through derivative securities), other than Alex Aravanis, who Illumina had hired from GRAIL, and Mostafa Ronaghi, Illumina's former CTO, who received GRAIL shares upon

joining GRAIL's Board in May 2020. The economic interests and relationships of these individuals with GRAIL were fully disclosed to, and known by, Illumina and its Board, and, consistent with good corporate governance practices, both

were recused from any decisions to sign and close the GRAIL acquisition. In addition, Illumina’s Board engaged Goldman Sachs as its financial advisor in connection with the GRAIL acquisition and Goldman, acting exclusively for Illumina,

delivered a customary fairness opinion to Illumina’s Board immediately prior to Illumina entering into the GRAIL acquisition agreement.

|

|

●

|

On Board refreshment, our nine directors bring extensive, deep and highly relevant experience as shareholder representatives. Illumina has an ongoing Board refreshment process and two years ago developed

profiles for two new directors, based on the skills that would help Illumina achieve its strategic objectives over the next five years and beyond. The profiles are:

|

|

o

|

a public healthcare company CEO with experience scaling a growth company and experience with manufacturing/operating in China

|

||

|

o

|

a public healthcare company CFO with previous Wall Street experience

|

|

Illumina engaged a specialized, external recruiter through a rigorous process which began with more than 85 candidates. The Board did not complete the evaluation process prior to the relevant deadlines for

the upcoming Annual Meeting. So, the appointment of additional Board members will be subject to post-annual shareholder meeting Board approval and thereafter annual shareholder approval.

|

In closing, let me reiterate – this Board is very clear about its shareholders’ perspectives, expectations and governance priorities. We are committed to delivering results consistent with the high standards of

performance and value creation expected of us by shareholders and our own standards for excellence.

Shareholder democracy is perhaps the most fundamental tenet of American public equity markets and it is in the spirit of that tradition that I ask you today to support our Board

with a vote on the white card for all nine company nominees.

Thank you for your support.

John W. Thompson

Chair of the Board

YOUR VOTE IS IMPORTANT!

Please follow the easy instructions on the enclosed WHITE proxy card or in the accompanying email.

If you have any questions, or need assistance in voting your shares

please call our proxy solicitor:

INNISFREE M&A INCORPORATED

1 (800) 422-8620

(toll-free from the U.S. and Canada)

or

+1 (412) 232-3651

(from other countries)

Remember, if you hold your shares in more than one account,

you will receive separate notifications for each account.

Please be sure to vote ALL your accounts

using the WHITE proxy card relating to each account.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding mandates, the future,

business plans and other statements that are not historical in nature. These statements are made on the basis of Illumina’s views and assumptions regarding future events and business performance and plans as of the time the statements are made.

These forward-looking statements may be accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “target,” “will” and other words and terms of similar

meaning. Illumina does not undertake any obligation to update these statements unless required by applicable laws or regulations, and you should not place undue reliance on forward-looking statements. Among the important factors to which our

business is subject that could cause actual results to differ materially from those in any forward-looking statements are: (i) changes in the rate of growth in the markets we serve; (ii) the volume, timing and mix of customer orders among our

products and services; (iii) our ability to adjust our operating expenses to align with our revenue expectations; (iv) our ability to manufacture robust instrumentation and consumables; (v) the success of products and services competitive with

our own; (vi) challenges inherent in developing, manufacturing, and launching new products and services, including expanding or modifying manufacturing operations and reliance on third-party suppliers for critical components; (vii) the impact

of recently launched or pre-announced products and services on existing products and services; (viii) our ability to modify our business strategies to accomplish our desired operational goals; (ix) our ability to realize the anticipated

benefits from prior or future actions to streamline and improve our R&D processes, reduce our operating expenses and maximize our revenue growth; (x) our ability to further develop and commercialize our instruments, consumables, and

products, including Galleri™, the cancer screening test developed by GRAIL, to deploy new products, services, and applications, and to expand the markets for our technology platforms; (xi) the risks and costs associated with our

ongoing inability to integrate GRAIL due to the interim measures imposed on us by the European Commission as a result of their prohibition of our acquisition of GRAIL; (xii) the risks and costs associated with the integration of GRAIL’s

business if we are ultimately able to integrate GRAIL; (xiii) the risk that disruptions from the consummation of our acquisition of GRAIL and associated legal or regulatory proceedings, including related appeals, or obligations will harm our

business, including current plans and operations; (xiv) the risk of incurring fines associated with the consummation of our acquisition of GRAIL and the possibility that we may be required to divest all or a portion of the assets or equity

interests of GRAIL on terms that could be materially worse than the terms on which we acquired GRAIL; (xv) our ability to obtain approval by third-party payors to reimburse patients for our products; (xvi) our ability to obtain regulatory

clearance for our products from government agencies; (xvii) our ability to successfully partner with other companies and organizations to develop new products, expand markets, and grow our business; (xviii) uncertainty, or adverse economic and

business conditions, including as a result of slowing or uncertain economic growth, COVID-19 pandemic mitigation measures, or armed conflict; (xix) the application of generally accepted accounting principles, which are highly complex and

involve many subjective assumptions, estimates, and judgments and (xx) legislative, regulatory and economic developments, together with the factors set forth in Illumina’s Annual Report on Form 10-K for the year ended January 1, 2023 under the

caption “Risk Factors”, in information disclosed in public conference calls, the date and time of which are released beforehand, and in filings with the Securities and Exchange Commission (the “SEC”) including, among others, quarterly reports

on Form 10-Q.

Additional Information and Where to Find It

Illumina has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for Illumina’s 2023 Annual

Meeting of Stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY ILLUMINA AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR

ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Illumina free of charge through the

website maintained by the SEC at www.sec.gov. Copies of the documents filed by Illumina are also available free of charge by accessing Illumina’s website at www.illumina.com.

Note regarding GRAIL

The European Commission adopted an order on September 6, 2022 prohibiting Illumina’s acquisition of GRAIL. We have filed an appeal of the Commission’s decision. The Commission has also adopted

an order requiring Illumina and GRAIL to be held and operated as distinct and separate entities for an interim period. Compliance with the order is monitored by an independent Monitoring Trustee. During this period, Illumina and GRAIL are not

permitted to share confidential business information unless legally required, and GRAIL must be run independently, exclusively in the best interests of GRAIL. Commercial interactions between the two companies must be undertaken at arm’s length.

Statement regarding use of non‐GAAP financial measures

The company only provides non‐GAAP measures for operating margin targets because of the difficulty of projecting with reasonable certainty the financial impact of specific GAAP operating

adjustments, such as acquisition‐related expenses, gains and losses from our strategic investments, fair value adjustments related to contingent consideration and contingent value rights, potential future asset impairments, restructuring

activities, and the ultimate outcome of pending litigation without unreasonable effort. These items are uncertain, inherently difficult to predict, depend on various factors, and could have a material impact on GAAP measures for the operating

margin target periods. For the same reasons, the company is unable to address the significance of the unavailable information, which could be material to future results.

Participants

Illumina, its directors and executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation by Illumina.

Information about Illumina’s executive officers and directors, including information regarding the direct or indirect interests, by security holdings or otherwise, is available in Illumina’s definitive proxy statement for its 2023 Annual

Meeting, which was filed with the SEC on April 20, 2023. To the extent holdings by our directors and executive officers of Illumina securities reported in the proxy statement for the 2023 Annual Meeting have changed, such changes have been or

will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at www.sec.gov.

Investors:

Salli Schwartz

858-291-6421

IR@illumina.com

Media:

David McAlpine

347-327-1336

PR@illumina.com

Steve Lipin

Gladstone Place Partners

212-230-5930

212-230-5930

On May 18, 2023, the following letter was shared with Illumina’s shareholders in connection with Illumina’s 2023 Annual Meeting of Stockholders:

VOTE USING THE WHITE PROXY CARD TODAY IN SUPPORT OF ILLUMINA’S NINE HIGHLY QUALIFIED DIRECTORS

May 18, 2023

Fellow Shareholders,

As Independent Chair of the Board of Illumina, I am writing today to share some reflections and my perspectives on the real “state of Illumina” as we quickly approach our

contested Annual Meeting on May 25.

My fellow directors and I have met with each of our top shareholders to describe our plan for the company and, most importantly, take and act on shareholder feedback. While

support for the company is widespread, there is no doubt that a number of shareholders have had well-reasoned and pointed feedback for us as a Board, for Francis, and for the management team. We have heard these views and we understand the

perspectives. While Illumina continues to strive to improve what is possible in healthcare, our financial results and shareholder returns have not met shareholder expectations, nor our own expectations for ourselves.

I will describe how we plan to address these issues, and how the Board will continue to drive accountability for each:

|

●

|

On operating performance, we have challenged management to focus on topline growth acceleration and expanding margins. On April 25, 2023, the company announced a

commitment to reduce annualized run rate expenses by more than $100 million starting later this year, which will help accelerate operating margin improvements to 25% in 2024 and 27% in 2025.1 These commitments are the result

of a redoubling of efforts on operational excellence and we expect to achieve them without sacrificing our high-growth ambition.

|

|

|

●

|

On core execution, we’re ramping up the successful rollout of NovaSeqTM X, our breakthrough high-throughput sequencer which improves speed and throughput by

200% and 250%, respectively. The Board and management team are laser-focused on ensuring that we carry out this launch to its full promise (its order book shows the strongest pre-launch demand seen for any instrument) and that it paves

the path for years of future growth.

|

|

|

●

|

On GRAIL, it is innovative breakthrough technology that was launched at Illumina and will forever change the way early-stage cancer is detected, saving many lives. We

recognize investor concerns about Illumina owning GRAIL and are re-evaluating our strategy to make an objective decision designed to maximize shareholder returns for this asset, including divesting if that is the best thing to do. That

said, there is no faster path to resolution. This is a finite process ending in a decision by early 2024. Illumina would have to win both

its U.S. and EU appeals in order to keep GRAIL. Even if we do win both appeals, we are committed to a full review of the total GRAIL opportunity, including potential synergies still

achievable, before making a decision to keep GRAIL. The appeals processes do not impede preparatory divestiture work. A win in the EU appeal would remove any fines. A win in either the U.S. or EU appeal would nullify their respective

divestiture order requirements.

|

|

|

●

|

On conflicts of interest, there is an important question I would like to put to bed: “Did any Illumina directors have a financial interest in GRAIL at the time of the

acquisition?” This question is not a matter of interpretation or explanation. The answer is simply no. As we have said before, no director who oversaw any part of the GRAIL transaction has ever owned any equity interest in GRAIL – that

includes Jay Flatley, Francis deSouza, myself, and any member of the Board now or at the time of acquisition. In addition, no executive officers of Illumina held GRAIL shares at the signing or closing of the GRAIL acquisition (including

indirect ownership interests such as through trusts, LP or GP stakes in investment vehicles, or through derivative securities), other than Alex Aravanis, who Illumina had hired from GRAIL, and Mostafa Ronaghi, Illumina's former CTO, who

received GRAIL shares upon joining GRAIL's Board in May 2020. The economic interests and relationships of these individuals with GRAIL were fully disclosed to, and known by, Illumina and its Board, and, consistent with good corporate

governance practices, both were recused from any decisions to sign and close the GRAIL acquisition. In addition, Illumina’s Board engaged Goldman Sachs as its financial advisor in connection with the GRAIL acquisition and Goldman,

acting exclusively for Illumina, delivered a customary fairness opinion to Illumina’s Board immediately prior to Illumina entering into the GRAIL acquisition agreement.

|

1 The company only provides non‐GAAP measures for operating margin targets because of the difficulty of projecting with reasonable

certainty the financial impact of specific GAAP operating adjustments. Please see the “Statement regarding use of non‐GAAP financial measures” for more information.

|

●

|

On Board refreshment, our nine directors bring extensive, deep and highly relevant experience as shareholder representatives. Illumina has an ongoing Board refreshment

process and two years ago developed profiles for two new directors, based on the skills that would help Illumina achieve its strategic objectives over the next five years and beyond. The profiles are:

|

|

o

|

a public healthcare company CEO with experience scaling a growth company and experience with manufacturing/operating in China

|

||

|

o

|

a public healthcare company CFO with previous Wall Street experience

|

|

Illumina engaged a specialized, external recruiter through a rigorous process which began with more than 85 candidates. The Board did not complete the evaluation process prior to the

relevant deadlines for the upcoming Annual Meeting. So, the appointment of additional Board members will be subject to post-annual shareholder meeting Board approval and thereafter annual shareholder approval.

|

In closing, let me reiterate – this Board is very clear about its shareholders’ perspectives, expectations and governance priorities. We are committed to delivering results

consistent with the high standards of performance and value creation expected of us by shareholders and our own standards for excellence.

Shareholder democracy is perhaps the most fundamental tenet of American public equity markets and it is in the spirit of that tradition that I

ask you today to support our Board with a vote on the white card for all nine company nominees.

Thank you for your support.

John W. Thompson

Chair of the Board

YOUR VOTE IS IMPORTANT!

Please follow the easy instructions on the enclosed WHITE proxy card

or in the accompanying email.

If you have any questions, or need assistance in voting your shares

please call our proxy solicitor:

INNISFREE M&A INCORPORATED

1 (800) 422-8620

(toll-free from the U.S. and Canada)

or

+1 (412) 232-3651

(from other countries)

Remember, if you hold your shares in more than one account,

you will receive separate notifications for each account.

Please be sure to vote ALL your accounts

using the WHITE proxy card relating to each account.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including

statements regarding mandates, the future, business plans and other statements that are not historical in nature. These statements are made on the basis of Illumina’s views and assumptions regarding future events and business performance and

plans as of the time the statements are made. These forward-looking statements may be accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “target,”

“will” and other words and terms of similar meaning. Illumina does not undertake any obligation to update these statements unless required by applicable laws or regulations, and you should not place undue reliance on forward-looking statements.

Among the important factors to which our business is subject that could cause actual results to differ materially from those in any forward-looking statements are: (i) changes in the rate of growth in the markets we serve; (ii) the volume,

timing and mix of customer orders among our products and services; (iii) our ability to adjust our operating expenses to align with our revenue expectations; (iv) our ability to manufacture robust instrumentation and consumables; (v) the

success of products and services competitive with our own; (vi) challenges inherent in developing, manufacturing, and launching new products and services, including expanding or modifying manufacturing operations and reliance on third-party

suppliers for critical components; (vii) the impact of recently launched or pre-announced products and services on existing products and services; (viii) our ability to modify our business strategies to accomplish our desired operational goals;

(ix) our ability to realize the anticipated benefits from prior or future actions to streamline and improve our R&D processes, reduce our operating expenses and maximize our revenue growth; (x) our ability to further develop and

commercialize our instruments, consumables, and products, including Galleri™, the cancer screening test developed by GRAIL, to deploy new products, services, and applications, and to expand the markets for our technology platforms;

(xi) the risks and costs associated with our ongoing inability to integrate GRAIL due to the interim measures imposed on us by the European Commission as a result of their prohibition of our acquisition of GRAIL; (xii) the risks and costs

associated with the integration of GRAIL’s business if we are ultimately able to integrate GRAIL; (xiii) the risk that disruptions from the consummation of our acquisition of GRAIL and associated legal or regulatory proceedings, including

related appeals, or obligations will harm our business, including current plans and operations; (xiv) the risk of incurring fines associated with the consummation of our acquisition of GRAIL and the possibility that we may be required to divest

all or a portion of the assets or equity interests of GRAIL on terms that could be materially worse than the terms on which we acquired GRAIL; (xv) our ability to obtain approval by third-party payors to reimburse patients for our products;

(xvi) our ability to obtain regulatory clearance for our products from government agencies; (xvii) our ability to successfully partner with other companies and organizations to develop new products, expand markets, and grow our business;

(xviii) uncertainty, or adverse economic and business conditions, including as a result of slowing or uncertain economic growth, COVID-19 pandemic mitigation measures, or armed conflict; (xix) the application of generally accepted accounting

principles, which are highly complex and involve many subjective assumptions, estimates, and judgments and (xx) legislative, regulatory and economic developments, together with the factors set forth in Illumina’s Annual Report on Form 10-K for

the year ended January 1, 2023 under the caption “Risk Factors”, in information disclosed in public conference calls, the date and time of which are released beforehand, and in filings with the Securities and Exchange Commission (the “SEC”)

including, among others, quarterly reports on Form 10-Q.

Additional Information and Where to Find It

Illumina has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE

proxy card, with respect to its solicitation of proxies for Illumina’s 2023 Annual Meeting of Stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY

ILLUMINA AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these

documents and other documents filed with the SEC by Illumina free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed

by Illumina are also available free of charge by accessing Illumina’s website at www.illumina.com.

Note regarding GRAIL

The European Commission adopted an order on September 6, 2022 prohibiting Illumina’s acquisition of GRAIL. We have filed an appeal of the Commission’s

decision. The Commission has also adopted an order requiring Illumina and GRAIL to be held and operated as distinct and separate entities for an interim period. Compliance with the order is monitored by an independent Monitoring Trustee. During

this period, Illumina and GRAIL are not permitted to share confidential business information unless legally required, and GRAIL must be run independently, exclusively in the best interests of GRAIL. Commercial interactions between the two

companies must be undertaken at arm’s length.

Statement regarding use of non‐GAAP financial measures

The company only provides non‐GAAP measures for operating margin targets because of the difficulty of projecting with reasonable certainty the financial

impact of specific GAAP operating adjustments, such as acquisition‐related expenses, gains and losses from our strategic investments, fair value adjustments related to contingent consideration and contingent value rights, potential future

asset impairments, restructuring activities, and the ultimate outcome of pending litigation without unreasonable effort. These items are uncertain, inherently difficult to predict, depend on various factors, and could have a material impact

on GAAP measures for the operating margin target periods. For the same reasons, the company is unable to address the significance of the unavailable information, which could be material to future results.

Participants

Illumina, its directors and executive officers and other members of management and employees will be participants in the solicitation

of proxies with respect to a solicitation by Illumina. Information about Illumina’s executive officers and directors, including information regarding the direct or indirect interests, by security holdings or otherwise, is available in

Illumina’s definitive proxy statement for its 2023 Annual Meeting, which was filed with the SEC on April 20, 2023. To the extent holdings by our directors and executive officers of Illumina securities reported in the proxy statement for the

2023 Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at www.sec.gov.

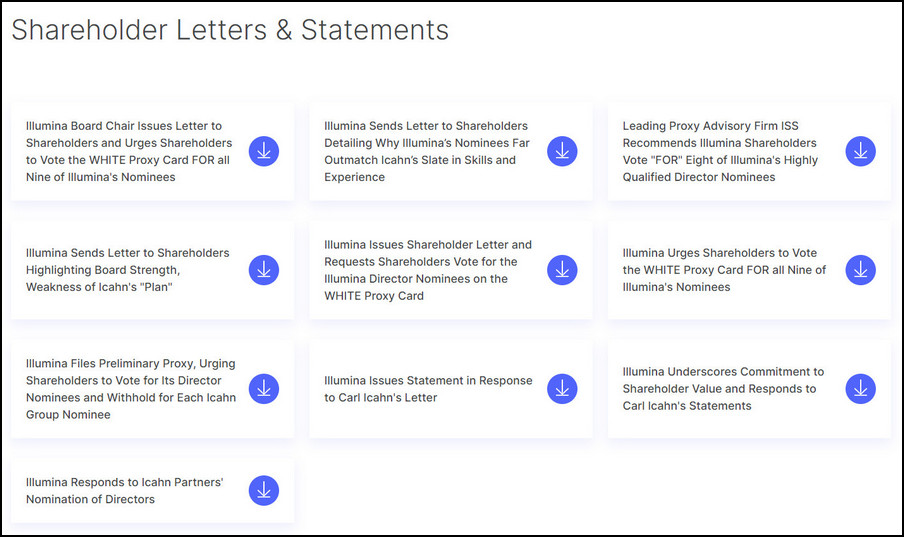

On May 18, 2023, Illumina updated its website www.IlluminaForward.com, which contains information relating to Illumina’s 2023 Annual Meeting of Stockholders. A copy of the updated website content (other than

that previously filed) can be found below: