Updated Forecast

2015-2017

April 15, 2015

Confidential: Subject to NDA

|

Updated Forecast

2015-2017

April 15, 2015

Confidential: Subject to NDA

|

Privileged & Confidential

Prepared at the Request of

Counsel

Subject to FRE 408

UPDATED

FORECAST

-

U.K.

CASH

FLOWS

2

Confidential: Subject to NDA

U.K. CASH FLOWS

Note

1:

Note

2:

Note

3:

Note

4:

Note

5:

Note

6:

Note

7:

Note

8:

UK Cash Flow

1Q

2Q

3Q

4Q

FY 2015

FY 2016

FY 2017

Net Revenue

52,781

$

50,900

$

39,118

$

55,340

$

198,139

$

204,841

$

217,572

$

Operating Expense

19,580

20,420

17,810

20,061

77,872

78,374

79,167

Net Operating Cash Flow

33,201

$

30,479

$

21,308

$

35,278

$

120,267

$

126,467

$

138,405

$

General & Administrative

-

679

1,018

1,018

2,716

4,950

4,800

EBITDA

33,201

$

29,800

$

20,289

$

34,260

$

117,551

$

121,517

$

133,605

$

Restructuring Costs

-

$

1,500

$

-

$

-

$

1,500

$

-

$

-

$

Capex

12,617

32,589

10,386

8,683

64,274

87,321

46,690

Tax Expense

13,936

4,181

(8,576)

-

9,541

360

61

Interest

12,100

12,100

12,100

12,100

48,400

48,400

46,709

LC Funding

-

-

-

20,000

20,000

-

-

Debt Amortization

-

-

-

-

-

-

44,122

Working Capital / Other

4,452

-

-

-

4,452

-

-

Total UK Cash Flow

(1,000)

$

(20,569)

$

6,380

$

(6,523)

$

(21,712)

$

(14,565)

$

(3,978)

$

Ending UK Cash

49,000

$

28,431

$

34,811

$

28,288

$

28,288

$

13,723

$

9,745

$

Ending US Cash

17,000

$

3,337

$

(8,710)

$

(26,435)

$

(26,435)

$

Net income (loss)

(23,331)

$

(15,158)

$

(15,631)

$

(2,617)

$

(56,738)

$

(53,765)

$

(79,619)

$

DD&A

43,462

48,000

36,668

48,154

176,285

177,446

182,081

Tax expense

(178)

(17,789)

(13,995)

(24,525)

(56,486)

(55,154)

(15,567)

Loan Cost & Discount Amort.

1,147

1,147

1,147

1,147

4,590

4,590

-

Interest expense

12,100

12,100

12,100

12,100

48,400

48,400

46,709

Restructuring cost

-

1,500

-

-

1,500

-

-

EBITDA

33,201

$

29,800

$

20,289

$

34,260

$

117,551

$

121,517

$

133,605

$

Emerge from Chapter 11 at the end of October 2015.

First quarter production set to actual.

Strip pricing as of April 10, 2015; exchange rate updated to 1.47

USD to GBP. Professional fees updated based on later

emergence date and recent monthly fees. Assumes that the

current EEUK loan is refinanced at an 11% interest and is amortized at 10%.

Certain cost reductions associated with OPEX and SG&A are

implemented throughout 2015. Net Income and EBITDA do not

factor in the non-cash allocation of G&A from the US to the UK.

Covenant EBITDA would be adjusted downward by approximately $10mm in

2015 due to allocation of US G&A. |

Privileged & Confidential

Prepared at the Request of

Counsel

Subject to FRE 408

3

Confidential: Subject to NDA

UPDATED

FORECAST

-

U.S.

CASH

FLOWS

U.S. CASH FLOWS

Note 1:

US Cash Flow

1Q

2Q

3Q

4Q

FY 2015

Net Revenue

1,001

$

1,880

$

591

$

-

$

3,472

$

Operating Expense

802

502

104

-

1,408

Net Operating Cash Flow

199

$

1,378

$

487

$

-

$

2,064

$

General & Administrative

3,704

3,324

3,134

1,045

11,207

EBITDA

(3,505)

$

(1,946)

$

(2,647)

$

(1,045)

$

(9,143)

$

Professional Fees

8,258

$

8,601

$

9,373

$

14,680

$

40,912

$

Other Restructuring Costs

-

500

-

2,000

2,500

Capex

1,941

2,616

27

-

4,584

Proceeds from Asset Sale

-

-

[

] -

[

] Working Capital / Other

(796)

-

-

-

(796)

Total US Cash Flow

(14,500)

$

(13,663)

$

(12,047)

$

(17,725)

$

(57,935)

$

Ending US Cash

17,000

$

3,337

$

(8,710)

$

(26,435)

$

(26,435)

$

Net income (loss)

(12,785)

$

(11,416)

$

(13,480)

$

(17,725)

$

(55,405)

$

DD&A

514

970

297

-

1,781

Tax expense

507

(601)

1,164

-

1,069

Loan Cost & Discount Amort.

-

-

-

-

-

Interest expense

-

-

-

-

-

Restructuring cost

8,258

9,101

9,373

16,680

43,412

EBITDA

(3,505)

$

(1,946)

$

(2,647)

$

(1,045)

$

(9,143)

$

Net Income and EBITDA do not factor in the non-cash allocation

of G&A from the US to the UK. |

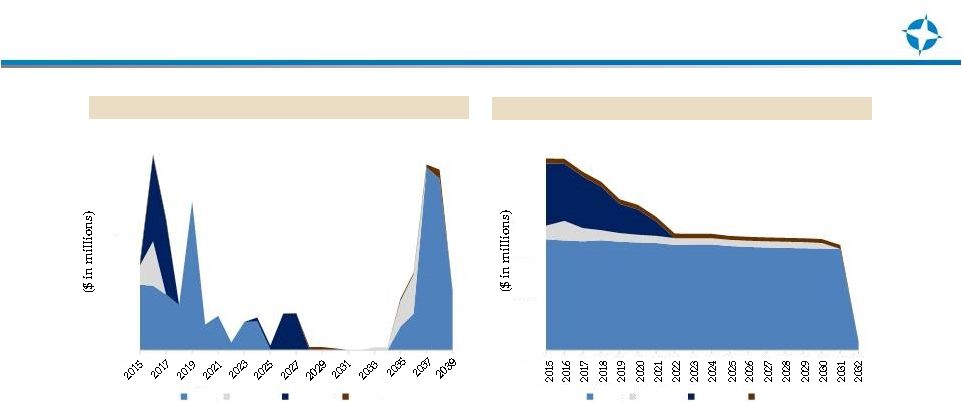

U.K.

3P STRIP CASE INTERNAL UNAUDITED RESERVE REPORT METRICS

4

Confidential: Subject to NDA

NET MMBOE

Note 1: Reserve report as disclosed in the 8-k dated February 27,

2015. 0.0

1.0

2.0

3.0

4.0

5.0

6.0

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

Alba 1P

Alba 2P

Alba 3P

Bacchus 1P

Bacchus 2P

Bacchus 3P

Rochelle 1P

Rochelle 2P

Rochelle 3P

Other 1P

Other 2P

Other 3P

Privileged & Confidential

Prepared at the Request of

Counsel

Subject to FRE 408 |

U.K.

3P STRIP CASE INTERNAL UNAUDITED RESERVE REPORT METRICS

5

Confidential: Subject to NDA

CAPEX

OPEX

Note 1: Reserve report as disclosed in the 8-k dated February 27,

2015. Note 2: Reserve report OPEX and CAPEX do not include any

allocations of SG&A. In 2014, SG&A allocated to UK OPEX and UK CAPEX were $4 million and $6 million, respectively. In 2014,

SG&A allocated to US OPEX and US CAPEX were $3 million and

$5 million, respectively. Note 3: Post production CAPEX is

associated with plugging and abandonment liabilities which, as in the case of Alba, requires financial security be posted in the form of a Letter of Credit.

Note 4: From the beginning to the end of Q1-2015 the UK cash

balance has remained flat. $0

$20

$40

$60

$80

Alba

Bacchus

Rochelle

Other

$0

$20

$40

$60

$80

$100

Alba

Bacchus

Rochelle

Other

Privileged & Confidential

Prepared at the Request of

Counsel

Subject to FRE 408 |