Filed by Pinnacle Financial Partners, Inc. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Steel Newco Inc. Commission File No.: 333-289866 Date: October 16, 2025 [The following slides were included in a slide presentation prepared by Pinnacle Financial Partners, Inc. (“Pinnacle”) and made available by Pinnacle on its public investor relations website on October 15, 2025.]

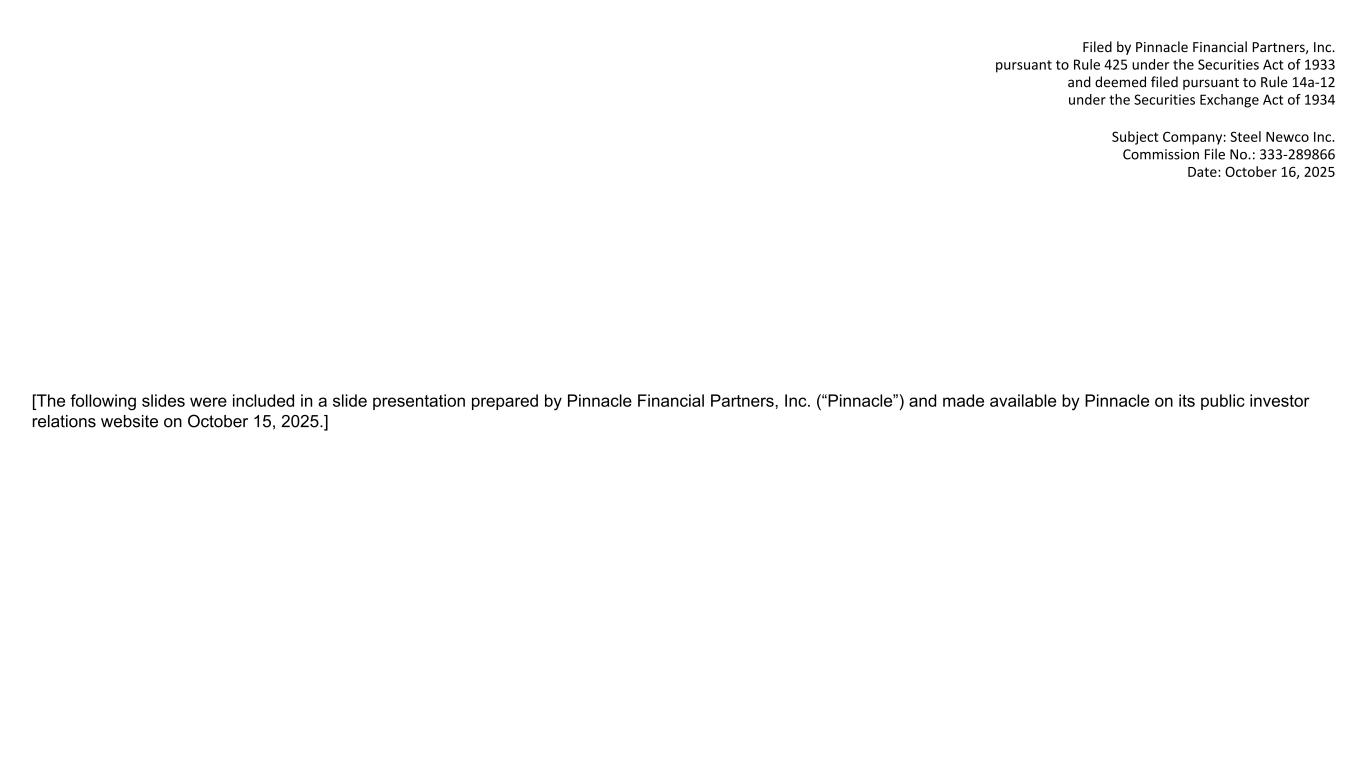

PNFP/SNV Merger is Progressing Well 2 • Financially and strategically compelling transaction • Key decisions were finalized pre-announcement 2027E EPS Accretion 21% Pro Forma CET1 at Close 10.1% Key Decisions Made Corporate / Org. Technology Expected Closing Q1 2026 Expected Operational Conversion Q1 2027 Deal Rationale Completed Work • Key leadership positions have now been finalized • Key systems have been evaluated, most decisions made • Proxy statements mailed • Regulatory applications filed • Pre-merger exam conducted by the Atlanta Fed • Special shareholder meeting -- November 6, 2025 • Complete organization chart and benefit plans -- November 10, 2025 • Expected closing following receipt of shareholder and regulatory approvals Major Remaining Milestones Transaction Highlights

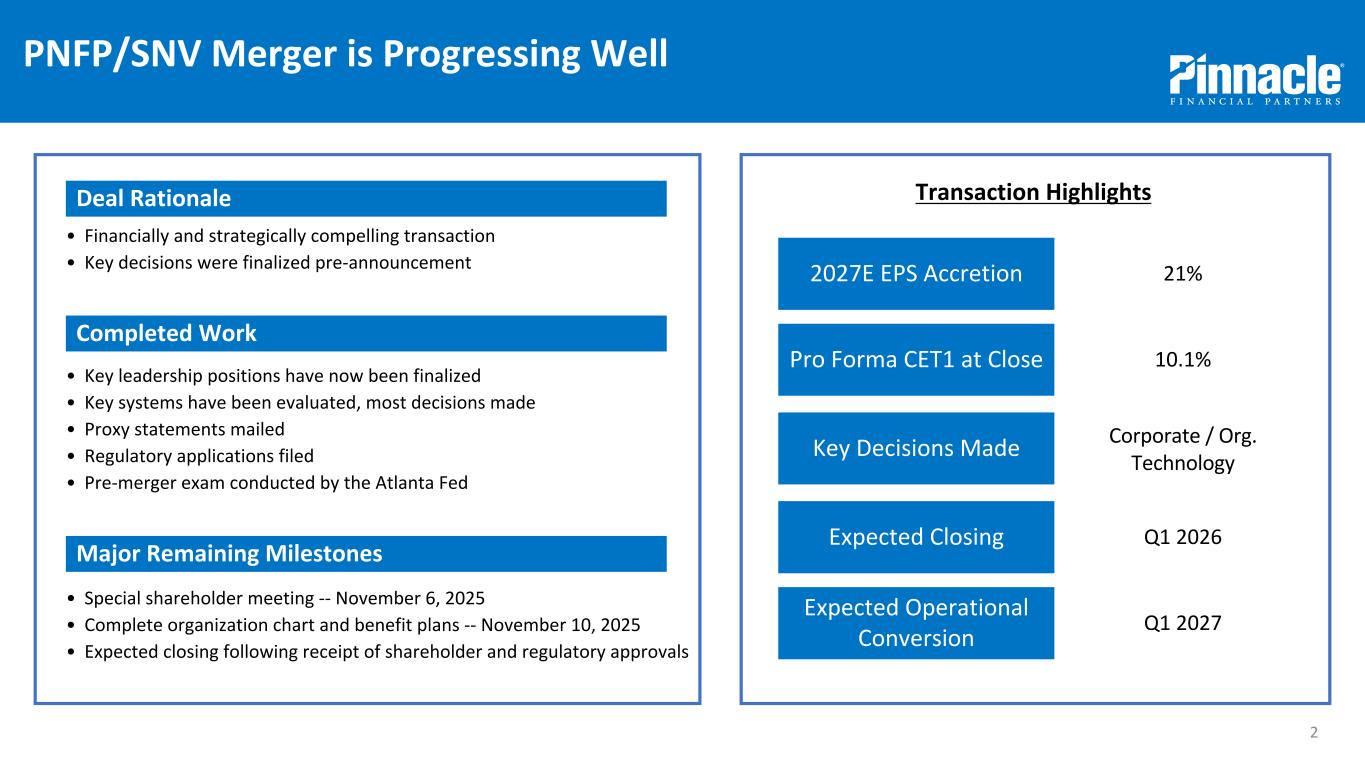

Pro Forma Branch Footprint Synovus Pro forma footprint population projected to grow 2x faster than national average Source: July 24, 2025, PNFP-SNV merger presentation; (1) 2025-2027E pro forma revenue growth CAGR of 10.5% (#1 among peers), 47% pro forma 2027E efficiency ratio (#1 among peers), 1.38% pro forma 2027E return on average assets (#2 among peers) and 18.0% pro forma 2027E return on average tangible common equity (#1 among peers) Fully Committed to Continuing the Highly Successful PNFP Operating and Recruiting Model Positioned to Remain Employer of Choice with Industry-Leading Client Service Versus Competitors Strong Pro Forma Capital Generation Minimal Geographic Overlap Supports Low-Risk Integration Builds on Significant, Multi-Year Investments to Prepare for LFI Standards Capitalizes on Positive Regulatory Environment for Larger Bank Mergers Creates Fastest-Growing, Most Profitable Regional Bank with 21% 2027E EPS Accretion and 2.6 Year TBV Dilution Earnback(1) Pinnacle Merger Update Financially and strategically compelling transaction 3

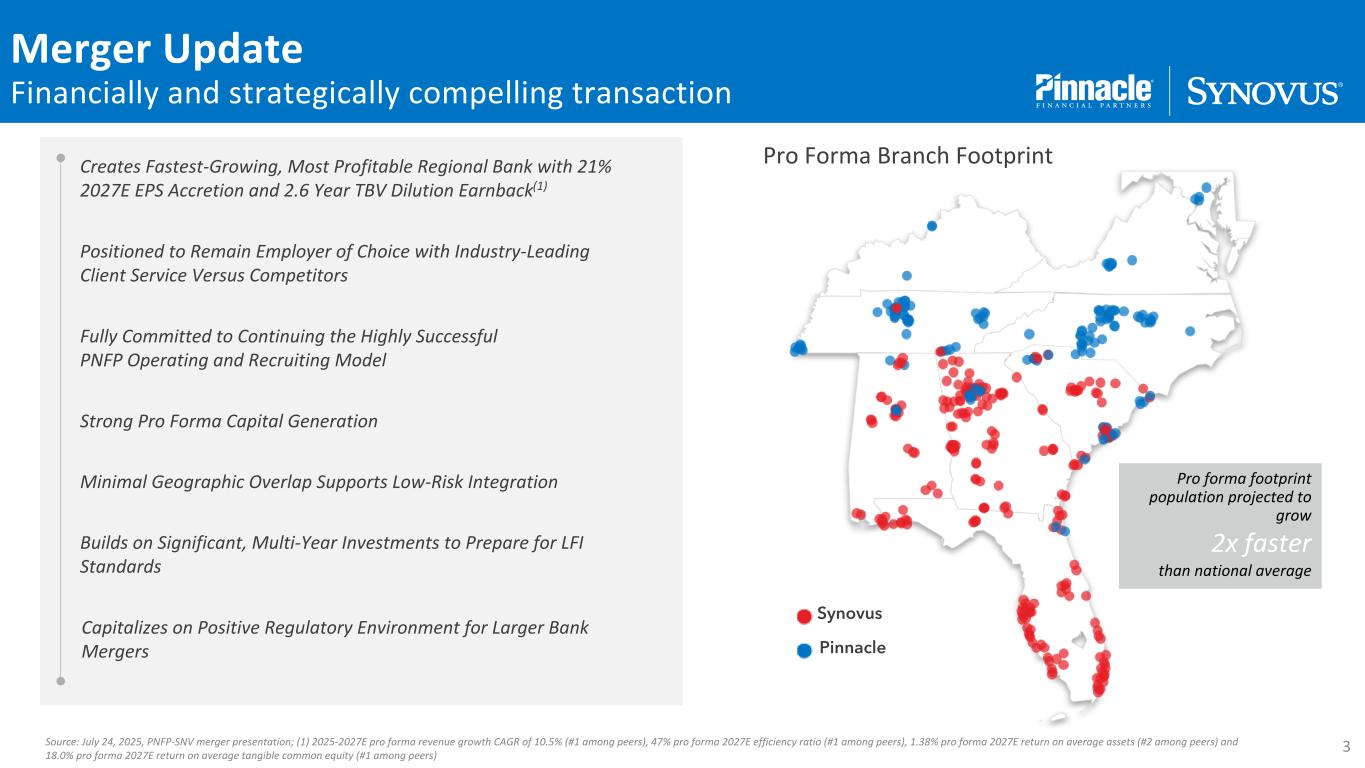

Cumulative Deposit Growth(1) (2014 – 2024) Sources: SNL Financials, Peer group defined as CFG, FITB, HBAN, KEY, MTB, PNC, RF, TFC and USB; (1) Not adjusted for M&A Cumulative Revenue Growth(1) (2014 – 2024) Cumulative Growth in Adjusted EPS (2014 – 2024) Peers Both franchises have delivered peer-leading top-line and bottom-line results through disciplined strategic execution and operational excellence Peers Peers Merger Update PNFP and SNV produced consistent top-quartile financial results 4

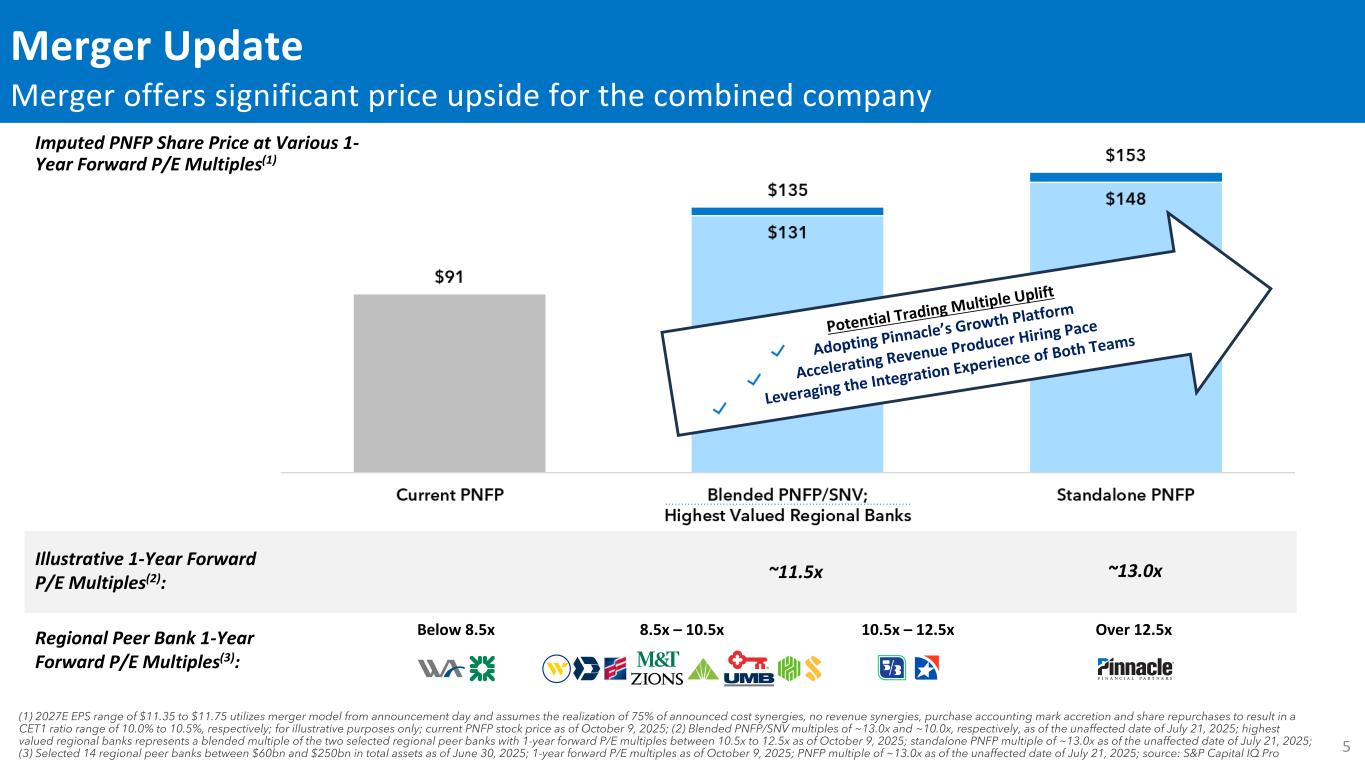

Below 8.5x 8.5x – 10.5x Over 12.5x10.5x – 12.5x Imputed PNFP Share Price at Various 1- Year Forward P/E Multiples(1) ~13.0x (1) 2027E EPS range of $11.35 to $11.75 utilizes merger model from announcement day and assumes the realization of 75% of announced cost synergies, no revenue synergies, purchase accounting mark accretion and share repurchases to result in a CET1 ratio range of 10.0% to 10.5%, respectively; for illustrative purposes only; current PNFP stock price as of October 9, 2025; (2) Blended PNFP/SNV multiples of ~13.0x and ~10.0x, respectively, as of the unaffected date of July 21, 2025; highest valued regional banks represents a blended multiple of the two selected regional peer banks with 1-year forward P/E multiples between 10.5x to 12.5x as of October 9, 2025; standalone PNFP multiple of ~13.0x as of the unaffected date of July 21, 2025; (3) Selected 14 regional peer banks between $60bn and $250bn in total assets as of June 30, 2025; 1-year forward P/E multiples as of October 9, 2025; PNFP multiple of ~13.0x as of the unaffected date of July 21, 2025; source: S&P Capital IQ Pro Illustrative 1-Year Forward P/E Multiples(2): Regional Peer Bank 1-Year Forward P/E Multiples(3): ~11.5x Potential Trading M ultiple Up lift Adopting Pinnacle ’s Growth Platform Accelerat ing Reven ue Produ cer Hiring Pace Leveragin g the Inte gration E xperience of Both T eams Merger Update Merger offers significant price upside for the combined company 5

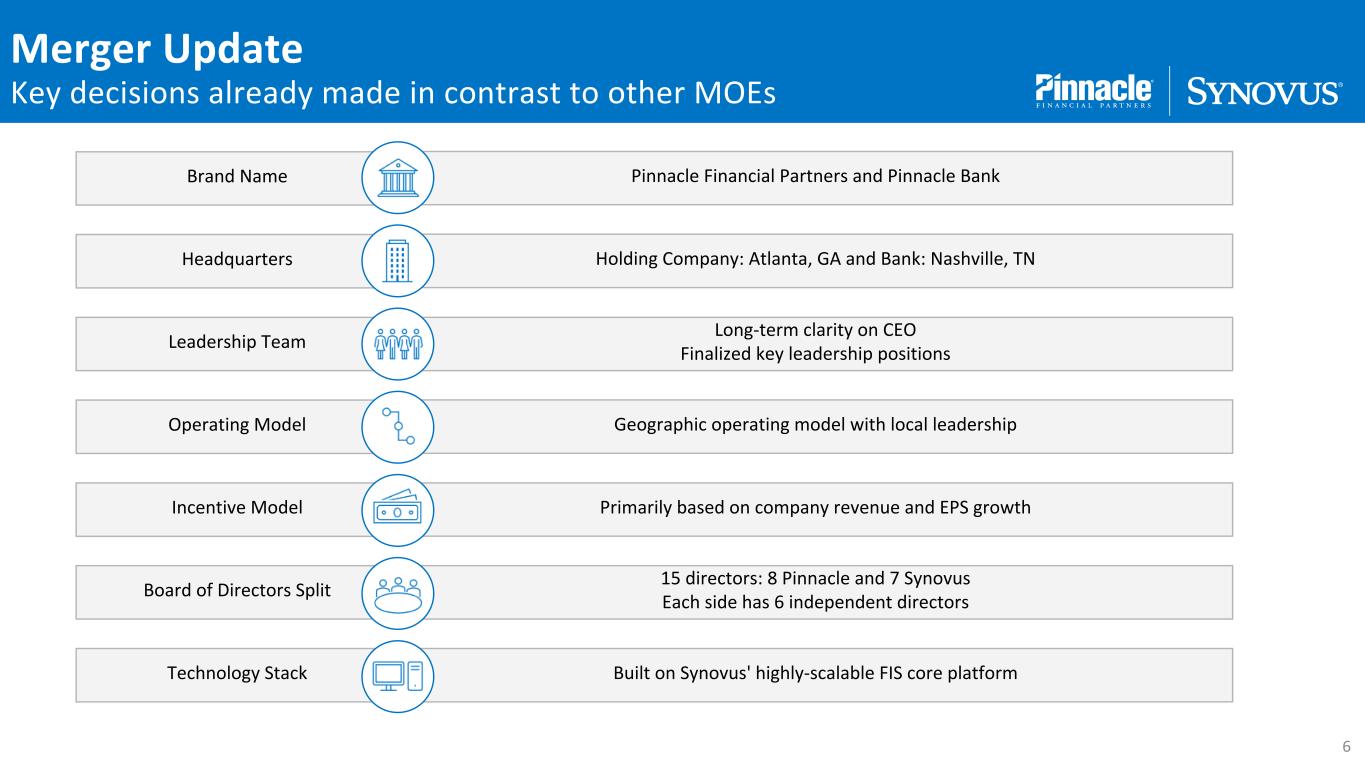

Brand Name Headquarters Leadership Team Operating Model Incentive Model Board of Directors Split Technology Stack Pinnacle Financial Partners and Pinnacle Bank Built on Synovus' highly-scalable FIS core platform Primarily based on company revenue and EPS growth 15 directors: 8 Pinnacle and 7 Synovus Each side has 6 independent directors Geographic operating model with local leadership Long-term clarity on CEO Finalized key leadership positions Holding Company: Atlanta, GA and Bank: Nashville, TN Merger Update Key decisions already made in contrast to other MOEs 6

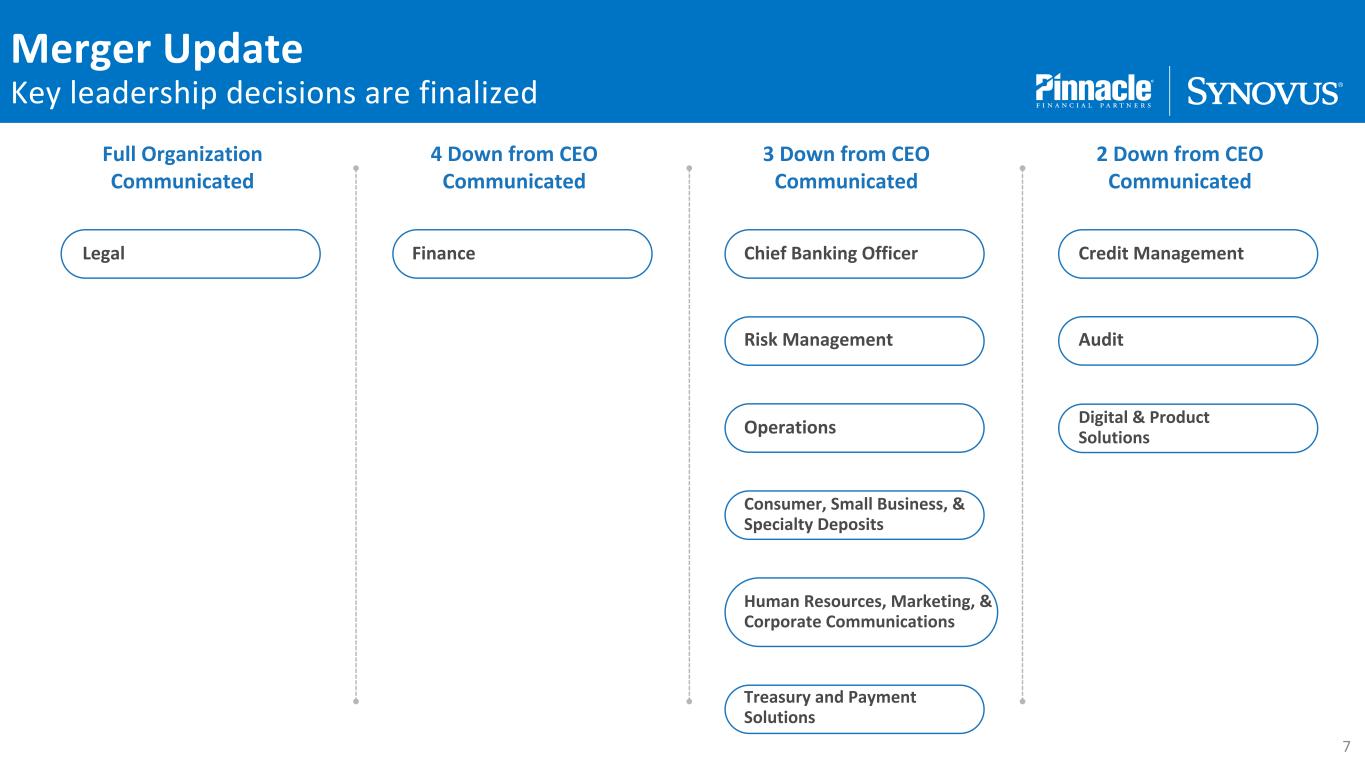

Full Organization Communicated 3 Down from CEO Communicated 2 Down from CEO Communicated Legal Finance Risk Management Operations Human Resources, Marketing, & Corporate Communications Digital & Product Solutions Audit Consumer, Small Business, & Specialty Deposits Treasury and Payment Solutions 4 Down from CEO Communicated Credit ManagementChief Banking Officer Merger Update Key leadership decisions are finalized 7

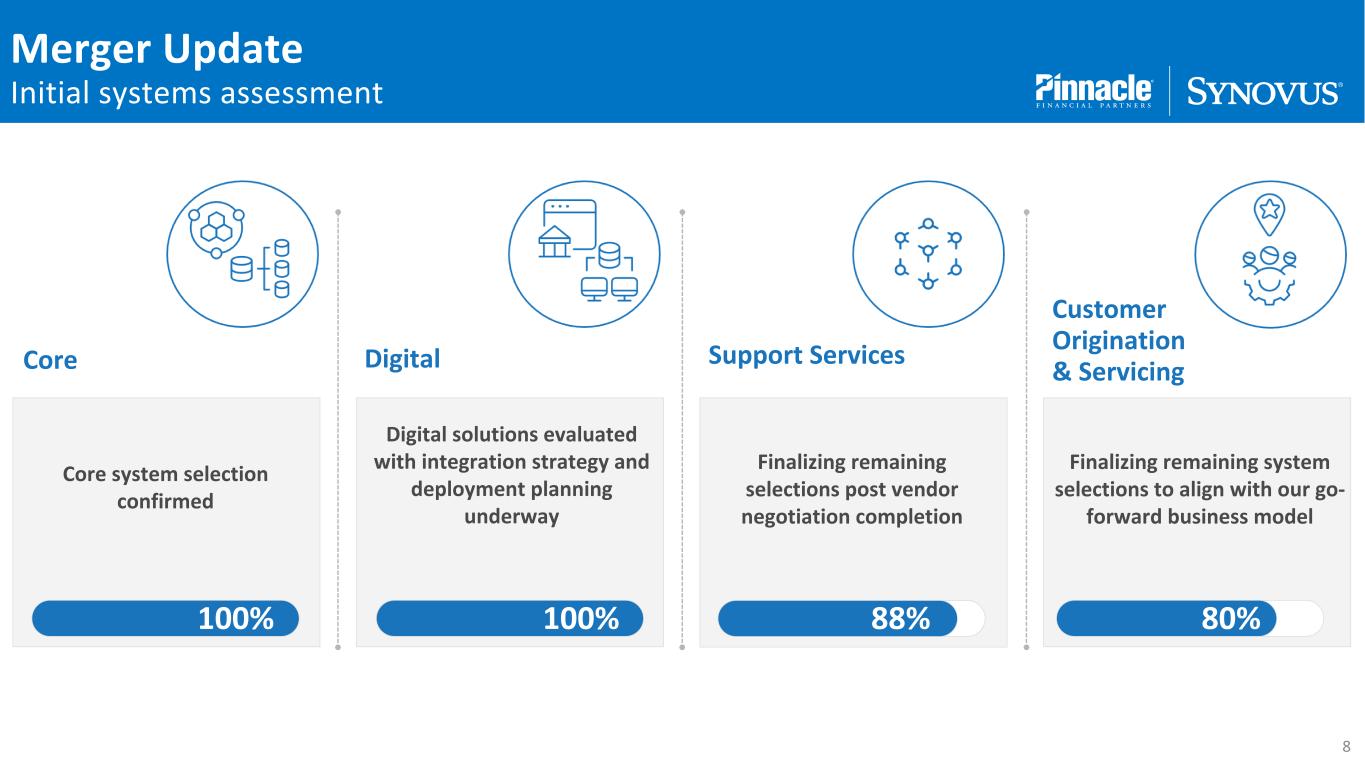

Digital Support Services Core system selection confirmed Finalizing remaining system selections to align with our go- forward business model Finalizing remaining selections post vendor negotiation completion Digital solutions evaluated with integration strategy and deployment planning underway Customer Origination & Servicing 80% Core 100% 100% 88% Merger Update Initial systems assessment 8

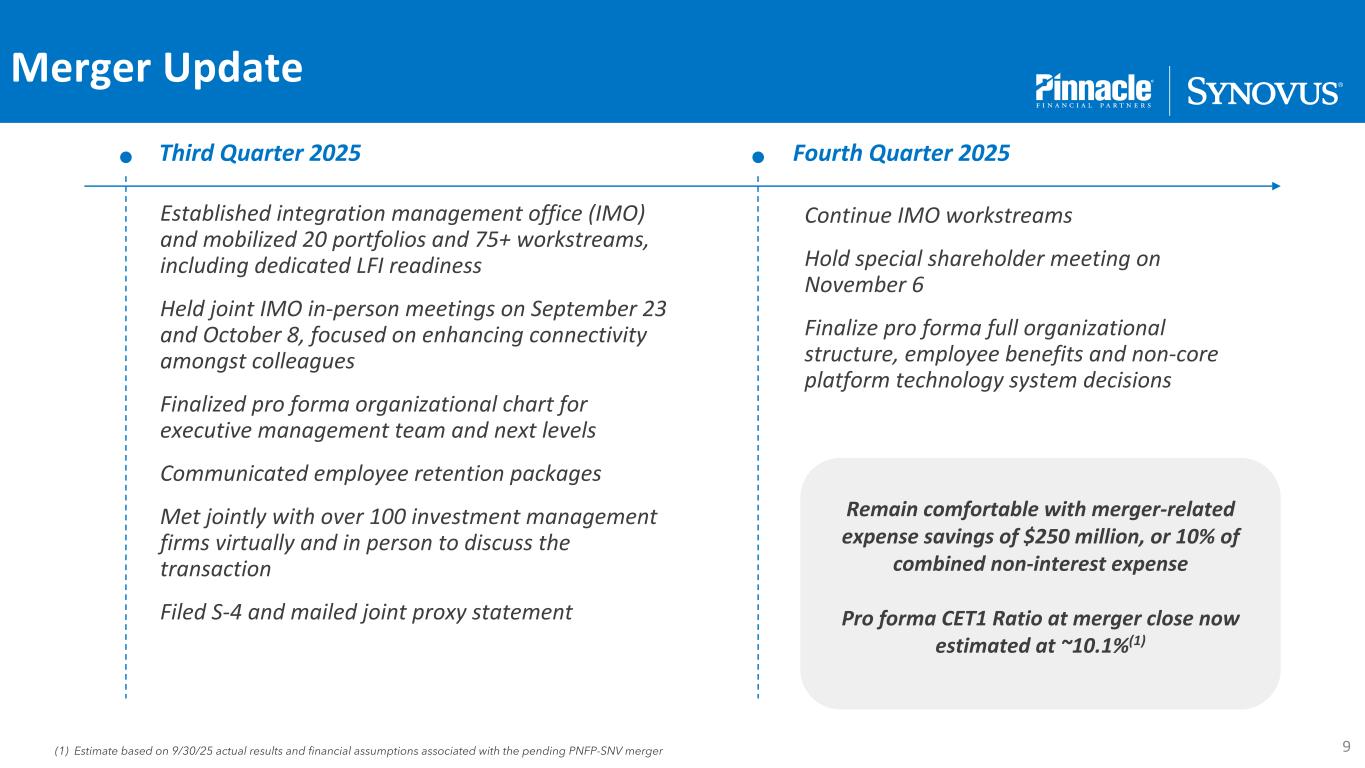

Third Quarter 2025 Fourth Quarter 2025 Established integration management office (IMO) and mobilized 20 portfolios and 75+ workstreams, including dedicated LFI readiness Held joint IMO in-person meetings on September 23 and October 8, focused on enhancing connectivity amongst colleagues Finalized pro forma organizational chart for executive management team and next levels Communicated employee retention packages Met jointly with over 100 investment management firms virtually and in person to discuss the transaction Filed S-4 and mailed joint proxy statement Continue IMO workstreams Hold special shareholder meeting on November 6 Finalize pro forma full organizational structure, employee benefits and non-core platform technology system decisions Remain comfortable with merger-related expense savings of $250 million, or 10% of combined non-interest expense Pro forma CET1 Ratio at merger close now estimated at ~10.1%(1) (1) Estimate based on 9/30/25 actual results and financial assumptions associated with the pending PNFP-SNV merger Merger Update 9

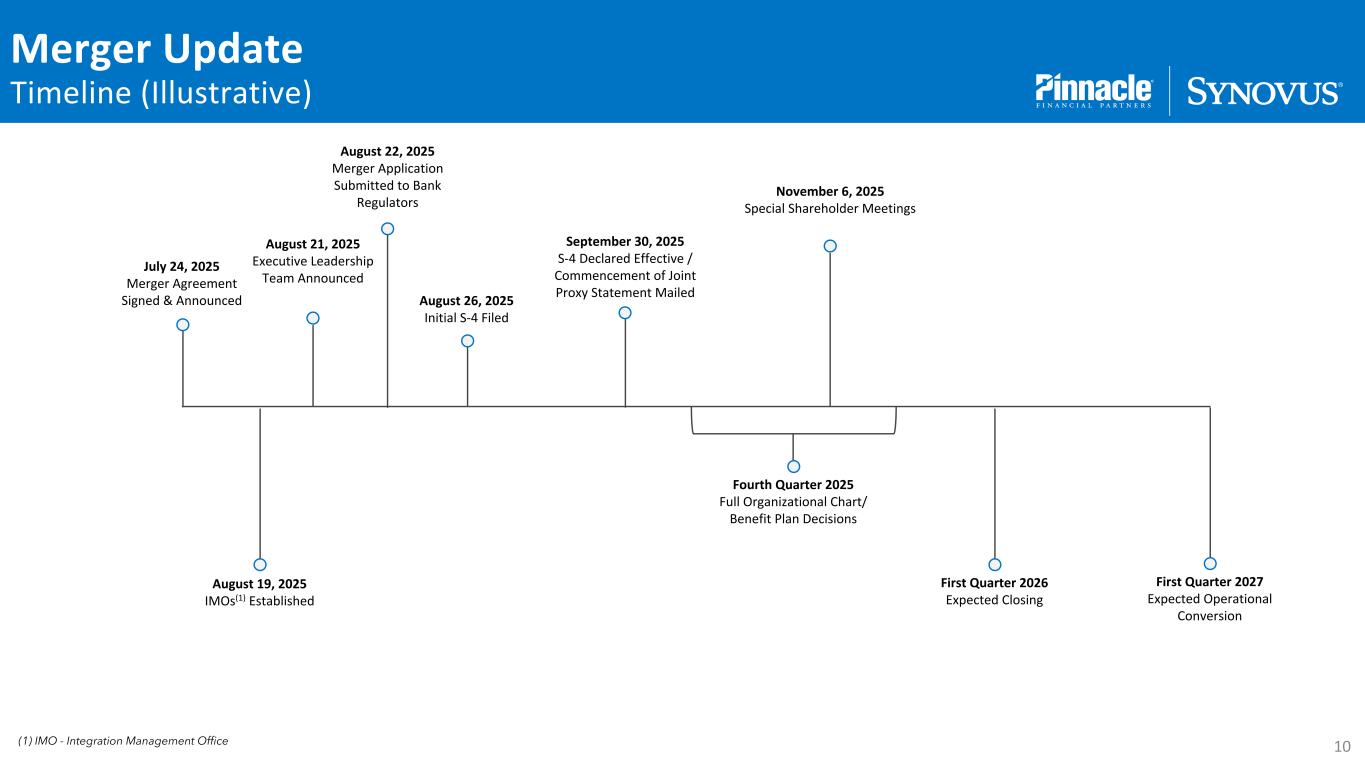

August 21, 2025 Executive Leadership Team Announced August 22, 2025 Merger Application Submitted to Bank Regulators August 19, 2025 IMOs(1) Established November 6, 2025 Special Shareholder Meetings First Quarter 2026 Expected Closing First Quarter 2027 Expected Operational Conversion (1) IMO - Integration Management Office September 30, 2025 S-4 Declared Effective / Commencement of Joint Proxy Statement Mailed Fourth Quarter 2025 Full Organizational Chart/ Benefit Plan Decisions August 26, 2025 Initial S-4 Filed July 24, 2025 Merger Agreement Signed & Announced Merger Update Timeline (Illustrative) 10

11 This communication contains statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. These forward-looking statements include, but are not limited to, statements about the benefits of the proposed transaction between Synovus Financial Corp. (“Synovus”) and Pinnacle Financial Partners, Inc. (“Pinnacle”), including future financial and operating results (including the anticipated impact of the proposed transaction on Synovus’ and Pinnacle’s respective earnings and tangible book value), statements related to the expected timing of the completion of the proposed transaction, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. You can identify these forward-looking statements through the use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the outlook for Synovus’, Pinnacle’s or combined company’s future businesses and financial performance and/or the performance of the banking industry and economy in general. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus, Pinnacle or the combined company to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus or Pinnacle and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this communication. Many of these factors are beyond Synovus’, Pinnacle’s or the combined company’s ability to control or predict. These factors include, among others, (1) the risk that the cost savings and synergies from the proposed transaction may not be fully realized or may take longer than anticipated to be realized, (2) disruption to Synovus’ business and to Pinnacle’s business as a result of the announcement and pendency of the proposed transaction, (3) the risk that the integration of Pinnacle’s and Synovus’ respective businesses and operations will be materially delayed or will be more costly or difficult than expected, including as a result of unexpected factors or events, (4) the failure to obtain the necessary approvals by the shareholders of Synovus or Pinnacle, (5) the amount of the costs, fees, expenses and charges related to the transaction, (6) the ability by each of Synovus and Pinnacle to obtain required governmental approvals of the proposed transaction on the timeline expected, or at all, and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company after the closing of the proposed transaction or adversely affect the expected benefits of the proposed transaction, (7) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the proposed transaction, (8) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the proposed transaction or the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (9) the dilution caused by the issuance of shares of the combined company’s common stock in the transaction, (10) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (11) risks related to management and oversight of the expanded business and operations of the combined company following the closing of the proposed transaction, (12) the possibility the combined company is subject to additional regulatory requirements as a result of the proposed transaction or expansion of the combined company’s business operations following the proposed transaction, (13) the outcome of any legal or regulatory proceedings or governmental inquiries or investigations that may be currently pending or later instituted against Synovus, Pinnacle or the combined company and (14) general competitive, economic, political and market conditions and other factors that may affect future results of Synovus and Pinnacle including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; and capital management activities. Additional factors which could affect future results of Synovus and Pinnacle can be found in Synovus’ or Pinnacle’s filings with the Securities and Exchange Commission (the “SEC”), including in Synovus’ Annual Report on Form 10-K for the year ended December 31, 2024, under the captions “Forward-Looking Statements” and “Risk Factors,” and Synovus’ Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and Pinnacle’s Annual Report on Form 10-K for the year ended December 31, 2024, under the captions “Forward-Looking Statements” and “Risk Factors,” and in Pinnacle’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. Synovus and Pinnacle do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. Forward-Looking Statements

Steel Newco Inc. (“Newco”) filed a registration statement on Form S-4 (File No. 333-289866) with the SEC on August 26, 2025, and an amendment on September 29, 2025, to register the shares of Newco common stock that will be issued to Pinnacle shareholders and Synovus shareholders in connection with the proposed transaction. The registration statement includes a joint proxy statement of Synovus and Pinnacle that also constitutes a prospectus of Newco. The registration statement was declared effective on September 30, 2025. Newco filed a prospectus on September 30, 2025, and Synovus and Pinnacle each filed a definitive proxy statement on September 30, 2025. Synovus and Pinnacle each commenced mailing of the definitive joint proxy statement/prospectus to their respective shareholders on or about September 30, 2025. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS (AND ANY OTHER DOCUMENTS THAT HAVE BEEN OR MAY BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE DEFINITIVE JOINT PROXY STATEMENT/ PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Synovus, Pinnacle or Newco through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Synovus or Pinnacle at: Synovus Financial Corp. Pinnacle Financial Partners, Inc. 33 West 14th Street 21 Platform Way South Columbus, GA 31901 Nashville, TN 37203 Attention: Investor Relations Attention: Investor Relations InvestorRelations@Synovus.com Investor.Relations@pnfp.com (706) 641-6500 (615) 743-8219 Before making any voting or investment decision, investors and security holders of Synovus and Pinnacle are urged to read carefully the entire registration statement and definitive joint proxy statement/prospectus, including any amendments thereto, because they contain important information about the proposed transaction. Free copies of these documents may be obtained as described above. Participants in Solicitation Synovus and Pinnacle and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Synovus’ shareholders and Pinnacle’s shareholders in respect of the proposed transaction under the rules of the SEC. Information regarding Synovus’ directors and executive officers is available in Synovus’ proxy statement for its 2025 annual meeting of shareholders, filed with the SEC on March 12, 2025 (and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000018349/000001834925000057/syn-20250312.htm) (the “Synovus 2025 Proxy”), under the headings “Corporate Governance and Board Matters,” “Director Compensation,” “Proposal 1 Election of Directors,” “Executive Officers,” “Stock Ownership of Directors and Named Executive Officers,” “Executive Compensation,” “Compensation and Human Capital Committee Report,” “Summary Compensation Table,” and “Certain Relationships and Related Transactions,” and in Synovus’ Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 21, 2025 (and available at https://www.sec.gov/ix? doc=/Archives/edgar/data/0000018349/000001834925000049/syn-20241231.htm), and in other documents subsequently filed by Synovus with the SEC, which can be obtained free of charge through the website maintained by the SEC at http:// www.sec.gov. Any changes in the holdings of Synovus’ securities by Synovus’ directors or executive officers from the amounts described in the Synovus 2025 Proxy have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 or on Statements of Change in Ownership on Form 4 filed with the SEC subsequent to the filing date of the Synovus 2025 Proxy and are available at the SEC’s website at www.sec.gov. Information regarding Pinnacle’s directors and executive officers is available in Pinnacle’s proxy statement for its 2025 annual meeting of shareholders, filed with the SEC on March 3, 2025 (and available at https://www.sec.gov/ix?doc=/Archives/edgar/ data/1115055/000111505525000063/pnfp-20250303.htm) (the “Pinnacle 2025 Proxy”), under the headings “Environmental, Social and Corporate Governance,” “Proposal 1 Election of Directors,” “Information About Our Executive Officers,” “Executive Compensation,” “Security Ownership of Certain Beneficial Owners and Management,” and “Certain Relationships and Related Transactions,” and in Pinnacle’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 25, 2025 (and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1115055/000111505525000042/pnfp-20241231.htm), and in other documents subsequently filed by Pinnacle with the SEC, which can be obtained free of charge through the website maintained by the SEC at http://www.sec.gov. Any changes in the holdings of Pinnacle’s securities by Pinnacle’s directors or executive officers from the amounts described in the Pinnacle 2025 Proxy have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 or on Statements of Change in Ownership on Form 4 filed with the SEC subsequent to the filing date of the Pinnacle 2025 Proxy and are available at the SEC’s website at www.sec.gov. Additional information regarding the interests of such participants is included in the definitive joint proxy statement/prospectus and will be included in other relevant materials to be filed with the SEC. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Important Information About the Merger and Where to Find It