Exhibit 2

December 17, 2025

VIA EMAIL

Mr. John P. Kenny

Chairman of the Board

OraSure Technologies, Inc.

150 Webster St.

Bethlehem, PA 18015

CC: Board of Directors of OraSure

Dear Mr. Kenny and Members of the Board:

Altai Capital Management, L.P. (“Altai Capital” or “we”) is a beneficial owner of approximately 5.2% of the outstanding common stock of OraSure Technologies, Inc. (“OraSure” or the “Company”), making us one of OraSure’s largest shareholders. Since November 2024, we have had several private conversations with OraSure’s Board of Directors (“the Board”) and management to explore ways to create value for OraSure. Through this dialogue and the subsequent actions of the Company, it is clear to us that the Board remains obstinately committed to the Company’s failing strategy in life sciences that has destroyed significant shareholder value across every reasonable metric.

We are now more convinced than ever that the current Board is not capable of taking the necessary steps to transform the Company. We therefore intend to nominate John Bertrand, CEO of Digital Diagnostics, and myself, Rishi Bajaj, President and CIO of Altai Capital, for election to the Board at the 2026 Annual Meeting of Stockholders. Please see Exhibits A and B, respectively, for Mr. Bertrand’s and my biographies.

We believe that the causes of the Company’s underperformance are primarily driven by extremely poor strategy and capital allocation decisions. First, management failed to execute the steps required to turn around its core product segments amidst its Covid-19 windfall revenue winding down. Second, the Company has squandered millions of dollars making ill-timed venture-like investments in failing, subscale and/or unprofitable companies. Finally, OraSure continues to burn cash in its core product segments with no tangible return on the horizon.

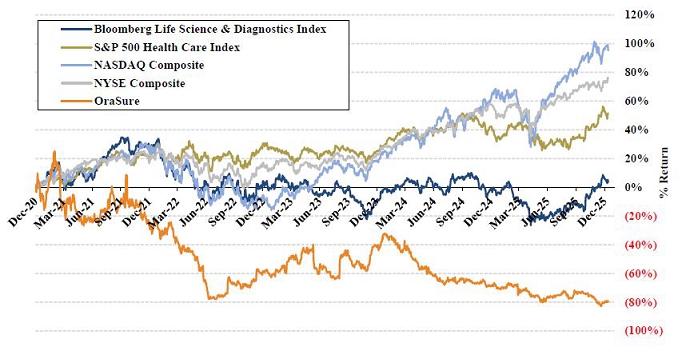

Price Performance Graph: OraSure vs. Relevant Indices1

_____________________________

1 Performance is calculated for the period 12/01/20 –

12/12/25. Data for the Bloomberg US 3000 Life Science & Diagnostics Price Return Index, S&P Health Care Index, NASDAQ Composite

Index and the NYSE Composite Index assume reinvestment of dividends.

1

Price Performance: OraSure vs. Relevant Indices2

| 5-Year Performance | 10-Year Performance | ||||||||||||

| % Return | OraSure vs. Relevant Index | % Return | OraSure vs. Relevant Index | ||||||||||

| Bloomberg Life Science & Diagnostics Index | 411111 | % | (83) | % | 22311111 | % | (283) | % | |||||

| S&P 500 Health Care Index | 5211111 | % | (131) | % | 15511111 | % | (215) | % | |||||

| NASDAQ Composite Index | 9511111 | % | (175) | % | 39511111 | % | (456) | % | |||||

| NYSE Composite Index | 7611111 | % | (155) | % | 17011111 | % | (230) | % | |||||

| OraSure | (80) | % | (60) | % | |||||||||

Adding a motivated, experienced board member with significant stock ownership should be an obvious step in the right direction for any board, especially one with a track record as poor as OraSure’s. Yet, the Board has made clear in private conversations that it would not be persuaded by our arguments or give proper consideration to my candidacy. Instead of appointing someone with a meaningful ownership interest who is aligned with shareholders, the Board recently added Stephen Boyd, who is a former, not current, shareholder of the Company, with no apparent board, operating or business restructuring experience.

We are not saying that Mr. Boyd is incapable of learning on the job. We are instead emphatically saying that shareholders should not fund Mr. Boyd’s education as OraSure attempts to navigate a critical turnaround situation. Despite the Company’s so-called board refreshment efforts, OraSure has made no meaningfully positive operational or directional changes. It is transparent to us and many other shareholders that these actions are simply cosmetic and are not intended to take real accountability. As such, we do not believe the Company is committed to responding to its past mistakes through a comprehensive reevaluation of its strategy which is imperative for value creation.

OraSure is at a pivotal moment in its journey and faces significant obstacles ahead. Mr. Boyd’s appointment clearly demonstrates that the Board has little respect for the challenges the Company is facing, and little regard for the anger shareholders feel for the way the Company has addressed many of these same challenges in the past. This pattern of disregard for shareholder interests must cease immediately. OraSure has squandered 25% of its cash and cash equivalents balance since Q4 2023 while its quarterly revenue (excluding Covid-19 products) has declined over 20% in the same timeframe. Shareholders like us who are anxious and motivated to drive change deserve better. If the Board does not change course immediately, the risk of permanent capital impairment will continue to increase. Perhaps more importantly, we see little hope that OraSure will outperform relative to its risk.

We and Mr. Bertrand believe there is a better path forward to transform the Company that will deliver substantial near-term and long-term value to all shareholders while mitigating the potential for future value destruction. As we have stated to you numerous times throughout this year, Mr. Bertrand and I stand ready to join the Board immediately and draw upon our collective experience and successful track records to drive value to all shareholders. We look forward to enthusiastically presenting our case directly to shareholders if the Board fails to act. Until then, we remain open to engaging with the Board and management to achieve what should be our shared long-term goal of delivering sustained and enduring value to shareholders.

Sincerely,

_____________________

Rishi Bajaj

President & Chief Investment Officer

_____________________________

2 The 5-year and 10-year performance is calculated for the period

12/01/20 – 12/12/25 and 12/01/15 – 12/12/25, respectively. Data for the Bloomberg US 3000 Life Science & Diagnostics Price

Return Index, S&P Health Care Index, NASDAQ Composite Index and the NYSE Composite Index assume reinvestment of dividends. OraSure

vs. Relevant Index performance figures may not equal the calculated differences due to rounding.

2

EXHIBIT A

John Bertrand Biography:

John Bertrand co-founded and has served as the Chief Executive Officer of Digital Diagnostics Inc., a leading health technology company, since 2019. Since co-founding the company, Mr. Bertrand has led the company’s transformation from a primarily research-driven organization to a commercial enterprise that acts as a global artificial intelligence platform to diagnose many diseases.

Previously, from 2006 to 2019, Mr. Bertrand served in various roles, including as a Business Development and Product Management Executive, at Epic Systems Corporation, a healthcare software company, where he led cross-functional teams in a variety of product, customer success, and business development roles with a focus on growth.

Mr. Bertrand has served in advisory roles and on the boards of directors of numerous technology companies. Mr. Bertrand has served as a Senior Advisor to Bain Capital, a private investment firm, since 2023, supporting the firm’s private equity practice in the healthcare information technology, diagnostics and therapeutics sectors. Mr. Bertrand has served in various roles, including as a Senior Advisor and Executive in Residence, at 8VC, a leading Silicon Valley venture capital firm focused on healthcare technology, since 2018. Mr. Bertrand has served on the Board of Directors of Keycare, Inc., a telehealth platform, since 2022, on the Board of Directors of Surlogs Inc., a regulatory compliance software company, since 2020, on the Board of Directors of Digital Diagnostics Inc., since 2019, and on the Board of Directors of Sirona Medical Inc., a medical software company, since 2019. Previously, Mr. Bertrand served on the Board of Advisors at Innovaccer, Inc., a digital healthcare company, from 2019 to 2020, and on the Board of Advisors at iRhythm Technologies Inc., a digital healthcare company, from 2019 to 2020. From 2018 to 2020, Mr. Bertrand served on the Board of Advisors of Digital Surgery, a health technology company, and from 2016 to 2018, he served on the Board of Advisors at Matrix Capital Management, a hedge fund.

Mr. Bertrand holds a B.S. in Business Management from Purdue University.

Mr. Bertrand’s qualifications to serve as a director of the Corporation include over a decade of executive leadership experience in the healthcare technology sector, where he has developed expertise in the application of artificial intelligence and computer vision in healthcare, identifying market opportunities, creating new products, and pivoting existing businesses.

3

EXHIBIT B

Rishi Bajaj Biography:

Rishi Bajaj founded Altai Capital Management, L.P., a private investment firm, in 2009. He serves as its President and Chief Investment Officer, where he is responsible for the management and operations of the business. From 2024 to 2025, Mr. Bajaj also served as the Chief Executive Officer of ContextLogic Holdings Inc. (“ContextLogic”, OTCQB: LOGC).

Prior to founding Altai Capital, Mr. Bajaj served as a Senior Investment Analyst at Silver Point Capital, L.P., a private investment management firm, from 2003 to 2009, and as an M&A and Restructuring Analyst at Gleacher Partners, LLC, an M&A advisory firm, from 2001 to 2003.

Mr. Bajaj has served on the Board of Directors of Digimarc Corporation (“Digimarc”, NASDAQ: DMRC), a digital watermarking company, since July 2025. He is currently a member of Digimarc’s Audit Committee. Mr. Bajaj previously served (i) on the Board of Directors of ContextLogic from 2023 to 2025, where he served as Chairman, from 2024 to 2025, as well as a member of the Compensation Committee and Transformation Committee, (ii) on the Board of Directors of MobileIron, Inc. (NASDAQ: MOBL, formerly), a cybersecurity company, in 2020, where he served on the Strategy Committee, and (iii) on the Board of Directors of ServiceSource International, Inc. (NASDAQ: SREV, formerly), a software and services company, from 2014 to 2016, where he served on the Compensation Committee.

Mr. Bajaj holds a B.S. in Economics with concentrations in Finance and Statistics from The Wharton School at the University of Pennsylvania.

Mr. Bajaj’s qualifications to serve as a director of the Corporation include his years of service on public company boards and his extensive investment management experience and operational expertise, particularly in the technology sector.

4