OraSure Q3 2025 Investor Update NOVEMBER 2025 .2

© 2025 OraSure Technologies, Inc. 2OTI Proprietary Disclaimers Forward-Looking Statements: This presentation of OraSure Technologies, Inc. (the “Company” or “OraSure”) contains certain “forward-looking statements” within the meaning of federal securities laws, including with respect to products, product candidate development and manufacturing activities, regulatory submissions and authorizations, revenue growth and guidance, expected revenue from government orders, cost savings, cash flow, increasing margins and other matters. Forward-looking statements are not guarantees of future performance or results. Known and unknown factors that could cause actual performance or results to be materially different from those expressed or implied in these statements include, but are not limited to: OraSure’s ability to satisfy customer demand; ability to reduce OraSure’s spending rate, capitalize on manufacturing efficiencies and drive profitable growth; ability to market and sell products, whether through the Company’s internal, direct sales force or third parties; impact of significant customer concentration in the genomics business; failure of distributors or other customers to meet purchase forecasts, historic purchase levels or minimum purchase requirements for our products; ability to manufacture products in accordance with applicable specifications, performance standards and quality requirements; ability to obtain, and timing and cost of obtaining, necessary regulatory approvals for new products or new indications or applications for existing products; ability to comply with applicable regulatory requirements; ability to effectively resolve warning letters, audit observations and other findings or comments from the FDA or other regulators; changes in relationships, including disputes or disagreements, with strategic partners or other parties and reliance on strategic partners for the performance of critical activities under collaborative arrangements; impact of replacing distributors; inventory levels at distributors and other customers; OraSure’s ability to achieve its financial and strategic objectives and increase its revenues, including the ability to expand international sales; ability to achieve the anticipated benefits from the BioMedomics transaction; impact of competitors, competing products and technology changes; reduction or deferral of public funding available to customers; competition from new or better technology or lower cost products; ability to develop, commercialize and market new products; changes in market acceptance of products based on product performance or other factors, including changes in testing guidelines, algorithms or other recommendations by the Centers for Disease Control and Prevention or other agencies; ability to fund research and development and other products and operations; ability to obtain and maintain new or existing product distribution channels; reliance on sole supply sources for critical products and components; availability of related products produced by third parties or products required for use of the Company’s products; impact of contracting with the U.S. government; impact of negative economic conditions; ability to achieve and maintain sustained profitability; ability to increase OraSure’s gross margins; ability to utilize net operating loss carry forwards or other deferred tax assets; uncertainty relating to patent protection and potential patent infringement claims; uncertainty and costs of litigation relating to patents, trade secrets and other intellectual property; availability of licenses to patents or other technology; ability to enter into international manufacturing agreements; obstacles to international marketing and manufacturing of products; impact of changes in international funding sources and testing algorithms on international sales; adverse movements in foreign currency exchange rates; loss or impairment of sources of capital; ability to attract and retain qualified personnel; exposure to product liability and other types of litigation; changes in international, federal or state laws and regulations; customer consolidations and inventory practices; equipment failures and ability to obtain needed raw materials and components; the impact of cybersecurity incidents and other disruptions involving the Company’s computer systems or those of our third-party IT service providers, suppliers and customers; the impact of terrorist attacks, civil unrest, hostilities and war; and general political, business and economic conditions, including interest rates, inflationary pressures, capital market disruptions, changes in governmental agencies, international tariffs, trade protection measures, economic sanctions and economic slowdowns or recession. These and other factors that could affect the Company’s results are discussed more fully in OraSure’s filings with the Securities and Exchange Commission (the “SEC”), including the Company’s registration statements, Annual Report on Form 10-K for the year ended December 31, 2024, Quarterly Reports on Form 10-Q, and other filings with the SEC. Although forward-looking statements help to provide information about future prospects, readers should keep in mind that forward-looking statements may not be reliable. Readers are cautioned not to place undue reliance on the forward-looking statements. The forward-looking statements are made as of the date of this presentation and OraSure undertakes no duty to update these statements. Estimates and Other Data: This presentation contains estimates and other data made by independent parties and the Company relating to market size and growth and other data about its industry. Such data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of the Company’s future performance and the future performance of the markets in which it operates are necessarily subject to a high degree of uncertainty and risks. Non-GAAP Financial Measures This presentation makes use of certain financial measures that are not prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Please refer to the Appendix to this presentation for a reconciliation of any non-GAAP financial measures. We encourage investors to carefully consider the Company’s results under GAAP, as well as our supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand the Company’s business. Non-GAAP financial results are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Further, non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared. No Solicitation: This presentation does not constitute an offer to sell or a solicitation of an offer to buy securities in any potential transaction, nor shall there by any offer, solicitation or sale of any such securities in any jurisdiction, or to whom any person, where such offer, solicitation or sale would be unlawful.

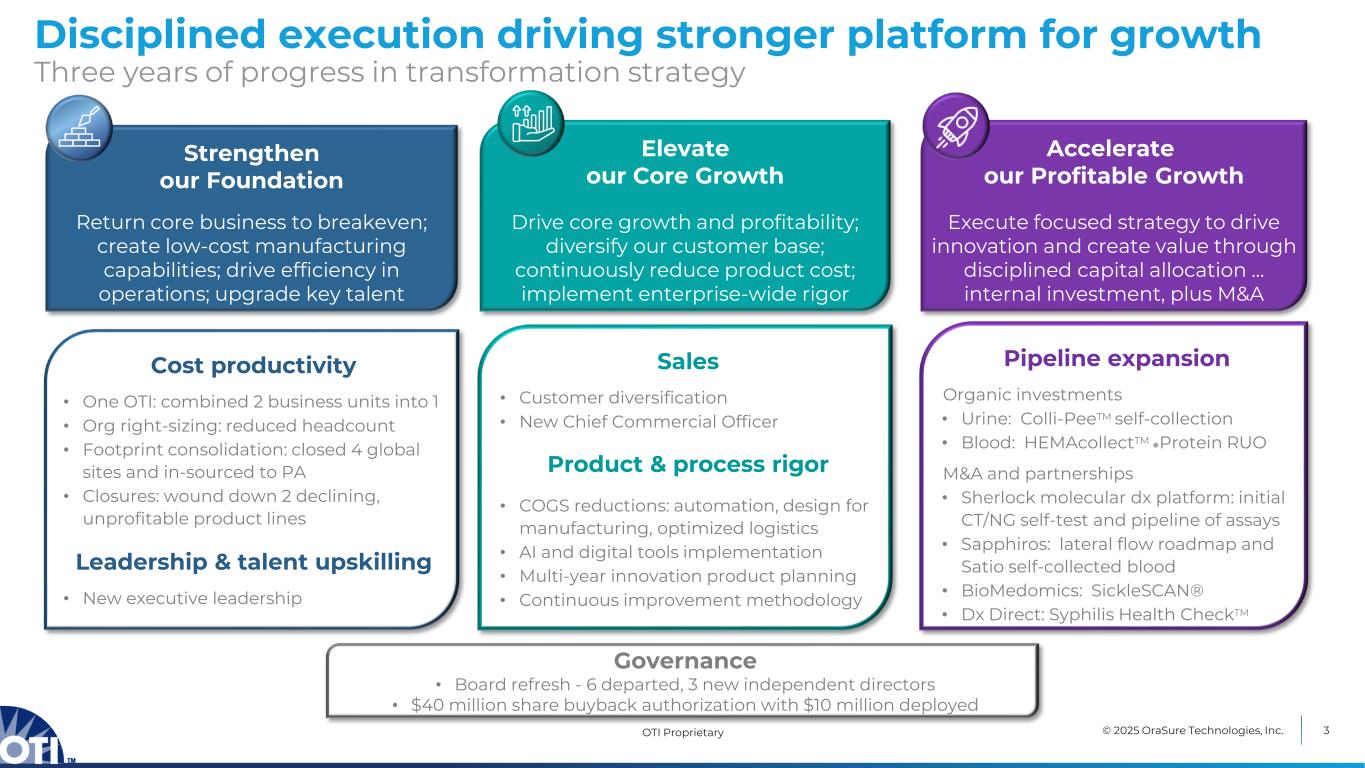

© 2025 OraSure Technologies, Inc. 3OTI Proprietary Disciplined execution driving stronger platform for growth Three years of progress in transformation strategy Strengthen our Foundation Elevate our Core Growth Accelerate our Profitable Growth Cost productivity • One OTI: combined 2 business units into 1 • Org right-sizing: reduced headcount • Footprint consolidation: closed 4 global sites and in-sourced to PA • Closures: wound down 2 declining, unprofitable product lines Leadership & talent upskilling • New executive leadership Return core business to breakeven; create low-cost manufacturing capabilities; drive efficiency in operations; upgrade key talent Sales • Customer diversification • New Chief Commercial Officer Product & process rigor • COGS reductions: automation, design for manufacturing, optimized logistics • AI and digital tools implementation • Multi-year innovation product planning • Continuous improvement methodology Drive core growth and profitability; diversify our customer base; continuously reduce product cost; implement enterprise-wide rigor Execute focused strategy to drive innovation and create value through disciplined capital allocation … internal investment, plus M&A Governance • Board refresh - 6 departed, 3 new independent directors • $40 million share buyback authorization with $10 million deployed Pipeline expansion Organic investments • Urine: Colli-PeeTM self-collection • Blood: HEMAcollectTM ●Protein RUO M&A and partnerships • Sherlock molecular dx platform: initial CT/NG self-test and pipeline of assays • Sapphiros: lateral flow roadmap and Satio self-collected blood • BioMedomics: SickleSCAN® • Dx Direct: Syphilis Health CheckTM

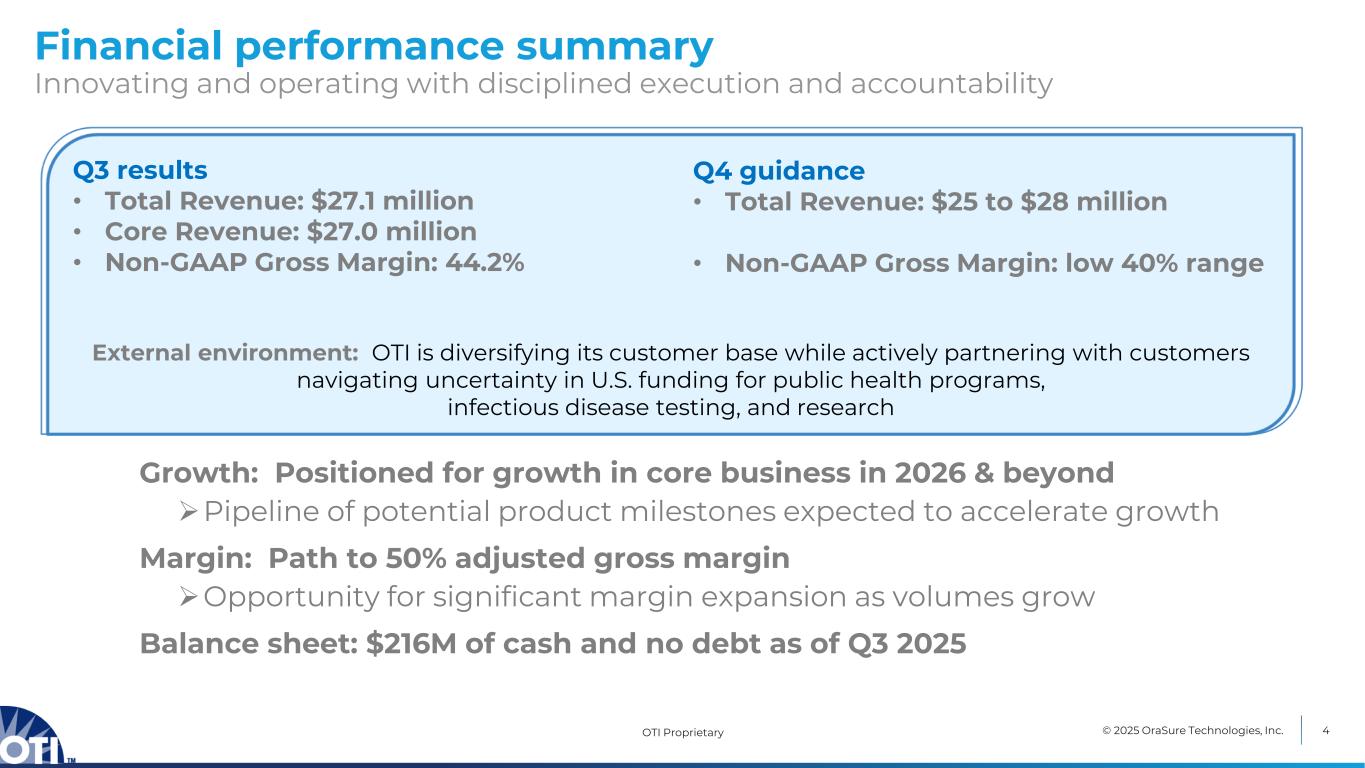

© 2025 OraSure Technologies, Inc. 4OTI Proprietary Financial performance summary Innovating and operating with disciplined execution and accountability Q3 results • Total Revenue: $27.1 million • Core Revenue: $27.0 million • Non-GAAP Gross Margin: 44.2% External environment: OTI is diversifying its customer base while actively partnering with customers navigating uncertainty in U.S. funding for public health programs, infectious disease testing, and research Growth: Positioned for growth in core business in 2026 & beyond ➢Pipeline of potential product milestones expected to accelerate growth Margin: Path to 50% adjusted gross margin ➢Opportunity for significant margin expansion as volumes grow Balance sheet: $216M of cash and no debt as of Q3 2025 Q4 guidance • Total Revenue: $25 to $28 million • Non-GAAP Gross Margin: low 40% range

© 2025 OraSure Technologies, Inc. 5OTI Proprietary Strategy to accelerate growth with near-term catalysts in attractive markets … Executing on Near-Term Innovation Delivering differentiated product pipeline with near-term milestones … aligned with long-term healthcare trends Expanding Product Pipeline Leveraging OTI strengths to compete and win in large & growing segments … expected to accelerate long-term growth

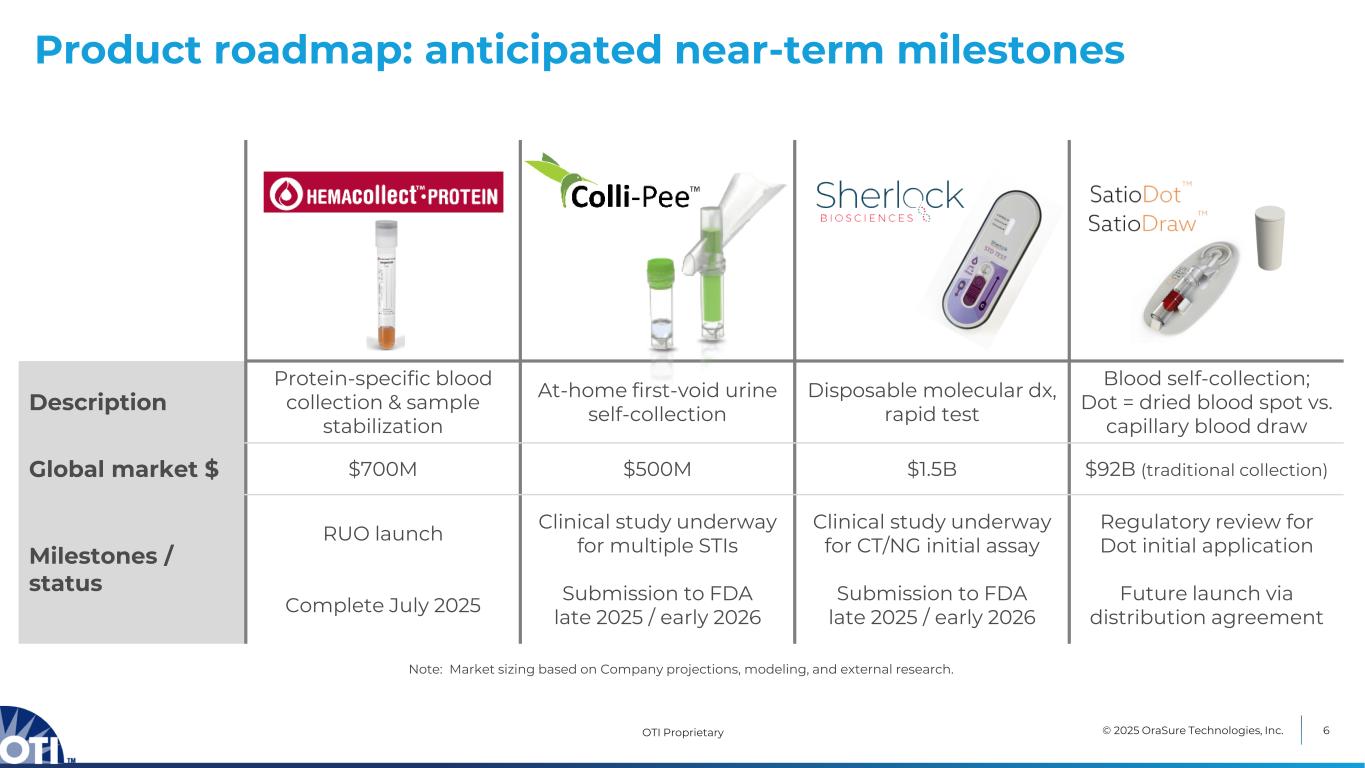

© 2025 OraSure Technologies, Inc. 6OTI Proprietary Product roadmap: anticipated near-term milestones Description Protein-specific blood collection & sample stabilization At-home first-void urine self-collection Disposable molecular dx, rapid test Blood self-collection; Dot = dried blood spot vs. capillary blood draw Global market $ $700M $500M $1.5B $92B (traditional collection) Milestones / status RUO launch Complete July 2025 Clinical study underway for multiple STIs Submission to FDA late 2025 / early 2026 Clinical study underway for CT/NG initial assay Submission to FDA late 2025 / early 2026 Regulatory review for Dot initial application Future launch via distribution agreement Note: Market sizing based on Company projections, modeling, and external research.

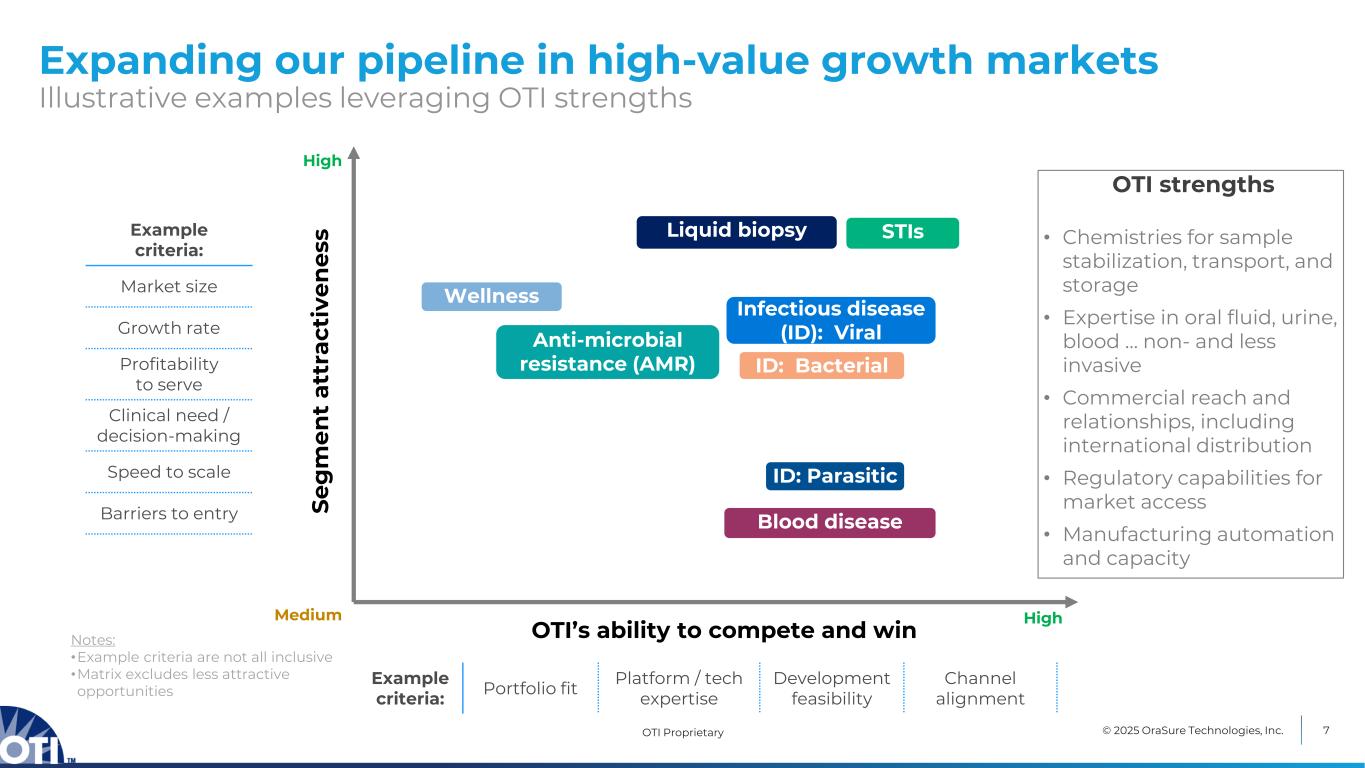

© 2025 OraSure Technologies, Inc. 7OTI Proprietary Expanding our pipeline in high-value growth markets Illustrative examples leveraging OTI strengths Notes: •Example criteria are not all inclusive •Matrix excludes less attractive opportunities Example criteria: Market size Growth rate Profitability to serve Clinical need / decision-making Speed to scale Barriers to entry Example criteria: Portfolio fit Platform / tech expertise Development feasibility Channel alignment OTI’s ability to compete and win S e g m e n t a tt ra ct iv e n e ss Medium High High Anti-microbial resistance (AMR) ID: Bacterial STIs ID: Parasitic Blood disease Wellness Liquid biopsy Infectious disease (ID): Viral OTI strengths • Chemistries for sample stabilization, transport, and storage • Expertise in oral fluid, urine, blood … non- and less invasive • Commercial reach and relationships, including international distribution • Regulatory capabilities for market access • Manufacturing automation and capacity

© 2025 OraSure Technologies, Inc. 8OTI Proprietary OraSure today: stronger, focused, and executing for sustainable growth Strengthen our Foundation Elevate our Core Growth Accelerate our Profitable Growth

© 2025 OraSure Technologies, Inc. 9 Appendix

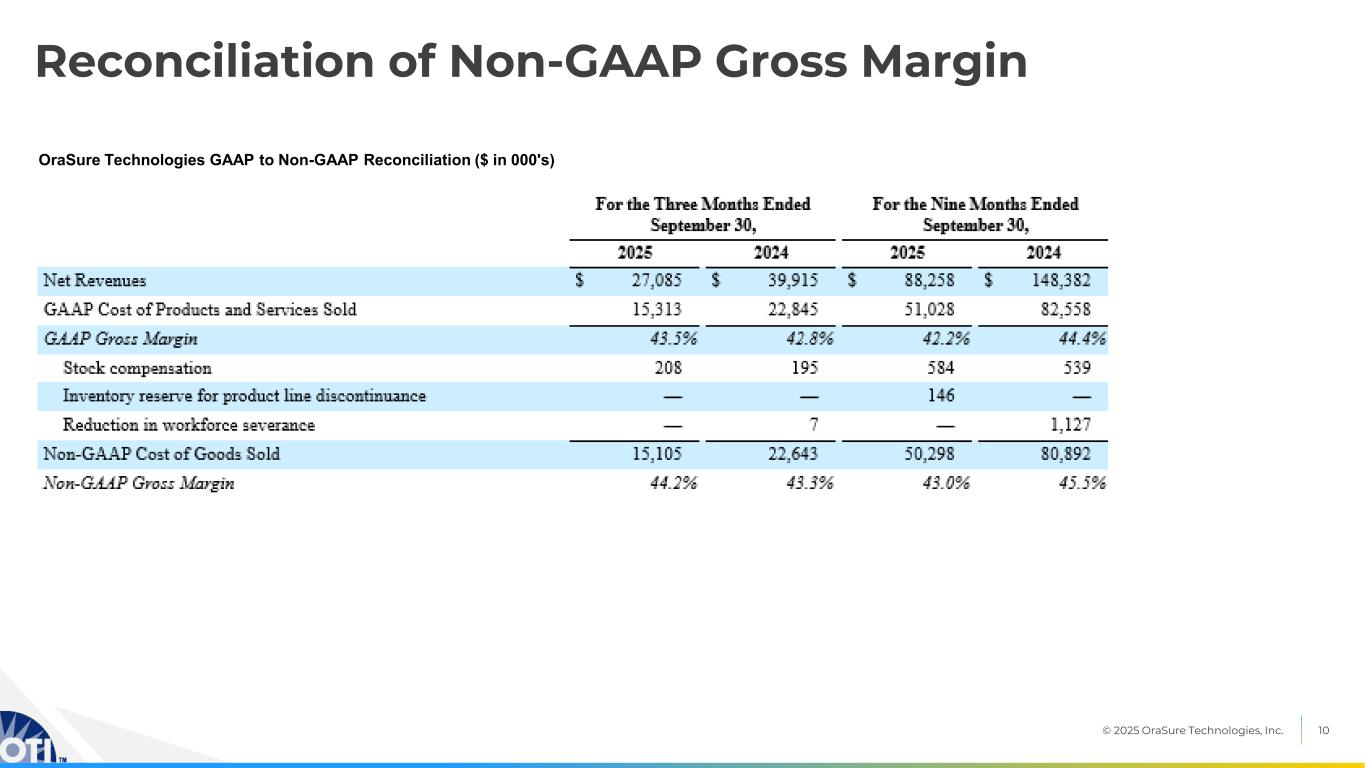

© 2025 OraSure Technologies, Inc. 10 Reconciliation of Non-GAAP Gross Margin OraSure Technologies GAAP to Non-GAAP Reconciliation ($ in 000's)