Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of the financial condition and results of operations of Nasdaq should be read in conjunction with our condensed consolidated financial statements and related notes included in this Form 10-Q.

Certain percentages and per share amounts herein may not sum or recalculate due to rounding.

EXECUTIVE OVERVIEW

Nasdaq is a global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence.

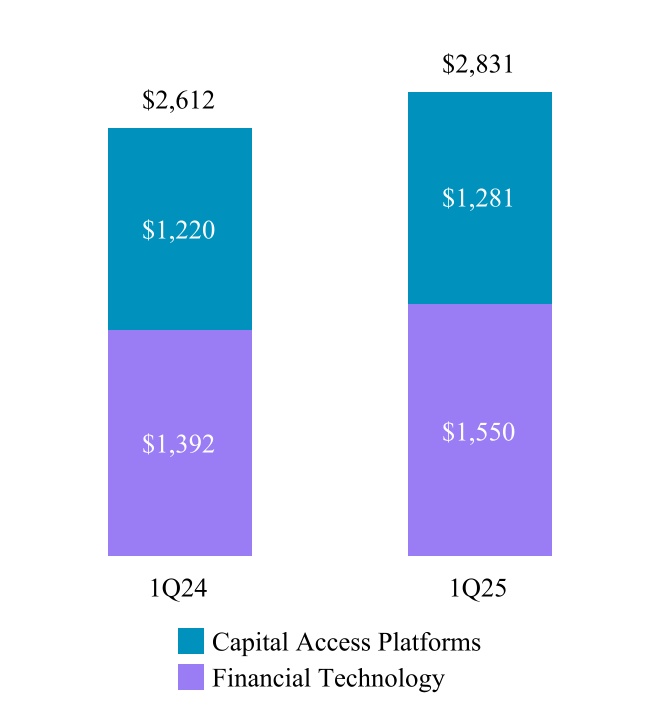

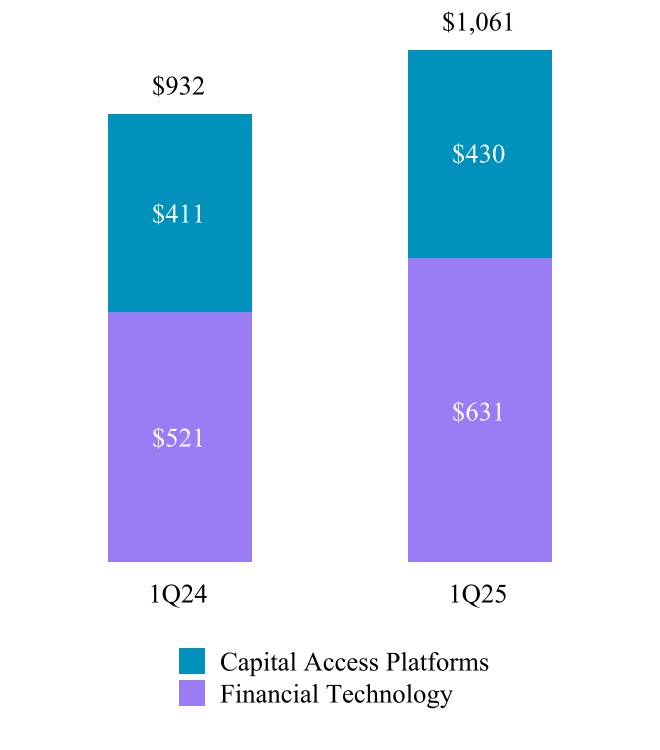

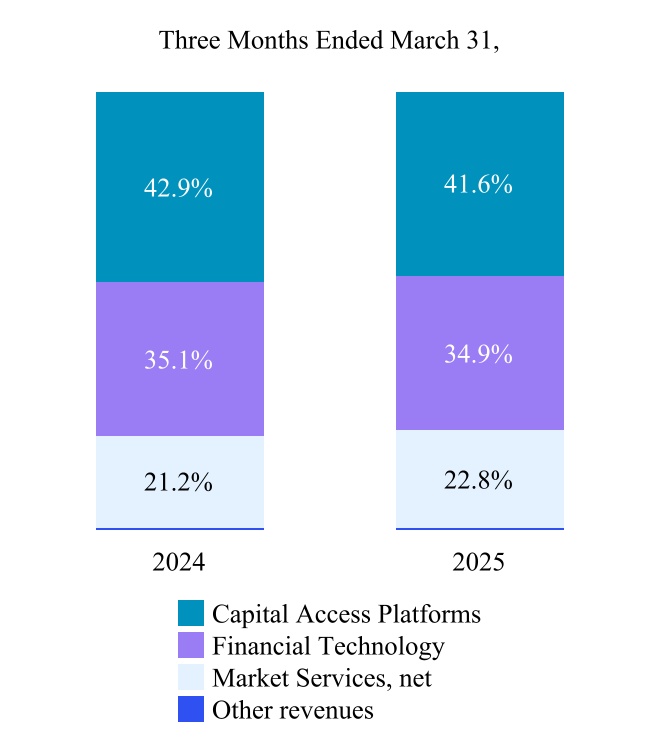

We manage, operate and provide our products and services in three business segments: Capital Access Platforms, Financial Technology and Market Services.

First Quarter 2025 Highlights

•In the first quarter of 2025, Nasdaq achieved an 82.0% win rate among Nasdaq-eligible operating company IPOs in the U.S., representing 45 offerings and $5 billion in total proceeds raised.

•Market Services delivered record revenues for the segment and record volumes across cash equities, equity options and index options volumes.

•Our Financial Technology segment delivered 11% ARR growth, reflecting an increase in new clients, cross-sells and upsells.

•Index achieved a sixth consecutive record quarter, reaching an average ETP AUM of $662 billion and $27 billion of net inflows in the first quarter.

Macroeconomic environment

Our business performance can be positively or negatively impacted by a number of factors, including general economic conditions, the geopolitical environment, current or expected inflation, interest rate fluctuations, the threat or imposition of broad-based tariffs, market volatility, changes in investment patterns and priorities, regulatory changes, pandemics and other factors that are generally beyond our control. For example, higher overall U.S. trading volumes in the first quarter of 2025, as compared to the same period in 2024, has led to an increase in our U.S. Equity Derivative Trading and U.S. Cash Equity Trading revenues. Market factors also contributed to higher valuations in Nasdaq Indices and higher overall volumes in Index derivatives. To the extent that global or national economic conditions weaken and result in slower growth or recessions, our business may be negatively impacted.

Nasdaq’s Operating Results

The following table summarizes our financial performance for the three months ended March 31, 2025 compared to the same period in 2024. For a detailed discussion of our results of operations, see “Segment Operating Results” below.

| Three Months Ended March 31, | Percentage Change | ||||||||||||||||

| 2025 | 2024 | ||||||||||||||||

| (in millions, except per share amounts) | |||||||||||||||||

| Revenues less transaction-based expenses | $ | 1,237 | $ | 1,117 | 10.7 | % | |||||||||||

| Operating expenses | 690 | 707 | (2.5) | % | |||||||||||||

| Operating income | $ | 547 | $ | 410 | 33.5 | % | |||||||||||

| Net income attributable to Nasdaq | $ | 395 | $ | 234 | 68.9 | % | |||||||||||

| Diluted earnings per share | $ | 0.68 | $ | 0.40 | 68.6 | % | |||||||||||

| Cash dividends declared per common share | $ | 0.24 | $ | 0.22 | 9.1 | % | |||||||||||

In countries with currencies other than the U.S. dollar, revenues and expenses are translated using monthly average exchange rates. Impacts on our revenues less transaction-based expenses and operating income associated with fluctuations in foreign currency are discussed in more detail under “Item 3. Quantitative and Qualitative Disclosures About Market Risk.”

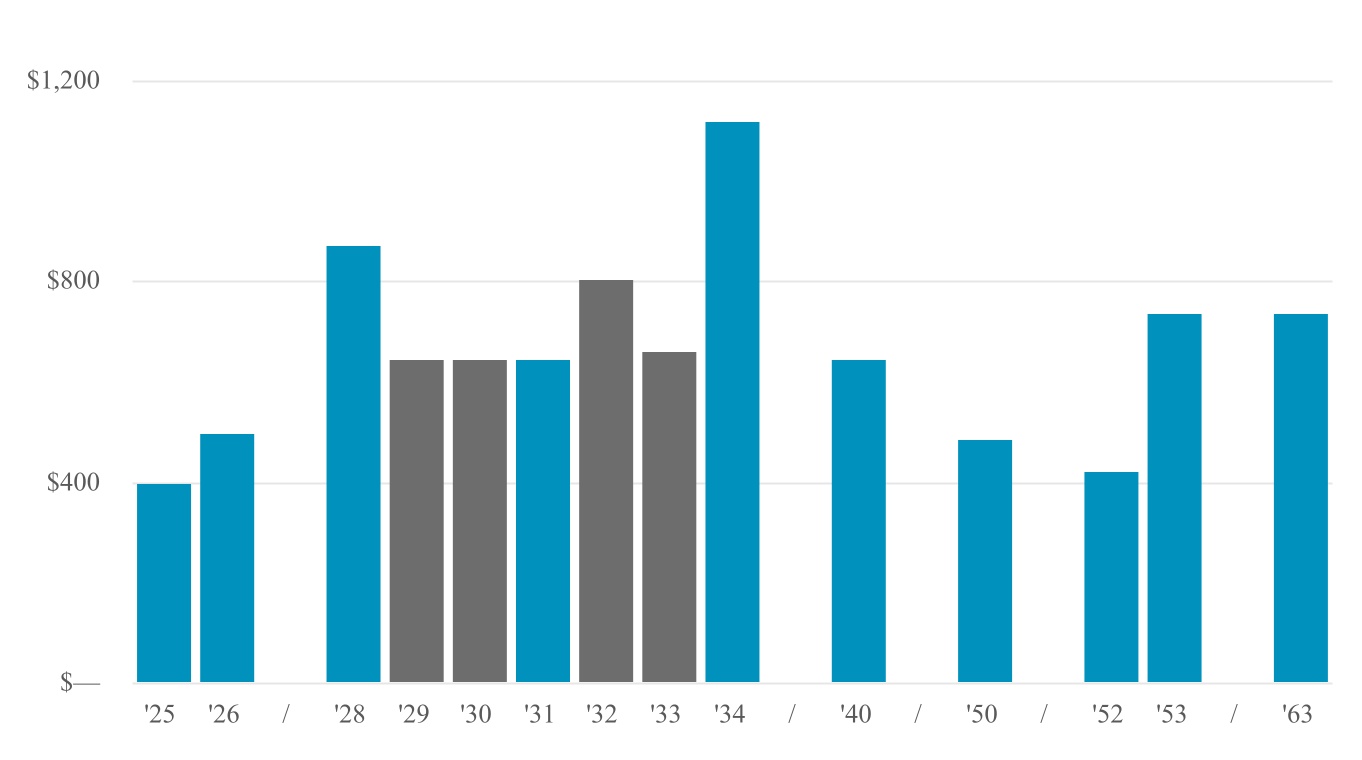

The following chart summarizes our ARR (in millions):