.2

1 Broadwind | Investor Presentation 2023 Second Quarter 2025 Conference Call Presentation August 12, 2025

2 Broadwind | Investor Presentation 2023 SAFE HARBOR STATEMENT This document contains “forward looking statements” — that is, statements related to future, not past, events — as defined in Section 21 E of the Securities Exchange Act of 1934 , as amended, that reflect our current expectations regarding our future growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities, as well as assumptions made by, and information currently available to, our management . We have tried to identify forward looking statements by using words such as “anticipate,” “believe,” “expect,” “intend,” “will,” “should,” “may,” “plan” and similar expressions, but these words are not the exclusive means of identifying forward looking statements . Forward looking statements include any statement that does not directly relate to a current or historical fact . Our forward - looking statements may include or relate to our beliefs, expectations, plans and/or assumptions with respect to the following : ( i ) the impact of global health concerns on the economies and financial markets and the demand for our products ; (ii) state, local and federal regulatory frameworks affecting the industries in which we compete, including the wind energy industry, and the related phase out, extension, continuation or renewal of federal tax incentives and grants, including the advanced manufacturing tax credits, and state renewable portfolio standards as well as new or continuing tariffs on steel or other products imported into the United States ; (iii) our customer relationships and our substantial dependency on a few significant customers and our efforts to diversify our customer base and sector focus and leverage relationships across business units ; (iv) our ability to operate our business efficiently, comply with our debt obligations, manage capital expenditures and costs effectively, and generate cash flow ; (v) the economic and operational stability of our significant customers and suppliers, including their respective supply chains, and the ability to source alternative suppliers as necessary ; (vi) our ability to continue to grow our business organically and through acquisitions ; (vii) the production, sales, collections, customer deposits and revenues generated by new customer orders and our ability to realize the resulting cash flows ; (viii) information technology failures, network disruptions, cybersecurity attacks or breaches in data security ; (ix) the sufficiency of our liquidity and alternate sources of funding, if necessary ; (x) our ability to realize revenue from customer orders and backlog (including our ability to finalize the terms of the remaining obligations under a supply agreement with a leading global wind turbine manufacturer) ; (xi) the economy and the potential impact it may have on our business, including our customers ; (xii) the state of the wind energy market and other energy and industrial markets generally, including the availability of tax credits, and the impact of competition and economic volatility in those markets ; (xiii) the effects of market disruptions and regular market volatility, including fluctuations in the price of oil, gas and other commodities ; (xiv) competition from new or existing industry participants including, in particular, increased competition from foreign tower manufacturers ; (xv) the effects of the change of administrations in the U . S . federal government ; (xvi) our ability to successfully integrate and operate acquired companies and to identify, negotiate and execute future acquisitions ; (xvii) the potential loss of tax benefits if we experience an “ownership change” under Section 382 of the Internal Revenue Code of 1986 , as amended ; (xviii) the effects of proxy contests and actions of activist stockholders ; (xix) the limited trading market for our securities and the volatility of market price for our securities ; (xx) our outstanding indebtedness and its impact on our business activities (including our ability to incur additional debt in the future) ; (xxi) the impact of future sales of our common stock or securities convertible into our common stock on our stock price ; ( xxii) our ability to complete the sale of our industrial fabrication operations in Manitowoc, Wisconsin (the “Manitowoc Sale”) in a timely manner, if at all ; and (xxiii) the impact that the Manitowoc Sale may have on our current plans and operations . These statements are based on information currently available to us and are subject to various risks, uncertainties and other factors that could cause our actual growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities to differ materially from those expressed in, or implied by, these statements including, but not limited to, those set forth under the caption “Risk Factors” in Part I, Item 1 A of our most recently filed Form 10 - K, in Part II, Item 1 A of our Quarterly Report on Form 10 - Q for the quarter ended June 30 , 2025 , and in our other filings with the Securities and Exchange Commission . We are under no duty to update any of these statements . You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or other factors that could cause our current beliefs, expectations, plans and/or assumptions to change . Accordingly, forward - looking statements should not be relied upon as a predictor of actual results .

PERFORMANCE SUMMARY

4 Broadwind | Investor Presentation 2023 PERFORMANCE UPDATE 2Q25 Performance As of August 2025 New business developments. Secured an over $6 million follow - on order for precision machined gearing products (announced July - 25) Accelerating customer activity. Orders increased 14% y/y, driven primarily by demand from power generation and oil & gas customers Sustained demand from core markets. Demand from the Wind and Industrial end - markets drove sales growth of 7.6% y/y Updated full - year 2025 financial guidance will be provided upon closing of the Manitowoc divestiture . In connection with closing the asset sale, the Company will provide updated 2025 financial guidance on revenue and Adjusted EBITDA Investment Thesis Building a platform for profitable growth Second Quarter 2025 Business Update 100% domestic precision manufacturing footprint remains a competitive advantage in the current operating environment, given continued focus on reshoring / onshoring trends Trade tariffs and import restrictions on the US onshore wind power sector to benefit domestic wind tower manufacturers We are successfully reallocating production capacity toward stable, recurring project revenue streams across diverse end - markets The pending divestiture of the Manitowoc industrial fabrication operations increases revenue diversification into the power generation and electrification end markets, optimizes asset base, and improves balance sheet flexibility and liquidity Disciplined cost control focus has stabilized gross margin and Adjusted EBITDA margin despite dynamic demand conditions Opportunistically optimized the asset base. The pending sale of the industrial fabrication operations will improve utilization rates and enhance operating leverage Recent strategic actions enhance balance sheet flexibility and reduce fixed overhead Increased diversification into higher - value growth markets supports long - term value creation strategy

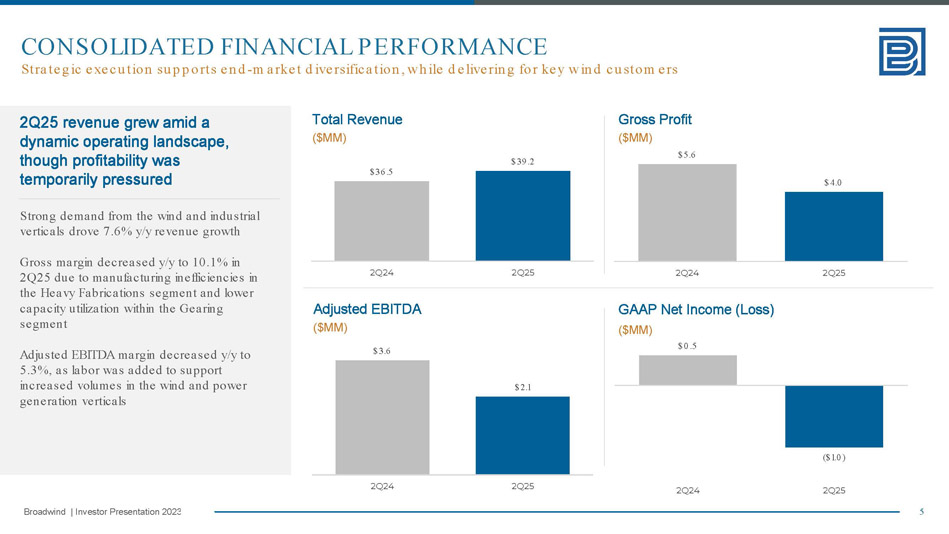

5 Broadwind | Investor Presentation 2023 Strategic execution supports end - market diversification, while delivering for key wind customers CONSOLIDATED FINANCIAL PERFORMANCE Total Revenue ($MM) Gross Profit ($MM) Adjusted EBITDA ($MM) GAAP Net Income (Loss) ($MM) 2Q25 revenue grew amid a dynamic operating landscape, though profitability was temporarily pressured Strong demand from the wind and industrial verticals drove 7.6% y/y revenue growth Gross margin decreased y/y to 10.1% in 2Q25 due to manufacturing inefficiencies in the Heavy Fabrications segment and lower capacity utilization within the Gearing segment Adjusted EBITDA margin decreased y/y to 5.3%, as labor was added to support increased volumes in the wind and power generation verticals $36.5 $39.2 2Q24 2Q25 $5.6 $4.0 2Q24 2Q25 $0.5 ($1.0) 2Q24 2Q25 $3.6 $2.1 2Q24 2Q25

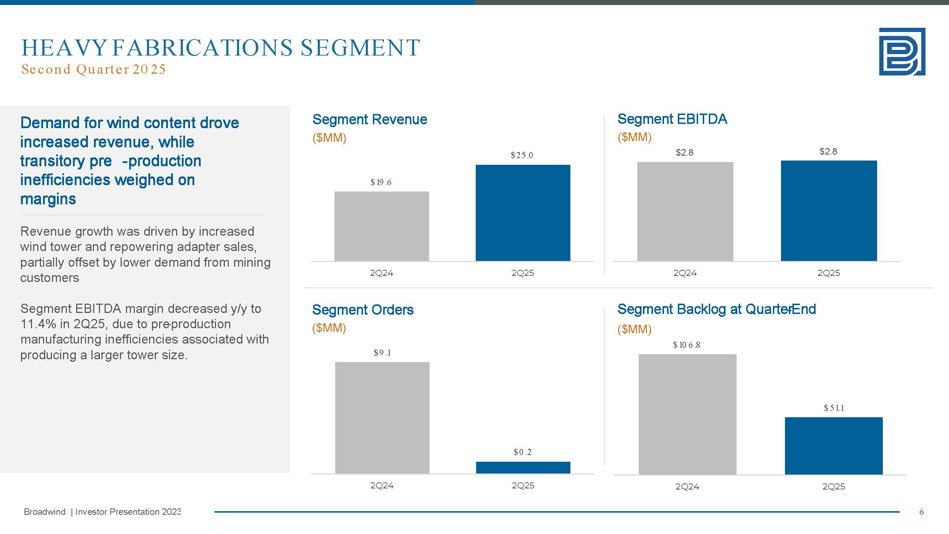

6 Broadwind | Investor Presentation 2023 Second Quarter 2025 HEAVY FABRICATIONS SEGMENT Demand for wind content drove increased revenue, while transitory pre - production inefficiencies weighed on margins Revenue growth was driven by increased wind tower and repowering adapter sales, partially offset by lower demand from mining customers Segment EBITDA margin decreased y/y to 11.4% in 2Q25, due to pre - production manufacturing inefficiencies associated with producing a larger tower size. Segment Revenue ($MM) Segment EBITDA ($MM) Segment Orders ($MM) Segment Backlog at Quarter - End ($MM) $2.8 $2.8 2Q24 2Q25 $9.1 $0.2 2Q24 2Q25 $106.8 $51.1 2Q24 2Q25 $19.6 $25.0 2Q24 2Q25

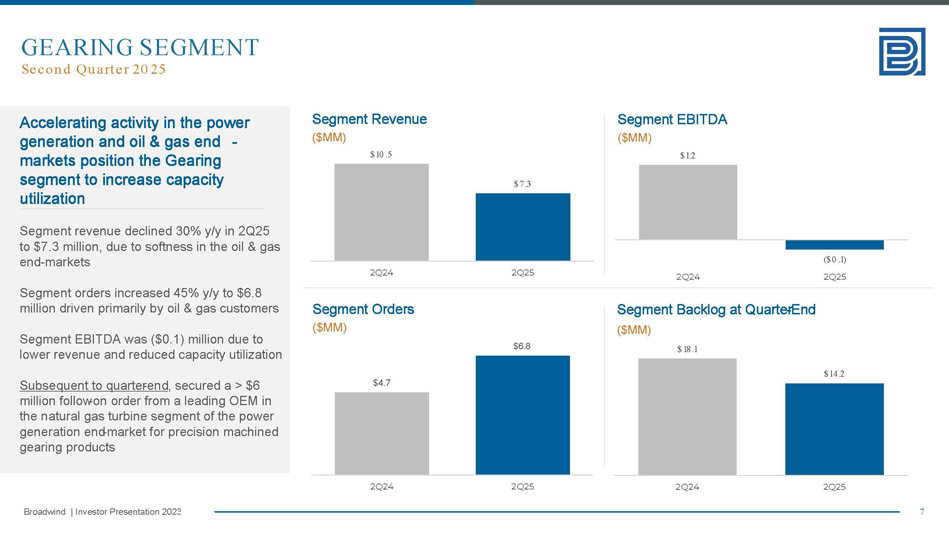

7 Broadwind | Investor Presentation 2023 Second Quarter 2025 GEARING SEGMENT Accelerating activity in the power generation and oil & gas end - markets position the Gearing segment to increase capacity utilization Segment revenue declined 30% y/y in 2Q25 to $7.3 million, due to softness in the oil & gas end - markets Segment orders increased 45% y/y to $6.8 million driven primarily by oil & gas customers Segment EBITDA was ($0.1) million due to lower revenue and reduced capacity utilization Subsequent to quarter - end , secured a > $6 million follow - on order from a leading OEM in the natural gas turbine segment of the power generation end - market for precision machined gearing products Segment EBITDA ($MM) Segment Orders ($MM) Segment Backlog at Quarter - End ($MM) Segment Revenue ($MM) $4.7 $6.8 2Q24 2Q25 $10.5 $7.3 2Q24 2Q25 $1.2 ($0.1) 2Q24 2Q25 $18.1 $14.2 2Q24 2Q25

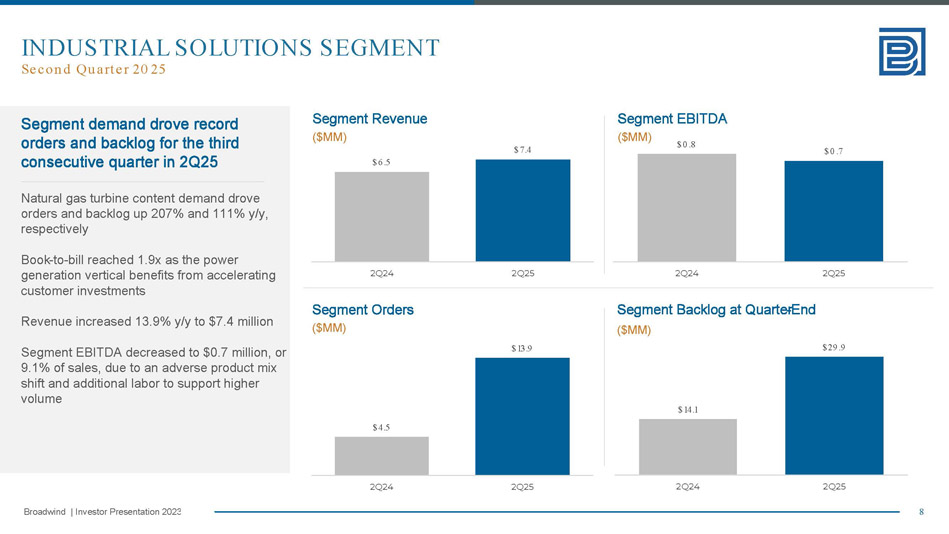

8 Broadwind | Investor Presentation 2023 Second Quarter 2025 INDUSTRIAL SOLUTIONS SEGMENT Segment demand drove record orders and backlog for the third consecutive quarter in 2Q25 Natural gas turbine content demand drove orders and backlog up 207% and 111% y/y, respectively Book - to - bill reached 1.9x as the power generation vertical benefits from accelerating customer investments Revenue increased 13.9% y/y to $7.4 million Segment EBITDA decreased to $0.7 million, or 9.1% of sales, due to an adverse product mix shift and additional labor to support higher volume Segment Revenue ($MM) Segment EBITDA ($MM) Segment Orders ($MM) Segment Backlog at Quarter - End ($MM) EBITDA margin rate +1146 bps y/y to 15.5% $6.5 $7.4 2Q24 2Q25 $0.8 $0.7 2Q24 2Q25 $4.5 $13.9 2Q24 2Q25 $14.1 $29.9 2Q24 2Q25

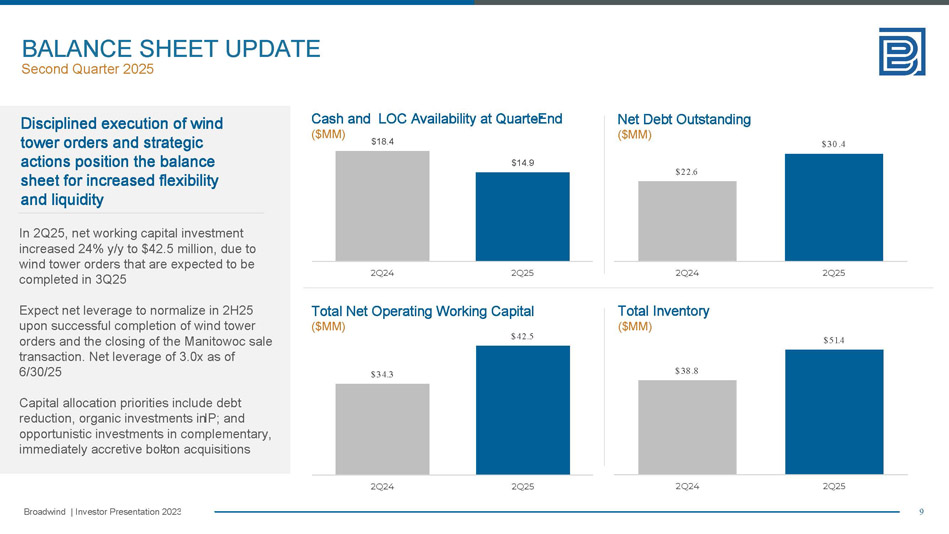

9 Broadwind | Investor Presentation 2023 Disciplined execution of wind tower orders and strategic actions position the balance sheet for increased flexibility and liquidity In 2Q25, net working capital investment increased 24% y/y to $42.5 million, due to wind tower orders that are expected to be completed in 3Q25 Expect net leverage to normalize in 2H25 upon successful completion of wind tower orders and the closing of the Manitowoc sale transaction. Net leverage of 3.0x as of 6/30/25 Capital allocation priorities include debt reduction, organic investments in IP; and opportunistic investments in complementary, immediately accretive bolt - on acquisitions Cash and LOC Availability at Quarter - End ($MM) Net Debt Outstanding ($MM) Total Inventory ($MM) Second Quarter 2025 BALANCE SHEET UPDATE Total Net Operating Working Capital ($MM) $18.4 $14.9 2Q24 2Q25 $22.6 $30.4 2Q24 2Q25 $38.8 $51.4 2Q24 2Q25 $34.3 $42.5 2Q24 2Q25

APPENDIX

11 Broadwind | Investor Presentation 2023 CORPORATE OVERVIEW Leading pure - play precision manufacturer serving diverse end - markets with 100% domestic footprint Broadwind is a precision manufacturer of technologically advanced, high - value components and solutions for commercial and industrial clients We are one of the leading independent precision manufacturers in the United States Our most significant business serves the US domestic wind energy industry, with primary production facilities that are strategically located to meet our customers’ project needs. We also serve industrial customers in a diversified set of industrial markets including oil & gas, industrial, power generation, mining and construction This strategic diversification allows us to leverage our manufacturing expertise to improve capacity utilization, expand our customer base and balance our exposure across diverse end - markets

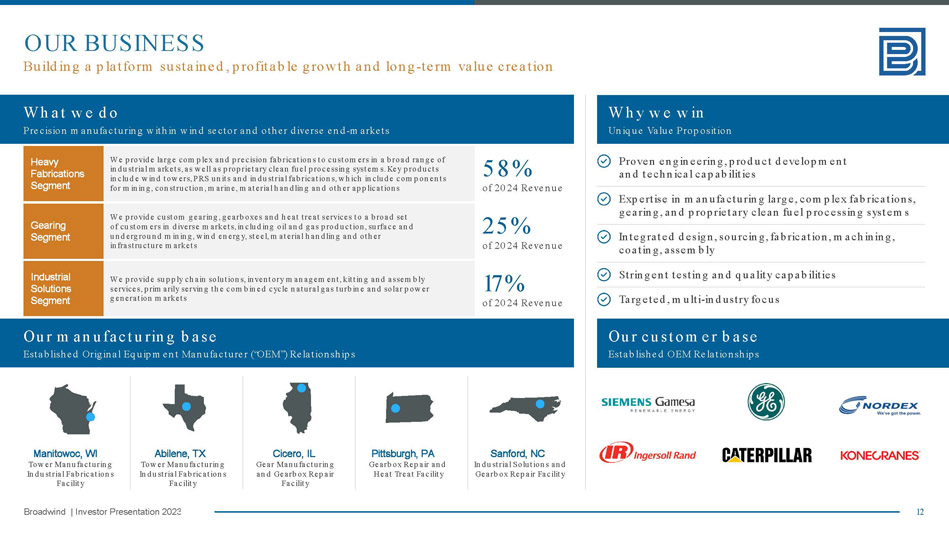

12 Broadwind | Investor Presentation 2023 What we do Precision manufacturing within wind sector and other diverse end - markets We provide large complex and precision fabrications to customers in a broad range of industrial markets, as well as proprietary clean fuel processing systems. Key products include wind towers, PRS units and industrial fabrications, which include components for mining, construction, marine, material handling and other applications Heavy Fabrications Segment 58% of 2024 Revenue We provide custom gearing, gearboxes and heat treat services to a broad set of customers in diverse markets, including oil and gas production, surface and underground mining, wind energy, steel, material handling and other infrastructure markets Gearing Segment 25% of 2024 Revenue We provide supply chain solutions, inventory management, kitting and assembly services, primarily serving the combined cycle natural gas turbine and solar power generation markets Industrial Solutions Segment 17% of 2024 Revenue Why we win Unique Value Proposition Proven engineering, product development and technical capabilities Expertise in manufacturing large, complex fabrications, gearing, and proprietary clean fuel processing systems Integrated design, sourcing, fabrication, machining, coating, assembly Stringent testing and quality capabilities Targeted, multi - industry focus Our manufacturing base Established Original Equipment Manufacturer (“OEM”) Relationships Our customer base Established OEM Relationships Manitowoc, WI Tower Manufacturing Industrial Fabrications Facility Abilene, TX Tower Manufacturing Industrial Fabrications Facility Cicero, IL Gear Manufacturing and Gearbox Repair Facility Pittsburgh, PA Gearbox Repair and Heat Treat Facility Sanford, NC Industrial Solutions and Gearbox Repair Facility OUR BUSINESS Building a platform sustained, profitable growth and long - term value creation

13 Broadwind | Investor Presentation 2023 APPENDIX Balance Sheet

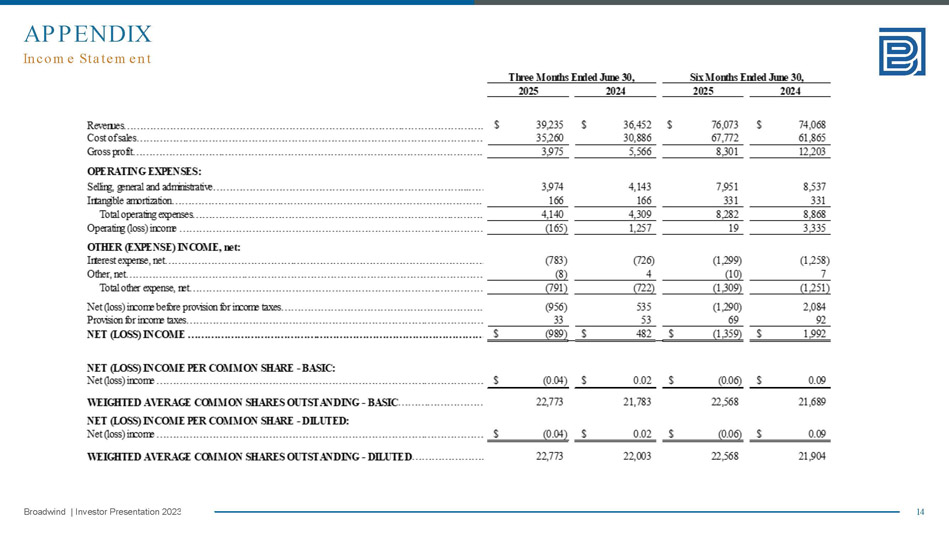

14 Broadwind | Investor Presentation 2023 APPENDIX Income Statement

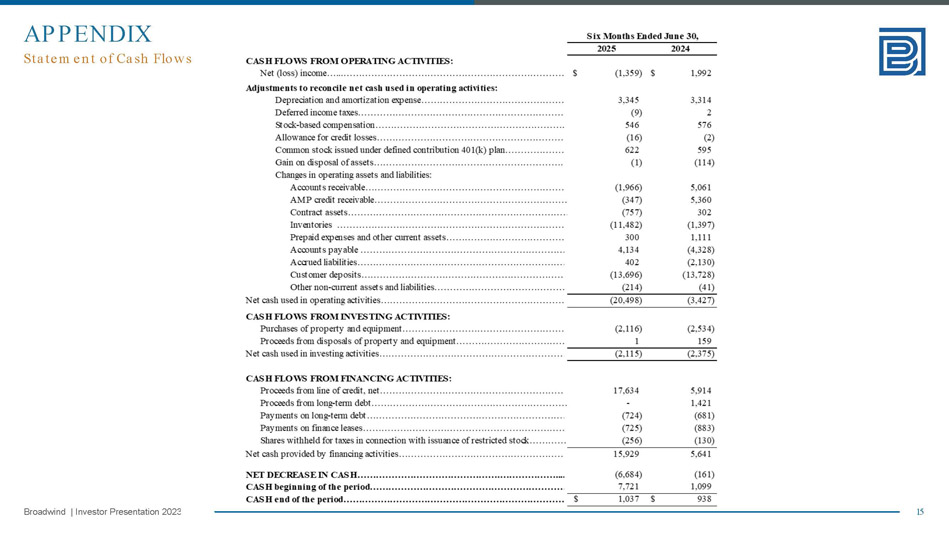

15 Broadwind | Investor Presentation 2023 APPENDIX Statement of Cash Flows

16 Broadwind | Investor Presentation 2023 APPENDIX GAAP to Non - GAAP Reconciliation

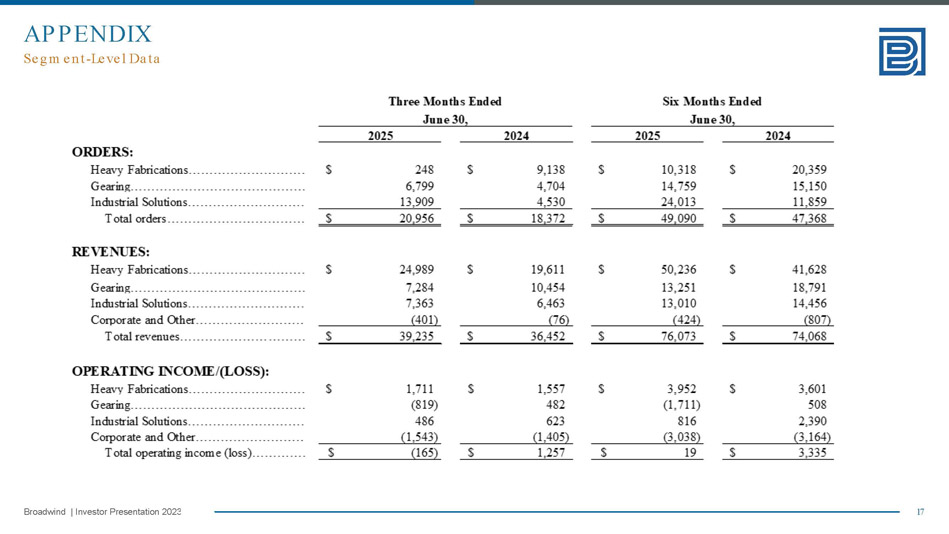

17 Broadwind | Investor Presentation 2023 APPENDIX Segment - Level Data

18 Broadwind | Investor Presentation 2023 Please contact our investor relations team at BWEN@val - adv.com IR CONTACT