.4

Acquisition of Blueprint in rare diseases June 2, 2025

Forward-looking statements This communication contains forward-looking statements that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those implied by the forward-looking statements. Forward-looking statements are statements that are not historical facts and may include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. Although Sanofi’s management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Sanofi, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include among other things, unexpected regulatory actions or delays, or government regulation generally, that could affect the availability or commercial potential of the product, or the fact that the product may not be commercially successful, and risks related to Sanofi’s and Blueprint’s ability to complete the acquisition on the proposed terms or on the proposed timeline or at all, including the receipt of required regulatory approvals, the risk that the conditions to the closing of the transaction may not be satisfied, the possibility that competing offers will be made, the risks that the milestones related to the contingent value right will not be achieved, the risk of securityholder litigation relating to the proposed acquisition, including resulting expense or delays, other risks associated with executing business combination transactions, such as the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the acquisition will not be realized, risks related to future opportunities and plans for the combined company, including uncertainty of the expected financial performance and results of the combined company following completion of the proposed acquisition, disruption from the proposed acquisition making it more difficult to conduct business as usual or to maintain relationships with customers, employees, manufacturers, suppliers or patient groups, and the possibility that, if the combined company does not achieve the perceived benefits of the proposed acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Sanofi’s shares could decline, as well as other risks related to Sanofi’s and Blueprint’s respective businesses, including the ability to grow sales and revenues from existing products and to develop, commercialize or market new products, competition, including potential generic competition, the uncertainties inherent in research and development, including future clinical data and analysis, regulatory obligations and oversight by regulatory authorities, such as the FDA or the EMA, including decisions of such authorities regarding whether and when to approve any drug, device or biological application that may be filed for any product candidates as well as decisions regarding labelling and other matters that could affect the availability or commercial potential of any product candidates, the absence of a guarantee that any product candidates, if approved, will be commercially successful, the future approval and commercial success of therapeutic alternatives, Sanofi’s ability to benefit from external growth opportunities, to complete related transactions and/or obtain regulatory clearances, risks associated with intellectual property and any related pending or future litigation and the ultimate outcome of such litigation, trends in exchange rates and prevailing interest rates, volatile economic and market conditions, cost containment initiatives and subsequent changes thereto, and the impact that global crises may have on us, our customers, suppliers, vendors, and other business partners, and the financial condition of any one of them, as well as on our employees and on the global economy as a whole. While the list of factors presented here is representative, no list should be considered a statement of all potential risks, uncertainties or assumptions that could have a material adverse effect on companies’ consolidated financial condition or results of operations. The foregoing factors should be read in conjunction with the risks and cautionary statements discussed or identified in the public filings with the U.S. Securities and Exchange Commission (the “SEC”) and the Autorité des marchés financiers made by Sanofi, including those listed under “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in Sanofi’s annual report on Form 20-F for the year ended December 31, 2024 and its other filings with the SEC and the current reports on Form 8-K, quarterly reports on Form 10-Q and annual reports on Form 10-K and other filings with the SEC filed by Blueprint. The forward-looking statements speak only as of the date hereof and, other than as required by applicable law, Sanofi and Blueprint do not undertake any obligation to update or revise any forward-looking information or statements. Blueprint Medicines, Ayvakit, Ayvakyt, and associated logos are trademarks of Blueprint Medicines Corporation.

Additional information for US shareholders of Blueprint The tender offer for the outstanding shares of Blueprint Medicines Corporation (“Blueprint”) common stock referenced in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Blueprint, nor is it a substitute for the tender offer materials that Sanofi and its acquisition subsidiary will file with the U.S. Securities and Exchange Commission (the “SEC”) upon commencement of the tender offer. At the time the tender offer is commenced, Sanofi and its acquisition subsidiary will file tender offer materials on Schedule TO, and Blueprint will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. The tender offer materials (including an Offer to Purchase, a related Letter of Transmittal and certain other tender offer documents) and the Solicitation/Recommendation Statement will contain important information. HOLDERS OF SHARES OF BLUEPRINT ARE URGED TO READ THESE DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT BLUEPRINT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of shares of Blueprint at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s web site at www.sec.gov. Additional copies may be obtained for free by contacting Sanofi’s Investor Relations Team at investor.relations@sanofi.com or on Sanofi’s website at https://www.sanofi.com/en/investors. In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, Sanofi files annual and special reports and other information with the SEC and Blueprint files annual, quarterly and special reports and other information with the SEC. You may read and copy any reports or other information filed by Sanofi and Blueprint at the SEC public reference room at 100 F. Street, N.E., Washington D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Sanofi’s and Blueprint's filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at www.sec.gov.

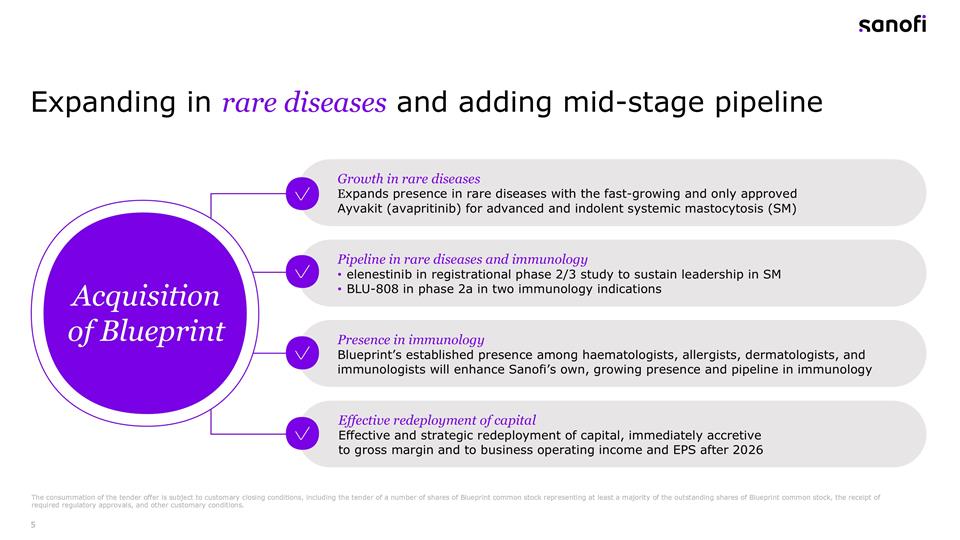

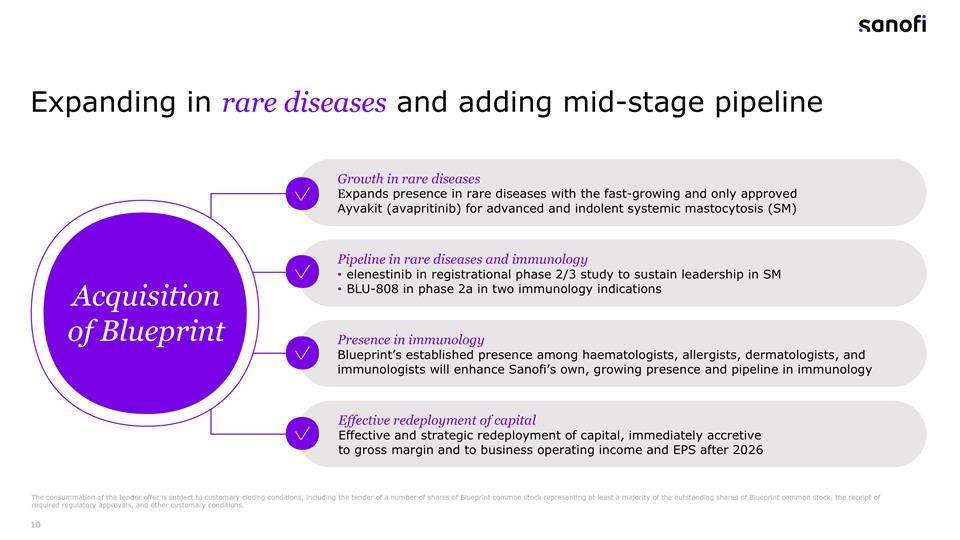

Expanding in rare diseases and adding mid-stage pipeline Growth in rare diseases Expands presence in rare diseases with the fast-growing and only approved Ayvakit (avapritinib) for advanced and indolent systemic mastocytosis (SM) Pipeline in rare diseases and immunology elenestinib in registrational phase 2/3 study to sustain leadership in SM BLU-808 in phase 2a in two immunology indications Presence in immunology Blueprint’s established presence among haematologists, allergists, dermatologists, and immunologists will enhance Sanofi’s own, growing presence and pipeline in immunology Effective redeployment of capital Effective and strategic redeployment of capital, immediately accretive to gross margin and to business operating income and EPS after 2026 Acquisition of Blueprint The consummation of the tender offer is subject to customary closing conditions, including the tender of a number of shares of Blueprint common stock representing at least a majority of the outstanding shares of Blueprint common stock, the receipt of required regulatory approvals, and other customary conditions.

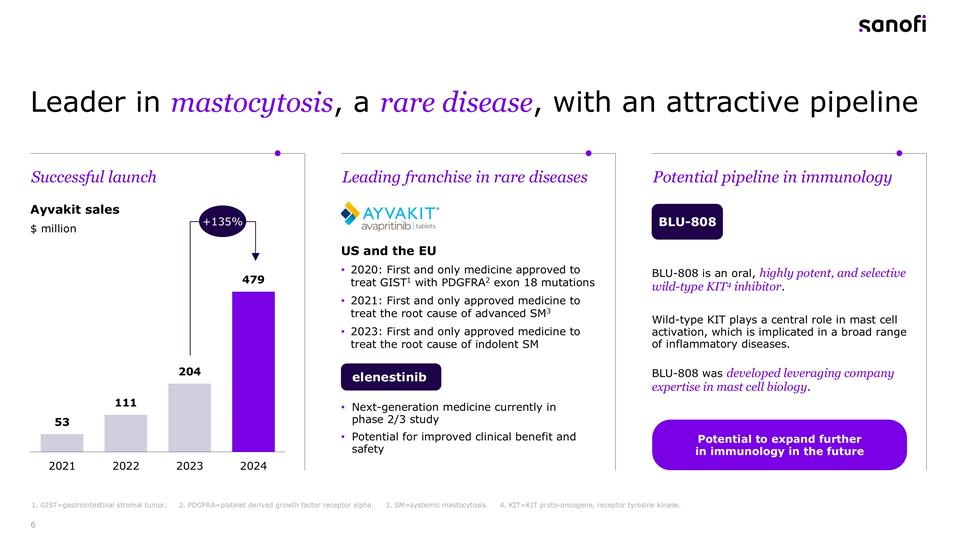

Leader in mastocytosis, a rare disease, with an attractive pipeline 1. GIST=gastrointestinal stromal tumor. 2. PDGFRA=platelet derived growth factor receptor alpha. 3. SM=systemic mastocytosis. 4. KIT=KIT proto-oncogene, receptor tyrosine kinase. Ayvakit sales BLU-808 $ million US and the EU 2020: First and only medicine approved to treat GIST1 with PDGFRA2 exon 18 mutations 2021: First and only approved medicine to treat the root cause of advanced SM3 2023: First and only approved medicine to treat the root cause of indolent SM Next-generation medicine currently in phase 2/3 study Potential for improved clinical benefit and safety Successful launch Potential pipeline in immunology Leading franchise in rare diseases +135% elenestinib BLU-808 is an oral, highly potent, and selective wild-type KIT4 inhibitor. Wild-type KIT plays a central role in mast cell activation, which is implicated in a broad range of inflammatory diseases. BLU-808 was developed leveraging company expertise in mast cell biology. Potential to expand further in immunology in the future

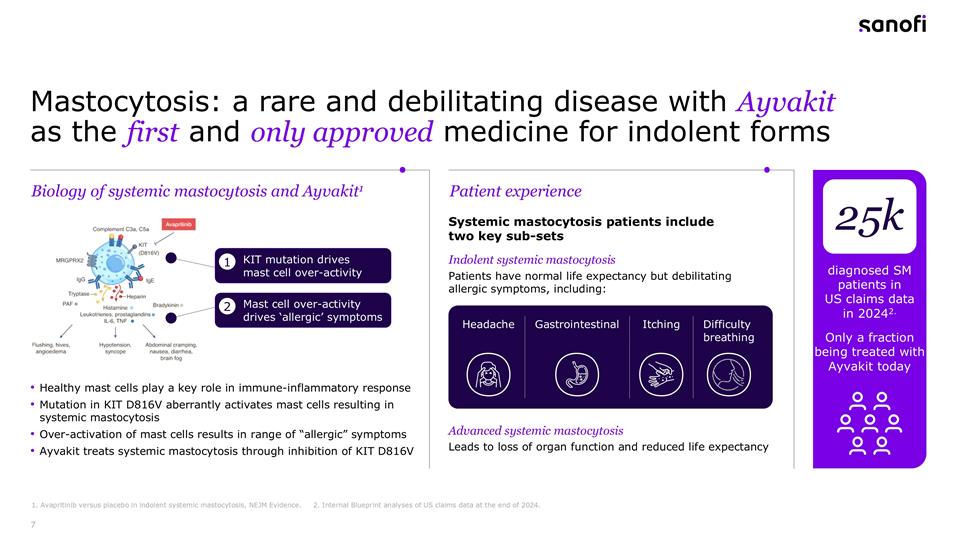

Mastocytosis: a rare and debilitating disease with Ayvakit as the first and only approved medicine for indolent forms Systemic mastocytosis patients include two key sub-sets Indolent systemic mastocytosis Patients have normal life expectancy but debilitating allergic symptoms, including: Healthy mast cells play a key role in immune-inflammatory response Mutation in KIT D816V aberrantly activates mast cells resulting in systemic mastocytosis Over-activation of mast cells results in range of “allergic” symptoms Ayvakit treats systemic mastocytosis through inhibition of KIT D816V KIT mutation drives mast cell over-activity Mast cell over-activity drives ‘allergic’ symptoms 1 2 Biology of systemic mastocytosis and Ayvakit1 Patient experience Advanced systemic mastocytosis Leads to loss of organ function and reduced life expectancy diagnosed SM patients in US claims data in 20242. Only a fraction being treated with Ayvakit today 25k 1. Avapritinib versus placebo in indolent systemic mastocytosis, NEJM Evidence. 2. Internal Blueprint analyses of US claims data at the end of 2024. Headache Gastrointestinal Itching Difficulty breathing

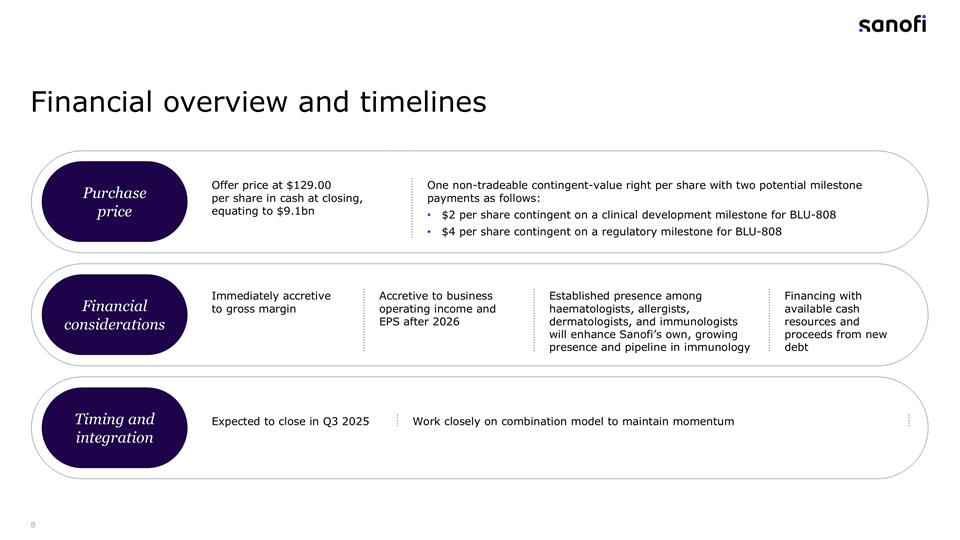

Financial overview and timelines Purchase price Financial considerations Timing and integration Offer price at $129.00 per share in cash at closing, equating to $9.1bn One non-tradeable contingent-value right per share with two potential milestone payments as follows: $2 per share contingent on a clinical development milestone for BLU-808 $4 per share contingent on a regulatory milestone for BLU-808 Immediately accretive to gross margin Accretive to business operating income and EPS after 2026 Established presence among haematologists, allergists, dermatologists, and immunologists will enhance Sanofi’s own, growing presence and pipeline in immunology Financing with available cash resources and proceeds from new debt Expected to close in Q3 2025 Work closely on combination model to maintain momentum

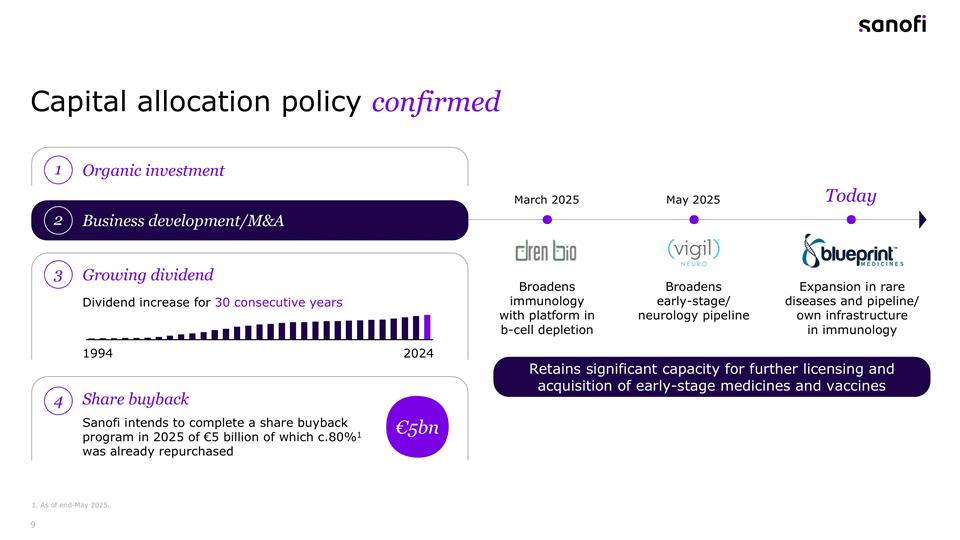

Capital allocation policy confirmed 1. As of end-May 2025. 3 Growing dividend Dividend increase for 30 consecutive years 1994 2024 Expansion in rare diseases and pipeline/ own infrastructure in immunology Broadens early-stage/ neurology pipeline Broadens immunology with platform in b-cell depletion May 2025 March 2025 Today Organic investment 1 Business development/M&A 2 Share buyback 4 €5bn Sanofi intends to complete a share buyback program in 2025 of €5 billion of which c.80%1 was already repurchased Retains significant capacity for further licensing and acquisition of early-stage medicines and vaccines

Expanding in rare diseases and adding mid-stage pipeline Growth in rare diseases Expands presence in rare diseases with the fast-growing and only approved Ayvakit (avapritinib) for advanced and indolent systemic mastocytosis (SM) Pipeline in rare diseases and immunology elenestinib in registrational phase 2/3 study to sustain leadership in SM BLU-808 in phase 2a in two immunology indications Presence in immunology Blueprint’s established presence among haematologists, allergists, dermatologists, and immunologists will enhance Sanofi’s own, growing presence and pipeline in immunology Effective redeployment of capital Effective and strategic redeployment of capital, immediately accretive to gross margin and to business operating income and EPS after 2026 Acquisition of Blueprint The consummation of the tender offer is subject to customary closing conditions, including the tender of a number of shares of Blueprint common stock representing at least a majority of the outstanding shares of Blueprint common stock, the receipt of required regulatory approvals, and other customary conditions.

Q&A session To ask a question Click on the Raise hand icon Check your audio device is well connected Raise and lower your hand: dial *9 Unmute and mute your microphone: dial *6 By phone Email us: investor.relations@sanofi.com Any problems? By zoom