Please wait

0001124140falseDEF 14Aiso4217:USD00011241402024-01-012024-12-3100011241402023-01-012023-12-3100011241402022-01-012022-12-3100011241402021-01-012021-12-3100011241402020-01-012020-12-310001124140exas:EquityAwardsAdjustmentOfSummaryCompensationTableValueOfPEOEquityAwardsMemberecd:PeoMember2024-01-012024-12-310001124140ecd:EqtyAwrdsAdjsMemberecd:PeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMemberMemberecd:PeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMemberMemberecd:PeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfCurrentAwardsVestedDuringCurrentYearMemberMemberecd:PeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMemberMemberecd:PeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentOfFairValueAtTheEndOfThePriorYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheYearMemberMemberecd:PeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMemberMemberecd:PeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentOfSummaryCompensationTableValueOfNonPEONEOEquityAwardsMemberMemberecd:NonPeoNeoMember2024-01-012024-12-310001124140ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMemberMemberecd:NonPeoNeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMemberMemberecd:NonPeoNeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfCurrentAwardsVestedDuringCurrentYearMemberMemberecd:NonPeoNeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMemberMemberecd:NonPeoNeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentOfFairValueAtTheEndOfThePriorYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheYearMemberMemberecd:NonPeoNeoMember2024-01-012024-12-310001124140exas:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMemberMemberecd:NonPeoNeoMember2024-01-012024-12-31000112414012024-01-012024-12-31000112414022024-01-012024-12-31000112414032024-01-012024-12-31000112414042024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Exact Sciences Corporation | | |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a—6(i)(1) and 0—11

5505 Endeavor Lane

Madison, Wisconsin 53719

April 29, 2025

To our shareholders,

The Exact Sciences team is building on the momentum we created in 2024 with a continued focus on advancing our mission to help eradicate cancer by providing innovative tests that prevent it, detect it earlier, and guide personalized treatment.

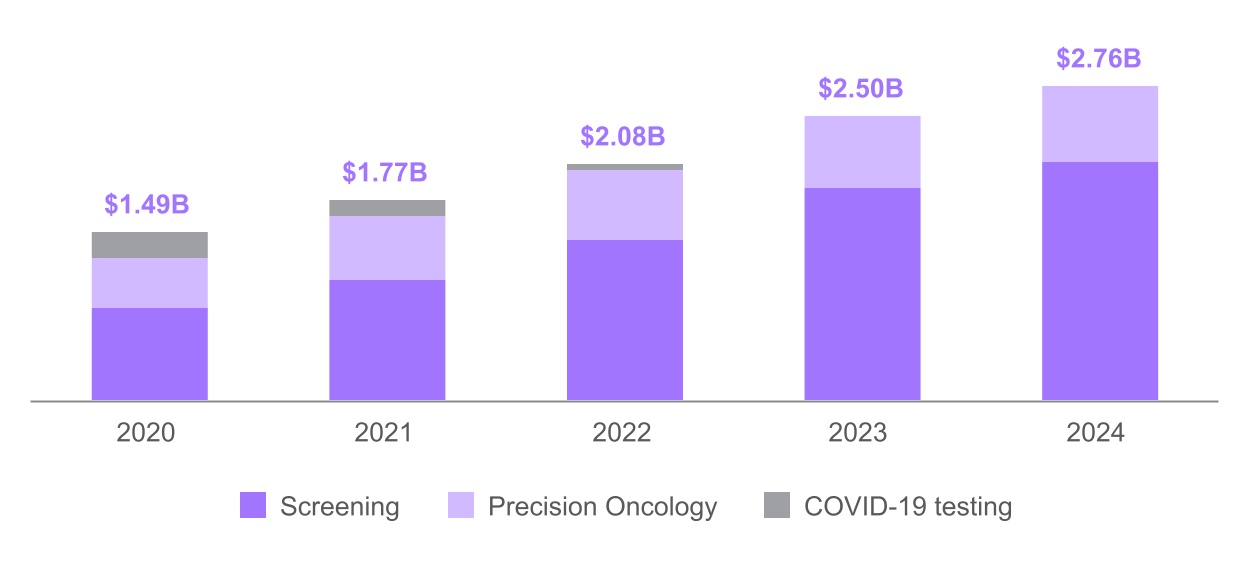

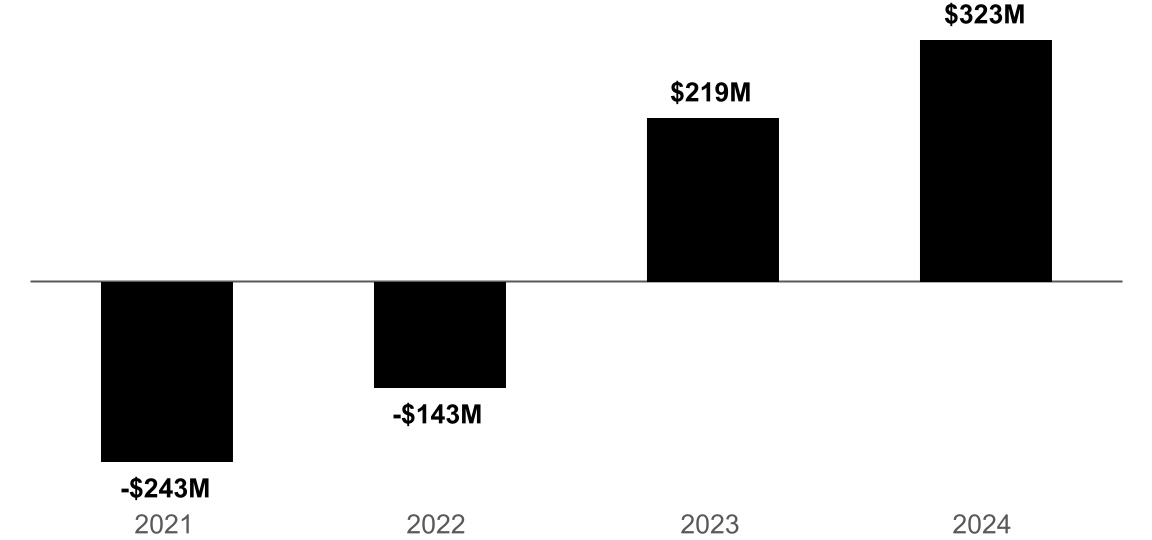

We achieved several important milestones in 2024. We delivered more than 4.6M test results to patients globally. We secured U.S. FDA approval and Medicare pricing for Cologuard PlusTM, our next-generation Cologuard® test that detects cancers and precancerous polyps with even greater sensitivity. We also generated $2.76 billion in revenue – an 11% increase from the prior year – while improving our operating efficiency and growing profitability. With our expanding customer base and long-term growth outlook, Exact Sciences is well positioned to continue reinvesting in our pipeline and helping more patients.

Supported by the success of our leading brands Cologuard and Oncotype DX®, we expect to launch three new innovative cancer tests by the end of 2025: Cologuard Plus, OncodetectTM, and CancerguardTM EX. These launches build on our strong foundation for R&D innovation, vast network of patients and healthcare providers and position us to execute across the largest impact opportunities in cancer diagnostics, supporting years of growth and profitability.

Strong corporate governance will continue to be critical to achieving our mission, and as a part of this commitment, the Board prioritizes ensuring a director composition that provides a balance of skills and expertise most critical to overseeing our continued strategic execution. To this end, in January 2025, we were pleased to add Kim Popovits, the former President and CEO of Genomic Health until its acquisition by Exact Sciences in 2019, as an independent director. We were also pleased to add Leslie Trigg, President and Chief Executive Officer of Outset Medical, Inc., as an independent director in April 2025. Together they bring more than 65 years of healthcare industry experience and leadership to the Board.

Exact Sciences is uniquely positioned to guide a cancer patient’s journey every step of the way, and we continue to strategically invest and rapidly expand our healthcare provider partnerships in order to fuel our purpose. On behalf of the Board, management, and our team, thank you for investing in Exact Sciences. Your trust and support have enabled us to transform lives, and I am confident that we will continue to execute on our mission of eradicating cancer.

Sincerely,

Kevin Conroy

Chairman, President, and Chief Executive Officer

5505 Endeavor Lane

Madison, Wisconsin 53719

NOTICE OF 2025 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 12, 2025

To the Shareholders of Exact Sciences Corporation:

NOTICE IS HEREBY GIVEN that the 2025 Annual Meeting (the “Annual Meeting”) of Shareholders of Exact Sciences Corporation, a Delaware corporation (the “Company”, “Exact Sciences”, “we”, “our”, or “us”), will be held on Thursday, June 12, 2025, at 10:00 a.m., Central Time. The Annual Meeting will be a virtual meeting held solely by means of remote communication, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/EXAS2025. For instructions on how to attend and vote your shares at the Annual Meeting, see the information in the enclosed Proxy Statement in the section titled “Questions and Answers” beginning on page 89.

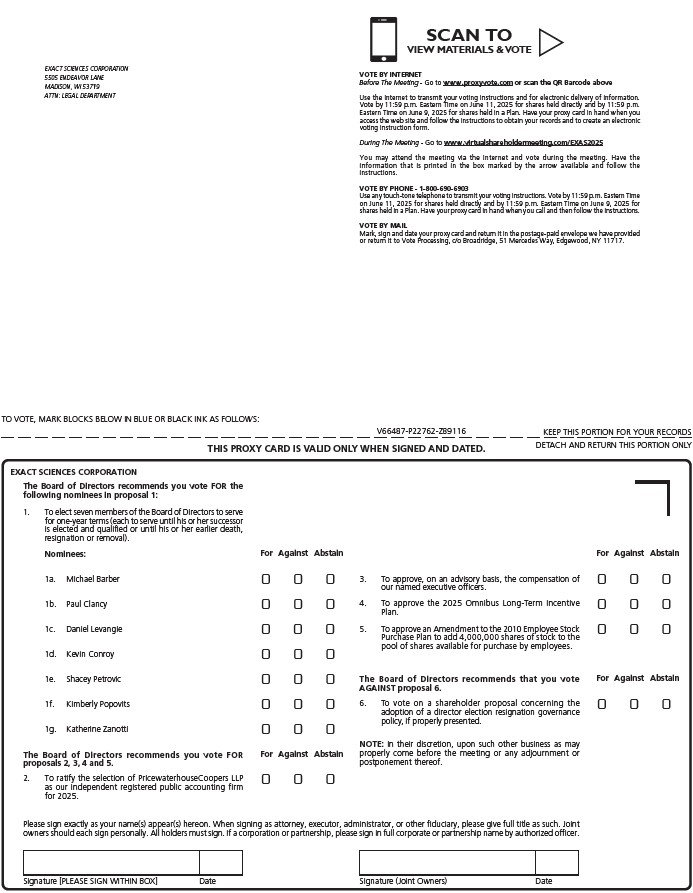

The Annual Meeting is being held for the following purposes:

1.To elect the seven nominees to our Board of Directors nominated by our Board of Directors to serve for a one-year term.

2.To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2025.

3.To hold an advisory vote on executive compensation.

4.To approve the Exact Sciences Corporation 2025 Omnibus Long-Term Incentive Plan.

5.To approve an Amendment to the Exact Sciences Corporation 2010 Employee Stock Purchase Plan (as amended and restated on July 31, 2024).

6.To hold a vote on a shareholder proposal concerning the adoption of a director election resignation governance policy, if properly presented.

7.To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

We are pleased to utilize the Securities and Exchange Commission (“SEC”) rules that allow issuers to furnish proxy materials to their shareholders on the Internet. We believe these rules allow us to provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting. On or about April 29, 2025, we will mail to our shareholders of record as of April 15, 2025 (other than those who previously requested electronic or paper delivery on an ongoing basis) a Notice of Meeting and Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and our 2024 Annual Report, which includes our Annual Report on Form 10-K for the year ended December 31, 2024.

By Order of our Board of Directors,

James Herriott

Senior Vice President, General Counsel,

and Secretary

Madison, Wisconsin

April 29, 2025

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about April 29, 2025.

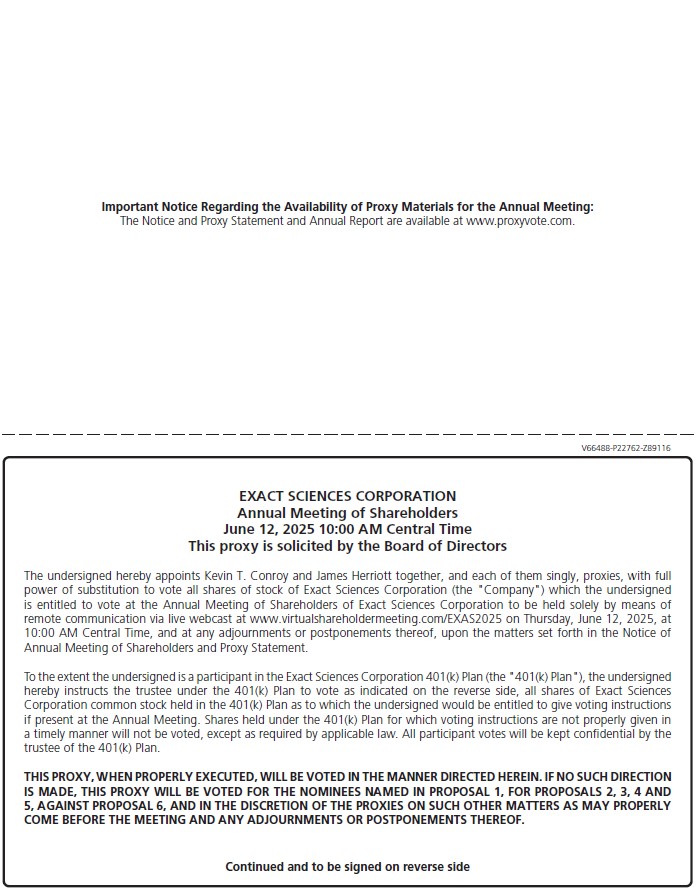

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

This Proxy Statement and our 2024 Annual Report are available free of charge at www.proxyvote.com.

TABLE OF CONTENTS

| | | | | | | | |

| Governance and Board of Directors | 2025 Proxy Statement Summary | |

| PROPOSAL 1—Election of Directors | |

| Information Concerning Directors and Nominees for Directors | |

| Information Concerning Executive Officers | |

| Corporate Governance Principles, Board Matters, and Non-Employee Director Compensation | |

Audit Committee Matters | PROPOSAL 2—Ratification of Appointment of Independent Registered Public Accounting Firm | |

| Independent Registered Public Accounting Firm | |

| Report of the Audit and Finance Committee | |

Executive Compensation | PROPOSAL 3—Advisory Vote on Executive Compensation | |

| Compensation and Other Information Concerning Named Executive Officers | |

| CEO Pay Ratio | |

| Pay versus Performance | |

Additional Management Proposals | PROPOSAL 4—Approval of the 2025 Omnibus Long-Term Incentive Plan | |

PROPOSAL 5—Amendment to the 2010 Employee Stock Purchase Plan (as amended and restated on July 31, 2024) | |

Shareholder Proposal | PROPOSAL 6—Shareholder Proposal Concerning the Adoption of a Director Election Resignation Governance Policy | |

Information About the Meeting | Securities Ownership of Certain Beneficial Owners and Management | |

Delinquent Section 16(a) Reports | |

| Other Business | |

| Questions and Answers | |

Appendix | APPENDIX A—Non-GAAP Reconciliation | |

APPENDIX B—2025 Omnibus Long-Term Incentive Plan | |

APPENDIX C—Amendment to the 2010 Employee Stock Purchase Plan (as amended and restated on July 31, 2024) | |

FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the “safe harbor” created by those sections. These forward-looking statements are based on assumptions that we have made as of the date hereof and are subject to known and unknown risks and uncertainties that could cause actual results, conditions and events to differ materially from those anticipated. Therefore, you should not place undue reliance on forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the Risk Factors sections of our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, and in our other reports filed with the Securities and Exchange Commission. We undertake no obligation to publicly update any forward-looking statement, which speak only as of the date made, except as required by law.

| | | | | | | | |

| | |

i | Exact Sciences 2025 Proxy Statement | |

2025 PROXY STATEMENT SUMMARY

This summary highlights the proposals to be acted upon, nominees for election as directors, as well as selected environmental, social, and governance information described in more detail in this Proxy Statement.

Annual Meeting of Shareholders | | | | | | | | |

| | |

| Date and Time: | | June 12, 2025, at 10:00 a.m., Central Time |

| Location: | | www.virtualshareholdermeeting.com/EXAS2025 |

| | |

The record date for the Annual Meeting is April 15, 2025. Only shareholders of record as of the close of business on this date are entitled to notice of and to vote at the Annual Meeting. Shareholders will need the 16-digit control number included on the Notice of Internet Availability of Proxy Materials, on the proxy card, or on the instructions that accompanied their proxy materials. Voting Matters

At or before the Annual Meeting, we ask that you vote on the following items: | | | | | | | | |

| Proposal | Recommendation

of the Board |

| 1. | Election of Directors | FOR EACH NOMINEE |

| 2. | Ratification of Appointment of Independent Registered Public Accounting Firm | FOR |

| 3. | Non-Binding, Advisory Approval of Fiscal 2024 Compensation to Named Executive Officers | FOR |

4. | Approval of the 2025 Omnibus Long-Term Incentive Plan | FOR |

5. | Amendment to the 2010 Employee Stock Purchase Plan (as amended and restated on July 31, 2024) | FOR |

6. | Shareholder Proposal Concerning the Adoption of a Director Election Resignation Governance Policy, if properly presented | AGAINST |

How to Vote

Our Board of Directors is requesting you to allow your common stock to be represented at the Annual Meeting by the proxies named on the proxy card.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Vote in Advance of the Meeting | | | | | Vote Online During the Meeting | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | Vote your shares at www.proxyvote.com. Have your Notice of Internet Availability or proxy card for the 16-digit control number needed to vote. | | | | | | See page 91 - How can I attend and vote at the Annual Meeting? for details on voting your shares during the Annual Meeting through www.virtualshareholdermeeting.com/EXAS2025 | | |

| | | | | | | | | | | | | |

| | | | Call toll-free number 1-800-690-6903 | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | Sign, date, and return the enclosed proxy card or voting instruction form. | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 1 |

In connection with this request, on or about April 29, 2025, we expect to send to our shareholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our Proxy Statement and our 2024 Annual Report, which includes our Annual Report on Form 10-K for the year ended December 31, 2024 (the “2024 Annual Report”), and how to vote through the Internet or by telephone.

Shareholders of record may vote their shares prior to the Annual Meeting via the Internet, by telephone, or by mail. Beneficial owners of shares held in “street name” may vote by following the voting instructions provided to them by their bank or broker.

| | | | | | | | |

| | |

2 | Exact Sciences 2025 Proxy Statement | |

| | | | | | | | |

| | 2025 PROXY STATEMENT SUMMARY |

Nominees for Election as Directors and Continuing Directors

Our Board of Directors recommends a vote FOR the election of each of the following nominees for director for a one-year term (each to serve until his or her successor is elected and qualified or until his or her earlier death, resignation or removal): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Director Class | Primary Occupation | | Committee Membership |

| AFC | CGNC | HCC | ITPC |

Nominees for Election as Directors | | | | | | |

Michael Barber* | 64 | 2024 | Class III | Former Chief Diversity Officer of General Electric Company and former President and CEO of GE Molecular Imaging and Computed Tomography | | | | | |

| Paul Clancy* | 63 | 2021 | Class III | Former Executive Vice President and Chief Financial Officer of Alexion Pharmaceuticals, Inc. | | | | | |

| Daniel Levangie* | 74 | 2010 | Class III | Former Chief Executive Officer and President of Cytyc Health Corporation; Currently Co-founder and Manager of ATON Partners and Chairman, President and Chief Executive Officer of CereVasc | | | | | |

Kevin Conroy | 59 | 2009 | Class I | President, Chief Executive Officer, and Chairman of the Board of Directors of Exact Sciences Corporation | | | | | |

| Shacey Petrovic* | 51 | 2020 | Class I | Former President and Chief Executive Officer of Insulet Corporation | | | | | |

Kimberly Popovits* | 66 | 2025 | Class I | Former President and Chief Executive Officer of Genomic Health, Inc. and Advisor to the Coalition for 21st Century Medicine | | | | | |

| Katherine Zanotti* | 70 | 2009 | Class I | Former Chief Executive Officer of Arbonne International | | | | | |

| Continuing Directors | | | | | | | | | |

| D. Scott Coward | 60 | 2022 | Class II | Former Chief Legal Officer, Secretary, General Counsel, and Chief Administrative Officer of Exact Sciences Corporation | | | | | |

| James Doyle*† | 79 | 2014 | Class II | Former Governor of Wisconsin; Currently Of Counsel at Foley & Lardner LLP and Partner of Doyle & Boyce Strategies | | | | | |

Leslie Trigg* | 54 | 2025 | Class II | President, Chief Executive Officer, and Chair of Outset Medical, Inc. | | |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Independent | | Chair | | Member | † | Lead Independent Director | |

AFC = Audit and Finance Committee; HCC = Human Capital Committee; CGNC = Corporate Governance and Nominating Committee; ITPC = Innovation, Technology & Pipeline Committee |

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 3 |

| | | | | | | | |

2025 PROXY STATEMENT SUMMARY | | |

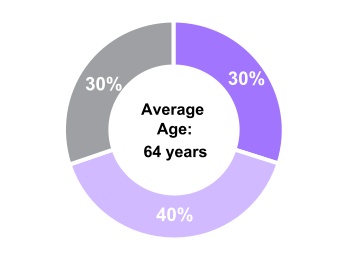

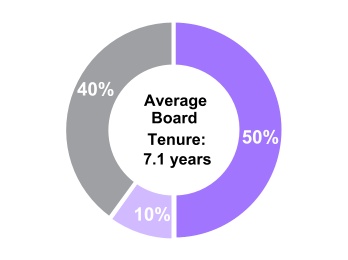

Diverse Skill Sets and Experiences Among Our Continuing Directors and Director Candidates

Our Board strives to maintain a highly independent, balanced, and diverse group of directors that collectively possesses the expertise to ensure effective oversight of management. The following reflects the characteristics of our continuing directors and director nominees. We believe that diversity of backgrounds, perspectives, and experiences strengthens our ability to oversee management, navigate complex challenges, and create sustainable value for our shareholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| n | Independent | | n | Women/Ethnically Diverse | | n | ≤ 60 years | | n | < 5 years | |

| n | Non-Independent | | n | Men/White | | n | 61-69 years | | n | 5-10 years | |

| | | | | | | n | ≥ 70 years | | n | > 10 years | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Qualifications and Experience | Barber | Conroy | Clancy | Coward | Doyle | Levangie | Petrovic | Popovits | Trigg | Zanotti |

| Diagnostics/Medical Device and Technology | l | l | | l | l | l | l | l | l | l |

| Pipeline Development/Commercialization | l | l | l | l | | l | l | l | l | l |

| Global Business Perspective | l | l | l | l | l | l | l | l | l | l |

| Corporate Governance and Sustainability | l | l | | l | | | l | l | l | l |

| Executive Leadership | l | l | l | l | l | l | l | l | l | l |

| Finance, Corporate Strategy, and M&A | l | l | l | l | | l | l | l | l | l |

| Talent Management | l | l | l | l | l | l | l | l | l | l |

| Science, Research, and Development | l | l | | l | | l | l | | l | l |

| Government, Regulatory, and Compliance | l | l | | l | l | l | l | l | l | l |

| Risk Management | l | | l | l | l | | l | | | l |

| Cybersecurity Oversight | l | | l | | l | | l | | | l |

| | | | | | | | |

| | |

4 | Exact Sciences 2025 Proxy Statement | |

| | | | | | | | |

| | 2025 PROXY STATEMENT SUMMARY |

Governance Highlights

| | | | | | | | | | | | | | |

| Strong Governance Practices |

| | | | |

Regular executive sessions of non-management directors Clawback provisions above and beyond the requirements set forth in the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) Firm limits on board service at other public companies | | Caps on performance-based cash and equity incentive compensation for our executive officers Annual review and approval of executive compensation program Significant portion of executive compensation is variable and at risk based on performance | | Robust stock ownership guidelines for non-employee directors and executive officers Anti-hedging, anti-short sale, and anti-pledging policies Limited perquisites No post-termination pension-type benefits or perquisites for our executive officers that are not generally available to our employees |

| Independent Oversight | | Continuous Improvement | | Shareholder Rights |

| | | | |

Eight of ten directors are independent Audit and finance, human capital, and corporate governance and nominating committees comprised entirely of independent directors Lead Independent Director exercises decisive, energetic, and independent leadership Diverse Board based on gender, ethnicity, experience, education, and talents | | Annual Board and committee self-evaluations Annual Board evaluation of CEO Risk oversight by Board and committees Robust director nominee selection process with recent focus on board refreshment Annual shareholder engagement efforts with director participation Onboarding and continuing education opportunities for directors | | Majority voting standard for directors in uncontested elections Proxy Access by-law provisions Annual “say-on-pay” advisory vote Board declassification in process after Board-sponsored and shareholder-approved proposal |

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 5 |

| | | | | | | | |

2025 PROXY STATEMENT SUMMARY | | |

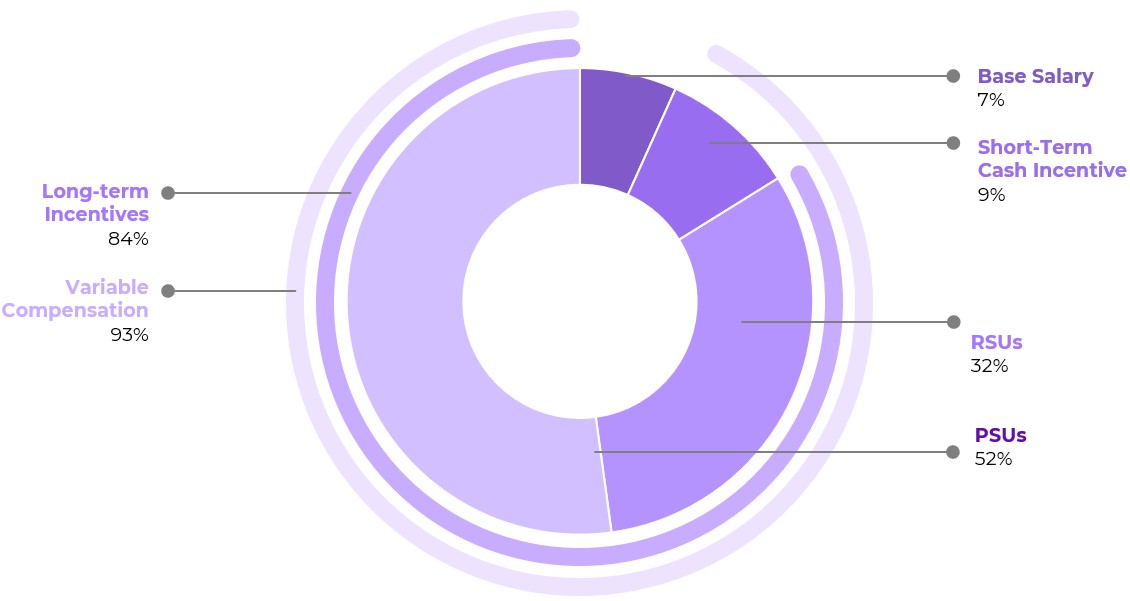

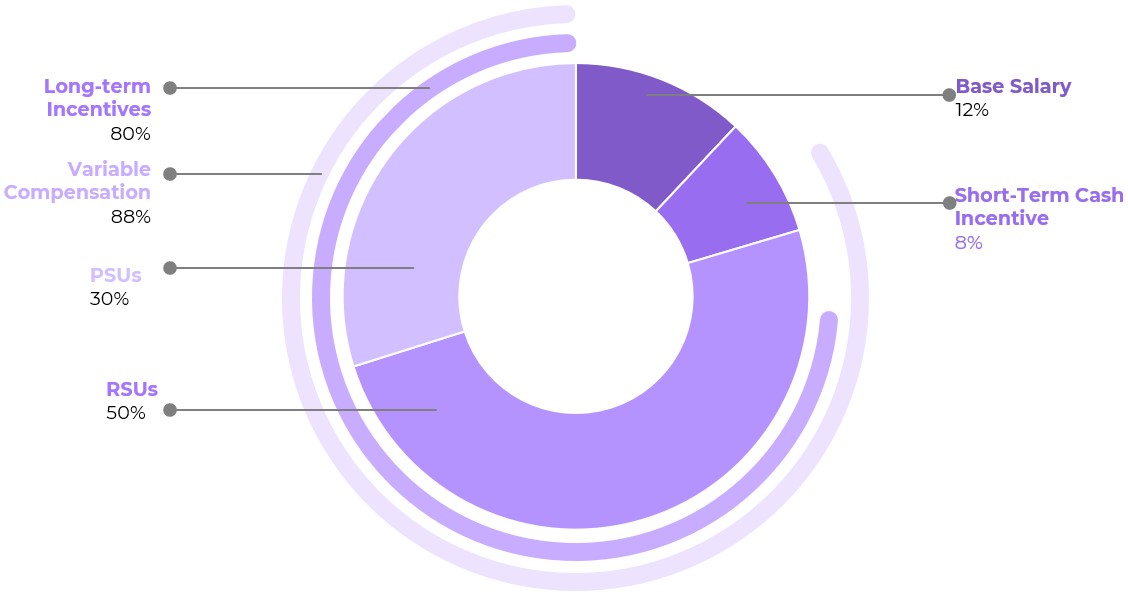

Executive Compensation Highlights

| | | | | | | | | | | | | | |

Pay-for-Performance |

| | | | |

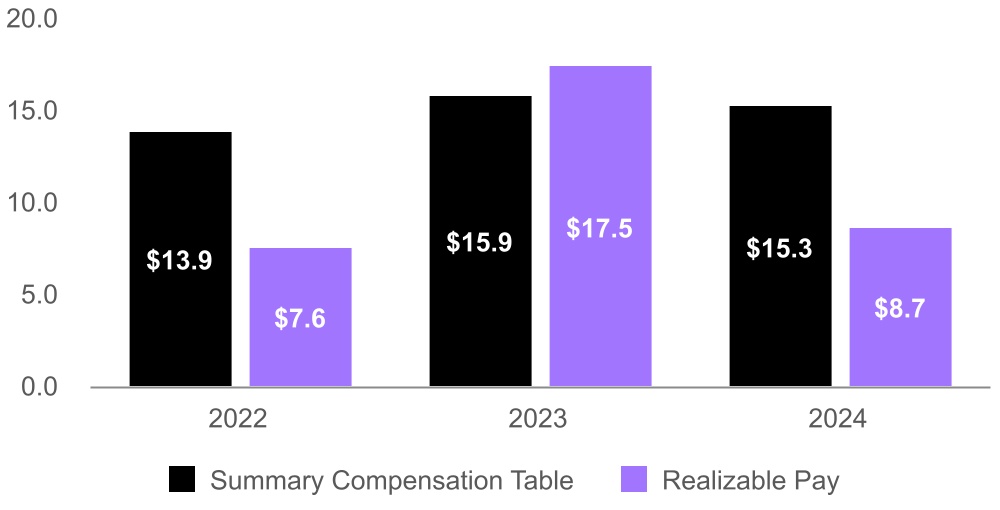

Our executive compensation program supports long-term value creation. Approximately 93% of our CEO target compensation and approximately 88% of the target compensation for our other NEOs serving at the end of fiscal 2024 is variable and at risk, tied to our stock price performance, or subject to achievement of pre-set rigorous performance targets. | | Our NEO compensation program reflects our focus on long-term shareholder value creation, including the following: Percentage of 2024 equity awards as target PSUs for CEO at 60%, percentage for other non-CEO NEOs serving at the end of fiscal 2024 at 50% (excluding Mr. Bloomer’s new-hire compensation package and Mr. Orville’s and Mr. Baranick’s promotion RSUs); Use of a relative total shareholder return (“rTSR” or “relative TSR”) modifier for the PSUs granted in 2024, which may increase or decrease the earned payout by up to 50% to reinforce alignment with shareholders; and A clawback policy that goes beyond the requirements set forth in the Dodd-Frank Act by allowing recoupment of incentive compensation in the event of misconduct that did not result in a financial restatement. | | Our 2024 annual incentive plan paid out at 47% of target, and our 2022 PSU program paid out at 60.7% of target. These payouts underscore the rigor of our incentive programs and their alignment with our shareholders. |

Responsible Business

| | | | | | | | | | | | | | |

Responsible Business Overview |

The work we do every day is aimed at eliminating the suffering cancer causes to create a more enduring, cancer-free world for future generations. The success of Exact Sciences would reduce the economic and social burden of cancer care around the world. Our Responsible Business strategy is consistent with our mission to empower patients with the most effective methods of cancer detection and treatment guidance to help eradicate the disease and save lives. We believe that to serve patients well, it is important to foster a strong workforce, uphold high ethical standards, and operate responsibly.

We are committed to: (1) investing in our people; (2) conducting our business with the highest professional and ethical standards; (3) maintaining effectiveness of our quality management system; (4) making it easy and affordable to complete our tests; and (5) working safely and being environmentally responsible. Exact Sciences publicly discloses information about our Responsible Business efforts in our Responsible Business report (formerly known as our ESG report), which adheres to the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD). Our Responsible Business report is available at www.investor.exactsciences.com/investor-relations/corporate-governance. The information contained in our Responsible Business report and on our website does not constitute a part of this proxy statement and is not incorporated by reference herein.

| | | | | | | | |

| | |

6 | Exact Sciences 2025 Proxy Statement | |

| | | | | | | | |

| | 2025 PROXY STATEMENT SUMMARY |

Oversight of Responsible Business practices by our Board of Directors and Committees

Our Board of Directors and its Committees provide oversight and regularly receives updates on policies and risks associated with Responsible Business, including covering topics such as cyber security at least quarterly. Topics such as the following were reviewed by our Board and its Committees in the past year:

| | | | | | | | | | | | | | |

| | | | |

Executive compensation Culture, talent, and human capital Environmental and social affairs Data privacy | | Legal and regulatory compliance Clinical research standards Shareholder feedback Risk management | | Information and cyber security Product quality and safety Product development Artificial intelligence |

Responsible Business Highlights

Human Capital

At Exact Sciences, we rely on the vision and expertise of our employees to foster our innovative solutions, and are committed to the health and safety, well-being, and development of our global workforce.

Our culture is built on shared values, collaboration, and a relentless commitment to our mission. By creating an environment where employees feel included, engaged, supported, and empowered, we continue to make a meaningful impact on patient health outcomes.

We create opportunities for personal and professional growth and have extensive training offerings that are available to our full-time, part-time, and temporary employees. Our employee programs span a broad range of topics focused on skill-building, decision-making, career-building, and role-specific topics to help employees be successful. We utilize several tools such as our employee engagement survey to measure the effectiveness of our employee engagement programs.

We demonstrate our commitment to employee well-being by providing comprehensive, market-competitive total rewards to our global workforce. Our total rewards investments include base pay and short-term and long-term incentives, and culturally-appropriate health, wellness, time-off and retirement programs. We enable workforce strategy by providing mobility solutions that align with business priorities.

Environmental Impact

We are committed to operating responsibly, meeting regulatory requirements, and minimizing environmental impact where feasible. We have dedicated environmental resources that work closely with all business units and functions to implement energy and waste management programs and policies. To enhance operational efficiency and address investor interest in environmental responsibility, we have made investments in energy efficiency, recycling, and water conservation.

Our Environmental Policy is embedded in our Code of Business Conduct and Ethics and applies to all our global locations. We require all operations to maintain compliance with national, regional, and local regulations relating to the environment, such as those affecting air emissions, water purity, and waste disposal.

Patient Accessibility

We remain focused on expanding the availability, accessibility and affordability of our tests for patients. In addition to working with many health plans, we pursue a variety of strategies to maximize insurance coverage and have a dedicated patient support team that provides informational resources to patients, including assistance with insurance coverage inquiries and financial assistance availability.

Our dedicated FOCUS program funds colorectal cancer screening initiatives in hard-to-reach populations, focusing on clinical and community projects aimed at improving screening by overcoming barriers for cancer screening and follow-up colonoscopies, as well as offering education about prevention and early detection of the disease.

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 7 |

PROPOSAL 1—ELECTION OF DIRECTORS | | |

|

| WHAT YOU ARE VOTING ON: |

Shareholders are being asked to elect a total of seven directors to our Board of Directors each to hold office until the 2026 annual meeting and until his or her respective successor is elected and qualified, or until his or her earlier death, resignation, or removal. |

We are seeking the election of seven members to our Board of Directors. Our Board of Directors currently consists of ten members and is currently divided into three classes. Upon the recommendation of the Corporate Governance and Nominating Committee, our Board of Directors has nominated and recommended (i) Kevin Conroy, Shacey Petrovic, Kimberly Popovits, and Katherine Zanotti for election to our Board of Directors for a one year term as our Class I directors and (ii) Michael Barber, Paul Clancy, and Daniel Levangie for election to our Board of Directors for a one-year term as our Class III directors.

At our 2023 annual meeting of shareholders, our shareholders approved an amendment to the Company’s Certificate of Incorporation providing for the elimination of the classified board structure over a three-year period (the “Declassification Amendment”). Beginning with the election of our Class III directors at the 2024 annual meeting, directors are elected for a one-year term (each to serve until his or her successor is elected and qualified or until his or her earlier death, resignation or removal). The approval of the Declassification Amendment by the shareholders did not shorten the terms for any previously elected directors. This means that the Class II directors will continue to hold office until the 2026 annual meeting, the end of the terms for which they were elected (each to serve until his or her successor is elected and qualified or until his or her earlier death, resignation or removal). By the 2026 annual meeting, all directors will be elected on an annual basis. Accordingly, each nominee for director at the Annual Meeting, if elected, will serve for a one-year term, expiring at our 2026 annual meeting (each to serve until his or her successor is elected and qualified or until his or her earlier death, resignation or removal).

Shares represented by all proxies received by our Board of Directors and not marked with voting direction for any individual nominee will be voted FOR the election of each nominee. Our Board of Directors knows of no reason why any nominee would be unable or unwilling to serve, but if such should be the case, proxies may be voted for the election of some other person nominated by our Board of Directors.

Our By-laws provide that, in an election of directors where the number of nominees does not exceed the number of directors to be elected (referred to as an “uncontested election”), each director must receive the vote of the majority of the votes cast with respect to that director. Under our By-laws, this means that the number of shares voted “for” a director must exceed the number of shares voted “against” that director. Our Board of Directors believes this majority vote standard appropriately gives shareholders a greater voice in the election of directors than the traditional plurality voting standard.

If an incumbent director does not receive a majority of the votes cast in an uncontested election, our Corporate Governance Guidelines provide that such director must tender his or her written resignation as a director to the Chairman of our Board of Directors for consideration by the Corporate Governance and Nominating Committee. As provided in our Corporate Governance Guidelines, the Corporate Governance and Nominating Committee will consider such tendered resignation and, within 45 days following the date of the shareholders’ meeting at which the election occurred, recommend to our Board of Directors whether to accept or reject such resignation. Our Board of Directors will, as provided in our Corporate Governance Guidelines, no later than 75 days following the date of the shareholders’ meeting at which the election occurred, take formal action upon such recommendation and promptly disclose its decision, together with an explanation of the process by which the decision was made and, if applicable, our Board of Directors’ reason or reasons for rejecting the tendered resignation, by filing a Form 8-K with the SEC.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE NOMINEES | | | |

| | | | | | |

| | | | | | |

| | | | | | | | |

| | |

8 | Exact Sciences 2025 Proxy Statement | |

INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR

Evaluation of Director Candidates

Director candidates are considered based upon a variety of criteria, including:

•demonstrated business and professional skills and experiences relevant to our business and strategic direction;

•concern for long-term shareholder interests;

•personal integrity; and

•sound business judgment.

Our Board of Directors seeks members from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise that, in concert, offer us and our shareholders diversity of opinion and insight in the areas most important to us and our corporate mission. In addition, nominees for director are selected to have complementary, rather than overlapping, skill sets. When filling positions for Board membership, including through retained searches by third party search firms, we are committed to actively seeking qualified candidates with a broad range of experience, viewpoints, professions, skills, geographic representations, and backgrounds as well as diversity of race, ethnicity, gender, age, and culture. All director candidates must have time available to devote to the activities of our Board of Directors. Our Corporate Governance and Nominating Committee also considers the independence of director candidates, including the appearance of any conflict in serving as a director.

Below is background information for each current director and nominee for director, as well as information regarding additional experience, qualifications, attributes or skills that led our Board of Directors to conclude that such director or nominee should serve on our Board of Directors.

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 9 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

Nominees for Director

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Conroy has served as our Chief Executive Officer since 2009, and as Chairman of our Board of Directors since 2014. He has been responsible for transforming the organization into one of the world’s premier cancer diagnostics companies and contributes his extensive business knowledge, legal and executive leadership experience and strategic counsel to the Board. With more than 20 years in the healthcare and health technology space, Mr. Conroy has a deep understanding of our industry. KEY SKILLS AND EXPERTISE Executive Leadership; Finance, Corporate Strategy, and M&A: Obtained from his tenure as Chief Executive Officer of two major public diagnostics companies, Exact Sciences (Nasdaq: EXAS) and Third Wave Technologies (Nasdaq: TWTI). As our Chief Executive Officer, he has created shareholder value through innovative new technologies and key acquisitions, positioning the Company as a global leader in cancer screening and diagnostics. Diagnostics/Medical Device and Technology; Science, Research, and Development: Acquired significant experience overseeing the development, regulatory approval, and commercialization of diagnostic tests and building a high performing team culture within our Company. While Chief Executive Officer of Exact Sciences, he spearheaded collaborative research efforts to identify highly discriminant cancer biomarkers, leading to the development of Cologuard® and Cologuard Plus, our proprietary multi-marker tests for the early detection of colorectal cancer. Pipeline Development/Commercialization; Global Business Perspective: In his current role as Chief Executive Officer, he has led the Company through the regulatory approval and commercialization of Cologuard® - the first cancer diagnostic test to receive simultaneous FDA approval and national Medicare coverage. Additionally, he led the Company through development of innovative new tests such as Cologuard PlusTM, OncodetectTM, and CancerguardTM. Separately, while serving as Chief Executive Officer of Third Wave Technologies, he was responsible for the successful development oversight of Cervista, a cervical cancer screening test. His insight and global perspective into the development, regulatory approval and commercialization processes of diagnostic tests provides valuable insight to the Board in shaping our business strategy. CAREER HIGHLIGHTS Exact Sciences (Nasdaq: EXAS) •President, Chairman and Chief Executive Officer (since 2009, Chairman since 2014) Third Wave Technologies, (Nasdaq: TWTI) (acquired by Hologic, Inc. in 2008) – molecular diagnostics business •President and Chief Executive Officer (2005-2008) •General Counsel (2004-2005) GE Healthcare – healthcare technology arm of General Electric (NYSE: GE) •Intellectual Property Counsel (2002-2004) EDUCATION •B.S., Electrical Engineering, Michigan State University •J.D., University of Michigan | |

| | Kevin Conroy | | | |

| | | | | |

| | AGE: 59 NON-INDEPENDENT DIRECTOR (CLASS I) SINCE: 2009

| | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Align Technology, Inc. (Nasdaq: ALGN) (since 2023) Adaptive Biotechnologies Corporation (Nasdaq: ADPT) (2019-2023) Epizyme, Inc. (Nasdaq: EPZM) (2017-2022) CM Life Sciences II Inc. (Nasdaq: CMIIU) (2021) SomaLogic, Inc. (Nasdaq: SLGC) (2021) Arya Sciences Acquisition Corp. (Nasdaq: ARYA) (2018-2020) | | | |

| | | | | | | | |

| | |

10 | Exact Sciences 2025 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Ms. Petrovic contributes decades of experience as an executive in the medical device industry, where she is well-known as a visionary and inspiring leader who has dedicated her career to improving care for patients, while bringing tremendous value to the clinical community. She contributes extensive industry leadership experience and first-hand oversight of the successful launch of impact-focused technologies and medical devices, which have positively impacted business growth. KEY SKILLS AND EXPERTISE Executive Leadership; Pipeline Development/Commercialization: During Ms. Petrovic’s tenure as Chief Executive Officer of Insulet Corporation (Nasdaq: PODD), she spearheaded a period of strong financial growth as the company shifted to pharmacy and launched its flagship innovation, the Omnipod 5. She also contributes deep sales and marketing experience to the Board from her previous role as Chief Executive Officer at Clinical Innovations and several leadership positions at Hologic (Nasdaq: HOLX). Diagnostics/Medical Device and Technology; Government, Regulatory, and Compliance: Obtained from her career of developing deep relationships within the healthcare industry, particularly within diagnostics and screening, which has been critical in her oversight of the full commercialization lifespan of medical device products, including the critical regulatory approval stage. Talent Management; Finance, Corporate Strategy, and M&A: Acquired valuable talent acquisition and management experience from her numerous leadership positions of increasing responsibility at both Insulet Corporation and Hologic. While serving as Chief Executive Officer of Insulet Corporation, her responsibilities included active ultimate oversight of the finance and corporate strategy functions, which resulted in the company’s growth from $2 billion to over $20 billion in market capitalization. CAREER HIGHLIGHTS Insulet Corporation, (Nasdaq: PODD) – innovative medical device company •Board Member and Advisor (2018-2024) •President and Chief Executive Officer (2019-2022) •President and Chief Operating Officer (2016-2018) •President, Insulet Diabetes Products (2016) •Chief Commercial Officer (2015-2016) Clinical Innovations, LLC – developer and manufacturer of medical devices and diagnostics for women’s health •President and Chief Executive Officer (2013-2015) Hologic, Inc, (Nasdaq: HOLX) – medical technology company •Vice President and General Manager, GYN Surgical Products (2012-2013) •Vice President, Global Surgical Marketing (2010-2012) •Business Director (2008-2010) Cytyc Corporation (acquired by Hologic, Inc. in 2007) – biotechnology company focused on women’s health •Various leadership roles, including in sales (2000-2007) EDUCATION •B.S., Biology, University of Wisconsin-Milwaukee | |

| | Shacey Petrovic | | | |

| | | | | |

| | AGE: 51 INDEPENDENT DIRECTOR (CLASS I) SINCE: 2020 COMMITTEES Corporate Governance and Nominating (Chair) | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Ambu A/S (Nasdaq Nordic: AMBU B) (since 2022) Insulet Corporation (Nasdaq: PODD) (2018-2024) | | | |

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 11 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Ms. Popovits has over 40 years of experience in the healthcare industry, serving in various leadership roles at Genomic Health, Inc, Genentech Inc., and American Critical Care. Ms. Popovits served as President and Chief Executive Officer of Genomic Health, Inc. (“Genomic Health”) from 2009 until its acquisition by Exact Sciences in 2019. Prior to that role, Ms. Popovits served as Genomic Health’s Chief Operating Officer from 2002 to 2009 and as its Chairman of the Board from 2012 to 2019. Prior her time at Genomic Health, Ms. Popovits served as Senior Vice President, Marketing and Sales from 2001 to 2002 and Vice President, Sales from 1994 to 2001 at Genentech, Inc. She also served as interim Chief Executive Officer for Talis Biomedical Corporation in 2021. Ms. Popovits was named the Most Admired CEO in 2014 by the San Francisco Business Times, Woman of the Year by Women Health Care Executives in 2008, received the Ferolyn Powell Leadership Award from MedTechWomen in 2019 and the Salute to Excellence Award from the American Liver Foundation in 2017. KEY SKILLS AND EXPERTISE Pipeline Development/Commercialization: Acquired significant executive and operational experience from her positions with pharmaceutical and other healthcare companies, including extensive experience in commercial strategy and capability building. Finance, Corporate Strategy and M&A: Possesses deep knowledge and expertise in advising and managing companies with multiple business units and in various segments of the healthcare industry. Executive Leadership: Ms. Popovits contributes proven leadership skills acquired from executive roles at Genomic Health and past and present board service at numerous public companies.

CAREER HIGHLIGHTS Genomic Health, Inc – healthcare company •President and Chief Executive Officer (2009-2019) •President and Chief Operating Officer (2002-2009) Genentech, Inc. – biotechnology company •Senior Vice President, Marketing and Sales (2001-2002) •Vice President, Sales (1994-2001) •National Sales Manager (1987-1994) American Hospital Supply, American Critical Care Division •Division Manager, Southeast Region (1981-1987)

EDUCATION •B.A., Business, Michigan State University | |

| | Kimberly Popovits | | | |

| | (NOMINEE) | | | |

| | AGE: 66 INDEPENDENT DIRECTOR (CLASS I) SINCE: 2025 COMMITTEES Human Capital Innovation, Technology & Pipeline | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS 10x Genomics, Inc. (Nasdaq: TXG) (Since 2020)

Talis Biomedical Corporation (Nasdaq: TLIS) (Since 2020)

Kiniksa Pharmaceuticals, Ltd. (Nasdaq: KNSA) (Since 2018)

| | | |

| | | | | | | | |

| | |

12 | Exact Sciences 2025 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Ms. Zanotti contributes over four decades of health and personal care industry expertise, including executive and senior leadership experience. She contributes an impressive track record of successfully executing on international omni-channel growth initiatives, with valuable insights on go-to-market and customer engagement strategies that have reached millions of global customers. KEY SKILLS AND EXPERTISE Executive Leadership; Finance, Corporate Strategy, and M&A: Obtained from her various executive and senior level leadership experiences, including multiple public company board directorships. In her most recent role as Chief Executive Officer of Arbonne International, she was responsible for successfully fortifying the company’s financial standing and reputation as a premium international skin care and wellness enterprise. She has also overseen three public company sale transactions to strategic acquirers throughout her career. Pipeline Development/Commercialization: Acquired over four-decade career primarily in the health and personal care industry where she led global commercialization of multiple consumer products at Procter & Gamble (NYSE: PG), McDonald's Corporation (NYSE: MCD), and Arbonne International; led global pipeline development of pharmaceutical products for P&G, and then commercialized in North American market. All leadership positions led to significant business growth and profitability. Talent Management; Corporate Governance and Sustainability: Developed from her time serving on six public company boards, where she has contributed her expertise in compensation and talent acquisition and development. Her former directorships include companies focused on creating cleaner, more efficient and safer consumer and medical technology products that have helped transform the health and wellness industry. CAREER HIGHLIGHTS Arbonne International (acquired by Groupe Rocher in 2018) – botanically based skin care, cosmetic and nutrition company •Chief Executive Officer (2009-2018) McDonald’s Corporation, (NYSE: MCD) – global fast-food chain •Senior Vice President, Marketing (2002-2006) Procter & Gamble, (NYSE: PG) – manufacturer and marketer of consumer goods •Vice President and General Manager, North American Pharmaceutical and Corporate Women’s Health (1997-2002) •Various other leadership roles (1979-1997) EDUCATION •B.A., Economics/Studio Fine Arts, Georgetown University •M.B.A., Finance and Marketing, Xavier University

| |

| | Katherine Zanotti | | | |

| | | | | |

| | AGE: 70 INDEPENDENT DIRECTOR (CLASS I) SINCE: 2009 COMMITTEES Human Capital (Chair) | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Diversey Holdings, Ltd. (Nasdaq: DSEQ) (2022-2023) Cutera, Inc. (Nasdaq: CUTR) (2019-2022) Hill-Rom Holdings, Inc. (NYSE: HRC) (2009-2013) Mentor Corporation (NYSE: MNT) (2007-2009) Alberto Culver Company (NYSE: ACV) (2006-2009) Third Wave Technologies, Inc. (Nasdaq: TWTI) (2006-2008) | | | |

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 13 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Barber contributes over 40 years of experience serving in a series of executive roles with increasing scope of responsibilities in operations, human capital, engineering, and product management at General Electric Company (NYSE: GE). He is a well-respected innovator, inventor, and healthcare industry leader, with a proven global track record of launching transformational technologies and successfully delivering advanced products to market in the diagnostic imaging and point of care technology fields. KEY SKILLS AND EXPERTISE Global Business Perspective; Pipeline Development/Commercialization: Mr. Barber contributes significant global operational insights from his experience at pharmaceutical and other healthcare companies, where he has led product development for advanced healthcare technologies, positioning him with a unique understanding of product impact on a wide variety of healthcare focused stakeholders. While serving as CEO of GE’s Molecular Imaging and Computed Tomography business, he oversaw the launch of a revolutionary CT portfolio, game-changing, deep learning-based image reconstruction and patient positioning technology, as well as the world’s first digital PET scanner, transforming GE’s position in the cancer, oncology, and cardiac care markets globally. Talent Management; Corporate Governance and Sustainability: Acquired in his most recent role as Chief Diversity Officer for GE, where he was responsible for leading the approximately 179,000 employee company’s inclusion and diversity strategy to drive sustainable change with an added focus on enhancing employee engagement, leadership accountability, building an inclusive culture and reinvigorating inclusion and diversity learning and mentoring. He also brings valuable insight from his experience overseeing human capital management efforts, including a deep understanding of human resources, labor relations and sustainability matters. Executive Leadership: Obtained from Mr. Barber’s numerous executive leadership positions throughout his career at GE. While serving as CEO of GE’s Molecular Imaging and Computed Tomography business, he was responsible for driving growth and innovation to meet customer and business needs for multiple product lines. His executive responsibilities have also included oversight of complex operational execution of healthcare company manufacturing processes. CAREER HIGHLIGHTS General Electric (NYSE: GE) – multinational provider of energy solutions, jet engines and healthcare technologies •Chief Diversity Officer (2020-2022) •President and Chief Executive Officer, GE Molecular Imaging and Computed Tomography (2016-2020) •Chief Engineer, GE Healthcare and Chief Operating Officer, GE Healthcare Systems (2013-2015) •Vice President and General Manager, Molecular Imaging, GE Healthcare (2011-2012) •Vice President, Healthymagination Strategy (2009-2011) •Vice President of Technology, GE Healthcare (2007-2008) •Vice President of Engineering, Diagnostic Imaging (2005-2006) •Several additional roles (1982-2005) EDUCATION •B.S., Engineering, Milwaukee School of Engineering •Honorary Doctorate, Engineering, Milwaukee School of Engineering

| |

| | Michael Barber | | | |

| |

| | | |

| | AGE: 64 INDEPENDENT DIRECTOR (CLASS III) SINCE: 2024 COMMITTEES Audit and Finance Innovation, Technology & Pipeline (Chair) | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Dentsply Sirona, Inc (Nasdaq:XRAY) (since 2025)

Catalent, Inc. (NYSE: CTLT) (2021-2024)

| | | |

| | | | | | | | |

| | |

14 | Exact Sciences 2025 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Clancy contributes over 30 years of experience in financial management and strategic business planning, as well as extensive financial leadership in the biopharmaceutical and biotechnology industries. His broad experience in strategic planning, financial management, capital allocation, mergers and acquisitions, business development and investor relations allow him to contribute insights to the Board’s oversight of value-creation initiatives. KEY SKILLS AND EXPERTISE Finance, Corporate Strategy and M&A: Acquired from his extensive financial and executive leadership experience at large, public companies with complex operations, including his former roles as the Chief Financial Officer of Alexion Pharmaceuticals, Inc. (Nasdaq: ALXN) and Biogen Inc. (Nasdaq: BIIB). During his tenure at Biogen, he oversaw the company’s rapid growth and shareholder value creation that ranked at the top decile of S&P 500 companies, driven by its expanded product lines and pipeline through organic growth opportunities and M&A. Mr. Clancy was recognized in the top three biotech CFOs in the Institutional Investor annual survey in all years from 2011-2020. Risk Management: As a board director at three other public life sciences companies, Mr. Clancy brings a deep understanding of the evolving risks associated with the industry. Additionally, he brings significant risk management expertise to the Board from his over 30-year career in financial management. His responsibilities have included leading the treasury, tax, investor relations and business planning groups of several multinational large companies. Diagnostics/Medical Device and Technology: Obtained through his service at executive level positions at large biopharmaceutical and biotechnology companies, where he was responsible for aligning the company’s financial management with strategic business planning. CAREER HIGHLIGHTS Alexion Pharmaceuticals, Inc. (Nasdaq: ALXN) – biopharmaceutical company •Executive Vice President and Senior Adviser (2019-2020) •Executive Vice President and Chief Financial Officer (2017-2019) Biogen, Inc. (Nasdaq: BIIB) – biotechnology company •Executive Vice President, Finance and Chief Financial Officer (2007-2017) •Senior Vice President, Finance (2006-2007) •Various other leadership roles, including Vice President, U.S. Marketing and Vice President of Portfolio Management (2001-2006) PepsiCo, Inc. (Nasdaq: PEP) – multinational food, snack and beverage company •Vice President and General Manager, Great West business unit (1997-2000) •Various other leadership positions (1987-1996) EDUCATION •B.S., Finance, Babson College •M.B.A., Columbia University | |

| | Paul Clancy | | | |

| | | | | |

| | AGE: 63 INDEPENDENT DIRECTOR (CLASS III) SINCE: 2021 COMMITTEES Audit and Finance (Chair) Corporate Governance and Nominating | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Sionna Therapeutics, Inc. (Nasdaq: SION) (Since 2022) Xilio Therapeutics (Nasdaq: XLO) (since 2020)

Incyte Corporation (Nasdaq: INCY) (since 2015)

Agios Pharmaceuticals (Nasdaq: AGIO) (2013-2023) | | | |

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 15 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Levangie contributes his extensive expertise in all stages of product pipeline development acquired through his executive leadership roles overseeing commercialization, sales and marketing, operations and talent management throughout different product’s life cycles. He has a proven track record of successfully operating and leading companies in in the in vitro diagnostics and medical devices fields, with extensive product development and commercialization expertise. KEY SKILLS AND EXPERTISE Pipeline Development/Commercialization; Talent Management: Developed extensive expertise through his over a 40-year career in the in vitro diagnostics and medical device industry, successfully overseeing complex diagnostic testing processes at the early stage of the pipeline development. Diagnostics/Medical Device and Technology: Acquired a deep knowledge of the healthcare industry, particularly in diagnostics and screening, from his experience overseeing a number of impactful, innovative diagnostic products in the oncology and diabetes markets while serving in senior executive roles with oversight responsibilities for driving growth initiatives and product integrations with other pharmaceutical products. Executive Leadership: Obtained significant executive leadership from numerous roles leading medical device and in vitro diagnostics companies, including as Chief Executive Officer of CereVasc, Dune Medical Devices and Keystone Dental, further enhanced by public company board experience. CAREER HIGHLIGHTS CereVasc, LLC – early-stage medical device company •Chairman, Founder, President and Chief Executive Officer (since 2018) ATON Partners – private management advisory and investment firm focused on healthcare companies and technologies •Founder and Managing Partner (2013-2018) Insulet Corporation (Nasdaq: PODD) – innovative medical device company •President, Insulet Drug Delivery (2013-2017) Dune Medical Devices, Inc. – medical device company focused on specialized diagnostic and therapeutic applications •Chief Executive Officer (2011-2013) Constitution Medical Investors, Inc (acquired by Roche in 2013) – private investment and product development firm •Co-Founder and Managing Partner (2008-2013) Keystone Dental – dental implant and manufacturing company •Chief Executive Officer (2009-2011) Cytyc Corporation (acquired by Hologic, Inc. in 2007) – in vitro diagnostics and medical device company focused on women’s health •Executive Vice President and Chief Operating Officer (2002-2007) •Various other leadership positions (1992-2007) Abbott Laboratories (Nasdaq: ABT) – a diversified healthcare company •Various sales, marketing and management positions (1975-1992) EDUCATION •B.S., Pharmacy, Northeastern University

| |

| | Daniel Levangie | | | |

| | | | | |

| | AGE: 74 INDEPENDENT DIRECTOR (CLASS III) SINCE: 2010 COMMITTEES Audit and Finance Human Capital | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Renalytix, plc (Nasdaq: RNLX) (2021-2024) Insulet Corporation (Nasdaq: PODD) (2011-2016) Hologic, Inc. (Nasdaq: HOLX) (2007-2009)

| | | |

| | | | | | | | |

| | |

16 | Exact Sciences 2025 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

Other Members of Our Board of Directors

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Coward contributes to the board decades of legal experience working with large corporations and emerging growth healthcare companies, where he has gained extensive legal and healthcare industry expertise. His previous role leading our legal department uniquely positions him with critical knowledge to advise on complex nuances that may impact our strategy and rapidly evolving business. KEY SKILLS AND EXPERTISE Diagnostics/Medical Device and Technology; Executive Leadership: Obtained significant operational and executive leadership experience from his multiple roles overseeing and advising the legal teams at a number of large public and early-stage growth companies. His strategic counsel included issues related to real estate, corporate affairs, governmental affairs, clinical and regulatory matters. Corporate Governance and Sustainability; Finance, Corporate Strategy, and M&A: Contributes a deep understanding of our business, gained during his time as our Chief Legal Officer, General Counsel, and Chief Administrative Officer, including experience analyzing and navigating legal, regulatory, compliance, corporate governance and sustainability issues, particularly as they affect the company’s corporate strategy and M&A. Pipeline Development/Commercialization, Global Business Perspective: Acquired expertise navigating the global, public company regulatory and legal landscape in the healthcare industry from his long career advising life sciences companies, including as a Managing Partner of the Raleigh, North Carolina office of K&L Gates LLP and as Associate General Counsel of GE Medical Systems. His pharmaceutical and biotechnology company counsel has spanned multiple pipeline development stages in areas including R&D, complex licensing, healthcare data and intellectual property. CAREER HIGHLIGHTS College of Charleston – public university •Adjunct professor of business law (since 2023) Exact Sciences (Nasdaq: EXAS) •Chief Legal Officer (January - December 2022) •Executive Vice President, Chief Administrative Officer (2018-2021) •Executive Vice President, General Counsel (2015-2022) K&L Gates LLP – global law firm •Managing Partner of Raleigh, NC office (2004-2014) Blue Rhino Corporation – leading supplier of consumer propane-related products •General Counsel (2003-2004) GE Medical Systems – a business of General Electric Company (NYSE: GE), medical electronic equipment manufacturer •Associate General Counsel (2002-2003) Smith Anderson Blount Dorsett Mitchell & Jernigan LLP – business and litigation law firm •Partner (1991-2002) EDUCATION •B.S., Business Administration, University of North Carolina at Chapel Hill •J.D., Columbia Law School | |

| | D. Scott Coward | | | |

| | | | | |

| | AGE: 60 NON-INDEPENDENT DIRECTOR (CLASS II) SINCE: 2022 COMMITTEES Innovation, Technology and Pipeline | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 17 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Doyle contributes extensive leadership experience from his career serving in various government leadership roles, including his two terms serving as the 44th Governor of the state of Wisconsin. He is a seasoned and skilled lawyer with expertise guiding both private and public companies as they operate through complex legal challenges and highly regulated industries. KEY SKILLS AND EXPERTISE Government, Regulatory, and Compliance: Mr. Doyle contributes significant government, regulatory and compliance experience from his decades serving in various elected official positions, including as Governor of Wisconsin, where he worked closely with policy makers and gained insights into policy and regulatory issues impacting the healthcare industry. He has experience working closely with the White House, high-ranking Administration officials and other governors, has led multiple coordinated multi-state legislative efforts and has argued three cases before the U.S. Supreme Court. Medical Practice and Public Health; Risk Management: Acquired throughout his career providing strategic legal counsel in the healthcare industry, including his oversight work of a major Medicare program and initiatives to expand healthcare coverage for state residents and advising clients on compliance with the evolving legal and regulatory frameworks governing the healthcare industry. He contributes to the Board strong analytical skills to evaluate the legal and regulatory risks affecting our business and strategy. Executive Leadership; Talent Management: Obtained proven executive leadership, managerial and talent management skills from his time serving as an elected state official and law firm partner. CAREER HIGHLIGHTS

Doyle & Boyce Strategies – national foundations consultant •Partner (since 2011) Foley and Lardner LLP – international law firm •Of Counsel (2011-2024) State of Wisconsin, U.S. •44th State Governor (2003-2011) •Attorney General (1991-2003) •District Attorney, Dane County (1977-1982) EDUCATION •B.A., University of Wisconsin-Madison •J.D., Harvard Law School | |

| | James Doyle | | | |

| | | | | |

| | AGE: 79 INDEPENDENT DIRECTOR (CLASS II) SINCE: 2014 COMMITTEES Human Capital Corporate Governance and Nominating | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | |

| | |

18 | Exact Sciences 2025 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Ms. Trigg contributes over 25 years of experience in leadership within the healthcare and medical device industries. Through her executive experience at a number of corporations in the medical device field and her current role as CEO of a public company, Ms. Trigg has acquired expertise in cultivating relationships with shareholders and investors to advance her companies’ goals. Ms. Trigg brings to the Board a wealth of knowledge in developing strong governance practices and making high-level, strategic decisions to successfully shape a company’s future direction and growth. KEY SKILLS AND EXPERTISE Executive Leadership; Obtained from her experience holding executive level positions and leading multiple medical device companies, where she was charged with guiding companies towards their long-term goals, and developing strategic visions lending to future success. She has also obtained leadership experience from her previous board roles, acting as an oversight authority and financial steward for the benefit of the corporation. Finance/Corporate Strategy and M&A: Obtained from her time serving in executive level roles, Ms. Trigg has experience in developing strategy and commercial infrastructure which has led to successful initial public offerings and multiple favorable acquisitions of the companies she has led. Ms. Trigg’s early background in communications and marketing allow her to consider corporate strategies with a unique approach, which will be valuable to our Board. CAREER HIGHLIGHTS Outset Medical, Inc. (Nasdaq: OM) – dialysis focused medical device company •President and Chief Executive Officer (2014 - Present) •Chair of Board of Directors (2022 - Present) Warburg Pincus LLC - private equity firm •Executive in Residence (2012-2014) Medical Device Manufacturers Association (MDMA) •Chair of Board of Directors (2022-Present) Lutonix, Inc. (acquired by CR Bard) – cardiovascular medical device company •Executive Vice President (2010-2012) AccessClosure, Inc. (acquired by Cardinal Health) – vascular closure medical device company ▪Chief Business Officer (2006-2009) FoxHollow Technologies, Inc. (acquired by ev3/Covidien) - medical device company ▪Vice President, Marketing (2003-2006) Cytyc Corporation (acquired by Hologic, Inc.) - cervical cancer diagnostic systems company ▪Business Unit Director (2001-2002) Pro-Duct Health, Inc. (acquired by Cytyc Corporation) - breast cancer diagnostics company ▪Director, Market Development (2000-2001) Guidant Corporation ▪Senior Product Manager (1998-2000) EDUCATION •B.S., Communications, Northwestern University •M.B.A., Haas School of Business, University of California, Berkeley | |

| | Leslie Trigg | | | |

| | | | | |

| | AGE: 54 INDEPENDENT DIRECTOR (CLASS II) SINCE: 2025 COMMITTEES | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Outset Medical, Inc. (Nasdaq: OM) (since 2014) Adaptive Biotechnologies (Nasdaq: ADPT) (2021-2023)

Cardiovascular Systems, Inc. (Nasdaq: CSII) (2010-2017) | | | |

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 19 |

INFORMATION CONCERNING EXECUTIVE OFFICERS

Below is background information relating to our executive officers. Kevin Conroy is discussed above under “Information Concerning Directors and Nominees for Director”.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Brian Baranick | | | | | |

| | | | | | | |

| | | | | | Brian Baranick, age 47, has served as General Manager, Precision Oncology since July 2022, and served as Senior Vice President, Strategy and Business Development from February 2021 to July 2022, and Vice President, Corporate Strategy from August 2020 to February 2021. Prior to joining Exact Sciences, Mr. Baranick was with L.E.K. Consulting, LLC, where Mr. Baranick was a Partner and Managing Director focused on growing the diagnostics and life science tools segment of L.E.K.’s healthcare vertical from 2007 to July 2020. Mr. Baranick holds a Ph.D. in Molecular Biology from the University of California Los Angeles. | |

| | Position: Executive Vice President and General Manager, Precision Oncology | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Aaron Bloomer | | | | | |

| | | | | | | |

| | | | | | Aaron Bloomer, age 39, has served as our Chief Financial Officer since May 15, 2024. Prior to joining Exact Sciences, Mr. Bloomer previously served as the Vice President, Corporate Financial Planning, Reporting, and Analytics for Baxter International Inc. (NYSE: BAX), where he led Baxter International’s global financial planning and reporting function. Prior to joining Baxter International in August 2021, Mr. Bloomer held a series of increasingly senior roles with 3M Company (NYSE: MMM) from June 2008 to August 2021, including Senior Vice President, Corporate Financial Planning, Reporting and Analytics of 3M, Vice President and CFO of 3M’s Greater China area, Global Director and Division CFO for 3M’s Display Materials Division, and Global Senior Finance Manager and Division CFO of 3M’s Consumer Health Care Division. Mr. Bloomer earned a bachelor’s degree in business administration from the University of Wisconsin-Eau Claire and an M.B.A. from the University of Minnesota. | |

| | Position: Executive Vice President and Chief Financial Officer | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | |

| | |

20 | Exact Sciences 2025 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING EXECUTIVE OFFICERS |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Sarah Condella | | | | | |

| | | | | | | |

| | | | | | Sarah Condella, age 44, has served as our Executive Vice President, Human Resources since January 2021, and previously served in increasing roles of responsibility, including as Senior Vice President, Human Resources; Vice President; Senior Director; and Director, since joining Exact Sciences in 2012. Prior to joining Exact Sciences, Ms. Condella served as a Human Resources Manager at GE Healthcare and as a Manager and Project Director at the University of Wisconsin Survey Center. Ms. Condella currently serves on the board of the Madison Children’s Museum. Ms. Condella earned a bachelor’s degree and an M.B.A. from the University of Wisconsin-Madison. | |

| | Position: Executive Vice President, Human Resources & Service | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | James Herriott | | | | | |

| | | | | | | |

| | | | | | James Herriott, age 45, has served as our Senior Vice President, General Counsel since January 2022 and as our Secretary since December 2022. Mr. Herriott previously served as our Deputy General Counsel from February 2020 until January 2022 and Senior Counsel from August 2018 to February 2020. Mr. Herriott joined us from the global law firm K&L Gates LLP, where he practiced corporate and securities law. Prior to his tenure at K&L Gates, Mr. Herriott practiced corporate and securities law at Paul Hastings LLP. Mr. Herriott earned a bachelor’s degree in economics from Duke University and a Juris Doctor from Vanderbilt University Law School. | |

| | Position: Senior Vice President, General Counsel | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Jacob Orville | | | | | |

| | | | | | | |

| | | | | | Jacob Orville, age 51, has served as our General Manager, Screening since July 2022, as General Manager, Pipeline from November 2019 to July 2022, and as Senior Vice President, Pipeline from February 2019 to November 2019. Mr. Orville previously served as General Manager, Cardiometabolic & Endocrinology Franchise at Quest Diagnostics, Inc. from November 2017 to February 2018. Mr. Orville co-founded Cleveland HeartLab, Inc. in December 2008 and served as its Chief Executive Officer from December 2008 to November 2017, when it was acquired by Quest Diagnostics. Earlier in his career, Mr. Orville served in leadership and operational roles at NextGen Sciences, Inc. and Third Wave Technologies, Inc. Mr. Orville earned a bachelor’s degree from University of Massachusetts-Amherst and an M.B.A. from the University of Wisconsin-Madison. | |

| | Position: Executive Vice President and General Manager, Screening | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | |

| | |

| Exact Sciences 2025 Proxy Statement | 21 |

CORPORATE GOVERNANCE PRINCIPLES, BOARD MATTERS, AND NON-EMPLOYEE DIRECTOR COMPENSATION

Board Independence

Our Board of Directors has determined that Michael Barber, Paul Clancy, James Doyle, Daniel Levangie, Shacey Petrovic, Kimberly Popovits, Leslie Trigg, and Katherine Zanotti are each independent within the meaning of the director independence standards of The Nasdaq Stock Market (“Nasdaq”). Our Board of Directors also previously determined that each of Pierre Jacquet, Freda Lewis-Hall and Timothy Scannell, who served on our Board of Directors until the 2024 annual meeting of shareholders and Kathleen Sebelius, who resigned for her retirement on April 29, 2025, were independent under the Nasdaq director independence standards. Furthermore, our Board of Directors has determined that all of the members of our Audit and Finance Committee, Human Capital Committee, and Corporate Governance and Nominating Committee are independent within the meaning of the director independence standards of Nasdaq and the rules of the SEC applicable to each such committee.

Our Board of Directors has determined that Kevin Conroy and D. Scott Coward are not independent within the meaning of director independence standards of Nasdaq.

Executive Sessions of Independent Directors

Our independent directors meet in regularly scheduled executive sessions without members of management present. Executive sessions are led by James Doyle, our Lead Independent Director, who actively solicits other independent directors for agenda items in advance of such meetings. The independent directors utilize the executive sessions to discuss, among other items, corporate strategy and planning, including succession planning for our executive officers.

Board Qualifications

Our Corporate Governance and Nominating Committee is responsible for identifying the desired qualifications, skills, and characteristics of our Board of Directors, considering the needs of the business and the current composition of our Board.

Director candidates are considered based upon a variety of criteria, including demonstrated business and professional skills and experiences relevant to our business and strategic direction, concern for long-term shareholder interests, personal integrity, and sound business judgment. Our Board of Directors seeks members from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise that, in concert, offer us and our shareholders diversity of opinion and insight in the areas most important to us and our corporate mission. In addition, nominees for director are selected to have complementary, rather than overlapping, skill sets. When filling positions for Board membership, including through retained searches by third party search firms, we are committed to actively seeking qualified candidates with a broad range of experience, viewpoints, professions, skills, geographic representations, and backgrounds as well as diversity of race, ethnicity, gender, age, and culture. All director candidates must have time available to devote to the activities of our Board of Directors. Our Corporate Governance and Nominating Committee also considers the independence of director candidates, including the appearance of any conflict in serving as a director.

Director candidates who do not meet all of these criteria may still be considered for nomination to our Board of Directors if our Corporate Governance and Nominating Committee believes that the candidate will make an exceptional contribution to us and our shareholders.

Board Refreshment