Exhibit (a)(1)(B)

LETTER OF TRANSMITTAL

To Tender Shares of Common Stock

of

Beacon Roofing Supply, Inc.

Pursuant to the Offer to Purchase

dated January 27, 2025

of

Queen MergerCo, Inc

A Wholly Owned Subsidiary of

QXO, Inc.

THE OFFER AND WITHDRAWAL RIGHTS EXPIRE AT 12:00 MIDNIGHT,

NEW YORK CITY TIME, AT THE END OF FEBRUARY 24, 2025, UNLESS THE OFFER IS EXTENDED.

The undersigned represents that I (we) have full authority to surrender without restriction the certificate(s) for exchange. You are hereby authorized and instructed to prepare in the name of and deliver to the address indicated below (unless otherwise instructed in the boxes on the following page) a check representing a cash payment for shares tendered pursuant to this Letter of Transmittal. Such cash payment shall equal $124.25 per share of common

stock tendered.

Method and delivery of the certificate(s) is at the option and risk of the owner. Mail or deliver this Letter of Transmittal, together with the certificate(s) representing your shares, to the Depositary for this Offer:

By Mail: | By Express Mail; or Courier: | ||

Computershare Trust Company, N.A. Attn: Voluntary Corporate Actions COY BECN P.O. Box 43011 Providence, Rhode Island 02940 | Computershare Trust Company, N.A. Attn: Voluntary Corporate Actions COY BECN 150 Royall Street, Suite V Canton, Massachusetts 02021 | ||

ALL QUESTIONS REGARDING THE OFFER SHOULD BE DIRECTED TO THE INFORMATION AGENT, INNISFREE M&A INCORPORATED, AT THE ADDRESS OR TELEPHONE NUMBERS AS SET FORTH ON THE BACK COVER PAGE OF THE OFFER TO PURCHASE.

IF YOU WOULD LIKE ADDITIONAL COPIES OF THIS LETTER OF TRANSMITTAL OR ANY OF THE OTHER MATERIALS RELATED TO THE OFFER, YOU SHOULD CONTACT THE INFORMATION AGENT, INNISFREE M&A INCORPORATED, AT THE ADDRESS OR TELEPHONE NUMBERS AS SET FORTH ON THE BACK COVER PAGE OF THE OFFER TO PURCHASE.

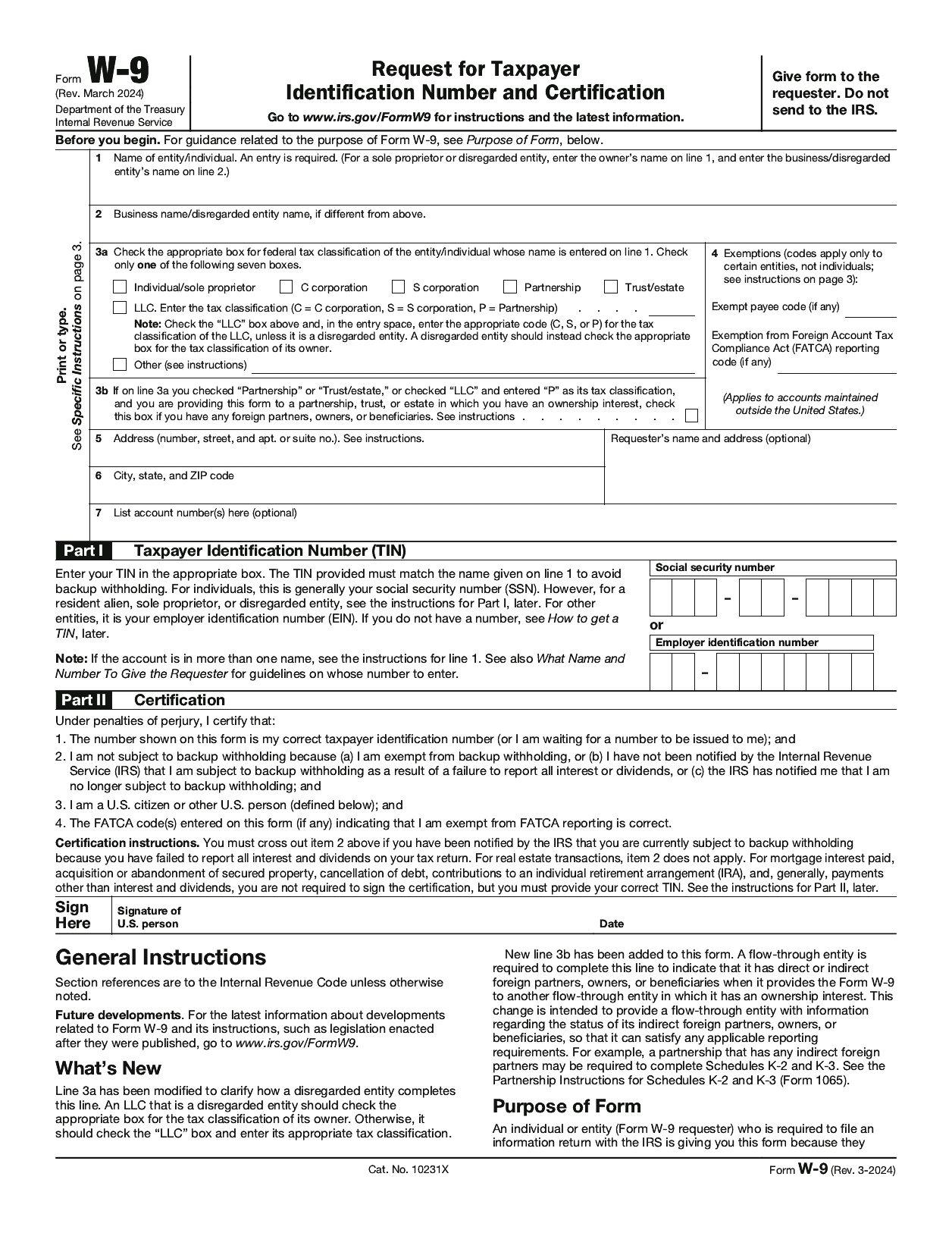

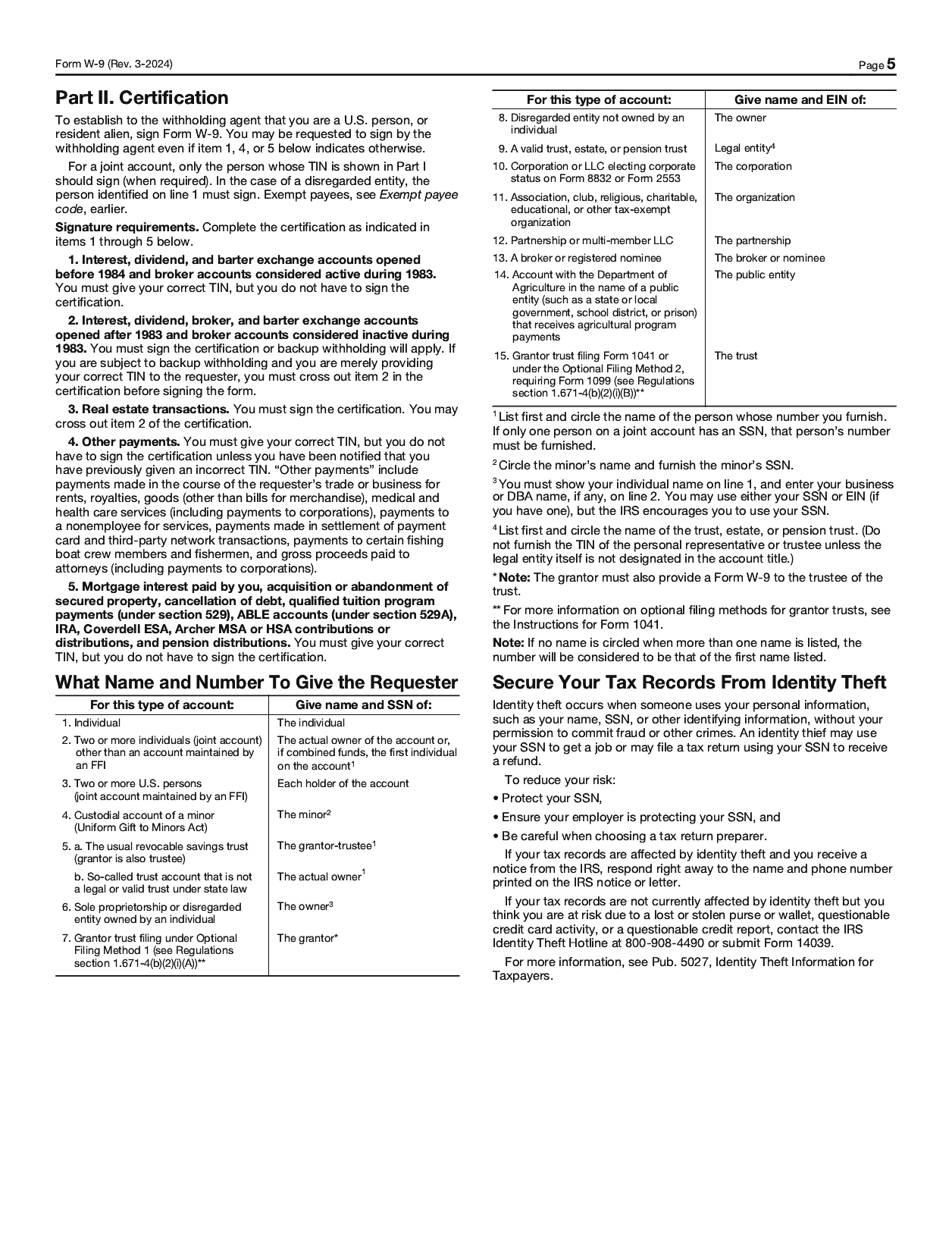

DELIVERY OF THIS LETTER OF TRANSMITTAL TO AN ADDRESS OTHER THAN AS SET FORTH ABOVE FOR THE DEPOSITARY WILL NOT CONSTITUTE A VALID DELIVERY. YOU MUST SIGN THIS LETTER OF TRANSMITTAL IN THE APPROPRIATE SPACE PROVIDED BELOW, WITH A SIGNATURE GUARANTEE, IF REQUIRED, AND COMPLETE THE IRS FORM W-9 SET FORTH BELOW, IF REQUIRED. PLEASE READ THE INSTRUCTIONS ACCOMPANYING THIS LETTER OF TRANSMITTAL CAREFULLY BEFORE COMPLETING THIS LETTER OF TRANSMITTAL.

NEITHER THE PURCHASER NOR QXO IS AWARE OF ANY JURISDICTION WHERE THE MAKING OF THE OFFER IS PROHIBITED BY ANY ADMINISTRATIVE OR JUDICIAL ACTION PURSUANT TO ANY VALID STATE STATUTE. IF WE BECOME AWARE OF ANY VALID STATE STATUTE PROHIBITING THE MAKING OF THE OFFER OR THE ACCEPTANCE OF THE SHARES PURSUANT THERETO, WE WILL MAKE A GOOD FAITH EFFORT TO COMPLY WITH THAT STATE STATUTE OR SEEK TO HAVE SUCH STATUTE DECLARED INAPPLICABLE TO THE OFFER. IF, AFTER A GOOD FAITH EFFORT, WE CANNOT CAUSE THE OFFER TO COMPLY WITH THE STATE STATUTE, WE WILL NOT MAKE THE OFFER TO THE HOLDERS OF SHARES IN THAT STATE. IN THOSE JURISDICTIONS WHERE APPLICABLE LAWS REQUIRE THE OFFER TO BE MADE BY A LICENSED BROKER OR DEALER, THE OFFER WILL BE DEEMED TO BE MADE ON BEHALF OF PURCHASER BY ONE OR MORE REGISTERED BROKERS OR DEALERS LICENSED UNDER THE LAWS OF SUCH JURISDICTION TO BE DESIGNATED BY PURCHASER.

THIS LETTER OF TRANSMITTAL AND THE INSTRUCTIONS ACCOMPANYING THIS LETTER OF TRANSMITTAL SHOULD BE READ CAREFULLY BEFORE THIS LETTER OF TRANSMITTAL IS COMPLETED.