Exhibit (e)(1)

Excerpts from Beacon Roofing Supply, Inc.’s Definitive Proxy Statement on Schedule 14A related to the 2024 Annual Meeting of Stockholders, as filed with the Securities and Exchange Commission on April 3, 2024.

|

STOCK OWNERSHIP |

The following table shows information regarding the beneficial ownership of our common stock for the following:

• Each stockholder known by us to beneficially own more than 5% of our common stock;

• Each of our directors;

• Each executive officer named in the Summary Compensation Table in “Executive Compensation;” and

• All directors and executive officers as a group.

|

Common stock |

|||||

|

Name and address of beneficial owners |

Shares |

Percent |

|||

|

Stockholders owning more than 5% of our common stock: |

|

||||

|

The Vanguard Group2 |

6,905,191 |

10.9 |

% |

||

|

100 Vanguard Boulevard |

|

||||

|

Malvern, PA 19355 |

|

||||

|

FMR, LLC3 |

6,462,547 |

10.2 |

% |

||

|

245 Summer Street |

|

||||

|

Boston, MA 02210 |

|

||||

|

BlackRock, Inc.4 |

4,711,466 |

7.4 |

% |

||

|

50 Hudson Yards |

|

||||

|

New York, NY 10001 |

|

||||

|

Dimensional Fund Advisors LP5 |

3,500,742 |

5.5 |

% |

||

|

6300 Bee Cave Road |

|

||||

|

Building One |

|

||||

|

Austin, TX 78746 |

|

||||

|

T. Rowe Price Investment Management, Inc.6 |

3,423,271 |

5.4 |

% |

||

|

101 E. Pratt Street |

|

||||

|

Baltimore, MD 21201 |

|

||||

|

Directors and named executive officers: |

|

||||

|

Julian G. Francis7 |

297,423 |

* |

|

||

|

Frank A. Lonegro |

55,160 |

* |

|

||

|

Jonathan S. Bennett8 |

12,270 |

* |

|

||

|

Jason L. Taylor9 |

41,198 |

* |

|

||

|

C. Munroe Best III10 |

122,081 |

* |

|

||

|

Barbara G. Fast11 |

15,442 |

* |

|

||

|

Richard W. Frost12 |

63,791 |

* |

|

||

|

Alan Gershenhorn13 |

23,107 |

* |

|

||

|

Melanie M. Hart14 |

3,095 |

* |

|

||

|

Racquel H. Mason15 |

2,408 |

* |

|

||

|

Robert M. McLaughlin16 |

31,777 |

* |

|

||

|

Earl Newsome, Jr.17 |

6,804 |

* |

|

||

|

Neil S. Novich18 |

43,612 |

* |

|

||

|

Stuart A. Randle19 |

39,281 |

* |

|

||

|

Douglas L. Young20 |

40,212 |

* |

|

||

|

All directors and executive officers as a group (20 persons)21: |

861,700 |

1.3 |

% |

||

____________

* Less than 1%.

1

1. Except as noted otherwise, information concerning beneficial ownership of shares is as of March 18, 2024, including the percentage of shares beneficially owned which is based on 63,575,857 shares of common stock outstanding as of March 18, 2024. Amounts include the number of shares beneficially owned as of that date, as well as the number of shares that such person has the right to acquire beneficial ownership of within 60 days thereafter. In addition, except as noted otherwise, all persons named as beneficial owners have sole voting power and sole investment power with respect to the shares indicated as beneficially owned.

2. Based on the share information for The Vanguard Group as of January 31, 2024, reported on Schedule 13G/A filed by it on February 12, 2024. The Vanguard Group reported sole voting power with respect to none of the shares, shared voting power with respect to 47,103 shares, sole dispositive power with respect to 6,795,498 shares and shared dispositive power with respect to 109,693 shares.

3. Based on the share information for FMR LLC reported on Schedule 13G/A filed by it on February 9, 2024. Abigail P. Johnson is a Director, the Chairman and the Chief Executive Officer of FMR LLC. Both of the foregoing are named as reporting persons in the Schedule 13G/A. FMR LLC reported sole voting power with respect to 6,454,217 shares and Ms. Johnson reported sole voting power with respect to none of the shares. FMR LLC and Ms. Johnson reported sole dispositive power with respect to 6,462,547 shares and shared voting and dispositive power with respect to none of the shares.

4. Based on the share information for BlackRock, Inc. as of December 31, 2023, reported on Schedule 13G/A filed by it on January 26, 2024. BlackRock, Inc. reported sole voting power with respect to 4,562,380 shares, sole dispositive power with respect to 4,711,466 shares and shared voting and dispositive power with respect to none of the shares.

5. Based on the share information for Dimensional Fund Advisors LP as of December 29, 2023, reported on Schedule 13G/A filed by it on February 9, 2024. Dimensional Fund Advisors LP reported sole voting power with respect to 3,422,179 shares, sole dispositive power with respect to 3,500,742 shares and shared voting and dispositive power with respect to none of the shares.

6. Based on the share information for T. Rowe Price Investment Management, Inc. as of December 31, 2023, reported on Schedule 13G filed by it on February 14, 2024. T. Rowe Price Investment Management, Inc. reported sole voting power with respect to 1,258,363 shares, sole dispositive power with respect to 3,423,271 shares and shared voting and dispositive power with respect to none of the shares.

7. Includes 197,337 shares issuable upon the exercise of vested stock options. Does not include 55,956 stock options, 40,518 restricted stock units with time-based vesting, or 81,036 restricted stock units with performance-based vesting, all of which were unvested and outstanding as of the record date.

8. Includes 5,855 shares issuable upon the exercise of vested stock options. Does not include 10,240 stock options, 20,313 restricted stock units with time-based vesting, or 22,109 restricted stock units with performance-based vesting, all of which were unvested and outstanding as of the record date.

9. Includes 28,862 shares issuable upon the exercise of vested stock options. Does not include 9,506 stock options, 6,731 restricted stock units with time-based vesting, or 21,842 restricted stock units with performance-based vesting, all of which were unvested and outstanding as of the record date.

10. Includes 53,701 shares issuable upon the exercise of vested stock options. Does not include 9,506 stock options, 6,731 restricted stock units with time-based vesting, or 21,842 restricted stock units with performance-based vesting, all of which were unvested and outstanding as of the record date.

11. Consists of 15,442 restricted stock units with time-based vesting, 2,053 of which vest within 60 days of the record date.

12. Includes 26,712 restricted stock units with time-based vesting, 2,053 of which vest within 60 days of the record date. Does not include 4,404 restricted stock units with time-based vesting that will not settle until six months after termination of service on the Board.

13. Includes 18,150 restricted stock units with time-based vesting, 2,053 of which vest within 60 days of the record date.

14. Consists of 3,095 restricted stock units with time-based vesting, 2,053 of which vest within 60 days of the record date.

15. Consists of 2,408 restricted stock units with time-based vesting that vest within 60 days of the record date.

16. Includes 7,821 restricted stock units with time-based vesting, 2,053 of which vest within 60 days of the record date.

17. Consists of 6,804 restricted stock units with time-based vesting, 2,053 of which vest within 60 days of the record date.

18. Includes 18,020 restricted stock units with time-based vesting, 2,053 of which vest within 60 days of the record date. Does not include 4,404 restricted stock units with time-based vesting that will not settle until six months after termination of service on the Board.

19. Includes 7,864 restricted stock units with time-based vesting, 2,053 of which vest within 60 days of the record date. Does not include 10,678 restricted stock units with time-based vesting that will not settle until six months after termination of service on the Board.

20. Includes 25,712 resstricted stock units with time-based vesting, 2,053 of which vest within 60 days of the record date.

21. Includes 348,674 shares that are issuable upon the exercise of vested stock options and 22,581 restricted stock units that vest within 60 days of the record date.

2

|

INFORMATION ON EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides detail on the Company’s compensation for our Chief Executive Officer, Chief Financial Officer, and the three other most highly compensated executive officers (collectively, our “NEOs”), including the overall objectives of our compensation program, each element of compensation provided, and an explanation of the reasons for the compensation decisions we have made for these individuals with respect to Fiscal Year 2023.

Our NEOs for Fiscal Year 2023 are:

• Julian G. Francis, our President and Chief Executive Officer;

• Frank A. Lonegro, our Former Executive Vice President and Chief Financial Officer;

• Jonathan S. Bennett, our Executive Vice President and Chief Commercial Officer;

• Jason L. Taylor, our President, West Division; and

• C. Munroe Best III, our President, South Division.

Subsequent to the end of Fiscal Year 2023, Mr. Lonegro voluntarily resigned from the Company, and forfeited his unvested equity awards and Fiscal Year 2023 annual cash incentive. Mr. Lonegro was not entitled to severance. On January 8, 2024, the Company appointed Carmelo Carrubba as the Company’s Interim Chief Financial Officer, effective as of January 20, 2024, until a permanent Chief Financial Officer has been appointed.

Overview

The responsibilities of our Compensation Committee are to review our compensation and benefit plans to ensure that they meet our objectives, recommend to the Board the annual compensation of our Chief Executive Officer, review our Chief Executive Officer’s recommendations on, and approve the compensation of, our other NEOs, and make recommendations for adopting and changing major compensation policies and practices. The Compensation Committee also administers and approves equity awards under our stock plan and administers and approves awards to our NEOs under our cash incentive plan.

Objectives and Summary of Compensation Program

Our compensation practices are intended to attract, motivate and retain high performing executives in a competitive marketplace as well as align such executives’ total compensation with the long-term interests of our stockholders and the attainment of our annual and long-term performance goals. The program provides our NEOs with compensation that is industry competitive, internally equitable and commensurate with their skills, knowledge, experience, results and responsibilities.

The compensation of our NEOs consists of base salary, annual cash incentives, long-term equity incentive compensation in the form of Company stock options and restricted stock unit awards, and certain perquisites such as an auto allowance and fuel reimbursement. The Company also provides its NEOs executive life insurance. From time to time, the Company will also pay for relocation expenses, including temporary housing, commuting airfare, automobile lease and related expenses associated with relocating executives.

For performance-based compensation, the annual cash incentive performance goals since fiscal year 2020 have been based on earnings before interest, income taxes, depreciation and amortization, stock-based compensation, acquisition costs, restructuring costs, and COVID-19 impacts (limited to costs directly related to our response to the COVID-19 pandemic)(“Adjusted EBITDA”), as further adjusted to exclude the financial results of acquisitions not completed at the time budgets are established (“AEBITDA”) and operating working capital as a percentage of net sales (“Operating Working Capital”), as well as an individual performance component. The long-term performance goals for Fiscal Year 2021 were based on the Company metrics of Adjusted Earnings Per Share (“Adjusted EPS”)

3

and average organic net sales growth. Adjusted EPS is calculated by dividing Adjusted Net Income (which is net income excluding acquisition costs, restructuring costs, COVID-19 impacts, less the tax impact of adjusting items) by the weighted-average diluted shares outstanding after assuming full conversion of the participating preferred stock and excluding the impact of any preferred stock dividends. Beginning in Fiscal Year 2022, we continued to base long-term performance goals on daily average organic net sales growth, but Adjusted EBITDA margin percent (“Adjusted EBITDA Margin %”), defined as Adjusted EBITDA as percent of fiscal year net sales, replaced Adjusted EPS.

Use of Consultants and Peer Group Data

The Company establishes executive compensation levels through evaluation of a comprehensive benchmarking analysis prepared every two years by Frederic W. Cook & Co., Inc. (“FW Cook”), an independent compensation consultant retained by the Compensation Committee. Although the Company does not use strict numeric benchmarking to establish individual executive compensation levels, the Company takes into account the 25th percentile, median, and 75th percentile level of compensation for similarly situated executives at the peer group companies used by the Compensation Committee to guide executive compensation decisions. Where direct comparisons are not available from the peer group, we utilize market-based executive pay survey data on similarly situated executives to help guide our decisions. Because job content, accountability, responsibility and performance criteria vary from one company to the next, our Compensation Committee uses the numerical benchmarking data and median levels of similarly situated executives’ information as a guideline in exercising its discretion in determining compensation for our NEOs.

In reviewing and determining executive compensation levels for Fiscal Year 2023, FW Cook utilized the Fiscal Year 2022 benchmarking analysis, adjusted to Fiscal Year 2023 based on current executive pay increase trends, from a peer group of distribution companies, most of which are of similar sales, earnings, market capitalization, number of employees, and complexity as the Company, in developing its recommendations for executive compensation to the Compensation Committee. Based on the review performed by FW Cook, and at its recommendation, the Compensation Committee utilized the following peer group in assessing our executive compensation for Fiscal Year 2023:

|

Applied Industrial Technologies Boise Cascade Company Builders FirstSource Fastenal Company GMS Henry Schein |

LKQ Corporation MRC Global MSC Industrial Direct Co., Inc. Owens & Minor Patterson Companies Pool Corporation |

Site One Landscape Supply Univar Solutions Veritiv Corporation Watsco W.W. Grainger, Inc. WESCO International |

The Compensation Committee used the peer group data as general guidance, together with other information such as general business trends, the competitiveness of the markets in which we operate, individual performance, and its own judgment in setting overall executive compensation. Also, the Compensation Committee considered the results of the then most recent stockholder advisory vote on our executive compensation held on February 18, 2022, at which over 98% of the votes cast supported the compensation of our NEOs. (Because our Compensation Committee typically establishes compensation early in the year, prior to our annual meeting, it reviews the previous year’s stockholder advisory vote when setting NEO compensation. Subsequently, at the Company’s 2023 Annual Meeting, our stockholders approved the Company’s NEO compensation, with over 99% of the votes cast being voted in favor.) Although the approval was advisory in nature, the Compensation Committee viewed the overwhelmingly positive response as confirmation that our stockholders generally believe that the pay of our NEOs is appropriately aligned with their performance and the performance of the Company as well as the interests of our stockholders.

The Compensation Committee considered various factors bearing upon FW Cook’s independence and determined that FW Cook is independent and that its engagement did not present any conflicts of interest. FW Cook provides no other services to the Company.

4

Base Salaries

The first element of our compensation program is base salary. Each year, our Board evaluates the performance of our Chief Executive Officer, and the Compensation Committee considers the Board’s evaluation in determining an appropriate overall compensation package for our Chief Executive Officer. The Compensation Committee recommends the salary of our Chief Executive Officer to the full Board in light of that evaluation and other factors described below. Base salaries of our NEOs other than the Chief Executive Officer are set annually by the Compensation Committee, taking into account the recommendations of the Chief Executive Officer.

The Compensation Committee considers a number of factors when evaluating our Chief Executive Officer’s recommendations regarding base salaries for our other NEOs. Periodically, the Compensation Committee reviews industry-specific compensation surveys that provide detailed information regarding the compensation practices of industry peers, competitors and companies of similar market value and revenue. The Compensation Committee also considers the compensation recommendations provided by FW Cook. Other information that the Compensation Committee deems relevant, such as general business trends, the competitiveness of the markets in which we operate and special circumstances also may be considered in its evaluation.

Based on such process, effective April 2, 2023, Mr. Francis’s base salary was increased by the Compensation Committee to $950,000 from $875,000. The Compensation Committee considered the following quantitative and qualitative factors in evaluating our Chief Executive Officer’s performance and setting his compensation: the Company’s performance and relative total stockholder return, the value of Mr. Francis’s leadership, the compensation plans of chief executive officers of comparable companies, and the recommendation of our independent compensation consultant.

The base salary of each other NEO is recommended by our Chief Executive Officer to the Compensation Committee after evaluating each NEO’s performance over the year in consideration of (i) the Company’s overall financial performance, (ii) the individual’s performance and contributions to the Company during the preceding year, (iii) industry and peer company compensation data and (iv) other relevant factors (for example, market conditions). The amounts for NEOs other than the Chief Executive Officer are set forth in the Summary Compensation Table under the heading “Salary.”

Annual Cash Incentives

The second element of our compensation program is an annual cash incentive. Annual cash incentives are a significant component of executive compensation, reflecting the Company’s belief that management’s contribution to long-term stockholder returns (via increasing stock price) comes from increasing current earnings and asset utilization and properly preparing the Company for future earnings growth. We believe these incentives play a key role in enabling us to attract, retain and motivate our employees.

For Fiscal Year 2023, under the terms of our annual cash incentive plan, a target incentive amount was set for each participant. Those amounts are set forth below in the Grants of Plan-Based Awards table under the heading “Estimated future payouts under non-equity incentive plan awards — Target.”

The incentives for our NEOs named in the Summary Compensation Table were based on the following: (i) 60% on an AEBITDA target with Messrs. Francis, Lonegro, and Bennett’s incentives based on a Company-wide target, Mr. Best’s incentive based on the South Division target and Mr. Taylor’s incentive based on the West Division target; (ii) 20% on a Company-wide Operating Working Capital target; and (iii) 20% on qualitative performance evaluations of strategic performance goals (“individual goals”). For Fiscal Year 2023, AEBITDA means net income (loss) excluding the impact of interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, acquisition costs and restructuring costs, as further adjusted to exclude the financial results of acquisitions not completed at the time budgets are established. AEBITDA is a non-GAAP financial measure that is equivalent to Adjusted EBITDA as reported in the Company’s periodic reports filed with the SEC and the Company’s earnings releases, as further adjusted to exclude the financial results of acquisitions not completed at the time budgets are established. The numerator in the Operating Working Capital calculation is defined as inventory plus accounts receivable less accounts payable. The Operating Working Capital calculation is based on thirteen (13)-month average Operating Working Capital divided by trailing twelve (12)-month net sales, as reported in the Company’s consolidated financial statements in the Form 10-K.

5

The following table shows potential payouts for each of the three targets at threshold, target and maximum, both as a percentage of the incentive related to the individual target and as a percentage of the total incentive:

|

AEBITDA (Weighted at 60% in the Annual Cash Incentive Plan) |

|

Achievement Level |

||||||

|

Threshold |

Target |

Maximum |

||||

|

Payout as Percentage of AEBITDA Target |

50% |

100% |

200% |

|||

|

Payout as Percentage of Total Incentive |

30% |

60% |

120% |

|||

|

Operating Working Capital (Weighted at 20% in the Annual Cash Incentive Plan) |

|

Achievement Level |

||||||

|

Threshold |

Target |

Maximum |

||||

|

Payout as Percentage of Operating Working Capital Target |

20% |

100% |

200% |

|||

|

Payout as Percentage of Total Incentive |

4% |

20% |

40% |

|||

|

Individual Goals (Weighted at 20% in the Annual Cash Incentive Plan) |

|

Achievement Level |

||||||

|

Threshold |

Target |

Maximum |

||||

|

Payout as Percentage of Individual Goals Target |

—% |

100% |

200% |

|||

|

Payout as Percentage of Total Incentive |

—% |

20% |

40% |

|||

Payouts between threshold achievement and target achievement and between target achievement and maximum achievement are adjusted on the basis of straight-line interpolation.

The Chair of the Compensation Committee, in consultation with our Board Chair and each other member of the Board, performs the individual goal evaluations of our Chief Executive Officer, and our Chief Executive Officer performs the individual goal evaluations of the remaining NEOs. In each case, the results are then presented to and discussed with the Compensation Committee and FW Cook, and in the case of the Chief Executive Officer, presented to and discussed with the Board.

For the Fiscal Year 2023 annual cash incentive plan, Beacon achieved a Company-wide AEBITDA of approximately $921.8 million compared to the established target of $885.5 million. For Fiscal Year 2023, the South Division achieved AEBITDA of $352.9 million compared to the established target of $364.2 million. For Fiscal Year 2023, the West Division achieved AEBITDA of $382.4 million compared to the established target of $344.8 million. For Fiscal Year 2023, the Company achieved an Operating Working Capital as a percent of trailing twelve (12)-month sales of 17.02%, compared to an established target of 17.59%, 57 bps better than target. Our Board established the Fiscal Year 2023 Company and division AEBITDA targets and the Operating Working Capital target as part of the Company’s budget and long-range planning process, which includes but is not limited to a review of historical and expected growth, profit margin and working capital management rates. The targets were set at the beginning of Fiscal Year 2023 and the Board believed at the time that it would require a high degree of execution of the business plan to attain these goals. Based on actual AEBITDA results, each participant with Company-wide responsibilities earned 136% of the AEBITDA portion of their target incentive and each participant with divisional responsibilities earned the percentage of the AEBITDA portion of their target incentive set forth in the table below. Based on the Company’s actual Operating Working Capital results, each participant earned 195% of the Operating Working Capital portion of his target incentive.

6

In addition to the duties and responsibilities associated with his executive position, each of our NEOs is assigned specific individual goals in order to qualify for part or all of the remaining 20% portion of his target incentive amount. If the goal objectives are exceeded, each NEO can receive an additional incentive. Total incentives earned for Fiscal Year 2023, including the executive’s achievement of individual goals, are described in the table below and are set forth in the Summary Compensation Table under the heading “Non-Equity Incentive Plan Compensation”.

|

Fiscal Year 2023 Annual Cash Incentive Payout (AIP) |

|

Name |

Financial Goals |

Individual Goals |

Total |

|||||||||||||||||||||||||||||||||

|

Target |

AEBITDA |

Operating Working Capital |

||||||||||||||||||||||||||||||||||

|

Weight |

Payout |

Payout |

Weight |

Payout |

Payout |

Weight |

Payout |

Payout |

Actual |

Payout |

||||||||||||||||||||||||||

|

Julian G. Francis |

$ |

1,092,500 |

60 |

% |

136 |

% |

$ |

893,381 |

20 |

% |

195 |

% |

$ |

426,075 |

20 |

% |

100 |

% |

$ |

218,500 |

$ |

1,537,956 |

141 |

% |

||||||||||||

|

Jonathan S. Bennett |

$ |

351,000 |

60 |

% |

136 |

% |

$ |

287,027 |

20 |

% |

195 |

% |

$ |

136,890 |

20 |

% |

130 |

% |

$ |

91,260 |

$ |

515,177 |

147 |

% |

||||||||||||

|

Jason L. Taylor |

$ |

356,250 |

60 |

% |

194 |

% |

$ |

414,483 |

20 |

% |

195 |

% |

$ |

138,938 |

20 |

% |

105 |

% |

$ |

74,813 |

$ |

628,233 |

176 |

% |

||||||||||||

|

C. Munroe Best III |

$ |

371,250 |

60 |

% |

81 |

% |

$ |

180,650 |

20 |

% |

195 |

% |

$ |

144,788 |

20 |

% |

95 |

% |

$ |

70,538 |

$ |

395,975 |

107 |

% |

||||||||||||

Mr. Lonegro’s Fiscal Year 2023 Target AIP was $476,000. Mr. Lonegro did not receive a Fiscal Year 2023 AIP payout due to his termination of employment on February 2, 2024, which was prior to the AIP payout date.

The individual goals for each NEO pursuant to our Fiscal Year 2023 annual cash incentive plan were as follows:

Mr. Francis’ specific individual goals were:

• continue to develop a higher level of company-wide safety commitment and awareness;

• drive the Company’s financial performance to deliver improved analyst ratings of the Company’s stock;

• execute the Ambition 2025 plan, including the development of processes and metrics to ensure best possible execution;

• lead the design and implementation of key operational leader development programs; and

• increase diversity representation in management training programs.

Mr. Lonegro’s specific individual goals were:

• drive the Company’s financial performance to deliver improved analyst ratings of the Company’s stock;

• lead the development of division finance leadership with increasing emphasis on sponsoring cross-functional company-wide finance initiatives;

• deliver on the Company’s return on capital and capital allocation objectives; and

• continuously advance the Company’s diversity, equity and safety programs.

Mr. Bennett’s specific individual goals were:

• improve gross margins by implementing a Company pricing model;

• deliver organic sales growth by continuing the implementation of customer experience initiative;

• build out commercial product line business model; and

• continuously advance the Company’s diversity, equity and safety programs.

Mr. Taylor’s specific individual goals were:

• increase inventory turns and working capital efficiency in division footprint;

• improve branch productivity and manufacturing partnerships;

7

• deliver on growth initiatives, including customer experience and acquisition strategies;

• develop key sales and operational leadership talent; and

• continuously advance the Company’s diversity, equity and safety programs.

Mr. Best’s specific individual goals were:

• deliver on organic growth initiatives, including greenfield, sales productivity and digital sales strategies;

• improve branch productivity and bottom quintile branch performance;

• develop key sales and operational leadership talent;

• increase inventory turns and working capital efficiency in division footprint; and

• continuously advance the Company’s diversity, equity and safety programs.

Each of the above NEO’s respective specific individual management objectives reflect our focus on continued growth and improvement in execution over our past performance. The Compensation Committee, led by Mr. Young, in consultation with Mr. Randle and each other member of our Board, reviewed the level of achievement of Mr. Francis’ specific individual management objectives set forth above. Mr. Francis reviewed the level of achievement of Messrs. Lonegro, Bennett, Best, and Taylor’s specific individual management objectives set forth above and reported his recommendations to the Compensation Committee. After careful consideration of the outcomes, the Compensation Committee recommended to the Board the payment of the incentive awards in the amounts set forth in the table above and in the Summary Compensation Table under the heading “Non-equity incentive plan compensation.”

In addition to the management annual cash incentive plan, the Compensation Committee retains full discretion to award discretionary bonuses to reward extraordinary efforts by our NEOs in various projects or initiatives during the year. The Compensation Committee considers the Chair’s and Chief Executive Officer’s recommendations in determining discretionary cash awards for our other NEOs. No discretionary cash awards were given for Fiscal Year 2023.

Long-Term Equity Incentive Compensation

The third element of our compensation program is long-term equity incentive compensation. Equity incentive compensation is intended to more closely align total compensation with the long-term financial interests of our stockholders. The equity incentive compensation component of our compensation program is based upon awards of stock options and other stock awards.

Our Compensation Committee administers our stock plan. The purpose of the stock plan is to advance the interests of our stockholders by aligning compensation to the long-term performance results of the Company by:

• providing directors, officers, employees and other eligible persons with additional incentives determined by the achievement of long-term financial and strategic objectives;

• encouraging stock ownership by eligible persons;

• aligning the interests of eligible persons with the interests of the Company;

• encouraging eligible persons to remain with the Company or its affiliates; and

• attracting new employees, officers and directors to the Company or its affiliates.

In determining whether to grant stock options and/or other stock awards, and, if so, how many to grant to eligible persons under our stock plan, each individual’s past performance and contribution to the Company is considered, as well as that individual’s expected ability to contribute to the Company in the future along with market data and the quantitative analysis of peer group company stock awards provided by FW Cook. These performance assessments are not intended to be rigid or formulaic, but rather to serve as the framework upon which the Chief Executive Officer evaluates the executive’s overall past performance and expected contributions.

8

The above evaluation provides the basis for the Chief Executive Officer’s recommendation to the Compensation Committee of equity incentive compensation for each NEO. The Compensation Committee meets with the Chief Executive Officer and discusses the Chief Executive Officer’s recommendations before meeting separately in executive session to discuss the Chief Executive Officer’s and FW Cook’s recommendations and making a final determination of the equity incentive compensation to the NEOs. The Compensation Committee applies similar factors in determining the equity incentive compensation to the Chief Executive Officer.

Since the Company’s initial public offering and through Fiscal Year 2023, non-qualified stock options have been granted to key members of management at an exercise price equal to the closing price of the Company’s common stock as reported by Nasdaq on the date of grant. Accordingly, grants of stock options will produce value only if there are increases in the underlying stock price. In fiscal year 2011, we began issuing performance-based restricted stock unit awards to certain key members of management. Beginning in fiscal year 2014, we also began issuing time-based restricted stock unit awards to certain key members of management. Similar to stock options, we believe that restricted stock unit awards reward performance because the value of the stock is linked to our Company’s long-term performance. The Compensation Committee believes that time-based and performance-based restricted stock unit awards can play an important retentive and motivational role that stock options alone may not.

The Company’s annual equity awards are typically granted by the Compensation Committee in March of each year following the close of the Company’s fiscal year and subsequent to the approval of the annual budget for the upcoming fiscal year. The Company typically does not make stock option and other stock awards other than annually, except in certain cases for key members of management hired during the course of a year or to improve the prospects of retaining key management members.

On March 1, 2023, the Compensation Committee authorized awards of stock options, time-based restricted stock units and annual performance-based restricted stock units. Awards were granted to our NEOs using the considerations described above, including target value recommendations from FW Cook, who reviewed peer group data and took into consideration the value of NEO equity awards in prior years. Of that target value, and pursuant to the guidelines approved by our Board, approximately 50% of the target value was represented by annual performance-based restricted stock units, approximately 25% in time-based restricted stock units and approximately 25% in stock options. Under this methodology, the awards to each of our NEOs were as follows:

|

Annual Long-Term Equity Incentive Awards |

|

# of Stock |

% of Total |

# of Time- |

# of Annual |

Total # of |

% of Total |

|||||||||

|

Julian G. Francis |

28,700 |

26 |

% |

14,067 |

28,135 |

42,202 |

11 |

% |

||||||

|

Frank A. Lonegro |

8,632 |

8 |

% |

4,231 |

8,462 |

12,693 |

3 |

% |

||||||

|

Jonathan S. Bennett |

5,297 |

5 |

% |

2,596 |

5,192 |

7,788 |

2 |

% |

||||||

|

Jason L. Taylor |

4,904 |

4 |

% |

2,404 |

4,808 |

7,212 |

2 |

% |

||||||

|

C. Munroe Best III |

4,904 |

4 |

% |

2,404 |

4,808 |

7,212 |

2 |

% |

||||||

See the table “Fiscal Year 2023 Grants of Plan-based Awards” under Executive Compensation for the grant date fair value of these awards.

As a result of Mr. Lonegro’s termination of employment on February 2, 2024, all his outstanding equity incentive awards were forfeited, including those described above.

The stock option awards granted to our NEOs had an exercise price of $65.00, vest one-third annually which starts on the first anniversary of the grant (March 1, 2024) and expire on the tenth anniversary of the date of grant, or March 1, 2033. The time-based restricted stock unit awards granted to our NEOs on March 1, 2023, will vest and convert into common shares upon the third anniversary of the date of grant.

The annual performance-based restricted stock unit awards granted to our NEOs will vest and convert after March 1, 2026, subject to the Company achieving certain Adjusted EBITDA Margin % and daily average organic net sales growth targets, each weighted at 50%, established on the grant date for the fiscal years ended December 31, 2023, 2024 and 2025 (each a “component year”).

9

The following table shows the percentage of the total of the award that can be earned for each metric for each component year of the three-year period, at threshold, target and maximum, as well as totals for each metric and combined totals for the three-year period:

|

Adjusted EBITDA Margin % Metric |

|

Component Year |

Threshold |

Target |

Maximum |

||||||

|

2023 |

3.33 |

% |

16.66 |

% |

33.33 |

% |

|||

|

2024 |

3.33 |

% |

16.66 |

% |

33.33 |

% |

|||

|

2025 |

3.33 |

% |

16.66 |

% |

33.33 |

% |

|||

|

Total |

10 |

% |

50 |

% |

100 |

% |

|||

|

Daily Average Organic Net Sales Growth Metric |

|

Component Year |

Threshold |

Target |

Maximum |

||||||

|

2023 |

3.33 |

% |

16.66 |

% |

33.33 |

% |

|||

|

2024 |

3.33 |

% |

16.66 |

% |

33.33 |

% |

|||

|

2025 |

3.33 |

% |

16.66 |

% |

33.33 |

% |

|||

|

Total |

10 |

% |

50 |

% |

100 |

% |

|||

|

Combined Total |

20 |

% |

100 |

% |

200 |

% |

|||

For the Adjusted EBITDA Margin % metric, achievement of a target between 80% and 100% and between 100% and 120% will be adjusted on the basis of straight-line interpolation. For the daily average organic net sales growth metric, achievement of a target between two percentage points below target and target, and between target and two percentage points above target, will be adjusted on the basis of straight-line interpolation.

On November 9, 2023, the annual performance-based restricted stock unit awards that were granted in Fiscal Year 2021 vested. The vesting was subject to the Company achieving certain Adjusted EPS and daily average organic net sales growth targets, each weighted at 50%, established on the grant date for the years ended September 30, 2021, 2022 and 2023 (each a “component year”). Performance of each metric was calculated at the end of the three-year period for each component year independently.

The following table shows the percentage of the total of the award that could be earned for each metric for each component year of the three-year period, at threshold, target and maximum, as well as totals for each metric and combined totals for the three-year period:

|

Adjusted EPS Metric |

|

Component Year |

Threshold |

Target |

Maximum |

||||||

|

2021 |

0 |

% |

16.66 |

% |

33.33 |

% |

|||

|

2022 |

0 |

% |

16.66 |

% |

33.33 |

% |

|||

|

2023 |

0 |

% |

16.66 |

% |

33.33 |

% |

|||

|

Total |

0 |

% |

50 |

% |

100 |

% |

|||

10

|

Daily Average Organic Net Sales Growth Metric |

|

Component Year |

Threshold |

Target |

Maximum |

||||||

|

2021 |

0 |

% |

16.66 |

% |

33.33 |

% |

|||

|

2022 |

0 |

% |

16.66 |

% |

33.33 |

% |

|||

|

2023 |

0 |

% |

16.66 |

% |

33.33 |

% |

|||

|

Total |

0 |

% |

50 |

% |

100 |

% |

|||

|

Combined Total |

0 |

% |

100 |

% |

200 |

% |

|||

For the Adjusted EPS metric, achievement of a target between 80% and 100% and between 100% and 120% could be adjusted on the basis of straight-line interpolation. For the daily average organic net sales growth metric, achievement of a target between two percentage points below target and target, and between target and two percentage points above target, could be adjusted on the basis of straight-line interpolation.

The Company achieved the actual performance for each metric in each component year as indicated below, which resulted in a payout of 190% for the Fiscal Year 2021 performance-based restricted stock unit award:

|

Fiscal Year Ending |

Year Ending |

Year Ending |

|||||||||||||||||||||||||||||||

|

Metric |

Target |

Actual |

Payout |

Target |

Actual |

Payout |

Target |

Actual |

Payout |

||||||||||||||||||||||||

|

Adjusted EPS |

$ |

2.34 |

|

$ |

4.61 |

|

33.3 |

% |

$ |

2.48 |

|

$ |

6.94 |

|

33.3 |

% |

$ |

2.79 |

|

$ |

6.66 |

|

33.3 |

% |

|||||||||

|

Daily Average Organic Net Sales Growth |

|

2.0 |

% |

|

12.7 |

% |

33.3 |

% |

|

2.0 |

% |

|

21.3 |

% |

33.3 |

% |

|

2.0 |

% |

|

2.8 |

% |

23.3 |

% |

|||||||||

|

Payout % for Component Year |

|

|

|

|

66.7 |

% |

|

|

|

|

66.7 |

% |

|

|

|

|

56.7 |

% |

|||||||||||||||

|

Total Payout % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

190.0 |

% |

|||||||||||||||||

In 2022, in connection with the Company’s Ambition 2025 strategic plan, and to further align executives and managers at various levels of the Company with long-term stockholder returns (a priority set forth in the Ambition 2025 strategic plan), the Compensation Committee authorized awards of performance-based restricted stock units (the “A25 Performance Stock Units”) to a substantial group of employees. The awards were made to fully align executives and managers at various levels of the Company with the initiatives implemented to achieve the Company’s long-term stockholder return goals set forth in the Ambition 2025 strategic plan. The awards were made under the Company’s Second Amended and Restated 2014 Stock Plan, and were in addition to the Company’s regularly scheduled annual long-term equity incentive awards made on the same date. The NEOs (other than the Chief Executive Officer who was not eligible for the program) received the amounts indicated below:

|

Name |

No. of A25 |

|

|

Frank A. Lonegro |

11,170 |

|

|

Jonathan S. Bennett |

9,320 |

|

|

Jason L. Taylor |

11,170 |

|

|

C. Munroe Best III |

11,170 |

No additional awards were made to NEOs in 2023.

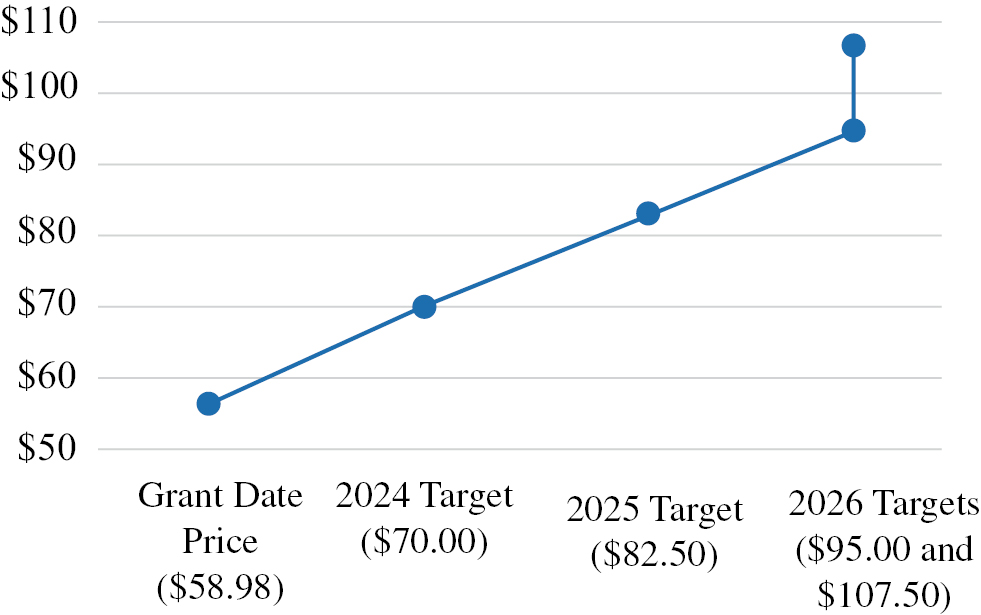

The A25 Performance Stock Unit awards vest into shares of the Company’s common stock and consist of four equal portions, with one portion relating to a performance period ending March 31, 2024, one portion relating to a performance period ending March 31, 2025 and two portions relating to performance periods ending March 31, 2026.

11

Each performance period has a stock price target, which must be met if that portion of the grant is to vest. The performance target for each performance period is the stock price to be achieved by performance period end if the yearly and overall Ambition 2025 financial objectives are met.

|

Performance period |

Portion of |

Stock price |

||||

|

Portion 1: March 10, 2022 – March 31, 2024 |

25 |

% |

$ |

70.00 |

||

|

Portion 2: March 10, 2022 – March 31, 2025 |

25 |

% |

$ |

82.50 |

||

|

Portion 3: March 10, 2022 – March 31, 2026 |

25 |

% |

$ |

95.00 |

||

|

Portion 4: March 10, 2022 – March 31, 2026 |

25 |

% |

$ |

107.50 |

||

Each performance period’s stock price target is considered met if the Company achieves a rolling 90-calendar-day average closing price of its common stock, on any date on or prior to the end of such performance period, equal to or greater than the stock price target with respect to such performance period, each as set forth above.

If stock price targets are met within the applicable performance period, the related portion of the award vests as follows:

• In the event a performance period stock price target is met, half of the performance stock units subject to such performance period shall vest immediately and the remaining half of the performance stock units subject to such performance period shall vest on March 31, 2026, subject to continued employment to that date, subject to limited exceptions.

On July 16, 2023, the performance period stock price target of $70.00 was met, resulting in the following units granted to NEOs vesting.

|

Name |

No. of A25 |

|

|

Frank A. Lonegro |

1,396 |

|

|

Jonathan S. Bennett |

1,165 |

|

|

Jason L. Taylor |

1,396 |

|

|

C. Munroe Best III |

1,396 |

An equal number of units will vest on March 31, 2026, subject to continued employment to that date. On January 30, 2024, subsequent to Fiscal Year 2023, the performance period stock price target of $82.50 was met, resulting in the same number of units listed in the table above vesting, with an equal number to vest on March 31, 2026, subject to continued employment to that date. As a result of Mr. Lonegro’s resignation on February 2, 2024, his remaining unvested units were forfeited.

12

Emphasis on Variable Pay

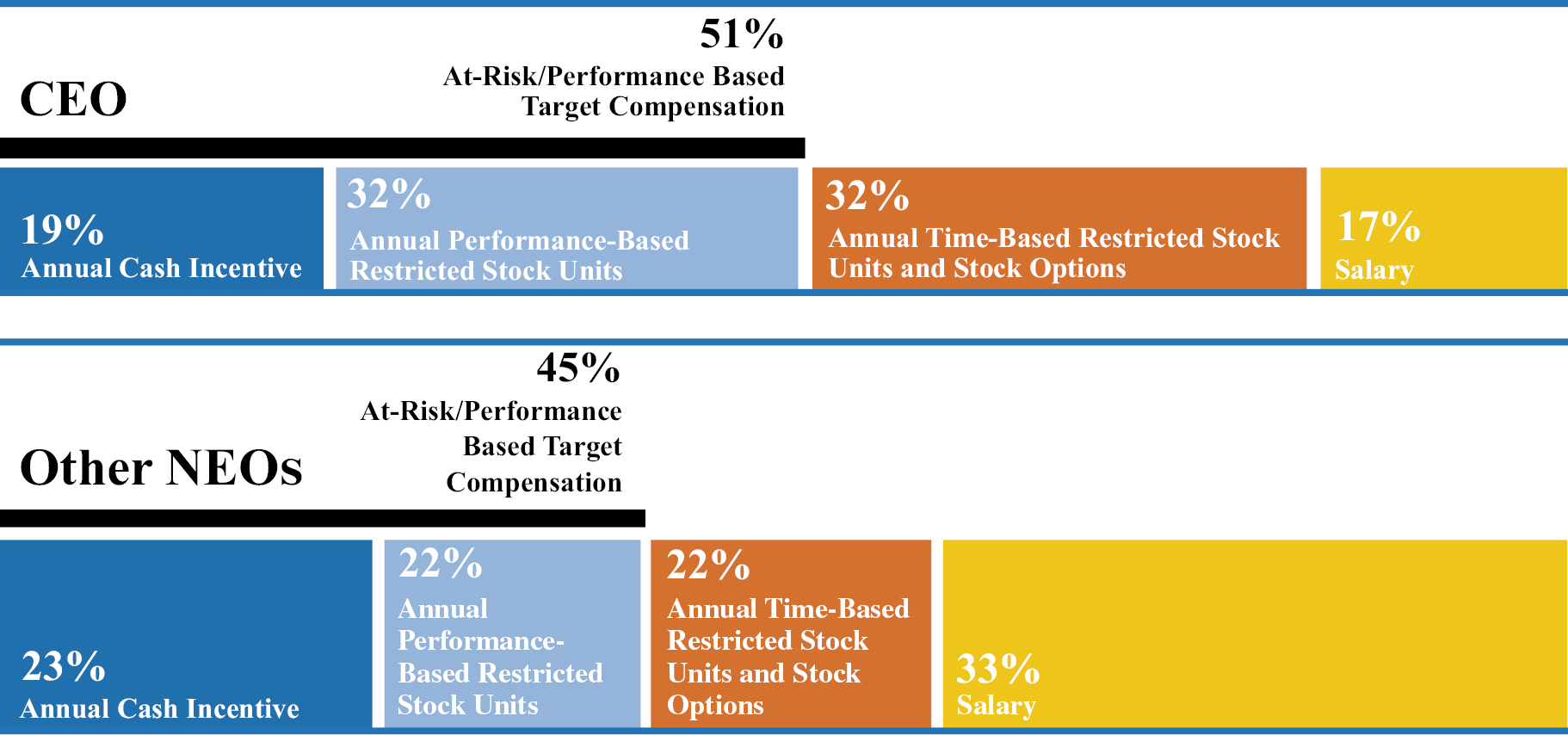

Approximately half of our Chief Executive Officer’s and our other NEOs’ target compensation is at-risk compensation directly contingent on performance. Actual annual cash incentives and the annual performance-based restricted stock unit awards (excluding the A25 Performance Stock Units) as described above are subject to the achievement of pre-established performance requirements and designed to align to stockholder value. Base salary and other fixed elements of compensation are essential to any compensation program and enable the recruitment and retention of top talent. However, we believe that variable compensation for our most senior executives should be a material component of target compensation for our NEOs. Our 2023 NEO compensation reflects this philosophy. The following charts illustrate the target pay mix for our Chief Executive Officer and other NEOs (as an average) for 2023:

Employment Agreements

Except for the Executive Severance and Restrictive Covenant Agreements described below under “Executive Compensation — Potential Payments upon Termination or Change-in-Control — Severance Agreements”, there are no other employment, severance or change-in-control agreements currently entered into by and between any NEOs and the Company.

Stock Ownership Guidelines

Our NEOs and members of our Executive Committee (consisting of divisional presidents and other senior leadership) are expected to own stock of the Company having a value set forth below:

• Chief Executive Officer = 5 times annual base salary

• NEOs and other members of the Executive Committee = 2 times annual base salary

As of March 18, 2024, our NEOs then employed by the Company held the following multiples of base salary (rounded to the nearest decimal):

|

Name |

Multiple of Base Salary |

|||

|

Current |

Guideline |

|||

|

Julian G. Francis |

24.1x |

5x |

||

|

Jonathan S. Bennett |

4.7x |

2x |

||

|

Jason L. Taylor |

7.0x |

2x |

||

|

C. Munroe Best III |

19.3x |

2x |

||

13

Until an executive obtains the required ownership level, executives are required to retain 50% of net profit shares attributable to stock option exercises or vesting of restricted stock units. Profit shares represent the shares remaining after payment of applicable tax obligations and, in the case of stock options, payment of the stock option exercise price. There is no defined time period to meet the stock ownership requirement. Participants may satisfy their ownership guidelines with (i) shares directly owned, (ii) time-based restricted stock units (which settle in stock), whether vested or unvested and (iii) “in-the-money” value of vested stock options, based upon the spread between the exercise price and the current stock price. Unvested stock options and unearned performance based restricted stock units are not counted.

In addition, pursuant to the Company’s Insider Trading Policy (available on the “Investor Relations” page at www.becn.com), Company directors, officers, employees and members of their households may not enter into hedging transactions or similar arrangements with respect to Company securities, including forward sale or purchase contracts, equity swaps or collars, nor may they hold Company securities in a margin account or pledge Company stock as collateral for a loan.

Retirement and Executive Life Insurance Plans

The Company sponsors the Beacon 401(k) Plan, a tax-qualified defined contribution plan which covers substantially all of our U.S. employees, including our NEOs. We currently provide a match of 50% of participants’ before-tax contributions up to 3% of eligible compensation. During Fiscal Year 2023, each of the NEOs was eligible to participate in the Beacon 401(k) Plan, and if participating in the plan, the eligible NEO received a matching contribution in accordance with plan rules. Additional annual profit-sharing contributions may be made at the discretion of the Board but were not made for Fiscal Year 2023.

Our NEOs do not participate in any special or separate executive retirement plans. We consider the Beacon 401(k) Plan to be an important factor in our ability to hire, retain and motivate our employees by providing an added measure of financial security for our employees.

The Company provides an executive life insurance benefits program for the NEOs and other key executives. The program provides life insurance at a coverage level of three times (3x) base salary up to $2.0 million. The Company subsidizes the required premium payments for each employee.

Deferred Compensation Plan

Effective February 16, 2023, Beacon established the Beacon Roofing Supply, Inc. Deferred Compensation Plan. The plan is an unfunded, unsecured non-qualified deferred compensation plan that allows participants to defer cash compensation in a manner intended to comply with Section 409A of the Internal Revenue Code of 1986. NEOs, members of the Executive Committee, and other employees with a job title of Vice President or above and members of the Board of Directors are eligible to participate.

Employee participants may elect to defer up to 50% of their annual base pay and 100% of their annual cash incentive plan payout. Board members may elect to defer up to 100% of their director annual retainer and fees. The Company will make a restorative retirement plan company match (i.e., payment of the company matching contribution that could not be made under the Beacon 401(k) Plan due to participation in this plan). Amounts credited to a participant’s account will be invested in one or more investment funds chosen by the participant and held in a grantor trust held by the Company. The investment funds are the same investment alternatives available under the Beacon 401(k) Plan. Although the amounts in the trust are invested pursuant to participants’ direction, the participants have no right to the funds other than as general creditors of the Company. Participants will be fully vested at all times in their elective deferrals.

Distributions under the plan upon separation from service will be paid in a lump sum or in up to ten annual installments, depending upon the type of separation and prior election by the participant. A participant may also elect an in-service distribution of his or her account to occur on a fixed date, subject to a minimum three-year waiting period, either in a lump sum or in up to five annual installments, subject to earlier distribution due to a separation from service. All distributions are paid in cash.

14

Perquisites

We have no formal perquisites program. Personal benefits may be provided from time to time when we determine that such personal benefits are a useful part of an executive’s compensation package. Specifically, we have agreed to provide each of the NEOs with a monthly auto allowance of $1,000 and reimbursement of their auto fuel costs and other driving expenses. Further, we lease a fractional share of a private aircraft to allow our executive officers to efficiently and safely travel for business purposes. Particularly in light of Beacon’s large retail footprint with many locations not accessible by commercial airlines, the private aircraft provides a confidential and productive environment to conduct business. The private aircraft is not used for any personal travel.

Tax Deductibility of Compensation

Section 162(m) of the Internal Revenue Code as in effect for fiscal years prior to 2018 limited the deductibility of executive compensation paid to the chief executive officer and to each of the three other most highly compensated officers of a public company (other than the chief financial officer) who are NEOs to $1 million per year. However, compensation that was considered qualified “performance-based compensation” generally did not count toward the $1 million deduction limit.

The Tax Cuts and Jobs Act of 2017 amended Section 162(m) to cover a public company’s chief financial officer and eliminated the performance-based exception. Accordingly, the Company’s grants of stock options, performance-based restricted stock units and annual cash incentive payments made for fiscal year 2018 and later years no longer qualify for this exception. Under a transition rule, outstanding stock options and performance-based restricted stock units will not be subject to Section 162(m) as amended to the extent such compensation is considered paid pursuant to a binding written contract in effect as of November 2, 2017. There are no outstanding performance-based restricted stock unit awards subject to the Section 162(m) transition rule.

The Compensation Committee takes into consideration the potential deductibility of the compensation as one of the factors to be considered when establishing our executive compensation program. However, the Compensation Committee believes that its primary responsibility is to provide a compensation program that attracts, retains, and rewards our executive officers that are critical to our success. Following the Tax Cuts and Jobs Act, the Compensation Committee may continue to consider tax deductibility as a factor in determining executive compensation but may not structure its compensation arrangements around tax deductibility. The Compensation Committee will continue to monitor the effect of tax reform on our executive compensation program.

Incentive Compensation Recoupment Policy

In the event of (i) a financial restatement or (ii) misconduct by a NEO, an officer who is a member of our Executive Committee, or an officer who is deemed to be subject to Section 16 of the Exchange Act, the Compensation Committee will review all incentive compensation paid, awarded or granted on or after January 1, 2022 to the involved officer. The Compensation Committee (with the assistance of independent counsel in the case of misconduct) can recommend that a decision be made by the non-employee members of the Board to recoup from the officer all or a portion of the following incentive compensation:

• Incentive Plan: The Compensation Committee can recommend that the non-employee members of the Board (i) cancel and forfeit the officer’s annual cash incentive opportunity for the then current plan year, and/or (ii) require repayment of any annual cash incentive awards previously paid for prior years within the recoupment period described below.

• Equity: The Compensation Committee can recommend that the non-employee members of the Board (i) cancel and forfeit any outstanding equity awards, (ii) require the officer to return a number of shares of Company stock received upon vesting and settlement of any restricted stock unit awards during the recoupment period described below (or pay the cash value of such shares), and (iii) require the officer to return a number of shares received upon the exercise of any stock options during the recoupment period described below (or pay the cash value of such shares).

• The Compensation Committee may recommend recoupment to the Board for incentive compensation that is paid, vested or awarded to the officer within 36 months preceding the date the Company determines the restatement obligation or the officer’s misconduct.

15

• For incentive compensation paid, awarded or granted on or after January 1, 2017 and before January 1, 2022, the Compensation Committee may also recoup incentive compensation under our prior policy, but only in the event of a financial restatement resulting from misconduct.

A restatement means an accounting restatement prepared by the Company to correct noncompliance by the Company with any financial reporting requirement under the securities laws, including any accounting restatement to correct an error in previously issued Company financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period.

All NEOs and members of the Executive Committee have agreed to the terms of this policy.

In connection with the adoption of the new SEC “clawback” rule, as implemented by Nasdaq Stock Market Rule 5608, we have added the following mandatory provisions to the incentive recoupment policy to apply to executive officers (which for these purposes are our Section 16 officers) with respect to incentive-based compensation received on or after October 2, 2023.

In the event that the Company has determined to prepare a restatement, the Company must recover, as promptly as reasonably practicable, during the recovery period described in the next sentence, from any person who served as an executive officer at any time during the performance period for that Financial Measure-Based Incentive Compensation (as defined below), the Erroneously Awarded Financial Measure-Based Incentive Compensation (as defined below) received by such person after the date such person began service as an executive officer, even if such person is no longer an executive officer or employed by the Company. The Company must reasonably promptly recover Erroneously Awarded Financial Measure-Based Compensation received by executive officers during the three completed fiscal years immediately preceding the date that the Company is required to prepare a restatement, and any transition period (that results from a change in the Company’s fiscal year) of less than nine months within or immediately following those three completed fiscal years.

“Erroneously Awarded Financial Measure-Based Incentive Compensation” means the amount of Financial Measure-Based Incentive Compensation received that exceeds the amount of Financial Measure-Based Incentive Compensation that otherwise would have been received had it been determined based on the restated financial results from a restatement, and must be computed without regard to any employee taxes paid.

“Financial Measure-Based Incentive Compensation” means any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure.

“Financial Reporting Measures” mean those measures that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and any measures that are derived wholly or in part from such measures. Stock price and relative total shareholder return are also Financial Reporting Measures.

16

Executive Compensation

The following table sets forth all compensation earned during Fiscal Years 2023 and 2022, the Transition Quarter and Fiscal Year 2021, by each person who served as our Chief Executive Officer and our Chief Financial Officer during Fiscal Year 2023, and by our three other most highly compensated executive officers who were serving as executive officers at the end of Fiscal Year 2023, collectively referred to as our named executive officers or NEOs:

|

SUMMARY COMPENSATION TABLE |

|

Name and principal |

Fiscal |

Salary |

Bonus1 |

Stock |

Option |

Non-equity |

All other |

Total |

|||||||||||||||

|

Julian G. Francis |

2023 |

$ |

929,808 |

$ |

— |

$ |

2,743,130 |

$ |

914,382 |

$ |

1,537,956 |

$ |

29,670 |

$ |

6,154,945 |

||||||||

|

President and Chief Executive Officer |

2022 |

|

858,846 |

|

— |

|

2,459,289 |

|

819,760 |

|

1,748,359 |

|

28,870 |

|

5,915,125 |

||||||||

|

Transition |

|

219,423 |

|

— |

|

— |

|

— |

|

— |

|

10,065 |

|

229,488 |

|||||||||

|

2021 |

|

810,673 |

|

— |

|

2,287,523 |

|

762,506 |

|

1,705,795 |

|

95,421 |

|

5,661,918 |

|||||||||

|

Frank A. Lonegro |

2023 |

$ |

590,962 |

$ |

— |

$ |

825,045 |

$ |

275,016 |

$ |

— |

$ |

33,525 |

$ |

1,724,547 |

||||||||

|

Former Executive Vice President and Chief Financial Officer |

2022 |

|

574,885 |

|

— |

|

1,294,098 |

|

265,006 |

|

829,400 |

|

328,495 |

|

3,291,884 |

||||||||

|

Transition Quarter |

|

151,038 |

|

— |

|

— |

|

— |

|

— |

|

73,431 |

|

224,470 |

|||||||||

|

2021 |

|

557,827 |

|

— |

|

757,498 |

|

252,498 |

|

825,792 |

|

29,078 |

|

2,422,693 |

|||||||||

|

Jonathan S. Bennett |

2023 |

$ |

580,962 |

$ |

187,500 |

$ |

506,220 |

$ |

168,762 |

$ |

515,177 |

$ |

26,594 |

$ |

1,985,215 |

||||||||

|

Executive Vice Presidentand Chief Commercial Officer |

2022 |

|

567,308 |

|

187,500 |

|

903,911 |

|

162,490 |

|

594,225 |

|

25,034 |

|

2,440,468 |

||||||||

|

Transition Quarter |

|

150,769 |

|

— |

|

— |

|

— |

|

— |

|

4,911 |

|

155,680 |

|||||||||

|

2021 |

|

170,154 |

|

|

1,200,025 |

|

|

201,031 |

|

3,692 |

|

1,574,903 |

|||||||||||

|

Jason L. Taylor |

2023 |

$ |

466,923 |

$ |

— |

$ |

468,780 |

$ |

156,241 |

$ |

628,233 |

$ |

25,002 |

$ |

1,745,178 |

||||||||

|

President, West Division |

2022 |

|

432,885 |

|

— |

|

874,102 |

|

125,006 |

|

579,891 |

|

29,763 |

|

2,041,646 |

||||||||

|

Transition Quarter |

|

107,692 |

|

— |

|

— |

|

— |

|

— |

|

93,432 |

|

201,125 |

|||||||||

|

2021 |

|

395,385 |

|

25,000 |

|

224,985 |

|

75,006 |

|

432,000 |

|

259,034 |

|

1,411,409 |

|||||||||

|

C. Munroe Best III |

2023 |

$ |

490,962 |

$ |

— |

$ |

468,780 |

$ |

156,241 |

$ |

395,975 |

$ |

26,466 |

$ |

1,538,423 |

||||||||

|

President, South Division |

2022 |

|

474,975 |

|

— |

|

874,102 |

|

125,006 |

|

625,500 |

|

27,754 |

|

2,127,337 |

||||||||

|

Transition Quarter |

|

124,206 |

|

— |

|

— |

|

— |

|

— |

|

7,925 |

|

132,130 |

|||||||||

|

2021 |

|

457,460 |

|

— |

|

337,477 |

|

112,493 |

|

498,243 |

|

24,400 |

|

1,430,073 |

|||||||||

____________

1. For Fiscal Years 2023 and 2022, for Mr. Bennett, these amounts constitute a new hire cash award paid in two equal installments 12 months and 24 months after his hire date. For Fiscal Year 2021, for Mr. Taylor, amount constitutes a retention award.

2. These amounts represent the estimated grant date fair value of time-based and performance-based restricted stock unit awards, in each case computed in accordance with FASB ASC Topic 718. In the case of the performance-based restricted stock units, this value is based on the probable outcome of the performance conditions as of the grant date for the annual performance-based awards. Market conditions are incorporated into the grant date fair value of the management awards with market conditions (the A25 Performance Stock Unit Awards, which were issued to the NEOs in 2022 only) using a Monte Carlo valuation model. The performance-based awards are recognized by the Company as share-based compensation expense over a three-year period. Compensation expense for management awards with market conditions is recognized over the service period. Assuming the annual performance-based restricted stock units vest at the maximum level, which is 200% of the target, the grant date values of Fiscal Year 2023 performance-based restricted stock units plus the grant date values of Fiscal Year 2023 time-based restricted stock units would be as follows: Mr. Francis — $4,571,905; Mr. Lonegro — $1,375,075; Mr. Bennett — $843,700; Mr. Taylor — $781,300; and Mr. Best — $781,300. For additional information regarding assumptions underlying the valuation of stock awards, please refer to Notes 2 and 7 of our audited financial statements included in our Annual Report on Form 10-K for Fiscal Year 2023.

3. These amounts represent the grant date fair value of the stock options computed in accordance with FASB ASC Topic 718. They are recognized by the Company as share-based compensation expense over the three-year vesting period. For additional information, please refer to Notes 2 and 7 of our audited financial statements included in our Annual Report on Form 10-K for Fiscal Year 2023.

4. These amounts represent the annual cash incentives that were paid during the first quarter of the following fiscal year.

17

5. For Fiscal Year 2023, these figures include the following:

|

Name and principal position |

401(k) Plan |

Executive Life |

Auto-Related |

Relocation |

Total |

||||||||||

|

Julian G. Francis |

$ |

9,900 |

$ |

7,161 |

$ |

12,608 |

$ |

— |

$ |

29,670 |

|||||

|

Frank A. Lonegro |

$ |

9,900 |

$ |

4,983 |

$ |

12,000 |

$ |

6,642 |

$ |

33,525 |

|||||

|

Jonathan S. Bennett |

$ |

9,900 |

$ |

4,694 |

$ |

12,000 |

$ |

— |

$ |

26,594 |

|||||

|

Jason L. Taylor |

$ |

9,900 |

$ |

3,102 |

$ |

12,000 |

$ |

— |

$ |

25,002 |

|||||

|

C. Munroe Best III |

$ |

9,900 |

$ |

3,276 |

$ |

13,290 |

$ |

— |

$ |

26,466 |

|||||

____________

(a) Includes auto allowance, auto fuel cost reimbursement and other driving expenses. (b) Includes a tax gross-up for Mr. Lonegro of $2,996.

(b) Includes a tax gross-up for Mr. Lonegro of $2,996.

The following table sets forth the individual grants of plan-based awards to the NEOs during Fiscal Year 2023:

|

FISCAL YEAR 2023 GRANTS OF PLAN-BASED AWARDS |

|

Name |

Grant |

|

|

All other |

All other |

Exercise |

Grant |

||||||||||||||||||||

|

Threshold |

Target |

Maximum |

Threshold |

Target |

Maximum |

||||||||||||||||||||||

|

Julian G. Francis |

$ |

371,450 |

$ |

1,092,500 |

$ |

2,185,000 |

|

|

|||||||||||||||||||

|

3/1/2023 |

|

|

|

28,700 |

$ |

65.00 |

$ |

914,382 |

|||||||||||||||||||

|

3/1/2023 |

|

|

|

5,627 |

28,135 |

56,270 |

|

$ |

1,828,775 |

||||||||||||||||||

|

3/1/2023 |

|

|

|

14,067 |

|

$ |

914,355 |

||||||||||||||||||||

|

Frank A. Lonegro6 |

$ |

161,840 |

$ |

476,000 |

$ |

952,000 |

|

|

|||||||||||||||||||

|

3/1/2023 |

|

|

|

8,632 |

$ |

65.00 |

$ |

275,016 |

|||||||||||||||||||

|

3/1/2023 |

|

|

|

1,692 |

8,462 |

16,924 |

|

$ |

550,030 |

||||||||||||||||||

|

3/1/2023 |

|

|

|

4,231 |

|

$ |

275,015 |

||||||||||||||||||||

|

Jonathan S. Bennett |

$ |

119,340 |

$ |

351,000 |

$ |

702,000 |

|

|

|||||||||||||||||||

|

3/1/2023 |

|

|

|

5,297 |

$ |

65.00 |

$ |

168,762 |

|||||||||||||||||||

|

3/1/2023 |

|

|

|

1,038 |

5,192 |

10,384 |

|

$ |

337,480 |

||||||||||||||||||

|

3/1/2023 |

|

|

|

2,596 |

|

$ |

168,740 |

||||||||||||||||||||

|

Jason L. Taylor |

$ |

121,125 |

$ |

356,250 |

$ |

712,500 |

|

|

|||||||||||||||||||

|

3/1/2023 |

|

|

|

4,904 |

$ |

65.00 |

$ |

156,241 |

|||||||||||||||||||

|

3/1/2023 |

|

|

|

962 |

4,808 |

9,616 |

|

$ |

312,520 |

||||||||||||||||||

|

3/1/2023 |

|

|

|

2,404 |

|

$ |

156,260 |

||||||||||||||||||||

|

C. Munroe Best III |

$ |

126,225 |

$ |

371,250 |

$ |

742,500 |

|

|

|||||||||||||||||||

|

3/1/2023 |

|

|

|

4,904 |

$ |

65.00 |

$ |

156,241 |

|||||||||||||||||||

|

3/1/2023 |

|

|

|

962 |

4,808 |

9,616 |

|

$ |

312,520 |

||||||||||||||||||

|

3/1/2023 |

|

|

|

2,404 |

|

$ |

156,260 |

||||||||||||||||||||

____________

1. These non-equity incentive plan awards were based on AEBITDA (with Messrs. Francis, Lonegro and Bennett’s incentives based on a Company-wide target and Messrs. Taylor and Best’s incentives based on their respective division targets), Operating Working Capital, and individual performance. See Compensation Discussion and Analysis under the heading “Annual Cash Incentives.”

2. The restricted stock units vest and convert into common shares, subject to the Company achieving certain Adjusted EBITDA margin percentages and average organic net sales growth targets, each weighted at 50%, for the fiscal years 2023, 2024 and 2025, and the units can vest at a percentage equal to 0% to 200% of the target. See Compensation Discussion and Analysis under the heading “Long-Term Equity Incentive Compensation.”

3. These time-based restricted stock units will vest and convert into common shares upon the third anniversary of the grant date. See Compensation Discussion and Analysis under the heading “Long-Term Equity Incentive Compensation.”

4. These stock options vest (become exercisable) in three annual installments on the first, second and third anniversaries of the grant date, and expire ten years from the date of grant. See Compensation Discussion and Analysis under the heading “Long-Term Equity Incentive Compensation.”

5. These amounts represent the grant date fair value of stock options and restricted stock units awarded to the NEOs in Fiscal Year 2023, computed in accordance with FASB ASC Topic 718. Assumptions used in calculating these amounts are included in Notes 2 and 7 of our audited financial statements included in our Annual Report on Form 10-K for Fiscal Year 2023.

6. All awards listed in this table for Mr. Lonegro were forfeited upon his resignation on February 2, 2024.

18

The following table sets forth the details of all of the outstanding equity awards of the NEOs as of December 31, 2023:

|

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END |

|

Option Awards1 |

Stock Awards |

||||||||||||||||||

|

Name |

Grant date |

Number of |

Number of |

Option |

Option |

Number of |

Market |

Equity |

Equity |

||||||||||

|

Julian G. Francis |

8/22/2019 |

62,984 |

$ |

31.16 |

8/22/2029 |

||||||||||||||

|

11/12/2019 |

54,545 |

$ |

33.47 |

11/12/2029 |

|||||||||||||||

|

11/12/2020 |

49,610 |

$ |

35.78 |

11/12/2030 |

|||||||||||||||

|

3/10/2022 |

10,315 |

20,631 |

$ |

58.98 |

3/10/2032 |

||||||||||||||

|

3/10/2022 |

|

27,798 |

2,418,982 |

||||||||||||||||

|

3/10/2022 |

|

13,899 |

1,209,491 |

||||||||||||||||

|

3/1/2023 |

28,700 |

$ |