2025 Fourth Quarter Earnings Conference Call January 27, 2026

Forward Looking Statements & Additional Disclosures Some statements in this news release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements preceded by, followed by or that include the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” and similar expressions. With respect to any such forward-looking statements, Hope Bancorp claims the protection provided for in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. Hope Bancorp’s actual results, performance or achievements may differ significantly from the results, performance or achievements expressed or implied in any forward-looking statements. With the consummation of the acquisition of Territorial Bancorp, factors that may cause actual outcomes to differ from what is expressed or forecasted in these forward-looking statements include, among things: difficulties and delays in integrating Hope Bancorp and Territorial Bancorp and achieving anticipated synergies, cost savings and other benefits from the transaction; higher than anticipated transaction costs; and deposit attrition, operating costs, customer loss and business disruption following the acquisition, including difficulties in maintaining relationships with employees and customers, may be greater than expected. Other risks and uncertainties include, but are not limited to: possible renewed deterioration in economic conditions in Hope Bancorp’s areas of operation or elsewhere; interest rate risk associated with volatile interest rates and related asset-liability matching risk; liquidity risks; risk of significant non-earning assets, and net credit losses that could occur, particularly in times of weak economic conditions or times of rising interest rates; the failure of or changes to assumptions and estimates underlying Hope Bancorp’s allowances for credit losses; potential increases in deposit insurance assessments and regulatory risks associated with current and future regulations; the outcome of any legal proceedings that may be instituted against Hope Bancorp; the impact of U.S. and global trade policies and tensions, including changes in, or the imposition of, tariffs and/or trade barriers and the economic impacts, volatility and uncertainty resulting therefrom, and geopolitical instability; and risks from natural disasters. For additional information concerning these and other risk factors, see Hope Bancorp’s most recent Annual Report on Form 10-K and other documents Hope Bancorp files with the SEC from time to time. Hope Bancorp does not undertake, and specifically disclaims any obligation, to update any forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law. 2

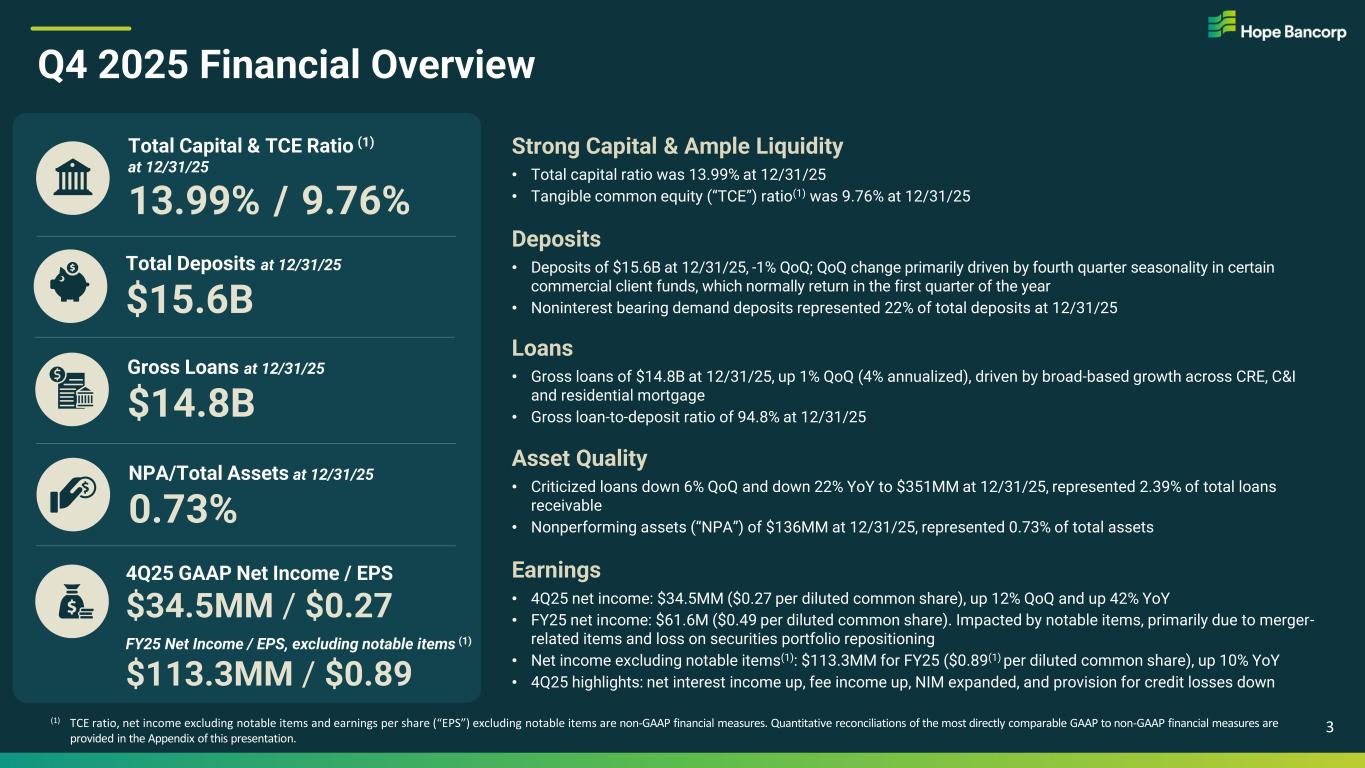

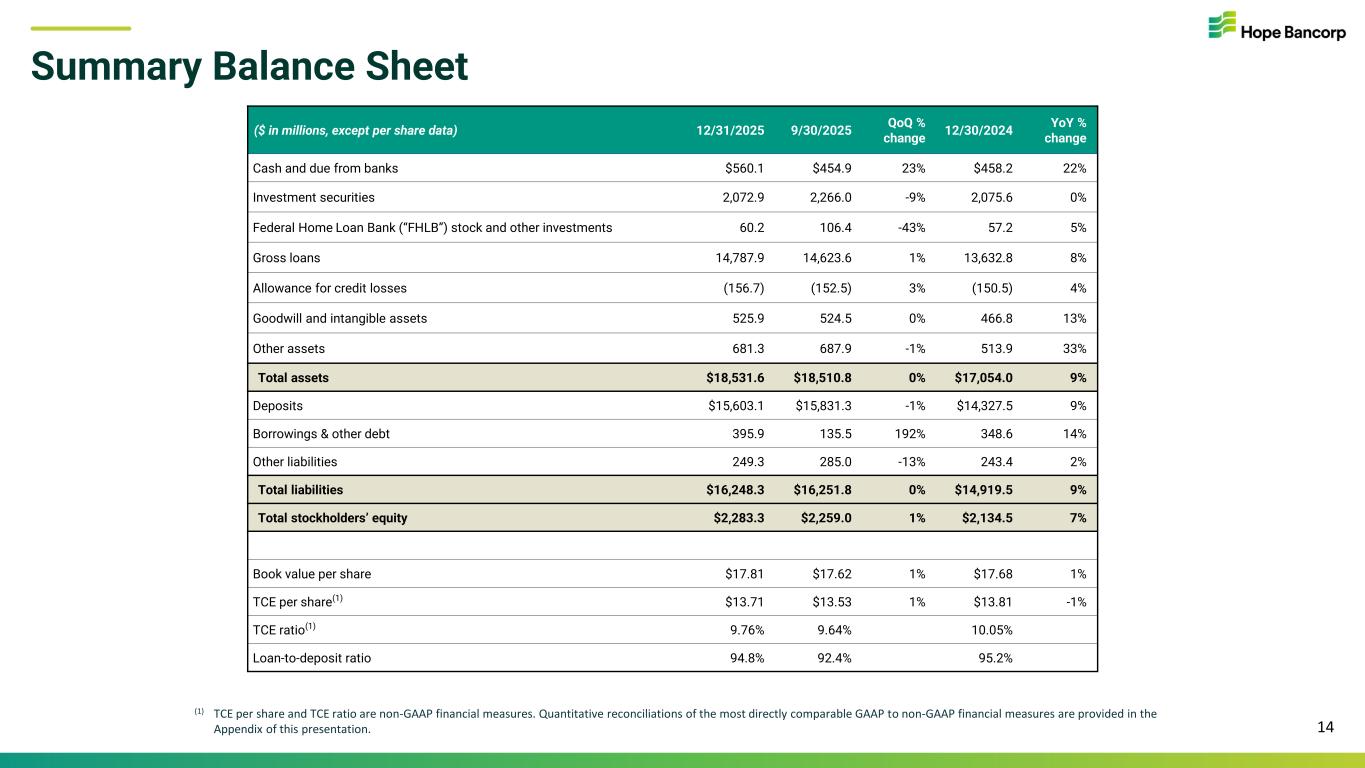

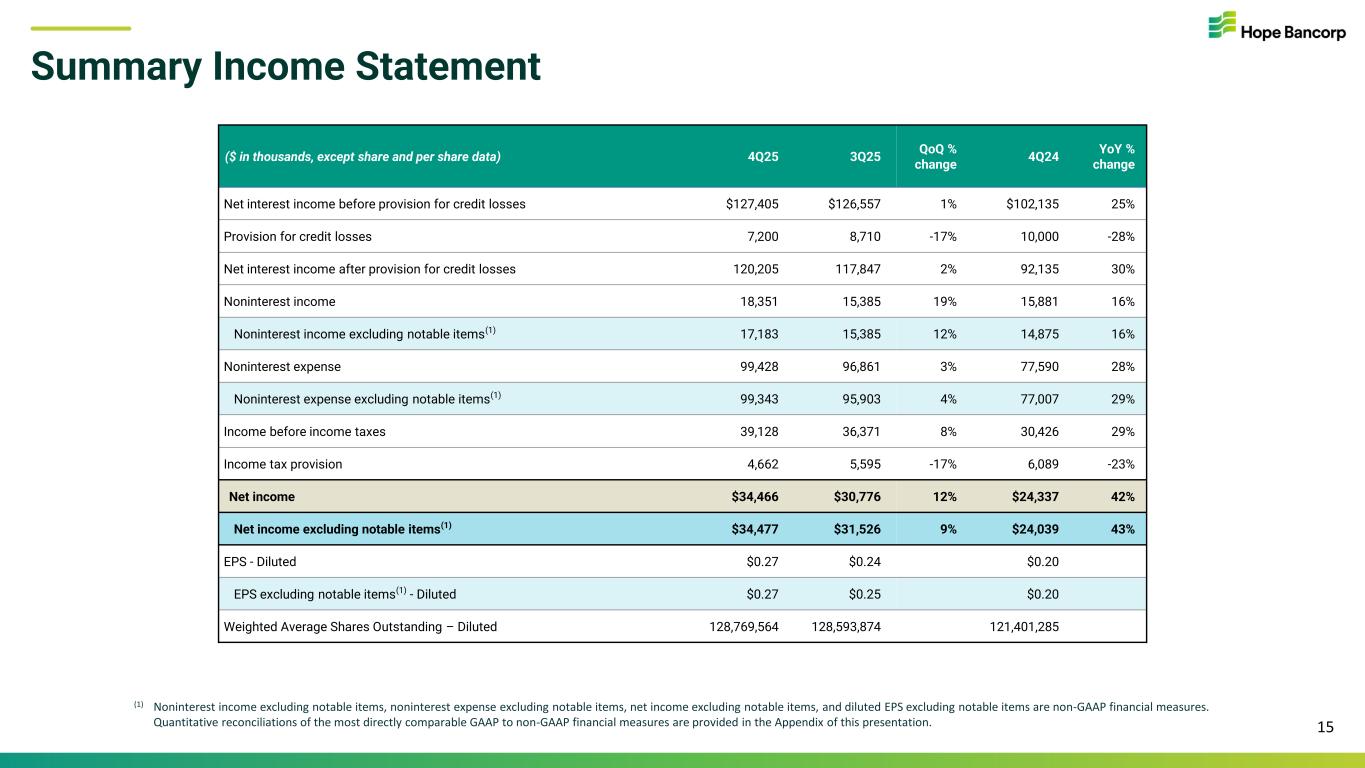

Strong Capital & Ample Liquidity • Total capital ratio was 13.99% at 12/31/25 • Tangible common equity (“TCE”) ratio(1) was 9.76% at 12/31/25 Deposits • Deposits of $15.6B at 12/31/25, -1% QoQ; QoQ change primarily driven by fourth quarter seasonality in certain commercial client funds, which normally return in the first quarter of the year • Noninterest bearing demand deposits represented 22% of total deposits at 12/31/25 Loans • Gross loans of $14.8B at 12/31/25, up 1% QoQ (4% annualized), driven by broad-based growth across CRE, C&I and residential mortgage • Gross loan-to-deposit ratio of 94.8% at 12/31/25 Asset Quality • Criticized loans down 6% QoQ and down 22% YoY to $351MM at 12/31/25, represented 2.39% of total loans receivable • Nonperforming assets (“NPA”) of $136MM at 12/31/25, represented 0.73% of total assets Earnings • 4Q25 net income: $34.5MM ($0.27 per diluted common share), up 12% QoQ and up 42% YoY • FY25 net income: $61.6M ($0.49 per diluted common share). Impacted by notable items, primarily due to merger- related items and loss on securities portfolio repositioning • Net income excluding notable items(1): $113.3MM for FY25 ($0.89(1) per diluted common share), up 10% YoY • 4Q25 highlights: net interest income up, fee income up, NIM expanded, and provision for credit losses down Q4 2025 Financial Overview Total Capital & TCE Ratio (1) at 12/31/25 13.99% / 9.76% NPA/Total Assets at 12/31/25 0.73% Gross Loans at 12/31/25 $14.8B Total Deposits at 12/31/25 $15.6B 3 4Q25 GAAP Net Income / EPS $34.5MM / $0.27 FY25 Net Income / EPS, excluding notable items (1) $113.3MM / $0.89 (1) TCE ratio, net income excluding notable items and earnings per share (“EPS”) excluding notable items are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation.

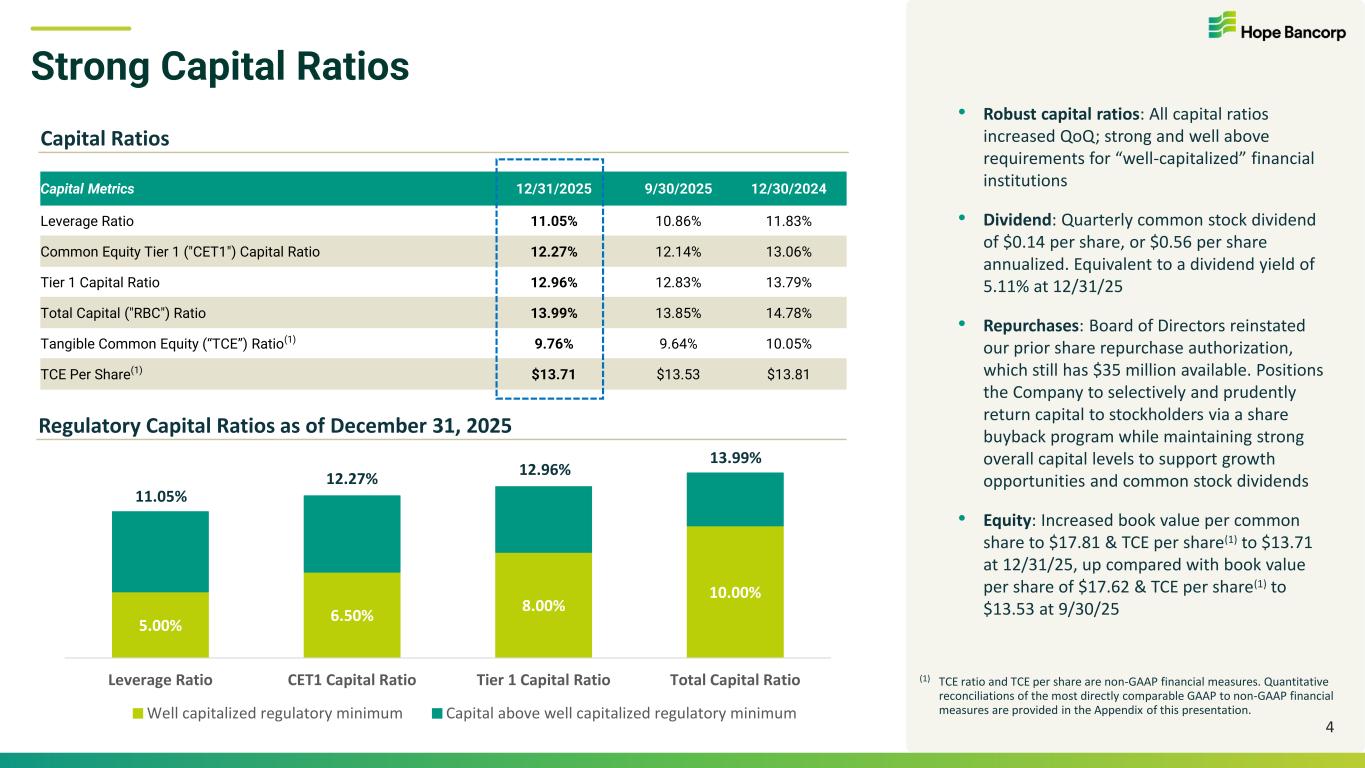

Strong Capital Ratios Capital Ratios • Robust capital ratios: All capital ratios increased QoQ; strong and well above requirements for “well-capitalized” financial institutions • Dividend: Quarterly common stock dividend of $0.14 per share, or $0.56 per share annualized. Equivalent to a dividend yield of 5.11% at 12/31/25 • Repurchases: Board of Directors reinstated our prior share repurchase authorization, which still has $35 million available. Positions the Company to selectively and prudently return capital to stockholders via a share buyback program while maintaining strong overall capital levels to support growth opportunities and common stock dividends • Equity: Increased book value per common share to $17.81 & TCE per share(1) to $13.71 at 12/31/25, up compared with book value per share of $17.62 & TCE per share(1) to $13.53 at 9/30/25 4 (1) TCE ratio and TCE per share are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation. Regulatory Capital Ratios as of December 31, 2025 11.05% 12.27% 12.96% 13.99% Capital Metrics 12/31/2025 9/30/2025 12/30/2024 Leverage Ratio 11.05% 10.86% 11.83% Common Equity Tier 1 ("CET1") Capital Ratio 12.27% 12.14% 13.06% Tier 1 Capital Ratio 12.96% 12.83% 13.79% Total Capital ("RBC") Ratio 13.99% 13.85% 14.78% Tangible Common Equity (“TCE”) Ratio(1) 9.76% 9.64% 10.05% TCE Per Share(1) $13.71 $13.53 $13.81 5.00% 6.50% 8.00% 10.00% Leverage Ratio CET1 Capital Ratio Tier 1 Capital Ratio Total Capital Ratio Well capitalized regulatory minimum Capital above well capitalized regulatory minimum

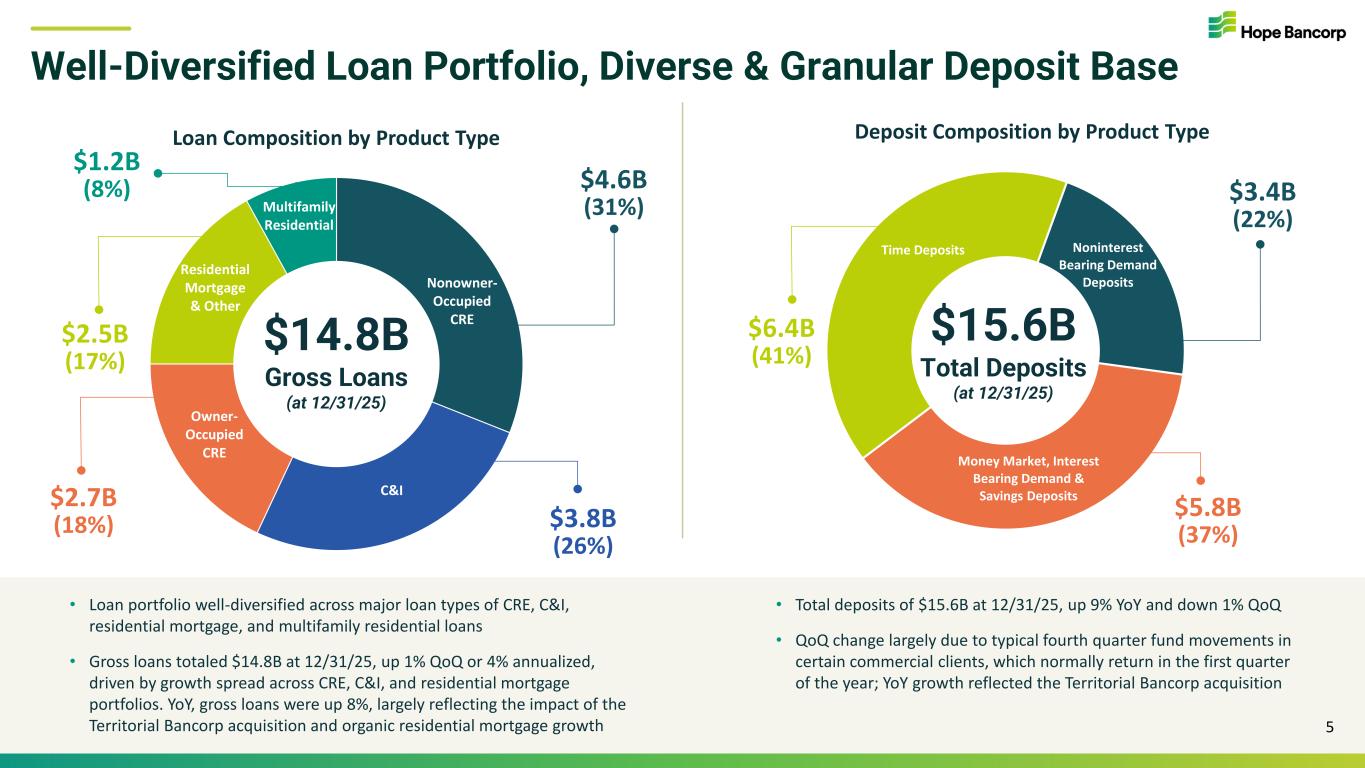

Well-Diversified Loan Portfolio, Diverse & Granular Deposit Base Loan Composition by Product Type • Total deposits of $15.6B at 12/31/25, up 9% YoY and down 1% QoQ • QoQ change largely due to typical fourth quarter fund movements in certain commercial clients, which normally return in the first quarter of the year; YoY growth reflected the Territorial Bancorp acquisition 5 Deposit Composition by Product Type Noninterest Bearing Demand Deposits Money Market, Interest Bearing Demand & Savings Deposits Time Deposits $15.6B Total Deposits (at 12/31/25) Nonowner- Occupied CRE C&I Owner- Occupied CRE Residential Mortgage & Other Multifamily Residential $1.2B (8%) $14.8B Gross Loans (at 12/31/25) $2.5B (17%) $4.6B (31%) $2.7B (18%) $3.8B (26%) • Loan portfolio well-diversified across major loan types of CRE, C&I, residential mortgage, and multifamily residential loans • Gross loans totaled $14.8B at 12/31/25, up 1% QoQ or 4% annualized, driven by growth spread across CRE, C&I, and residential mortgage portfolios. YoY, gross loans were up 8%, largely reflecting the impact of the Territorial Bancorp acquisition and organic residential mortgage growth $6.4B (41%) $5.8B (37%) $3.4B (22%)

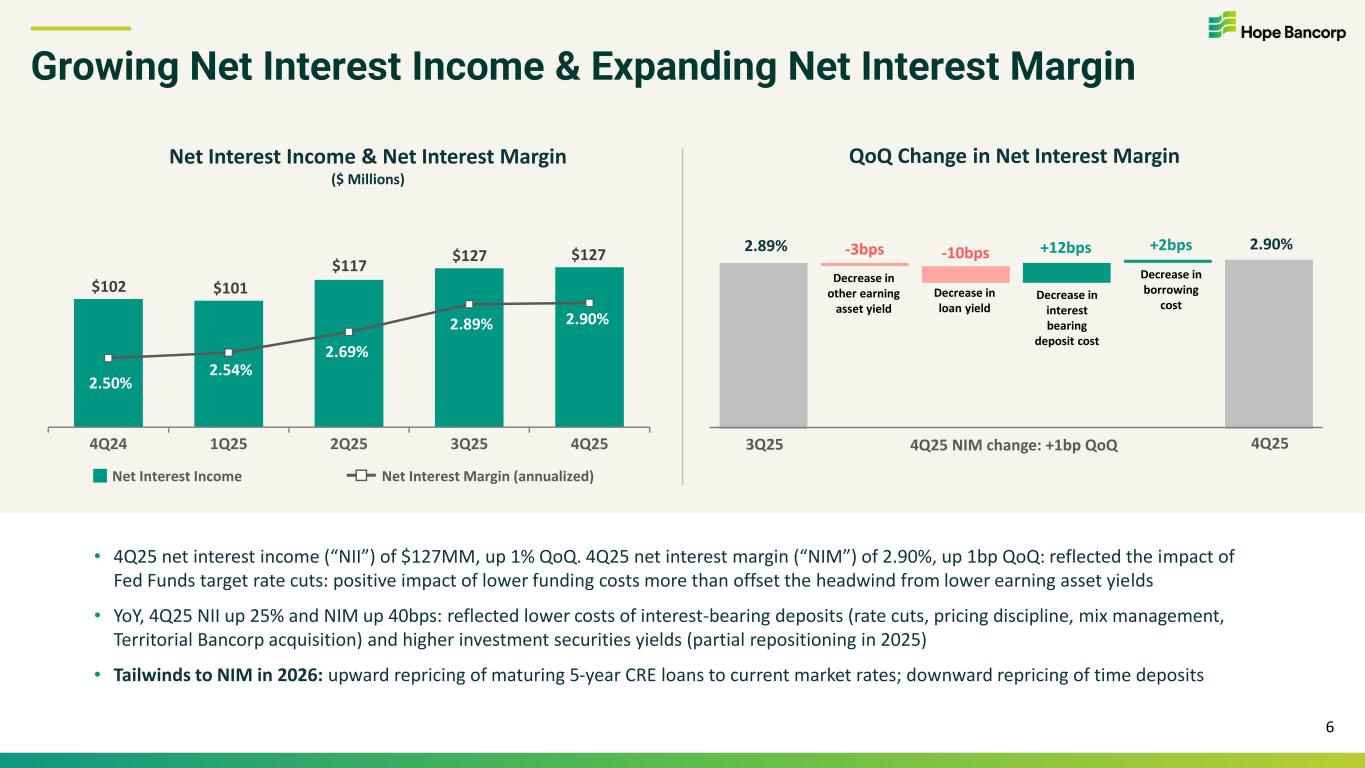

Growing Net Interest Income & Expanding Net Interest Margin 6 Net Interest Income & Net Interest Margin ($ Millions) $102 $101 $117 $127 $127 2.50% 2.54% 2.69% 2.89% 2.90% 4Q24 1Q25 2Q25 3Q25 4Q25 2.90%2.89% Decrease in loan yield -3bps 4Q25 NIM change: +1bp QoQ Net Interest Income Net Interest Margin (annualized) QoQ Change in Net Interest Margin 3Q25 4Q25 Decrease in other earning asset yield -10bps Decrease in borrowing cost +12bps Decrease in interest bearing deposit cost • 4Q25 net interest income (“NII”) of $127MM, up 1% QoQ. 4Q25 net interest margin (“NIM”) of 2.90%, up 1bp QoQ: reflected the impact of Fed Funds target rate cuts: positive impact of lower funding costs more than offset the headwind from lower earning asset yields • YoY, 4Q25 NII up 25% and NIM up 40bps: reflected lower costs of interest-bearing deposits (rate cuts, pricing discipline, mix management, Territorial Bancorp acquisition) and higher investment securities yields (partial repositioning in 2025) • Tailwinds to NIM in 2026: upward repricing of maturing 5-year CRE loans to current market rates; downward repricing of time deposits +2bps

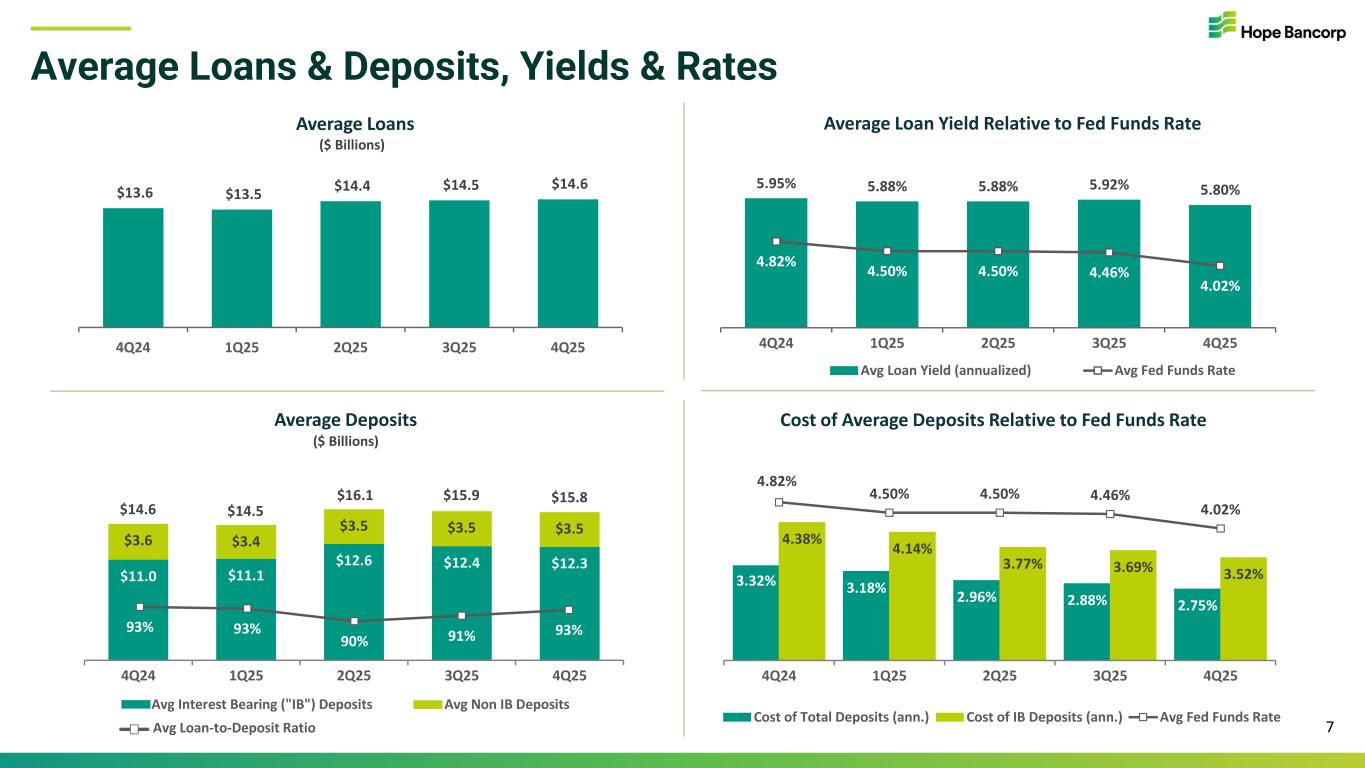

5.95% 5.88% 5.88% 5.92% 5.80% 4.82% 4.50% 4.50% 4.46% 4.02% 4Q24 1Q25 2Q25 3Q25 4Q25 Avg Loan Yield (annualized) Avg Fed Funds Rate $11.0 $11.1 $12.6 $12.4 $12.3 $3.6 $3.4 $3.5 $3.5 $3.5 4Q24 1Q25 2Q25 3Q25 4Q25 Avg Interest Bearing ("IB") Deposits Avg Non IB Deposits 93% 93% 90% 91% 93% 3.32% 3.18% 2.96% 2.88% 2.75% 4.38% 4.14% 3.77% 3.69% 3.52% 4.82% 4.50% 4.50% 4.46% 4.02% 4Q24 1Q25 2Q25 3Q25 4Q25 Cost of Total Deposits (ann.) Cost of IB Deposits (ann.) Avg Fed Funds Rate Average Loans & Deposits, Yields & Rates Average Deposits Average Loans ($ Billions) ($ Billions) $13.6 $13.5 $14.4 $14.5 $14.6 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 4Q24 1Q25 2Q25 3Q25 4Q25 Avg Loan-to-Deposit Ratio Cost of Average Deposits Relative to Fed Funds Rate Average Loan Yield Relative to Fed Funds Rate $15.9$16.1 $14.5$14.6 $15.8 7

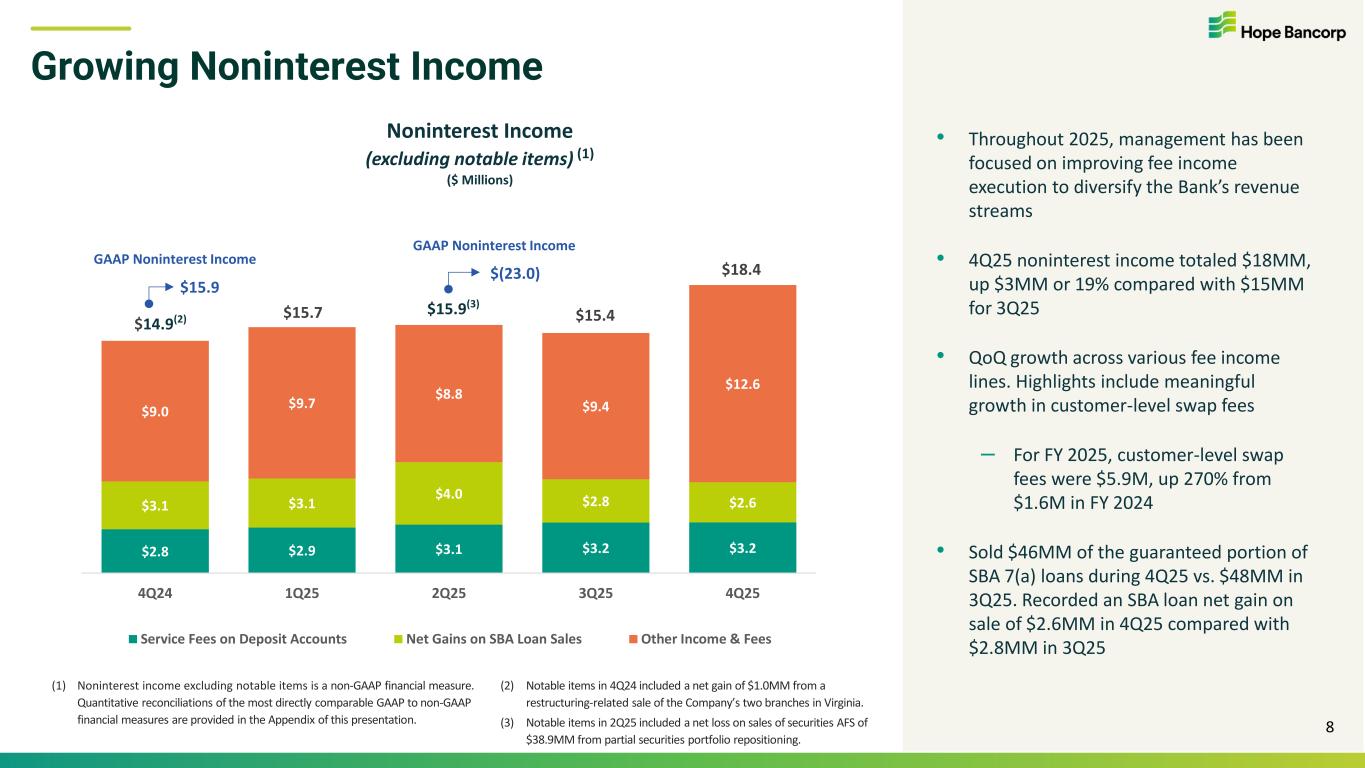

$2.8 $2.9 $3.1 $3.2 $3.2 $3.1 $3.1 $4.0 $2.8 $2.6 $9.0 $9.7 $8.8 $9.4 $12.6 4Q24 1Q25 2Q25 3Q25 4Q25 Service Fees on Deposit Accounts Net Gains on SBA Loan Sales Other Income & Fees $(23.0) Growing Noninterest Income Noninterest Income (excluding notable items) (1) ($ Millions) $14.9(2) $15.7 $15.9(3) • Throughout 2025, management has been focused on improving fee income execution to diversify the Bank’s revenue streams • 4Q25 noninterest income totaled $18MM, up $3MM or 19% compared with $15MM for 3Q25 • QoQ growth across various fee income lines. Highlights include meaningful growth in customer-level swap fees – For FY 2025, customer-level swap fees were $5.9M, up 270% from $1.6M in FY 2024 • Sold $46MM of the guaranteed portion of SBA 7(a) loans during 4Q25 vs. $48MM in 3Q25. Recorded an SBA loan net gain on sale of $2.6MM in 4Q25 compared with $2.8MM in 3Q25 (1) Noninterest income excluding notable items is a non-GAAP financial measure. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation. GAAP Noninterest Income $15.9 $15.4 (2) Notable items in 4Q24 included a net gain of $1.0MM from a restructuring-related sale of the Company’s two branches in Virginia. (3) Notable items in 2Q25 included a net loss on sales of securities AFS of $38.9MM from partial securities portfolio repositioning. 8 GAAP Noninterest Income $18.4

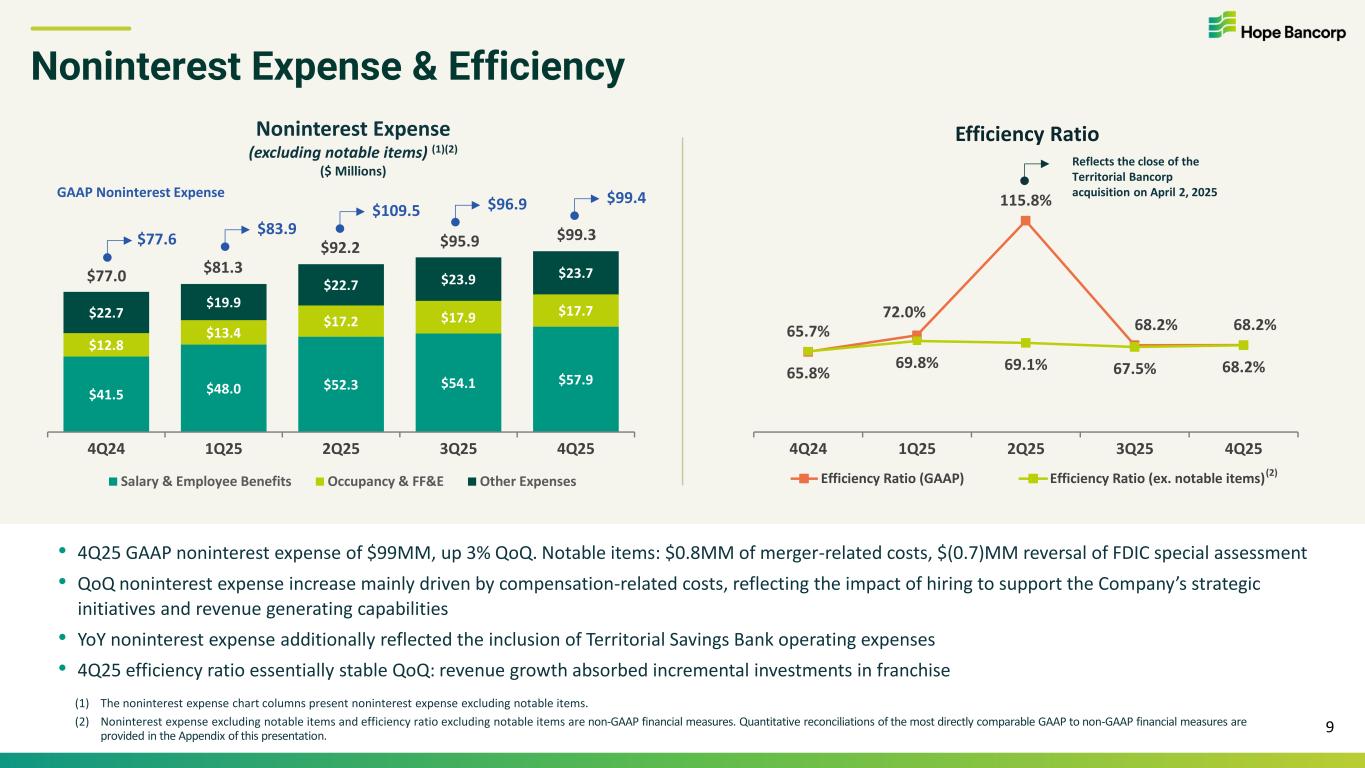

65.7% 72.0% 115.8% 68.2% 68.2% 65.8% 69.8% 69.1% 67.5% 68.2% 4Q24 1Q25 2Q25 3Q25 4Q25 Efficiency Ratio (GAAP) Efficiency Ratio (ex. notable items) $41.5 $48.0 $52.3 $54.1 $57.9 $12.8 $13.4 $17.2 $17.9 $17.7$22.7 $19.9 $22.7 $23.9 $23.7 4Q24 1Q25 2Q25 3Q25 4Q25 Salary & Employee Benefits Occupancy & FF&E Other Expenses Efficiency Ratio Noninterest Expense & Efficiency $77.0 $81.3 $92.2 Noninterest Expense (excluding notable items) (1)(2) ($ Millions) GAAP Noninterest Expense $77.6 $83.9 $109.5 (2) $95.9 $96.9 (1) The noninterest expense chart columns present noninterest expense excluding notable items. (2) Noninterest expense excluding notable items and efficiency ratio excluding notable items are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation. 9 Reflects the close of the Territorial Bancorp acquisition on April 2, 2025 $99.3 $99.4 • 4Q25 GAAP noninterest expense of $99MM, up 3% QoQ. Notable items: $0.8MM of merger-related costs, $(0.7)MM reversal of FDIC special assessment • QoQ noninterest expense increase mainly driven by compensation-related costs, reflecting the impact of hiring to support the Company’s strategic initiatives and revenue generating capabilities • YoY noninterest expense additionally reflected the inclusion of Territorial Savings Bank operating expenses • 4Q25 efficiency ratio essentially stable QoQ: revenue growth absorbed incremental investments in franchise

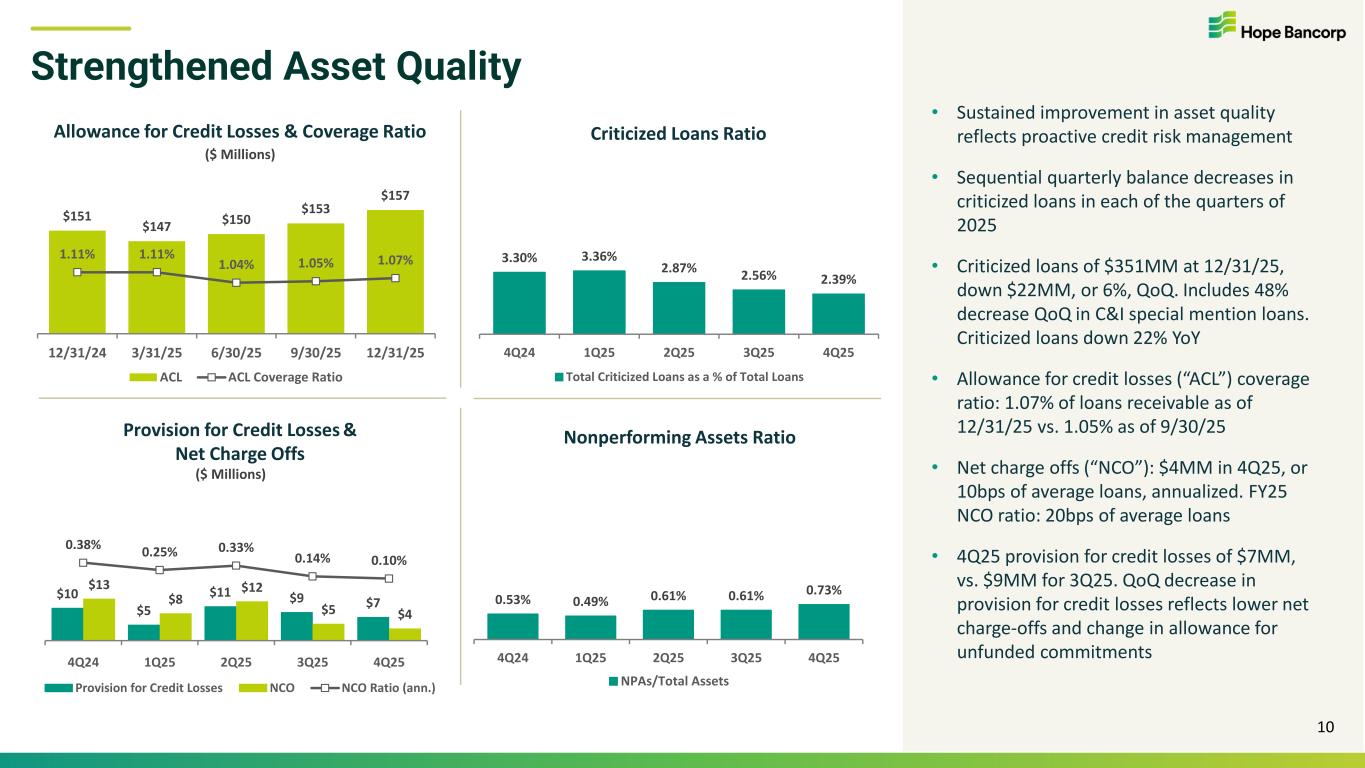

$151 $147 $150 $153 $157 1.11% 1.11% 1.04% 1.05% 1.07% 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 ACL ACL Coverage Ratio • Sustained improvement in asset quality reflects proactive credit risk management • Sequential quarterly balance decreases in criticized loans in each of the quarters of 2025 • Criticized loans of $351MM at 12/31/25, down $22MM, or 6%, QoQ. Includes 48% decrease QoQ in C&I special mention loans. Criticized loans down 22% YoY • Allowance for credit losses (“ACL”) coverage ratio: 1.07% of loans receivable as of 12/31/25 vs. 1.05% as of 9/30/25 • Net charge offs (“NCO”): $4MM in 4Q25, or 10bps of average loans, annualized. FY25 NCO ratio: 20bps of average loans • 4Q25 provision for credit losses of $7MM, vs. $9MM for 3Q25. QoQ decrease in provision for credit losses reflects lower net charge-offs and change in allowance for unfunded commitments Strengthened Asset Quality Provision for Credit Losses & Net Charge Offs Nonperforming Assets Ratio Allowance for Credit Losses & Coverage Ratio Criticized Loans Ratio $10 $5 $11 $9 $7 $13 $8 $12 $5 $4 0.38% 0.25% 0.33% 0.14% 0.10% 4Q24 1Q25 2Q25 3Q25 4Q25 Provision for Credit Losses NCO NCO Ratio (ann.) 3.30% 3.36% 2.87% 2.56% 2.39% 4Q24 1Q25 2Q25 3Q25 4Q25 Total Criticized Loans as a % of Total Loans ($ Millions) ($ Millions) 0.53% 0.49% 0.61% 0.61% 0.73% 4Q24 1Q25 2Q25 3Q25 4Q25 NPAs/Total Assets 10

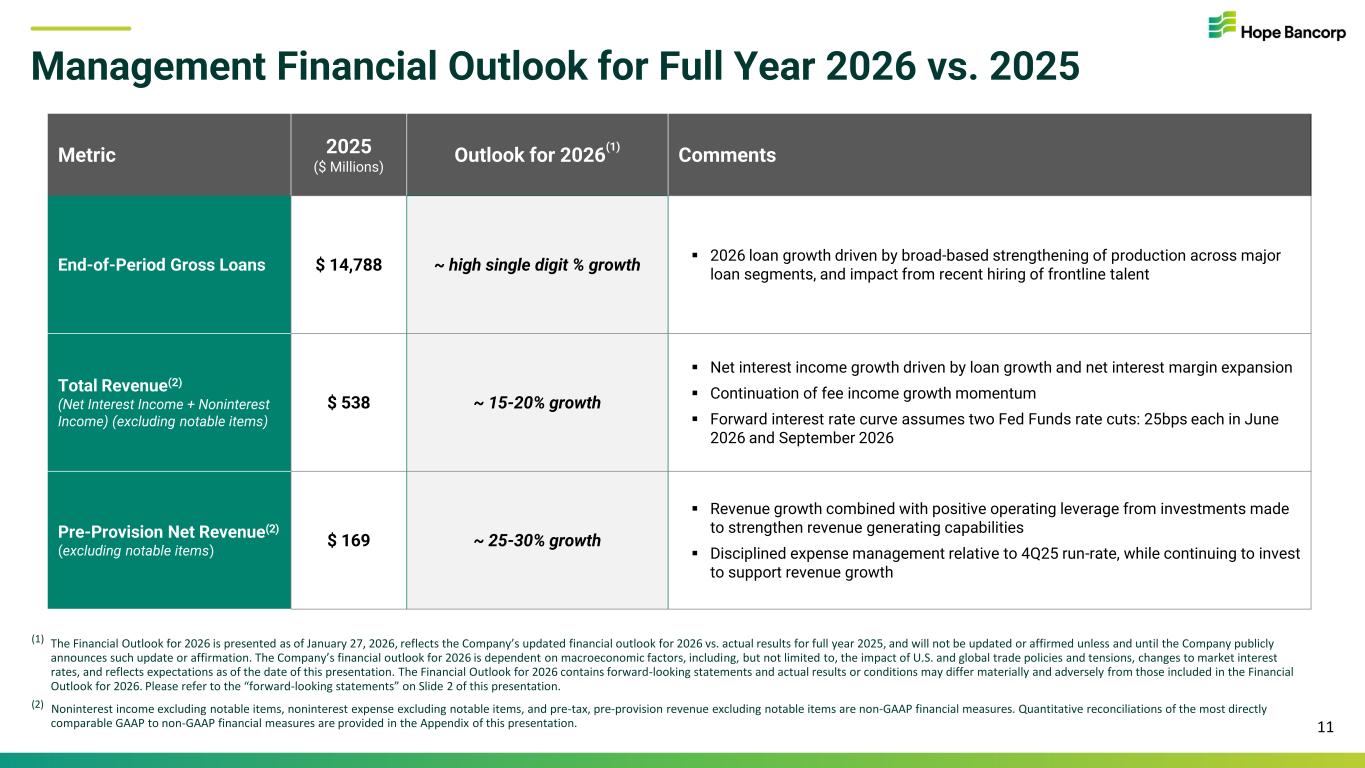

Management Financial Outlook for Full Year 2026 vs. 2025 11 Metric 2025 ($ Millions) Outlook for 2026 (1) Comments End-of-Period Gross Loans $ 14,788 ~ high single digit % growth ▪ 2026 loan growth driven by broad-based strengthening of production across major loan segments, and impact from recent hiring of frontline talent Total Revenue(2) (Net Interest Income + Noninterest Income) (excluding notable items) $ 538 ~ 15-20% growth ▪ Net interest income growth driven by loan growth and net interest margin expansion ▪ Continuation of fee income growth momentum ▪ Forward interest rate curve assumes two Fed Funds rate cuts: 25bps each in June 2026 and September 2026 Pre-Provision Net Revenue(2) (excluding notable items) $ 169 ~ 25-30% growth ▪ Revenue growth combined with positive operating leverage from investments made to strengthen revenue generating capabilities ▪ Disciplined expense management relative to 4Q25 run-rate, while continuing to invest to support revenue growth (1) The Financial Outlook for 2026 is presented as of January 27, 2026, reflects the Company’s updated financial outlook for 2026 vs. actual results for full year 2025, and will not be updated or affirmed unless and until the Company publicly announces such update or affirmation. The Company’s financial outlook for 2026 is dependent on macroeconomic factors, including, but not limited to, the impact of U.S. and global trade policies and tensions, changes to market interest rates, and reflects expectations as of the date of this presentation. The Financial Outlook for 2026 contains forward-looking statements and actual results or conditions may differ materially and adversely from those included in the Financial Outlook for 2026. Please refer to the “forward-looking statements” on Slide 2 of this presentation. (2) Noninterest income excluding notable items, noninterest expense excluding notable items, and pre-tax, pre-provision revenue excluding notable items are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation.

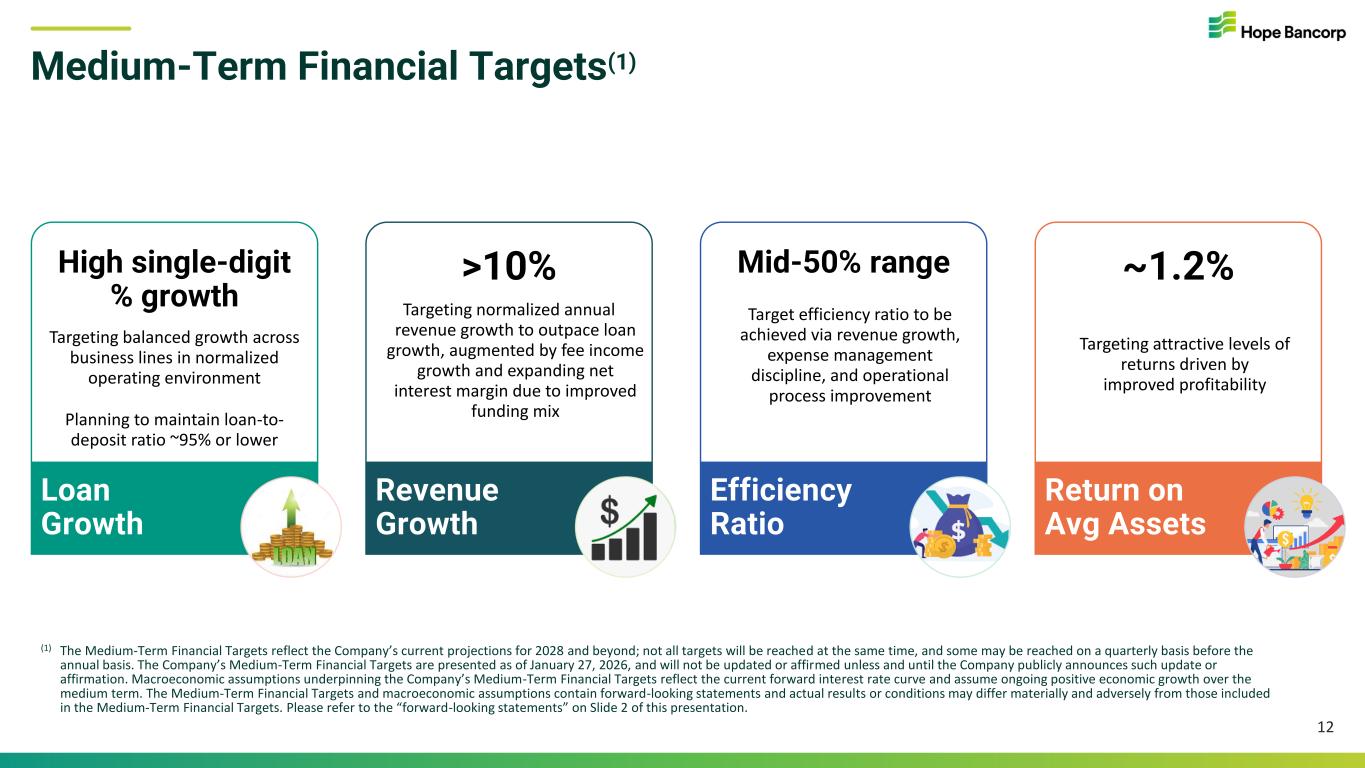

(1) The Medium-Term Financial Targets reflect the Company’s current projections for 2028 and beyond; not all targets will be reached at the same time, and some may be reached on a quarterly basis before the annual basis. The Company’s Medium-Term Financial Targets are presented as of January 27, 2026, and will not be updated or affirmed unless and until the Company publicly announces such update or affirmation. Macroeconomic assumptions underpinning the Company’s Medium-Term Financial Targets reflect the current forward interest rate curve and assume ongoing positive economic growth over the medium term. The Medium-Term Financial Targets and macroeconomic assumptions contain forward-looking statements and actual results or conditions may differ materially and adversely from those included in the Medium-Term Financial Targets. Please refer to the “forward-looking statements” on Slide 2 of this presentation. High single-digit % growth Targeting balanced growth across business lines in normalized operating environment Planning to maintain loan-to- deposit ratio ~95% or lower Loan Growth >10% Targeting normalized annual revenue growth to outpace loan growth, augmented by fee income growth and expanding net interest margin due to improved funding mix Revenue Growth Mid-50% range Target efficiency ratio to be achieved via revenue growth, expense management discipline, and operational process improvement Efficiency Ratio ~1.2% Targeting attractive levels of returns driven by improved profitability Return on Avg Assets Medium-Term Financial Targets(1) 12

Appendix 13

($ in millions, except per share data) 12/31/2025 9/30/2025 QoQ % change 12/30/2024 YoY % change Cash and due from banks $560.1 $454.9 23% $458.2 22% Investment securities 2,072.9 2,266.0 -9% 2,075.6 0% Federal Home Loan Bank (“FHLB”) stock and other investments 60.2 106.4 -43% 57.2 5% Gross loans 14,787.9 14,623.6 1% 13,632.8 8% Allowance for credit losses (156.7) (152.5) 3% (150.5) 4% Goodwill and intangible assets 525.9 524.5 0% 466.8 13% Other assets 681.3 687.9 -1% 513.9 33% Total assets $18,531.6 $18,510.8 0% $17,054.0 9% Deposits $15,603.1 $15,831.3 -1% $14,327.5 9% Borrowings & other debt 395.9 135.5 192% 348.6 14% Other liabilities 249.3 285.0 -13% 243.4 2% Total liabilities $16,248.3 $16,251.8 0% $14,919.5 9% Total stockholders’ equity $2,283.3 $2,259.0 1% $2,134.5 7% Book value per share $17.81 $17.62 1% $17.68 1% TCE per share(1) $13.71 $13.53 1% $13.81 -1% TCE ratio(1) 9.76% 9.64% 10.05% Loan-to-deposit ratio 94.8% 92.4% 95.2% Summary Balance Sheet (1) TCE per share and TCE ratio are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation. 14

Summary Income Statement (1) Noninterest income excluding notable items, noninterest expense excluding notable items, net income excluding notable items, and diluted EPS excluding notable items are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation. 15 ($ in thousands, except share and per share data) 4Q25 3Q25 QoQ % change 4Q24 YoY % change Net interest income before provision for credit losses $127,405 $126,557 1% $102,135 25% Provision for credit losses 7,200 8,710 -17% 10,000 -28% Net interest income after provision for credit losses 120,205 117,847 2% 92,135 30% Noninterest income 18,351 15,385 19% 15,881 16% Noninterest income excluding notable items(1) 17,183 15,385 12% 14,875 16% Noninterest expense 99,428 96,861 3% 77,590 28% Noninterest expense excluding notable items(1) 99,343 95,903 4% 77,007 29% Income before income taxes 39,128 36,371 8% 30,426 29% Income tax provision 4,662 5,595 -17% 6,089 -23% Net income $34,466 $30,776 12% $24,337 42% Net income excluding notable items(1) $34,477 $31,526 9% $24,039 43% EPS - Diluted $0.27 $0.24 $0.20 EPS excluding notable items(1) - Diluted $0.27 $0.25 $0.20 Weighted Average Shares Outstanding – Diluted 128,769,564 128,593,874 121,401,285

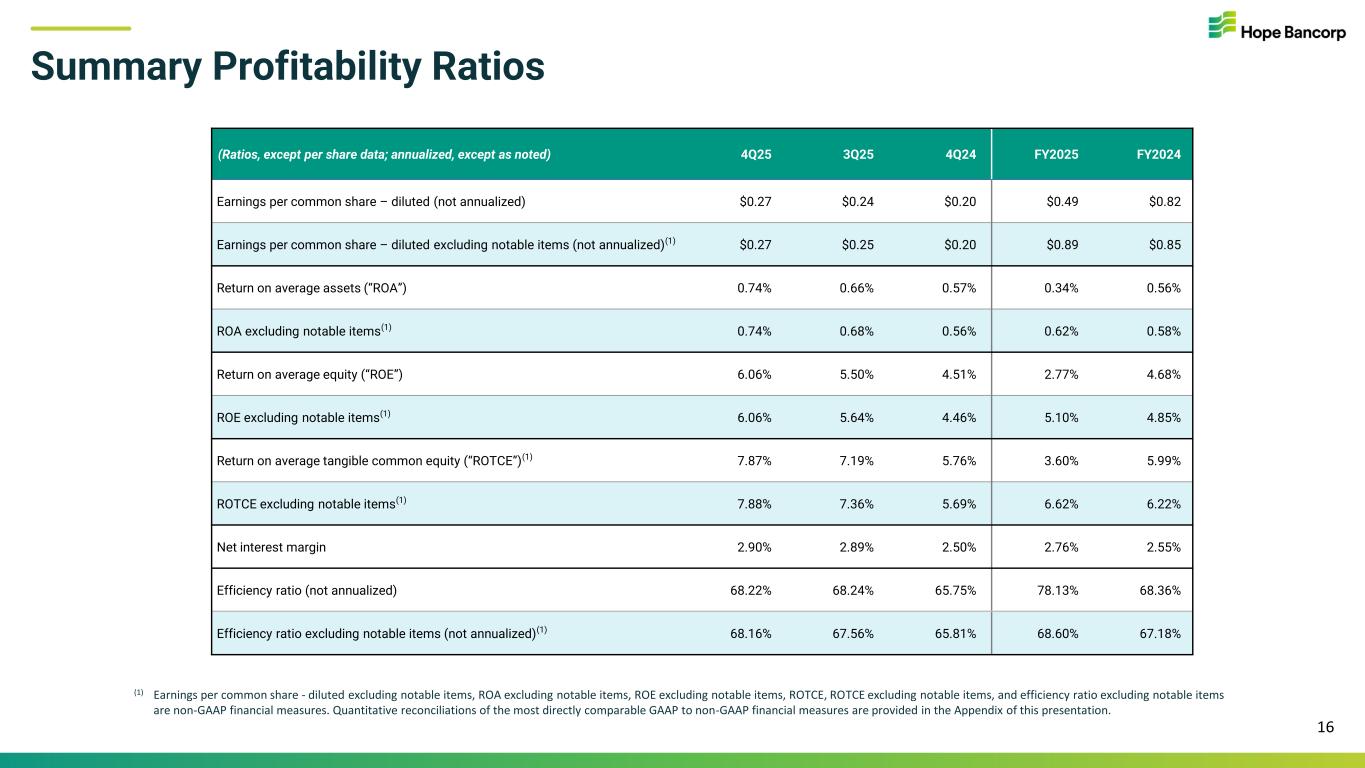

Summary Profitability Ratios (1) Earnings per common share - diluted excluding notable items, ROA excluding notable items, ROE excluding notable items, ROTCE, ROTCE excluding notable items, and efficiency ratio excluding notable items are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation. 16 (Ratios, except per share data; annualized, except as noted) 4Q25 3Q25 4Q24 FY2025 FY2024 Earnings per common share – diluted (not annualized) $0.27 $0.24 $0.20 $0.49 $0.82 Earnings per common share – diluted excluding notable items (not annualized)(1) $0.27 $0.25 $0.20 $0.89 $0.85 Return on average assets (“ROA”) 0.74% 0.66% 0.57% 0.34% 0.56% ROA excluding notable items(1) 0.74% 0.68% 0.56% 0.62% 0.58% Return on average equity (“ROE”) 6.06% 5.50% 4.51% 2.77% 4.68% ROE excluding notable items(1) 6.06% 5.64% 4.46% 5.10% 4.85% Return on average tangible common equity (“ROTCE”)(1) 7.87% 7.19% 5.76% 3.60% 5.99% ROTCE excluding notable items(1) 7.88% 7.36% 5.69% 6.62% 6.22% Net interest margin 2.90% 2.89% 2.50% 2.76% 2.55% Efficiency ratio (not annualized) 68.22% 68.24% 65.75% 78.13% 68.36% Efficiency ratio excluding notable items (not annualized)(1) 68.16% 67.56% 65.81% 68.60% 67.18%

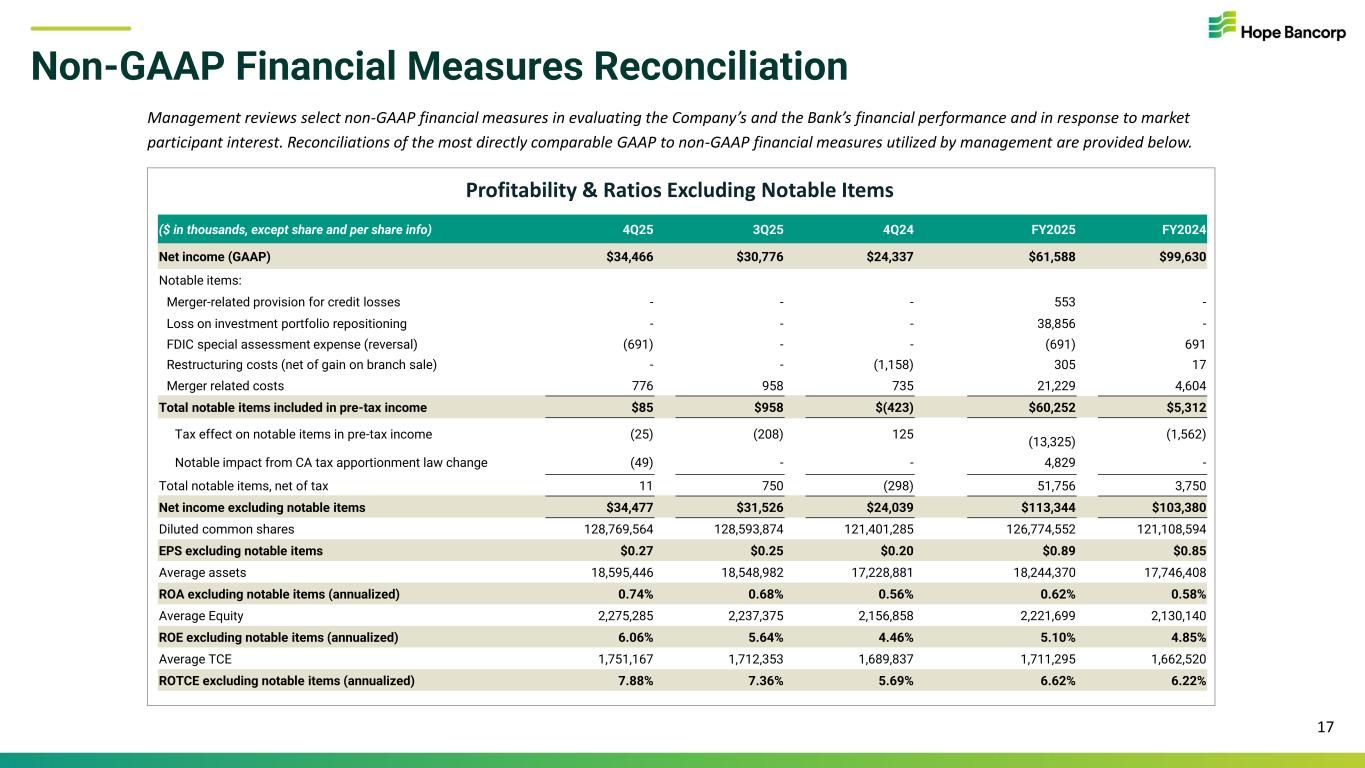

Non-GAAP Financial Measures Reconciliation Management reviews select non-GAAP financial measures in evaluating the Company’s and the Bank’s financial performance and in response to market participant interest. Reconciliations of the most directly comparable GAAP to non-GAAP financial measures utilized by management are provided below. Profitability & Ratios Excluding Notable Items 17 ($ in thousands, except share and per share info) 4Q25 3Q25 4Q24 FY2025 FY2024 Net income (GAAP) $34,466 $30,776 $24,337 $61,588 $99,630 Notable items: Merger-related provision for credit losses - - - 553 - Loss on investment portfolio repositioning - - - 38,856 - FDIC special assessment expense (reversal) (691) - - (691) 691 Restructuring costs (net of gain on branch sale) - - (1,158) 305 17 Merger related costs 776 958 735 21,229 4,604 Total notable items included in pre-tax income $85 $958 $(423) $60,252 $5,312 Tax effect on notable items in pre-tax income (25) (208) 125 (13,325) (1,562) Notable impact from CA tax apportionment law change (49) - - 4,829 - Total notable items, net of tax 11 750 (298) 51,756 3,750 Net income excluding notable items $34,477 $31,526 $24,039 $113,344 $103,380 Diluted common shares 128,769,564 128,593,874 121,401,285 126,774,552 121,108,594 EPS excluding notable items $0.27 $0.25 $0.20 $0.89 $0.85 Average assets 18,595,446 18,548,982 17,228,881 18,244,370 17,746,408 ROA excluding notable items (annualized) 0.74% 0.68% 0.56% 0.62% 0.58% Average Equity 2,275,285 2,237,375 2,156,858 2,221,699 2,130,140 ROE excluding notable items (annualized) 6.06% 5.64% 4.46% 5.10% 4.85% Average TCE 1,751,167 1,712,353 1,689,837 1,711,295 1,662,520 ROTCE excluding notable items (annualized) 7.88% 7.36% 5.69% 6.62% 6.22%

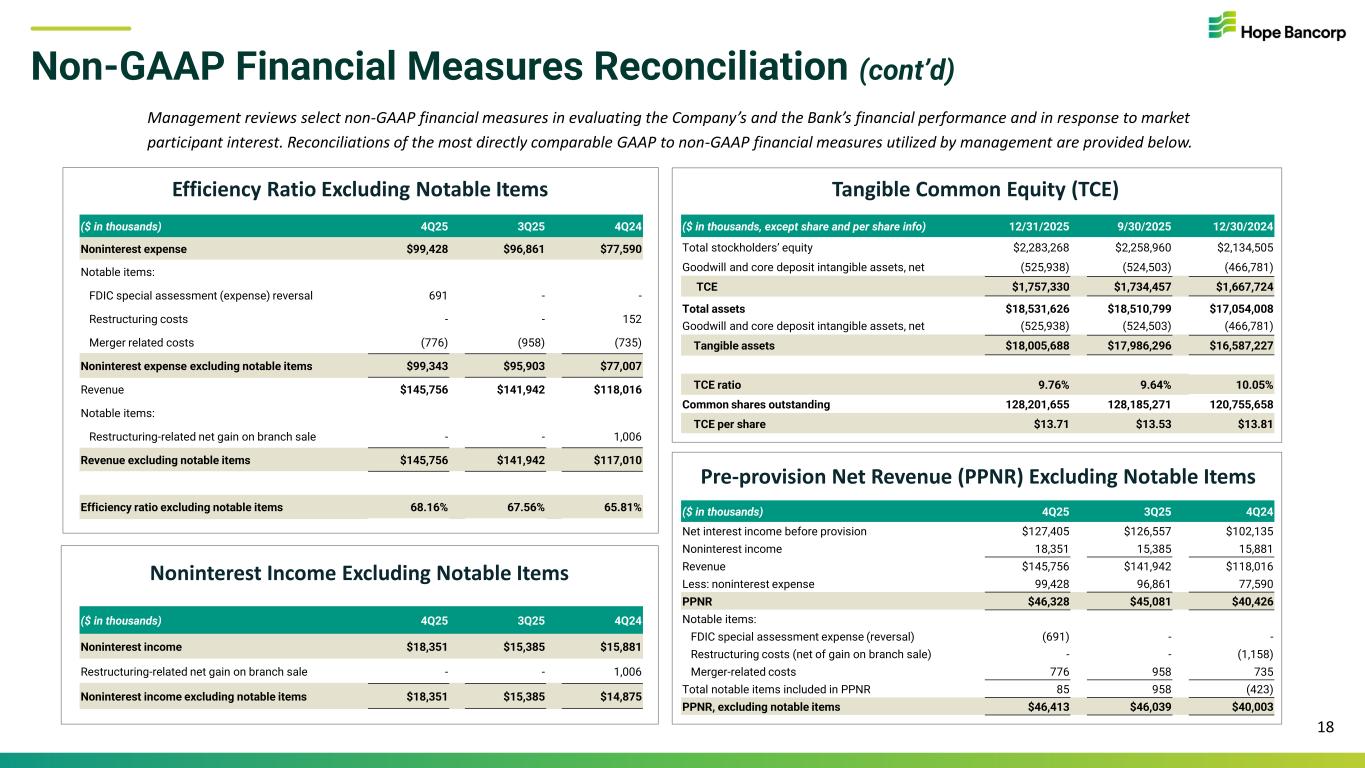

Efficiency Ratio Excluding Notable Items Noninterest Income Excluding Notable Items 18 Non-GAAP Financial Measures Reconciliation (cont’d) ($ in thousands) 4Q25 3Q25 4Q24 Noninterest expense $99,428 $96,861 $77,590 Notable items: FDIC special assessment (expense) reversal 691 - - Restructuring costs - - 152 Merger related costs (776) (958) (735) Noninterest expense excluding notable items $99,343 $95,903 $77,007 Revenue $145,756 $141,942 $118,016 Notable items: Restructuring-related net gain on branch sale - - 1,006 Revenue excluding notable items $145,756 $141,942 $117,010 Efficiency ratio excluding notable items 68.16% 67.56% 65.81% ($ in thousands) 4Q25 3Q25 4Q24 Noninterest income $18,351 $15,385 $15,881 Restructuring-related net gain on branch sale - - 1,006 Noninterest income excluding notable items $18,351 $15,385 $14,875 Tangible Common Equity (TCE) Pre-provision Net Revenue (PPNR) Excluding Notable Items ($ in thousands, except share and per share info) 12/31/2025 9/30/2025 12/30/2024 Total stockholders’ equity $2,283,268 $2,258,960 $2,134,505 Goodwill and core deposit intangible assets, net (525,938) (524,503) (466,781) TCE $1,757,330 $1,734,457 $1,667,724 Total assets $18,531,626 $18,510,799 $17,054,008 Goodwill and core deposit intangible assets, net (525,938) (524,503) (466,781) Tangible assets $18,005,688 $17,986,296 $16,587,227 TCE ratio 9.76% 9.64% 10.05% Common shares outstanding 128,201,655 128,185,271 120,755,658 TCE per share $13.71 $13.53 $13.81 ($ in thousands) 4Q25 3Q25 4Q24 Net interest income before provision $127,405 $126,557 $102,135 Noninterest income 18,351 15,385 15,881 Revenue $145,756 $141,942 $118,016 Less: noninterest expense 99,428 96,861 77,590 PPNR $46,328 $45,081 $40,426 Notable items: FDIC special assessment expense (reversal) (691) - - Restructuring costs (net of gain on branch sale) - - (1,158) Merger-related costs 776 958 735 Total notable items included in PPNR 85 958 (423) PPNR, excluding notable items $46,413 $46,039 $40,003 Management reviews select non-GAAP financial measures in evaluating the Company’s and the Bank’s financial performance and in response to market participant interest. Reconciliations of the most directly comparable GAAP to non-GAAP financial measures utilized by management are provided below.

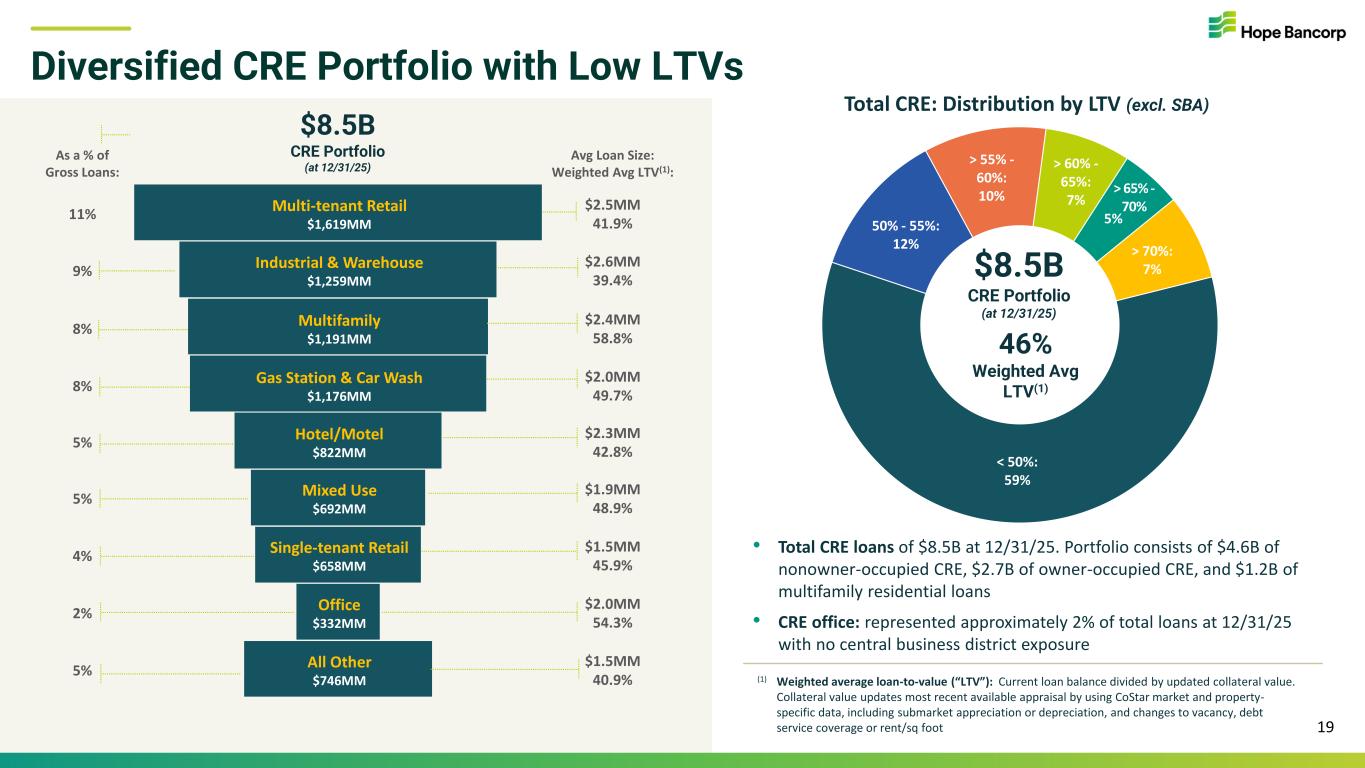

As a % of Gross Loans: Avg Loan Size: Weighted Avg LTV(1): 11% Multi-tenant Retail $1,619MM $2.5MM 41.9% 9% Industrial & Warehouse $1,259MM $2.6MM 39.4% 8% Multifamily $1,191MM $2.4MM 58.8% 8% Gas Station & Car Wash $1,176MM $2.0MM 49.7% 5% Hotel/Motel $822MM $2.3MM 42.8% 5% Mixed Use $692MM $1.9MM 48.9% 4% Single-tenant Retail $658MM $1.5MM 45.9% 2% Office $332MM $2.0MM 54.3% 5% All Other $746MM $1.5MM 40.9% Diversified CRE Portfolio with Low LTVs Total CRE: Distribution by LTV (excl. SBA) < 50%: 59% 50% - 55%: 12% > 55% - 60%: 10% > 60% - 65%: 7% > 65% - 70% > 70%: 7%$8.5B CRE Portfolio (at 12/31/25) 46% Weighted Avg LTV(1) (1) Weighted average loan-to-value (“LTV”): Current loan balance divided by updated collateral value. Collateral value updates most recent available appraisal by using CoStar market and property- specific data, including submarket appreciation or depreciation, and changes to vacancy, debt service coverage or rent/sq foot • Total CRE loans of $8.5B at 12/31/25. Portfolio consists of $4.6B of nonowner-occupied CRE, $2.7B of owner-occupied CRE, and $1.2B of multifamily residential loans • CRE office: represented approximately 2% of total loans at 12/31/25 with no central business district exposure $8.5B CRE Portfolio (at 12/31/25) 5% 19

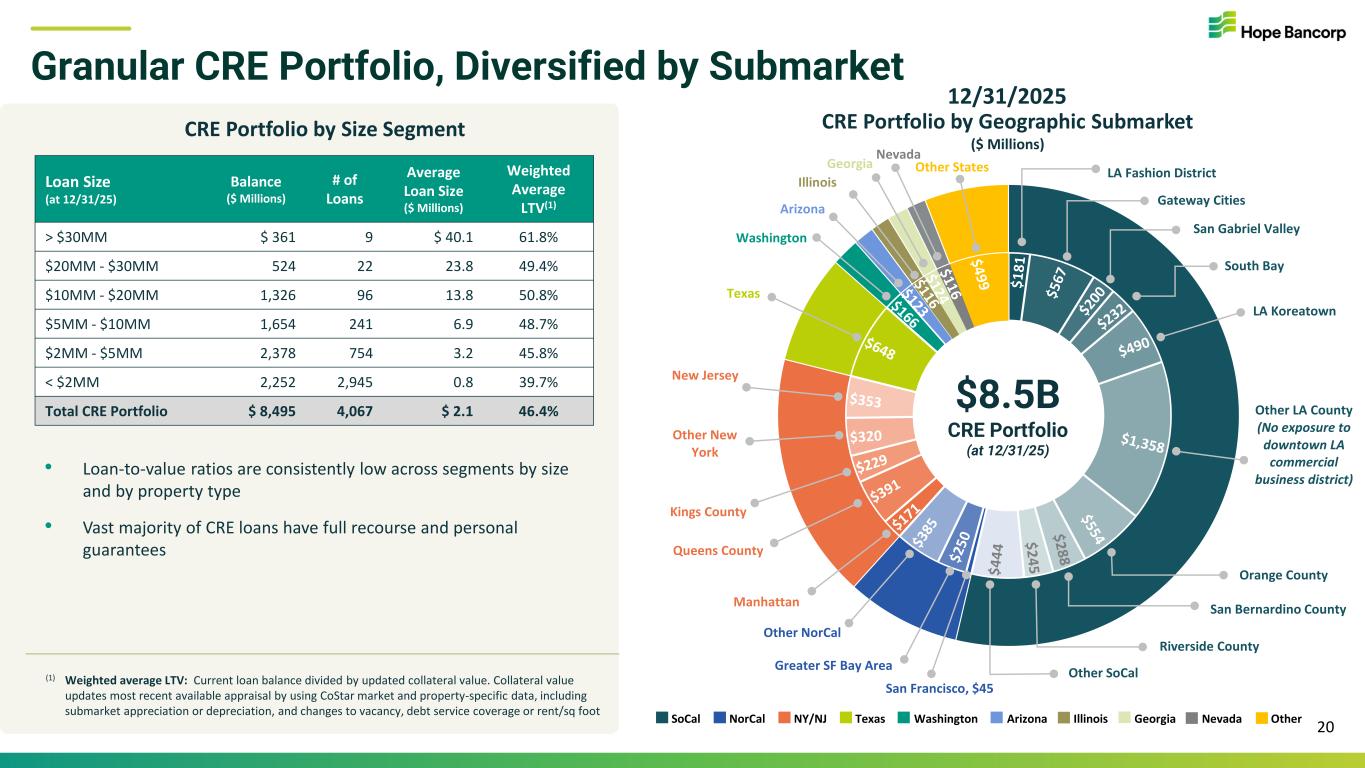

LA Fashion District Gateway Cities San Gabriel Valley South Bay LA Koreatown Other LA County (No exposure to downtown LA commercial business district) Orange County San Bernardino County Riverside County Other SoCal San Francisco, $45 Greater SF Bay Area Other NorCal Manhattan Queens County Kings County Other New York New Jersey Texas Washington Arizona Illinois Georgia Nevada Other States 12/31/2025 CRE Portfolio by Geographic Submarket ($ Millions) Granular CRE Portfolio, Diversified by Submarket Loan Size (at 12/31/25) Balance ($ Millions) # of Loans Average Loan Size ($ Millions) Weighted Average LTV(1) > $30MM $ 361 9 $ 40.1 61.8% $20MM - $30MM 524 22 23.8 49.4% $10MM - $20MM 1,326 96 13.8 50.8% $5MM - $10MM 1,654 241 6.9 48.7% $2MM - $5MM 2,378 754 3.2 45.8% < $2MM 2,252 2,945 0.8 39.7% Total CRE Portfolio $ 8,495 4,067 $ 2.1 46.4% • Loan-to-value ratios are consistently low across segments by size and by property type • Vast majority of CRE loans have full recourse and personal guarantees CRE Portfolio by Size Segment (1) Weighted average LTV: Current loan balance divided by updated collateral value. Collateral value updates most recent available appraisal by using CoStar market and property-specific data, including submarket appreciation or depreciation, and changes to vacancy, debt service coverage or rent/sq foot $8.5B CRE Portfolio (at 12/31/25) SoCal NorCal NY/NJ Texas Washington Arizona Illinois Georgia Nevada Other 20