| F E B R U A R Y 5 , 2026 1 MASTERCRAFT + MARINE PRODUCTS TO COMBINE |

| 2 DISCLAIMER Forward Looking Statements This presentation includes forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). Forward-looking statements can often be identified by such words and phrases as “believes,” “anticipates,” “expects,” “intends,” “estimates,” “may,” “will,” “should,” “continue,” and similar expressions and comparable terminology, or the negative thereof. Forward-looking statements are subject to risks, uncertainties, and other important factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, including, but not limited to: (i) the anticipated financial performance of the combined company; (ii) the expected synergies and efficiencies to be achieved as a result of the proposed transactions ; (iii) expectations regarding the diversification and complementary nature of brand portfolios ; (iv) expectations regarding the complementary nature of dealer networks ; (v) expectations regarding enhancements to the manufacturing platform and technological innovation; (vi) the financial profile and profitability of the combined company; (vii) expectations regarding cost savings ; (viii) expectations regarding the combined company’s employees, vendors, dealers, and manufacturing operations ; (ix) expectations regarding the realization of benefits of the proposed transactions and the timing associated with realization thereof; and (x) the receipt of all necessary approvals to close the proposed transactions, and the timing associated therewith. These and other important factors discussed under the caption “Risk Factors” in MasterCraft Boat Holdings, Inc.’s (“MCBH”) Annual Report on Form 10-K for the fiscal year ended June 30, 2025, filed with the Securities and Exchange Commission (the “SEC”) on August 27, 2025, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings made with the SEC, and Marine Products Corporation’s (“Marine Products”) Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 28, 2025, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings made with the SEC, in each case could cause actual results to differ materially from those indicated by the forward-looking statements . The discussion of these risks is specifically incorporated by reference into this presentation. Any such forward-looking statements represent estimates as of the date of this presentation. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. MCBH undertakes no obligation (and expressly disclaims any obligation) to update or supplement any forward-looking statements that may become untrue or cause our views to change, whether because of new information, future events, changes in assumptions or otherwise. Comparisons of results for current and prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. Use of Non-GAAP Financial Measures To supplement MCBH’s financial measures prepared in accordance with United States generally accepted accounting principles (“GAAP”), the Company uses certain non-GAAP financial measures in this presentation. Reconciliations of the non-GAAP measures used in this release to the most comparable GAAP measures for the respective periods can be found in the appendix to this presentation. The non-GAAP measures have limitations as analytical tools and should not be considered in isolation or as a substitute for MCBH’s financial results prepared in accordance with GAAP. W e do not provide forward-looking guidance for certain financial measures on a GAAP basis because we are unable to predict certain items contained in the GAAP measures without unreasonable efforts . |

| 3 DISCLAIMER (CONTINUED) Additional Information and Where to Find It In connection with the proposed transactions, MCBH intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”), which will include a prospectus with respect to the shares of MCBH common stock to be issued in the proposed transactions and a joint proxy statement/prospectus for MCBH’s and Marine Products’ respective stockholders (the “Joint Proxy Statement/Prospectus”). The definitive joint proxy statement (if and when available) will be mailed to stockholders of MCBH and Marine Products . Eac h of MCBH and Marine Products may also file with or furnish to the SEC other relevant documents regarding the proposed transactions . This presentation is not a substitute for the Registration Statement, the Joint Proxy Statement/Prospectus or any other document that MCBH and Marine Products may mail to their respective stockholders in connection with the proposed transactions . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS, AS W ELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED W ITH THE SEC IN CONNECTION W ITH THE PROPOSED TRANSACTIONS, W HEN THEY BECOME AVAILABLE, BECAUSE THEY DO AND W ILL CONTAIN IMPORTANT INFORMATION ABOUT MCBH, MARINE PRODUCTS CORPORATION, AND THE PROPOSED TRANSACTIONS. Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from MCBH at its website, www.mastercraft.com, or from Marine Products at its website, www.marineproductscorp.com. Documents filed with the SEC by MCBH will be available free of charge by accessing the investor section of MCBH’s website, www.investors .mastercraft.com, or, alternatively, by directing a request by email to MCBH at investorrelations@mastercraft .com, and documents filed with the SEC by Marine Products will be available free of charge by accessing Marine Products’ website at www.marineproductscorp.com under the heading Investor Relations or, alternatively, by directing a request by email to Marine Products at jlarge@marineproductscorp.com. Participants in the Solicitation MCBH, Marine Products, and certain of their respective directors, executive officers, and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of MCBH and Marine Products in connection with the proposed transactions under the rules of the SEC. Information about MCBH’s directors and executive officers is available in MCBH’s proxy statement dated September 15, 2025 for its 2025 Annual Meeting of Stockholders (available here). To the extent holdings of MCBH common stock by the directors and executive officers of MCBH have changed from the amounts of MCBH common stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC (available here). Information about Marine Products’ directors and executive officers is available in Marine Products’ proxy statement dated March 12, 2025, for its 2025 Annual Meeting of Stockholders (available here). To the extent holdings of Marine Products common stock by the directors and executive officers of Marine Products have changed from the amounts of Marine Products common stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC (available here). Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials to be filed with the SEC regarding the proposed transactions when they become available. Investors should read the Joint Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions . You may obtain free copies of these documents from the SEC’s website at www.sec.gov or from MCBH or Marine Products using the sources indicated above. No Offer or Solicitation This presentation does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior t o registration or qualification under the securities laws of such jurisdiction. |

| 4 TODAY’S PRESENTERS Brad Nelson Chief Executive Officer and Director Scott Kent Chief Financial Officer |

| M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 5 CREATING A DIVERSIFIED PORTFOLIO OF PROVEN RECREATIONAL MARINE BRANDS LEADING BRANDS ACROSS FOUR DISTINCT CATEGORIES 5 Combination of MasterCraft, Crest, Balise, Chaparral, and Robalo More Than Doubles Consumer Reach EXPANDED GEOGRAPHIC COVERAGE AND OFFERINGS Unlocks Growth Opportunities Through Complementary Coastal and Inland Dealer Networks ENHANCED INNOVATION AND MANUFACTURING CAPABILITIES Delivers Differentiated and Innovative New Products While Accelerating New Model Launches ATTRACTIVE FINANCIAL PROFILE Robust Balance Sheet to Drive Growth, Value Creation, and Focused Capital Allocation |

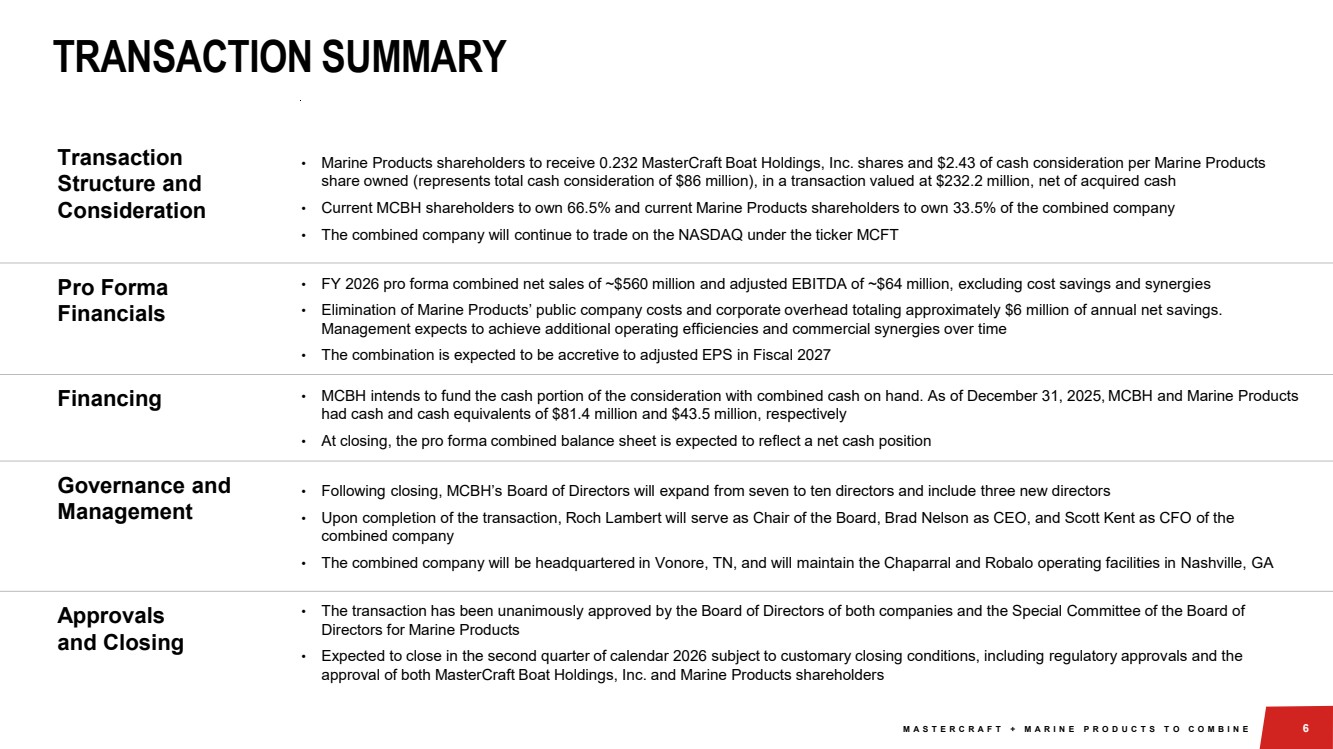

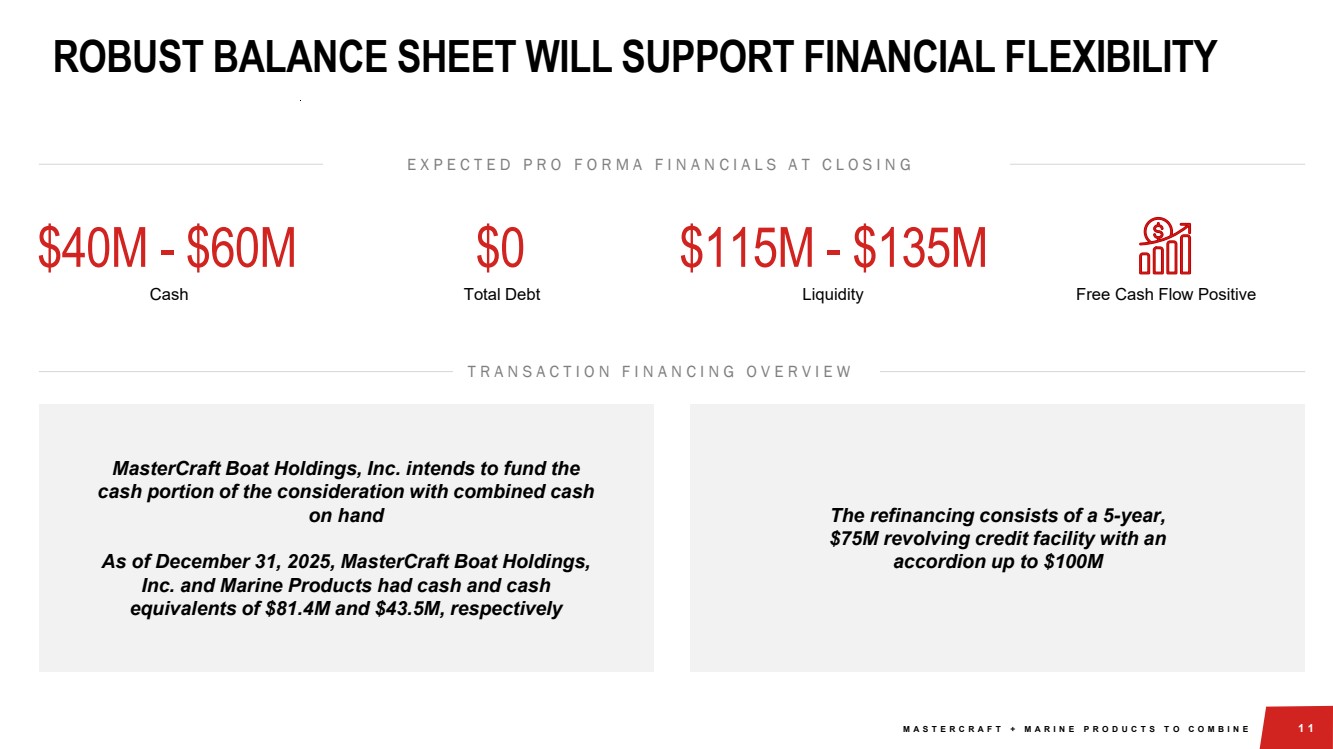

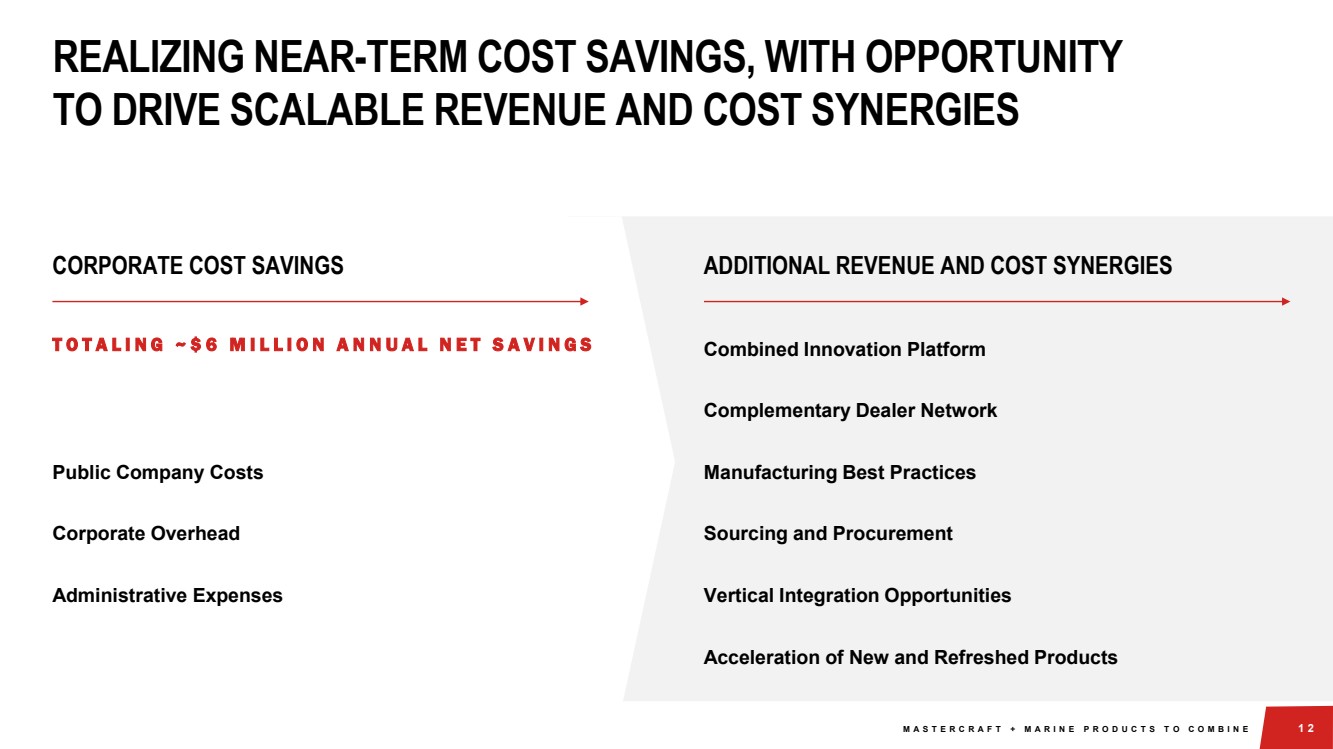

| M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 6 TRANSACTION SUMMARY Transaction Structure and Consideration • Marine Products shareholders to receive 0.232 MasterCraft Boat Holdings, Inc. shares and $2.43 of cash consideration per Marine Products share owned (represents total cash consideration of $86 million), in a transaction valued at $232.2 million, net of acquired cash • Current MCBH shareholders to own 66.5% and current Marine Products shareholders to own 33.5% of the combined company • The combined company will continue to trade on the NASDAQ under the ticker MCFT Pro Forma Financials • FY 2026 pro forma combined net sales of ~$560 million and adjusted EBITDA of ~$64 million, excluding cost savings and synergies • Elimination of Marine Products’ public company costs and corporate overhead totaling approximately $6 million of annual net savings. Management expects to achieve additional operating efficiencies and commercial synergies over time • The combination is expected to be accretive to adjusted EPS in Fiscal 2027 Financing • MCBH intends to fund the cash portion of the consideration with combined cash on hand. As of December 31, 2025, MCBH and Marine Products had cash and cash equivalents of $81.4 million and $43.5 million, respectively • At closing, the pro forma combined balance sheet is expected to reflect a net cash position Governance and Management • Following closing, MCBH’s Board of Directors will expand from seven to ten directors and include three new directors • Upon completion of the transaction, Roch Lambert will serve as Chair of the Board, Brad Nelson as CEO, and Scott Kent as CFO of the combined company • The combined company will be headquartered in Vonore, TN, and will maintain the Chaparral and Robalo operating facilities in Nashville, GA Approvals and Closing • The transaction has been unanimously approved by the Board of Directors of both companies and the Special Committee of the Board of Directors for Marine Products • Expected to close in the second quarter of calendar 2026 subject to customary closing conditions, including regulatory approvals and the approval of both MasterCraft Boat Holdings, Inc. and Marine Products shareholders |

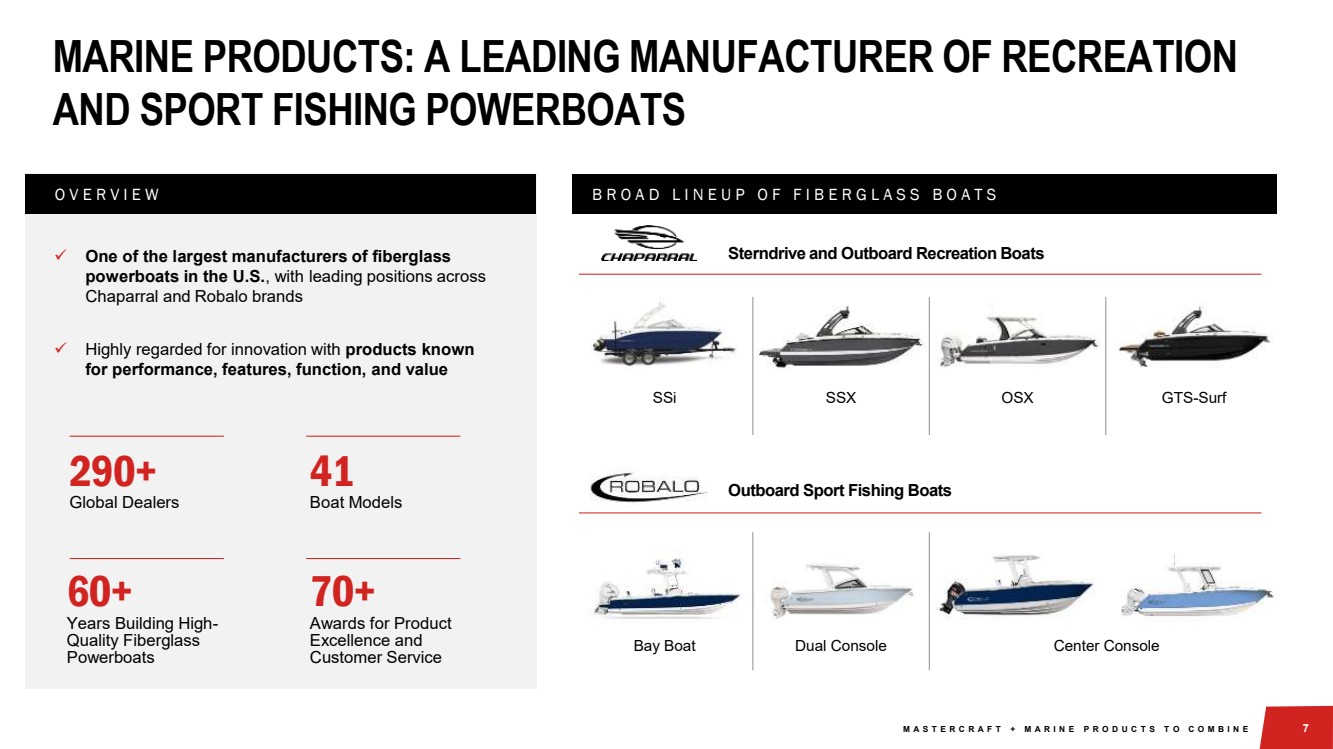

| M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 7 MARINE PRODUCTS: A LEADING MANUFACTURER OF RECREATION AND SPORT FISHING POWERBOATS Sterndrive and Outboard Recreation Boats SSi OSX GTS-Surf Bay Boat Outboard Sport Fishing Boats B R O A D L I N E U P O F F I B E R G L A S S B O A T S SSX Dual Console Center Console ✓ One of the largest manufacturers of fiberglass powerboats in the U.S., with leading positions across Chaparral and Robalo brands ✓ Highly regarded for innovation with products known for performance, features, function, and value 70+ Awards for Product Excellence and Customer Service 290+ Global Dealers 41 Boat Models 60+ Years Building High-Quality Fiberglass Powerboats O V E R V I E W |

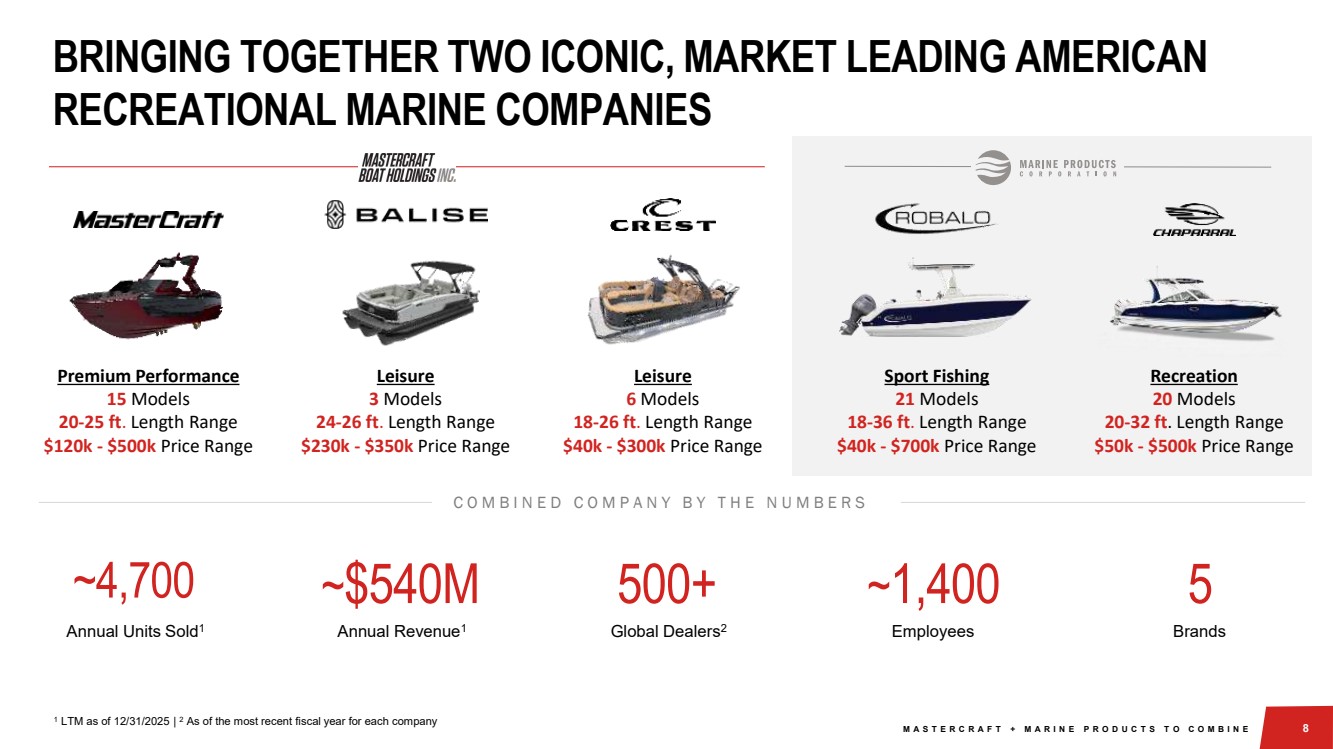

| M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 8 BRINGING TOGETHER TWO ICONIC, MARKET LEADING AMERICAN RECREATIONAL MARINE COMPANIES ~4,700 ~$540M 500+ ~1,400 5 Annual Units Sold1 Annual Revenue1 Global Dealers2 Employees Brands C O M B I N E D C O M P A N Y B Y T H E N U M B E R S 1 LTM as of 12/31/2025 | 2 As of the most recent fiscal year for each company Premium Performance 15 Models 20-25 ft. Length Range $120k - $500k Price Range Sport Fishing 21 Models 18-36 ft. Length Range $40k - $700k Price Range Recreation 20 Models 20-32 ft. Length Range $50k - $500k Price Range Leisure 3 Models 24-26 ft. Length Range $230k - $350k Price Range Leisure 6 Models 18-26 ft. Length Range $40k - $300k Price Range |

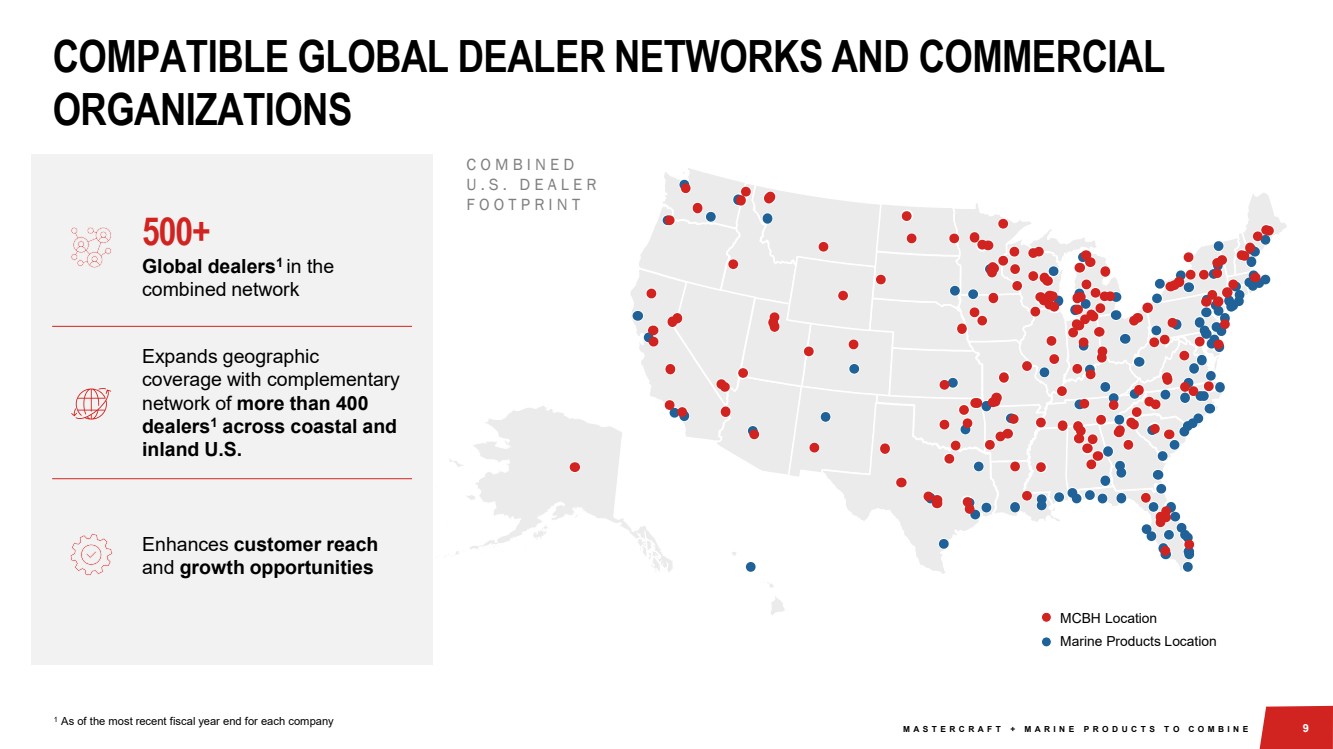

| M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 9 COMPATIBLE GLOBAL DEALER NETWORKS AND COMMERCIAL ORGANIZATIONS C O M B I N E D U . S . D E A L E R F O O T P R I N T 500+ Global dealers1 in the combined network Expands geographic coverage with complementary network of more than 400 dealers1 across coastal and inland U.S. Enhances customer reach and growth opportunities Marine Products Location 1 As of the most recent fiscal year end for each company MCBH Location |

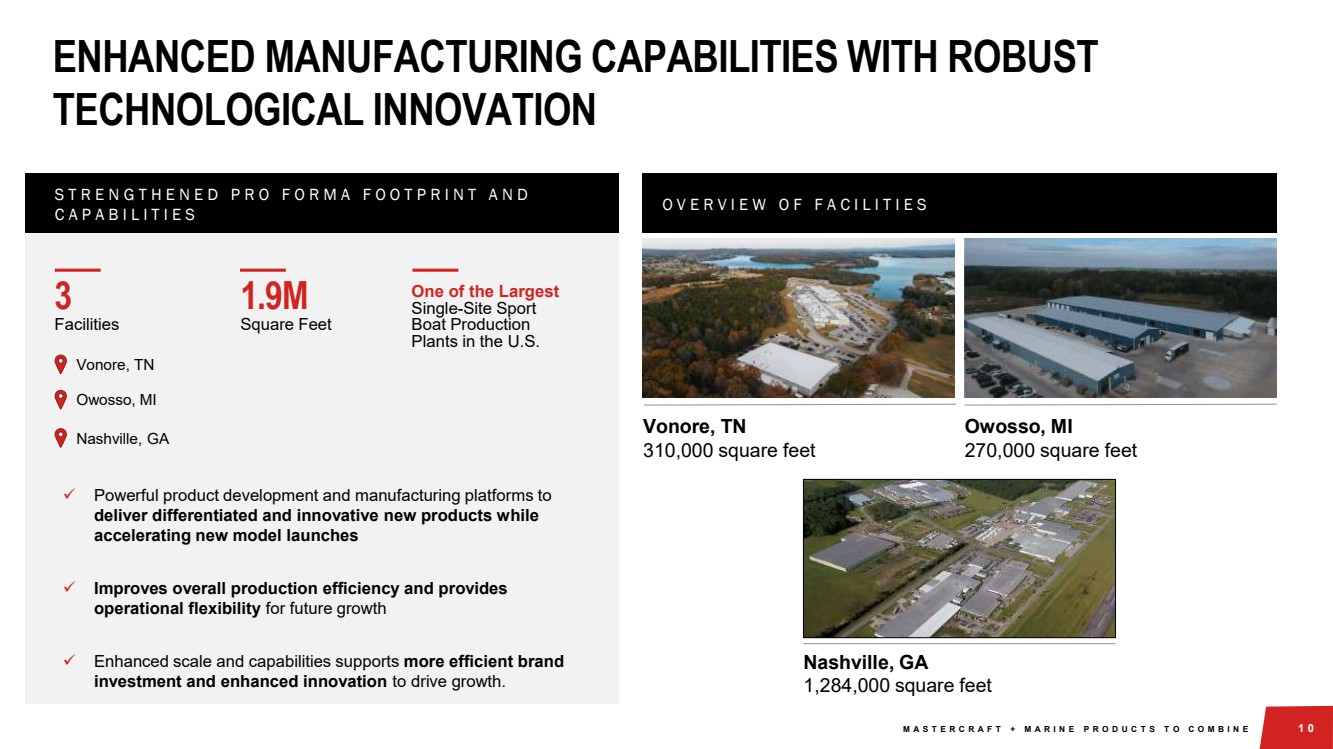

| M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 1 0 S T R E N G T H E N E D P R O F O R M A F O O T P R I N T A N D C A P A B I L I T I E S ENHANCED MANUFACTURING CAPABILITIES WITH ROBUST TECHNOLOGICAL INNOVATION Vonore, TN 310,000 square feet Owosso, MI 270,000 square feet Nashville, GA 1,284,000 square feet Vonore, TN Owosso, MI Nashville, GA ✓ Powerful product development and manufacturing platforms to deliver differentiated and innovative new products while accelerating new model launches ✓ Improves overall production efficiency and provides operational flexibility for future growth ✓ Enhanced scale and capabilities supports more efficient brand investment and enhanced innovation to drive growth. 1.9M Square Feet One of the Largest Single-Site Sport Boat Production Plants in the U.S. 3 Facilities O V E R V I E W O F F A C I L I T I E S |

| M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 1 1 ROBUST BALANCE SHEET WILL SUPPORT FINANCIAL FLEXIBILITY $40M - $60M $0 $115M - $135M Cash Total Debt Liquidity Free Cash Flow Positive E X P E C T E D P R O F O R M A F I N A N C I A L S A T C L O S I N G T R A N S A C T I O N F I N A N C I N G O V E R V I E W MasterCraft Boat Holdings, Inc. intends to fund the cash portion of the consideration with combined cash on hand As of December 31, 2025, MasterCraft Boat Holdings, Inc. and Marine Products had cash and cash equivalents of $81.4M and $43.5M, respectively The refinancing consists of a 5-year, $75M revolving credit facility with an accordion up to $100M |

| M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 1 2 REALIZING NEAR-TERM COST SAVINGS, WITH OPPORTUNITY TO DRIVE SCALABLE REVENUE AND COST SYNERGIES CORPORATE COST SAVINGS T O T A L I N G ~ $ 6 M I L L I O N A N N U A L N E T S A V I N G S ADDITIONAL REVENUE AND COST SYNERGIES Public Company Costs Corporate Overhead Administrative Expenses Combined Innovation Platform Complementary Dealer Network Manufacturing Best Practices Sourcing and Procurement Vertical Integration Opportunities Acceleration of New and Refreshed Products |

| M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 1 3 TRANSFORMATIVE COMBINATION DELIVERING SCALE, INNOVATION, AND GROWTH TO DRIVE SHAREHOLDER VALUE CREATION LEADING BRANDS ACROSS FOUR DISTINCT CATEGORIES Combination of MasterCraft, Crest, Balise, Chaparral, and Robalo More Than Doubles Consumer Reach ENHANCED INNOVATION AND MANUFACTURING CAPABILITIES Delivers Differentiated and Innovative New Products While Accelerating New Model Launches ATTRACTIVE FINANCIAL PROFILE Robust Balance Sheet to Drive Growth, Value Creation, and Focused Capital Allocation EXPANDED GEOGRAPHIC COVERAGE AND OFFERINGS Unlocks Growth Opportunities Through Complementary Coastal and Inland Dealer Networks M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 1 3 |

| 1 4 |