2025 Fourth Quarter and Full Year Review Feb. 5, 2026

Forward-looking Statements COMPANY INFORMATION Black Hills Corporation P.O. Box 1400 Rapid City, SD 57709-1400 NYSE Ticker: BKH www.blackhillscorp.com Company Contacts Kimberly Nooney Senior Vice President and CFO 605-721-2370 kim.nooney@blackhillscorp.com Sal Diaz Director of Investor Relations 605-399-5079 sal.diaz@blackhillscorp.com This presentation includes “forward-looking statements” as defined by the Securities and Exchange Commission. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. This includes, without limitations, our 2026 earnings guidance, long-term growth target and our expectations for regulatory filings for and the closing of the merger with NorthWestern Energy. These forward-looking statements are based on assumptions which we believe are reasonable based on current expectations and projections about future events and industry conditions and trends affecting our business. However, whether actual results and developments will conform to our expectations and predictions is subject to a number of risks and uncertainties that, among other things, could cause actual results to differ materially from those contained in the forward-looking statements, including without limitation, the risk factors described in Item 1A of our Quarterly Report on Form 10-Q for the quarter ended Sept. 30, 2025, Item 1A of Part I of our forthcoming 2025 Annual Report on Form 10-K, and other reports that we file with the SEC from time to time, and the following: The accuracy of our assumptions on which our earnings guidance and growth target are based; Our ability to obtain adequate cost recovery for our utility operations through regulatory proceedings and favorable rulings on periodic applications to recover costs for capital additions, plant retirements and decommissioning, fuel, transmission, purchased power and other operating costs, and the timing in which new rates would go into effect; Our ability to complete our capital program in a cost-effective and timely manner; Our ability to execute on our strategy; Our ability to successfully execute our financing plans; The effects of changing interest rates; Our ability to achieve our greenhouse gas emissions intensity reduction goals; The impact of future governmental regulation; Our ability to overcome the impacts of supply chain disruptions on availability and cost of materials; Our ability to obtain sufficient insurance coverage at acceptable costs and whether such coverage will protect us against significant losses; The effects of inflation, tariffs and volatile energy prices; The expected timing and likelihood of completion and our ability to realize the anticipated benefits of the proposed merger with NorthWestern Energy Group, Inc., including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed acquisition that could reduce anticipated benefits or give rise to the termination of the merger; and Other factors discussed from time to time in our filings with the SEC. New factors that could cause actual results to differ materially from those described in forward-looking statements emerge from time to time, and it is not possible for us to predict all such factors, or the extent to which any such factor or combination of factors may cause actual results to differ from those contained in any forward-looking statement. We assume no obligation to update publicly any such forward-looking statements, whether as a result of new information, future events or otherwise. MERGER-RELATED INFORMATION No Offer or Solicitation This document is for informational purposes only and is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Important Information and Where to Find It Black Hills filed a registration statement on Form S-4 with the SEC to register the shares of Black Hills’ common stock that will be issued to NorthWestern stockholders in connection with the pending merger transaction. The registration statement included a preliminary joint proxy statement of Black Hills and NorthWestern that will also constitute a prospectus of Black Hills. The definitive joint proxy statement/prospectus will be sent to the stockholders of each of Black Hills and NorthWestern in connection with the pending merger transaction. Additionally, Black Hills and NorthWestern will file other relevant materials in connection with the pending merger transaction with the SEC. Investors and security holders are urged to read the registration statement and joint proxy statement/prospectus when they become available (and any other documents filed with the SEC in connection with the transaction or incorporated by reference into the joint proxy statement/prospectus) because such documents will contain important information regarding the pending merger transaction and related matters. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Black Hills or NorthWestern through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Black Hills or NorthWestern at investorrelations@blackhillscorp.com or travis.meyer@northwestern.com, respectively. Before making any voting or investment decision, investors and security holders of Black Hills and NorthWestern are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto (and any other documents filed with the SEC in connection with the pending merger transaction) because they will contain important information about the pending merger transaction. Free copies of these documents may be obtained as described above. Participants in Solicitation Black Hills, NorthWestern and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of Black Hills and NorthWestern in connection with the pending merger transaction. Information regarding the directors and executive officers of Black Hills and NorthWestern and other persons who may be deemed participants in the solicitation of the stockholders of Black Hills or of NorthWestern in connection with the pending merger transaction will be included in the joint proxy statement/prospectus related to the pending merger transaction, which will be filed by Black Hills with the SEC. Information about the directors and executive officers of Black Hills and their ownership of Black Hills common stock can also be found in Black Hills’ filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed on February 12, 2025, under the header “Information About Our Executive Officers,” and its Proxy Statement on Schedule 14A, which was filed on March 14, 2025, under the headers “Election of Directors” and “Security Ownership of Management and Principal Shareholders,” and other documents subsequently filed by Black Hills with the SEC. Information about the directors and executive officers of NorthWestern and their ownership of NorthWestern common stock can also be found in NorthWestern’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed on February 13, 2025, under the header “Information About Our Executive Officers” and its Proxy Statement on Schedule 14A, which was filed on March 12, 2025, under the headers “Election of Directors” and “Who Owns our Stock”. Additional information regarding the respective directors and executive officers of Black Hills and NorthWestern and other participants in each respective proxy solicitation and a description of their direct and indirect interests in the proposed merger is contained in the registration statement and the joint proxy statement/prospectus under the headings “Additional Interests Of Black Hills and Northwestern Directors and Officers,” and “Shares Beneficially Owned by NorthWestern Directors and Officers.” To the extent any such person's ownership of Black Hills’ or NorthWestern’s securities, respectively, has changed since the filing of such proxy statement, such changes have been or will be reflected on Forms 3, 4 or 5 filed with the SEC. Additional information regarding the interests of such participants will be included in other relevant documents regarding the pending merger transaction filed with the SEC when they become available.

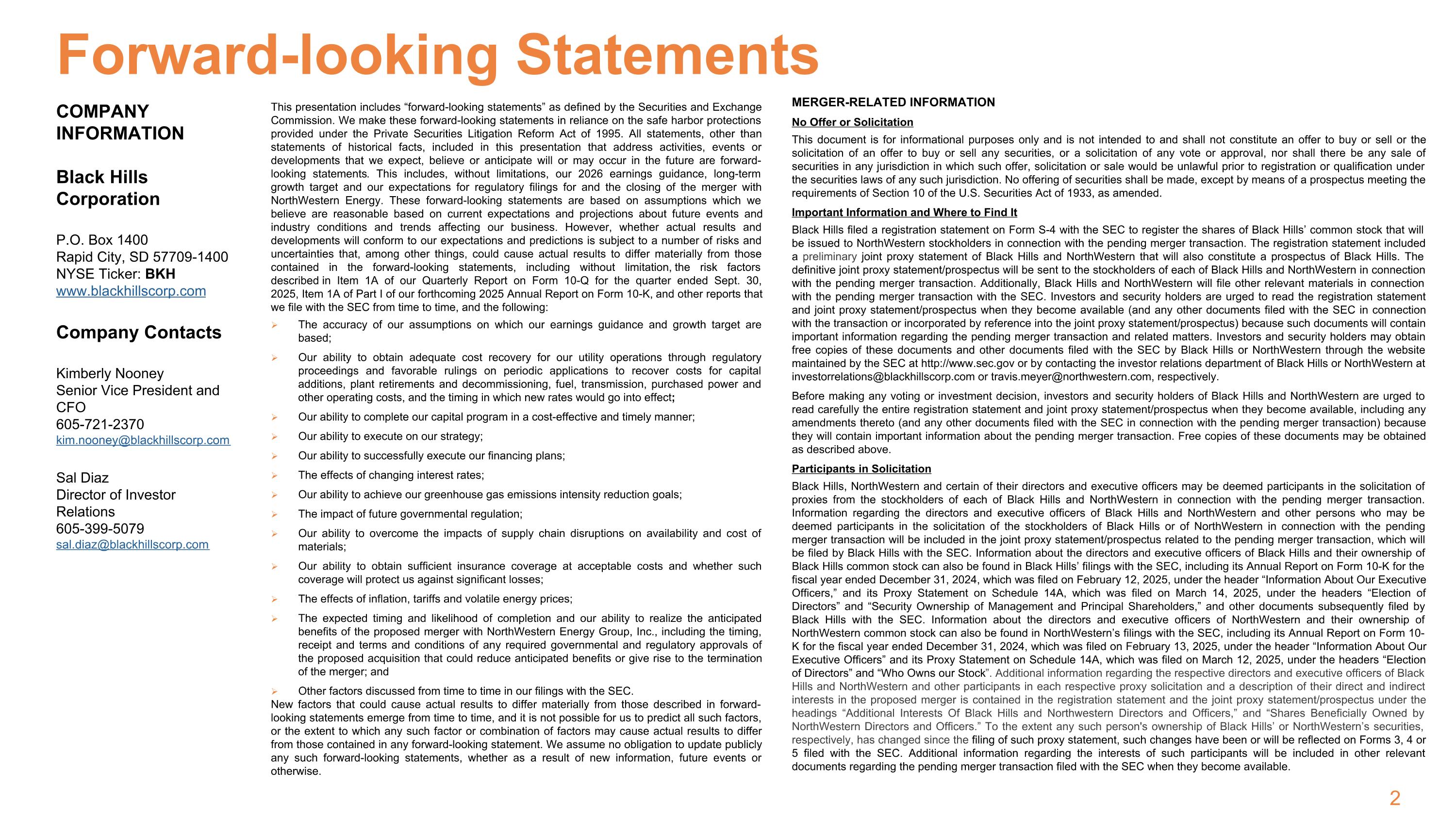

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | 2025 Achievements for Stakeholders Announced tax-free, all-stock merger with NorthWestern Energy Filed joint regulatory requests for transaction approval in Montana, Nebraska, South Dakota, and with FERC Achieved midpoint of earnings guidance and long-term growth target Maintained strong balance sheet and liquidity Increased dividend, completing 55 consecutive years of increase Completed rate reviews in Colorado, Kansas and Nebraska Energized Ready Wyoming 260-mile transmission expansion Commenced construction on Lange II 99 MW generation project Obtained approval for 50 MW battery project in 2027 for Colorado Increased data center pipeline to 3 GW+ of load requests from 1 GW+ Delivered industry-leading reliability Established emergency public safety power shutoff program (PSPS) Served four new peaks at Wyoming Electric, a 21% increase over 2024 Advance Regulatory and Growth Initiatives Deliver Excellent Operational Performance Deliver on Financial Commitments Announced Merger with NorthWestern Energy

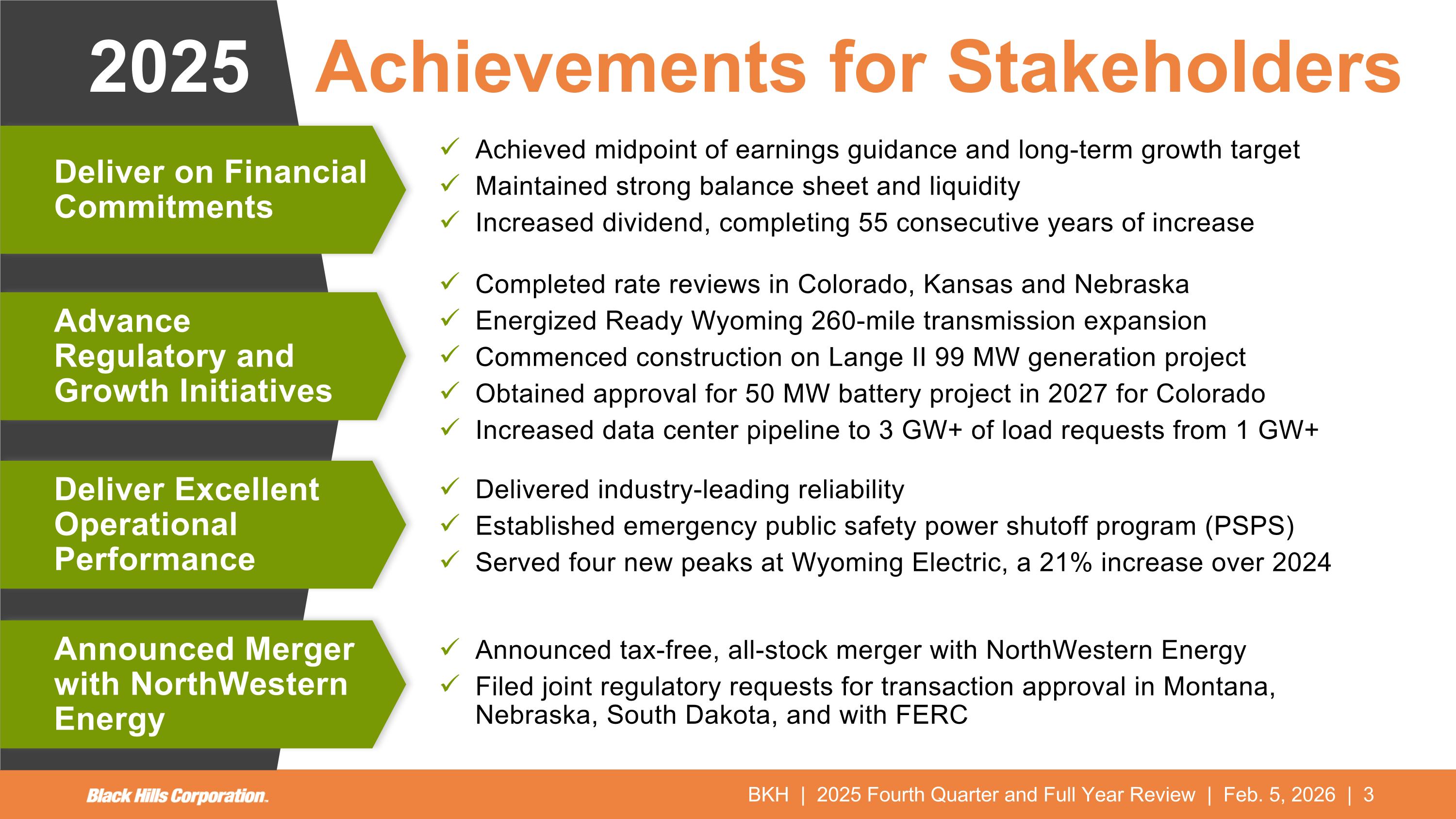

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Deliver year-over-year adjusted EPS growth of 6% Maintain strong balance sheet to enable growth Increased dividend, extending track record to 56 consecutive years 2026 Key Initiatives Complete rate reviews for Arkansas Gas and South Dakota Electric Complete 99 MW Lange II generation project in Rapid City Serve current data center customers’ growing demand Capture upside data center demand opportunities Deliver industry-leading reliability Invest in safety, reliability and growth-focused capital projects Obtain approval of wildfire mitigation plan in Wyoming and support new wildfire liability legislation in South Dakota and Colorado Filed S-4 / joint proxy statement Obtain state regulatory, federal and shareholder approvals Advance Regulatory and Growth Initiatives Deliver Excellent Operational Performance Deliver on Financial Commitments Close Merger with NorthWestern Energy

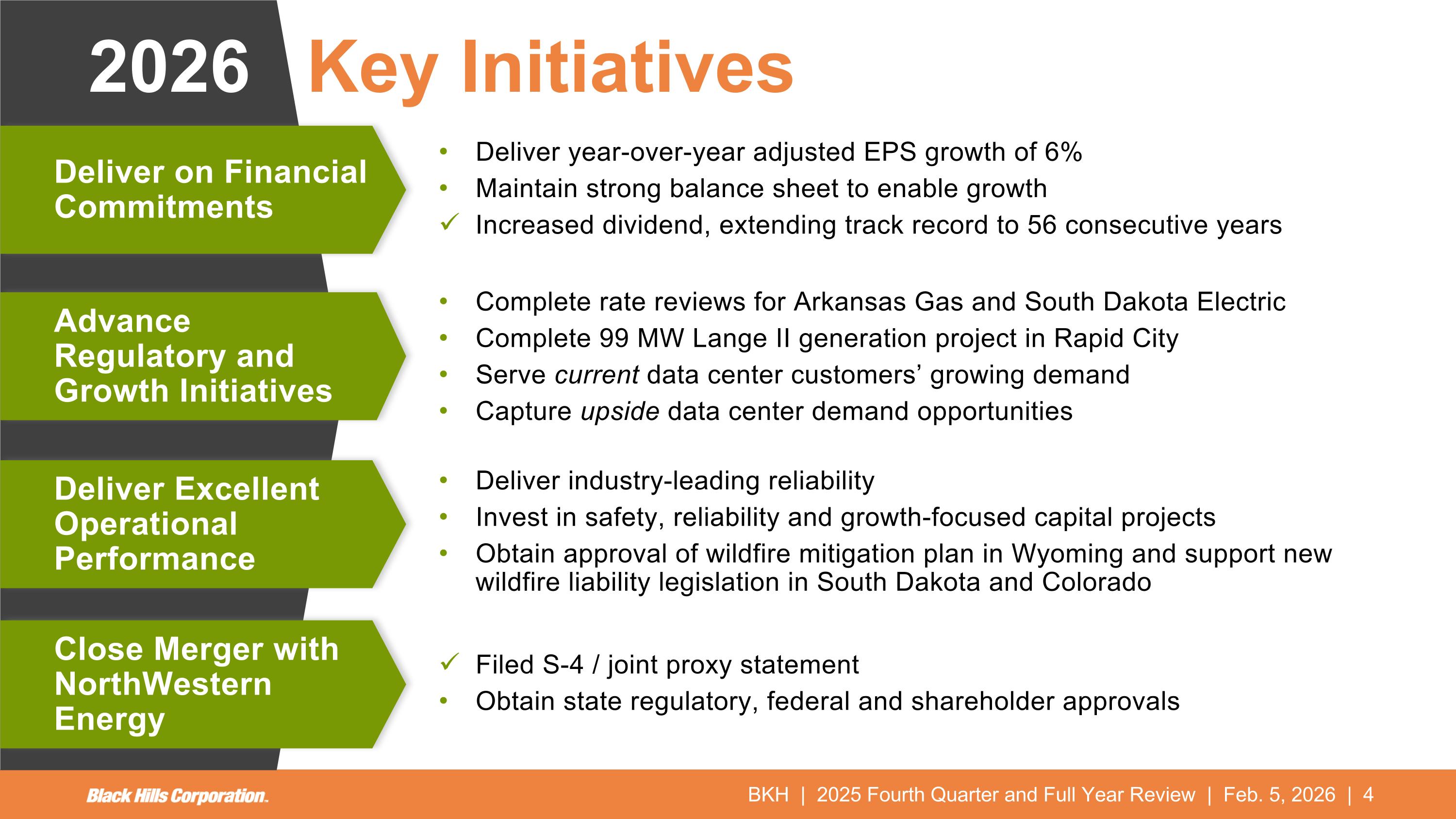

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Current plan includes: Data center load of 600 MW by 2030 with minimal capital investment Data center demand contributing 10%+ of growing consolidated EPS beginning in 2028 Upside opportunities: Negotiating with high-quality partners to serve additional load requests Investment in generation as part of resource mix to serve unique needs of our customers Investment in transmission Strong and growing data center demand Innovative tariff 2 providing flexibility for the unique needs of our customers with a mix of: Market energy procurement (minimal capital) Contracted resources (minimal capital) Utility-owned resources Cost-effectively enabling speed to market Benefits to other customers and communities High-Quality Data Center Pipeline1 of 3 GW+ Flexible service model 1 Pipeline includes large-load requests under non-disclosure agreements 2 Large Power Contract Service (LPCS) tariff in Wyoming

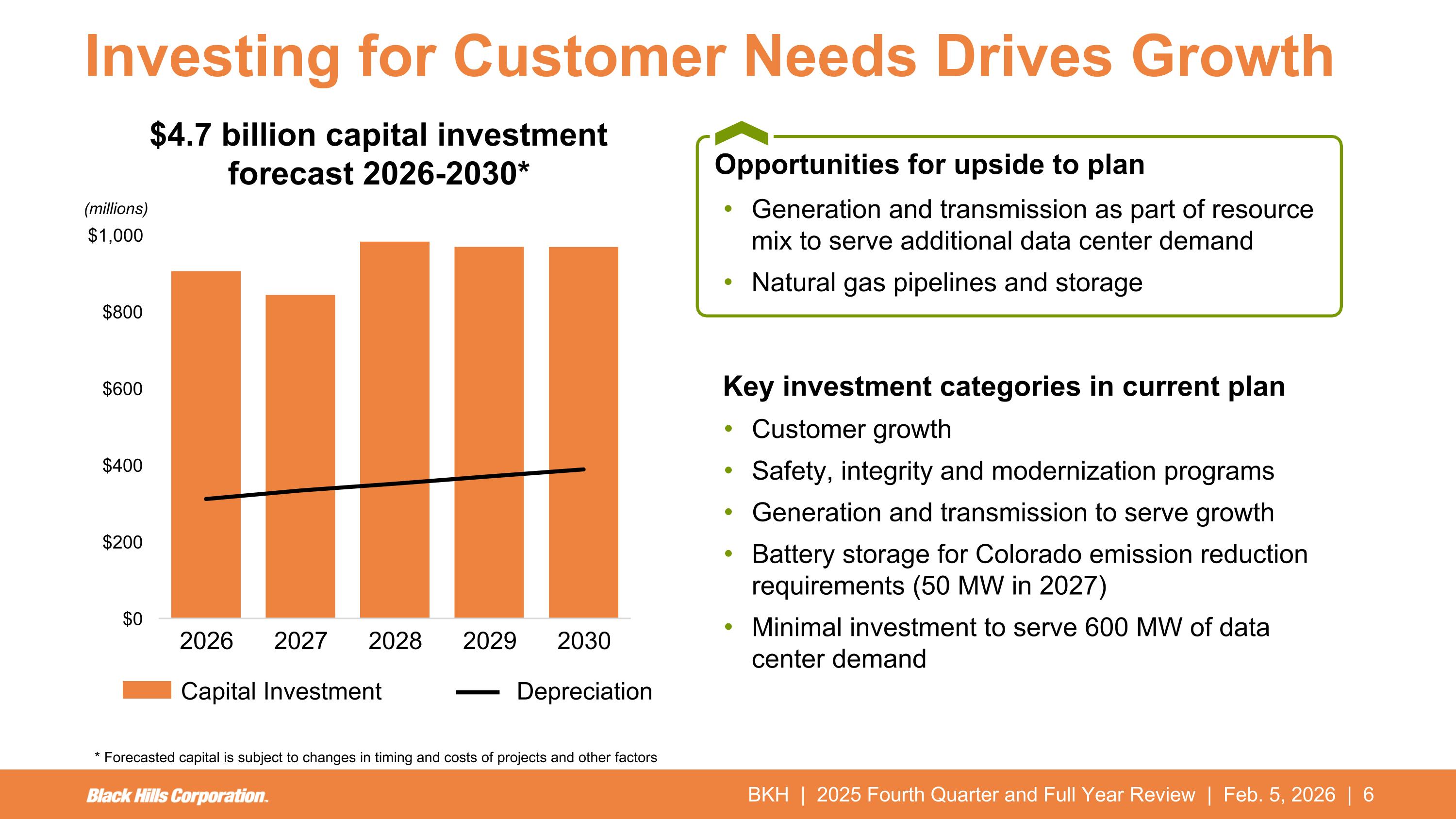

Key investment categories in current plan Customer growth Safety, integrity and modernization programs Generation and transmission to serve growth Battery storage for Colorado emission reduction requirements (50 MW in 2027) Minimal investment to serve 600 MW of data center demand BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Investing for Customer Needs Drives Growth (millions) * Forecasted capital is subject to changes in timing and costs of projects and other factors Capital Investment Depreciation Opportunities for upside to plan Generation and transmission as part of resource mix to serve additional data center demand Natural gas pipelines and storage $4.7 billion capital investment forecast 2026-2030*

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Merger with NorthWestern Benefits Stakeholders Increases Scale Position and Growth Increases the combined company target EPS growth rate to 5-7%, supported by the doubling of each company’s rate base to total of ~$11 billion with significant growth opportunities Expands Investment Opportunity Leverages enhanced resources to make strategic investments that foster economic development, including addressing the growing demand for energy, including from data centers Substantial Long-Term Value for Customers Enhances Business Diversity Delivering energy to more than 2.1 million customers across multiple contiguous jurisdictions, served by a highly skilled workforce focused on safety and reliability Strengthens Balance Sheet Strong and predictable cash flows support a customer-focused capital investment program while producing high-quality, investment-grade credit metrics Bringing together two complementary teams focused on reliability and exceptional customer service to deliver even greater value. For more information, see http://www.blackhillsnorthwesternbettertogether.com Strategic combination represents a highly attractive value creation opportunity for both companies

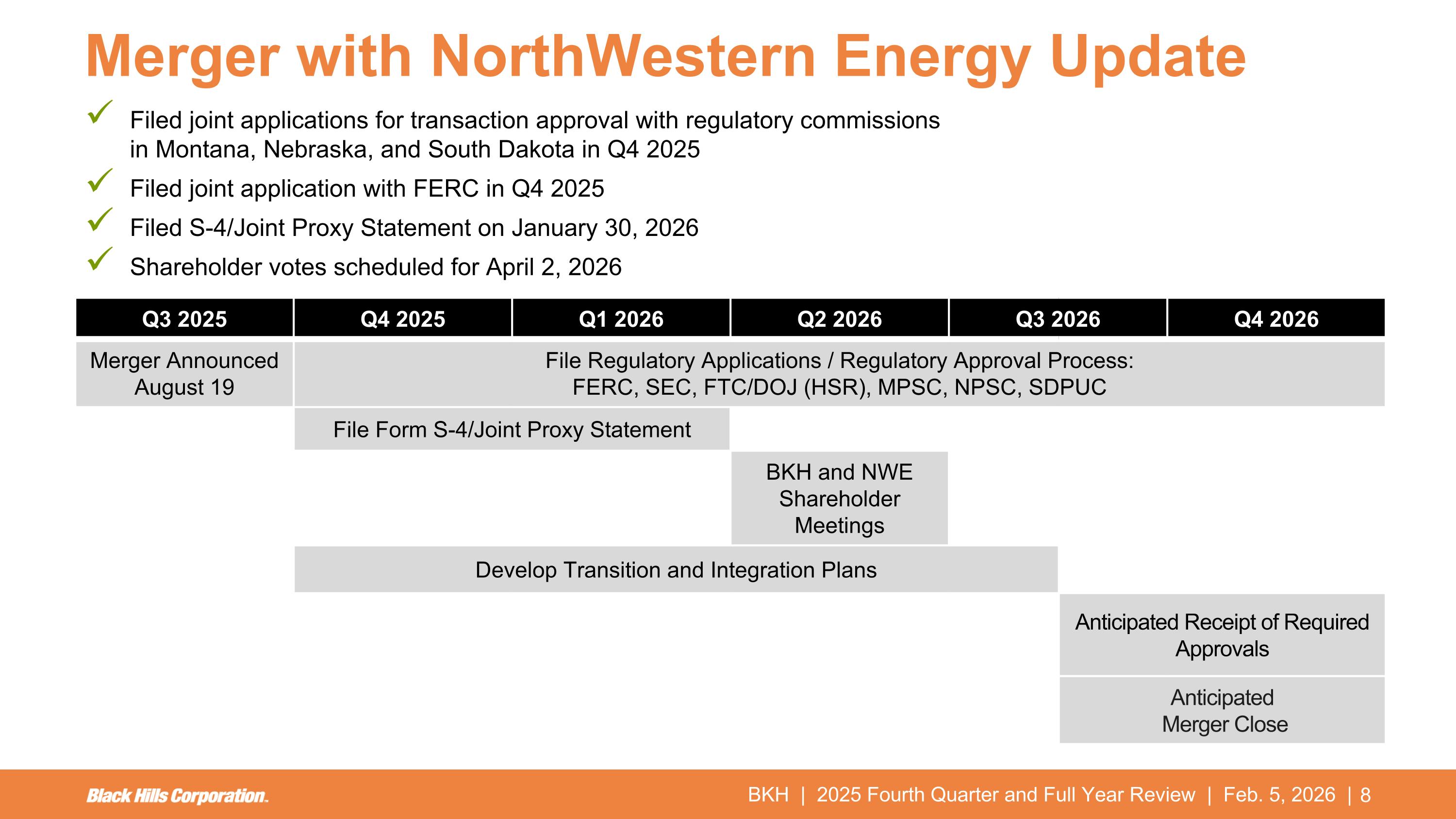

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Merger with NorthWestern Energy Update Filed joint applications for transaction approval with regulatory commissions in Montana, Nebraska, and South Dakota in Q4 2025 Filed joint application with FERC in Q4 2025 Filed S-4/Joint Proxy Statement on January 30, 2026 Shareholder votes scheduled for April 2, 2026 Q3 2025 Q4 2025 Q1 2026 Q2 2026 Q3 2026 Q4 2026 Merger Announced August 19 File Regulatory Applications / Regulatory Approval Process: FERC, SEC, FTC/DOJ (HSR), MPSC, NPSC, SDPUC File Form S-4/Joint Proxy Statement BKH and NWE Shareholder Meetings Develop Transition and Integration Plans Anticipated Receipt of Required Approvals Anticipated Receipt of Required Approvals Anticipated Merger Close Anticipated Merger Close

2025 Financial Review BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 |

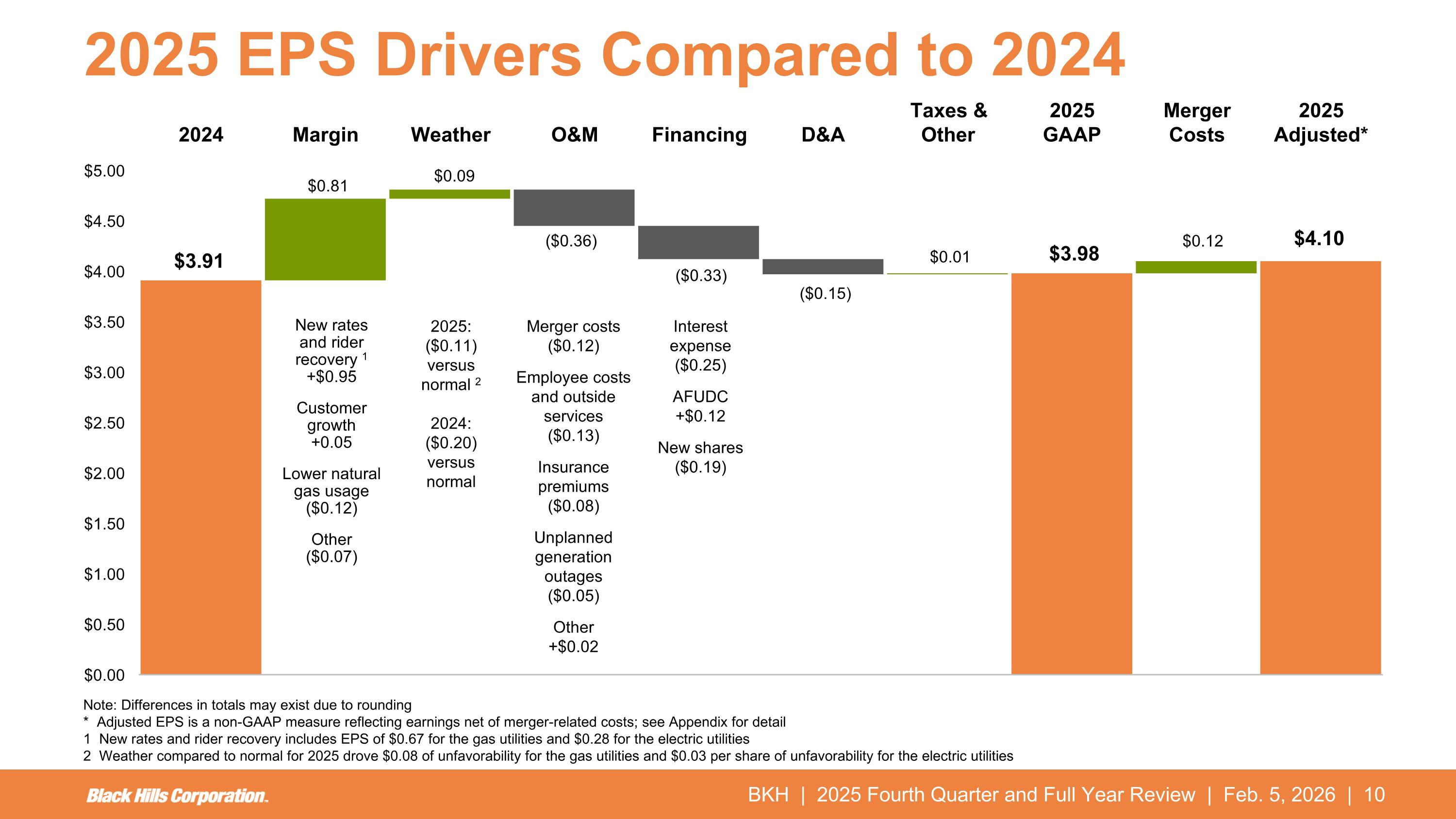

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | 2025 EPS Drivers Compared to 2024 Interest expense ($0.25) AFUDC +$0.12 New shares ($0.19) Merger costs ($0.12) Employee costs and outside services ($0.13) Insurance premiums ($0.08) Unplanned generation outages ($0.05) Other +$0.02 New rates and rider recovery 1 +$0.95 Customer growth +0.05 Lower natural gas usage ($0.12) Other ($0.07) 2025: ($0.11) versus normal 2 2024: ($0.20) versus normal Note: Differences in totals may exist due to rounding * Adjusted EPS is a non-GAAP measure reflecting earnings net of merger-related costs; see Appendix for detail 1 New rates and rider recovery includes EPS of $0.67 for the gas utilities and $0.28 for the electric utilities 2 Weather compared to normal for 2025 drove $0.08 of unfavorability for the gas utilities and $0.03 per share of unfavorability for the electric utilities

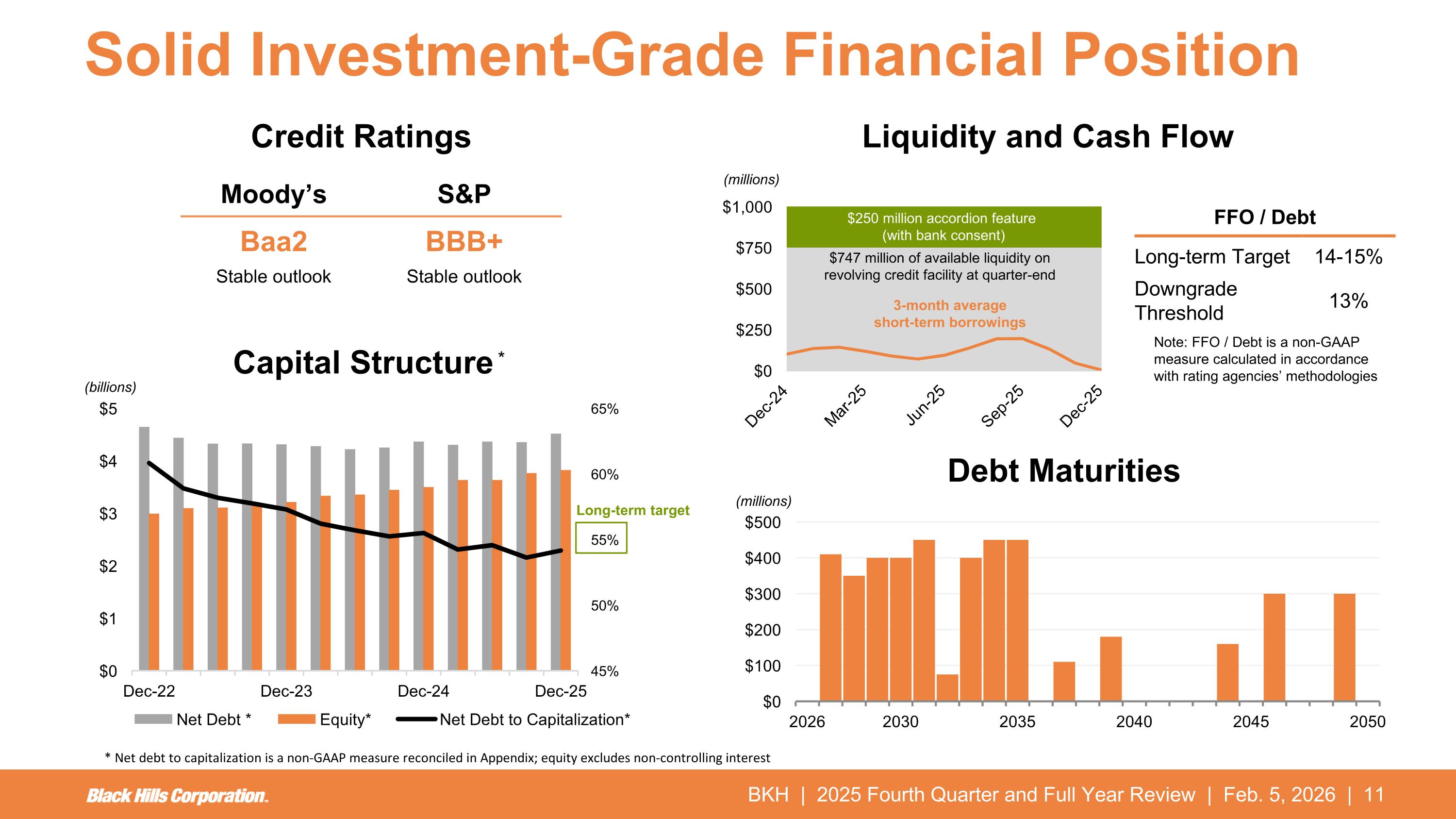

$250 million accordion feature (with bank consent) (millions) BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Solid Investment-Grade Financial Position Capital Structure * Liquidity and Cash Flow Debt Maturities (millions) Long-term target $747 million of available liquidity on revolving credit facility at quarter-end (billions) Credit Ratings FFO / Debt Long-term Target 14-15% Downgrade Threshold 13% Note: FFO / Debt is a non-GAAP measure calculated in accordance with rating agencies’ methodologies 3-month average short-term borrowings Moody’s S&P Baa2 BBB+ Stable outlook Stable outlook * Net debt to capitalization is a non-GAAP measure reconciled in Appendix; equity excludes non-controlling interest

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Note: Outlook excludes pending merger with NorthWestern Energy, expected to close in the second half of 2026 1 Average annual compound growth rate off 2023 guidance midpoint of $3.75 per share 2 Adjusted EPS is a non-GAAP measure which excludes merger-related costs; see slide 13 for a list of key guidance assumptions 3 Quarterly dividend payout increased on Jan. 23, 2026; 56 consecutive years of increase based on annualized rate for 2026 BKH Financial Outlook Targeting 55% to 65% payout ratio 56 consecutive years of increases in 2026 3 Dividend Initiated guidance in the range of $4.25 to $4.45 Midpoint represents 6% growth compared to $4.10 adjusted EPS in 2025 Expect to deliver in upper half of 4% to 6% growth in 2026 to 2030 Includes 600 MW of data center pipeline with minimal capital investment Long-term EPS Growth1 2026 Adjusted EPS2 Capital Investment Forecasting $4.7 billion of investment from 2026 to 2030 Excludes upside potential from investments as part of resource mix to serve additional data center demand

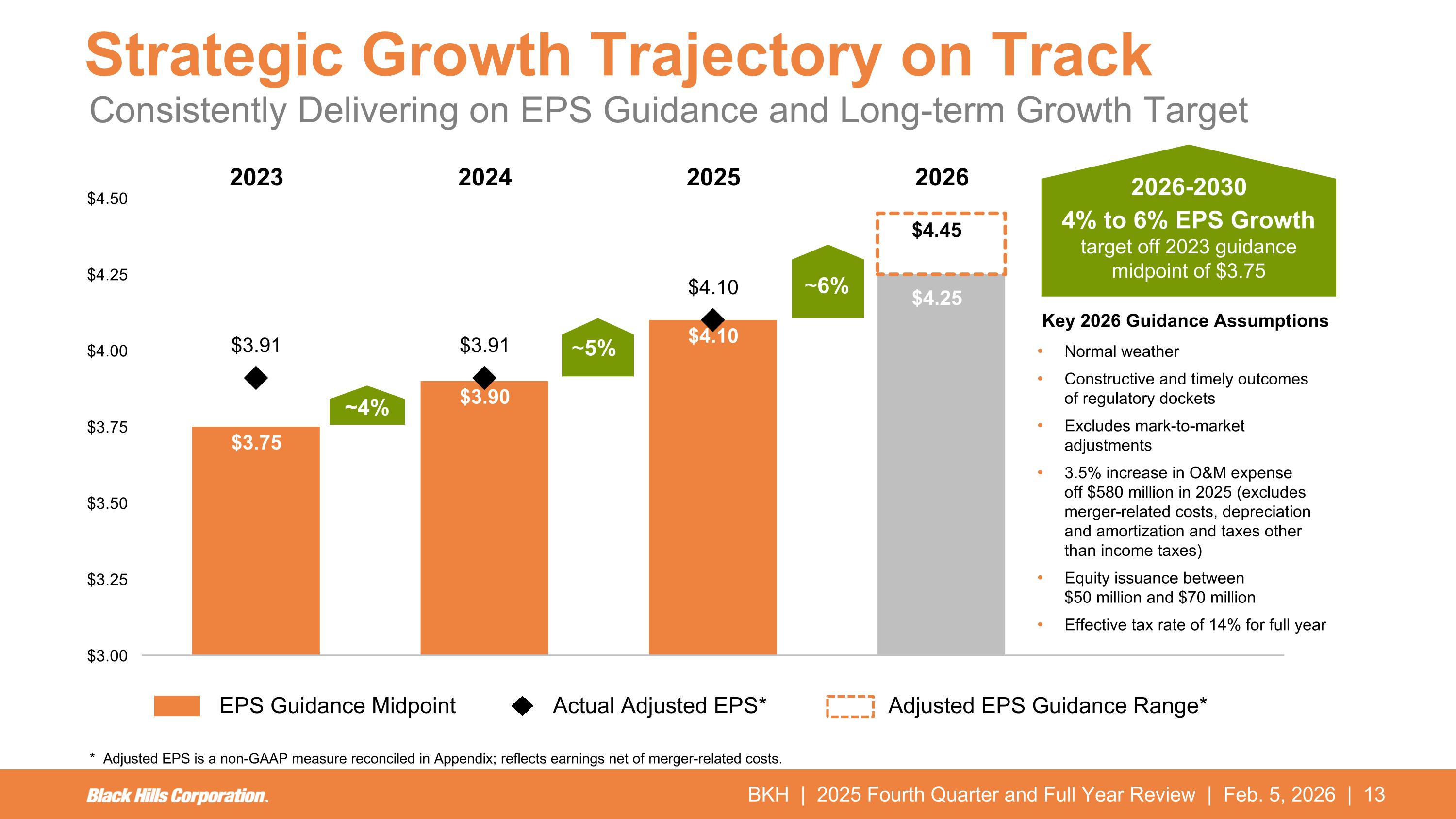

$4.45 $4.25 BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Strategic Growth Trajectory on Track ~4% EPS Guidance Midpoint Actual Adjusted EPS* Adjusted EPS Guidance Range* 2026-2030 4% to 6% EPS Growth target off 2023 guidance midpoint of $3.75 ~5% Consistently Delivering on EPS Guidance and Long-term Growth Target Key 2026 Guidance Assumptions Normal weather Constructive and timely outcomes of regulatory dockets Excludes mark-to-market adjustments 3.5% increase in O&M expense off $580 million in 2025 (excludes merger-related costs, depreciation and amortization and taxes other than income taxes) Equity issuance between $50 million and $70 million Effective tax rate of 14% for full year * Adjusted EPS is a non-GAAP measure reconciled in Appendix; reflects earnings net of merger-related costs. ~5% ~6%

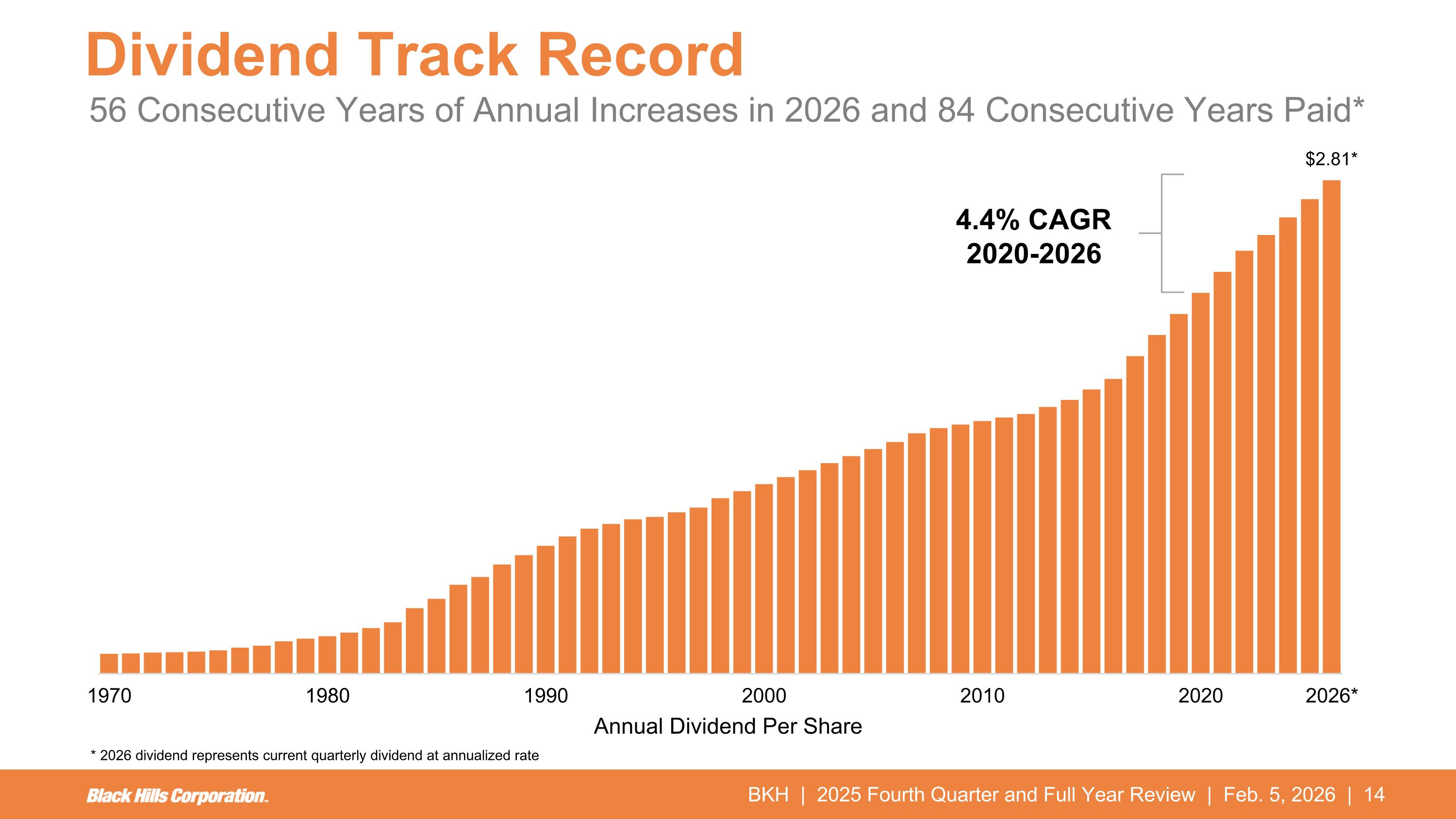

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Dividend Track Record 56 Consecutive Years of Annual Increases in 2026 and 84 Consecutive Years Paid* Annual Dividend Per Share * 2026 dividend represents current quarterly dividend at annualized rate 4.4% CAGR 2020-2026

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Business Update Pictured: Ready Wyoming electric transmission line connection at Orchard Valley Substation

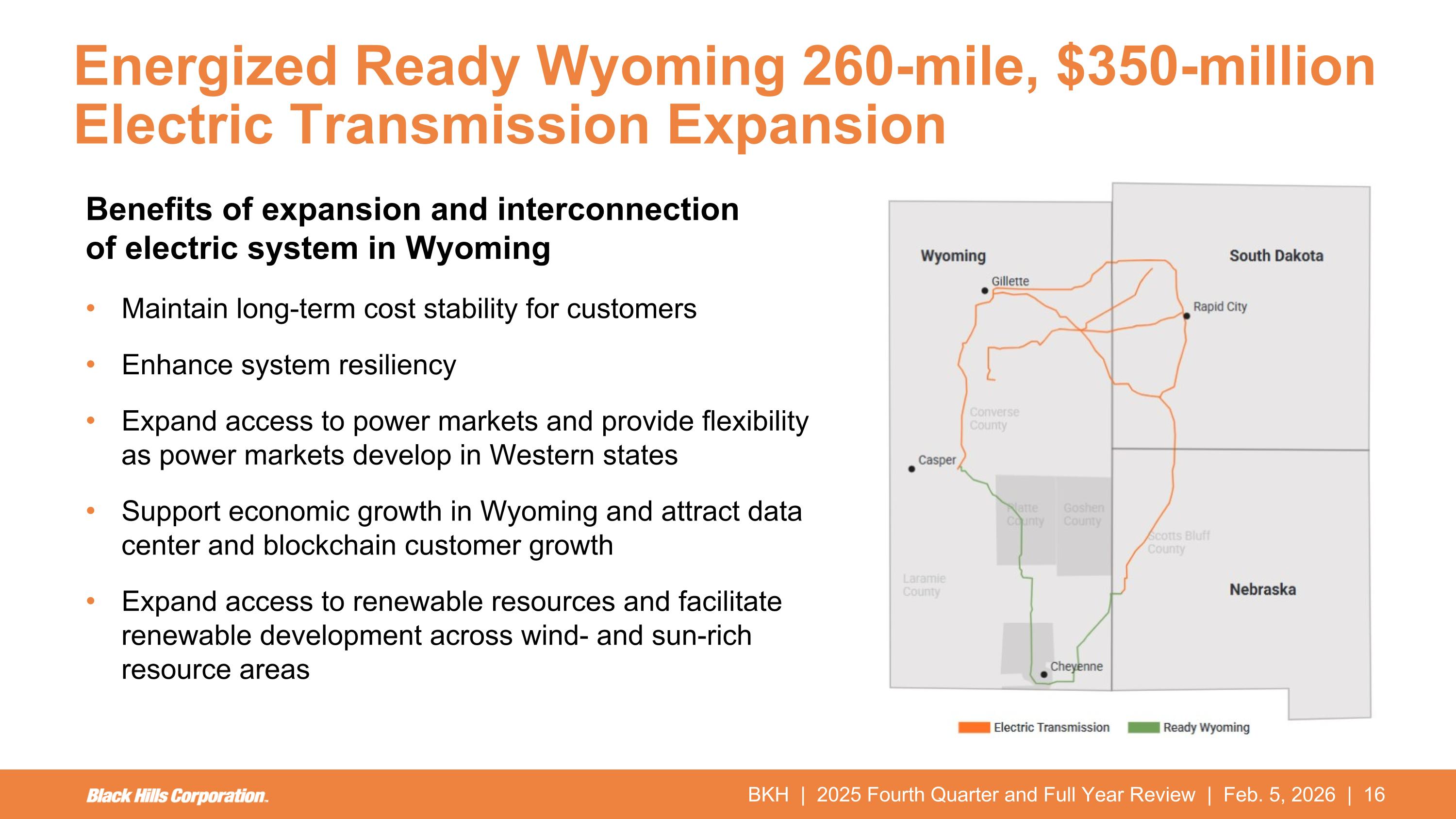

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Energized Ready Wyoming 260-mile, $350-million Electric Transmission Expansion Benefits of expansion and interconnection of electric system in Wyoming Maintain long-term cost stability for customers Enhance system resiliency Expand access to power markets and provide flexibility as power markets develop in Western states Support economic growth in Wyoming and attract data center and blockchain customer growth Expand access to renewable resources and facilitate renewable development across wind- and sun-rich resource areas

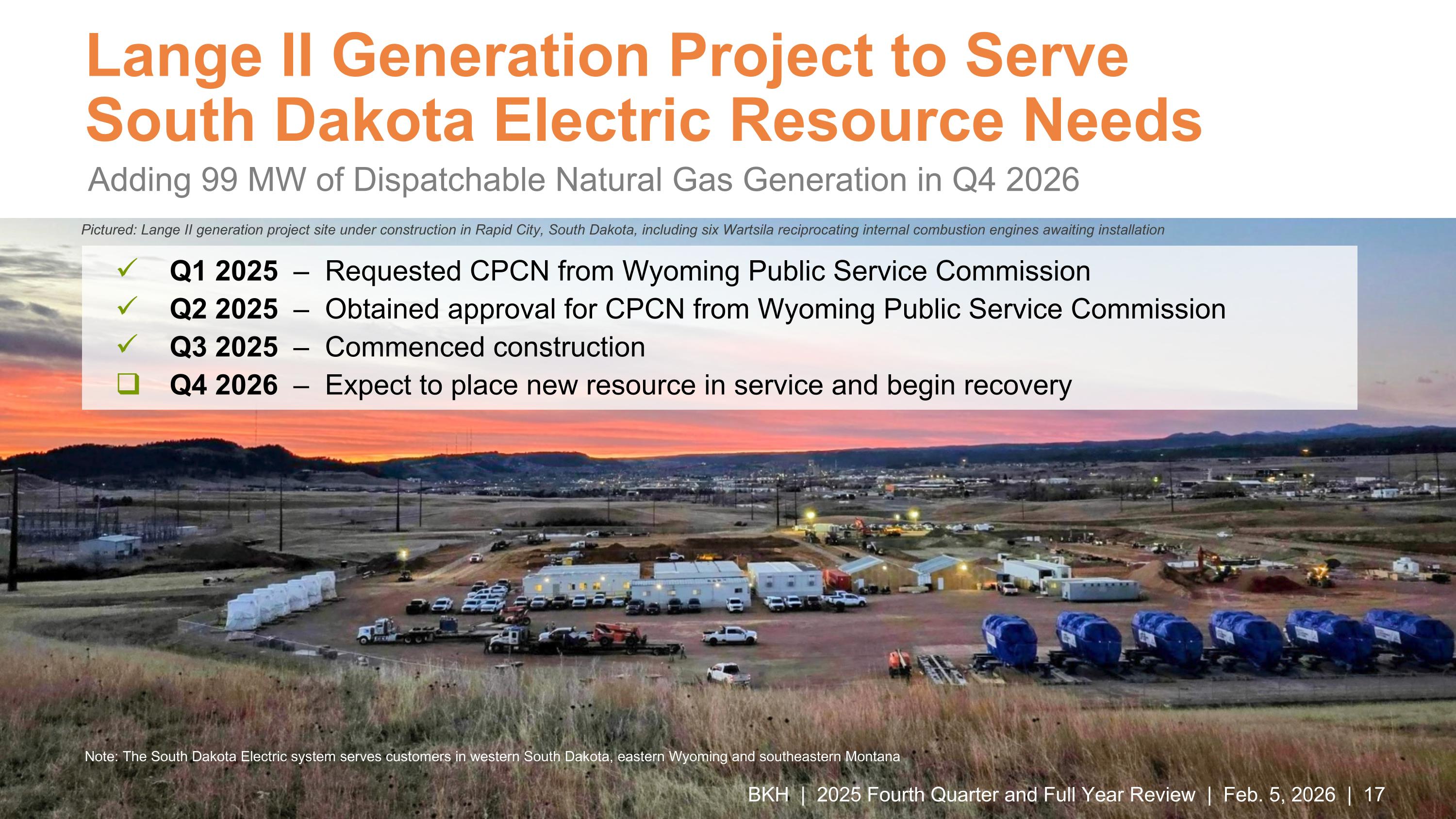

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Lange II Generation Project to Serve South Dakota Electric Resource Needs Adding 99 MW of Dispatchable Natural Gas Generation in Q4 2026 Q1 2025 – Requested CPCN from Wyoming Public Service Commission Q2 2025 – Obtained approval for CPCN from Wyoming Public Service Commission Q3 2025 – Commenced construction Q4 2026 – Expect to place new resource in service and begin recovery Pictured: Lange II generation project site under construction in Rapid City, South Dakota, including six Wartsila reciprocating internal combustion engines awaiting installation Note: The South Dakota Electric system serves customers in western South Dakota, eastern Wyoming and southeastern Montana

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Colorado Clean Energy Plan Adding 250 MW of New Renewable Resources to Reduce Emissions 80% by 2030 from a 2005 Baseline Clean Energy Plan portfolio: 50 MW battery storage build-transfer (utility-owned) Received Colorado Public Utilities Commission approval of settlement for CPCN request; expect to place in service in 2027 200 MW solar power purchase agreement Expect to sign agreement in Q1 2026 Pictured: Pueblo Airport Generating Station facilities in Colorado

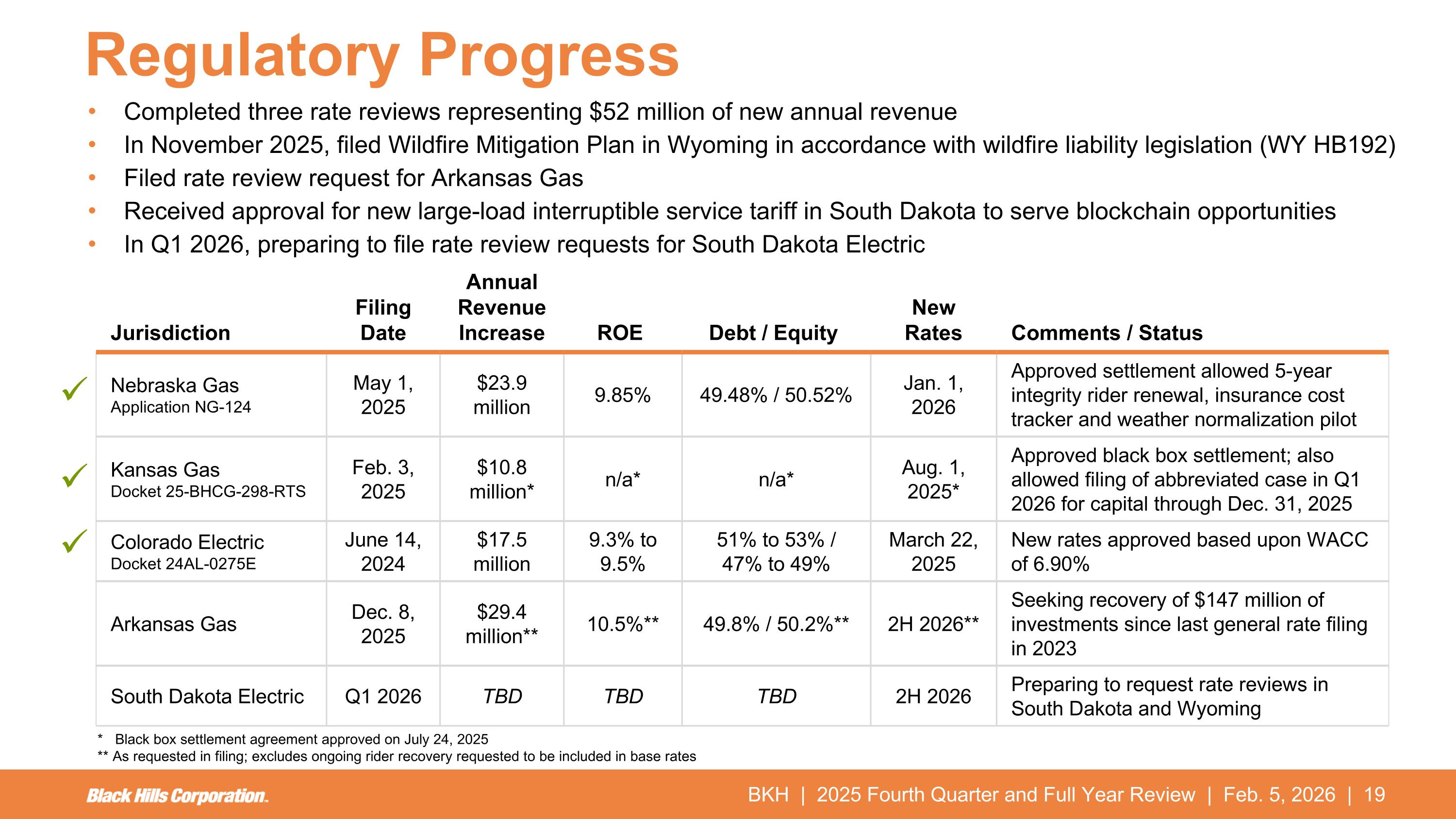

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Regulatory Progress * Black box settlement agreement approved on July 24, 2025 ** As requested in filing; excludes ongoing rider recovery requested to be included in base rates Jurisdiction Filing Date Annual Revenue Increase ROE Debt / Equity New Rates Comments / Status Nebraska Gas Application NG-124 May 1, 2025 $23.9 million 9.85% 49.48% / 50.52% Jan. 1, 2026 Approved settlement allowed 5-year integrity rider renewal, insurance cost tracker and weather normalization pilot Kansas Gas Docket 25-BHCG-298-RTS Feb. 3, 2025 $10.8 million* n/a* n/a* Aug. 1, 2025* Approved black box settlement; also allowed filing of abbreviated case in Q1 2026 for capital through Dec. 31, 2025 Colorado Electric Docket 24AL-0275E June 14, 2024 $17.5 million 9.3% to 9.5% 51% to 53% / 47% to 49% March 22, 2025 New rates approved based upon WACC of 6.90% Arkansas Gas Dec. 8, 2025 $29.4 million** 10.5%** 49.8% / 50.2%** 2H 2026** Seeking recovery of $147 million of investments since last general rate filing in 2023 South Dakota Electric Q1 2026 TBD TBD TBD 2H 2026 Preparing to request rate reviews in South Dakota and Wyoming Completed three rate reviews representing $52 million of new annual revenue In November 2025, filed Wildfire Mitigation Plan in Wyoming in accordance with wildfire liability legislation (WY HB192) Filed rate review request for Arkansas Gas Received approval for new large-load interruptible service tariff in South Dakota to serve blockchain opportunities In Q1 2026, preparing to file rate review requests for South Dakota Electric

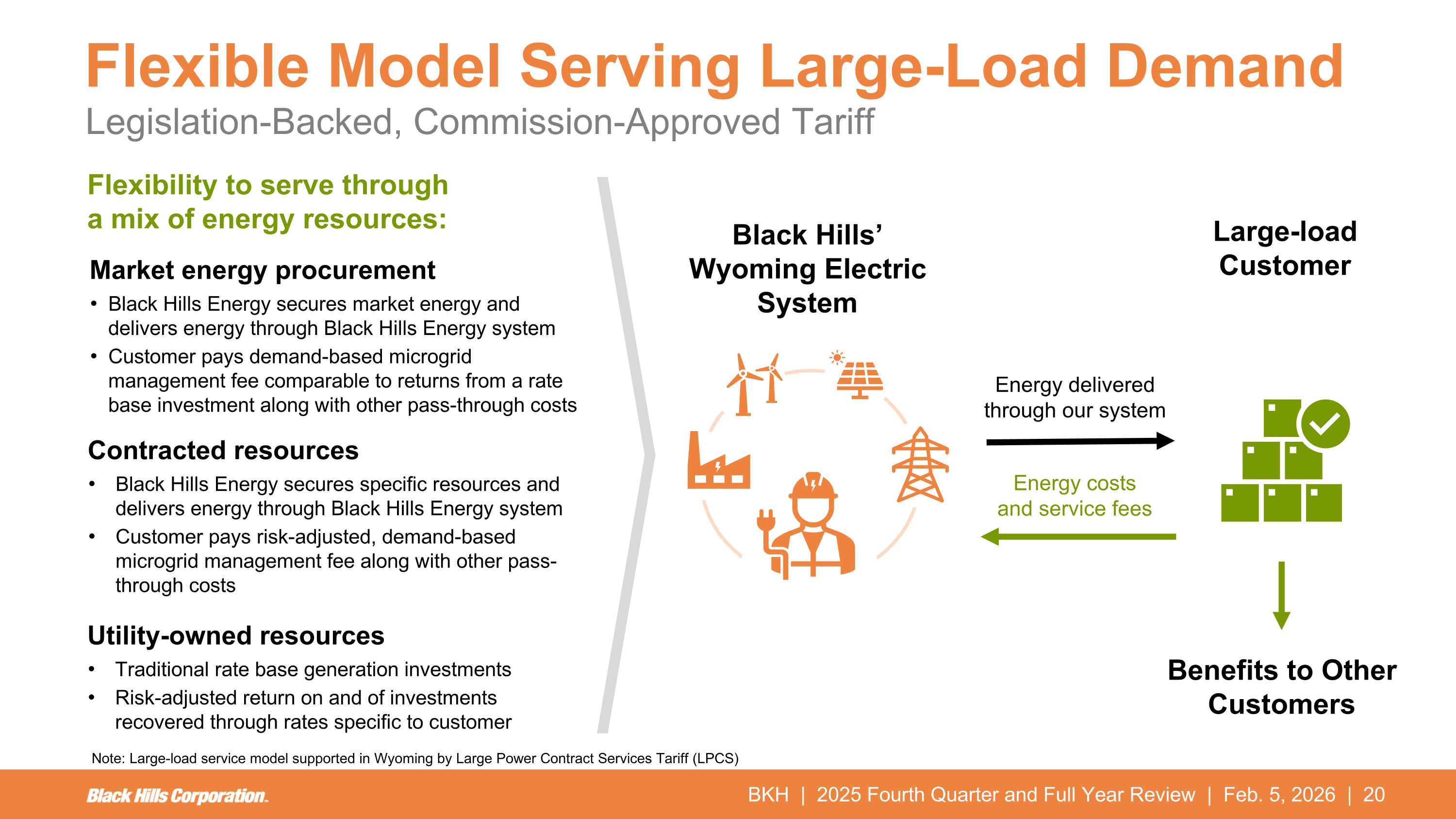

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Flexible Model Serving Large-Load Demand Legislation-Backed, Commission-Approved Tariff Black Hills’ Wyoming Electric System Large-load Customer Energy delivered through our system Energy costs and service fees Contracted resources Black Hills Energy secures specific resources and delivers energy through Black Hills Energy system Customer pays risk-adjusted, demand-based microgrid management fee along with other pass-through costs Market energy procurement Black Hills Energy secures market energy and delivers energy through Black Hills Energy system Customer pays demand-based microgrid management fee comparable to returns from a rate base investment along with other pass-through costs Utility-owned resources Traditional rate base generation investments Risk-adjusted return on and of investments recovered through rates specific to customer Note: Large-load service model supported in Wyoming by Large Power Contract Services Tariff (LPCS) Benefits to Other Customers Flexibility to serve through a mix of energy resources:

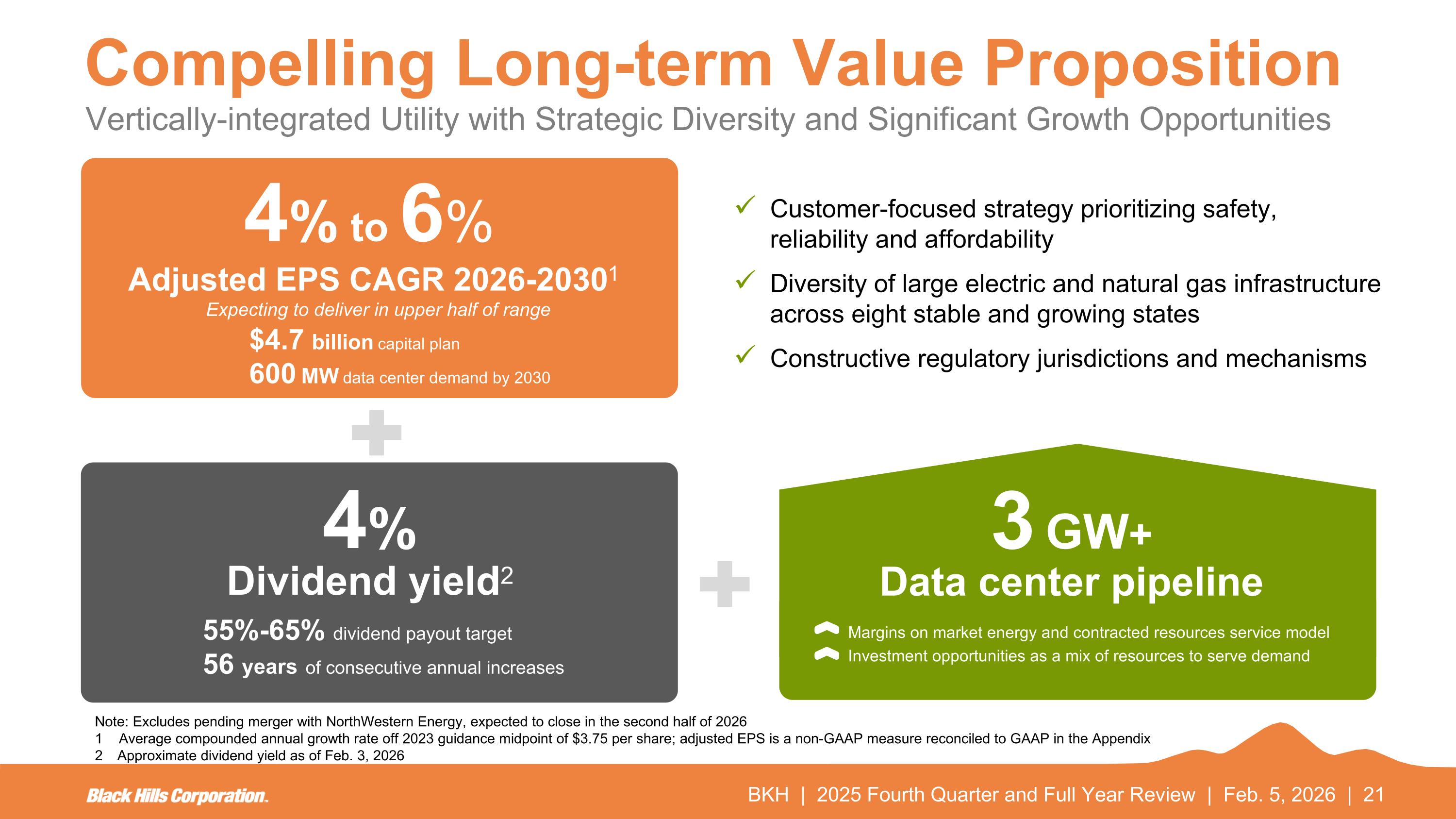

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | 2 Compelling Long-term Value Proposition 4% to 6% Adjusted EPS CAGR 2026-20301 $4.7 billion capital plan 600 MW data center demand by 2030 Note: Excludes pending merger with NorthWestern Energy, expected to close in the second half of 2026 1 Average compounded annual growth rate off 2023 guidance midpoint of $3.75 per share; adjusted EPS is a non-GAAP measure reconciled to GAAP in the Appendix 2 Approximate dividend yield as of Feb. 3, 2026 4% Dividend yield2 55%-65% dividend payout target 56 years of consecutive annual increases 3 GW+ Data center pipeline Margins on market energy and contracted resources service model Investment opportunities as a mix of resources to serve demand Customer-focused strategy prioritizing safety, reliability and affordability Diversity of large electric and natural gas infrastructure across eight stable and growing states Constructive regulatory jurisdictions and mechanisms Vertically-integrated Utility with Strategic Diversity and Significant Growth Opportunities Expecting to deliver in upper half of range

Questions BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 |

Appendix BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Ready Wyoming transmission lines connecting with Orchard Valley Substation

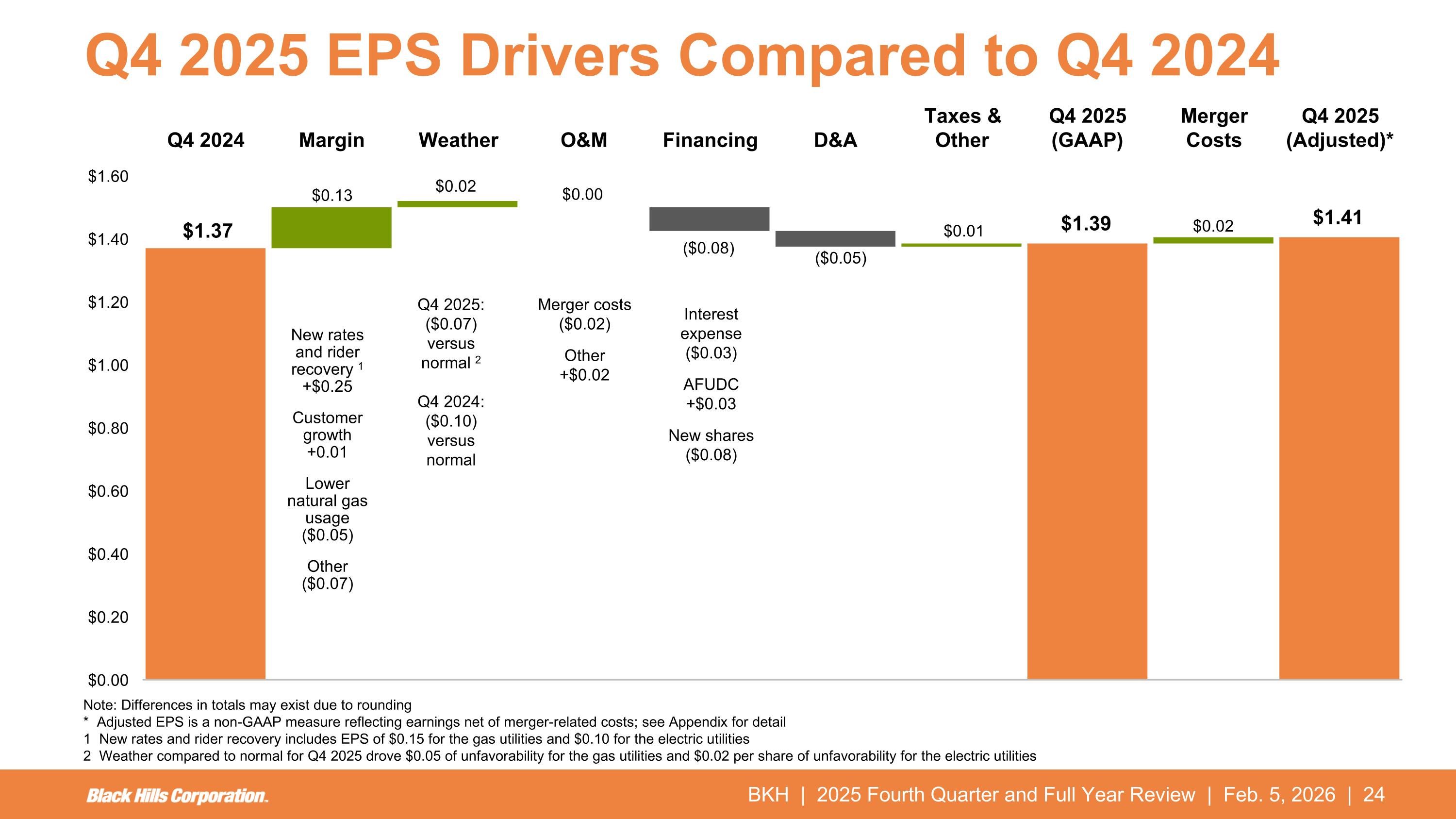

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Q4 2025 EPS Drivers Compared to Q4 2024 Interest expense ($0.03) AFUDC +$0.03 New shares ($0.08) Merger costs ($0.02) Other +$0.02 New rates and rider recovery 1 +$0.25 Customer growth +0.01 Lower natural gas usage ($0.05) Other ($0.07) Q4 2025: ($0.07) versus normal 2 Q4 2024: ($0.10) versus normal Note: Differences in totals may exist due to rounding * Adjusted EPS is a non-GAAP measure reflecting earnings net of merger-related costs; see Appendix for detail 1 New rates and rider recovery includes EPS of $0.15 for the gas utilities and $0.10 for the electric utilities 2 Weather compared to normal for Q4 2025 drove $0.05 of unfavorability for the gas utilities and $0.02 per share of unfavorability for the electric utilities

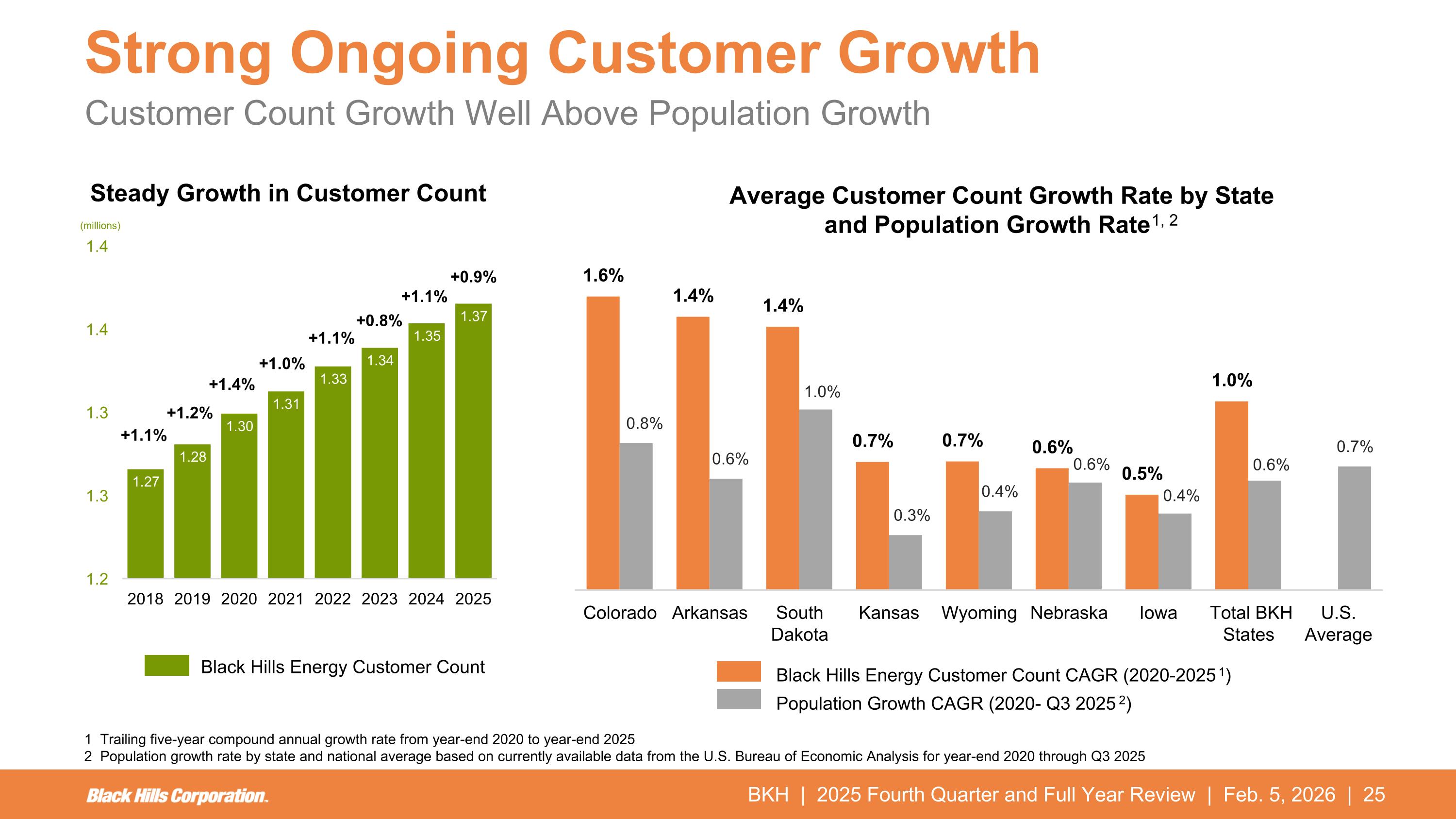

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Strong Ongoing Customer Growth 1 Trailing five-year compound annual growth rate from year-end 2020 to year-end 2025 2 Population growth rate by state and national average based on currently available data from the U.S. Bureau of Economic Analysis for year-end 2020 through Q3 2025 Customer Count Growth Well Above Population Growth Black Hills Energy Customer Count CAGR (2020-2025 1) Population Growth CAGR (2020- Q3 2025 2) Steady Growth in Customer Count Average Customer Count Growth Rate by State and Population Growth Rate1, 2 Black Hills Energy Customer Count (millions)

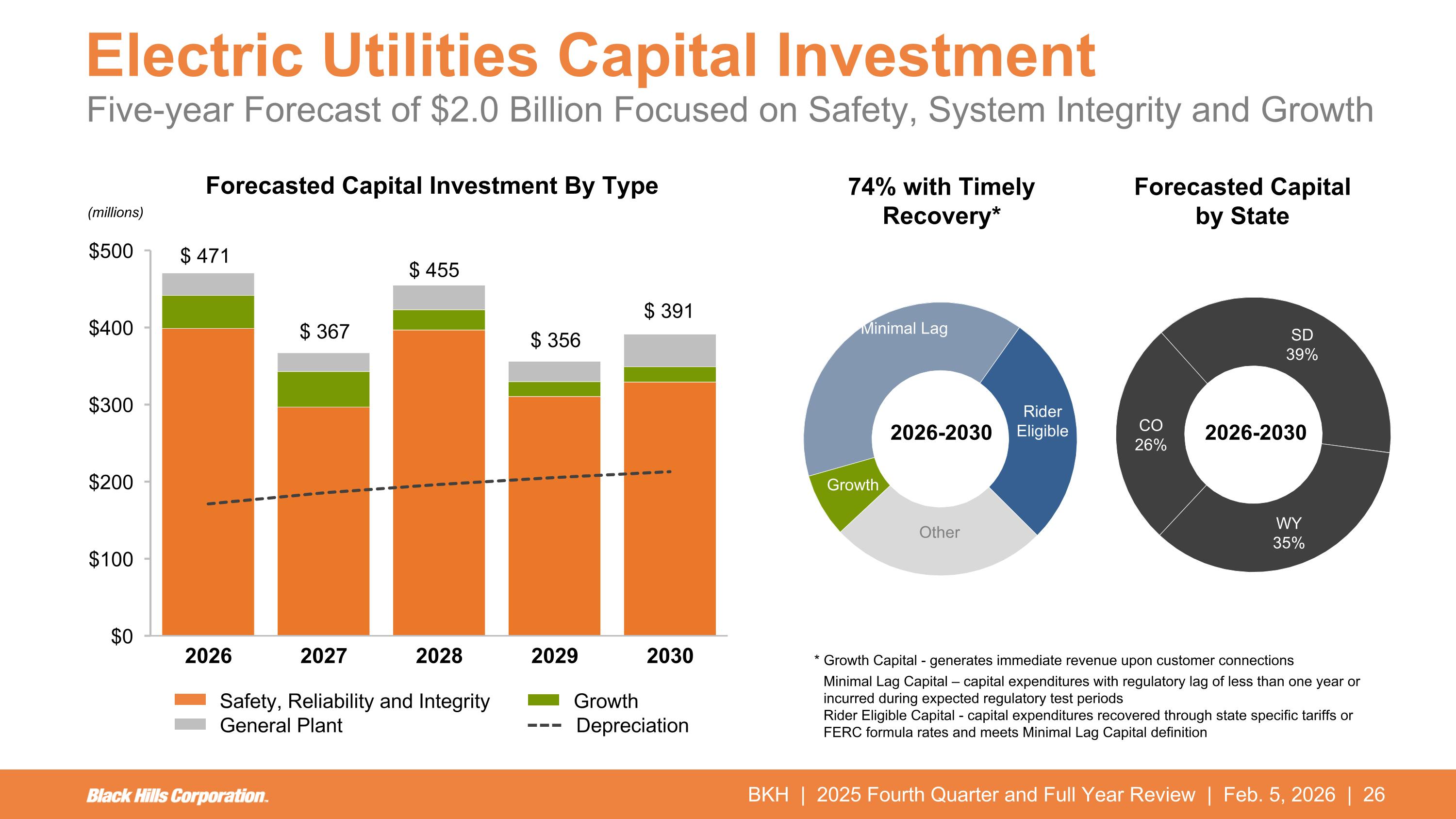

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Electric Utilities Capital Investment Five-year Forecast of $2.0 Billion Focused on Safety, System Integrity and Growth Forecasted Capital by State * Growth Capital - generates immediate revenue upon customer connections Minimal Lag Capital – capital expenditures with regulatory lag of less than one year or incurred during expected regulatory test periods Rider Eligible Capital - capital expenditures recovered through state specific tariffs or FERC formula rates and meets Minimal Lag Capital definition 74% with Timely Recovery* Safety, Reliability and Integrity Growth General Plant Depreciation 2026-2030 2026-2030 Forecasted Capital Investment By Type (millions)

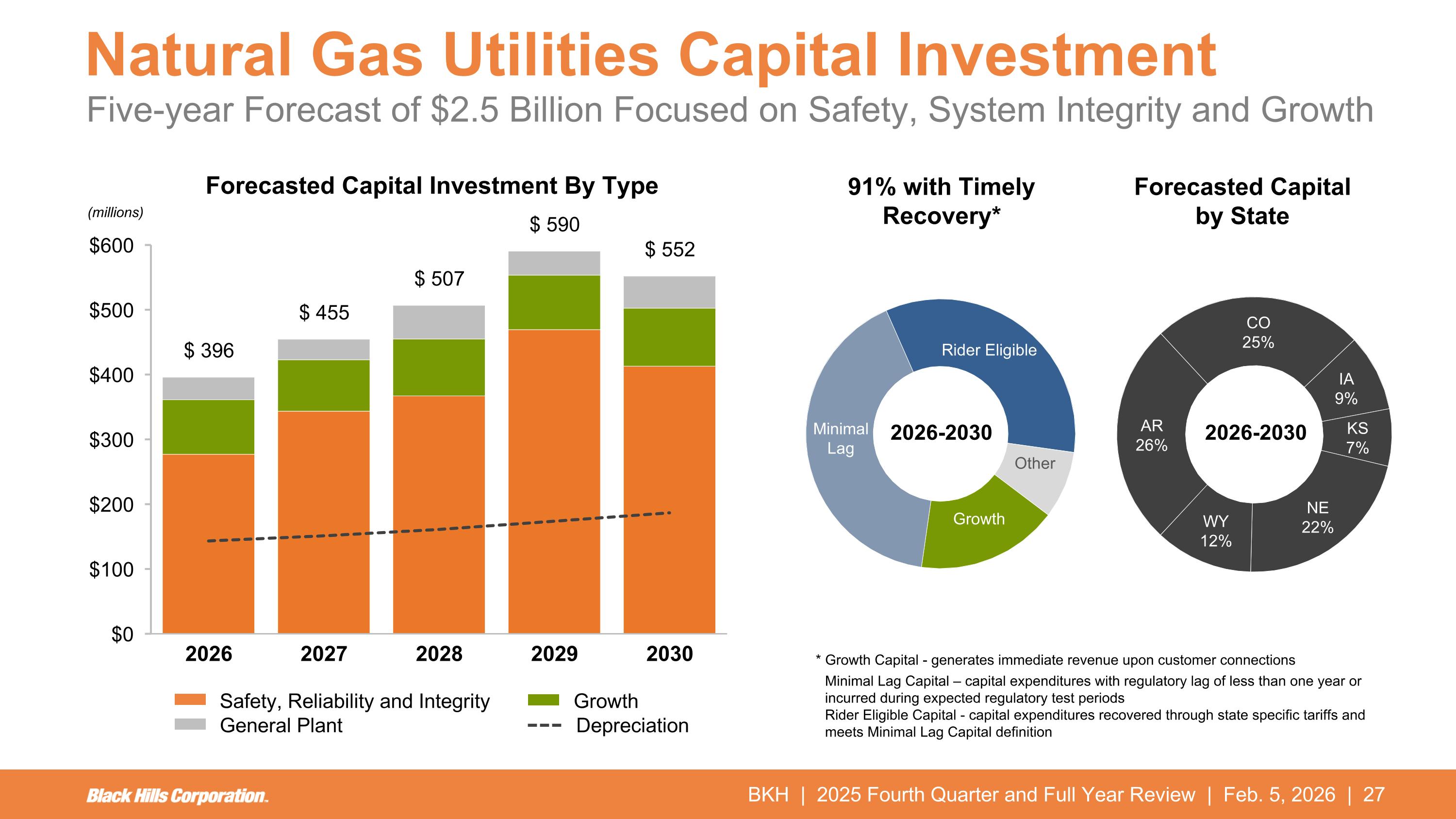

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Natural Gas Utilities Capital Investment Five-year Forecast of $2.5 Billion Focused on Safety, System Integrity and Growth Forecasted Capital by State 91% with Timely Recovery* * Growth Capital - generates immediate revenue upon customer connections Minimal Lag Capital – capital expenditures with regulatory lag of less than one year or incurred during expected regulatory test periods Rider Eligible Capital - capital expenditures recovered through state specific tariffs and meets Minimal Lag Capital definition Forecasted Capital Investment By Type (millions) 2026-2030 2026-2030 Safety, Reliability and Integrity Growth General Plant Depreciation

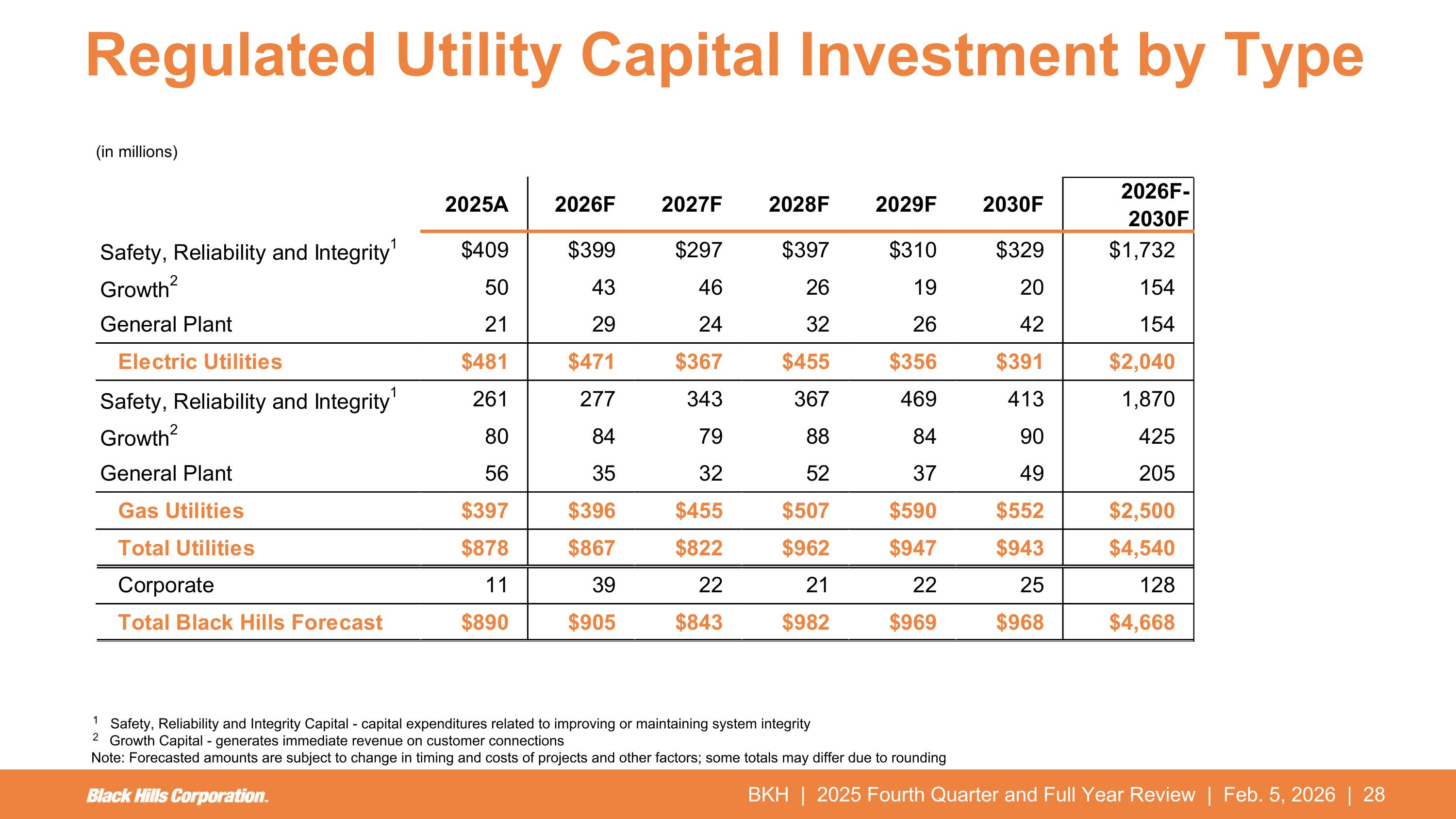

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Regulated Utility Capital Investment by Type 1 Safety, Reliability and Integrity Capital - capital expenditures related to improving or maintaining system integrity 2 Growth Capital - generates immediate revenue on customer connections Note: Forecasted amounts are subject to change in timing and costs of projects and other factors; some totals may differ due to rounding (in millions)

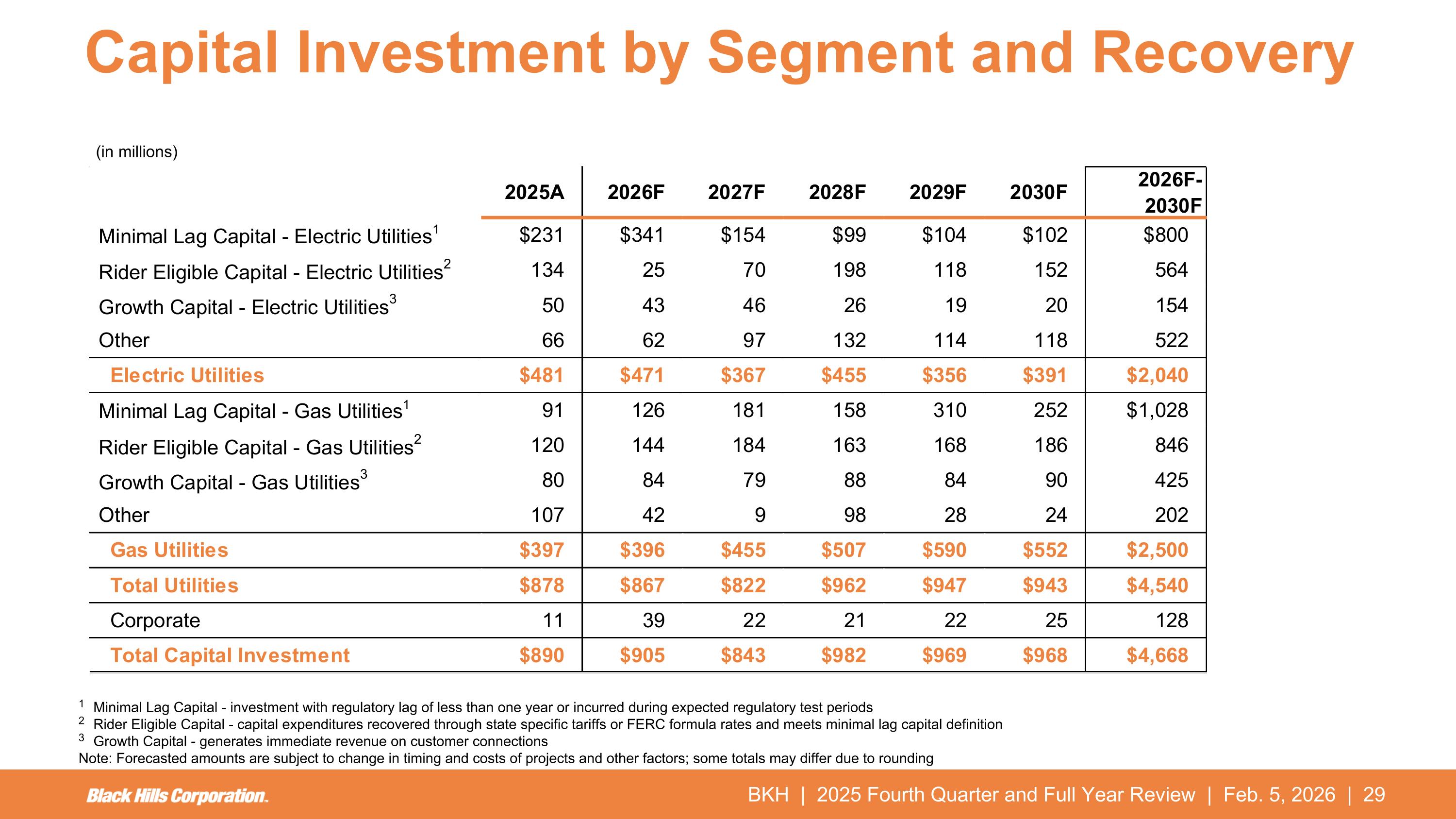

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Capital Investment by Segment and Recovery 1 Minimal Lag Capital - investment with regulatory lag of less than one year or incurred during expected regulatory test periods 2 Rider Eligible Capital - capital expenditures recovered through state specific tariffs or FERC formula rates and meets minimal lag capital definition 3 Growth Capital - generates immediate revenue on customer connections Note: Forecasted amounts are subject to change in timing and costs of projects and other factors; some totals may differ due to rounding (in millions)

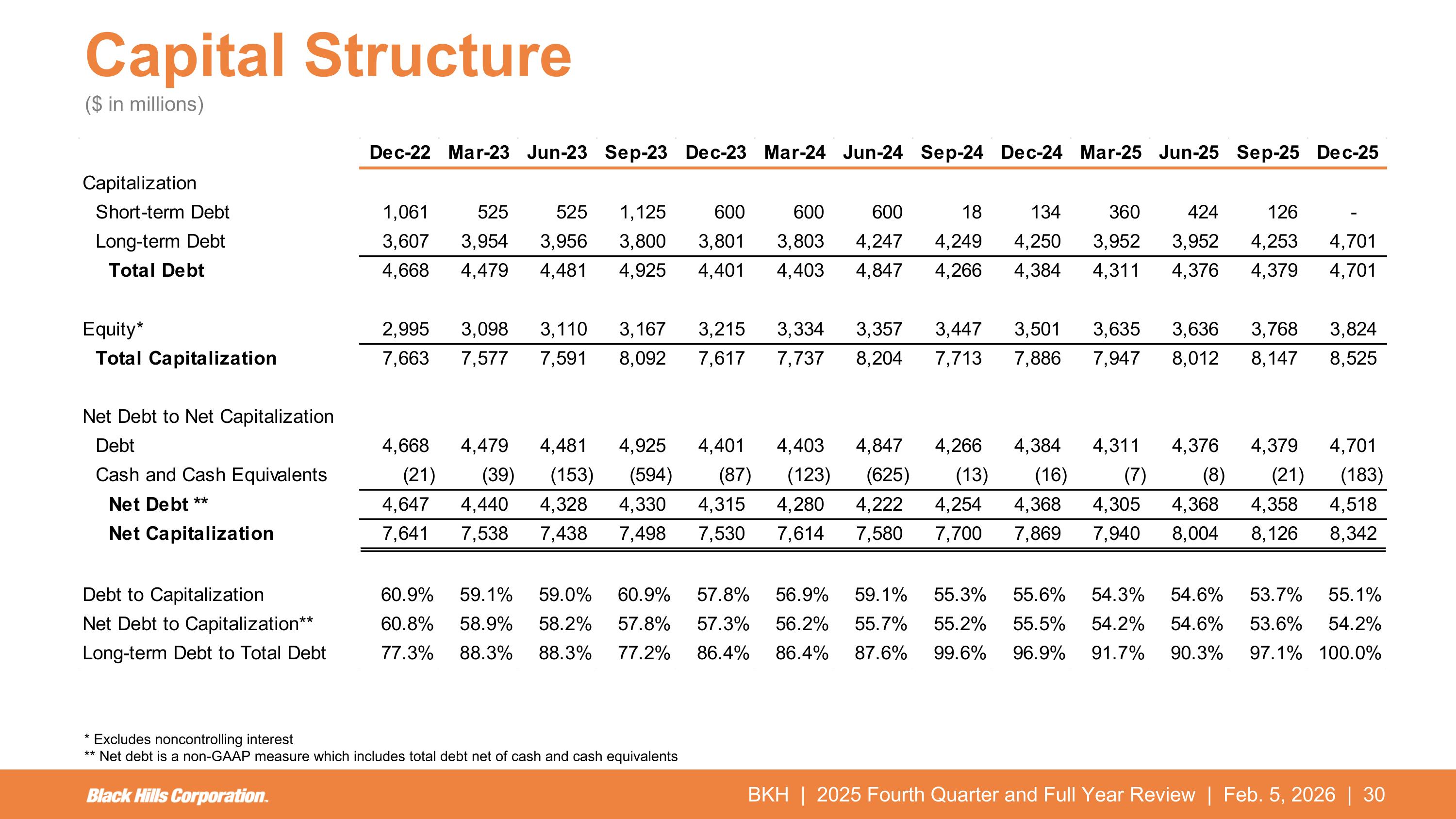

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Capital Structure * Excludes noncontrolling interest ** Net debt is a non-GAAP measure which includes total debt net of cash and cash equivalents ($ in millions)

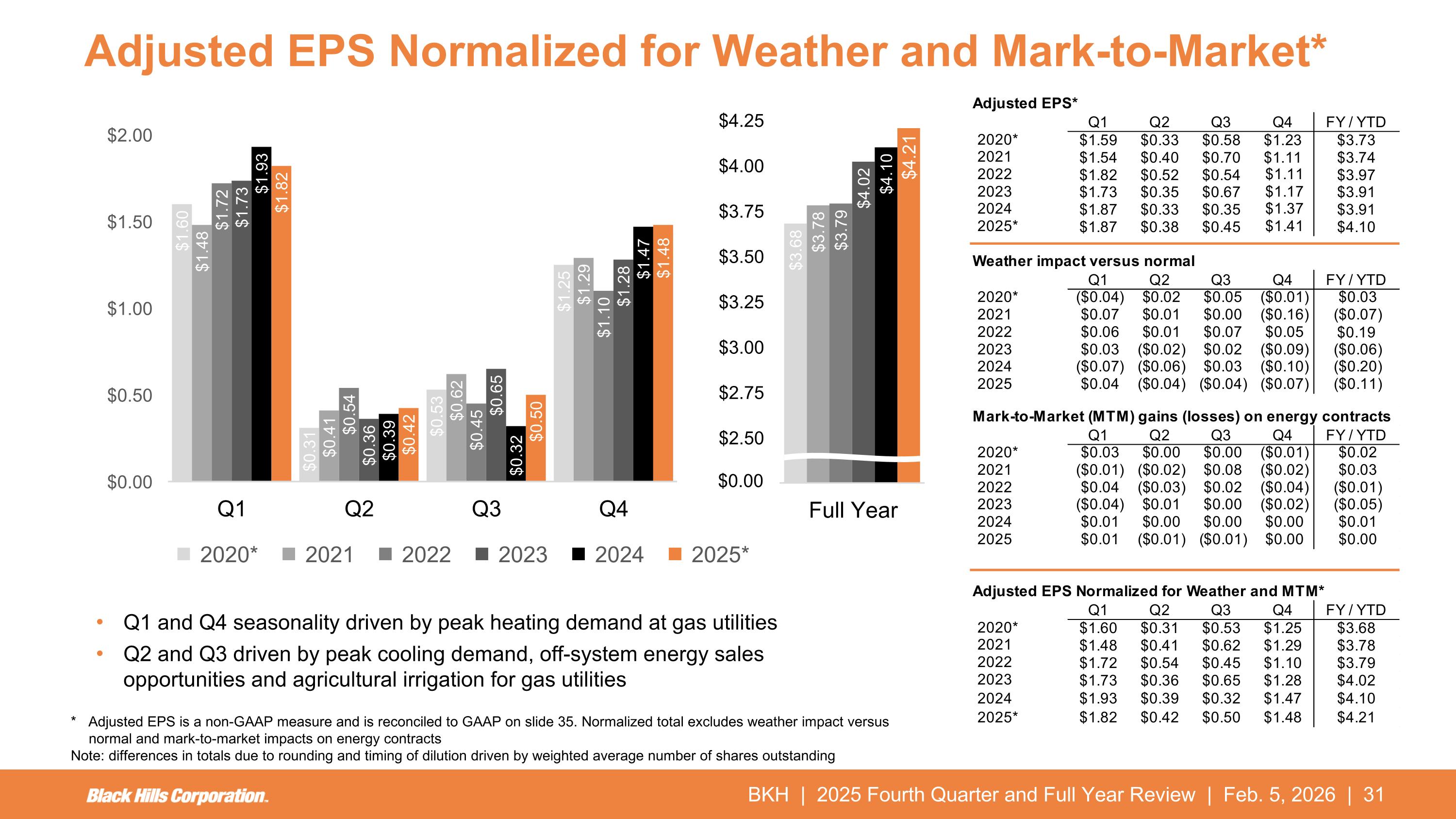

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | * Adjusted EPS is a non-GAAP measure and is reconciled to GAAP on slide 35. Normalized total excludes weather impact versus normal and mark-to-market impacts on energy contracts Note: differences in totals due to rounding and timing of dilution driven by weighted average number of shares outstanding Adjusted EPS Normalized for Weather and Mark-to-Market* Q1 and Q4 seasonality driven by peak heating demand at gas utilities Q2 and Q3 driven by peak cooling demand, off-system energy sales opportunities and agricultural irrigation for gas utilities $0.00

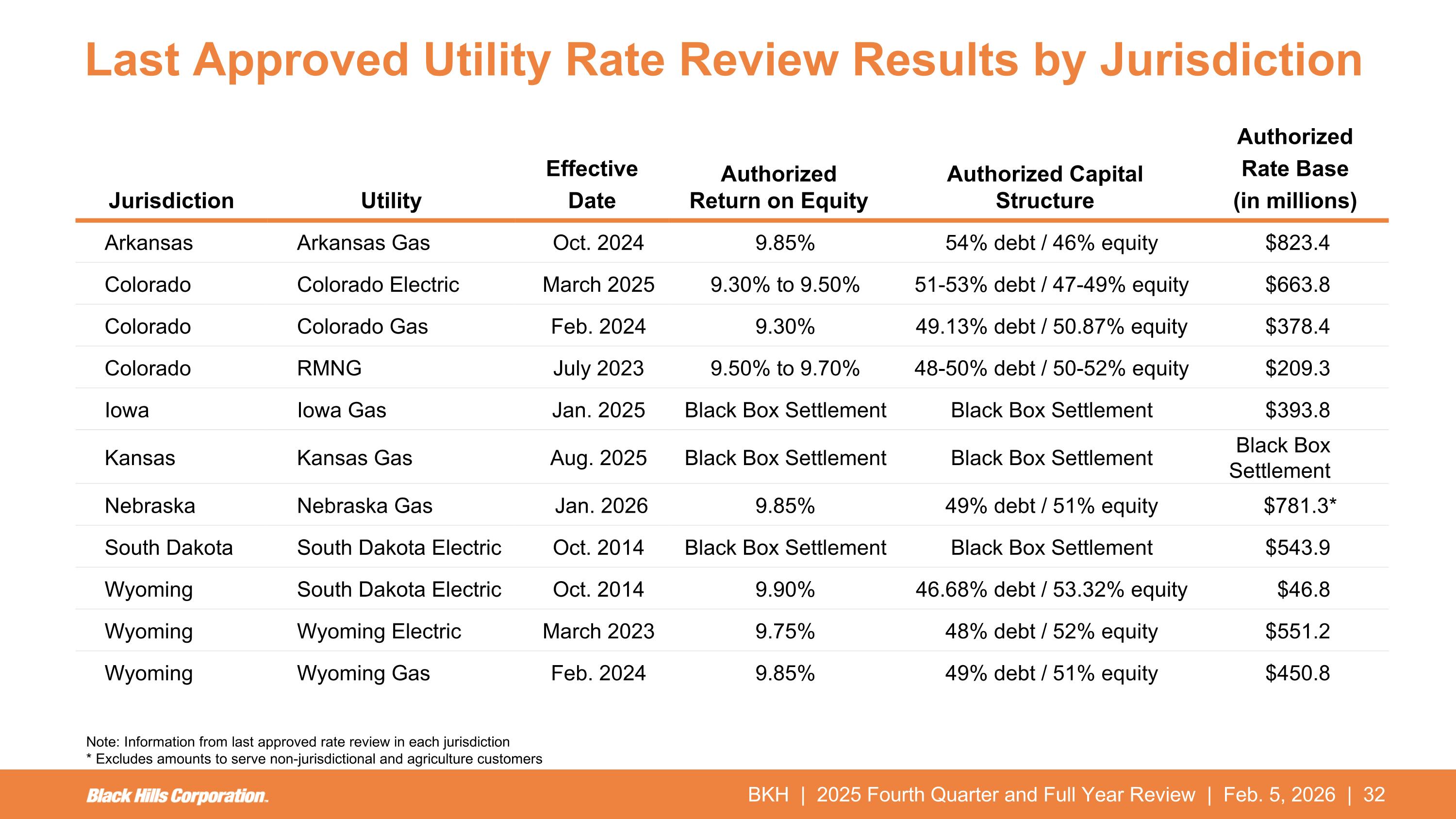

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Last Approved Utility Rate Review Results by Jurisdiction Note: Information from last approved rate review in each jurisdiction * Excludes amounts to serve non-jurisdictional and agriculture customers Jurisdiction Utility Effective Date Authorized Return on Equity Authorized Capital Structure Authorized Rate Base (in millions) Arkansas Arkansas Gas Oct. 2024 9.85% 54% debt / 46% equity $823.4 Colorado Colorado Electric March 2025 9.30% to 9.50% 51-53% debt / 47-49% equity $663.8 Colorado Colorado Gas Feb. 2024 9.30% 49.13% debt / 50.87% equity $378.4 Colorado RMNG July 2023 9.50% to 9.70% 48-50% debt / 50-52% equity $209.3 Iowa Iowa Gas Jan. 2025 Black Box Settlement Black Box Settlement $393.8 Kansas Kansas Gas Aug. 2025 Black Box Settlement Black Box Settlement Black Box Settlement Nebraska Nebraska Gas Jan. 2026 9.85% 49% debt / 51% equity $781.3*_ South Dakota South Dakota Electric Oct. 2014 Black Box Settlement Black Box Settlement $543.9 Wyoming South Dakota Electric Oct. 2014 9.90% 46.68% debt / 53.32% equity $46.8 Wyoming Wyoming Electric March 2023 9.75% 48% debt / 52% equity $551.2 Wyoming Wyoming Gas Feb. 2024 9.85% 49% debt / 51% equity $450.8

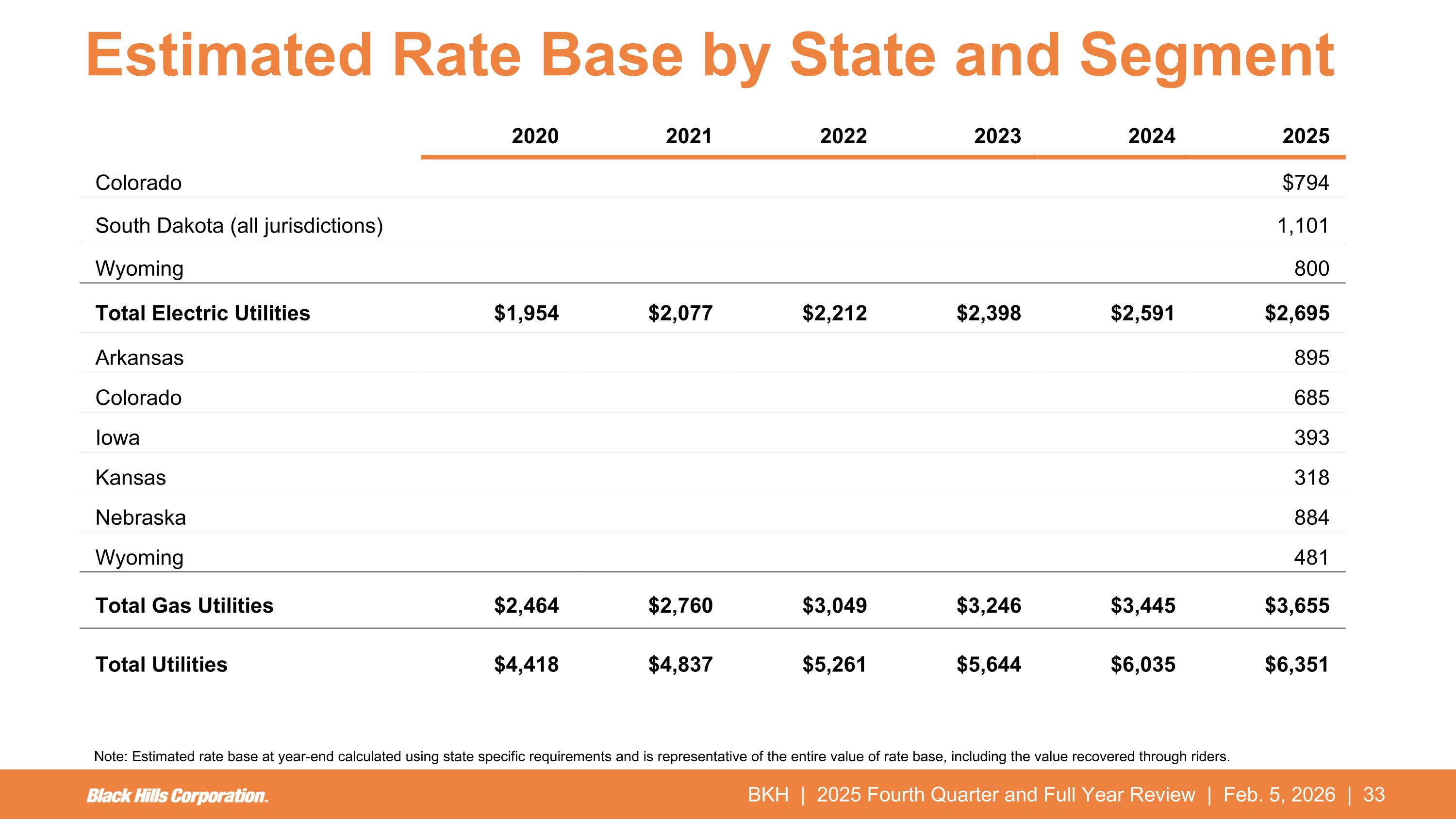

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | 2020 2021 2022 2023 2024 2025 Colorado $794 South Dakota (all jurisdictions) 1,101 Wyoming 800 Total Electric Utilities $1,954 $2,077 $2,212 $2,398 $2,591 $2,695 Arkansas 895 Colorado 685 Iowa 393 Kansas 318 Nebraska 884 Wyoming 481 Total Gas Utilities $2,464 $2,760 $3,049 $3,246 $3,445 $3,655 Total Utilities $4,418 $4,837 $5,261 $5,644 $6,035 $6,351 Estimated Rate Base by State and Segment Note: Estimated rate base at year-end calculated using state specific requirements and is representative of the entire value of rate base, including the value recovered through riders.

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Adjusted earnings and Adjusted EPS As noted in this presentation, in addition to presenting its earnings information in conformity with Generally Accepted Accounting Principles (GAAP), the company has presented non-GAAP Adjusted earnings and Adjusted EPS, which reflect adjustments for expenses, gains and losses that the company believes do not reflect ongoing core operating performance, such as costs related to the pending merger with NorthWestern. The company’s management uses non-GAAP measures for financial planning and analysis, for reporting of results to the Board of Directors, in determining performance-based compensation and communicating its earnings outlook to analysts and investors. Non-GAAP financial measures are intended to supplement investors’ understanding of our performance and should not be considered alternatives for financial measures presented in accordance with GAAP. Our non-GAAP measures may not be comparable to those of other companies. Reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the reconciliation on the following page. Non-GAAP Financial Measures

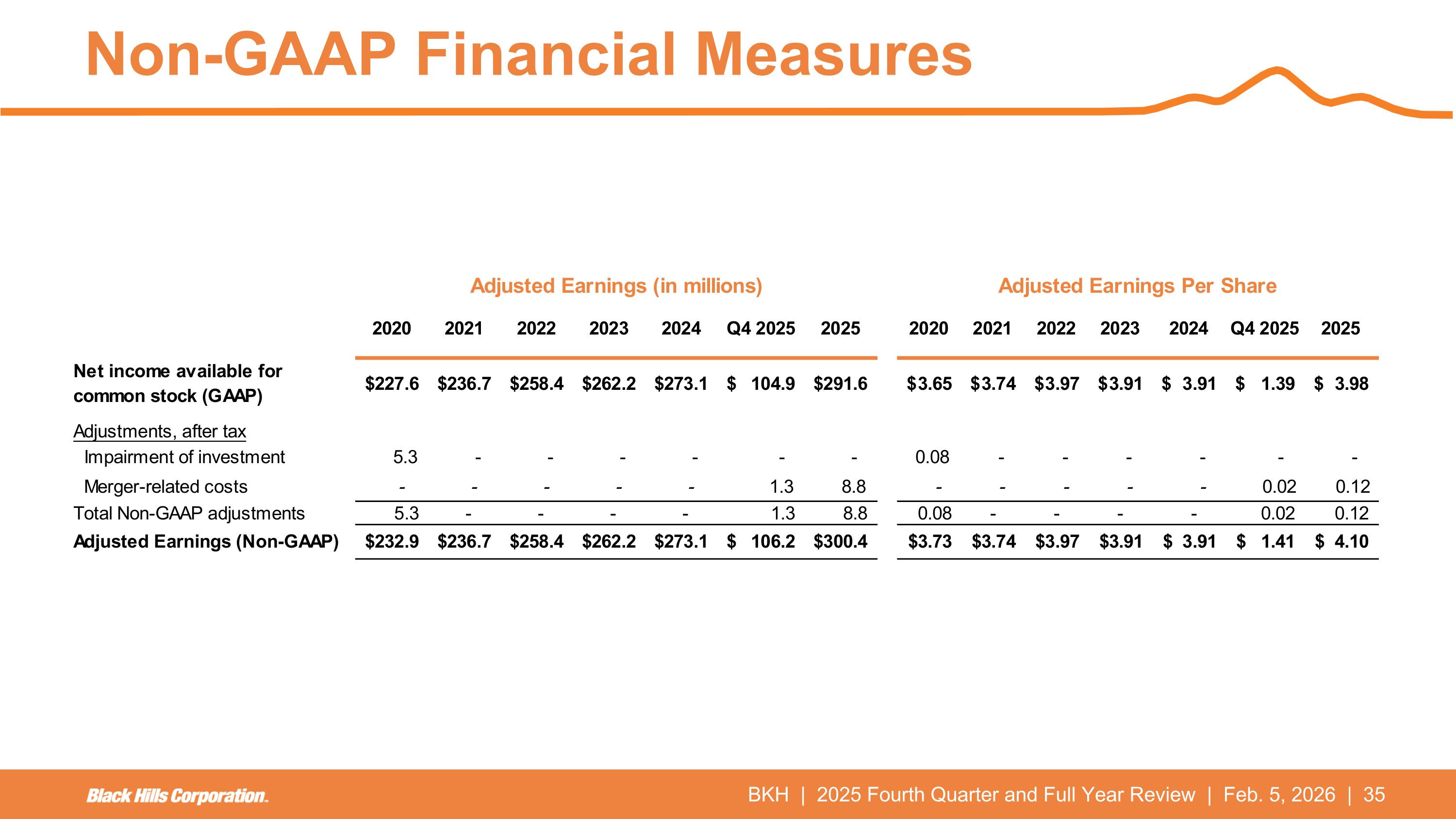

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 | Non-GAAP Financial Measures

BKH | 2025 Fourth Quarter and Full Year Review | Feb. 5, 2026 |