The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated , 2024

PROSPECTUS

Shares

Hornbeck Offshore Services, Inc.

Common Stock

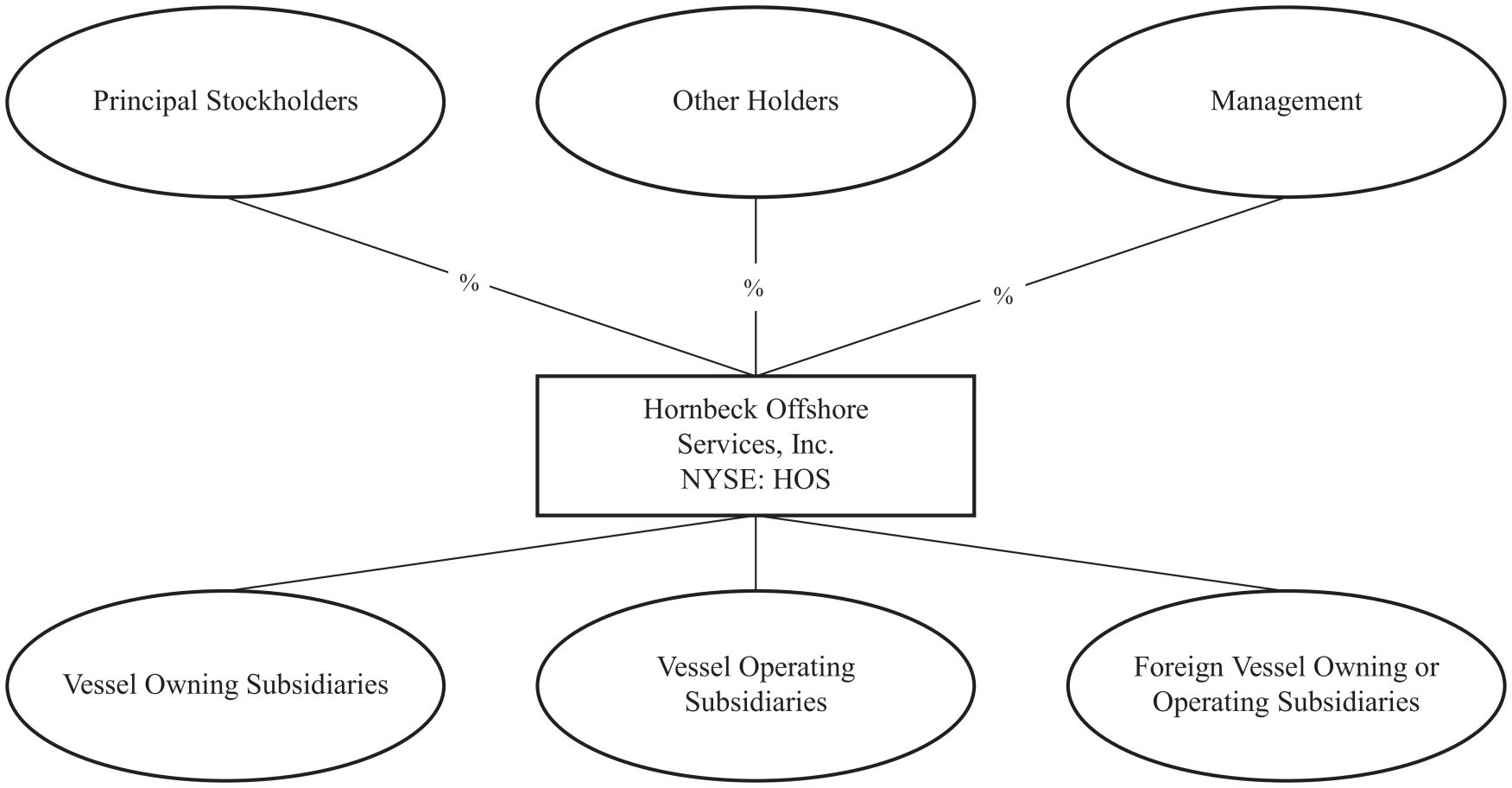

This is an initial public offering of shares of our common stock, $0.00001 par value per share. We are offering shares of our common stock. Certain selling stockholders identified in this prospectus are offering shares of our common stock.

Prior to this offering, there has been no public market for our common stock. We estimate that the initial public offering price per share will be between $ and $ . See “Underwriting (Conflicts of Interest)” for a discussion of the factors to be considered in determining the initial offering price. We have applied to list our common stock on the New York Stock Exchange (the “NYSE”) under the symbol “HOS.”

Investing in shares of our common stock involves significant risks. See “Risk Factors” beginning on page 31.

By participating in this offering, you are representing that you are a citizen of the United States, as defined in the Jones Act (as defined herein). The Jones Act requires that at least 75% of the outstanding shares of each class or series of our capital stock must be owned and controlled by U.S. citizens and, in order to provide a reasonable margin for compliance with this requirement, our amended and restated certificate of incorporation will provide that all non-U.S. citizens in the aggregate may not own more than 21% of the outstanding shares of our common stock, with certain limited grandfathered circumstances allowing up to 24% of the outstanding shares of our common stock to be owned by non-U.S. citizens on and after the effective date of the initial public offering. Failure to comply with the Jones Act could cause us to lose the privilege of owning and operating vessels in the coastwise trade. Accordingly, our common stock is subject to limitations on foreign ownership and possible required divestiture by non-U.S. citizen stockholders. See “Description of Capital Stock and Warrants—Limitations on Ownership by Non-U.S. Citizens” and “Risk Factors—Our common stock is subject to restrictions on foreign ownership and possible required divestiture by non-U.S. citizen stockholders.”

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses. See “Underwriting (Conflicts of Interest).” |

At our request, the underwriters have reserved up to 5% of the shares of common stock offered by the prospectus for sale, at the initial public offering price, to certain individuals associated with us. See “Underwriting (Conflicts of Interest)—Directed Share Program.”

The selling stockholders have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to an additional shares of our common stock at the initial public offering price, less the underwriting discounts and commissions. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders, including upon the sale of shares of our common stock by the selling stockholders if the underwriters exercise their option.

Highbridge Capital Management LLC, a holder of approximately 10.6% of the outstanding shares of our common stock, is an indirect subsidiary of J.P. Morgan Chase & Co. and will receive greater than 5% of the net proceeds of this offering. Accordingly, J.P. Morgan Chase & Co. is deemed to have a “conflict of interest” under Rule 5121 of the Financial Industry Regulatory Authority, or FINRA, and this offering is being conducted in accordance with the applicable provisions of FINRA Rule 5121, including the requirement that a “qualified independent underwriter” participate in the preparation of the prospectus and exercise the usual standards of due diligence in connection with such participation. Barclays Capital Inc. has agreed to serve as the qualified independent underwriter for this offering. See “Underwriting (Conflicts of Interest).”

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2024.

| J.P. Morgan | Barclays | |||

| Goldman Sachs | DNB Markets | Piper Sandler | Guggenheim Securities | Raymond James |

| BTIG | Johnson Rice & Company | Pickering Energy Partners | Seaport Global Securities | |||||

| Academy Securities | Drexel Hamilton | |||||||

Prospectus dated , 2024