Exhibit 15.2

gsk do more feel better live longer Annual Report

Exhibit 15.2

gsk do more feel better live longer Annual Report

We are a science-led global healthcare company

| 2020 performance summary | |||||||||||||||||||

| £34.1bn | AER | +1% | £9.7bn | AER | +11% | ||||||||||||||

| Group turnover | CER | +3% | New and specialty medicines | CER | +12% | ||||||||||||||

| £7.8bn | AER | +12% | £8.9bn | AER | - 1% | ||||||||||||||

| Total operating profit | CER | +15% | Adjusted operating profit | CER | +2% | ||||||||||||||

| 115.5p | AER | +23% | 115.9p | AER | - 6% | ||||||||||||||

| Total earnings per share | CER | +26% | Adjusted earnings per share | CER | - 4% | ||||||||||||||

| 9 | 80p | 1st | 2nd | ||||||||||||||||

| major pipeline approvals |

Dividend | in the Access to Medicine Index |

in the pharmaceutical industry for Dow Jones Sustainability Index | ||||||||||||||||

| Contents | ||||||||||||||

| Strategic report | ||||||||||||||

|

|

|

|

||||||||||||

| 01 | 86 | |||||||||||||

| 03 | 87 | |||||||||||||

| 04 | 90 | 238 | ||||||||||||

| 06 | The Board’s approach to engagement | 91 | ||||||||||||

| 09 | 94 | Investor information |

||||||||||||

| 10 | 96 | 244 | ||||||||||||

| 11 | 97 | 249 | ||||||||||||

| 12 | 108 | 255 | ||||||||||||

| 16 | 109 | |||||||||||||

| 18 | 258 | |||||||||||||

| 28 | Remuneration report |

261 | ||||||||||||

| 33 | 112 | 276 | ||||||||||||

| 43 | 114 | 278 | ||||||||||||

| 50 | 133 | 279 | ||||||||||||

| 279 | ||||||||||||||

| Corporate Governance |

Financial statements |

280 | ||||||||||||

| 78 | 282 | |||||||||||||

| 80 | 140 | 284 | ||||||||||||

| 83 | 142 | 287 | ||||||||||||

| 85 | 154 | 299 | ||||||||||||

| 158 | ||||||||||||||

Cautionary statement

See the inside back cover of this document for the cautionary statement regarding forward-looking statements.

Non-IFRS measures

We use a number of adjusted, non-IFRS, measures to report the performance of our business. Total reported results represent the Group’s overall performance under IFRS. Adjusted results, pro-forma growth rates and other non-IFRS measures may be considered in addition to, but not as a substitute for or superior to, information presented in accordance with IFRS. Adjusted results and other non-IFRS measures are defined on pages 51 to 53 and reconciliations to the nearest IFRS measures are on pages 64 and 68.

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Every day, we help improve the health of millions of people around the

world by discovering, developing and manufacturing innovative medicines,

vaccines and consumer healthcare products.

GSK Annual Report 2020 01

|

|

||

|

|

Our business model continued

Preparing for the future

Capital allocation

02 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

CEO’s statement continued

GSK Annual Report 2020 05

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Financial performance continued

Total and Adjusted results

| Adjusting items | Total results £m |

Intangible asset amortisation £m |

Intangible asset impairment £m |

Major restructuring £m |

Transaction- £m |

Divestments, significant legal and other items £m |

Separation £m |

Adjusted results £m |

||||||||||||||||||||||||

| Turnover |

34,099 | 34,099 | ||||||||||||||||||||||||||||||

| Cost of sales |

(11,704 | ) | 699 | 31 | 667 | 116 | (10,191 | ) | ||||||||||||||||||||||||

| Gross profit |

22,395 | 699 | 31 | 667 | 116 | 23,908 | ||||||||||||||||||||||||||

| Selling, general and administration |

(11,456 | ) | 1 | 18 | 659 | (23 | ) | 16 | 68 | (10,717 | ) | |||||||||||||||||||||

| Research and development |

(5,098 | ) | 75 | 214 | 206 | (4,603 | ) | |||||||||||||||||||||||||

| Royalty income |

318 | 318 | ||||||||||||||||||||||||||||||

| Other operating income/(expense) |

1,624 | 1,215 | (2,839 | ) | – | |||||||||||||||||||||||||||

| Operating profit |

7,783 | 775 | 263 | 1,532 | 1,308 | (2,823 | ) | 68 | 8,906 | |||||||||||||||||||||||

| Net finance costs |

(848 | ) | 2 | 2 | (844 | ) | ||||||||||||||||||||||||||

| Share of after-tax profits of associates and joint ventures |

33 | 33 | ||||||||||||||||||||||||||||||

| Profit before taxation |

6,968 | 775 | 263 | 1,534 | 1,308 | (2,821 | ) | 68 | 8,095 | |||||||||||||||||||||||

| Taxation |

(580 | ) | (150 | ) | (47 | ) | (292 | ) | (229 | ) | 17 | (14 | ) | (1,295 | ) | |||||||||||||||||

| Tax rate |

8.3 | % | 16.0 | % | ||||||||||||||||||||||||||||

| Profit after taxation |

6,388 | 625 | 216 | 1,242 | 1,079 | (2,804 | ) | 54 | 6,800 | |||||||||||||||||||||||

| Profit attributable to non-controlling interests |

639 | 392 | 1,031 | |||||||||||||||||||||||||||||

| Profit attributable to shareholders |

5,749 | 625 | 216 | 1,242 | 687 | (2,804 | ) | 54 | 5,769 | |||||||||||||||||||||||

| Earnings per share |

115.5 | p | 12.6 | p | 4.4 | p | 25.0 | p | 13.8 | p | (56.5) | p | 1.1 | p | 115.9 | p | ||||||||||||||||

GSK Annual Report 2020 07

|

|

||

|

|

Financial performance continued

Adjusted results

| 2020 | 2019 | |||||||||||||||||||||||||||

| £m | % of turnover |

£m | % of turnover |

£% | Growth CER% |

Pro-forma growth CER% |

||||||||||||||||||||||

| Turnover |

34,099 | 100 | 33,754 | 100 | 1 | 3 | (2 | ) | ||||||||||||||||||||

| Cost of sales |

(10,191 | ) | (29.9 | ) | (10,079 | ) | (29.9 | ) | 1 | 2 | (3 | ) | ||||||||||||||||

| Gross profit |

23,908 | 70.1 | 23,675 | 70.1 | 1 | 3 | (1 | ) | ||||||||||||||||||||

| Selling, general and administration |

(10,717 | ) | (31.4 | ) | (10,715 | ) | (31.7 | ) | – | 2 | (3 | ) | ||||||||||||||||

| Research and development |

(4,603 | ) | (13.5 | ) | (4,339 | ) | (12.9 | ) | 6 | 7 | 6 | |||||||||||||||||

| Royalty income |

318 | 0.9 | 351 | 1.1 | (9 | ) | (9 | ) | (9 | ) | ||||||||||||||||||

| Operating profit |

8,906 | 26.1 | 8,972 | 26.6 | (1 | ) | 2 | (3 | ) | |||||||||||||||||||

| Net finance costs |

(844 | ) | (810 | ) | ||||||||||||||||||||||||

| Share of after-tax profits of associates and joint ventures |

33 | 74 | ||||||||||||||||||||||||||

| Profit before taxation |

8,095 | 8,236 | (2 | ) | 1 | |||||||||||||||||||||||

| Taxation |

(1,295 | ) | (1,318 | ) | ||||||||||||||||||||||||

| Tax rate |

16.0 | % | 16.0 | % | ||||||||||||||||||||||||

| Profit after taxation |

6,800 | 6,918 | (2 | ) | 1 | |||||||||||||||||||||||

| Profit attributable to non-controlling interests |

1,031 | 787 | ||||||||||||||||||||||||||

| Profit attributable to shareholders |

5,769 | 6,131 | ||||||||||||||||||||||||||

| Earnings per share |

115.9 | p | 123.9 | p | (6 | ) | (4 | ) | ||||||||||||||||||||

08 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

We believe GSK’s long-term priorities will create lasting value for our patients,

consumers and shareholders. In 2020, despite a very challenging operating

environment, we delivered a resilient performance and our strategic objectives

remain on track.

|

Innovation |

Performance |

Trust | ||||||

|

We invest in scientific and technical excellence to develop and launch a pipeline of new products that meet the needs of our patients, payers and consumers. |

We deliver growth by investing effectively in our business, developing our people and executing competitively. |

We are a responsible company. We commit to use our science and technology to address health needs, make our products affordable and available and be a modern employer.

| ||||||

|

2020 objectives |

2020 objectives |

2020 objectives | ||||||

| – Deliver Innovation sales with excellent commercial, R&D and supply chain execution

– Further accelerate and strengthen pipeline with six potential approvals expected

|

– Prioritise spending to deliver growth and return on investment

– Successful Consumer Healthcare JV integration, including driving growth and delivering synergies

– Deliver further capability building in specialty Pharmaceuticals

– Deliver two-year programme to prepare GSK for separation into two new companies

|

– Continue to deliver on-time, in-full supply of our products

– Build reputation with a focus on Innovation

– Deliver progress on Trust commitments

| ||||||

|

Progress |

Progress |

Progress | ||||||

| – Strong performance from new innovations including Shingrix, Trelegy, Juluca, Dovato and Zejula

– Nine major regulatory approvals, including in HIV, Oncology and Respiratory

– Extended indications across portfolio, including for Shingrix, Bexsero, Trelegy Ellipta and Benlysta

– Accelerated pipeline with nine pivotal study starts and now have over 20 assets in late-stage development

– Established multiple partnerships to develop COVID-19 solutions, including with CureVac to develop next generation mRNA COVID vaccines and Vir Biotechnology for therapeutic antibody treatments

– Strengthened capabilities with more than 20 business development deals

– 28 first-market launches for Consumer Healthcare

|

– Strong sales performance from key growth drivers in HIV, Respiratory, Oncology and Consumer Healthcare, reflecting our resource focus on therapy areas, markets and brands with greatest potential

– Advanced Consumer Healthcare integration; on track for £500 million annual cost savings by 2022 and £1.1 billion divestment proceeds achieved

– Advanced specialty medicine capabilities with over 500 new hires in Oncology

– Programme to separate GSK into two leading businesses remains on track |

– Sector leading positions in ESG indices including 1st in the Access to Medicine Index

– Despite the pandemic, we have been able to maintain the supply of our pharmaceutical, vaccine and consumer healthcare products and continue manufacturing without significant disruption

– FDA and EMA approved paediatric dolutegravir

– Joined global efforts to develop COVID-19 solutions and supported partners

– Set ambitious new environmental sustainability goals in climate and nature

– Introduced all-employee mandatory inclusion and diversity training

| ||||||

|

2021 priority objectives |

2021 priority objectives |

2021 priority objectives | ||||||

|

– Deliver Innovation sales with excellent commercial, R&D and supply chain execution in Oncology, HIV and Vaccines

– Accelerate and strengthen pipeline with robust commercial input, including business development |

– Continue to prioritise spending to deliver growth and return on investment

– Continue to deliver two-year programme to prepare GSK for separation into two new leading companies

– Build a stronger, more diverse workforce for two new leading companies

|

– Continue to deliver on-time, in-full supply of our products

– Improve manager capability to motivate, focus, develop and care for people

– Continue to deliver progress on Trust commitments

| ||||||

|

Culture As we move towards the creation of two new leading companies, we continue to focus on being more performance driven, while remaining firmly purpose led and values based. We track our cultural change with a range of indicators and the Board receives regular updates. See pages 90 and 102.

| ||||||||

|

Principal risks

| ||||||||

| Our principal risks are: patient safety; product quality; financial controls and reporting; anti-bribery and corruption; commercial practices and pricing; non-promotional engagement; privacy; research practices; environment, health and safety; environmental sustainability; information security; supply continuity; and transformation. Our risk management framework is designed to support our long-term priorities. See pages 43 to 45 and 261 to 275. | ||||||||

GSK Annual Report 2020 09

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

We track progress against our long-term priorities with ten operating key

performance indicators. These measure our performance at a Group level

and across our three businesses.

| Innovation | 2020 | 2019 | 2018 | |||||||||

| Innovation sales

|

||||||||||||

| Pharmaceuticals and Vaccines – sales of products launched in the last five years |

|

£4.1bn

|

|

|

£3.0bna

|

|

|

£1.1bna

|

| |||

| Consumer Healthcare – sales from products which are new to a market in the last three years as a % of total sales |

|

11%

|

|

|

12%

|

|

|

11%

|

| |||

|

Pipeline value and progress – the value of products in our pipeline and R&D milestones achieved |

|

n/r

|

|

|

n/r

|

|

|

n/r

|

| |||

| Performance | 2020 | 2019 | 2018 | |||||||||

| Group turnover

|

£34.1bn | £33.8bn | £30.8bn | |||||||||

| Profit

|

||||||||||||

| Total operating profit – up 12% AER, 15% CER

|

£7.8bn | £7.0bn | £5.5bn | |||||||||

| Adjusted operating profit – down 1% AER, up 2% CER

|

£8.9bn | £9.0bn | £8.7bn | |||||||||

| Total operating margin

|

22.8% | 20.6% | 17.8% | |||||||||

| Adjusted operating margin

|

26.1% | 26.6% | 28.4% | |||||||||

|

Free cash flow

|

£5.4bn | £5.1bn | £5.7bn | |||||||||

| Market share – our market share in relation to our competitors |

n/r | n/r | n/r | |||||||||

| Top talent and succession plans for key roles – our most talented employees in key roles with succession plans in place | n/r | n/r | n/r | |||||||||

| Trust | 2020 | 2019 | 2018 | |||||||||

| Employee feedback – employee engagement scores from our global employee survey |

|

84%

|

|

|

78%

|

|

|

78%

|

| |||

| Supply service level – percentage of orders delivered on-time, in-full |

|

n/r

|

|

|

n/r

|

|

|

n/r

|

| |||

| Corporate reputation – reputation index among stakeholders and informed public measured globally and in top 13 markets |

|

n/r

|

|

|

n/r

|

|

|

n/r

|

| |||

|

Linked to Executive LTI awards and bonus, see pages 113, 119 and 121. |

| a | Comparative information reflects sales of those products that meet the definition for 2020. |

| n/r | Not reported externally due to commercial sensitivities. |

GSK Annual Report 2020 11

|

|

||

|

|

We are operating in a dynamic environment, shaped by fast-changing

and interdependent global trends, many of which were accelerated

by the COVID-19 pandemic. We continue to respond to this changing

environment by advancing our strategy and long-term priorities.

12 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Industry trends continued

GSK Annual Report 2020 13

|

|

||

|

|

Industry trends continued

14 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Industry trends continued

GSK Annual Report 2020 15

|

|

||

|

|

Engaging and building trust with the broad range of stakeholders that

interact with, or are impacted by, our business is key to delivering our

strategy and ensuring our success over the long term.

Our approach to enable management and the Board to understand and consider stakeholder views as part of their oversight and decision making is explained in our section 172 statement, set out in full on page 108 and incorporated by reference into this Strategic report. On this page we summarise our key stakeholder groups, how we engage with them, the issues that matter most to them and what we are doing in response.

| Patients and consumers |

Insights from patients and consumers enable us to develop products that better meet their needs.

How we engage

– Advisory boards, disease-specific patient panels and Patient Advocacy Leaders Summits to provide patient insights

– Engagement and support for patient groups (disclosed on GSK.com), and initiatives that empower patients to get involved in medicine development

– Market research including consumer sensory labs |

What matters

– Differentiated product innovation based on patient and consumer needs

– Access to a reliable supply of high-quality, safe products

– Pricing of healthcare products, particularly out-of-pocket expenses

What we are doing

– Strengthening our pipeline of innovative products

– Maintaining high standards for product quality and safety

– Continuing to take a value-based approach to pricing to balance reward for innovation with access and affordability

| ||

| Investors |

We maintain regular and constructive dialogue with investors to communicate our strategy and performance in order to promote investor confidence and ensure our continued access to capital.

How we engage

– Ongoing communications including the AGM, quarterly results calls, in-person and virtual roadshows and detailed company information online

– One-to-one meetings between Board members, senior executives and institutional investors

– Biennial investors and analysts perception study

|

What matters

– Financial performance and commercial success

– Understanding how our R&D strategy is successfully developing our pipeline

– The increasing importance of good management of ESG issues

What we are doing

– Good financial performance and transparent reporting

– Business and R&D updates and events on key pipeline milestones

– Increasing our engagement on ESG matters | ||

| Healthcare |

We work with healthcare professionals (HCPs) and medical experts to understand patient needs and to ensure our products are being administered in the right way.

How we engage

– Scientific dialogue to increase understanding of disease management and patient experience

– Providing high-quality, balanced information about our medicines and vaccines

– Collaborating on clinical trials and research |

What matters

– Access to product and scientific information

– Responsible sales and marketing practices

– Safety, efficacy and differentiated innovation

What we are doing

– Increasing the use of digital channels to deliver a more personalised and effective sharing of information to HCPs

– Ensuring we attract and retain the best talent while upholding responsible sales and marketing standards

– Using HCP insights on disease management and patient experience to inform the development of our medicines

| ||

| R&D partners and academia |

We partner with scientific institutions, national health systems, business partners and academia to help ensure we develop differentiated healthcare products.

How we engage

– Collaborating with outstanding scientists from organisations across the globe

– Establishing joint ventures to strengthen innovation and efficiency

– Working with academic institutions to accelerate discovery and development of new medicines |

What matters

– Finding the right partner to accelerate a potential medicine or vaccine to approval to reach patients

– Pushing the science as far as it can go to advance human health

– Dissemination and advancement of scientific knowledge

What we are doing

– Working with world-leading experts at biotechs, universities and other scientific institutions to improve drug discovery and increase the productivity of our R&D pipeline

– Collaborating with partners such as with CureVac on mRNA technology and Vir Biotechnology for new antibody therapies; and expanding genetic and genomics collaborations such as with the Broad Institute

| ||

16 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Stakeholder engagement continued

| Governments and regulators |

We work with governments and regulators to advocate for policies that encourage innovation, promote efficient management of healthcare spending and give patients the support they need.

How we engage

– Meeting with regulatory bodies throughout the development process to ensure high-quality and safe new products

– Engaging with government health agencies to demonstrate the value of our products for patients and economies

– Working with governments to protect and strengthen the right operating environment for life sciences innovation and launches

– Participating in international efforts to address global health threats, such as the COVID-19 pandemic |

What matters

– Investment in innovation and life sciences

– Scientific funding and collaboration

– Medicines pricing and reimbursement

– Public health threats – COVID-19 and antimicrobial resistance (AMR)

– Investment in preventive health and strengthening health systems

What we are doing

– Working with UK and EU policymakers to ensure post-Brexit there remains a sustained flow of goods, investment capital and talent for life sciences innovation

– Engaging in US policy pricing/reimbursement debates and, with phRMA, commenting on legislative proposals for healthcare reform

– Partnering across industry and governments to tackle AMR

– Engaging with governments, including the US, UK, EU and Canada, regarding production and procurement of COVID-19 vaccines

| ||

| NGOs and multilateral organisations |

We work with partners to improve access to healthcare services and our products, and to advocate for the policy environment in which we can be successful.

How we engage

– Working with non-governmental organisations (NGOs) and partners to research and develop products to address global health challenges

– Collaborating with NGOs and generic manufacturers to sustainably supply our products to developing countries

– Partnering to strengthen health systems in developing countries and drive progress on global health priorities |

What matters

– Access to medicines and vaccines

– UN SDGs and WHO targets for specific disease areas

– Universal health coverage and the future of health systems

– Financing for global health, including COVID-19 solutions

What we are doing

– Focusing on our unique role as a global health partner to develop products where we have scientific expertise

– Partnering with organisations that have complementary capabilities and reach to create sustainable models that share risk, including our partnership with Gavi to support access to vaccines in low and lower middle-income countries

– Leveraging our community investment programmes to support our scientific expertise and deliver greater impact for patients

| ||

| Suppliers |

We work with thousands of suppliers, large and small, who provide goods and services that support us in delivering a reliable supply of high-quality, safe products for our patients and consumers.

How we engage

– Regular direct engagement with suppliers to ensure they support GSK’s strategies and targets

– Engaging with suppliers through our Third-Party Oversight programme and by conducting in-depth audits

– Participating in forums such as the Pharmaceutical Supply Chain Initiative and the Consumer Goods Forum to improve supply chain sustainability |

What matters

– Prompt payment for smaller suppliers

– Understanding GSK policies to ensure compliance

– Opportunities to innovate and grow the relationship

What we are doing

– Engaging with our suppliers throughout the COVID-19 pandemic to understand their operating and financial status, and offering support if necessary

– Engaging with suppliers to develop improvement plans and track progress when we identify areas for improvement

– Providing proactive support through our third-party EH&S team in countries where our priority suppliers are located

| ||

| Employees |

We involve and listen to employees to help us maintain strong employee engagement and retain talented people.

How we engage

– Regular ‘Let’s Talk’ and ‘Let’s Listen’ events with the Corporate Executive Team and other senior leaders

– Facilitating dialogue and collaboration through our internal communications platform

– Through Works Councils, Employee Forums and Employee Resource Groups

– Global all-employee survey and One80 Survey for employees to provide feedback on line managers |

What matters

– Our purpose and being able to see the difference we make

– Having a great line manager

– Feeling understood and valued

– Being part of an inclusive and diverse workplace

What we are doing

– Delivering more frequent, authentic communications during the pandemic

– Clarifying our expectations of managers to motivate, focus, care for and develop our employees

– Supporting employee safety, mental wellbeing and enabling work-life balance

– Expanded our I&D commitments by setting aspirational targets to improve ethnic and gender diversity in leadership

| ||

GSK Annual Report 2020 17

|

|

||

|

|

2020 was a year of significant progress for R&D. Across our biopharma portfolio, we achieved a substantial number of new launches, regulatory filings and late-stage research milestones. In Consumer Healthcare, we delivered first market launches of new innovations across all categories.

|

Progress

|

||||

|

– Strengthened the biopharma

– Accelerated the portfolio with

– Over 20 assets in late-stage

|

– Fast tracked COVID-19 solutions,

– Started phase III trials for our RSV

– Launched first clinical trial of an |

– Invested significantly in strategic

– Consumer Healthcare had 28

|

Pharmaceuticals and Vaccines

18 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Innovation continued

GSK Annual Report 2020 19

|

|

||

|

|

Innovation continued

1 Internal data

20 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Innovation continued

GSK Annual Report 2020 21

|

|

||

|

|

Innovation continued

22 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Innovation continued

GSK Annual Report 2020 23

|

|

||

|

|

Innovation continued

24 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Innovation continued

GSK Annual Report 2020 25

|

|

||

|

|

Innovation continued

Pipeline overview

We have 59 assets in development, of which over 20 are late-stage.

|

Pivotal (phase II/III/registration)

|

||||

| Benlysta + rituximab SLE | letetresgene-autoleuceI1 (3377794, NY-ES0-1 TCR) SS2 | |||

|

|

| |||

| cabotegravir LA HIV PrEP | 41821361 (VIR-7831) COVID-19 | |||

|

|

| |||

| daprodustat (HIF-PHI) anaemia | 35112941 (LA anti-IL5 antagonist) asthma | |||

|

|

| |||

| Nucala COPD/nasal polyps | Shingrix immuno-compromised vaccine1 | |||

|

|

| |||

| Blenrep1 (BCMA ADC) multiple myeloma7 | Bexsero infants vaccine (US) | |||

|

|

| |||

| Zejula1 (PARP inhibitor) ovarian and lung cancer2 | MMR vaccine (US) | |||

|

|

| |||

| dostarlimab1 (PD-1 antagonist) dMMR/MSI-H EC | Rotarix liquid vaccine (US) | |||

|

|

| |||

| bintrafusp alfa1 (TGFß trap/anti-PDL1) BTC2 | MenABCWY vaccine | |||

|

|

| |||

| otilimab1 (3196165, aGM-CSF inhibitor) RA2,6 | RSV maternal vaccine1 | |||

|

|

| |||

| gepotidacin1 (2140944) uUTI and GC | COVID-19 (Medicago) vaccine1,3 | |||

|

|

| |||

| feladilimab1 (3359609 ICOS receptor agonist) HNSCC2,4 | RSV older adults vaccine1 | |||

|

Proof of concept (phase Ib/II)

|

||||

| 3640254 (maturation inhibitor) HIV | Menveo liquid vaccine | |||

|

|

| |||

| 32288361 (HBV ASO) HBV | RSV paediatric vaccine | |||

|

|

| |||

| linerixibat (IBATi) cholestatic pruritus in PBC | Therapeutic HBV vaccine1,5 | |||

|

|

| |||

| 33265951 (PRMT5 inhibitor) cancer | Malaria1 (fractional dose) vaccine | |||

|

|

| |||

| cobolimab1 (TSR-022, TIM-3 antagonist) NSCLC | Shigella vaccine1 | |||

|

|

| |||

| 30366561 (leucyl t-RNA inhibitor) TB | COVID-19 (Sanofi) vaccine1,3 | |||

|

|

| |||

| 40743861 (TSR-033, LAG3 antagonist) cancer | ||||

|

First time in human/POM (phase I/Ib)

|

||||

| 38582791 (CCL 17 inhibitor) OA pain | 39019611 (CD8/NYESO TCR) cancer | |||

|

|

| |||

| 3745417 (STING agonist) cancer | 38450971 (TGFbR2/NYESO TCR) cancer | |||

|

|

| |||

| 34391711 (hPGD2 synthase inhibitor) DMD | 34942451 (proteosome inhibitor) visceral leishmaniasis | |||

|

|

| |||

| 31868991 (CRK-12 inhibitor) visceral leishmaniasis | 39153931 (TG2 inhibitor) celiac disease | |||

|

|

| |||

| 38101091 (broadly neutralising antibody) HIV | 25562861 (Mtb inhibitor) TB | |||

|

|

| |||

| 33687151 (Type 1 PRMT inhibitor) cancer | 37290981 (ethionamide booster) TB | |||

|

|

| |||

| 27987451 (TRPV4 blocker) DME | 41821371 (VIR-7832) COVID-19 | |||

|

|

| |||

| 60976081 (CD96) cancer | C. difficile vaccine1 | |||

|

|

| |||

| 2982772 (RIP1-k) psoriasis | SAM (rabies model) vaccine | |||

|

|

| |||

| 38823471 (FimH antagonist) uUTI | S. aureus vaccine1 | |||

|

|

| |||

| 3739937 (maturation inhibitor) HIV | COVID-19 (SK Bioscience) vaccine1,3,5 | |||

|

|

| |||

| 3923868 (Pl4kß inhibitor) viral COPD exacerbations | SAM (COVID-19 model) vaccine |

Only the most advanced indications are shown for each asset.

26 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Innovation continued

Consumer Healthcare

| 1 | Based on Nicholas Hall’s DB6 Global OTC database 2019 (on the basis of consumption at manufacturers’ price) |

GSK Annual Report 2020 27

|

|

||

|

|

We delivered our guidance for the year, offsetting the significant impact of COVID-19 on adult vaccinations, with strong sales performance from key growth drivers in HIV, Respiratory, Oncology and Consumer Healthcare, and effective cost control.

|

Pharmaceuticals |

Vaccines |

Consumer Healthcare | ||

|

|

|

| ||

| – Total 2020 turnover £17 billion, -3% AER, -1% CER

– Sales of new and specialty pharmaceuticals £9.7 billion +11% AER, +12% CER

– Strong commercial execution of key growth products, including launches in HIV, Oncology and Respiratory

– Accelerated digital capabilities, supporting enhanced HCP engagement and strong supply performance despite disruption from COVID-19 pandemic

|

– Total 2020 turnover £7 billion, -2% AER, -1% CER. COVID-19 adversely impacted adult vaccination in particular

– Shingrix launched to new, self-pay markets China, Belgium, the Netherlands, Japan and Sweden. Strong performance in Europe, reflecting robust demand in Germany

– Further strengthened Bexsero’s profile with compelling real-world evidence in multiple settings

– Strong flu sales across all regions

– Overall strong supply performance

|

– Total 2020 turnover £10 billion +12% AER, +14% CER (pro-forma -2% CER, +4% CER excluding brands divested/under review)

– Strong progress on joint venture integration

– Exceeded target of raising £1 billion through non-core brand divestments

– On track to deliver synergies of £500 million annual cost savings by 2022

|

Pharmaceuticals

| 1 | New and Specialty products comprises Pharmaceuticals excluding Established Pharmaceuticals |

28 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Performance continued

GSK Annual Report 2020 29

|

|

||

|

|

Performance continued

Vaccines

1 Internal data

30 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Performance continued

Consumer Healthcare

GSK Annual Report 2020 31

|

|

||

|

|

Performance continued

32 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Trust is one of our three long-term priorities and is crucial to our purpose,

enabling us to add value for our shareholders and society.

|

Progress

| ||||||||||||||||||

|

– Committed to ambitious new environmental sustainability goals: net zero impact on climate and net positive impact on nature by 2030

– Strong performance against our ESG benchmarks

– Licensed our TB candidate vaccine to the Bill and Melinda Gates Medical Research Institute for continued development |

– Partnered to launch the $1 billion AMR Action Fund aiming to bring two to four novel antibiotics to patients by 2030

– FDA and EMA approved an age-appropriate formulation of Tivicay, for children living with HIV weighing at least 3kg and from four weeks of age

– Set new aspirational targets for gender and for race and ethnicity, to improve representation at VP level and above, and introduced mandatory inclusion and diversity training for all employees

|

– Formed partnerships to better prepare for future pandemics and ensure access to future COVID-19 treatments and vaccines. Including through the Trinity Challenge, our industry commitment with the Bill and Melinda Gates Foundation and our engagement with the COVAX facility

– Record response (85%) to our employee survey, with engagement score of 84% (up 6%) |

||||||||||||||||

GSK Annual Report 2020 33

|

|

||

|

|

Trust continued

Science and technology

34 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Trust continued

Affordability and availability

GSK Annual Report 2020 35

|

|

||

|

|

Trust continued

Modern employer

36 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Trust continued

GSK Annual Report 2020 37

|

|

||

|

|

Trust continued

38 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Trust continued

Responsible business

GSK Annual Report 2020 39

|

|

||

|

|

Trust continued

40 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Trust continued

GSK Annual Report 2020 41

|

|

||

|

|

Trust continued

42 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

GSK has a well-embedded risk management framework, which is reviewed continually. Board committees provide oversight of the framework, assisted

by the Risk Oversight and Compliance Council.

GSK Annual Report 2020 43

|

|

||

|

|

Risk management continued

|

Risk |

Assessment and mitigation activities | |||

|

| ||||

| Patient safety |

|

The macro risk level is unchanged and remains challenging as politicisation of drug and vaccine safety and efficacy in the context of COVID-19 could provoke distrust and alter public reporting. Restrictive privacy regulations, that impact how we manage safety data, create further complications. | ||

|

GSK’s exposure is also unchanged. While operational risk has stabilised through embedding of pharmacovigilance organisational efficiencies, this is offset by challenges accompanying fast-paced development of medicines and vaccines for COVID-19. To mitigate these and other risks, we apply our well-established safety governance and risk management framework to ensure we are safeguarding patients throughout the lifecycle of all GSK products. | |||

|

| ||||

| Product quality |

|

The macro risk remains the same despite concerns of potential drug shortages associated with COVID-19, the ongoing evaluation of products for the presence of nitrosamines and the increased focus on data integrity requirements. | ||

|

GSK’s exposure remains unchanged with quality oversight processes in place to monitor and maintain a strong compliance profile throughout the pandemic. Governance and control strategies have been developed and deployed for the timely completion of our nitrosamine assessments. We have continued to invest in technology and digital platforms to further strengthen our controls around good data management practices. | |||

|

| ||||

| Financial controls and reporting |

|

The macro risk level has increased, with the external environment remaining challenging due to political uncertainty and increasing societal expectations of the role of the auditor. There are increased fraud attempts and challenging financial markets, informed mainly by the COVID-19 pandemic and evolving political responses. | ||

|

GSK’s risk exposure has remained stable due to the resilience and focus of personnel. We continue to implement transformational programmes, leverage technology, centralise processes, strengthen controls and maintain effective tax and treasury strategies. | |||

|

| ||||

| Anti-bribery and corruption (ABAC) |

|

The macro risk level for bribery and corruption increased as we continued to see legal frameworks similar to those in the UK and US develop elsewhere; more rigorous standards aided by improved technology; increased enforcement with focus on third-party intermediaries; and the impact of COVID-19 on businesses. | ||

|

GSK’s ABAC risk exposure has maintained as we continue to improve our ABAC programme to ensure appropriate controls, training, capability building, awareness raising, strong monitoring and use of data analytics. We continue to understand and assess our risk exposure to money laundering and wider corruption to mitigate any existing risk. | |||

|

| ||||

| Commercial practices and pricing |

|

COVID-19 has increased the macro-level risk on the industry go-to-market model, boosting the importance of different channel activities (e.g. internet based) for consumers, promoting, connecting and commercialising. There is also an increased risk of downward price pressure due to international reference pricing, aggressive healthcare budget controls and tighter reimbursement. | ||

|

GSK’s risk exposure level remains stable due to our mature and robust control environment. We continue to evolve our commercial practices. We have invested in new technologies that support virtual customer engagement. We maintain proportionate controls, training and monitoring for employees that engage with healthcare organisations and professionals. In Consumer Healthcare, improvements in our digital sales and marketing control framework are mitigating emerging risks. | |||

|

| ||||

| Non-promotional engagement |

|

The macro environment for non-promotional activities and scientific engagement with HCPs and patients is stable. This is despite being impacted by the complexity and dynamic nature of disease areas and treatments, the increasing diversity of engagement platforms, and a significant increase in virtual engagements since the pandemic. | ||

|

GSK’s exposure has not increased. We further modernised and adapted our practices and applied our internal principles and policies, designed to mitigate risk, to this rapidly evolving environment. We evolved employee training so that our people understand the risk associated with non-promotional activities and conduct them in compliance with GSK’s values and policies, local laws and regulations. | |||

|

| ||||

44 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Risk management continued

| Risk | Assessment and mitigation activities | |||

|

| ||||

| Privacy |

|

The macro risk continues to increase, with priority GSK markets such as the US, China and India instituting new – or enforcing existing – privacy laws, and court rulings invalidating privacy mechanisms that international companies had relied on, including the EU-US Privacy Shield. COVID-19 has further highlighted the fragmented nature of the regulatory environment. | ||

|

GSK’s exposure remains unchanged, due to our continued efforts to embed our privacy framework in our markets, the evolution of risk mitigation in the business, and the advancing of our privacy strategy from a centrally-driven, mitigation approach to one where the business proactively embeds privacy by design standards. | |||

|

| ||||

| Research practices |

|

The macro risk level has increased due to COVID-19. The pandemic has created continuity challenges for R&D, particularly human subject research, where disruption to global clinical trial programmes has introduced additional risks. | ||

|

GSK’s exposure remains unchanged. We are offsetting external impacts of the pandemic by risk mitigation actions to embed and monitor additional business continuity measures and controls. Ongoing and planned work to further enhance and monitor our culture of quality is continuing. | |||

|

| ||||

| Environment, health and safety (EHS) |

|

The macro risk level has increased. Although regulators and stakeholders’ expectations are broadly the same, new regulations to control the spread of COVID-19 in the workplace have added significant complexity to how we comply with existing EHS regulations. | ||

|

GSK’s risk exposure has increased, due both to our adjustment of work practices to enable COVID-19 control measures and because of our transition to a period of significant organisational change. Both factors require us to refocus on applying EHS fundamentals. | |||

|

| ||||

| Environmental sustainability |

|

The macro risk level increased as investors, regulators and other stakeholders increasingly expect companies to understand and reduce the environmental impacts across their value chain and mitigate the impacts climate change could have on their operations and supply chains. | ||

|

GSK’s risk exposure is unchanged. We set ambitious new environmental sustainability targets in 2020 and have implemented detailed water resilience assessments, increased our Task Force on Climate-related Financial Disclosures (TCFD) analysis and continued to monitor trends in physical, reputational and regulatory risks from climate change impacts. | |||

|

| ||||

| Information security |

|

The macro risk level continues to rise, as large multinationals increase their digital footprints and threats from hackers become ever more sophisticated. During the year COVID-19 also added to a measurable increase in threats targeting the healthcare industry. | ||

|

GSK’s risk exposure has increased. GSK’s cybersecurity programme continues a rapid improvement of controls to increase cyber threat intelligence capabilities and protect critical information and systems including operational technology and networks. While GSK continues to strengthen cybersecurity and information protection capabilities, the targeting of pharmaceutical and vaccine intellectual property leveraging cybersecurity, as well as third party service availability as a means of disruption, has intensified. | |||

|

| ||||

| Supply continuity |

|

The macro risk level remains high due to the ongoing impact of the COVID-19 pandemic on product supply. The potential for increasing protectionism between countries and Brexit uncertainties also continues. | ||

|

GSK’s risk exposure has increased. There is an elevated risk of supply issues of bioscience materials such as glass vials and filters. This is an industry-wide concern arising from the rapid ramp up of COVID-19 vaccines and therapeutics driving increased demand for components. | |||

|

| ||||

| Transformation |

|

The macro risk level is increasing due to COVID-19 having introduced uncertainty into the external global environment and necessitating temporary measures in certain countries to protect employment. | ||

|

GSK’s risk exposure level remains unchanged. Our transformation and separation projects have progressed as planned throughout 2020, with workforce engagement being a priority. | |||

|

| ||||

GSK Annual Report 2020 45

|

|

||

|

|

Risk management continued

Climate-related financial disclosure

| 1 | Scenarios are based on IPPC Representative Concentration Pathways 2.6, 4.5 and 8.5, the IEA World Energy Outlook 2018 New Policy Scenario, Current Policy Scenario and Sustainable Development Scenario; and data sets from WWF and WRI for water stress and flood risk modelling |

46 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Risk management continued

GSK Annual Report 2020 47

|

|

||

|

|

Risk management continued

Viability statement

48 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Risk management continued

Impact of Brexit

Non-financial information statement

The following aligns to the non-financial reporting requirements contained in sections 414CA and 414CB of the Companies Act 2006.

GSK Annual Report 2020 49

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review

Reporting framework

GSK Annual Report 2020 51

|

|

||

|

|

Group financial review continued

Reporting framework continued

Historical record of Adjusting items

The reconciliations between Total and Adjusted operating profit over the last five years can be summarised as follows:

|

2020 £m |

2019 £m |

2018 £m |

2017 £m |

2016 £m |

||||||||||||||||

| Total operating profit |

7,783 | 6,961 | 5,483 | 4,087 | 2,598 | |||||||||||||||

| Intangible asset amortisation |

775 | 777 | 580 | 591 | 588 | |||||||||||||||

| Intangible asset impairment |

263 | 83 | 116 | 688 | 20 | |||||||||||||||

| Major restructuring |

1,532 | 1,105 | 809 | 1,056 | 970 | |||||||||||||||

| Transaction-related items |

1,308 | 345 | 1,977 | 1,599 | 3,919 | |||||||||||||||

| Divestments, significant legal and other items |

(2,823 | ) | (299 | ) | (220 | ) | (119 | ) | (424 | ) | ||||||||||

| Separation costs |

68 | – | – | – | – | |||||||||||||||

| US tax reform |

– | – | – | 666 | – | |||||||||||||||

| Adjusted operating profit |

8,906 | 8,972 | 8,745 | 8,568 | 7,671 | |||||||||||||||

| The analysis of the impact of transaction-related items on operating profit for each of the last five years is as follows: |

| |||||||||||||||||||

| 2020 £m |

2019 £m |

2018 £m |

2017 £m |

2016 £m |

||||||||||||||||

| Novartis Consumer Healthcare Joint Venture put option |

– | – | 658 | 986 | 1,133 | |||||||||||||||

| Contingent consideration on former Shionogi-ViiV Healthcare JV (including Shionogi preferential dividends) |

1,114 | 31 | 1,188 | 556 | 2,162 | |||||||||||||||

| ViiV Healthcare put options and Pfizer preferential dividends |

(52) | (234 | ) | (58 | ) | (126 | ) | 577 | ||||||||||||

| Contingent consideration on former Novartis Vaccines business |

172 | 76 | 58 | 101 | 69 | |||||||||||||||

| Release of fair value uplift on acquired Pfizer inventory |

91 | 366 | – | – | – | |||||||||||||||

| Other adjustments |

(17) | 106 | 131 | 82 | (22 | ) | ||||||||||||||

| Transaction-related items |

1,308 | 345 | 1,977 | 1,599 | 3,919 | |||||||||||||||

Full reconciliations between Total and Adjusted results for 2016–2020 are set out on pages 252 to 254. Further explanations on the Adjusting items for 2020 are reported on page 64.

52 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Reporting framework continued

GSK Annual Report 2020 53

|

|

||

|

|

Group financial review continued

Our approach to tax

54 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Financial performance

GSK Annual Report 2020 55

|

|

||

|

|

Group financial review continued

Financial performance continued

56 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Financial performance continued

GSK Annual Report 2020 57

|

|

||

|

|

Group financial review continued

Financial performance continued

58 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Financial performance continued

GSK Annual Report 2020 59

|

|

||

|

|

Group financial review continued

Financial performance continued

60 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Financial performance continued

GSK Annual Report 2020 61

|

|

||

|

|

Group financial review continued

Financial performance continued

62 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Financial performance continued

GSK Annual Report 2020 63

|

|

||

|

|

Group financial review continued

Adjusting items

| Adjusted results reconciliation 31 December 2020 |

Total results £m |

Intangible asset amortisation £m |

Intangible asset impairment £m |

Major restructuring £m |

Transaction- £m |

Divestments, significant legal and other items £m |

Separation £m |

Adjusted results £m |

||||||||||||||||||||||||

| Turnover |

34,099 | 34,099 | ||||||||||||||||||||||||||||||

| Cost of sales |

(11,704 | ) | 699 | 31 | 667 | 116 | (10,191 | ) | ||||||||||||||||||||||||

| Gross profit |

22,395 | 699 | 31 | 667 | 116 | 23,908 | ||||||||||||||||||||||||||

| Selling, general and administration |

(11,456 | ) | 1 | 18 | 659 | (23 | ) | 16 | 68 | (10,717 | ) | |||||||||||||||||||||

| Research and development |

(5,098 | ) | 75 | 214 | 206 | (4,603 | ) | |||||||||||||||||||||||||

| Royalty income |

318 | 318 | ||||||||||||||||||||||||||||||

| Other operating (expense)/income |

1,624 | 1,215 | (2,839 | ) | – | |||||||||||||||||||||||||||

| Operating profit |

7,783 | 775 | 263 | 1,532 | 1,308 | (2,823 | ) | 68 | 8,906 | |||||||||||||||||||||||

| Net finance costs |

(848 | ) | 2 | 2 | (844 | ) | ||||||||||||||||||||||||||

| Share of after-tax profits of associates and joint ventures |

33 | 33 | ||||||||||||||||||||||||||||||

| Profit before taxation |

6,968 | 775 | 263 | 1,534 | 1,308 | (2,821 | ) | 68 | 8,095 | |||||||||||||||||||||||

| Taxation |

(580 | ) | (150 | ) | (47 | ) | (292 | ) | (229 | ) | 17 | (14 | ) | (1,295 | ) | |||||||||||||||||

| Tax rate |

8.3% | 16.0% | ||||||||||||||||||||||||||||||

| Profit after taxation |

6,388 | 625 | 216 | 1,242 | 1,079 | (2,804 | ) | 54 | 6,800 | |||||||||||||||||||||||

| Profit attributable to non-controlling interests |

639 | 392 | 1,031 | |||||||||||||||||||||||||||||

| Profit attributable to shareholders |

5,749 | 625 | 216 | 1,242 | 687 | (2,804 | ) | 54 | 5,769 | |||||||||||||||||||||||

| Earnings per share |

115.5p | 12.6p | 4.4p | 25.0p | 13.8p | (56.5)p | 1.1p | 115.9p | ||||||||||||||||||||||||

| Weighted average number of shares (millions) |

4,976 | 4,976 | ||||||||||||||||||||||||||||||

| Adjusted results reconciliation 31 December 2019 |

Total results £m |

Intangible asset amortisation £m |

Intangible asset impairment £m |

Major restructuring £m |

Transaction- £m |

Divestments, significant legal and other items £m |

Adjusted results £m |

|||||||||||||||||||||||||

| Turnover |

33,754 | 33,754 | ||||||||||||||||||||||||||||||

| Cost of sales |

(11,863 | ) | 713 | 30 | 658 | 383 | (10,079 | ) | ||||||||||||||||||||||||

| Gross profit |

21,891 | 713 | 30 | 658 | 383 | 23,675 | ||||||||||||||||||||||||||

| Selling, general and administration |

(11,402 | ) | 4 | 332 | 104 | 247 | (10,715 | ) | ||||||||||||||||||||||||

| Research and development |

(4,568 | ) | 64 | 49 | 114 | 2 | (4,339 | ) | ||||||||||||||||||||||||

| Royalty income |

351 | 351 | ||||||||||||||||||||||||||||||

| Other operating (expense)/income |

689 | 1 | (142 | ) | (548 | ) | – | |||||||||||||||||||||||||

| Operating profit |

6,961 | 777 | 83 | 1,105 | 345 | (299 | ) | 8,972 | ||||||||||||||||||||||||

| Net finance costs |

(814 | ) | 5 | (1 | ) | (810 | ) | |||||||||||||||||||||||||

| Share of after-tax profits of associates and joint ventures |

74 | 74 | ||||||||||||||||||||||||||||||

| Profit before taxation |

6,221 | 777 | 83 | 1,110 | 345 | (300 | ) | 8,236 | ||||||||||||||||||||||||

| Taxation |

(953 | ) | (156 | ) | (17 | ) | (208 | ) | (124 | ) | 140 | (1,318 | ) | |||||||||||||||||||

| Tax rate |

15.3% | 16.0% | ||||||||||||||||||||||||||||||

| Profit after taxation |

5,268 | 621 | 66 | 902 | 221 | (160 | ) | 6,918 | ||||||||||||||||||||||||

| Profit attributable to non-controlling interests |

623 | 164 | 787 | |||||||||||||||||||||||||||||

| Profit attributable to shareholders |

4,645 | 621 | 66 | 902 | 57 | (160 | ) | 6,131 | ||||||||||||||||||||||||

| Earnings per share |

93.9p | 12.6p | 1.3p | 18.2p | 1.2p | (3.3)p | 123.9p | |||||||||||||||||||||||||

| Weighted average number of shares (millions) |

4,947 | 4,947 | ||||||||||||||||||||||||||||||

64 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Adjusting items continued

GSK Annual Report 2020 65

|

|

||

|

|

Group financial review continued

Adjusting items continued

66 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Adjusting items continued

GSK Annual Report 2020 67

|

|

||

|

|

Group financial review continued

Cash generation and conversion

68 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Financial position and resources

GSK Annual Report 2020 69

|

|

||

|

|

Group financial review continued

Financial position and resources continued

70 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

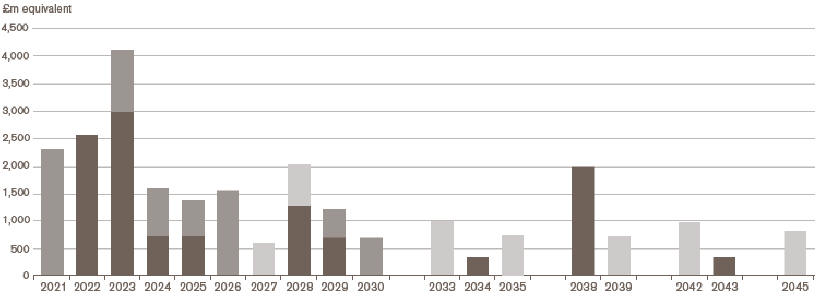

Group financial review continued

Financial position and resources continued

Maturity profile of bond debt

GSK Annual Report 2020 71

|

|

||

|

|

Group financial review continued

Financial position and resources continued

72 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Financial position and resources continued

GSK Annual Report 2020 73

|

|

||

|

|

Group financial review continued

Treasury policies

74 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Group financial review continued

Critical accounting policies

GSK Annual Report 2020 75

|

|

||

|

|

Group financial review continued

Critical accounting policies continued

Strategic report

The Strategic report was approved by the Board of Directors on

8 March 2021

Iain Mackay

Chief Financial Officer

8 March 2021

76 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

Corporate Governance

| In this section |

|

|||||||||||

| Chairman’s Governance statement | 78 | |||||||||||

| The Board |

80 | |||||||||||

| Corporate Executive Team

|

|

83

|

|

|||||||||

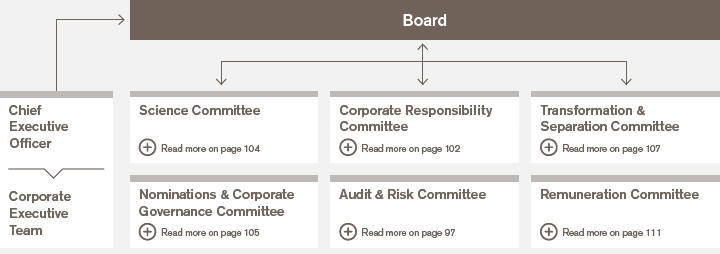

| Board architecture

|

|

85

|

|

|||||||||

| Board roles and responsibilities

|

|

86

|

|

|||||||||

| Board activity and principal decisions | 87 | |||||||||||

| Our purpose, values and culture

|

|

90

|

|

|||||||||

| The Board’s approach to engagement | 91 | |||||||||||

| Board performance

|

|

94

|

|

|||||||||

| Board Committee information | 96 | |||||||||||

| Our Board Committee reports | 97 | |||||||||||

| Section 172 statement | 108 | |||||||||||

| Directors’ report |

109 | |||||||||||

| GSK Annual Report 2020 77 | ||||||||||||

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

GSK Annual Report 2020 79

|

|

||

|

|

|

Board composition

|

Board diversity

|

International experience

|

||||||||||||||||||||||

|

Composition |

|

Gender |

|

|||||||||||||||||||||

| Executive | 25% | Male | 58% | Global | 92% | |||||||||||||||||||

| Non-Executive | 75% | Female | 42% | US | 100% | |||||||||||||||||||

| Tenure Non-Executive |

|

Ethnicity |

Europe | 92% | ||||||||||||||||||||

| Up to 3 years | 22% | Black, Asian and minority ethnic | 8% | EMAP | 83% | |||||||||||||||||||

| 3-6 years | 45% | White | 92% | |||||||||||||||||||||

| 6-9 years | 22% | |||||||||||||||||||||||

| 9-10 years | 11% |

See more information on page 106

See more information on page 106 |

||||||||||||||||||||||

|

Sir Jonathan Symonds, CBE Non-Executive Chairman

Age: 62 Nationality: British Appointed: 1 September 2019

|

Skills and experience Jon has extensive international financial, life sciences and governance experience.

Jon served as an Independent Non-Executive Director of HSBC Holdings plc from April 2014, and as Deputy Group Chairman from August 2018, until his retirement from the Board in February 2020. He was previously Chairman of HSBC Bank plc, Chief Financial Officer of Novartis AG, Partner and Managing Director of Goldman Sachs, Chief Financial Officer of AstraZeneca plc, and a Partner at KPMG. His governance experience includes roles as Non-Executive Director and Chair of the Audit Committees of Diageo plc and QinetiQ Group plc and Non-Executive Chair of Proteus Digital Health Inc.

Jon is a Fellow of the Institute of Chartered Accountants in England and Wales.

External appointments Non-Executive Director, Rubius Therapeutics, Inc; Non-Executive Director, Genomics England Limited having previously served as its Chairman; Member, European Round Table for Industry.

| |

|

Dame Emma Walmsley Chief Executive Officer

Age: 51 Nationality: British Appointed: 1 January 2017 Chief Executive Officer from 1 April 2017 |

Skills and experience Prior to her appointment as GSK’s CEO, Emma was the CEO of GSK Consumer Healthcare, a Joint Venture between GSK and Novartis, from its creation in March 2015. Emma joined GSK in 2010 from L’Oreal, having worked for 17 years in a variety of roles in Paris, London, New York and Shanghai. Emma was previously a Non-Executive Director of Diageo plc.

Emma holds an MA in Classics and Modern Languages from Oxford University.

External appointments Independent director, Microsoft, Inc; Honorary Fellow, Royal Society of Chemistry.

| |

|

Iain Mackay Chief Financial Officer

Age: 59 Nationality: British Appointed: 14 January 2019 Chief Financial Officer from 1 April 2019 |

Skills and experience Prior to joining GSK, Iain was Group Finance Director at HSBC Holdings plc, a position he held for eight years. A chartered accountant, Iain has worked in Asia, the US and Europe and before HSBC was at General Electric, Schlumberger Dowell and Price Waterhouse. Iain was previously a Trustee of the British Heart Foundation and Chair of its Audit and Risk Committee.

Iain holds an MA in Business Studies and Accounting and holds an Honorary Doctorate from Aberdeen University in Scotland.

Iain is a member of the Institute of Chartered Accountants of Scotland.

External appointments Member, Court of the University of Aberdeen and Chair of its Remuneration Committee; Member, The 100 Group and Chair of its Financial Reporting Committee.

| |

|

Dr Hal Barron Chief Scientific Officer and President, R&D

Age: 58 Nationality: American Appointed: 1 January 2018 Chief Scientific Officer and President, R&D from 1 April 2018 |

Skills and experience Prior to joining GSK, Hal was President, R&D at Calico LLC (California Life Company), an Alphabet- funded company that uses advanced technologies to increase understanding of lifespan biology. Prior to this, Hal was Executive Vice President, Head of Global Product Development, and Chief Medical Officer of Roche, responsible for all the products in the combined portfolio of Roche and Genentech. At Genentech, he was Senior Vice President of Development and Chief Medical Officer. Hal was a Non-Executive Director and Chair of the Science & Technology Committee at Juno Therapeutics, Inc until March 2018, when it was acquired by Celgene Corporation.

External appointments Associate Adjunct Professor, Epidemiology & Biostatistics, University of California, San Francisco; Non-Executive Board Director, GRAIL, Inc, an early cancer detection healthcare company; Advisory Board Member, Verily Life Sciences LLC, a subsidiary of Alphabet, Inc.

|

Key

Committee Chair

Committee Chair

Nominations & Corporate Governance

Nominations & Corporate Governance

Audit & Risk

Audit & Risk

Remuneration

Remuneration

Science

Science

Corporate Responsibility

Corporate Responsibility

Transformation & Separation

Transformation & Separation

80 GSK Annual Report 2020

|

Strategic report

| ||

|

Governance and remuneration

| ||

|

Financial statements

| ||

|

Investor information

|

The Board continued

|

Charles Bancroft Independent Non-Executive Director

Age: 61 Nationality: American Appointed: 1 May 2020

|

Skills and experience Charlie has a wealth of financial and management experience in global biopharma.

Charlie retired from a successful career at Bristol Myers Squibb (BMS) in March 2020 where he held a number of leadership roles in commercial, strategy and finance. Beginning his career at BMS in 1984, he held positions of increasing responsibility within the finance organisation and had commercial operational responsibility for Latin America, Middle East, Africa, Canada, Japan and several Pacific Rim countries. He was appointed Chief Financial Officer in 2010, Chief Financial Officer and Executive Vice President, Global Business Operations in 2016 and Executive Vice President and Head of Integration and Strategy & Business Development in 2019. Charlie successfully steered BMS through a period of strategic transformation, including its recent $74bn acquisition of Celgene. Charlie also served as a member of the Board of Colgate-Palmolive Company from 2017 until March 2020.

External appointments Board Member, Kodiak Sciences Inc; Board Member, BioVector Inc; Advisory Board Member, Drexel University’s LeBow College of Business.

The Board determined that Charlie has recent and relevant financial experience and agreed that he has the appropriate qualifications and background to be an audit committee financial expert.

| |

|

Manvinder Singh (Vindi) Banga Senior Independent Non-Executive Director

Age: 66 Nationality: British Appointed: 1 September 2015 Senior Independent Non-Executive Director from 5 May 2016

|

Skills and experience Vindi has many years of commercial experience and a track record of delivering outstanding performance in highly competitive global consumer-focused businesses.

Prior to joining GSK, Vindi spent 33 years at Unilever plc, where his last role (amongst several senior positions) was President of the Global Foods, Home and Personal Care businesses, and a member of the Unilever Executive Board. Vindi sat on the Prime Minister of India’s Council of Trade & Industry from 2004 to 2014 and was on the Board of Governors of the Indian Institute of Management (IIM), Ahmedabad. Vindi is also the recipient of the Padma Bhushan, one of India’s highest civilian honours. Vindi has been a Non-Executive Director of the Confederation of British Industry (CBI) and Thomson Reuters Corp, Chairman of the Supervisory Board of Mauser Group, Chairman of Kalle GmbH and Senior Independent Director of Marks & Spencer Group plc.

External appointments Partner, Clayton Dubilier & Rice; Director, High Ridge Brands Co; Non-Executive Director, The Economist Newspaper Limited; Member, Holdingham International Advisory Board; Board Member, International Chamber of Commerce United Kingdom; Member, Governing Board of the Indian School of Business, Hyderabad; Member, Global Leadership Council of Saïd Business School, Oxford; Member, Indo UK CEO Forum; Chair of the Board of Trustees, Marie Curie.

| |

|

Dr Vivienne Cox, CBE Independent Non-Executive Director & Workforce Engagement Director

Age: 61 Nationality: British Appointed: 1 July 2016

|

Skills and experience Vivienne has wide experience of business gained in the energy, natural resources and publishing sectors. She also has a deep understanding of regulatory organisations and government.

Vivienne worked for BP plc for 28 years, in Britain and Continental Europe, in posts including Executive Vice President and Chief Executive of BP’s gas, power and renewable business and its alternative energy unit. Vivienne was previously a Non-Executive Director of BG Group plc and Rio Tinto plc and the Lead Independent Director at the UK Government’s Department for International Development. Vivienne was appointed Commander of the Order of the British Empire in the 2016 New Year Honours for services to the UK Economy and Sustainability.

External appointments Senior Independent Director, Pearson plc; Chairman of the Supervisory Board, Vallourec; Non- Executive Director, Stena AB; Advisory Board Member, African Leadership Institute; Vice President, Energy Institute; Advisory Board Member, Montrose Associates; Chair, Rosalind Franklin Institute; Vice Chair, Saïd Business School, Oxford and member of its Global Leadership Council; Patron, Hospice of St Francis.

| |

|

Lynn Elsenhans Independent Non-Executive Director

Age: 64 Nationality: American Appointed: 1 July 2012

|

Skills and experience Lynn has a wealth of experience running a global business and significant knowledge of the global markets in which GSK operates.

Lynn served as Chair, President and Chief Executive Officer of Sunoco Inc from 2009 to 2012. Prior to joining Sunoco in 2008 as President and Chief Executive Officer, Lynn worked for Royal Dutch Shell, which she joined in 1980, and where she held a number of senior roles, including Executive Vice President, Global Manufacturing from 2005 to 2008. Lynn was previously a Non-Executive Director of the First Tee of Greater Houston, Flowserve Corporation and the Texas Medical Center, and a Trustee of the United Way of Greater Houston.

External appointments Non-Executive Director and Chair of the Governance and Corporate Responsibility Committee, Baker Hughes Company; Board Director and Chair of the Audit Committee, Saudi Aramco; Advisory Board Member, Johns Hopkins University, Whiting School of Engineering; Member, Audit Committee Leadership Network.

|

Key

Committee Chair

Committee Chair

Nominations & Corporate Governance

Nominations & Corporate Governance

Audit & Risk

Audit & Risk

Remuneration

Remuneration

Science

Science

Corporate Responsibility

Corporate Responsibility

Transformation & Separation

Transformation & Separation

GSK Annual Report 2020 81

|

|

||

|

|

The Board continued

|

Dr Laurie Glimcher Independent Non-Executive Director and Scientific & Medical Expert

Age: 69 Nationality: American Appointed: 1 September 2017

|

Skills and experience Laurie brings scientific and public health expertise to the Board’s deliberations, and a wealth of global, publicly listed pharmaceutical business experience.

In addition to a number of senior leadership positions held at both Harvard Medical School and Harvard School of Public Health, Laurie has also served as Stephen and Suzanne Weiss Dean and Professor of Medicine at Weill Cornell Medical College and as an Attending Physician at the New York Presbyterian Hospital/Weill Cornell Medical Center. Laurie stepped down from the Board of Bristol-Myers Squibb (BMS) in 2017 after serving for 20 years on its Board. Laurie was previously a Non-Executive Director of the Waters Corporation and co-founder and Chair of the Scientific Advisory Board of Quentis Therapeutics Inc.

External appointments Professor of Medicine, Harvard Medical School; CEO, President and Attending Physician, Dana-Farber Cancer Institute.

Member, US National Academy of Sciences and the National Academy of Medicine; Member, Scientific Steering Committee of the Parker Institute for Cancer Immunotherapy; Independent Director, Analog Devices Inc; Member, Scientific Advisory Boards of Repare Therapeutics Inc, Abpro Therapeutics and Kaleido Biosciences Inc.

| |

|

Dr Jesse Goodman Independent Non-Executive Director and Scientific & Medical Expert

Age: 69 Nationality: American Appointed: 1 January 2016

|