| (3) | the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company or its designee giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated floating rate notes at such time. |

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of the Interest Period, timing and frequency of determining rates and making payments of interest, rounding of amounts or tenors and other administrative matters) that the Company or its designee decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if the Company or its designee decides that adoption of any portion of such market practice is not administratively feasible or if the Company or its designee determines that no market practice for use of the Benchmark Replacement exists, in such other manner as the Company or its designee determines is reasonably necessary).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark (including the daily published component used in the calculation thereof):

| (1) | in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark (or such component); or |

| (2) | in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein. |

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark (including the daily published component used in the calculation thereof):

| (1) | a public statement or publication of information by or on behalf of the administrator of the Benchmark (or such component) announcing that such administrator has ceased or will cease to provide the Benchmark (or such component), permanently or indefinitely; provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); |

| (2) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark (or such component), the central bank for the currency of the Benchmark (or such component), an insolvency official with jurisdiction over the administrator for the Benchmark (or such component), a resolution authority with jurisdiction over the administrator for the Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark (or such component) has ceased or will cease to provide the Benchmark (or such component) permanently or indefinitely; provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); or |

| (3) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative. |

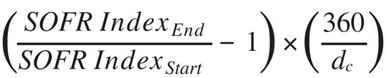

“Compounded SOFR” means, with respect to any Interest Period, the rate computed in accordance with the following formula set forth below (and the resulting percentage will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point (e.g., 9.753973% (or .09753973) being rounded down to 9.75397% (or .0975397) and 9.753978% (or .09753978) being rounded up to 9.75398% (or .0975398)):

where: