Mission Produce, Inc. Acquisition of Calavo Growers, Inc. January 2026

Disclaimer FORWARD-LOOKING STATEMENTS This communication contains certain “forward-looking statements” within the meaning of federal securities laws. Forward-looking statements may be identified by words such as “anticipates,” “believes,” “could,” “continue,” “estimate,” “expects,” “intends,” “will,” “should,” “may,” “plan,” “predict,” “project,” “would” and similar expressions. Forward-looking statements are not statements of historical fact and reflect Calavo’s and Mission’s current views about future events. Such forward-looking statements include, without limitation, statements about the benefits of the proposed transaction involving Calavo and Mission, including future financial and operating results, Calavo’s and Mission’s plans, objectives, expectations and intentions, the expected timing and likelihood of completion of the proposed transaction, and other statements that are not historical facts, including the combined company’s ability to create an advanced marketing and sales platform, the combined company’s ability to accelerate innovation and enhance efficiency through the transaction, and the combined company’s plan on future stockholder returns. No assurances can be given that the forward-looking statements contained in this communication will occur as projected, and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without limitation, the ability to obtain the requisite Calavo and Mission stockholder approvals; the risk that Calavo or Mission may be unable to obtain governmental and regulatory approvals required for the proposed transaction (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the risk that an event, change or other circumstance could give rise to the termination of the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied; the risk of delays in completing the proposed transaction; the risk that the businesses will not be integrated successfully or that the integration will be more costly or difficult than expected; the risk that the cost savings and any other synergies from the proposed transaction may not be fully realized or may take longer to realize than expected; the risk that any announcement relating to the proposed transaction could have adverse effects on the market price of Calavo’s or Mission’s common stock; the risk of litigation related to the proposed transaction; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the diversion of management time from ongoing business operations and opportunities as a result of the proposed transaction; the risk of adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; adverse economic conditions; reductions in spending from Calavo or Mission clients, a slowdown in payments by such clients; risks related to each company’s ability to attract new clients and retain existing clients; changes in client advertising, marketing, and corporate communications requirements; failure to manage potential conflicts of interest between or among clients of each company; unanticipated changes related to competitive factors in the fresh foods or packaged foods industries; unanticipated changes to, or any inability to hire and retain key personnel at either company; currency exchange rate fluctuations; reliance on information technology systems and risks related to cybersecurity incidents; changes in legislation or governmental regulations; risks associated with assumptions made in connection with critical accounting estimates and legal proceedings; risks related to international operations; risks related to environmental, social, and governance goals and initiatives; and other risks inherent in Calavo’s and Mission’s businesses. All such factors are difficult to predict, are beyond Calavo’s and Mission’s control, and are subject to additional risks and uncertainties, including those detailed in Calavo’s most recent annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K that are available on its website at https://ir.calavo.com/financial-information/sec-filings and on the U.S. Securities and Exchange Commission (“SEC”)’s website at http://www.sec.gov, and those detailed in Mission’s most recent annual report, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Mission’s website at https://investors.missionproduce.com/financial-information/sec-filings and on the SEC’s website at http://www.sec.gov. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Neither Calavo nor Mission undertakes any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. NO OFFER OR SOLICITATION This communication is not intended to be, and shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC In connection with the proposed transaction, Calavo and Mission intend to file a joint proxy statement with the SEC and Calavo intends to file with the SEC a registration statement on Form S-4 that will include the joint proxy statement of Calavo and Mission and that will also constitute a prospectus of Calavo (the “Joint Proxy Statement/Prospectus”). Each of Calavo and Mission may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the Joint Proxy Statement/Prospectus or registration statement or any other document that Calavo or Mission may file with the SEC. The definitive Joint Proxy Statement/Prospectus (if and when available) will be mailed to stockholders of Calavo and Mission. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT CALAVO, MISSION AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and Joint Proxy Statement/Prospectus (if and when available) and other documents containing important information about Calavo, Mission and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the Form S-4 and Joint Proxy Statement/Prospectus (if and when available) and other documents filed with the SEC by Calavo may be obtained free of charge on Calavo’s website at Calavo’s SEC Filings Website or, alternatively, by directing a request by mail to Calavo’s Corporate Secretary at Calavo Attention: Corporate Secretary, Calavo Growers, Inc., 1141A Cummings Road, Santa Paula, CA 93060. Copies of the registration statement and Joint Proxy Statement/Prospectus (if and when available) and other documents filed with the SEC by Mission may be obtained free of charge on Mission’s website at Mission’s SEC Filings Website or, alternatively, by directing a request by mail to Mission’s Corporate Secretary at Mission Attention: Corporate Secretary, Mission Produce, Inc., 2710 Camino Del Sol, Oxnard, CA 93030. PARTICIPANTS IN THE SOLICITATION Calavo, Mission and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Calavo, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Calavo’s annual report on Form 10-K for the year ended October 31, 2024, including under the heading “ Directors, Executive Officers, and Corporate Governance;” proxy statement for Calavo’s 2025 Annual Meeting of Stockholders, which was filed with the SEC on February 28, 2025, including under the headings and subheadings “Executive Compensation,” “Proposal No. 1 Election Board of Directors,” and “Common Stock Ownership Information of Certain Beneficial Owners and Managers;” and Item 5.02 of Calavo’s current reports on Form 8-K filed on November 13, 2025, November 25, 2025, and December 12, 2025. To the extent holdings of Calavo Common Stock by the directors and executive officers of Calavo have changed from the amounts reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 (“Form 3”), Statements of Changes in Beneficial Ownership on Form 4 (“Form 4”) or Annual Statements of Changes in Beneficial Ownership of Securities on Form 5 (“Form 5”), subsequently filed by Calavo’s directors and executive officers with the SEC. Information about the directors and executive officers of Mission, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Mission’s annual report on Form 10-K for the year ended October 31, 2025, and proxy statement for Mission’s 2025 Annual Meeting of Stockholders, which was filed with the SEC on February 25, 2025, including under the headings and subheadings “2024 Director Composition,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management.” To the extent holdings of Mission Shares by the directors and executive officers of Mission have changed from the amounts reflected therein, such changes have been or will be reflected on Forms 3, Forms 4 or Forms 5, subsequently filed by Mission’s directors and executive officers with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement and Joint Proxy Statement/Prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors and security holders should read the registration statement and Joint Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein from Calavo or Mission using the sources indicated above. 1

Today’s Speakers Stephen J. Barnard John Pawlowski John Lindeman Co-Founder and Chief President, Chief Operating President and Chief Executive Officer Officer and Chief Executive Executive Officer Officer-designate 2

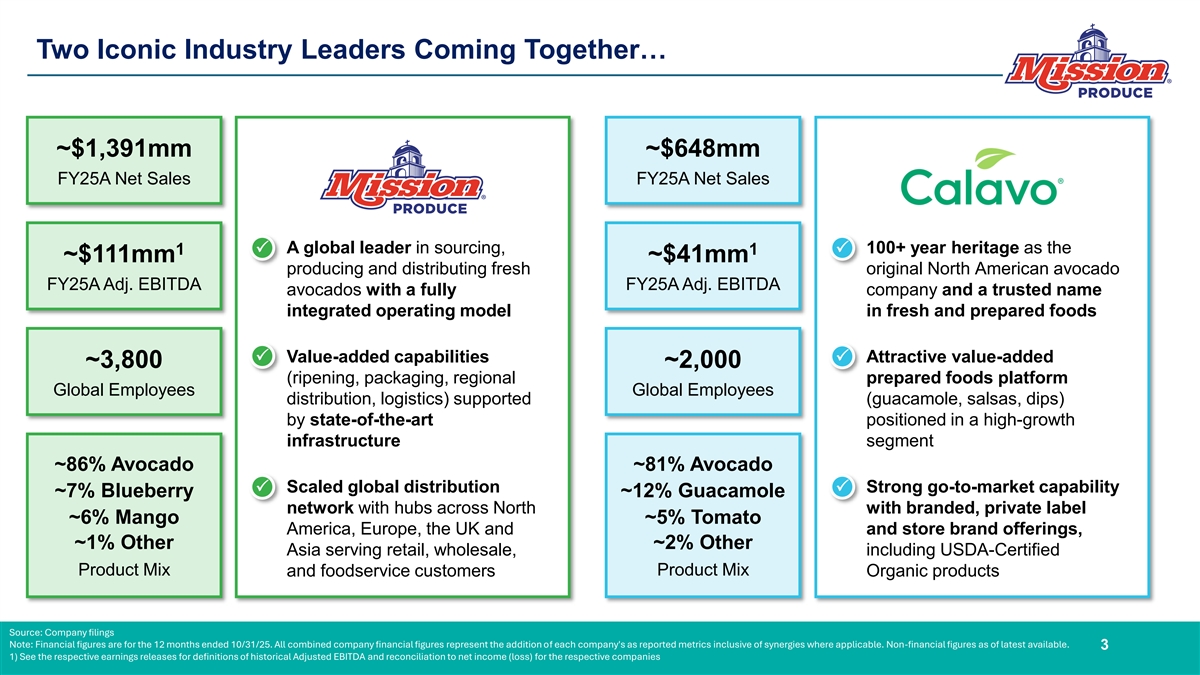

Two Iconic Industry Leaders Coming Together… ~$1,391mm ~$648mm FY25A Net Sales FY25A Net Sales Leading Global Supplier With • A global leader in sourcing, • 100+ year heritage as the 1P 1P Integrated Operations Across ~$111mm ~$41mm producing and distributing fresh original North American avocado Farming, Ripening, Packaging, FY25A Adj. EBITDA FY25A Adj. EBITDA avocados with a fully company and a trusted name Regional Distribution And Logistics integrated operating model in fresh and prepared foods P• Value-added capabilities P• Attractive value-added ~3,800 ~2,000 (ripening, packaging, regional prepared foods platform Global Employees Global Employees distribution, logistics) supported (guacamole, salsas, dips) by state-of-the-art positioned in a high-growth infrastructure segment ~86% Avocado ~81% Avocado • Scaled global distribution • Strong go-to-market capability PP ~7% Blueberry ~12% Guacamole network with hubs across North with branded, private label ~6% Mango ~5% Tomato America, Europe, the UK and and store brand offerings, ~1% Other ~2% Other Asia serving retail, wholesale, including USDA-Certified Product Mix and foodservice customers Product Mix Organic products Source: Company filings Note: Financial figures are for the 12 months ended 10/31/25. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable. Non-financial figures as of latest available. 3 1) See the respective earnings releases for definitions of historical Adjusted EBITDA and reconciliation to net income (loss) for the respective companies

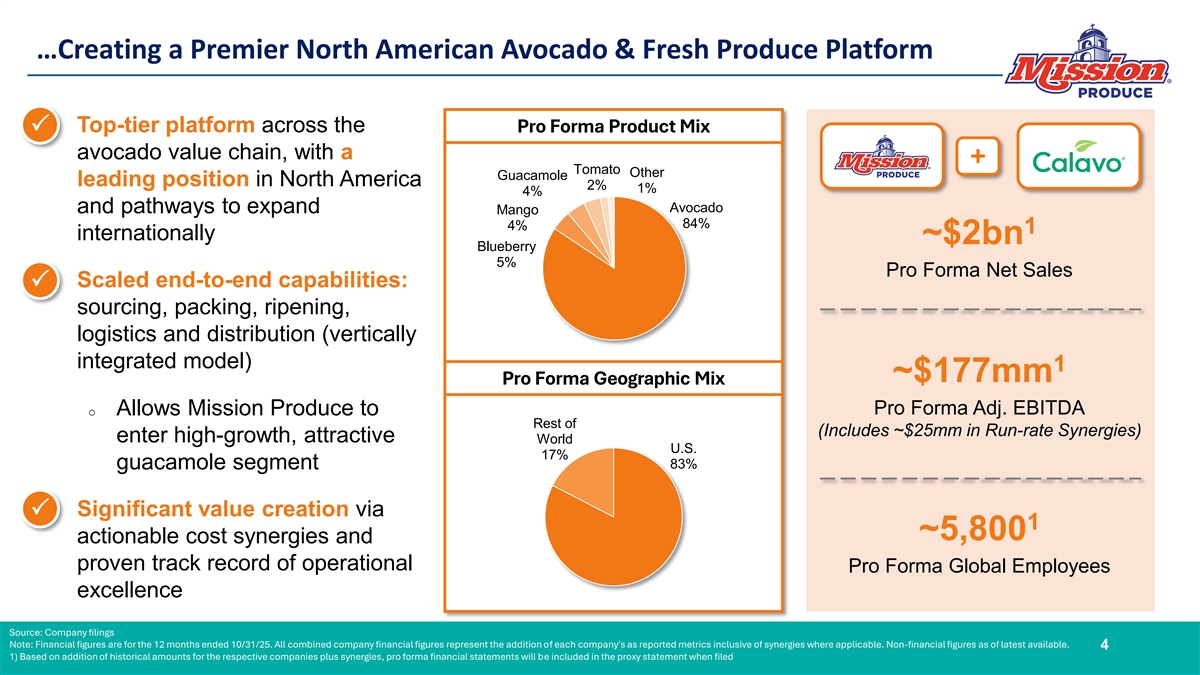

…Creating a Premier North American Avocado & Fresh Produce Platform • Top-tier platform across the Pro Forma Product Mix P avocado value chain, with a + Tomato Other Guacamole leading position in North America 2% 1% 4% Avocado and pathways to expand Mango 84% 4% 1 internationally ~$2bn Blueberry 5% Pro Forma Net Sales • Scaled end-to-end capabilities: P sourcing, packing, ripening, logistics and distribution (vertically integrated model) 1 ~$177mm Pro Forma Geographic Mix o Allows Mission Produce to Pro Forma Adj. EBITDA Rest of (Includes ~$25mm in Run-rate Synergies) enter high-growth, attractive World U.S. 17% 83% guacamole segment • Significant value creation via P 1 ~5,800 actionable cost synergies and proven track record of operational Pro Forma Global Employees excellence Source: Company filings Note: Financial figures are for the 12 months ended 10/31/25. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable. Non-financial figures as of latest available. 4 1) Based on addition of historical amounts for the respective companies plus synergies, pro forma financial statements will be included in the proxy statement when filed

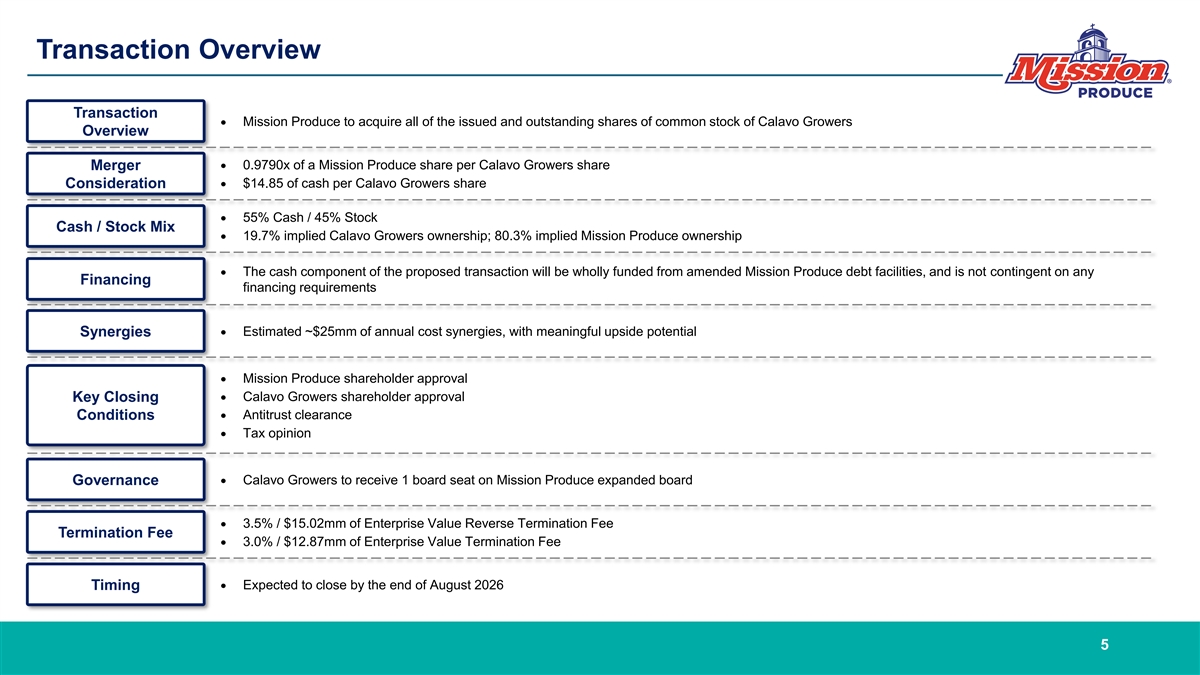

Transaction Overview Transaction • Mission Produce to acquire all of the issued and outstanding shares of common stock of Calavo Growers Overview Merger • 0.9790x of a Mission Produce share per Calavo Growers share • $14.85 of cash per Calavo Growers share Consideration • 55% Cash / 45% Stock Cash / Stock Mix • 19.7% implied Calavo Growers ownership; 80.3% implied Mission Produce ownership • The cash component of the proposed transaction will be wholly funded from amended Mission Produce debt facilities, and is not contingent on any Financing financing requirements Synergies• Estimated ~$25mm of annual cost synergies, with meaningful upside potential • Mission Produce shareholder approval • Calavo Growers shareholder approval Key Closing Conditions• Antitrust clearance • Tax opinion Governance• Calavo Growers to receive 1 board seat on Mission Produce expanded board • 3.5% / $15.02mm of Enterprise Value Reverse Termination Fee Termination Fee • 3.0% / $12.87mm of Enterprise Value Termination Fee Timing• Expected to close by the end of August 2026 5

Transaction Highlights Diversified, Year-Round Avocado and Fresh Produce Portfolio 1 Scaled North American Platform with Global Reach and Capabilities 2 Vertically Integrated Platform Across Growing, Marketing, Distribution and Value-Added Foods 3 Entry into High Growth and Margin Accretive Prepared Foods Category 4 Strong Combined Financial Profile with Significant Synergy Potential 5 6

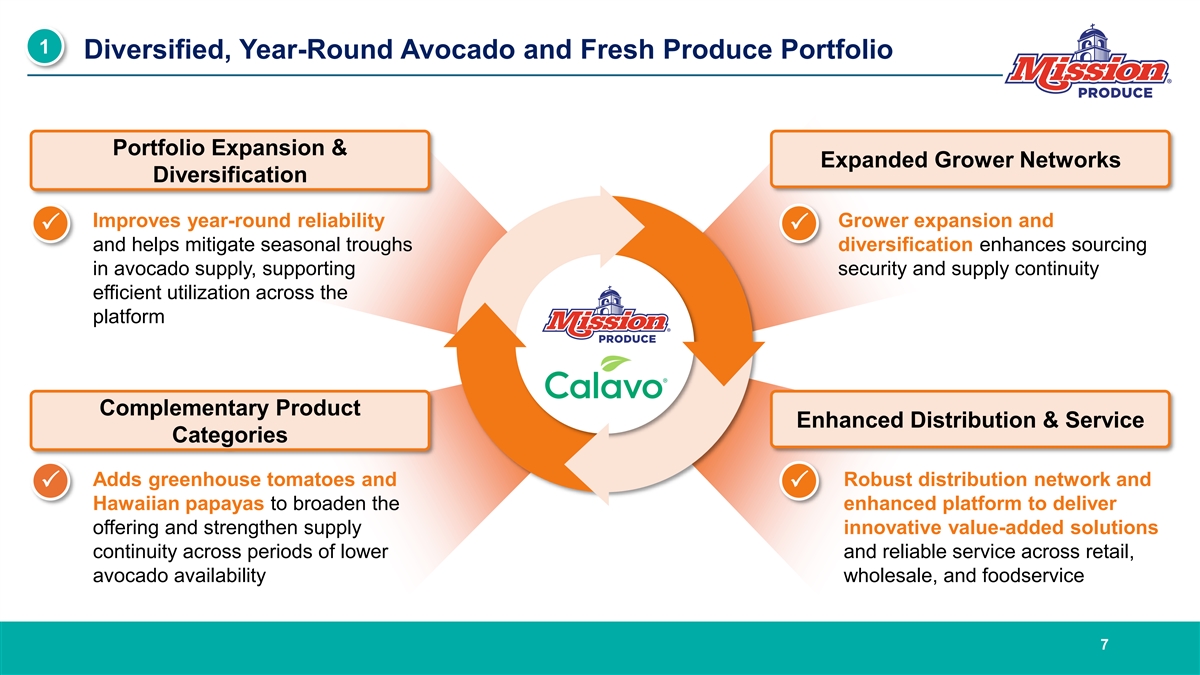

1 Diversified, Year-Round Avocado and Fresh Produce Portfolio Portfolio Expansion & Expanded Grower Networks Diversification • Improves year-round reliability • Grower expansion and PP and helps mitigate seasonal troughs diversification enhances sourcing in avocado supply, supporting security and supply continuity efficient utilization across the platform 1m Complementary Product Enhanced Distribution & Service Categories • Adds greenhouse tomatoes and • Robust distribution network and PP Hawaiian papayas to broaden the enhanced platform to deliver offering and strengthen supply innovative value-added solutions continuity across periods of lower and reliable service across retail, avocado availability wholesale, and foodservice 7

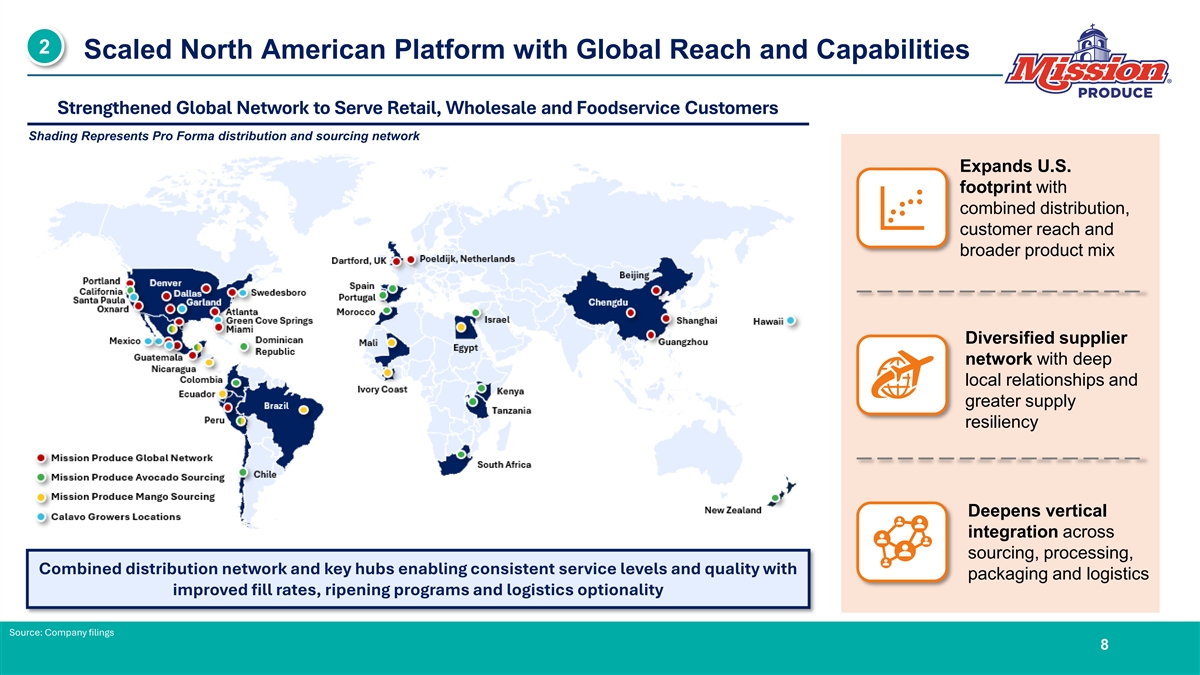

2 Scaled North American Platform with Global Reach and Capabilities Strengthened Global Network to Serve Retail, Wholesale and Foodservice Customers Shading Represents Pro Forma distribution and sourcing network Expands U.S. footprint with combined distribution, customer reach and broader product mix Diversified supplier network with deep local relationships and greater supply resiliency Deepens vertical integration across sourcing, processing, Combined distribution network and key hubs enabling consistent service levels and quality with packaging and logistics improved fill rates, ripening programs and logistics optionality Source: Company filings 8

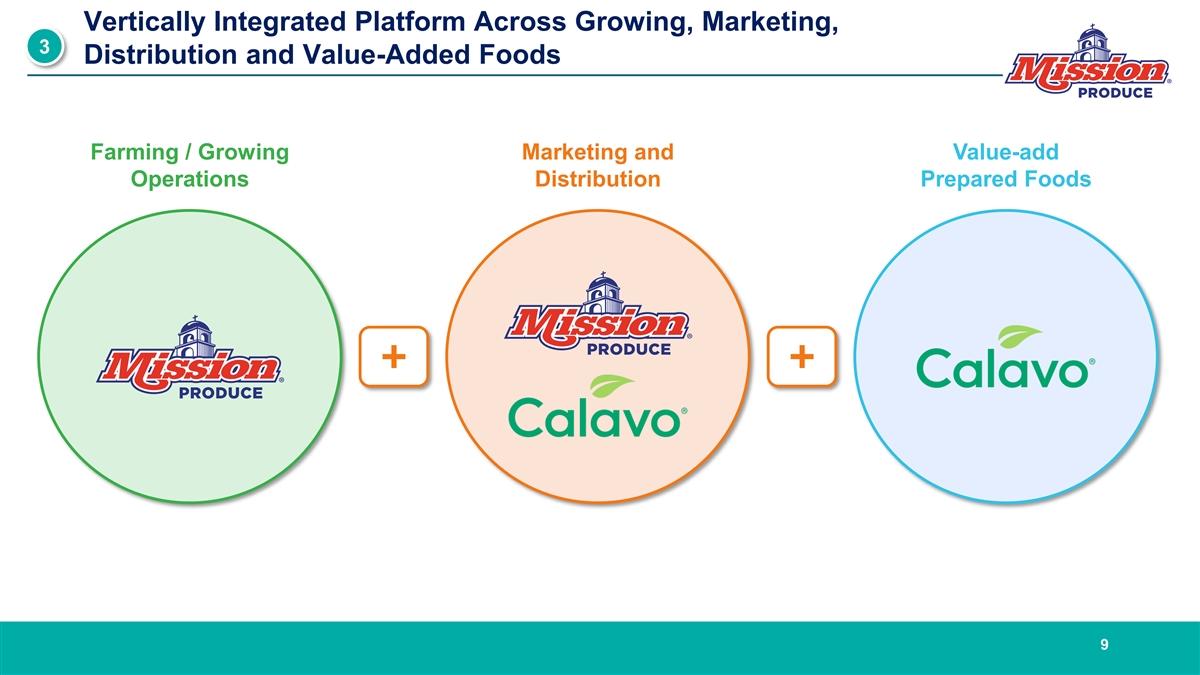

Vertically Integrated Platform Across Growing, Marketing, 3 Distribution and Value-Added Foods Farming / Growing Marketing and Value-add Operations Distribution Prepared Foods + + 9

4 Entry into High Growth and Margin Accretive Prepared Foods Category • Prepared segment focused on P Key Products High-Growth Category with Additional Upside guacamole and other value-add foods, providing exposure to a high growth ~$2.7bn ~8% and margin accretive category 2025 Global 2025 – 2033 Avocado Processing CAGR Segment Size • Strong product innovation P capabilities to meet consumer demand or different use occasions Well Positioned to Capture Share P• Complimentary supply chain; product can be shipped fresh or ~$77mm ~12% frozen for extended shelf life for U.S. Net YoY Net Sales Sales Growth and international customers 2 Years / • Strong recent new win momentum P ~150 90 Days across retail and food service Diverse Frozen / Refrigerated customers generating tailwinds for SKUs Shelf Life continued growth Source: Company filings, IMARC Group Note: Financial figures are for the 12 months ended 10/31/25. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable. Non-financial figures as of latest available. 10

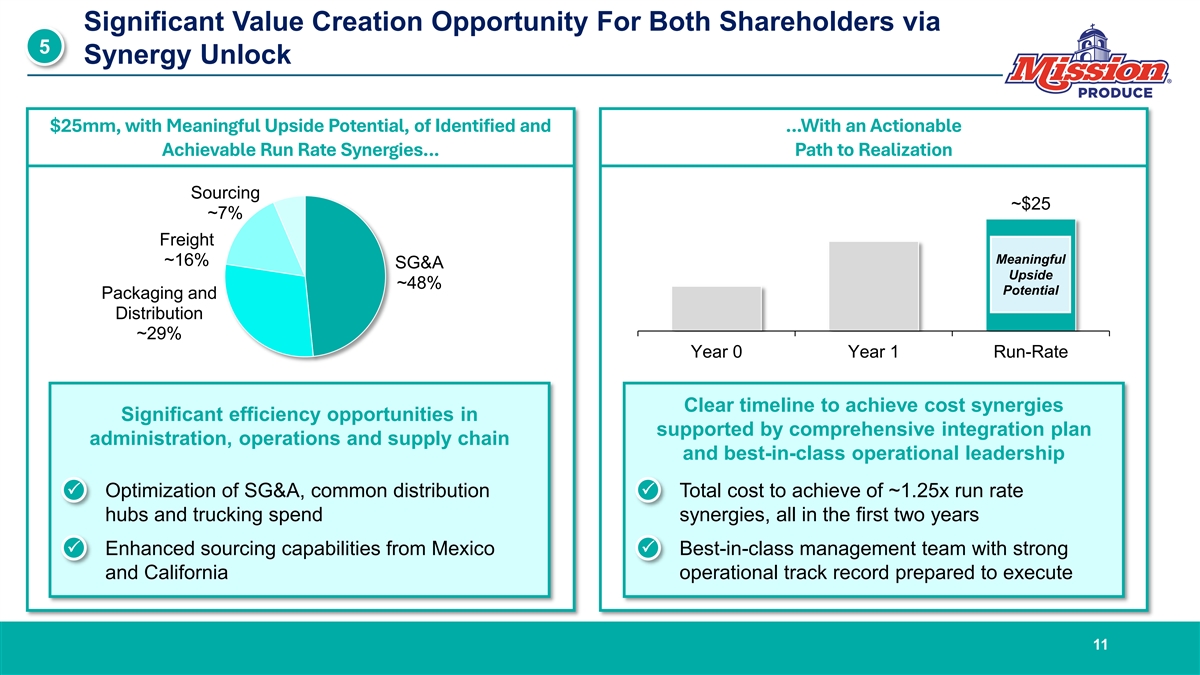

Significant Value Creation Opportunity For Both Shareholders via 5 Synergy Unlock $25mm, with Meaningful Upside Potential, of Identified and …With an Actionable Achievable Run Rate Synergies… Path to Realization Sourcing ~$25 ~7% Freight Meaningful ~16% SG&A Upside ~48% Potential Packaging and Distribution ~29% Year 0 Year 1 Run-Rate Clear timeline to achieve cost synergies Significant efficiency opportunities in supported by comprehensive integration plan administration, operations and supply chain and best-in-class operational leadership PP • Optimization of SG&A, common distribution • Total cost to achieve of ~1.25x run rate hubs and trucking spend synergies, all in the first two years PP • Enhanced sourcing capabilities from Mexico • Best-in-class management team with strong and California operational track record prepared to execute 11

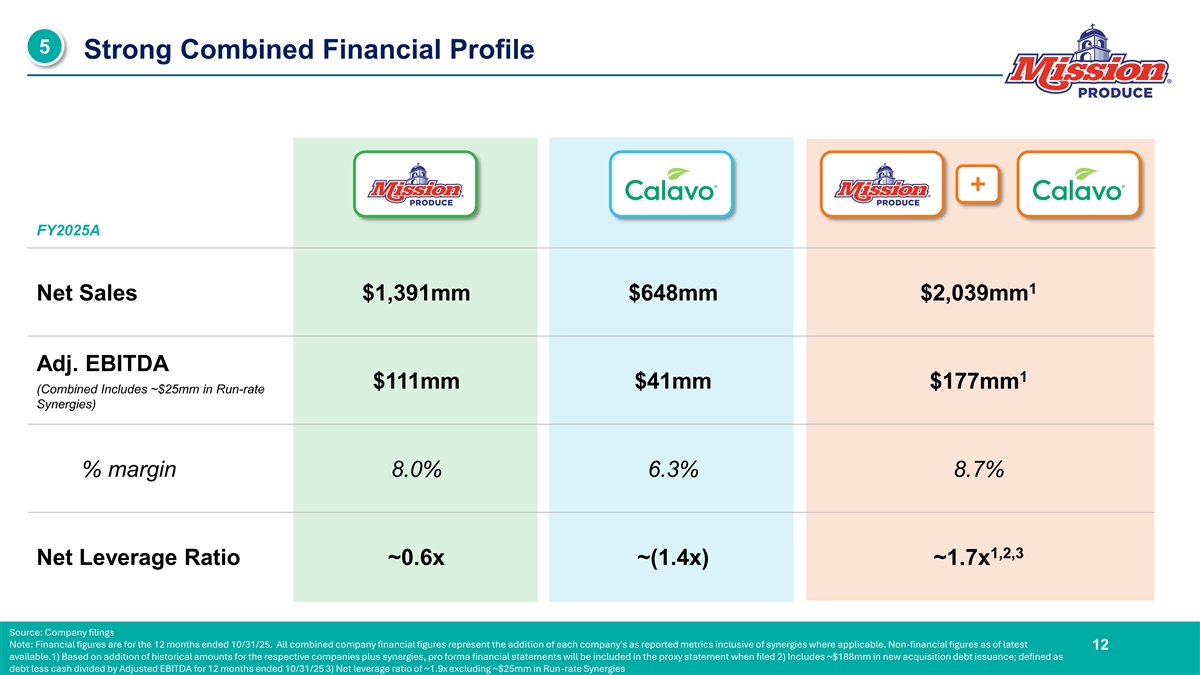

5 Strong Combined Financial Profile + FY2025A 1 Net Sales $1,391mm $648mm $2,039mm Adj. EBITDA 1 $111mm $41mm $177mm (Combined Includes ~$25mm in Run-rate Synergies) % margin 8.0% 6.3% 8.7% 1,2,3 Net Leverage Ratio ~0.6x ~(1.4x) ~1.7x Source: Company filings Note: Financial figures are for the 12 months ended 10/31/25. All combined company financial figures represent the addition of each company's as reported metrics inclusive of synergies where applicable. Non-financial figures as of latest 12 available.1) Based on addition of historical amounts for the respective companies plus synergies, pro forma financial statements will be included in the proxy statement when filed 2) Includes ~$188mm in new acquisition debt issuance; defined as debt less cash divided by Adjusted EBITDA for 12 months ended 10/31/25 3) Net leverage ratio of ~1.9x excluding ~$25mm in Run-rate Synergies

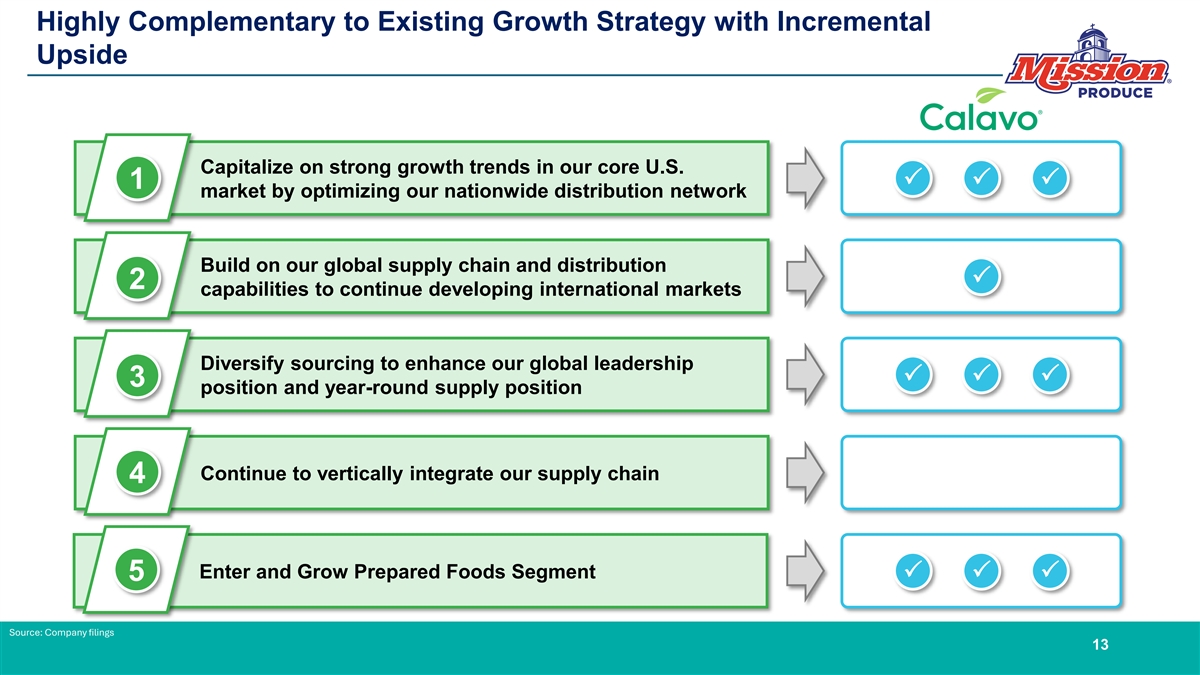

Highly Complementary to Existing Growth Strategy with Incremental Upside Capitalize on strong growth trends in our core U.S. PPP 1 market by optimizing our nationwide distribution network Build on our global supply chain and distribution P 2 capabilities to continue developing international markets Diversify sourcing to enhance our global leadership PPP 3 position and year-round supply position Continue to vertically integrate our supply chain 4 Enter and Grow Prepared Foods Segment PPP 5 Source: Company filings 13

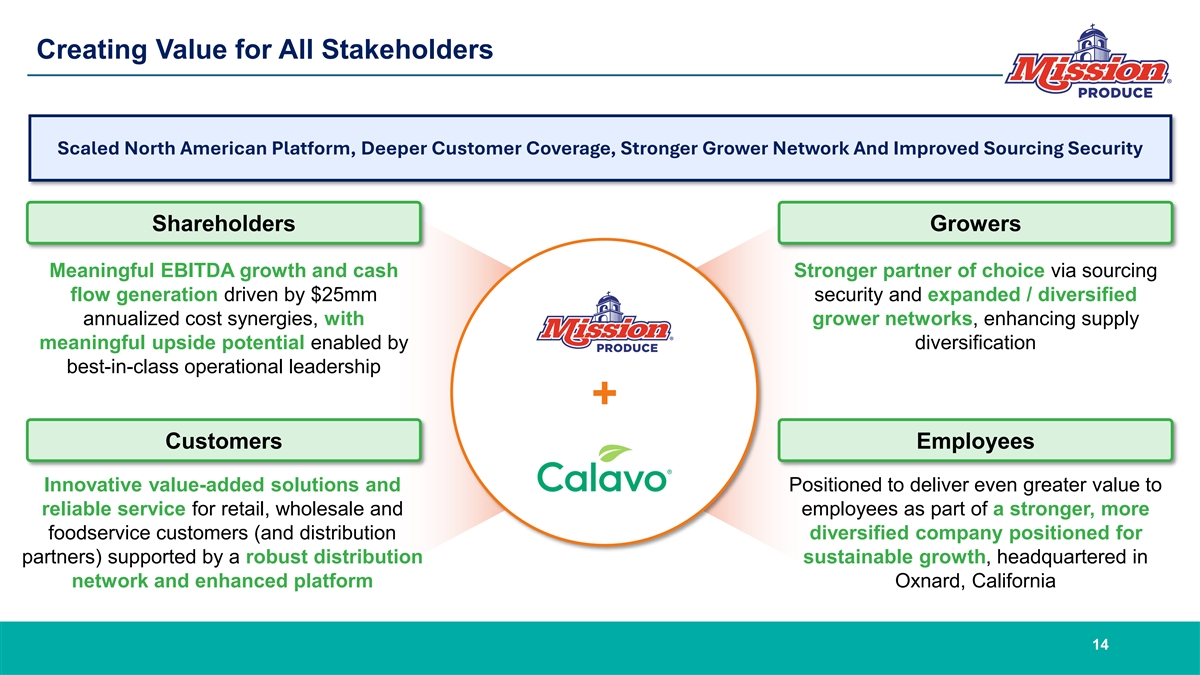

Creating Value for All Stakeholders Scaled North American Platform, Deeper Customer Coverage, Stronger Grower Network And Improved Sourcing Security Shareholders Growers Meaningful EBITDA growth and cash Stronger partner of choice via sourcing flow generation driven by $25mm security and expanded / diversified annualized cost synergies, with grower networks, enhancing supply meaningful upside potential enabled by diversification best-in-class operational leadership + Customers Employees Innovative value-added solutions and Positioned to deliver even greater value to reliable service for retail, wholesale and employees as part of a stronger, more foodservice customers (and distribution diversified company positioned for partners) supported by a robust distribution sustainable growth, headquartered in network and enhanced platform Oxnard, California 14