2024 Oil and gas reserves report Contents Introduction 3 Proved oil and gas reserves 4 Preparation of reserves estimates 10 Operational statistics 11 Delivery commitments 14 Entitlement production 15 Supplementary oil and gas information (unaudited) 17 Terms and abbreviations 26 2 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

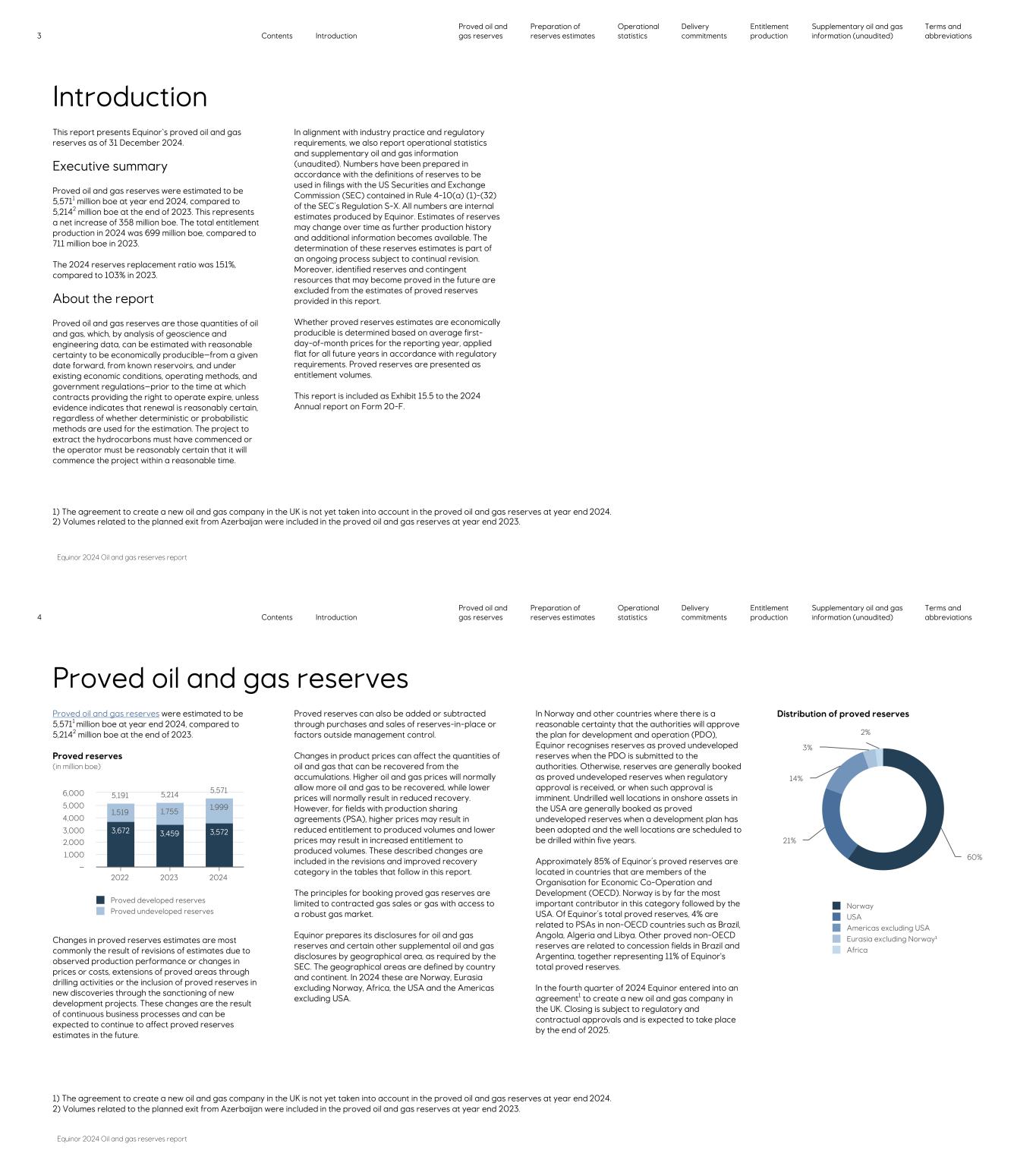

Introduction This report presents Equinor`s proved oil and gas reserves as of 31 December 2024. Executive summary Proved oil and gas reserves were estimated to be 5,5711 million boe at year end 2024, compared to 5,2142 million boe at the end of 2023. This represents a net increase of 358 million boe. The total entitlement production in 2024 was 699 million boe, compared to 711 million boe in 2023. The 2024 reserves replacement ratio was 151%, compared to 103% in 2023. About the report Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. In alignment with industry practice and regulatory requirements, we also report operational statistics and supplementary oil and gas information (unaudited). Numbers have been prepared in accordance with the definitions of reserves to be used in filings with the US Securities and Exchange Commission (SEC) contained in Rule 4-10(a) (1)-(32) of the SEC’s Regulation S-X. All numbers are internal estimates produced by Equinor. Estimates of reserves may change over time as further production history and additional information becomes available. The determination of these reserves estimates is part of an ongoing process subject to continual revision. Moreover, identified reserves and contingent resources that may become proved in the future are excluded from the estimates of proved reserves provided in this report. Whether proved reserves estimates are economically producible is determined based on average first- day-of-month prices for the reporting year, applied flat for all future years in accordance with regulatory requirements. Proved reserves are presented as entitlement volumes. This report is included as Exhibit 15.5 to the 2024 Annual report on Form 20-F. 1) The agreement to create a new oil and gas company in the UK is not yet taken into account in the proved oil and gas reserves at year end 2024. 2) Volumes related to the planned exit from Azerbaijan were included in the proved oil and gas reserves at year end 2023. 3 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Proved oil and gas reserves Proved oil and gas reserves were estimated to be 5,5711 million boe at year end 2024, compared to 5,2142 million boe at the end of 2023. Proved reserves (in million boe) 5,191 5,214 5,571 3,672 3,459 3,572 1,519 1,755 1,999 Proved developed reserves Proved undeveloped reserves 2022 2023 2024 — 1,000 2,000 3,000 4,000 5,000 6,000 Changes in proved reserves estimates are most commonly the result of revisions of estimates due to observed production performance or changes in prices or costs, extensions of proved areas through drilling activities or the inclusion of proved reserves in new discoveries through the sanctioning of new development projects. These changes are the result of continuous business processes and can be expected to continue to affect proved reserves estimates in the future. Proved reserves can also be added or subtracted through purchases and sales of reserves-in-place or factors outside management control. Changes in product prices can affect the quantities of oil and gas that can be recovered from the accumulations. Higher oil and gas prices will normally allow more oil and gas to be recovered, while lower prices will normally result in reduced recovery. However, for fields with production sharing agreements (PSA), higher prices may result in reduced entitlement to produced volumes and lower prices may result in increased entitlement to produced volumes. These described changes are included in the revisions and improved recovery category in the tables that follow in this report. The principles for booking proved gas reserves are limited to contracted gas sales or gas with access to a robust gas market. Equinor prepares its disclosures for oil and gas reserves and certain other supplemental oil and gas disclosures by geographical area, as required by the SEC. The geographical areas are defined by country and continent. In 2024 these are Norway, Eurasia excluding Norway, Africa, the USA and the Americas excluding USA. In Norway and other countries where there is a reasonable certainty that the authorities will approve the plan for development and operation (PDO), Equinor recognises reserves as proved undeveloped reserves when the PDO is submitted to the authorities. Otherwise, reserves are generally booked as proved undeveloped reserves when regulatory approval is received, or when such approval is imminent. Undrilled well locations in onshore assets in the USA are generally booked as proved undeveloped reserves when a development plan has been adopted and the well locations are scheduled to be drilled within five years. Approximately 85% of Equinor’s proved reserves are located in countries that are members of the Organisation for Economic Co-Operation and Development (OECD). Norway is by far the most important contributor in this category followed by the USA. Of Equinor’s total proved reserves, 4% are related to PSAs in non-OECD countries such as Brazil, Angola, Algeria and Libya. Other proved non-OECD reserves are related to concession fields in Brazil and Argentina, together representing 11% of Equinor's total proved reserves. In the fourth quarter of 2024 Equinor entered into an agreement1 to create a new oil and gas company in the UK. Closing is subject to regulatory and contractual approvals and is expected to take place by the end of 2025. Distribution of proved reserves 60% 21% 14% 3% 2% Norway USA Americas excluding USA Eurasia excluding Norway¹ Africa 1) The agreement to create a new oil and gas company in the UK is not yet taken into account in the proved oil and gas reserves at year end 2024. 2) Volumes related to the planned exit from Azerbaijan were included in the proved oil and gas reserves at year end 2023. 4 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

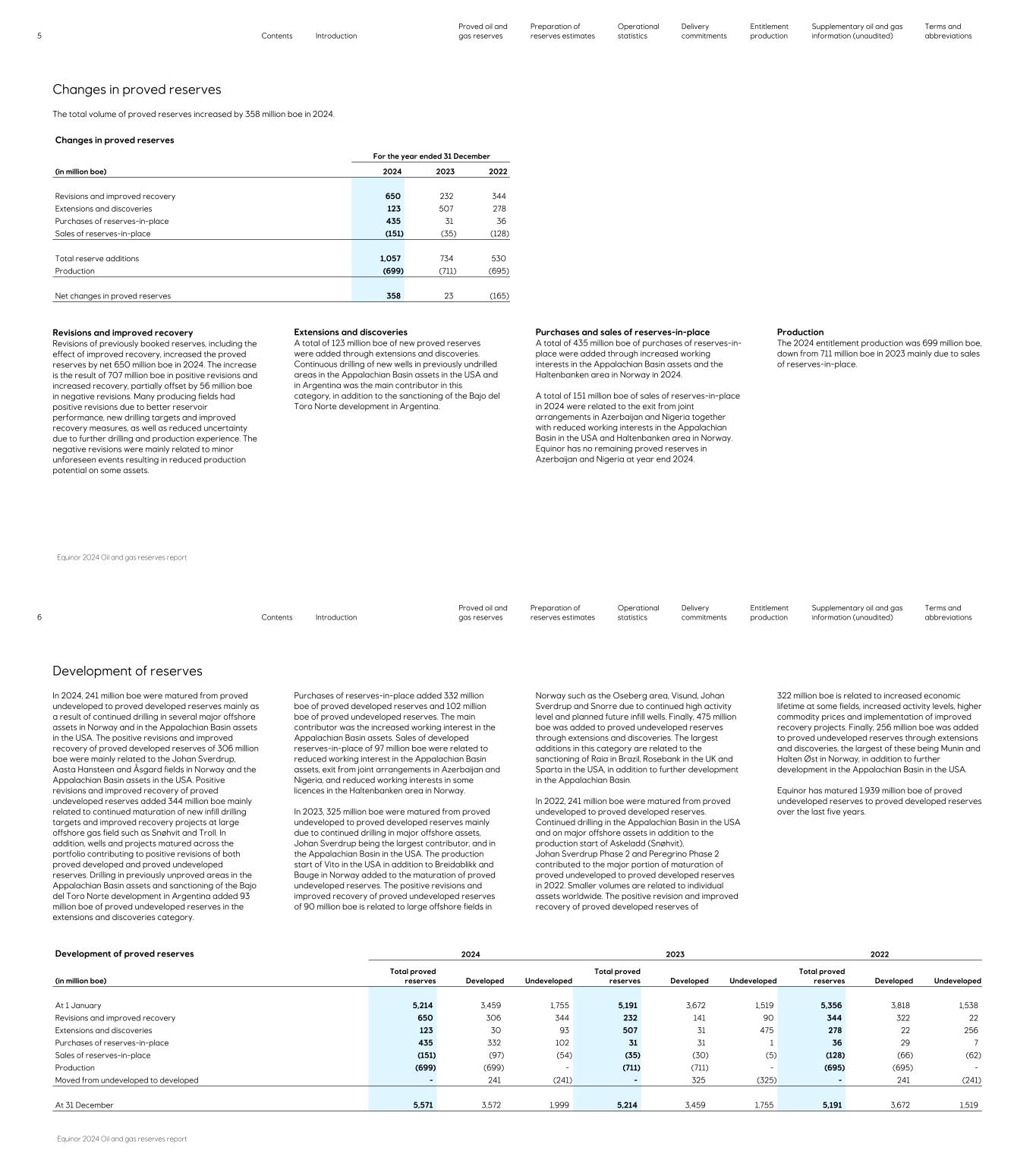

Changes in proved reserves The total volume of proved reserves increased by 358 million boe in 2024. Changes in proved reserves For the year ended 31 December (in million boe) 2024 2023 2022 Revisions and improved recovery 650 232 344 Extensions and discoveries 123 507 278 Purchases of reserves-in-place 435 31 36 Sales of reserves-in-place (151) (35) (128) Total reserve additions 1,057 734 530 Production (699) (711) (695) Net changes in proved reserves 358 23 (165) Revisions and improved recovery Revisions of previously booked reserves, including the effect of improved recovery, increased the proved reserves by net 650 million boe in 2024. The increase is the result of 707 million boe in positive revisions and increased recovery, partially offset by 56 million boe in negative revisions. Many producing fields had positive revisions due to better reservoir performance, new drilling targets and improved recovery measures, as well as reduced uncertainty due to further drilling and production experience. The negative revisions were mainly related to minor unforeseen events resulting in reduced production potential on some assets. Extensions and discoveries A total of 123 million boe of new proved reserves were added through extensions and discoveries. Continuous drilling of new wells in previously undrilled areas in the Appalachian Basin assets in the USA and in Argentina was the main contributor in this category, in addition to the sanctioning of the Bajo del Toro Norte development in Argentina. Purchases and sales of reserves-in-place A total of 435 million boe of purchases of reserves-in- place were added through increased working interests in the Appalachian Basin assets and the Haltenbanken area in Norway in 2024. A total of 151 million boe of sales of reserves-in-place in 2024 were related to the exit from joint arrangements in Azerbaijan and Nigeria together with reduced working interests in the Appalachian Basin in the USA and Haltenbanken area in Norway. Equinor has no remaining proved reserves in Azerbaijan and Nigeria at year end 2024. Production The 2024 entitlement production was 699 million boe, down from 711 million boe in 2023 mainly due to sales of reserves-in-place. 5 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Development of reserves In 2024, 241 million boe were matured from proved undeveloped to proved developed reserves mainly as a result of continued drilling in several major offshore assets in Norway and in the Appalachian Basin assets in the USA. The positive revisions and improved recovery of proved developed reserves of 306 million boe were mainly related to the Johan Sverdrup, Aasta Hansteen and Åsgard fields in Norway and the Appalachian Basin assets in the USA. Positive revisions and improved recovery of proved undeveloped reserves added 344 million boe mainly related to continued maturation of new infill drilling targets and improved recovery projects at large offshore gas field such as Snøhvit and Troll. In addition, wells and projects matured across the portfolio contributing to positive revisions of both proved developed and proved undeveloped reserves. Drilling in previously unproved areas in the Appalachian Basin assets and sanctioning of the Bajo del Toro Norte development in Argentina added 93 million boe of proved undeveloped reserves in the extensions and discoveries category. Purchases of reserves-in-place added 332 million boe of proved developed reserves and 102 million boe of proved undeveloped reserves. The main contributor was the increased working interest in the Appalachian Basin assets. Sales of developed reserves-in-place of 97 million boe were related to reduced working interest in the Appalachian Basin assets, exit from joint arrangements in Azerbaijan and Nigeria, and reduced working interests in some licences in the Haltenbanken area in Norway. In 2023, 325 million boe were matured from proved undeveloped to proved developed reserves mainly due to continued drilling in major offshore assets, Johan Sverdrup being the largest contributor, and in the Appalachian Basin in the USA. The production start of Vito in the USA in addition to Breidablikk and Bauge in Norway added to the maturation of proved undeveloped reserves. The positive revisions and improved recovery of proved undeveloped reserves of 90 million boe is related to large offshore fields in Norway such as the Oseberg area, Visund, Johan Sverdrup and Snorre due to continued high activity level and planned future infill wells. Finally, 475 million boe was added to proved undeveloped reserves through extensions and discoveries. The largest additions in this category are related to the sanctioning of Raia in Brazil, Rosebank in the UK and Sparta in the USA, in addition to further development in the Appalachian Basin. In 2022, 241 million boe were matured from proved undeveloped to proved developed reserves. Continued drilling in the Appalachian Basin in the USA and on major offshore assets in addition to the production start of Askeladd (Snøhvit), Johan Sverdrup Phase 2 and Peregrino Phase 2 contributed to the major portion of maturation of proved undeveloped to proved developed reserves in 2022. Smaller volumes are related to individual assets worldwide. The positive revision and improved recovery of proved developed reserves of 322 million boe is related to increased economic lifetime at some fields, increased activity levels, higher commodity prices and implementation of improved recovery projects. Finally, 256 million boe was added to proved undeveloped reserves through extensions and discoveries, the largest of these being Munin and Halten Øst in Norway, in addition to further development in the Appalachian Basin in the USA. Equinor has matured 1.939 million boe of proved undeveloped reserves to proved developed reserves over the last five years. Development of proved reserves 2024 2023 2022 (in million boe) Total proved reserves Developed Undeveloped Total proved reserves Developed Undeveloped Total proved reserves Developed Undeveloped At 1 January 5,214 3,459 1,755 5,191 3,672 1,519 5,356 3,818 1,538 Revisions and improved recovery 650 306 344 232 141 90 344 322 22 Extensions and discoveries 123 30 93 507 31 475 278 22 256 Purchases of reserves-in-place 435 332 102 31 31 1 36 29 7 Sales of reserves-in-place (151) (97) (54) (35) (30) (5) (128) (66) (62) Production (699) (699) - (711) (711) - (695) (695) - Moved from undeveloped to developed - 241 (241) - 325 (325) - 241 (241) At 31 December 5,571 3,572 1,999 5,214 3,459 1,755 5,191 3,672 1,519 6 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

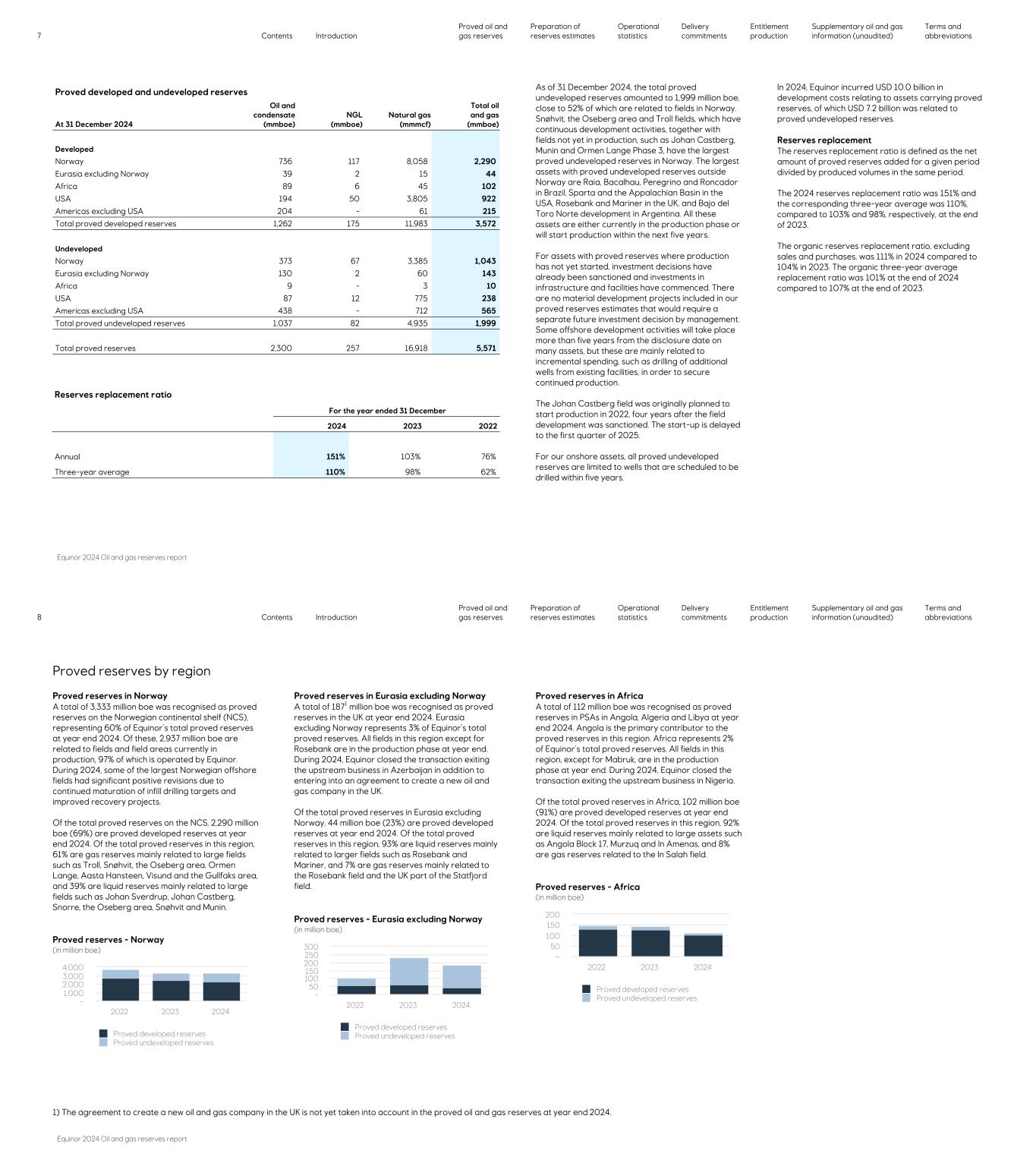

As of 31 December 2024, the total proved undeveloped reserves amounted to 1,999 million boe, close to 52% of which are related to fields in Norway. Snøhvit, the Oseberg area and Troll fields, which have continuous development activities, together with fields not yet in production, such as Johan Castberg, Munin and Ormen Lange Phase 3, have the largest proved undeveloped reserves in Norway. The largest assets with proved undeveloped reserves outside Norway are Raia, Bacalhau, Peregrino and Roncador in Brazil, Sparta and the Appalachian Basin in the USA, Rosebank and Mariner in the UK, and Bajo del Toro Norte development in Argentina. All these assets are either currently in the production phase or will start production within the next five years. For assets with proved reserves where production has not yet started, investment decisions have already been sanctioned and investments in infrastructure and facilities have commenced. There are no material development projects included in our proved reserves estimates that would require a separate future investment decision by management. Some offshore development activities will take place more than five years from the disclosure date on many assets, but these are mainly related to incremental spending, such as drilling of additional wells from existing facilities, in order to secure continued production. The Johan Castberg field was originally planned to start production in 2022, four years after the field development was sanctioned. The start-up is delayed to the first quarter of 2025. For our onshore assets, all proved undeveloped reserves are limited to wells that are scheduled to be drilled within five years. In 2024, Equinor incurred USD 10.0 billion in development costs relating to assets carrying proved reserves, of which USD 7.2 billion was related to proved undeveloped reserves. Reserves replacement The reserves replacement ratio is defined as the net amount of proved reserves added for a given period divided by produced volumes in the same period. The 2024 reserves replacement ratio was 151% and the corresponding three-year average was 110%, compared to 103% and 98%, respectively, at the end of 2023. The organic reserves replacement ratio, excluding sales and purchases, was 111% in 2024 compared to 104% in 2023. The organic three-year average replacement ratio was 101% at the end of 2024 compared to 107% at the end of 2023. 7 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Proved developed and undeveloped reserves At 31 December 2024 Oil and condensate (mmboe) NGL (mmboe) Natural gas (mmmcf) Total oil and gas (mmboe) Developed Norway 736 117 8,058 2,290 Eurasia excluding Norway 39 2 15 44 Africa 89 6 45 102 USA 194 50 3,805 922 Americas excluding USA 204 - 61 215 Total proved developed reserves 1,262 175 11,983 3,572 Undeveloped Norway 373 67 3,385 1,043 Eurasia excluding Norway 130 2 60 143 Africa 9 - 3 10 USA 87 12 775 238 Americas excluding USA 438 - 712 565 Total proved undeveloped reserves 1,037 82 4,935 1,999 Total proved reserves 2,300 257 16,918 5,571 Reserves replacement ratio For the year ended 31 December 2024 2023 2022 Annual 151% 103% 76% Three-year average 110% 98% 62% Proved reserves by region Proved reserves in Norway A total of 3,333 million boe was recognised as proved reserves on the Norwegian continental shelf (NCS), representing 60% of Equinor’s total proved reserves at year end 2024. Of these, 2,937 million boe are related to fields and field areas currently in production, 97% of which is operated by Equinor. During 2024, some of the largest Norwegian offshore fields had significant positive revisions due to continued maturation of infill drilling targets and improved recovery projects. Of the total proved reserves on the NCS, 2,290 million boe (69%) are proved developed reserves at year end 2024. Of the total proved reserves in this region, 61% are gas reserves mainly related to large fields such as Troll, Snøhvit, the Oseberg area, Ormen Lange, Aasta Hansteen, Visund and the Gullfaks area, and 39% are liquid reserves mainly related to large fields such as Johan Sverdrup, Johan Castberg, Snorre, the Oseberg area, Snøhvit and Munin. Proved reserves - Norway (in million boe) Proved developed reserves Proved undeveloped reserves 2022 2023 2024 - 1,000 2,000 3,000 4,000 Proved reserves in Eurasia excluding Norway A total of 1871 million boe was recognised as proved reserves in the UK at year end 2024. Eurasia excluding Norway represents 3% of Equinor’s total proved reserves. All fields in this region except for Rosebank are in the production phase at year end. During 2024, Equinor closed the transaction exiting the upstream business in Azerbaijan in addition to entering into an agreement to create a new oil and gas company in the UK. Of the total proved reserves in Eurasia excluding Norway, 44 million boe (23%) are proved developed reserves at year end 2024. Of the total proved reserves in this region, 93% are liquid reserves mainly related to larger fields such as Rosebank and Mariner, and 7% are gas reserves mainly related to the Rosebank field and the UK part of the Statfjord field. Proved reserves - Eurasia excluding Norway (in million boe) Proved developed reserves Proved undeveloped reserves 2022 2023 2024 - 50 100 150 200 250 300 Proved reserves in Africa A total of 112 million boe was recognised as proved reserves in PSAs in Angola, Algeria and Libya at year end 2024. Angola is the primary contributor to the proved reserves in this region. Africa represents 2% of Equinor’s total proved reserves. All fields in this region, except for Mabruk, are in the production phase at year end. During 2024, Equinor closed the transaction exiting the upstream business in Nigeria. Of the total proved reserves in Africa, 102 million boe (91%) are proved developed reserves at year end 2024. Of the total proved reserves in this region, 92% are liquid reserves mainly related to large assets such as Angola Block 17, Murzuq and In Amenas, and 8% are gas reserves related to the In Salah field. Proved reserves - Africa (in million boe) Proved developed reserves Proved undeveloped reserves 2022 2023 2024 — 50 100 150 200 1) The agreement to create a new oil and gas company in the UK is not yet taken into account in the proved oil and gas reserves at year end 2024. 8 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

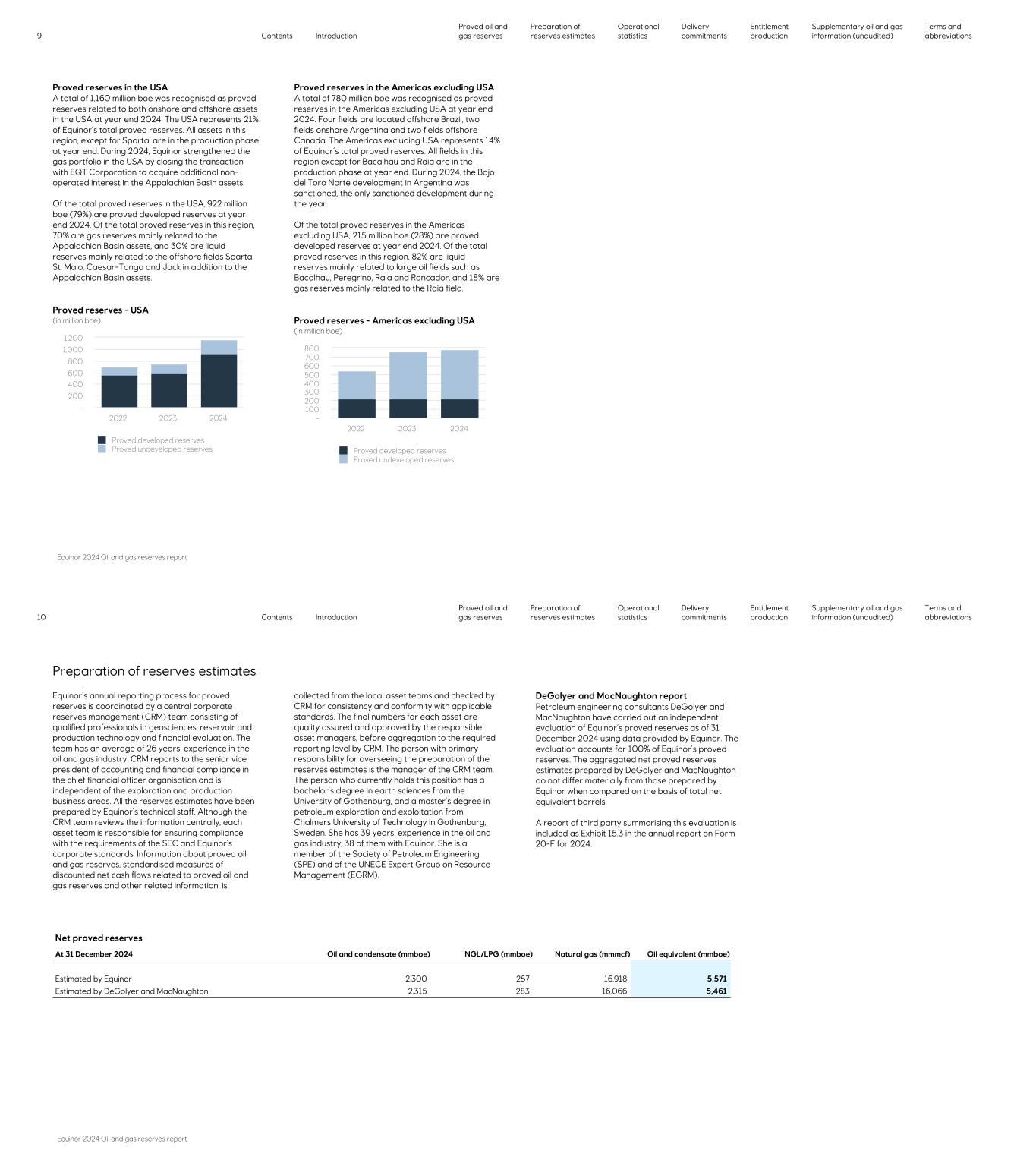

Proved reserves in the USA A total of 1,160 million boe was recognised as proved reserves related to both onshore and offshore assets in the USA at year end 2024. The USA represents 21% of Equinor’s total proved reserves. All assets in this region, except for Sparta, are in the production phase at year end. During 2024, Equinor strengthened the gas portfolio in the USA by closing the transaction with EQT Corporation to acquire additional non- operated interest in the Appalachian Basin assets. Of the total proved reserves in the USA, 922 million boe (79%) are proved developed reserves at year end 2024. Of the total proved reserves in this region, 70% are gas reserves mainly related to the Appalachian Basin assets, and 30% are liquid reserves mainly related to the offshore fields Sparta, St. Malo, Caesar-Tonga and Jack in addition to the Appalachian Basin assets. Proved reserves - USA (in million boe) Proved developed reserves Proved undeveloped reserves 2022 2023 2024 - 200 400 600 800 1,000 1,200 Proved reserves in the Americas excluding USA A total of 780 million boe was recognised as proved reserves in the Americas excluding USA at year end 2024. Four fields are located offshore Brazil, two fields onshore Argentina and two fields offshore Canada. The Americas excluding USA represents 14% of Equinor’s total proved reserves. All fields in this region except for Bacalhau and Raia are in the production phase at year end. During 2024, the Bajo del Toro Norte development in Argentina was sanctioned, the only sanctioned development during the year. Of the total proved reserves in the Americas excluding USA, 215 million boe (28%) are proved developed reserves at year end 2024. Of the total proved reserves in this region, 82% are liquid reserves mainly related to large oil fields such as Bacalhau, Peregrino, Raia and Roncador, and 18% are gas reserves mainly related to the Raia field. Proved reserves - Americas excluding USA (in million boe) Proved developed reserves Proved undeveloped reserves 2022 2023 2024 - 100 200 300 400 500 600 700 800 9 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Preparation of reserves estimates Equinor’s annual reporting process for proved reserves is coordinated by a central corporate reserves management (CRM) team consisting of qualified professionals in geosciences, reservoir and production technology and financial evaluation. The team has an average of 26 years’ experience in the oil and gas industry. CRM reports to the senior vice president of accounting and financial compliance in the chief financial officer organisation and is independent of the exploration and production business areas. All the reserves estimates have been prepared by Equinor’s technical staff. Although the CRM team reviews the information centrally, each asset team is responsible for ensuring compliance with the requirements of the SEC and Equinor’s corporate standards. Information about proved oil and gas reserves, standardised measures of discounted net cash flows related to proved oil and gas reserves and other related information, is collected from the local asset teams and checked by CRM for consistency and conformity with applicable standards. The final numbers for each asset are quality assured and approved by the responsible asset managers, before aggregation to the required reporting level by CRM. The person with primary responsibility for overseeing the preparation of the reserves estimates is the manager of the CRM team. The person who currently holds this position has a bachelor’s degree in earth sciences from the University of Gothenburg, and a master’s degree in petroleum exploration and exploitation from Chalmers University of Technology in Gothenburg, Sweden. She has 39 years’ experience in the oil and gas industry, 38 of them with Equinor. She is a member of the Society of Petroleum Engineering (SPE) and of the UNECE Expert Group on Resource Management (EGRM). DeGolyer and MacNaughton report Petroleum engineering consultants DeGolyer and MacNaughton have carried out an independent evaluation of Equinor’s proved reserves as of 31 December 2024 using data provided by Equinor. The evaluation accounts for 100% of Equinor’s proved reserves. The aggregated net proved reserves estimates prepared by DeGolyer and MacNaughton do not differ materially from those prepared by Equinor when compared on the basis of total net equivalent barrels. A report of third party summarising this evaluation is included as Exhibit 15.3 in the annual report on Form 20-F for 2024. Net proved reserves At 31 December 2024 Oil and condensate (mmboe) NGL/LPG (mmboe) Natural gas (mmmcf) Oil equivalent (mmboe) Estimated by Equinor 2,300 257 16,918 5,571 Estimated by DeGolyer and MacNaughton 2,315 283 16,066 5,461 10 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

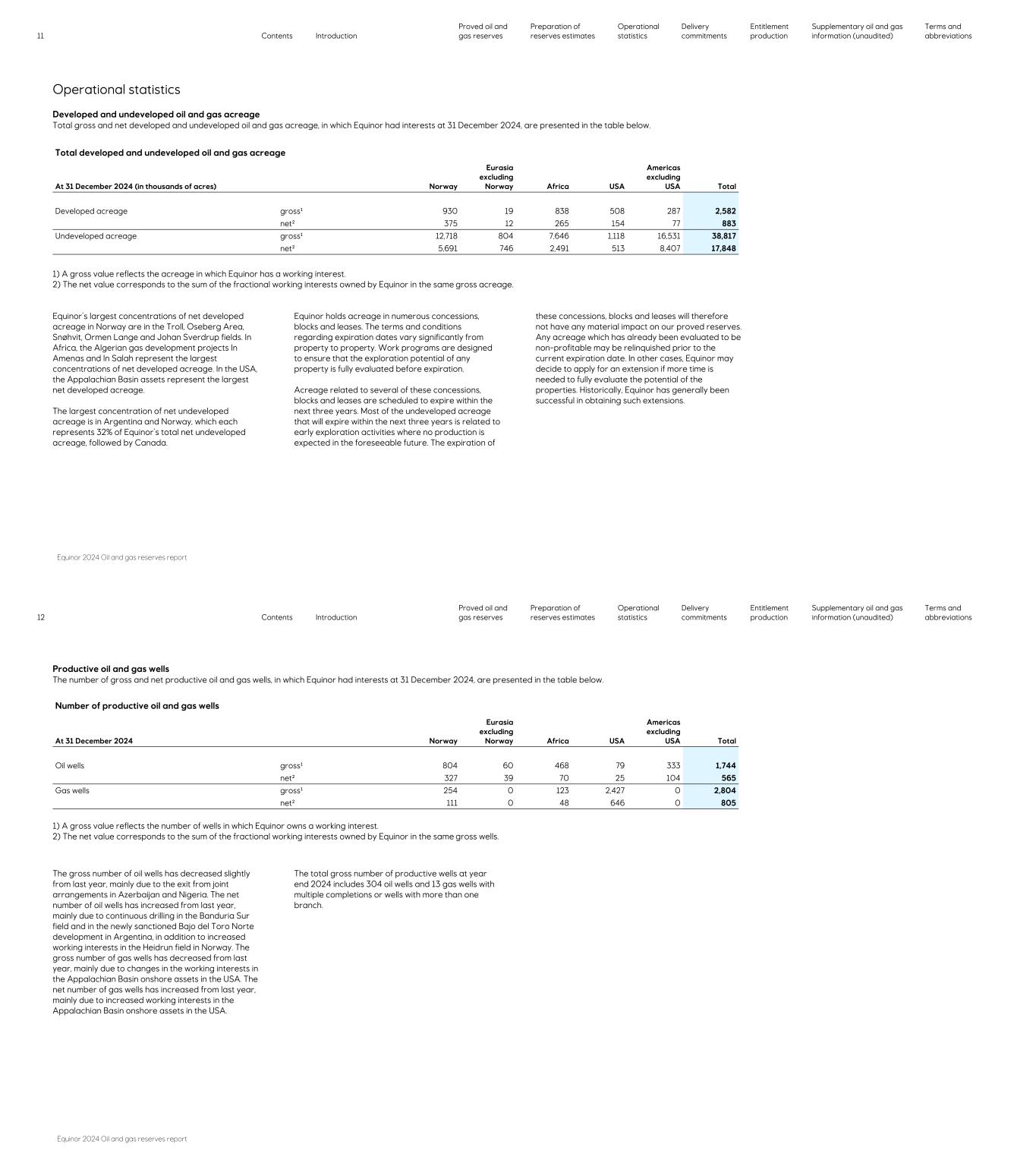

Operational statistics Developed and undeveloped oil and gas acreage Total gross and net developed and undeveloped oil and gas acreage, in which Equinor had interests at 31 December 2024, are presented in the table below. Total developed and undeveloped oil and gas acreage At 31 December 2024 (in thousands of acres) Norway Eurasia excluding Norway Africa USA Americas excluding USA Total Developed acreage gross¹ 930 19 838 508 287 2,582 net² 375 12 265 154 77 883 Undeveloped acreage gross¹ 12,718 804 7,646 1,118 16,531 38,817 net² 5,691 746 2,491 513 8,407 17,848 1) A gross value reflects the acreage in which Equinor has a working interest. 2) The net value corresponds to the sum of the fractional working interests owned by Equinor in the same gross acreage. Equinor’s largest concentrations of net developed acreage in Norway are in the Troll, Oseberg Area, Snøhvit, Ormen Lange and Johan Sverdrup fields. In Africa, the Algerian gas development projects In Amenas and In Salah represent the largest concentrations of net developed acreage. In the USA, the Appalachian Basin assets represent the largest net developed acreage. The largest concentration of net undeveloped acreage is in Argentina and Norway, which each represents 32% of Equinor’s total net undeveloped acreage, followed by Canada. Equinor holds acreage in numerous concessions, blocks and leases. The terms and conditions regarding expiration dates vary significantly from property to property. Work programs are designed to ensure that the exploration potential of any property is fully evaluated before expiration. Acreage related to several of these concessions, blocks and leases are scheduled to expire within the next three years. Most of the undeveloped acreage that will expire within the next three years is related to early exploration activities where no production is expected in the foreseeable future. The expiration of these concessions, blocks and leases will therefore not have any material impact on our proved reserves. Any acreage which has already been evaluated to be non-profitable may be relinquished prior to the current expiration date. In other cases, Equinor may decide to apply for an extension if more time is needed to fully evaluate the potential of the properties. Historically, Equinor has generally been successful in obtaining such extensions. 11 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Productive oil and gas wells The number of gross and net productive oil and gas wells, in which Equinor had interests at 31 December 2024, are presented in the table below. Number of productive oil and gas wells At 31 December 2024 Norway Eurasia excluding Norway Africa USA Americas excluding USA Total Oil wells gross¹ 804 60 468 79 333 1,744 net² 327 39 70 25 104 565 Gas wells gross¹ 254 0 123 2,427 0 2,804 net² 111 0 48 646 0 805 1) A gross value reflects the number of wells in which Equinor owns a working interest. 2) The net value corresponds to the sum of the fractional working interests owned by Equinor in the same gross wells. The gross number of oil wells has decreased slightly from last year, mainly due to the exit from joint arrangements in Azerbaijan and Nigeria. The net number of oil wells has increased from last year, mainly due to continuous drilling in the Banduria Sur field and in the newly sanctioned Bajo del Toro Norte development in Argentina, in addition to increased working interests in the Heidrun field in Norway. The gross number of gas wells has decreased from last year, mainly due to changes in the working interests in the Appalachian Basin onshore assets in the USA. The net number of gas wells has increased from last year, mainly due to increased working interests in the Appalachian Basin onshore assets in the USA. The total gross number of productive wells at year end 2024 includes 304 oil wells and 13 gas wells with multiple completions or wells with more than one branch. 12 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

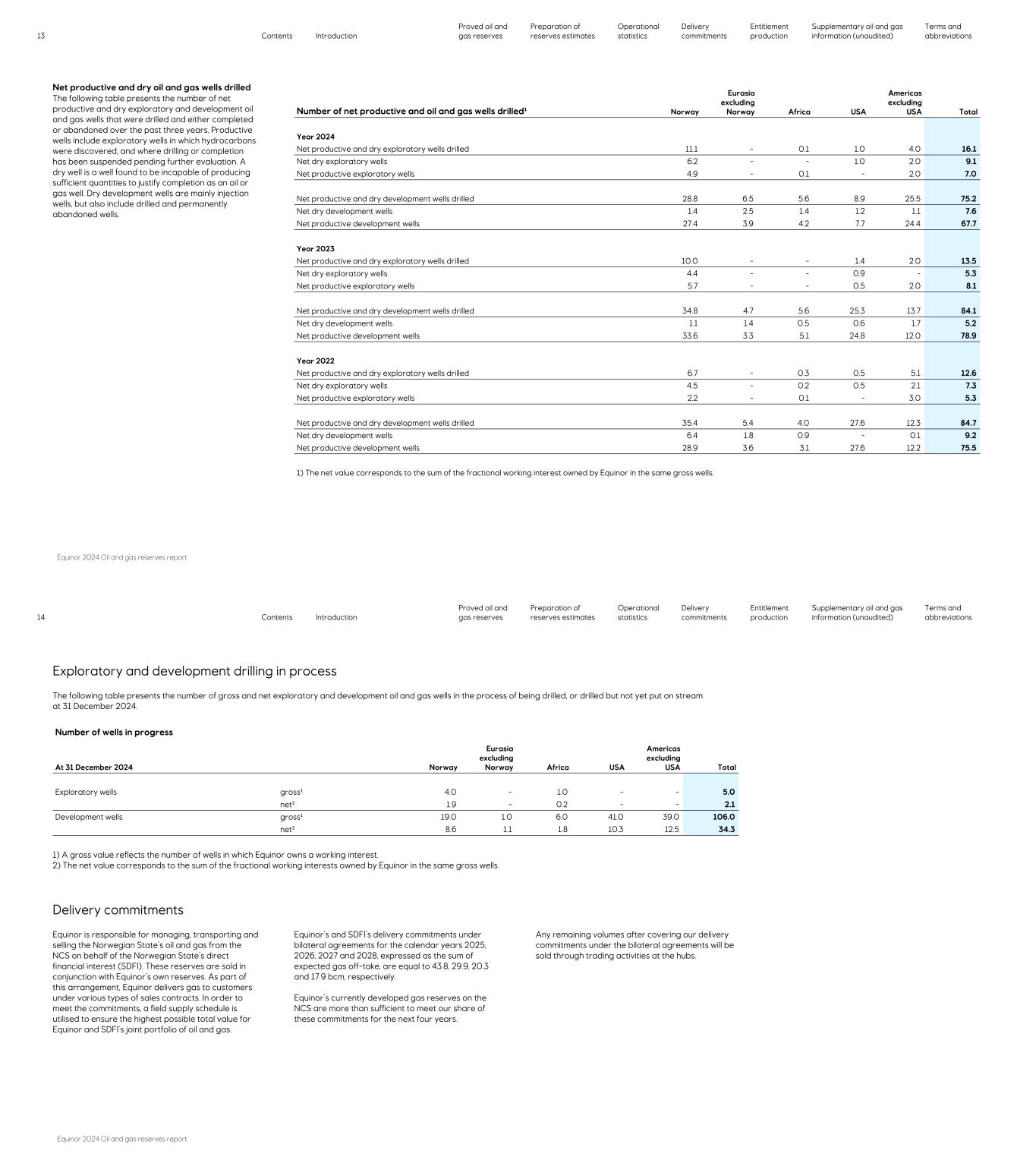

Net productive and dry oil and gas wells drilled The following table presents the number of net productive and dry exploratory and development oil and gas wells that were drilled and either completed or abandoned over the past three years. Productive wells include exploratory wells in which hydrocarbons were discovered, and where drilling or completion has been suspended pending further evaluation. A dry well is a well found to be incapable of producing sufficient quantities to justify completion as an oil or gas well. Dry development wells are mainly injection wells, but also include drilled and permanently abandoned wells. 13 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Number of net productive and oil and gas wells drilled¹ Norway Eurasia excluding Norway Africa USA Americas excluding USA Total Year 2024 Net productive and dry exploratory wells drilled 11.1 - 0.1 1.0 4.0 16.1 Net dry exploratory wells 6.2 - - 1.0 2.0 9.1 Net productive exploratory wells 4.9 - 0.1 - 2.0 7.0 Net productive and dry development wells drilled 28.8 6.5 5.6 8.9 25.5 75.2 Net dry development wells 1.4 2.5 1.4 1.2 1.1 7.6 Net productive development wells 27.4 3.9 4.2 7.7 24.4 67.7 Year 2023 Net productive and dry exploratory wells drilled 10.0 - - 1.4 2.0 13.5 Net dry exploratory wells 4.4 - - 0.9 - 5.3 Net productive exploratory wells 5.7 - - 0.5 2.0 8.1 Net productive and dry development wells drilled 34.8 4.7 5.6 25.3 13.7 84.1 Net dry development wells 1.1 1.4 0.5 0.6 1.7 5.2 Net productive development wells 33.6 3.3 5.1 24.8 12.0 78.9 Year 2022 Net productive and dry exploratory wells drilled 6.7 - 0.3 0.5 5.1 12.6 Net dry exploratory wells 4.5 - 0.2 0.5 2.1 7.3 Net productive exploratory wells 2.2 - 0.1 - 3.0 5.3 Net productive and dry development wells drilled 35.4 5.4 4.0 27.6 12.3 84.7 Net dry development wells 6.4 1.8 0.9 - 0.1 9.2 Net productive development wells 28.9 3.6 3.1 27.6 12.2 75.5 1) The net value corresponds to the sum of the fractional working interest owned by Equinor in the same gross wells. Exploratory and development drilling in process The following table presents the number of gross and net exploratory and development oil and gas wells in the process of being drilled, or drilled but not yet put on stream at 31 December 2024. Number of wells in progress At 31 December 2024 Norway Eurasia excluding Norway Africa USA Americas excluding USA Total Exploratory wells gross¹ 4.0 - 1.0 - - 5.0 net² 1.9 - 0.2 - - 2.1 Development wells gross¹ 19.0 1.0 6.0 41.0 39.0 106.0 net² 8.6 1.1 1.8 10.3 12.5 34.3 1) A gross value reflects the number of wells in which Equinor owns a working interest. 2) The net value corresponds to the sum of the fractional working interests owned by Equinor in the same gross wells. Delivery commitments Equinor is responsible for managing, transporting and selling the Norwegian State’s oil and gas from the NCS on behalf of the Norwegian State’s direct financial interest (SDFI). These reserves are sold in conjunction with Equinor’s own reserves. As part of this arrangement, Equinor delivers gas to customers under various types of sales contracts. In order to meet the commitments, a field supply schedule is utilised to ensure the highest possible total value for Equinor and SDFI’s joint portfolio of oil and gas. Equinor’s and SDFI’s delivery commitments under bilateral agreements for the calendar years 2025, 2026, 2027 and 2028, expressed as the sum of expected gas off-take, are equal to 43.8, 29.9, 20.3 and 17.9 bcm, respectively. Equinor’s currently developed gas reserves on the NCS are more than sufficient to meet our share of these commitments for the next four years. Any remaining volumes after covering our delivery commitments under the bilateral agreements will be sold through trading activities at the hubs. 14 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

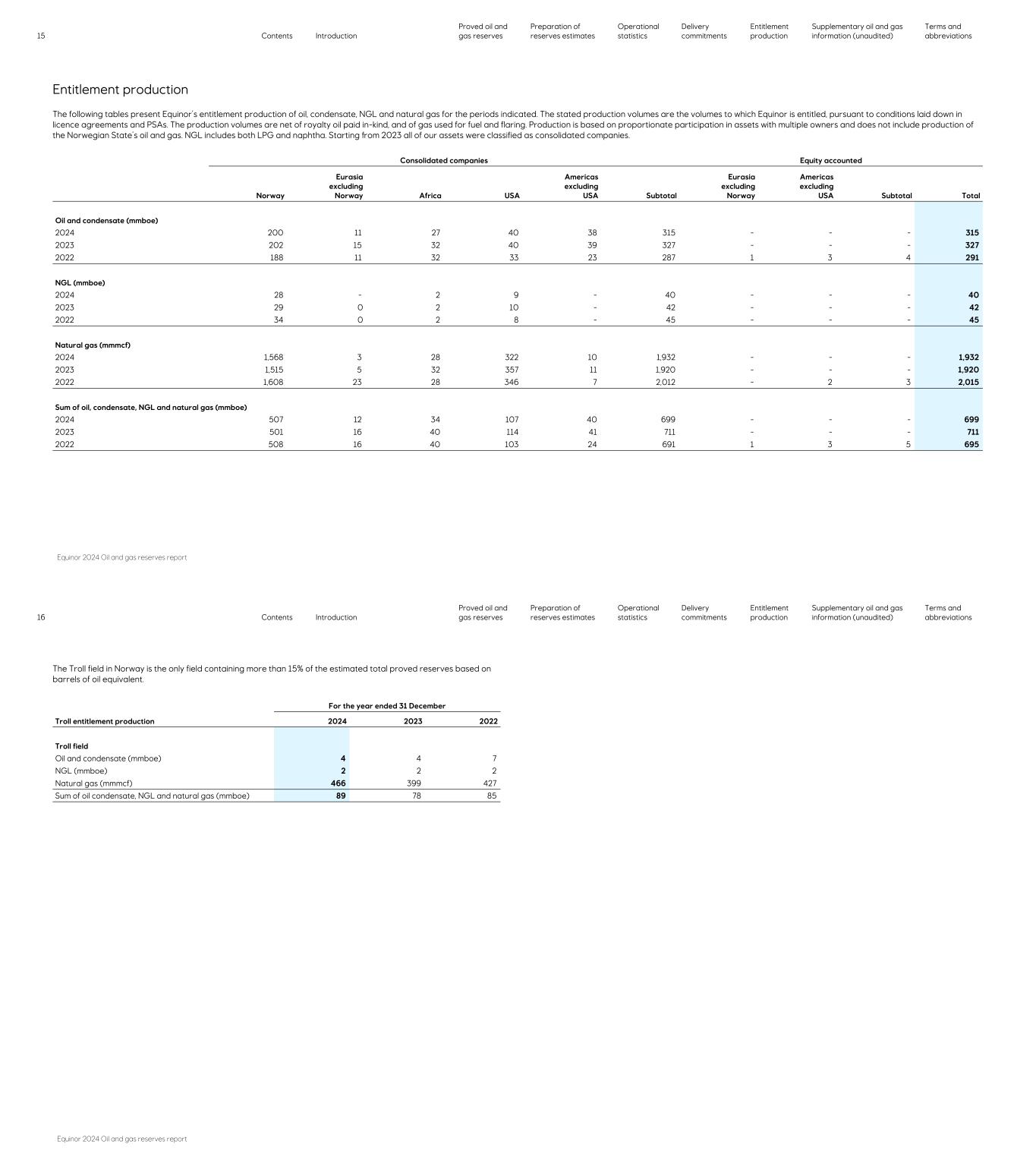

Entitlement production The following tables present Equinor’s entitlement production of oil, condensate, NGL and natural gas for the periods indicated. The stated production volumes are the volumes to which Equinor is entitled, pursuant to conditions laid down in licence agreements and PSAs. The production volumes are net of royalty oil paid in-kind, and of gas used for fuel and flaring. Production is based on proportionate participation in assets with multiple owners and does not include production of the Norwegian State’s oil and gas. NGL includes both LPG and naphtha. Starting from 2023 all of our assets were classified as consolidated companies. Consolidated companies Equity accounted Norway Eurasia excluding Norway Africa USA Americas excluding USA Subtotal Eurasia excluding Norway Americas excluding USA Subtotal Total Oil and condensate (mmboe) 2024 200 11 27 40 38 315 - - - 315 2023 202 15 32 40 39 327 - - - 327 2022 188 11 32 33 23 287 1 3 4 291 NGL (mmboe) 2024 28 - 2 9 - 40 - - - 40 2023 29 0 2 10 - 42 - - - 42 2022 34 0 2 8 - 45 - - - 45 Natural gas (mmmcf) 2024 1,568 3 28 322 10 1,932 - - - 1,932 2023 1,515 5 32 357 11 1,920 - - - 1,920 2022 1,608 23 28 346 7 2,012 - 2 3 2,015 Sum of oil, condensate, NGL and natural gas (mmboe) 2024 507 12 34 107 40 699 - - - 699 2023 501 16 40 114 41 711 - - - 711 2022 508 16 40 103 24 691 1 3 5 695 15 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report The Troll field in Norway is the only field containing more than 15% of the estimated total proved reserves based on barrels of oil equivalent. For the year ended 31 December Troll entitlement production 2024 2023 2022 Troll field Oil and condensate (mmboe) 4 4 7 NGL (mmboe) 2 2 2 Natural gas (mmmcf) 466 399 427 Sum of oil condensate, NGL and natural gas (mmboe) 89 78 85 16 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

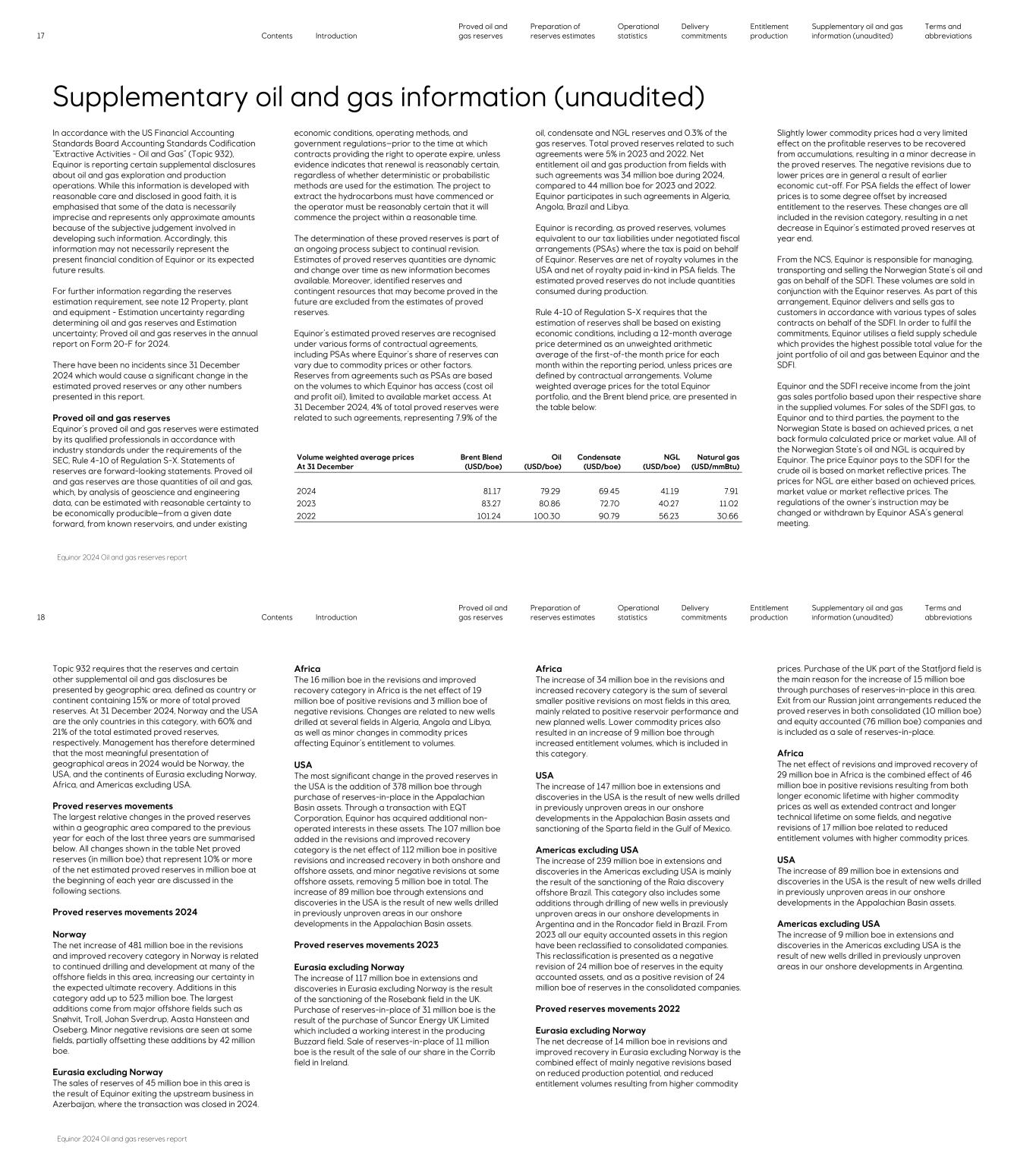

Supplementary oil and gas information (unaudited) In accordance with the US Financial Accounting Standards Board Accounting Standards Codification “Extractive Activities - Oil and Gas” (Topic 932), Equinor is reporting certain supplemental disclosures about oil and gas exploration and production operations. While this information is developed with reasonable care and disclosed in good faith, it is emphasised that some of the data is necessarily imprecise and represents only approximate amounts because of the subjective judgement involved in developing such information. Accordingly, this information may not necessarily represent the present financial condition of Equinor or its expected future results. For further information regarding the reserves estimation requirement, see note 12 Property, plant and equipment - Estimation uncertainty regarding determining oil and gas reserves and Estimation uncertainty; Proved oil and gas reserves in the annual report on Form 20-F for 2024. There have been no incidents since 31 December 2024 which would cause a significant change in the estimated proved reserves or any other numbers presented in this report. Proved oil and gas reserves Equinor’s proved oil and gas reserves were estimated by its qualified professionals in accordance with industry standards under the requirements of the SEC, Rule 4-10 of Regulation S-X. Statements of reserves are forward-looking statements. Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. The determination of these proved reserves is part of an ongoing process subject to continual revision. Estimates of proved reserves quantities are dynamic and change over time as new information becomes available. Moreover, identified reserves and contingent resources that may become proved in the future are excluded from the estimates of proved reserves. Equinor’s estimated proved reserves are recognised under various forms of contractual agreements, including PSAs where Equinor’s share of reserves can vary due to commodity prices or other factors. Reserves from agreements such as PSAs are based on the volumes to which Equinor has access (cost oil and profit oil), limited to available market access. At 31 December 2024, 4% of total proved reserves were related to such agreements, representing 7.9% of the oil, condensate and NGL reserves and 0.3% of the gas reserves. Total proved reserves related to such agreements were 5% in 2023 and 2022. Net entitlement oil and gas production from fields with such agreements was 34 million boe during 2024, compared to 44 million boe for 2023 and 2022. Equinor participates in such agreements in Algeria, Angola, Brazil and Libya. Equinor is recording, as proved reserves, volumes equivalent to our tax liabilities under negotiated fiscal arrangements (PSAs) where the tax is paid on behalf of Equinor. Reserves are net of royalty volumes in the USA and net of royalty paid in-kind in PSA fields. The estimated proved reserves do not include quantities consumed during production. Rule 4-10 of Regulation S-X requires that the estimation of reserves shall be based on existing economic conditions, including a 12-month average price determined as an unweighted arithmetic average of the first-of-the month price for each month within the reporting period, unless prices are defined by contractual arrangements. Volume weighted average prices for the total Equinor portfolio, and the Brent blend price, are presented in the table below: Slightly lower commodity prices had a very limited effect on the profitable reserves to be recovered from accumulations, resulting in a minor decrease in the proved reserves. The negative revisions due to lower prices are in general a result of earlier economic cut-off. For PSA fields the effect of lower prices is to some degree offset by increased entitlement to the reserves. These changes are all included in the revision category, resulting in a net decrease in Equinor’s estimated proved reserves at year end. From the NCS, Equinor is responsible for managing, transporting and selling the Norwegian State’s oil and gas on behalf of the SDFI. These volumes are sold in conjunction with the Equinor reserves. As part of this arrangement, Equinor delivers and sells gas to customers in accordance with various types of sales contracts on behalf of the SDFI. In order to fulfil the commitments, Equinor utilises a field supply schedule which provides the highest possible total value for the joint portfolio of oil and gas between Equinor and the SDFI. Equinor and the SDFI receive income from the joint gas sales portfolio based upon their respective share in the supplied volumes. For sales of the SDFI gas, to Equinor and to third parties, the payment to the Norwegian State is based on achieved prices, a net back formula calculated price or market value. All of the Norwegian State’s oil and NGL is acquired by Equinor. The price Equinor pays to the SDFI for the crude oil is based on market reflective prices. The prices for NGL are either based on achieved prices, market value or market reflective prices. The regulations of the owner’s instruction may be changed or withdrawn by Equinor ASA’s general meeting. 17 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Volume weighted average prices At 31 December Brent Blend (USD/boe) Oil (USD/boe) Condensate (USD/boe) NGL (USD/boe) Natural gas (USD/mmBtu) 2024 81.17 79.29 69.45 41.19 7.91 2023 83.27 80.86 72.70 40.27 11.02 2022 101.24 100.30 90.79 56.23 30.66 Topic 932 requires that the reserves and certain other supplemental oil and gas disclosures be presented by geographic area, defined as country or continent containing 15% or more of total proved reserves. At 31 December 2024, Norway and the USA are the only countries in this category, with 60% and 21% of the total estimated proved reserves, respectively. Management has therefore determined that the most meaningful presentation of geographical areas in 2024 would be Norway, the USA, and the continents of Eurasia excluding Norway, Africa, and Americas excluding USA. Proved reserves movements The largest relative changes in the proved reserves within a geographic area compared to the previous year for each of the last three years are summarised below. All changes shown in the table Net proved reserves (in million boe) that represent 10% or more of the net estimated proved reserves in million boe at the beginning of each year are discussed in the following sections. Proved reserves movements 2024 Norway The net increase of 481 million boe in the revisions and improved recovery category in Norway is related to continued drilling and development at many of the offshore fields in this area, increasing our certainty in the expected ultimate recovery. Additions in this category add up to 523 million boe. The largest additions come from major offshore fields such as Snøhvit, Troll, Johan Sverdrup, Aasta Hansteen and Oseberg. Minor negative revisions are seen at some fields, partially offsetting these additions by 42 million boe. Eurasia excluding Norway The sales of reserves of 45 million boe in this area is the result of Equinor exiting the upstream business in Azerbaijan, where the transaction was closed in 2024. Africa The 16 million boe in the revisions and improved recovery category in Africa is the net effect of 19 million boe of positive revisions and 3 million boe of negative revisions. Changes are related to new wells drilled at several fields in Algeria, Angola and Libya, as well as minor changes in commodity prices affecting Equinor’s entitlement to volumes. USA The most significant change in the proved reserves in the USA is the addition of 378 million boe through purchase of reserves-in-place in the Appalachian Basin assets. Through a transaction with EQT Corporation, Equinor has acquired additional non- operated interests in these assets. The 107 million boe added in the revisions and improved recovery category is the net effect of 112 million boe in positive revisions and increased recovery in both onshore and offshore assets, and minor negative revisions at some offshore assets, removing 5 million boe in total. The increase of 89 million boe through extensions and discoveries in the USA is the result of new wells drilled in previously unproven areas in our onshore developments in the Appalachian Basin assets. Proved reserves movements 2023 Eurasia excluding Norway The increase of 117 million boe in extensions and discoveries in Eurasia excluding Norway is the result of the sanctioning of the Rosebank field in the UK. Purchase of reserves-in-place of 31 million boe is the result of the purchase of Suncor Energy UK Limited which included a working interest in the producing Buzzard field. Sale of reserves-in-place of 11 million boe is the result of the sale of our share in the Corrib field in Ireland. Africa The increase of 34 million boe in the revisions and increased recovery category is the sum of several smaller positive revisions on most fields in this area, mainly related to positive reservoir performance and new planned wells. Lower commodity prices also resulted in an increase of 9 million boe through increased entitlement volumes, which is included in this category. USA The increase of 147 million boe in extensions and discoveries in the USA is the result of new wells drilled in previously unproven areas in our onshore developments in the Appalachian Basin assets and sanctioning of the Sparta field in the Gulf of Mexico. Americas excluding USA The increase of 239 million boe in extensions and discoveries in the Americas excluding USA is mainly the result of the sanctioning of the Raia discovery offshore Brazil. This category also includes some additions through drilling of new wells in previously unproven areas in our onshore developments in Argentina and in the Roncador field in Brazil. From 2023 all our equity accounted assets in this region have been reclassified to consolidated companies. This reclassification is presented as a negative revision of 24 million boe of reserves in the equity accounted assets, and as a positive revision of 24 million boe of reserves in the consolidated companies. Proved reserves movements 2022 Eurasia excluding Norway The net decrease of 14 million boe in revisions and improved recovery in Eurasia excluding Norway is the combined effect of mainly negative revisions based on reduced production potential, and reduced entitlement volumes resulting from higher commodity prices. Purchase of the UK part of the Statfjord field is the main reason for the increase of 15 million boe through purchases of reserves-in-place in this area. Exit from our Russian joint arrangements reduced the proved reserves in both consolidated (10 million boe) and equity accounted (76 million boe) companies and is included as a sale of reserves-in-place. Africa The net effect of revisions and improved recovery of 29 million boe in Africa is the combined effect of 46 million boe in positive revisions resulting from both longer economic lifetime with higher commodity prices as well as extended contract and longer technical lifetime on some fields, and negative revisions of 17 million boe related to reduced entitlement volumes with higher commodity prices. USA The increase of 89 million boe in extensions and discoveries in the USA is the result of new wells drilled in previously unproven areas in our onshore developments in the Appalachian Basin assets. Americas excluding USA The increase of 9 million boe in extensions and discoveries in the Americas excluding USA is the result of new wells drilled in previously unproven areas in our onshore developments in Argentina. 18 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

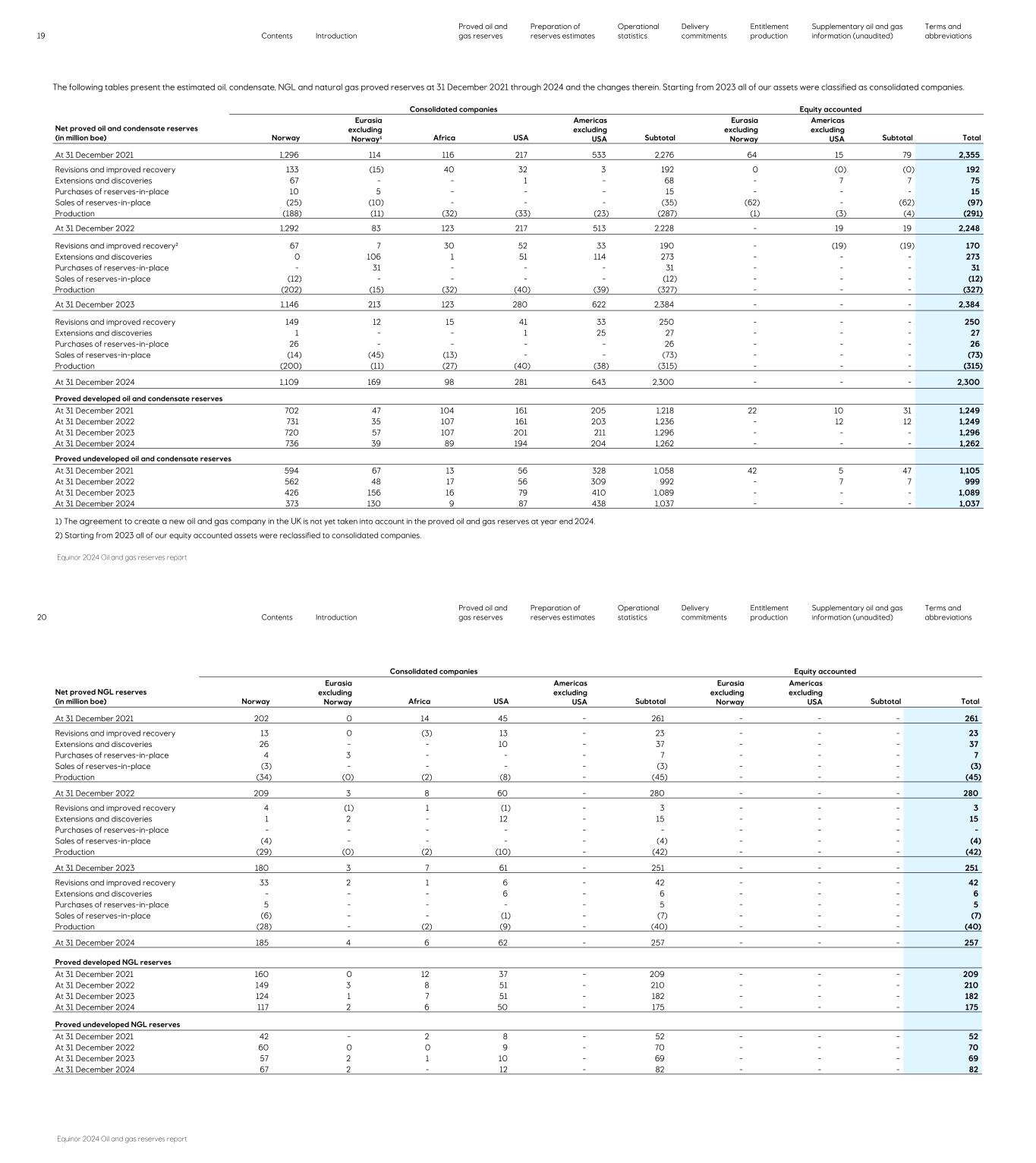

The following tables present the estimated oil, condensate, NGL and natural gas proved reserves at 31 December 2021 through 2024 and the changes therein. Starting from 2023 all of our assets were classified as consolidated companies. 19 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Consolidated companies Equity accounted Net proved oil and condensate reserves (in million boe) Norway Eurasia excluding Norway¹ Africa USA Americas excluding USA Subtotal Eurasia excluding Norway Americas excluding USA Subtotal Total At 31 December 2021 1,296 114 116 217 533 2,276 64 15 79 2,355 Revisions and improved recovery 133 (15) 40 32 3 192 0 (0) (0) 192 Extensions and discoveries 67 - - 1 - 68 - 7 7 75 Purchases of reserves-in-place 10 5 - - - 15 - - - 15 Sales of reserves-in-place (25) (10) - - - (35) (62) - (62) (97) Production (188) (11) (32) (33) (23) (287) (1) (3) (4) (291) At 31 December 2022 1,292 83 123 217 513 2,228 - 19 19 2,248 Revisions and improved recovery² 67 7 30 52 33 190 - (19) (19) 170 Extensions and discoveries 0 106 1 51 114 273 - - - 273 Purchases of reserves-in-place - 31 - - - 31 - - - 31 Sales of reserves-in-place (12) - - - - (12) - - - (12) Production (202) (15) (32) (40) (39) (327) - - - (327) At 31 December 2023 1,146 213 123 280 622 2,384 - - - 2,384 Revisions and improved recovery 149 12 15 41 33 250 - - - 250 Extensions and discoveries 1 - - 1 25 27 - - - 27 Purchases of reserves-in-place 26 - - - - 26 - - - 26 Sales of reserves-in-place (14) (45) (13) - - (73) - - - (73) Production (200) (11) (27) (40) (38) (315) - - - (315) At 31 December 2024 1,109 169 98 281 643 2,300 - - - 2,300 Proved developed oil and condensate reserves At 31 December 2021 702 47 104 161 205 1,218 22 10 31 1,249 At 31 December 2022 731 35 107 161 203 1,236 - 12 12 1,249 At 31 December 2023 720 57 107 201 211 1,296 - - - 1,296 At 31 December 2024 736 39 89 194 204 1,262 - - - 1,262 Proved undeveloped oil and condensate reserves At 31 December 2021 594 67 13 56 328 1,058 42 5 47 1,105 At 31 December 2022 562 48 17 56 309 992 - 7 7 999 At 31 December 2023 426 156 16 79 410 1,089 - - - 1,089 At 31 December 2024 373 130 9 87 438 1,037 - - - 1,037 1) The agreement to create a new oil and gas company in the UK is not yet taken into account in the proved oil and gas reserves at year end 2024. 2) Starting from 2023 all of our equity accounted assets were reclassified to consolidated companies. Consolidated companies Equity accounted Net proved NGL reserves (in million boe) Norway Eurasia excluding Norway Africa USA Americas excluding USA Subtotal Eurasia excluding Norway Americas excluding USA Subtotal Total At 31 December 2021 202 0 14 45 - 261 - - - 261 Revisions and improved recovery 13 0 (3) 13 - 23 - - - 23 Extensions and discoveries 26 - - 10 - 37 - - - 37 Purchases of reserves-in-place 4 3 - - - 7 - - - 7 Sales of reserves-in-place (3) - - - - (3) - - - (3) Production (34) (0) (2) (8) - (45) - - - (45) At 31 December 2022 209 3 8 60 - 280 - - - 280 Revisions and improved recovery 4 (1) 1 (1) - 3 - - - 3 Extensions and discoveries 1 2 - 12 - 15 - - - 15 Purchases of reserves-in-place - - - - - - - - - - Sales of reserves-in-place (4) - - - - (4) - - - (4) Production (29) (0) (2) (10) - (42) - - - (42) At 31 December 2023 180 3 7 61 - 251 - - - 251 Revisions and improved recovery 33 2 1 6 - 42 - - - 42 Extensions and discoveries - - - 6 - 6 - - - 6 Purchases of reserves-in-place 5 - - - - 5 - - - 5 Sales of reserves-in-place (6) - - (1) - (7) - - - (7) Production (28) - (2) (9) - (40) - - - (40) At 31 December 2024 185 4 6 62 - 257 - - - 257 Proved developed NGL reserves At 31 December 2021 160 0 12 37 - 209 - - - 209 At 31 December 2022 149 3 8 51 - 210 - - - 210 At 31 December 2023 124 1 7 51 - 182 - - - 182 At 31 December 2024 117 2 6 50 - 175 - - - 175 Proved undeveloped NGL reserves At 31 December 2021 42 - 2 8 - 52 - - - 52 At 31 December 2022 60 0 0 9 - 70 - - - 70 At 31 December 2023 57 2 1 10 - 69 - - - 69 At 31 December 2024 67 2 - 12 - 82 - - - 82 20 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

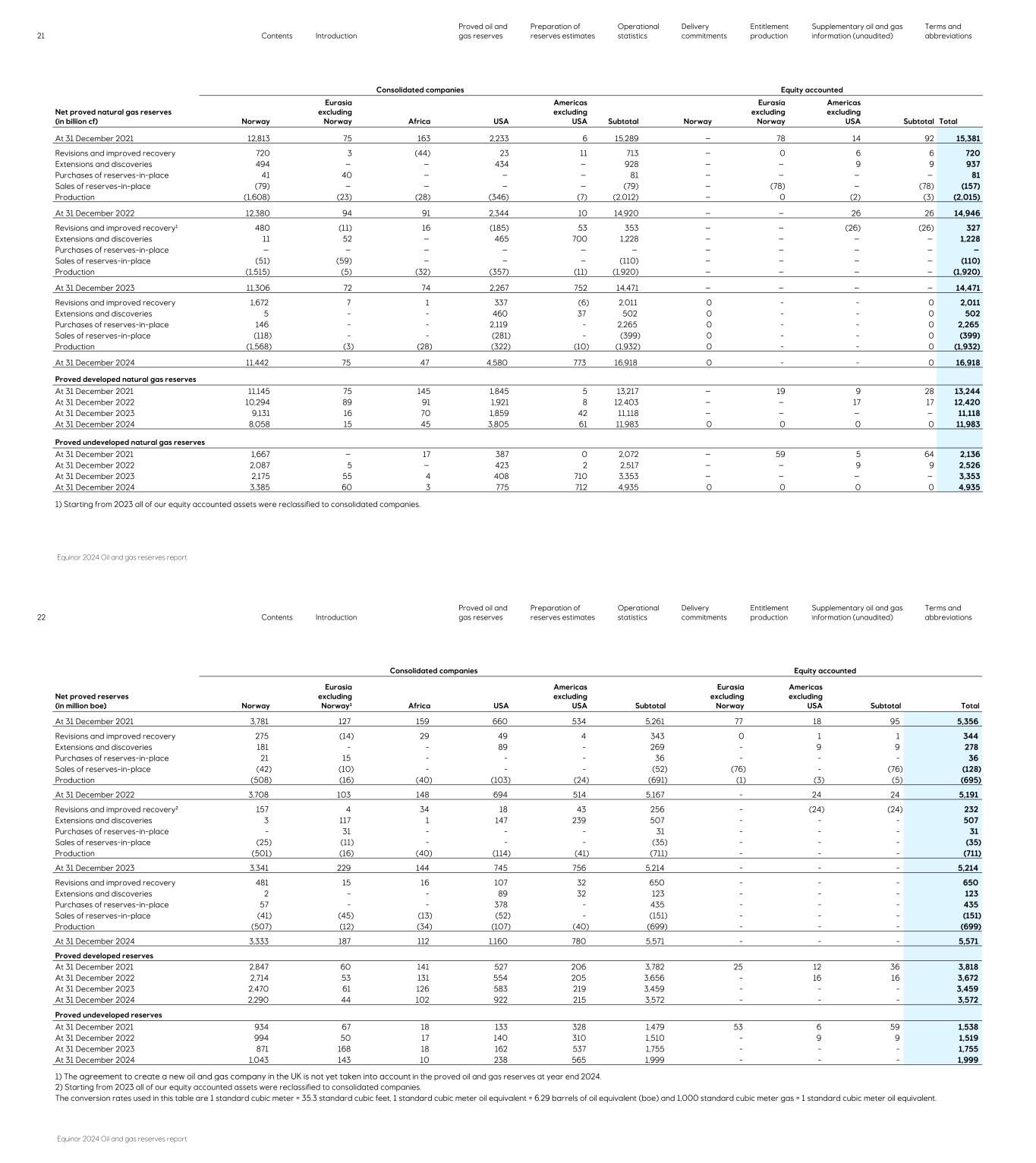

Consolidated companies Equity accounted Net proved natural gas reserves (in billion cf) Norway Eurasia excluding Norway Africa USA Americas excluding USA Subtotal Norway Eurasia excluding Norway Americas excluding USA Subtotal Total At 31 December 2021 12,813 75 163 2,233 6 15,289 — 78 14 92 15,381 Revisions and improved recovery 720 3 (44) 23 11 713 — 0 6 6 720 Extensions and discoveries 494 — — 434 — 928 — — 9 9 937 Purchases of reserves-in-place 41 40 — — — 81 — — — — 81 Sales of reserves-in-place (79) — — — — (79) — (78) — (78) (157) Production (1,608) (23) (28) (346) (7) (2,012) — 0 (2) (3) (2,015) At 31 December 2022 12,380 94 91 2,344 10 14,920 — — 26 26 14,946 Revisions and improved recovery¹ 480 (11) 16 (185) 53 353 — — (26) (26) 327 Extensions and discoveries 11 52 — 465 700 1,228 — — — — 1,228 Purchases of reserves-in-place — — — — — — — — — — — Sales of reserves-in-place (51) (59) — — — (110) — — — — (110) Production (1,515) (5) (32) (357) (11) (1,920) — — — — (1,920) At 31 December 2023 11,306 72 74 2,267 752 14,471 — — — — 14,471 Revisions and improved recovery 1,672 7 1 337 (6) 2,011 0 - - 0 2,011 Extensions and discoveries 5 - - 460 37 502 0 - - 0 502 Purchases of reserves-in-place 146 - - 2,119 - 2,265 0 - - 0 2,265 Sales of reserves-in-place (118) - - (281) - (399) 0 - - 0 (399) Production (1,568) (3) (28) (322) (10) (1,932) 0 - - 0 (1,932) At 31 December 2024 11,442 75 47 4,580 773 16,918 0 - - 0 16,918 Proved developed natural gas reserves At 31 December 2021 11,145 75 145 1,845 5 13,217 — 19 9 28 13,244 At 31 December 2022 10,294 89 91 1,921 8 12,403 — — 17 17 12,420 At 31 December 2023 9,131 16 70 1,859 42 11,118 — — — — 11,118 At 31 December 2024 8,058 15 45 3,805 61 11,983 0 0 0 0 11,983 Proved undeveloped natural gas reserves At 31 December 2021 1,667 — 17 387 0 2,072 — 59 5 64 2,136 At 31 December 2022 2,087 5 — 423 2 2,517 — — 9 9 2,526 At 31 December 2023 2,175 55 4 408 710 3,353 — — — — 3,353 At 31 December 2024 3,385 60 3 775 712 4,935 0 0 0 0 4,935 1) Starting from 2023 all of our equity accounted assets were reclassified to consolidated companies. 21 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Consolidated companies Equity accounted Net proved reserves (in million boe) Norway Eurasia excluding Norway¹ Africa USA Americas excluding USA Subtotal Eurasia excluding Norway Americas excluding USA Subtotal Total At 31 December 2021 3,781 127 159 660 534 5,261 77 18 95 5,356 Revisions and improved recovery 275 (14) 29 49 4 343 0 1 1 344 Extensions and discoveries 181 - - 89 - 269 - 9 9 278 Purchases of reserves-in-place 21 15 - - - 36 - - - 36 Sales of reserves-in-place (42) (10) - - - (52) (76) - (76) (128) Production (508) (16) (40) (103) (24) (691) (1) (3) (5) (695) At 31 December 2022 3,708 103 148 694 514 5,167 - 24 24 5,191 Revisions and improved recovery² 157 4 34 18 43 256 - (24) (24) 232 Extensions and discoveries 3 117 1 147 239 507 - - - 507 Purchases of reserves-in-place - 31 - - - 31 - - - 31 Sales of reserves-in-place (25) (11) - - - (35) - - - (35) Production (501) (16) (40) (114) (41) (711) - - - (711) At 31 December 2023 3,341 229 144 745 756 5,214 - - - 5,214 Revisions and improved recovery 481 15 16 107 32 650 - - - 650 Extensions and discoveries 2 - - 89 32 123 - - - 123 Purchases of reserves-in-place 57 - - 378 - 435 - - - 435 Sales of reserves-in-place (41) (45) (13) (52) - (151) - - - (151) Production (507) (12) (34) (107) (40) (699) - - - (699) At 31 December 2024 3,333 187 112 1,160 780 5,571 - - - 5,571 Proved developed reserves At 31 December 2021 2,847 60 141 527 206 3,782 25 12 36 3,818 At 31 December 2022 2,714 53 131 554 205 3,656 - 16 16 3,672 At 31 December 2023 2,470 61 126 583 219 3,459 - - - 3,459 At 31 December 2024 2,290 44 102 922 215 3,572 - - - 3,572 Proved undeveloped reserves At 31 December 2021 934 67 18 133 328 1,479 53 6 59 1,538 At 31 December 2022 994 50 17 140 310 1,510 - 9 9 1,519 At 31 December 2023 871 168 18 162 537 1,755 - - - 1,755 At 31 December 2024 1,043 143 10 238 565 1,999 - - - 1,999 1) The agreement to create a new oil and gas company in the UK is not yet taken into account in the proved oil and gas reserves at year end 2024. 2) Starting from 2023 all of our equity accounted assets were reclassified to consolidated companies. The conversion rates used in this table are 1 standard cubic meter = 35.3 standard cubic feet, 1 standard cubic meter oil equivalent = 6.29 barrels of oil equivalent (boe) and 1,000 standard cubic meter gas = 1 standard cubic meter oil equivalent. 22 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

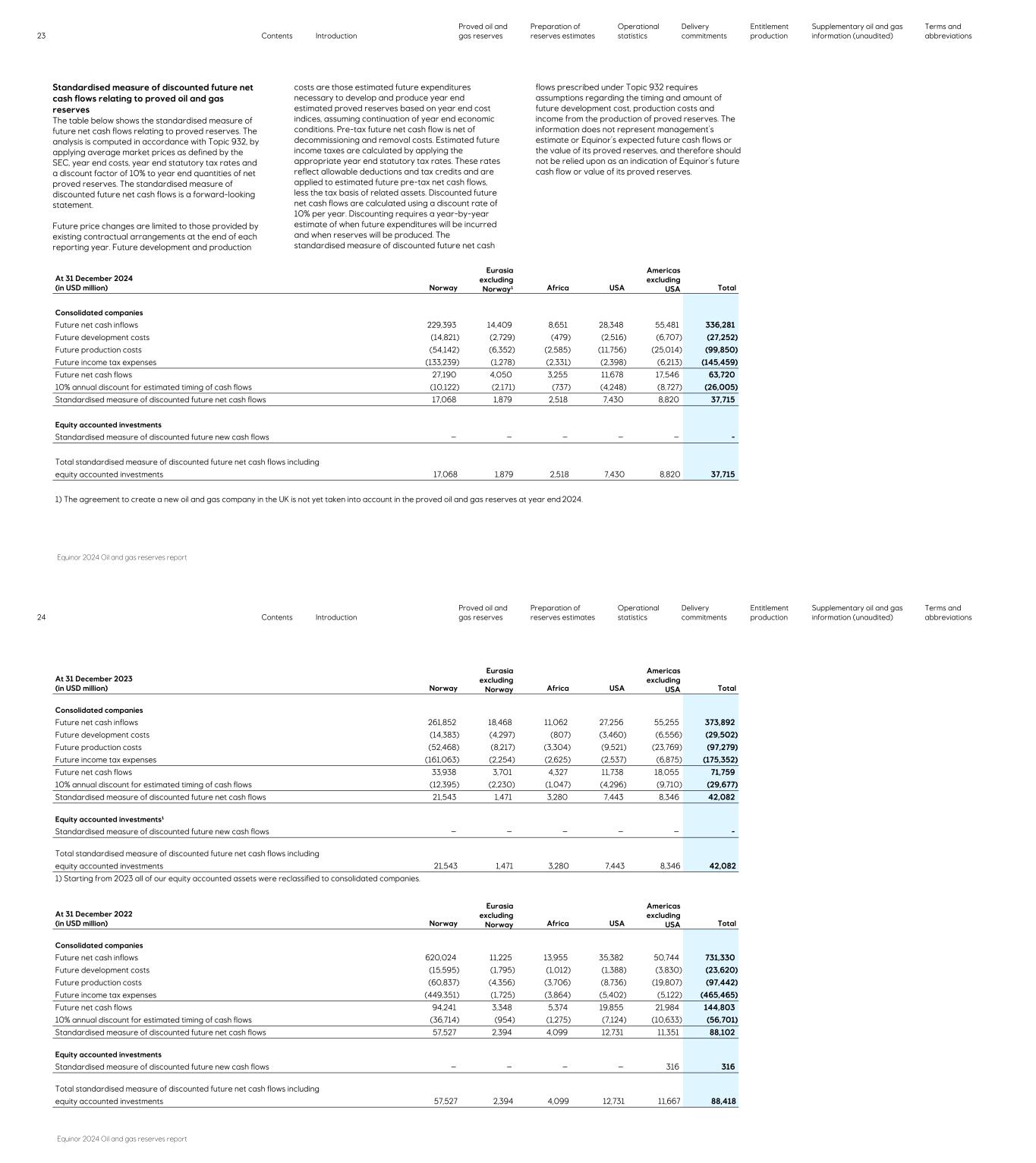

Standardised measure of discounted future net cash flows relating to proved oil and gas reserves The table below shows the standardised measure of future net cash flows relating to proved reserves. The analysis is computed in accordance with Topic 932, by applying average market prices as defined by the SEC, year end costs, year end statutory tax rates and a discount factor of 10% to year end quantities of net proved reserves. The standardised measure of discounted future net cash flows is a forward-looking statement. Future price changes are limited to those provided by existing contractual arrangements at the end of each reporting year. Future development and production costs are those estimated future expenditures necessary to develop and produce year end estimated proved reserves based on year end cost indices, assuming continuation of year end economic conditions. Pre-tax future net cash flow is net of decommissioning and removal costs. Estimated future income taxes are calculated by applying the appropriate year end statutory tax rates. These rates reflect allowable deductions and tax credits and are applied to estimated future pre-tax net cash flows, less the tax basis of related assets. Discounted future net cash flows are calculated using a discount rate of 10% per year. Discounting requires a year-by-year estimate of when future expenditures will be incurred and when reserves will be produced. The standardised measure of discounted future net cash flows prescribed under Topic 932 requires assumptions regarding the timing and amount of future development cost, production costs and income from the production of proved reserves. The information does not represent management’s estimate or Equinor’s expected future cash flows or the value of its proved reserves, and therefore should not be relied upon as an indication of Equinor’s future cash flow or value of its proved reserves. At 31 December 2024 (in USD million) Norway Eurasia excluding Norway¹ Africa USA Americas excluding USA Total Consolidated companies Future net cash inflows 229,393 14,409 8,651 28,348 55,481 336,281 Future development costs (14,821) (2,729) (479) (2,516) (6,707) (27,252) Future production costs (54,142) (6,352) (2,585) (11,756) (25,014) (99,850) Future income tax expenses (133,239) (1,278) (2,331) (2,398) (6,213) (145,459) Future net cash flows 27,190 4,050 3,255 11,678 17,546 63,720 10% annual discount for estimated timing of cash flows (10,122) (2,171) (737) (4,248) (8,727) (26,005) Standardised measure of discounted future net cash flows 17,068 1,879 2,518 7,430 8,820 37,715 Equity accounted investments Standardised measure of discounted future new cash flows — — — — — - Total standardised measure of discounted future net cash flows including equity accounted investments 17,068 1,879 2,518 7,430 8,820 37,715 1) The agreement to create a new oil and gas company in the UK is not yet taken into account in the proved oil and gas reserves at year end 2024. 23 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report At 31 December 2023 (in USD million) Norway Eurasia excluding Norway Africa USA Americas excluding USA Total Consolidated companies Future net cash inflows 261,852 18,468 11,062 27,256 55,255 373,892 Future development costs (14,383) (4,297) (807) (3,460) (6,556) (29,502) Future production costs (52,468) (8,217) (3,304) (9,521) (23,769) (97,279) Future income tax expenses (161,063) (2,254) (2,625) (2,537) (6,875) (175,352) Future net cash flows 33,938 3,701 4,327 11,738 18,055 71,759 10% annual discount for estimated timing of cash flows (12,395) (2,230) (1,047) (4,296) (9,710) (29,677) Standardised measure of discounted future net cash flows 21,543 1,471 3,280 7,443 8,346 42,082 Equity accounted investments¹ Standardised measure of discounted future new cash flows — — — — — - Total standardised measure of discounted future net cash flows including equity accounted investments 21,543 1,471 3,280 7,443 8,346 42,082 1) Starting from 2023 all of our equity accounted assets were reclassified to consolidated companies. At 31 December 2022 (in USD million) Norway Eurasia excluding Norway Africa USA Americas excluding USA Total Consolidated companies Future net cash inflows 620,024 11,225 13,955 35,382 50,744 731,330 Future development costs (15,595) (1,795) (1,012) (1,388) (3,830) (23,620) Future production costs (60,837) (4,356) (3,706) (8,736) (19,807) (97,442) Future income tax expenses (449,351) (1,725) (3,864) (5,402) (5,122) (465,465) Future net cash flows 94,241 3,348 5,374 19,855 21,984 144,803 10% annual discount for estimated timing of cash flows (36,714) (954) (1,275) (7,124) (10,633) (56,701) Standardised measure of discounted future net cash flows 57,527 2,394 4,099 12,731 11,351 88,102 Equity accounted investments Standardised measure of discounted future new cash flows — — — — 316 316 Total standardised measure of discounted future net cash flows including equity accounted investments 57,527 2,394 4,099 12,731 11,667 88,418 24 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

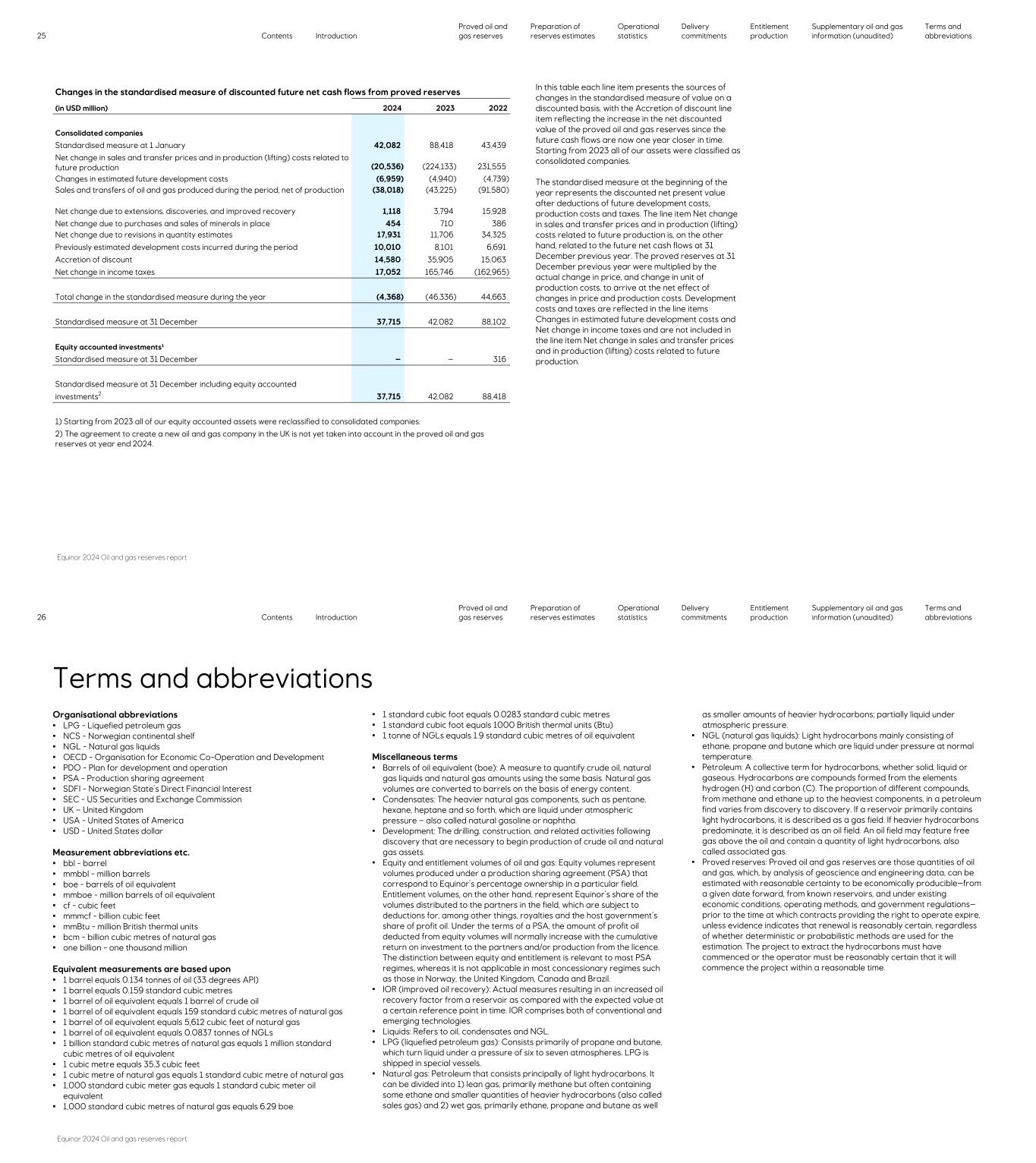

Changes in the standardised measure of discounted future net cash flows from proved reserves (in USD million) 2024 2023 2022 Consolidated companies Standardised measure at 1 January 42,082 88,418 43,439 Net change in sales and transfer prices and in production (lifting) costs related to future production (20,536) (224,133) 231,555 Changes in estimated future development costs (6,959) (4,940) (4,739) Sales and transfers of oil and gas produced during the period, net of production (38,018) (43,225) (91,580) Net change due to extensions, discoveries, and improved recovery 1,118 3,794 15,928 Net change due to purchases and sales of minerals in place 454 710 386 Net change due to revisions in quantity estimates 17,931 11,706 34,325 Previously estimated development costs incurred during the period 10,010 8,101 6,691 Accretion of discount 14,580 35,905 15,063 Net change in income taxes 17,052 165,746 (162,965) Total change in the standardised measure during the year (4,368) (46,336) 44,663 Standardised measure at 31 December 37,715 42,082 88,102 Equity accounted investments¹ Standardised measure at 31 December — — 316 Standardised measure at 31 December including equity accounted investments2 37,715 42,082 88,418 1) Starting from 2023 all of our equity accounted assets were reclassified to consolidated companies. 2) The agreement to create a new oil and gas company in the UK is not yet taken into account in the proved oil and gas reserves at year end 2024. In this table each line item presents the sources of changes in the standardised measure of value on a discounted basis, with the Accretion of discount line item reflecting the increase in the net discounted value of the proved oil and gas reserves since the future cash flows are now one year closer in time. Starting from 2023 all of our assets were classified as consolidated companies. The standardised measure at the beginning of the year represents the discounted net present value after deductions of future development costs, production costs and taxes. The line item Net change in sales and transfer prices and in production (lifting) costs related to future production is, on the other hand, related to the future net cash flows at 31 December previous year. The proved reserves at 31 December previous year were multiplied by the actual change in price, and change in unit of production costs, to arrive at the net effect of changes in price and production costs. Development costs and taxes are reflected in the line items Changes in estimated future development costs and Net change in income taxes and are not included in the line item Net change in sales and transfer prices and in production (lifting) costs related to future production. 25 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report Terms and abbreviations Organisational abbreviations • LPG - Liquefied petroleum gas • NCS - Norwegian continental shelf • NGL - Natural gas liquids • OECD - Organisation for Economic Co-Operation and Development • PDO - Plan for development and operation • PSA - Production sharing agreement • SDFI - Norwegian State’s Direct Financial Interest • SEC - US Securities and Exchange Commission • UK – United Kingdom • USA - United States of America • USD - United States dollar Measurement abbreviations etc. • bbl - barrel • mmbbl - million barrels • boe - barrels of oil equivalent • mmboe - million barrels of oil equivalent • cf - cubic feet • mmmcf - billion cubic feet • mmBtu - million British thermal units • bcm - billion cubic metres of natural gas • one billion - one thousand million Equivalent measurements are based upon • 1 barrel equals 0.134 tonnes of oil (33 degrees API) • 1 barrel equals 0.159 standard cubic metres • 1 barrel of oil equivalent equals 1 barrel of crude oil • 1 barrel of oil equivalent equals 159 standard cubic metres of natural gas • 1 barrel of oil equivalent equals 5,612 cubic feet of natural gas • 1 barrel of oil equivalent equals 0.0837 tonnes of NGLs • 1 billion standard cubic metres of natural gas equals 1 million standard cubic metres of oil equivalent • 1 cubic metre equals 35.3 cubic feet • 1 cubic metre of natural gas equals 1 standard cubic metre of natural gas • 1,000 standard cubic meter gas equals 1 standard cubic meter oil equivalent • 1,000 standard cubic metres of natural gas equals 6.29 boe • 1 standard cubic foot equals 0.0283 standard cubic metres • 1 standard cubic foot equals 1000 British thermal units (Btu) • 1 tonne of NGLs equals 1.9 standard cubic metres of oil equivalent Miscellaneous terms • Barrels of oil equivalent (boe): A measure to quantify crude oil, natural gas liquids and natural gas amounts using the same basis. Natural gas volumes are converted to barrels on the basis of energy content. • Condensates: The heavier natural gas components, such as pentane, hexane, heptane and so forth, which are liquid under atmospheric pressure – also called natural gasoline or naphtha. • Development: The drilling, construction, and related activities following discovery that are necessary to begin production of crude oil and natural gas assets. • Equity and entitlement volumes of oil and gas: Equity volumes represent volumes produced under a production sharing agreement (PSA) that correspond to Equinor’s percentage ownership in a particular field. Entitlement volumes, on the other hand, represent Equinor’s share of the volumes distributed to the partners in the field, which are subject to deductions for, among other things, royalties and the host government’s share of profit oil. Under the terms of a PSA, the amount of profit oil deducted from equity volumes will normally increase with the cumulative return on investment to the partners and/or production from the licence. The distinction between equity and entitlement is relevant to most PSA regimes, whereas it is not applicable in most concessionary regimes such as those in Norway, the United Kingdom, Canada and Brazil. • IOR (improved oil recovery): Actual measures resulting in an increased oil recovery factor from a reservoir as compared with the expected value at a certain reference point in time. IOR comprises both of conventional and emerging technologies. • Liquids: Refers to oil, condensates and NGL. • LPG (liquefied petroleum gas): Consists primarily of propane and butane, which turn liquid under a pressure of six to seven atmospheres. LPG is shipped in special vessels. • Natural gas: Petroleum that consists principally of light hydrocarbons. It can be divided into 1) lean gas, primarily methane but often containing some ethane and smaller quantities of heavier hydrocarbons (also called sales gas) and 2) wet gas, primarily ethane, propane and butane as well as smaller amounts of heavier hydrocarbons; partially liquid under atmospheric pressure. • NGL (natural gas liquids): Light hydrocarbons mainly consisting of ethane, propane and butane which are liquid under pressure at normal temperature. • Petroleum: A collective term for hydrocarbons, whether solid, liquid or gaseous. Hydrocarbons are compounds formed from the elements hydrogen (H) and carbon (C). The proportion of different compounds, from methane and ethane up to the heaviest components, in a petroleum find varies from discovery to discovery. If a reservoir primarily contains light hydrocarbons, it is described as a gas field. If heavier hydrocarbons predominate, it is described as an oil field. An oil field may feature free gas above the oil and contain a quantity of light hydrocarbons, also called associated gas. • Proved reserves: Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations— prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. 26 Contents Introduction Proved oil and gas reserves Preparation of reserves estimates Operational statistics Delivery commitments Entitlement production Supplementary oil and gas information (unaudited) Terms and abbreviations Equinor 2024 Oil and gas reserves report

Equinor 2024 Oil and gas reserves report Equinor ASA Box 8500 NO-4035 Stavanger Norway Telephone: +47 51 99 00 00 www.equinor.com