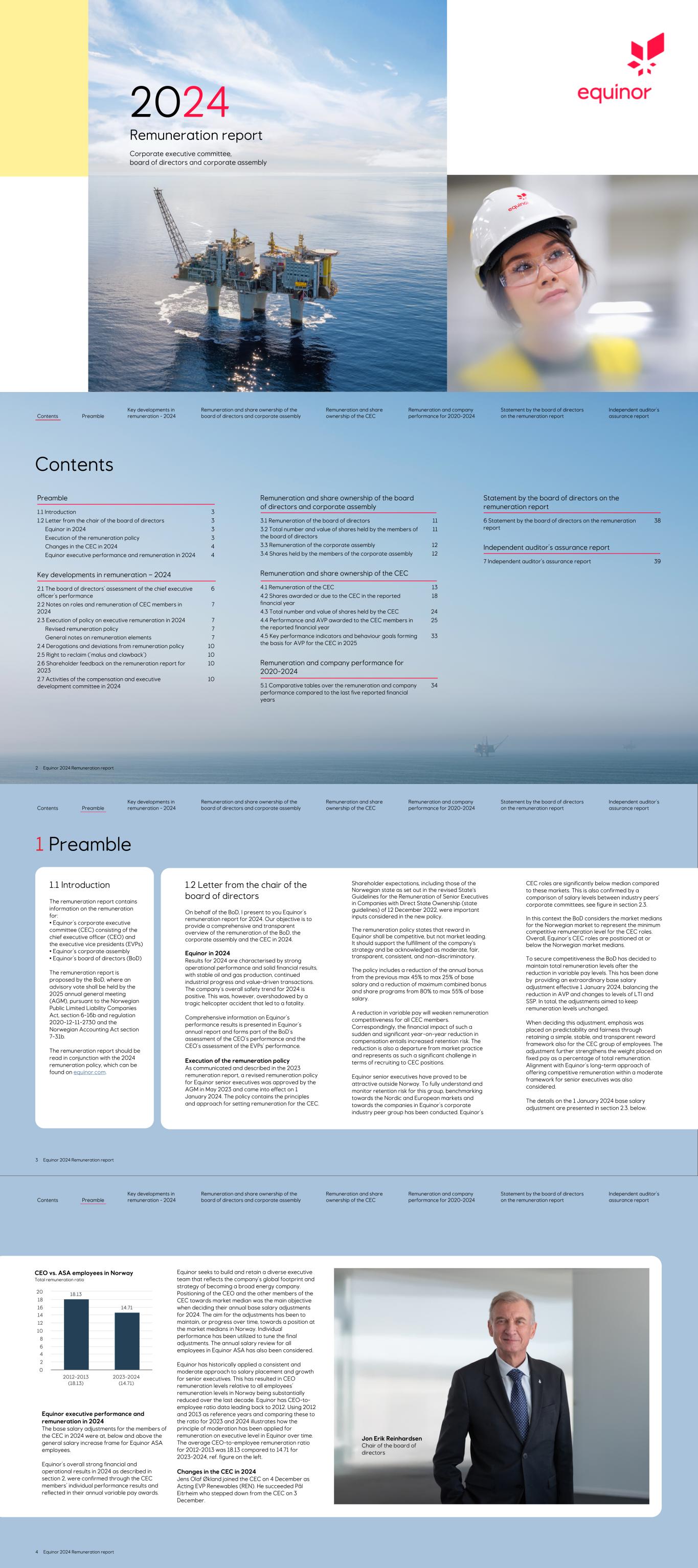

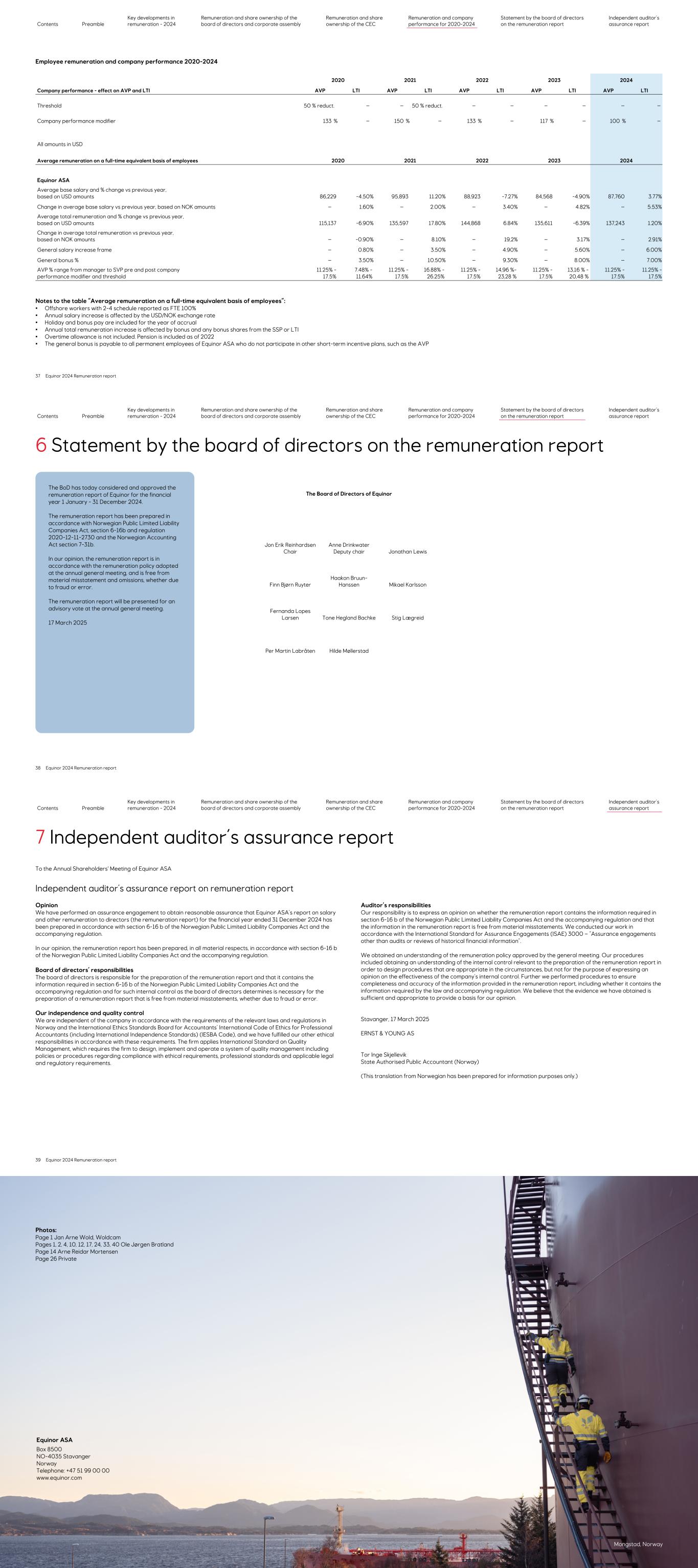

2024 Remuneration report Corporate executive committee, board of directors and corporate assembly Preamble 1.1 Introduction 3 1.2 Letter from the chair of the board of directors 3 Equinor in 2024 3 Execution of the remuneration policy 3 Changes in the CEC in 2024 4 Equinor executive performance and remuneration in 2024 4 Key developments in remuneration – 2024 2.1 The board of directors’ assessment of the chief executive officer’s performance 6 2.2 Notes on roles and remuneration of CEC members in 2024 7 2.3 Execution of policy on executive remuneration in 2024 7 Revised remuneration policy 7 General notes on remuneration elements 7 2.4 Derogations and deviations from remuneration policy 10 2.5 Right to reclaim (‘malus and clawback’) 10 2.6 Shareholder feedback on the remuneration report for 2023 10 2.7 Activities of the compensation and executive development committee in 2024 10 Remuneration and share ownership of the board of directors and corporate assembly 3.1 Remuneration of the board of directors 11 3.2 Total number and value of shares held by the members of the board of directors 11 3.3 Remuneration of the corporate assembly 12 3.4 Shares held by the members of the corporate assembly 12 Remuneration and share ownership of the CEC 4.1 Remuneration of the CEC 13 4.2 Shares awarded or due to the CEC in the reported financial year 18 4.3 Total number and value of shares held by the CEC 24 4.4 Performance and AVP awarded to the CEC members in the reported financial year 25 4.5 Key performance indicators and behaviour goals forming the basis for AVP for the CEC in 2025 33 Remuneration and company performance for 2020-2024 5.1 Comparative tables over the remuneration and company performance compared to the last five reported financial years 34 Statement by the board of directors on the remuneration report 6 Statement by the board of directors on the remuneration report 38 Independent auditor’s assurance report 7 Independent auditor’s assurance report 39 Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 2 Equinor 2024 Remuneration report Contents 1 Preamble 1.1 Introduction The remuneration report contains information on the remuneration for: • Equinor’s corporate executive committee (CEC) consisting of the chief executive officer (CEO) and the executive vice presidents (EVPs) • Equinor’s corporate assembly • Equinor’s board of directors (BoD) The remuneration report is proposed by the BoD, where an advisory vote shall be held by the 2025 annual general meeting (AGM), pursuant to the Norwegian Public Limited Liability Companies Act, section 6-16b and regulation 2020-12-11-2730 and the Norwegian Accounting Act section 7-31b. The remuneration report should be read in conjunction with the 2024 remuneration policy, which can be found on equinor.com. 1.2 Letter from the chair of the board of directors On behalf of the BoD, I present to you Equinor’s remuneration report for 2024. Our objective is to provide a comprehensive and transparent overview of the remuneration of the BoD, the corporate assembly and the CEC in 2024. Equinor in 2024 Results for 2024 are characterised by strong operational performance and solid financial results, with stable oil and gas production, continued industrial progress and value-driven transactions. The company’s overall safety trend for 2024 is positive. This was, however, overshadowed by a tragic helicopter accident that led to a fatality. Comprehensive information on Equinor’s performance results is presented in Equinor’s annual report and forms part of the BoD’s assessment of the CEO’s performance and the CEO’s assessment of the EVPs’ performance. Execution of the remuneration policy As communicated and described in the 2023 remuneration report, a revised remuneration policy for Equinor senior executives was approved by the AGM in May 2023 and came into effect on 1 January 2024. The policy contains the principles and approach for setting remuneration for the CEC. Shareholder expectations, including those of the Norwegian state as set out in the revised State's Guidelines for the Remuneration of Senior Executives in Companies with Direct State Ownership (state guidelines) of 12 December 2022, were important inputs considered in the new policy. The remuneration policy states that reward in Equinor shall be competitive, but not market leading. It should support the fulfillment of the company's strategy and be acknowledged as moderate, fair, transparent, consistent, and non-discriminatory. The policy includes a reduction of the annual bonus from the previous max 45% to max 25% of base salary and a reduction of maximum combined bonus and share programs from 80% to max 55% of base salary. A reduction in variable pay will weaken remuneration competitiveness for all CEC members. Correspondingly, the financial impact of such a sudden and significant year-on-year reduction in compensation entails increased retention risk. The reduction is also a departure from market practice and represents as such a significant challenge in terms of recruiting to CEC positions. Equinor senior executives have proved to be attractive outside Norway. To fully understand and monitor retention risk for this group, benchmarking towards the Nordic and European markets and towards the companies in Equinor’s corporate industry peer group has been conducted. Equinor’s CEC roles are significantly below median compared to these markets. This is also confirmed by a comparison of salary levels between industry peers’ corporate committees, see figure in section 2.3. In this context the BoD considers the market medians for the Norwegian market to represent the minimum competitive remuneration level for the CEC roles. Overall, Equinor’s CEC roles are positioned at or below the Norwegian market medians. To secure competitiveness the BoD has decided to maintain total remuneration levels after the reduction in variable pay levels. This has been done by providing an extraordinary base salary adjustment effective 1 January 2024, balancing the reduction in AVP and changes to levels of LTI and SSP. In total, the adjustments aimed to keep remuneration levels unchanged. When deciding this adjustment, emphasis was placed on predictability and fairness through retaining a simple, stable, and transparent reward framework also for the CEC group of employees. The adjustment further strengthens the weight placed on fixed pay as a percentage of total remuneration. Alignment with Equinor’s long-term approach of offering competitive remuneration within a moderate framework for senior executives was also considered. The details on the 1 January 2024 base salary adjustment are presented in section 2.3. below. Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 3 Equinor 2024 Remuneration report Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 4 Equinor 2024 Remuneration report CEO vs. ASA employees in Norway Total remuneration ratio 18.13 14.71 2012-2013 (18.13) 2023-2024 (14.71) 0 2 4 6 8 10 12 14 16 18 20 Equinor executive performance and remuneration in 2024 The base salary adjustments for the members of the CEC in 2024 were at, below and above the general salary increase frame for Equinor ASA employees. Equinor’s overall strong financial and operational results in 2024 as described in section 2, were confirmed through the CEC members’ individual performance results and reflected in their annual variable pay awards. Equinor seeks to build and retain a diverse executive team that reflects the company’s global footprint and strategy of becoming a broad energy company. Positioning of the CEO and the other members of the CEC towards market median was the main objective when deciding their annual base salary adjustments for 2024. The aim for the adjustments has been to maintain, or progress over time, towards a position at the market medians in Norway. Individual performance has been utilized to tune the final adjustments. The annual salary review for all employees in Equinor ASA has also been considered. Equinor has historically applied a consistent and moderate approach to salary placement and growth for senior executives. This has resulted in CEO remuneration levels relative to all employees’ remuneration levels in Norway being substantially reduced over the last decade. Equinor has CEO-to- employee ratio data leading back to 2012. Using 2012 and 2013 as reference years and comparing these to the ratio for 2023 and 2024 illustrates how the principle of moderation has been applied for remuneration on executive level in Equinor over time. The average CEO-to-employee remuneration ratio for 2012-2013 was 18.13 compared to 14.71 for 2023-2024, ref. figure on the left. Changes in the CEC in 2024 Jens Olaf Økland joined the CEC on 4 December as Acting EVP Renewables (REN). He succeeded Pål Eitrheim who stepped down from the CEC on 3 December. Jon Erik Reinhardsen Chair of the board of directors

Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 5 Equinor 2024 Remuneration report Corporate executive committee The president and CEO has the overall responsibility for day-to- day operations in Equinor. The CEO also appoints the CEC, which considers proposals for strategy, goals, financial statements, as well as important investments prior to submission to the BoD. Anders Opedal President and Chief Executive Officer Read Anders's CV Torgrim Reitan Executive Vice President and Chief Financial Officer Read Torgrim's CV Jannicke Nilsson Executive Vice President Safety, Security & Sustainability Read Jannicke's CV Kjetil Hove Executive Vice President Exploration & Production Norway Read Kjetil's CV Philippe Francois Mathieu Executive Vice President Exploration & Production International Read Philippe's CV Geir Tungesvik Executive Vice President Projects, Drilling & Procurement Read Geir's CV Irene Rummelhoff Executive Vice President Marketing, Midstream & Processing Read Irene's CV Jens Olaf Økland Acting Executive Vice President Renewables Read Jens's CV Hege Skryseth Executive Vice President Technology, Digital & Innovation Read Hege's CV Siv Helen Rygh Torstensen Executive Vice President Legal & Compliance Read Siv Helen's CV Jannik Lindbæk Executive Vice President Communication Read Jannik's CV Aksel Stenerud Executive Vice President People & Organisation Read Aksel's CV 2 Key developments in remuneration – 2024 2.1 The board of directors’ assessment of the chief executive officer’s performance 2024 proved to be a year characterised by high transactional activity, organisational adjustments and stable operations for Equinor. The challenging global security situation continued throughout the year. The volatility in interest rates, inflation and energy markets impacted the company's performance both positively and negatively throughout the different areas of the business. Equinor’s role as a key enabler for Europe’s energy security and supply remained important throughout the year. During 2024, the company developed a revised Energy Transition Plan subject to advisory vote at the 2025 AGM. For 2024, the power generation was affected negatively, especially due to operational matters in connection with commissioning of the Dogger Bank A project. Further commitment to the strategy was demonstrated though, through acquisitions, significant development within low carbon solutions and continued rightsizing of the organization within renewables . The board of directors acknowledge that the tragic fatality in connection with the SAR helicopter accident impairs the safety, security and sustainability (SSU) result. However, the chief executive officer`s long term commitment to improving results within the wider SSU perspective continues to show consistent and positive results. 2024 saw the lowest serious incident frequency score in the history of the company. For the oil and gas part of the business the operational results ended very strong. In total, Equinor delivered financially strong results with a very good relative return on average capital employed (RoACE). This proves the company’s ability to maintain high earnings and deliver on its ambitions even through challenging business contexts. In its total assessment of the chief executive officer`s performance for 2024, the board of directors has considered that the deliveries in the key areas have been above, at or below targets: The business delivery dimension (WHAT) used for the assessment of the chief executive officer`s variable remuneration (performance year 2024) was based on the following KPIs: serious incident frequency (SIF), upstream CO₂ intensity, REN power production, relative total shareholder return (TSR), RoACE and Unit production cost. Ref. also Table 4 for details. The 12 months’ SIF ratio result of 0.3 (0.29) is a record low result and according to the target of ≤ 0,3. Over the last 12 months 42 incidents have occurred. This represents a reduction of 20% in incidents compared to 2023. The CO2 intensity for the upstream portfolio ended at 6.2 kg CO2/boe in 2024. This is approximately a 7% decrease from the 2023 level, and the result is well below the target of 7.0 kg CO2/per boe. The positive development is primarily driven by increased gas exports at Troll and Oseberg, along with new production from the Breidablikk field. Additionally, decreased emissions resulting from the partial electrification of Troll B and C in 2024 contributed to the reduction in CO2 intensity. Unit production cost (UPC) ended at 6.4 USD/boe, which is according to the target of < 6.5 USD/boe. UPC has been impacted by general inflation. The NOK/USD currency effect has been 0.3 USD/boe favourable for UPC whilst lower production has had a negative effect of 0.03 USD/boe. REN power production, although increased by around 1,000 GWh from 2023, ended at 2,935 GWh, which was well below target. This was mainly due to a slow ramp-up of Dogger Bank. Two externally communicated downgrades have also been made in 2024. Financial results showed strong earnings. Equinor came out at the top among peers on relative RoACE. On the TSR ranking the result was however below target with Equinor ending 10 out of 12 in the peer group ranking. The financial robustness remains strong. The business behavior dimension (HOW) used for the assessment of the chief executive officer`s variable remuneration was based on the following set of goals: Demonstrate accountability, visibility, and engagement for safety, security, and compliance, Build trust in Equinor, Transform the organization to deliver on our common purpose and become a leading company in the energy transition, Develop strong and diverse succession pipeline, ref Table 4. The board of directors’ total assessment of these goals showed a continuous robust result and an overall improvement from 2023. There has been a high engagement from the chief executive officer in the process of updating the "I am safety roadmap" during autumn 2024, as well as continued structured focus both internally and externally related to security. Several significant transformative organisational measures have been taken during 2024 to reinforce the resilience of the company’s transition strategy. The year saw new leadership development programs being designed and implemented. Strong focus is placed on balancing continuity and talent acceleration in leadership appointments to secure robustness to corporate priority group roles and strengthen succession planning. The board of directors’ impression of progress and the status on overall employee satisfaction remains positive. Some aspects of confidence in senior management and belief in Equinor’s strategic level of ambitions have seen a decline in the 2024 Equinor employee’s satisfaction survey (GPS). The GPS does, however, show generally strong results. Overall, the board of directors is very satisfied with the chief executive officer`s performance in 2024. Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 6 Equinor 2024 Remuneration report 2.2 Notes on roles and remuneration of CEC members in 2024 2.3 Execution of policy on executive remuneration in 2024 The remuneration of the CEC members for 2024 was determined in accordance with the remuneration policy and principles approved by the AGM 10 May 2023. These principles, as well as details on the elements constituting executive remuneration are outlined in Equinor’s remuneration policy, ref equinor.com. The values-based performance framework and the main elements of remuneration applies to the CEC members employed by Equinor ASA and subsidiaries, in accordance with Equinor’s remuneration policy. Revised remuneration policy As noted in the 2023 remuneration report and explained in the letter from the chair of the board of directors, a revised executive remuneration policy came into effect from 1 January 2024. The policy reflects the expectations set out in the state guidelines of 12 December 2022. The following changes were introduced as compared to the previous policy: • The annual variable pay (AVP) target for CEC members employed in Equinor ASA has been reduced from 25% to 12.5% of base salary, with a maximum pay-out of 25% including the effect of the company performance modifier (CPM). • The CEO’s annual long-term incentive grant (LTI) has been reduced from 30% to 25% of base salary. The 25% LTI grant for EVPs, the 5% share saving plan (SSP) contribution and the 18% fixed salary addition paid in lieu of pension contributions above 12G1 remain unchanged. The above ensures that no CEC member exceeds the maximum of 55% variable remuneration as set out in Equinor's remuneration policy. To mitigate the changes in AVP and LTI, an adjustment has been calculated and applied to the base salary from 1 January 2024 to ensure that remuneration is maintained at the former level. Details on this calculation are described below. General notes on remuneration elements Fixed pay As in 2023, market benchmarks were conducted to establish Equinor’s position towards relevant peers in Norway. The peer group encompasses the largest companies in Norway, including peers where the Norwegian state has ownership interests. Based on Equinor’s financial value, business complexity and impact, the executive roles are generally being weighted higher than similar roles amongst peers in Norway. The benchmarks have therefore been supplemented with an extensive market data report allowing for comparison of remuneration data for similarly weighted executive roles across all market segments in Norway. This combined approach has enabled the establishment of broadly substantiated base salary market medians for all the Equinor CEC roles in a Norwegian market context. The BoD considers the market medians for the Norwegian market to represent the minimum competitive remuneration level for the CEC roles. Overall, Equinor’s CEC roles are positioned at or below the Norwegian market medians. The objective of the annual base salary review in 2024 has been to maintain or progress towards market median for similar positions in Norway, balancing individual performance and considering average salary growth for all employees in Equinor ASA. The annual base salary increases for the members of the CEC in 2024 were below, at or above the general increase frame in Equinor ASA. Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 7 Equinor 2024 Remuneration report CEC member Position Period on CEC in 2024 and notes on remuneration Anders Opedal President and chief executive officer (CEO) Full year Irene Rummelhoff EVP Marketing, Midstream & Processing (MMP) Full year Geir Tungesvik EVP Projects, Drilling & Procurement (PDP) Full year Geir Tungesvik maintained in the closed defined benefit scheme. Jannicke Nilsson EVP Safety, Security & Sustainability (SSU) Full year Pål Eitrheim EVP Renewables (REN) Until 3 December Philippe Francois Mathieu EVP Exploration & Production International (EPI) Full year Kjetil Hove EVP Exploration & Production Norway (EPN) Full year Hege Skryseth EVP Technology, Digital & Innovation (TDI) Full year Torgrim Reitan EVP and Chief financial officer (CFO) Full year Torgrim Reitan is entitled to early retirement from age 65 with a pension level amounting to 66% of pensionable salary. Siv Helen Rygh Torstensen EVP Legal & Compliance (LEG) Full year Aksel Stenerud EVP People & Organisation (PO) Full year Jannik Lindbæk EVP Communication (COM) Full year Jens Olaf Økland Acting EVP Renewables (REN) From 4 December 1) G represents the basic amount of the Norwegian social security system. 1G per 31 December 2024 equals NOK 124,028 While benchmarking towards Norwegian market medians forms the basis for reviewing base salary levels, the BoD also continuously monitors Equinor’s positioning towards the global market for executives. The difference between executive remuneration levels in Equinor compared to the Nordics, Europe and US has remained significant also in 2024. Equinor’s positioning vs. corporate industry peer group Numbers are total remuneration in MNOK Source: 2023 annual reports/remuneration reports Adjustment for reduced AVP To ensure competitiveness the BoD decided to maintain remuneration levels after the reduction in variable pay levels under the new 2024 remuneration policy, through providing an extraordinary base salary adjustment, effective 1 January 2024. The objective of this adjustment was to maintain the level of remuneration, as expressed by base salary, AVP, LTI, and SSP. The individual’s base salary increase is offset by the reduced AVP, while amounts on LTI for EVPs and SSP are increased proportionate to the base salary adjustment by the fixed percentages for these schemes. The LTI for the CEO is reduced due to a lowered LTI percentage. In totality, the adjustments to the referred reward elements have a neutral calculated effect on the individual’s remuneration per 1 January 2024, as compared to 31 December 2023. For the calculation of AVP, the average AVP award relative to target and the average company performance modifier (CPM) for the preceding 5- year period have been applied, to ensure that application of the AVP element in the above considerations is based on historical payment levels. The 18% fixed salary addition paid in lieu of pension contributions above 12 G is a contractual obligation and was therefore not considered when restructuring the remuneration components. Hence, the fixed salary addition has increased proportionate to the base salary adjustment. Variable remuneration Performance-based modifiers used in calculating variable pay As described in the remuneration policy, a threshold and a company performance modifier (CPM) are applied as a means of strengthening the link between the company’s overall financial results and the individual’s variable pay. The results of these modifiers for 2024 are presented to the right. Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 8 Equinor 2024 Remuneration report USA Europe Nordics Equinor 0 50 100 150 200 250 300 Threshold for payments under variable pay plans With reference to the definitions and parameters described in the remuneration policy, the company performance for 2024 is assessed as being in the green zone. (1) Cash flow provided by operating activities after tax and before working capital items was USD 17.9 billion (2) Net debt ratio and development was 11.9% (3) Company’s overall operational and financial performance: ref. the annual report Combined result in green zone No reduction in payout Company performance modifier With reference to the definitions and parameters described in the remuneration policy, the CPM for 2024 is set at 100 %. Q1 100% 117% 133% 150% Q2 83% 100% 117% 133% Q3 67% 83% 100% 117% Q4 50% 67% 83% 100% Q4 Q3 Q2 Q1 Relative RoACE result: number one (first quartile) in the peer group of 12 companies, including Equinor. Relative TSR result: number 10 (fourth quartile) in the same peer group. This results in a CPM at 100 % Relative TSR Re la tiv e Ro A C E

Effect of performance-based modifiers on variable pay in 2024 Based on the overall company performance in 2024 and in accordance with the results for the threshold criteria described in the remuneration policy, no threshold effect was applied for 2024 and consequently the AVP payments were not reduced. The target for annual variable pay for the CEC members, all of whom were employees of Equinor ASA in 2024 was 12.5% of base salary, and the maximum annual variable pay for 2024 was 25% of base salary including the effect of the CPM. The CPM was set at 100% for 2024. The LTI grants in 2024 were not reduced, as the threshold for the previous year – 2023 – was in the green zone. Summary of targets and achievement of corporate performance indicators and goals forming the basis for annual variable pay As described in the remuneration policy: • performance forms the basis for the decision on AVP percentages for the members of the CEC • common corporate delivery KPIs, business area specific delivery KPIs and behaviour goals are measured separately and assessed holistically Delivery in 2024 against the selected corporate delivery goals (“what” dimension) which are applied to the CEO, as well as the individual EVPs, is summarized as follows: In terms of the “how” dimension, common behaviour goals are defined for the CEO and the EVPs with reference to Equinor’s core values and leadership principles, as follows: • Demonstrate accountability, visibility, and engagement for safety, security and compliance • Build trust in Equinor • Transform the organization to deliver on our common purpose and become a leading company in the energy transition • Develop strong and diverse succession pipeline Performance against these behaviour goals is measured on an individual basis for the CEC members. The KPI targets and results of the business deliveries (“what”), and the behaviour goals and results (“how”) and how these translate into the AVP award are presented for the individual CEC members in the Table 4 section further below. The KPI targets and behaviour goals applicable for the performance measurement for AVP in 2025 are presented in section 4.5. Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 9 Equinor 2024 Remuneration report KPI Target Performance Serious Incident Frequency 0.3 or better 0.3 CO2 intensity for the upstream portfolio 7 kg CO₂ per boe or better 6.2 kg/boe Relative TSR Ranked better than peer average Fourth quartile Relative RoACE Ranked in first quartile among peers First quartile Unit production cost (UPC)1 better than 6.5 USD / boe 6.4 USD / boe Renewable (REN) power production1 Doubling from 2023 2.9 TWh 1) Only apply to the CEO and staffs EVPs For EVPs with business area responsibilities, the assessment of the business delivery dimension has in addition been made against the following KPIs: Business area KPI Unit Target EPN Production kboe/d 1,400 UPC nominal USD/boe <6.0 Break-even project portfolio USD/bbl real 2023 ~35 EPI Production kboe/d 672 UPC nominal USD/boe <7.8 Break-even project portfolio USD/bbl real 2023 ~35 MMP Production efficiency % ≥91.5 Accessed storage volume additions Mton >6 Adjusted earnings USD bn Above mid-range (>2.4) REN REN power generation TWh Doubling from 2023 Adjusted earnings USD bn >-0.35 Strategic progress in renewables – Projects progressed to Final Investment Decision GW 2.5 PDP Number of wells number 107 Break-even project portfolio USD/bbl real 2023 ~35 Estimate development DG3-DG4 (changes) % ≤0 TDI High Impact Technology Implementation (HITI) - Tier 1 Implementation (value and implementation %, EPN) % >90 IT investment and R&D (cost development %) % <0 IT Opex (cost development %) % <0 Benefits As described in the remuneration policy, members of the CEC employed in Equinor ASA are covered by the company’s general occupational defined contribution pension scheme. A defined benefit scheme is retained for a grandfathered group of employees. In 2024, this applies to Geir Tungesvik. A fixed salary addition calculated as 18% of base salary is provided in lieu of pension accrual above 12 G to members of the CEC covered by the general defined contribution pension scheme and who were employed by Equinor ASA before 1 September 2017. This addition does not form part either of the pensionable salary or of the basis for variable pay. 2.4 Derogations and deviations from remuneration policy There were no derogations or deviations from the remuneration policy in 2024. 2.5 Right to reclaim (‘malus and clawback’) There were no cases where the right to reclaim was exercised in 2024. 2.6 Shareholder feedback on the remuneration report for 2023 The remuneration report for 2023 was presented for approval (advisory vote) at the annual general meeting on 14 May 2024 and was endorsed by a significant majority. The portion of the votes in favour of the remuneration report for 2023 constituted 97% of the total votes cast. There were no additional statements from shareholders regarding the 2023 remuneration report to the 2024 AGM. 2.7 Activities of the compensation and executive development committee in 2024 The activities of the board compensation and executive development committee (BCC) in 2024 were in line with the instructions from the BoD which are available on equinor.com. The BCC had a high focus in 2024 on ensuring that the 2024 remuneration report accurately reflects the new policy and the revised state guidelines. Other activities included: • Discussions on the trends within the executive talent market and executive remuneration • Executive succession planning and talent review • Recommendation to the BoD on the threshold used in calculating variable remuneration, based on relevant company performance results • Recommendation to the BoD on the base salary review for the CEO • Review and submission for approval of the BoD of the performance evaluation and goals for the CEO • Assessment and submission for the decision of the BoD of the proposal for AVP of the CEO • Presentation by the CEO of the performance assessment and considerations on AVP awards to the EVPs • Discussion of the evaluation by the BoD and self-assessment of the performance of the BCC • Review and submission for approval of the BoD of the instructions to the BCC Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 10 Equinor 2024 Remuneration report Tjeldbergodden, Norway 3 Remuneration and share ownership of the board of directors and corporate assembly 3.1 Remuneration of the board of directors In 2024, the total remuneration to the BoD, including fees for the BoD's three committees, was USD 805 thousand (NOK 8,644 thousand). Detailed information about the individual remuneration to the members of the BoD in 2024 is provided in the table below. 3.2 Total number and value of shares held by the members of the board of directors The number of Equinor shares owned by members of the BoD of and/or owned by their close associates is shown below. Individually, each member of the BoD owned less than 1% of the outstanding Equinor shares. The voting rights of members of the BoD, the CEC and the corporate assembly as a shareholder do not differ from those of ordinary shareholders. Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 11 Equinor 2024 Remuneration report Total remuneration Members of the BoD (figures in USD thousands) 2020 2021 2022 2023 2024 Jon Erik Reinhardsen (chair of the BoD) 108 119 110 103 110 Anne Drinkwater (deputy chair of the BoD) 88 82 96 101 107 Rebekka Glasser Herlofsen1 59 66 66 67 33 Jonathan Lewis 76 70 80 82 91 Finn Bjørn Ruyter 69 77 71 67 69 Tove Andersen1 27 59 55 52 26 Haakon Bruun-Hanssen — — — 66 67 Mikael Karlsson2 — — — — 57 Fernanda Lopes Larsen3 — — — — 36 Tone Hegland Bachke3 — — — — 28 Stig Lægreid4 54 59 55 53 56 Per Martin Labråten4 54 66 65 62 64 Hilde Møllerstad4 59 66 61 57 59 Employee representative deputy members of the BoD Bjørn Palerud — — — — — Anita Skaga Myking — — — — — Harald Wesenberg — — — — — 1) Member of the BoD until 30 June 2024. 2) Member of the BoD from 1 April 2024. 3) Member of the BoD from 1 July 2024. 4) Employee-representative members of the BoD. Total remuneration of members of the BoD (figures in USD thousand) 2020 2021 2022 2023 2024 754 832 801 746 805 Ownership of Equinor shares (incl. shares owned by close associates) As of 1 Jan 2024 As of 31 Dec 2024 Market value as of 31 Dec 2024, USD thousands As of 4 March 2025 Jon Erik Reinhardsen 4,584 4,584 113 4,584 Anne Drinkwater 1,100 1,100 27 1,100 Rebekka Glasser Herlofsen 220 — — — Jonathan Lewis — — — — Finn Bjørn Ruyter 620 620 15 620 Tove Andersen 4,700 — — — Haakon Bruun-Hanssen — — — — Mikael Karlsson — — — — Fernanda Lopes Larsen — — — — Tone Hegland Bachke — 5,400 133 5,400 Stig Lægreid 147 340 8 340 Per Martin Labråten 894 1,171 29 1,265 Hilde Møllerstad 3,005 4,413 109 4,813 Deputy members Bjørn Palerud 1,305 1,922 47 1,922 Anita Skaga Myking 6,654 7,032 174 7,189 Harald Wesenberg 936 584 14 431 Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 12 Equinor 2024 Remuneration report 3.3 Remuneration of the corporate assembly In 2024, the total remuneration to the shareholder and employee-elected members of the corporate assembly was USD 124 thousand (NOK 1,336 thousand). Total remuneration Corporate assembly employee elected members (figures in USD thousand) 2023 2024 Peter B., Sabel 5 5 Trine Hansen Stavland 3 5 Ingvild Berg Martiniussen 5 5 Berit Søgnen Sandven 5 5 Frank Indreland Gundersen 3 5 Per Helge Ødegård 5 5 Vidar Frøseth (observer) 3 5 Kjetil Gjerstad (observer) 4 5 Porfirio Esquivel (observer)1 1 5 Employee elected deputy members who received member fees Hans Fjære Øvrum 1 Monica Martinsen 1 Total remuneration 45 48 1) Porfirio Esquivel took over as observer 1 January 2024 as previous observer Raymond Midtgård is on leave. 3.4 Shares held by the members of the corporate assembly Individually, each member of the corporate assembly owned less than 1% of the outstanding Equinor shares as of 31 December 2024 and as of 4 March 2025. In aggregate, members of the corporate assembly owned a total of 23,975 shares as of 31 December 2024 and a total of 23,779 shares as of 4 March 2025. Information about the individual share ownership of the members of the corporate assembly is presented in section 8 in the «Board statement on corporate governance».

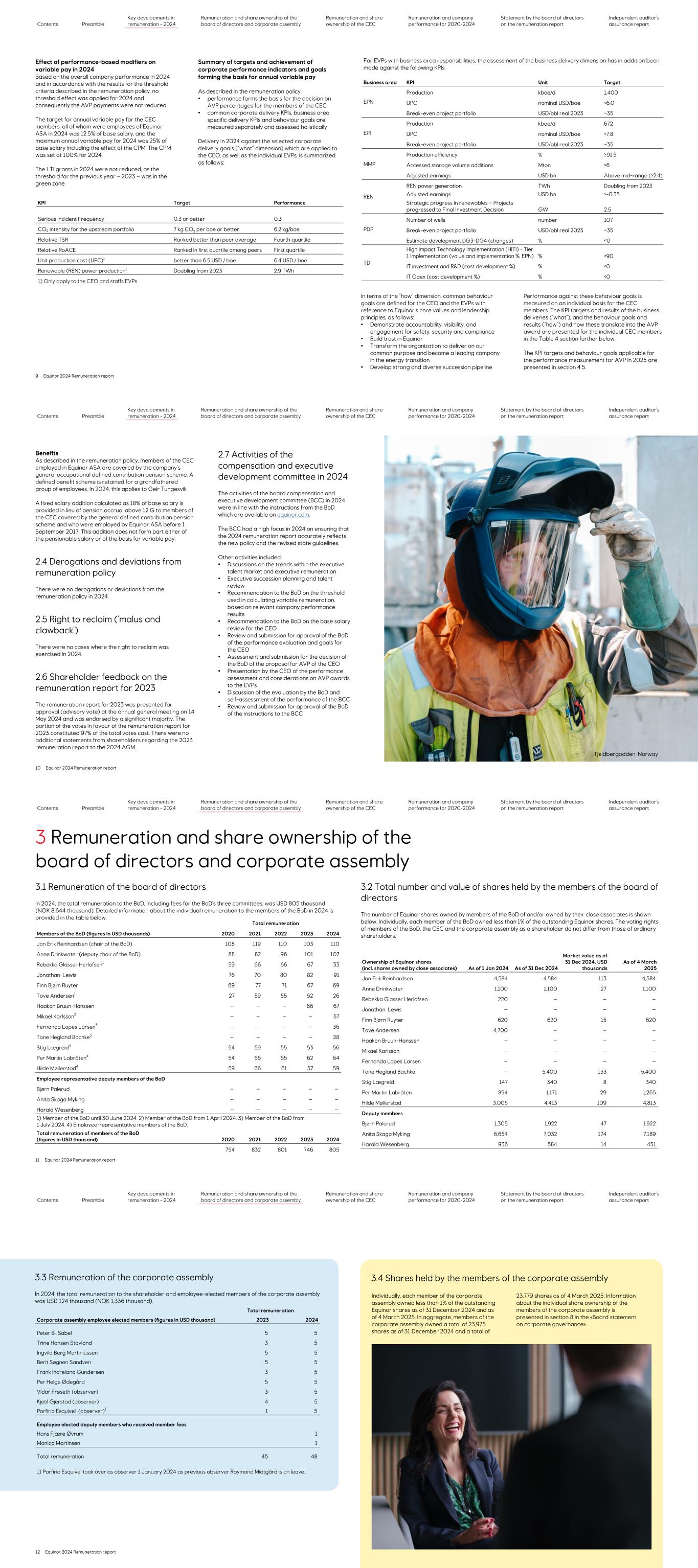

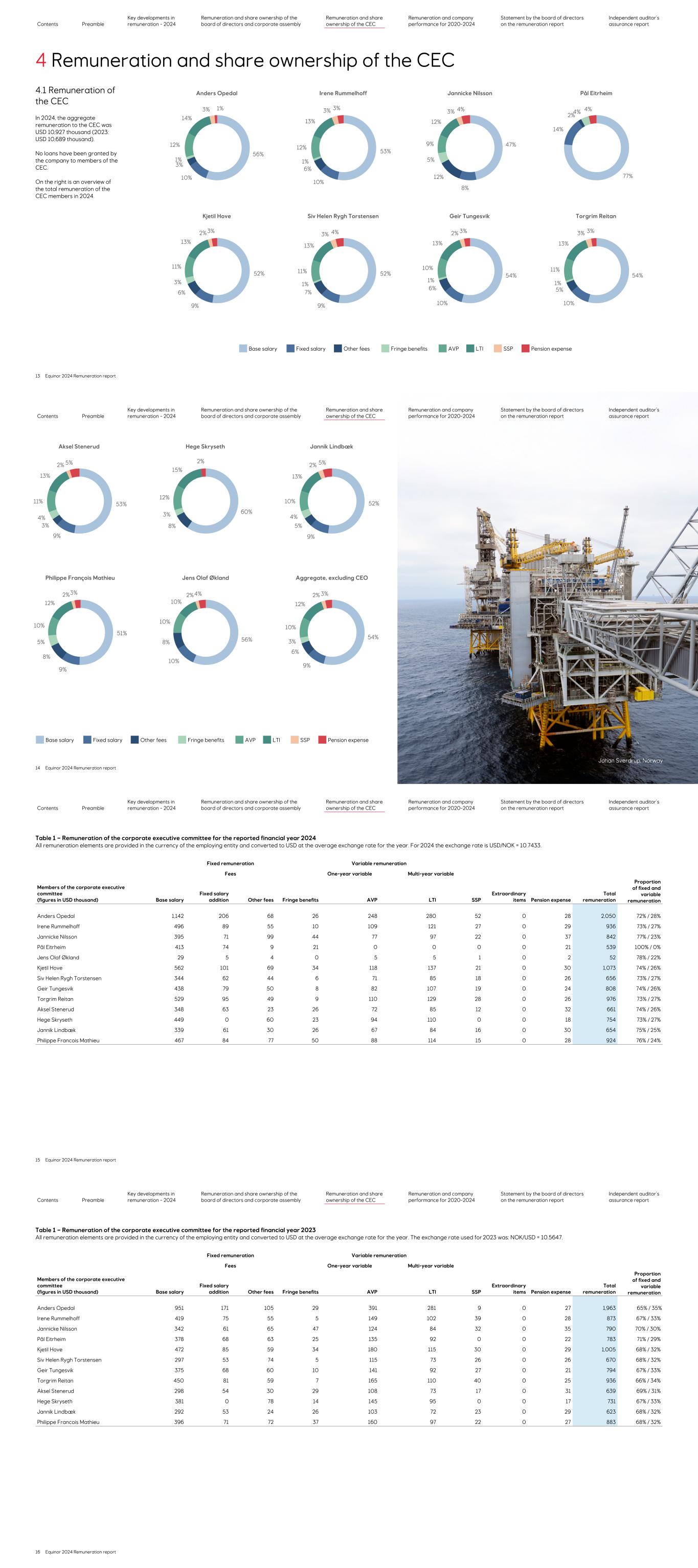

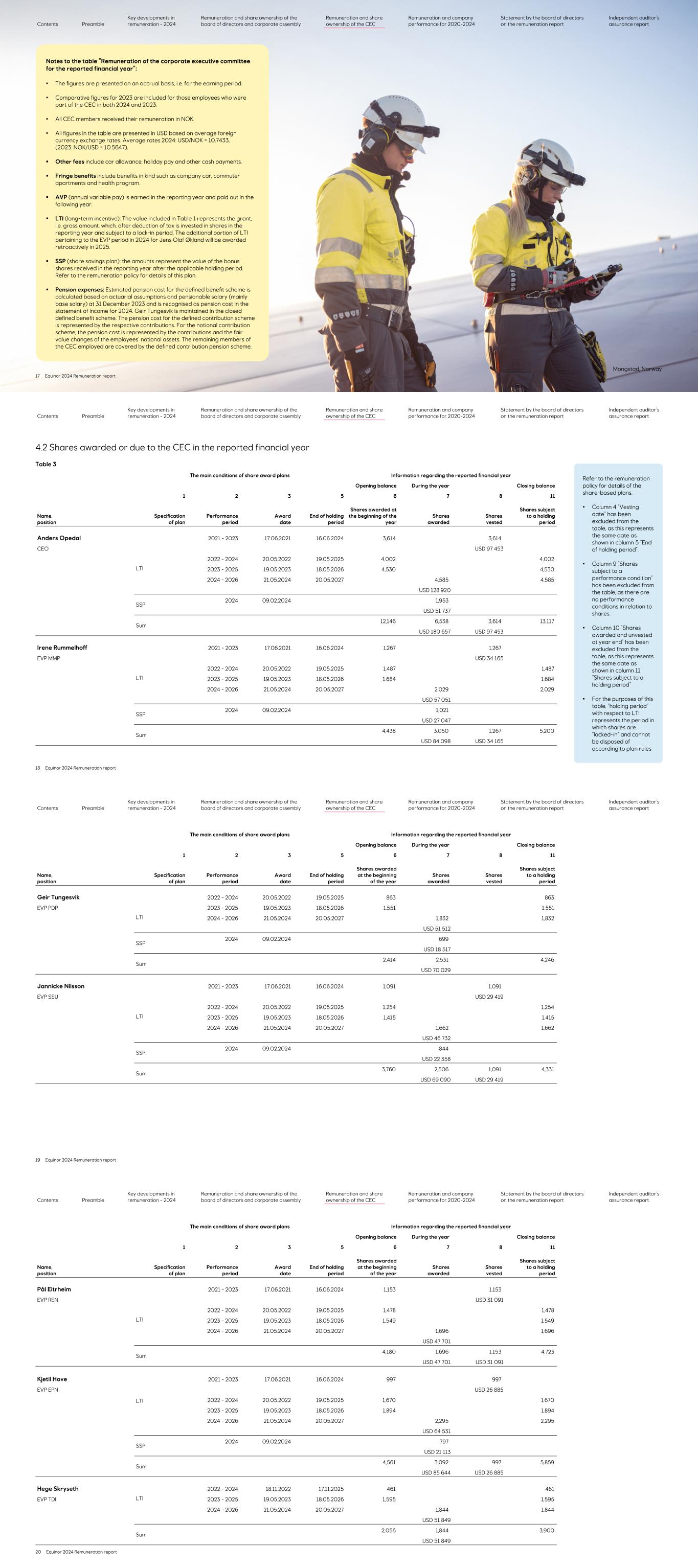

4 Remuneration and share ownership of the CEC 4.1 Remuneration of the CEC In 2024, the aggregate remuneration to the CEC was USD 10,927 thousand (2023: USD 10,689 thousand). No loans have been granted by the company to members of the CEC. On the right is an overview of the total remuneration of the CEC members in 2024. Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 13 Equinor 2024 Remuneration report Anders Opedal 56% 10% 3% 1% 12% 14% 3% 1% Irene Rummelhoff 53% 10% 6% 1% 12% 13% 3% 3% Jannicke Nilsson 47% 8% 12% 5% 9% 12% 3% 4% Pål Eitrheim 77% 14% 2%4% 4% Kjetil Hove 52% 9% 6% 3% 11% 13% 2%3% Siv Helen Rygh Torstensen 52% 9% 7% 1% 11% 13% 3% 4% Geir Tungesvik 54% 10% 6% 1% 10% 13% 2% 3% Torgrim Reitan 54% 10% 5% 1% 11% 13% 3% 3% Base salary Fixed salary Other fees Fringe benefits AVP LTI SSP Pension expense Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 14 Equinor 2024 Remuneration report Aksel Stenerud 53% 9% 3% 4% 11% 13% 2% 5% Hege Skryseth 60% 8% 3% 12% 15% 2% Jannik Lindbæk 52% 9% 5% 4% 10% 13% 2% 5% Philippe François Mathieu 51% 9% 8% 5% 10% 12% 2%3% Aggregate, excluding CEO 54% 9% 6% 3% 10% 12% 2% 3% Base salary Fixed salary Other fees Fringe benefits AVP LTI SSP Pension expense Jens Olaf Økland 56% 10% 8% 10% 10% 2%4% Johan Sverdrup, Norway Table 1 – Remuneration of the corporate executive committee for the reported financial year 2024 All remuneration elements are provided in the currency of the employing entity and converted to USD at the average exchange rate for the year. For 2024 the exchange rate is USD/NOK = 10.7433. Fixed remuneration Variable remuneration Fees One-year variable Multi-year variable Members of the corporate executive committee (figures in USD thousand) Base salary Fixed salary addition Other fees Fringe benefits AVP LTI SSP Extraordinary items Pension expense Total remuneration Proportion of fixed and variable remuneration Anders Opedal 1,142 206 68 26 248 280 52 0 28 2,050 72% / 28% Irene Rummelhoff 496 89 55 10 109 121 27 0 29 936 73% / 27% Jannicke Nilsson 395 71 99 44 77 97 22 0 37 842 77% / 23% Pål Eitrheim 413 74 9 21 0 0 0 0 21 539 100% / 0% Jens Olaf Økland 29 5 4 0 5 5 1 0 2 52 78% / 22% Kjetil Hove 562 101 69 34 118 137 21 0 30 1,073 74% / 26% Siv Helen Rygh Torstensen 344 62 44 6 71 85 18 0 26 656 73% / 27% Geir Tungesvik 438 79 50 8 82 107 19 0 24 808 74% / 26% Torgrim Reitan 529 95 49 9 110 129 28 0 26 976 73% / 27% Aksel Stenerud 348 63 23 26 72 85 12 0 32 661 74% / 26% Hege Skryseth 449 0 60 23 94 110 0 0 18 754 73% / 27% Jannik Lindbæk 339 61 30 26 67 84 16 0 30 654 75% / 25% Philippe Francois Mathieu 467 84 77 50 88 114 15 0 28 924 76% / 24% Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 15 Equinor 2024 Remuneration report Table 1 – Remuneration of the corporate executive committee for the reported financial year 2023 All remuneration elements are provided in the currency of the employing entity and converted to USD at the average exchange rate for the year. The exchange rate used for 2023 was: NOK/USD = 10.5647. Fixed remuneration Variable remuneration Fees One-year variable Multi-year variable Members of the corporate executive committee (figures in USD thousand) Base salary Fixed salary addition Other fees Fringe benefits AVP LTI SSP Extraordinary items Pension expense Total remuneration Proportion of fixed and variable remuneration Anders Opedal 951 171 105 29 391 281 9 0 27 1,963 65% / 35% Irene Rummelhoff 419 75 55 5 149 102 39 0 28 873 67% / 33% Jannicke Nilsson 342 61 65 47 124 84 32 0 35 790 70% / 30% Pål Eitrheim 378 68 63 25 135 92 0 0 22 783 71% / 29% Kjetil Hove 472 85 59 34 180 115 30 0 29 1,005 68% / 32% Siv Helen Rygh Torstensen 297 53 74 5 115 73 26 0 26 670 68% / 32% Geir Tungesvik 375 68 60 10 141 92 27 0 21 794 67% / 33% Torgrim Reitan 450 81 59 7 165 110 40 0 25 936 66% / 34% Aksel Stenerud 298 54 30 29 108 73 17 0 31 639 69% / 31% Hege Skryseth 381 0 78 14 145 95 0 0 17 731 67% / 33% Jannik Lindbæk 292 53 24 26 103 72 23 0 29 623 68% / 32% Philippe Francois Mathieu 396 71 72 37 160 97 22 0 27 883 68% / 32% Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 16 Equinor 2024 Remuneration report

Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 17 Equinor 2024 Remuneration report Notes to the table “Remuneration of the corporate executive committee for the reported financial year”: • The figures are presented on an accrual basis, i.e. for the earning period. • Comparative figures for 2023 are included for those employees who were part of the CEC in both 2024 and 2023. • All CEC members received their remuneration in NOK. • All figures in the table are presented in USD based on average foreign currency exchange rates. Average rates 2024: USD/NOK = 10.7433, (2023: NOK/USD = 10.5647). • Other fees include car allowance, holiday pay and other cash payments. • Fringe benefits include benefits in kind such as company car, commuter apartments and health program. • AVP (annual variable pay) is earned in the reporting year and paid out in the following year. • LTI (long-term incentive): The value included in Table 1 represents the grant, i.e. gross amount, which, after deduction of tax is invested in shares in the reporting year and subject to a lock-in period. The additional portion of LTI pertaining to the EVP period in 2024 for Jens Olaf Økland will be awarded retroactively in 2025. • SSP (share savings plan): the amounts represent the value of the bonus shares received in the reporting year after the applicable holding period. Refer to the remuneration policy for details of this plan. • Pension expenses: Estimated pension cost for the defined benefit scheme is calculated based on actuarial assumptions and pensionable salary (mainly base salary) at 31 December 2023 and is recognised as pension cost in the statement of income for 2024. Geir Tungesvik is maintained in the closed defined benefit scheme. The pension cost for the defined contribution scheme is represented by the respective contributions. For the notional contribution scheme, the pension cost is represented by the contributions and the fair value changes of the employees’ notional assets. The remaining members of the CEC employed are covered by the defined contribution pension scheme. Mongstad, Norway 4.2 Shares awarded or due to the CEC in the reported financial year Table 3 The main conditions of share award plans Information regarding the reported financial year Opening balance During the year Closing balance 1 2 3 5 6 7 8 11 Name, position Specification of plan Performance period Award date End of holding period Shares awarded at the beginning of the year Shares awarded Shares vested Shares subject to a holding period Anders Opedal 2021 - 2023 17.06.2021 16.06.2024 3,614 3,614 CEO USD 97 453 LTI 2022 - 2024 20.05.2022 19.05.2025 4,002 4,002 2023 - 2025 19.05.2023 18.05.2026 4,530 4,530 2024 - 2026 21.05.2024 20.05.2027 4,585 4,585 USD 128 920 SSP 2024 09.02.2024 1,953 USD 51 737 Sum 12,146 6,538 3,614 13,117 USD 180 657 USD 97 453 Irene Rummelhoff 2021 - 2023 17.06.2021 16.06.2024 1,267 1,267 EVP MMP USD 34 165 LTI 2022 - 2024 20.05.2022 19.05.2025 1,487 1,487 2023 - 2025 19.05.2023 18.05.2026 1,684 1,684 2024 - 2026 21.05.2024 20.05.2027 2,029 2,029 USD 57 051 SSP 2024 09.02.2024 1,021 USD 27 047 Sum 4,438 3,050 1,267 5,200 USD 84 098 USD 34 165 Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 18 Equinor 2024 Remuneration report Refer to the remuneration policy for details of the share-based plans. • Column 4 “Vesting date” has been excluded from the table, as this represents the same date as shown in column 5 “End of holding period”. • Column 9 “Shares subject to a performance condition” has been excluded from the table, as there are no performance conditions in relation to shares. • Column 10 “Shares awarded and unvested at year end” has been excluded from the table, as this represents the same date as shown in column 11 “Shares subject to a holding period“ • For the purposes of this table, “holding period” with respect to LTI represents the period in which shares are “locked-in” and cannot be disposed of according to plan rules The main conditions of share award plans Information regarding the reported financial year Opening balance During the year Closing balance 1 2 3 5 6 7 8 11 Name, position Specification of plan Performance period Award date End of holding period Shares awarded at the beginning of the year Shares awarded Shares vested Shares subject to a holding period Geir Tungesvik 2022 - 2024 20.05.2022 19.05.2025 863 863 EVP PDP 2023 - 2025 19.05.2023 18.05.2026 1,551 1,551 LTI 2024 - 2026 21.05.2024 20.05.2027 1,832 1,832 USD 51 512 SSP 2024 09.02.2024 699 USD 18 517 Sum 2,414 2,531 4,246 USD 70 029 Jannicke Nilsson 2021 - 2023 17.06.2021 16.06.2024 1,091 1,091 EVP SSU USD 29 419 LTI 2022 - 2024 20.05.2022 19.05.2025 1,254 1,254 2023 - 2025 19.05.2023 18.05.2026 1,415 1,415 2024 - 2026 21.05.2024 20.05.2027 1,662 1,662 USD 46 732 SSP 2024 09.02.2024 844 USD 22 358 Sum 3,760 2,506 1,091 4,331 USD 69 090 USD 29 419 Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 19 Equinor 2024 Remuneration report The main conditions of share award plans Information regarding the reported financial year Opening balance During the year Closing balance 1 2 3 5 6 7 8 11 Name, position Specification of plan Performance period Award date End of holding period Shares awarded at the beginning of the year Shares awarded Shares vested Shares subject to a holding period Pål Eitrheim 2021 - 2023 17.06.2021 16.06.2024 1,153 1,153 EVP REN USD 31 091 LTI 2022 - 2024 20.05.2022 19.05.2025 1,478 1,478 2023 - 2025 19.05.2023 18.05.2026 1,549 1,549 2024 - 2026 21.05.2024 20.05.2027 1,696 1,696 USD 47 701 Sum 4,180 1,696 1,153 4,723 USD 47 701 USD 31 091 Kjetil Hove LTI 2021 - 2023 17.06.2021 16.06.2024 997 997 EVP EPN USD 26 885 2022 - 2024 20.05.2022 19.05.2025 1,670 1,670 2023 - 2025 19.05.2023 18.05.2026 1,894 1,894 2024 - 2026 21.05.2024 20.05.2027 2,295 2,295 USD 64 531 SSP 2024 09.02.2024 797 USD 21 113 Sum 4,561 3,092 997 5,859 USD 85 644 USD 26 885 Hege Skryseth 2022 - 2024 18.11.2022 17.11.2025 461 461 EVP TDI LTI 2023 - 2025 19.05.2023 18.05.2026 1,595 1,595 2024 - 2026 21.05.2024 20.05.2027 1,844 1,844 USD 51 849 Sum 2,056 1,844 3,900 USD 51 849 Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 20 Equinor 2024 Remuneration report

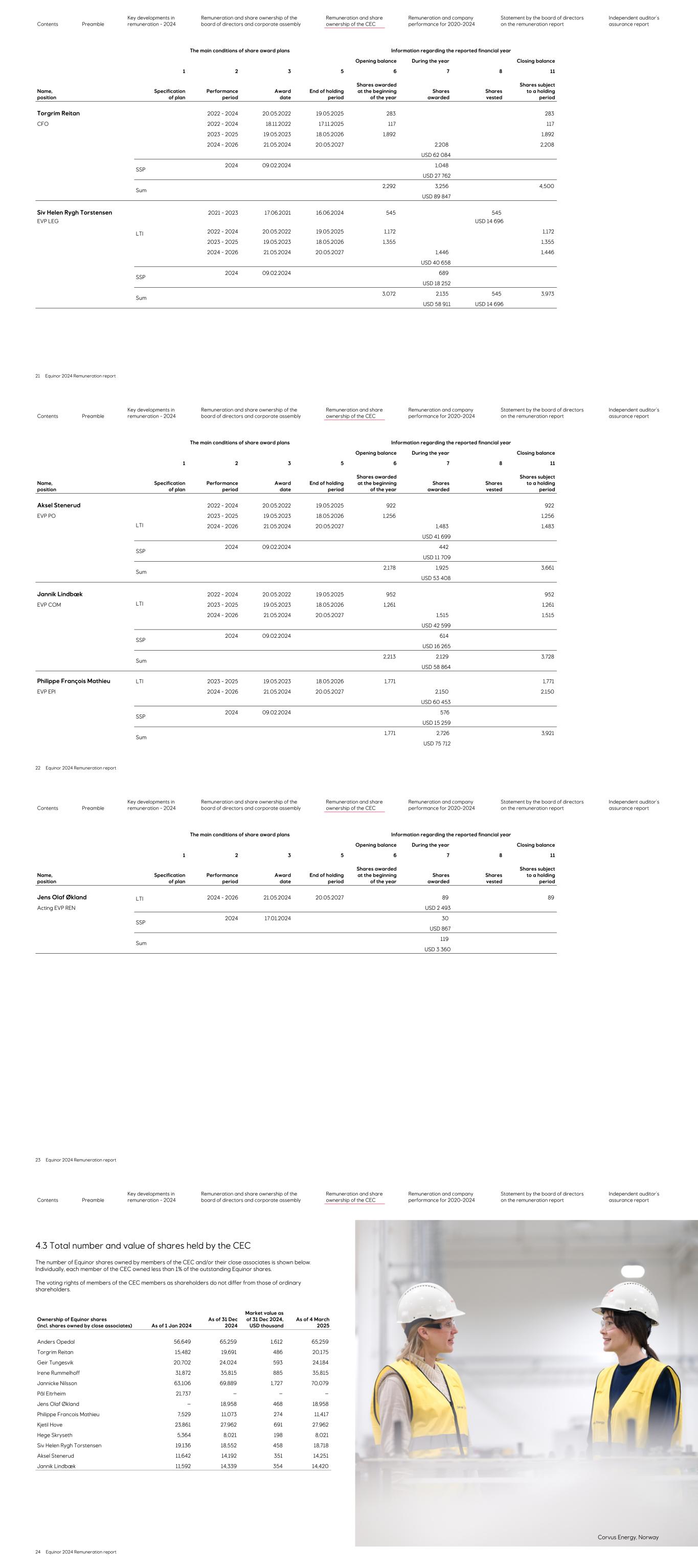

The main conditions of share award plans Information regarding the reported financial year Opening balance During the year Closing balance 1 2 3 5 6 7 8 11 Name, position Specification of plan Performance period Award date End of holding period Shares awarded at the beginning of the year Shares awarded Shares vested Shares subject to a holding period Torgrim Reitan 2022 - 2024 20.05.2022 19.05.2025 283 283 CFO 2022 - 2024 18.11.2022 17.11.2025 117 117 2023 - 2025 19.05.2023 18.05.2026 1,892 1,892 2024 - 2026 21.05.2024 20.05.2027 2,208 2,208 USD 62 084 SSP 2024 09.02.2024 1,048 USD 27 762 Sum 2,292 3,256 4,500 USD 89 847 Siv Helen Rygh Torstensen LTI 2021 - 2023 17.06.2021 16.06.2024 545 545 EVP LEG USD 14 696 2022 - 2024 20.05.2022 19.05.2025 1,172 1,172 2023 - 2025 19.05.2023 18.05.2026 1,355 1,355 2024 - 2026 21.05.2024 20.05.2027 1,446 1,446 USD 40 658 SSP 2024 09.02.2024 689 USD 18 252 Sum 3,072 2,135 545 3,973 USD 58 911 USD 14 696 Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 21 Equinor 2024 Remuneration report The main conditions of share award plans Information regarding the reported financial year Opening balance During the year Closing balance 1 2 3 5 6 7 8 11 Name, position Specification of plan Performance period Award date End of holding period Shares awarded at the beginning of the year Shares awarded Shares vested Shares subject to a holding period Aksel Stenerud 2022 - 2024 20.05.2022 19.05.2025 922 922 EVP PO 2023 - 2025 19.05.2023 18.05.2026 1,256 1,256 LTI 2024 - 2026 21.05.2024 20.05.2027 1,483 1,483 USD 41 699 SSP 2024 09.02.2024 442 USD 11 709 Sum 2,178 1,925 3,661 USD 53 408 Jannik Lindbæk 2022 - 2024 20.05.2022 19.05.2025 952 952 EVP COM LTI 2023 - 2025 19.05.2023 18.05.2026 1,261 1,261 2024 - 2026 21.05.2024 20.05.2027 1,515 1,515 USD 42 599 SSP 2024 09.02.2024 614 USD 16 265 Sum 2,213 2,129 3,728 USD 58 864 Philippe François Mathieu LTI 2023 - 2025 19.05.2023 18.05.2026 1,771 1,771 EVP EPI 2024 - 2026 21.05.2024 20.05.2027 2,150 2,150 USD 60 453 SSP 2024 09.02.2024 576 USD 15 259 Sum 1,771 2,726 3,921 USD 75 712 Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 22 Equinor 2024 Remuneration report The main conditions of share award plans Information regarding the reported financial year Opening balance During the year Closing balance 1 2 3 5 6 7 8 11 Name, position Specification of plan Performance period Award date End of holding period Shares awarded at the beginning of the year Shares awarded Shares vested Shares subject to a holding period Jens Olaf Økland LTI 2024 - 2026 21.05.2024 20.05.2027 89 89 Acting EVP REN USD 2 493 SSP 2024 17.01.2024 30 USD 867 Sum 119 USD 3 360 Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 23 Equinor 2024 Remuneration report 4.3 Total number and value of shares held by the CEC The number of Equinor shares owned by members of the CEC and/or their close associates is shown below. Individually, each member of the CEC owned less than 1% of the outstanding Equinor shares. The voting rights of members of the CEC members as shareholders do not differ from those of ordinary shareholders. Ownership of Equinor shares (incl. shares owned by close associates) As of 1 Jan 2024 As of 31 Dec 2024 Market value as of 31 Dec 2024, USD thousand As of 4 March 2025 Anders Opedal 56,649 65,259 1,612 65,259 Torgrim Reitan 15,482 19,691 486 20,175 Geir Tungesvik 20,702 24,024 593 24,184 Irene Rummelhoff 31,872 35,815 885 35,815 Jannicke Nilsson 63,106 69,889 1,727 70,079 Pål Eitrheim 21,737 — — — Jens Olaf Økland — 18,958 468 18,958 Philippe Francois Mathieu 7,529 11,073 274 11,417 Kjetil Hove 23,861 27,962 691 27,962 Hege Skryseth 5,364 8,021 198 8,021 Siv Helen Rygh Torstensen 19,136 18,552 458 18,718 Aksel Stenerud 11,642 14,192 351 14,251 Jannik Lindbæk 11,592 14,339 354 14,420 Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 24 Equinor 2024 Remuneration report Corvus Energy, Norway

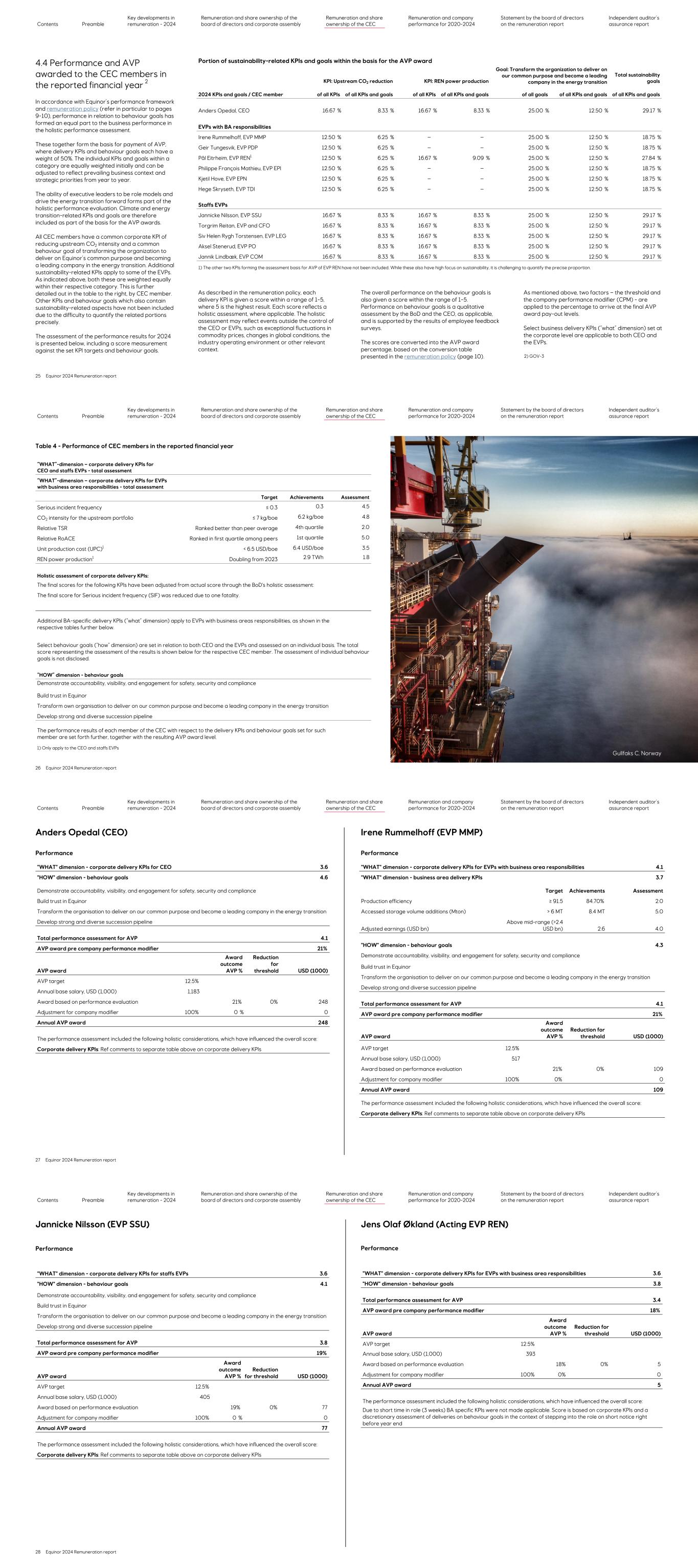

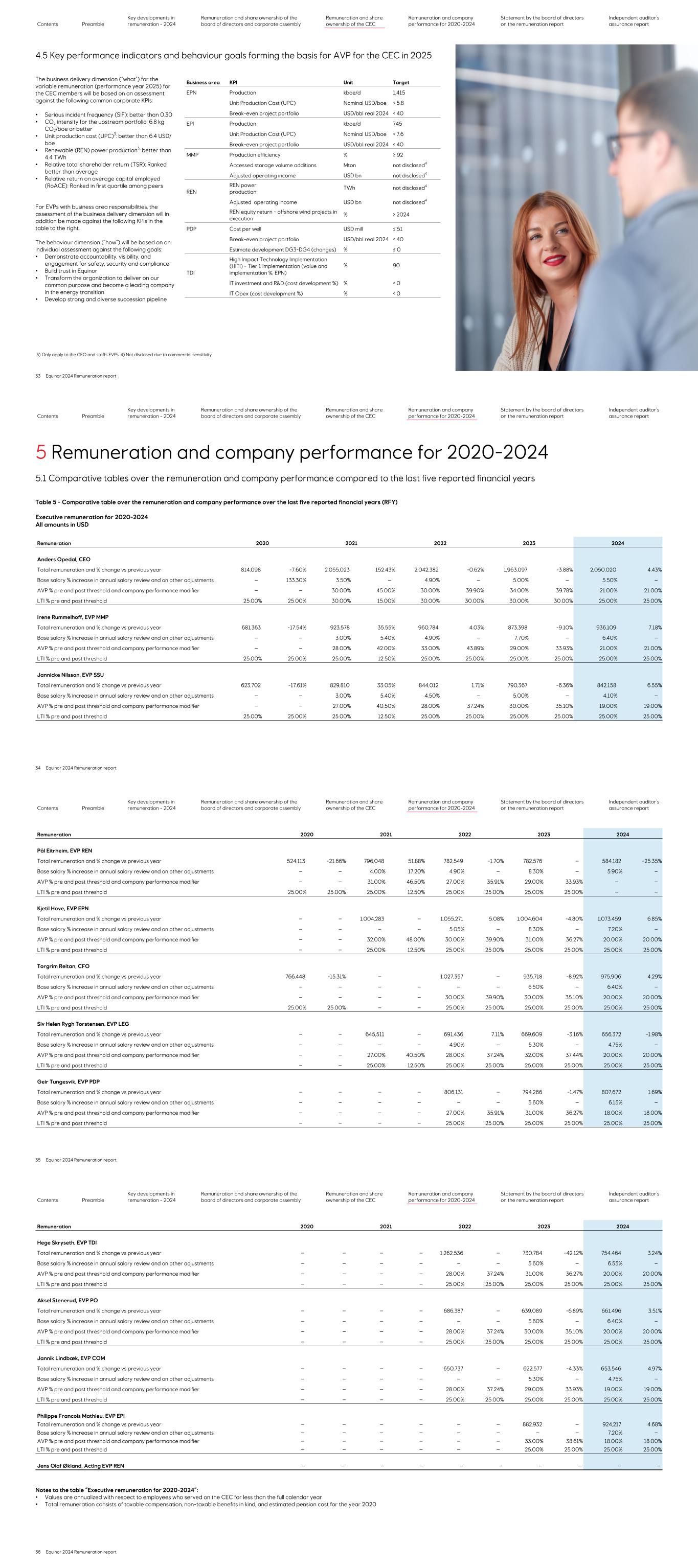

4.4 Performance and AVP awarded to the CEC members in the reported financial year In accordance with Equinor’s performance framework and remuneration policy (refer in particular to pages 9-10), performance in relation to behaviour goals has formed an equal part to the business performance in the holistic performance assessment. These together form the basis for payment of AVP, where delivery KPIs and behaviour goals each have a weight of 50%. The individual KPIs and goals within a category are equally weighted initially and can be adjusted to reflect prevailing business context and strategic priorities from year to year. The ability of executive leaders to be role models and drive the energy transition forward forms part of the holistic performance evaluation. Climate and energy transition-related KPIs and goals are therefore included as part of the basis for the AVP awards. All CEC members have a common corporate KPI of reducing upstream CO2 intensity and a common behaviour goal of transforming the organization to deliver on Equinor’s common purpose and becoming a leading company in the energy transition. Additional sustainability-related KPIs apply to some of the EVPs. As indicated above, both these are weighted equally within their respective category. This is further detailed out in the table to the right, by CEC member. Other KPIs and behaviour goals which also contain sustainability-related aspects have not been included due to the difficulty to quantify the related portions precisely. The assessment of the performance results for 2024 is presented below, including a score measurement against the set KPI targets and behaviour goals. As described in the remuneration policy, each delivery KPI is given a score within a range of 1-5, where 5 is the highest result. Each score reflects a holistic assessment, where applicable. The holistic assessment may reflect events outside the control of the CEO or EVPs, such as exceptional fluctuations in commodity prices, changes in global conditions, the industry operating environment or other relevant context. The overall performance on the behaviour goals is also given a score within the range of 1-5. Performance on behaviour goals is a qualitative assessment by the BoD and the CEO, as applicable, and is supported by the results of employee feedback surveys. The scores are converted into the AVP award percentage, based on the conversion table presented in the remuneration policy (page 10). As mentioned above, two factors – the threshold and the company performance modifier (CPM) - are applied to the percentage to arrive at the final AVP award pay-out levels. Select business delivery KPIs (“what” dimension) set at the corporate level are applicable to both CEO and the EVPs. Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 25 Equinor 2024 Remuneration report Portion of sustainability-related KPIs and goals within the basis for the AVP award 2024 KPIs and goals / CEC member KPI: Upstream CO2 reduction KPI: REN power production Goal: Transform the organization to deliver on our common purpose and become a leading company in the energy transition Total sustainability goals of all KPIs of all KPIs and goals of all KPIs of all KPIs and goals of all goals of all KPIs and goals of all KPIs and goals Anders Opedal, CEO 16.67 % 8.33 % 16.67 % 8.33 % 25.00 % 12.50 % 29.17 % EVPs with BA responsibilities Irene Rummelhoff, EVP MMP 12.50 % 6.25 % — — 25.00 % 12.50 % 18.75 % Geir Tungesvik, EVP PDP 12.50 % 6.25 % — — 25.00 % 12.50 % 18.75 % Pål Eitrheim, EVP REN1 12.50 % 6.25 % 16.67 % 9.09 % 25.00 % 12.50 % 27.84 % Philippe François Mathieu, EVP EPI 12.50 % 6.25 % — — 25.00 % 12.50 % 18.75 % Kjetil Hove, EVP EPN 12.50 % 6.25 % — — 25.00 % 12.50 % 18.75 % Hege Skryseth, EVP TDI 12.50 % 6.25 % — — 25.00 % 12.50 % 18.75 % Staffs EVPs Jannicke Nilsson, EVP SSU 16.67 % 8.33 % 16.67 % 8.33 % 25.00 % 12.50 % 29.17 % Torgrim Reitan, EVP and CFO 16.67 % 8.33 % 16.67 % 8.33 % 25.00 % 12.50 % 29.17 % Siv Helen Rygh Torstensen, EVP LEG 16.67 % 8.33 % 16.67 % 8.33 % 25.00 % 12.50 % 29.17 % Aksel Stenerud, EVP PO 16.67 % 8.33 % 16.67 % 8.33 % 25.00 % 12.50 % 29.17 % Jannik Lindbæk, EVP COM 16.67 % 8.33 % 16.67 % 8.33 % 25.00 % 12.50 % 29.17 % 1) The other two KPIs forming the assessment basis for AVP of EVP REN have not been included. While these also have high focus on sustainability, it is challenging to quantify the precise proportion. 2 2) GOV-3 Table 4 - Performance of CEC members in the reported financial year “WHAT”-dimension – corporate delivery KPIs for CEO and staffs EVPs - total assessment “WHAT”-dimension – corporate delivery KPIs for EVPs with business area responsibilities - total assessment Target Achievements Assessment Serious incident frequency ≤ 0.3 0.3 4.5 CO2 intensity for the upstream portfolio ≤ 7 kg/boe 6.2 kg/boe 4.8 Relative TSR Ranked better than peer average 4th quartile 2.0 Relative RoACE Ranked in first quartile among peers 1st quartile 5.0 Unit production cost (UPC)1 < 6.5 USD/boe 6.4 USD/boe 3.5 REN power production1 Doubling from 2023 2.9 TWh 1.8 Holistic assessment of corporate delivery KPIs: The final scores for the following KPIs have been adjusted from actual score through the BoD's holistic assessment: The final score for Serious incident frequency (SIF) was reduced due to one fatality. Additional BA-specific delivery KPIs (“what” dimension) apply to EVPs with business areas responsibilities, as shown in the respective tables further below. Select behaviour goals (“how” dimension) are set in relation to both CEO and the EVPs and assessed on an individual basis. The total score representing the assessment of the results is shown below for the respective CEC member. The assessment of individual behaviour goals is not disclosed. “HOW” dimension - behaviour goals Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform own organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline The performance results of each member of the CEC with respect to the delivery KPIs and behaviour goals set for such member are set forth further, together with the resulting AVP award level. 1) Only apply to the CEO and staffs EVPs Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 26 Equinor 2024 Remuneration report Gullfaks C, Norway Anders Opedal (CEO) Performance Irene Rummelhoff (EVP MMP) Performance Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 27 Equinor 2024 Remuneration report "WHAT" dimension - corporate delivery KPIs for CEO 3.6 "HOW" dimension - behaviour goals 4.6 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 4.1 AVP award pre company performance modifier 21% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 1,183 Award based on performance evaluation 21% 0% 248 Adjustment for company modifier 100% 0 % 0 Annual AVP award 248 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs "WHAT" dimension - corporate delivery KPIs for EVPs with business area responsibilities 4.1 "WHAT" dimension - business area delivery KPIs 3.7 Target Achievements Assessment Production efficiency ≥ 91.5 84.70% 2.0 Accessed storage volume additions (Mton) > 6 MT 8.4 MT 5.0 Adjusted earnings (USD bn) Above mid-range (>2.4 USD bn) 2.6 4.0 "HOW" dimension - behaviour goals 4.3 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 4.1 AVP award pre company performance modifier 21% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 517 Award based on performance evaluation 21% 0% 109 Adjustment for company modifier 100% 0% 0 Annual AVP award 109 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs Jannicke Nilsson (EVP SSU) Performance Jens Olaf Økland (Acting EVP REN) Performance "WHAT" dimension - corporate delivery KPIs for EVPs with business area responsibilities 3.6 "HOW" dimension - behaviour goals 3.8 Total performance assessment for AVP 3.4 AVP award pre company performance modifier 18% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 393 Award based on performance evaluation 18% 0% 5 Adjustment for company modifier 100% 0% 0 Annual AVP award 5 The performance assessment included the following holistic considerations, which have influenced the overall score: Due to short time in role (3 weeks) BA specific KPIs were not made applicable. Score is based on corporate KPIs and a discretionary assessment of deliveries on behaviour goals in the context of stepping into the role on short notice right before year end Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 28 Equinor 2024 Remuneration report "WHAT" dimension - corporate delivery KPIs for staffs EVPs 3.6 "HOW" dimension - behaviour goals 4.1 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 3.8 AVP award pre company performance modifier 19% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 405 Award based on performance evaluation 19% 0% 77 Adjustment for company modifier 100% 0 % 0 Annual AVP award 77 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs

Kjetil Hove (EVP EPN) Performance Siv Helen Rygh Torstensen (EVP LEG) Performance Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 29 Equinor 2024 Remuneration report "WHAT" dimension - corporate delivery KPIs for EVPs with business area responsibilities 4.1 "WHAT" dimension - business area delivery KPIs 3.3 Target Achievements Assessment Production (kboe/d) 1400 1,386 3.4 Unit Production Cost (nominal USD/boe) < 6.0 5.7 3.8 Break-even price project portfolio (USD/bbl real 2023) ~ 35 < 40 2.8 "HOW" dimension - behaviour goals 4.2 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 4.0 AVP award pre company performance modifier 20% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 589 Award based on performance evaluation 20% 0% 118 Adjustment for company modifier 100% 0% 0 Annual AVP award 118 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs BA-specific KPIs: The final scores for the following KPIs have been adjusted from actual score through the CEO`s holistic assessment of the performance: Production (kboe/d): Increased score to capture performance on executed turnarounds and record production from Troll and Johan Sverdrup fields "WHAT" dimension - corporate delivery KPIs for staffs EVPs 3.6 "HOW" dimension - behaviour goals 4.3 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 4.0 AVP award pre company performance modifier 20% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 355 Award based on performance evaluation 20% 0% 71 Adjustment for company modifier 100% 0 % 0 Annual AVP award 71 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs Geir Tungesvik (EVP PDP) Performance "WHAT" dimension - corporate delivery KPIs for EVPs with business area responsibilities 4.1 "WHAT" dimension - business area delivery KPIs 2.7 Target Achievements Assessment Number of new wells 107 92 2.5 Break-even project portfolio (USD/bbl real 2023) ~ 35 < 40 2.8 Estimate development DG3-DG4 (changes) ≤ 0 % 5% 2.9 "HOW" dimension - behaviour goals 4.1 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 3.7 AVP award pre company performance modifier 18% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 456 Award based on performance evaluation 18% 0% 82 Adjustment for company modifier 100% 0% 0 Annual AVP award 82 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs BA-specific KPIs: The final scores for the following KPIs have been adjusted from actual score through the CEO's holistic assessment of the performance: Number of new wells: Increased score to capture increasing complexity in wells portfolio Torgrim Reitan (CFO) Performance "WHAT" dimension - corporate delivery KPIs for staffs EVPs 3.6 "HOW" dimension - behaviour goals 4.3 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 3.9 AVP award pre company performance modifier 20% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 551 Award based on performance evaluation 20% 0% 110 Adjustment for company modifier 100% 0 % 0 Annual AVP award 110 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 30 Equinor 2024 Remuneration report Aksel Stenerud (EVP PO) Performance "WHAT" dimension - corporate delivery KPIs for staffs EVPs 3.6 "HOW" dimension - behaviour goals 4.3 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 4.0 AVP award pre company performance modifier 20% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 362 Award based on performance evaluation 20% 0% 72 Adjustment for company modifier 100% 0 % 0 Annual AVP award 72 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs Hege Skryseth (EVP TDI) Performance "WHAT" dimension - corporate delivery KPIs for EVPs with business area responsibilities 4.1 "WHAT" dimension - business area delivery KPIs 3.6 Target Achievements Assessment High Impact Technology Implementation - Tier 1 Implementation (value and implementation %, EPN) > 90 % target 2.9 IT investment and R&D (cost development %) < 0 % -7% 4.0 IT Opex (cost development %) < 0 % -10% 4.0 "HOW" dimension - behaviour goals 4.1 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 4.0 AVP award pre company performance modifier 20% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 470 Award based on performance evaluation 20% 0% 94 Adjustment for company modifier 100% 0% 0 Annual AVP award 94 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 31 Equinor 2024 Remuneration report Jannik Lindbæk (EVP COM) Performance "WHAT" dimension - corporate delivery KPIs for staffs EVPs 3.6 "HOW" dimension - behaviour goals 4.1 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 3.8 AVP award pre company performance modifier 19% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 350 Award based on performance evaluation 19% 0% 67 Adjustment for company modifier 100% 0 % 0 Annual AVP award 67 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs Philippe Francois Mathieu (EVP EPI) Performance "WHAT" dimension - corporate delivery KPIs for EVPs with business area responsibilities 4.1 "WHAT" dimension - business area delivery KPIs 3.0 Target Achievements Assessment Production (kboe/d) 672 681 3.6 Unit Producion Cost (nominal USD/boe) < 7.8 8.1 2.5 Break-even project portfolio ~ 35 < 40 2.8 "HOW" dimension - behaviour goals 4.1 Demonstrate accountability, visibility, and engagement for safety, security and compliance Build trust in Equinor Transform the organisation to deliver on our common purpose and become a leading company in the energy transition Develop strong and diverse succession pipeline Total performance assessment for AVP 3.8 AVP award pre company performance modifier 18% AVP award Award outcome AVP % Reduction for threshold USD (1000) AVP target 12.5% Annual base salary, USD (1,000) 489 Award based on performance evaluation 18% 0% 88 Adjustment for company modifier 100% 0% 0 Annual AVP award 88 The performance assessment included the following holistic considerations, which have influenced the overall score: Corporate delivery KPIs: Ref comments to separate table above on corporate delivery KPIs BA-specific KPIs: The final scores for the following KPIs have been adjusted from actual score through the CEO`s holistic assessment of the performance: Production (kboe/d) and Unit production cost (nominal USD/boe): Both adjusted to include Azerbaijan and Nigeria assets in results and reflected in scores Contents Preamble Key developments in remuneration - 2024 Remuneration and share ownership of the board of directors and corporate assembly Remuneration and share ownership of the CEC Remuneration and company performance for 2020-2024 Statement by the board of directors on the remuneration report Independent auditor’s assurance report 32 Equinor 2024 Remuneration report