1 | Equinor remuneration policy Remuneration policy Corporate executive committee, board of directors and corporate assembly Table of Contents 1 PREAMBLE Objective 3 Authority 4 Conflicts of interest 4 2 REMUNERATION OF THE CORPORATE ASSEMBLY AND BOARD OF DIRECTORS Corporate assembly 5 Board of directors 5 3 REMUNERATION OF THE CORPORATE EXECUTIVE COMMITTEE Authorisations 6 Remuneration structure 6 Fixed pay 6 Base salary 6 Fixed salary addition 6 Fixed car allowance 6 Variable remuneration 7 Threshold for payments under variable pay plans 7 Company performance modifier (CPM) 8 Annual variable pay scheme (AVP) 9 Long-term incentive plan (LTI) 11 Share savings plan (SSP) 11 Benefits 12 Pension and insurance 12 Other benefits 12 Other terms of employment 13 Term / duration of contracts 13 Severance payment 13 Clawback 13 External hiring 13 Hiring from a different market 13 Buy-out provisions 13 Mobility 13 4 GOVERNANCE Considerations for the policy 14 Variations to the policy 15 Approval and publication 15 2 | Equinor remuneration policy 3 | Equinor remuneration policy 1 Preamble In accordance with the Norwegian Public Limited Liability Companies Act, section 6-16a and supplementing regulations, the board of directors of Equinor ASA is required to prepare an executive remuneration policy (the “policy”) describing the principles and approaches used for setting the remuneration for the leading personnel of the Equinor group (“Equinor” or the “company”), i.e. the corporate executive committee (“CEC”) consisting of the president and chief executive officer (“CEO”), and the executive vice presidents (“EVPs”). For completeness, the policy also includes a description of the remuneration relating to members of the corporate assembly and board of directors. In addition to fulfilling statutory requirements and general best practice for an executive remuneration structure, the board of directors have paid particular attention to the following as the basis and overarching guidance in their preparation of this policy. • Provide an executive remuneration policy that meets Equinor requirements for achieving strategic goals and maximize value creation over time • Consider shareholder expectations, hereunder the Norwegian government`s expectations to Equinor’s executive remuneration through “The State’s Guidelines for the Remuneration of Senior Executives in Companies with direct State Ownership (Stipulated by the Ministry of Trade, Industry and Fisheries on 12 December 2022)” (“state guidelines”) • Maintain predictability for executives and shareholders • Maintain a competitive remuneration structure for all employees, including the CEC • Maintain moderation in all aspects of remuneration policies and decisions • Strive towards simplicity and fit for purpose solutions in the remuneration structure and reporting Optimised oil and gas portfolio High value growth in renewables New market opportunities in low carbon solutions Always safe High value Low carbon Creating value through the energy transition Net -zero ambition gives new industry opportunities Technology excellence and innovation define winners Together as one team – engaging partners and society Safe and secure operations Building on competencies and our experience Market dynamics set margins under pressure Why we are changing Accelerating our transition Guided by our values How we will get there - together Objective Equinor’s remuneration policy shall support the company’s transition agenda and purpose of turning natural resources into energy for people and progress for society. This policy forms an integrated part of a values-based performance framework, translating the principle of pay-for-performance into remuneration elements that are designed to promote continuous improvement and drive performance in line with the company’s strategy. The strategic objectives are established for the company as a whole and for its executive management to among other things support Equinor’s transition into a broad energy company and its ambitions of reaching net zero by 2050. More details can be found in the annual report. Equinor’s remuneration framework contributes to the business strategy, long-term interests and sustainability of the company. The performance criteria for the CEC are selected annually with the ambition to steer focus and performance, supporting the effective fulfilment of our strategy – always safe, high value, low carbon. The policy shall contribute to attract and retain executives and motivate them to drive the success of the company in a fast-paced and increasingly challenging global environment. The Equinor values – open, collaborative, courageous and caring – and the company’s health, safety and environment (“HSE”) standards are reflected in the policy. The policy should also be acknowledged as fair, transparent, consistent, and non-discriminatory. A key principle for Equinor’s remuneration strategy is moderation. Reward should be competitive but not market leading, and aligned with the markets that the company recruits from, maintaining an overall sustainable cost level. Equinor places a high focus on fostering alignment between the interests of its executive management and those of its owners and other stakeholders, with a particular focus on the link between performance remuneration and long-term commitment. This policy governs Equinor’s general remuneration framework and constitutes the basis for executive pay. The related results are reported in a transparent way and in accordance with statutory laws and regulations enabling stakeholders to evaluate executive pay, its development over time and compare it to that of non-executive employees. Authority The board of directors is responsible for (i) designing the executive remuneration policy and proposing the policy for adoption by the company’s shareholders at the annual general meeting (“AGM”); and (ii) implementing and evaluating the adopted policy, including determining the remuneration and other terms and conditions for the CEO, and (iii) reporting on how it follows up requirements in the Norwegian Public Limited Liability Companies Act, section 6-16b, including in its subsidiaries. The remuneration report will also be subject to an advisory vote at the AGM. The board of directors has appointed a compensation and executive development committee (“BCC”) consisting of members of the board of directors which among other tasks shall assist the board in its work with executive compensation, including the remuneration policy. The BCC is responsible for preparing and recommending a proposal to the board of directors on the remuneration policy, including assessing new and/ or amended policies. The BCC shall support and advise the CEO on matters related to the terms, conditions, and remuneration of the EVPs. The BCC does not have independent decision-making authority and its work does not alter the responsibilities of the board of directors. The instructions from the board of directors to the BCC are updated annually and are available on equinor.com. The policy will be effective for a period of four years, subject to any proposed material changes by the board of directors requiring adoption by the AGM before the four-year term concludes. Conflicts of interest No members of the CEC are present at the BCC meetings when their own remuneration is discussed so no conflicts of interest should arise in terms of remuneration of the CEC. As the remuneration of the board of directors is decided by the company’s corporate assembly it is also the view of the board of directors that no conflicts of interest should arise in terms of remuneration of the board of directors. More details on conflict of interest and director independence can be found in Equinor’s annual report. 4 | Equinor remuneration policy

5 | Equinor remuneration policy 2 Remuneration of the corporate assembly and board of directors Corporate assembly The remuneration to the corporate assembly is resolved annually by the AGM, after proposal to the general meeting from the nomination committee. The proposal from the nomination committee is included in the notice of AGM. The members of the corporate assembly receive an annual fixed remuneration, except for deputy members who receive remuneration per meeting attended. Separate rates are set for the chair, deputy chair and other members of the corporate assembly. The employee-elected members of the corporate assembly receive the same remuneration as the shareholder-elected members. The members of the corporate assembly receive travel reimbursement for each meeting attended. Board of directors The remuneration of the board of directors is, in accordance with the Norwegian Public Limited Liability Companies Act, decided by the corporate assembly annually, following a recommendation from the nomination committee. The decision of the corporate assembly will be made public on equinor.com on the same date and the remuneration of the board members is also disclosed in the remuneration report for the relevant reporting year. The board members generally receive an annual fixed fee. Deputy members, who are only elected for employee-elected board members, receive remuneration per meeting attended. Separate rates are set for the chair, deputy chair and the other members of the board of directors. Separate rates are also adopted for the board’s committees, with similar differentiation between the chair and the other members of each committee. The employee-elected members of the board receive the same remuneration as the shareholder-elected members. The board receives its remuneration in cash. Board members from Europe but outside Scandinavia or from outside Europe, respectively, receive separate travel allowances for each meeting attended. Remuneration for board members is not linked to performance and board members do not receive any shares or share options etc. as part of their remuneration. However, members of the board of directors are encouraged by the nomination committee to own shares in the company. Employee-elected board members may participate in variable pay, pension and benefit programs according to the provisions in place in their employing entity and grade in line with programmes available to other employees. Any such variable pay is not related to their position as board members. None of the shareholder-elected board members have a pension scheme or agreement concerning pay after termination of their office with the company. If shareholder-elected members of the board and/or companies they are associated with take on specific assignments for Equinor, this will be disclosed to the full board and follow the requirements as set out in the rules of procedure for the board of directors of Equinor ASA. 6 | Equinor remuneration policy 3 Remuneration of the corporate executive committee Base salary Equinor regularly participates in salary surveys and other benchmarking exercises in the Norwegian, Nordic and other relevant markets. ¹ G represents the basic amount of the Norwegian social security system. 1G per 31 December 2022 equals NOK 111 477. Authorisations In accordance with this policy: • the remuneration of the CEO is decided annually by the board of directors based on a recommendation from the BCC • the remuneration of the EVPs is decided annually by the CEO following consultations with the BCC Remuneration structure Equinor’s remuneration for the CEC consists of fixed and variable elements, and benefits. The core elements are: • Fixed pay: base salary • Variable remuneration: annual variable pay (“AVP”), long-term incentive (“LTI”) and share savings plan (“SSP”) • Benefits: pension, insurance and other benefits • Other terms: severance pay The elements described below are based on the same key principles as those generally applicable to the remuneration of employees in Equinor. Fixed pay The fixed pay elements provide executives with a secure and competitive remuneration basis enabling them to perform in their roles on an ongoing basis and without undue consideration for variable incentives. Fixed salary addition Members of the CEC who were employed by Equinor ASA prior to 1 September 2017 and took up their first position in the CEC after 13 February 2015, receive a fixed salary addition in lieu of pension accrual above 12G, ref. section “Pension and insurance”. The fixed salary addition is not pensionable and does not form basis for variable pay. Fixed car allowance Key objective Level Attract and retain the right individuals by providing competitive but not market-leading terms. Main compensation element reflecting scope of role, individual responsibility, positioning to market and the executive’s experience and business impact. Reviewed annually and adjusted as needed to reflect the executive’s pay relative to market and performance. When adjusting the base salary of the CEC members, the average salary adjustment for other employees within the same market will be considered. Any higher increase for the CEC, including in absolute figures, will be subject to a further explanation in the remuneration report. Key objective Level Paid in lieu of previous pension accrual above 12G¹, to ensure an overall competitive level of reward. 18 % of base salary. Key objective Level Option for transport support for executive to choose a cash payment in lieu of company car. Aimed to cover the annual cost of the company car arrangement. 7 | Equinor remuneration policy Variable remuneration Normally no payout (1) Cash flows provided by operat- ing activities after tax and before working capital items (2) Net debt ratio and development (3) Company’s overall operational and financial performance. Green zone: (1) higher than USD 12 billion and (2) below 30% Yellow zone: (1) between USD 8 billion and USD 12 billion and (2) between 30% and 45% Red zone: (1) under USD 8 billion and (2) above 45% Normally no reduction in payout Normally reduction in payout Normally no payout Threshold for payments under variable pay plans Criteria for threshold Variable remuneration is aimed at driving performance in line with the company’s strategy and securing long-term commitment and retention with the company. The receipt of variable remuneration is dependent on individual and company performance and for some elements subject to a holding period requirement. A threshold and a company performance modifier (“CPM”) are applied as a means of strengthening the link between the company’s overall financial results and the individual’s variable pay. Details of the threshold and the CPM are given below. The threshold has been established to protect the company in years with weak financial results and/or reduced company performance, through reducing variable pay. The threshold is applicable for payment of AVP and award of LTI grant. It also applies to the payment of the general bonus to those employees who do not receive AVP. The threshold is a measure for the company’s achieved results and how these results are expected to impact the company’s medium and long-term value creation. It is based on an assessment of the company’s overall operational and financial performance, supported by the results of two guiding parameters: (1) the level of cash flow from operating activities after tax and before working capital items, and (2) the level and development of the net debt ratio. Any decision on application of the threshold will be referenced in the remuneration report. The threshold is recommended by the CEO to the board of directors in accordance with the criteria set out in the below figure. This recommendation will apply unless the board of directors decides to apply a lower threshold. The board of directors’ decision is discretionary. 8 | Equinor remuneration policy Company performance modifier (CPM) The CPM reflects Equinor’s performance compared to that of our industry peers and is intended to adjust variable pay accordingly. It also moderates the effect of fluctuating commodity prices on remuneration. The CPM is set within the range of 50 - 150% and is applied to the calculation of AVP and general bonus for all eligible employees, and LTI for employees of international subsidiaries. The CPM is determined by comparing Equinor’s performance relative to that of companies in a defined peer group (“peer group”) on two equally weighted measures: relative total shareholder return (TSR) and relative return on average capital employed (RoACE). The composition of the peer group is decided by the board of directors. The results of these two performance measures are compared to the peer group and in combination determine Equinor’s relative position, as shown below. The percentages in the below matrix may be adjusted if the effects of commodity prices or other circumstances outside the company’s control are deemed to have a disproportionate impact on results in a given year. In the event such a discretionary adjustment is made, this will be explained in the remuneration report. Re la tiv e Ro A C E Q1 Q2 Q2 Q1 Q3 Q3 Q4 Q4 100 % 117 % 133 % 150 % 67 % 83 % 100 % 117 % 50 % 67 % 83 % 100 % 83 % 100 % 117 % 133 % Relative TSR Equinor’s score is low compared to peers, resulting in a CPM below 100% Equinor’s score is at the high end compared to peers, resulting in a CPM at 100% or higher

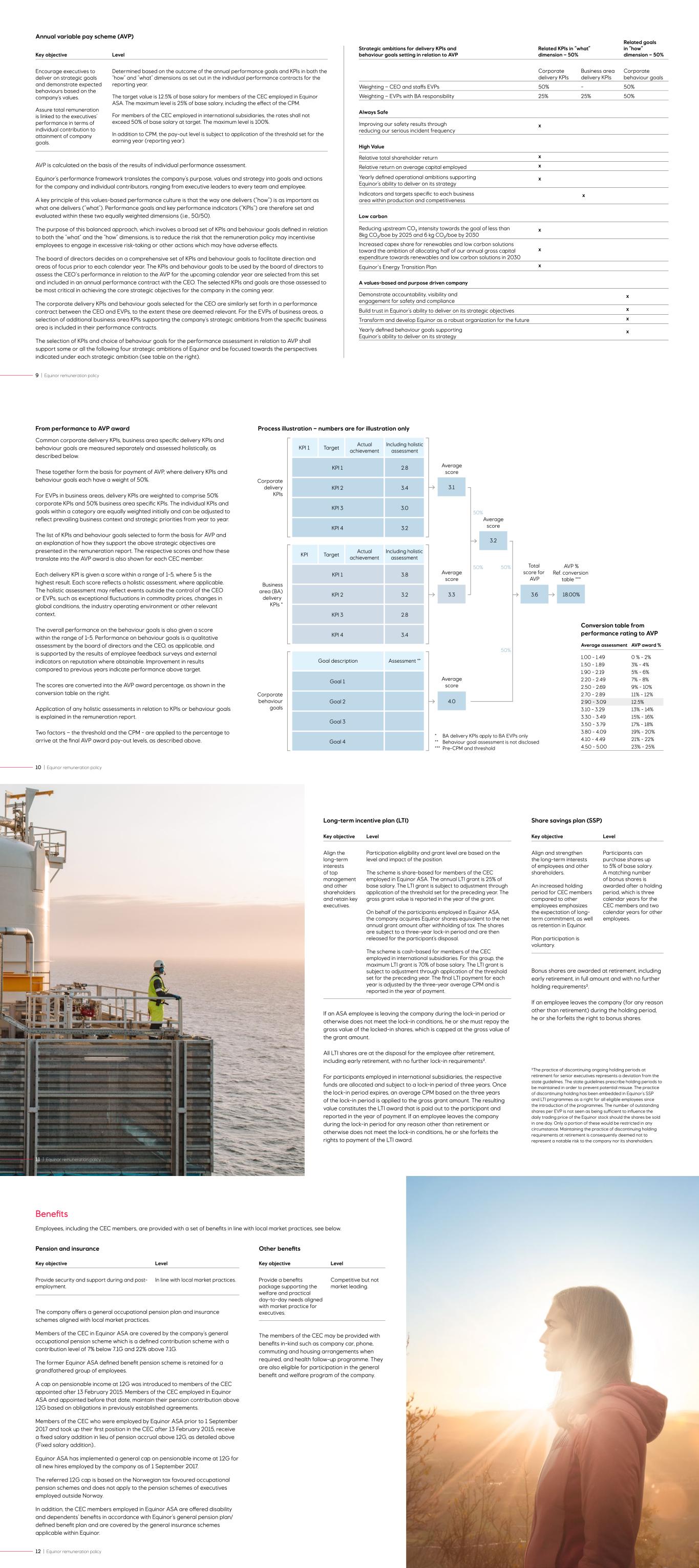

9 | Equinor remuneration policy AVP is calculated on the basis of the results of individual performance assessment. Equinor’s performance framework translates the company’s purpose, values and strategy into goals and actions for the company and individual contributors, ranging from executive leaders to every team and employee. A key principle of this values-based performance culture is that the way one delivers (“how”) is as important as what one delivers (“what”). Performance goals and key performance indicators (“KPIs”) are therefore set and evaluated within these two equally weighted dimensions (i.e., 50/50). The purpose of this balanced approach, which involves a broad set of KPIs and behaviour goals defined in relation to both the “what” and the “how” dimensions, is to reduce the risk that the remuneration policy may incentivise employees to engage in excessive risk-taking or other actions which may have adverse effects. The board of directors decides on a comprehensive set of KPIs and behaviour goals to facilitate direction and areas of focus prior to each calendar year. The KPIs and behaviour goals to be used by the board of directors to assess the CEO`s performance in relation to the AVP for the upcoming calendar year are selected from this set and included in an annual performance contract with the CEO. The selected KPIs and goals are those assessed to be most critical in achieving the core strategic objectives for the company in the coming year. The corporate delivery KPIs and behaviour goals selected for the CEO are similarly set forth in a performance contract between the CEO and EVPs, to the extent these are deemed relevant. For the EVPs of business areas, a selection of additional business area KPIs supporting the company’s strategic ambitions from the specific business area is included in their performance contracts. The selection of KPIs and choice of behaviour goals for the performance assessment in relation to AVP shall support some or all the following four strategic ambitions of Equinor and be focused towards the perspectives indicated under each strategic ambition (see table on the right). Key objective Level Encourage executives to deliver on strategic goals and demonstrate expected behaviours based on the company’s values. Assure total remuneration is linked to the executives’ performance in terms of individual contribution to attainment of company goals. Determined based on the outcome of the annual performance goals and KPIs in both the “how” and “what” dimensions as set out in the individual performance contracts for the reporting year. The target value is 12.5% of base salary for members of the CEC employed in Equinor ASA. The maximum level is 25% of base salary, including the effect of the CPM. For members of the CEC employed in international subsidiaries, the rates shall not exceed 50% of base salary at target. The maximum level is 100%. In addition to CPM, the pay-out level is subject to application of the threshold set for the earning year (reporting year). Strategic ambitions for delivery KPIs and behaviour goals setting in relation to AVP Related KPIs in “what” dimension – 50% Related goals in “how” dimension – 50% Corporate delivery KPIs Business area delivery KPIs Corporate behaviour goals Weighting – CEO and staffs EVPs 50% - 50% Weighting – EVPs with BA responsibility 25% 25% 50% Improving our safety results through reducing our serious incident frequency x Relative total shareholder return x Relative return on average capital employed x Yearly defined operational ambitions supporting Equinor’s ability to deliver on its strategy x Indicators and targets specific to each business area within production and competitiveness x Reducing upstream CO₂ intensity towards the goal of less than 8kg CO₂/boe by 2025 and 6 kg CO₂/boe by 2030 x Increased capex share for renewables and low carbon solutions toward the ambition of allocating half of our annual gross capital expenditure towards renewables and low carbon solutions in 2030 x Equinor`s Energy Transition Plan x Demonstrate accountability, visibility and engagement for safety and compliance x Build trust in Equinor’s ability to deliver on its strategic objectives x Transform and develop Equinor as a robust organization for the future x Yearly defined behaviour goals supporting Equinor’s ability to deliver on its strategy x Always Safe High Value Low carbon A values-based and purpose driven company Annual variable pay scheme (AVP) 10 | Equinor remuneration policy From performance to AVP award Common corporate delivery KPIs, business area specific delivery KPIs and behaviour goals are measured separately and assessed holistically, as described below. These together form the basis for payment of AVP, where delivery KPIs and behaviour goals each have a weight of 50%. For EVPs in business areas, delivery KPIs are weighted to comprise 50% corporate KPIs and 50% business area specific KPIs. The individual KPIs and goals within a category are equally weighted initially and can be adjusted to reflect prevailing business context and strategic priorities from year to year. The list of KPIs and behaviour goals selected to form the basis for AVP and an explanation of how they support the above strategic objectives are presented in the remuneration report. The respective scores and how these translate into the AVP award is also shown for each CEC member. Each delivery KPI is given a score within a range of 1-5, where 5 is the highest result. Each score reflects a holistic assessment, where applicable. The holistic assessment may reflect events outside the control of the CEO or EVPs, such as exceptional fluctuations in commodity prices, changes in global conditions, the industry operating environment or other relevant context. The overall performance on the behaviour goals is also given a score within the range of 1-5. Performance on behaviour goals is a qualitative assessment by the board of directors and the CEO, as applicable, and is supported by the results of employee feedback surveys and external indicators on reputation where obtainable. Improvement in results compared to previous years indicate performance above target. The scores are converted into the AVP award percentage, as shown in the conversion table on the right. Application of any holistic assessments in relation to KPIs or behaviour goals is explained in the remuneration report. Two factors – the threshold and the CPM - are applied to the percentage to arrive at the final AVP award pay-out levels, as described above. KPI 1 Target Actual achievement Including holistic assessment KPI 2 3.4 KPI 1 2.8 KPI 3 3.0 KPI 4 3.2 KPI Target Actual achievement Including holistic assessment 3.8 KPI 2 KPI 1 3.2 KPI 3 2.8 3.1 3.3 KPI 4 3.4 KPI 1 Goal 2 Goal 3 Goal 4 Corporate delivery KPIs Business area (BA) delivery KPIs * Corporate behaviour goals Goal 1 4.0 Average score Average score Average score 3.2 Average score 3.6 Total score for AVP 18.00% AVP % Ref. conversion table *** BA delivery KPIs apply to BA EVPs only Behaviour goal assessment is not disclosed Pre-CPM and threshold * ** *** 50% 50% 50% 50% Assessment **Goal description Conversion table from performance rating to AVP Average assessment AVP award % 1.00 - 1.49 0 % - 2% 1.50 - 1.89 3% - 4% 1.90 - 2.19 5% - 6% 2.20 - 2.49 7% - 8% 2.50 - 2.69 9% - 10% 2.70 - 2.89 11% - 12% 2.90 - 3.09 12.5% 3.10 - 3.29 13% - 14% 3.30 - 3.49 15% - 16% 3.50 - 3.79 17% - 18% 3.80 - 4.09 19% - 20% 4.10 - 4.49 21% - 22% 4.50 - 5.00 23% - 25% Process illustration – numbers are for illustration only Long-term incentive plan (LTI) Key objective Level Align the long-term interests of top management and other shareholders and retain key executives. Participation eligibility and grant level are based on the level and impact of the position. The scheme is share-based for members of the CEC employed in Equinor ASA. The annual LTI grant is 25% of base salary. The LTI grant is subject to adjustment through application of the threshold set for the preceding year. The gross grant value is reported in the year of the grant. On behalf of the participants employed in Equinor ASA, the company acquires Equinor shares equivalent to the net annual grant amount after withholding of tax. The shares are subject to a three-year lock-in period and are then released for the participant’s disposal. The scheme is cash-based for members of the CEC employed in international subsidiaries. For this group, the maximum LTI grant is 70% of base salary. The LTI grant is subject to adjustment through application of the threshold set for the preceding year. The final LTI payment for each year is adjusted by the three-year average CPM and is reported in the year of payment. 11 | Equinor remuneration policy Share savings plan (SSP) Bonus shares are awarded at retirement, including early retirement, in full amount and with no further holding requirements². If an employee leaves the company (for any reason other than retirement) during the holding period, he or she forfeits the right to bonus shares. Key objective Level Align and strengthen the long-term interests of employees and other shareholders. An increased holding period for CEC members compared to other employees emphasizes the expectation of long- term commitment, as well as retention in Equinor. Plan participation is voluntary. Participants can purchase shares up to 5% of base salary. A matching number of bonus shares is awarded after a holding period, which is three calendar years for the CEC members and two calendar years for other employees. If an ASA employee is leaving the company during the lock-in period or otherwise does not meet the lock-in conditions, he or she must repay the gross value of the locked-in shares, which is capped at the gross value of the grant amount. All LTI shares are at the disposal for the employee after retirement, including early retirement, with no further lock-in requirements². For participants employed in international subsidiaries, the respective funds are allocated and subject to a lock-in period of three years. Once the lock-in period expires, an average CPM based on the three years of the lock-in period is applied to the gross grant amount. The resulting value constitutes the LTI award that is paid out to the participant and reported in the year of payment. If an employee leaves the company during the lock-in period for any reason other than retirement or otherwise does not meet the lock-in conditions, he or she forfeits the rights to payment of the LTI award. ²The practice of discontinuing ongoing holding periods at retirement for senior executives represents a deviation from the state guidelines. The state guidelines prescribe holding periods to be maintained in order to prevent potential misuse. The practice of discontinuing holding has been embedded in Equinor’s SSP and LTI programmes as a right for all eligible employees since the introduction of the programmes. The number of outstanding shares per EVP is not seen as being sufficient to influence the daily trading price of the Equinor stock should the shares be sold in one day. Only a portion of these would be restricted in any circumstance. Maintaining the practice of discontinuing holding requirements at retirement is consequently deemed not to represent a notable risk to the company nor its shareholders. 12 | Equinor remuneration policy Pension and insurance The company offers a general occupational pension plan and insurance schemes aligned with local market practices. Members of the CEC in Equinor ASA are covered by the company’s general occupational pension scheme which is a defined contribution scheme with a contribution level of 7% below 7.1G and 22% above 7.1G. The former Equinor ASA defined benefit pension scheme is retained for a grandfathered group of employees. A cap on pensionable income at 12G was introduced to members of the CEC appointed after 13 February 2015. Members of the CEC employed in Equinor ASA and appointed before that date, maintain their pension contribution above 12G based on obligations in previously established agreements. Members of the CEC who were employed by Equinor ASA prior to 1 September 2017 and took up their first position in the CEC after 13 February 2015, receive a fixed salary addition in lieu of pension accrual above 12G, as detailed above (Fixed salary addition).. Equinor ASA has implemented a general cap on pensionable income at 12G for all new hires employed by the company as of 1 September 2017. The referred 12G cap is based on the Norwegian tax favoured occupational pension schemes and does not apply to the pension schemes of executives employed outside Norway. In addition, the CEC members employed in Equinor ASA are offered disability and dependents’ benefits in accordance with Equinor’s general pension plan/ defined benefit plan and are covered by the general insurance schemes applicable within Equinor. Key objective Level Provide security and support during and post- employment. In line with local market practices. Other benefits The members of the CEC may be provided with benefits in-kind such as company car, phone, commuting and housing arrangements when required, and health follow-up programme. They are also eligible for participation in the general benefit and welfare program of the company. Benefits Employees, including the CEC members, are provided with a set of benefits in line with local market practices, see below. Key objective Level Provide a benefits package supporting the welfare and practical day-to-day needs aligned with market practice for executives. Competitive but not market leading.

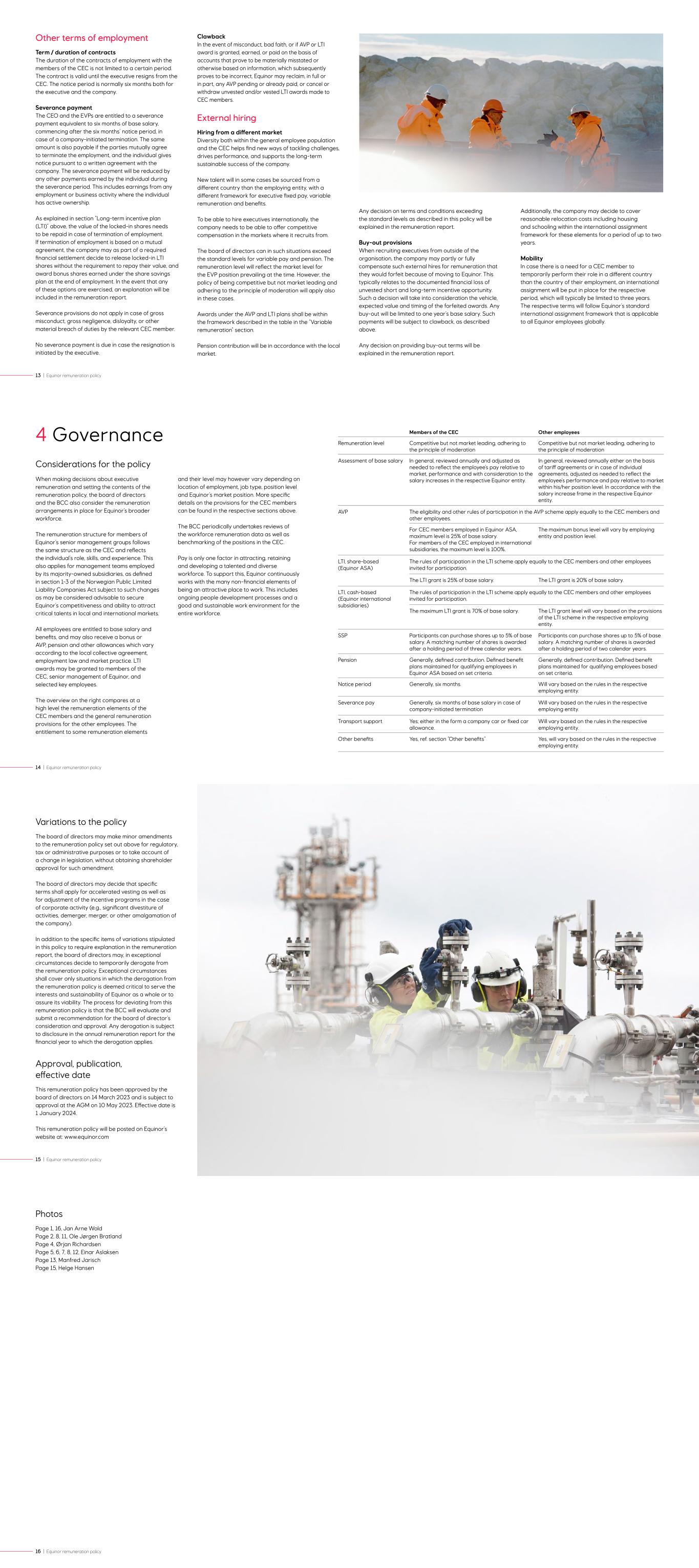

13 | Equinor remuneration policy Other terms of employment Term / duration of contracts The duration of the contracts of employment with the members of the CEC is not limited to a certain period. The contract is valid until the executive resigns from the CEC. The notice period is normally six months both for the executive and the company. Severance payment The CEO and the EVPs are entitled to a severance payment equivalent to six months of base salary, commencing after the six months’ notice period, in case of a company-initiated termination. The same amount is also payable if the parties mutually agree to terminate the employment, and the individual gives notice pursuant to a written agreement with the company. The severance payment will be reduced by any other payments earned by the individual during the severance period. This includes earnings from any employment or business activity where the individual has active ownership. As explained in section “Long-term incentive plan (LTI)” above, the value of the locked-in shares needs to be repaid in case of termination of employment. If termination of employment is based on a mutual agreement, the company may as part of a required financial settlement decide to release locked-in LTI shares without the requirement to repay their value, and award bonus shares earned under the share savings plan at the end of employment. In the event that any of these options are exercised, an explanation will be included in the remuneration report. Severance provisions do not apply in case of gross misconduct, gross negligence, disloyalty, or other material breach of duties by the relevant CEC member. No severance payment is due in case the resignation is initiated by the executive. Clawback In the event of misconduct, bad faith, or if AVP or LTI award is granted, earned, or paid on the basis of accounts that prove to be materially misstated or otherwise based on information, which subsequently proves to be incorrect, Equinor may reclaim, in full or in part, any AVP pending or already paid, or cancel or withdraw unvested and/or vested LTI awards made to CEC members. External hiring Hiring from a different market Diversity both within the general employee population and the CEC helps find new ways of tackling challenges, drives performance, and supports the long-term sustainable success of the company. New talent will in some cases be sourced from a different country than the employing entity, with a different framework for executive fixed pay, variable remuneration and benefits. To be able to hire executives internationally, the company needs to be able to offer competitive compensation in the markets where it recruits from. The board of directors can in such situations exceed the standard levels for variable pay and pension. The remuneration level will reflect the market level for the EVP position prevailing at the time. However, the policy of being competitive but not market leading and adhering to the principle of moderation will apply also in these cases. Awards under the AVP and LTI plans shall be within the framework described in the table in the “Variable remuneration” section. Pension contribution will be in accordance with the local market. Any decision on terms and conditions exceeding the standard levels as described in this policy will be explained in the remuneration report. Buy-out provisions When recruiting executives from outside of the organisation, the company may partly or fully compensate such external hires for remuneration that they would forfeit because of moving to Equinor. This typically relates to the documented financial loss of unvested short and long-term incentive opportunity. Such a decision will take into consideration the vehicle, expected value and timing of the forfeited awards. Any buy-out will be limited to one year’s base salary. Such payments will be subject to clawback, as described above. Any decision on providing buy-out terms will be explained in the remuneration report. Additionally, the company may decide to cover reasonable relocation costs including housing and schooling within the international assignment framework for these elements for a period of up to two years. Mobility In case there is a need for a CEC member to temporarily perform their role in a different country than the country of their employment, an international assignment will be put in place for the respective period, which will typically be limited to three years. The respective terms will follow Equinor’s standard international assignment framework that is applicable to all Equinor employees globally. 14 | Equinor remuneration policy 4 Governance When making decisions about executive remuneration and setting the contents of the remuneration policy, the board of directors and the BCC also consider the remuneration arrangements in place for Equinor’s broader workforce. The remuneration structure for members of Equinor’s senior management groups follows the same structure as the CEC and reflects the individual’s role, skills, and experience. This also applies for management teams employed by its majority-owned subsidiaries, as defined in section 1-3 of the Norwegian Public Limited Liability Companies Act subject to such changes as may be considered advisable to secure Equinor’s competitiveness and ability to attract critical talents in local and international markets. All employees are entitled to base salary and benefits, and may also receive a bonus or AVP, pension and other allowances which vary according to the local collective agreement, employment law and market practice. LTI awards may be granted to members of the CEC, senior management of Equinor, and selected key employees. The overview on the right compares at a high level the remuneration elements of the CEC members and the general remuneration provisions for the other employees. The entitlement to some remuneration elements and their level may however vary depending on location of employment, job type, position level and Equinor’s market position. More specific details on the provisions for the CEC members can be found in the respective sections above. The BCC periodically undertakes reviews of the workforce remuneration data as well as benchmarking of the positions in the CEC. Pay is only one factor in attracting, retaining and developing a talented and diverse workforce. To support this, Equinor continuously works with the many non-financial elements of being an attractive place to work. This includes ongoing people development processes and a good and sustainable work environment for the entire workforce. Members of the CEC Other employees Remuneration level Competitive but not market leading, adhering to the principle of moderation Competitive but not market leading, adhering to the principle of moderation Assessment of base salary In general, reviewed annually and adjusted as needed to reflect the employee’s pay relative to market, performance and with consideration to the salary increases in the respective Equinor entity. In general, reviewed annually either on the basis of tariff agreements or in case of individual agreements, adjusted as needed to reflect the employee’s performance and pay relative to market within his/her position level. In accordance with the salary increase frame in the respective Equinor entity. AVP The eligibility and other rules of participation in the AVP scheme apply equally to the CEC members and other employees. For CEC members employed in Equinor ASA, maximum level is 25% of base salary. For members of the CEC employed in international subsidiaries, the maximum level is 100%. The maximum bonus level will vary by employing entity and position level. LTI, share-based (Equinor ASA) The rules of participation in the LTI scheme apply equally to the CEC members and other employees invited for participation. The LTI grant is 25% of base salary. The LTI grant is 20% of base salary. LTI, cash-based (Equinor international subsidiaries) The rules of participation in the LTI scheme apply equally to the CEC members and other employees invited for participation. The maximum LTI grant is 70% of base salary. The LTI grant level will vary based on the provisions of the LTI scheme in the respective employing entity. SSP Participants can purchase shares up to 5% of base salary. A matching number of shares is awarded after a holding period of three calendar years. Participants can purchase shares up to 5% of base salary. A matching number of shares is awarded after a holding period of two calendar years. Pension Generally, defined contribution. Defined benefit plans maintained for qualifying employees in Equinor ASA based on set criteria. Generally, defined contribution. Defined benefit plans maintained for qualifying employees based on set criteria. Notice period Generally, six months. Will vary based on the rules in the respective employing entity. Severance pay Generally, six months of base salary in case of company-initiated termination Will vary based on the rules in the respective employing entity. Transport support Yes; either in the form a company car or fixed car allowance. Will vary based on the rules in the respective employing entity. Other benefits Yes, ref. section “Other benefits” Yes, will vary based on the rules in the respective employing entity. Considerations for the policy 15 | Equinor remuneration policy Variations to the policy The board of directors may make minor amendments to the remuneration policy set out above for regulatory, tax or administrative purposes or to take account of a change in legislation, without obtaining shareholder approval for such amendment. The board of directors may decide that specific terms shall apply for accelerated vesting as well as for adjustment of the incentive programs in the case of corporate activity (e.g., significant divestiture of activities, demerger, merger, or other amalgamation of the company). In addition to the specific items of variations stipulated in this policy to require explanation in the remuneration report, the board of directors may, in exceptional circumstances decide to temporarily derogate from the remuneration policy. Exceptional circumstances shall cover only situations in which the derogation from the remuneration policy is deemed critical to serve the interests and sustainability of Equinor as a whole or to assure its viability. The process for deviating from this remuneration policy is that the BCC will evaluate and submit a recommendation for the board of director’s consideration and approval. Any derogation is subject to disclosure in the annual remuneration report for the financial year to which the derogation applies. Approval, publication, effective date This remuneration policy has been approved by the board of directors on 14 March 2023 and is subject to approval at the AGM on 10 May 2023. Effective date is 1 January 2024. This remuneration policy will be posted on Equinor’s website at: www.equinor.com 16 | Equinor remuneration policy Photos Page 1, 16, Jan Arne Wold Page 2, 8, 11, Ole Jørgen Bratland Page 4, Ørjan Richardsen Page 5, 6, 7, 8, 12, Einar Aslaksen Page 13, Manfred Jarisch Page 15, Helge Hansen

17 | Equinor remuneration policy Equinor ASA Box 8500 NO-4035 Stavanger Norway Telephone: +47 51 99 00 00 www.equinor.com