1In relation to primary insiders, including the members of the Equinor ASA board of directors, reference is also given

to section 4.4 of this document.

Page 1 | ||

Requirements: Inside information |

1Objective, target group and provision

The objective of this document is to define and describe the requirements and guidelines for inside

information related to Equinor securities necessary to ensure that Equinor and persons working for

Equinor comply with applicable legislation, regulations and stock exchange requirements.

The target group is all persons working for the Equinor group, including the members of the board of

directors of Equinor ASA1 and of Equinor subsidiaries.

This document is provided for in Corporate Policy CP01 – Code of Conduct (CP01), section 3.10 Inside

information Equinor’s primary listing is on the Oslo Stock Exchange and the trading of Equinor shares is

regulated by the Norwegian Securities Trading Act (“STA”) and the Oslo Stock Exchange listing

requirements. Equinor is also listed on the New York Stock Exchange, as its secondary listing. Equinor is

therefore also subject to the requirements of the US Securities Exchange Act of 1934 and the New York

Stock Exchange listing requirements, applicable to foreign private issuers.

2Inside Information

2.1Definition of “Inside Information”

“Inside information” means any information of a precise nature (as defined below) relating to financial

instruments, the issuers thereof or other circumstances which have not been made public and are not

commonly known in the market, hence is likely to have a significant effect (as defined below) on the price

of those financial instruments or of related financial instruments.

•Information of a “precise nature” means information which indicates circumstances that exist or may

reasonably be expected to come into existence or an event that has occurred or may reasonably be

expected to occur and which is specific enough to enable a conclusion to be drawn as to the possible

effect of those circumstances or that event on the price of the financial instruments or related financial

instruments.

•Information likely to have a “significant effect” on the price of financial instruments or of related

financial instruments” means information which a reasonable investor would be likely to use as part of

the basis of his investment decisions.

“Equinor inside information” is inside information related to Equinor securities, including the Equinor

share.

Note that inside information for purposes of the US federal securities laws is information which is “material”

and “non-public”. Information is considered material if its disclosure would likely affect the price of a

security or a reasonable investor would consider the information important as part of the existing available

information concerning the company in deciding whether to buy, sell or hold a security. Information is

considered non-public if it has not been effectively communicated to the market place in the United States,

or made generally available in the United States.

2.2Obligations related to Inside Information

All persons working for the Equinor group are obliged to continually assess whether the information that

he/she obtains knowledge of or has access to as a result of his/her position in Equinor can be considered

as or has the potential of developing into Equinor inside information. Anyone who obtains such information

shall immediately report this to the owner of the information, who in turn will report to CFO Investor

Page 2 | ||

Requirements: Inside information |

Relations (IR). If there is any doubt (including as to who is the owner of the information), one should

immediately consult directly with CFO IR.

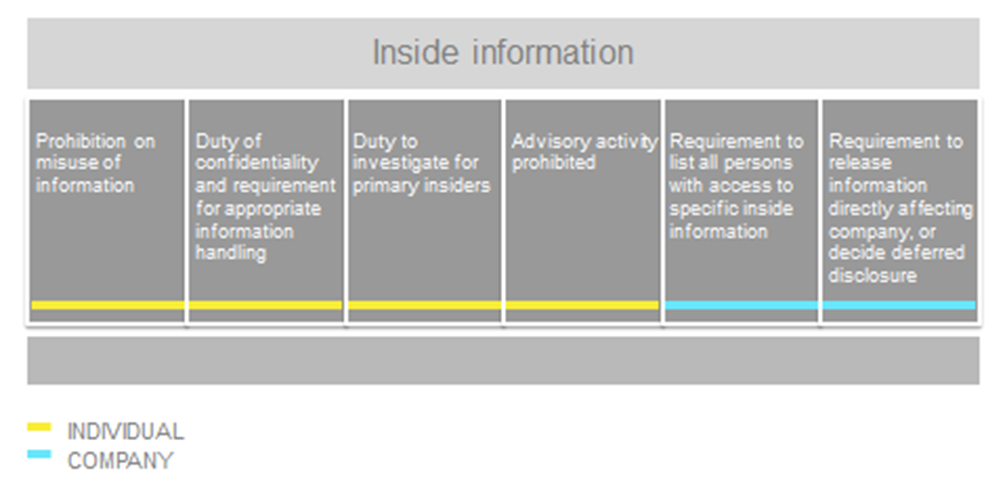

The illustration below gives an overview of the obligations and responsibilities according to the STA, for the

individual and for Equinor as a listed company, in a situation with Equinor inside information.

Reference to appendix which describes the process in more detail

3The obligations on the individual

It is important to note that obligations for the individual described under sections 3.1 and 3.2 also are

applicable for inside information which an individual has knowledge about related to another company than

Equinor.

3.1Prohibition on misuse of Inside Information

Subscription to, purchasing, selling or exchanging financial instruments issued by Equinor must not be

executed by person(s) in possession of Equinor inside information. This prohibition applies to any physical

or legal person, indirect or direct trading and both trading on own behalf or on behalf of others, irrespective

of the settlement method. The prohibition also applies to incitement of trading, i.e. it is not permitted to give

others (such as family members) advice or in any way influence anyone to make, or to refrain from making

such dispositions when in possession of Equinor inside information.

This applies equally to entry into, purchasing, selling or exchanging options or forward contracts or similar

rights (including financial derivatives) related to such financial instruments or to incite such dispositions.

However, pursuant to the Securities Trading Act, the prohibition on misuse of inside information does not

hinder normal execution of options or forward contracts entered into earlier when the contract period

comes to an end. It is not considered misuse of Equinor inside information to receive Equinor shares

under Equinor’s general share saving scheme for employees. The sale of shares obtained under the share

savings scheme is subject to the same restrictions as shares obtained in the open market.

Page 3 | ||

Requirements: Inside information |

3.2Duty of confidentiality

Inside information is confidential information and shall not be given to or in any other way be made

available to unauthorised individuals or companies.

The information can only be transferred to or made available to others in the event that the recipient has a

justifiable and well-founded need for the information seen in light of Equinor's interests. A strict "need to

know" principle should be applied, i.e. the number of people with access to the information shall be as low

as possible.

Those who transmit inside information or make the information accessible to others must immediately

notify the person responsible for inside listing (ref Appendix 1) about the recipient’s name, function, reason

for access and date and time for access to Equinor inside information.

Persons possessing inside information shall handle such information with due care so that the inside

information does not come into the possession of unauthorised persons.

Anyone with access to inside information must comply with Equinor’s requirements for handling of

confidential information when handling such inside information. (See WR 0158 “Information management”

and WR1211Information security”.)

4Equinor’s obligations regarding Inside Information

4.1Public disclosure of Inside Information

Subject to the following paragraph in this Section 4.1, CFO IR shall without delay publicly disclose Equinor

inside information.

However, publication may in some cases be postponed in order to protect Equinor’s interests, such as not

to prejudice Equinor’s legitimate interests, provided that such omission does not mislead the public and

provided that the issuer ensures the confidentiality of that information. The assessment as to whether

there is basis for delayed public disclosure shall be made by CFO IR in consultation with LEG. CFO IR

shall immediately notify the Oslo Stock Exchange privately of the circumstances, the background for the

postponement and that Equinor has initiated listing.

4.2Insider listing

Equinor has an obligation in situations with postponed disclosure to ensure that an insider list is made. It is

the responsibility of the project leader, with assistance from CFO IR, to initiate and execute insider listing

in accordance with this art. 4.2 and the detailed procedures described in Appendix 1 and Appendix 2.

The list shall be continuously updated and shall state the identity of persons, including externals, with

access to inside information, the date and time the persons were given access to such information, the

functions of the persons, the reasons why the persons are on the list and the date of entries

and changes to the list. The list shall be retained in a satisfactory manner for at least 5 years after its

creation or updating.

The person responsible for listing shall ensure that persons given access to inside information are aware

of the fact that they are included on the insider list, their duties and responsibilities of holding inside

information, as well as the criminal liability associated with misuse or unwarranted distribution of such

information.

Page 4 | ||

Requirements: Inside information |

Equinor may request external parties, for instance service providers, to prepare such insider list within its

own legal entity. Such delegation of insider listing must be considered on a case to case basis and shall be

agreed with CFO IR.

Equinor does not have any listing obligations in respect of information that is considered to be inside

information for Equinor’s contractors, partners or other third parties. Such third parties may however

request that Equinor lists all Equinor employees with access to their inside information.

Equinor has, as described in Appendix 1, an IT-tool that shall be used within Equinor when insider lists are

created. The use of this IT-tool shall ensure that the obligations related to listing as described above are

fulfilled.

Each BA and corporate function must ensure that they at any time have at least two people who have the

responsibility for the actual listing based on input from the project leader and who are trained in the

requirements and the practical use of the listing tool. (Ref Appendix 1)

Each BA and corporate function must nominate a person in the management team that has the on-going

responsibility for ensuring that respective project leaders perform the required quality control of insider

listing undertaken during their projects.

4.3Sanctions

Misuse of inside information and breach of regulations relating to proper handling of inside information is a

criminal offence. Infringements are punishable by substantial fines as well as imprisonment. Both

deliberate and negligent infringements may be subject to prosecution. Aiding and abetting, as well as

attempted misuse of the information, are similarly punishable. In addition, one may incur personal liability

for damage to Equinor and others, as well as disciplinary actions relating to the employment relationship,

up to and including dismissal.

4.4Primary insiders

In addition to these instructions applicable when dealing with inside information, Equinor’s primary insiders

are also subject to WR 1921 “Primary insiders”. Detailed routines for primary insiders' trading in financial

instruments, the duty to inspect, seek clearance and the duty of disclosure are established in these rules

and regulations.

A “primary insider” is a person holding one of the following positions or offices:

(a)members of Equinor ASA’s board of directors,

(b)elected auditor(s) for Equinor ASA,

(c)members of Equinor ASA’s corporate executive committee,

(d)other leading employees within the Equinor group who are placed on the list of primary insiders and

(e)Equinor ASA’s company secretary.

A list of Equinor ASA’s primary insiders is defined by the board of directors and publicly available on the

webpage of the Oslo Stock Exchange. The list of primary insiders is not to be confused with the list of

people that are listed as the holders of inside information in specific cases. Primary insiders shall in relation

to insider listing be treated as any other holder of inside information.

Page 5 | ||

Requirements: Inside information |

5Additional information

5.1Definitions and abbreviations

5.2Changes from previous version

•Updated provision.

5.3References

•Information management (WR0158)

•Information security (WR1211)

•Primary insiders (WR1921)

Page 6 | ||

Requirements: Inside information |

App AProcesses for insider listing in Equinor

Equinor’s obligation in accordance with the STA to ensure listing of persons with access to Equinor inside

information is described in Section 4.2.

•Responsibility for initiation and execution of insider listing is assigned to the project leader, with

assistance on request from CFO IR. Practical registration through the inside information database

listing tool is performed by dedicated personnel in each BA or corporate function or by the project

leader.

Quality control of the listing practice is the responsibility of a person nominated by the BA. This person is

also responsible for keeping updated on Equinor’s requirements and ensuring that relevant people have

taken the e- learning program “Detect & Handle Price Sensitive info”. Furthermore, perform quality control

as described in the quality control check list.

Link to BA overview of who is responsible for quality control and insider listing tool

Insider listing is done through the use of the inside information database tool. Access to and the practical

use of the tool and its dedicated database is managed by CFO IR, who will also provide training as required

to the designated personnel in each BA responsible for the practical listing.

•A link to the user manual for the tool can be found here Link to instruction Inside information database

tool.

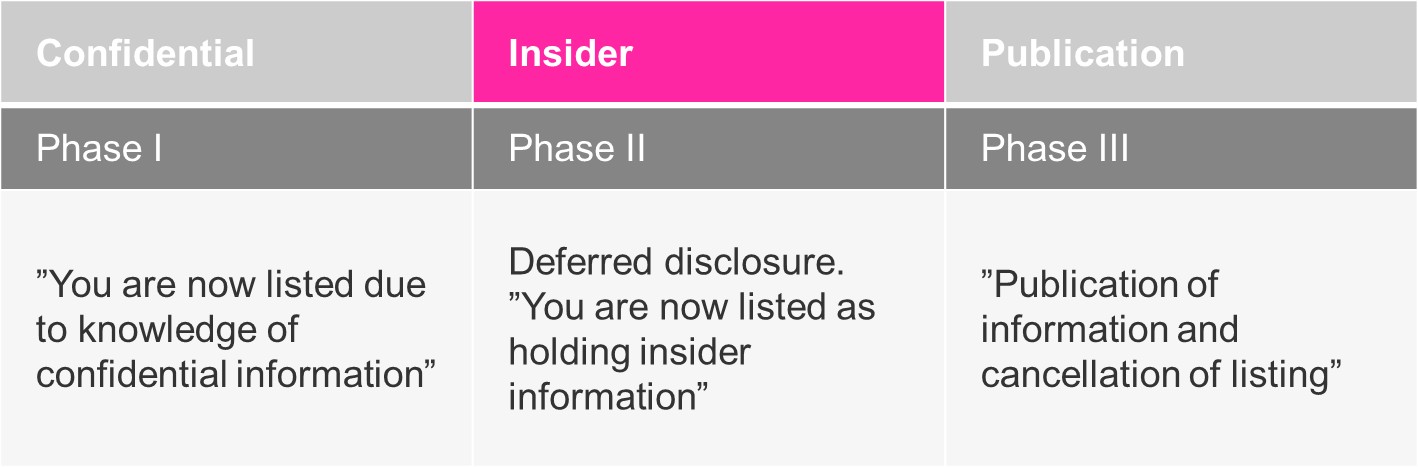

•In order to secure compliance with the listing requirements in the STA, Equinor has implemented three

phases in the listing process, as further described below.

A three phase listing process is executed through the insider listing tool;

Phase 1. Listing of persons with confidential information

1.The project leader (in Exploration; the area VP for the well) is responsible for identifying the presence

of confidential information with a potential to develop into inside information through continuous

monitoring of information in the project. If in doubt as to whether the information has the potential to

develop into inside information, the project leader should discuss with the area responsible in F&C and

then consult with CFO IR for evaluation.

The evaluation will be documented by CFO IR.

Examples of relevant triggers for considering if there is confidential information with a potential to develop

into inside information are;

Page 7 | ||

Requirements: Inside information |

•Business development projects that are subject to board approval should be evaluated with regards to

potential to develop into inside information before the DGB decision document is submitted to the

corporate executive committee (CEC).

•High impact exploration wells should be evaluated for potential to develop into inside information

potential (EXP to review timing with IR).

It should be noted that also other information than in the examples above might have a potential to

develop into inside information.

2.When confidential information is assessed as having the potential of developing into inside information,

project leader is responsible for initiating the Phase 1 listing process. Project leader is responsible for

preparation of the list of persons with access to such information.

The list should include the following information for each person listed:

•Name

•Work title

•E-mail address

•Reason for the person having access to the information

•Date and time for when access was given. The time listed has to be the exact time for giving access to

the information, not the time of listing.

•The system automatically registers the date and time changes are made to the list.

3.Project leader triggers the practical listing by providing the list to the designated BA personnel, who

executes the listing by entering the data into the inside information database tool. Standardised Phase

1 mails should always be sent to each person on the list making them aware that they are now in

possession of confidential information with a potential to develop into inside information and of their

obligations hereto. These e-mails are generated through the inside information database listing tool

and have the content as described in Appendix 2 hereto.

Phase 2. Listing of persons with inside information

1.When in Phase 1, project leader has an obligation to continuously monitor the project development and

evaluate whether the information is approaching the stage where it turns into inside information. When

approaching this stage he or she should contact CFO IR for an assessment of if and when inside

information will occur.

2.CFO IR will, in cooperation with LEG and the project leader, determine whether the information has

turned into inside information.

3.If CFO IR in consultation with LEG decides that inside information is present or would occur at a certain

time in the future the project leader will be advised to execute or prepare for listing in Phase 2.

Page 8 | ||

Requirements: Inside information |

4.At the time the information turns into inside information and it is deemed necessary to postpone

disclosure the project leader shall initiate Phase 2 listing. CFO IR will notify the Oslo Stock exchange,

the CFO, the General Counsel, the Head of Communication and the EVP for the relevant

businessarea. The decision will be documented. If postponed disclosure is decided, the project leader

evaluates which of the people listed in Phase 1 are now holders of inside information. The name of the

persons in possession of insideinformation are transferred to Phase 2 in the inside information

database listing tool and any additional names that are given access to the information shall as soon

as practically possible be added in the inside information database listing phase 2 with the required

data. Standardised Phase 2 mails shall immediately be sent to each person listed in Phase 2 to make

them aware that they are now in possession of Insider information and of their obligations hereto.

These e-mails are generated through the inside listing tool and have the content as described in

Appendix 2 hereto.

Phase 3. Publication and Cancellation

Upon final disclosure of the information through a stock exchange announcement – or if the project or

work on the project has been stopped – project leader is responsible for cancellation of listing through the

inside information database listing tool. Standardised Phase 3 mails are sent to each person on the active

lists making them aware that the special restrictions regarding trading of shares have been lifted. These e-

mails are generated through the inside information database listing tool and have the content as described

in Appendix 2 hereto.

General

CFO IR has access to all lists and can be contacted for general questions about existing lists.

CFO IR is responsible for saving all Insider Lists in the Meridio database for five years: The Financial

Supervisory Authority (No: Finanstilsynet) and Oslo Stock Exchange may require submission of the lists at

any point in time during this period.

Page 9 | ||

Requirements: Inside information |

App BNotices for phase 1, phase 2 and phase 3

Introduction

In connection with handling of inside information in Equinor notices are submitted for three phases to

holders of relevant information.

Phase 1 – notice to be sent at an early stage to make the holders of information aware that the information

related to a particular issue (for instance an exploration well or a BD project) might at a later stage develop

into inside information as defined in the Securities Trading Act. The intention of the phase 1 notice is to

make the holder aware of the sensitive nature of the information they are holding – which at this stage is

confidential – and further also to have names readily available if the information later develops into inside

information and a period with deferred disclosure is required.

Phase 1 notice should be submitted by using the inside information database listing tool. The line has the

responsibility for submitting the notice – if in doubt whether information at a later stage might qualify as

inside information; IR should be consulted before the phase 1 notice is submitted. However, IR should

always be informed when a phase 1 notice has been submitted – and IR will keep an updated overview of

notices submitted.

The phase 1 notice should be sent to all who hold or have access to the confidential information,

irrespective of whether these are primary insiders or not.

Phase 2 – notice to be sent when information is defined as inside information and there is a legal basis for

deferred disclosure. The line shall always consult with IR (which will consult with LEG) before a phase 2

notice is submitted.

The phase 2 notice should be sent to all who hold or have access to the inside information, irrespective of

whether these are primary insiders or not.

The notice is required in order to fulfill the requirements set forth in the Securities Trading Act.

Phase 3 – notice to be sent when listing is dormant – for instance when inside information is public or

when it is evident that the information will not develop from confidential information (phase 1) to inside

information (phase 2).

The notice should be sent to those who have previously received a notice about phase 1 or 2 listing.

Page 10 | ||

Requirements: Inside information |

Notice text to be used in phase 1, phase 2 and phase 3

Phase 1 - You are now listed due to knowledge of confidential information

“We have now started an internal listing of people with information regarding [project X]. Information about

this is regarded as confidential information that could potentially at a later stage develop into inside

information as defined in the Norwegian Securities Trading Act (Verdipapirhandelloven).

You are listed as a holder of information in this regard. We are now potentially entering into a "grey zone"

and you should therefore refrain from trading shares or ADRs in Equinor and/or in companies affected by

this non-public information without prior written consent from CFO IR.

Information can only be passed on to people on a need-to-know basis and these people must immediately

be listed by notice to the sender of this e-mail. Please ensure that you inform in such notice at which time

such person(s) were given access (time and date) and the reason why access was granted.

Handling of confidential information must be in compliance with Equinor’s information security

requirements.

Reference is made to the Equinor’s Code of Conduct sections 3.9 Information Management

and Confidentiality,

3.10 Inside information and 5.4 Public communication, as well as WR 2401 Inside information.

If you have any questions related to this notice or if you have received the notice by mistake, please inform

the sender of this e-mail.”

Phase 2 - You are now listed as holding Inside Information

“You may or may not have received an e-mail earlier about [project X]. Please be aware that the

information as of [date and time] has developed from an early warning, where you have been

registered as holding confidential information about [project X], to a situation where you are formally

in possession of inside information about [project X]. Since you have access to Inside Information you

are hereby informed that you are listed on Equinor ASA’s insider list related to [project X]. This means

that you are subject to the following obligations and responsibilities:

•Prohibition against misuse of inside information (section 3-3 of the Norwegian Securities Trading

Act (STA)); Subscription, purchase, sale of exchange of shares or ADRs, or other financial instruments,

in Equinor ASA, or in other companies where knowledge of this information constitutes inside

information, shall not take place directly or indirectly on own or others account.

•Duty of confidentiality and due care in handling of inside information (section 3-4 of the STA);

Persons possessing inside information must not disclose such information to unauthorised persons.

Further, persons possessing inside information shall handle such information with due care so that the

inside information does not come into the possession of unauthorized persons or is misused.

•Prohibition of advice (section 3-7 of the STA); Persons possessing inside information shall not give

advice about trading in shares or ADRs, or other financial instruments, to which the information relates.

The primary insiders in Equinor has also in accordance with Section 3-6 of the STA a duty to investigate,

reference is given to WR 1921 Primary Insiders.

Page 11 | ||

Requirements: Inside information |

Please note that information can only be passed on to persons on a need-to-know basis, subject to

informing such persons about the obligations and responsibilities referred to in this e-mail. Further these

persons must immediately be listed by you giving notice to the sender of this e-mail. In such notice please

inform at which time such person(s) were given access (time and date), their function and the reason for

why they were given access.

Kindly note that these restrictions also apply to the subscription for dividend shares under

Equinor's scrip dividend programme, i.e. you cannot subscribe for scrip dividend shares whilst in

possession of inside information. If you have already subscribed for dividend shares (i.e. before

you were listed in phase 2) – you will need to cancel your subscription for scrip dividend shares, if

the subscription period for the relevant scrip dividend is still open, as soon as practicable

possible.

Misuse or unwarranted distribution of inside information can result in criminal liability in form of fine or

imprisonment up to six years (cf STA section 17-3). Where an unlawful gain is obtained by negligent or

willful violation of these regulations the party to whom such gain has accrued may be ordered to surrender

all or part of it.

The handling of inside information must be in compliance with Equinor’s information security requirements

for confidential information.

Reference is made to the Equinor’s Code of Conduct sections 3.9 Information Management

and Confidentiality,

3.10 Inside information, and 5.4 Public communication, as well as WR 2401 Inside information.

If you have any questions related to this notice or if you have received the notice by mistake please inform

the sender of this e-mail immediately.”

Phase 3 - Cancellation of listing

Cancellation of listing in phase 1

“Please be informed that special restrictions related to trading shares or ADRs in Equinor and/or in

companies affected by this non-public information regarding [project X] is now lifted. If the information

related to [project X] is not available in the public domain it may still be subject to confidentiality until

becoming public.”

Cancellation of listing after phase 2

“Please be informed that information regarding [project X] is now public or no longer considered as Inside

information and the list is now inactive and archived. Special restrictions are lifted.”