THE LEADER AND INNOVATOR IN TOTAL TALENT SOLUTIONS 1 Investor Presentation C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . January 2026

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 2 Non-GAAP Measures This presentation contains certain financial measures that are not in accordance with generally accepted accounting principles in the United States (“GAAP”) or with rules adopted by the SEC that apply to registration statements under the Securities Act of 1933, as amended, and periodic reports under the Exchange Act. These “non-GAAP financial measures,” as defined under the rules of the SEC, are intended as supplemental measures of our operating performance that are not required by, or presented in accordance with GAAP, and are not intended be an alternative to the Company's condensed consolidated financial statements presented in accordance with GAAP. The non-GAAP financial measures included in this presentation consist of (1) Adjusted EBITDA, (2) Adjusted Net Income, (3) Adjusted EBITDA Margin, and (4) Free Cash Flow (which means cash flow from operations less capital expenditures) referenced throughout the presentation. Management believes that the items excluded from Adjusted EBITDA, Adjusted Net Income, Adjusted EBITDA Margin, and Free Cash Flow are significant components in understanding and assessing operating performance. Therefore, Adjusted EBITDA, Adjusted Net Income, Adjusted EBITDA Margin, and Free Cash Flow should not be considered a substitute for net income, cash flows from operating, investing or financing activities, operating margin, or cash flow from operations, as the case may be. Because Adjusted EBITDA, Adjusted Net Income, Adjusted EBITDA Margin, and Free Cash Flow are not measurements determined in accordance with GAAP and are thus susceptible to varying calculations, the Adjusted EBITDA, Adjusted Net Income, Adjusted EBITDA Margin, and Free Cash Flow numbers contained herein may not be comparable to other similarly titled measures of other companies. In addition, our management believes that Adjusted EBITDA and Adjusted EBITDA Margin serve as industry-wide financial measures. The non-GAAP measures contained in this presentation should not be used in isolation to evaluate the Company's performance. A quantitative reconciliation of the Adjusted EBITDA, Adjusted Net Income, Adjusted EBITDA Margin and Free Cash Flow non-GAAP measures identified in this presentation, along with further detail about the use and limitations of certain of these non-GAAP measures, to the most directly comparable GAAP financial measures may be found in the appendix slides to this presentation and on the Company's website at http://ir.amnhealthcare.com.

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 3 Forward-Looking Statements This investor presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include, among others, statements concerning the trajectory of the healthcare industry, future demand for our services and demand within the healthcare industry, duration and severity of labor shortages, our debt and leverage strategies, our capabilities related to our digital customer experience and technology-enabled solutions and analytics, our ability to attract and retain talent and continue to serve the needs of large and growing clients, our ability to deliver long-term profitable growth, our ability to effectively incorporate acquisitions into our business operations, our ability to automate tasks and reduce costs, our working capital needs and our capabilities to address challenges and trends in the healthcare industry. AMN Healthcare Services, Inc. (the “Company”) bases these forward-looking statements on its current beliefs, expectations, estimates, forecasts and projections about future events and the industry in which it operates. Forward-looking statements are identified by words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “will,” “should,” “would,” “project,” “may,” variations of such words and other similar expressions. In addition, statements that refer to performance; plans, objectives and strategies for future operations; and other characterizations of future events or circumstances, are forward-looking statements. The Company’s actual results could differ materially from those discussed in, or implied by, these forward-looking statements. Factors and other cautionary statements that could cause actual results to differ from those discussed in or implied by the forward-looking statements contained in this presentation are set forth in (i) the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, (ii) its subsequent periodic reports, current reports, and other SEC filings, and (iii) the cautionary statements included in the Company’s most recent earnings release issued on November 6, 2025, including our financial condition and our results of operations, future demand for staffing and other services, our ability to attract new clients and the opportunities ahead for AMN, the intensity, impact and duration of workforce shortages, our ability to anticipate and quickly respond to changing marketplace conditions, such as alternative modes of healthcare delivery, reimbursement, or client needs, our ability to implement our strategic plan and advancement in our technology platform and processes, our projected capital expenditures, and our ability to manage the pricing impact that the labor market and consolidation of healthcare delivery organizations may have on our business. Be advised that developments subsequent to this presentation are likely to cause these statements to become outdated and the Company is under no obligation (and expressly disclaims any such obligation) to update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 4 Investment Highlights We Innovate to Solve Problems in the Healthcare Labor Force Technology- Enabled Solutions Provide Flexibility for Professionals and Their Employers Sustainable Long- Term Macro Growth Drivers Aging U.S. and Clinical Population Driving Higher Demand for Workforce Solutions Well-Positioned to Generate Long- Term Revenue Growth and Operating Leverage to Deliver >10% Annual Growth in Adjusted EBITDA Opportunity for Strategic M&A to Expand Offerings, Grow Share, Increase Margins and Sustain More Resilient Revenues Purpose-Driven, Value-Based Organization Celebrating 40 Years, Broad Solutions, High- Quality Leadership with Diverse Experience and Industry Knowledge

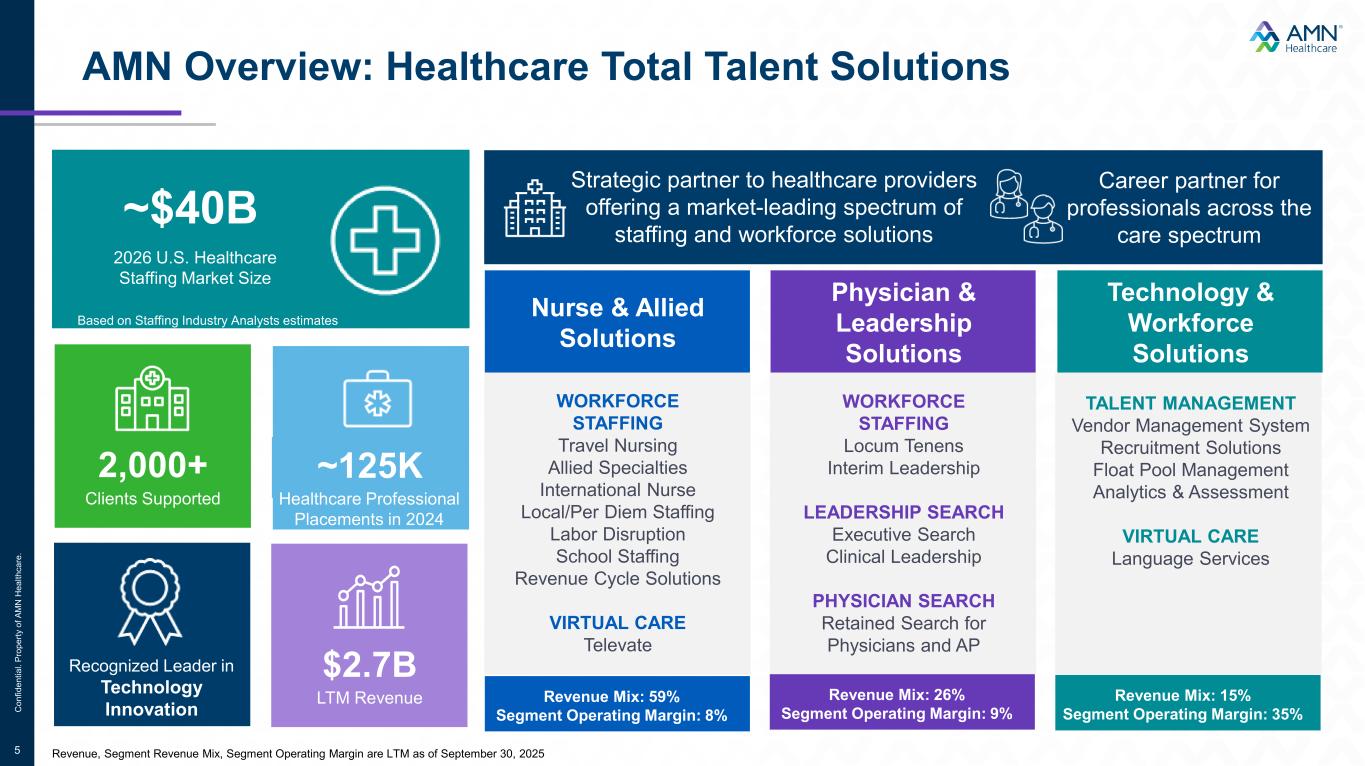

Recognized Leader in Technology InnovationC o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 5 AMN Overview: Healthcare Total Talent Solutions WORKFORCE STAFFING Travel Nursing Allied Specialties International Nurse Local/Per Diem Staffing Labor Disruption School Staffing Revenue Cycle Solutions VIRTUAL CARE Televate WORKFORCE STAFFING Locum Tenens Interim Leadership LEADERSHIP SEARCH Executive Search Clinical Leadership PHYSICIAN SEARCH Retained Search for Physicians and AP Nurse & Allied Solutions Physician & Leadership Solutions Technology & Workforce Solutions TALENT MANAGEMENT Vendor Management System Recruitment Solutions Float Pool Management Analytics & Assessment VIRTUAL CARE Language Services 2,000+ Clients Supported Strategic partner to healthcare providers offering a market-leading spectrum of staffing and workforce solutions ~$40B 2026 U.S. Healthcare Staffing Market Size Career partner for professionals across the care spectrum ~125K Healthcare Professional Placements in 2024 Revenue, Segment Revenue Mix, Segment Operating Margin are LTM as of September 30, 2025 Revenue Mix: 59% Segment Operating Margin: 8% Revenue Mix: 26% Segment Operating Margin: 9% Revenue Mix: 15% Segment Operating Margin: 35% $2.7B LTM Revenue Based on Staffing Industry Analysts estimates

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 6 Strategic Growth Pillars Expand Share Across the Broader Market • Serve clients across all delivery models (supplier-led, vendor neutral, direct) • Cross-sell our portfolio of solutions into our client base • Accelerate growth in faster growing markets and care settings (post-acute, imaging, PT, schools, etc.) Accelerate Growth as Industry Demand Increases • Gain incremental share from improved speed to fill and fulfillment initiatives • Benefit from demand increases across our broader market footprint • Drive scale benefit from our tech-enabled global workforce Drive Earnings Growth with Operating Leverage • Continue automation of tasks and process redesign to lower costs, improve speed and leverage talent • Grow higher-margin service lines to improve operating leverage • Grow revenue 2x operating expenses, leading to double- digit long-term earnings growth

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 7 Factors That Enable Our Growth Model Macro Factors AMN Factors Aging patient and clinician populations driving demand faster than supply Growing supply of clinicians who prefer/demand flexible work models Increasing specialization and creation of tech-intensive caregiving roles Productivity-enhancing technology enables high quality, lower cost services Outsized growth opportunity in previously under-penetrated markets and service models Breadth of solutions increases market potential and operating leverage

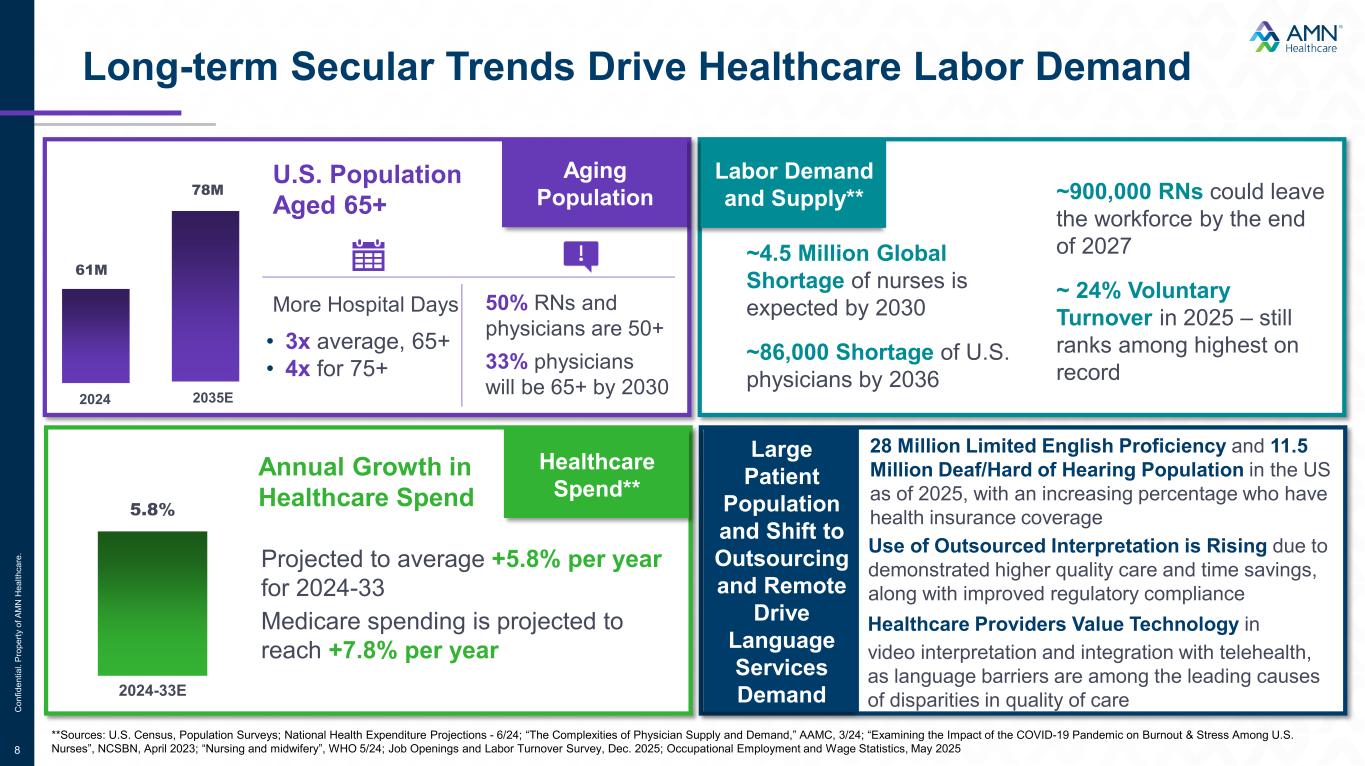

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 8 Long-term Secular Trends Drive Healthcare Labor Demand More Hospital Days • 3x average, 65+ • 4x for 75+ 50% RNs and physicians are 50+ 33% physicians will be 65+ by 2030 61M 78M 2035E2024 Projected to average +5.8% per year for 2024-33 Medicare spending is projected to reach +7.8% per year 5.8% 2024-33E **Sources: U.S. Census, Population Surveys; National Health Expenditure Projections - 6/24; “The Complexities of Physician Supply and Demand,” AAMC, 3/24; “Examining the Impact of the COVID-19 Pandemic on Burnout & Stress Among U.S. Nurses”, NCSBN, April 2023; “Nursing and midwifery”, WHO 5/24; Job Openings and Labor Turnover Survey, Dec. 2025; Occupational Employment and Wage Statistics, May 2025 U.S. Population Aged 65+ Aging Population Labor Demand and Supply** Healthcare Spend** Annual Growth in Healthcare Spend ~4.5 Million Global Shortage of nurses is expected by 2030 ~86,000 Shortage of U.S. physicians by 2036 ~900,000 RNs could leave the workforce by the end of 2027 ~ 24% Voluntary Turnover in 2025 – still ranks among highest on record Large Patient Population and Shift to Outsourcing and Remote Drive Language Services Demand 28 Million Limited English Proficiency and 11.5 Million Deaf/Hard of Hearing Population in the US as of 2025, with an increasing percentage who have health insurance coverage Use of Outsourced Interpretation is Rising due to demonstrated higher quality care and time savings, along with improved regulatory compliance Healthcare Providers Value Technology in video interpretation and integration with telehealth, as language barriers are among the leading causes of disparities in quality of care

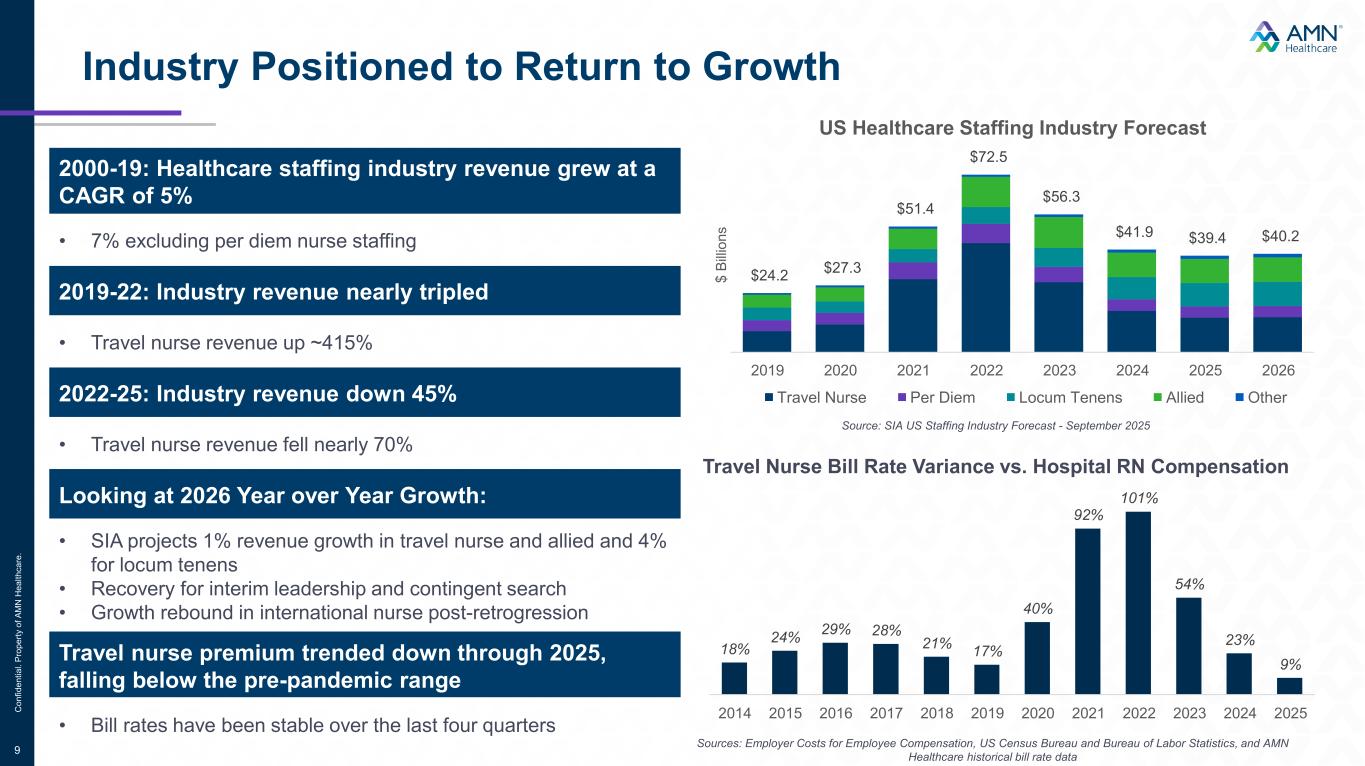

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 9 Industry Positioned to Return to Growth $24.2 $27.3 $51.4 $72.5 $56.3 $41.9 $39.4 $40.2 2019 2020 2021 2022 2023 2024 2025 2026 $ B ill io n s US Healthcare Staffing Industry Forecast Travel Nurse Per Diem Locum Tenens Allied Other Source: SIA US Staffing Industry Forecast - September 2025 18% 24% 29% 28% 21% 17% 40% 92% 101% 54% 23% 9% 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Travel Nurse Bill Rate Variance vs. Hospital RN Compensation Sources: Employer Costs for Employee Compensation, US Census Bureau and Bureau of Labor Statistics, and AMN Healthcare historical bill rate data 2000-19: Healthcare staffing industry revenue grew at a CAGR of 5% • 7% excluding per diem nurse staffing 2019-22: Industry revenue nearly tripled • Travel nurse revenue up ~415% 2022-25: Industry revenue down 45% • Travel nurse revenue fell nearly 70% Looking at 2026 Year over Year Growth: • SIA projects 1% revenue growth in travel nurse and allied and 4% for locum tenens • Recovery for interim leadership and contingent search • Growth rebound in international nurse post-retrogression Travel nurse premium trended down through 2025, falling below the pre-pandemic range • Bill rates have been stable over the last four quarters

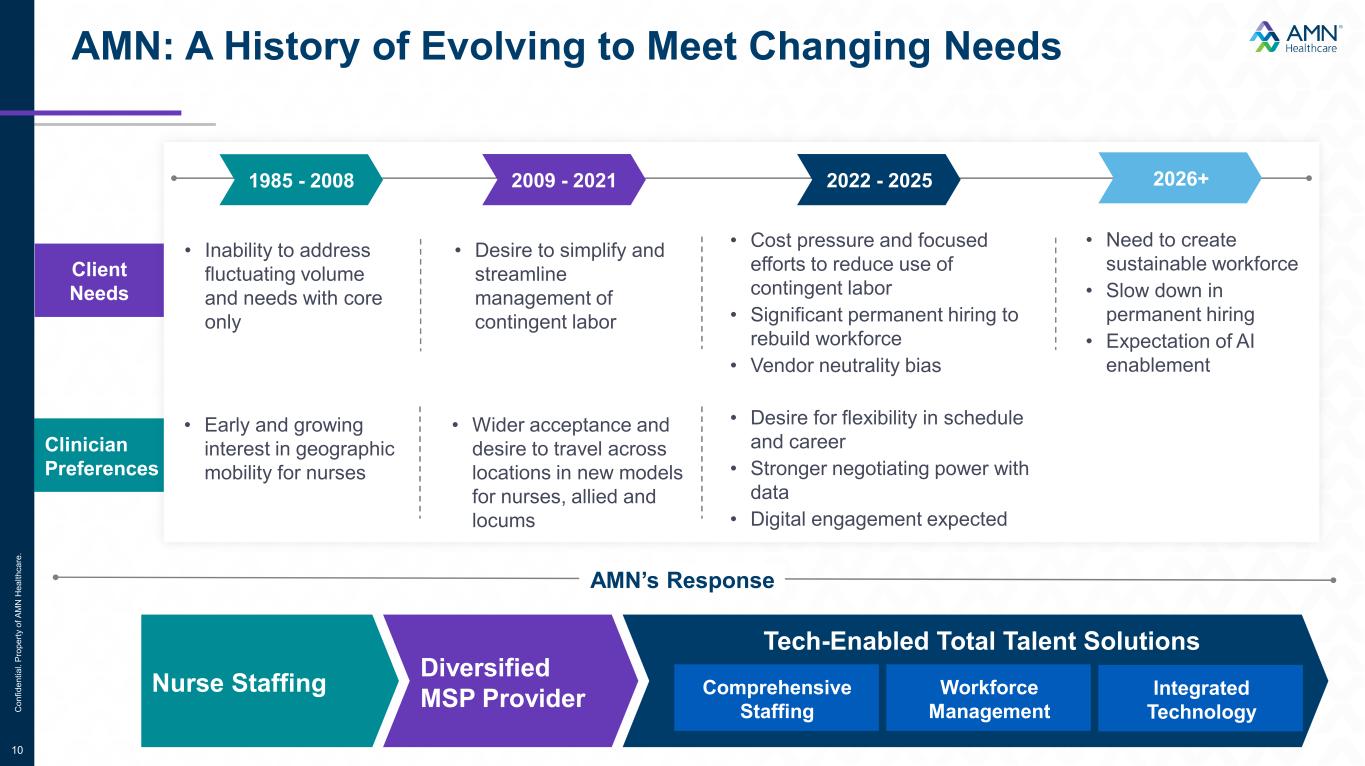

10 AMN: A History of Evolving to Meet Changing Needs Nurse Staffing Diversified MSP Provider AMN’s Response C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . Comprehensive Staffing Tech-Enabled Total Talent Solutions Workforce Management Integrated Technology Client Needs Clinician Preferences • Desire for flexibility in schedule and career • Stronger negotiating power with data • Digital engagement expected • Early and growing interest in geographic mobility for nurses • Wider acceptance and desire to travel across locations in new models for nurses, allied and locums • Need to create sustainable workforce • Slow down in permanent hiring • Expectation of AI enablement • Cost pressure and focused efforts to reduce use of contingent labor • Significant permanent hiring to rebuild workforce • Vendor neutrality bias • Inability to address fluctuating volume and needs with core only • Desire to simplify and streamline management of contingent labor 1985 - 2008 2009 - 2021 2022 - 2025 2026+

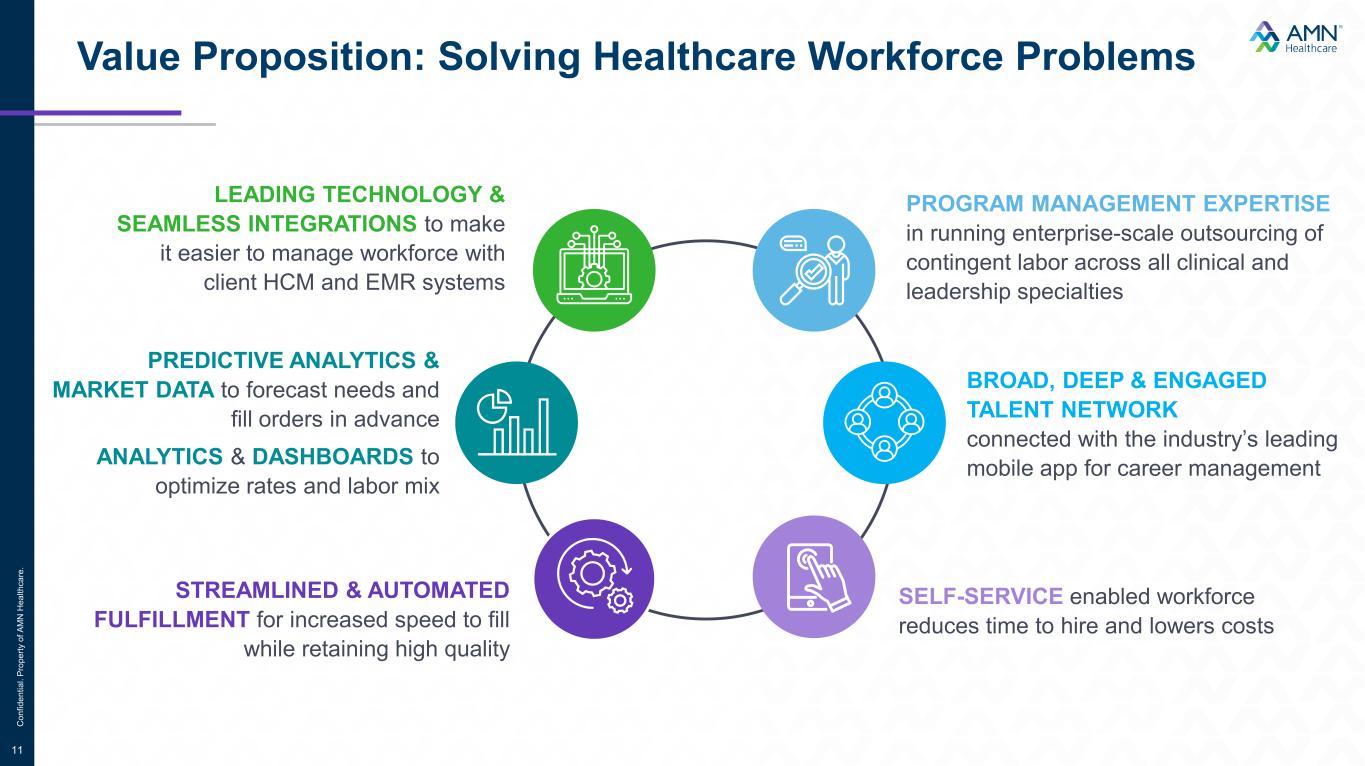

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 11 Value Proposition: Solving Healthcare Workforce Problems LEADING TECHNOLOGY & SEAMLESS INTEGRATIONS to make it easier to manage workforce with client HCM and EMR systems PREDICTIVE ANALYTICS & MARKET DATA to forecast needs and fill orders in advance ANALYTICS & DASHBOARDS to optimize rates and labor mix PROGRAM MANAGEMENT EXPERTISE in running enterprise-scale outsourcing of contingent labor across all clinical and leadership specialties BROAD, DEEP & ENGAGED TALENT NETWORK connected with the industry’s leading mobile app for career management SELF-SERVICE enabled workforce reduces time to hire and lowers costs STREAMLINED & AUTOMATED FULFILLMENT for increased speed to fill while retaining high quality

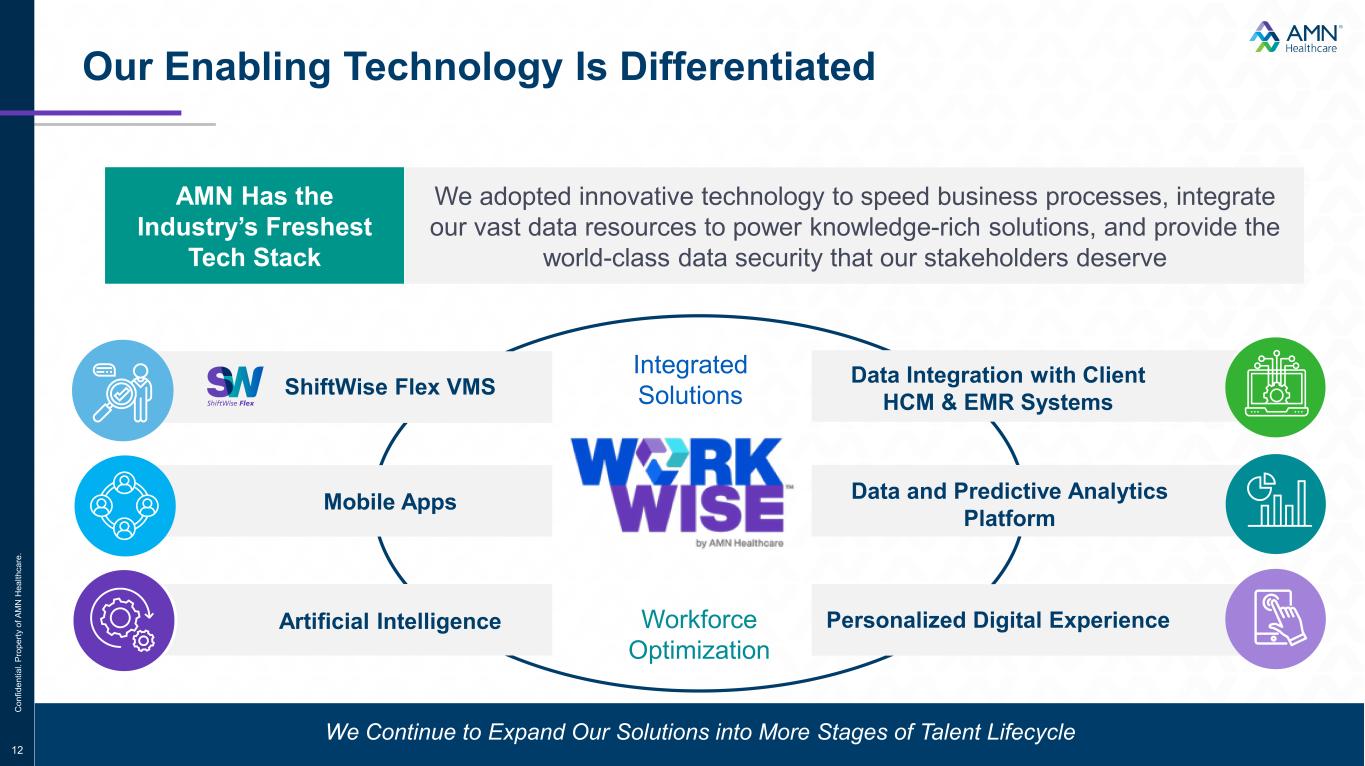

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 12 Our Enabling Technology Is Differentiated We Continue to Expand Our Solutions into More Stages of Talent Lifecycle We adopted innovative technology to speed business processes, integrate our vast data resources to power knowledge-rich solutions, and provide the world-class data security that our stakeholders deserve AMN Has the Industry’s Freshest Tech Stack Mobile Apps Data and Predictive Analytics Platform Artificial Intelligence Personalized Digital Experience ShiftWise Flex VMS Data Integration with Client HCM & EMR Systems Integrated Solutions Workforce Optimization

Time and Invoice Compliance Automation Spend Management Artificial Intelligence Pillars C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . Managing all clinical and non-clinical roles along with all assignment lengths, float pools, internal agency, permanent positions and SOW Our Leading Client VMS Solution: ShiftWise Flex 13 Advanced Analytics for contingent spend, supplier performance, and market insights Submission Workflow • Predictive Analytics • Candidate Scoring • Job Descriptions • Supplier Scoring & Management 53k Submissions/month YTD Avg. 1,200+ Supplier Network 86% Order Fill Rate YTD

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 14 Innovation in Action: AMN Passport MOBILE APP THAT SUPPORTS NURSING, ALLIED, AND LOCUMS NEEDS ACROSS TRAVEL, PERM AND PER DIEM OPPORTUNITIES AI DRIVE Utilizes AI to process secure documents and match clinicians to jobs based on work history and personal preferences SELF SERVICE Simplify staffing and administration with self-service workflows, mobile scheduling, and time & expense management 47k Monthly Active Users 345k Registered Users WORKWISE INTEGRATION Seamless data flow with VMS and ATS to accelerate placements 2025“ ”

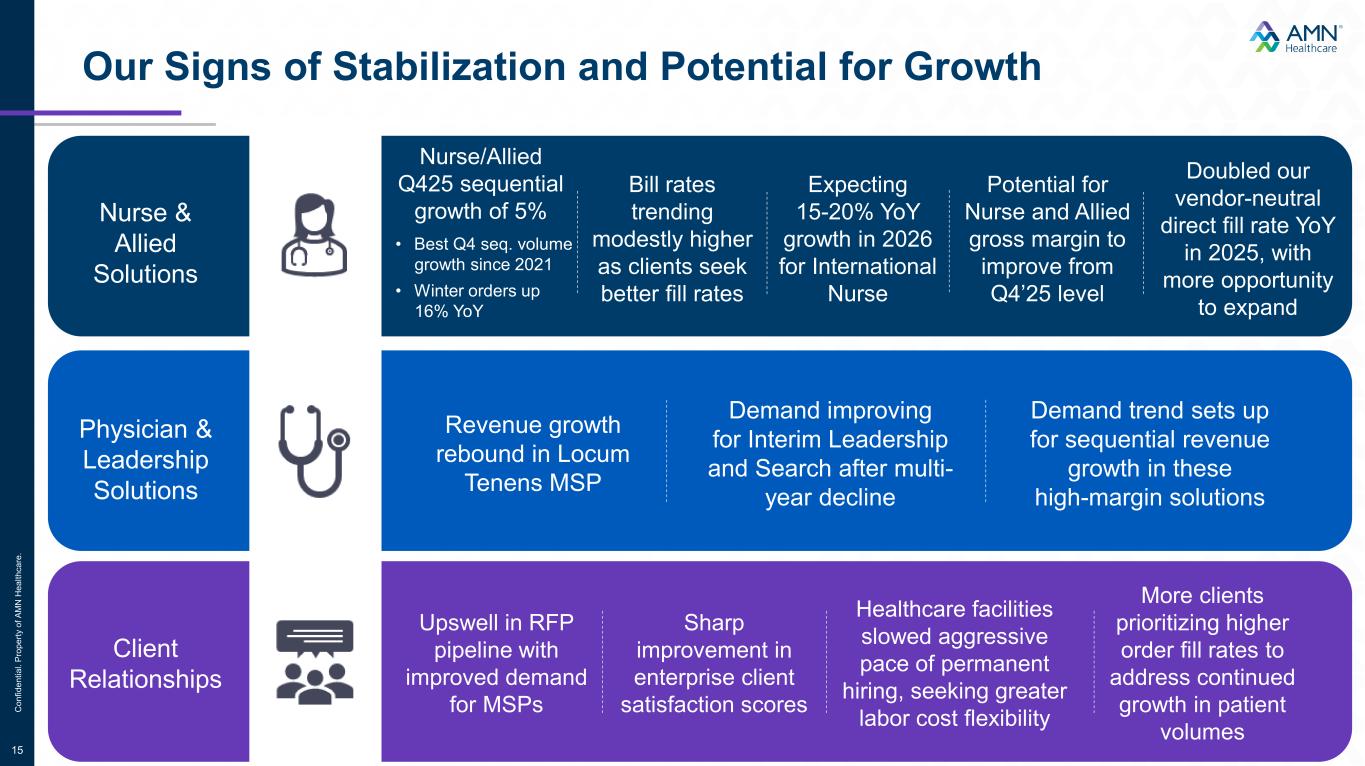

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 15 Our Signs of Stabilization and Potential for Growth Revenue growth rebound in Locum Tenens MSP Demand improving for Interim Leadership and Search after multi- year decline Demand trend sets up for sequential revenue growth in these high-margin solutions Upswell in RFP pipeline with improved demand for MSPs Sharp improvement in enterprise client satisfaction scores Healthcare facilities slowed aggressive pace of permanent hiring, seeking greater labor cost flexibility More clients prioritizing higher order fill rates to address continued growth in patient volumes Client Relationships Physician & Leadership Solutions Nurse & Allied Solutions Nurse/Allied Q425 sequential growth of 5% Bill rates trending modestly higher as clients seek better fill rates Expecting 15-20% YoY growth in 2026 for International Nurse Potential for Nurse and Allied gross margin to improve from Q4’25 level Doubled our vendor-neutral direct fill rate YoY in 2025, with more opportunity to expand • Best Q4 seq. volume growth since 2021 • Winter orders up 16% YoY

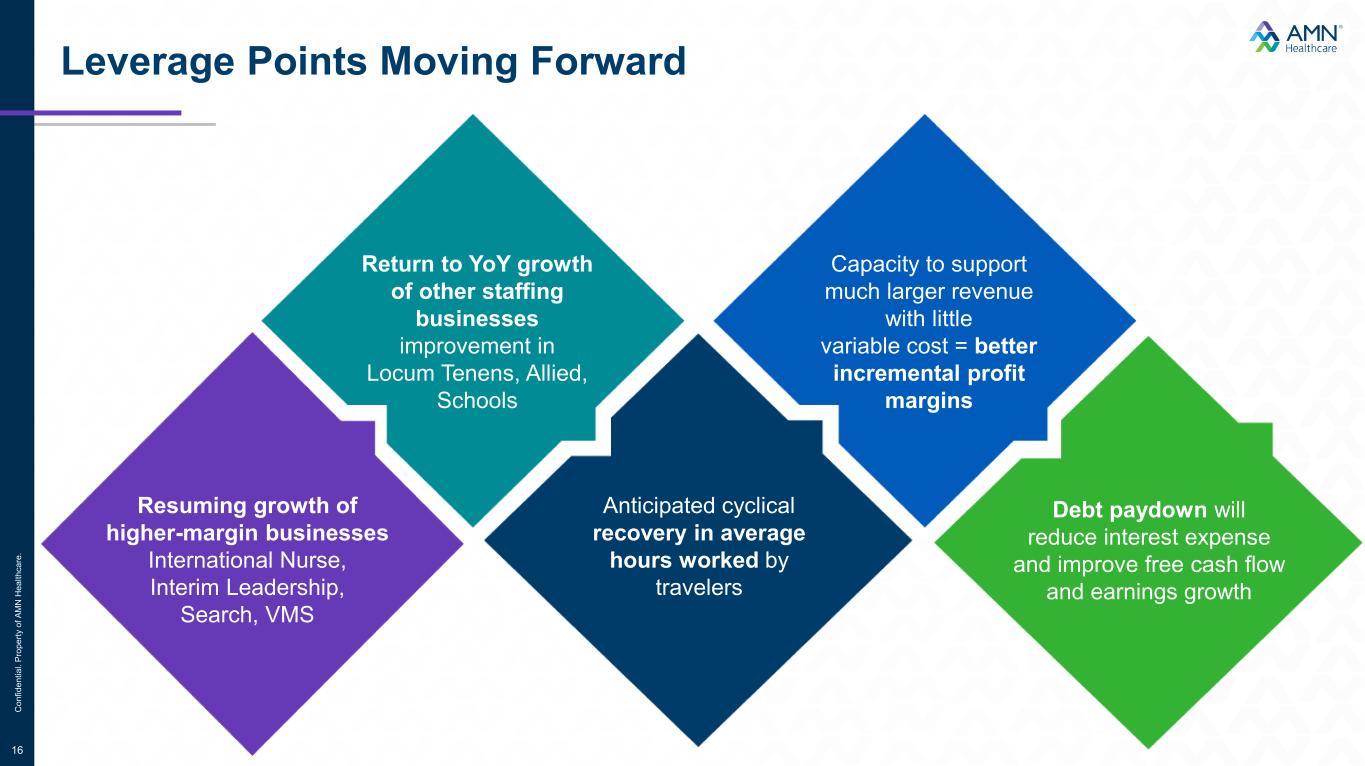

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 16 Leverage Points Moving Forward Resuming growth of higher-margin businesses International Nurse, Interim Leadership, Search, VMS Debt paydown will reduce interest expense and improve free cash flow and earnings growth Return to YoY growth of other staffing businesses improvement in Locum Tenens, Allied, Schools Anticipated cyclical recovery in average hours worked by travelers Capacity to support much larger revenue with little variable cost = better incremental profit margins

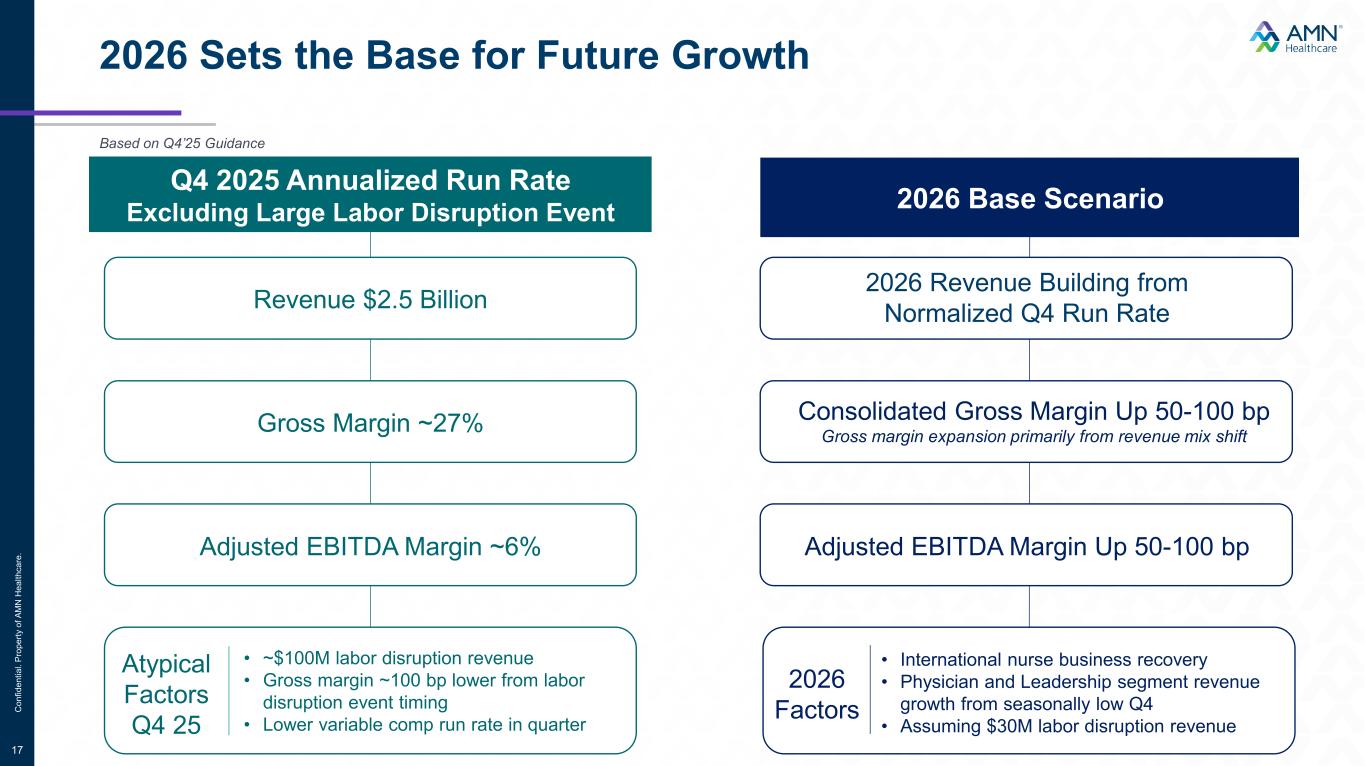

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 17 Q4 2025 Annualized Run Rate Excluding Large Labor Disruption Event 2026 Base Scenario 2026 Sets the Base for Future Growth Revenue $2.5 Billion Gross Margin ~27% Adjusted EBITDA Margin ~6% 2026 Revenue Building from Normalized Q4 Run Rate Consolidated Gross Margin Up 50-100 bp Gross margin expansion primarily from revenue mix shift Adjusted EBITDA Margin Up 50-100 bp Atypical Factors Q4 25 • ~$100M labor disruption revenue • Gross margin ~100 bp lower from labor disruption event timing • Lower variable comp run rate in quarter 2026 Factors • International nurse business recovery • Physician and Leadership segment revenue growth from seasonally low Q4 • Assuming $30M labor disruption revenue Based on Q4’25 Guidance

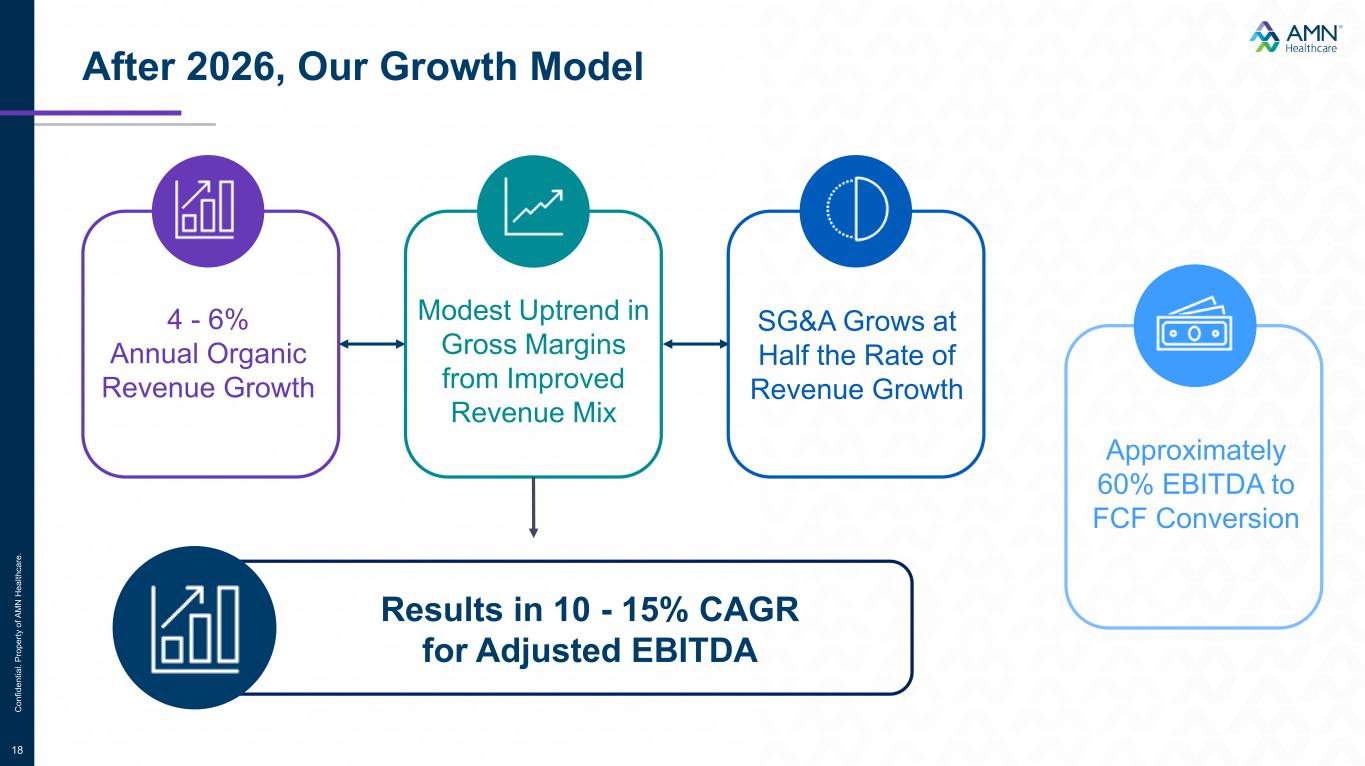

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 18 After 2026, Our Growth Model 4 - 6% Annual Organic Revenue Growth Modest Uptrend in Gross Margins from Improved Revenue Mix SG&A Grows at Half the Rate of Revenue Growth Results in 10 - 15% CAGR for Adjusted EBITDA Approximately 60% EBITDA to FCF Conversion

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 19 Next Chapter in Our Industry & Our Positioning Healthcare staffing market is turning from a focus on restrained demand to concerns about sustainable labor supply AI-empowerment reaches into every step from workforce planning to recruiting, credentialing, onboarding and career guidance AMN has the brand strength, breadth and depth of expertise, and transparency that healthcare organizations need now in a partner Need for scale, breadth and depth will force industry consolidation, and AMN will participate

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 20 Appendix

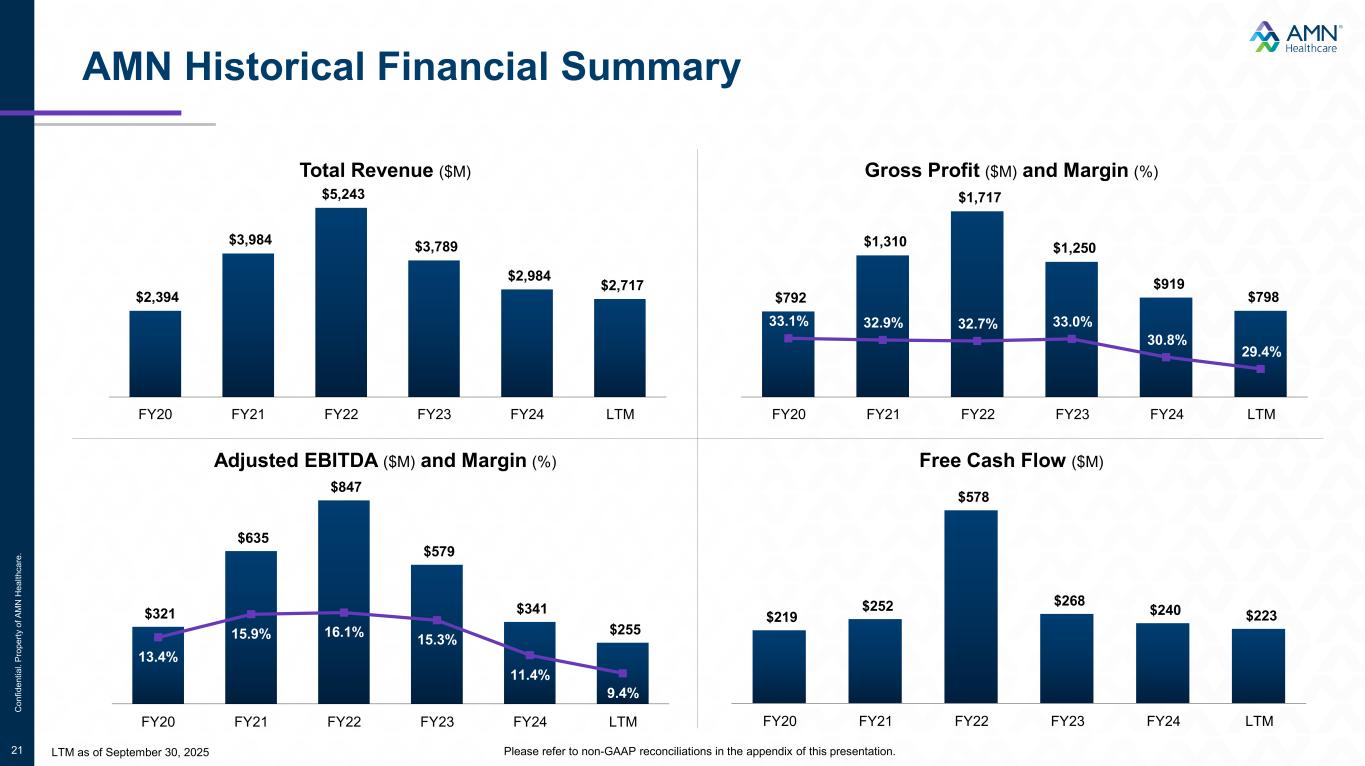

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 21 AMN Historical Financial Summary Total Revenue ($M) Gross Profit ($M) and Margin (%) Adjusted EBITDA ($M) and Margin (%) Free Cash Flow ($M) $2,394 $3,984 $5,243 $3,789 $2,984 $2,717 FY20 FY21 FY22 FY23 FY24 LTM $792 $1,310 $1,717 $1,250 $919 $798 33.1% 32.9% 32.7% 33.0% 30.8% 29.4% 26.0% 31.0% 36.0% 41.0% 46.0% 51.0% $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 FY20 FY21 FY22 FY23 FY24 LTM $321 $635 $847 $579 $341 $255 13.4% 15.9% 16.1% 15.3% 11.4% 9.4% 6.0% 11.0% 16.0% 21.0% 26.0% $- $100 $200 $300 $400 $500 $600 $700 $800 $900 FY20 FY21 FY22 FY23 FY24 LTM Please refer to non-GAAP reconciliations in the appendix of this presentation. $219 $252 $578 $268 $240 $223 0.31 0.32 0.33 0.34 0.35 0.36 0.37 0.38 0.39 0.4 $(50) $50 $150 $250 $350 $450 $550 $650 FY20 FY21 FY22 FY23 FY24 LTM LTM as of September 30, 2025

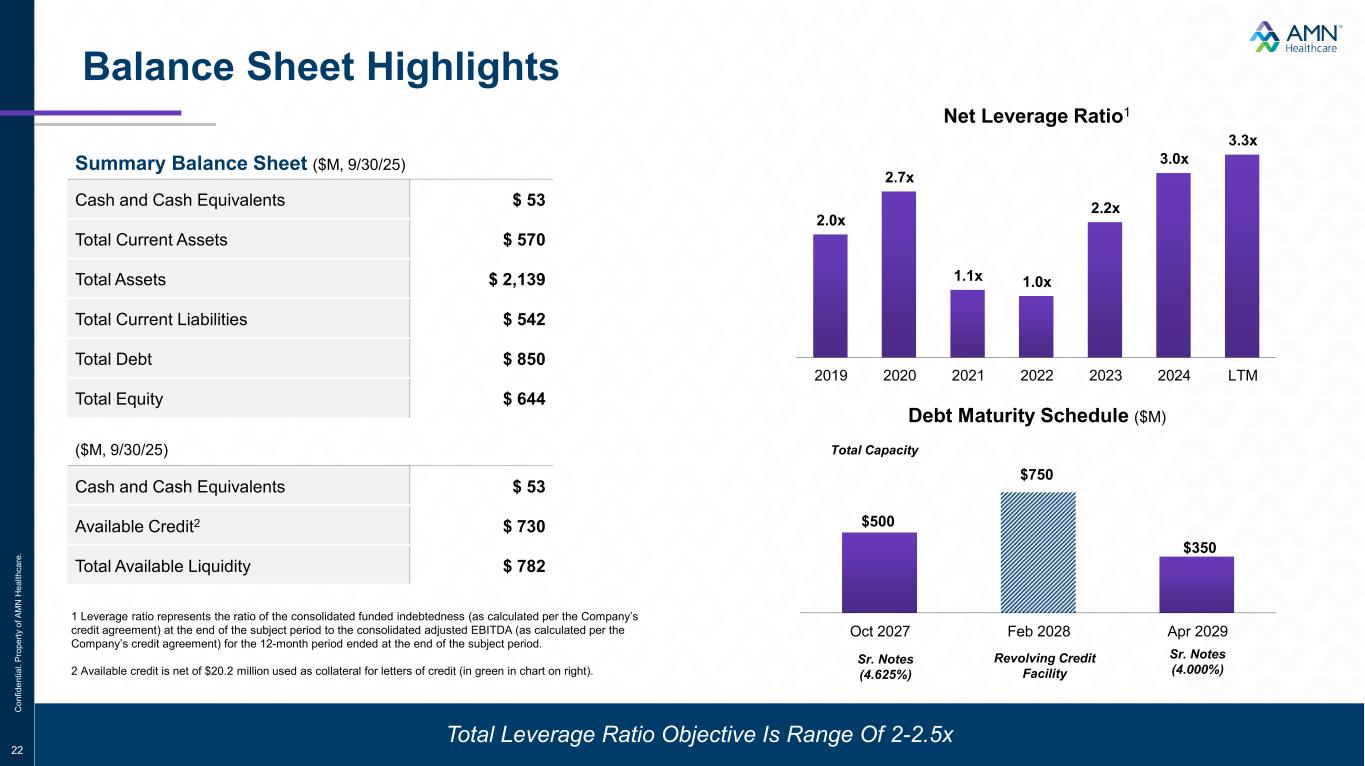

C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 22 Balance Sheet Highlights 1 Leverage ratio represents the ratio of the consolidated funded indebtedness (as calculated per the Company’s credit agreement) at the end of the subject period to the consolidated adjusted EBITDA (as calculated per the Company’s credit agreement) for the 12-month period ended at the end of the subject period. 2 Available credit is net of $20.2 million used as collateral for letters of credit (in green in chart on right). Summary Balance Sheet ($M, 9/30/25) Cash and Cash Equivalents $ 53 Total Current Assets $ 570 Total Assets $ 2,139 Total Current Liabilities $ 542 Total Debt $ 850 Total Equity $ 644 ($M, 9/30/25) Cash and Cash Equivalents $ 53 Available Credit2 $ 730 Total Available Liquidity $ 782 $500 $350 Oct 2027 Feb 2028 Apr 2029 Debt Maturity Schedule ($M) 2.0x 2.7x 1.1x 1.0x 2.2x 3.0x 3.3x 2019 2020 2021 2022 2023 2024 LTM Net Leverage Ratio1 Sr. Notes (4.000%) Revolving Credit Facility Sr. Notes (4.625%) Total Capacity Total Leverage Ratio Objective Is Range Of 2-2.5x $750

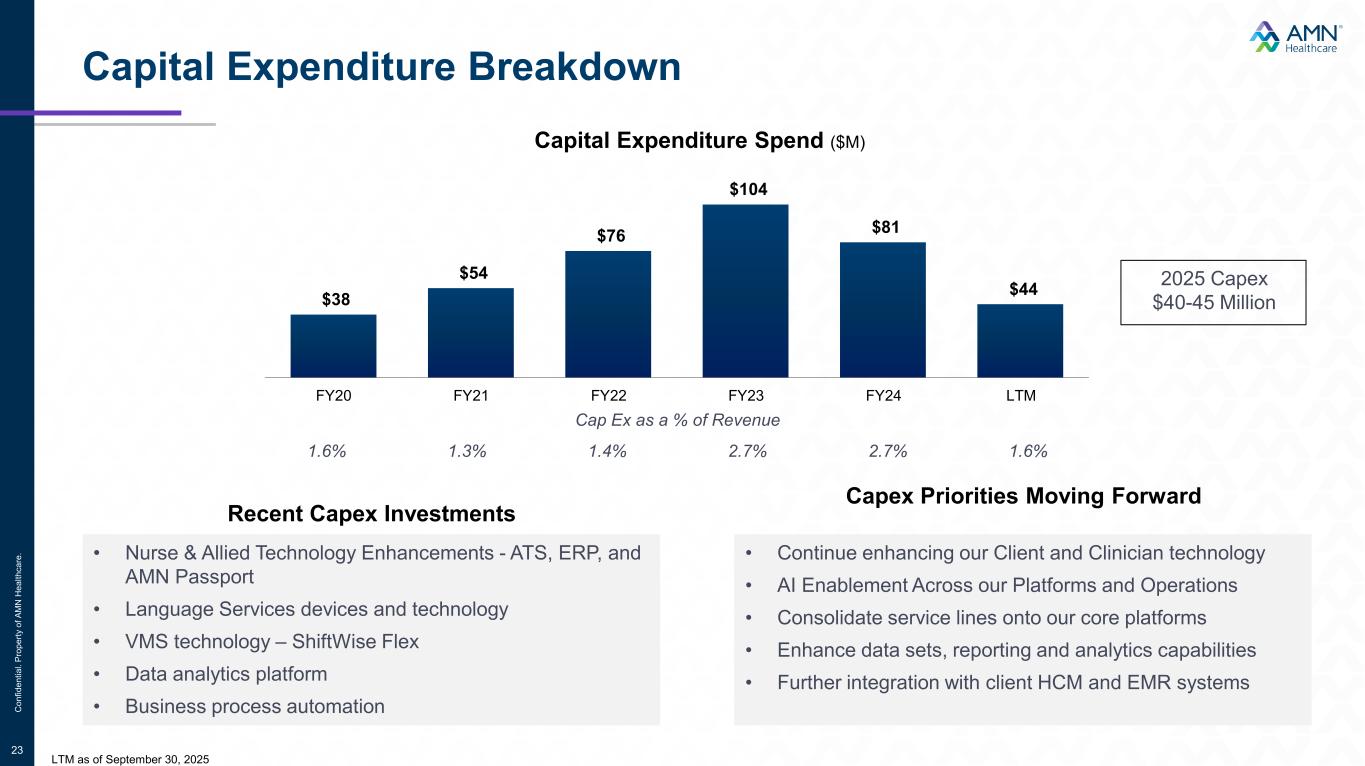

$38 $54 $76 $104 $81 $44 FY20 FY21 FY22 FY23 FY24 LTM C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 23 Capital Expenditure Breakdown Capital Expenditure Spend ($M) Recent Capex Investments • Continue enhancing our Client and Clinician technology • AI Enablement Across our Platforms and Operations • Consolidate service lines onto our core platforms • Enhance data sets, reporting and analytics capabilities • Further integration with client HCM and EMR systems Cap Ex as a % of Revenue 1.6% 1.3% 1.4% 2.7% 2.7% 1.6% • Nurse & Allied Technology Enhancements - ATS, ERP, and AMN Passport • Language Services devices and technology • VMS technology – ShiftWise Flex • Data analytics platform • Business process automation 2025 Capex $40-45 Million LTM as of September 30, 2025 Capex Priorities Moving Forward

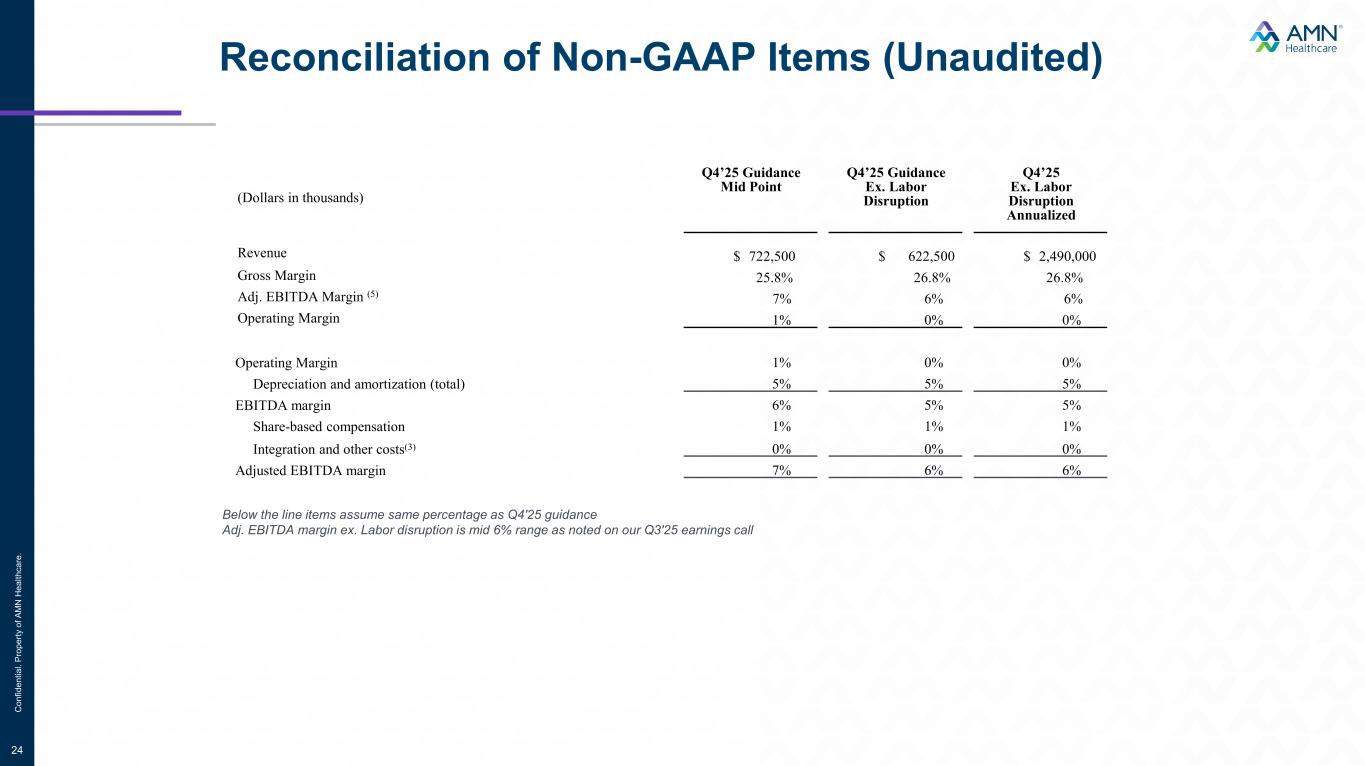

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 24 (Dollars in thousands) Q4’25 Guidance Mid Point Q4’25 Guidance Ex. Labor Disruption Q4’25 Ex. Labor Disruption Annualized Revenue $ 722,500 $ 622,500 $ 2,490,000 Gross Margin 25.8% 26.8% 26.8% Adj. EBITDA Margin (5) 7% 6% 6% Operating Margin 1% 0% 0% Operating Margin 1% 0% 0% Depreciation and amortization (total) 5% 5% 5% EBITDA margin 6% 5% 5% Share-based compensation 1% 1% 1% Integration and other costs(3) 0% 0% 0% Adjusted EBITDA margin 7% 6% 6% Below the line items assume same percentage as Q4'25 guidance Adj. EBITDA margin ex. Labor disruption is mid 6% range as noted on our Q3'25 earnings call

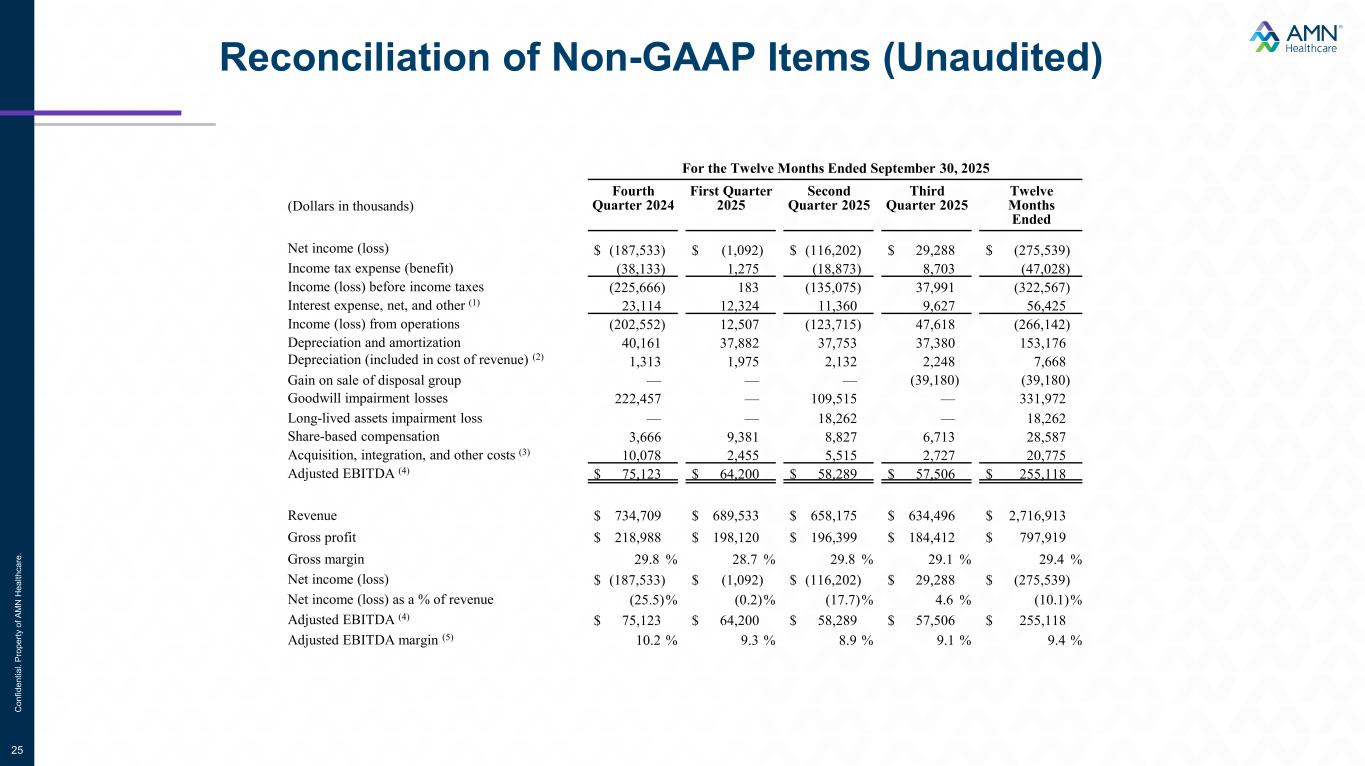

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 25 For the Twelve Months Ended September 30, 2025 (Dollars in thousands) Fourth Quarter 2024 First Quarter 2025 Second Quarter 2025 Third Quarter 2025 Twelve Months Ended Net income (loss) $ (187,533) $ (1,092) $ (116,202) $ 29,288 $ (275,539) Income tax expense (benefit) (38,133) 1,275 (18,873) 8,703 (47,028) Income (loss) before income taxes (225,666) 183 (135,075) 37,991 (322,567) Interest expense, net, and other (1) 23,114 12,324 11,360 9,627 56,425 Income (loss) from operations (202,552) 12,507 (123,715) 47,618 (266,142) Depreciation and amortization 40,161 37,882 37,753 37,380 153,176 Depreciation (included in cost of revenue) (2) 1,313 1,975 2,132 2,248 7,668 Gain on sale of disposal group — — — (39,180) (39,180) Goodwill impairment losses 222,457 — 109,515 — 331,972 Long-lived assets impairment loss — — 18,262 — 18,262 Share-based compensation 3,666 9,381 8,827 6,713 28,587 Acquisition, integration, and other costs (3) 10,078 2,455 5,515 2,727 20,775 Adjusted EBITDA (4) $ 75,123 $ 64,200 $ 58,289 $ 57,506 $ 255,118 Revenue $ 734,709 $ 689,533 $ 658,175 $ 634,496 $ 2,716,913 Gross profit $ 218,988 $ 198,120 $ 196,399 $ 184,412 $ 797,919 Gross margin 29.8 % 28.7 % 29.8 % 29.1 % 29.4 % Net income (loss) $ (187,533) $ (1,092) $ (116,202) $ 29,288 $ (275,539) Net income (loss) as a % of revenue (25.5)% (0.2)% (17.7)% 4.6 % (10.1)% Adjusted EBITDA (4) $ 75,123 $ 64,200 $ 58,289 $ 57,506 $ 255,118 Adjusted EBITDA margin (5) 10.2 % 9.3 % 8.9 % 9.1 % 9.4 %

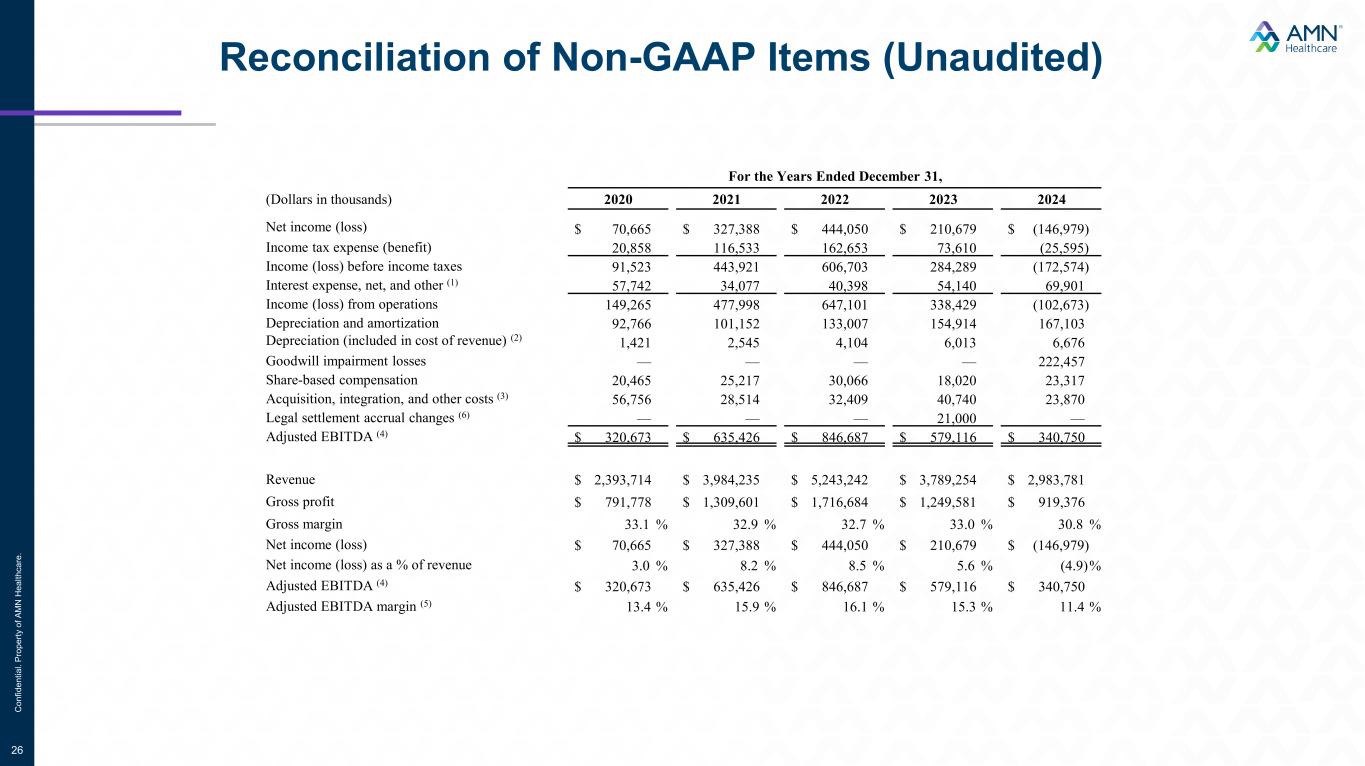

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 26 For the Years Ended December 31, (Dollars in thousands) 2020 2021 2022 2023 2024 Net income (loss) $ 70,665 $ 327,388 $ 444,050 $ 210,679 $ (146,979) Income tax expense (benefit) 20,858 116,533 162,653 73,610 (25,595) Income (loss) before income taxes 91,523 443,921 606,703 284,289 (172,574) Interest expense, net, and other (1) 57,742 34,077 40,398 54,140 69,901 Income (loss) from operations 149,265 477,998 647,101 338,429 (102,673) Depreciation and amortization 92,766 101,152 133,007 154,914 167,103 Depreciation (included in cost of revenue) (2) 1,421 2,545 4,104 6,013 6,676 Goodwill impairment losses — — — — 222,457 Share-based compensation 20,465 25,217 30,066 18,020 23,317 Acquisition, integration, and other costs (3) 56,756 28,514 32,409 40,740 23,870 Legal settlement accrual changes (6) — — — 21,000 — Adjusted EBITDA (4) $ 320,673 $ 635,426 $ 846,687 $ 579,116 $ 340,750 Revenue $ 2,393,714 $ 3,984,235 $ 5,243,242 $ 3,789,254 $ 2,983,781 Gross profit $ 791,778 $ 1,309,601 $ 1,716,684 $ 1,249,581 $ 919,376 Gross margin 33.1 % 32.9 % 32.7 % 33.0 % 30.8 % Net income (loss) $ 70,665 $ 327,388 $ 444,050 $ 210,679 $ (146,979) Net income (loss) as a % of revenue 3.0 % 8.2 % 8.5 % 5.6 % (4.9)% Adjusted EBITDA (4) $ 320,673 $ 635,426 $ 846,687 $ 579,116 $ 340,750 Adjusted EBITDA margin (5) 13.4 % 15.9 % 16.1 % 15.3 % 11.4 %

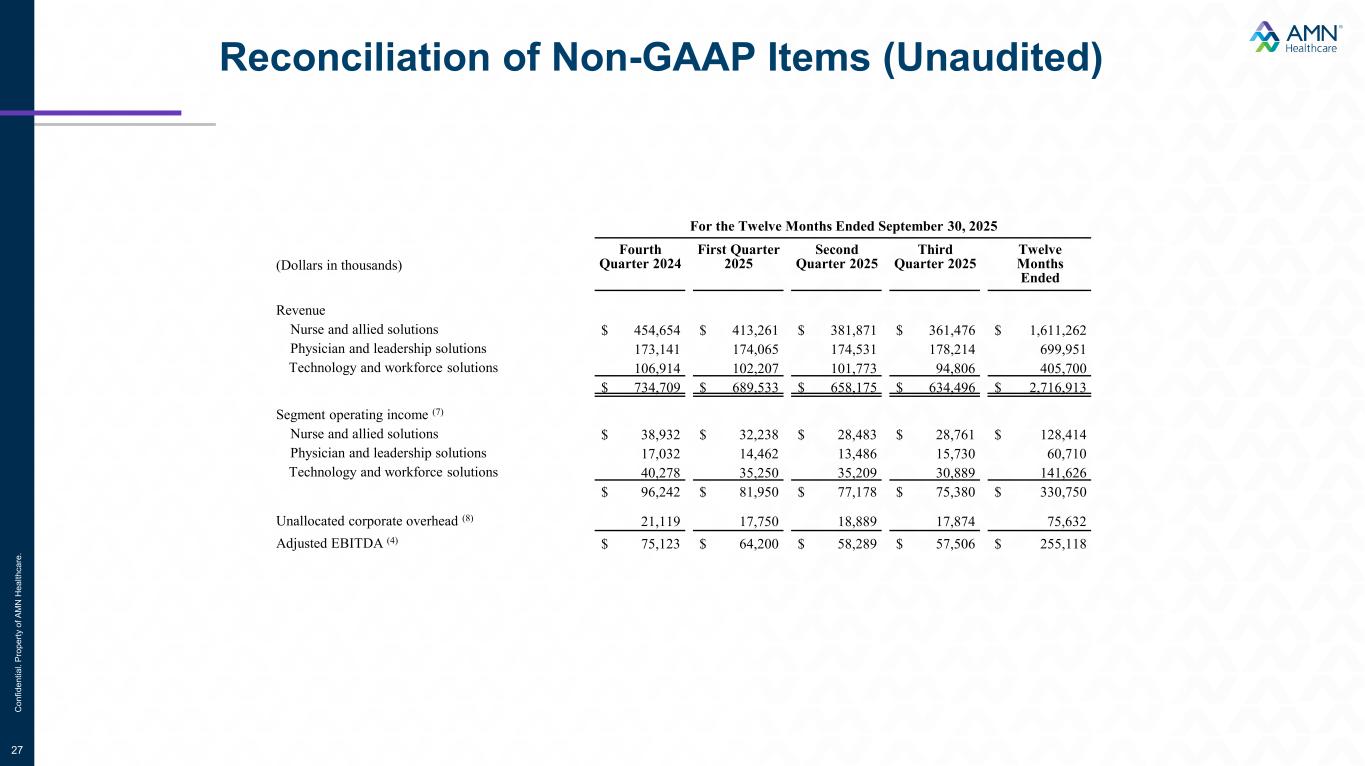

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 27 For the Twelve Months Ended September 30, 2025 (Dollars in thousands) Fourth Quarter 2024 First Quarter 2025 Second Quarter 2025 Third Quarter 2025 Twelve Months Ended Revenue Nurse and allied solutions $ 454,654 $ 413,261 $ 381,871 $ 361,476 $ 1,611,262 Physician and leadership solutions 173,141 174,065 174,531 178,214 699,951 Technology and workforce solutions 106,914 102,207 101,773 94,806 405,700 $ 734,709 $ 689,533 $ 658,175 $ 634,496 $ 2,716,913 Segment operating income (7) Nurse and allied solutions $ 38,932 $ 32,238 $ 28,483 $ 28,761 $ 128,414 Physician and leadership solutions 17,032 14,462 13,486 15,730 60,710 Technology and workforce solutions 40,278 35,250 35,209 30,889 141,626 $ 96,242 $ 81,950 $ 77,178 $ 75,380 $ 330,750 Unallocated corporate overhead (8) 21,119 17,750 18,889 17,874 75,632 Adjusted EBITDA (4) $ 75,123 $ 64,200 $ 58,289 $ 57,506 $ 255,118

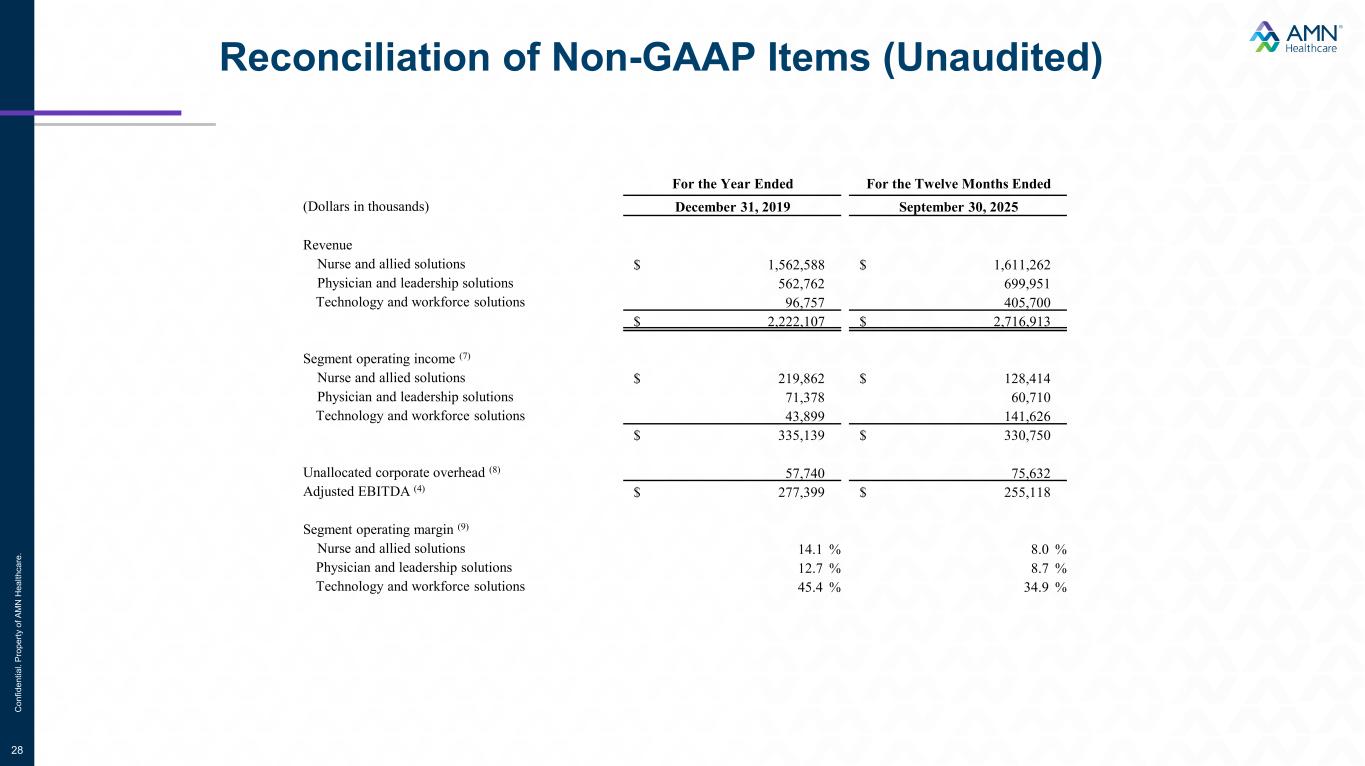

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 28 For the Year Ended For the Twelve Months Ended (Dollars in thousands) December 31, 2019 September 30, 2025 Revenue Nurse and allied solutions $ 1,562,588 $ 1,611,262 Physician and leadership solutions 562,762 699,951 Technology and workforce solutions 96,757 405,700 $ 2,222,107 $ 2,716,913 Segment operating income (7) Nurse and allied solutions $ 219,862 $ 128,414 Physician and leadership solutions 71,378 60,710 Technology and workforce solutions 43,899 141,626 $ 335,139 $ 330,750 Unallocated corporate overhead (8) 57,740 75,632 Adjusted EBITDA (4) $ 277,399 $ 255,118 Segment operating margin (9) Nurse and allied solutions 14.1 % 8.0 % Physician and leadership solutions 12.7 % 8.7 % Technology and workforce solutions 45.4 % 34.9 %

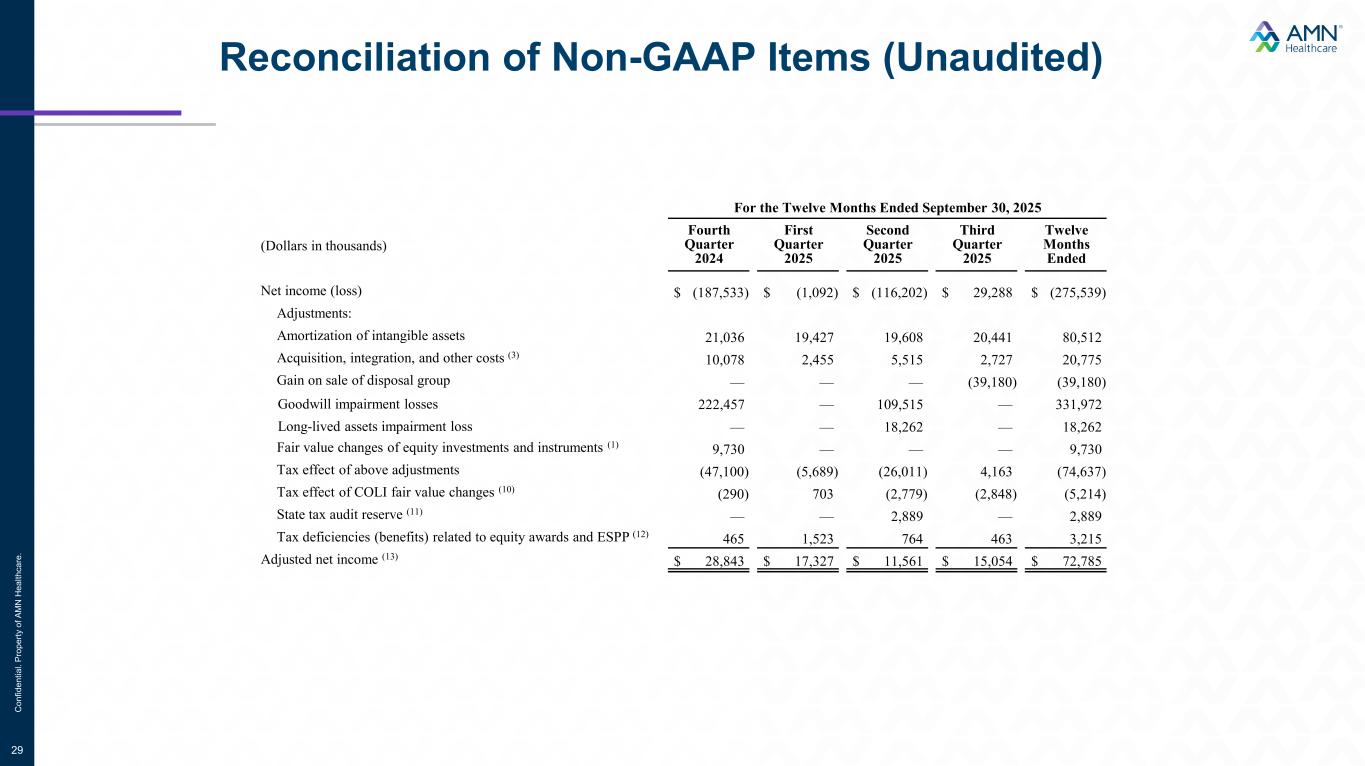

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 29 For the Twelve Months Ended September 30, 2025 (Dollars in thousands) Fourth Quarter 2024 First Quarter 2025 Second Quarter 2025 Third Quarter 2025 Twelve Months Ended Net income (loss) $ (187,533) $ (1,092) $ (116,202) $ 29,288 $ (275,539) Adjustments: Amortization of intangible assets 21,036 19,427 19,608 20,441 80,512 Acquisition, integration, and other costs (3) 10,078 2,455 5,515 2,727 20,775 Gain on sale of disposal group — — — (39,180) (39,180) Goodwill impairment losses 222,457 — 109,515 — 331,972 Long-lived assets impairment loss — — 18,262 — 18,262 Fair value changes of equity investments and instruments (1) 9,730 — — — 9,730 Tax effect of above adjustments (47,100) (5,689) (26,011) 4,163 (74,637) Tax effect of COLI fair value changes (10) (290) 703 (2,779) (2,848) (5,214) State tax audit reserve (11) — — 2,889 — 2,889 Tax deficiencies (benefits) related to equity awards and ESPP (12) 465 1,523 764 463 3,215 Adjusted net income (13) $ 28,843 $ 17,327 $ 11,561 $ 15,054 $ 72,785

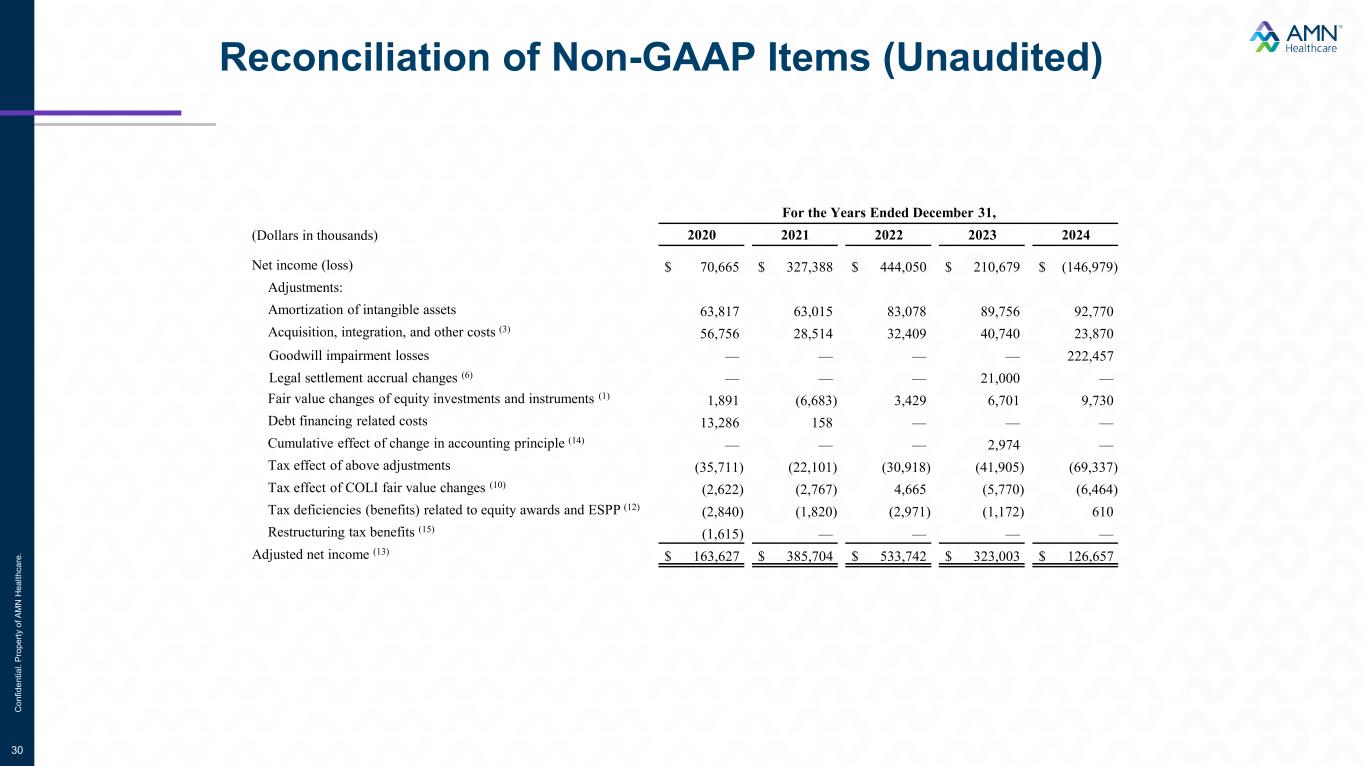

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 30 For the Years Ended December 31, (Dollars in thousands) 2020 2021 2022 2023 2024 Net income (loss) $ 70,665 $ 327,388 $ 444,050 $ 210,679 $ (146,979) Adjustments: Amortization of intangible assets 63,817 63,015 83,078 89,756 92,770 Acquisition, integration, and other costs (3) 56,756 28,514 32,409 40,740 23,870 Goodwill impairment losses — — — — 222,457 Legal settlement accrual changes (6) — — — 21,000 — Fair value changes of equity investments and instruments (1) 1,891 (6,683) 3,429 6,701 9,730 Debt financing related costs 13,286 158 — — — Cumulative effect of change in accounting principle (14) — — — 2,974 — Tax effect of above adjustments (35,711) (22,101) (30,918) (41,905) (69,337) Tax effect of COLI fair value changes (10) (2,622) (2,767) 4,665 (5,770) (6,464) Tax deficiencies (benefits) related to equity awards and ESPP (12) (2,840) (1,820) (2,971) (1,172) 610 Restructuring tax benefits (15) (1,615) — — — — Adjusted net income (13) $ 163,627 $ 385,704 $ 533,742 $ 323,003 $ 126,657

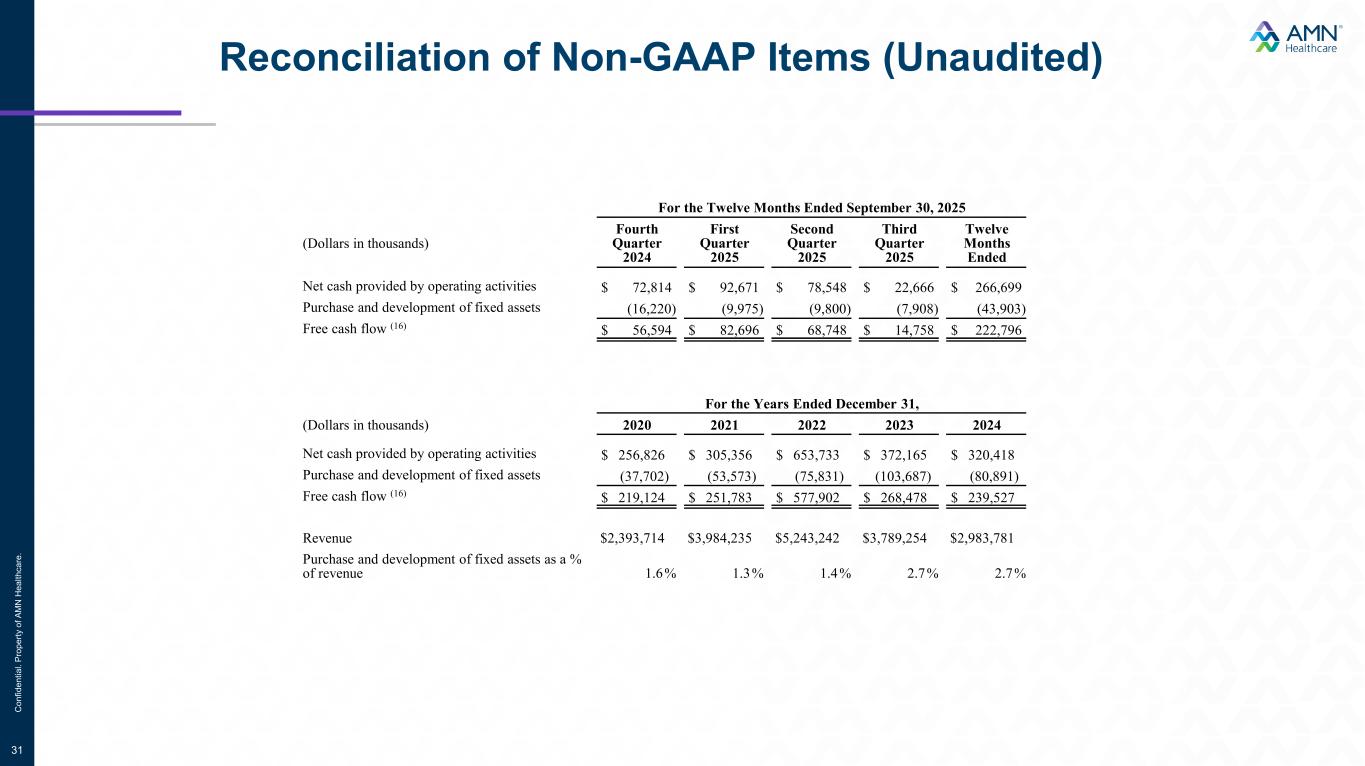

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 31 For the Twelve Months Ended September 30, 2025 (Dollars in thousands) Fourth Quarter 2024 First Quarter 2025 Second Quarter 2025 Third Quarter 2025 Twelve Months Ended Net cash provided by operating activities $ 72,814 $ 92,671 $ 78,548 $ 22,666 $ 266,699 Purchase and development of fixed assets (16,220) (9,975) (9,800) (7,908) (43,903) Free cash flow (16) $ 56,594 $ 82,696 $ 68,748 $ 14,758 $ 222,796 For the Years Ended December 31, (Dollars in thousands) 2020 2021 2022 2023 2024 Net cash provided by operating activities $ 256,826 $ 305,356 $ 653,733 $ 372,165 $ 320,418 Purchase and development of fixed assets (37,702) (53,573) (75,831) (103,687) (80,891) Free cash flow (16) $ 219,124 $ 251,783 $ 577,902 $ 268,478 $ 239,527 Revenue $2,393,714 $3,984,235 $5,243,242 $3,789,254 $2,983,781 Purchase and development of fixed assets as a % of revenue 1.6% 1.3% 1.4% 2.7% 2.7%

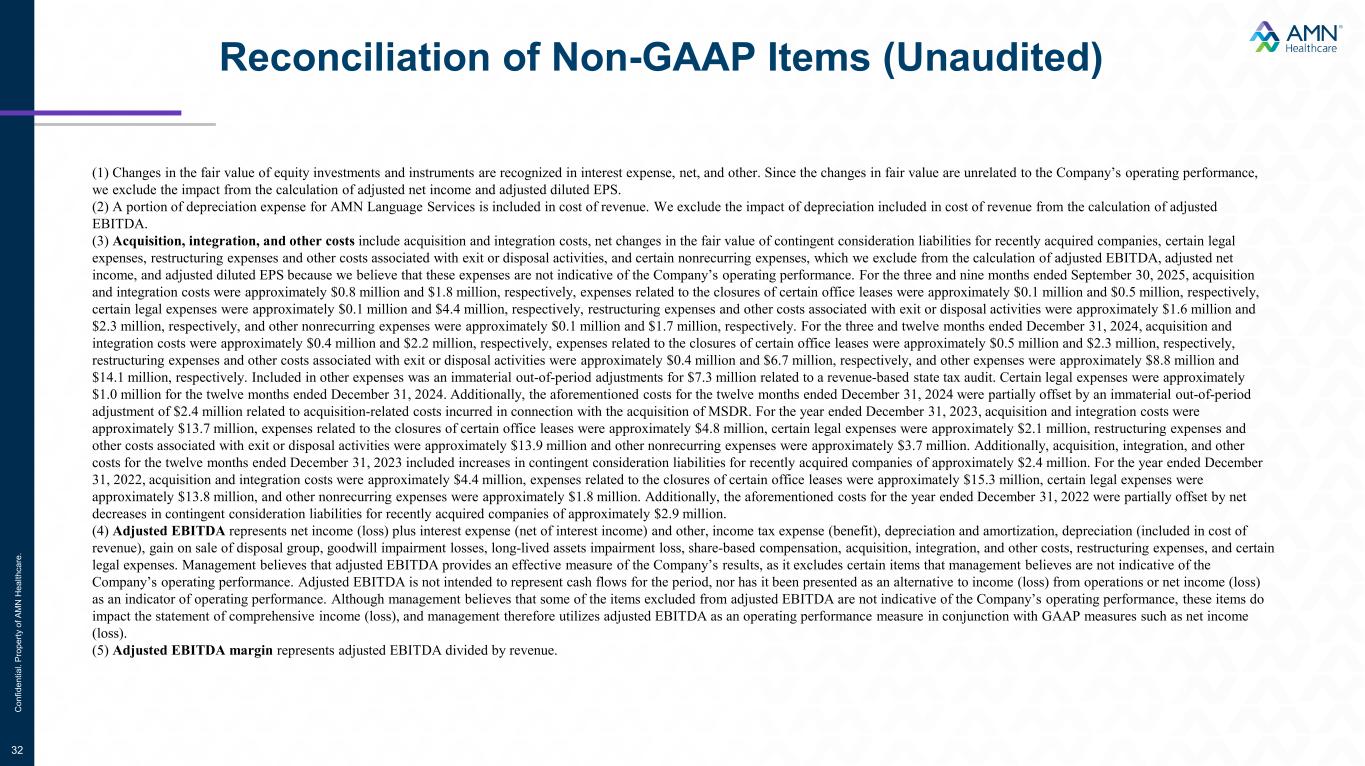

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 32 (1) Changes in the fair value of equity investments and instruments are recognized in interest expense, net, and other. Since the changes in fair value are unrelated to the Company’s operating performance, we exclude the impact from the calculation of adjusted net income and adjusted diluted EPS. (2) A portion of depreciation expense for AMN Language Services is included in cost of revenue. We exclude the impact of depreciation included in cost of revenue from the calculation of adjusted EBITDA. (3) Acquisition, integration, and other costs include acquisition and integration costs, net changes in the fair value of contingent consideration liabilities for recently acquired companies, certain legal expenses, restructuring expenses and other costs associated with exit or disposal activities, and certain nonrecurring expenses, which we exclude from the calculation of adjusted EBITDA, adjusted net income, and adjusted diluted EPS because we believe that these expenses are not indicative of the Company’s operating performance. For the three and nine months ended September 30, 2025, acquisition and integration costs were approximately $0.8 million and $1.8 million, respectively, expenses related to the closures of certain office leases were approximately $0.1 million and $0.5 million, respectively, certain legal expenses were approximately $0.1 million and $4.4 million, respectively, restructuring expenses and other costs associated with exit or disposal activities were approximately $1.6 million and $2.3 million, respectively, and other nonrecurring expenses were approximately $0.1 million and $1.7 million, respectively. For the three and twelve months ended December 31, 2024, acquisition and integration costs were approximately $0.4 million and $2.2 million, respectively, expenses related to the closures of certain office leases were approximately $0.5 million and $2.3 million, respectively, restructuring expenses and other costs associated with exit or disposal activities were approximately $0.4 million and $6.7 million, respectively, and other expenses were approximately $8.8 million and $14.1 million, respectively. Included in other expenses was an immaterial out-of-period adjustments for $7.3 million related to a revenue-based state tax audit. Certain legal expenses were approximately $1.0 million for the twelve months ended December 31, 2024. Additionally, the aforementioned costs for the twelve months ended December 31, 2024 were partially offset by an immaterial out-of-period adjustment of $2.4 million related to acquisition-related costs incurred in connection with the acquisition of MSDR. For the year ended December 31, 2023, acquisition and integration costs were approximately $13.7 million, expenses related to the closures of certain office leases were approximately $4.8 million, certain legal expenses were approximately $2.1 million, restructuring expenses and other costs associated with exit or disposal activities were approximately $13.9 million and other nonrecurring expenses were approximately $3.7 million. Additionally, acquisition, integration, and other costs for the twelve months ended December 31, 2023 included increases in contingent consideration liabilities for recently acquired companies of approximately $2.4 million. For the year ended December 31, 2022, acquisition and integration costs were approximately $4.4 million, expenses related to the closures of certain office leases were approximately $15.3 million, certain legal expenses were approximately $13.8 million, and other nonrecurring expenses were approximately $1.8 million. Additionally, the aforementioned costs for the year ended December 31, 2022 were partially offset by net decreases in contingent consideration liabilities for recently acquired companies of approximately $2.9 million. (4) Adjusted EBITDA represents net income (loss) plus interest expense (net of interest income) and other, income tax expense (benefit), depreciation and amortization, depreciation (included in cost of revenue), gain on sale of disposal group, goodwill impairment losses, long-lived assets impairment loss, share-based compensation, acquisition, integration, and other costs, restructuring expenses, and certain legal expenses. Management believes that adjusted EBITDA provides an effective measure of the Company’s results, as it excludes certain items that management believes are not indicative of the Company’s operating performance. Adjusted EBITDA is not intended to represent cash flows for the period, nor has it been presented as an alternative to income (loss) from operations or net income (loss) as an indicator of operating performance. Although management believes that some of the items excluded from adjusted EBITDA are not indicative of the Company’s operating performance, these items do impact the statement of comprehensive income (loss), and management therefore utilizes adjusted EBITDA as an operating performance measure in conjunction with GAAP measures such as net income (loss). (5) Adjusted EBITDA margin represents adjusted EBITDA divided by revenue.

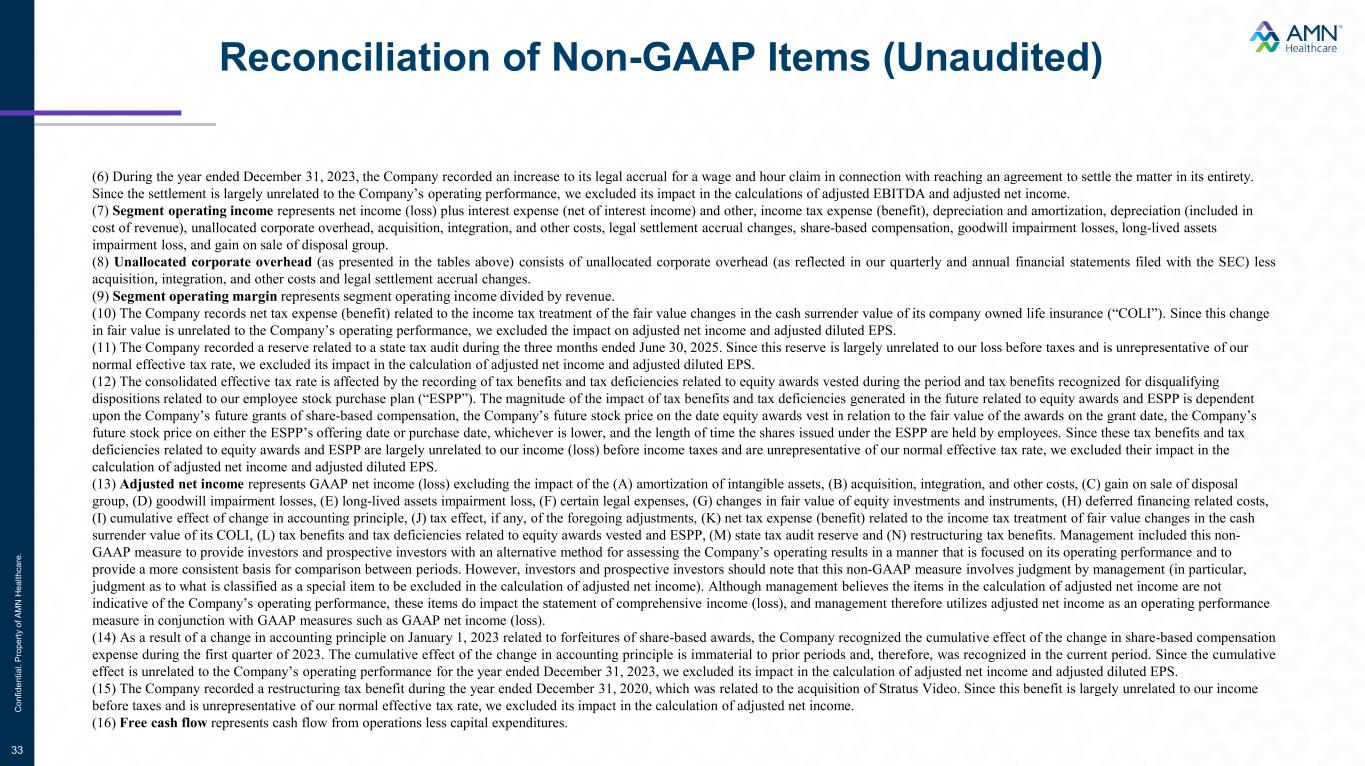

Reconciliation of Non-GAAP Items (Unaudited) C o n fi d e n ti a l. P ro p e rt y o f A M N H e a lt h ca re . 33 (6) During the year ended December 31, 2023, the Company recorded an increase to its legal accrual for a wage and hour claim in connection with reaching an agreement to settle the matter in its entirety. Since the settlement is largely unrelated to the Company’s operating performance, we excluded its impact in the calculations of adjusted EBITDA and adjusted net income. (7) Segment operating income represents net income (loss) plus interest expense (net of interest income) and other, income tax expense (benefit), depreciation and amortization, depreciation (included in cost of revenue), unallocated corporate overhead, acquisition, integration, and other costs, legal settlement accrual changes, share-based compensation, goodwill impairment losses, long-lived assets impairment loss, and gain on sale of disposal group. (8) Unallocated corporate overhead (as presented in the tables above) consists of unallocated corporate overhead (as reflected in our quarterly and annual financial statements filed with the SEC) less acquisition, integration, and other costs and legal settlement accrual changes. (9) Segment operating margin represents segment operating income divided by revenue. (10) The Company records net tax expense (benefit) related to the income tax treatment of the fair value changes in the cash surrender value of its company owned life insurance (“COLI”). Since this change in fair value is unrelated to the Company’s operating performance, we excluded the impact on adjusted net income and adjusted diluted EPS. (11) The Company recorded a reserve related to a state tax audit during the three months ended June 30, 2025. Since this reserve is largely unrelated to our loss before taxes and is unrepresentative of our normal effective tax rate, we excluded its impact in the calculation of adjusted net income and adjusted diluted EPS. (12) The consolidated effective tax rate is affected by the recording of tax benefits and tax deficiencies related to equity awards vested during the period and tax benefits recognized for disqualifying dispositions related to our employee stock purchase plan (“ESPP”). The magnitude of the impact of tax benefits and tax deficiencies generated in the future related to equity awards and ESPP is dependent upon the Company’s future grants of share-based compensation, the Company’s future stock price on the date equity awards vest in relation to the fair value of the awards on the grant date, the Company’s future stock price on either the ESPP’s offering date or purchase date, whichever is lower, and the length of time the shares issued under the ESPP are held by employees. Since these tax benefits and tax deficiencies related to equity awards and ESPP are largely unrelated to our income (loss) before income taxes and are unrepresentative of our normal effective tax rate, we excluded their impact in the calculation of adjusted net income and adjusted diluted EPS. (13) Adjusted net income represents GAAP net income (loss) excluding the impact of the (A) amortization of intangible assets, (B) acquisition, integration, and other costs, (C) gain on sale of disposal group, (D) goodwill impairment losses, (E) long-lived assets impairment loss, (F) certain legal expenses, (G) changes in fair value of equity investments and instruments, (H) deferred financing related costs, (I) cumulative effect of change in accounting principle, (J) tax effect, if any, of the foregoing adjustments, (K) net tax expense (benefit) related to the income tax treatment of fair value changes in the cash surrender value of its COLI, (L) tax benefits and tax deficiencies related to equity awards vested and ESPP, (M) state tax audit reserve and (N) restructuring tax benefits. Management included this non- GAAP measure to provide investors and prospective investors with an alternative method for assessing the Company’s operating results in a manner that is focused on its operating performance and to provide a more consistent basis for comparison between periods. However, investors and prospective investors should note that this non-GAAP measure involves judgment by management (in particular, judgment as to what is classified as a special item to be excluded in the calculation of adjusted net income). Although management believes the items in the calculation of adjusted net income are not indicative of the Company’s operating performance, these items do impact the statement of comprehensive income (loss), and management therefore utilizes adjusted net income as an operating performance measure in conjunction with GAAP measures such as GAAP net income (loss). (14) As a result of a change in accounting principle on January 1, 2023 related to forfeitures of share-based awards, the Company recognized the cumulative effect of the change in share-based compensation expense during the first quarter of 2023. The cumulative effect of the change in accounting principle is immaterial to prior periods and, therefore, was recognized in the current period. Since the cumulative effect is unrelated to the Company’s operating performance for the year ended December 31, 2023, we excluded its impact in the calculation of adjusted net income and adjusted diluted EPS. (15) The Company recorded a restructuring tax benefit during the year ended December 31, 2020, which was related to the acquisition of Stratus Video. Since this benefit is largely unrelated to our income before taxes and is unrepresentative of our normal effective tax rate, we excluded its impact in the calculation of adjusted net income. (16) Free cash flow represents cash flow from operations less capital expenditures.