UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant | ||

Check the appropriate box: | |||

☐ | Preliminary Proxy Statement | ||

☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | ||

☑ | Definitive Proxy Statement | ||

☐ | Definitive Additional Materials | ||

☐ | Soliciting Material under §240.14a-12 | ||

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | ||||||

☑ | No fee required. | |||||

☐ | Fee paid previously with preliminary materials. | |||||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||

| |||

Notice of Annual Meeting

of Shareholders

Thursday, May 22, 2025

8:00 a.m., Eastern Time

Your Vote is Important | |||||

Whether or not you plan to attend the Annual Meeting virtually via live webcast, you are encouraged to vote your shares prior to the Annual Meeting in one of the following ways: | |||||

| By Internet, following the instructions on the proxy card; | ||||

| By telephone, using the telephone number printed on the proxy card; or | ||||

| By mail (if you received your proxy materials by mail), using the enclosed proxy card and return envelope. | ||||

Votes made by proxy over the phone or on the internet must be received by 11:59 p.m., Eastern Time, on May 21, 2025. | |||||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting | |||||

The proxy statement, the Insulet Annual Report on Form 10-K for the year ended December 31, 2024, and the Proxy Card are available at www.proxyvote.com | |||||

You are cordially invited to attend the Insulet Corporation 2025 Annual Meeting of Shareholders (the “Annual Meeting”) on Thursday, May 22, 2025, at 8:00 a.m., Eastern Time. The Annual Meeting will once again be held in a virtual format only, via live webcast, at www.virtualshareholdermeeting.com/PODD2025. Online access to the meeting will begin at 7:45 a.m., Eastern Time.

The Annual Meeting will be held for the following purposes:

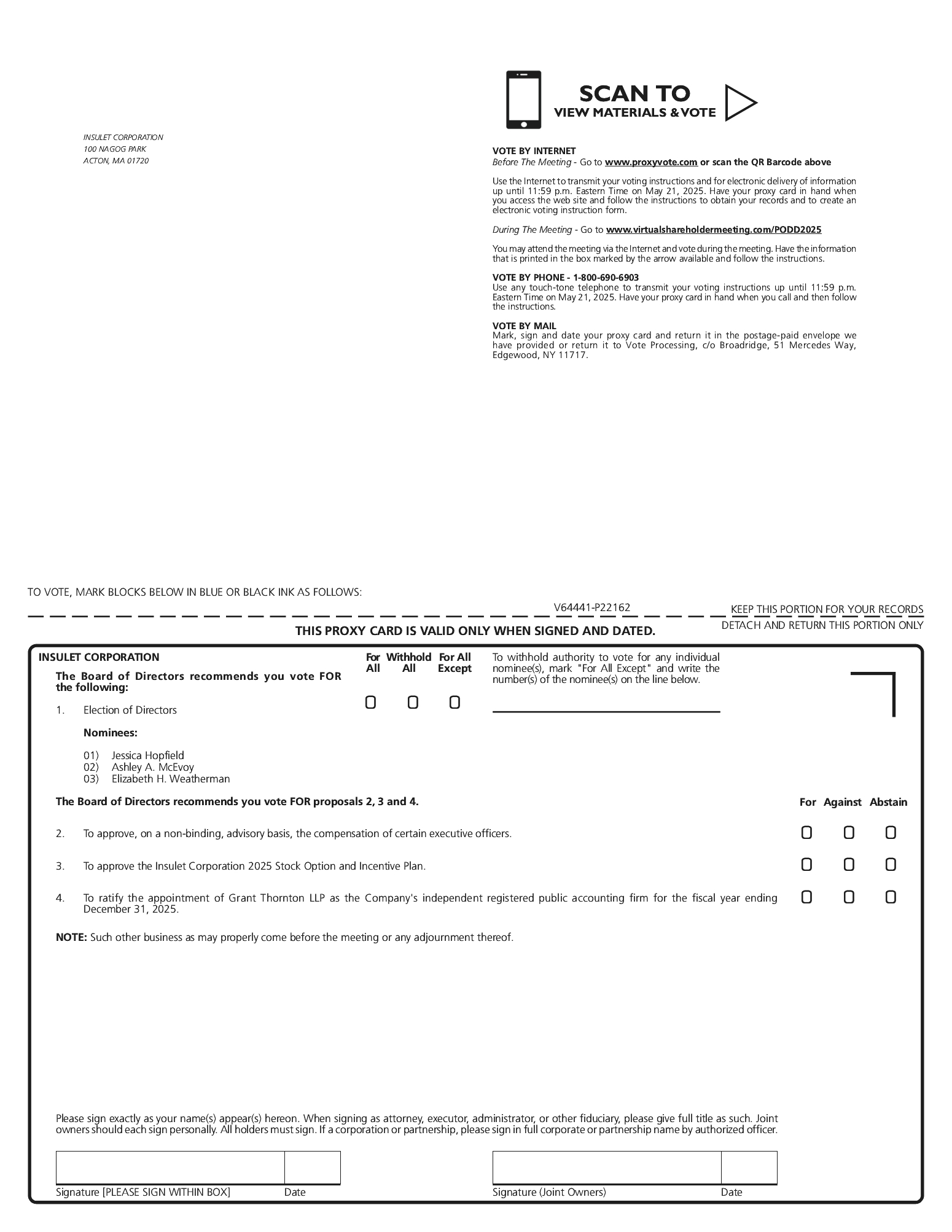

1. | To elect three Class III Directors nominated by the Company’s Directors, each to serve for a three-year term and until her successor has been duly elected and qualified or until her earlier death, resignation or removal; |

2. | To conduct an advisory vote to approve the compensation of certain executive officers as more fully described in the accompanying proxy statement; |

3. | To approve the Insulet Corporation 2025 Stock Option and Incentive Plan as more fully described in the accompanying proxy statement; |

4. | To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025; and |

5. | To consider and vote upon such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Our Board of Directors has fixed the close of business on March 26, 2025, as the record date. Only shareholders of record on the record date are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof.

On or about April 29, 2025, we will mail to our shareholders of record as of March 26, 2025 (other than those who previously requested electronic or paper delivery on an ongoing basis) this Notice of Meeting, proxy statement, and proxy card as well as our Annual report on Form 10-K.

For further information about how to attend the Annual Meeting and how to submit questions during the live webcast, please see page 68 of the accompanying proxy statement.

Our Board of Directors appreciates and encourages stockholder participation in the Company’s affairs. Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented; we encourage you to vote your shares in advance of the meeting.

Acton, Massachusetts April 29, 2025 | By Order of the Board of Directors, | ||

| |||

PATRICIA K. DOLAN | |||

Vice President and Secretary | |||

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting to be held on Thursday, May 22, 2025, at 8:00 a.m., Eastern Time. The meeting will be held via live webcast at www.virtualshareholdermeeting.com/PODD2025. The Company’s Annual Report on Form 10-K for the year ended December 31, 2024 (the “10-K”) containing financial statements for the fiscal year ended December 31, 2024, is being made available, together with this proxy statement, to shareholders at www.proxyvote.com.

This summary highlights information related to topics discussed throughout this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Thursday, May 22, 2025 8:00 a.m., Eastern Time | ||

Access to Live Webcast: www.virtualshareholdermeeting.com/PODD2025 | ||

How to Vote Prior to the Annual Meeting

Vote by Mail | Vote by Telephone | Vote by Internet | ||||||

Cast your ballot, sign your proxy card and send by free post |  Dial toll-free 24/7 1-800-690-6903 |  Visit 24/7 www.proxyvote.com | ||||||

Complete, sign, and date your proxy card, and return it in the postage-paid envelope included in your proxy materials. Your proxy card must arrive by May 21, 2025. | Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m., Eastern Time, on May 21, 2025. Have your proxy card in hand when you call and then follow the instructions. | Use the internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m., Eastern Time, on May 21, 2025. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. | ||||||

If you attend the Annual Meeting, you may vote your shares electronically during the Annual Meeting even if you have previously returned your proxy card or completed your proxy by phone or on the internet.

Proposals | Board Recommendations | Page | ||||||

Proposal 1: Election of three Class III directors | ✔ FOR each nominee | |||||||

Proposal 2: Say on Pay: Advisory Vote to Approve Executive Compensation | ✔ FOR | |||||||

Proposal 3: Approval of Insulet Corporation 2025 Stock Option and Incentive Plan | ✔ FOR | |||||||

Proposal 4: Ratification of independent registered public accounting firm for fiscal 2025 | ✔ FOR | |||||||

Insulet Corporation (NASDAQ: PODD), headquartered in Massachusetts, is an innovative medical device company dedicated to simplifying life for people with diabetes and other conditions through its Omnipod product platform. The Omnipod Insulin Management System provides a unique alternative to traditional insulin delivery methods. With its simple, wearable design, the tubeless disposable Pod provides up to three days of non-stop insulin delivery, without the need to see or handle a needle. Insulet’s flagship innovation, the Omnipod 5 Automated Insulin Delivery System, integrates with a continuous glucose monitor to manage blood sugar with no multiple daily injections, zero fingersticks, and can be controlled by a compatible personal smartphone or the Omnipod 5 Controller. Insulet also leverages the unique design of its Pod by tailoring its Omnipod technology platform for the delivery of non-insulin subcutaneous drugs across other therapeutic areas.

INSULET CORPORATION - 2025 Proxy Statement 1 |

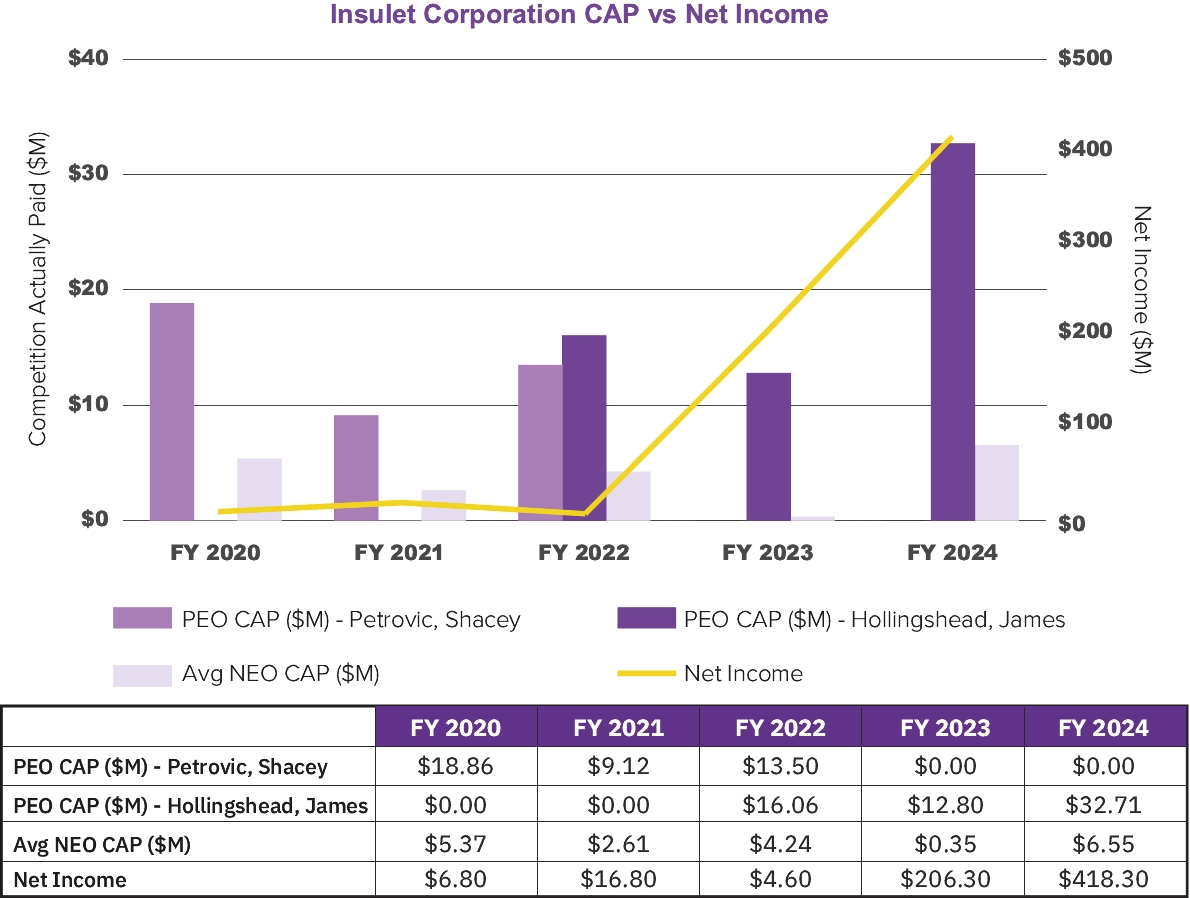

Fiscal 2024 was another year of significant growth, as continued strong adoption of our Omnipod® 5 Automated Insulin Delivery (AID) System helped us to exceed $2 billion in revenue for the first time in Insulet’s history and drove revenue growth of 22%, our ninth consecutive year of 20% or more revenue growth on a constant currency basis*. Our gross margin continued to expand in 2024, increasing 150 basis points from the prior year, our net income increased by $212 million, and our operating margin of 14.9% reflects an increase of 190 basis points.

REVENUE | GROSS MARGIN | OPERATING MARGIN | ||||||

$2.1B (22% growth) | 69.8% (up 150 basis points) | 14.9% (up 190 basis points) | ||||||

* Constant currency revenue growth is a non-GAAP measure. Reconciliations of this measure to the most directly comparable GAAP financial measure are provided in Annex A to this proxy statement.

Our 2024 accomplishments demonstrate our team’s ability to perform in the face of the continued challenges related to global political and macroeconomic conditions. The resiliency and strength of our people and culture is a testament to the loyalty of our customers and the strong value proposition of our differentiated technology. As we balance profitability and strategic investments across our innovation pipeline, sales and marketing capabilities, and global manufacturing operations, we continue to build upon our existing robust foundation for sustainable long-term growth.

Our Culture

We believe that empowered, inspired, and supported employees do great things. And while we nurture a fast-paced, high-performance environment, it is in service to our purpose of simplifying the lives of people with diabetes, enabling them to live healthier and happier lives. That purpose gives our efforts focus, discipline, and accountability. At Insulet, we are privileged to have employees who truly care about our mission to improve the lives of people with diabetes. Many of our employees have a personal connection to diabetes and reflect their commitment to our mission in their work. We have a responsibility to shape a culture that maximizes the impact of our exceptional employees. In 2024, we defined and shared our Ways of Working, the key behaviors that we believe are most important to our success and to creating an exceptional employee experience. Teams across the organization are applying our Ways of Working in their daily practices. We continue to build an inclusive culture where our people love what they do and have fun achieving remarkable results.

Flexibility during the workday can be life-changing for caregivers and those managing health challenges—situations that our customers face—and we know that both remote and in-person arrangements can enable high productivity. Although we increased in-office work in 2024, we continued our commitment to flexibility through our Future of Work program. Our sustained commitment to flexibility enables access to a broader and more diverse talent pool. To facilitate connections, we still took advantage of the opportunity to celebrate our culture together in-person in 2024 at several events, while retaining virtual offerings that are valuable for connecting employees around the world. We strive to instill a sense of belonging among our employees while championing flexible working conditions that improve their wellbeing.

Our success depends on the diversity of perspective, thought, experience, and background within our workforce. We recognize that a diverse and inclusive workplace leads to more innovative ideas, more fruitful collaboration, and a more vibrant culture. Accordingly, Insulet strives to recruit, develop, and retain people from all backgrounds and to create an environment that enables employees to bring their whole selves to work.

Our voluntary, employee-led Employee Resource Groups (“ERGs”) help foster a culture aligned with our mission, values, and goals. The main objectives of Insulet’s ERGs are to promote a welcoming and respectful workforce, create a more inclusive work environment, empower, engage, and connect employees, increase collaboration, and harness diverse workforces for common business goals. Our ERGs serve as a source of inclusion across nine categories: African Descent, Asian and Pacific Islander, InsuLatinos, Jewish Heritage, OmniPRIDE, Podder Alliance Network, Sustainability, Veterans and First Responders, Women, and Young Professionals. These ERGs are sponsored by senior leaders across our organization.

2 INSULET CORPORATION - 2025 Proxy Statement |

The data in this Corporate Governance summary reflects the composition of the Board following the 2025 Annual Meeting, assuming the three Class III nominees are elected.

Board of Directors and Board Committees

Name and Principal Occupation | Age | Director Since | Audit Committee | Nominating, Governance and Risk Committee | Talent and Compensation Committee | Science and Technology Committee | |||||||||||||||||

| Luciana Borio, M.D. Venture partner, ARCH Venture Partners (Independent) | 54 | 2021 | • | • | • | |||||||||||||||||

| Wayne A. I. Frederick, M.D. President Emeritus, Howard University (Independent) | 53 | 2020 | • | • | Chair | |||||||||||||||||

| Jessica Hopfield, Ph.D. Strategic advisor to healthcare and technology firms | 60 | 2015 | • | |||||||||||||||||||

| Ashley A. McEvoy President and Chief Executive Officer, Insulet Corporation | 54 | 2025 | ||||||||||||||||||||

| Michael R. Minogue President and Chief Executive Officer, Minogue Consulting, LLC (Independent) | 58 | 2017 | • | |||||||||||||||||||

| Flavia H. Pease Executive Vice President and Chief Financial Officer Charles River Laboratories (Independent) | 52 | 2024 | • | |||||||||||||||||||

| Timothy J. Scannell+ Former President and Chief Operating Officer, Stryker Corporation (Independent Board Chair) | 60 | 2014 | Chair | |||||||||||||||||||

| Timothy C. Stonesifer Chief Financial Officer Alcon Inc. (Independent) | 57 | 2024 | Chair | |||||||||||||||||||

| Elizabeth H. Weatherman Special Limited Partner, Warburg Pincus (Independent) | 65 | 2022 | Chair | |||||||||||||||||||

+ Board Chair • Committee Member

INSULET CORPORATION - 2025 Proxy Statement 3 |

Board Composition

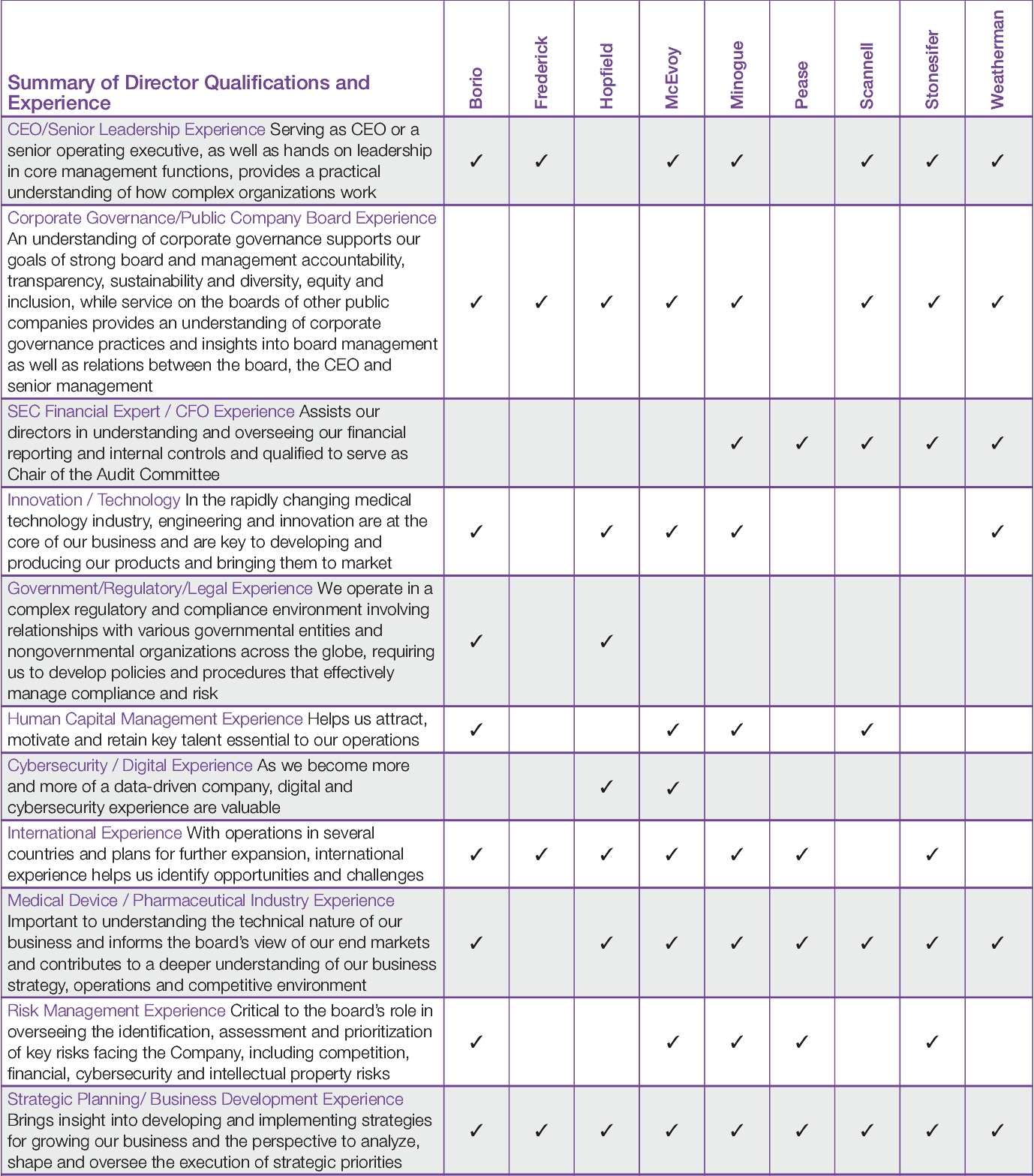

The Board of Directors carefully reviews its composition to ensure that it has the right mix of people with diverse perspectives, business and professional experience, as well as high personal and professional integrity, sound judgment and the ability to participate effectively and collegially in Board discussions. Our directors bring a diverse range of viewpoints, qualifications, backgrounds, skills and experiences:

• | They are seasoned leaders who have held an array of diverse leadership positions in complex, highly regulated businesses (including other medical device organizations) |

• | They have served as chief executives and in other senior positions in the areas of operations, finance, and technology |

• | They bring deep and diverse experience in public and private companies, academia, non-profit organizations, and other domestic and international businesses |

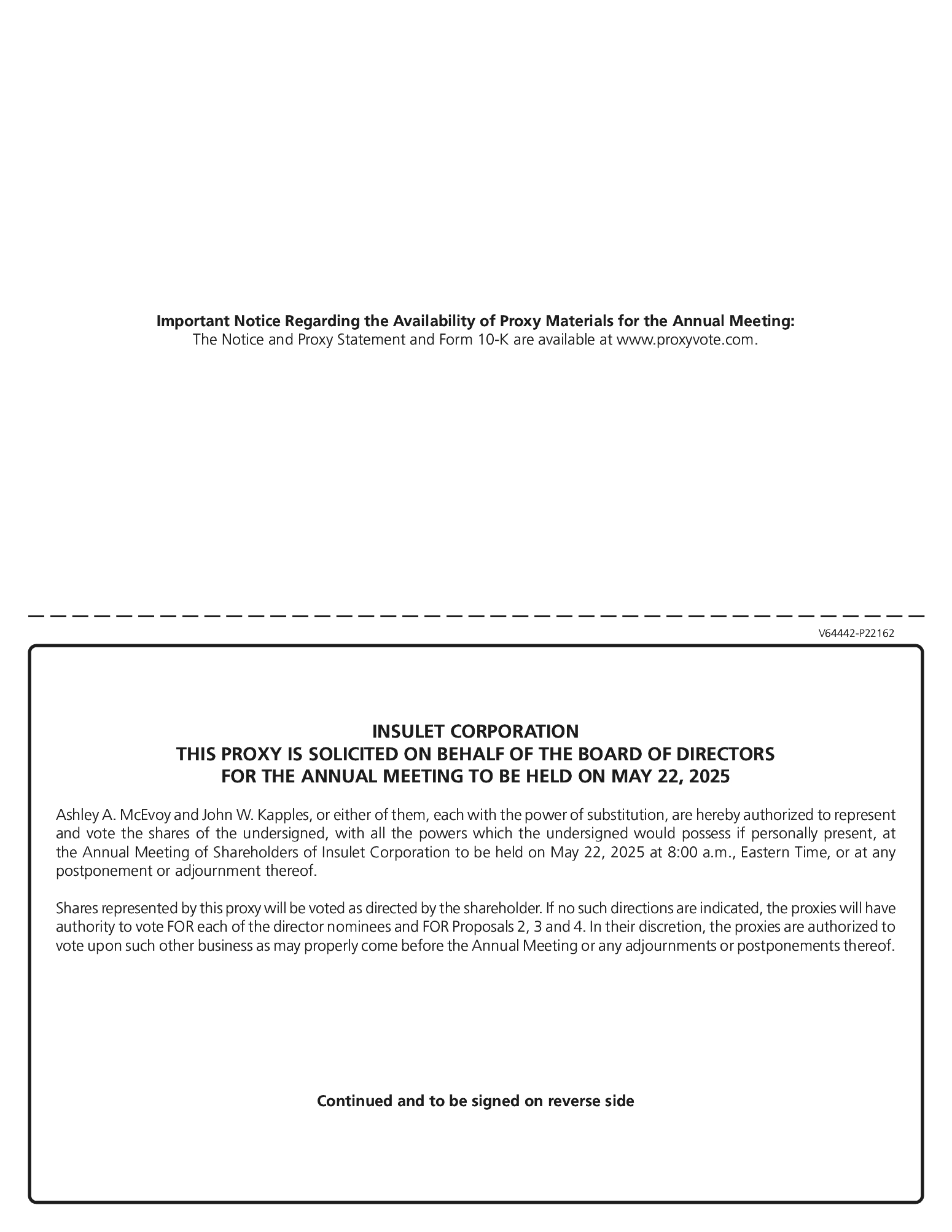

• | They strengthen our Board’s oversight capabilities by having varied lengths of tenure that provide historical and new perspectives about our Company |

• | Our Board is currently 67% diverse by gender and/or racial/ethnic diversity |

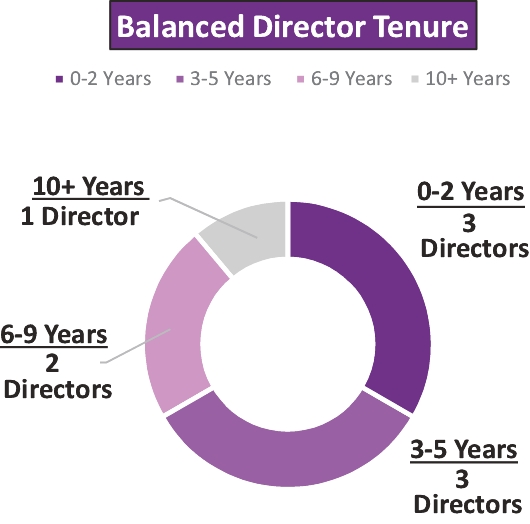

Below is a snapshot of our Board as it will be composed immediately following the 2025 Annual Meeting, assuming the three Class III nominees are elected.

|  | ||

Proactive Board Refreshment 6 New Directors Since 2020 – 5 of Whom are Diverse |

4 INSULET CORPORATION - 2025 Proxy Statement |

Strong Governance Practices

The Company is committed to good corporate governance, which we believe will help us sustain our success and continue to build long-term shareholder value. To that end, we have in place Corporate Governance Guidelines which are designed to assist the Company and the Board in implementing effective corporate governance practices. The Board believes that good governance requires not only an effective set of specific practices, but also a culture of responsibility throughout an organization. Governance at Insulet is intended to achieve both. The Board also believes that good governance ultimately depends on the quality of an organization’s leadership, and it is committed to recruiting and retaining directors and officers with proven leadership ability and personal integrity.

The following table highlights some of our corporate governance policies and practices that serve the long-term interests of the Company and our shareholders.

• Independent Board Chair • Significant Board refreshment – we have added six new directors to the Board in the last six years • All statutory Board Committees consist solely of independent members • A Director who does not receive a majority vote in an uncontested election must promptly tender his or her resignation to the Board, which will consider whether to accept the resignation • Women currently constitute 56% of the Board and our current Talent and Compensation Committee Chair is a woman • Regular executive sessions of independent Directors | • Proxy access Bylaw provisions • No shareholder rights plan (i.e., no “poison pill”) • Director overboarding policy ensures Directors can devote sufficient time to the Company • Annual Board and committee self-evaluations • Proactive, year-round engagement with shareholders • One class of voting stock and “one share, one vote” standard • Directors have free access to management • Robust Executive and Director stock ownership guidelines • No hedging or pledging of securities by executives or Directors | ||||

Shareholder Engagement

We believe that the delivery of sustainable, long-term value requires regular dialogue with, and accountability to, our shareholders. While the Board, through the Nominating, Governance and Risk Committee, oversees stockholder matters and participates in meetings with stockholders, as appropriate, management has the principal responsibility for stockholder communications and engagement. Accordingly, our management team participates in numerous investor meetings to discuss our business, strategy and financial results. These meetings generally include in-person, telephonic and webcast engagements as well as investor conferences and, from time-to-time, tours of Company facilities. Management also pro-actively reaches out to a number of our stockholders in the “offseason” to discuss governance, executive compensation, sustainability and board refreshment as well as any other topics or trends stockholders may wish to share with us.

We believe that positive, two-way dialogue builds informed relationships that promote transparency and accountability. Management provides written and oral updates on the discussions with stockholders to our Board Chair, the Talent and Compensation Committee and the Nominating, Governance and Risk Committee. Each Board committee reviews relevant feedback and determines if additional discussion and actions are necessary by the respective committee or the full Board. The Board considers stockholder perspectives, as well as the interests of all stakeholders, when overseeing Company strategy, formulating governance practices and designing compensation programs.

INSULET CORPORATION - 2025 Proxy Statement 5 |

Compensation Objectives and Mix

We design and manage our compensation programs to align with our overall business strategy and to focus our employees on delivering sustained financial and operating results that drive long-term shareholder value. We believe it is important for our compensation programs to be competitive, maintain a performance and achievement-oriented culture, and align our executives’ interests with those of our shareholders.

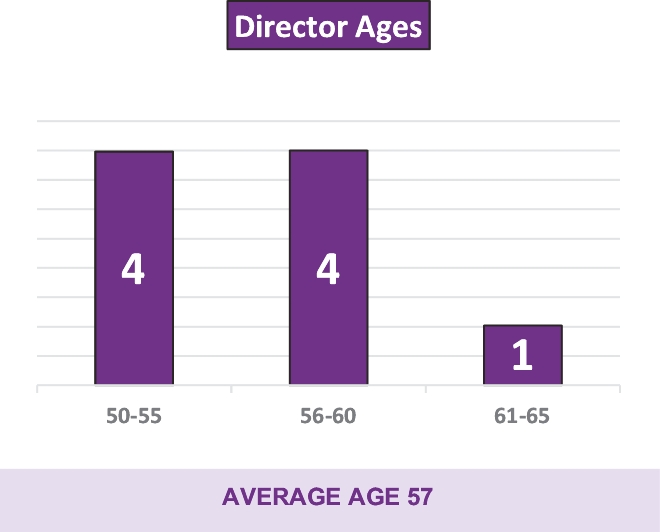

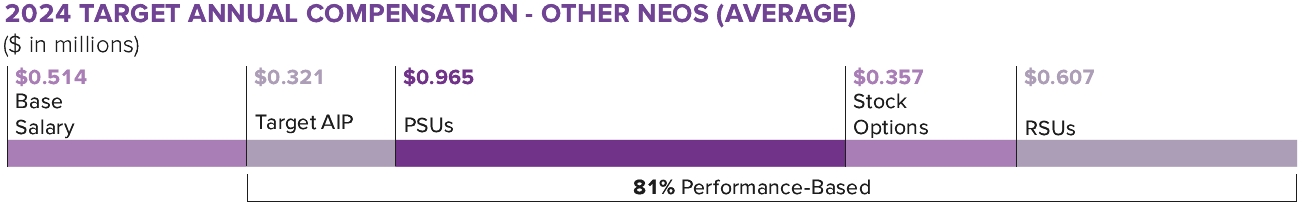

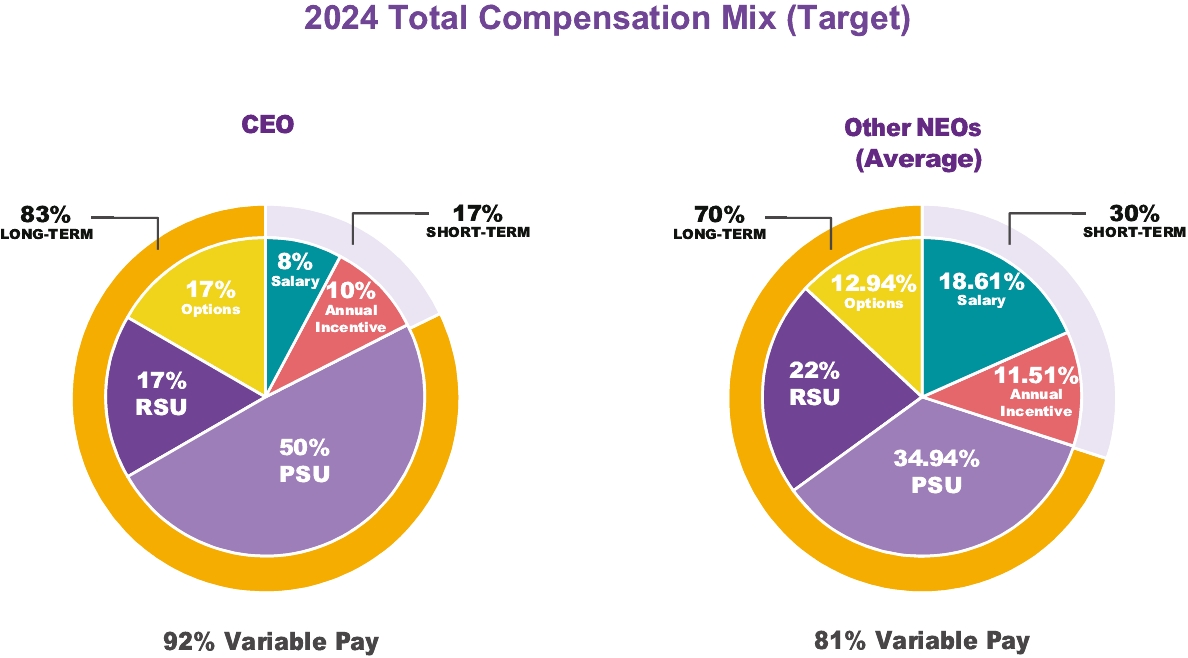

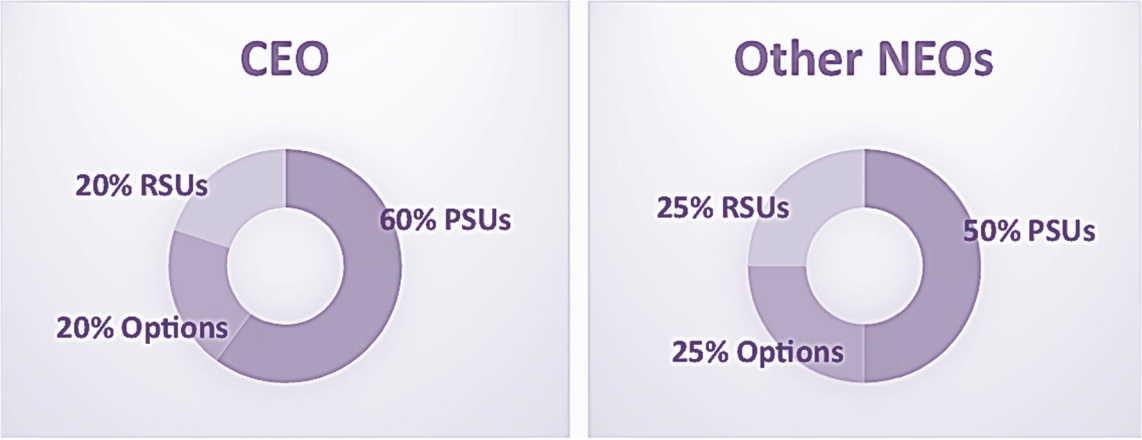

The charts below illustrate, for fiscal 2024, the distribution of value among the three elements of direct compensation - base salary, target annual incentive awards and target long-term equity incentive awards - for our former Chief Executive Officer and, on average, for the other named executive officers. The components of the long-term equity incentive awards are also illustrated.

Focus on Performance-Based, Long-Term Compensation. Of target total direct compensation, 92% of our former Chief Executive Officer’s compensation, and, on average, 81% of our other named executive officers’ compensation was variable, either because it was subject to performance goals, or to fluctuations in stock price, or both.

Responsible Compensation Practices

Our compensation programs and practices demonstrate our commitment to responsible pay and governance principles. We evaluate our compensation programs and practices regularly and we modify them to address evolving best practices. The following table highlights some of the practices we have adopted, and those we have avoided, to serve the long-term interests of our shareholders.

What We Do | What We Don’t Do | ||||||||||

✔ | Solicit shareholder feedback on our programs | ✘ | No employment agreements with executives | ||||||||

✔ | Set robust stock ownership guidelines | ✘ | No excise tax assistance (gross-ups) upon a change in control | ||||||||

✔ | Double-trigger provisions for change-in-control benefits | ✘ | No defined benefit pension programs | ||||||||

✔ | Compensation recoupment (“clawback”) policy | ✘ | No significant executive perquisites | ||||||||

✔ | Caps on annual incentive payments | ✘ | No cash severance in excess of 2x salary and bonus | ||||||||

✔ | Engage independent compensation consultant | ✘ | No hedging or pledging of Company securities | ||||||||

✔ | Conduct annual compensation risk assessment | ✘ | No “single trigger” change-in-control benefits | ||||||||

✔ | Use both financial and strategic measures to determine incentive payouts | ||||||||||

✔ | Emphasis on performance-based pay | ||||||||||

6 INSULET CORPORATION - 2025 Proxy Statement |

Insulet is passionate about our mission to simplify and improve the lives of people living with diabetes. Along with our focus on positively impacting the diabetes community, we are committed to responsible and sustainable growth as a company. Our vision to “Deliver growth with purpose: innovating to improve lives and preserve our planet” guides our efforts to grow sustainably and maximize our positive impacts. We have embraced a holistic approach to sustainability that considers a full range of environmental, social, and governance (“ESG”) topics and their related impacts on our operations, supply chain, internal and external stakeholders, and our planet.

Our Vice President, Global Sustainability and Chief Sustainability Officer (“CSO”) leads the implementation of our comprehensive multi-year sustainability strategy. This strategy focuses on three pillars – Resilient Operations, Sustainable Product Innovation, and People and Communities – and establishes an integrated approach for growing responsibly, building on existing capabilities, and setting the foundation for even greater impact on behalf of the global diabetes community. We publish an annual Sustainability Report; each year our Report evolves, increasing in depth as we progress in our journey.

We recognize that our products and operations impact our planet, and we are taking thoughtful steps to reduce our environmental footprint. To divert more products from landfills, we are seeking to expand our takeback programs and increase product recyclability. In 2024, we continued our established Pod takeback programs in Europe, Canada and Australia. Through our takeback programs, customers can return their used Pods for recycling and responsible disposal. We also continued our U.S. product takeback pilot in Massachusetts and expanded the geographic scope of the pilot to include California in 2024. We look forward to expanding product takeback options in other regions as Insulet grows and considers novel recycling or reuse processes based on local regulations and available services.

We are also actively working to improve efficiency in our facilities, conserve our use of natural resources, and prepare ourselves for the transition to a low-carbon economy. At our corporate headquarters in Acton, Massachusetts, we have active solar arrays and continue to explore additional opportunities to invest in clean energy. At our new Malaysia plant, which we opened in 2024, we used a portion of materials with recycled content to construct the building, and our designs incorporated efficient technology for lighting, heating, and water consumption, including a rainwater harvesting system. We also installed a charging station for electric vehicles. Additionally, the facility generates renewable energy using rooftop solar panels to make the local electricity grid more sustainable and resilient. Together, these measures optimize the facility’s energy use and enable us to responsibly grow our manufacturing footprint. The facility is on track to receive both Green Building Index (GBI) and Leadership in Energy and Environmental Design (LEED) Silver certification.

In 2024, we worked diligently to further embed our sustainability strategy into our policies, processes, and goals. Our Code of Business Conduct and Ethics, Supplier Code of Conduct, and Human Rights Statement set the foundation for our human rights commitment and compliance with applicable laws and regulations, including the California Supply Chain Act and the U.K. Modern Slavery Act. We continued to operationalize sustainability while still maintaining our focus on enhancing transparency, preserving stakeholder trust, and creating value. Additionally, in 2024, we launched our Insulet for Good program, which enables employees globally to engage in volunteerism and corporate philanthropy in ways aligned with our corporate strategic priorities. We continue to explore opportunities to establish ambitious sustainability targets, and we plan to disclose our progress against these goals in the future.

Sustainability Governance

Reporting to the Senior Vice President, General Counsel, our Vice President, Global Sustainability and CSO leads our sustainability strategy and maintains responsibility for our ESG practices, as described above. This role fosters cross-functional collaboration and drives our commitment to deliver growth with purpose. Insulet’s Executive Leadership Team and Global Sustainability Team own, implement, and track the Company’s sustainability strategy and efforts in collaboration with every major business function and with oversight from the Board of Directors, with particular focus by the Nominating, Governance and Risk Committee. The CSO meets with the Nominating, Governance, and Risk Committee at least twice per year to report on ESG matters, including our holistic approach to sustainable development. The full Board receives an annual update from the CSO and may also discuss specific material topics, such as climate change and product stewardship.

INSULET CORPORATION - 2025 Proxy Statement 7 |

The Company’s Certificate of Incorporation divides the Board of Directors into three classes. One class is elected each year for a term of three years. At this year’s Annual Meeting, the shareholders will elect three Class III Directors. The Class III Directors currently consist of Ashley A. McEvoy, Jessica Hopfield and Elizabeth H. Weatherman. Accordingly, the Board of Directors, consistent with the recommendation of the Nominating, Governance and Risk Committee, has nominated each of the following to be elected to the Board of Directors as a Class III Director, to hold office until the Annual Meeting of Shareholders to be held in 2028, and until her successor has been duly elected and qualified or until her earlier death, resignation or removal:

Director Nominees

Name | Age | Director Since | Current Positions | Independent | Committee Memberships | ||||||||||||

Jessica Hopfield | 60 | 2015 | Strategic advisor to healthcare and technology firms | Science and Technology Committee | |||||||||||||

Ashley A. McEvoy | 54 | 2025 | President and Chief Executive Officer | None | |||||||||||||

Elizabeth H. Weatherman | 65 | 2022 | Special Limited Partner, Warburg Pincus | ✔ | Talent and Compensation Committee (CHAIR) | ||||||||||||

Following the Annual Meeting, the Board of Directors will also include:

• | Three Class I Directors (Luciana Borio, Michael R. Minogue and Timothy C. Stonesifer), whose terms expire at the Annual Meeting of Shareholders to be held in 2026; and |

• | Three Class II Directors (Wayne A. I. Frederick, Flavia H. Pease and Timothy J. Scannell), whose terms expire at the Annual Meeting of Shareholders to be held in 2027. |

The Board of Directors knows of no reason why any of the nominees would be unable or unwilling to serve, but if any nominee should for any reason be unable or unwilling to serve, the proxies will be voted for the election of such other person for the office of Director as the Board of Directors may recommend in the place of such nominee. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named herein (or, if any nominee should for any reason be unable or unwilling to serve, for such other person as the Board of Directors may recommend).

Assuming a quorum is present at the Annual Meeting, the nominees receiving the highest number of affirmative votes of the shares present or represented by proxy and entitled to vote on such matter at the Annual Meeting will be elected as Class III Directors. However, in accordance with the Company’s majority voting policy, in the event that a nominee receives a greater number of “withhold” votes than votes “for” her election, such nominee shall tender her written resignation to the Chairman of the Board and such resignation will be considered by the Nominating, Governance and Risk Committee and the Board of Directors. (For additional information, see “Governance of the Company – Governance Policies and Procedures.”)

8 INSULET CORPORATION - 2025 Proxy Statement |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” ELECTION OF THE THREE CLASS III NOMINEES LISTED BELOW. |

Set forth below is certain biographical information concerning our Director nominees, including the experiences, qualifications, attributes, or skills that caused the Nominating, Governance and Risk Committee and the Board of Directors to determine that the person should serve as a Director of the Company. Following the biographical information is a chart that categorizes various skill sets for each Board member.

Class III Director Nominees – Term expires at the 2025 Annual Meeting

Age 60 Director Since July 2015 Committees Science and Technology | Jessica Hopfield, Ph.D. KEY EXPERIENCES AND QUALIFICATIONS Dr. Hopfield, who is NACD Directorship certified, has served on our Board of Directors since July 2015, serving as our Lead Independent Director from August 2016 through December 2018. She is the former Chair of the Joslin Diabetes Center. Dr. Hopfield is a distinguished healthcare executive and diabetes expert with over two decades of experience in the medical and healthcare fields. She is a strategic advisor and investor in healthcare and technology firms seeking to commercialize innovative intellectual property. From 1995 to 2009, Dr. Hopfield was a Partner at McKinsey & Company in their global pharmaceuticals and medical devices practice and she served clients across the pharmaceutical, biotech, medical device and consumer industries with a focus on strategy, R&D management and marketing. She also previously held management positions at Merck Sharp & Dohme Corp. in clinical development, outcomes research, and marketing. Dr. Hopfield earned a Bachelor of Science from Yale College, an MBA from the Harvard Graduate School of Business Administration as a Baker Scholar, and a Doctor of Philosophy in Neuroscience/Biochemistry from The Rockefeller University. Dr. Hopfield brings proven experience in the diabetes field, along with vast executive and consulting experience in the healthcare, pharmaceutical, and medical device industries. OTHER CURRENT PUBLIC COMPANY BOARDS Editas Medicine, Inc. Maravai LifeSciences Holdings, Inc. FORMER PUBLIC COMPANY BOARDS PhenomeX Inc. Radius Health, Inc. | |||

INSULET CORPORATION - 2025 Proxy Statement 9 |

Age 54 Director Since April 2025 | Ashley A. McEvoy KEY EXPERIENCES AND QUALIFICATIONS Ms. McEvoy has served on the Board and as our President and Chief Executive Officer since April 2025. She is the former Executive Vice President, Worldwide Chairman of MedTech at Johnson & Johnson, a position she held from 2018 to 2023. In this role, Ms. McEvoy had responsibility for the company’s surgery, orthopaedics, interventional solutions, and eye health businesses. She previously served as Company Group Chairman, Consumer Medical Devices from 2014 to 2018 and as Company Group Chairman, Vision Care from 2012 to 2014. Ms. McEvoy also led J&J’s global suture products business as Worldwide President, Ethicon Products from 2009 to 2011, served as President, McNeil Consumer Healthcare from 2006 to 2009, and served as Vice President, Marketing and General Manager, McNeil Labs from 2003 to 2006. She joined J&J in 1996 as an Assistant Brand Manager, having previously worked in advertising at both Grey Advertising and J. Walter Thompson (now Wunderman Thompson). In addition to her professional work, Ms. McEvoy previously served on the Board of Trustees of the Children’s Hospital of Philadelphia. Ms. McEvoy brings to the Board and the Company a breadth of leadership, strategy, and risk management experience across her roles at J&J, where she led significant and diverse businesses with a global footprint, driving strategic investments in innovation platforms and commercial executions that delivered significant growth for J&J’s MedTech business. OTHER CURRENT PUBLIC COMPANY BOARDS The Procter & Gamble Company | |||

Age 65 Independent Director Since February 2022 Committees Talent and Compensation (Chair) | Elizabeth H. Weatherman KEY EXPERIENCES AND QUALIFICATIONS Elizabeth Weatherman has served on our Board of Directors since February 2022. She has been a Special Limited Partner of Warburg Pincus since January 2016. Ms. Weatherman joined Warburg Pincus in 1988 and led the firm’s Healthcare Group from 2008 to 2015. She was also previously a Managing Director and a member of the firm’s Executive Management Group. Ms. Weatherman serves as a director of Nevro Corp. and Stanford Health Care. She serves as a trustee of Stanford University and as a trustee and chair of the Investment Committee of Mount Holyoke College. Ms. Weatherman received a BA in English from Mount Holyoke College and holds an MBA from the Stanford Graduate School of Business. With her extensive healthcare investment knowledge as well as her experience on the boards of other public medical device companies, Ms. Weatherman brings strong strategic and governance perspectives. OTHER CURRENT PUBLIC COMPANY BOARDS Nevro Corp. FORMER PUBLIC COMPANY BOARDS Silk Road Medical, Inc. Vapotherm, Inc. Wright Medical Group, N.V. | |||

10 INSULET CORPORATION - 2025 Proxy Statement |

Continuing Class I Directors – Term expires at the 2026 Annual Meeting

Age 54 Independent Director Since October 2021 Committees Talent and Compensation Nominating, Governance and Risk Science and Technology | Luciana Borio, M.D. KEY EXPERIENCES AND QUALIFICATIONS Dr. Borio has served on our Board of Directors since October 2021. She is a venture partner at ARCH Venture Partners where she advises on new investment opportunities related to biologics manufacturing, clinical trials, novel therapies, and areas with large unmet clinical needs. She also assists with formation of new companies backed by ARCH. From 2019 to 2020, she was Senior Vice President at In-Q-Tel, an independent, non-profit, strategic investment firm. From 2017 to 2019, she was Director for Medical and Biodefense Preparedness Policy at the National Security Council. While at the FDA from 2009 to 2017, Dr. Borio held roles of increasing responsibility, including Acting Chief Scientist and Assistant Commissioner for Counterterrorism Policy. She helped develop and execute the FDA’s medical countermeasures and public health responses to the 2009 H1N1 flu pandemic, the 2014 Ebola epidemic, and the 2015 Zika outbreak. She also served on the World Health Organization’s Emergency Preparedness and Response Scientific Advisory Group. In 2020, Dr. Borio served as a member of the President’s Transition COVID-19 Advisory Board. Dr. Borio is an adjunct faculty member at Johns Hopkins Hospital and a senior fellow for Global Health at the Council on Foreign Relations. She earned a Doctor of Medicine from George Washington University School of Medicine and a Bachelor of Science in Zoology from George Washington University. With her medical and public health background as well as her experience at the FDA, Dr. Borio brings exceptional regulatory and scientific perspective. OTHER CURRENT PUBLIC COMPANY BOARDS Eagle Pharmaceuticals, Inc. | |||

Age 58 Independent Director Since August 2017 Committees Audit | Michael R. Minogue KEY EXPERIENCES AND QUALIFICATIONS Mr. Minogue has served on our Board of Directors since August 2017. He is the President and CEO of Minogue Consulting, LLC and Heartwork Capital, LLC. From 2004 until its sale in December 2022, Mr. Minogue served as Chairman, President and Chief Executive Officer of Abiomed, Inc., a global leader in healthcare technology and innovation. Prior to joining Abiomed, he spent 11 years with General Electric Healthcare, where he held numerous leadership roles and holds three patents. Mr. Minogue served as a director of the medical device industry association Board of Directors for the Advanced Medical Technology Association (AdvaMed) from 2007 to 2023, serving as Chairman from 2021 to 2023. He previously served on the Board of Directors of Abiomed, LifeCell, Bioventus and the Medical Device Innovation Consortium (MDIC) and as the Chairman of the Governor’s Advisory Council on Veterans’ Services for the Commonwealth of Massachusetts. Mr. Minogue cofounded the Mike and Renee Minogue Foundation and MedTechVets, a 501(c)(3) nonprofit organization that helps military veterans network with industry mentors to discover career opportunities in the medtech industry; he serves on the board of directors after serving as Chairman for 8 years. Mr. Minogue served as an officer in the U.S. Army, receiving multiple distinctions, including Airborne, Ranger, Desert Storm veteran and a Bronze Star. He received a Bachelor of Science in Engineering Management from the United States Military Academy at West Point and an MBA from the University of Chicago. Mr. Minogue brings distinguished senior executive leadership experience, as well as direct experience driving innovation and product development. FORMER PUBLIC COMPANY BOARDS Abiomed, Inc. | |||

INSULET CORPORATION - 2025 Proxy Statement 11 |

Age 57 Independent Director Since January 2024 Committees Audit | Timothy C. Stonesifer KEY EXPERIENCES AND QUALIFICATIONS Mr. Stonesifer has served on our Board of Directors since January 2024. He has been the Chief Financial Officer at Alcon Inc. since April 2019. Prior to joining Alcon, he had served as Executive Vice President and Chief Financial Officer at Hewlett Packard Enterprise from November 2015 through September 2018. Prior to that role, Mr. Stonesifer acted as Senior Vice President and Chief Financial Officer, Enterprise Group at HP Co. since 2014. Before joining HP Co., he served as Chief Financial Officer of General Motors’ International Operations from 2011 to 2014. Previously, he served as Chief Financial Officer of Alegco Scotsman, a storage company, from 2010 to May 2011; Chief Financial Officer of Sabic Innovative Plastics (formerly GE Plastics) from 2007 to 2010; and various other positions at General Electric since joining the company in 1989. Mr. Stonesifer holds a Bachelor of Arts in Economics from the University of Michigan. Mr. Stonesifer brings to Insulet’s Board an international perspective as well as significant financial expertise. | |||

Age 53 Independent Director Since October 2020 Committees Talent and Compensation Nominating, Governance and Risk Science and Technology (Chair) | Wayne A.I. Frederick, M.D. KEY EXPERIENCES AND QUALIFICATIONS Dr. Frederick has served on our Board of Directors since October 2020. Since November 2, 2024, he has served as the Interim Chief Executive Officer of the American Cancer Society and its advocacy affiliate, the American Cancer Society Cancer Action Network (ACS CAN). Dr. Frederick is the distinguished Charles R. Drew Professor of Surgery at the Howard University College of Medicine as well as President Emeritus of Howard University, having previously served as President of Howard University from July 2014 to September 2023. Prior to being appointed President of Howard in 2014, Dr. Frederick served as Howard’s Provost and Chief Academic Officer. Dr. Frederick is a practicing cancer surgeon, distinguished researcher and scholar, and the author of numerous peer-reviewed articles, book chapters, abstracts, and editorials. A widely recognized expert in the fields of health care disparities and medical education, his medical research focuses on reducing racial, ethnic, and gender disparities in cancer care outcomes, with a particular emphasis on gastrointestinal cancers. Throughout his career, Dr. Frederick has received numerous recognitions, including the Distinguished Alumnus Award from the University of Texas MD Anderson Cancer Center. In 2021, he was recognized by the Carnegie Corporation of New York as one of 34 naturalized citizens honored for their contributions to strengthening the United States. Dr. Frederick currently serves on the boards of Humana, Inc., Tempus AI, Inc. and Workday, Inc. and served on the American Cancer Society Board before assuming the role of Interim Chief Executive Officer. He is an active member of several professional associations, including the American Surgical Association and the American College of Surgeons. Recently, he was appointed senior independent director of Mutual of America and also serves as an advisor for Boston Consulting Group. He received his Bachelor of Science, Doctor of Medicine, and Master of Business Administration from Howard University. Dr. Frederick’s vast experience in medical research, healthcare academics, and business administration brings valuable insights to Insulet’s Board. OTHER CURRENT PUBLIC COMPANY BOARDS Humana Inc. Workday, Inc. Tempus AI, Inc. FORMER PUBLIC COMPANY BOARDS Forma Therapeutics Holdings, Inc. Agostini’s Limited | |||

12 INSULET CORPORATION - 2025 Proxy Statement |

Age 52 Independent Director Since January 2024 Committees Audit | Flavia H. Pease KEY EXPERIENCES AND QUALIFICATIONS Ms. Pease has served on our Board of Directors since January 2024. She has been the Corporate Executive Vice President and Chief Financial Officer at Charles River Laboratories since 2022. Prior to joining Charles River, Ms. Pease served as Vice President and Group Chief Financial Officer of Johnson & Johnson’s global Medical Devices businesses since 2019. With more than 20 years in financial leadership roles at Johnson & Johnson, Ms. Pease has developed deep industry knowledge and experience managing the Finance organizations of large, growing businesses. During her tenure, Ms. Pease was also Vice President, Finance for Janssen North America from 2016 to 2019, which is Johnson & Johnson’s Pharmaceutical business in the United States and Canada. Before Janssen, from 2014 to 2016, Ms. Pease was Vice President of the Enterprise Program Management Office, responsible for supporting Johnson & Johnson’s executive management team with the strategic planning process and the advancement of enterprise growth initiatives. From 2009 to 2012, she led the integration of the Mentor and Acclarent acquisitions as a Vice President of Finance, and subsequently became the Vice President of Finance for Janssen Supply Chain from 2012 to 2014. Ms. Pease began her career at Johnson & Johnson in 1998 with the LifeScan business and subsequently held finance leadership positions within Mergers and Acquisitions Analysis and Johnson & Johnson Medical Brazil. Prior to joining Johnson & Johnson, Ms. Pease worked for SC Johnson and an investment bank in Brazil. Ms. Pease holds a bachelor’s degree in Economics from the Pontifícia Universidade Católica in Rio de Janeiro, Brazil and a Master of Business Administration from Santa Clara University. Ms. Pease brings to Insulet’s Board an international perspective and significant financial expertise as well as business development experience. | |||

Age 60 Independent Director Since August 2014 Board Chair Committees Nominating, Governance and Risk (Chair) | Timothy J. Scannell KEY EXPERIENCES AND QUALIFICATIONS Mr. Scannell has served on our Board of Directors since August 2014 and as our Board Chair since January 2019. From October 2021 to March 2023, he served as an Executive Advisor at Stryker Corporation, one of the world's leading medical technology companies that offers innovative products and services in Orthopaedics, Medical and Surgical, and Neurotechnology and Spine that help improve patient and hospital outcomes. From August 2018 to September 2021, he served as the President and Chief Operating Officer at Stryker, and from 2009 to August 2018, he served as a Group President and oversaw Stryker’s MedSurg and Neurotechnology divisions. From 1990 to 2009, Mr. Scannell served in various roles at Stryker, including a range of sales and marketing leadership roles, Vice President and General Manager of its Biotech division and President of its Spine business. Mr. Scannell holds a Bachelor of Business Administration and a Master of Business Administration from the University of Notre Dame. He brings extensive strategic, organizational, and operational skills and experience. OTHER CURRENT PUBLIC COMPANY BOARDS NovoCure Limited Masimo Corporation FORMER PUBLIC COMPANY BOARDS Exact Sciences Corporation Molekule Group, Inc. Renalytix plc | |||

INSULET CORPORATION - 2025 Proxy Statement 13 |

The business and affairs of the Company are managed under the direction of our Board of Directors, which currently consists of nine members. The Board has four standing committees: an Audit Committee, a Nominating, Governance and Risk Committee (the “Governance Committee”), a Talent and Compensation Committee, and a Science and Technology Committee. Each of these committees operates under a written charter that it reviews at least annually. These charters, which have been approved by the Board, are available in the Corporate Governance section of the Company’s website at http://www.insulet.com. The Board also has an ad hoc Transactions Committee and an informal Board Strategy Working Group. Additional details concerning the role and structure of the Board of Directors are contained in the Board’s Corporate Governance Guidelines, which can be found in the Corporate Governance section of the Company’s website at http://www.insulet.com.

The Board has determined that each of our Directors, other than Ashley A. McEvoy, our President and Chief Executive Officer, and Jessica Hopfield, are independent within the meaning of the director independence standards of The Nasdaq Stock Market, Inc. (“Nasdaq”). Those independent directors are: Luciana Borio, Wayne A. I. Frederick, Michael R. Minogue, Flavia H. Pease, Timothy J. Scannell, Timothy C. Stonesifer, and Elizabeth H. Weatherman. The Audit Committee, Governance Committee, and Talent and Compensation Committee each consist solely of independent Directors.

The Company’s Board of Directors regularly assesses the Board’s leadership structure to determine the appropriate leadership for the Company. Based on the Board’s most recent assessment, the Board determined that the most advantageous leadership structure for the Company and its shareholders was to continue to have an independent, non-employee Director, Timothy J. Scannell, serve as Chairman of the Board.

The Chairman of the Board is responsible for, among other things, coordinating with the Chief Executive Officer on the creation of the agenda for each meeting, providing input regarding the materials provided to the Board of Directors in advance of each meeting, ensuring that topics at each meeting are effectively covered, chairing executive sessions of the Board, acting as the principal liaison between the independent Directors and management, and serving as the focal point for shareholder requests addressed to the independent Directors. Additionally, pursuant to the Company’s Bylaws and Corporate Governance Guidelines, the Chairman of the Board is responsible for, among other things, receiving Board member resignation letters, calling special meetings, and presiding at Board meetings. The Board believes that having an independent Director serve as Chairman of the Board ensures a greater role for the independent Directors in the oversight of the Company and active participation of the independent Directors in setting agendas and establishing priorities and procedures for the work of the Board.

The Company does not have a policy as to whether the same person should serve as both Chief Executive Officer and Chairman of the Board. The Board believes that it should have the flexibility to make these determinations at any given point in time in the way that it believes provides the most appropriate leadership for the Company at that time. The Company recognizes that, depending on the circumstances, different Board leadership structures may be appropriate. However, the Company believes its current Board leadership structure, which includes an independent Chairman of the Board, supports the CEO in driving the Company’s growth and objectives and currently is the preferable Board leadership structure for the Company.

The Governance Committee is responsible for reviewing with the Board from time to time the appropriate qualities, skills, and characteristics desired of members of the Board in the context of the needs of the business and current make-up of the Board. The Governance Committee must be satisfied that each committee-recommended nominee will have high personal and professional integrity, demonstrated exceptional ability and judgment, a broad experience base or an area of particular expertise or experience that is important to the long-term success of the Company, a background that is complementary to that of existing Directors so as to provide management and the Board with a diversity and freshness of views, a level of self-confidence and articulateness to participate effectively and cooperatively in Board discussions, the willingness and ability to devote the necessary time and effort to perform the duties and responsibilities of Board membership, and the experience and ability to bring informed, thoughtful and well-considered opinions for the benefit of all shareholders to the Board and management.

In addition to these minimum qualifications, the Governance Committee will recommend that the Board select persons for nomination to help ensure that (i) a majority of the Board is “independent,” in accordance with the standards established by Nasdaq, (ii) at least one member of the Audit Committee has the experience, education and other qualifications necessary to qualify as an “audit committee financial expert,” as defined by SEC rules, (iii) the Audit Committee, the Talent and Compensation Committee and the Governance Committee are each composed entirely of independent Directors, and (iv) each member of the Audit Committee is able to read and

INSULET CORPORATION - 2025 Proxy Statement 15 |

understand fundamental financial statements, including a balance sheet, income statement and cash flow statement. Finally, in addition to any other standards the Governance Committee may deem appropriate for the overall structure and composition of the Board, the Governance Committee may consider whether a nominee has direct experience in the industry or in the markets in which the Company operates.

At least annually, the Board reviews the skills of its members, as well as the overall composition of the Board, in order to ensure that the Board maintains the diverse set of skills, attributes, experience, perspectives, and breadth of knowledge that is necessary to effectively oversee the Company’s business and strategy. The Board’s continued focus on refreshment has resulted in the addition of six new directors in the last six years.

• | In April 2025, the Board appointed Ashley A. McEvoy to the Board in connection with her appointment as President and Chief Executive Officer. Ms. McEvoy was with Johnson & Johnson for over 25 years, most recently as the Executive Vice President, Worldwide Chairman of MedTech, a position she held from 2018 to 2023. Ms. McEvoy brings to the Board and the Company a breadth of leadership, strategy, and risk management experience across her roles at J&J, where she led significant and diverse businesses with a global footprint, driving strategic investments in innovation platforms and commercial executions that delivered significant growth for J&J’s MedTech business. |

• | In January 2024, the Board appointed Flavia H. Pease to the Board. Ms. Pease has been the Corporate Executive Vice President and Chief Financial Officer at Charles River Laboratories since 2022. Prior to Charles River Laboratories, she served in various financial leadership roles at Johnson & Johnson for over 20 years, developing deep industry knowledge and experience as she managed the finance organizations of large, growing businesses. Most recently at Johnson and Johnson, she was Group Chief Financial Officer of their global medical devices business. Ms. Pease brings to Insulet’s Board an international perspective and financial acumen as well as business development experience. |

• | In January 2024, the Board appointed Timothy C. Stonesifer to the Board. Mr. Stonesifer has been the Chief Financial Officer at Alcon Inc. since 2019. With over 34 years of global financial and operational experience, Mr. Stonesifer is a seasoned executive. He has served as Chief Financial Officer of numerous organizations, including, among others, Hewlett-Packard Enterprises and General Motors International Operations. Mr. Stonesifer brings to the Board financial acumen, deep experience in capital markets transactions as well as senior executive leadership and international experience. |

• | In February 2022, the Board appointed Elizabeth H. Weatherman to the Board. Ms. Weatherman has been with the Warburg Pincus, a global private equity firm, for over 30 years, serving as head of the firm’s Healthcare Group, a member of the Executive Management Group, Managing Director and Special Limited Partner, among other positions. She has served on the boards of a number of other publicly traded medical device companies. With her extensive healthcare investment knowledge as well as her experience on the boards of other public medical device companies, Ms. Weatherman brings strong strategic and governance perspectives to the Board. |

• | In October 2021, the Board appointed Luciana Borio to the Board. Dr. Borio currently advises on new investment opportunities related to biologics manufacturing, clinical trials, novel therapies, and areas with large unmet clinical needs as a partner with the venture capital firm, ARCH Venture Partners. Dr. Borio is an adjunct faculty member at Johns Hopkins Hospital and a senior fellow for Global Health at the Council on Foreign Relations and has also worked for the FDA and served as the Director for Medical and Biodefense Preparedness Policy at the National Security Council. With her medical and public health background as well as her experience at the FDA, Dr. Borio brings exceptional regulatory and scientific perspective. |

• | In October 2020, the Board appointed Wayne A.I. Frederick to the Board. Dr. Frederick is the Interim Chief Executive Officer of the American Cancer Society and its advocacy affiliate, the American Cancer Society Cancer Action Network (ACS CAN). He is also the President Emeritus of Howard University. A distinguished researcher and surgeon, Dr. Frederick continues to work as a surgeon and also lectures to medical students and residents of Howard’s College of Medicine. The Board believes that with his exemplary career as a leader in medical research, healthcare academics and business administration, Dr. Frederick provides valuable perspective to the Board to assist in the advancement of our global strategic growth initiatives and our cascade of innovation. |

The Board of Directors met 5 times during the fiscal year ended December 31, 2024. Each of our Directors then in office attended 100% of the aggregate of the total number of meetings of the Board and the committees of the Board on which they served during the fiscal year ended December 31, 2024.

The Company’s policy is that all Directors are encouraged to attend the Annual Meeting of Shareholders. Every Director then in office attended the Annual Meeting of Shareholders held in 2024.

16 INSULET CORPORATION - 2025 Proxy Statement |

The following table sets forth the current membership and chairs of the three statutory committees of the Board as well as the number of meetings held by each committee in fiscal 2024. In addition to the statutory committees listed below, the Board has a Science and Technology Committee, consisting of Dr. Frederick (Chair), Dr. Borio, and Dr. Hopfield and an ad hoc transactions committee, consisting of Ms. Weatherman (Chair), Dr. Frederick, Dr. Hopfield and Mr. Minogue.

Name | Audit Committee | Nominating, Governance and Risk Committee | Talent and Compensation Committee | ||||||||

Luciana Borio | • | • | |||||||||

Wayne A.I. Frederick | • | • | |||||||||

Michael R. Minogue | • | ||||||||||

Flavia H. Pease | • | ||||||||||

Timothy J. Scannell | Chair | ||||||||||

Timothy C. Stonesifer | Chair | ||||||||||

Elizabeth H. Weatherman | Chair | ||||||||||

Number of Meetings in Fiscal 2024 | 7 | 4 | 4 | ||||||||

AUDIT COMMITTEE | |||||

Members: Timothy C. Stonesifer (Chair), Michael R. Minogue, and Flavia H. Pease | |||

Roles and Responsibilities | |||

The Audit Committee, among other functions, | |||

• | oversees the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements, and takes, or recommends that the Board of Directors take, appropriate action to oversee the qualifications, independence and performance of the Company’s independent auditors, and | ||

• | prepares the Audit Committee Report for inclusion in this and subsequent proxy statements in accordance with applicable rules and regulations. | ||

The Board of Directors has determined that each member of the Audit Committee meets the independence and other requirements promulgated by Nasdaq and the SEC, including Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the Exchange Act”). In addition, the Board has determined that each member of the Audit Committee is financially literate and that Mr. Stonesifer, Mr. Minogue, and Ms. Pease, and each qualifies as an “audit committee financial expert” under SEC rules. | |||

NOMINATING, GOVERNANCE AND RISK COMMITTEE | |||||

Members: Timothy J. Scannell (Chair), Luciana Borio, and Wayne A. I. Frederick | |||

Roles and Responsibilities | |||

The Nominating, Governance and Risk Committee, among other functions, | |||

• | identifies individuals qualified to become Board members, | ||

• | recommends that the Board of Directors select the Director nominees for election at each Annual Meeting of Shareholders, | ||

• | periodically reviews and recommends to the Board of Directors any changes to the Company’s Corporate Governance Guidelines, | ||

• | reviews matters relating to regulatory compliance, | ||

• | reviews the Company’s ESG and sustainability initiatives, | ||

• | discusses the guidelines and policies that govern the process by which the Company’s exposure to risk is assessed and managed by management, and | ||

• | reviews and monitors the Company’s cybersecurity policies and practices. | ||

The Board of Directors has determined that each member of the Nominating, Governance and Risk Committee meets the independence requirements promulgated by Nasdaq. | |||

As described below in the section entitled “Governance Policies and Procedures,” the Governance Committee will consider Director nominees recommended by shareholders. For more corporate governance information, you are invited to access the Corporate Governance section of the Company’s website available at http://www.insulet.com. | |||

INSULET CORPORATION - 2025 Proxy Statement 17 |

TALENT AND COMPENSATION COMMITTEE | |||||

Members: Elizabeth H. Weatherman (Chair), Luciana Borio, and Wayne A.I. Frederick | |||

Roles and Responsibilities | |||

The Talent and Compensation Committee, among other functions, | |||

• | discharges the Board of Directors’ responsibilities relating to compensation of the Company’s Directors and executive officers, | ||

• | oversees the Company’s overall compensation programs, | ||

• | oversees talent and culture development, and | ||

• | prepares the Compensation Committee Report required to be included in this and subsequent proxy statements. | ||

The Board of Directors has determined that each member of the Talent and Compensation Committee meets the independence requirements promulgated by Nasdaq. See the section entitled “Compensation Decision Making Process” in the Compensation Discussion and Analysis portion of this proxy statement for a more detailed description of the policies and procedures of the Talent and Compensation Committee. | |||

No member of the Talent and Compensation Committee was an employee or former employee of the Company or any of its subsidiaries or had any relationship with the Company requiring disclosure herein. | |||

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | |||

During 2024, no executive officer of the Company served as: (i) a member of the compensation committee (or other committee of the board of directors performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on the Talent and Compensation Committee of the Company, (ii) a director of another entity, one of whose executive officers served on the Talent and Compensation Committee of the Company, or (iii) a member of the compensation committee (or other committee of the board of directors performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served as a Director of the Company. | |||

Independent members of the Board of Directors meet without the non-independent Directors of the Company following all regularly scheduled Board meetings and occasionally at specially called meetings arranged by our independent Chairman of the Board. These executive sessions include only those Directors who meet the independence requirements promulgated by Nasdaq. Timothy J. Scannell, as Chairman of the Board, is responsible for chairing these executive sessions.

The Board views ensuring thoughtful, seamless, and effective transitions of leadership to be a primary responsibility of the Board. The full Board and the Governance Committee periodically review succession planning for our Chief Executive Officer. Our Chief Executive Officer periodically discusses with the Board recommendations and evaluations of potential successors, including in the event of an unexpected emergency, and reviews development plans, if any, recommended for such individuals. The Talent and Compensation Committee also reviews succession plans for the entire Executive Leadership team, discussing individuals identified as emergency successors and individuals zero to three moves of readiness away. Most recently, following thoughtful deliberation, the Board executed on its CEO succession plan and appointed a new President and Chief Executive Officer to lead the Company.

Each year, the Nominating, Governance and Risk Committee, together with the Board Chair (who also chairs the Nominating, Governance and Risk Committee), oversees an annual evaluation process. The evaluations help inform the Committee’s discussions regarding Board succession planning and refreshment and complement the Committee’s evaluation of the size and composition of the Board. The Board also recognizes that a robust and constructive evaluation process is an important part of good corporate governance and board effectiveness. Our Board is committed to an annual evaluation process, which the Board believes promotes continuous improvement. The annual self-assessment evaluates the performance of the Board and its committees in accordance with a procedure established by the Nominating, Governance and Risk Committee. In 2024, in addition to the Board Chair having individual discussions with each Board member, the full Board and each Board committee completed anonymous written questionnaires that requested ratings as well as subjective comments in key areas and solicited input for areas of development. The results were compiled and discussed by the Board and each committee, as applicable, and changes in practices or procedures were considered and implemented as appropriate. The evaluation results were reviewed in detail by the Board Chair, who led a discussion with the full Board highlighting both areas of strength and areas of opportunity.

18 INSULET CORPORATION - 2025 Proxy Statement |

The Board of Directors is responsible for overseeing the Company’s risk assessment and management function, considering the Company’s major financial risk exposures, and evaluating the steps that the Company’s management has taken to monitor and control such exposures. For example, the Board receives regular reports from senior management on areas of material risk to the Company, including operational, financial, legal, regulatory, and reputational risks. In particular, the Board reviews cybersecurity risks and incidents as well as other risks and incidents relevant to our information technology system controls and security. The Board also reviews the risks associated with the Company’s strategic plan and discusses the appropriate levels of risk in light of the Company’s business objectives. This is done through an annual strategy review process and throughout the year as part of the Board’s ongoing review of corporate strategy.

The various Committees of the Board are also responsible for monitoring and reporting to the full Board on risks associated with their respective areas of oversight. The Audit Committee, among other things, oversees the management of market and operational risks that could have a financial impact, such as those relating to internal controls, the integrity of the Company’s financial statements and financial liquidity. The Talent and Compensation Committee oversees risks associated with the Company’s compensation practices and programs. The Governance Committee oversees risks relating to the Company’s corporate governance practices, including director independence and the breadth of skills of directors serving on the Board, succession planning for the Chief Executive Officer, and matters relating to regulatory and legal compliance, sustainability, and cybersecurity. In connection with its oversight responsibilities, each Committee often meets with the members of management who are primarily responsible for the management of risk in their respective areas, including, among others, the Company’s Chief Financial Officer, General Counsel, Chief Human Resources Officer, Chief Sustainability Officer, Chief Compliance Officer, Chief Information Security Officer, Vice President of Internal Audit and other senior regulatory, information technology, internal audit, research and development and compliance officers.

As provided in our Corporate Governance Guidelines, the Board has established an overboarding policy to help ensure a director’s service on other public company boards does not impair the director’s ability to effectively serve on our Board. To that end, the Board believes that directors who serve as the chief executive officer of any business corporation (including the Company) should not serve on more than two public company boards (inclusive of our Board) and that all other directors should not serve on more than five public company boards (inclusive of our Board).

The Company has adopted a “code of ethics,” as defined by regulations promulgated under the Securities Act of 1933, as amended, that applies to all of the Company’s Directors and employees worldwide, including its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A current copy of the Code of Business Conduct and Ethics is available in the Investor Relations section of the Company’s website at http://www.insulet.com. A copy of the Code of Business Conduct and Ethics may also be obtained, free of charge, from the Company upon a request directed to: Insulet Corporation, 100 Nagog Park, Acton, Massachusetts 01720, Attention: Secretary. The Company intends to disclose any amendment to, or waiver of, a provision of the Code of Business Conduct and Ethics that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, by posting such information on its website at http://www.insulet.com. For more corporate governance information, you are invited to access the Investor Relations section of the Company’s website available at http://www.insulet.com.

The Board of Directors has adopted a compensation recoupment policy (the “Recoupment Policy”) which provides that, if the Company is required to prepare an accounting restatement of its financial statements due to material non-compliance with any financial reporting requirement under U.S. securities laws, the Company will recover on a reasonably prompt basis the amount of any incentive-based compensation received by a covered executive (including former executives) during the recovery period that exceeds the amount that otherwise would have been received had it been calculated based on the financial results reported in the restatement financial statements. The recovery period includes the three completed fiscal years immediately preceding the date the Company is required to prepare the accounting restatement and any transition period, as prescribed under Rule 10D-1 of the Exchange Act.

The Company may effect any recovery under the Recoupment Policy by requiring payment of such amount(s) to the Company by set-off, by reducing future compensation, or by such other means or combination of means as the Committee determines to be appropriate. The Company need not recover the excess amount of incentive-based Compensation if and to the extent that the Committee determines that such recovery is impracticable or not required under Rule 10D-1, including if the Committee determines that the direct expense paid to a third party to assist in enforcing this Policy would exceed the amount to be recovered.

INSULET CORPORATION - 2025 Proxy Statement 19 |

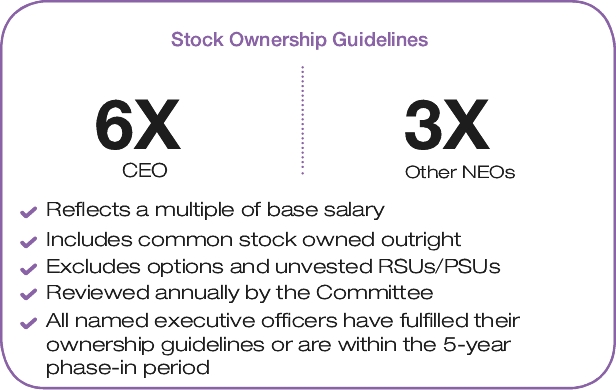

The Board of Directors has adopted a policy recommending that all Directors and executive officers own a significant equity interest in the Company’s common stock, subject to a phase-in period. The policy advises that Directors own Company common stock with a value at least equal to five times their annual cash retainer. The policy recommends that the Chief Executive Officer own Company common stock with a value at least equal to six times her base salary, and that the other executives own Company common stock with a value at least equal to three times their base salaries. Subject to the phase-in requirements, all of the Directors and executive officers are in compliance with this policy. Further information regarding this policy can be found in the Compensation Discussion and Analysis section of this proxy statement.

The Board of Directors has adopted Insider Trading Procedures which prohibit Directors and officers from:

• | engaging in any short sales of the Company’s securities, |

• | buying or selling puts, calls, or other derivative securities relating to any of the Company’s securities, |

• | holding any Company securities on margin or collateralizing any brokerage account with any Company securities, or |

• | pledging any Company securities as collateral for any loan, unless such transaction has been specifically pre-approved by the Talent and Compensation Committee. |

The Company’s Bylaws provide for plurality voting in Director elections. In February 2012, the Board of Directors adopted a majority voting policy. Pursuant to the Company’s majority voting policy, in any uncontested election of Directors, any nominee for Director who receives a greater number of “withhold” votes than votes “for” his or her election must, within five days following the certification of the shareholder vote, tender his or her written resignation to the Chairman of the Board for consideration by the Governance Committee.

Any resignation tendered pursuant to the majority voting policy will be effective on the earlier of (i) the date such resignation is accepted by the Board or (ii) the 61st day following the date of the shareholders’ meeting at which the election occurred, unless the Board chooses not to accept such resignation.

The Governance Committee will consider such tendered resignation and, within 30 days following the date of the shareholders’ meeting at which the election occurred, will make a recommendation to the Board concerning the acceptance or rejection of such resignation. In determining its recommendation to the Board, the Governance Committee will consider all factors deemed relevant by the members of the Governance Committee including, without limitation:

• | the stated and perceived reasons why shareholders withheld votes for election from such Director, in part as reflected in the reports issued by proxy advisory firms; |

• | the length of service and qualifications of such Director; |

• | the Director’s past and expected future contributions to the Board of Directors and any Committees of the Board on which he or she sits; |

• | the overall composition of the Board and the Committees of the Board on which the Director sits, |

• | whether acceptance of the Director’s resignation would cause the Company to fail to satisfy any regulatory requirements, and |

• | whether acceptance of the resignation is in the best interest of the Company and its shareholders. |

The Board will take formal action on the Governance Committee’s recommendation no later than 60 days following the date of the shareholders’ meeting at which the election occurred. In considering the Governance Committee’s recommendation, the Board will consider the information and factors considered by the Governance Committee and such additional information and factors as the Board deems relevant.

Within four business days following the Board’s decision on the Governance Committee’s recommendation, the Company will publicly disclose the Board’s decision in a Form 8-K, providing an explanation of the process by which the decision was reached and, if applicable, the reasons for rejecting the tendered resignation.

Any Director who is the subject of the evaluation described in this section will not participate in Governance Committee or Board deliberations or recommendations regarding the appropriateness of his or her continued service, except to respond to requests for information. If a majority of the members of the Governance Committee are subject to this evaluation process, then the independent Directors on the Board who are not subject to the evaluation will appoint a Board committee amongst themselves solely for the purpose of conducting the required evaluation. This special committee will make the recommendation to the Board otherwise required of the Governance Committee.

20 INSULET CORPORATION - 2025 Proxy Statement |

The Board of Directors is responsible for approving nominees to the Board. Generally, the Governance Committee identifies candidates for Director nominees in consultation with management, through the use of search firms or other advisors, through the recommendations submitted by members of the Board, shareholders, or through such other methods as the Governance Committee deems to be helpful to identify candidates. Once candidates have been identified, the Governance Committee will assess whether the candidates meet all of the minimum qualifications for Director nominees established by the Governance Committee. The Governance Committee may gather information about the candidates through interviews, detailed questionnaires, background checks or other means that the Governance Committee deems helpful in the evaluation process. The Governance Committee then meets as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of the Board. Based on the results of the evaluation process, the Governance Committee recommends candidates to the Board of Directors for approval as nominees for election to the Board of Directors. The Governance Committee also recommends candidates to the Board of Directors for appointment to the Committees of the Board of Directors.

The Governance Committee will consider stockholder recommendations for Board nominees using the criteria described on page 15 under the heading “Director Qualifications”. The name of any recommended candidate for director, together with a brief biographical sketch, a document indicating the candidate’s willingness to serve, if elected, and evidence of the nominating stockholder’s ownership of the Company’s stock should be sent to the attention of our Secretary, Insulet Corporation, 100 Nagog Park, Acton, Massachusetts 01720. If you wish to formally nominate a candidate, you must follow the procedures described in our Bylaws.