11.26 “Overall Share Limit” means 8,107,457 Shares.1

11.27 “Participant” means a Service Provider who has been granted an Award.

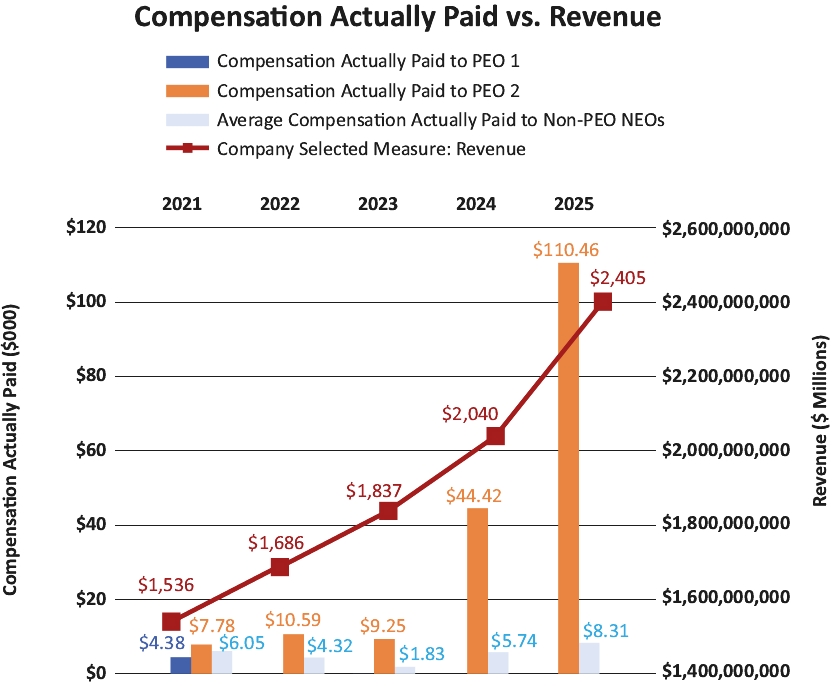

11.28 “Performance Criteria” mean the criteria (and adjustments) that the Administrator may select for an Award to establish performance goals for a performance period, which may include, without limitation, the following: net earnings (either before or after interest, taxes, depreciation and amortization), sales or revenue, net income (either before or after taxes), operating earnings, cash flow (including, but not limited to, operating cash flow and free cash flow), return on net assets, return on stockholders’ equity, return on assets, return on capital, return on sales, gross or net profit margin, total shareholder return, internal rate of return (IRR), financial ratios (including those measuring liquidity, activity, profitability or leverage), working capital, earnings per Share, price per Share, market capitalization, any GAAP financial performance measures, inventory management, measures related to A/R balance and write-offs, timeliness and/or accuracy of business reporting, approval or implementation of strategic plans, financing and other capital raising transactions, debt levels or reductions, cash levels, acquisition activity, investment sourcing activity, marketing initiatives, projects or processes, achievement of customer satisfaction objectives, number of new states entered, number of new countries entered, number of new schools, number of students/new students, student retention percentage, student lifetime value, number of new courses, number of classrooms using our curriculum, curriculum enhancement and compliance with state standards, learning and content management system improvements, development and/or implementation of school initiatives and services, academic performance, training and professional development goals, state testing measures for schools and students, infrastructure scaling, new product development, business development, human capital development, human resources goals, employee satisfaction, regulatory compliance objectives, supervision of litigation and other legal matters, managing relationships with charter authorizers, charter school boards, or other organizations that influence charter schools, cost management, expense reduction goals, budget comparisons, and contract renewals, any of which may be measured in absolute terms or as compared to any incremental increase or decrease. Such performance goals also may be based solely by reference to the Company’s performance or the performance of a Subsidiary, division, business segment or business unit of the Company or a Subsidiary, or based upon performance relative to performance of other companies or upon comparisons of any of the indicators of performance relative to performance of other companies. Any performance goals that are financial metrics, may be determined in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), in accordance with accounting principles established by the International Accounting Standards Board (“IASB Principles”), or may be adjusted when established to include or exclude any items otherwise includable or excludable under GAAP or under IASB Principles. The Committee may provide for exclusion of the impact of an event or occurrence which the Committee determines should appropriately be excluded, including (a) restructurings, discontinued operations, extraordinary items, and other unusual, infrequently occurring or non-recurring charges or events, (b) asset write-downs, (c) litigation or claim judgments or settlements, (d) acquisitions or divestitures, (e) reorganization or change in the corporate structure or capital structure of the Company, (f) an event either not directly related to the operations of the Company, Subsidiary, division, business segment or business unit or not within the reasonable control of management, (g) foreign exchange gains and losses, (h) a change in the fiscal year of the Company, (i) the refinancing or repurchase of bank loans or debt