Our industry

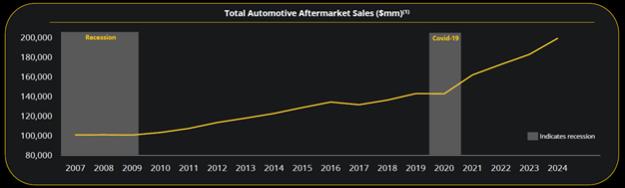

We operate in the growing and attractive auto aftermarket industry. The industry is currently valued at $200 billion and is supported by strong demand drivers, including the size of the car parc (or vehicles-in-operation), the average age of the car parc and vehicle miles driven. In the United States, the number of vehicles-in-operation continues to grow and is nearly 290 million vehicles today. Of those vehicles, approximately 85% are at least four years old, which is the age at which vehicles tend to require additional maintenance.

The average age of a vehicle on the road has increased from 11.8 years to 12.8 years from 2018 to 2024, as consumers continue to hold onto their cars longer. The average age of a vehicle is expected to increase for the foreseeable future due to, among other drivers, higher prevailing interest rates, increased new car prices, high insurance costs and recently enacted and/or proposed new global trade tariffs. Additionally, vehicle miles traveled annually has grown in recent years to above 3.3 trillion in 2024.

Furthermore, the automotive industry is resilient in times of macroenvironment uncertainty as demonstrated by the automotive aftermarket industry sales remaining flat during the Great Recession and increasing during the COVID-19 pandemic, as shown in the following chart.

Source: Auto Care Association; (1) Includes automotive parts sold to DIY and professional customers in the United States

These strong demand drivers, coupled with the resilience of the automotive industry, contribute to healthy consumer spending on auto repair and maintenance, supporting demand for parts and accessories and creating a strong backdrop for growth.

Our competition

Our primary competitors are (i) both national and regional chains of automotive parts stores, including AutoZone, Inc., NAPA, O’Reilly Automotive, Inc., The Pep Boys-Manny, Moe & Jack and Auto Plus (formerly Uni-Select USA, Inc.); (ii) internet-based retailers; (iii) discount stores and mass merchandisers that carry automotive products; (iv) wholesalers or jobbers stores, including those associated with national parts distributors or associations; (v) independently-owned stores; and (vi) automobile dealers that supply parts. We believe that chains of automotive parts stores that, like us, have multiple locations in one or more markets have a competitive advantage in terms of customer service, marketing, inventory selection, purchasing and distribution compared with independent retailers and jobbers that are not part of a chain or associated with other retailers or jobbers. The principal methods of competition in the business include brand recognition, customer service, product offerings, availability, quality, service with speed, price and store location.