4Q25 Earnings Presentation January 27, 2026

The JetBlue Way Forward | Our Strategic Evolution | Returning to Historical Earnings Power Safe Harbor This Presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this Presentation are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements contained in this Presentation include, without limitation, statements regarding our outlook and future results of operations and financial position, including our expected return to profitability, any expected headwinds, our use of artificial intelligence, our aircraft fleet, our product offerings and loyalty initiatives, and our business strategy and plans and objectives for future operations, such as our JetForward initiatives and its Blue Sky component. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; the risk associated with the execution of our strategic operating plans in the near- term and long-term; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs, including those that impact commercial aircraft and related parts imported from outside the United States; the outcome of current or future legal proceedings or regulatory actions; risks associated with stockholder activism; risks associated with cybersecurity and privacy, including potential disruptions to our information technology systems or information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; possible failure to comply with financial and other debt covenants included in the agreements governing our debt; financial risks associated with credit card processors; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; limits on our ability to use certain tax attributes; risks associated with our development and use of AI-powered solutions; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing scrutiny of, and evolving expectations regarding, environmental matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Presentation, could cause our results to differ materially from those expressed in the forward- looking statements. Further information concerning these and other factors is contained in JetBlue's filings with the U.S. Securities and Exchange Commission (the "SEC"), including but not limited to in our Annual Report on Form 10-K for the year ended December 31, 2024, as may be updated by our other SEC filings, including our Annual Report on Form 10-K for the year ended December 31, 2025, to be filed with the SEC. In light of these risks and uncertainties, the forward-looking events discussed in this Presentation might not occur. Our forward-looking statements speak only as of the date of this Presentation. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. 2

The JetBlue Way Forward | Our Strategic Evolution | Returning to Historical Earnings Power 2025 Recap Joanna Geraghty Chief Executive Officer 3

Progressed JetForward transformation, delivering $305M of incremental EBIT (1) • Net Promoter Score (NPS) increased eight points year-over-year (YoY) as investments in operational reliability ramped • Introduced collaboration with United Airlines, called Blue Sky, and launched initial phase - reciprocal loyalty accrual and redemption • Expanded co-brand card portfolio with the introduction of a premium card • Opened JetBlue’s first lounge, BlueHouse, at JFK’s Terminal 5 • Regained position as Fort Lauderdale's largest airline with new routes and additional frequencies Delivered unit costs within initial range (2) of up 5% to 7% while navigating a dynamic year with two points of proactive capacity reductions in response to demand (1) Management reviews the estimated amount of earnings before interest and taxes attributable to JetForward initiatives within a given period to evaluate progress against our financial and operational targets. Incremental EBIT reflects the estimated impact of strategic initiatives on profitability, such as partnerships, fleet optimization, network changes, and cost reduction programs. (2) CASM ex-Fuel guidance as of January 28, 2025. (3) Includes cash and cash equivalents and investment securities. Excludes $600M undrawn revolving credit facility. Retired remaining E190 aircraft and moved to a more cost-efficient all-Airbus fleet ✓ Maintained solid liquidity position of $2.5B (2) (~27% of trailing twelve-month revenue) and ~$6.5B in unencumbered assets 2025 Year in Review 4

Continued to Execute on JetForward Priorities to Drive Our Path to Profitability 4Q demand remained healthy even with disruption challenges • 4Q YoY RASM finished positive, 2.2pts better than guidance midpoint (1), driven by strong underlying demand, and ancillary and loyalty revenue performing above expectations • Hurricane Melissa, government shutdown (2), Airbus airworthiness directive and Winter Storm Devin reduced 4Q capacity by nearly 2pts, impacting CASM ex-fuel by over 2pts Continued to make progress on JetForward and the path back to profitability • Achieved best performing day of NPS since 2020 in mid-November • Set a program record for highest co-brand spend in December • Generated all-time high revenue in Fort Lauderdale in December 4Q25 (1) Guidance as of October 28, 2025. (2) Air traffic control (ATC) delays and ATC reductions during the government shutdown. 5

The JetBlue Way Forward | Our Strategic Evolution | Returning to Historical Earnings Power Commercial Update, JetForward Progress and Outlook Marty St. George President 6

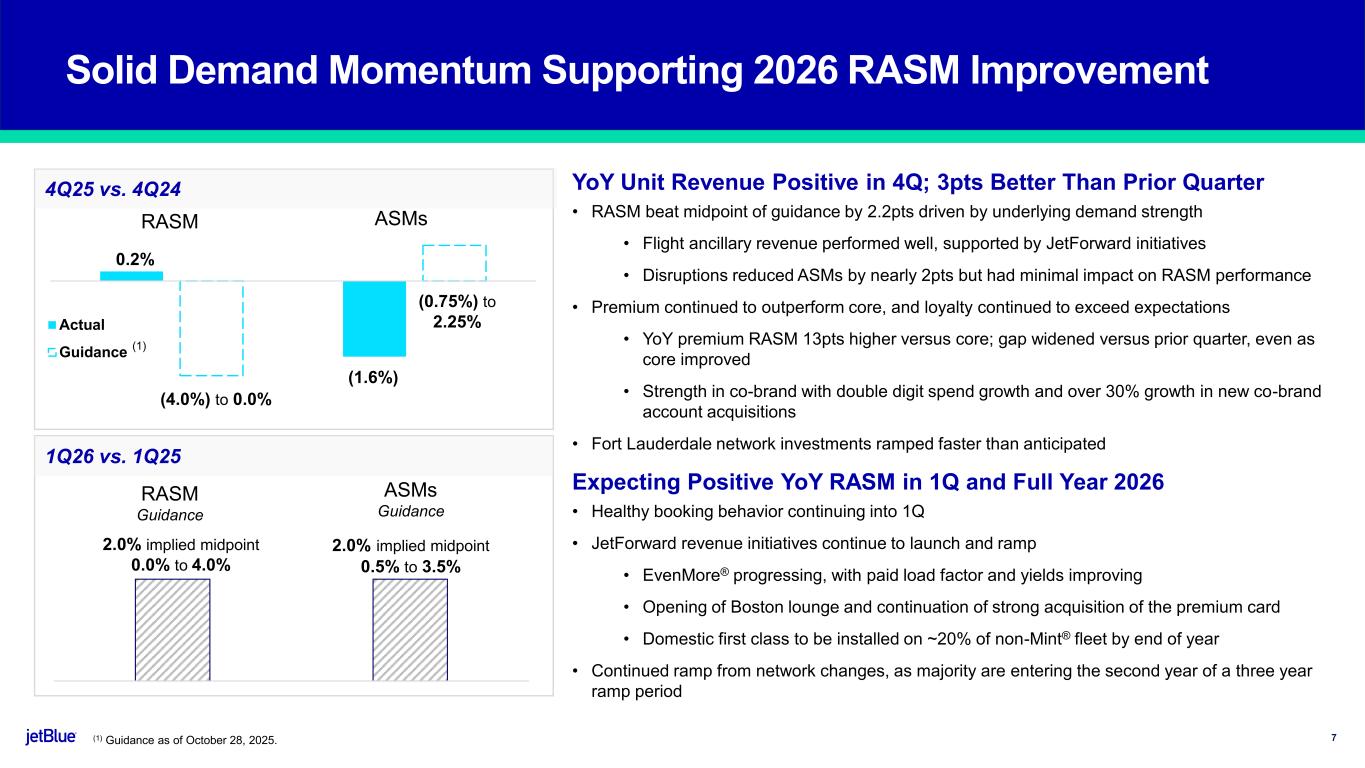

7 YoY Unit Revenue Positive in 4Q; 3pts Better Than Prior Quarter • RASM beat midpoint of guidance by 2.2pts driven by underlying demand strength • Flight ancillary revenue performed well, supported by JetForward initiatives • Disruptions reduced ASMs by nearly 2pts but had minimal impact on RASM performance • Premium continued to outperform core, and loyalty continued to exceed expectations • YoY premium RASM 13pts higher versus core; gap widened versus prior quarter, even as core improved • Strength in co-brand with double digit spend growth and over 30% growth in new co-brand account acquisitions • Fort Lauderdale network investments ramped faster than anticipated Expecting Positive YoY RASM in 1Q and Full Year 2026 • Healthy booking behavior continuing into 1Q • JetForward revenue initiatives continue to launch and ramp • EvenMore® progressing, with paid load factor and yields improving • Opening of Boston lounge and continuation of strong acquisition of the premium card • Domestic first class to be installed on ~20% of non-Mint® fleet by end of year • Continued ramp from network changes, as majority are entering the second year of a three year ramp period Solid Demand Momentum Supporting 2026 RASM Improvement (1) Guidance as of October 28, 2025. 4Q25 vs. 4Q24 1Q26 vs. 1Q25 ASMs Guidance RASM Guidance 2.0% implied midpoint 0.0% to 4.0% 2.0% implied midpoint 0.5% to 3.5% Actual Guidance RASM ASMs (4.0%) to 0.0% 0.2% (1.6%) (0.75%) to 2.25% (1)

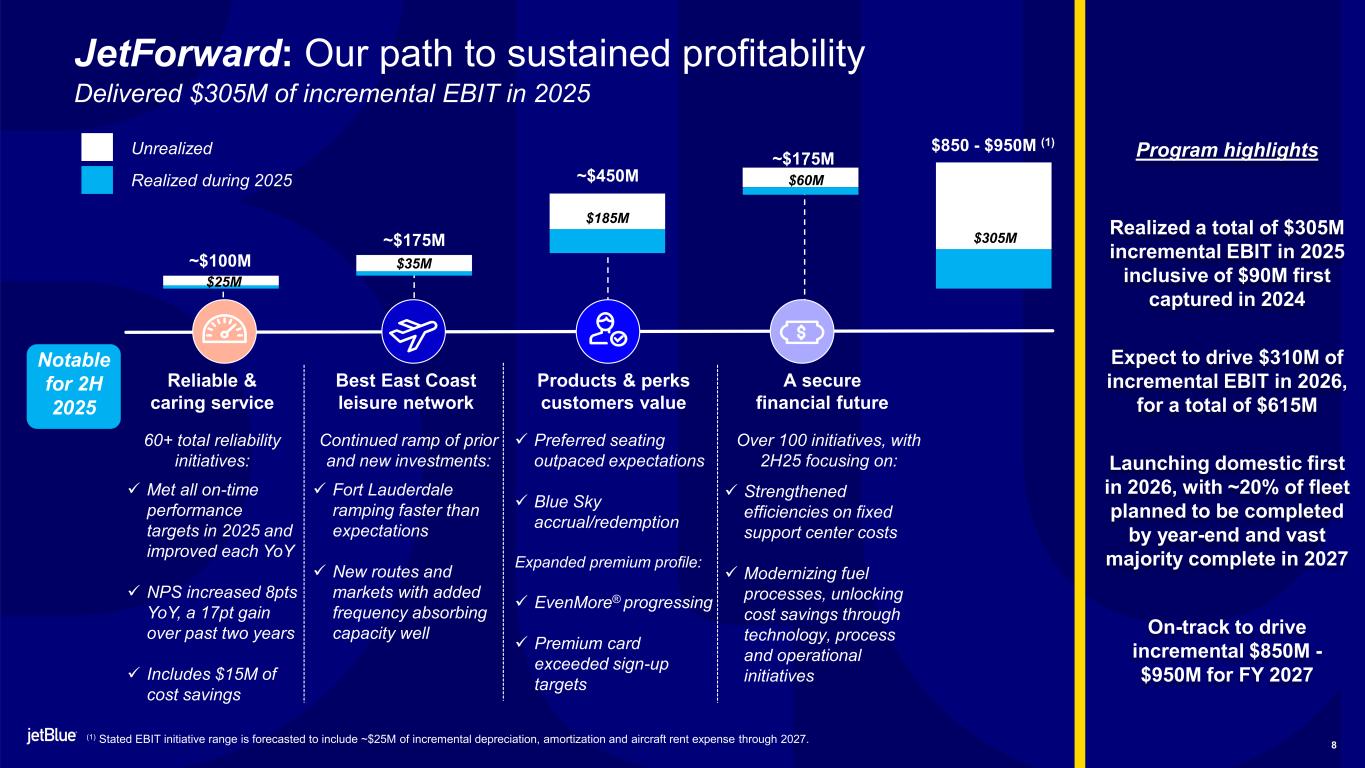

8 JetForward: Our path to sustained profitability Delivered $305M of incremental EBIT in 2025 (1) Stated EBIT initiative range is forecasted to include ~$25M of incremental depreciation, amortization and aircraft rent expense through 2027. 8 $305M $60M $185M $25M $35M Notable for 2H 2025 Reliable & caring service Best East Coast leisure network Products & perks customers value A secure financial future 60+ total reliability initiatives: ✓ Met all on-time performance targets in 2025 and improved each YoY ✓ NPS increased 8pts YoY, a 17pt gain over past two years ✓ Includes $15M of cost savings Continued ramp of prior and new investments: ✓ Fort Lauderdale ramping faster than expectations ✓ New routes and markets with added frequency absorbing capacity well ✓ Preferred seating outpaced expectations ✓ Blue Sky accrual/redemption Expanded premium profile: ✓ EvenMore® progressing ✓ Premium card exceeded sign-up targets Over 100 initiatives, with 2H25 focusing on: ✓ Strengthened efficiencies on fixed support center costs ✓ Modernizing fuel processes, unlocking cost savings through technology, process and operational initiatives Program highlights Realized a total of $305M incremental EBIT in 2025 inclusive of $90M first captured in 2024 Expect to drive $310M of incremental EBIT in 2026, for a total of $615M Launching domestic first in 2026, with ~20% of fleet planned to be completed by year-end and vast majority complete in 2027 On-track to drive incremental $850M - $950M for FY 2027 Realized during 2025 Unrealized ~$450M $850 - $950M (1) ~$175M ~$175M ~$100M

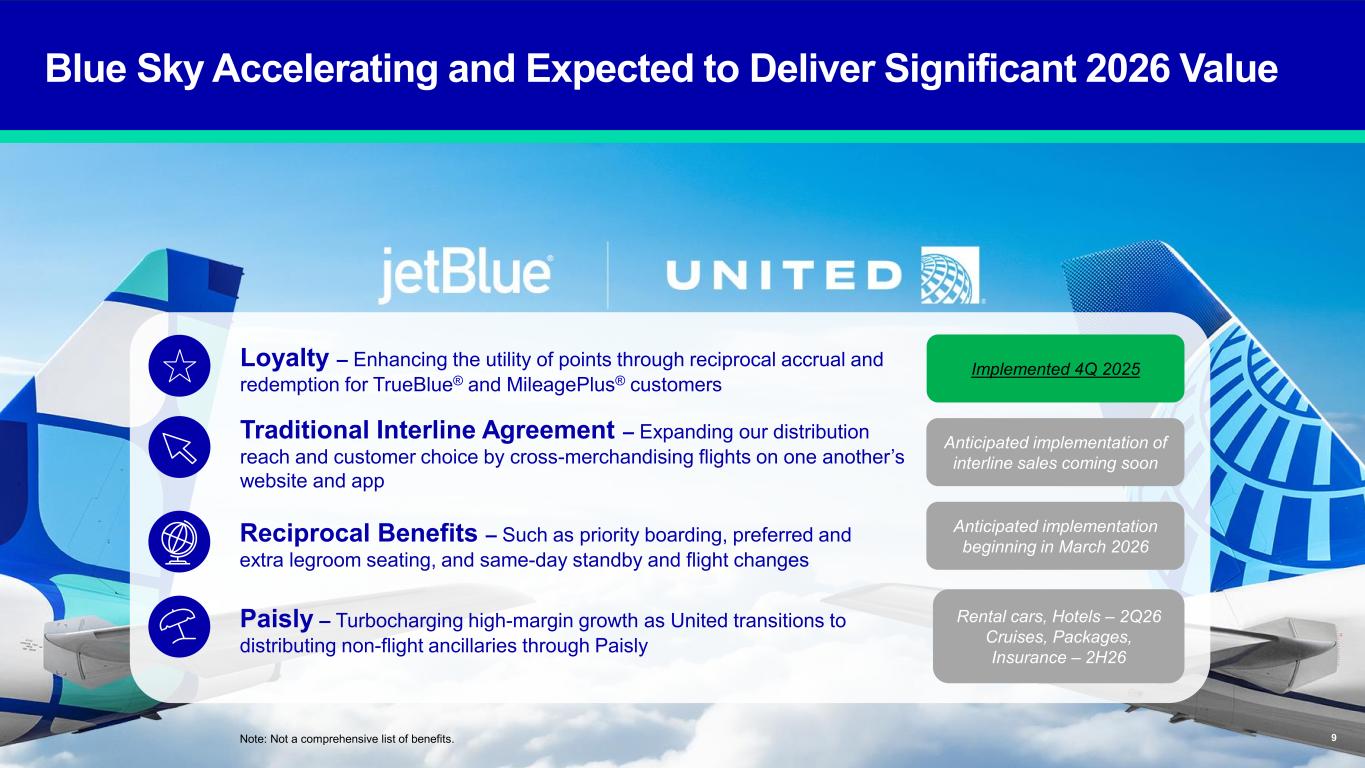

9Note: Not a comprehensive list of benefits. Traditional Interline Agreement – Expanding our distribution reach and customer choice by cross-merchandising flights on one another’s website and app Loyalty – Enhancing the utility of points through reciprocal accrual and redemption for TrueBlue® and MileagePlus® customers Paisly – Turbocharging high-margin growth as United transitions to distributing non-flight ancillaries through Paisly Blue Sky Accelerating and Expected to Deliver Significant 2026 Value Anticipated implementation of interline sales coming soon Implemented 4Q 2025 Rental cars, Hotels – 2Q26 Cruises, Packages, Insurance – 2H26 Reciprocal Benefits – Such as priority boarding, preferred and extra legroom seating, and same-day standby and flight changes Anticipated implementation beginning in March 2026

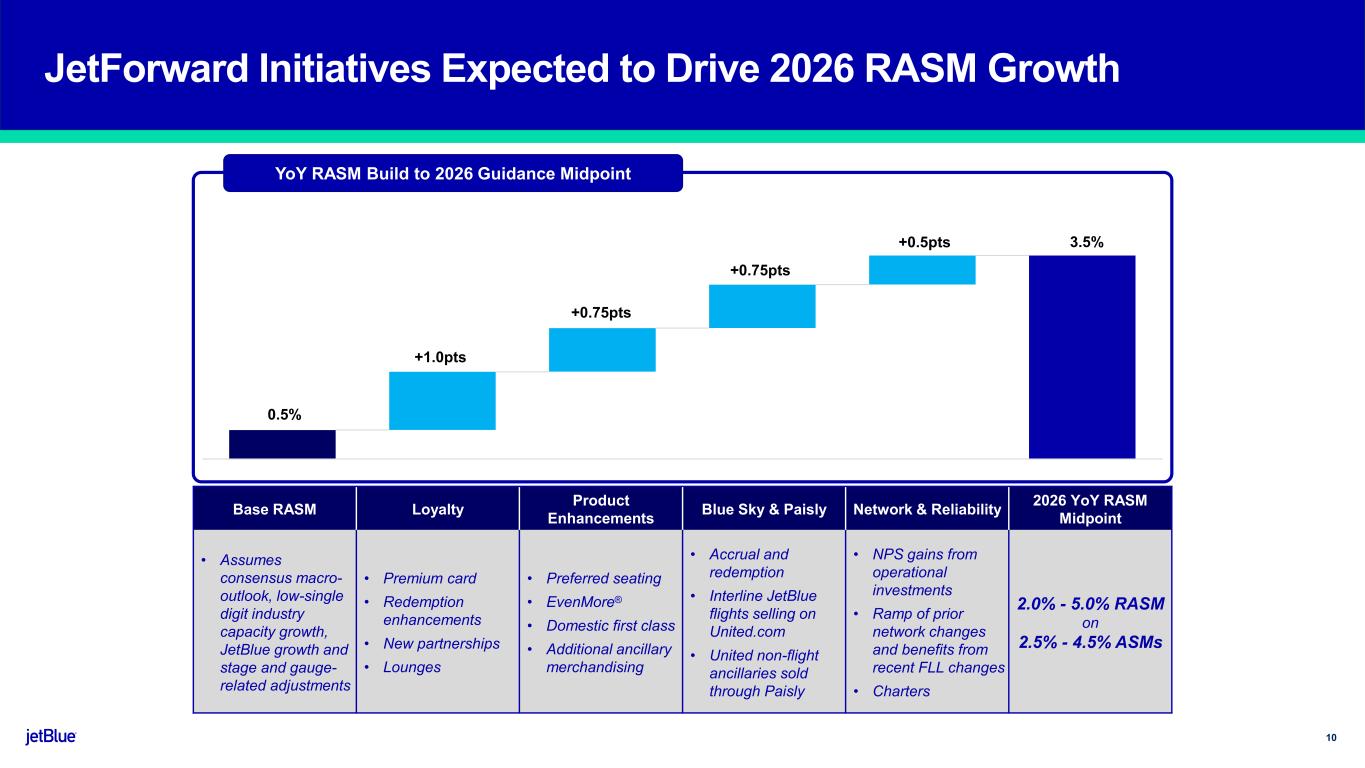

10 Macro Loyalty Product Enhancements Blue Sky and Paisly Network and Reliability 2026 RASM YoY (Midpoint) +1.0pts Base RASM Loyalty Product Enhancements Blue Sky & Paisly Network & Reliability 2026 YoY RASM Midpoint • Assumes consensus macro- outlook, low-single digit industry capacity growth, JetBlue growth and stage and gauge- related adjustments • Premium card • Redemption enhancements • New partnerships • Lounges • Preferred seating • EvenMore® • Domestic first class • Additional ancillary merchandising • Accrual and redemption • Interline JetBlue flights selling on United.com • United non-flight ancillaries sold through Paisly • NPS gains from operational investments • Ramp of prior network changes and benefits from recent FLL changes • Charters 2.0% - 5.0% RASM on 2.5% - 4.5% ASMs TBU 3.5% YoY RASM Build to 2026 Guidance Midpoint 0.5% +0.75pts +0.75pts +0.5pts JetForward Initiatives Expected to Drive 2026 RASM Growth

The JetBlue Way Forward | Our Strategic Evolution | Returning to Historical Earnings Power Financial Update and Outlook Ursula Hurley Chief Financial Officer 11

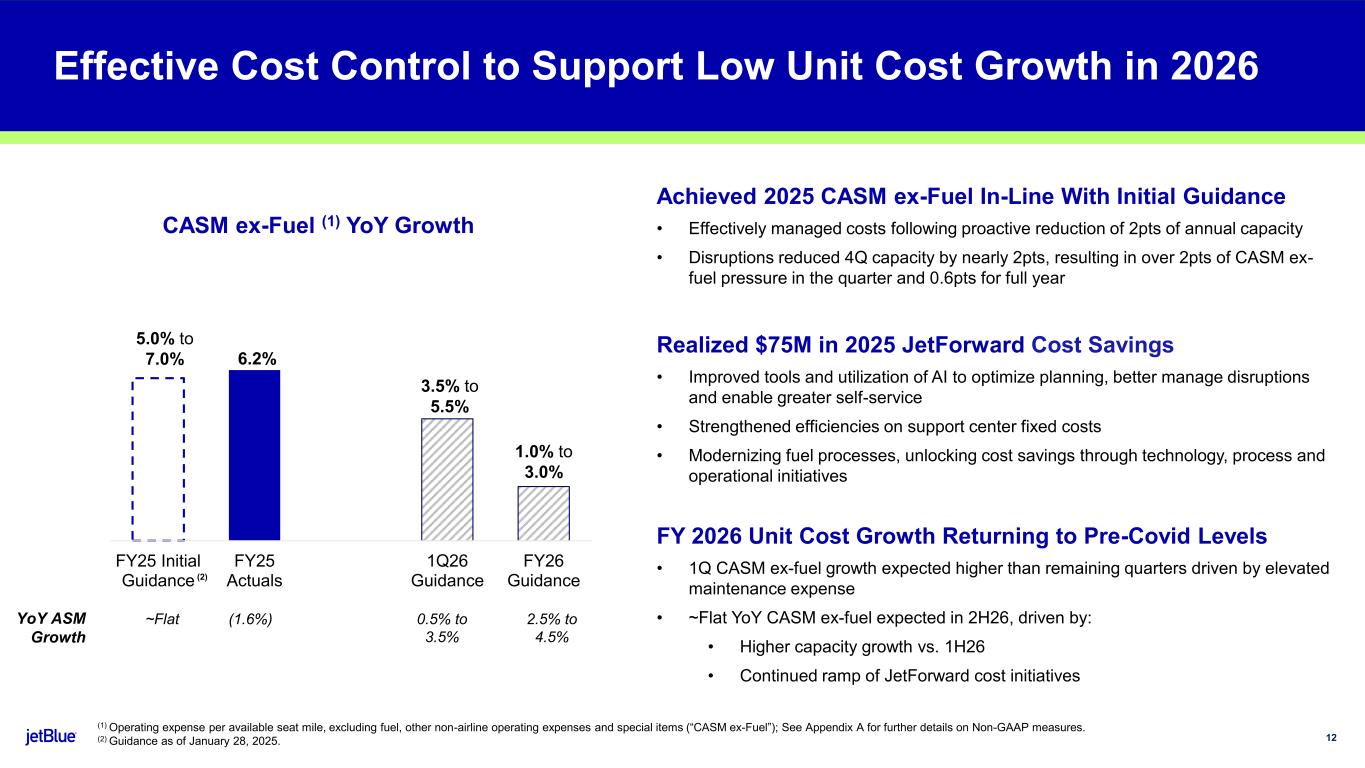

12 FY25 Initial Guidance FY25 Actuals 1Q26 Guidance FY26 Guidance 3.5% to 5.5% CASM ex-Fuel (1) YoY Growth Achieved 2025 CASM ex-Fuel In-Line With Initial Guidance • Effectively managed costs following proactive reduction of 2pts of annual capacity • Disruptions reduced 4Q capacity by nearly 2pts, resulting in over 2pts of CASM ex- fuel pressure in the quarter and 0.6pts for full year Realized $75M in 2025 JetForward Cost Savings • Improved tools and utilization of AI to optimize planning, better manage disruptions and enable greater self-service • Strengthened efficiencies on support center fixed costs • Modernizing fuel processes, unlocking cost savings through technology, process and operational initiatives FY 2026 Unit Cost Growth Returning to Pre-Covid Levels • 1Q CASM ex-fuel growth expected higher than remaining quarters driven by elevated maintenance expense • ~Flat YoY CASM ex-fuel expected in 2H26, driven by: • Higher capacity growth vs. 1H26 • Continued ramp of JetForward cost initiatives (1) Operating expense per available seat mile, excluding fuel, other non-airline operating expenses and special items (“CASM ex-Fuel”); See Appendix A for further details on Non-GAAP measures. (2) Guidance as of January 28, 2025. Effective Cost Control to Support Low Unit Cost Growth in 2026 1.0% to 3.0% ~Flat (1.6%) 0.5% to 3.5% 2.5% to 4.5% 5.0% to 7.0% 6.2% YoY ASM Growth (2)

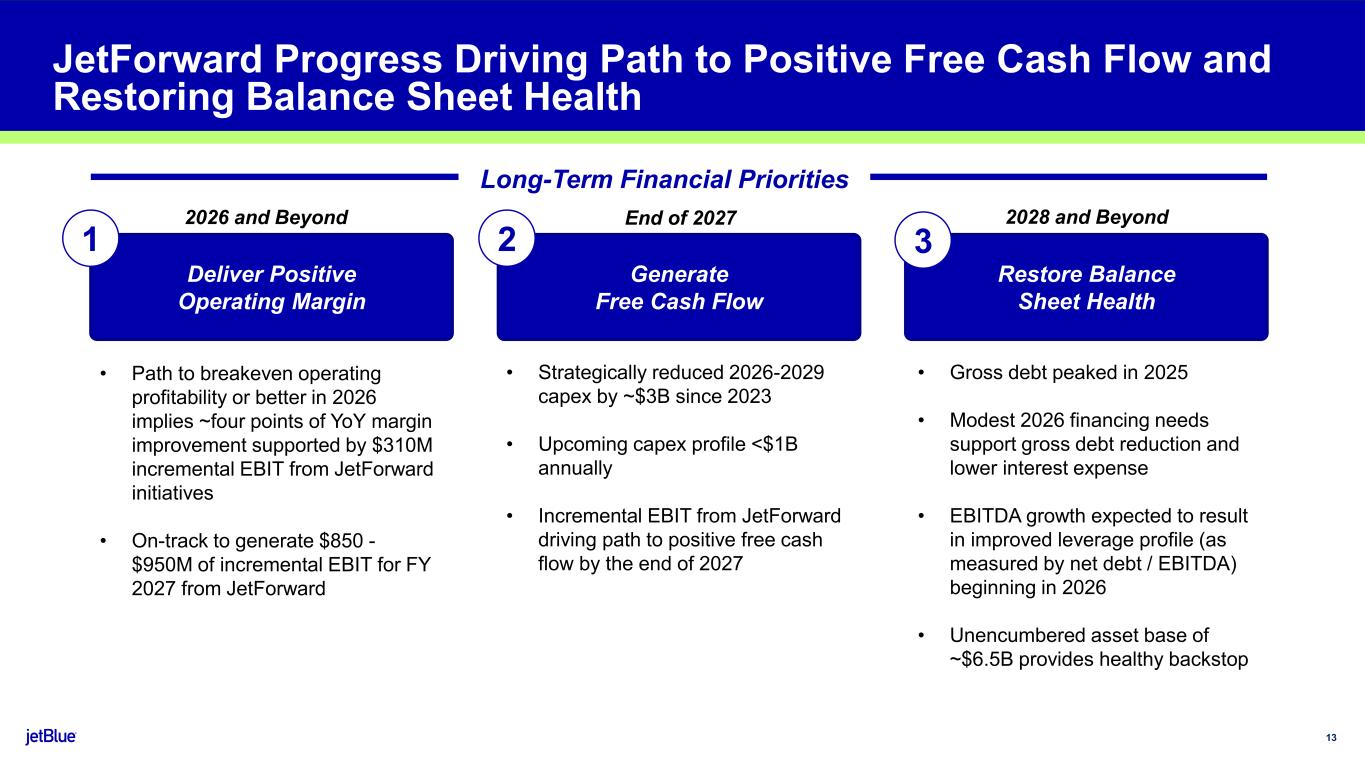

13 JetForward Progress Driving Path to Positive Free Cash Flow and Restoring Balance Sheet Health Deliver Positive Operating Margin Generate Free Cash Flow Restore Balance Sheet Health 1 3 Long-Term Financial Priorities 2 • Gross debt peaked in 2025 • Modest 2026 financing needs support gross debt reduction and lower interest expense • EBITDA growth expected to result in improved leverage profile (as measured by net debt / EBITDA) beginning in 2026 • Unencumbered asset base of ~$6.5B provides healthy backstop • Path to breakeven operating profitability or better in 2026 implies ~four points of YoY margin improvement supported by $310M incremental EBIT from JetForward initiatives • On-track to generate $850 - $950M of incremental EBIT for FY 2027 from JetForward 2026 and Beyond End of 2027 2028 and Beyond • Strategically reduced 2026-2029 capex by ~$3B since 2023 • Upcoming capex profile <$1B annually • Incremental EBIT from JetForward driving path to positive free cash flow by the end of 2027

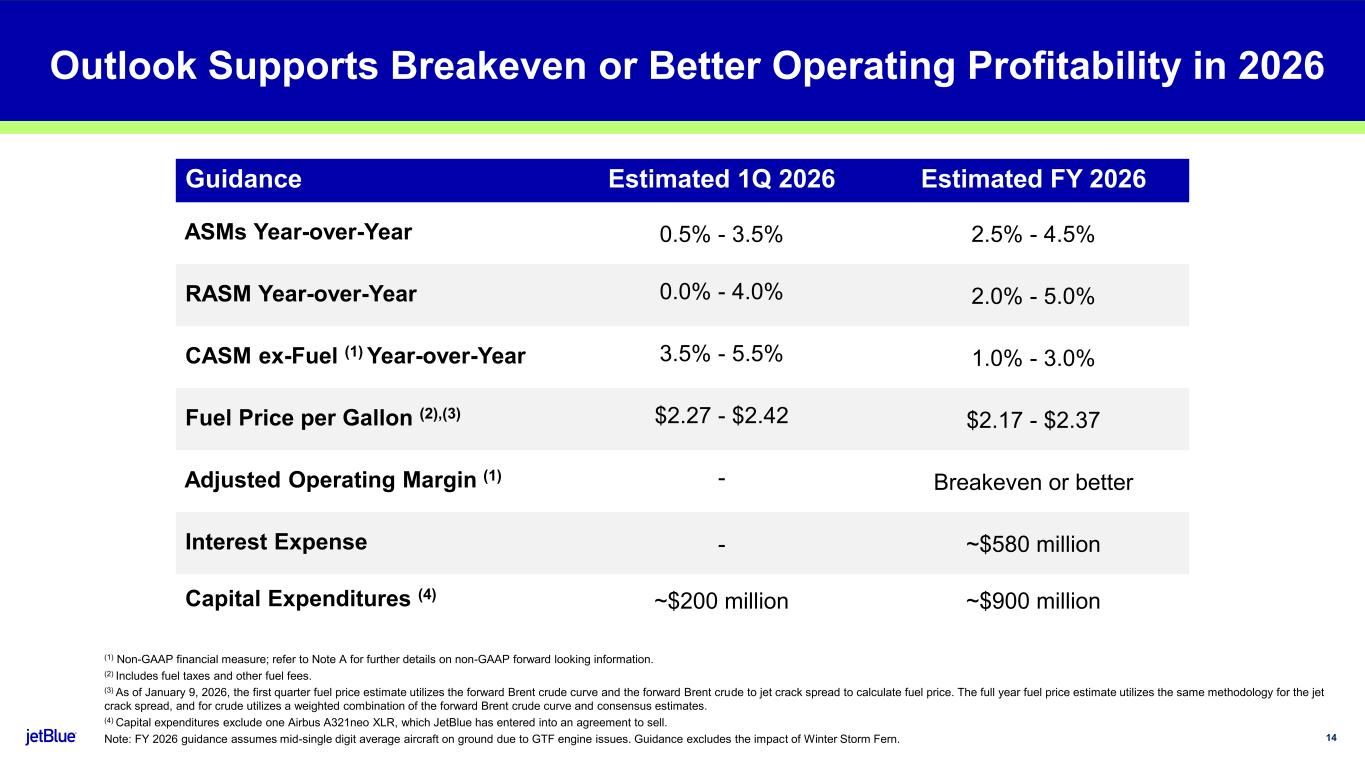

14 (1) Non-GAAP financial measure; refer to Note A for further details on non-GAAP forward looking information. (2) Includes fuel taxes and other fuel fees. (3) As of January 9, 2026, the first quarter fuel price estimate utilizes the forward Brent crude curve and the forward Brent crude to jet crack spread to calculate fuel price. The full year fuel price estimate utilizes the same methodology for the jet crack spread, and for crude utilizes a weighted combination of the forward Brent crude curve and consensus estimates. (4) Capital expenditures exclude one Airbus A321neo XLR, which JetBlue has entered into an agreement to sell. Note: FY 2026 guidance assumes mid-single digit average aircraft on ground due to GTF engine issues. Guidance excludes the impact of Winter Storm Fern. Guidance Estimated 1Q 2026 Estimated FY 2026 ASMs Year-over-Year 0.5% - 3.5% 2.5% - 4.5% RASM Year-over-Year 0.0% - 4.0% 2.0% - 5.0% CASM ex-Fuel (1) Year-over-Year 3.5% - 5.5% 1.0% - 3.0% Fuel Price per Gallon (2),(3) $2.27 - $2.42 $2.17 - $2.37 Adjusted Operating Margin (1) - Breakeven or better Interest Expense - ~$580 million Capital Expenditures (4) ~$200 million ~$900 million Outlook Supports Breakeven or Better Operating Profitability in 2026

The JetBlue Way Forward | Our Strategic Evolution | Returning to Historical Earnings Power Appendix 15

Non-GAAP Financial Measures We report our financial results in accordance with GAAP; however, we present certain non-GAAP financial measures in this Presentation. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with GAAP. We present these non-GAAP financial measures because we believe they provide useful supplemental information that enables a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. This Presentation includes an explanation of each non-GAAP financial measure presented in this Presentation and a reconciliation of certain non-GAAP financial measures used in this Presentation to the most directly comparable GAAP financial measures. With respect to JetBlue’s CASM Ex-Fuel (1) and Adjusted Operating Margin (2) guidance, we are not able to provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measures cannot be calculated or predicted at this time without unreasonable efforts. In these cases, the reconciling information that is unavailable includes a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors beyond our control. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on our future GAAP financial results. (1) CASM Ex-Fuel is a non-GAAP measure that excludes fuel, other non-airline operating expenses, and special items. (2) Adjusted Operating Margin is a non-GAAP measure that excludes special items. Appendix A 16

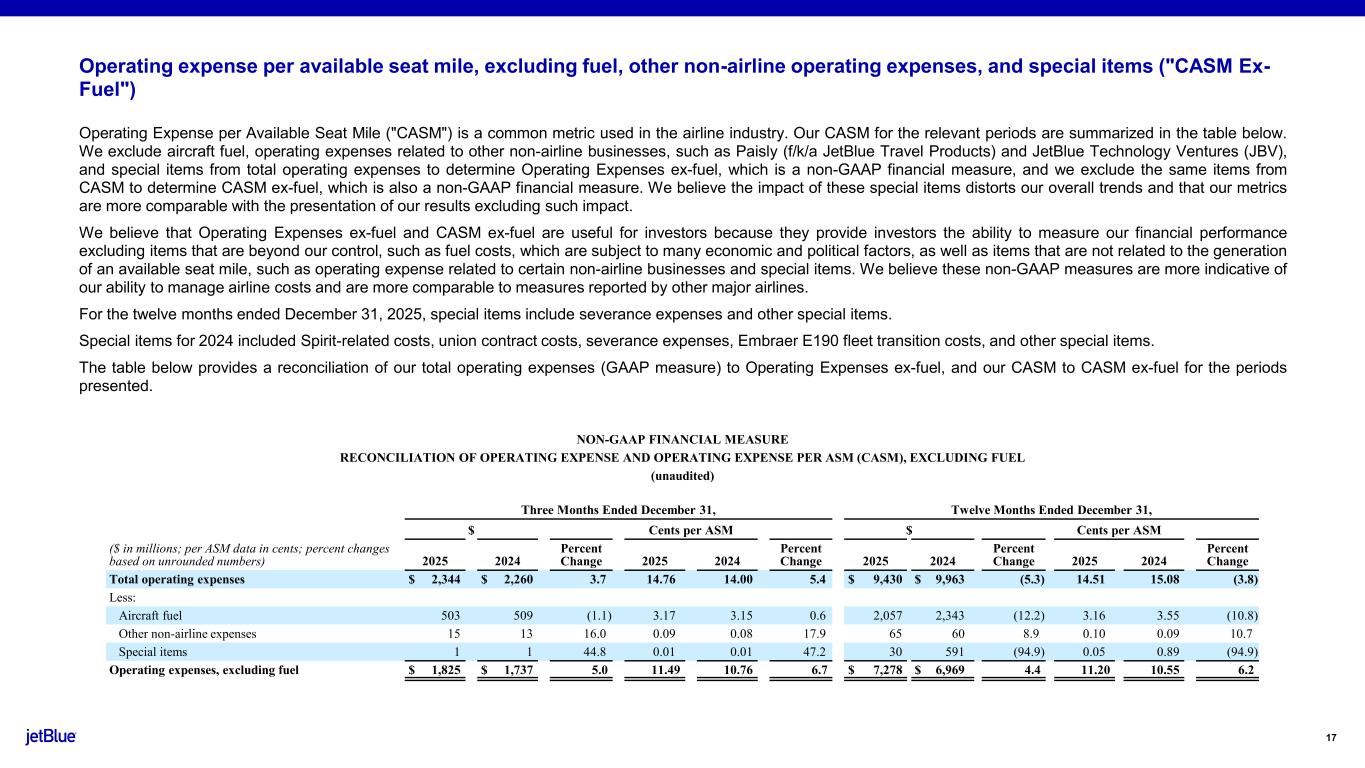

Operating expense per available seat mile, excluding fuel, other non-airline operating expenses, and special items ("CASM Ex- Fuel") Operating Expense per Available Seat Mile ("CASM") is a common metric used in the airline industry. Our CASM for the relevant periods are summarized in the table below. We exclude aircraft fuel, operating expenses related to other non-airline businesses, such as Paisly (f/k/a JetBlue Travel Products) and JetBlue Technology Ventures (JBV), and special items from total operating expenses to determine Operating Expenses ex-fuel, which is a non-GAAP financial measure, and we exclude the same items from CASM to determine CASM ex-fuel, which is also a non-GAAP financial measure. We believe the impact of these special items distorts our overall trends and that our metrics are more comparable with the presentation of our results excluding such impact. We believe that Operating Expenses ex-fuel and CASM ex-fuel are useful for investors because they provide investors the ability to measure our financial performance excluding items that are beyond our control, such as fuel costs, which are subject to many economic and political factors, as well as items that are not related to the generation of an available seat mile, such as operating expense related to certain non-airline businesses and special items. We believe these non-GAAP measures are more indicative of our ability to manage airline costs and are more comparable to measures reported by other major airlines. For the twelve months ended December 31, 2025, special items include severance expenses and other special items. Special items for 2024 included Spirit-related costs, union contract costs, severance expenses, Embraer E190 fleet transition costs, and other special items. The table below provides a reconciliation of our total operating expenses (GAAP measure) to Operating Expenses ex-fuel, and our CASM to CASM ex-fuel for the periods presented. NON-GAAP FINANCIAL MEASURE RECONCILIATION OF OPERATING EXPENSE AND OPERATING EXPENSE PER ASM (CASM), EXCLUDING FUEL (unaudited) Three Months Ended December 31, Twelve Months Ended December 31, $ Cents per ASM $ Cents per ASM ($ in millions; per ASM data in cents; percent changes based on unrounded numbers) 2025 2024 Percent Change 2025 2024 Percent Change 2025 2024 Percent Change 2025 2024 Percent Change Total operating expenses $ 2,344 $ 2,260 3.7 14.76 14.00 5.4 $ 9,430 $ 9,963 (5.3) 14.51 15.08 (3.8) Less: Aircraft fuel 503 509 (1.1) 3.17 3.15 0.6 2,057 2,343 (12.2) 3.16 3.55 (10.8) Other non-airline expenses 15 13 16.0 0.09 0.08 17.9 65 60 8.9 0.10 0.09 10.7 Special items 1 1 44.8 0.01 0.01 47.2 30 591 (94.9) 0.05 0.89 (94.9) Operating expenses, excluding fuel $ 1,825 $ 1,737 5.0 11.49 10.76 6.7 $ 7,278 $ 6,969 4.4 11.20 10.55 6.2 17

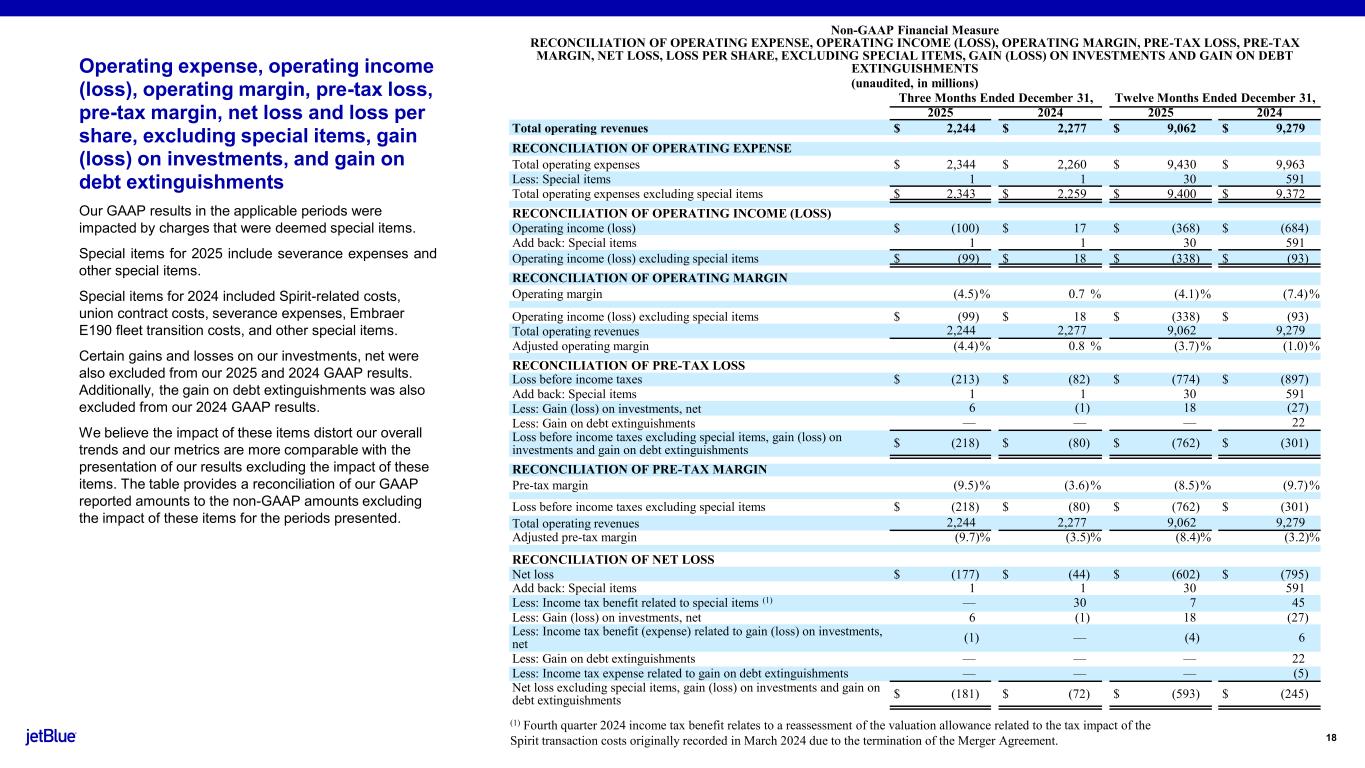

Operating expense, operating income (loss), operating margin, pre-tax loss, pre-tax margin, net loss and loss per share, excluding special items, gain (loss) on investments, and gain on debt extinguishments Our GAAP results in the applicable periods were impacted by charges that were deemed special items. Special items for 2025 include severance expenses and other special items. Special items for 2024 included Spirit-related costs, union contract costs, severance expenses, Embraer E190 fleet transition costs, and other special items. Certain gains and losses on our investments, net were also excluded from our 2025 and 2024 GAAP results. Additionally, the gain on debt extinguishments was also excluded from our 2024 GAAP results. We believe the impact of these items distort our overall trends and our metrics are more comparable with the presentation of our results excluding the impact of these items. The table provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impact of these items for the periods presented. Non-GAAP Financial Measure RECONCILIATION OF OPERATING EXPENSE, OPERATING INCOME (LOSS), OPERATING MARGIN, PRE-TAX LOSS, PRE-TAX MARGIN, NET LOSS, LOSS PER SHARE, EXCLUDING SPECIAL ITEMS, GAIN (LOSS) ON INVESTMENTS AND GAIN ON DEBT EXTINGUISHMENTS (unaudited, in millions) Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 Total operating revenues $ 2,244 $ 2,277 $ 9,062 $ 9,279 RECONCILIATION OF OPERATING EXPENSE Total operating expenses $ 2,344 $ 2,260 $ 9,430 $ 9,963 Less: Special items 1 1 30 591 Total operating expenses excluding special items $ 2,343 $ 2,259 $ 9,400 $ 9,372 RECONCILIATION OF OPERATING INCOME (LOSS) Operating income (loss) $ (100) $ 17 $ (368) $ (684) Add back: Special items 1 1 30 591 Operating income (loss) excluding special items $ (99) $ 18 $ (338) $ (93) RECONCILIATION OF OPERATING MARGIN Operating margin (4.5)% 0.7 % (4.1)% (7.4)% Operating income (loss) excluding special items $ (99) $ 18 $ (338) $ (93) Total operating revenues 2,244 2,277 9,062 9,279 Adjusted operating margin (4.4)% 0.8 % (3.7)% (1.0)% RECONCILIATION OF PRE-TAX LOSS Loss before income taxes $ (213) $ (82) $ (774) $ (897) Add back: Special items 1 1 30 591 Less: Gain (loss) on investments, net 6 (1) 18 (27) Less: Gain on debt extinguishments — — — 22 Loss before income taxes excluding special items, gain (loss) on investments and gain on debt extinguishments $ (218) $ (80) $ (762) $ (301) RECONCILIATION OF PRE-TAX MARGIN Pre-tax margin (9.5)% (3.6)% (8.5)% (9.7)% Loss before income taxes excluding special items $ (218) $ (80) $ (762) $ (301) Total operating revenues 2,244 2,277 9,062 9,279 Adjusted pre-tax margin (9.7)% (3.5)% (8.4)% (3.2)% RECONCILIATION OF NET LOSS Net loss $ (177) $ (44) $ (602) $ (795) Add back: Special items 1 1 30 591 Less: Income tax benefit related to special items (1) — 30 7 45 Less: Gain (loss) on investments, net 6 (1) 18 (27) Less: Income tax benefit (expense) related to gain (loss) on investments, net (1) — (4) 6 Less: Gain on debt extinguishments — — — 22 Less: Income tax expense related to gain on debt extinguishments — — — (5) Net loss excluding special items, gain (loss) on investments and gain on debt extinguishments $ (181) $ (72) $ (593) $ (245) 18 (1) Fourth quarter 2024 income tax benefit relates to a reassessment of the valuation allowance related to the tax impact of the Spirit transaction costs originally recorded in March 2024 due to the termination of the Merger Agreement.

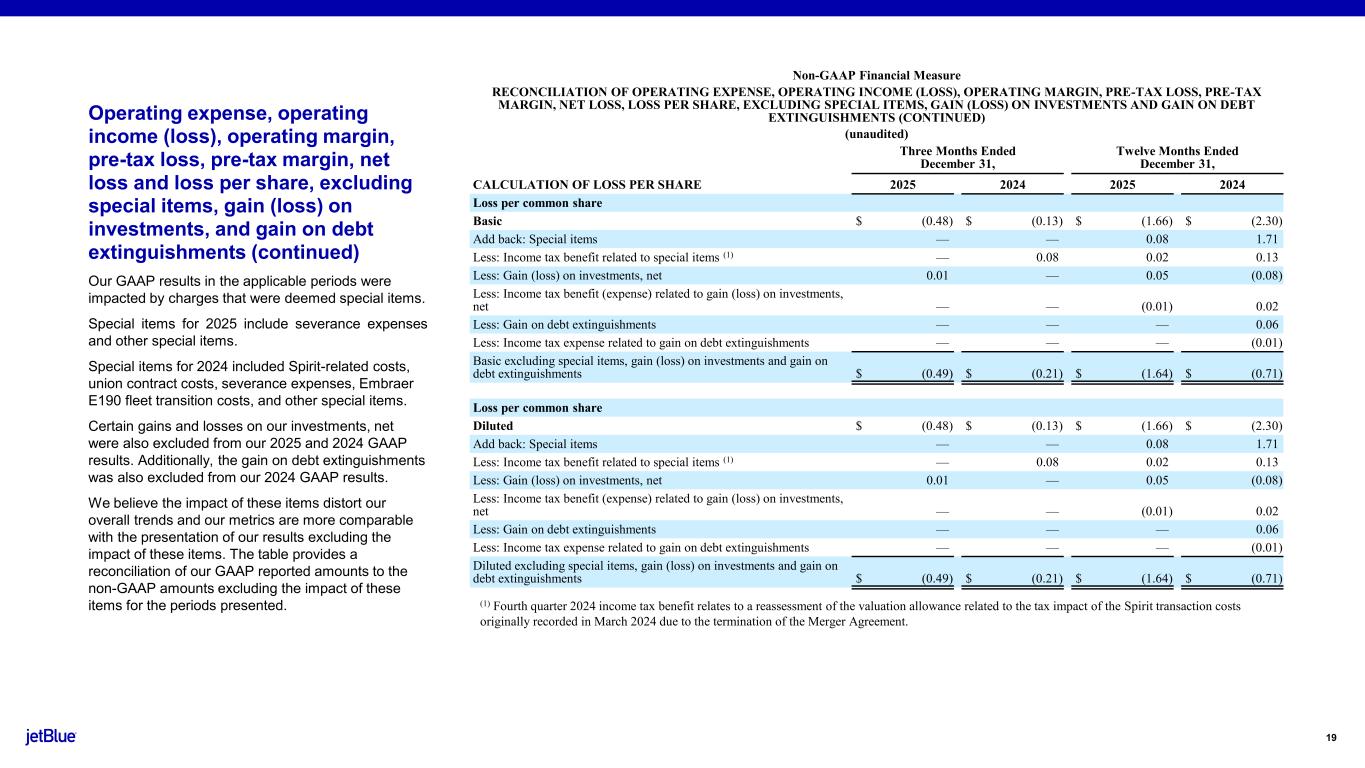

Operating expense, operating income (loss), operating margin, pre-tax loss, pre-tax margin, net loss and loss per share, excluding special items, gain (loss) on investments, and gain on debt extinguishments (continued) Our GAAP results in the applicable periods were impacted by charges that were deemed special items. Special items for 2025 include severance expenses and other special items. Special items for 2024 included Spirit-related costs, union contract costs, severance expenses, Embraer E190 fleet transition costs, and other special items. Certain gains and losses on our investments, net were also excluded from our 2025 and 2024 GAAP results. Additionally, the gain on debt extinguishments was also excluded from our 2024 GAAP results. We believe the impact of these items distort our overall trends and our metrics are more comparable with the presentation of our results excluding the impact of these items. The table provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impact of these items for the periods presented. Non-GAAP Financial Measure RECONCILIATION OF OPERATING EXPENSE, OPERATING INCOME (LOSS), OPERATING MARGIN, PRE-TAX LOSS, PRE-TAX MARGIN, NET LOSS, LOSS PER SHARE, EXCLUDING SPECIAL ITEMS, GAIN (LOSS) ON INVESTMENTS AND GAIN ON DEBT EXTINGUISHMENTS (CONTINUED) (unaudited) Three Months Ended December 31, Twelve Months Ended December 31, CALCULATION OF LOSS PER SHARE 2025 2024 2025 2024 Loss per common share Basic $ (0.48) $ (0.13) $ (1.66) $ (2.30) Add back: Special items — — 0.08 1.71 Less: Income tax benefit related to special items (1) — 0.08 0.02 0.13 Less: Gain (loss) on investments, net 0.01 — 0.05 (0.08) Less: Income tax benefit (expense) related to gain (loss) on investments, net — — (0.01) 0.02 Less: Gain on debt extinguishments — — — 0.06 Less: Income tax expense related to gain on debt extinguishments — — — (0.01) Basic excluding special items, gain (loss) on investments and gain on debt extinguishments $ (0.49) $ (0.21) $ (1.64) $ (0.71) Loss per common share Diluted $ (0.48) $ (0.13) $ (1.66) $ (2.30) Add back: Special items — — 0.08 1.71 Less: Income tax benefit related to special items (1) — 0.08 0.02 0.13 Less: Gain (loss) on investments, net 0.01 — 0.05 (0.08) Less: Income tax benefit (expense) related to gain (loss) on investments, net — — (0.01) 0.02 Less: Gain on debt extinguishments — — — 0.06 Less: Income tax expense related to gain on debt extinguishments — — — (0.01) Diluted excluding special items, gain (loss) on investments and gain on debt extinguishments $ (0.49) $ (0.21) $ (1.64) $ (0.71) (1) Fourth quarter 2024 income tax benefit relates to a reassessment of the valuation allowance related to the tax impact of the Spirit transaction costs originally recorded in March 2024 due to the termination of the Merger Agreement. 19

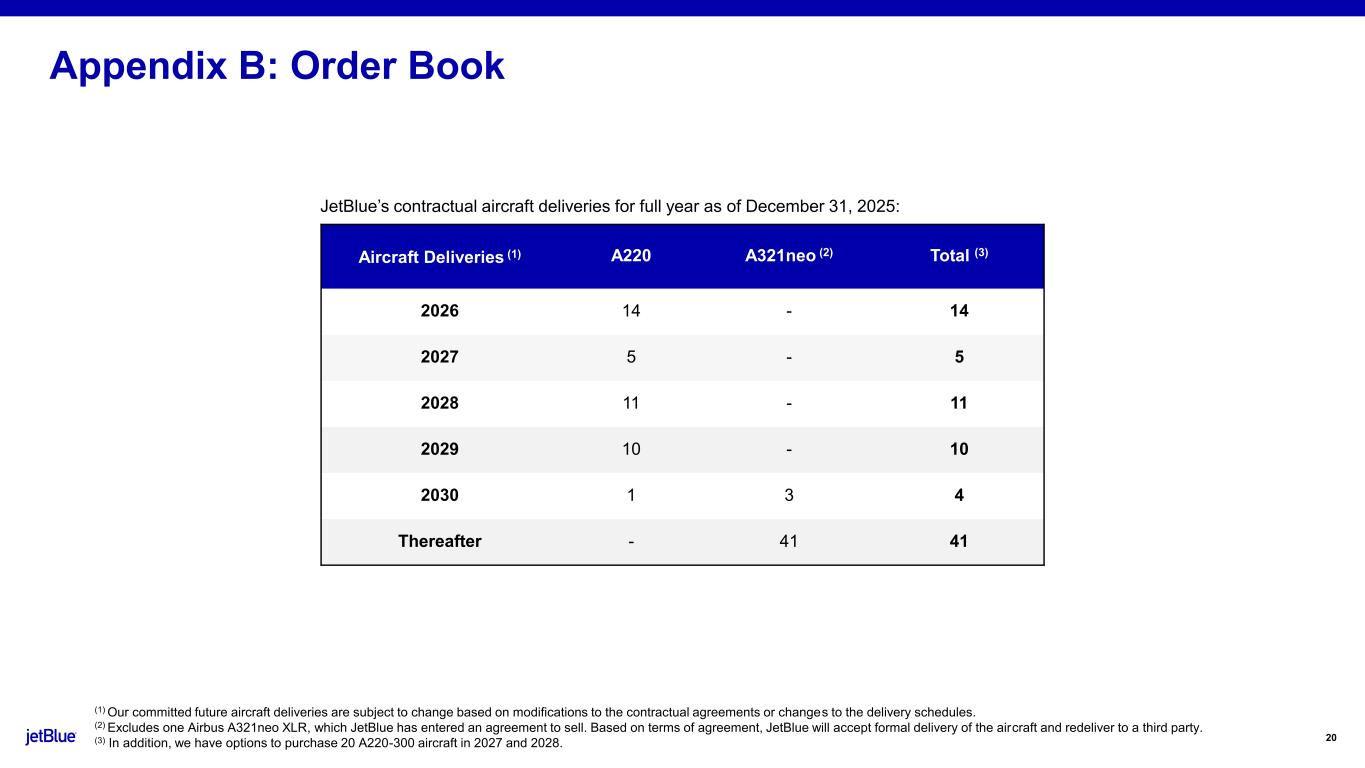

20 Aircraft Deliveries (1) A220 A321neo (2) Total (3) 2026 14 - 14 2027 5 - 5 2028 11 - 11 2029 10 - 10 2030 1 3 4 Thereafter - 41 41 (1) Our committed future aircraft deliveries are subject to change based on modifications to the contractual agreements or changes to the delivery schedules. (2) Excludes one Airbus A321neo XLR, which JetBlue has entered an agreement to sell. Based on terms of agreement, JetBlue will accept formal delivery of the aircraft and redeliver to a third party. (3) In addition, we have options to purchase 20 A220-300 aircraft in 2027 and 2028. JetBlue’s contractual aircraft deliveries for full year as of December 31, 2025: Appendix B: Order Book

The JetBlue Way Forward | Our Strategic Evolution | Returning to Historical Earnings Power 21