Corporate Overview October 2025 © Savara Inc. All Rights Reserved. .2

Safe Harbor Statement © Savara Inc. All Rights Reserved. Savara Inc. (“Savara” or the “Company”) cautions you that statements in this presentation that are not a description of historical fact are forward-looking statements which may be identified by the use of words such as “expect,” “intend,” “plan,” “anticipate,” “believe,” and “will,” among others. Such statements include, but are not limited to, statements regarding the planned use of proceeds from the proposed equity financing; statements related to the planned royalty financing; the potential health benefits and risks and projected development timeline of MOLBREEVI; the timing of regulatory submissions; the potential for and impact of regulatory approval; the potential addressable patient population, market size, commercial opportunity, and competitive landscape for MOLBREEVI; Savara’s commercial launch planning activities and the potential impact of those activities; GM-CSF autoantibody testing and its potential impact; and the sufficiency of our resources to fund the advancement of our development program and potential sources of additional capital. Savara may not actually achieve any of its plans or product development goals in a timely manner, if at all, or otherwise carry out its current intentions or meet the expectations or projections disclosed in its forward-looking statements, and you should not place undue reliance on these forward-looking statements. These forward-looking statements are based upon Savara's current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, the risks associated with our ability to successfully develop, obtain regulatory approval for and commercialize MOLBREEVI for autoimmune PAP; risks and uncertainties associated with the ability to project future cash utilization and reserves needed for contingent future liabilities and business operations; the ability to successfully conduct clinical trials for our product candidate; the availability of sufficient resources and the timing and ability of Savara to raise additional capital as needed to fund continued operations. The risks and uncertainties facing Savara are described more fully in Savara's filings with the Securities and Exchange Commission, including our filings on Form 8-K, our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2025. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date on which they were made. Savara undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law. Third-party information included herein has been obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed by, and should not be construed as a representation by, the Company. Additionally, this presentation includes internal research and estimates performed by the Company, which have not been independently verified. MOLBREEVI (molgramostim inhalation solution) is an investigational product that has not been approved for sale or determined to be safe or effective by the U.S. Food & Drug Administration or any regulatory authority. MOLBREEVI and aPAP ClearPath are trademarks of Savara. All other trademarks included herein are the property of the owners thereof and are used for reference purposes only.

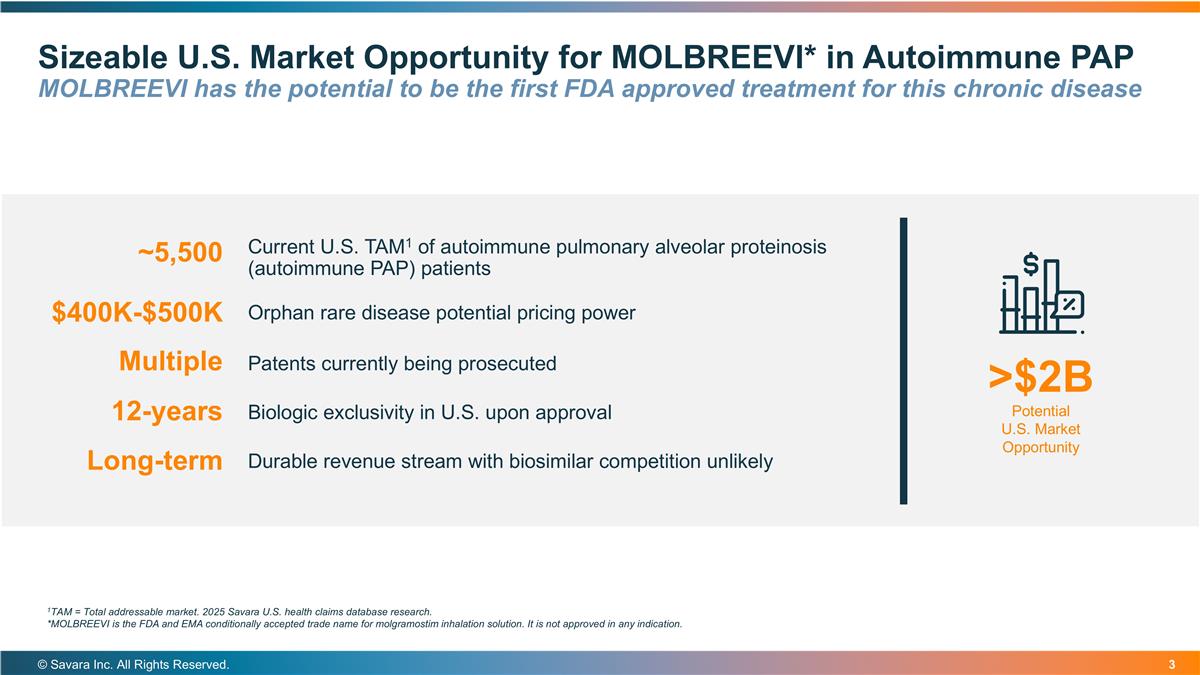

Sizeable U.S. Market Opportunity for MOLBREEVI* in Autoimmune PAP MOLBREEVI has the potential to be the first FDA approved treatment for this chronic disease © Savara Inc. All Rights Reserved. Current U.S. TAM1 of autoimmune pulmonary alveolar proteinosis (autoimmune PAP) patients >$2B Potential U.S. Market Opportunity $400K-$500K ~5,500 Orphan rare disease potential pricing power Patents currently being prosecuted Multiple Biologic exclusivity in U.S. upon approval Durable revenue stream with biosimilar competition unlikely 12-years Long-term 1TAM = Total addressable market. 2025 Savara U.S. health claims database research. *MOLBREEVI is the FDA and EMA conditionally accepted trade name for molgramostim inhalation solution. It is not approved in any indication.

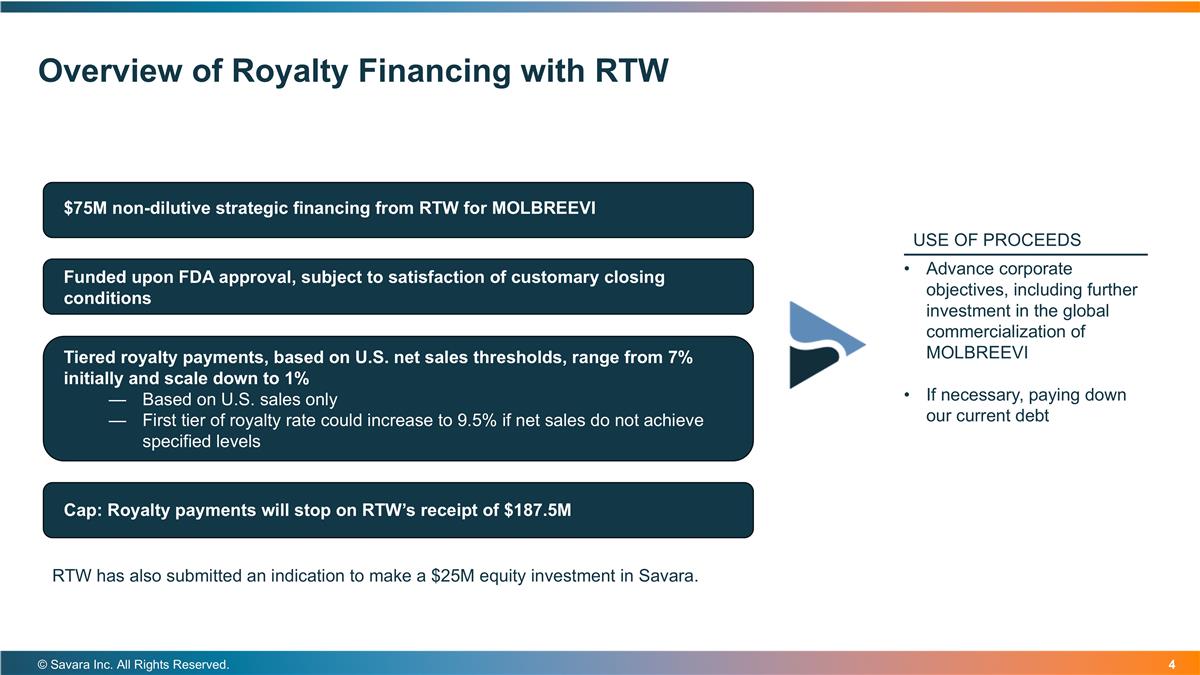

Overview of Royalty Financing with RTW © Savara Inc. All Rights Reserved. $75M non-dilutive strategic financing from RTW for MOLBREEVI Funded upon FDA approval, subject to satisfaction of customary closing conditions Tiered royalty payments, based on U.S. net sales thresholds, range from 7% initially and scale down to 1% Based on U.S. sales only First tier of royalty rate could increase to 9.5% if net sales do not achieve specified levels DEBT Cap: Royalty payments will stop on RTW’s receipt of $187.5M Advance corporate objectives, including further investment in the global commercialization of MOLBREEVI If necessary, paying down our current debt USE OF PROCEEDS RTW has also submitted an indication to make a $25M equity investment in Savara.

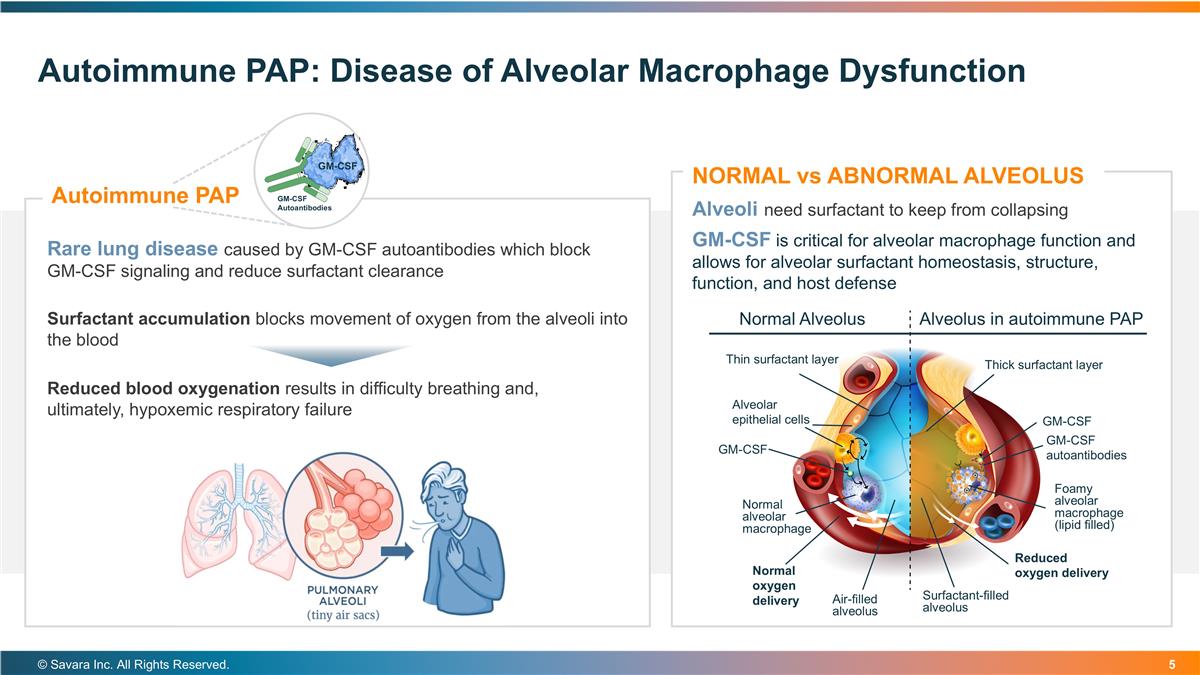

Autoimmune PAP: Disease of Alveolar Macrophage Dysfunction © Savara Inc. All Rights Reserved. Alveoli need surfactant to keep from collapsing GM-CSF is critical for alveolar macrophage function and allows for alveolar surfactant homeostasis, structure, function, and host defense NORMAL vs ABNORMAL ALVEOLUS Surfactant accumulation blocks movement of oxygen from the alveoli into the blood Reduced blood oxygenation results in difficulty breathing and, ultimately, hypoxemic respiratory failure Rare lung disease caused by GM-CSF autoantibodies which block GM-CSF signaling and reduce surfactant clearance Autoimmune PAP GM-CSF Autoantibodies GM-CSF GM-CSF autoantibodies Alveolus in autoimmune PAP Normal Alveolus Thin surfactant layer Thick surfactant layer Alveolar epithelial cells GM-CSF GM-CSF Normal oxygen delivery Reduced oxygen delivery Foamy alveolar macrophage (lipid filled) Normal alveolar macrophage Air-filled alveolus Surfactant-filled alveolus

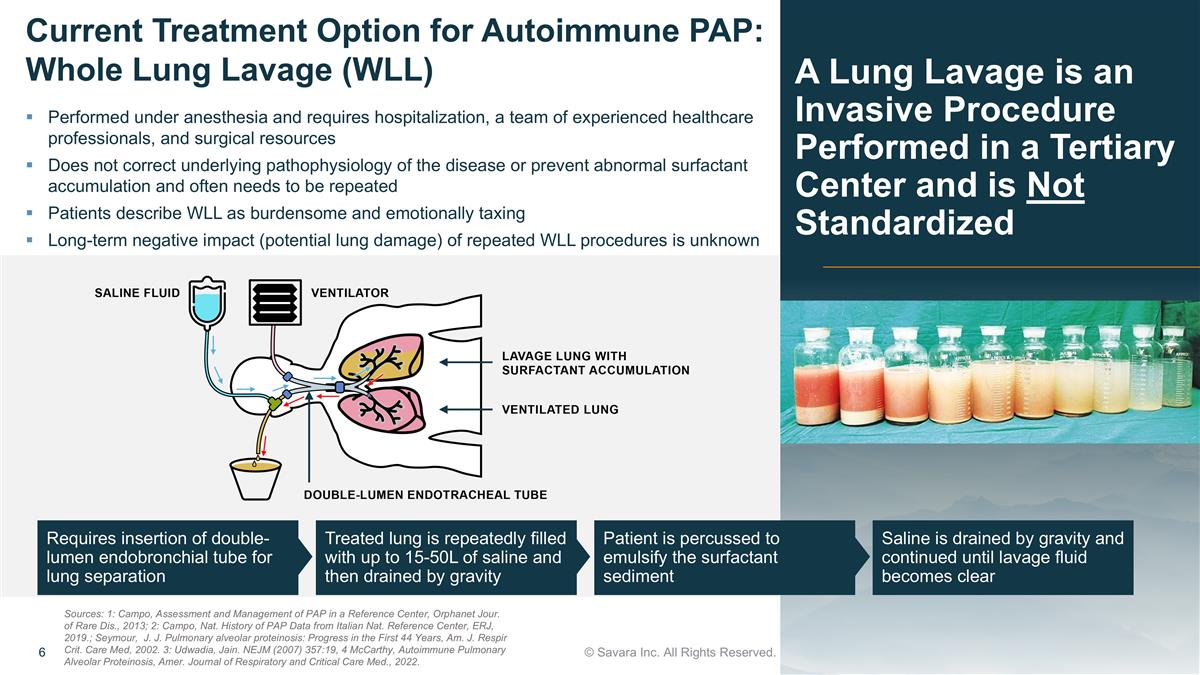

Requires insertion of double-lumen endobronchial tube for lung separation Treated lung is repeatedly filled with up to 15-50L of saline and then drained by gravity Patient is percussed to emulsify the surfactant sediment Saline is drained by gravity and continued until lavage fluid becomes clear A Lung Lavage is an Invasive Procedure Performed in a Tertiary Center and is Not Standardized © Savara Inc. All Rights Reserved. Current Treatment Option for Autoimmune PAP: Whole Lung Lavage (WLL) Performed under anesthesia and requires hospitalization, a team of experienced healthcare professionals, and surgical resources Does not correct underlying pathophysiology of the disease or prevent abnormal surfactant accumulation and often needs to be repeated Patients describe WLL as burdensome and emotionally taxing Long-term negative impact (potential lung damage) of repeated WLL procedures is unknown Sources: 1: Campo, Assessment and Management of PAP in a Reference Center, Orphanet Jour. of Rare Dis., 2013; 2: Campo, Nat. History of PAP Data from Italian Nat. Reference Center, ERJ, 2019.; Seymour, J. J. Pulmonary alveolar proteinosis: Progress in the First 44 Years, Am. J. Respir Crit. Care Med, 2002. 3: Udwadia, Jain. NEJM (2007) 357:19, 4 McCarthy, Autoimmune Pulmonary Alveolar Proteinosis, Amer. Journal of Respiratory and Critical Care Med., 2022.

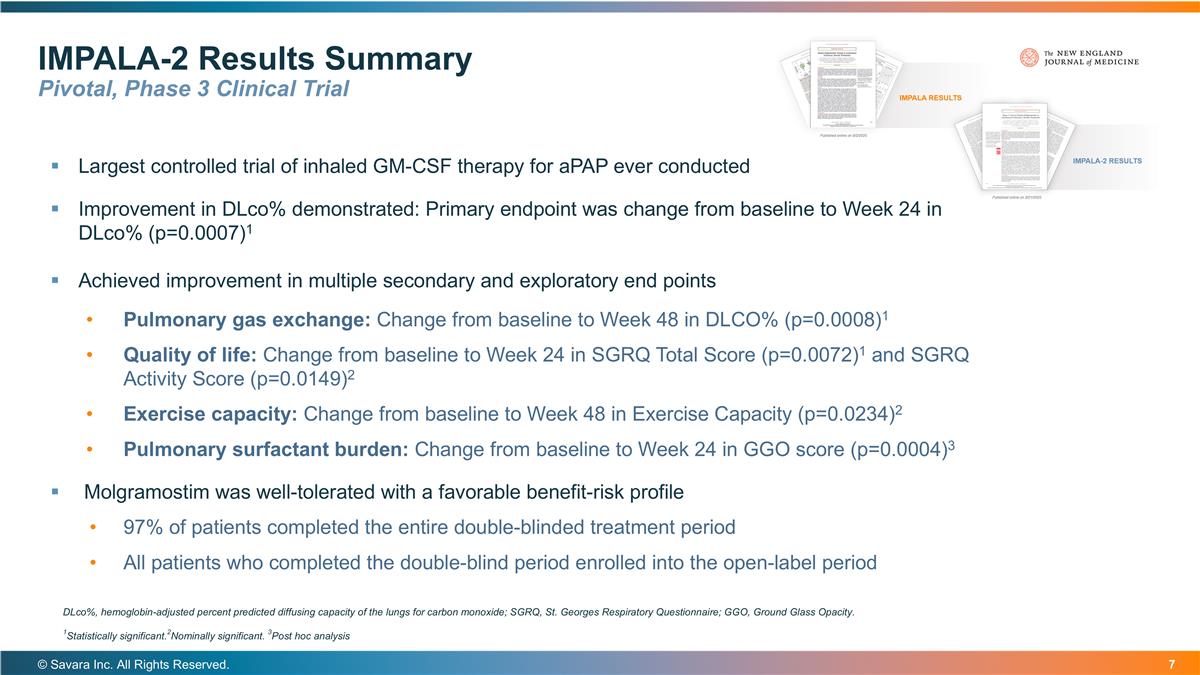

Largest controlled trial of inhaled GM-CSF therapy for aPAP ever conducted Improvement in DLco% demonstrated: Primary endpoint was change from baseline to Week 24 in DLco% (p=0.0007)1 Achieved improvement in multiple secondary and exploratory end points Pulmonary gas exchange: Change from baseline to Week 48 in DLCO% (p=0.0008)1 Quality of life: Change from baseline to Week 24 in SGRQ Total Score (p=0.0072)1 and SGRQ Activity Score (p=0.0149)2 Exercise capacity: Change from baseline to Week 48 in Exercise Capacity (p=0.0234)2 Pulmonary surfactant burden: Change from baseline to Week 24 in GGO score (p=0.0004)3 Molgramostim was well-tolerated with a favorable benefit-risk profile 97% of patients completed the entire double-blinded treatment period All patients who completed the double-blind period enrolled into the open-label period IMPALA-2 Results Summary Pivotal, Phase 3 Clinical Trial © Savara Inc. All Rights Reserved. DLco%, hemoglobin-adjusted percent predicted diffusing capacity of the lungs for carbon monoxide; SGRQ, St. Georges Respiratory Questionnaire; GGO, Ground Glass Opacity. 1Statistically significant.2Nominally significant. 3Post hoc analysis

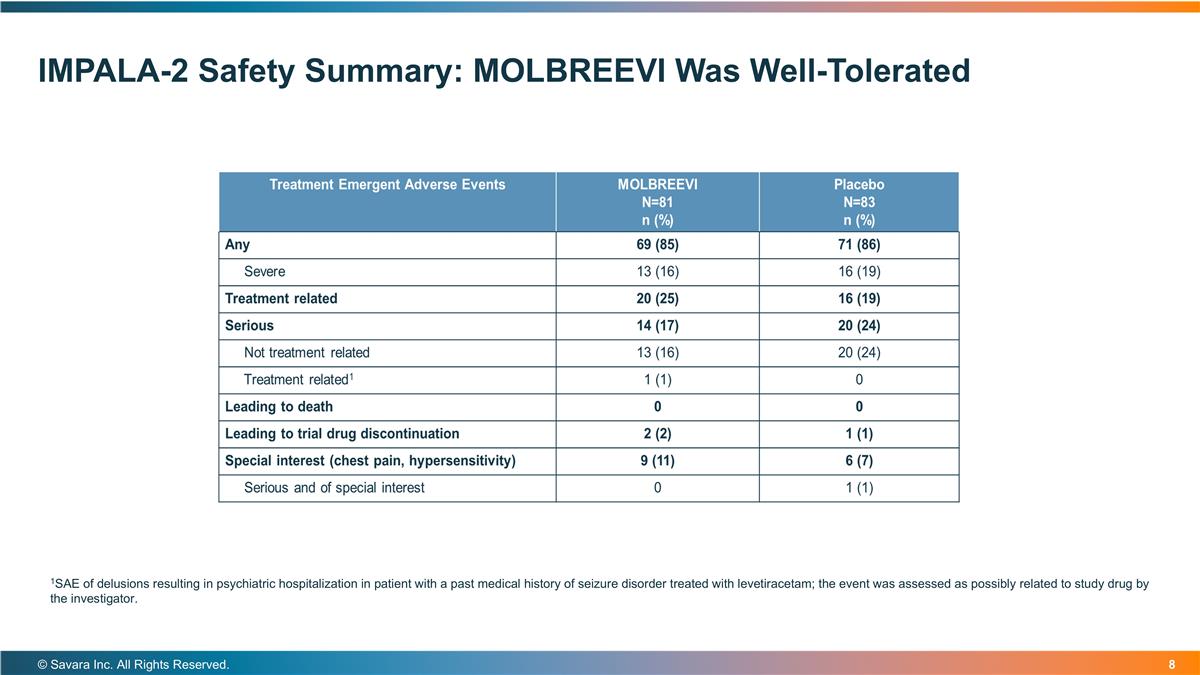

IMPALA-2 Safety Summary: MOLBREEVI Was Well-Tolerated © Savara Inc. All Rights Reserved. 1SAE of delusions resulting in psychiatric hospitalization in patient with a past medical history of seizure disorder treated with levetiracetam; the event was assessed as possibly related to study drug by the investigator.

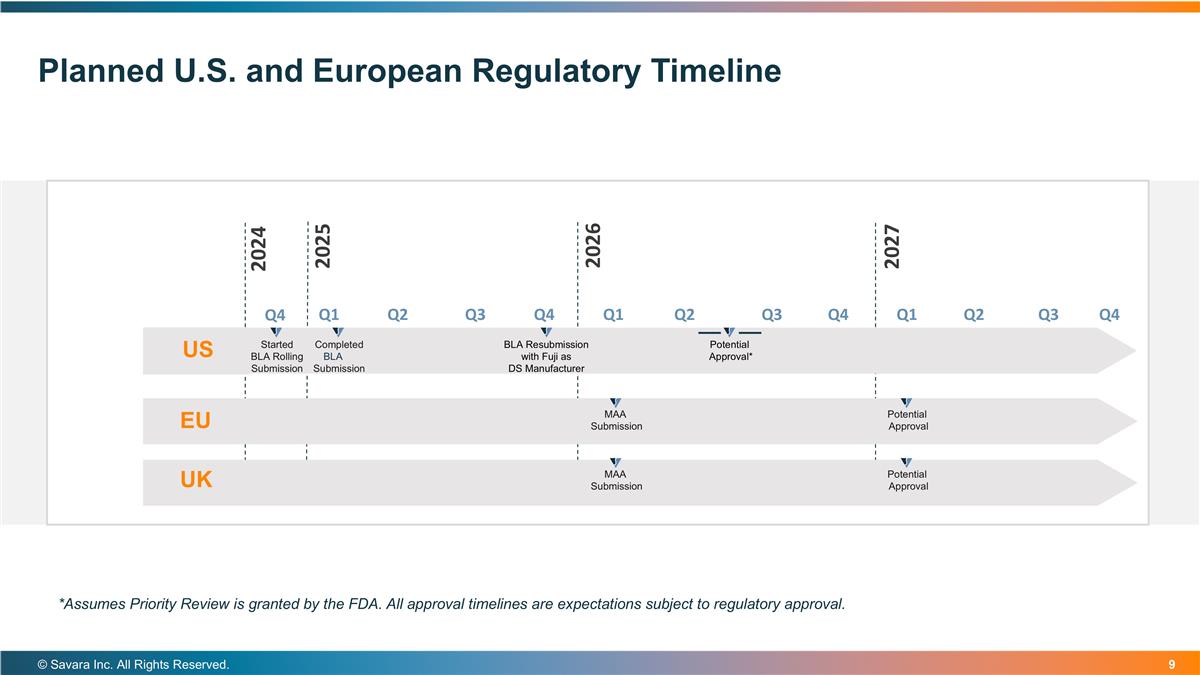

Planned U.S. and European Regulatory Timeline US Started BLA Rolling Submission EU Completed BLALA Submission BLA Resubmission with Fuji as DS Manufacturer Potential Approval* MAA Submission Potential Approval © Savara Inc. All Rights Reserved. *Assumes Priority Review is granted by the FDA. All approval timelines are expectations subject to regulatory approval. UK MAA Submission Potential Approval

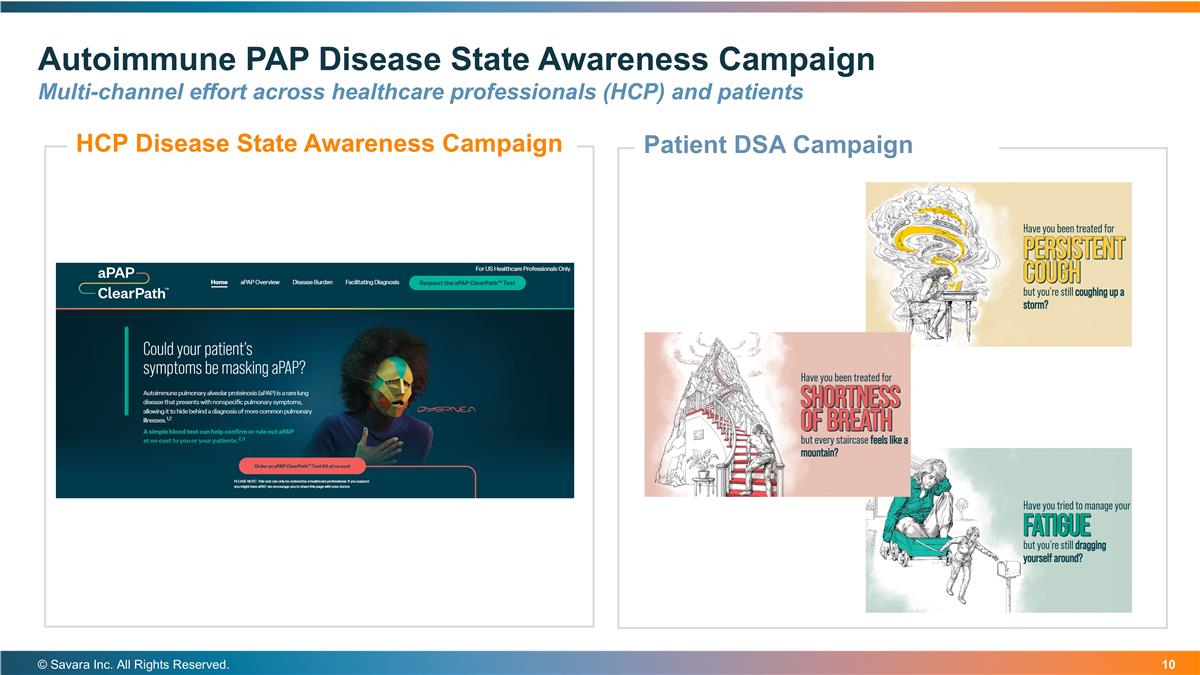

Autoimmune PAP Disease State Awareness Campaign Multi-channel effort across healthcare professionals (HCP) and patients © Savara Inc. All Rights Reserved. HCP Disease State Awareness Campaign Patient DSA Campaign

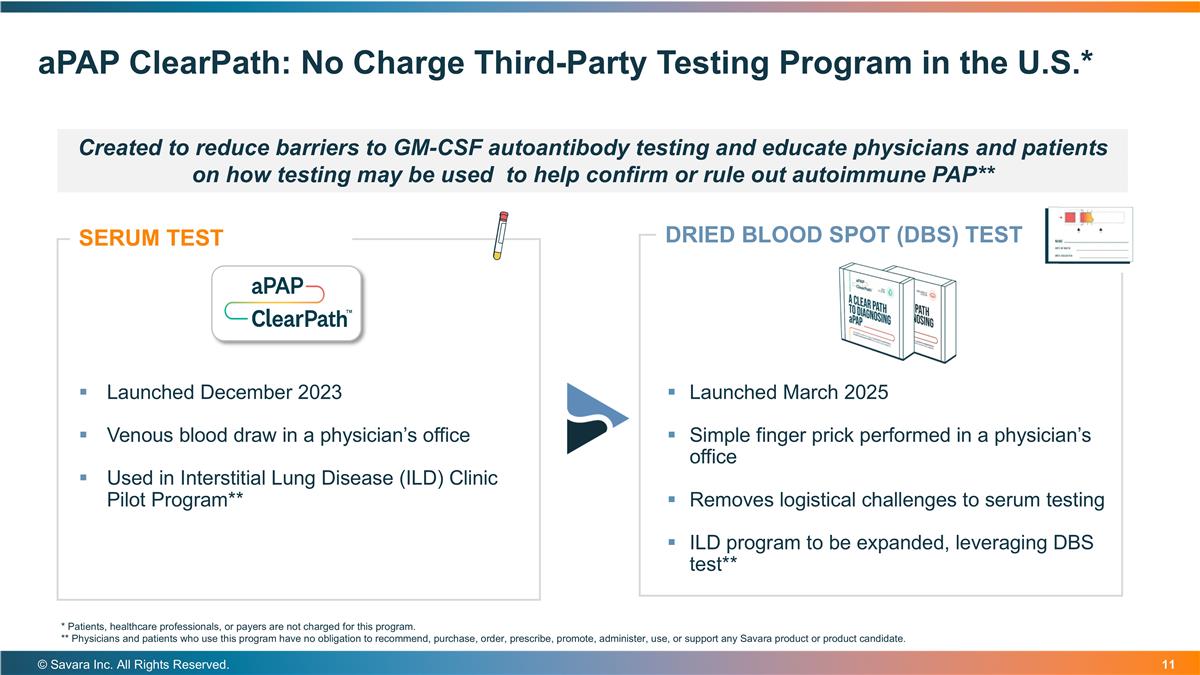

aPAP ClearPath: No Charge Third-Party Testing Program in the U.S.* © Savara Inc. All Rights Reserved. Launched March 2025 Simple finger prick performed in a physician’s office Removes logistical challenges to serum testing ILD program to be expanded, leveraging DBS test** SERUM TEST Launched December 2023 Venous blood draw in a physician’s office Used in Interstitial Lung Disease (ILD) Clinic Pilot Program** DRIED BLOOD SPOT (DBS) TEST * Patients, healthcare professionals, or payers are not charged for this program. ** Physicians and patients who use this program have no obligation to recommend, purchase, order, prescribe, promote, administer, use, or support any Savara product or product candidate. Created to reduce barriers to GM-CSF autoantibody testing and educate physicians and patients on how testing may be used to help confirm or rule out autoimmune PAP**

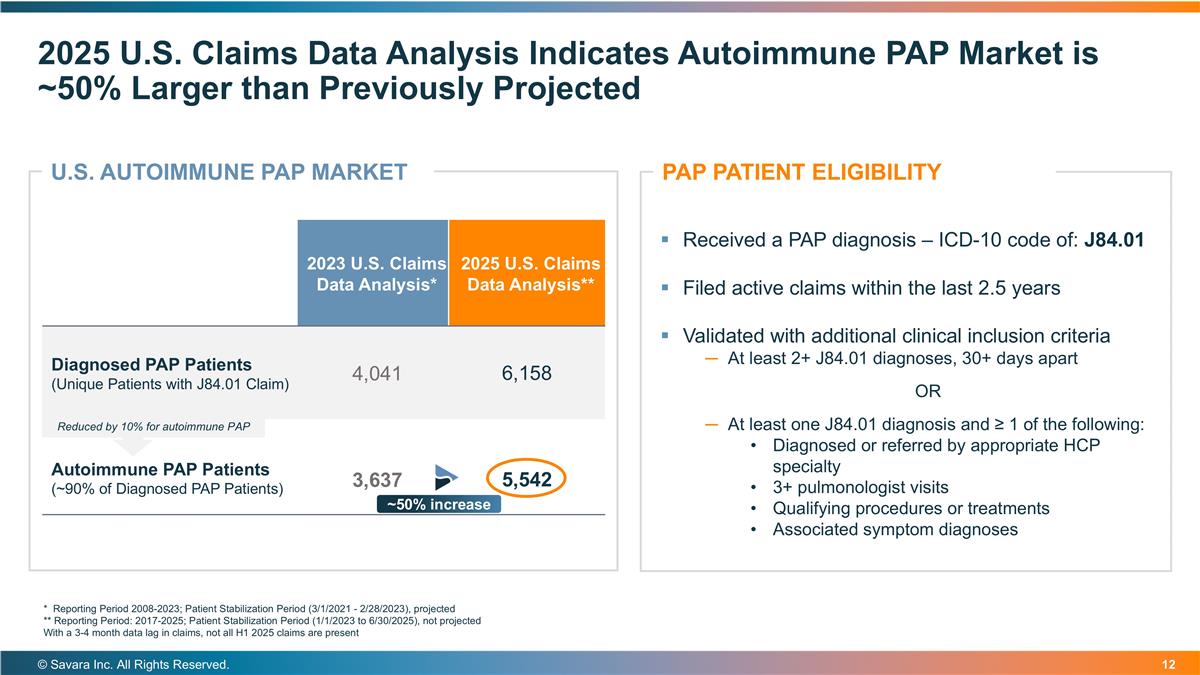

2025 U.S. Claims Data Analysis Indicates Autoimmune PAP Market is ~50% Larger than Previously Projected © Savara Inc. All Rights Reserved. * Reporting Period 2008-2023; Patient Stabilization Period (3/1/2021 - 2/28/2023), projected ** Reporting Period: 2017-2025; Patient Stabilization Period (1/1/2023 to 6/30/2025), not projected With a 3-4 month data lag in claims, not all H1 2025 claims are present Received a PAP diagnosis – ICD-10 code of: J84.01 Filed active claims within the last 2.5 years Validated with additional clinical inclusion criteria At least 2+ J84.01 diagnoses, 30+ days apart OR At least one J84.01 diagnosis and ≥ 1 of the following: Diagnosed or referred by appropriate HCP specialty 3+ pulmonologist visits Qualifying procedures or treatments Associated symptom diagnoses PAP PATIENT ELIGIBILITY 2023 U.S. Claims Data Analysis* 2025 U.S. Claims Data Analysis** Diagnosed PAP Patients (Unique Patients with J84.01 Claim) 4,041 6,158 Autoimmune PAP Patients (~90% of Diagnosed PAP Patients) 3,637 5,542 U.S. AUTOIMMUNE PAP MARKET ~50% increase Reduced by 10% for autoimmune PAP

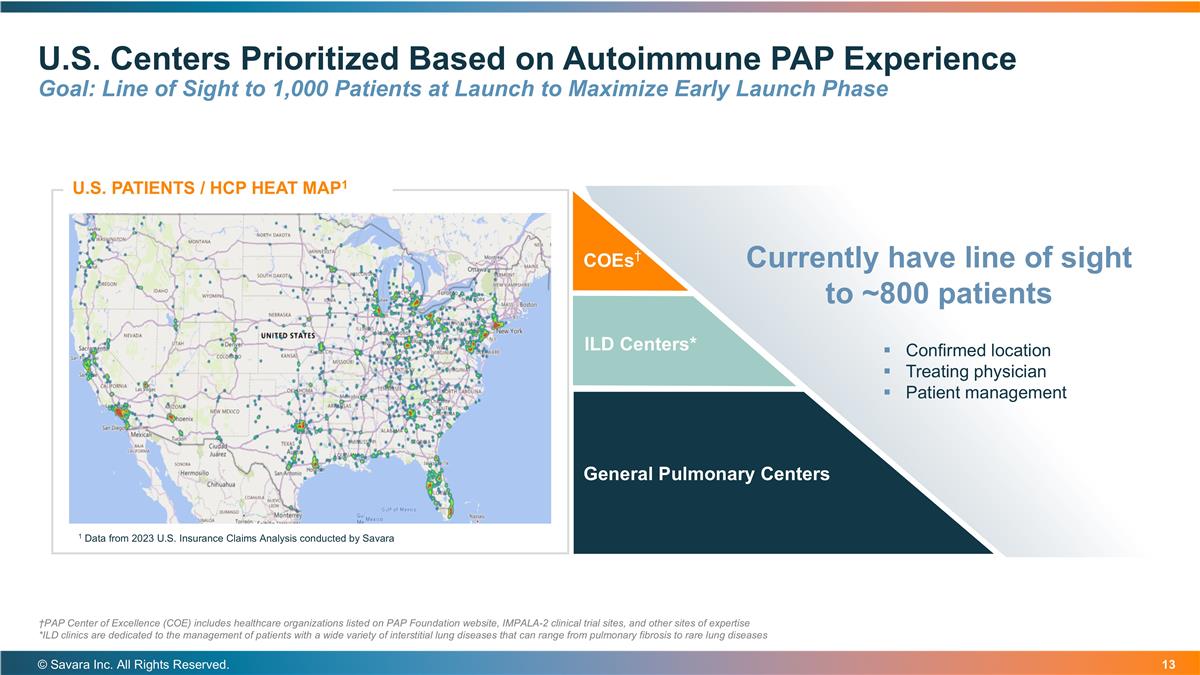

U.S. Centers Prioritized Based on Autoimmune PAP Experience Goal: Line of Sight to 1,000 Patients at Launch to Maximize Early Launch Phase © Savara Inc. All Rights Reserved. COEs† ILD Centers* General Pulmonary Centers U.S. PATIENTS / HCP HEAT MAP1 1 Data from 2023 U.S. Insurance Claims Analysis conducted by Savara Currently have line of sight to ~800 patients Confirmed location Treating physician Patient management †PAP Center of Excellence (COE) includes healthcare organizations listed on PAP Foundation website, IMPALA-2 clinical trial sites, and other sites of expertise *ILD clinics are dedicated to the management of patients with a wide variety of interstitial lung diseases that can range from pulmonary fibrosis to rare lung diseases

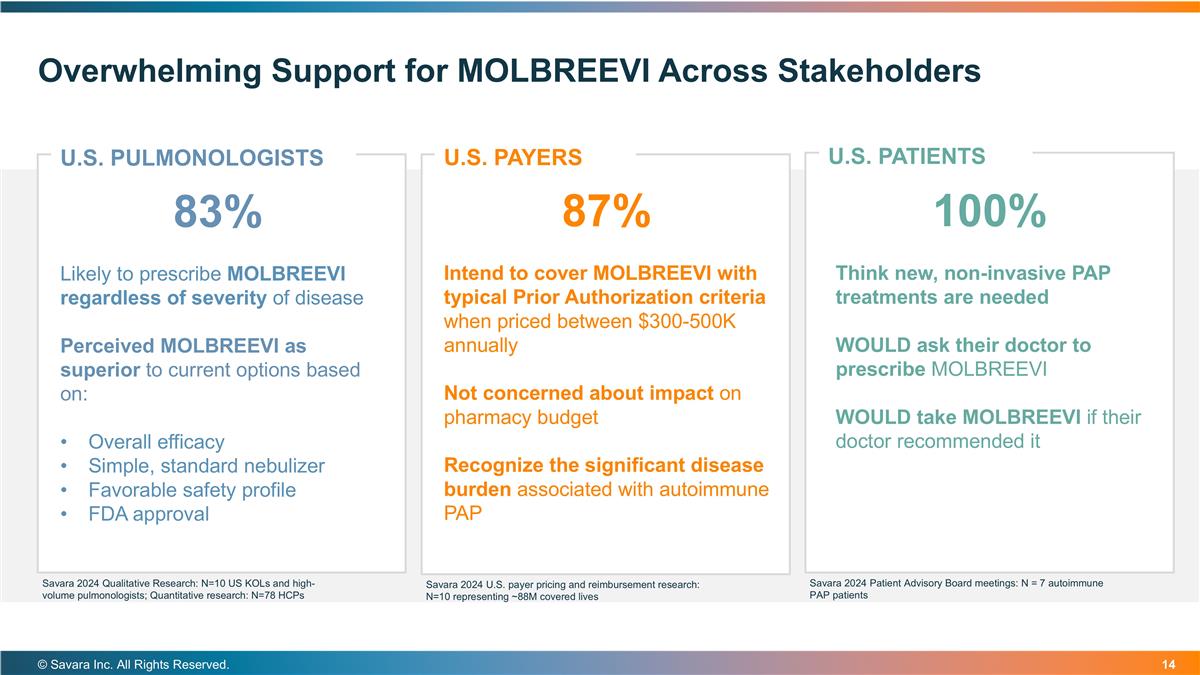

Overwhelming Support for MOLBREEVI Across Stakeholders © Savara Inc. All Rights Reserved. U.S. PATIENTS U.S. PULMONOLOGISTS 83% Likely to prescribe MOLBREEVI regardless of severity of disease Perceived MOLBREEVI as superior to current options based on: Overall efficacy Simple, standard nebulizer Favorable safety profile FDA approval U.S. PAYERS 87% Intend to cover MOLBREEVI with typical Prior Authorization criteria when priced between $300-500K annually Not concerned about impact on pharmacy budget Recognize the significant disease burden associated with autoimmune PAP 100% Think new, non-invasive PAP treatments are needed WOULD ask their doctor to prescribe MOLBREEVI WOULD take MOLBREEVI if their doctor recommended it Savara 2024 Qualitative Research: N=10 US KOLs and high-volume pulmonologists; Quantitative research: N=78 HCPs Savara 2024 U.S. payer pricing and reimbursement research: N=10 representing ~88M covered lives Savara 2024 Patient Advisory Board meetings: N = 7 autoimmune PAP patients

THANK YOU © Savara Inc. All Rights Reserved.