Fixed Income Investor Presentation November 2025 Nasdaq: NRIM 1

Safe Harbor Statement and Other Disclaimers Forward-Looking Statements This investor presentation (this “Presentation”) contains, and future oral and written statements of Northrim BanCorp, Inc. (the “Company” or “Northrim”) and its wholly owned banking subsidiary, Northrim Bank (the “Bank”), may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect Northrim’s current views with respect to future events and Northrim’s financial performance. Any statements about Northrim’s expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Forward-looking statements include, but are not limited to: (i) projections and estimates of revenues, expenses, income or loss, earnings or loss per share, and other financial items, (ii) statements of plans, objectives and expectations of Northrim or its management, (iii) statements of future economic performance, and (iv) statements of assumptions underlying such statements. Forward-looking statements should not be relied on because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of the Company and the Bank. These risks, uncertainties and other factors may cause the actual results, performance, and achievements of the Company and the Bank to be materially different from the anticipated future results, performance or achievements expressed in, or implied by, the forward-looking statements. Due to these and other possible uncertainties and risks, Northrim can give no assurance that the results contemplated in the forward-looking statements will be realized and readers are cautioned not to place undue reliance on the forward-looking statements contained in this Presentation. Additional information regarding these factors and uncertainties to which Northrim’s business and future financial performance are subject is contained in Northrim’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q on file with the U.S. Securities and Exchange Commission (the “SEC”), including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of such documents, and other documents Northrim files or furnishes with the SEC from time to time. Further, any forward-looking statement speaks only as of the date on which it is made and Northrim undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as required by applicable law. All forward-looking statements, express or implied, herein are qualified in their entirety by this cautionary statement. Use of Unaudited Pro Forma and Non-GAAP Financial Measures Annualized, pro forma, projected, and estimated financial information included in this Presentation are used for illustrative purposes only, are not forecasts and may not necessarily reflect actual financial results the Company may achieve. This Presentation includes certain non-GAAP measures, which provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. These non-GAAP measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related non-GAAP measures. Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this Presentation. Industry and Market Data This Presentation includes statistical and other industry and market data that we obtained from government reports and other third-party sources. Our internal data, estimates and forecasts are based on information obtained from government reports, trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that this information (including the industry publications and third-party research, surveys and studies) is accurate and reliable, we have not independently verified such information, and no representations or warranties are made by us of our affiliates as to the accuracy of any such statements or projections. In addition, estimates, forecasts, and assumptions are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this Presentation. These and other factors could cause our results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. 2

Safe Harbor Statement and Other Disclaimers (cont.) Trademarks and Trade Names The Company owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights to these trademarks, service marks and trade names under applicable law. Other service marks, trademarks and trade names referred to in this Presentation, if any, are the property of their respective owners. Offering Disclaimer The information contained in this Presentation is a summary and is not complete. It has been prepared for use only in connection with the proposed private placement (the “Offering”) of subordinated notes of the Company (the “Securities”). The offer and sale of the Securities have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and are being offered in a private placement exempt from registration under the Securities Act and other applicable securities laws and may not be re-offered or re-sold absent registration or an applicable exemption from the registration requirements. The Securities are being offered only to entities that qualify as institutional “accredited investors,” as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D promulgated by the SEC under the Securities Act, and “qualified institutional buyers” as defined in Rule 144A under the Securities Act. This Presentation does not constitute an offer to sell, or a solicitation of an offer to buy, any securities of the Company by any person in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation. Neither this Presentation nor any of the information contained herein may be reproduced or distributed, directly or indirectly, to any other person and is provided conditioned upon, and subject to, an agreement regarding confidentiality between the Company and the original recipient hereof. This Presentation is provided for informational purposes only and is being furnished on a confidential basis to a limited number of institutional accredited investors and qualified institutional buyers solely for the purposes of enabling them to determine whether they wish to proceed with further investigation of the Company and the Offering. As it is a summary, such information is not intended to and does not contain all the information that you will require to form the basis of any investment decision. The information contained in this Presentation speaks only as of the date hereof. Neither the delivery of this Presentation nor any eventual sale of the Securities shall, under any circumstances, imply that the information contained herein is correct as of any future date or that there has been no change in the Company’s business affairs described herein after the date hereof. Nothing contained herein is, or should be relied upon as, a promise or representation as to the future performance of the Company or any of its subsidiaries and affiliates. Neither the Company nor any of its subsidiaries and affiliates undertakes any obligation to update or revise this Presentation except to the extent required by applicable law. The Company anticipates providing you with the opportunity to ask questions, receive answers, obtain additional information, and complete your own due diligence review concerning the Company and the Offering prior to entering into any agreement to offer and sell the Securities to investors. By accepting delivery of the information contained herein, you agree to undertake and rely upon your own independent investigation and analysis and consult with your own attorneys, accountants, and other professional advisors regarding the Company and the merits and risks of an investment in the Securities, including all related legal, investment, tax and other matters. None of the Company, the Bank or any representative of the Company or the Bank, or any other person shall have any liability for any information included herein or otherwise made available in connection with the Offering, except for liabilities expressly assumed by the Company in the definitive purchase agreement and the related documentation for the offer and sale of the Securities to investors. Any such offer or sale may be made only by a definitive purchase agreement and the information contained herein will be superseded in its entirety by such definitive purchase agreement. Each investor must comply with all legal requirements in each jurisdiction in which it purchases, offers, or sells the Securities, and must obtain any consent, approval, or permission required by it in connection with the Securities or the Offering. The Company does not make any representation or warranty regarding, and has no responsibility for, the legality of an investment in the Securities under any investment, securities or similar laws or regulations. THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED, AND THE COMPLETENESS AND ACCURACY OF THE DISCLOSURES IN THIS PRESENTATION HAVE NOT BEEN PASSED UPON BY, THE SEC, ANY STATE SECURITIES COMMISSION, THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM, THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER REGULATORY BODY. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THE SECURITIES ARE NOT A DEPOSIT OR A BANK ACCOUNT AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY. 3

Management Introductions Joseph M. Schierhorn | Chairman • Joined Northrim Bank in 1990, promoted to Chairman in 2018 • Previously Chief Financial Officer, Chief Operating Officer, Chief Executive Officer and President • JD and Master of Management from Willamette University School of Law, Atkinson Graduate School of Management and Bachelor’s from Stanford University; graduate of Pacific Coast Banking School and CPA Mark Edwards | EVP, Chief Credit Officer & Bank Economist • Joined Northrim Bank in 2007, promoted to Chief Credit Officer and Bank Economist in 2019 • Previously served as a Commercial Loan Officer and Commercial Loan Unit Manager • B.A. in Economics from the University of Virginia, Master of International Management at the Thunderbird School of Global Management Michael Huston | President, CEO & COO * • Joined Northrim Bank in May 2017, promoted to President in 2022 and CEO in 2024 • Over 35 years of banking expertise, previously served as Chief Banking Officer at First Interstate Bank • B.S. in Finance from Arizona State University, Magna Cum Laude; graduate of Pacific Coast Banking School Jed W. Ballard | EVP, Chief Financial Officer * • Joined Northrim Bank in 2018 • Board member and Chair of the Audit & Finance Committee of the Alaska Native Heritage Center and Board member of Junior Achievement Alaska • Previously at KPMG for 16 years as a Senior Audit Manager • B.B.A. in Accounting from the University of Alaska Fairbanks; graduate of Pacific Coast Banking School and CPA Jason Criqui | EVP, Chief Banking Officer * • Joined Northrim Bank in 2014 • Previously Senior Vice President, Commercial Loan Manager and Commercial Lender • Graduated from Emporia State University and Pacific Coast Banking School Nathan Reed | EVP, Chief Information Officer • Joined Northrim Bank in 2024 • Prior banking expertise as a Senior Vice President, Chief Data Officer, most recently at Colombia/Umpqua • B.S. in Computer Science from National American University; graduate of Pacific Coast Banking School Amber R. Zins | EVP, Chief Operating Officer • Joined Northrim Bank in 2008, promoted to Chief Operating Officer in 2022 • Previously served as internal audit manager, Chief Administrative Officer and human resources director • B.B.A. in Accounting from the University of Alaska Fairbanks; graduate of Pacific Coast Banking School and CPA * Today’s Speakers 4 Source: Company documents.

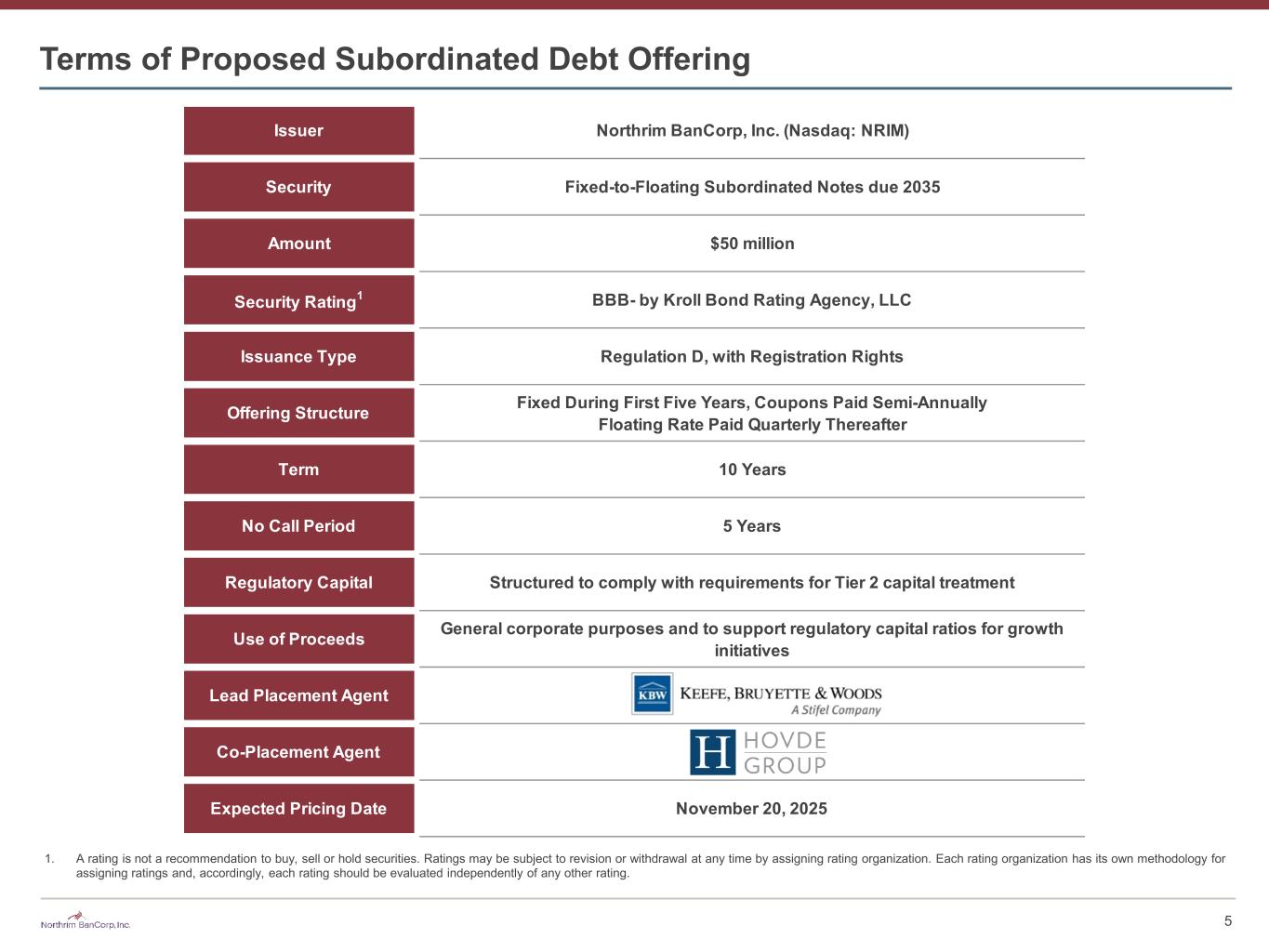

Terms of Proposed Subordinated Debt Offering 5 Issuer Northrim BanCorp, Inc. (Nasdaq: NRIM) Security Fixed-to-Floating Subordinated Notes due 2035 Amount $50 million Security Rating1 BBB- by Kroll Bond Rating Agency, LLC Issuance Type Regulation D, with Registration Rights Offering Structure Fixed During First Five Years, Coupons Paid Semi-Annually Floating Rate Paid Quarterly Thereafter Term 10 Years No Call Period 5 Years Regulatory Capital Structured to comply with requirements for Tier 2 capital treatment Use of Proceeds General corporate purposes and to support regulatory capital ratios for growth initiatives Lead Placement Agent Co-Placement Agent Expected Pricing Date November 20, 2025 1. A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any time by assigning rating organization. Each rating organization has its own methodology for assigning ratings and, accordingly, each rating should be evaluated independently of any other rating.

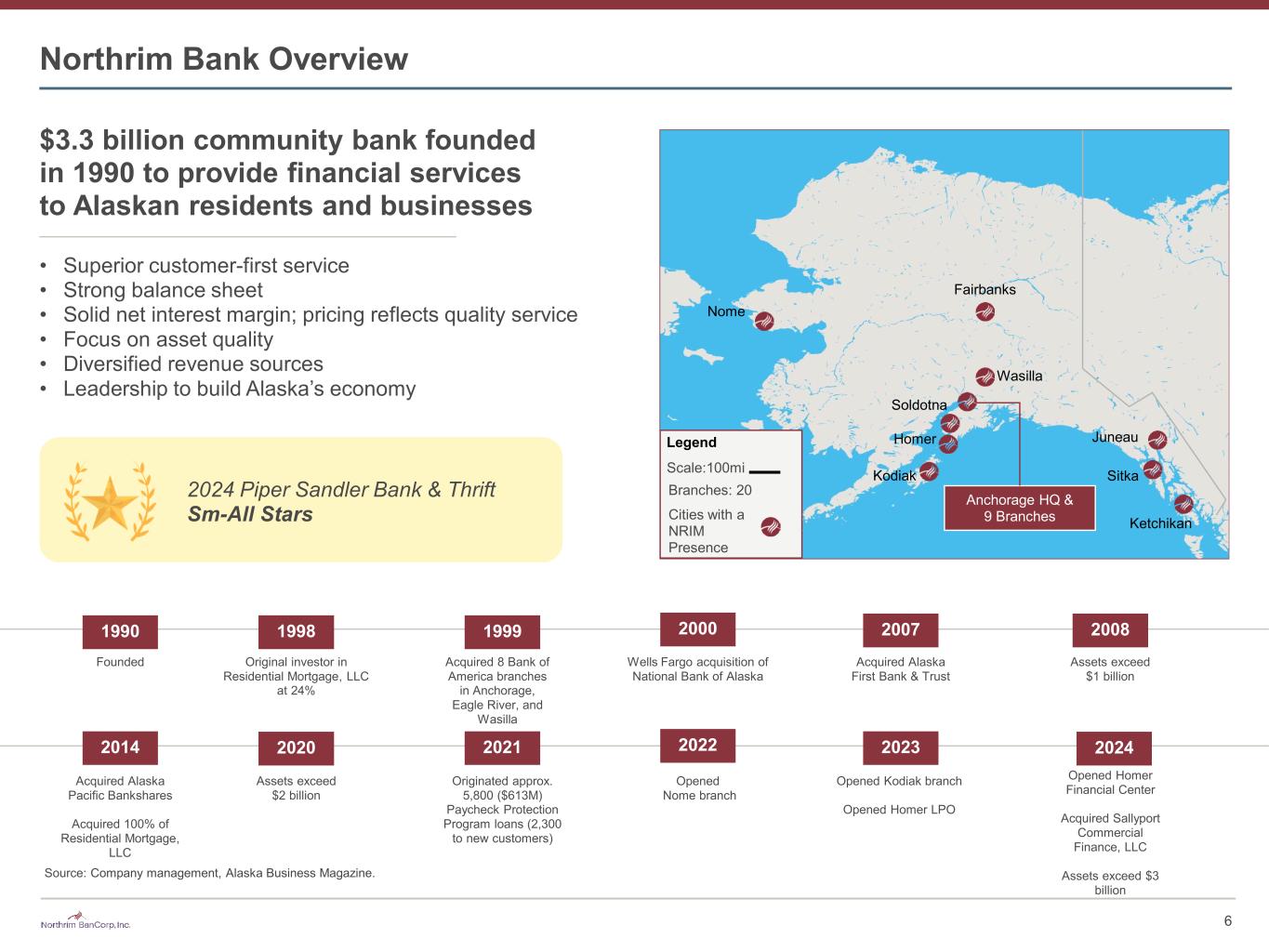

Northrim Bank Overview $3.3 billion community bank founded in 1990 to provide financial services to Alaskan residents and businesses • Superior customer-first service • Strong balance sheet • Solid net interest margin; pricing reflects quality service • Focus on asset quality • Diversified revenue sources • Leadership to build Alaska’s economy 1990 1999 2000 2007 2008 2014 2020 2021 Founded Acquired 8 Bank of America branches in Anchorage, Eagle River, and Wasilla Wells Fargo acquisition of National Bank of Alaska Assets exceed $1 billion Acquired Alaska First Bank & Trust Acquired Alaska Pacific Bankshares Acquired 100% of Residential Mortgage, LLC Assets exceed $2 billion Originated approx. 5,800 ($613M) Paycheck Protection Program loans (2,300 to new customers) 2022 Opened Nome branch 2023 Opened Kodiak branch Opened Homer LPO 2024 Opened Homer Financial Center Acquired Sallyport Commercial Finance, LLC Assets exceed $3 billion 1998 Original investor in Residential Mortgage, LLC at 24% Anchorage HQ & 9 Branches Nome Fairbanks Soldotna Kodiak Juneau Sitka Ketchikan Homer Wasilla 2024 Piper Sandler Bank & Thrift Sm-All Stars 6 Legend Scale:100mi Branches: 20 Cities with a NRIM Presence Source: Company management, Alaska Business Magazine.

Investment Highlights Unique Banking Environment Provides Opportunities to Gain Market Share • Northrim deposit market share in Alaska has increased by 727 bps since 2018 Alaska Banking Environment Drives Higher Yields on Loans and Lower Deposit Costs • Northrim loan yields averaged 5.82% over last 10 years vs 5.09% in the U.S. (as of 12/31/2024) • Northrim interest-bearing deposits costs averaged 63 bps over last 10 years vs 91 bps in the U.S. (as of 12/31/2024) • Increasingly diverse economy Experienced Management Team Delivering Asset and Profitability Growth • Branch expansion strategy benefiting from competitor pull back • Adding additional team members has enhanced loan and deposit originations New and Repricing Loans Will Drive Stable / Improving NIM • 30% of loans mature or reprice in the next three months, 14% of loans mature or reprice in three to twelve months, and 30% of loans mature or reprice in one to three years • 30% of deposits are non-interest bearing Capital Management • Contemplated subordinated debt raise will support long-term growth strategy • Credit culture and diversified revenue streams in mortgage and specialty finance have positioned the Bank well for potential economic downturn 7 Source: S&P Global and company management. Deposit market share data as of 6/30/2025.

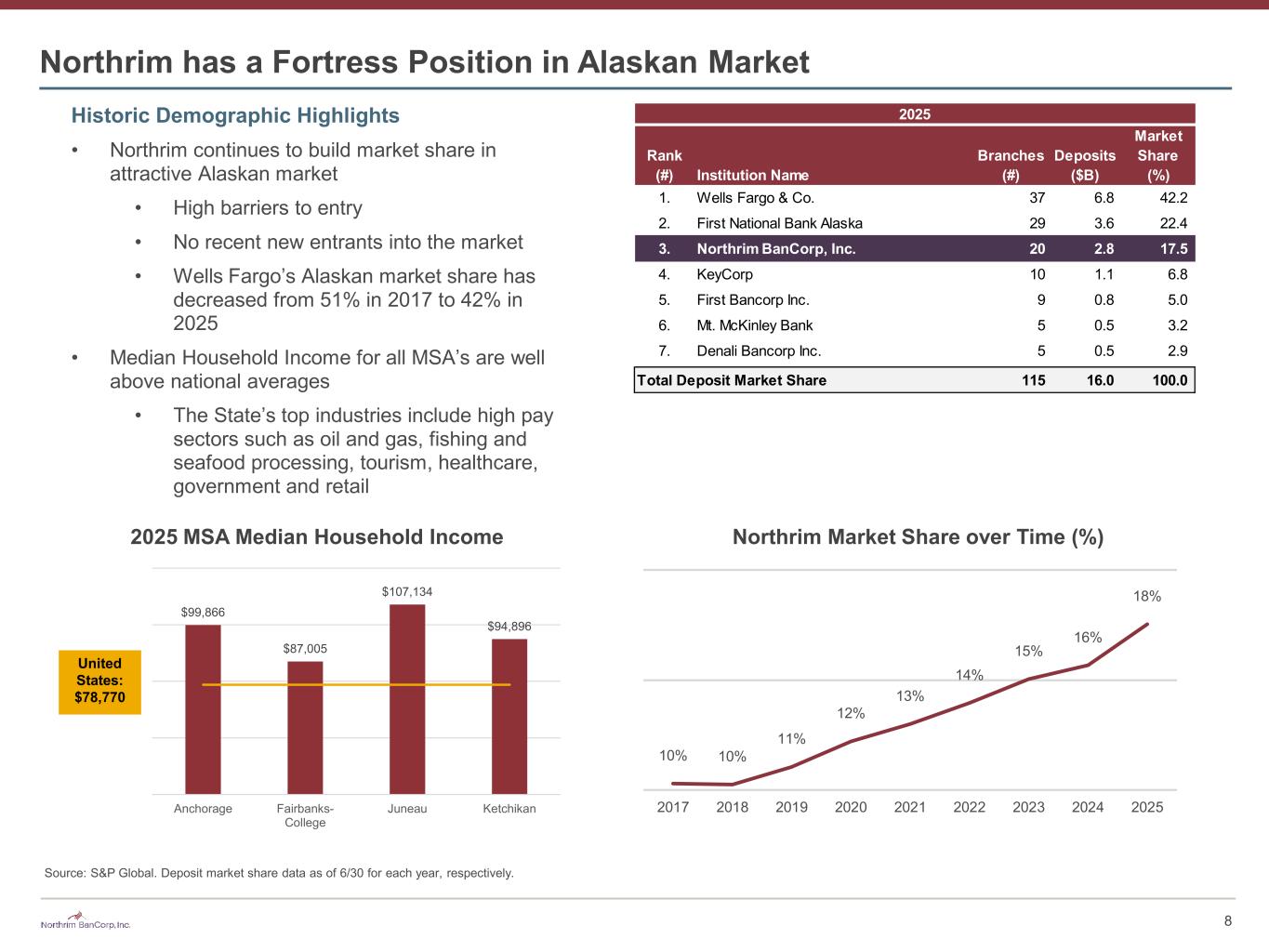

Northrim has a Fortress Position in Alaskan Market Historic Demographic Highlights • Northrim continues to build market share in attractive Alaskan market • High barriers to entry • No recent new entrants into the market • Wells Fargo’s Alaskan market share has decreased from 51% in 2017 to 42% in 2025 • Median Household Income for all MSA’s are well above national averages • The State’s top industries include high pay sectors such as oil and gas, fishing and seafood processing, tourism, healthcare, government and retail Market Rank Branches Deposits Share (#) Institution Name (#) ($B) (%) 1. Wells Fargo & Co. 37 6.8 42.2 2. First National Bank Alaska 29 3.6 22.4 3. Northrim BanCorp, Inc. 20 2.8 17.5 4. KeyCorp 10 1.1 6.8 5. First Bancorp Inc. 9 0.8 5.0 6. Mt. McKinley Bank 5 0.5 3.2 7. Denali Bancorp Inc. 5 0.5 2.9 Total Deposit Market Share 115 16.0 100.0 2025 10% 10% 11% 12% 13% 14% 15% 16% 18% 2017 2018 2019 2020 2021 2022 2023 2024 2025 Northrim Market Share over Time (%) Source: S&P Global. Deposit market share data as of 6/30 for each year, respectively. 2025 MSA Median Household Income $99,866 $87,005 $107,134 $94,896 Anchorage Fairbanks- College Juneau Ketchikan United States: $78,770 8

Alaskan Market Snapshot • Alaska Permanent Fund value $83.3 billion (as of 8/31/2025) • Monthly average ANS oil prices $67 - $76 / barrel • Payroll jobs increase 0.8%, up 2,900 jobs from Aug. ‘24 – Aug. ‘25 • Gross State Product +2% in 2nd quarter annualized: $74.2 billion • Personal Income +5% in 2nd quarter annualized: $59.4 billion ◦ 6th Best State in 2024 • Alaskan CPI inflation index rose 2.9% from Aug. ‘24 – Aug. ‘25 ◦ Historically lower than US due to slower increase housing cost • Average home prices +3.7% in Anchorage • 4th largest cargo airport in the world and 2nd largest in the U.S. ◦ Serves approximately 5.5 million passengers a year • Oil production is projected to increase to 663,000 barrels per day (bpd) (+44%) by 2034; signal of economic stability Source: Alaska Department of Labor and Airports Council International. Leading Cargo Airports – 2024 Metrics Alaskan Job Sectors – August 2025 Industry Jobs August 2025 Aug 2024-2025 YoY Growth Oil & Gas 8,800 +0.8% Manufacturing (Seafood) 16,600 +6.0% Construction 21,900 +5.7% Health Care 43,100 +4.8% Transport/Wharehouse/Utilities 28,500 +2.1% Retail 36,000 +1.1% Leisure & Hospitality 44,200 -0.3% Government 76,400 -0.2% Total Payroll Jobs 355,900 -0.1% 9 Cargo Airport 2024 Rank % Change vs 2019 Metric Tonnes 2024 Hong Kong 1 +2.7% 4,938,211 Shanghai 2 +4.0% 3,778,331 Memphis 3 -13.2% 3,754,236 Anchorage 4 +34.7% 3,699,284 Louisville 5 +13.0% 3,152,969 Incheon 6 +6.0% 2,946,902

Capital Investment Drives Economic Growth - Partial List of Projects • $6 billion in various federal infrastructure projects over the next 5 years • $250 million Port of Nome • $170 million Lowell Creek flood diversion in Seward • $88 million Moose Creek dam in North Pole to protect Fairbanks • $46 million UAA Center for Homeland Security Awareness in the Arctic $107 million runway extension at JBER in the Defense Authorization Bill Coast Guard – $600 million over 5 years for Kodiak, Juneau and Sitka Juneau land conveyance and $125 million to finance icebreaker ship Telecom – GCI & Quintillion fiber optics projects, $100 million from Feds Manh Choh gold mine near Tok - 500 mining, 200 transportation jobs Graphite One - $37 million Department of Defense grant $9.3 million HUD grant for Alaska Native Community housing Alaska Energy Authority - $413 million rail belt electric grid update 10 Source: Company documents.

Financial Overview

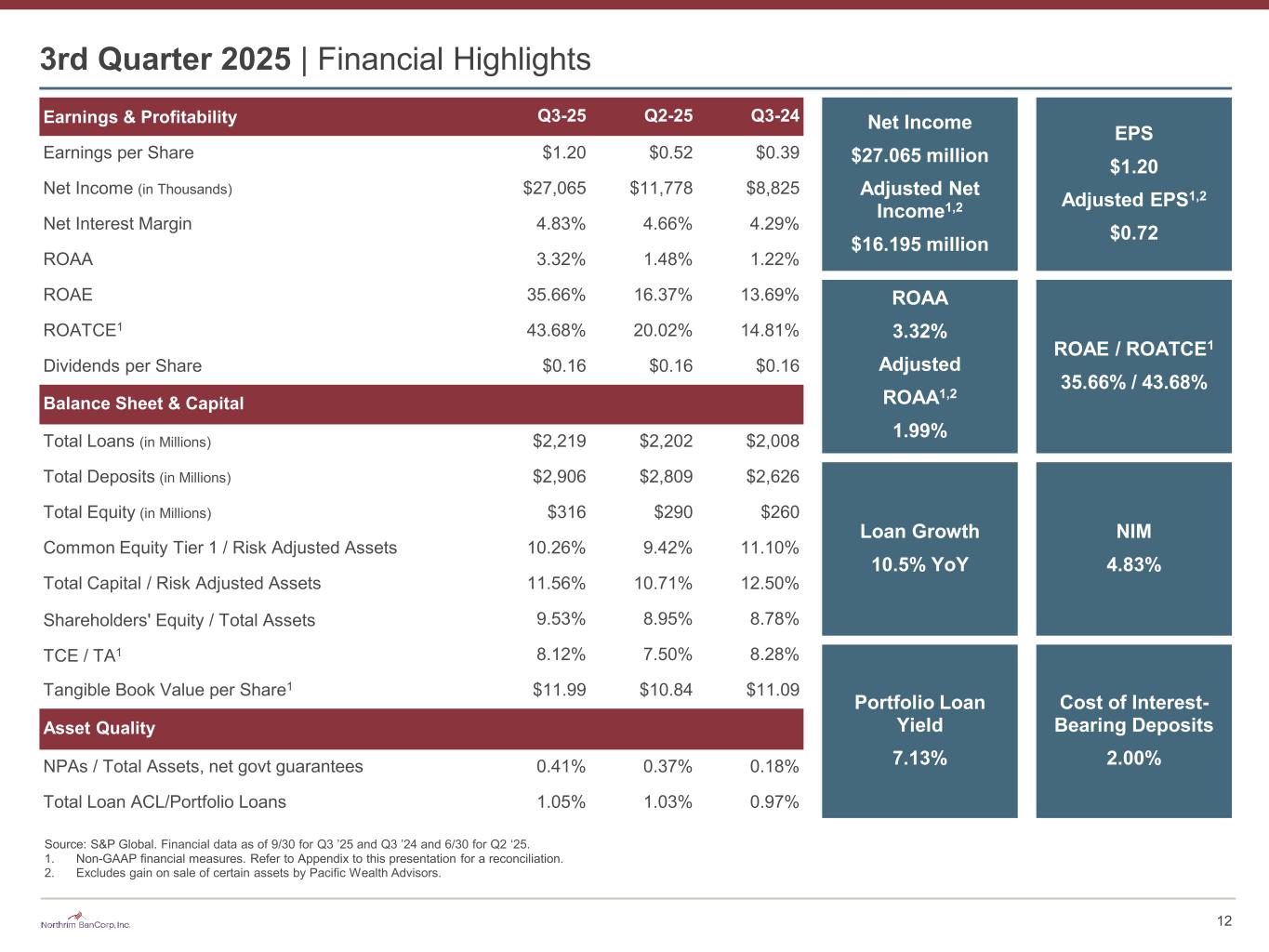

3rd Quarter 2025 | Financial Highlights Earnings & Profitability Q3-25 Q2-25 Q3-24 Earnings per Share $1.20 $0.52 $0.39 Net Income (in Thousands) $27,065 $11,778 $8,825 Net Interest Margin 4.83% 4.66% 4.29% ROAA 3.32% 1.48% 1.22% ROAE 35.66% 16.37% 13.69% ROATCE1 43.68% 20.02% 14.81% Dividends per Share $0.16 $0.16 $0.16 Balance Sheet & Capital Total Loans (in Millions) $2,219 $2,202 $2,008 Total Deposits (in Millions) $2,906 $2,809 $2,626 Total Equity (in Millions) $316 $290 $260 Common Equity Tier 1 / Risk Adjusted Assets 10.26% 9.42% 11.10% Total Capital / Risk Adjusted Assets 11.56% 10.71% 12.50% Shareholders' Equity / Total Assets 9.53% 8.95% 8.78% TCE / TA1 8.12% 7.50% 8.28% Tangible Book Value per Share1 $11.99 $10.84 $11.09 Asset Quality NPAs / Total Assets, net govt guarantees 0.41% 0.37% 0.18% Total Loan ACL/Portfolio Loans 1.05% 1.03% 0.97% Net Income $27.065 million Adjusted Net Income1,2 $16.195 million EPS $1.20 Adjusted EPS1,2 $0.72 ROAA 3.32% Adjusted ROAA1,2 1.99% ROAE / ROATCE1 35.66% / 43.68% Loan Growth 10.5% YoY NIM 4.83% Portfolio Loan Yield 7.13% Cost of Interest- Bearing Deposits 2.00% Source: S&P Global. Financial data as of 9/30 for Q3 ’25 and Q3 ’24 and 6/30 for Q2 ‘25. 1. Non-GAAP financial measures. Refer to Appendix to this presentation for a reconciliation. 2. Excludes gain on sale of certain assets by Pacific Wealth Advisors. 12

Resilient Performance Amid Market Cycles 72.3% 71.9% 74.8% 66.0% 66.7% 67.9% 72.5% 66.7% 45.5% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 0.89% 1.34% 1.33% 1.70% 1.54% 1.16% 0.94% 1.29% 3.32% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 7.0% 10.0% 9.9% 15.5% 15.7% 13.7% 11.2% 14.7% 35.7% 7.6% 10.9% 10.8% 16.8% 16.9% 14.8% 12.1% 16.1% 43.7% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 ROAE ROATCE 4.22% 4.55% 4.65% 4.02% 3.58% 3.85% 4.14% 4.28% 4.83% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 Net Interest MarginEfficiency Ratio1 Return on Average Assets1 Return on Average Equity and Average Tangible Common Equity1,2 Source: S&P Global. Financial data as of 12/31 for each year and as of 9/30/2025 for Q3 ‘25. 1. Includes gain on sale of certain assets by Pacific Wealth Advisors. 2. Non-GAAP financial measures. Refer to Appendix to this presentation for a reconciliation. 13

NIM Net Interest Margin Driven by Asset Yields and Low Cost Liabilities • Increasing loan and portfolio investment yields support increasing asset yields ◦ 26 bps increase since Q2 2024 • Deposit franchise provides low cost financing ◦ 28% non-interest bearing deposits in Q3 2025 • Stabilizing NIM helps maintain profitability ◦ NIM up 77 bps since Q4 2023 5.27% 5.52% 6.05% 5.98% 6.28% 6.48% 6.61% 6.55% 6.75% 6.87% 6.91% 6.93% 6.89% 6.99% 7.13% Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 0.20% 0.20% 0.32% 0.60% 1.23% 1.65% 1.88% 2.06% 2.14% 2.25% 2.29% 2.18% 2.04% 2.12% 2.04% Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 3.18% 3.67% 4.22% 4.31% 4.22% 4.14% 4.15% 4.06% 4.16% 4.24% 4.29% 4.41% 4.55% 4.66% 4.83% Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Source: S&P Global and company documents. Net Interest Margin Yield on Portfolio Loans Cost of Interest-Bearing Liabilities 14

3.82% 3.86% 4.15% 3.50% 2.72% 2.65% 3.06% 3.18% 3.30% 2017 2018 2019 2020 2021 2022 2023 2024 2025 (LTM) CB Operating Expense / Avg Earning Assets 4.22% 4.55% 4.65% 4.02% 3.58% 3.85% 4.14% 4.28% 4.68% 3.63% 3.73% 3.70% 3.44% 3.35% 3.57% 3.37% 3.28% 3.48% 2017 2018 2019 2020 2021 2022 2023 2024 YTD '25 Operating Expenses Mitigated by Attractive Market Dynamics • Alaskan bank operating expenses are higher than mainland banks ◦ 1,300 miles from Nome to Ketchikan (1,400 miles from New York to Dallas) ◦ 6 branches only accessible by boat or plane • Alaskan bank loan yields are higher and deposit costs are lower ◦ Top 4 banks have 90% deposit market share ◦ Last new market entrant was in 2000 when Wells Fargo acquired National Bank of Alaska Higher Operating Expenses... ...Are Balanced by Higher Loan Yields and Lower Deposit Costs that Drive Attractive NIM Peer NIM2NIM Source: S&P Global and company documents. Financial data as of 12/31 for each year and as of 9/30/2025 for YTD’25 and 2025 (LTM). 1. Community Bank Operating Expense ratio is a non-GAAP financial measure - see Non-GAAP reconciliations in Appendix. 2. Peers consist of SNL US Banks with assets between $1B and $5B. Peer metrics as of the most recent quarter available. 15 1

Noninterest Income Supported by Multiple Business Lines Treasury Management and Deposit Solutions Specialty Finance Home Mortgage Lending and Residential Mortgage, LLC • Includes bankcard fees and service charges on deposit accounts • Payables Automation • Fraud Mitigation • Account Reconciliation Tools • Receivables Automation • Treasury Tools • Merchant Fees • Purchased receivable income • Northrim Funding Services: Bellevue-based factoring business founded in 2004 • Sallyport Commercial Finance, LLC: acquired October 31, 2024 • Higher risk-adjusted returns • Includes mortgage servicing • Largest mortgage originator in the State of Alaska • Majority of loans serviced are Alaska Housing Finance Corporation (AHFC) mortgages • $1.60B servicing portfolio acts as hedge against origination volume • Expanding mortgage originations into lower 48 states YTD 2024 YTD 2025 Q3-24 Q3-25 $5.4M $6.4M $1.9M $2.1M YTD 2024 YTD 2025 Q3-24 Q3-25 $3.6M $19.3M $1.0M $7.3M YTD 2024 YTD 2025 Q3-24 Q3-25 $17.0M $18.9M $7.0M $7.3M Business Line Description Operating Income 2025 ($60.9M) Non-Interest Income / Operating Revenue 38.44% 34.89% 36.10% 47.20% 39.28% 25.87% 20.27% 26.81% 31.74% 2017 2018 2019 2020 2021 2022 2023 2024 2025YTD Source: S&P Global. Financial data as of 12/31 for each year and as of 9/30/2025 for 2025YTD. 16

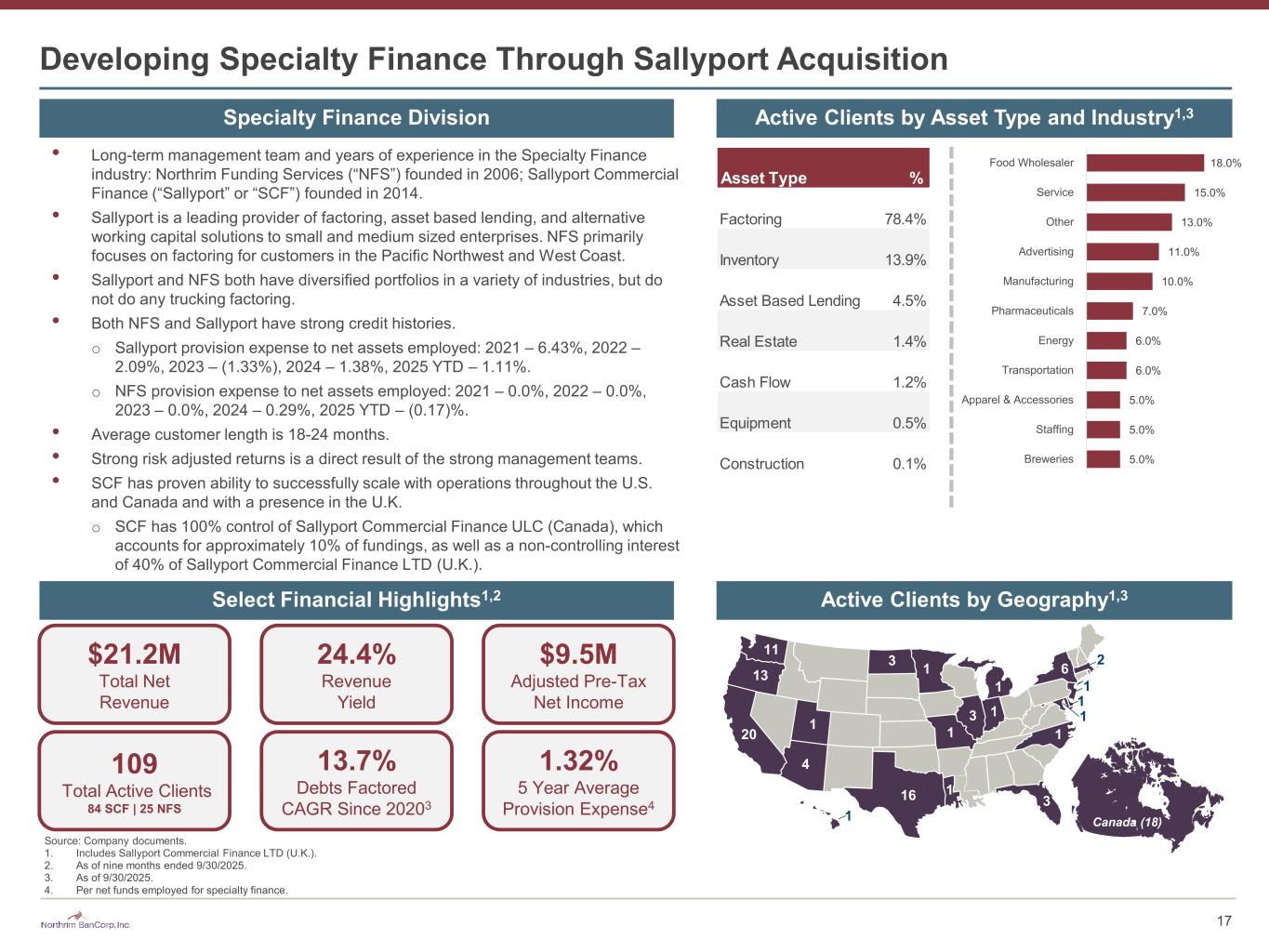

18.0% 15.0% 13.0% 11.0% 10.0% 7.0% 6.0% 6.0% 5.0% 5.0% 5.0% Food Wholesaler Service Other Advertising Manufacturing Pharmaceuticals Energy Transportation Apparel & Accessories Staffing Breweries Asset Type % Factoring 78.4% Inventory 13.9% Asset Based Lending 4.5% Real Estate 1.4% Cash Flow 1.2% Equipment 0.5% Construction 0.1% Developing Specialty Finance Through Sallyport Acquisition Select Financial Highlights1,2 109 Total Active Clients 84 SCF | 25 NFS 13.7% Debts Factored CAGR Since 20203 1.32% 5 Year Average Provision Expense4 $21.2M Total Net Revenue 24.4% Revenue Yield $9.5M Adjusted Pre-Tax Net Income Specialty Finance Division • Long-term management team and years of experience in the Specialty Finance industry: Northrim Funding Services (“NFS”) founded in 2006; Sallyport Commercial Finance (“Sallyport” or “SCF”) founded in 2014. • Sallyport is a leading provider of factoring, asset based lending, and alternative working capital solutions to small and medium sized enterprises. NFS primarily focuses on factoring for customers in the Pacific Northwest and West Coast. • Sallyport and NFS both have diversified portfolios in a variety of industries, but do not do any trucking factoring. • Both NFS and Sallyport have strong credit histories. o Sallyport provision expense to net assets employed: 2021 – 6.43%, 2022 – 2.09%, 2023 – (1.33%), 2024 – 1.38%, 2025 YTD – 1.11%. o NFS provision expense to net assets employed: 2021 – 0.0%, 2022 – 0.0%, 2023 – 0.0%, 2024 – 0.29%, 2025 YTD – (0.17)%. • Average customer length is 18-24 months. • Strong risk adjusted returns is a direct result of the strong management teams. • SCF has proven ability to successfully scale with operations throughout the U.S. and Canada and with a presence in the U.K. o SCF has 100% control of Sallyport Commercial Finance ULC (Canada), which accounts for approximately 10% of fundings, as well as a non-controlling interest of 40% of Sallyport Commercial Finance LTD (U.K.). Active Clients by Asset Type and Industry1,3 Active Clients by Geography1,3 1 Canada (18) 17 Source: Company documents. 1. Includes Sallyport Commercial Finance LTD (U.K.). 2. As of nine months ended 9/30/2025. 3. As of 9/30/2025. 4. Per net funds employed for specialty finance. 4 20 1 3 3 1 1 2 1 1 6 1 3 13 16 1 11 1 1 1 1

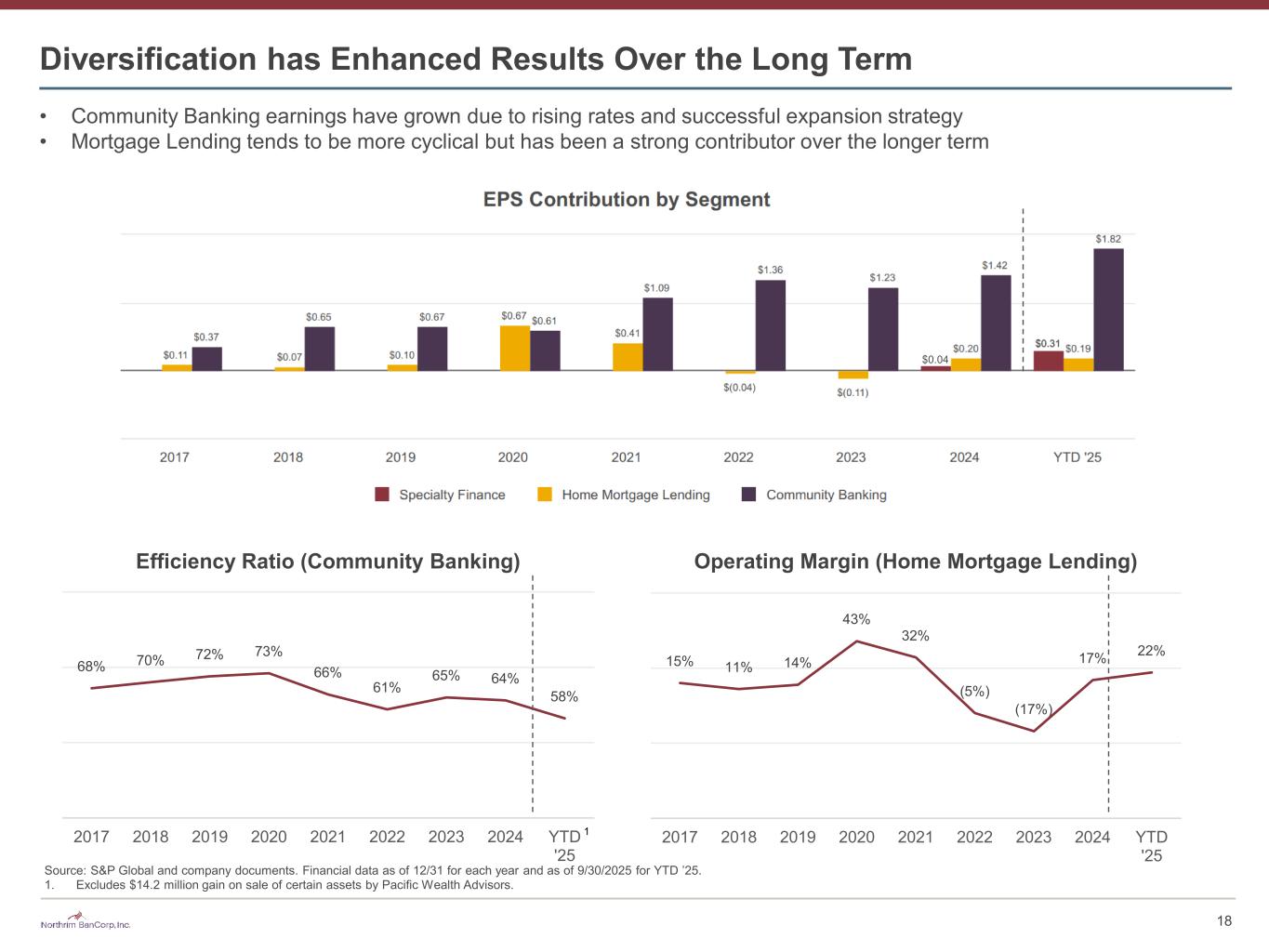

Diversification has Enhanced Results Over the Long Term Efficiency Ratio (Community Banking) 15% 11% 14% 43% 32% (5%) (17%) 17% 22% 2017 2018 2019 2020 2021 2022 2023 2024 YTD '25 18 • Community Banking earnings have grown due to rising rates and successful expansion strategy • Mortgage Lending tends to be more cyclical but has been a strong contributor over the longer term Operating Margin (Home Mortgage Lending) Source: S&P Global and company documents. Financial data as of 12/31 for each year and as of 9/30/2025 for YTD ’25. 1. Excludes $14.2 million gain on sale of certain assets by Pacific Wealth Advisors. 68% 70% 72% 73% 66% 61% 65% 64% 58% 2017 2018 2019 2020 2021 2022 2023 2024 YTD '25 1 $0.04

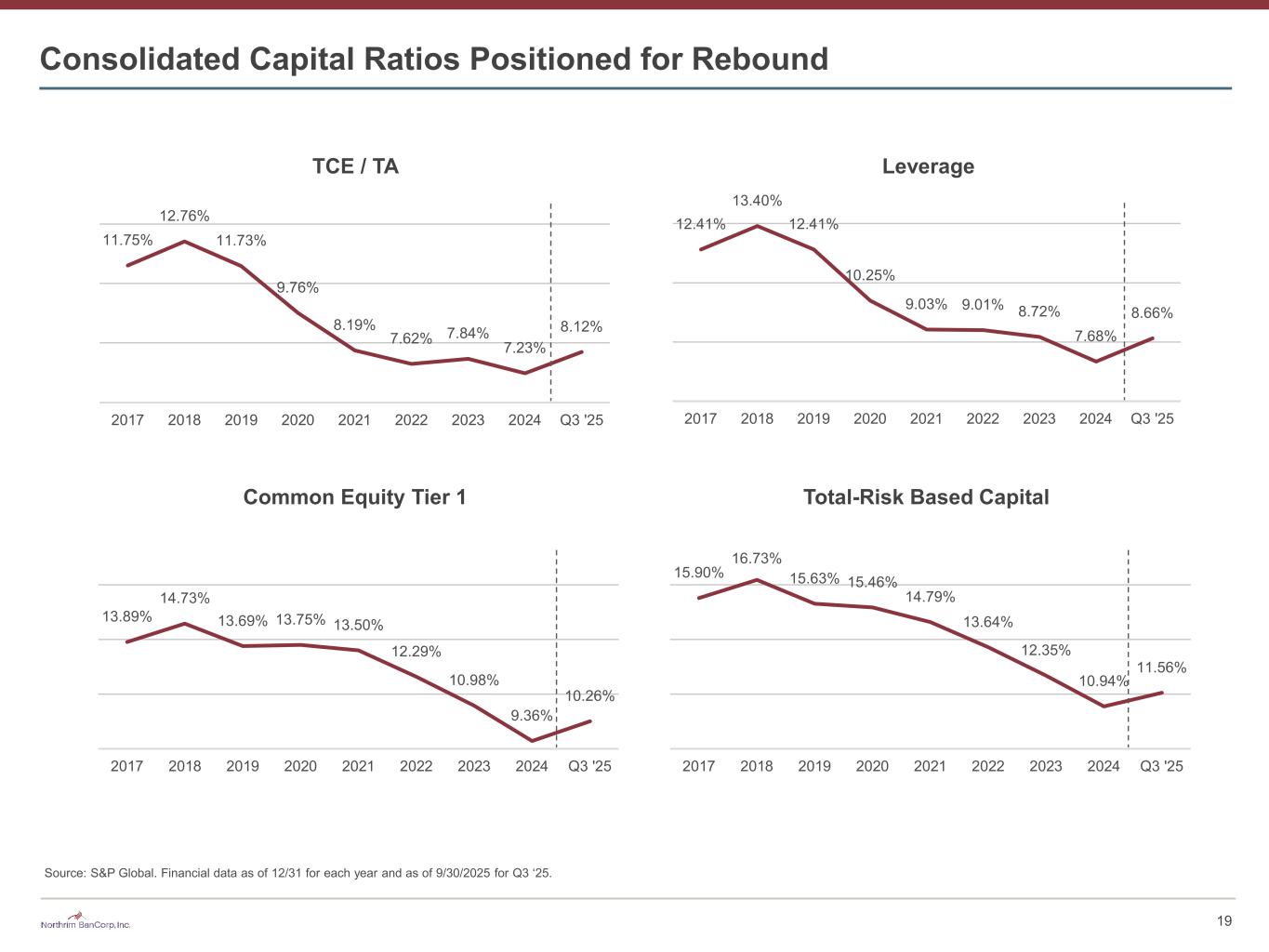

11.75% 12.76% 11.73% 9.76% 8.19% 7.62% 7.84% 7.23% 8.12% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 12.41% 13.40% 12.41% 10.25% 9.03% 9.01% 8.72% 7.68% 8.66% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 Consolidated Capital Ratios Positioned for Rebound Common Equity Tier 1 TCE / TA 13.89% 14.73% 13.69% 13.75% 13.50% 12.29% 10.98% 9.36% 10.26% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 Leverage Source: S&P Global. Financial data as of 12/31 for each year and as of 9/30/2025 for Q3 ‘25. 19 15.90% 16.73% 15.63% 15.46% 14.79% 13.64% 12.35% 10.94% 11.56% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 Total-Risk Based Capital

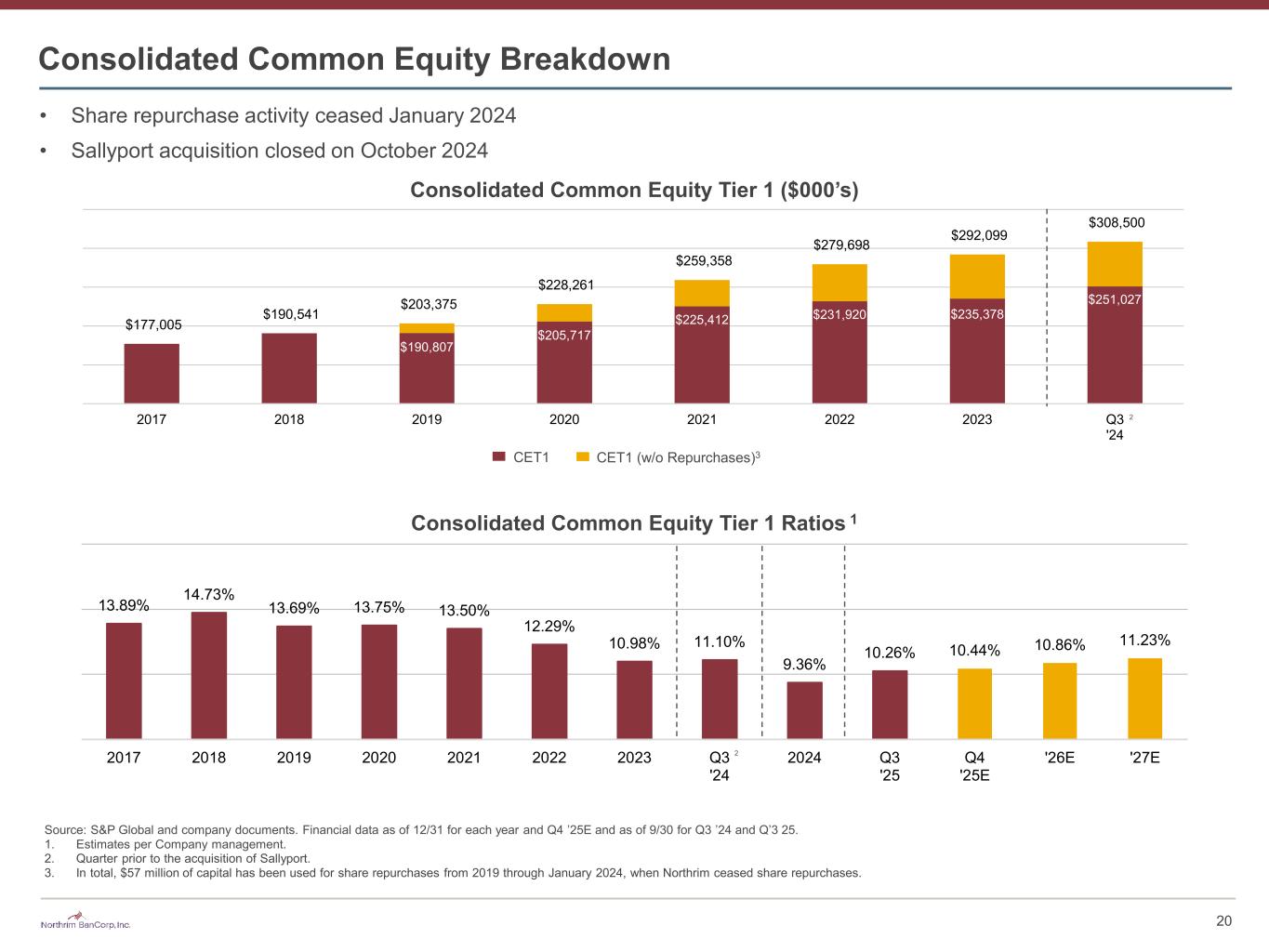

$190,807 $205,717 $225,412 $231,920 $235,378 $251,027 $177,005 $190,541 $203,375 $228,261 $259,358 $279,698 $292,099 $308,500 2017 2018 2019 2020 2021 2022 2023 Q3 '24 13.89% 14.73% 13.69% 13.75% 13.50% 12.29% 10.98% 11.10% 9.36% 10.26% 10.44% 10.86% 11.23% 2017 2018 2019 2020 2021 2022 2023 Q3 '24 2024 Q3 '25 Q4 '25E '26E '27E Consolidated Common Equity Tier 1 ($000’s) Consolidated Common Equity Tier 1 Ratios 1 Source: S&P Global and company documents. Financial data as of 12/31 for each year and Q4 ’25E and as of 9/30 for Q3 ’24 and Q’3 25. 1. Estimates per Company management. 2. Quarter prior to the acquisition of Sallyport. 3. In total, $57 million of capital has been used for share repurchases from 2019 through January 2024, when Northrim ceased share repurchases. CET1 CET1 (w/o Repurchases)3 Consolidated Common Equity Breakdown 2 2 20 • Share repurchase activity ceased January 2024 • Sallyport acquisition closed on October 2024

Loan Portfolio

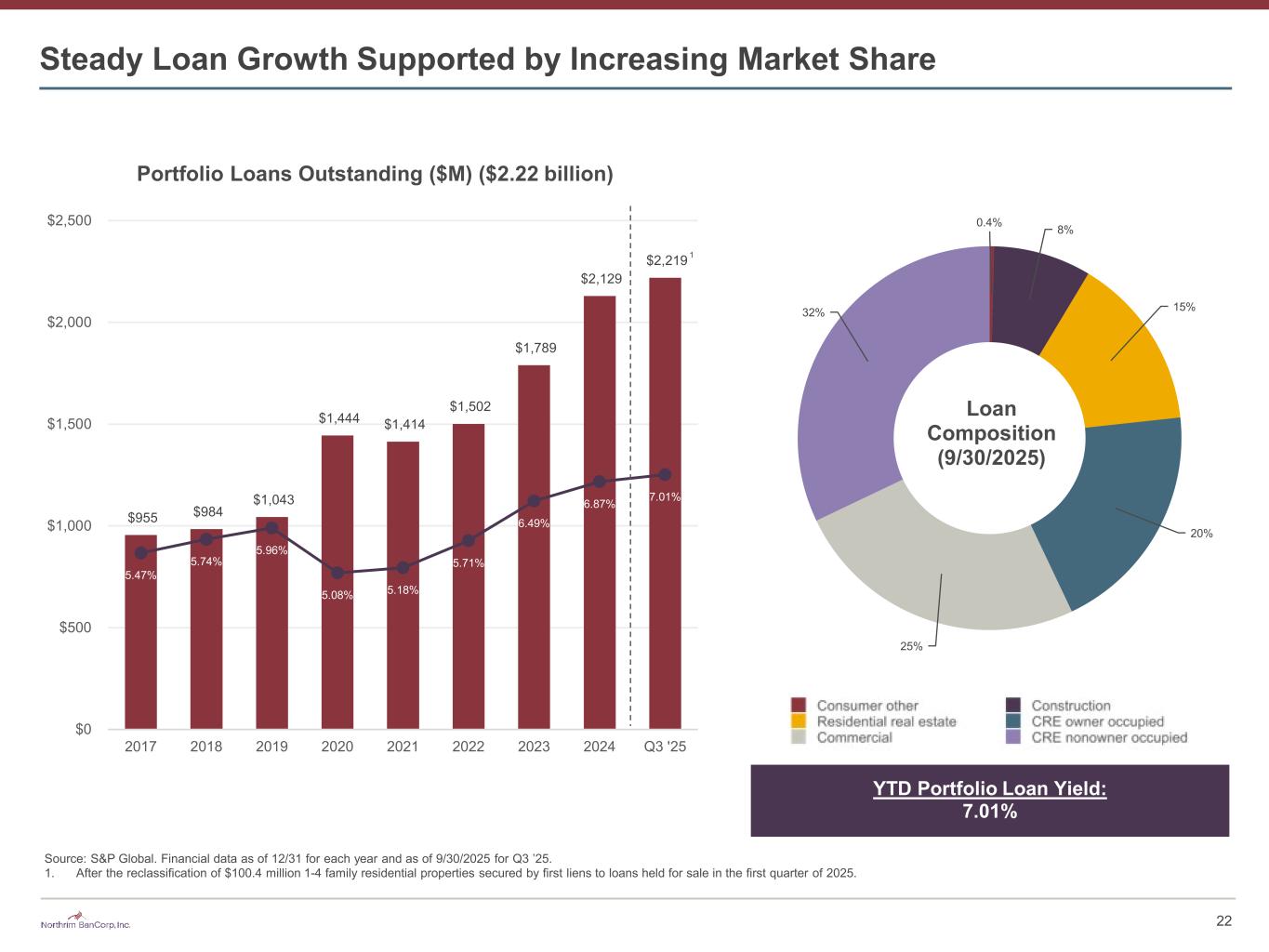

0.4% 8% 15% 20% 25% 32% Steady Loan Growth Supported by Increasing Market Share Portfolio Loans Outstanding ($M) ($2.22 billion) Loan Composition (9/30/2025) YTD Portfolio Loan Yield: 7.01% $955 $984 $1,043 $1,444 $1,414 $1,502 $1,789 $2,129 $2,219 5.47% 5.74% 5.96% 5.08% 5.18% 5.71% 6.49% 6.87% 7.01% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% $0 $500 $1,000 $1,500 $2,000 $2,500 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 1 Source: S&P Global. Financial data as of 12/31 for each year and as of 9/30/2025 for Q3 ’25. 1. After the reclassification of $100.4 million 1-4 family residential properties secured by first liens to loans held for sale in the first quarter of 2025. 22

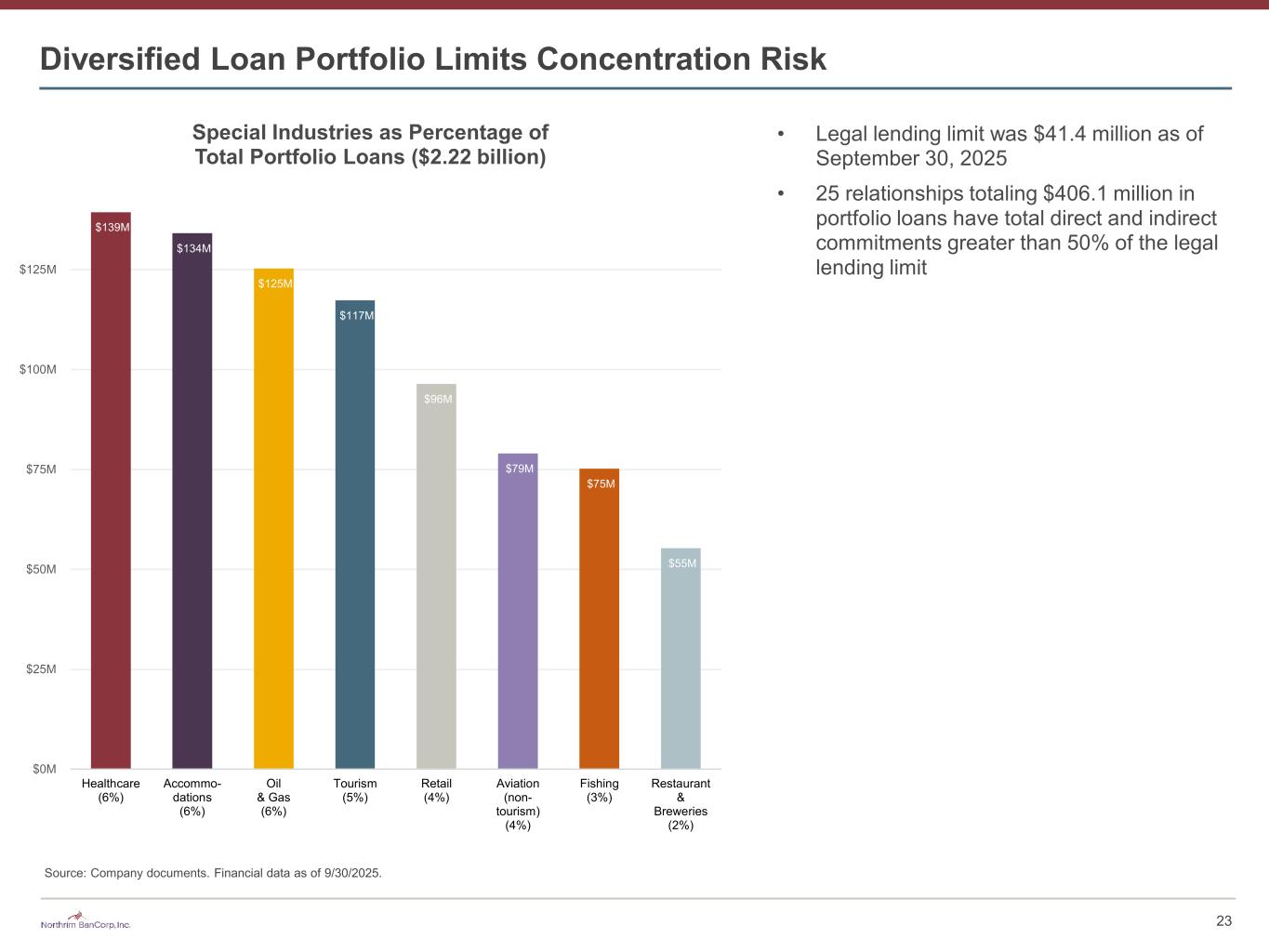

Diversified Loan Portfolio Limits Concentration Risk Special Industries as Percentage of Total Portfolio Loans ($2.22 billion) 23 $139M $134M $125M $117M $96M $79M $75M $55M $0M $25M $50M $75M $100M $125M Healthcare (6%) Accommo- dations (6%) Oil & Gas (6%) Tourism (5%) Retail (4%) Aviation (non- tourism) (4%) Fishing (3%) Restaurant & Breweries (2%) • Legal lending limit was $41.4 million as of September 30, 2025 • 25 relationships totaling $406.1 million in portfolio loans have total direct and indirect commitments greater than 50% of the legal lending limit Source: Company documents. Financial data as of 9/30/2025.

Commercial Real Estate Non-Owner Occupied Portfolio Details Property Type ($ millions) Amount Outstanding Number of Properties Avg Balance % of CRE Non-Owner Occupied Portfolio Apartments $157.0 93 $1.7 22 % Retail Centers $97.7 38 $2.6 14 % Hotels $91.1 28 $3.3 13 % Office, Class A or B $80.3 49 $1.6 11 % Office / Warehouse $72.0 44 $1.6 10 % Mini Warehouse / Self Storage $48.9 21 $2.3 7 % Warehouse $42.3 20 $2.1 6 % Other $128.3 138 $0.9 17 % Total $717.6 431 $1.7 100 % CRE Non-owner Occupied Portfolio Metrics (9/30/2025) Average Loan Size $1.65 million Nonaccrual $0.00 million Special Mention $1.15 million / 0.16% of CRE Non-Owner Occupied Adversely Classified $9.81 million / 1.37% of CRE Non-Owner Occupied • 23% of Non-Owner Occupied CRE includes 25 properties outside of Alaska • 32% of Non-Owner Occupied CRE are Fixed Rate loans 24 Source: Company documents. Financial data as of 9/30/2025.

9% 60% 17% 13% 1% Healthcare by Loan Category (as of 9/30/2025) C&I CRE owner occupied CRE nonowner occupied Construction Other Loan Exposure to Key Industry Sectors 25 Healthcare: 54% 43% 1% 0.7% 2% Tourism by Loan Category (as of 9/30/2025) C&I CRE owner occupied CRE nonowner occupied Construction Other By Specialty # of Loans Balance Outstanding Physicians 27 $47.3 million Outpatient Clinics 15 $29.4 million Dentists 36 $11.4 million Surgical Centers 2 $3.1 million Chiropractor 19 $5.5 million Other 66 $42.8 million Tourism: $139M By Industry # of Loans Balance Outstanding Touring-Boats, Planes, RV 105 $99.8 million Souvenir and Retail 10 $17.5 million Travel Agencies 2 < $0.1 million $117M Source: Company documents. Financial data as of 9/30/2025.

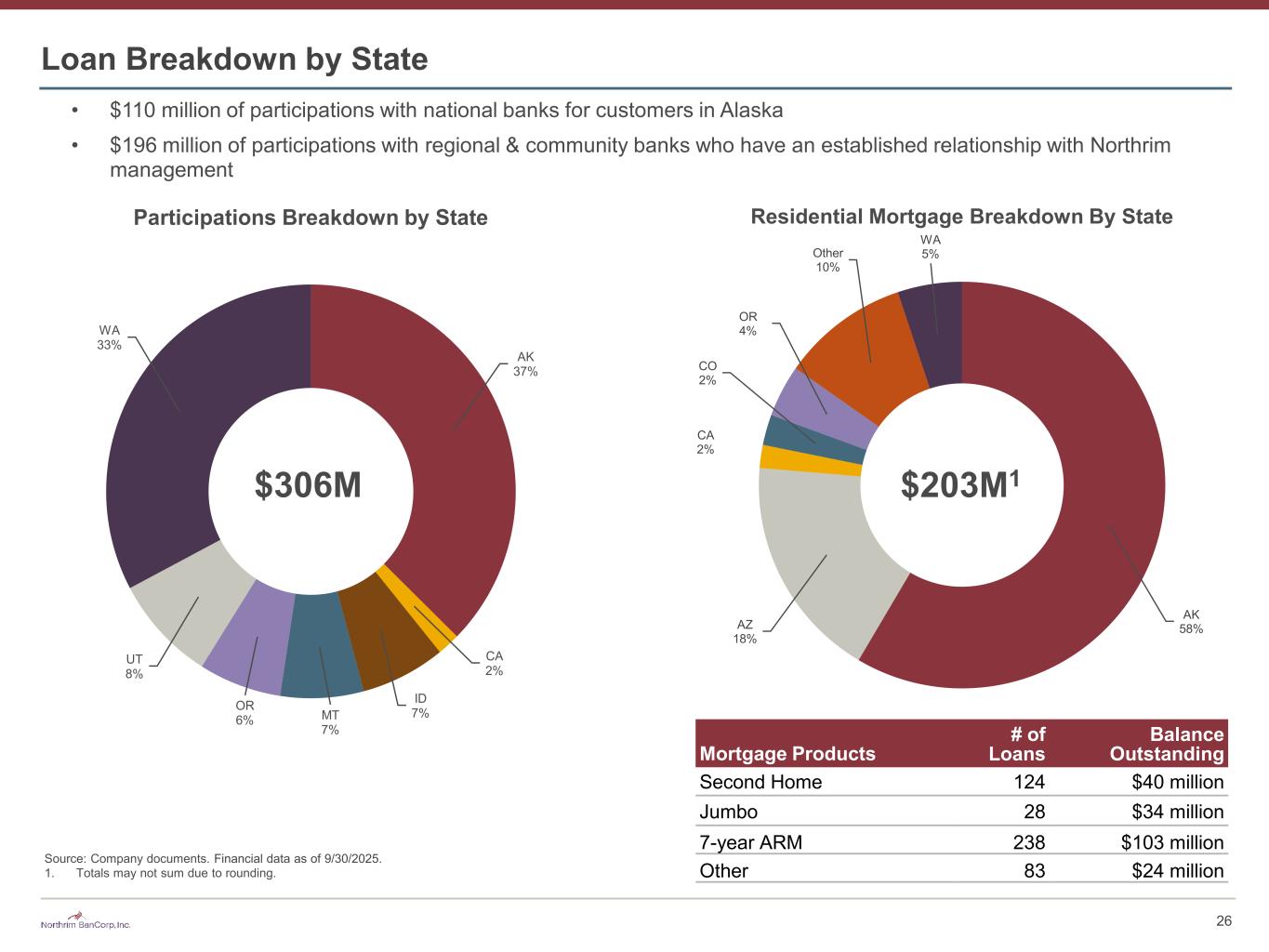

Loan Breakdown by State AK 58%AZ 18% CA 2% CO 2% OR 4% Other 10% WA 5% Residential Mortgage Breakdown By State $203M1 AK 37% CA 2% ID 7%MT 7% OR 6% UT 8% WA 33% Participations Breakdown by State $306M Source: Company documents. Financial data as of 9/30/2025. 1. Totals may not sum due to rounding. • $110 million of participations with national banks for customers in Alaska • $196 million of participations with regional & community banks who have an established relationship with Northrim management 26 Mortgage Products # of Loans Balance Outstanding Second Home 124 $40 million Jumbo 28 $34 million 7-year ARM 238 $103 million Other 83 $24 million

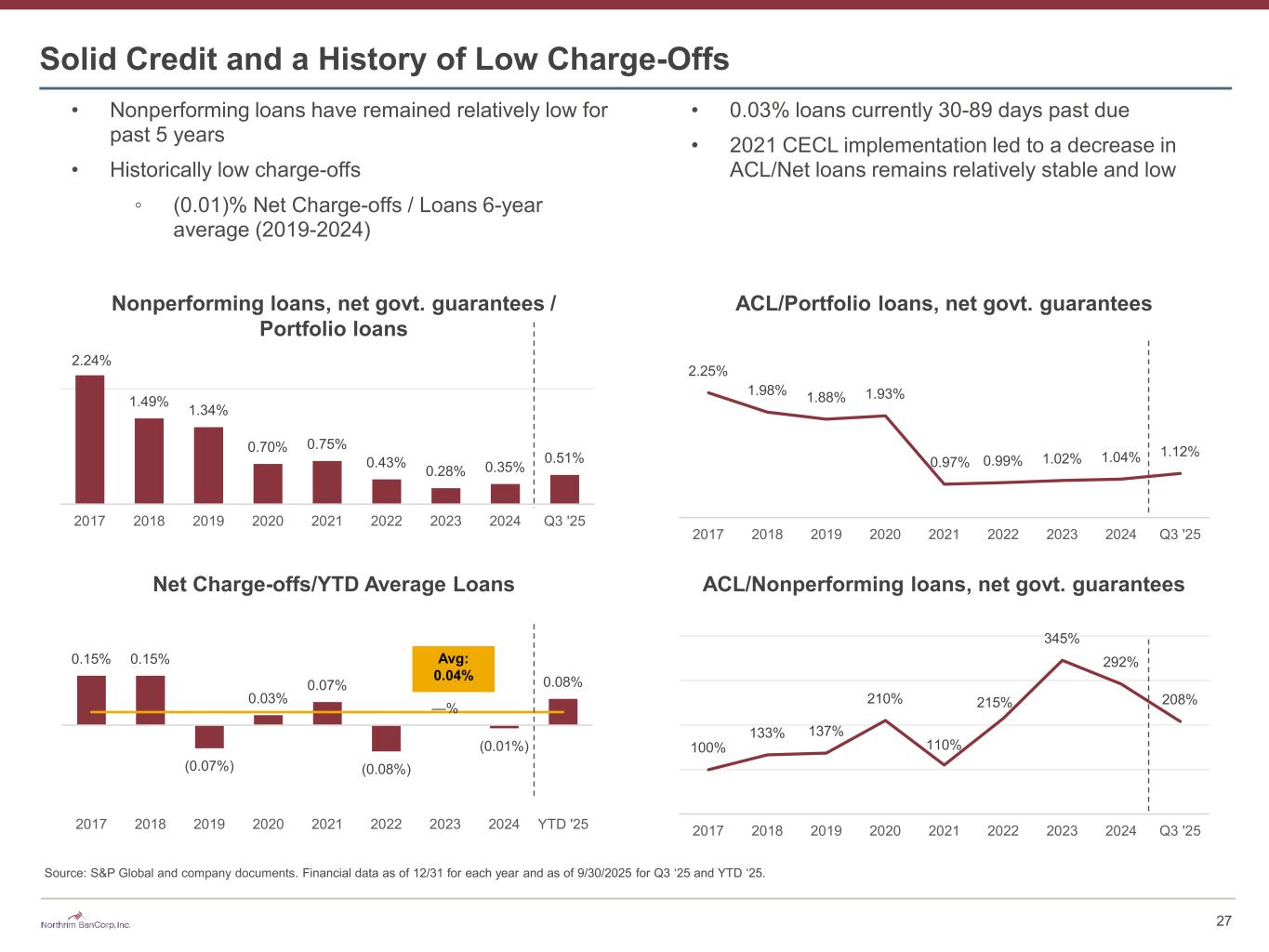

2.25% 1.98% 1.88% 1.93% 0.97% 0.99% 1.02% 1.04% 1.12% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 100% 133% 137% 210% 110% 215% 345% 292% 208% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 Credit Quality – Non-Performing Assets (“NPAs”)Solid Credit and a History of Low Charge-Offs 2.24% 1.49% 1.34% 0.70% 0.75% 0.43% 0.28% 0.35% 0.51% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 0.15% 0.15% (0.07%) 0.03% 0.07% (0.08%) —% (0.01%) 0.08% 2017 2018 2019 2020 2021 2022 2023 2024 YTD '25 • Nonperforming loans have remained relatively low for past 5 years • Historically low charge-offs ◦ (0.01)% Net Charge-offs / Loans 6-year average (2019-2024) Avg: 0.04% Nonperforming loans, net govt. guarantees / Portfolio loans Net Charge-offs/YTD Average Loans ACL/Nonperforming loans, net govt. guarantees • 0.03% loans currently 30-89 days past due • 2021 CECL implementation led to a decrease in ACL/Net loans remains relatively stable and low ACL/Portfolio loans, net govt. guarantees 27 Source: S&P Global and company documents. Financial data as of 12/31 for each year and as of 9/30/2025 for Q3 ‘25 and YTD ‘25.

5.66% 6.10% 5.14% 3.19% 3.88% 1.81% 3.58% 3.40% 3.77% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 0.15% 0.15% (0.07%) 0.03% 0.07% (0.08%) —% (0.01%) 0.08% 2017 2018 2019 2020 2021 2022 2023 2024 YTD '25 Credit Quality – Non-Performing Assets (“NPAs”)Special Mention and Adversely Classified Loan and Net Charge-Off History Northrim believes it has a consistent lending approach throughout economic cycles, which emphasizes appropriate loan-to- value ratios, adequate debt coverage ratios, and competent management. 1 Special Mention and Adversely Classified Loans to Total Loans Source: S&P Global and company documents. Financial data as of 12/31 for each year and as of 9/30/2025 for Q3 ’25 and YTD ‘25. 1. Peers consist of 16 specific peer banks in Northrim’s peer group as of 12/31/2024. Peer metrics as of the most recent quarter available. Peer Median Net Charge-offs/YTD Average Loans 1 28

Investments

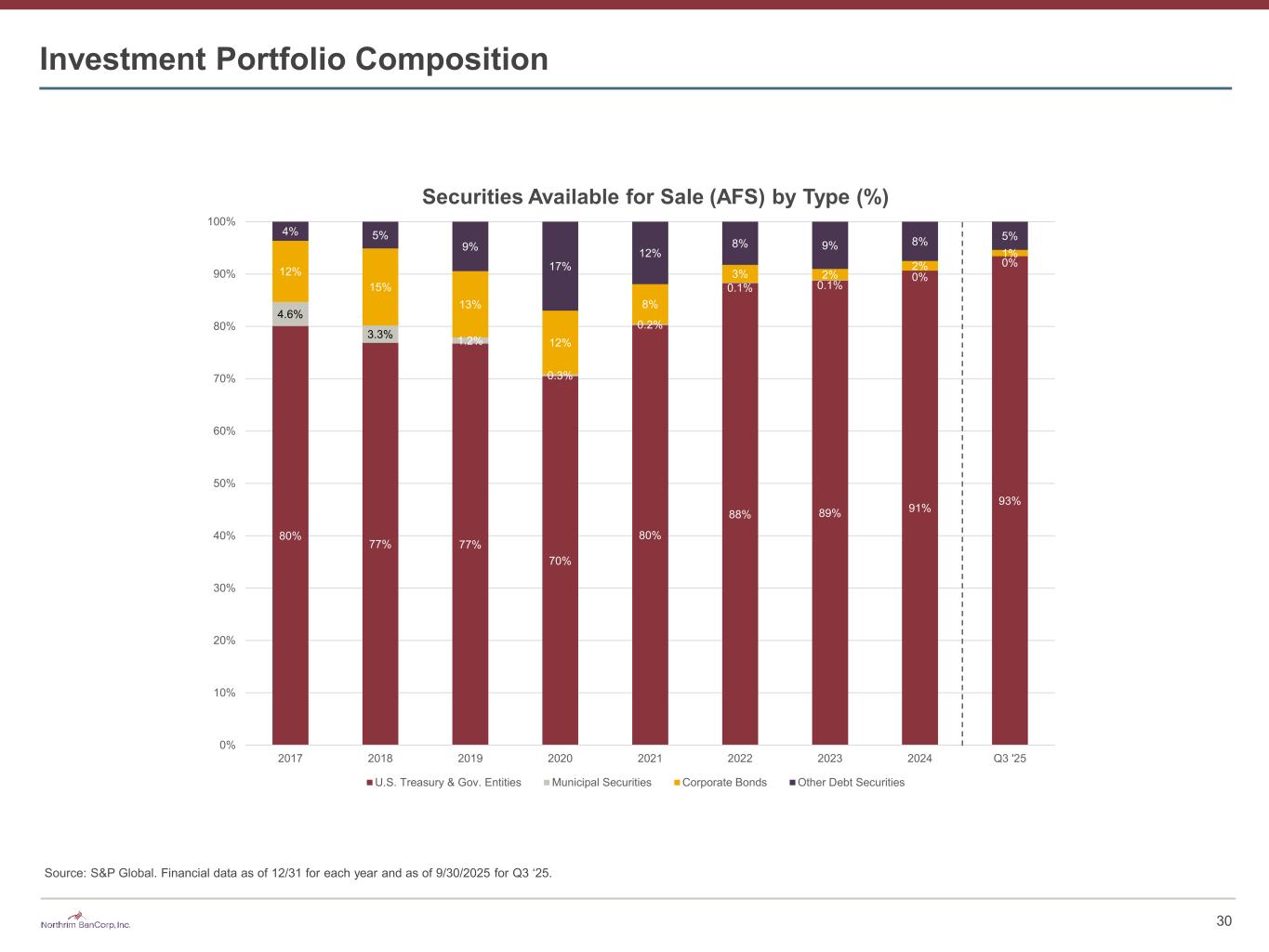

Securities Available for Sale (AFS) by Type (%) Investment Portfolio Composition 80% 77% 77% 70% 80% 88% 89% 91% 93% 4.6% 3.3% 1.2% 0.3% 0.2% 0.1% 0.1% 0% 0% 12% 15% 13% 12% 8% 3% 2% 2% 1% 4% 5% 9% 17% 12% 8% 9% 8% 5% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 U.S. Treasury & Gov. Entities Municipal Securities Corporate Bonds Other Debt Securities 30 Source: S&P Global. Financial data as of 12/31 for each year and as of 9/30/2025 for Q3 ‘25.

Tracking Portfolio Shifts Across Yield and Maturity Source: S&P Global and company documents. Financial data as of 12/31 for each year and as of 9/30/2025 for Q3 ‘25. 2.0 2.5 1.5 3.0 4.0 3.3 2.8 2.4 2.2 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 Investment Portfolio - Maturity Maturity - Years 1.65% 2.36% 2.38% 1.25% 0.93% 3.15% 2.31% 2.44% 3.09% 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 Investment Portfolio - Yield Yield (%) As of September 30, 2025 • $80.7 million of AFS securities with a weighted average yield of 1.15% are scheduled to mature in next 6 months • $103.9 million with a weighted average yield of 1.44% are scheduled to mature in 6 months – 1 year • $124.8 million with a weighted average yield of 2.69% are scheduled to mature the following year Total $309.4 million (10% of earning assets) scheduled to mature in next 24 months 31

Fair Value Trends of AFS Securities Fair Value of AFS Securities by Type ($000) $249.5 $208.9 $211.9 $174.6 $341.5 $595.2 $564.1 $432.9 $391.4 $14.4 $9.1 $3.3 $0.9 $0.8 $0.8 $0.8 $37.1 $39.8 $35.1 $30.5 $32.9 $23.6 $13.6 $8.8 $4.9 $11.7 $13.9 $25.9 $41.7 $51.4 $57.4 $59.4 $36.9 $22.9 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 $800.0 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 U.S. Treasury & Gov. Entities Municipal Securities Corporate Bonds Other Debt Securities 32 Gain/(Loss) on AFS Securities: ($2.5 million) Source: S&P Global. Financial data as of 12/31 for each year and as of 9/30/2025 for Q3 ‘25.

Deposit Portfolio

41% 30% 14% 8% 7% Deposit Franchise also Benefiting from Increasing Market Share Steady Market Share Growth Driving Deposits Deposit Composition (9/30/2025) $415 $421 $452 $644 $888 $797 $750 $706 $872 $743 $694 $756 $1,006 $1,356 $1,397 $1,404 $1,556 $1,634 $101 $113 $164 $176 $178 $193 $331 $418 $400 10.3% 10.3% 11.1% 12.3% 13.0% 14.0% 15.0% 15.7% 17.5% 6.0% 11.0% 16.0% 21.0% 26.0% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2017 2018 2019 2020 2021 2022 2023 2024 Q3 '25 YTD Cost of Interest-Bearing Deposits: 2.02% 34 Source: S&P Global. Financial data as of 12/31 for each year and as of 9/30/2025 for Q3 ‘25.

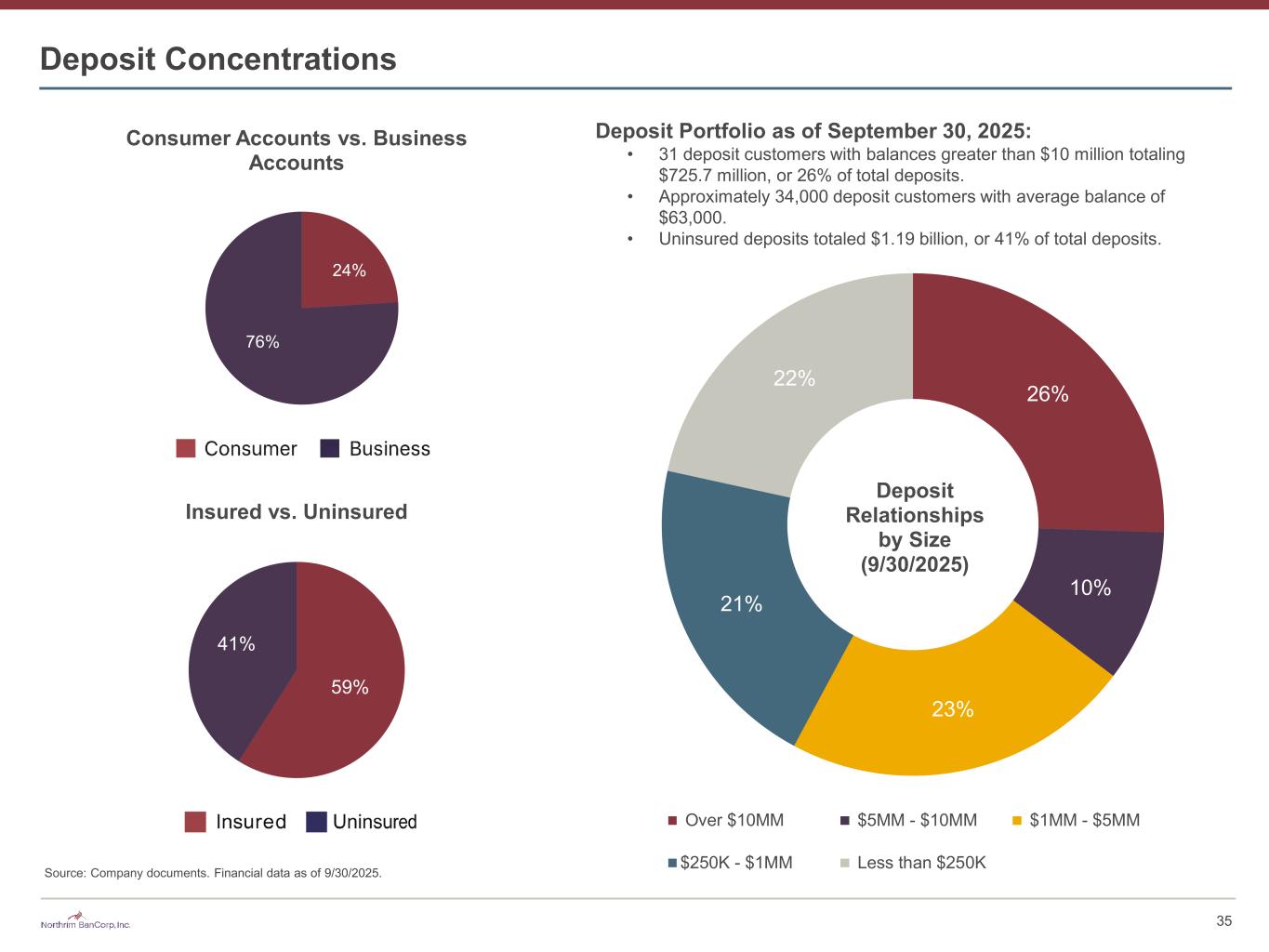

59% 41% 24% 76% Deposit Concentrations Deposit Portfolio as of September 30, 2025: • 31 deposit customers with balances greater than $10 million totaling $725.7 million, or 26% of total deposits. • Approximately 34,000 deposit customers with average balance of $63,000. • Uninsured deposits totaled $1.19 billion, or 41% of total deposits. 35 Consumer Accounts vs. Business Accounts Insured vs. Uninsured 26% 10% 23% 21% 22% Over $10MM $5MM - $10MM $1MM - $5MM $250K - $1MM Less than $250K Deposit Relationships by Size (9/30/2025) Source: Company documents. Financial data as of 9/30/2025.

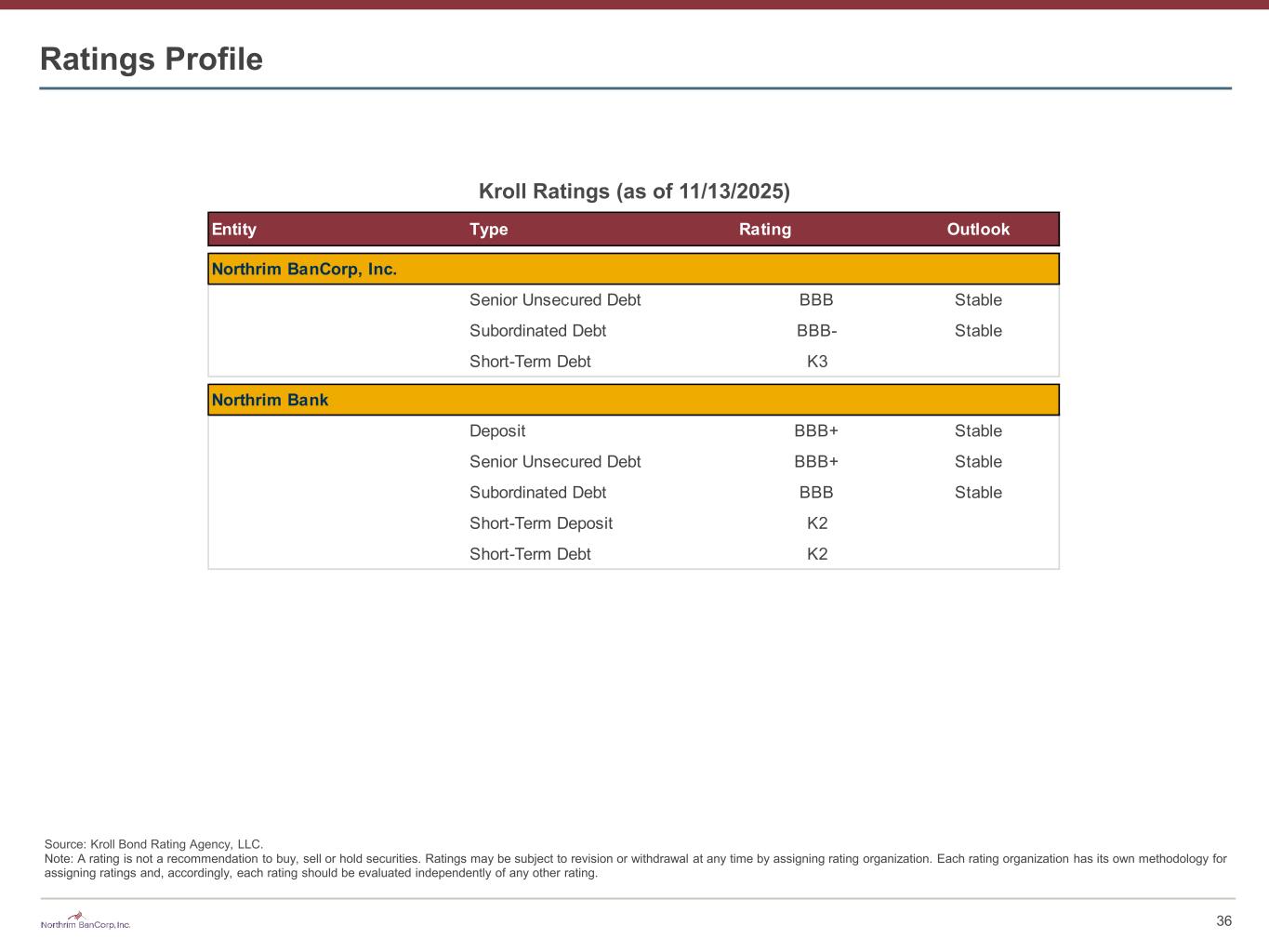

Ratings Profile 36 Kroll Ratings (as of 11/13/2025) Entity Type Rating Outlook Northrim BanCorp, Inc. Senior Unsecured Debt BBB Stable Subordinated Debt BBB- Stable Short-Term Debt K3 Northrim Bank Deposit BBB+ Stable Senior Unsecured Debt BBB+ Stable Subordinated Debt BBB Stable Short-Term Deposit K2 Short-Term Debt K2 Source: Kroll Bond Rating Agency, LLC. Note: A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any time by assigning rating organization. Each rating organization has its own methodology for assigning ratings and, accordingly, each rating should be evaluated independently of any other rating.

Appendix

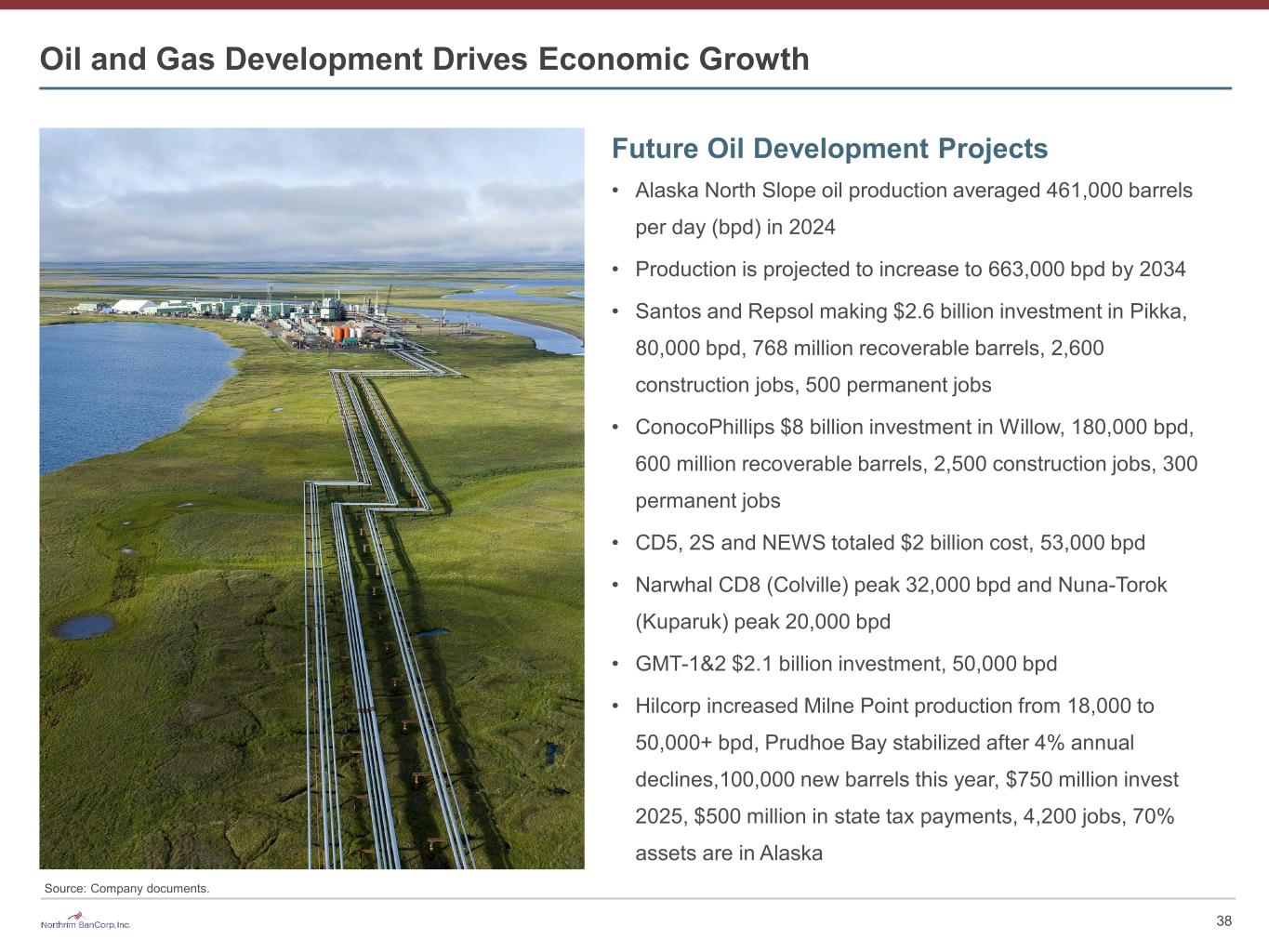

Oil and Gas Development Drives Economic Growth Future Oil Development Projects • Alaska North Slope oil production averaged 461,000 barrels per day (bpd) in 2024 • Production is projected to increase to 663,000 bpd by 2034 • Santos and Repsol making $2.6 billion investment in Pikka, 80,000 bpd, 768 million recoverable barrels, 2,600 construction jobs, 500 permanent jobs • ConocoPhillips $8 billion investment in Willow, 180,000 bpd, 600 million recoverable barrels, 2,500 construction jobs, 300 permanent jobs • CD5, 2S and NEWS totaled $2 billion cost, 53,000 bpd • Narwhal CD8 (Colville) peak 32,000 bpd and Nuna-Torok (Kuparuk) peak 20,000 bpd • GMT-1&2 $2.1 billion investment, 50,000 bpd • Hilcorp increased Milne Point production from 18,000 to 50,000+ bpd, Prudhoe Bay stabilized after 4% annual declines,100,000 new barrels this year, $750 million invest 2025, $500 million in state tax payments, 4,200 jobs, 70% assets are in Alaska 38 Source: Company documents.

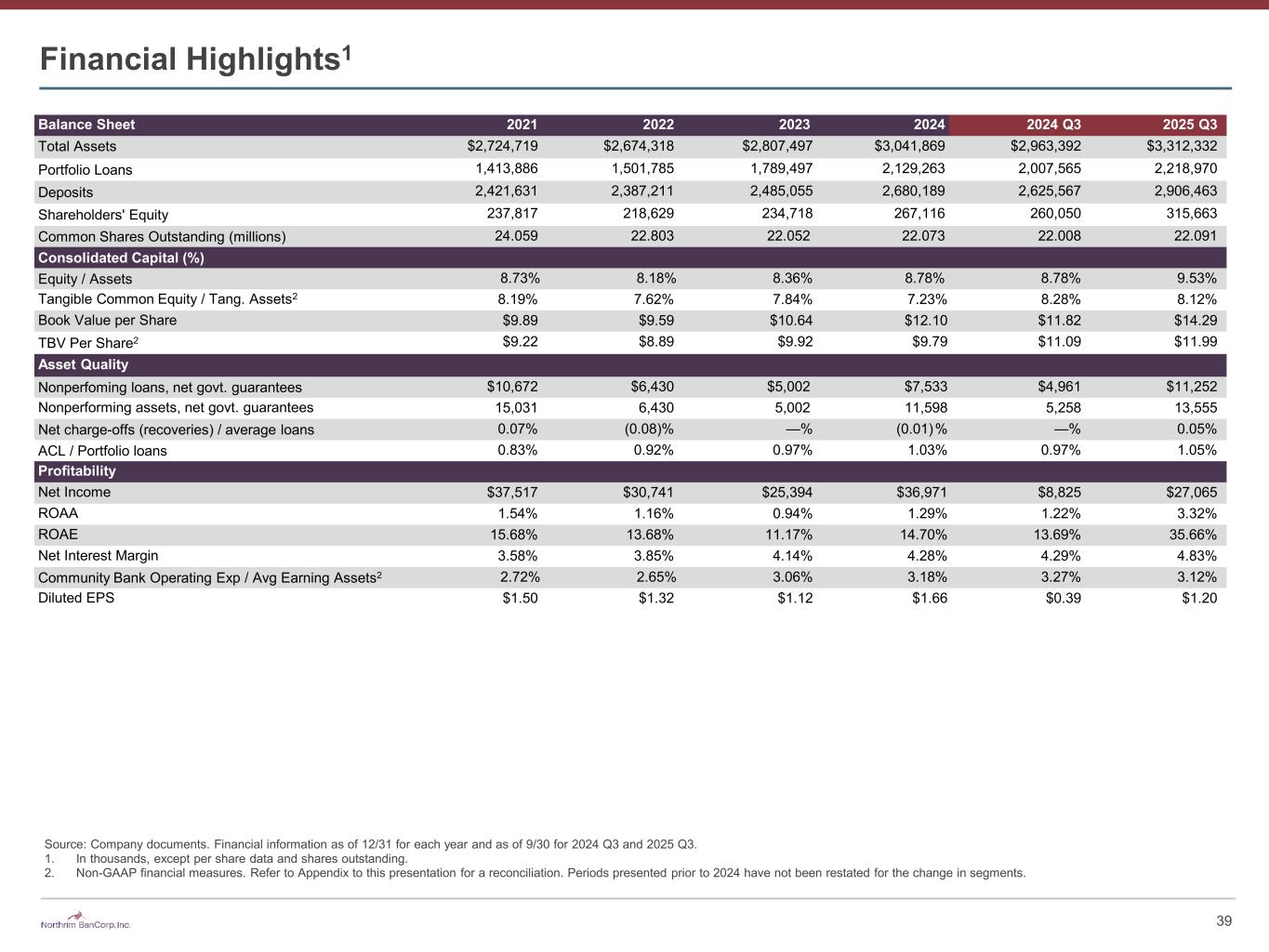

Balance Sheet 2021 2022 2023 2024 2024 Q3 2025 Q3 Total Assets $2,724,719 $2,674,318 $2,807,497 $3,041,869 $2,963,392 $3,312,332 Portfolio Loans 1,413,886 1,501,785 1,789,497 2,129,263 2,007,565 2,218,970 Deposits 2,421,631 2,387,211 2,485,055 2,680,189 2,625,567 2,906,463 Shareholders' Equity 237,817 218,629 234,718 267,116 260,050 315,663 Common Shares Outstanding (millions) 24.059 22.803 22.052 22.073 22.008 22.091 Consolidated Capital (%) Equity / Assets 8.73% 8.18% 8.36% 8.78% 8.78% 9.53% Tangible Common Equity / Tang. Assets2 8.19% 7.62% 7.84% 7.23% 8.28% 8.12% Book Value per Share $9.89 $9.59 $10.64 $12.10 $11.82 $14.29 TBV Per Share2 $9.22 $8.89 $9.92 $9.79 $11.09 $11.99 Asset Quality Nonperfoming loans, net govt. guarantees $10,672 $6,430 $5,002 $7,533 $4,961 $11,252 Nonperforming assets, net govt. guarantees 15,031 6,430 5,002 11,598 5,258 13,555 Net charge-offs (recoveries) / average loans 0.07% (0.08)% —% (0.01)% —% 0.05% ACL / Portfolio loans 0.83% 0.92% 0.97% 1.03% 0.97% 1.05% Profitability Net Income $37,517 $30,741 $25,394 $36,971 $8,825 $27,065 ROAA 1.54% 1.16% 0.94% 1.29% 1.22% 3.32% ROAE 15.68% 13.68% 11.17% 14.70% 13.69% 35.66% Net Interest Margin 3.58% 3.85% 4.14% 4.28% 4.29% 4.83% Community Bank Operating Exp / Avg Earning Assets2 2.72% 2.65% 3.06% 3.18% 3.27% 3.12% Diluted EPS $1.50 $1.32 $1.12 $1.66 $0.39 $1.20 Financial Highlights1 Source: Company documents. Financial information as of 12/31 for each year and as of 9/30 for 2024 Q3 and 2025 Q3. 1. In thousands, except per share data and shares outstanding. 2. Non-GAAP financial measures. Refer to Appendix to this presentation for a reconciliation. Periods presented prior to 2024 have not been restated for the change in segments. 39

Non-GAAP Reconciliation (In thousands) 2021 2022 2023 2024 2024 Q3 2025 Q3 Shareholders' Equity $237,817 $218,629 $234,718 $267,116 $260,050 $315,663 Total Assets 2,724,719 2,672,041 2,807,497 3,041,869 2,963,392 3,312,332 Total Shareholders' Equity to Total Assets Ratio 8.73% 8.18% 8.36% 8.78% 8.78% 9.53% Shareholders' Equity $237,817 $218,629 $234,718 $267,116 $260,050 $315,663 Less: Goodwill and Other Intangible Assets 16,009 15,984 15,967 50,968 15,967 50,824 Tangible Common Shareholders' Equity $221,808 $202,645 $218,751 $216,148 $244,083 $264,839 Total Assets $2,724,719 $2,674,318 $2,807,497 $3,041,869 $2,963,392 $3,312,332 Less: Goodwill and Other Intangible Assets 16,009 15,984 15,967 50,968 15,967 50,824 Tangible assets $2,708,710 $2,658,334 $2,791,530 $2,990,901 $2,947,425 $3,261,508 Tangible Common Equity to Tangible Assets Ratio 8.19% 7.62% 7.84% 7.23% 8.28% 8.12% 2019 2020 2021 2022 2023 2024 2025 (LTM) Operating Expense, Community Banking Segment $54,988 $57,614 $58,647 $63,902 $70,684 $73,085 $79,426 Avg Earning Assets, Consolidated $1,386,557 $1,758,839 $2,260,778 $2,469,383 $2,491,651 $2,647,615 $2,841,252 Less: Avg Consumer Mortgages 131,810 224,613 235,265 Less: Avg Loans Held for Sale 56,344 105,287 101,752 51,566 41,644 68,790 102,776 Less: Avg Purchased Receivables 38,697 70,384 Less: Avg Interest-bearing Cash, RML 5,803 5,325 5,435 7,726 6,651 8,982 8,004 Less: Avg Purchased Receivable Loans 7,001 18,913 Avg Earning Assets, Community Banking Segment $1,324,410 $1,648,227 $2,153,591 $2,410,091 $2,311,546 $2,299,532 $2,405,910 Community Bank Operating Exp / Avg Earning Assets 4.15% 3.50% 2.72% 2.65 % 3.06% 3.18% 3.30% 40 Source: Company documents. Financial information as of 12/31 for each year and as of 9/30 for 2024 Q3 and 2025 Q3.

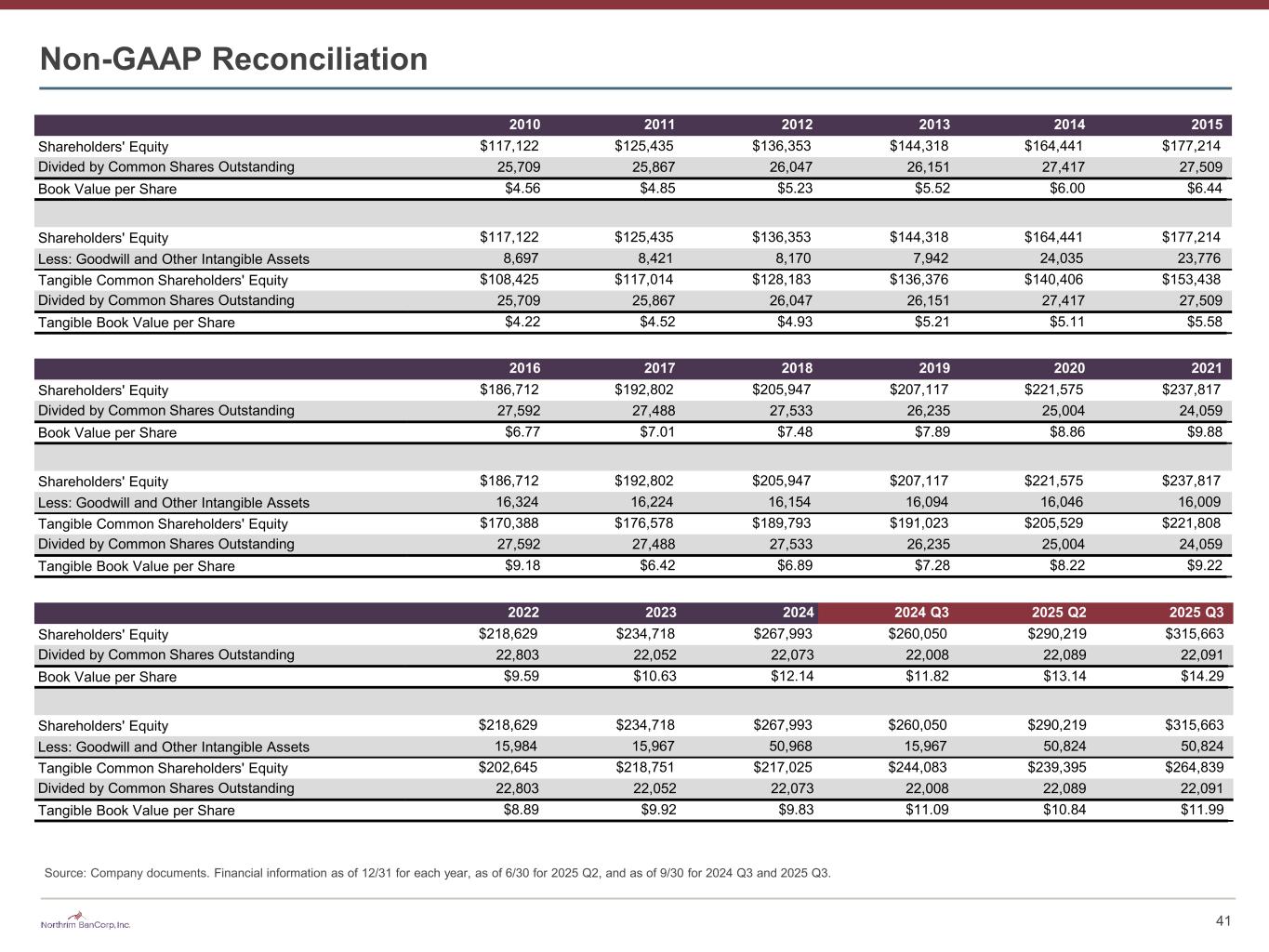

Non-GAAP Reconciliation 2010 2011 2012 2013 2014 2015 Shareholders' Equity $117,122 $125,435 $136,353 $144,318 $164,441 $177,214 Divided by Common Shares Outstanding 25,709 25,867 26,047 26,151 27,417 27,509 Book Value per Share $4.56 $4.85 $5.23 $5.52 $6.00 $6.44 Shareholders' Equity $117,122 $125,435 $136,353 $144,318 $164,441 $177,214 Less: Goodwill and Other Intangible Assets 8,697 8,421 8,170 7,942 24,035 23,776 Tangible Common Shareholders' Equity $108,425 $117,014 $128,183 $136,376 $140,406 $153,438 Divided by Common Shares Outstanding 25,709 25,867 26,047 26,151 27,417 27,509 Tangible Book Value per Share $4.22 $4.52 $4.93 $5.21 $5.11 $5.58 2016 2017 2018 2019 2020 2021 Shareholders' Equity $186,712 $192,802 $205,947 $207,117 $221,575 $237,817 Divided by Common Shares Outstanding 27,592 27,488 27,533 26,235 25,004 24,059 Book Value per Share $6.77 $7.01 $7.48 $7.89 $8.86 $9.88 Shareholders' Equity $186,712 $192,802 $205,947 $207,117 $221,575 $237,817 Less: Goodwill and Other Intangible Assets 16,324 16,224 16,154 16,094 16,046 16,009 Tangible Common Shareholders' Equity $170,388 $176,578 $189,793 $191,023 $205,529 $221,808 Divided by Common Shares Outstanding 27,592 27,488 27,533 26,235 25,004 24,059 Tangible Book Value per Share $9.18 $6.42 $6.89 $7.28 $8.22 $9.22 2022 2023 2024 2024 Q3 2025 Q2 2025 Q3 Shareholders' Equity $218,629 $234,718 $267,993 $260,050 $290,219 $315,663 Divided by Common Shares Outstanding 22,803 22,052 22,073 22,008 22,089 22,091 Book Value per Share $9.59 $10.63 $12.14 $11.82 $13.14 $14.29 Shareholders' Equity $218,629 $234,718 $267,993 $260,050 $290,219 $315,663 Less: Goodwill and Other Intangible Assets 15,984 15,967 50,968 15,967 50,824 50,824 Tangible Common Shareholders' Equity $202,645 $218,751 $217,025 $244,083 $239,395 $264,839 Divided by Common Shares Outstanding 22,803 22,052 22,073 22,008 22,089 22,091 Tangible Book Value per Share $8.89 $9.92 $9.83 $11.09 $10.84 $11.99 41 Source: Company documents. Financial information as of 12/31 for each year, as of 6/30 for 2025 Q2, and as of 9/30 for 2024 Q3 and 2025 Q3.

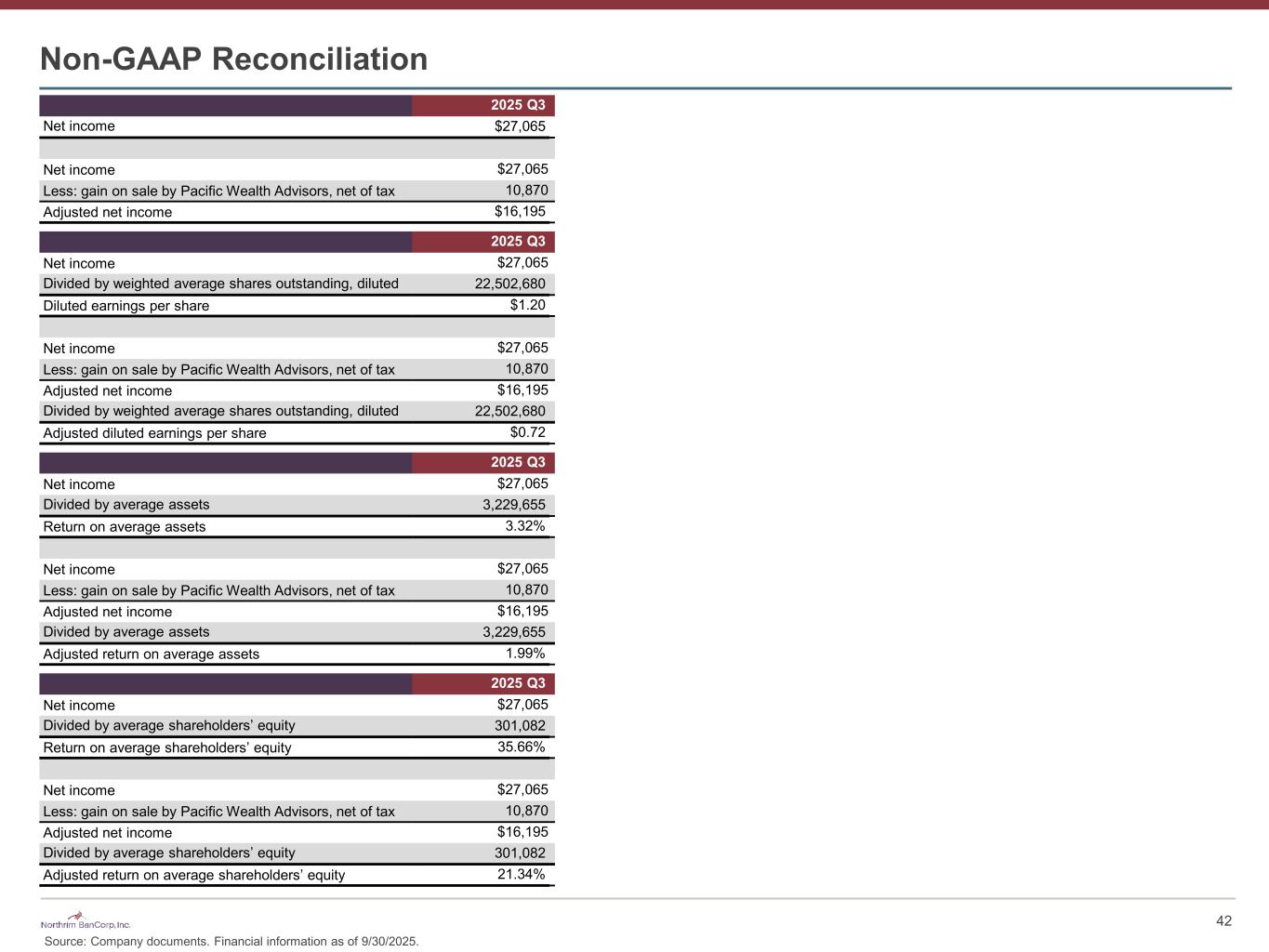

Non-GAAP Reconciliation 2025 Q3 Net income $27,065 Net income $27,065 Less: gain on sale by Pacific Wealth Advisors, net of tax 10,870 Adjusted net income $16,195 2025 Q3 Net income $27,065 Divided by weighted average shares outstanding, diluted 22,502,680 Diluted earnings per share $1.20 Net income $27,065 Less: gain on sale by Pacific Wealth Advisors, net of tax 10,870 Adjusted net income $16,195 Divided by weighted average shares outstanding, diluted 22,502,680 Adjusted diluted earnings per share $0.72 42 2025 Q3 Net income $27,065 Divided by average assets 3,229,655 Return on average assets 3.32% Net income $27,065 Less: gain on sale by Pacific Wealth Advisors, net of tax 10,870 Adjusted net income $16,195 Divided by average assets 3,229,655 Adjusted return on average assets 1.99% 2025 Q3 Net income $27,065 Divided by average shareholders’ equity 301,082 Return on average shareholders’ equity 35.66% Net income $27,065 Less: gain on sale by Pacific Wealth Advisors, net of tax 10,870 Adjusted net income $16,195 Divided by average shareholders’ equity 301,082 Adjusted return on average shareholders’ equity 21.34% Source: Company documents. Financial information as of 9/30/2025.

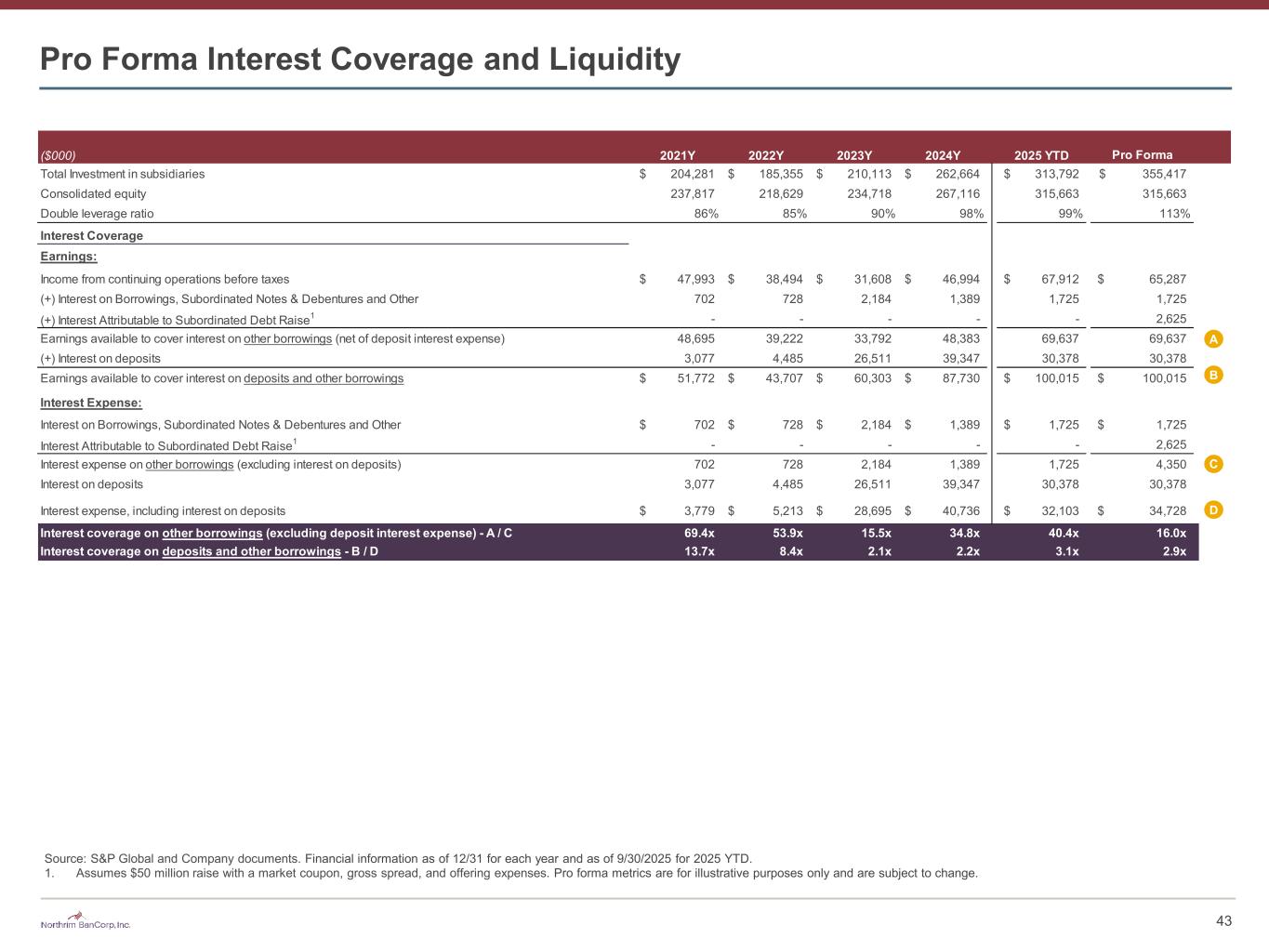

Pro Forma Interest Coverage and Liquidity ($000) 2021Y 2022Y 2023Y 2024Y 2025 YTD Pro Forma Total Investment in subsidiaries 204,281$ 185,355$ 210,113$ 262,664$ 313,792$ 355,417$ Consolidated equity 237,817 218,629 234,718 267,116 315,663 315,663 Double leverage ratio 86% 85% 90% 98% 99% 113% Interest Coverage Earnings: Income from continuing operations before taxes 47,993$ 38,494$ 31,608$ 46,994$ 67,912$ 65,287$ (+) Interest on Borrowings, Subordinated Notes & Debentures and Other 702 728 2,184 1,389 1,725 1,725 (+) Interest Attributable to Subordinated Debt Raise1 - - - - - 2,625 Earnings available to cover interest on other borrowings (net of deposit interest expense) 48,695 39,222 33,792 48,383 69,637 69,637 (+) Interest on deposits 3,077 4,485 26,511 39,347 30,378 30,378 Earnings available to cover interest on deposits and other borrowings 51,772$ 43,707$ 60,303$ 87,730$ 100,015$ 100,015$ Interest Expense: Interest on Borrowings, Subordinated Notes & Debentures and Other 702$ 728$ 2,184$ 1,389$ 1,725$ 1,725$ Interest Attributable to Subordinated Debt Raise1 - - - - - 2,625 Interest expense on other borrowings (excluding interest on deposits) 702 728 2,184 1,389 1,725 4,350 Interest on deposits 3,077 4,485 26,511 39,347 30,378 30,378 Interest expense, including interest on deposits 3,779$ 5,213$ 28,695$ 40,736$ 32,103$ 34,728$ Interest coverage on other borrowings (excluding deposit interest expense) - A / C 69.4x 53.9x 15.5x 34.8x 40.4x 16.0x Interest coverage on deposits and other borrowings - B / D 13.7x 8.4x 2.1x 2.2x 3.1x 2.9x B D A C Source: S&P Global and Company documents. Financial information as of 12/31 for each year and as of 9/30/2025 for 2025 YTD. 1. Assumes $50 million raise with a market coupon, gross spread, and offering expenses. Pro forma metrics are for illustrative purposes only and are subject to change. 43